Attached files

| file | filename |

|---|---|

| 8-K - Ally Financial Inc. | v192171_8-k.htm |

| EX-99.1 - Ally Financial Inc. | v192171_ex99-1.htm |

Ally Financial Inc.

2Q10 Earnings Review

August 3, 2010

Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Ally Financial Inc.

2Q10 Earnings Review

August 3, 2010

Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

Forward-Looking Statements and Additional Information

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual

Forward-Looking Statements and Additional Information

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2009 Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K.

This information is preliminary and based on company data available at the time of the presentation

In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,”

“initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “seek,” “may,”

“would,” “could,” “should,” “believe,” “potential,” “continue,” or similar expressions is intended to identify forward-looking statements. All statements

herein and in related management comments,

other than statements of historical fact, including without limitation, statements about future events

and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our

current

judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any

events or financial results, and Ally’s actual results may differ materially due to numerous important factors that are

described in the most recent

reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8-

K. Such factors include, among others, the following: our inability to repay our outstanding

obligations to the U.S. Department of the Treasury, or to

do so in a timely fashion and without disruption to our business; uncertainty of Ally's ability to enter into transactions or execute strategic

alternatives to realize the value of its Residential

Capital, LLC (“ResCap”) operations; our inability to successfully accommodate the additional risk

exposure relating to providing wholesale and retail financing to Chrysler dealers and customers and the resulting impact to our financial stability;

uncertainty related to Chrysler’s and GM’s recent exits from bankruptcy; uncertainty related to the new financing arrangement between Ally and

Chrysler; securing low cost funding for Ally and ResCap and maintaining the mutually beneficial

relationship between Ally and GM, and Ally and

Chrysler; our ability to maintain an appropriate level of debt and capital; the profitability and financial condition of GM and Chrysler; our ability to

realize the anticipated benefits associated with

our recent conversion to a bank holding company, and the increased regulation and restrictions

that we are now subject to; continued challenges in the residential mortgage and capital markets; the potential for deterioration in the residual

value of

off-lease vehicles; the continuing negative impact on ResCap of the decline in the U.S. housing market; changes in U.S. government-

sponsored mortgage programs or disruptions in the markets in which our mortgage subsidiaries operate; disruptions in the market

in which we

fund Ally’s and ResCap’s operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may require or

that result from changes in the accounting rules or their application, which could

result in an impact on earnings; changes in the credit ratings of

ResCap, Ally, Chrysler or GM; changes in economic conditions, currency exchange rates or political stability in the markets in which we operate;

and changes in the existing or the adoption

of new laws, regulations, policies or other activities of governments, agencies and similar organizations

(including as a result of the recently enacted financial regulatory reform bill). Investors are cautioned not to place undue reliance on

forward-

looking statements. Ally undertakes no obligation to update publicly or otherwise revise any forward-looking statements except where expressly

required by law. A reconciliation of certain non-GAAP financial measures included within this presentation

is provided in the supplemental charts.

Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s global operations. The specific products

include retail installment sales

contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase,

acquisition or direct origination of various “loan” products.

2

Second Quarter Highlights

Ally earned core pre-tax income(1) of $738 million and net income of $565 million in the

second quarter

Premier Auto

Second Quarter Highlights

Ally earned core pre-tax income(1) of $738 million and net income of $565 million in the

second quarter

Premier Auto

Finance

Provider

Capital Markets

Mortgage Risk

Cost Structure

Deposits

Bank Holding

Company

Strong auto franchise is the #1 provider of new car financing in the U.S.(2)

Significant growth in consumer auto originations, increasing over 30% quarter-over-quarter

Continued to increase penetration of GM and Chrysler retail originations with less than half

due to subvented business

Completed over $25 billion of secured and unsecured funding transactions year-to-date

Continued liquidation of legacy assets at gains; International sale to Fortress imminent

ResCap, LLC was profitable and required no additional capital or liquidity support in 2Q

Strategic review in progress

Expense reduction efforts on track, with quarterly controllable expenses down $124

million year-over-year and over $100 million ahead of plan

Bank deposits grew $2.3 billion with strong CD retention rates

Cost of funds has declined over 100 bps since becoming a bank holding company

Continued progress implementing policies and procedures

(1) Core pre-tax income is a non-GAAP financial measure. Please refer to slide 9 for further details

(2) Source: AutoCount

3

Auto Franchise Momentum

Ally will continue to leverage competitive advantages to evolve as a leading market driven competitor

Uniquely positioned with long-standing dealer relationships and over 90 years of industry experience

Leading provider across a full spectrum of products for dealers and their customers

Robust infrastructure integrated with dealers and OEMs

Focus on competitive rates and high quality service provided to dealers and their customers

Bank holding company structure provides added stability and cost-efficient funding

Vehicle

Service

Contracts

Full Service Platform

Finance Products

Insurance Products

Retail

Loans

Retail

Leases

Floorplan

Financing

Working

Capital

Loans

Smart-

Auction

Floorplan

Insurance

GAP

Protection

U.S. Consumer Auto Originations and Manufacturer Penetration

($ billions)

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

$10

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0%

10%

20%

30%

40%

50%

60%

U.S. Consumer Originations

GM Penetration

Chrysler Penetration

4

Auto Franchise Momentum

Ally will continue to leverage competitive advantages to evolve as a leading market driven competitor

Uniquely positioned with long-standing dealer relationships and over 90 years of industry experience

Leading provider across a full spectrum of products for dealers and their customers

Robust infrastructure integrated with dealers and OEMs

Focus on competitive rates and high quality service provided to dealers and their customers

Bank holding company structure provides added stability and cost-efficient funding

Vehicle

Service

Contracts

Full Service Platform

Finance Products

Insurance Products

Retail

Loans

Retail

Leases

Floorplan

Financing

Working

Capital

Loans

Smart-

Auction

Floorplan

Insurance

GAP

Protection

U.S. Consumer Auto Originations and Manufacturer Penetration

($ billions)

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

$10

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0%

10%

20%

30%

40%

50%

60%

U.S. Consumer Originations

GM Penetration

Chrysler Penetration

4

-39%

22.5%

14.4%

13.8%

- Next 5 Largest Competitors

-44%

7.8%

4.8%

4.4%

- Next Largest Competitor

% of GM/Chrysler Consumer Sales

-39%

22.5%

14.4%

13.8%

- Next 5 Largest Competitors

-44%

7.8%

4.8%

4.4%

- Next Largest Competitor

% of GM/Chrysler Consumer Sales

Financed by:

124%

17.0%

27.7%

38.1%

% of GM/Chrysler Consumer Sales

Financed by Ally

107%

189,767

314,541

392,484

# of New GM/Chrysler Vehicles Financed

for Consumers by Ally

42%

59%

81%

84%

% of GM/Chrysler Sales Through Dealers

Financed (Wholesale Penetration)

4%

504,441

485,983

525,307

Outstanding # of New Vehicles Financed

for Dealers by Ally (Period End)

0.4%

5,043

5,411

5,061

# of Dealers Financed by Ally

(Floorplan) (1)(2)

1H 2010

2H 2009

1H 2009

1H10 vs. 1H09

Growth (%)

(1) Total number of dealers financed by Ally calculated by taking average of the number of dealers financed at the end of each of the two quarters that comprise each respective period

(2) While total number of dealers declined from 2H09, Ally’s percentage of active dealers remains consistent

Source: Internal Ally data and AutoCount

Ally has Fulfilled its Mission of Supporting U.S. Auto Industry

5

Auto Finance Products

Given its broad market presence, Ally is a top

Auto Finance Products

Given its broad market presence, Ally is a top

four player in the new car subprime space

Ally has placed more emphasis on the higher

end of the subprime spectrum

No

#1

13% of Ally’s U.S. originations have

a credit score of less than 660

Approximately 2% are less

than 620

Nonprime

#1

#1

#1

#1

#1

Position with

GM / Chrysler

Ally wins and retains a significant portion of GM

and Chrysler dealer floorplan based on long-

standing relationships, superior platform and

service quality

No

Ally provides U.S. floorplan

financing for approximately 84% of

GM dealer stock and 75% of

Chrysler dealer stock

Floorplan

Loans

Ally competes against all other auto finance

companies for this business

Used car market seen as growth opportunity

No

Currently a majority of Ally’s retail

auto originations

Non-

Incentivized

Retail Loans

Ally competes against all other insurance

protection providers

Chrysler vehicle service contracts seen as a

growth opportunity

No

#1 provider of vehicle service

contracts for GM

#1 provider for wholesale insurance

for GM and Chrysler

Insurance

Products

Ally continues to explore opportunities to

expand the leasing business in a prudent

manner

No

Ally has expanded its leasing

programs to comprise over 10% of

new U.S. originations

Retail Lease

GM can only offer incentivized retail loan

programs through third parties under certain

specified circumstances through 2010

GM can gradually introduce programs through

third parties(1) over the next three years

on a

non-exclusive side-by-side basis with Ally

Chrysler can offer a portion of incentivized retail

to third parties

Yes

41% of Ally’s new retail auto loans

originated

Incentivized

Retail Loans

Comment

Exclusive

Rights?

Metric

Product

(1) Subject to certain requirements

6

General Motors Relationship

General Motors and Ally maintain an important, mutually beneficial relationship

Ally and GM work together to develop attractive subvention programs for retail products

Ally remains committed to assisting GM in its mission to sell vehicles

Ally is the #1 provider for all retail and wholesale products for GM dealers and their customers

Twice the retail volume of next five competitors combined

Ally’s infrastructure and experience in floorplan lending provide significant competitive advantages in serving dealers:

Long-standing dealer relationships maintained throughout the market downturn as others exited

Ability to finance vehicles in-transit straight from the factory

VIN-based tracking to allow for constant portfolio monitoring and management

Well established risk management infrastructure and procedures

Working capital, floorplan insurance and other dealer financing solutions

Stated focus of AmeriCredit acquisition is subprime and lease products

Subprime: Ally and AmeriCredit tend to focus on different segments of the subprime market

Leasing: Ally balances prudent risk management with providing attractive value proposition for lease-oriented

General Motors Relationship

General Motors and Ally maintain an important, mutually beneficial relationship

Ally and GM work together to develop attractive subvention programs for retail products

Ally remains committed to assisting GM in its mission to sell vehicles

Ally is the #1 provider for all retail and wholesale products for GM dealers and their customers

Twice the retail volume of next five competitors combined

Ally’s infrastructure and experience in floorplan lending provide significant competitive advantages in serving dealers:

Long-standing dealer relationships maintained throughout the market downturn as others exited

Ability to finance vehicles in-transit straight from the factory

VIN-based tracking to allow for constant portfolio monitoring and management

Well established risk management infrastructure and procedures

Working capital, floorplan insurance and other dealer financing solutions

Stated focus of AmeriCredit acquisition is subprime and lease products

Subprime: Ally and AmeriCredit tend to focus on different segments of the subprime market

Leasing: Ally balances prudent risk management with providing attractive value proposition for lease-oriented

consumers

2Q U.S. lease originations increased to $0.8 billion from $0.2 billion in 4Q09

Certain lease programs may be more suitable in a captive environment

Ally is uniquely positioned to serve GM, its dealers and customers

Combination of a national, captive-like infrastructure and experience, along with stability and cost of funds advantage

of bank funding model over captive model

Bank holding company with #1 strategic objective of serving the auto industry

7

Leasing Dynamics

Ally continues to be the #1 provider of leasing to GM and Chrysler

Lease payments are primarily driven by residual value expectations

Residual value expectations are set by third party lease guides, such as ALG

Monthly payments can be managed through contractual residual values and OEM subvention

Based on residual value expectations, Ally has limited ability to influence the customer lease payment

Finance company margins do not allow for taking excessive residual risk, which is more appropriate for an OEM

In the case of the Malibu in the example below, if the finance company were to assume a 5% higher or lower

Leasing Dynamics

Ally continues to be the #1 provider of leasing to GM and Chrysler

Lease payments are primarily driven by residual value expectations

Residual value expectations are set by third party lease guides, such as ALG

Monthly payments can be managed through contractual residual values and OEM subvention

Based on residual value expectations, Ally has limited ability to influence the customer lease payment

Finance company margins do not allow for taking excessive residual risk, which is more appropriate for an OEM

In the case of the Malibu in the example below, if the finance company were to assume a 5% higher or lower

residual than ALG, the payment would only increase/decrease by $13 per month, which hardly addresses

the

fundamental competitiveness gap

* Monthly lease payments calculated by Ally using the following assumptions:

Mid size car segment with $24,000 MSRP assumed in calculating all payment scenarios

0.50% OEM incentivized rate and no OEM incentive cash or residual support

ALG variance of 8

percentage points leads

to a payment difference

of $53 per month

Make

Model

Expected 36-mo

Residual % (ALG)

Estimated Monthly

Payment

Chevrolet

Malibu

49

$348

Honda

Accord

57

$295

Ford

Fusion

52

$328

Toyota

Camry

51

$334

Monthly Lease Payment Example*

8

Second Quarter 2010 Results

Key Statistics

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Total net revenue (ex. OID)

2,392

$

2,251

$

1,535

$

141

$

857

$

Provision for loan losses

220

146

1,117

74

(897)

Controllable expenses

(1)

862

933

986

(71)

(124)

Other noninterest expenses

572

594

740

(22)

(168)

Total noninterest expense

1,434

1,527

1,726

(93)

(292)

Core pre-tax income (loss)

(2)

738

$

578

$

(1,308)

$

160

$

2,046

$

OID amortization expense

292

397

275

(104)

17

Income tax expense

33

36

1,096

(3)

(1,063)

Income (loss) from discontinued operations

152

17

(1,224)

135

1,376

Net income (loss)

565

$

162

$

(3,903)

$

403

$

4,468

$

Total assets

176,802

$

179,427

$

181,248

$

(2,625)

$

(4,446)

$

Allowance balance

2,377

$

2,480

$

3,301

$

(103)

$

(924)

$

Net interest margin

(3)

2.8%

3.0%

1.7%

Tier 1 capital ratio

15.3%

14.9%

13.6%

Total risk-based capital ratio

16.8%

16.4%

15.1%

(1) Includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing, restructuring expenses and FDIC fees

(2) Core pre-tax income is defined as income from continuing operations before taxes and bond exchange original issue discount ("OID") amortization expense

(3) Excludes OID amortization expense. The impact of historical financial statement restatements for discontinued operations is not reflected in prior period amounts

Increase/(Decrease) vs.

9

Second Quarter 2010 Results

Key Statistics

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Total net revenue (ex. OID)

2,392

$

2,251

$

1,535

$

141

$

857

$

Provision for loan losses

220

146

1,117

74

(897)

Controllable expenses

(1)

862

933

986

(71)

(124)

Other noninterest expenses

572

594

740

(22)

(168)

Total noninterest expense

1,434

1,527

1,726

(93)

(292)

Core pre-tax income (loss)

(2)

738

$

578

$

(1,308)

$

160

$

2,046

$

OID amortization expense

292

397

275

(104)

17

Income tax expense

33

36

1,096

(3)

(1,063)

Income (loss) from discontinued operations

152

17

(1,224)

135

1,376

Net income (loss)

565

$

162

$

(3,903)

$

403

$

4,468

$

Total assets

176,802

$

179,427

$

181,248

$

(2,625)

$

(4,446)

$

Allowance balance

2,377

$

2,480

$

3,301

$

(103)

$

(924)

$

Net interest margin

(3)

2.8%

3.0%

1.7%

Tier 1 capital ratio

15.3%

14.9%

13.6%

Total risk-based capital ratio

16.8%

16.4%

15.1%

(1) Includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing, restructuring expenses and FDIC fees

(2) Core pre-tax income is defined as income from continuing operations before taxes and bond exchange original issue discount ("OID") amortization expense

(3) Excludes OID amortization expense. The impact of historical financial statement restatements for discontinued operations is not reflected in prior period amounts

Increase/(Decrease) vs.

9

Results by Segment

All four operating segments were profitable for the second straight quarter

Global Automotive Services: Robust growth in retail originations and continued improvement in credit trends

Mortgage Operations: Strong margins and sales of legacy assets combined with favorable servicing revenue

(1) Ally Bank and ResCap, LLC legal entities were also profitable in 2Q

(2) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and net impact from treasury asset liability

management

Results by Segment

All four operating segments were profitable for the second straight quarter

Global Automotive Services: Robust growth in retail originations and continued improvement in credit trends

Mortgage Operations: Strong margins and sales of legacy assets combined with favorable servicing revenue

(1) Ally Bank and ResCap, LLC legal entities were also profitable in 2Q

(2) Corporate and Other as presented includes Commercial Finance Group (“CFG”), certain equity investments and net impact from treasury asset liability

management

(“ALM”) activities

See slide 23 or a listing of businesses classified as discontinued operations

Treasury ALM: $(256)

CFG/Other: $ (79)

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

North American Automotive Finance

630

$

653

$

451

$

(23)

$

179

$

International Automotive Finance

105

42

33

63

72

Insurance

108

183

99

(75)

9

Global Automotive Services

843

878

583

(35)

260

Mortgage Operations

230

156

(1,335)

74

1,565

Corporate and Other (ex. OID)

(1)

(335)

(456)

(556)

121

221

Core pre-tax income (loss)

738

$

578

$

(1,308)

$

160

$

2,046

$

OID amortization expense

292

397

275

(104)

17

Income tax expense

33

36

1,096

(3)

(1,063)

Income (loss) from discontinued operations

(2)

152

17

(1,224)

135

1,376

Net income (loss)

565

$

162

$

(3,903)

$

403

$

4,468

$

Increase/(Decrease) vs.

10

Outlook

Ally expects to sustain positive core income going forward

Certain positive factors currently contributing to earnings may moderate over the coming quarters

Auto forward flow gain on sales ($66mm in 2Q; $113mm in 1Q)

Lease portfolio remarketing gains due to all-time high used car prices ($205mm in 2Q; $185mm

in 1Q)

Legacy mortgage loan sale gains ($73mm in 2Q; $58mm in 1Q)

Insurance investment portfolio gains ($63mm in 2Q; $110mm in 1Q)

Over the long term, Ally expects to improve profitability from near term run rate

Cost of funds advantage as deposits grow

Repositioning balance sheet as auto franchise expands

Migration to more profitable asset mix

OID expense decline

11

Outlook

Ally expects to sustain positive core income going forward

Certain positive factors currently contributing to earnings may moderate over the coming quarters

Auto forward flow gain on sales ($66mm in 2Q; $113mm in 1Q)

Lease portfolio remarketing gains due to all-time high used car prices ($205mm in 2Q; $185mm

in 1Q)

Legacy mortgage loan sale gains ($73mm in 2Q; $58mm in 1Q)

Insurance investment portfolio gains ($63mm in 2Q; $110mm in 1Q)

Over the long term, Ally expects to improve profitability from near term run rate

Cost of funds advantage as deposits grow

Repositioning balance sheet as auto franchise expands

Migration to more profitable asset mix

OID expense decline

11

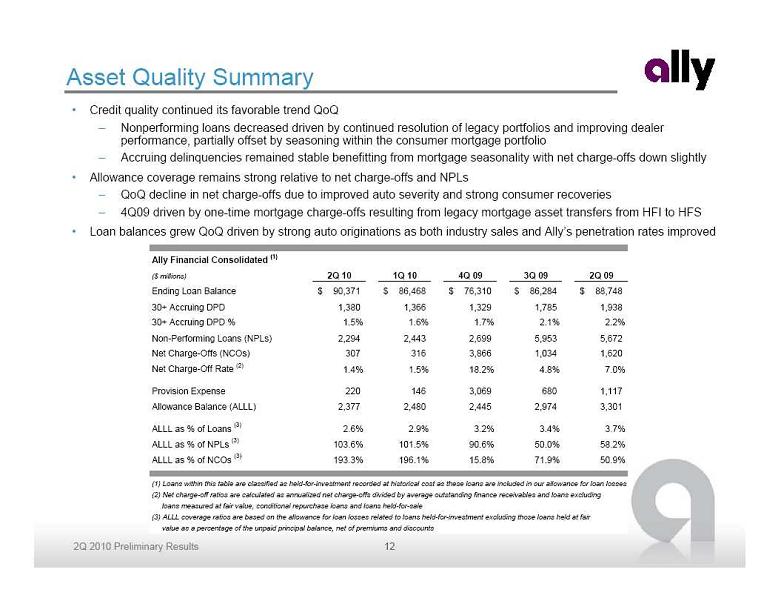

Asset Quality Summary

Credit quality continued its favorable trend QoQ

Nonperforming loans decreased driven by continued resolution of legacy portfolios and improving dealer

Asset Quality Summary

Credit quality continued its favorable trend QoQ

Nonperforming loans decreased driven by continued resolution of legacy portfolios and improving dealer

performance, partially offset by seasoning within the consumer mortgage portfolio

Accruing delinquencies remained stable benefitting from mortgage seasonality with net charge-offs down slightly

Allowance coverage remains strong relative to net charge-offs and NPLs

QoQ decline in net charge-offs due to improved auto severity and strong consumer recoveries

4Q09 driven by one-time mortgage charge-offs resulting from legacy mortgage asset transfers from HFI to HFS

Loan balances grew QoQ driven by strong auto originations as both industry sales and Ally’s penetration rates improved

Ally Financial Consolidated

(1)

($ millions)

2Q 10

1Q 10

4Q 09

3Q 09

2Q 09

Ending Loan Balance

90,371

$

86,468

$

76,310

$

86,284

$

88,748

$

30+ Accruing DPD

1,380

1,366

1,329

1,785

1,938

30+ Accruing DPD %

1.5%

1.6%

1.7%

2.1%

2.2%

Non-Performing Loans (NPLs)

2,294

2,443

2,699

5,953

5,672

Net Charge-Offs (NCOs)

307

316

3,866

1,034

1,620

Net Charge-Off Rate

(2)

1.4%

1.5%

18.2%

4.8%

7.0%

Provision Expense

220

146

3,069

680

1,117

Allowance Balance (ALLL)

2,377

2,480

2,445

2,974

3,301

ALLL as % of Loans

(3)

2.6%

2.9%

3.2%

3.4%

3.7%

ALLL as % of NPLs

(3)

103.6%

101.5%

90.6%

50.0%

58.2%

ALLL as % of NCOs

(3)

193.3%

196.1%

15.8%

71.9%

50.9%

(1) Loans within this table are classified as held-for-investment recorded at historical cost as these loans are included in our allowance for loan losses

(2) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance receivables and loans excluding

loans measured at fair value, conditional repurchase loans and loans held-for-sale

(3) ALLL coverage ratios are based on the allowance for loan losses related to loans held-for-investment excluding those loans held at fair

value as a percentage of the unpaid principal balance, net of premiums and discounts

12

Global Automotive Services

Global Automotive Services earned $843 million of pre-tax income from continuing operations in 2Q

Sixth consecutive profitable quarter from core auto business

North American Operations continued to drive results and International Operations performance improved

Robust growth in total retail consumer originations in the quarter

General improvement in the auto market

GM and Chrysler gained market share while Ally increased penetration of both

Growth in used vehicle originations

Leasing volume remained consistent

Brazil and China continued to grow originations

$303

$878

$411

$583

$843

Pre-Tax Income from Continuing Operations

Global Consumer Auto Originations

($ millions)

($ billions)

Note: Includes North American and International Operations

$272

$369

$653

$630

$(152)

$42

$99

$108

$183

$451

$105

$33

$31

$108

$86

$(400)

$(200)

$-

$200

$400

$600

$800

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

North American

International

Insurance

$3.3

$3.7

$6.1

$7.7

$8.2

$8.2

$10.7

$0

$2

$4

$6

$8

$10

$12

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

New - Retail

New - Leases

Used

13

Global Automotive Services

Global Automotive Services earned $843 million of pre-tax income from continuing operations in 2Q

Sixth consecutive profitable quarter from core auto business

North American Operations continued to drive results and International Operations performance improved

Robust growth in total retail consumer originations in the quarter

General improvement in the auto market

GM and Chrysler gained market share while Ally increased penetration of both

Growth in used vehicle originations

Leasing volume remained consistent

Brazil and China continued to grow originations

$303

$878

$411

$583

$843

Pre-Tax Income from Continuing Operations

Global Consumer Auto Originations

($ millions)

($ billions)

Note: Includes North American and International Operations

$272

$369

$653

$630

$(152)

$42

$99

$108

$183

$451

$105

$33

$31

$108

$86

$(400)

$(200)

$-

$200

$400

$600

$800

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

North American

International

Insurance

$3.3

$3.7

$6.1

$7.7

$8.2

$8.2

$10.7

$0

$2

$4

$6

$8

$10

$12

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

New - Retail

New - Leases

Used

13

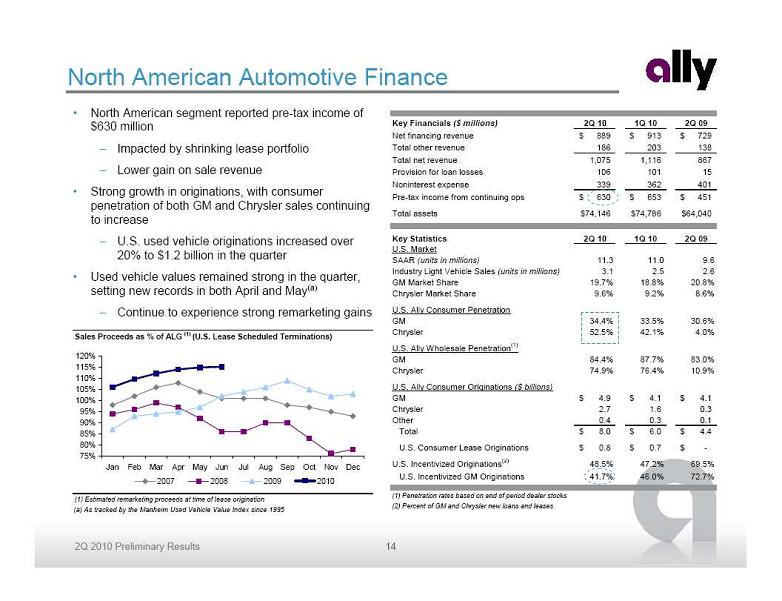

North American Automotive Finance

North American segment reported pre-tax income of

North American Automotive Finance

North American segment reported pre-tax income of

$630 million

Impacted by shrinking lease portfolio

Lower gain on sale revenue

Strong growth in originations, with consumer

penetration of both GM and Chrysler sales continuing

to increase

U.S. used vehicle originations increased over

20% to $1.2 billion in the quarter

Used vehicle values remained strong in the quarter,

setting new records in both April and May(a)

Continue to experience strong remarketing gains

(a) As tracked by the Manheim Used Vehicle Value Index since 1995

Sales Proceeds as % of ALG

(1)

(U.S. Lease Scheduled Terminations)

(1) Estimated remarketing proceeds at time of lease origination

75%

80%

85%

90%

95%

100%

105%

110%

115%

120%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2007

2008

2009

2010

Key Financials

($ millions)

2Q 10

1Q 10

2Q 09

Net financing revenue

889

$

913

$

729

$

Total other revenue

186

203

138

Total net revenue

1,075

1,116

867

Provision for loan losses

106

101

15

Noninterest expense

339

362

401

Pre-tax income from continuing ops

630

$

653

$

451

$

Total assets

74,146

$

74,786

$

64,040

$

Key Statistics

2Q 10

1Q 10

2Q 09

U.S. Market

SAAR

(units in millions)

11.3

11.0

9.6

Industry Light Vehicle Sales

(units in millions)

3.1

2.5

2.6

GM Market Share

19.7%

18.8%

20.8%

Chrysler Market Share

9.6%

9.2%

8.6%

U.S. Ally Consumer Penetration

GM

34.4%

33.5%

30.6%

Chrysler

52.5%

42.1%

4.0%

U.S. Ally Wholesale Penetration

(1)

GM

84.4%

87.7%

83.0%

Chrysler

74.9%

76.4%

10.9%

U.S. Ally Consumer Originations

($ billions)

GM

4.9

$

4.1

$

4.1

$

Chrysler

2.7

1.6

0.3

Other

0.4

0.3

0.1

Total

8.0

$

6.0

$

4.4

$

U.S. Consumer Lease Originations

0.8

$

0.7

$

-

$

U.S. Incentivized Originations

(2)

48.5%

47.2%

69.5%

U.S. Incentivized GM Originations

41.7%

46.0%

72.7%

(1) Penetration rates based on end of period dealer stocks

(2) Percent of GM and Chrysler new loans and leases

14

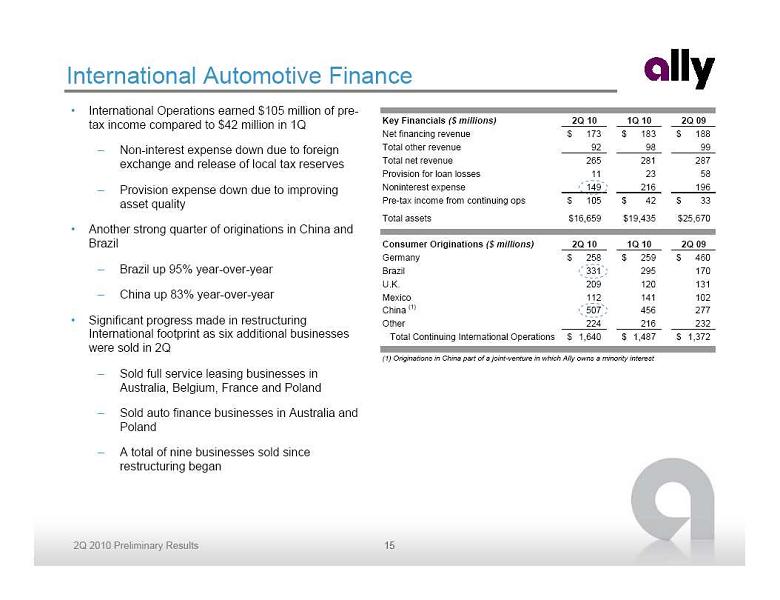

International Operations earned $105 million of pre-

International Operations earned $105 million of pre-

tax income compared to $42 million in 1Q

Non-interest expense down due to foreign

exchange and release of local tax reserves

Provision expense down due to improving

asset quality

Another strong quarter of originations in China and

Brazil

Brazil up 95% year-over-year

China up 83% year-over-year

Significant progress made in restructuring

International footprint as six additional businesses

were sold in 2Q

Sold full service leasing businesses in

Australia, Belgium, France and Poland

Sold auto finance businesses in Australia and

Poland

A total of nine businesses sold since

restructuring began

International Automotive Finance

Key Financials

($ millions)

2Q 10

1Q 10

2Q 09

Net financing revenue

173

$

183

$

188

$

Total other revenue

92

98

99

Total net revenue

265

281

287

Provision for loan losses

11

23

58

Noninterest expense

149

216

196

Pre-tax income from continuing ops

105

$

42

$

33

$

Total assets

16,659

$

19,435

$

25,670

$

Consumer Originations

($ millions)

2Q 10

1Q 10

2Q 09

Germany

258

$

259

$

460

$

Brazil

331

295

170

U.K.

209

120

131

Mexico

112

141

102

China

(1)

507

456

277

Other

224

216

232

Total Continuing International Operations

1,640

$

1,487

$

1,372

$

(1) Originations in China part of a joint-venture in which Ally owns a minority interest

15

Global Auto Finance – Consumer Credit Trends

Delinquency trends remained relatively stable in

Global Auto Finance – Consumer Credit Trends

Delinquency trends remained relatively stable in

the second quarter

Reflective of improved collection processes,

more stable economic conditions and

increased quality of newer vintages

Excluding the Nuvell portfolio, delinquencies

continued to fall in the quarter

Nuvell delinquencies elevated due to a

change in nonaccrual policy

Both the core auto portfolio and Nuvell subprime

portfolio experienced significant declines in losses

Results driven by used car market strength,

lower frequency of loss, post loss recoveries

and stronger performance on newer vintages

Continued focus on Nuvell portfolio with

losses declining over 500 bps in the quarter

Nuvell portfolio balance declined by

$400 million to $3.1 billion

Global Delinquencies - Managed

Retail Contract Amount

$ Amount of Accruing Contracts Greater than 30 Days Past Due (millions)

2.16%

2.22%

2.62%

2.80%

2.91%

2.66%

2.82%

3.27%

3.46%

3.48%

2.87%

2.93%

$0

$500

$1,000

$1,500

$2,000

$2,500

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

Nuvell Delinquent Contract $

Delinquent Contract $ (excluding Nuvell)

% of Retail Contract $ Outstanding

% of Retail Contract $ Outstanding (excluding Nuvell)

Global Annualized Credit Losses - Managed Retail Contracts

($ millions)

(1) 3Q and 4Q 2009 elevated due to change in charge-off policy

1.84%

1.80%

2.39%

2.48%

1.30%

0.77%

1.05%

2.04%

3.57%

3.29%

2.29%

2.43%

$0

$100

$200

$300

$400

$500

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Nuvell Credit Losses

Credit Losses (excluding Nuvell)

% of Avg. Managed Assets

% of Avg. Managed Assets (excluding Nuvell)

(1)

(1)

16

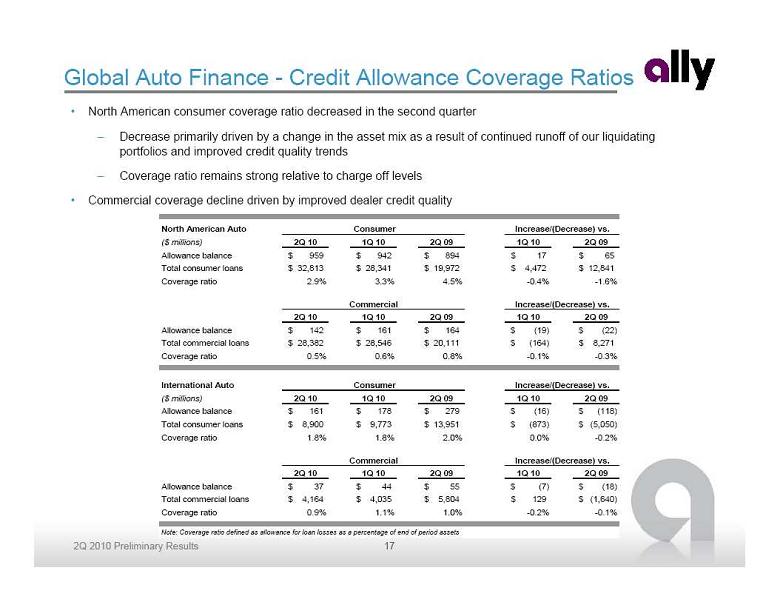

Global Auto Finance - Credit Allowance Coverage Ratios

North American consumer coverage ratio decreased in the second quarter

Decrease primarily driven by a change in the asset mix as a result of continued runoff of our liquidating

Global Auto Finance - Credit Allowance Coverage Ratios

North American consumer coverage ratio decreased in the second quarter

Decrease primarily driven by a change in the asset mix as a result of continued runoff of our liquidating

portfolios and improved credit quality trends

Coverage ratio remains strong relative to charge off levels

Commercial coverage decline driven by improved dealer credit quality

North American Auto

Consumer

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Allowance balance

959

$

942

$

894

$

17

$

65

$

Total consumer loans

32,813

$

28,341

$

19,972

$

4,472

$

12,841

$

Coverage ratio

2.9%

3.3%

4.5%

-0.4%

-1.6%

Commercial

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Allowance balance

142

$

161

$

164

$

(19)

$

(22)

$

Total commercial loans

28,382

$

28,546

$

20,111

$

(164)

$

8,271

$

Coverage ratio

0.5%

0.6%

0.8%

-0.1%

-0.3%

International Auto

Consumer

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Allowance balance

161

$

178

$

279

$

(16)

$

(118)

$

Total consumer loans

8,900

$

9,773

$

13,951

$

(873)

$

(5,050)

$

Coverage ratio

1.8%

1.8%

2.0%

0.0%

-0.2%

Commercial

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Allowance balance

37

$

44

$

55

$

(7)

$

(18)

$

Total commercial loans

4,164

$

4,035

$

5,804

$

129

$

(1,640)

$

Coverage ratio

0.9%

1.1%

1.0%

-0.2%

-0.1%

Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets

Increase/(Decrease) vs.

Increase/(Decrease) vs.

Increase/(Decrease) vs.

Increase/(Decrease) vs.

17

Insurance

Segment streamlined to focus primarily on

Insurance

Segment streamlined to focus primarily on

dealer-centric products

Dealer Products and Services (“DP&S”):

Offers extended service contracts

and

dealer inventory insurance

International: Includes the ABA Seguros

(“ABA”) and CarCare Plan (“CCP”)

businesses

Written premiums up in DP&S driven by

increase in auto finance originations and

increased used vehicle service contracts

International written premiums elevated

in 1Q driven by fleet contracts in Latin

America

Continued favorable investment income but

with lower capital gains in 2Q

Loss ratio increased due to typical seasonal

weather related losses

Key Financials

($ millions)

2Q 10

1Q 10

2Q 09

Insurance premiums and service revenue earned

469

$

460

$

484

$

Investment income

86

141

88

Other income

18

20

13

Total insurance premiums and other income

573

621

585

Insurance losses and loss adjustment expenses

224

196

224

Acquisition and underwriting expenses

241

242

262

Total expense

465

438

486

Pre-tax income from continuing ops

108

$

183

$

99

$

Total assets

8,552

$

9,083

$

11,588

$

Key Statistics

2Q 10

1Q 10

2Q 09

Written Premiums

($ millions)

Dealer Products & Services

251

$

226

$

211

$

International

164

197

140

Total

415

$

423

$

351

$

Loss ratio

46%

41%

45%

Underwriting expense ratio

50%

50%

53%

Combined ratio

96%

91%

98%

18

Mortgage Operations

Mortgage Operations reported pre-tax income

Mortgage Operations

Mortgage Operations reported pre-tax income

from continuing operations of $230 million in the

second quarter

Second quarter production was $13.5 billion, up

slightly from 1Q

Gain on sale from originations was $134

million, up from $86 million in 1Q as

margins continue to remain favorable

Strong servicing revenue

Continued progress of liquidating legacy assets

at gains

Domestic non-core: UPB of $510 million

and cash proceeds of $308 million at a

gain to book value of $73 million

International: UPB of $723 million and

cash proceeds of $447 million at a gain to

book

value of $93 million(1)

Continue to closely monitor new

repurchase requests

Repurchase reserve expense of $97

million with claims largely in line with

expectations

(1) Revenue reported in discontinued operations

Key Financials

($ millions)

2Q 10

1Q 10

2Q 09

Net financing revenue

154

$

182

$

137

$

Total other revenue

531

369

(84)

Total net revenue

685

551

53

Provision for loan losses

92

7

871

Noninterest expense

363

388

517

Pre-tax income (loss) from continuing ops

230

$

156

$

(1,335)

$

Total assets

46,043

$

44,536

$

44,401

$

Key Statistics

($ billions)

2Q 10

1Q 10

2Q 09

Mortgage Loan Production

Prime Conforming

9.1

$

9.5

$

10.5

$

Prime Non-Conforming

0.5

0.4

0.3

Government

3.6

3.1

7.6

Other

0.3

0.3

0.3

Total

13.5

$

13.3

$

18.8

$

Primary Servicing - Period End

371

$

379

$

381

$

($ millions)

2Q 10

1Q 10

2Q 09

Servicing fees

328

$

324

$

334

$

Servicing asset valuation, net of hedge

(21)

(133)

(225)

Net servicing revenue

307

$

191

$

109

$

Repurchase reserve expense

97

$

49

$

237

$

Repurchase reserve balance

855

$

890

$

463

$

19

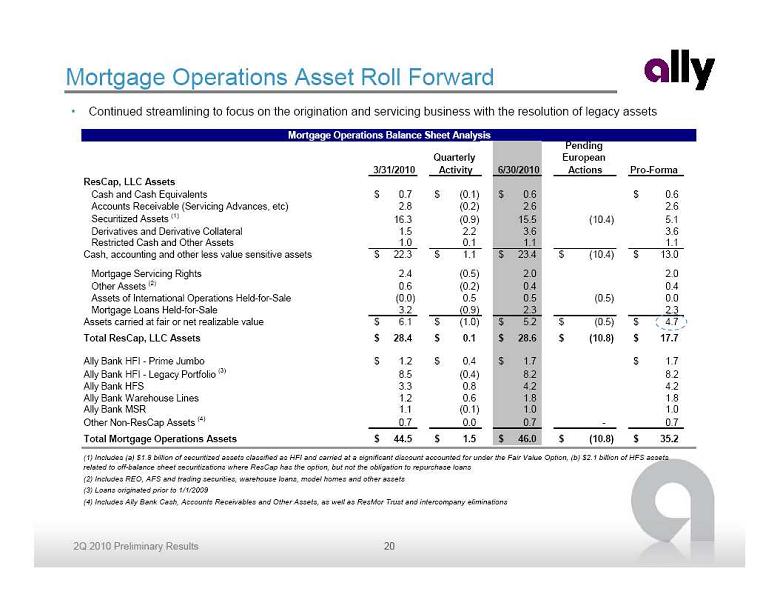

Mortgage Operations Asset Roll Forward

Continued streamlining to focus on the origination and servicing business with the resolution of legacy assets

3/31/2010

Quarterly

Activity

6/30/2010

Pending

European

Actions

Pro-Forma

ResCap, LLC Assets

Cash and Cash Equivalents

0.7

$

(0.1)

$

0.6

$

0.6

$

Accounts Receivable (Servicing Advances, etc)

2.8

(0.2)

2.6

2.6

Securitized Assets

(1)

16.3

(0.9)

15.5

(10.4)

5.1

Derivatives and Derivative Collateral

1.5

2.2

3.6

3.6

Restricted Cash and Other Assets

1.0

0.1

1.1

1.1

Cash, accounting and other less value sensitive assets

22.3

$

1.1

$

23.4

$

(10.4)

$

13.0

$

Mortgage Servicing Rights

2.4

(0.5)

2.0

2.0

Other Assets

(2)

0.6

(0.2)

0.4

0.4

Assets of International Operations Held-for-Sale

(0.0)

0.5

0.5

(0.5)

0.0

Mortgage Loans Held-for-Sale

3.2

(0.9)

2.3

2.3

Assets carried at fair or net realizable value

6.1

$

(1.0)

$

5.2

$

(0.5)

$

4.7

$

Total ResCap, LLC Assets

28.4

$

0.1

$

28.6

$

(10.8)

$

17.7

$

Ally Bank HFI - Prime Jumbo

1.2

$

0.4

$

1.7

$

1.7

$

Ally Bank HFI - Legacy Portfolio

(3)

8.5

(0.4)

8.2

8.2

Ally Bank HFS

3.3

0.8

4.2

4.2

Ally Bank Warehouse Lines

1.2

0.6

1.8

1.8

Ally Bank MSR

1.1

(0.1)

1.0

1.0

Other Non-ResCap Assets

(4)

0.7

0.0

0.7

-

0.7

Total Mortgage Operations Assets

44.5

$

1.5

$

46.0

$

(10.8)

$

35.2

$

(3) Loans originated prior to 1/1/2009

(4) Includes Ally Bank Cash, Accounts Receivables and Other Assets, as well as ResMor Trust and intercompany eliminations

Mortgage Operations Balance Sheet Analysis

(1) Includes (a) $1.8 billion of securitized assets classified as HFI and carried at a significant discount accounted for under the Fair Value Option, (b) $2.1 billion of HFS assets

related to off-balance sheet securitizations where ResCap has the option, but not the obligation to repurchase loans

(2) Includes REO, AFS and trading securities, warehouse loans, model homes and other assets

20

Mortgage Operations Asset Roll Forward

Continued streamlining to focus on the origination and servicing business with the resolution of legacy assets

3/31/2010

Quarterly

Activity

6/30/2010

Pending

European

Actions

Pro-Forma

ResCap, LLC Assets

Cash and Cash Equivalents

0.7

$

(0.1)

$

0.6

$

0.6

$

Accounts Receivable (Servicing Advances, etc)

2.8

(0.2)

2.6

2.6

Securitized Assets

(1)

16.3

(0.9)

15.5

(10.4)

5.1

Derivatives and Derivative Collateral

1.5

2.2

3.6

3.6

Restricted Cash and Other Assets

1.0

0.1

1.1

1.1

Cash, accounting and other less value sensitive assets

22.3

$

1.1

$

23.4

$

(10.4)

$

13.0

$

Mortgage Servicing Rights

2.4

(0.5)

2.0

2.0

Other Assets

(2)

0.6

(0.2)

0.4

0.4

Assets of International Operations Held-for-Sale

(0.0)

0.5

0.5

(0.5)

0.0

Mortgage Loans Held-for-Sale

3.2

(0.9)

2.3

2.3

Assets carried at fair or net realizable value

6.1

$

(1.0)

$

5.2

$

(0.5)

$

4.7

$

Total ResCap, LLC Assets

28.4

$

0.1

$

28.6

$

(10.8)

$

17.7

$

Ally Bank HFI - Prime Jumbo

1.2

$

0.4

$

1.7

$

1.7

$

Ally Bank HFI - Legacy Portfolio

(3)

8.5

(0.4)

8.2

8.2

Ally Bank HFS

3.3

0.8

4.2

4.2

Ally Bank Warehouse Lines

1.2

0.6

1.8

1.8

Ally Bank MSR

1.1

(0.1)

1.0

1.0

Other Non-ResCap Assets

(4)

0.7

0.0

0.7

-

0.7

Total Mortgage Operations Assets

44.5

$

1.5

$

46.0

$

(10.8)

$

35.2

$

(3) Loans originated prior to 1/1/2009

(4) Includes Ally Bank Cash, Accounts Receivables and Other Assets, as well as ResMor Trust and intercompany eliminations

Mortgage Operations Balance Sheet Analysis

(1) Includes (a) $1.8 billion of securitized assets classified as HFI and carried at a significant discount accounted for under the Fair Value Option, (b) $2.1 billion of HFS assets

related to off-balance sheet securitizations where ResCap has the option, but not the obligation to repurchase loans

(2) Includes REO, AFS and trading securities, warehouse loans, model homes and other assets

20

Mortgage Operations - Credit Allowance Coverage Ratios

Allowance balance and HFI portfolio down from prior year driven by strategic actions taken in 2009

Consumer coverage up slightly as HFI portfolio seasons and performs in line with expectations

Commercial coverage down relative to prior periods as certain distressed legacy assets have been resolved or

Mortgage Operations - Credit Allowance Coverage Ratios

Allowance balance and HFI portfolio down from prior year driven by strategic actions taken in 2009

Consumer coverage up slightly as HFI portfolio seasons and performs in line with expectations

Commercial coverage down relative to prior periods as certain distressed legacy assets have been resolved or

charged-off

Remaining commercial loans consist primarily of high quality correspondent warehouse lines at Ally Bank

Held For Investment Portfolio

Consumer

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Allowance balance

659

$

635

$

1,133

$

24

$

(474)

$

Total consumer loans

11,286

11,243

20,917

43

(9,631)

Coverage ratio

5.8%

5.6%

5.4%

0.2%

0.4%

Non-performing loans

624

$

446

$

2,052

$

178

$

(1,428)

$

Allowance as a % of NPLs

105.6%

142.3%

55.2%

-36.7%

50.4%

Commercial

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Allowance balance

70

$

82

$

536

$

(12)

$

(466)

$

Total commercial loans

2,002

1,542

3,412

460

(1,410)

Coverage ratio

3.5%

5.3%

15.7%

-1.8%

-12.2%

Non-performing loans

167

$

237

$

1,047

$

(70)

$

(880)

$

Allowance as a % of NPLs

41.9%

34.5%

51.2%

7.5%

-9.3%

Note: Coverage ratio defined as allowance for loan losses as a percentage of end of period assets (excluding loans held at fair value)

Increase/(Decrease) vs.

Increase/(Decrease) vs.

21

Corporate and Other

Results in the segment reflect amortization of

Corporate and Other

Results in the segment reflect amortization of

OID from bond exchanges

Approximately $600 million of OID

amortization expense remains for 2010,

with expense moderating significantly after

2011

Favorability from prior quarter driven by

Mark-to-market on deferred purchase price

asset related to auto forward flow

commitments

Lower restructuring charges

Hedge favorability

Additional OID amortization expense in 1Q

Key Financials

($ millions)

2Q 10

1Q 10

2Q 09

Net financing loss (ex. OID)

(1)

(237)

$

(256)

$

(439)

$

Total other revenue

(2)

36

(56)

188

Total net revenue

(201)

(312)

(251)

Provision for loan losses

11

15

173

Noninterest expense

123

129

132

Core pre-tax loss

(335)

$

(456)

$

(556)

$

OID Amortization

(292)

(397)

(275)

Pre-tax loss from continuing ops

(627)

$

(853)

$

(831)

$

Total Assets

31,465

$

31,644

$

35,622

$

(1) OID amortization expense of $296 million in 1Q10

(2) Excludes $101 million of accelerated OID amortization expense in 1Q10

OID Amortization Schedule

($ billions)

As of 6/30/2010

$0.6

$1.0

$0.3

$0.2

$0.1

Avg = $0.1 / yr

$0.3

$-

$0.2

$0.4

$0.6

$0.8

$1.0

$1.2

$1.4

Remaining

2010

2011

2012

2013

2014

2015

2016 and

thereafter

22

Discontinued Operations

Continued streamlining operations with seven additional businesses sold in 2Q

Asset sales generating gains driven by improved market conditions

Sale of U.K. mortgage assets generated net gain of $93 million

Sale of European mortgage business expected to close in 3Q10

Impact of Discontinued Operations, net of tax

($ millions)

2Q 10

1Q 10

International Automotive Finance

44

$

2

$

Insurance

(4)

(1)

Global Automotive Services

40

1

Mortgage Operations

98

12

Corporate and Other

14

4

Consolidated net income (loss)

152

$

17

$

Insurance

Mortgage

Corporate and Other

Discontinued Operations

sold in 2Q

Australia

Poland

Australia

Belgium

France

Poland

Commercial Services

(North American Factoring)

Businesses classified as

Discontinued Operations

as of 6/30/2010

Argentina

Ecuador

Russia

U.K. P&C

U.K. and Continental

Europe

(1)

(1) Definitive agreement signed in April. Sale expected to close in 3Q 2010

Auto Finance

United Kingdom

Full Service Leasing

23

Discontinued Operations

Continued streamlining operations with seven additional businesses sold in 2Q

Asset sales generating gains driven by improved market conditions

Sale of U.K. mortgage assets generated net gain of $93 million

Sale of European mortgage business expected to close in 3Q10

Impact of Discontinued Operations, net of tax

($ millions)

2Q 10

1Q 10

International Automotive Finance

44

$

2

$

Insurance

(4)

(1)

Global Automotive Services

40

1

Mortgage Operations

98

12

Corporate and Other

14

4

Consolidated net income (loss)

152

$

17

$

Insurance

Mortgage

Corporate and Other

Discontinued Operations

sold in 2Q

Australia

Poland

Australia

Belgium

France

Poland

Commercial Services

(North American Factoring)

Businesses classified as

Discontinued Operations

as of 6/30/2010

Argentina

Ecuador

Russia

U.K. P&C

U.K. and Continental

Europe

(1)

(1) Definitive agreement signed in April. Sale expected to close in 3Q 2010

Auto Finance

United Kingdom

Full Service Leasing

23

Liquidity

1) Ally utilizes a two-pronged funding strategy designed to support

Liquidity

1) Ally utilizes a two-pronged funding strategy designed to support

stable liquidity and diversify funding sources

Cost efficient funding at Ally Bank

Over 65% of new auto originations were funded at

the bank level

2) Net bank deposits grew by $2.3 billion with strong CD

retention rates

Consistent and diversified access to the capital markets

Over $25 billion YTD of funding in the U.S. and

abroad

Ally Financial Funding Transactions - 2Q 2010

($ billions)

ABS - Public / 144A

(1)

2.7

$

ABS - Private / Other

1.1

Revolving Bank Facilities

(2)

8.6

Unsecured Issuances

1.4

Total 2Q Funding Transactions

13.8

$

(1) Includes $674 million at ResCap

(2) Includes $600 million at ResCap

Available Liquidity

6/30/2010

3/31/2010

($ billions)

Parent

(1)(2)

Ally Bank

Parent

(1)(2)

Ally Bank

Cash and Cash Equivalents

10.3

$

2.6

$

9.0

$

4.3

$

Unencumbered Securities

(3)

1.1

3.8

0.3

3.4

Secured Committed Unused Capacity

(4)

10.5

6.9

12.7

1.6

Unsecured Committed Unused Capacity

0.1

-

0.1

-

Total Current Available Liquidity

22.0

$

13.3

$

22.1

$

9.3

$

Whole Loan Forward Flow Agreements

1.5

-

4.5

-

Total Available Liquidity

23.5

$

13.3

$

26.6

$

9.3

$

(1)

Parent defined as Ally Consolidated less Ally Bank, ResCap (not shown) and Insurance (not shown)

(2)

Includes overnight funds placed at Ally Bank at quarter-end

(3)

Includes UST, Agency debt and Agency MBS

(4)

Includes equal allocation of shared capacity totaling $3.0 billion in 2Q and $2.1 billion in 1Q that can be used by Ally Bank or the parent company

24

Deposits

Average CD Maturity and Rate

Retail CD Balance Retention

(1)

(months)

($ billions)

(1) Retention includes balances retained in any Ally Bank product

25.5

24.2

12.8

11.3

12.0

12.1

1.82%

2.00%

2.34%

2.59%

2.96%

3.41%

0.0

5.0

10.0

15.0

20.0

25.0

30.0

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

Avg. Maturity of Newly Originated CDs

Avg Retail Deposit Rate

82%

73%

69%

65%

63%

69%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

CD Balances Up for Renewal

CD Balances Retained

Retention Rate

Bank Deposit Levels

(1)

($ billions)

(1) Excludes certain parent company deposits

$34.3

$32.0

$31.1

$28.8

$26.3

$23.1

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

1Q 09

2Q 09

3Q 09

4Q 09

1Q10

2Q10

Ally Bank Retail

Ally Bank Brokered

Ally Bank Other

ResMor

Ally Bank - 2Q 2010 External Funding Sources

FHLB

Borrowings

11%

Retail Deposits

44%

Brokered CDs

23%

Securitization

22%

25

Deposits

Average CD Maturity and Rate

Retail CD Balance Retention

(1)

(months)

($ billions)

(1) Retention includes balances retained in any Ally Bank product

25.5

24.2

12.8

11.3

12.0

12.1

1.82%

2.00%

2.34%

2.59%

2.96%

3.41%

0.0

5.0

10.0

15.0

20.0

25.0

30.0

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

Avg. Maturity of Newly Originated CDs

Avg Retail Deposit Rate

82%

73%

69%

65%

63%

69%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

CD Balances Up for Renewal

CD Balances Retained

Retention Rate

Bank Deposit Levels

(1)

($ billions)

(1) Excludes certain parent company deposits

$34.3

$32.0

$31.1

$28.8

$26.3

$23.1

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

1Q 09

2Q 09

3Q 09

4Q 09

1Q10

2Q10

Ally Bank Retail

Ally Bank Brokered

Ally Bank Other

ResMor

Ally Bank - 2Q 2010 External Funding Sources

FHLB

Borrowings

11%

Retail Deposits

44%

Brokered CDs

23%

Securitization

22%

25

Cost of Funds

Ally’s total deposits as a percent of total interest bearing liabilities has increased from 13% in 4Q08 to 26% in 2Q10,

Cost of Funds

Ally’s total deposits as a percent of total interest bearing liabilities has increased from 13% in 4Q08 to 26% in 2Q10,

driving cost of funds improvement

Historical Portfolio Cost of Funds

(1)

(1) Reported amounts represent quarterly interest expense (excluding OID expense) divided by average debt

for continuing operations in each period. The impact of historical financial statement restatements for

discontinued operations is not reflected in prior period cost of funds.

(2) Including OID expense, stated cost of funds would be 5.2%

4.2%

4.4%

4.4%

4.8%

5.3%

5.3%

3.0%

4.0%

5.0%

6.0%

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

Cost of Funds

Cost of Funds

(2)

26

Capital Ratios

See slide 39 for further details on capital numbers stated above

Capital levels up in 2Q driven by positive net income and reduction of risk weighted assets (“RWA”)

RWA declined due to whole loan sales and continued amortization of the lease book, partially offset by increased

Capital Ratios

See slide 39 for further details on capital numbers stated above

Capital levels up in 2Q driven by positive net income and reduction of risk weighted assets (“RWA”)

RWA declined due to whole loan sales and continued amortization of the lease book, partially offset by increased

auto originations

Net income more than offset dividends on our preferred stock that have been paid or declared

2Q dividends lower as certain preferred dividends were accelerated to 1Q

($ billions)

6/30/2010

3/31/2010

Tier 1 Capital

22.4

$

22.1

$

Tier 1 Common Capital

7.7

$

7.4

$

Total Risk-Based Capital

24.6

$

24.4

$

Tangible Common Equity

8.1

$

7.8

$

Tangible Assets

176.3

$

178.9

$

Risk-Weighted Assets

146.3

$

148.4

$

Tier 1 Capital Ratio

15.3%

14.9%

Tier 1 Common Capital Ratio

5.2%

5.0%

Total Risk-Based Capital Ratio

16.8%

16.4%

Tangible Common Equity / Tangible Assets

4.6%

4.4%

Tangible Common Equity / Risk-Weighted Assets

5.5%

5.3%

27

Summary

All four operating segments were profitable, along with Ally Bank and ResCap legal entities

Credit trends continued to improve

Continued progress reducing legacy mortgage risk

Liquidity significantly strengthened

Cost of funds advantage of deposit base materializing

Second Quarter Progress

Continued Focus on Strategic Objectives

Become the premier global auto finance provider for dealers and consumers

Demonstrate consistent and diversified access to capital markets

Improve our liquidity position by building stable deposit base at Ally Bank

Continue to de-risk our mortgage business and define a viable long-term strategy for our mortgage origination and

Summary

All four operating segments were profitable, along with Ally Bank and ResCap legal entities

Credit trends continued to improve

Continued progress reducing legacy mortgage risk

Liquidity significantly strengthened

Cost of funds advantage of deposit base materializing

Second Quarter Progress

Continued Focus on Strategic Objectives

Become the premier global auto finance provider for dealers and consumers

Demonstrate consistent and diversified access to capital markets

Improve our liquidity position by building stable deposit base at Ally Bank

Continue to de-risk our mortgage business and define a viable long-term strategy for our mortgage origination and

servicing business

Improve our cost structure and efficiency

Fully transition to a bank holding company model

28

Supplemental Charts

Supplemental Charts

Condensed Consolidated Income Statement

Supplemental

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Total financing revenue and other interest income

2,902

$

3,117

$

3,389

$

(215)

$

(487)

$

Interest expense

1,664

1,705

1,940

(41)

(276)

Depreciation expense on operating lease assets

526

656

1,056

(130)

(530)

Net financing revenue

712

756

393

(44)

319

Servicing fees

384

385

393

(1)

(9)

Servicing asset valuation and hedge activities, net

(21)

(133)

(225)

112

204

Insurance premiums and service revenue earned

477

468

496

9

(19)

Gain on mortgage and automotive loans, net

266

271

206

(5)

60

(Loss) gain on extinguishment of debt

(3)

(118)

13

115

(16)

Other gain on investments, net

95

140

97

(45)

(2)

Other income, net of losses

190

85

(113)

105

303

Total other revenue

1,388

1,098

867

290

521

Total net revenue

2,100

1,854

1,260

246

840

Provision for loan losses

220

146

1,117

74

(897)

Insurance losses and loss adjustment expenses

224

211

261

13

(37)

Other operating expenses

1,210

1,316

1,465

(106)

(255)

Total noninterest expense

1,434

1,527

1,726

(93)

(292)

Income (loss) from cont. ops before income tax benefit

446

181

(1,583)

265

2,029

Income tax expense from continuing operations

33

36

1,096

(3)

(1,063)

Net income (loss) from continuing operations

413

145

(2,679)

268

3,092

Income (loss) from discontinued ops, net of tax

152

17

(1,224)

135

1,376

Net income (loss)

565

$

162

$

(3,903)

$

403

$

4,468

$

Increase/(Decrease) vs.

30

Condensed Consolidated Income Statement

Supplemental

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Total financing revenue and other interest income

2,902

$

3,117

$

3,389

$

(215)

$

(487)

$

Interest expense

1,664

1,705

1,940

(41)

(276)

Depreciation expense on operating lease assets

526

656

1,056

(130)

(530)

Net financing revenue

712

756

393

(44)

319

Servicing fees

384

385

393

(1)

(9)

Servicing asset valuation and hedge activities, net

(21)

(133)

(225)

112

204

Insurance premiums and service revenue earned

477

468

496

9

(19)

Gain on mortgage and automotive loans, net

266

271

206

(5)

60

(Loss) gain on extinguishment of debt

(3)

(118)

13

115

(16)

Other gain on investments, net

95

140

97

(45)

(2)

Other income, net of losses

190

85

(113)

105

303

Total other revenue

1,388

1,098

867

290

521

Total net revenue

2,100

1,854

1,260

246

840

Provision for loan losses

220

146

1,117

74

(897)

Insurance losses and loss adjustment expenses

224

211

261

13

(37)

Other operating expenses

1,210

1,316

1,465

(106)

(255)

Total noninterest expense

1,434

1,527

1,726

(93)

(292)

Income (loss) from cont. ops before income tax benefit

446

181

(1,583)

265

2,029

Income tax expense from continuing operations

33

36

1,096

(3)

(1,063)

Net income (loss) from continuing operations

413

145

(2,679)

268

3,092

Income (loss) from discontinued ops, net of tax

152

17

(1,224)

135

1,376

Net income (loss)

565

$

162

$

(3,903)

$

403

$

4,468

$

Increase/(Decrease) vs.

30

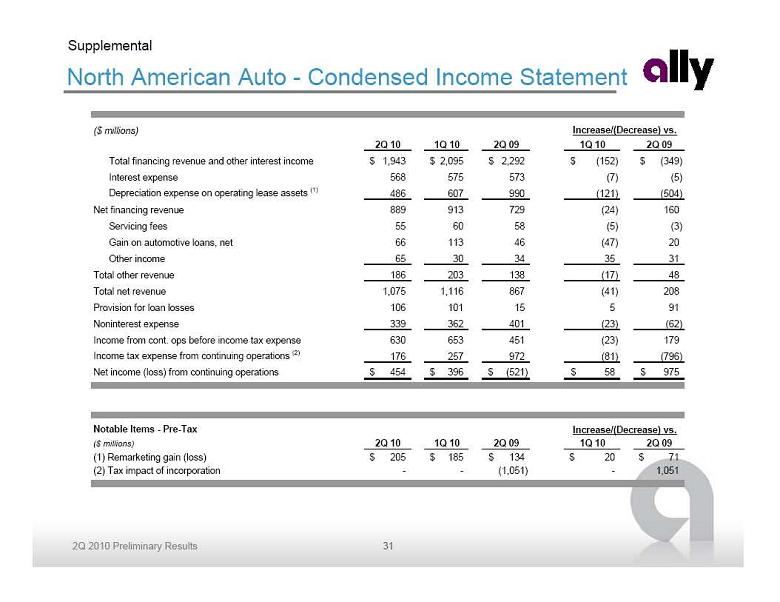

North American Auto - Condensed Income Statement

Supplemental

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Total financing revenue and other interest income

1,943

$

2,095

$

2,292

$

(152)

$

(349)

$

Interest expense

568

575

573

(7)

(5)

Depreciation expense on operating lease assets

(1)

486

607

990

(121)

(504)

Net financing revenue

889

913

729

(24)

160

Servicing fees

55

60

58

(5)

(3)

Gain on automotive loans, net

66

113

46

(47)

20

Other income

65

30

34

35

31

Total other revenue

186

203

138

(17)

48

Total net revenue

1,075

1,116

867

(41)

208

Provision for loan losses

106

101

15

5

91

Noninterest expense

339

362

401

(23)

(62)

Income from cont. ops before income tax expense

630

653

451

(23)

179

Income tax expense from continuing operations

(2)

176

257

972

(81)

(796)

Net income (loss) from continuing operations

454

$

396

$

(521)

$

58

$

975

$

Notable Items - Pre-Tax

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

(1) Remarketing gain (loss)

205

$

185

$

134

$

20

$

71

$

(2) Tax impact of incorporation

-

-

(1,051)

-

1,051

Increase/(Decrease) vs.

Increase/(Decrease) vs.

31

North American Auto - Condensed Income Statement

Supplemental

($ millions)

2Q 10

1Q 10

2Q 09

1Q 10

2Q 09

Total financing revenue and other interest income

1,943

$

2,095

$

2,292

$

(152)

$

(349)

$

Interest expense

568

575

573

(7)

(5)

Depreciation expense on operating lease assets

(1)

486

607

990

(121)

(504)

Net financing revenue

889

913

729

(24)

160

Servicing fees

55

60

58

(5)

(3)

Gain on automotive loans, net

66

113

46

(47)

20

Other income

65

30

34

35

31

Total other revenue

186

203

138

(17)

48

Total net revenue

1,075

1,116

867

(41)

208

Provision for loan losses

106

101

15

5

91

Noninterest expense

339

362

401

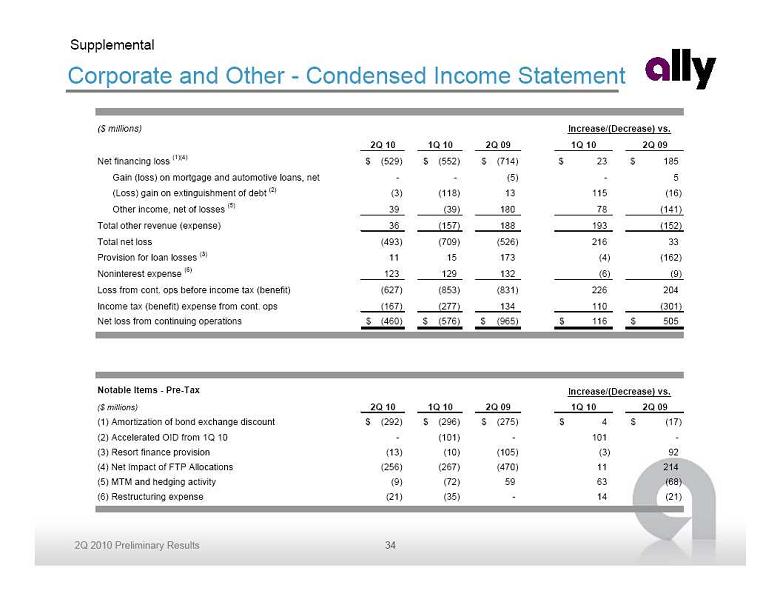

(23)