Attached files

| file | filename |

|---|---|

| 8-K - 6D Global Technologies, Inc | v191062_8k.htm |

Stock Symbol: EVCP

“Creating a Greener Future”

Safe Harbor Statement

This presentation contains "forward-looking statements" within the meaning

of the “safe-harbor” provisions of the Securities Litigation Reform Act of 1995.

Such statements involve known and unknown

risks, uncertainties and other

factors that could cause the actual results of the Company to differ materially

from the results expressed or implied by such statements, including changes

from anticipated levels of sales, future national or regional

economic and

competitive conditions, changes in relationships with customers, access to

capital, difficulties in developing and marketing new products, marketing

existing products, customer acceptance of existing and new products, and

other

factors. Accordingly, although the Company believes that the

expectations reflected in such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be correct.

The Company has no obligation to update

the forward-looking information

contained in this presentation.

2

3

China is the World’s Largest Polluter

A Sunny Day in the U.S

A Sunny Day in China

CleanTech Innovations tackles pollution through energy savings and pollution

reduction products

4

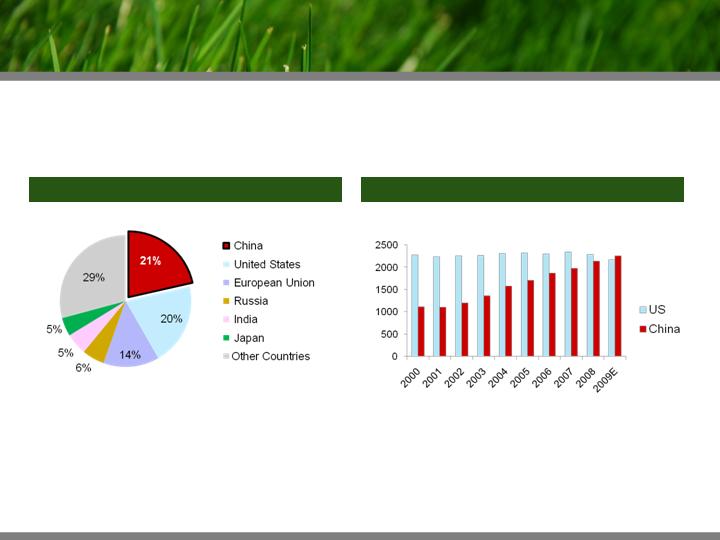

China Must Invest in Cleaner Sources of Energy

World CO2 Emissions: 28.4 billion metric tons

China CO2 Emissions: 6.1 billion metric tons

(1)

CDIAC data for 2006

(2)

Bloomberg.com

China

China, the world’s largest polluter, may spend about $738 billion in the next decade

developing cleaner sources of energy. China overtook the U.S as the largest energy user

in 2009.

(in Millions Metric Tons)

Total Energy Consumption(2): U.S. VS China

China consumed 2,252 million metric tons of oil

equivalent in 2009, the most in the world

CO2 Emission by Country(1) %

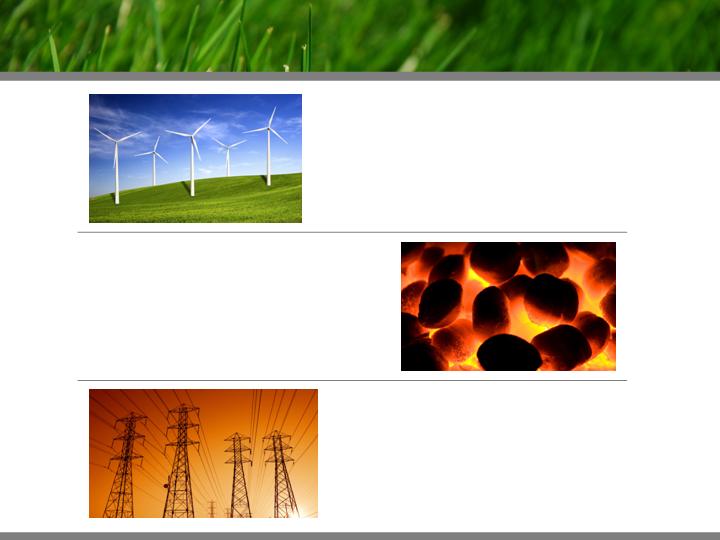

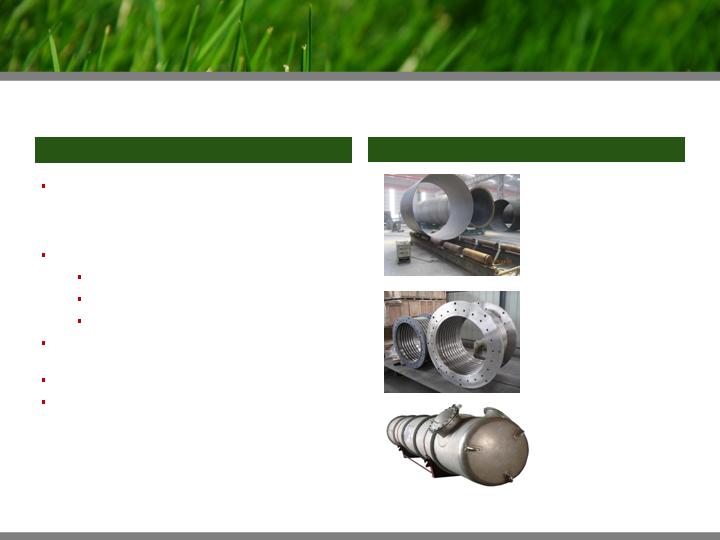

Our Products Contribute to a Greener Future

5

The Wind Power Industry:

We manufacture base towers

for wind turbines

The Utility Industry:

We produce essential products

for ultra high voltage grid

systems that improve efficiency

in electricity transmissions

The Steel Industry:

We produce critical components

for waste heat recycling systems

used in coke production, reducing

water and air pollution

Corporate Overview

Leading designer and manufacturer of high

performance clean tech products that promote

renewable energy production, pollution reduction,

and energy conservation in China

3 main product lines:

wind turbine tower

bellows expansion joints

pressure vessels

Critical components for various industries:

coking, steel, petrochemical, thermoelectric, utility

Strong R&D: owns 2 patents and 3 pending

Experienced managers: management has 20

years of extensive industry experience

We provide clean solutions that generate renewable energy, reduce pollution, and

conserve energy for fast growing industries in China

Bellow

Expansion Joints

Wind Turbine

Tower

Pressure

Vessel

Three Main Products Lines

Company Overview

6

Wind

Towers

2010E sales: ~60%

Functions: Provide structural

support for wind turbine nacelle

and blades

2010E sales: ~20%

Functions: Key part of pipeline;

absorb expansion, contraction and

vibrations under high temperature,

high pressure, highly corrosive

conditions

2010E sales: ~20%

Functions: Used in petrochemical,

electrical, steel, aerospace, and

metallurgical industries as heat

exchangers, storage tanks,

separators,

and industrial reactors

Bellow

Expansion

Joints

Pressure

Vessels

7

Diversified Revenue Mix

Tower

(up to 500 ft)

Axial

Lateral

Angular

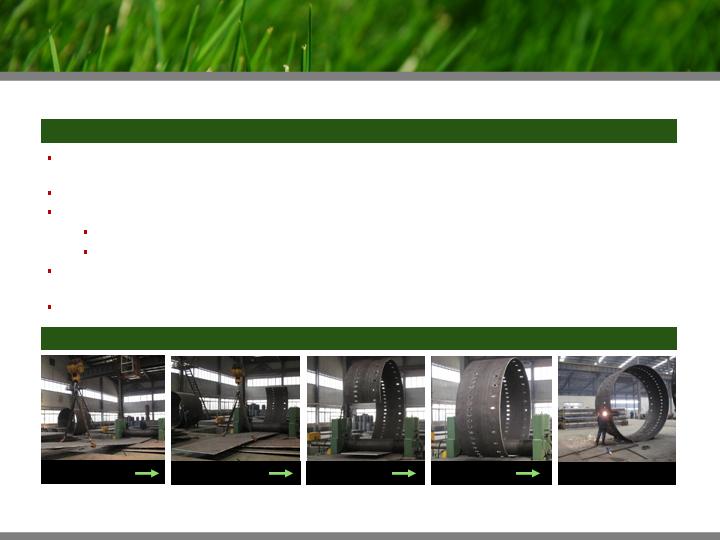

1. Wind Turbine Towers

8

China’s wind industry is the fastest growing in the world

Product Expansion - Currently producing 1.5 MW

on-shore wind towers, plans to produce 3MW and

5MW on-shore wind towers and 3MW off-shore wind towers

High Quality - Significant manufacturing experience in rolling and welding thick walled steel plates

Location Advantage

Manufacturing facility located in Tieling, one of the top regions for wind farms in China

Sole tower manufacturer in Tieling city, has majority market share in the region

Reputable Customers – Supplies towers to China Huaneng and China Guodian, 2 of the 5 largest

state-owned utilities companies that dominate

the wind industry in China

Stringent Testing – High tech non-destructive testing methods to ensure high product quality

Production of a Wind Turbine Tower at CleanTech Innovations

Step 1

Step 2

Step 3

Welding

Step 4

Company Strength

9

Wind - A Main Renewable Energy Source in China

1.5MW Wind Turbine

Coal Power Plant

Electricity Generated

3,942 MwH(1) (Annually)

3,942 MwH

$/KwH

$0.089(2)

$0.056(3)

Electricity Sales

$353,621

$218,936

CO2 Emitted Annually

0

3,443 metric tons(4)

Revenue from Carbon Credit

$34,427

$0

Total Revenue

$388,047

$218,936

Amount of Coal Used

0

1,314 tons(4)

Coal Cost in China

$77/ton(3)

$77/ton(3)

Costs of Coal Consumed

$0

($101,033)

Revenue Net of Fuel Costs

$388,047

$117,903

When using a wind turbine to generate 3,942 MwH of electricity rather than a coal power

plant, over 3,000 mt of CO

2 emission is prevented while generating 3 times more revenue

(1)

RenewableUK “Calculations for wind energy statistics”

(2)

Renewable Energy Law of the PRC

(3)

China Huaneng 2009 : average sale $/KwH, average per ton cost of coal

(4)

NDRC “ “2005

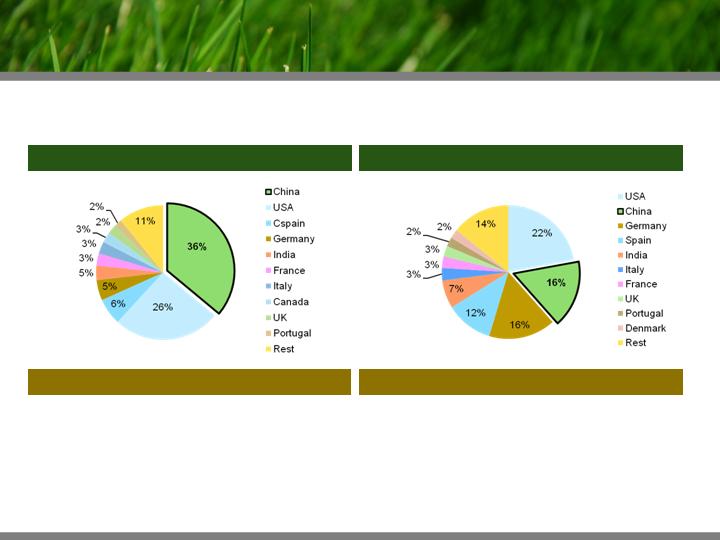

Wind Energy in the Global Markets

10

Worldwide New Capacity Installed in 2009(1) - 38GW

Total Worldwide Capacity in 2009(1) - 159 GW

China

China

U.S

U.S

China New Capacity Installed in 2009 - 13.8GW

China Total Capacity Installed – 26GW

(1)

WWEA 2009

In 2009, China installed 13.8GW of new capacity, the most in the world (36% of total)

At the end of 2009, China had 26GW of total capacity, 2nd largest in the world (16%)

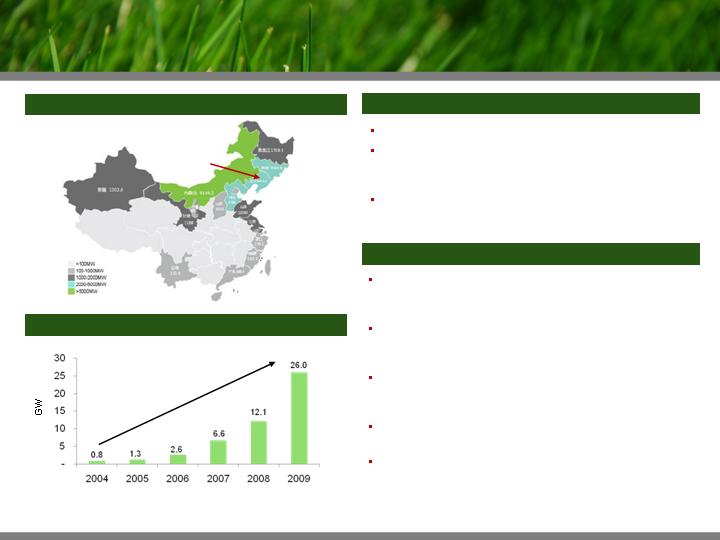

Wind Energy in the China Markets

11

(1)

WWEA 2009

(2)

Morgan Stanley “China Wind Energy” 6/8/2010

(3)

New Energy Finance Estimates

The Renewable Energy Law of PRC: Requires grid

operators to purchase power from local wind farms at a

fixed pricing of between 51 to 61 cents

RMB per KWH

High Rate of Return: Stable and clear policies ensure

high teens rate of return on equity for wind farm

operators

Planned Projects: NDRC plan to install at least 10GW

of capacity each in Hebei, Western Jilin, and Inner

Mongolia – all are near CleanTech’s

manufacturing site

Limited Natural Resources: China has limited fossil

fuel reserves and must invest in renewable energy

Ease of Project Approval: Unlike the U.S, China has

experienced little opposition from local land owners

towards new projects

Demand Drivers

Top Wind Farm Regions in China

Tieling,

Liaoning

CAGR: 102%

Total Capacity Installed in China(1) - 26 GW

Costs ~$1 billion USD to install 1 GW of wind capacity

China installed 14GW in 2009 and may install a record

18GW(3) in 2010, resulting in

about $18 billion spent on

wind energy this year.

China is projected to install 275-300GW by 2020(2) ,

resulting in roughly $250 billion

to be spent on wind

projects

Opportunities in the China Market

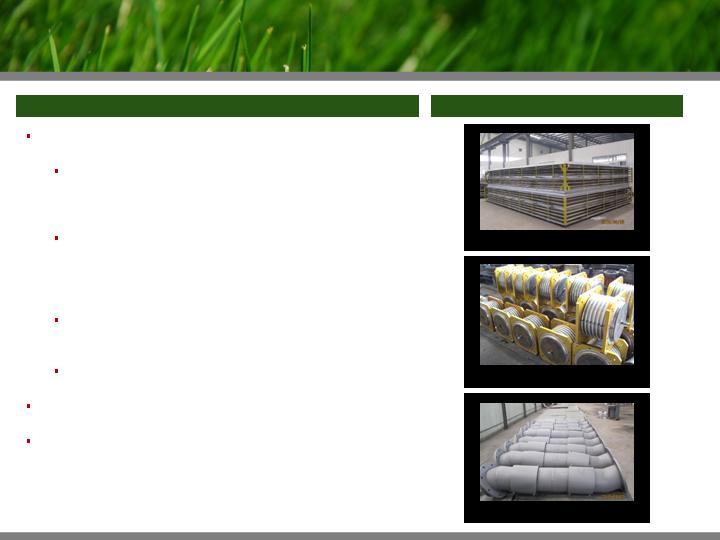

2. Metal Expansion Joints

12

Company Strength

Our Products are Necessary Components in Clean

Solution Systems:

Coke Dry Quench – We are the first domestic

manufacturer able to produce CDQ joints of equal quality

to Nippon Steel (previously dominated

the China market).

Currently there are no strong competitors

Ultra High Voltage Transmission – Our joints are

installed in gas insulated switchgear, an integral part of

ultra high voltage

systems. GIS rated over 1 million volts

are only produced by a handful of companies worldwide

such as ABB, Toshiba, and Siemens.

Coke Ovens – Our connecting bend pipes replaced rigid

elbows which rupture easily, thus preventing dangerous

leaks and explosions

Other Metal Expansion Joints –Increase operating

efficiency and safety

Stringent Testing – Utilize X-Ray, ultrasonic, pneumatic,

hydraulic, and SF6 gas leakage test

High Performance – Withstand harsh operating conditions of

high temperature, high pressure, and highly corrosive

environments

Company Products

Disk Spring Joints for GIS

High Temp Bellow Joints for CDQ

Connecting Bend Pipes

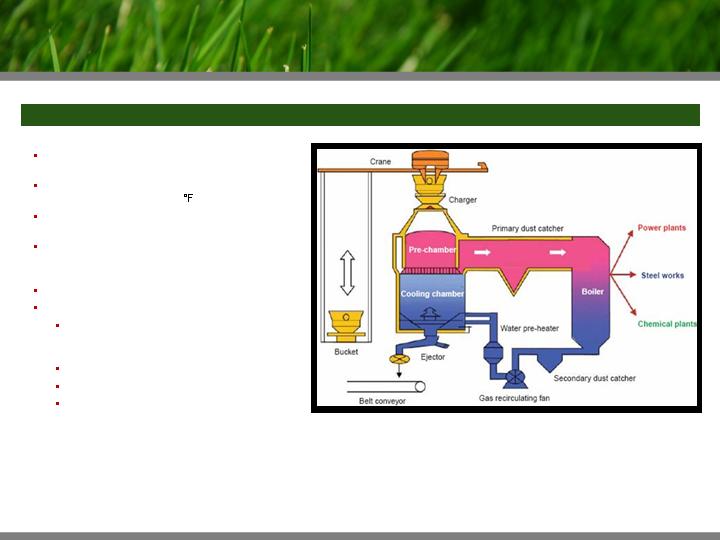

CDQ System Reuses Waste Energy

13

Coke Dry Quench System is More Economical than Wet Quench system

Coking process is an integral part of steel

production

Coking process involves baking coal at high

temperatures of over 2,000

Traditionally, water is used to cool the coke,

releasing pollutants while wasting water and heat

The Coke Dry Quench (CDQ) system is an advanced

technology that blows gas in an enclosed system to

cool the hot coke

The hot gas is then reused to create electricity

As a result of CDQ:

Waste heat energy is recycled to generate

electricity, saving money and reducing carbon

emissions

Water is not wasted

Water is not contaminated with toxic pollutants

Air pollutants are not released

High Temperature CDQ Expansion Joints are critical components in the system that can

withstand expansion, contraction, and lateral movements due to high temperature, high

pressure and highly corrosive conditions

14

CDQ Systems Reduce Costs and Pollutants

Coke Dry Quenching

Coke Wet Quenching

Electricity from Waste Heat

167 GwH/Yr(1)

0 GwH/Yr(1)

Electricity Savings

$9,260,630 (2)

0

Water Used

0

3,723,000 tons(3)

Cost of Water

0

($1,092,826) (4)

Total Benefit/(Costs):

$9,260,630

($1,092,826)

C02 Emitted

4,328 metric tons(1)

134,646 metric tons(1)

Toxic Particles Released(1)

Hydroxybenzene

None

33 mg/m3

Cyanide

None

4 mg/m3

Sulfide

None

7 mg/m3

Ammonia

None

14 mg/m3

Coke Dust

5 mg/m3

13 mg/m3

(1)

United Nations Framework Convention on Climate Change: Baotou Iron & Steel CDQ and Waste Heat Utilization for Electricity Generation

Project , 03/08/2007. Assumption: Using two CDQ

systems: each with 25t/hr of coal capacity and 15 MW electricity generating capacity

(2)

Huaneng 2009 average sale ($0.055 /KwH )

(3)

“CDQ-Modern coking technology” by Anhui Vocational College of Metallurgy and Technology

(4)

http://price.h2o-china.com/

By installing 2 CDQ systems, a steel mill can save over $9 million in electricity, almost

4 million tons of water and prevent emission of over

100,000 mt CO 2 annually

Higher Voltage is More Energy Efficient

15

Ultra High Voltage Systems Lead to Higher Energy Efficiency

Disk Spring Bellows Expansion Joints

are needed inside the Gas Insulated

Switchgear to balance the thrust generated from internal pressure

Higher voltage systems allow more efficient

transportation of electricity and reduce the

amount of energy lost during transmission

By increasing the voltage from 500KV to

1000KV, the amount of energy lost in the

transmission process is reduced by 4 times

Higher voltage results in less power lines,

towers, and substations

Gas Insulated Switchgear is a critical part

of the ultra high voltage systems (up to and

above 1,000KV)

China is in the process of upgrading the

grid system to the higher voltage system

Transmission efficiency is improved by 4X

when voltage is doubled

Markets – Bellow Expansion Joint

16

(1)

China Bellow Industry Investment Analyst and Research Report 2010 by Zero Power Intelligence Co. ,LTD.

Overall – Metal Expansion Joints improve efficiencies, safety, and performance of the underlining systems

Coke Dry Quenching

11th Five Year Plan – Mandates the use of CDQs and the reutilization of exhaust heat in broader scope

Consolidation of China’s Steel Industry – Larger and better capitalized plants are more conscious about energy

consumption and environmental

impact

Cost Savings – Implementation of CDQ system pays back for itself in a few years, providing incentives for steel mills to

install CDQs based

purely on project economics

Gas Insulated Switchgear

High Growth in Generation Capacity – China’s power generating capacity increased from 443GW at the end of 2004

to an estimated 860GW

at the end of 2009

Adoption of Ultra High Voltage Transmission – Long distances between energy source and energy consumption site

require efficient ultra high

voltage transmission

Coke Oven

Stricter Safety Requirements – Underground coke oven gas is flammable and explosive; our connecting bend pipes

significantly reduce risk of

explosion due to greater quality and flexibility. By using our products instead of rigid elbows

companies can minimize expenses due to work stoppage and work place casualties

Demand Drivers

Metal Bellow Expansion Joints

Market Size (1) (China 2009)

$3 billion USD

Expected CAGR Growth(1)

10%

Management expects the growth rate

for CDQ and GIS joints to be

significantly higher than the overall

bellow expansion joint markets due to

their low penetration rate

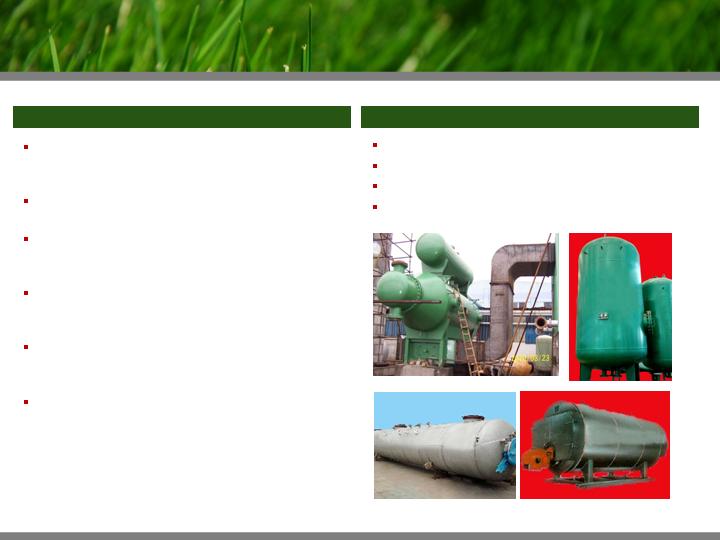

3. Pressure Vessels

17

Company Strength

Pressure Vessel License – Owns Class III A2

grade permit to manufacture products with

pressure rating of 0.1 MPA to 10 MPA

High Performance – Able to withstand high

temperature, pressure, and corrosion

Wide Product Offerings/Customization –

Various styles, shapes, and sizes built to

customer specification

Wide Industry Applications – Petroleum

refining, petrochemical, steel, electricity,

aerospace, and metallurgy industries

Stringent Testing – Utilize X-Ray, ultrasonic,

pneumatic, and hydraulic testing to ensure

quality

Product Safety – High product quality helps

to eliminate industrial accidents and associated

expenses

Heat exchangers

Storage tanks

Separators

Industrial reactors

Main Products

Markets – Metal Pressure Vessels

18

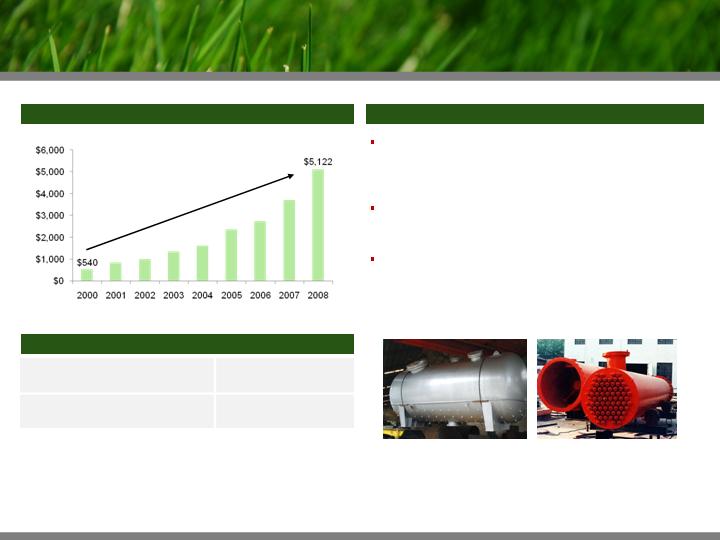

Pressure Vessels Market Size in China(1)

CAGR: 32.5%

(In Millions )

(1)

Source: China National Statistic Bureau Report 2008

(2)

China Metal Pressure Vessel Investment Analyst and Research Report (2010) by Zero Power Intelligence Co. ,LTD

Rapid Growth of Industries: High GDP growth

leads to rapid growth in China’s petroleum refining,

metallurgy, and electric generation industries,

creating demand for pressure vessels

Emphasis on Higher Efficiency: Increasing

demand for Class III pressure vessels that can

operate at higher temperature and pressure settings

Stricter Safety Requirements: Buyers place

higher emphasis on the integrity and safety of

pressure vessels, which operate in harsh conditions

Demand Drivers

Market Size - China 2009(2)

$6.6 billion USD

CAGR Growth (Next 5 Yrs) (2)

25%

2009 China Market Size and Future Growth

19

Broad Industry Applications

Wind Power

Thermoelectric Power

Coke Production

Petroleum Refinery

Steel Production

Electric Transmission

Strong & Reliable Customer Base

Repeat business from industry leaders due to our high quality products

20

Top Clients

Revenue

Description

China Guodian

$15 bn USD

One of the five largest power producers in China; engages in development,

investment, operation and management of power plants and power generation

China Huaneng

$11.2 bn USD

One of the five largest power producers in China; engages in development,

construction and operation of large power plants

Henan Pinggao

$344 mm USD

Pinggao Electric is engaged in research, development and manufacturing of

high voltage and ultra high voltage switchgear in China

Toshiba

$73.2 bn USD

Diversified manufacturer and marketer of electrical products, including

electronic components and materials, power systems, industrial and social

infrastructure systems, and household appliances.

Sinosteel

$24.7 bn USD

Engages in developing and processing of metallurgical mineral resources,

trading and logistics of metallurgical raw materials

Anshan Iron

$10.0 bn USD

The second largest steel maker in China by output with a focus on high-end

products targeted for the auto, computer, and telecommunications industries

Wuhan Iron

$7.9 bn USD

China’s first supergiant iron and steel producer with 90,000 staff and 20 million

tons of iron and steel production per year

Competitive Advantages

Cutting Edge R&D

Developed innovative products that significantly improved efficiency, safety, and performance

First domestic manufacturer in China to offer CDQ high temp bellow expansion joint of equal quality to

those offered by Nippon Steel which had previously dominated the space

Developed various new products that render older products obsolete

Low Costs

Sources directly from steel mills at large discounts to competitors, bypassing distributors

Approved for special high technology tax rate of 15%

Advanced Manufacturing Capabilities

Expertise in bending and welding thick steel plates; every welder is trained, licensed, and experienced

Utilizes welding equipments made by Panasonic and American Miller

Exceeds the requirements set by National Supervising and Testing Center with respect to appearance,

precision, rigidity, leakage, and stress

Class III A2 grade permit – highest specifications set by government

Products undergo stringent tests for defects

Protection Through Patents and Intellectual Properties

Owns patent for connecting bend pipes; in patent application process for CDQ high temp bellow

expansion joints and disk spring sleeve bellows expansion joint

Exclusively licensed to use a production method patent for lead free soft solder with mischmetal

21

Strong Organic Growth Strategies

22

Wind

Towers

Expand alongside China’s rapid growth in the wind industry

Grow existing relationships with China’s top 5 utility companies

Aggressively bid for planned projects in the home province as well as bordering provinces of

Inner Mongolia, Jilin, and Hebei

CDQ Bellows: Capture market share with high quality and low prices

GIS Bellows: Work with companies such as ABB, Toshiba, Siemens, and Henan Pinggao to capture

large market share

Connecting Pipes: Capture market share by replacing existing rigid coke oven elbows

Leverage growth in the petroleum refining, metallurgy, and electricity generation industries

Introduce new product lines that can withstand higher levels of temperature, pressure, and

corrosivity

Metal

Expansion

Joints

Pressure

Vessels

Utilize technological know-how for developing new products that promote:

Renewable energy generation

Reduction of air, water, and land pollution

Increased efficiency in underlining systems

New

Products

Continue to leverage the fast growing markets and capture market share by offering

innovative, high quality products

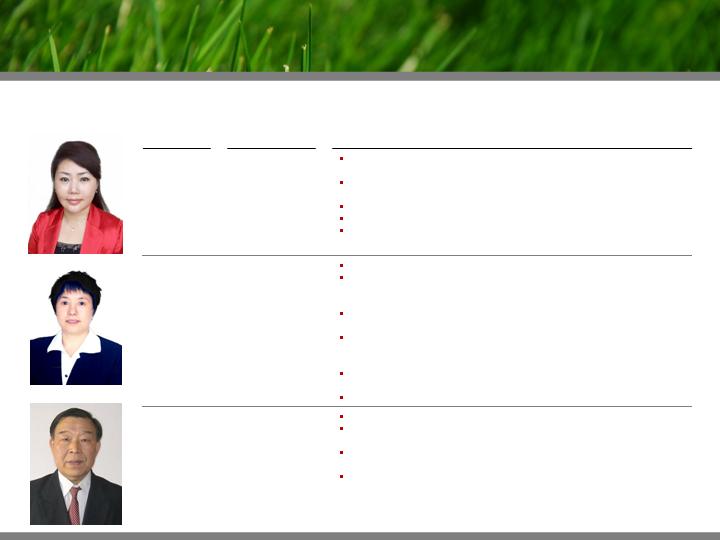

Results Driven Management Team

Name

Title

Experience

Bei Lu

Founder,

Chairman and

CEO

Founder of the company, appointed Director, Chairman and CEO in

September 2007

Served as General Manager of Shenyang Xinxingjia Bellows Manufacture

Co., Ltd. from September 1993 to July 2007

Selected as National Excellent Professional Manager

Designed many patented products in the bellows expansion joint industry

Bachelor’s degree from Shenyang University of Technology in 1992

Guifu Li

Chief Financial

Officer, CPA

Joined in March 2010 as Chief Financial Officer

Served as CFO of Shenyang Astron Mining Industries Ltd, a subsidiary of

Astron Limited (publicly traded Australian mining company) from August

2008 to August 2009

Served as Vice President of Liaoning Energy Conservation Material

Company from March 2001 to December 2003

Served as Financial Controller of Shenyang Economic and Technological

Development Zone Thermoelectric Company from January 2004 to July

2008

Served as accountant and CFO of Shenyang Cable Co., Ltd from

September 1970 to February 2001

Graduated from Dongbei University of Finance and Economics in 1976

Lige Zheng

Chief Operating

Officer

Joined in June 2008 as Chief Operating Officer

Served as Vice President of Dalian Baifute Cable Company from June

2005 to June 2008

Served as Vice General Manager at Shenyang Cable Co., Ltd. from

January 1974 to June 2005,

Graduated from Shenyang College of Finance and Economics in 1986

Strong industry experience - founders & managers own 65% of the Company

23

Capital Structure and Financials

Total Management Commitment:

Entire management team and insiders (67% of shares outstanding) entered into 3 year

share lockup agreements restricting share sales

Completed oversubscribed and upsized $10 Million PIPE Financing in July 2010 led

by Apollo Management and Witter Asset Management

24

CAPITAL STRUCTURE:

Basic shares outstanding:

22,463,333

Fully diluted shares outstanding:

23,296,666

Total Management/Insider shares (3 year lockup):

15,122,000

Management/Insider %

67.32%

FINANCIALS:

2009A

2010E

2011E

Revenue:

$2,730,954

$21,960,672

$60,270,863

Net Income:

$831,365

$4,277,593

$11,611,591

VALUATION:

2009A

2010E

2011E

EPS(fully diluted):

$0.04

$0.18

$0.50

EPS Increase:

-

415%

171%