Attached files

| file | filename |

|---|---|

| 8-K - Yinfu Gold Corp. | e92rform8k15june20101.htm |

1

2

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Joyous Fame International Limited

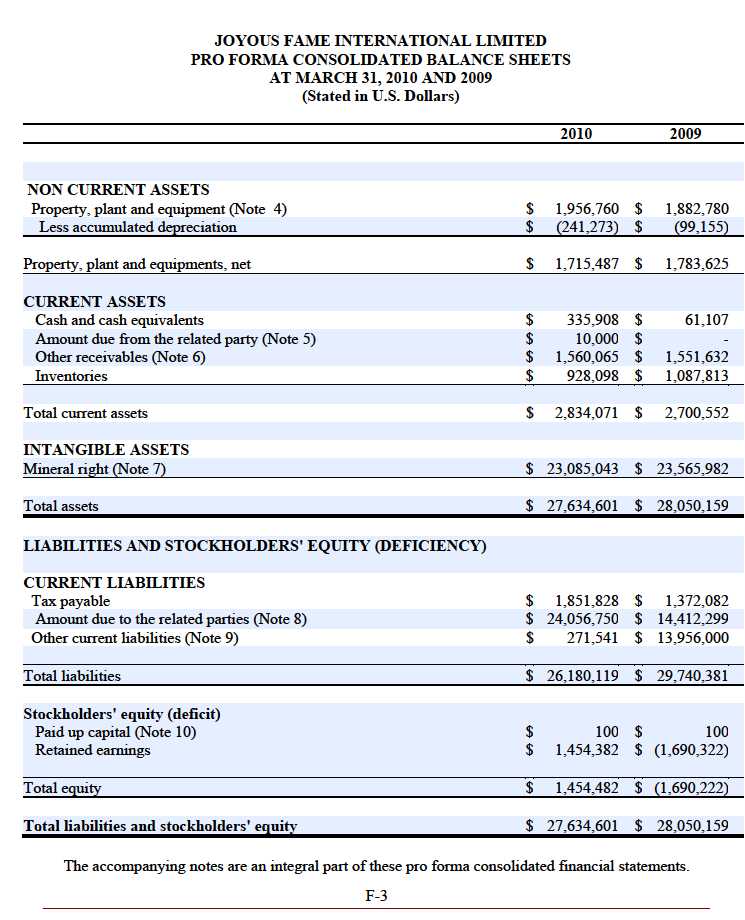

We have reviewed the accompanying pro forma consolidated balance sheets of Joyous Fame International Limited (the Company ) and its subsidiaries (hereafter collectively as the Group ) as at March 31, 2010 and 2009 and the related pro forma consolidated statements of operations and cash flows for the years then ended March 31, 2010 and 2009, and stockholders equity (deficiency) for the cumulative period from January 18, 2008 (date of incorporation) to March 31, 2010 (the Pro Forma Financial Information ), which has been prepared by the directors of the Company for illustrative purposes only.

It is the responsibility solely of the directors of the Company to prepare the Pro Forma Financial Information in accordance in accordance with the standards of the Public Company Accounting Oversight Board (United States).

The Pro Forma Financial Information has been prepared based on the individual audited financial statements of the Group for the years ended March 31, 2010 and 2009 prepared in accordance with International Financial Reporting Standard and the applicable rules and regulation issued by Public Company Accounting Oversight Board, with no adjustment made thereon. The Underlying Financial Statements for each of the years ended March 31, 2010 and 2009 were audited by Parker Randall CF (H.K.) Limited.

Our work to the Pro Forma Consolidated Financial Statement consisted primarily of comparing the unadjusted financial information with source documents, considering the evidence supporting the adjustments and discussing the Pro Forma Financial Information with the directors of the Company.

We planned and performed our work so as to obtain the information and explanations we considered necessary in order to provide us with sufficient evidence to give reasonable assurance that the Pro Forma Financial Information has been properly compiled by the directors of the Company on the basis stated, that such basis is consistent with the accounting policies of the Company and that the adjustments are appropriate for the purpose of the Pro Forma Financial Information.

Based on our review, nothing has come to our attention that causes us to believe that the Pro Forma Financial Information does not present fairly, in all material respect of the financial position of the Group as at March 31, 2010 and 2009 in accordance with International Financial Reporting Standard and the applicable rules and regulation issued by Public Company Accounting Oversight Board.

Parker Randall CF (HK) Limited

June 12, 2010

F-2

3

4

5

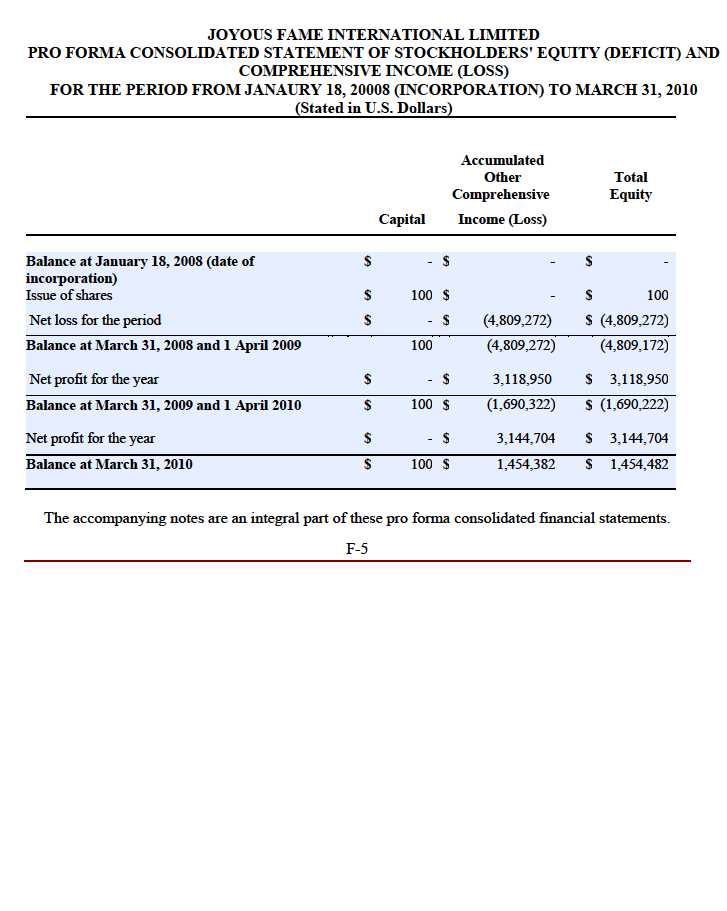

6

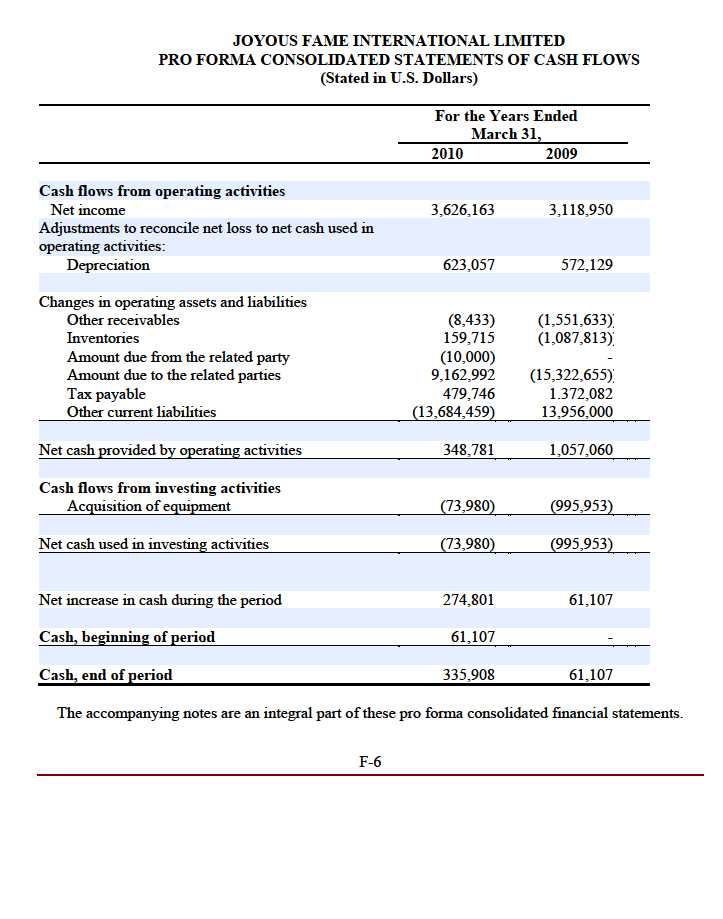

7

JOYOUS FAME INTERNATIONAL LIMITED

NOTES TO PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2010

(Stated in U.S. Dollars)

NOTE 1 ORGANIZATION AND BASIS OF PRESENTATION

Nature of Operations

Joyous Fame International Limited (the Company ) was incorporated in the British Virgin Islands on January 18, 2008. The registered office is P.O.Box 957, Offshore Incorporation Centre, Road Town, Tortola, British Virgin Islands. The principal activity of the Company is investment holding.

The Company acquired the entire interest of Yin Fu International Group Limited ( Yin Fu Int l ) on February 24, 2010, a company incorporated in Hong Kong. The principal activity of the Yin Fu Int l is investment holding.

Upon completion of the reorganization, Yin Fu Int l will acquire Penglai Yinfu Mining Consulting Company Limited, Yantai Yinlong Nonferrous Metal Company Limited, Penglai Huwei Mining Investment Company Limited and Rongcheng Longmao Trading Company Limited, of which are the companies incorporate in the People s Republic of China ( PRC ), the principal activities are gold mining and exploration.

Basis of Presentation

The Pro Forma Financial Information has been prepared as if the Group had acquired its subsidiaries as at March 31, 2010 and 2009. The Pro Forma Financial Information was prepared based on the individual audited financial statements of the Group and its subsidiaries for the years ended March 31, 2010 and 2009 prepared in accordance with International Financial Reporting Standard and the applicable rules and regulation issued by Public Group Accounting Oversight Board, with no adjustment made thereon (the Underlying Financial Statements ). The Underlying Financial Statements for each of the years ended March 31, 2010 and 2009 were audited by Parker Randall CF (H.K.) Limited.

The Pro Forma Financial Information have been presented on the basis that the Company and its subsidiaries (hereafter collectively as the Group ) through out the reporting period of these financial statements. However, the major operating entity, Penglai Huwei Mining Investment Company Ltd only became indirectly wholly owned subsidiary after the reporting period in early June 2010 and the other operating subsidiary, Rongcheng Longmao Trading Company Ltd., is still in the process of being acquired at the date of these pro forma consolidated financial statements.

The comparative figures for the year ended March 31, 2009 relate only to Penglai Huwei Mining Investment Company Limited being the only Company operating during this period.

8

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Method of Accounting

The Group maintains its general ledger and journals with the accrual method accounting for financial reporting purposes. The consolidated financial statements and notes are representations of management. Accounting policies adopted by the Group conform to generally accepted accounting principles in the United States of America ( US GAAP ) and have been consistently applied in the presentation of financial statements, which are compiled on the accrual basis of accounting.

Principles of consolidation

The pro forma consolidated financial statements include the financial statements of the Group and its subsidiaries. All significant inter-Group balances and transactions have been eliminated on the pro forma consolidation.

Use of estimates

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. These accounts and estimates include, but are not limited to, the valuation of accounts receivable, inventories, deferred income taxes and the estimation of useful lives of property, plant and equipment. Actual results could differ from those estimates.

Economic and political risks

The Group s operations are conducted in Hong Kong and the PRC. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Group s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

Concentration of risk

The Group had the concentration risk in excess of 50% of the total revenue with a single customer for the year ended March 31, 2010 and 2009.

Cash and cash equivalents

The Group only maintains cash in the Hong Kong and the PRC. The Group does not maintain any bank accounts in the United States of America. At March 31, 2010, the Group had US$335,908 in cash equivalents.

9

Foreign currency translation

The functional currency of Joyous Fame International Limited and Yin Fu International Company Limited are Hong Kong dollars while that of Penglai Huwei Mining Investment Company Limited and Rongcheng Longmao Trading Company Limited are RMB. The Company and its subsidiaries maintain their financial statements in the functional currency. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchanges rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income for the respective periods.

For financial reporting purposes, the financial statements of the Group which are prepared using the functional currency have been translated into United States dollars. Assets, liabilities and stockholders equity are translated at the exchange rates at the balance sheet dates and revenue and expenses are translated at the average exchange rates. Any translation adjustments resulting are not included in determining net income but are included in foreign exchange adjustment to other comprehensive income, a component of stockholders equity.

| 03.31.2010 | 03.31.2009 | |

| Year end RMB : US$ exchange rate | 6.8263 | 6.8359 |

| Average yearly RMB : US$ exchange rate | 6.8311 | 6.9275 |

RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US$ at the rates used in translation.

Income tax

The Group uses the asset and liability method of accounting for income taxes pursuant to SFAS No. 109 Accounting for Income Taxes . Under the asset and liability method of SFAS 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and loss carry forwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

Comprehensive income

The Group has adopted SFAS 130, Reporting Comprehensive Income , which establishes standards for reporting and display of comprehensive income, its components and accumulated balances.

Accumulated other comprehensive income represents the accumulated balance of foreign currency translation adjustments of the Group.

10

Fair values of financial instruments

The carrying values of the Group s financial instruments, including cash and cash equivalents, prepayment, deposit and other receivables approximate their fair values due to the short-term maturity of such instruments.

It is management s opinion that the Group is not exposed to significant interest, price or credit risks arising from these financial instruments.

The Group did not have any hedging activities during the reporting period. As the functional currencies of the Group are RMB, the exchange difference on translation to US dollars for reporting purpose is taken to other comprehensive income.

Commitments and contingencies

Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

Accounts Receivable

Accounts receivable consists of amounts due from customers. The Group extends unsecured credit to its customers in the ordinary course of business but mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and determined based on management s assessment of known requirements, aging of receivables, payment history, the customer s current credit worthiness and the economic environment.

Inventories

Inventories are valued at the lower of cost or market with cost is determined on the weighted average method. Finished goods inventories consist of raw materials, direct labor and overhead associated with the mining and processing costs. In assessing the ultimate realization of inventories, the management makes judgments as to future demand requirements compared to current or committed inventory levels. The Group s reserve requirements generally increase/decrease due to management projected demand requirements, market conditions and product life cycle changes.

Fair value of Financial Instruments

The carrying values of the Group s financial instruments, including cash and cash equivalents, accounts receivables, other receivables and prepayments, short-term borrowings, accounts payables, and other accrued liabilities their fair values due to the short-term maturity of such instruments.

Intangible Assets

Intangible assets acquired and with useful live are measured initially at cost and not subject to amortization shall be tested for impairment annually or more frequently if there is indication of impairment. If the carrying amount exceeds fair value, an impairment loss should be recognized.

Subsequently reversal of a recognized impairment loss is prohibited.

11

Property, plant and equipment

Property, plant and equipment, other than construction in progress, are stated at cost less depreciation and amortization and accumulated impairment loss. Cost represents the purchase price of the asset and other costs incurred to bring the asset into its existing use. Maintenance, repairs and betterments, including replacement of minor items, are charged to expense; major additions to physical properties are capitalized.

Depreciation of property, plant and equipment is calculated to written off the cost, less their estimated residual value, if any, using the straight-line method over their estimated useful lives. The principal annual rates are as follows:

| Leasehold improvement and | |

| buildings | 20 years |

| Machineries | 10 years |

| Motor vehicle | 5 years |

| Office equipment | 5 years |

Upon sale or disposition, the applicable amounts of asset cost and accumulated depreciation are removed from the accounts and the net amount less proceeds from disposal is charged or credited to income.

Mining rights

Mining rights with definite useful lives are carried at cost less accumulated amortization and any accumulated impairment loss. Amortization is provided using the unit of production method based on the actual production volume over the estimated total proved and probable reserves of the ore mines.

Accounting for the Impairment of Long-Lived Assets

The Group adopted Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Live Assets ( SFAS 144 ), which addresses financial accounting and reporting for the impairment or disposal of long-lived assets. The Group periodically evaluates the carrying value of long-lived assets to be held and used in accordance with SFAS 144. SFAS 144 requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair market values are reduced for the cost of disposal. Based on its review, the Group believes that, as of March 31, 2010, there were no significant impairments of its long-lived assets.

12

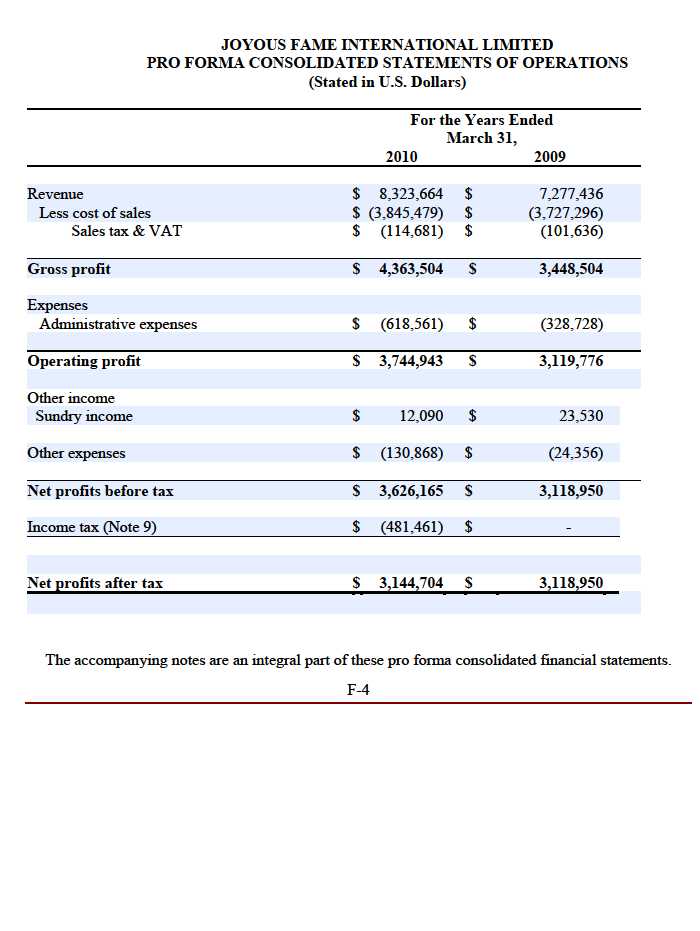

Revenue Recognition

Revenue represents the invoiced value of goods sold recognized upon the delivery of goods to customers. Revenue is recognized when all of the following criteria are met:

-

Persuasive evidence of an arrangement exists;

-

Delivery has occurred or services have been rendered;

-

The seller s price to the buyer is fixed or determinable; and

-

Collectability is reasonably assured. Payments have been established.

The return policy of goods is recognized in actual basis when the goods sold were being returned by customer then the closing balance of the period/year is actually deducted by the increment of relevant cost of sales. The sales return rate is insignificant and no such provision is required to be made accordingly.

Cost of Sales

Cost of sales are recognized on an accruals basis and are net of any VAT and primarily consist of the mining of ore, labor cost, overheads associated with the mining and processing of ore and related expenses directly attributable to the trading of gold concentrate.

Recent Accounting Pronouncements

In March 2008, the FASB issued SFAS No. 161, DISCLOSURES ABOUT DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES (an amendment to SFAS No. 133). This statement is effective for financial statements issued for fiscal year and interim periods beginning after November 15, 2008 and requires enhanced disclosures with respect to derivative and hedging activities. The Group will comply with the disclosure requirements of this statement if it utilizes derivative instruments or engages in hedging activities upon its effectiveness.

In April 2008, the FASB issued FASB Staff Position No. 142-3, DETERMINATION OF THE USEFUL LIFE OF INTANGIBLE ASSETS ( FSP No. 142-3 ) to improve the consistency between the useful life of a recognized intangible asset (under SFAS No. 142) and the period of expected cash flows used to measure the fair value of the intangible asset (under SFAS No. 141(R)). FSP No. 142-3 amends the factors to be considered when developing renewal or extension assumptions that are used to estimate an intangible asset s useful life under SFAS No. 142. The guidance in the new staff position is to be applied prospectively to intangible assets acquired after December 31, 2008. In addition, FSP No.142-3 increases the disclosure requirements related to renewal or extension assumptions. The Group does not believe implementation of FSP No. 142-3 have a material impact on its financial statements.

In May 2008, the FASB issued statement No. 162, THE HIERARCHY OF GENERALLY ACCEPTED ACCOUNTING PRINCIPLES. This statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (GAAP) in the United States (the GAAP hierarchy). This statement is effective 60 days following the SEC s approval of the Public Group Accounting Oversight Board amendments to AU Section 411, the Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles .

13

In May 2008, the FASB issued FSP Accounting Principles Board ( APB ) 14-1 Accounting for Convertible Debt instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement) ( FSP APB 14-1 ). FSP APB 14-1 requires the issuer of certain convertible debt instruments that may be settled in cash (or other assets) on conversion to separately account for the liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer s non-convertible debt borrowing rate. FSP APB 14-1 is effective for fiscal years beginning after December 15, 2008 on a retroactive basis. As we do not have convertible debt at this time, we currently believe the adoption of FSP APB 14-1 will have no effect on our combined results of operations and financial condition.

In May 2008, the FASB issued Statement No. 163, ACCOUNTING FOR FINANCE GUARANTEE INSURANCE CONTRACTS - AN INTERPRETATION OF FASB STATEMENT NO. 60. The premium revenue recognition approach for a financial guarantee insurance contract links premium revenue recognition to the amount of insurance protection and the period in which it is provided. For purposes of this statement, the amount of insurance protection provided is assumed to be a function of the insured principal amount outstanding, since the premium received requires the insurance enterprise to stand ready to protect holders of an insured financial obligation from loss due to default over the period of the insured financial obligation. This Statement is effective for financial statements issued for fiscal years beginning after December 15, 2008.

In June 2008, the FASB issued FASB Staff Position Emerging Issues Task Force (EITF) No. 03-6-1, DETERMINING WHETHER INSTRUMENTS GRANTED IN SHARE-BASED PAYMENT TRANSACTIONS ARE PARTICIPATING SECURITIES ( FSP EITF No. 03-6-1 ). Under FSP EITF No. 03-6-1, unvested share-based payment awards that contain rights to receive nonforfeitable dividends (whether paid or unpaid) are participating securities, and should be included in the two-class method of computing EPS. FSP EITF No. 03-6-1 is effective for fiscal years beginning after December 15, 2008, and interim periods within those years, and is not expected to have a significant impact on the financial statements.

In April 2009, the FASB issued FSP 157-4, DETERMINING FAIR VALUE WHEN THE VOLUME AND LEVEL OF ACTIVITY FOR THE ASSET OR LIABILITY HAVE SIGNIFICANTLY DECREASED AND IDENTIFYING TRANSACTIONS THAT ARE NOT ORDERLY ( FSP 157-4 ). FSP 157-4 provides additional guidance for estimating fair value in accordance with SFAS 157 when the volume and level of activity for the asset or liability have significantly decreased. FSP 157-4 also includes guidance on identifying circumstances that indicate a transaction is not orderly. FSP 157-4 is effective for interim and annual reporting periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009. FSP 157-4 does not require disclosures for earlier periods presented for comparative purposes at initial adoption. In periods after initial adoption, FSP 157-4 requires comparative disclosures only for periods ending after initial adoption. The adoption of the provisions of FSP 157-4 is not anticipated to materially impact on the Group s results of operations or the fair values of its assets and liabilities.

In May 2009, the FASB issued SFAS No. 165, SUBSEQUENT EVENTS ( SFAS 165 ). SFAS 165 establishes general standards for accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or available to be issued and was effective for interim and annual periods ending after June 15, 2009. The adoption of SFAS No. 165 did not have an impact on the Group s results of operations or financial condition. The Group evaluated all subsequent

14

events that occurred from April 1, 2010 through June 11, 2010, inclusive, and does not found any material subsequent events are required to disclose.

In June 2009, the FASB issued SFAS No. 166 ACCOUNTING FOR TRANSFERS OF FINANCIAL ASSETS ( SFAS 166). This statement is intended to improve the relevance, representational faithfulness, and comparability of the information that a reporting entity provides in its financial reports about a transfer of financial assets; the effects of a transfer on its financial position, financial performance, and cash flows; and a transferor s continuing involvement in transferred financial assets. This Statement must be applied as of the beginning of each reporting entity s first annual reporting period that begins after November 15, 2009, and is required to be adopted by the Group in the first quarter of fiscal year 2011. Earlier application is prohibited. This Statement must be applied to transfers occurring on or after the effective date. The Group does not expect the adoption of SFAS 166 to have a material impact on the Group s financial position, results of operations and cash flows.

In June 2009, the FASB issued SFAS No.167, Amendments to FASB Interpretation No.46(R) , which is codified as ASC 810. ASC 810 amends FASB Interpretation No.46(R), Variable Interest Entities for determining whether an entity is a variable interest entity ( VIE ) and requires an enterprise to perform an analysis to determine whether the enterprise s variable interest or interests give it a controlling financial interest in a VIE. Under ASC 810, an enterprise has a controlling financial interest when it has a) the power to direct the activities of a VIE that most significantly impact the entity s economic performance and b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. ASC 810 also requires an enterprise to assess whether it has an implicit financial responsibility to ensure that a VIE operates as designed when determining whether it has power to direct the activities of the VIE that most significantly impact the entity s economic performance. ASC 810 also requires ongoing assessments of whether an enterprise is the primary beneficiary of a VIE, requires enhanced disclosures and eliminates the scope exclusion for qualifying special-purpose entities. ASC 810 shall be effective as of the beginning of each reporting entity s first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter. Earlier application is prohibited. ASC 810 is effective for the Group in the first quarter of fiscal 2011. The Group is currently evaluating the effect of ASC 810 on its financial statements and results of operation and is currently not yet in a position to determine such effects.

In August 2009, the FASB issued Accounting Standards Update ( ASU ) No. 2009-05, Measuring Liabilities at Fair Value , which is codified as ASC 820, Fair Value Measurements and Disclosures . This Update provides amendments to ASC 820-10, Fair Value Measurements and Disclosures Overall, for the fair value measurement of liabilities. This Update provides clarification that in circumstances in which a quoted price in an active market for the identical liability is not available, a reporting entity is required to measure fair value using a valuation technique that uses the quoted price of the identical liability when traded as an asset, quoted prices for similar liabilities or similar liabilities when traded as assets, or that is consistent with the principles of ASC 820. The amendments in this Update also clarify that when estimating the fair value of a liability, a reporting entity is not required to include a separate input or adjustment to other inputs relating to the existence of a restriction that prevents transfer of the liability. The amendments in this Update also clarify that both a quoted price in an active market for the identical liability at the measurement date and the quoted price for the identical liability when traded as an asset in an active market when no adjustments to the quoted price of the assets are required are Level 1 fair value measurements. ASC 820 is effective for the first

15

reporting period (including interim periods) beginning after August 28, 2009. The adoption of this Update did not have a significant impact to the Group s financial statements.

In December 2009, the FASB issued ASU No. 2009-17, Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities ( ASU 2009-17 ) . ASU 2009-17 amends the variable-interest entity guidance in FASB ASC 810-10-05-8 to clarify the accounting treatment for legal entities in which equity investors do not have sufficient equity at risk for the entity to finance its activities without financial support. ASU 2009-17 shall be effective as of the beginning of each reporting entity s first annual reporting period that begins after November 15, 2009. ASU 2009-17 is effective for the Group in the first quarter of fiscal 2011. The Group is currently evaluating the effect of ASU 2009-17 on its consolidated financial statements and results of operation and is currently not yet in a position to determine such effects.

None of the above new pronouncements has current application to the Group, but may be applicable to the Group s future financial reporting.

NOTE 3 GOING CONCERN

These pro forma consolidated financial statements have been prepared using accounting principles generally accepted in the United States of America applicable to a going-concern basis, which implies the Group will continue to realize its assets and discharge its liabilities in the normal course of business. The Group has not generated any revenues from mineral sales since inception, has never paid any dividends and is unlikely to pay dividends or generate significant earnings in the immediate or foreseeable future. The continuation of the Group as a going concern is dependent upon the continued financial support of its shareholders, the ability of the Group to obtain equity financing and the attainment of profitable operations. The Group s ability to achieve and maintain profitability and positive cash flows is dependent upon its ability to locate profitable mineral properties, generate revenues from mineral production and control production costs. Based upon its current plans, the Group may incur operating losses in future periods. The Group plans to mitigate these operating losses through controlling its operating costs, depending upon the level of exploration expenditure to be incurred. The Group plans to obtain sufficient working capital through additional debt or equity financing and private loans. At March 31, 2010, the Group had accumulated profit of $1,454,382 since inception (January 18, 2008). These factors raise substantial doubt regarding the Group s ability to continue as a going concern. There is no assurance that the Group will be able to generate significant revenues in the future or be successful with any financing ventures. These pro forma consolidated financial statements do not give any effect to any adjustments that would be necessary should the Group be unable to continue as a going concern and therefore be required to realize its assets and discharge its liabilities in other than the normal course of business and at amounts different from those reflected in the accompanying pro forma consolidated financial statements.

16

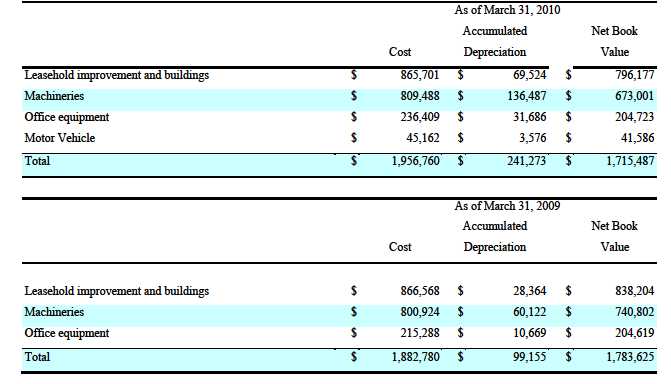

NOTE 4 PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment primarily consist of mining and processing facilities in the two operating subsidiaries and are summarized as follows:

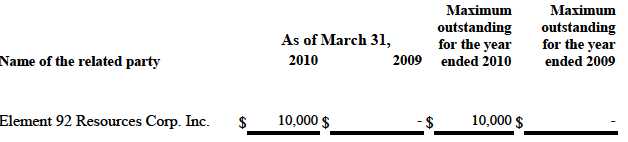

NOTE 5 AMOUNT DUE FROM THE RELATED PARTY

Elements 92 Resources Corp. Inc. is the ultimate shareholder of the Company upon the completion of the re-organization. The amount due from the related party is interest free and repayable on demand.

17

NOTE 6 OTHER RECEIVABLES

The aging analyzed of other receivables as of March 31, 2010 and 2009 are summarized as follows:

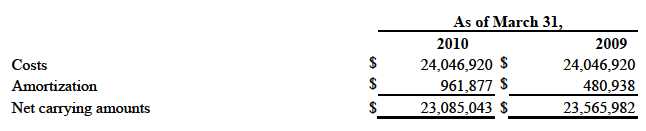

NOTE 7 MINERAL RIGHT

The Group had acquired the extraction right on the mining wells located in Penglai City Shandong Province PRC on the 5 year re-newel terms subject to governmental review on the environment. The mineral right had been record with historical cost. The amortization is provided using the unit of production method based on the actual production volume over the estimated total proved and probable reserves of the ore mines. As at March 31, 2010 and 2009, the mineral right had approximately to its fair value according to the fair value assessment. The valuations were carried out by an independent firm of surveyors, Asset Appraisal Ltd., who have among their staff Fellows of the Hong Kong Institute of Surveyors and qualified PRC appraiser with recent experience in the location and category of property being valued.

18

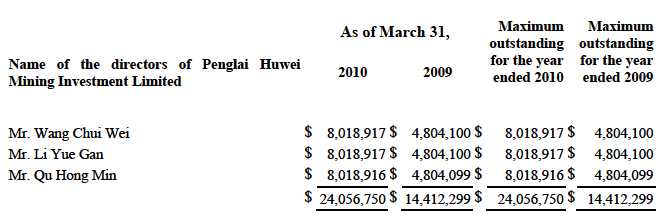

NOTE 8 AMOUNT DUE TO RELATED PARTIES

The amount due to the directors of Penglai Huwei Mining is interest free and repayable on demand.

NOTE 9 OTHER CURRENT LIABILITIES

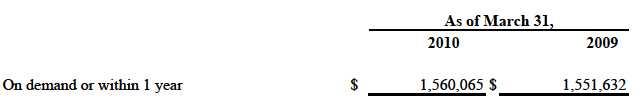

The aging analyzed of other current liabilities as of March 31, 20010 and 2009 are summarized as follows:

NOTE 10 CAPITAL STOCK Stock Transactions

On January 18, 2008(the date of incorporation) of the Company, it had issued 100 Units at a price of $1.00 per unit for total proceeds of $100.

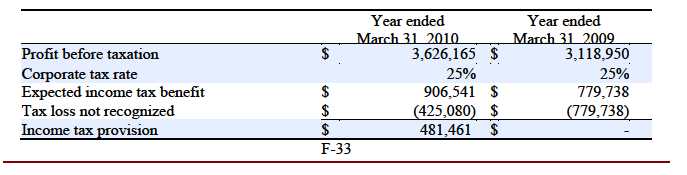

NOTE 9 - INCOME TAXES

Income tax expense has been recognized for the year ended March 31, 2010 base on the income tax rate 25% on the profit before tax.

The actual income tax expense differs from the expected amounts calculated by applying the income tax rates applicable in each jurisdiction to the Group s profit before income taxes. The components of these differences are as follows:

19

NOTE 11 SUBSEQUENT EVENTS

On June 4, 2010, the acquisition of Penglai Huwei Mining Investment Company Ltd was approved by the Administration of Industry and Commerce.

On March 31, 2010 the exploration permit held by Penglai Huwei Mining Investment Company Ltd expired and while an application for renewal has been made, as of the date of these pro forma financial statements no renewal has been received from the Ministry of Land and Natural Resources.

As of the date of these pro forma consolidated financial statements the transfer of registered capital from the former owners of Rongcheng Longmao Trading Company Ltd to the Group of Joyous Fame International Ltd has not been approval by the Administration of Industry and Commerce, although an application has been made.

Since March 31, 2010, the mining operations of Penglai Huwei Mining Investment Company Ltd have ceased whilst negotiations were taking place for its acquisition by the Group of Joyous Fame. The mining operations will recommence once the Group of Joyous Fame has reorganized the production team. However, the processing of ore mined prior to April 1, 2010 and third party ore continued as per normal.

20