Attached files

| file | filename |

|---|---|

| EX-99.1 - FINANCIAL STATEMENTS - Yinfu Gold Corp. | e92super8k061510ex991.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 25, 2010

ELEMENT92 RESOURCES, CORP.

(Exact name of registrant as specified in Charter

| WYOMING | 333-152242 | 20-8531222 |

| (State or other jurisdiction of | (Commission File No.) | (IRS Employee Identification No.) |

| incorporation or organization) |

2510 Warren Avenue, Cheyenne, Wyoming, 82001

(Address of Principal Executive Offices)

_______________

(518) 638-8192

(Issuer Telephone number)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: Common Name of each exchange on which registered: OTC Bulletin Board

Securities registered pursuant to section 12(g) of the Act:

Common

(Title of class)

Check the appropriate box below; if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

[ ] Pre commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

[ ] Pre commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

1

AVAILABLE INFORMATION

Element92 Resources Corp. files annual, quarterly and current reports, proxy statements, and other information with the Securities and Exchange Commission (the "SEC"). You may read and copy documents referred to in this Report on Form 8-K that have been filed with the SEC at the SEC's Public Reference Room, 450 Fifth Street, N.W., Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also obtain copies of our SEC filings by going to the SEC's website at http://www.sec.gov.

2

| Definitions | |

| Board or Board of | The board of directors of the Registrant. |

| Directors | |

| BVI | The British Virgin Islands. |

| Company , we , our , | For the periods prior to the closing of the Share Exchange, references to |

| us | the Company , we , our and us refer to Joyous Fame, and |

| references to the Company , we , our and us for the periods | |

| subsequent to the closing of the Share Exchange refer to the Registrant | |

| and its subsidiaries. | |

| Element92 Resources or | Element92 Resources Corporation Inc. A corporation incorporated in the |

| Registrant | USA State of Wyoming on September 1, 2005. |

| Hong Kong | Hong Kong Special Administrative Region of the PRC. |

| HK$ | Hong Kong dollars, the lawful currency of Hong Kong. |

| Joyous Fame | Joyous Fame International Limited. A company incorporated in the BVI |

| on January 18, 2008. | |

| Joyous Fame Group | Joyous Fame International Ltd and its wholly owned subsidiaries as at |

| the date of this Current Report. | |

| MOLAR | The Ministry of Land and Natural Resources in the PRC. |

| Penglai Huwei | Penglai Huwei Mining Investment Consulting Company Limited. A |

| domestic company incorporated in the PRC on January 8, 2008. | |

| Penglai Yinfu | Penglai Yinfu Mining Consulting Company Limited. A wholly owned |

| foreign enterprise company incorporated in the PRC on October 23, | |

| 2009. | |

| Rongcheng Longmao | Rongcheng Longmao Trading Company Ltd. A domestic company |

| incorporated in the PRC on September 7, 2009. | |

| PRC or China | The People s Republic of China. |

| PRC government | The government of the PRC, including all government subdivisions |

| (including provincial, municipal and other regional and local government | |

| entities). | |

| RMB | Renminbi, the lawful currency of the PRC. |

| Rule 144A | Rule 144A of the U. S. Securities Act. |

| SAFE | State Administration of Foreign Exchange of the PRC. |

| SGE | The Shanghai Gold Exchange of the PRC. |

| State | The government authorities authorized to perform specified duties in the |

| name of the PRC according to the PRC laws, including without limitation | |

| to the National People s Congress and the State Council. | |

| The Share Exchange | The sale and purchase of the entire issued capital in Joyous Fame under |

| a sale and purchase agreement dated January 25, 2010, which was | |

| subsequently amended by a revision agreement dated March 31, 2010. | |

| Details of the Share Exchange are disclosed in Item 1.01 Entry into a | |

| Material Definitive Agreement below. | |

| Ton | A unit measurement of a metric tonne. |

| USA or U.S. | The United States of America. |

| US$ | United States dollars, the lawful currency of the USA. |

| U.S. Securities Act | The United States Securities Act of 1933, as amended. |

| Yantai Muping | Yantai Muping Investment Consulting Company Limited. A local |

| company incorporated in the PRC on February 20, 2009. | |

| Yin Fu International | Yin Fu International Group Ltd. A company incorporated in Hong Kong |

| on December 2, 2003. | |

3

Table of Contents

| Item 1.01 | Entry into a Material Definitive Agreement |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

| Share Exchange | |

| Description of the Company | |

| Management s Discussion and Analysis or Plan of Operations | |

| Mining Laws in the People s Republic of China | |

| Gold Market in the People s Republic of China | |

| Risk factors | |

| Security Ownership of Certain beneficial Owners and Management | |

| Directors and Executive Officers | |

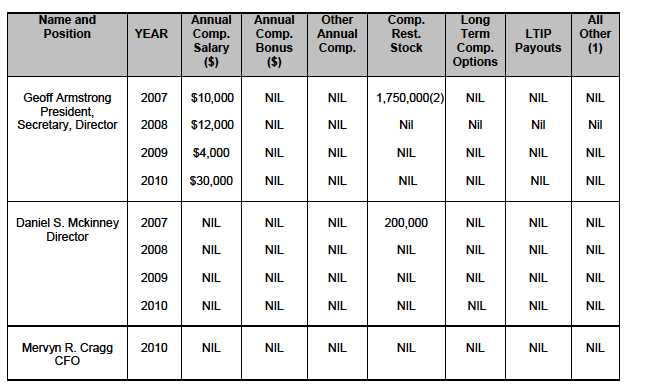

| Executive Compensation | |

| Certain Relationships and Related Transactions | |

| Item 5.01 | Changes in Control of Registrant |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain |

| Officers: Compensatory Arrangements of Certain Officers | |

| Item 5.05 | Amendments to the Registrant s Code of Ethics. |

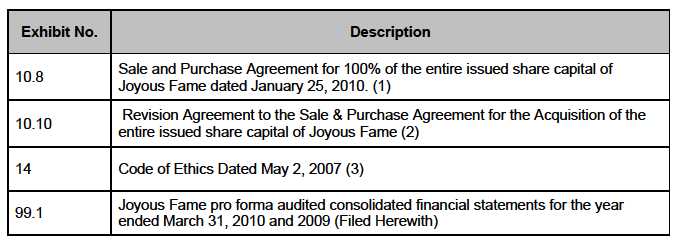

| Item 9.01 | Financial Statements and Exhibits |

4

PART I

Item 1.01 Entry into a Material Definitive Agreement.

On January 25, 2010 the Registrant, as purchaser, executed a sale and purchase agreement (the Sale and Purchase Agreement ) with the then shareholders of Joyous Fame, as vendors, for the sale and purchase of the entire issued share capital of Joyous Fame (the Share Exchange ). The consideration for the Share Exchange was the Registrant issuing and allotting 90 million restricted common shares to the shareholders of Joyous Fame (or its nominees).

On March 31, 2010, the Registrant executed a revision agreement to the Sale and Purchase Agreement (the Revision Agreement ) which amended the Sale and Purchase Agreement in which it was agreed that proposed acquisition of the Wengdeng mine would be terminated. Pursuant to the terms of the Sale and Purchase Agreement, the Registrant was to issue a total of 90 million restricted common shares as consideration for the acquisition of the three mines. Upon execution of the Revision Agreement, that number of shares to be issued by the Registrant has been reduced to 76,500,000 restricted common shares.

Upon closing of the Share Exchange under the Sale and Purchase Agreement as amended by the Revision Agreement, the shareholders of Joyous Fame transferred all their shares of Joyous Fame, representing the entire issued share capital of Joyous Fame, to the Registrant in exchange for an aggregate of 76,500,000 shares of restricted common shares of the Registrant, thus causing Joyous Fame to become a wholly-owned subsidiary of the Registrant.

In addition, pursuant to the terms and conditions of the Sale and Purchase Agreement:

-

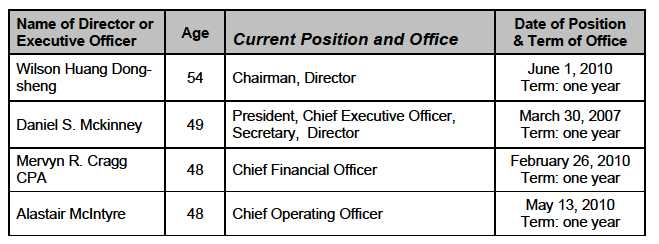

Upon closing of the Share Exchange, the Board of Directors will be reconstituted to consist initially of Wilson Huang Dong-sheng and Daniel McKinney.

-

Each of the Registrant and the then shareholders of Joyous Fame provides customary representations and warranties, closing conditions, including approval of the Share Exchange by the Board of Directors.

-

Within 60 days of closing the Share Exchange, the Registrant will initiate the change of its name to Yin Fu Gold Inc and its website to www.yinfugold.com.

As of the date of the Sale and Purchase Agreement (i.e. January 25, 2010) and the Revision Agreement (March 31, 2010) there was no material relationship between the Registrant or any of its affiliates and Joyous Fame, other than in respect of the Sale and Purchase Agreement.

The foregoing description of the Sale and Purchase Agreement and the Revision Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of these aforementioned agreements, which were filed as Exhibit 10.8 and 10.10.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Share Exchange

The Share Exchange On January 25, 2010 the Registrant executed the Sale and Purchase Agreement with the then shareholders of Joyous Fame. Subsequently, on March 31, 2010 the Revision Agreement was executed between the Registrant and the then shareholders of Joyous Fame. Upon closing of the Sale and Purchase Agreement the shareholders of Joyous Fame delivered the entire issued share capital in Joyous Fame in exchange for a controlling interest in the Registrant, resulting in Joyous Fame becoming a wholly-owned subsidiary of the Registrant.

5

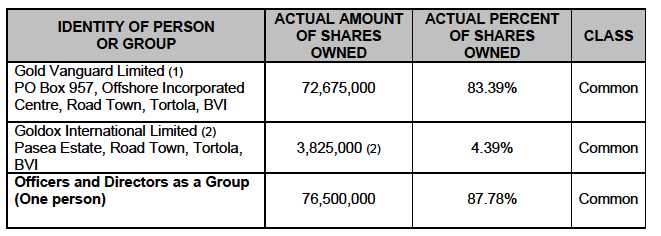

Pursuant to the Sale and Purchase Agreement, at closing, shareholders of Joyous Fame received 765,000 shares of the Registrants common stock for each issued outstanding common share of Joyous Fame. As a result, after closing, the Registrant will have issued 76,500,000 restricted shares of its common stock to the former shareholders of Joyous Fame, representing approximately 87.78% of the Registrant s then outstanding common stock.

Changes Resulting from the Share Exchange. The Registrant intends to focus its business on gold mining and exploration in the Asia Pacific region. The Registrant has relocated its executive offices to Two IFC, 19th Floor, 8 Finance Street, Central, Hong Kong. The Registrant will still retain all options to claims in the Province of Quebec, Canada and continue to develop these assets to determine whether they can be turned into commercially viable mining activities.

The Registrant announced on May 20, 2010 that it was contemplating a NASDAQ listing. The Registrant has been in discussions with NASDAQ officials based in Hong Kong in relation to the proposed listing. NASDAQ has reserved the symbol YIN for the proposed listed company as the Registrant plans to change its name to Yinfu Gold Inc shortly after closing of the Share Exchange. It should be noted that the Registrant can make no assurance that it will be able to achieve a listing on the NASDAQ exchange.

Changes to the Board of Directors. Pursuant to the terms of the Sale and Purchase Agreement, Wilson Huang Dong-sheng was appointed to the Board as a Director and Chairman of the Registrant, effective at the closing of the Share Exchange.

All directors hold office for one-year terms until the election and qualification of their successors. Officers are elected by the Board of Directors and serve at the discretion of the board of directors.

Accounting Treatment: Change of Control The Share Exchange is deemed to be a reverse merger , since the stockholders of Joyous Fame will own the majority of the outstanding shares of the Registrant s common stock immediately following the Share Exchange. Joyous Fame is deemed to be the acquirer in the reverse merger. Consequently the assets and liabilities and the operations that will be reflected in the financial statements will be those of Joyous Fame on a historical cost basis. The consolidated financial statements after completion of the Share Exchange will include the assets and liabilities of the Registrant and Joyous Fame, historical operations of Joyous Fame and of the Registrant from the closing date of the Share Exchange. Except as described in the previous paragraphs, no arrangements or understandings exist among present and former controlling stockholders with respect to the election of the Registrant s Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Registrant. Further, as a result of the issuance of the shares in the Registrant s common stock pursuant to the Share Exchange, a change in control of the Registrant occurred on the date of the consummation of the Share Exchange.

Description of the Registrant

The Registrant was incorporated in the State of Wyoming on September 1, 2005 having a fiscal year end of March 31. The Registrant was originally incorporated with the company name Ace Lock & Security. On March 5, 2007, the Registrant filed a Certificate of Amendment with the Wyoming Secretary of State changing its name to Element92 Resources Corporation Inc. and increasing its authorized capital to 100,000,000 common shares. On February 5, 2009, the Company received the trading symbol ELRE and was quoted on the OTC Bulletin Board. On March 5, 2010, pursuant to the Registrar s Articles of Amendment, the authorized capital was increased to 1,000,000,000 common shares with par value of $0.001 and this amendment was approved by the State of Wyoming. The Registrant is a start-up, exploration stage company engaged in the search for commercially viable minerals. The Registrant has optioned 14 mineral claims in the Province of Quebec, Canada. The

6

Registrant has no property other than an option to acquire the said claims. There is no assurance that a commercially viable mineral deposit, a reserve, exists on these claims or can be shown to exist until sufficient and appropriate exploration is done and a comprehensive evaluation of such work concludes that there is economic and legal feasibility. The Registrant will proceed only if minerals are found and their extraction be deemed economically feasible.

There is no assurance that a commercially viable mineral deposit exists on any the mineral claims upon which the Registrant holds an option to purchase. Extensive exploration will be required before a final evaluation as to the economic and legal feasibility of the claims is determined. Economic feasibility refers to a formal evaluation completed by an engineer or geologist which confirms that the properties can be successfully operated as a mine. Legal feasibility refers to a formal survey of the claims boundaries to ensure that all discovered mineralization is contained within these boundaries.

On April 26, 2010, the Registrant announced that it had executed a Sale and Purchase Agreement on the same date to acquire 51% of the entire issued share capital in Legarleon Precious Metal Limited ( LPM ). LPM is a company incorporated under the laws of Hong Kong which is a member of The Chinese Gold & Silver Exchange Society based in Hong Kong. As consideration for the 51% of the entire issued share capital in LPM, the Registrant will issue and allot 2 million restricted common shares to the shareholder of LPM. The closing is scheduled for June 30, 2010 and is subject to due diligence and approval by the board of The Chinese Gold & Silver Exchange Society. The Chinese Gold & Silver Exchange Society provides local and international investors with a gold market in which they can exploit gold as a vehicle of investment, speculation, hedging and arbitrage. An amended agreement was signed and closed on May 9, 2010 to acquire 28% for 1,098,000 shares with the balance of 23% scheduled to close on June 30, 2010.

Upon completion of the Share Exchange, the Registrant will focus its business activities in gold mining and exploration in the Asia Pacific region; although it will retain, and continue to assess, the commercial viability of the options to the 14 claims in the Province of Quebec, Canada.

Upon completion the Share Exchange, Joyous Fame became a wholly-owned subsidiary of the Registrant. As at the date of this Current Report, Joyous Fame indirectly owns a gold mining permit and a gold exploration permit through its wholly-owned subsidiary, Penglai Huwei. Joyous Fame will indirectly own another gold exploration permit through Rongcheng Longmao, the acquisition of the entire equity interest of which by the Joyous Fame group is still in progress.

Joyous Fame was incorporated on January 18, 2010 under the laws of the BVI as a holding company for the Yin Fu group of companies. Joyous Fame acquired all the issued shares of Yin Fu International on February 24, 2010.

Yin Fu International was incorporated on December 22, 2003 under the laws of Hong Kong in the name of Hong Kong Seagod Textile International Ltd and it changed its name to Yin Fu International Group Ltd on December 15, 2006.

Penglai Yinfu was incorporated under the laws of the PRC by Yin Fu International as a wholly foreign owned enterprise on October 23, 2009. Penglai Yinfu acquired the entire equity interest of Yantai Muping on May 21, 2010. Penglai Yinfu has filed an application to the Administration of the Industry and Commerce to change its name to Penglai Yinfu Mining Company Ltd and is pending approval for the change.

Yantai Muping was incorporated under the laws of the PRC in the Province of Shandong as a domestic company on February 20, 2009 in the name of Yantai Yinlong Nonferrous Metal Company Ltd. On May 21, 2010 its company name was changed to Yantai Muping Yinlong Investment Consulting Company Limited .

7

Penglai Huwei was incorporated under the laws of the PRC in the Province of Shandong as a domestic company on January 8, 2008.

Rongcheng Longmao was incorporated under the laws of the PRC in the Province of Shandong as a domestic company on September 7, 2009.

Acquisition of the entire equity interest in Penglai Huwei by Yantai Muping was completed and approved by the Administration of Industry and Commerce on 4 June 2010 whilst the acquisition of Rongcheng Longmao by Yantai Muping is still in process.

As at the date of this Current Report, Joyous Fame, through Penglai Huwei, indirectly owns a gold mining permit and an exploration permit. Upon completion of the acquisition of Rongcheng Longmao by Yantai Muping, Joyous Fame, through Rongcheng Longmao, will own another gold exploration permit. Details of the gold mining permit and the gold exploration permits are described under the section headed Mining Permits below.

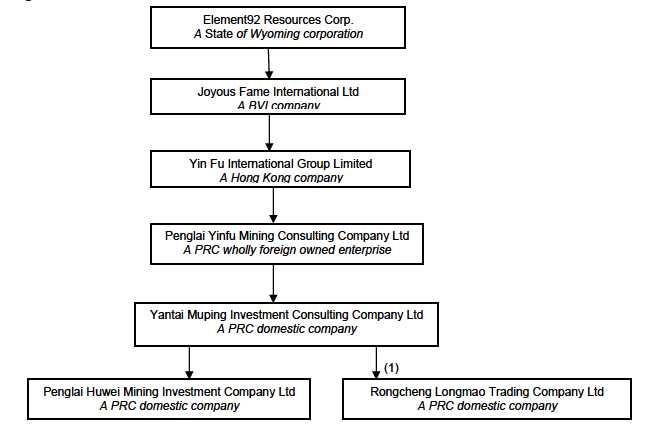

The chart below depicts the corporate structure of the Registrant, Joyous Fame and its subsidiaries upon completion of the Share Exchange and the completion of the acquisition of Rongcheng Longmao by Yantai Muping. Upon completion of the Share Exchange and the completion of the acquisition of Rongcheng Longmao by Yantai Muping, the Registrant owned 100% of the issued share capital of Joyous Fame and thus, 100% of the issued capital of Yin Fu International, and indirectly 100% of the entire equity interest in Penglai Yinfu, Yantai Muping, Penglai Huwei and Rongcheng Longmao. The Registrant has only one other subsidiary company at present being the recently incorporated Hong Kong company named Yin Fu Financial Holdings Limited (which is not shown in the below corporate chart), which was set up to hold the Registrant s investment in LPM. All significant operations will be carried out through the Registrant, Penglai Huwei and Rongcheng Longmao.

8

Note (1) The acquisition of the entire equity interest in Rongcheng Longmao by Yantai Muping is still in process as at the date of this Current Report.

DESCRIPTION OF THE BUSINESS

Management s Discussion and Analysis or Plan of Operations

The following discussion highlights the principal factors that have affected our financial condition and results of operations as well as our liquidity and capital resources for the periods described. This discussion contains forward-looking statements. Please see Special cautionary statement concerning forward looking statements and Risk factors for a discussion of the uncertainties, risks and assumptions with these forward-looking statements. The operating results for the periods presented were not significantly affected by inflation.

Company Overview

The Registrant was originally incorporated in the State of Wyoming as a for-profit company on September 1, 2005 under the name Ace Lock & Security . On March 5, 2007 the Registrant changed its name to Element92 Resources Corporation Inc. to reflect the nature of business being mineral exploration principally in the area of uranium.

Joyous Fame is an investment holding company incorporated under the laws of the British Virgin Islands on January 18, 2010. Joyous Fame does not conduct any business of its own, but rather conducts its primary business operations through Yin Fu International Group Ltd and the latter s subsidiaries established in the People s Republic of China.

Mining Permits

Penglai Huwei currently holds a mining permit conferring rights to carry out gold mining activities and an exploration permit conferring rights to carry out gold exploration activities in a mine close to the city of Penglai, in the Province of Shandong, PRC. The mining permit covers an area of 0.2224 sq km and will expire on January 22, 2015. The exploration permit covers an area of 3.40 sq km, which includes the 0.2224 sq km covered by the mining permit. The exploration permit expired on March 31, 2010 and an application of renewal has been submitted to the MOLAR. It is expected that the renewed exploration permit will only cover an area of 3.1176 sq km, as the area covered under the mining permit will be carved out.

Rongcheng Longmao currently holds an exploration permit conferring rights to carrying out gold exploration activities in a mine in Datuan of Rongcheng, in the Province of Shandong, PRC covering an area of 5.48 sq km. The permit will expire on September 30, 2011.

Whilst there is no assurance that the aforementioned permits will be renewable upon expiry, the Registrant intends to apply for the renewal of these permits upon expiry.

Existing Mining Operations in Penglai Huwei

The Penglai Gold Mine and Processing Plant are located 70 km northwest of Yantai City in the Province of Shandong in the PRC. The access to the property is by a good cement road. The mining permit was granted by the authorities at the end of 2009. The registered area is 0.2224 sq km existing in an exploration permit area of 3.4 sq km.

In the Penglai exploration area, there are 4 mineralized veins under active development (No. 1, No .2, No. 3 and No. 4). Veins No.1 and No. 3 have small scale excavation on the surface however; Vein No.

9

2 is the vein with the most active work. Vein No. 4 was previously worked by an earlier owner however they did not exploit the mineralization to its full potential. As a result, this vein is being reexamined for further potential.

The veins strike 25 degrees, dip 500-700 to southeast and lie in metamorphosed rocks altered with sericite silica and chlorite. Gold occurs in native form associated with hydrothermal veining. Associated mineralization includes galena, pyrite and chalcopyrite. The average gold grade in vein No.2 is 4.54 grams per ton with a maximum reported grade of 10.45 grams per ton. The maximum width of the vein is 3.03 m, average width of 2.04 m and is known to extend 1.5 km. In the northeast of the exploration area, the outcrop of vein No.4 can be observed in outcrop about 3m and containing high amounts of potash.

The company is building a new shaft to mine vein No. 2 and developing 4 new levels to exploit the current known mineralization. At the moment, maximum mining depth is about minus 215 m (elevation). Currently, the mill design is approved for and mining 33,000 tons per year or about 100 tons per day (which can be doubled). The average gold grade is 4.42 grams per ton and the mining recovery is 88.8%. The flotation concentrator uses machinery for sub-crushing, ball milling, mixing cage, flotation, and compression. The result is a concentrate containing roughly 30 ~ 50 grams per ton of gold, 250 grams per ton of silver and about 40% of sulfur. There is also a tailings pond on site, however a new tailings pond will be relocated southwest 2-3 km from the plant.

It is our plan to review the mine and exploration properties to increase reserves, improve mining and milling efficiencies, gold recovery and output and to develop new resources within the exploration license. The planned exploration drilling work includes new diamond drill holes to delineate Vein Nos. 2 and 3 and improve confidence in mineral resources. It is expected that the program will include up to 19 holes totalling approximately 8,070 m of drilling. Further work required includes underground surveys and re-sampling of old workings to further delineate the ore bodies.

Production and Sale of gold and by Penglai Huwei

In the years ended March 31, 2009 and 2010, Penglai Huwei s mining operations mined a total of 78,000 tons and 77,000 tons of ore respectively. During these years concentrate powder totaling 7,226 tons and 6,996 tons respectively were produced by the processing plant on site.

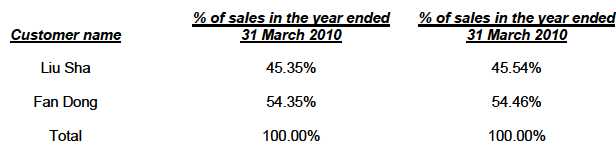

In the years ended March 31, 2009 and 2010 sales of gold amounted to 310,723 grams and 299,558 grams respectively. Sales were made to only two customers being Liu Sha and Fan Dong. The respective percentages of sales were as follows;

We acknowledge that we are over-reliant on two customers for the sales of gold concentrate produced at the Penglai Gold Mine and Processing Plant and the management will look towards increasing its customer base as production and sales start to increase in the following months and years.

10

Existing Exploration Operations in Rongcheng Longmao

The South Shijing Gold Exploration Area is located in Datuan of Rongcheng City and is accessible by dirt road. The exploration area and license is 5.48 sq km, valid from December 22, 2009 to September 30, 2011

The South Shijing Gold Exploration Area is an early stage exploration project which is currently completing exploration work to identify and define gold mineralization within the existing lease areas. A number of gold veins have been identified based on surface mapping, as well as trench sampling and limited exploration.

Our exploration interests include the East and West Exploration Areas. In the East Exploration Area, three outcrop points can be observed which define either single or multiple gold veins dipping at approximately 50 degrees to the north-northwest. In the West Exploration Area, three veins have been identified. We believe that significant exploration potential exists for both Exploration Areas. Current exploration activities are being undertaken by the No. 6 Geological Bureau of Shandong Province, Indications have been positive with samples returning maximum gold grades of about 9.4 grams per ton and the associated silver (Ag) reporting 400 grams per ton. These reports are preliminary and only represent select samples.

We are in the process of examining further exploration to better define the size of the currently identified gold veins and examine the potential acquisition of adjacent gold tenements.

Mining Laws and Regulations in the PRC

Laws and Regulations Relating to Mineral Resources

The Mineral Resources Law of the People s Republic of China (the Mineral Resources Law ) was promulgated by the Standing Committee of the National People s Congress on March 19, 1986 and became effective on October 1, 1986. On August 29, 1996 the Standing Committee of the National People s Congress amended the Mineral Resources Law. The amended Mineral Resources Law became effective on January 1, 1997.

The Mineral Resources Law and its implementation rules are as follows:

-

All mineral resources of the PRC, including such resources on the earth s surface or underground, are owned by the State. The State ownership of mineral resources shall remain unchanged notwithstanding that the ownership or the right to use the land to which such mineral resource are attached has been granted to a different entity or individual.

-

The Ministry of Land and Natural Resources (MOLAR) is responsible for the supervision and administration of the mining and exploration of mineral resources nationwide. The geology and mineral resources departments of the PRC government of the respective provinces, autonomous regions and municipalities are responsible for the supervision and administration of the exploration, development and mining of mineral resources within their respective jurisdictions.

-

Enterprises engaged in the mining or exploration of mineral resources must obtain mining and exploration permits, as the case may be, which are transferable for consideration only in certain circumstances as provided under the PRC laws, subject to approval by relevant administrative authorities. Furthermore, if mining activities involve gold resources, in accordance with the Provisions on the Administration of Obtaining the Letter of Approval for the Mining of Gold Minerals , promulgated by the National Development and Reform Commission on December 17, 2003 and became effective on January 1, 2004, the Gold

11

- Operating Permit must be obtained . The maximum validity period of the initial term of a Gold Operating Permit for a gold mine having an ore processing capacity of more than 500 tons per day, an ore processing capacity ranging from 100 tons per day to 500 tons per day and an ore processing capacity of less than 100 tons per day shall be 15 years, 10 years and 5 years, respectively.

-

MOLAR and the Geological and Mineral Resources Department of the PRC government of the provinces, autonomous regions and municipalities authorized by MOLAR are responsible for the granting of exploration and mining permits. Generally, holders of exploration permits and mining permits have those rights and obligations as prescribed by laws.

-

Anyone who exploits mineral resources must pay a resources tax and resources compensation levy in accordance with relevant regulations of the State.

The rights exercisable by the holder of an exploration permit include, among other things, the following:

| 1. |

To carry out exploration in the designated area and within the prescribed time; |

| 2. |

To have access to the exploration area and its adjacent areas; |

| 3. |

To temporarily use the land in accordance with the needs of the exploration project; |

| 4. |

To have priority in obtaining the mining right of the mineral resources as specified in the exploration permit and the exploration right of other newly discovered minerals within the designated exploration area; |

| 5. |

Upon fulfillment of the prescribed minimum expenditure requirements, to transfer the exploration right to any third party upon government approval; and |

| 6. |

To sell the mineral products extracted from the surface of the land in the exploration area, except for those mineral products which are required by the State Council to be sold to designated units. |

Meanwhile, the obligations of the holder of an exploration permit include, among other things, the following;

| 1. |

To commence and complete the exploration work within the term of the exploration permit; |

| 2. |

To carry out the exploration work in accordance with the exploration plan and to ensure no occurrence of unauthorized mining activities; |

| 3. |

To carry out integrated exploration and assessment on the mineral resources; and |

| 4. |

To submit an exploration report regarding the mineral resources to the relevant government authority for approval. |

The rights exercisable by the holder of a mining permit include, among other things, the following:

| 1. |

To engage in mining activities in the designated area and within the prescribed time; |

| 2. |

To set up ore processing facilities and amenities with the designated area; |

| 3. |

To engage in exploration and production within the vicinity of the mine as set out in the mining permit; |

| 4. |

To sell the mineral products, except for those mineral products which are required by the State Council to be sold to designated units; and |

| 5. |

To acquire the land use rights attaching to the mine. |

Meanwhile, the obligations of the holder of a mining permit include, among other things, the following;

| 1. |

To carry out mining activities in the prescribed designated area and within the term of the mining permit; |

12

| 2. |

To effectively protect and reasonably extract the mineral resources and to integrate the use of the mineral resources; |

| 3. |

To pay resource tax and resources compensation levy; and |

| 4. |

To submit a report on the utilization of mineral resources to the relevant government authority. |

Laws and Regulations Relating to Environmental Protection

The PRC government has formulated a comprehensive set of environmental protection laws and regulations that cover areas such as land rehabilitation, sewage discharge and waste disposal. The State Environmental Protection Administration Bureau regulates matters relating to environmental protection in the PRC and formulates the national standards on environmental quality and discharge of pollutants. The environmental protection departments at the county level or above are responsible for matters relating to environmental protection within their own jurisdictions.

The Environmental Protection Law of the PRC ( Environmental Protection Law ) and the Administrative Regulations on Environmental Protection for Construction Projects stipulate that prior to the construction of new production facilities or expansion or transformation of existing facilities that may cause a significant impact on the environment, a report on the environmental impact of the construction project shall be submitted to the relevant environmental protection authority. Newly constructed production facilities cannot operate until the relevant department is satisfied that such facilities are in compliance with all relevant environmental protection standards.

Pursuant to the Mineral Resources Law , Land Administration Law of the PRC and Rules on Land Rehabilitation , exploitation of mineral resources shall be conducted in compliance with the legal requirements on environmental protection so as to prevent environmental pollution. With respect to any damage caused to cultivated land, grassland or forest as a result of exploration or mining activities, mining enterprises shall restore the land to a state appropriate for use by reclamation, replanting trees or grasses or such other measures as are appropriate to the local conditions. In the event that the mining enterprise is unable to rehabilitate or the rehabilitation does not comply with the relevant requirements, the mining enterprise shall pay a fee for land rehabilitation. Upon the closure of a mine, a report in relation to land rehabilitation and environmental protection shall be submitted for approval. Enterprises that fail to perform or satisfy the requirements on land rehabilitation will be penalized by the relevant land administration authority.

The penalties for breaches of the environmental protection laws vary from warnings, fines to administrative sanctions, depending on the degree of damage. Any entity whose construction projects fail to satisfy the requirements on pollution prevention may be ordered to suspend its production or operation and be subject to a fine. The person responsible for the entity may be subject to criminal liability for serious breaches resulting in significant damage to private or public property or personal death or injury.

Laws and Regulations relating to Production Safety

The PRC government has formulated a relatively comprehensive set of laws and regulations on production safety, including the Law on Production Safety of the PRC , the Law on Mine Safety of the PRC as well as Regulations on Mine Safety and Regulations on the Monitoring of Mine Safety promulgated by the State Council, which pertain to the mining, processing and smelting operation of the mining industry. The State Administration of Work Safety is responsible for the overall supervision and management of the production safety nationwide, while the departments in charge of production safety at the county level or above are responsible for the overall supervision and management of production safety within their own jurisdictions.

13

The PRC government implements a licensing system for production safety of mining enterprises under the Regulations on Production Safety Permit . No mining enterprise may engage in production activities without holding a valid Production Safety Permit. Enterprises which fail to fulfill the production safety conditions may not carry out any production activity. Mining enterprises which have obtained the Production Safety Permits shall not lower their production safety standards, and shall be subject to the supervision and inspection of the licensing authorities from time to time. If the licensing authorities are of the opinion that the mining enterprises do not fulfill the production safety requirements, may order it to rectify within a specified period. In the event that the production safety requirements are not fulfilled after the relevant specified period, the Production Safety Permits may be withheld or revoked.

Gold Market (Global and in the PRC)

Gold Market

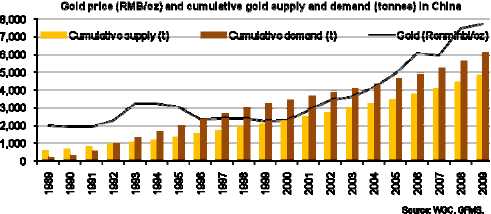

Much of the information and charts have been source through compliments of the World Gold Council ( WGC ) and statistical information from Gold Field Mineral Services ( GFMS ).

Introduction

Gold is considered a precious metal and is primarily used in the fabrication of jewelry, coinage and as a means for monetary exchange. The chemical symbol for gold is Au, derived from the Latin word for gold, Aurum. It is a naturally occurring element, with an atomic number of 79 and it is classified as a transitional metal in the Periodic Table. Among the unique physical and chemical properties of gold is that it does not corrode. Due to its superior electrical conductivity, resistance to corrosion, malleability and ductility, it is also an essential raw material in the production of electronics, such as computers and communications equipment. During times of uncertainty gold s property of financial diversification gains momentum.

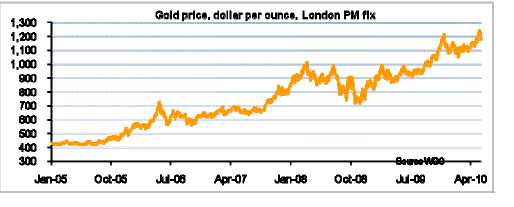

Pricing

Gold is openly traded in the over the counter OTC gold market and on various precious metal exchanges around the world. It is a very liquid commodity and trades in a very similar way to currencies such as US$/Yen and Euro/US$. The most significant markets are the London Bullion Market Association which provides twice daily reference or Fixing prices and the COMEX /NYMEX commodities and futures exchange in New York. There is no single factor in determining the price of gold. There are a number of intricately moving parts that will determine the price including microeconomic issues (supply and demand fundamentals) and macroeconomic issues (interest rates, monetary supply, US$). One of the strongest correlations to the gold price is the value of the US$. Gold has historically demonstrated an inverse relationship to the US$. Over the past 10 years, the correlation of gold to the US$ Index, a trade weighted basket of non-US currencies, was about -0.50.

14

Other pricing considerations include are trade deficits, inflation, monetary supply, long and short positions of funds and central bank sentiment.

Demand

Gold demand comes from three sources: jewelry, industry and investment. In the five years from 2005 through 2009, and according to GFMS annual demand for gold was about 3,600 tons on average. The primary source of demand comes from jewelry, accounting for 68% of total demand over the past five years. Investment demand, largely gold coins and bars and ETFs, accounted for 20% of aggregate demand during the same period. Industrial demand, which comprises electronics consumption as well as medical and dental uses, represented the remaining 12%.

Demand for gold is widely spread around the world. East Asia, the Indian sub-continent and the Middle East accounted for 70% of world demand in 2008. 55% of demand is attributable to just five countries - India, Italy, Turkey, USA and China, each market driven by a different set of socioeconomic and cultural factors. Rapid demographic and other socio-economic changes in many of the key consuming nations are also likely to produce new patterns of demand.

Jewelry consistently accounts for over two-thirds of gold demand. In the 12 months ended to December 2008, this amounted to around US$61 billion, making jewelry one of the world's largest categories of consumer goods. In terms of retail value, the USA is the largest market for gold Jewelry whereas India is the largest consumer in volume terms, accounting for 24% of demand in 2008.

Indian gold demand is supported by cultural and religious traditions which are not directly linked to global economic trends.

It should be noted, however, that the economic crisis and the consequent recessionary pressures that developed over 2007 and 2008 had a significant negative impact on consumer spending and this, in turn, resulted in the reduced volume of jewelry sales, particularly in western markets.

Generally, jewelry demand is driven by a combination of affordability and desirability by consumers, and tends to rise during periods of price stability or gradually rising prices, and declines in periods of price volatility. A steadily rising price reinforces the inherent value of gold jewelry, which is an intrinsic part of its desirability. Jewelry consumption in the developing markets was, until fairly recently, expanding quite rapidly following a period of sustained decline, although recent economic distress may have stalled this growth. But several countries, including China, still offer clear and considerable potential for future growth in demand.

Investment demand

Because a significant portion of investment demand is transacted in the over-the-counter market, it is not easily measurable. However, there is no doubt that identifiable investment demand in gold has increased considerably in recent years. Since 2003 investment has represented the strongest source of growth in demand, with an increase in the last five years in value terms to the end of 2008 of around 412%. Investment attracted net inflows of approximately US$32 billion in 2008.

There are a wide range of reasons and motivations for people and institutions seeking to invest in gold. And, clearly, a positive price outlook, underpinned by expectations that the growth in demand for the precious metal will continue to outstrip that of supply, provides a solid rationale for investment. Of the other key drivers of investment demand, one common thread can be identified: all are rooted in gold's abilities to insure against uncertainty and instability and protect against risk.

15

Gold investment can take many forms, and some investors may choose to combine two or more of these for flexibility. The distinction between buying physical gold and gaining exposure to movements in the gold price is not always clear, especially since it is possible to invest in bullion without actually taking physical delivery in the form of EFT markets, OTC or futures contracts or certificates from banks.

Industrial demand

Industrial, medical and dental uses account for around 11% of gold demand (an annual average of over 440 tons from 2004 to 2008). Gold's high thermal and electrical conductivity, and its outstanding resistance to corrosion, explain why over half of all industrial demand arises from its use in electrical components. Gold's use in medical applications has a long history and today, various biomedical applications make use of its bio-compatibility, resistance to bacterial colonization and corrosion, and other attributes. Recent research has uncovered a number of new practical uses for gold, including its use as a catalyst in fuel cells, chemical processing and controlling pollution. The potential to use nanoparticles of gold in advanced electronics, glazing coatings, and cancer treatments are nes areas of scientific research

Supply

According to GFMS the annual gold supply of gold is about 3,500 tons per year of which roughly two thirds is from newly mined production (2,500 tons). The remainder comes in the form of Central bank sales and sales of recycled gold.

Mine production

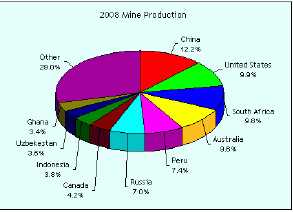

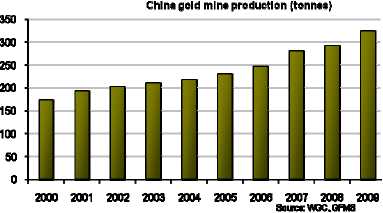

Gold is produced from mines on every continent except Antarctica, where mining is forbidden. Operations range from the tiny to the enormous and there are several hundred operating gold mines worldwide (excluding mining at the very small-scale, artisanal and often unofficial level). Today, the overall level of global mine production is relatively stable, averaging approximately 2,485 tons per year over the last five years. The majority of production comes from China, South Africa, USA, Australia and Canada. South Africa. South Africa typically was the world leader in mine production over the past 100 years however with depleting resources and increased cost of production to mine increasingly deeper deposits production has fallen from highs of 1,000 tons per year to currently around 230 tons. China is now the top producer at 314 tons per year.

New mines that are being developed are serving to replace current production, rather than to cause any significant expansion in the global total. The comparatively long lead times in gold production, with new mines often taking up to 10 years to come on stream, mean mining output is relatively inelastic and unable to react quickly to a change in price outlook. The incentives promised by a sustained price rally, as experienced by gold over the last seven years, are not therefore easily or rapidly translated into increased production.

16

Recycled gold (scrap)

Although gold mine production is relatively inelastic, recycled gold (or scrap) ensures there is a potential source of easily traded supply when needed, and this helps to stabilize the gold price. The value of gold means that it is economically viable to recover it from most of its uses; at least, that is, where it is in a form that is capable of being, if need be, extracted, then melted down, re-refined and reused. Between 2004 and 2008, recycled gold contributed an average 28% to annual supply flows.

Central banks

Central banks and supranational organizations (such as the International Monetary Fund) currently hold just under one-fifth of global above-ground stocks of gold as reserve assets (amounting to around 29,600 tons, dispersed across 110 organizations). On average, governments hold around 10% of their official reserves as gold, although the proportion varies country-by-country.

Although a number of central banks have increased their gold reserves in the past decade, the sector as a whole has typically been a net seller since 1989, contributing an average of 447 tons to annual supply flows between 2004 and 2008. Since 1999, the bulk of these sales have been regulated by the Central Bank Gold Sales Agreement (which have stabilized sales from 15 of the world's biggest holders of gold). Significantly, gold sales from official sector sources have been diminishing in recent years. Net central bank sales amounted to just 246 tons in 2008 and only 44 in 2009.

Gold production

The process of producing gold can be divided into six main phases: finding the ore body; creating access to the ore body; removing the ore by mining or breaking the ore body; transporting the broken material from the mining face to the plants for treatment; processing; and refining. This basic process applies to both underground and surface operations.

The world's principal gold refineries are based near major mining centers, or at major precious metals processing centers worldwide. In terms of capacity, the largest is the Rand Refinery in Germiston, South Africa. In terms of output, the largest is the Johnson Matthey refinery in Salt Lake City, USA.

Rather than buying the gold and then selling it onto the market later, the refiner typically takes a fee from the miner and the miner prices with a bullion bank based on the prevailing gold market. . Once refined, the bullion bars (with a purity of 99.5% or higher) are sold to bullion dealers who, in turn, trade with jewelry or electronics manufacturers or investors.

17

Chinese Gold Market

Gold plays a vital role in Chinese culture. The Chinese have a strong affinity to gold when compared with Western countries. Gold has been present in Chinese history since the time of the Han Dynasty and even today is regarded as a sign of prosperity, an ornament, a currency and an inherent part of Chinese religion. Weddings are important gold-buying occasions amongst the Chinese. Gold is also traditionally bought as a gift during the Chinese New Year.

Today, China is the second largest gold consumption market and the world s largest producer. Gold demand from China s two largest sectors, (jewelry and investment) reached a combined total of 423 tons in 2009. However, total domestic mine supply contributed only 314 tons during the same year. WGC studies indicate that in the long term, gold demand is likely to continue to accelerate, driven by investment demand in China, while current jewelry consumption is likely to continue to grow despite higher gold prices.

Gold could also gain further momentum from the liberalized Chinese gold market. The WGC believe that since the abolition of the ban on the private ownership of gold investment products in China, Chinese gold demand is catching up with Western consumption levels. This is because market liberalization tends to have a dramatic impact in a local market. In India, for example, its gold consumption more than doubled from around 300 tons in the early 1990s to over 700 tons at the end of 2008 when the liberalization process was in full swing.

Jewelry is by far the most dominant category of Chinese gold demand, accounting for almost 80% of all gold consumption in China in 2009. Chinese gold jewelry off-take increased 6% year-on-year to 347.1 tons in 2009 and China was the only country to experience an improvement in jewelry demand last year. WGC estimates that current per capita consumption of gold jewelry in China is around 0.26gram. This level is low when compared to countries with similar gold cultures.

China currently ranks fourth in annual retail investment demand in the world, behind Germany, the USA and Switzerland. Gold investment demand in China entered a new era with the opening of the Shanghai Gold Exchange in 2002. At the end of 2009, China s net retail investment in gold totaled 80.5 tons, up 22% year-on-year. Chinese consumers are typically high savers and gold investment amongst private individuals in China is developing rapidly. Going forward, WGC believes that Chinese gold investment demand could be supported by higher wealth and incomes and near-term inflationary expectations. Total gold investment demand in China has grown in line with the country s GDP and population since 2001 and this trend to be expected to continue in future. Gold s lower comparative volatility and low to negative correlations with mainstream financial asset classes make it attractive as a risk management vehicle for both institutional and retail investors in China.

18

Chinese gold consumption in industrial applications has been steadily growing over the past ten years. Nevertheless, industrial demand for gold in China has lagged behind the Western world, but it is potentially a booming market in the future owing to the ongoing rise of Chinese living standards and China s rise as the world s manufacturing centre. Electronics continues to dominate the domestic industrial demand landscape. Over the medium term, industrial demand is likely to improve as global economic conditions and Chinese exports improve. Longer term, industrial demand for gold is likely to rise following the potential launch of gold auto catalysts to reduce carbon monoxide emissions, and growth in mobile phone usage which is set to multiply among an expanding Chinese middle class.

China is the sixth largest official holder of gold, after the USA, Germany, the IMF, Italy and France. The gold reserves of the People s Bank of China, ( PBoC ) is 1.6% (low by international standards) where the majority of the country s US$2.4 trillion in total foreign exchange reserve is held in US$ Treasuries. China s foreign reserves are nearly two to 41 times the value of the G7 members total reserves at the end of 2009.

During the past decade, total Chinese gold mine output rose 84% and reached a new record in 2009 of 313.98 tons, according to China Gold Association ( CGA ). China is already the world s biggest producer and second largest consumer of gold, but has only 4% of total global gold reserves, according to the US Geological Survey (USGS) in 2009. Assuming the USGS recent figures are correct, China may exhaust existing gold mines in six years. This could occur more rapidly if demand for gold in China experiences a sudden surge from current levels. However, China s gold resources are still relatively undiscovered and could create new investment opportunities. WGC also found that the total cost of production in China has risen by more than 30% in the last six years as a result of higher input costs (such as energy and labor) and lower ore grades. Therefore, WGC believes that Chinese gold supply growth may be more challenging and is likely to decline unless there is further investment in the Chinese gold industry.

Recycled gold supply is a wildcard in China. However, WGC believes that Chinese consumers are in the process of accumulating gold, which suggests that they are less willing to sell back their holdings in response to higher gold prices. Although it is now eight years into the gold bull market, the Chinese gold industry is simply not responding fast enough to bring in new supply. These effects combined create a snowball effect in China whereby the domestic gold industry may not be able to catch up with the annual leap in local consumption. Each year, China s demand for gold continues to grow, and the gap increases between new demand and new supply. China has recently provided strong support for global gold demand during a period of weakness in other parts of the world in the gold industry.

19

Market

Prior to 2002, the PRC gold market was under the control of the PRC government s centralized purchase and allocation system. All gold reserves, as well as the sale, purchase and price of gold, were controlled by the PBOC. Jewelry manufacturing and sales were restricted to State-owned enterprises and foreign companies were prevented from participating in the local gold market. These restrictive practices resulted in limited production and consumption of gold within the PRC.

The PRC gold market has undergone significant reform over the last few years as China has deregulated the market in steps. One of these steps was to provide bullion licenses to the Big 4 banks in China Bank of China, the Industrial Commercial Bank of China, Agricultural Bank of China, and China Construction Bank. This feature permitted these banks to import and export gold and to determine the price of gold in local terms as well as in dealings with international banks. Additional features of deregulation included: (i) the establishment of the SGE in 2002 to provide liquidity to producers and consumers in China and having the principal responsibility of supervising and coordinating the trade of all gold and other precious metals for its members within the PRC. and (ii) the grant of permission to private domestic and foreign companies to enter the gold jewelry business.

Gold trading on the Shanghai Gold Exchange

The SGE is a platform for trading gold bullion and gold coins in RMB. The price of gold traded on the SGE largely converges to the price of gold in international markets. The SGE is the only legal source of VAT-free gold. Gold trading on the SGE is at the standard purities of Au9999 and Au9995. The standard weights for gold bullion bars (and coins where relevant) are 50 grams, 100 grams, 1 kilogram, 3 kilograms and 12.5 kilograms, and the unit of quotation is RMB per gram. Pricing contracts are in spot and limited future delivery contracts.

Gold trading on the SGE is settled through designated settlement banks in the PRC. The current 162 members of the SGE include qualified financial institutions and corporations that produce, smelt, process, wholesale, import and export precious metals and associated products. Some of these entities are certified as standard gold bullion production enterprises.

Legal Proceedings

The company is not a party to nor has any knowledge of any pending legal proceedings concerning the Company or any of its directors or officers.

Officers and/or Employees

The company currently has only three officers being the Chief Executive Officer, Daniel S. Mckinney, Chief Financial Officer, Mervyn R. Cragg and Chief Operating Officer, Alastair McIntyre .

As of March 31, 2010, Joyous Fame and its subsidiaries had 150 employees, all of which were employed on a full time basis and of which 25 were at the supervisory and managerial grades. To the best knowledge of the director of the company, Joyous Fame and its subsidiaries are compliant with local prevailing wage regulations and have good relations with their employees.

Competitive Advantages

The Company believes that we have the potential for future growth based on a strong core competence and management team. This can be attributive to a combination of a number of our competitive advantages:

20

| l |

The Company has close relationships with numerous provincial commercial entities and access to government authorities in China. This provides us the ability to seek out new acquisitions, obtain required permits, approvals and licenses needed to become a fully integrated gold mining company in China. |

| l |

The Company has a strong management team experienced in mining, bullion financing, trading and corporate finance. This will leverage our ability to raise debt, bonds and equity to finance further acquisitions and exploration. |

| l |

We have a core competence to effectively manage current mining and exploration properties to extract maximum value for the producing and development properties. With our new mine efficiencies and cost controls at Penglai Huwei this will increase liquidity and cash flow. |

| l |

Our management team and relationships will foster opportunity to acquire new mineral resources at competitive prices. |

| l |

Our cost of gold production is less than US$300 per ounce, well below the current global average production cost of US$485 per ounce in 2009. |

Forward-Looking Statements

This report contains forward-looking statements that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. In evaluating these statements, you should consider various factors, including the assumptions, risks and uncertainties outlined in this report under "Risk Factors". These factors or any of them may cause our actual results to differ materially from any forward-looking statement made in this annual report. Forward-looking statements in this annual report include, among others, statements regarding our capital needs; business plans; and expectations.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Some of the risks and assumptions include: our need for additional financing, our limited operating history, our history of operating losses, our exploration activities may not result in commercially exploitable quantities of ore on our mineral property, the risks inherent in the exploration for minerals such as geologic formation, weather, accidents, equipment failures and governmental restrictions, the competitive environment in which we operate, changes in governmental regulation and administrative practices, our dependence on key personnel, conflicts of interest of our directors and officers, our ability to fully implement our business plan, our ability to effectively manage our growth, and other regulatory, legislative and judicial developments.

We advise the reader that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to us or persons acting on our behalf. Important factors that you should also consider, include, but are not limited to, the factors discussed under "Risk Factors" in this report.

The forward-looking statements in this report are made as of the date of this report and we do not intend or undertake to update any of the forward-looking statements to conform these statements to actual results, except as required by applicable law, including the securities laws of the United States.

21

Fiscal year ended March 31, 2010 and 2009

The Joyous Fame group did not come into existence in its current form until recently, so all references and discussion below refer to pro forma consolidated financial statements (balance sheets, results of operations and cash flow statements) and not arising from actual consolidated financial statements.

Below we primarily refer to the results for the year ended March 31, 2010 since there was only one operating subsidiary, Penglai Huwei, in the year ended March 31, 2009. Thus, it should be highlighted that any comparative figures in the year ended March 31, 2009 are not directly comparable to the subsequent year.

Revenues: During the year ended March 31, 2010, Joyous Fame had revenues of US$8,323,664 from the sale of gold concentrate in its indirect subsidiary, Penglai Huwei, compared to US$7,277,436 in the previous year, representing an increase of 14%. This increase in revenues is largely due to the increase in global prices of gold in 2009/2010. The management of Joyous Fame will be looking at the operations of Penglai Huwei to identify ways to grow its revenue base through improvements in processing and the broadening of its customer base.

Gross Profit: Cost of sales of goods sold, which consists of costs of direct labor along with mining and processing costs were US$4,363,504 in the year ended March 31, 2010, compared to US$3,448,504 in the previous year. The improvement in gross margin is both a reflection of having one further years operations at the Penglai Gold Mine and Processing Plant (which commenced in early February 2008) along with increases in global prices for gold in 2009/2010. It is the intention of the management of Joyous Fame to look into the costs of mining and processing to see if efficiencies can be introduced into the operations of Penglai Huwei enabling margins to improve above the existing level of 52.4%.

Administration Expenses: Administration expenses totaled US$618,561 for the year ended March 31, 2010 and included costs relating to the setting up of the existing group structure and preliminary exploration costs within Rongcheng Longmao. Thus, no meaningful comparison can be made to those costs of US$328,728 incurred in the year ended March 31, 2009.

Net Profit (before tax): Joyous Fame had a net profit before tax of US$3,626,165 in the year ended March 31, 2010. The management of Joyous Fame will be looking at ways to increase the level of profitability in the operations of Penglai Huwei through investment in plant and equipment and to offset the additional exploration costs to be incurred within Rongcheng Longmao, after funding has been raised for this expenditure.

Liquidity and Capital Resources as at March 31, 2010

Cash and cash equivalents: The Joyous Fame Group had cash and cash equivalents in the amount of US$335,908 as of March 31, 2010 and improvement on the previous year by US$274,801, largely generated from the operations within Penglai Huwei.

In order to proceed with our planned investment in plant and equipment in Penglai Huwei and exploration activities in Rongcheng Longmao, we will need to raise additional capital either through loans, through equity financing or finding a joint venture partner. Unless we are able to raise additional capital or find a joint venture partner with sufficient funds there is no assurance that we will be able to maintain operations the current level of activity. Furthermore, we will be unable to invest in plant and equipment needed to improve the size and efficiency of the operations within Penglai Huwei.

Current liabilities. As of March 31, 2010, Joyous Fame had current liabilities of US$26,180,119

22

(US$29,740,381), primarily relating to funding from the former owners (and directors) of Penglai Huwei. These monies owed are unsecured, bear no interest and have no specific repayment terms.

Fiscal year ended March 31, 2010 and 2009

Net cash from operations. Joyous Fame generated positive cash flows from operations for the year ended March 31, 2010 amounting to US$348,781, significantly lower than in 2009 (US$1,057,060) due to costs relating to the setting of the Joyous Fame Group and exploration costs in Rongcheng Longmao in 2009/2010.

Net cash used in investing activities. Joyous Fame used US$73,980 in the year ended March 31, 2010 for the purchase of equipment significantly reduced from the previous year (US$995,953) since the Penglai Huwei operations were more established in 2009/2010.

Critical Accounting Policies and Estimates

The discussion and analysis of Joyous Fame s financial condition presented in this section are based upon the consolidated financial statements of Joyous Fame and its subsidiaries, which have been prepared in accordance with generally accepted accounting principles in the USA. During the preparation of the financial statements, Joyous Fame is required to make estimates and judgments, including those related to sales, bad debts, inventories, investments, fixed assets, intangible assets, income taxes and other contingencies. Joyous Fame bases its estimates on historical experience and on various other assumptions that it believes are reasonable under current conditions. Actual results may differ from these estimates under different assumptions and conditions.

In response to the SEC s Release No. 33-8040, Cautionary Advice Regarding Disclosure About Critical Accounting Policy , Joyous Fame identified the most critical accounting principles related to the use of estimates in inventory valuation, revenue recognition, income tax and the impairment of intangibles and other long-lived assets. Joyous Fame presents these accounting policies in the relevant sections in this management s discussion and analysis, including the Recently Issued Accounting Pronouncements discussed below.

Revenues and Expenses

Joyous Fame recognizes revenues when title is transferred to the customer. Since all products are sold in the domestic PRC market, revenue from products sold is recognized when delivery is made to the customer. Revenue presents the invoiced value of goods sold, net of a value added tax (VAT). All of Joyous Fame s products sold in China are subject to a Chinese VAT at a rate of 17% of the gross sale price or at a rate approved by the Chinese local government. This VAT may be offset by VAT paid by Joyous Fame on supplies of materials and services in the cost of producing the finished product. Expenses and costs are recognized on an actual basis and are net of any VAT which can be offset against VAT on sales.

Accounts Receivables

The other trade receivable of Joyous Fame consists of amounts due from customers. The Group extends unsecured credit to its customers in the ordinary course of business. An allowance for doubtful accounts is established and determined based on management s assessment of known requirements, aging of receivables, payment history, the customer s current credit worthiness and the economic environment.

23

Inventories

The inventories of Joyous Fame are recorded at the average costs of production, reduced to market value (net realizable value less a reasonable margin) when lower. Stockpiled inventories are accounted for as processed when they are removed from the mine. The cost of finished goods (gold concentrate) comprises depreciation and all direct costs necessary to convert stockpiled inventories into finished goods.

We periodically assess our inventories to identify obsolete or slow moving inventories, and if needed we recognize definitive allowances for them. As at March 31, 2010 Joyous Fame has determined that no reserves are needed.

Inflation

Joyous Fame believes that inflation has not had a material effect on its operations to date.

Income taxes

Joyous Fame uses the asset and liability method of accounting for income taxes. Under this method deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and loss carry forwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

Value Added Taxes

An indirect subsidiary of Joyous Fame sells commodities in the PRC and is thus subject to a value added tax of 17% of the gross sales price. A credit is available where VAT is paid on purchases of supplies of materials and services used in the production of this subsidiaries sale of products (gold concentrate). All other subsidiaries operating in the PRC incur VAT on the purchase of supplies of materials and services, these taxes are expensed to the income statement as incurred.

Property, plant and equipment

Property, plant and equipment of Joyous Fame are recorded at cost. We depreciate these assets on a straight line basis at annual rates which take into account the useful life s of the assets as follows: for leasehold improvements and buildings 20 years, machineries 10 years, for motor vehicles 5 years and office equipment 5 years. Expenditure for maintenance and repairs are charged to the income statement of the Company

We capitalize the costs of developing major new ore bodies or expanding the capacity operating mines and amortize these to operations on a unit-of production method based on the total probable and proven quantity of ore to be recovered. Exploration costs are expensed. Once the economic viability of mining activities is established, subsequent development costs are capitalized.

Separately acquired intangible assets are shown at historical cost. Intangible assets acquired in a business combination are recognized at fair value at the acquisition date. All our intangible assets have a definite useful lives and carried at cists less accumulated amortization, which is calculated using the straight line method over their useful lives.

24

Off-Balance Sheet Arrangements

Joyous Fame has not entered into any financial guarantees or other commitments to guarantee the payment of obligations of any third parties. Joyous Fame has not entered into any derivative contracts that are indexed to Joyous Fame s shares and classified as shareholders equity or that are not reflected in the financial statements of Joyous fame.

Recent issued Accounting Pronouncements

In March 2008, the FASB issued SFAS No. 161, Disclosures About Derivative Instruments and Hedging Activities an amendment to SFAS No. 133. This statement is effective for financial statements issued for fiscal year and interim periods beginning after November 15, 2008 and requires enhanced disclosures with respect to derivative and hedging activities. The Group will comply with the disclosure requirements of this statement if it utilizes derivative instruments or engages in hedging activities upon its effectiveness.

In April 2008, the FASB issued FASB Staff Position No. 142-3, Determination of the Useful Life of Intangible Assets ( FSP No. 142-3 ) to improve the consistency between the useful life of a recognized intangible asset (under SFAS No. 142) and the period of expected cash flows used to measure the fair value of the intangible asset (under SFAS No. 141(R)). FSP No. 142-3 amends the factors to be considered when developing renewal or extension assumptions that are used to estimate an intangible asset s useful life under SFAS No. 142. The guidance in the new staff position is to be applied prospectively to intangible assets acquired after December 31, 2008. In addition, FSP No.142-3 increases the disclosure requirements related to renewal or extension assumptions. The Company does not believe implementation of FSP No. 142-3 have a material impact on its financial statements.

In May 2008, the FASB issued statement No. 162, The Hierarchy of Generally Accepted Accounting Principles . This statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (GAAP) in the United States (the GAAP hierarchy). This statement is effective 60 days following the SEC s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, the Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles .

In May 2008, the FASB issued FSP Accounting Principles Board ( APB ) 14-1 Accounting for Convertible Debt instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement) ( FSP APB 14-1 ). FSP APB 14-1 requires the issuer of certain convertible debt instruments that may be settled in cash (or other assets) on conversion to separately account for the liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer s non-convertible debt borrowing rate. FSP APB 14-1 is effective for fiscal years beginning after December 15, 2008 on a retroactive basis. As we do not have convertible debt at this time, we currently believe the adoption of FSP APB 14-1 will have no effect on our combined results of operations and financial condition.

In May 2008, the FASB issued Statement No. 163, Accounting for Finance Guarantee Insurance Contracts - An Interpretation of FASB Statement No.60. The premium revenue recognition approach for a financial guarantee insurance contract links premium revenue recognition to the amount of insurance protection and the period in which it is provided. For purposes of this statement, the amount of insurance protection provided is assumed to be a function of the insured principal amount outstanding, since the premium received requires the insurance enterprise to stand ready to protect holders of an insured financial obligation from loss due to default over the period of the insured financial obligation. This Statement is effective for financial statements issued for fiscal years beginning after December 15, 2008.

25

In June 2008, the FASB issued FASB Staff Position Emerging Issues Task Force (EITF) No. 03-6-1, Determining whether Instruments Granted in Share-Based Payment Transactions are Participating Securities ( FSP EITF No. 03-6-1 ). Under FSP EITF No. 03-6-1, unvested share-based payment awards that contain rights to receive nonforfeitable dividends (whether paid or unpaid) are participating securities, and should be included in the two-class method of computing EPS. FSP EITF No. 03-6-1 is effective for fiscal years beginning after December 15, 2008, and interim periods within those years, and is not expected to have a significant impact on the financial statements.

In April 2009, the FASB issued FSP 157-4, Determining Fair Value When the Volume and Level of Activity for the Asset or Liability have Significantly Decreased and Identifying Transactions that are not Orderly ( FSP 157-4 ). FSP 157-4 provides additional guidance for estimating fair value in accordance with SFAS 157 when the volume and level of activity for the asset or liability have significantly decreased. FSP 157-4 also includes guidance on identifying circumstances that indicate a transaction is not orderly. FSP 157-4 is effective for interim and annual reporting periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009. FSP 157-4 does not require disclosures for earlier periods presented for comparative purposes at initial adoption. In periods after initial adoption, FSP 157-4 requires comparative disclosures only for periods ending after initial adoption. The adoption of the provisions of FSP 157-4 is not anticipated to materially impact on the Company s results of operations or the fair values of its assets and liabilities.