Attached files

| file | filename |

|---|---|

| 8-K - MID AMERICA APARTMENT COMMUNITIES INC. | v187567_8-k.htm |

NAREIT

Investor Forum June 2010 MAA Mid-America Apartment Communities

Successful

Public Company Platform MAA Sixteen Year Record of Success Top Tier Performance

for Shareholders Strong Operator; Sophisticated Platform S&P Small-Cap 600

Strong Corporate Governance Disciplined Capital Deployment Value Investor

Extensive Network & Deal Flow Proven Success with Joint Ventures Full Cycle

Performance Profile High Quality Multifamily Portfolio High Growth Sunbelt

Region Focus Young Portfolio Unique Two-Tier Market Strategy Strong Balance

Sheet Capacity to Pursue Opportunities Superior Ratios Dividend Payout Leverage

Fixed Charge 2

Focus on High

Growth Region MAA Pro-Business Environment Greater Access to Labor and Land

Strong Distribution And Logistics Structure Positive Demographic Flow Lower Cost

of Living Expanding Import/Export Activities Lower Taxes Higher Job Growth and

Household Formation Trends Port cities likely to benefit Household formation

trends in MAA markets exceed national outlook 3

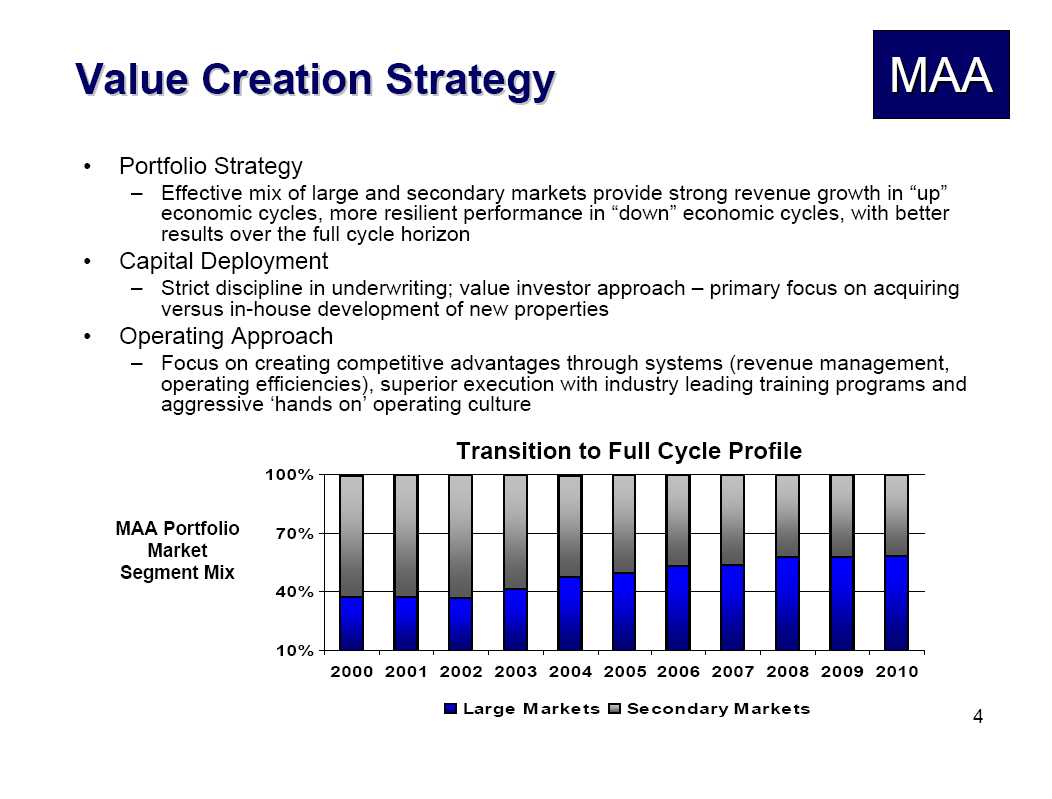

Value

Creation Strategy MAA Portfolio Strategy Effective mix of large and secondary

markets provide strong revenue growth in up economic cycles, more resilient

performance in down economic cycles, with better results over the full cycle

horizon Capital Deployment Strict discipline in underwriting; value investor

approach primary focus on acquiring versus in-house development of new

properties Operating Approach Focus on creating competitive advantages through

systems (revenue management, operating efficiencies), superior execution with

industry leading training programs and aggressive hands on operating culture

Transition to Full Cycle Profile MAA Portfolio Market Segment Mix Large Markets

Secondary Markets 4

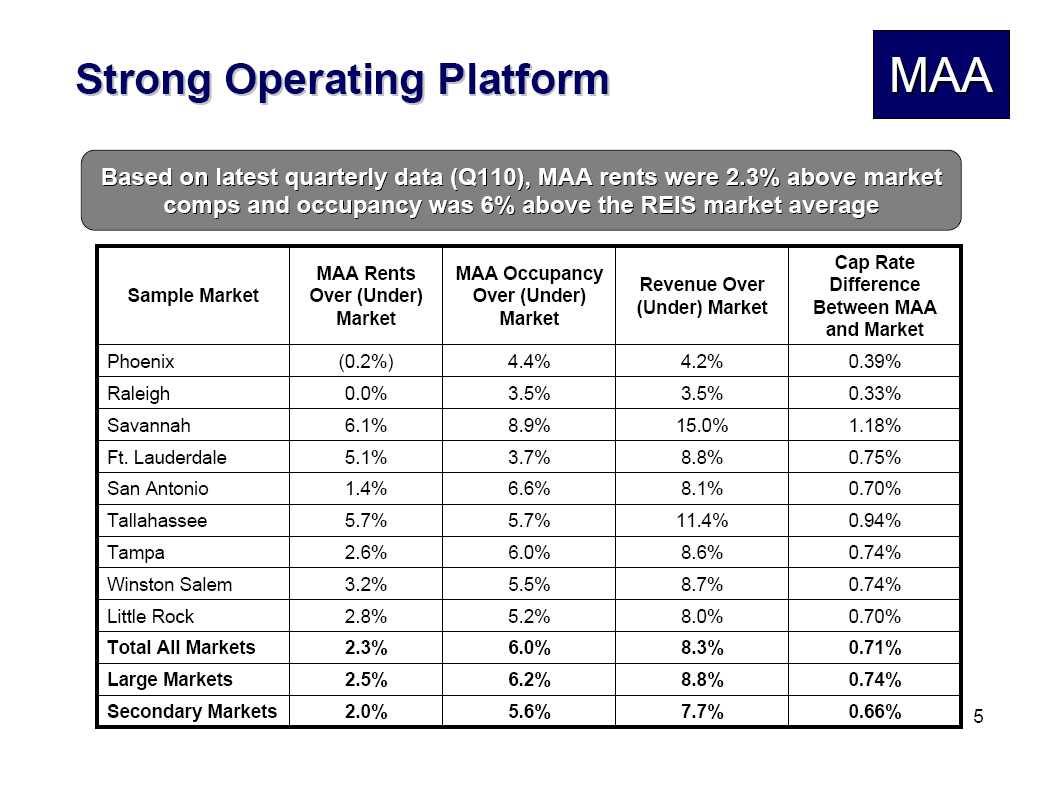

Strong

Operating Platform MMA Based on latest quarterly data (Q110), MAA rents were

2.3% above market comps and occupancy was 6% above the REIS market average

Sample Market MAA Rents Over (Under) Market MAA Occupancy Over (Under) Market

Revenue Over (Under) Market Cap Rate Difference Between MAA and Market Phoenix

(0.2%) 4.4% 4.2% 0.39% Raleigh 0.0% 3.5% 3.5% 0.33% Savannah 6.1% 8.9% 15.0%

1.18% Ft. Lauderdale 5.1% 3.7% 8.8% 0.75% San Antonio 1.4% 6.6% 8.1% 0.70%

Tallahassee 5.7% 5.7% 11.4% 0.94% Tampa 2.6% 6.0% 8.6% 0.74% Winston Salem 3.2%

5.5% 8.7% 0.74% Little Rock 2.8% 5.2% 8.0% 0.70% Total All Markets 2.3% 6.0%

8.3% 0.71% Large Markets 2.5% 6.2% 8.8% 0.74% Secondary Markets 2.0% 5.6% 7.7%

0.66% 5

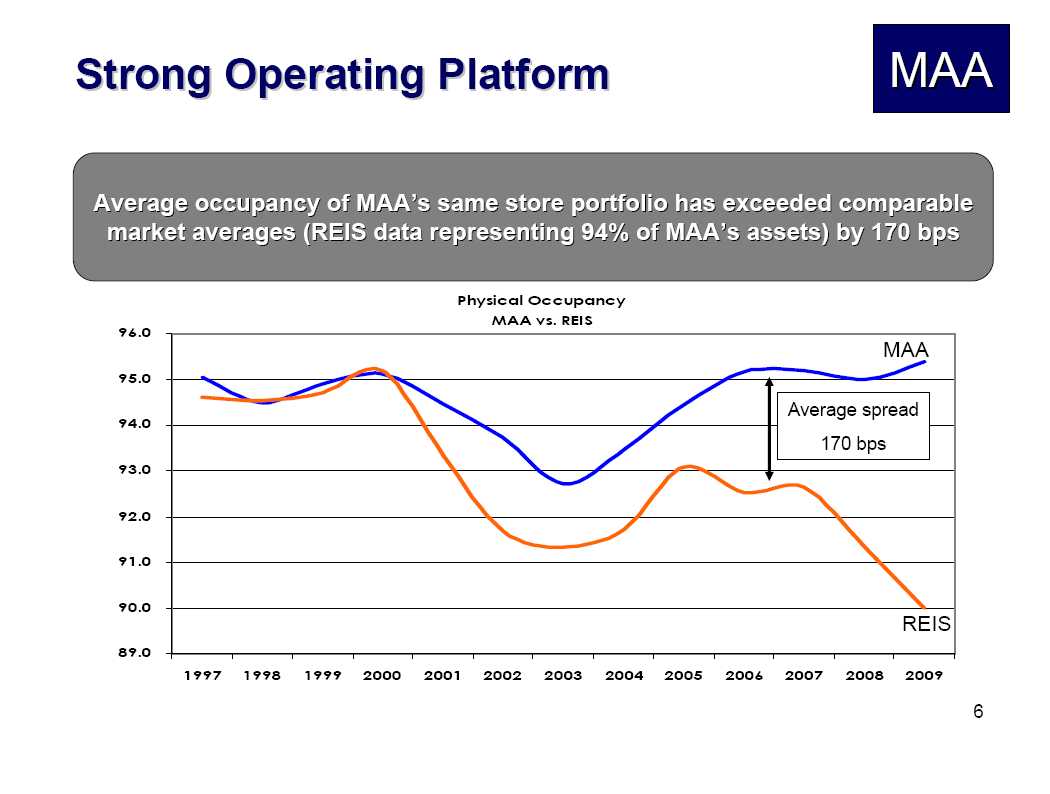

Strong

Operating Platform MAA Average occupancy of MAAs same store portfolio has

exceeded comparable market averages (REIS data representing 94% of MAAs assets)

by 170 bps Physical Occupancy MAA vs. REIS Average spread 170 bps 6

Out

Performing Sector Over Full Cycle MAA Better full cycle performance, with lower

volatility, drives stronger and more consistent long-term performance

Repositioned portfolio and strengthened platform = stronger up cycle performance

profile 2000-2010E NOI Std Dev MAA 1.0% 3.7% Sector 0.8% 5.3% Same Store NOI

Growth 2004-2010E NOIStd Dev MAA 2.0% 3.8% Sector 1.4% 4.9% Source: Green Street

May 10 Residential REIT Update Sector Average MAA 7

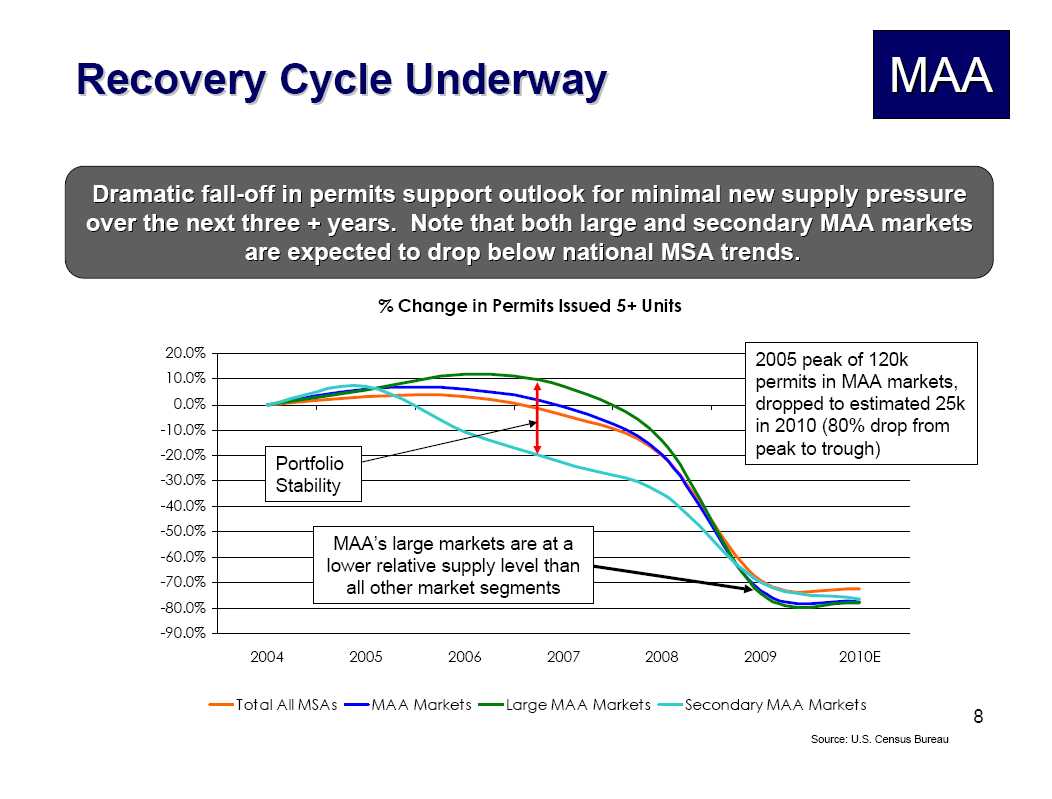

Recovery

Cycle Underway MAA Dramatic fall-off in permits support outlook for minimal new

supply pressure over the next three + years. Note that both large and secondary

MAA markets are expected to drop below national MSA trends. % Change in Permits

Issued 5+ Units Totall All MSAs MAA Markets Large MAA Markets Secondary MAA

Markets Source: 2005 peak of 120k permits in MAA markets, dropped to estimated

25k in 2010 (80% drop from peak to trough) U.S. Census Bureau 8

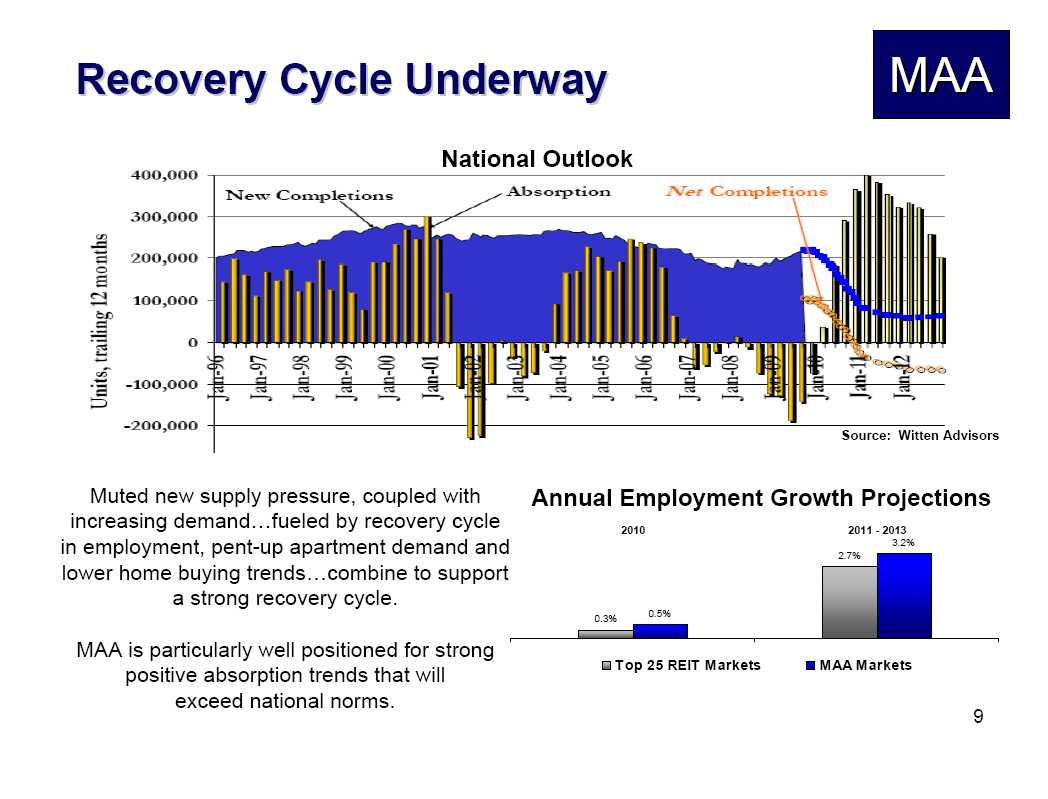

Recovery

Cycle Underway MAA National Outlook Muted new supply pressure, coupled with

increasing demandfueled by recovery cycle in employment, pent-up apartment

demand and lower home buying trendscombine to support a strong recovery cycle.

MAA is particularly well positioned for strong positive absorption trends that

will exceed national norms. Annual Employment Growth Projections Top 25 Reit

Markets MAA Markets 9

New Value

Growth Opportunities MAA Sixteen + year track record focused exclusively on

sourcing, underwriting, financing and closing on apartment properties Deal flow

has significantly increased in past 60 days Well established record of

performance for sellers; MAA active with all transaction market participants in

the region MAA is in a very strong position to execute for sellers Meaningful

relative opportunity for MAA external growth over the next few years 10

Platform

Value & Cap Rate Impact MAA Using the Q1 data discussed in slide 5, on a

typical acquisition MAA would generate additional NOI of $300-$400k per year

above market level performance At this average above market performance level,

income generated on MAA managed properties should imply a cap rate that is 71bps

lower than the market average (based on the NPV of MAA above market performance

at a 9% discount rate) Marginal NOI created by MAA, representing a cap rate

differential of 71bps Market NOI on a typical $25MM acquisition purchased at a

6% cap rate 11

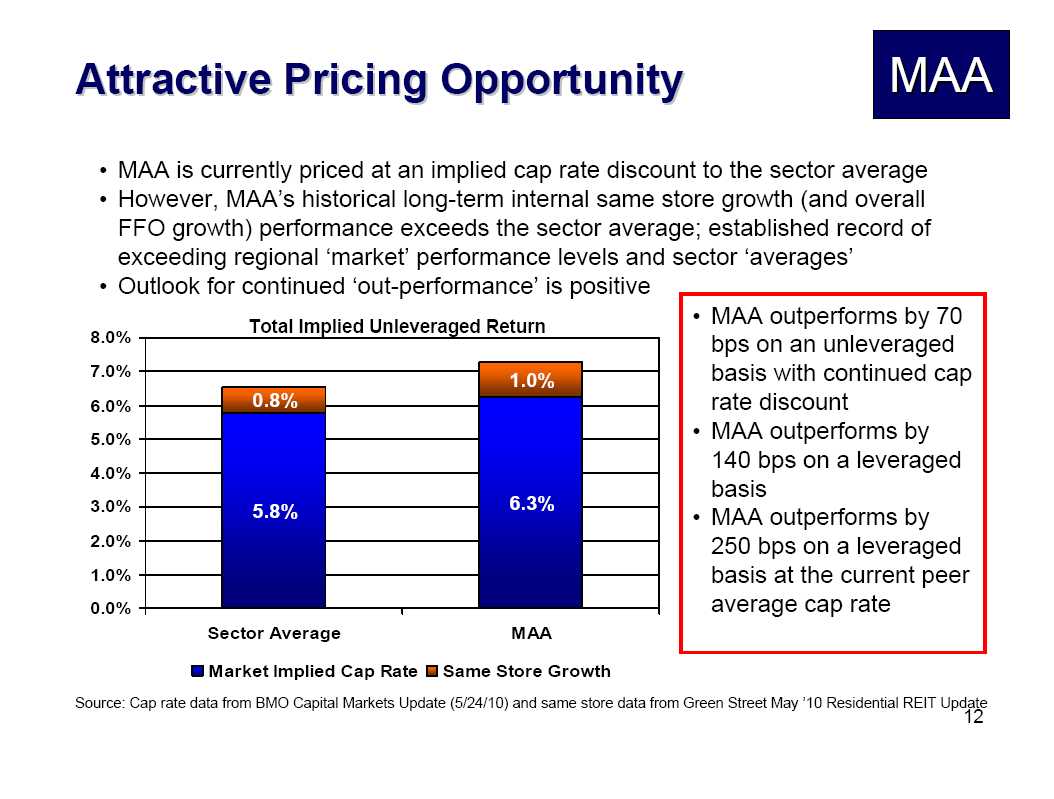

Attractive

Pricing Opportunity MAA MAA is currently priced at an implied cap rate discount

to the sector average However, MAAs historical long-term internal same store

growth (and overall FFO growth) performance exceeds the sector average;

established record of exceeding regional market performance levels and sector

averages Outlook for continued out-performance is positive Total Implied

Unleveraged Return 0.8% 5.8% 1.0% 6.3% Sector Average MAA Market Implied Cap

Rate Same Store Growth MAA outperforms by 70 bps on an unleveraged basis with

continued cap rate discount MAA outperforms by 140 bps on a leveraged basis MAA

outperforms by 250 bps on a leveraged basis at the current peer average cap rate

Source: Cap rate data from BMO Capital Markets Update (5/24/10) and same store

data from Green Street May 10 Residential REIT Update 12

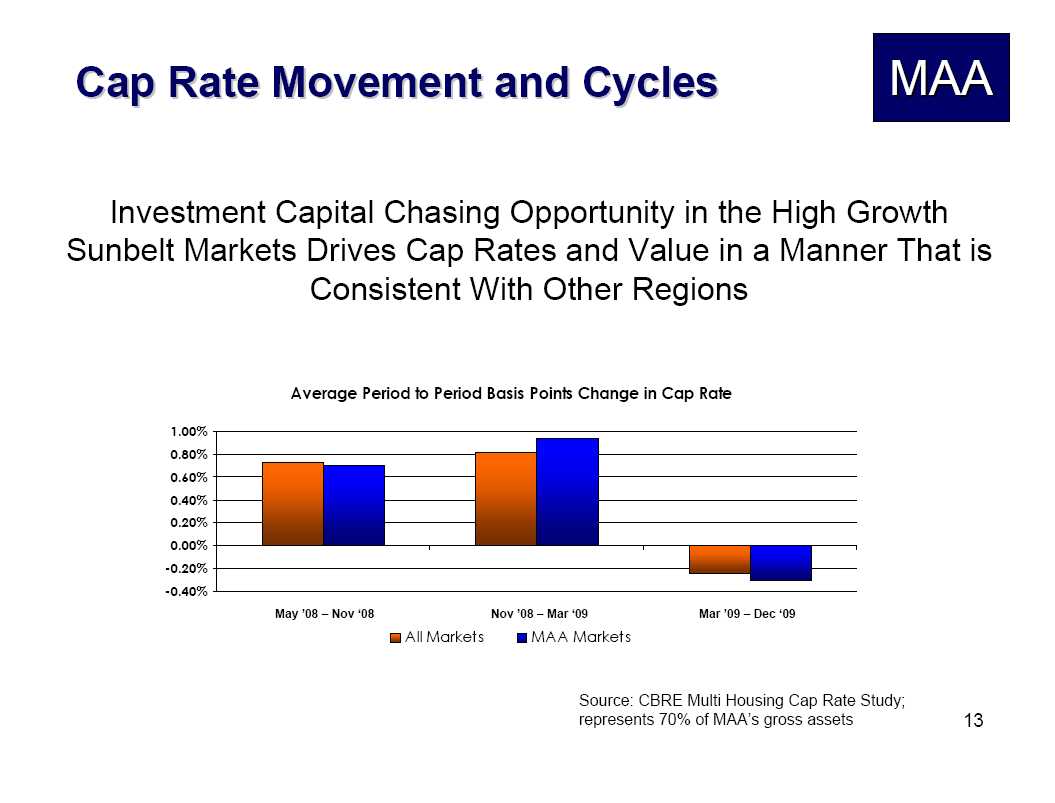

Cap Rate

Movement and Cycles MAA Investment Capital Chasing Opportunity in the High

Growth Sunbelt Markets Drives Cap Rates and Value in a Manner That is Consistent

With Other Regions Average Period to Period Basis Points Change in Cap Rate All

Markets MAA Markets Source: CBRE Multi Housing Cap Rate Study; represents 70% of

MAAs gross assets 13

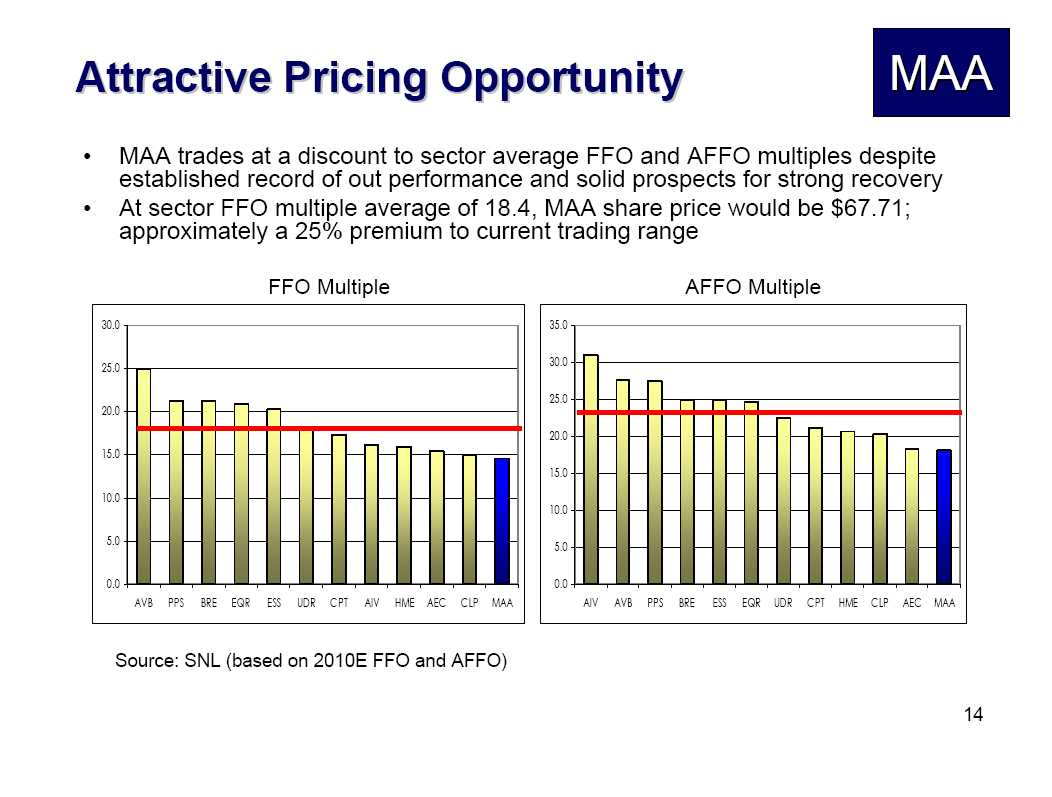

Attractive

Pricing Opportunity MAA MAA trades at a discount to sector average FFO and AFFO

multiples despite established record of out performance and solid prospects for

strong recovery At sector FFO multiple average of 18.4, MAA share price would be

$67.71; approximately a 25% premium to current trading range FFO Multiple AFFO

Multiple Source: SNL (based on 2010E FFO and AFFO) Source: SNL (based on 2010E

FFO and AFFO) AVB PPS BRE EQR ESS UDR CPT AIV HME AEC CLP MAA AVB PPS BRE EQR

ESS UDR CPT AIV HME AEC CLP MAA 14

Why Buy MAA

MAA High-growth region and strong operating platform well positioned for

recovery cycle Solid prospects for robust internal growth over the next few

years; demonstrated competitive recovery cycle performance Strong balance sheet

and extensive deal flow; well positioned to capture meaningful new growth

Dividend pay-out ratio that is better than sector average Implied cap rate

pricing compared to sector that discounts long-term historical performance and

near-term outlook FFO/AFFO multiple that discounts outlook for internal growth

and new growth as compared to sector Meaningful upside opportunity associated

with capturing sector average pricing 15

End of

Presentation MAA Mid-America Apartment Communities