Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cheniere Energy Partners, L.P. | form_8-k.htm |

Proposed Sabine Pass LNG Facility Expansion -

Adding Liquefaction Capabilities

Adding Liquefaction Capabilities

June 4, 2010

Cheniere Energy Partners / Cheniere Energy, Inc.

Forward Looking Statements

1

This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act of 1933, as amended. All statements, other than statements of historical facts,

included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

the Securities Act and Section 21E of the Securities Exchange Act of 1933, as amended. All statements, other than statements of historical facts,

included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

§ statements that we expect to commence or complete construction of a liquefaction facility by certain dates, or at all;

§ statements that we expect to receive authorization from the Federal Energy Regulatory Commission, or FERC, or the Department of Energy, or

DOE to construct and operate a proposed liquefaction facility by a certain date, or at all;

DOE to construct and operate a proposed liquefaction facility by a certain date, or at all;

§ statements regarding future levels of domestic or foreign natural gas production and consumption, or the future level of LNG imports into North

America or exports from the U.S., or regarding projected future capacity of liquefaction or regasification facilities worldwide;

America or exports from the U.S., or regarding projected future capacity of liquefaction or regasification facilities worldwide;

§ statements regarding any financing transactions or arrangements, whether on the part of Cheniere or at the project level;

§ statements regarding any commercial arrangements marketed or potential arrangements to be performed in the future, including any cash

distributions and revenues anticipated to be received;

distributions and revenues anticipated to be received;

§ statements regarding the commercial terms and potential revenues from activities described in this presentation;

§ statements that our proposed liquefaction facility, when completed, will have certain characteristics, including a number of trains;

§ statements regarding our business strategy, our business plan or any other plans, forecasts, examples, models, forecasts or objectives: any or all of

which are subject to change;

which are subject to change;

§ statements regarding estimated corporate overhead expenses; and

§ any other statements that relate to non-historical information.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,”

“expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the

expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of

this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of

factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Annual Reports on Form 10-K for

the year ended December 31, 2009, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or

persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the

date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,”

“expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the

expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of

this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of

factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Annual Reports on Form 10-K for

the year ended December 31, 2009, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or

persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the

date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

Sabine Pass to become bi-directional import/export facility

Expanding Operations - Adding Liquefaction

Compelling Proposition

Compelling Proposition

§ Market fundamentals create opportunity to expand into exports

§ Export services provide customers with an attractively priced

option to access U.S. natural gas supply

option to access U.S. natural gas supply

§ Sabine Pass facility location is strategically situated

– Many existing assets in place needed for an export terminal

reduces capital required, cost estimates comparable to liquefaction

expansion economics

reduces capital required, cost estimates comparable to liquefaction

expansion economics

– Abundance of supply and existing infrastructure in surrounding

regions, proximity to Henry Hub

regions, proximity to Henry Hub

§ Powerful tool for industry players to manage their portfolios

– Early indications of interest from both buyers and sellers of natural

gas and LNG

gas and LNG

Market Fundamentals Drive Liquefaction Project

§ The U.S. has become the largest producer of natural gas in the

world and production costs rank among the lowest

world and production costs rank among the lowest

– Productive capacity at $6.50/MMBtu could reach 95 Bcf/d by 2020

§ U.S. natural gas demand not likely to keep pace with incremental

supply as demand continues to lag market forecasts, threatening to

lead to price volatility

supply as demand continues to lag market forecasts, threatening to

lead to price volatility

§ Globally, a natural gas supply gap is projected to develop in 2014-15

– Key driver is decline of UK Continental Shelf production

– Exacerbates dependency of European consumers on imported gas

– Asian consumers highly dependent on imported LNG for gas supply

§ Simultaneously, global LNG and pipeline gas suppliers continue to

enforce oil-price indexation in new contracts

enforce oil-price indexation in new contracts

– Key markets in Asia and Europe import over 70 Bcf/d of natural gas

– Imports forecast to increase by 26 Bcf/d over the next ten years

Sources: EIA (US map graphic, pipelines and LNG terminals placed by Cheniere)

Advanced Resources Intl (Lower 48 Unconventional Recoverable Reserves), ARI shale estimates updated April 2010

Depicted Pipelines: Rockies Express, Texas Eastern, Trunkline, Transco, FGT, C/P/SESH/Gulf Crossing (as a single route)

Depicted LNG terminals: Freeport, Golden Pass, Sabine Pass, Cameron, Trunkline, Elba Island, Cove Point, Everett

366

Tcf

Tcf

1,167

Tcf

Tcf

US Proved

Reserves

Reserves

U.S. Unconventional Reserves

Basins Proximate to Premium Markets and Major Pipelines

Basins Proximate to Premium Markets and Major Pipelines

3

Project Estimates:

§ Initial Phase: 1 Bcf/d (two modular trains)

§ Second Phase: Additional 1 Bcf/d

§ Estimated capex similar to expansion

economics

economics

§ Commercial start date: 2015e

Sabine Pass LNG

Proposed Liquefaction Project - Overview

Proposed Liquefaction Project - Overview

§ Leveraging existing assets

– Large acreage position (853 acres)

• Can readily accommodate 4 liquefaction trains

(up to 2 Bcf/d capacity)

(up to 2 Bcf/d capacity)

– Existing infrastructure

• 2 docks, 4 dedicated tugs

• LNG storage tanks (5 x 160,000 cm)

• Power generation

• Pipeline connections (Creole Trail)

§ Gas sourced from pipeline grid - Henry

Hub indexed pricing

Hub indexed pricing

§ “Demand Pull” model

– Global supply gap

– Diversity of supply

– Flexible processing

– Henry Hub indexation

450

400

350

300

250

200

150

100

50

0

Cost

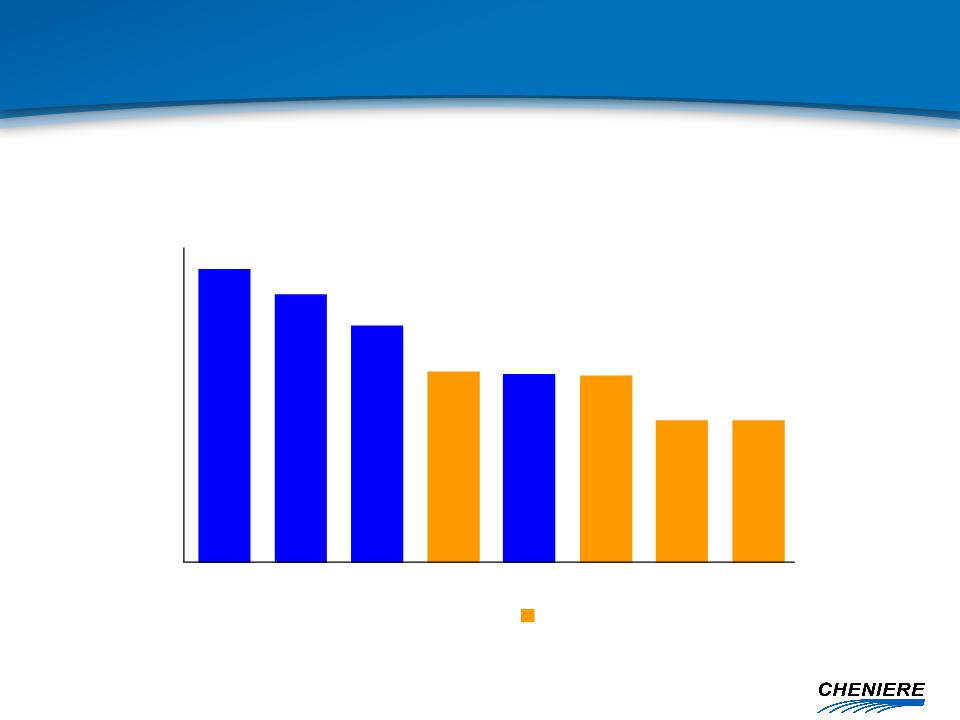

Qatargas Nigeria RasGas ELNGT1 Oman ALNGT1 ALNGT1-3 ELNGT1-2

ConocoPhillips-Bechtel - Global Liquefaction Collaboration

Source: ConocoPhillips-Bechtel

ConocoPhillips-Bechtel trains

$/Ton per Annum

Low Cost Liquefaction Facilities

Proven Technology

Proven Technology

Capacity fee includes regasification and liquefaction services -

provides customer option to import or export

Estimated cost to purchase U.S. supply:

Commercial Structure

Estimated Terms for LNG Sales Agreements

Estimated Terms for LNG Sales Agreements

Ê Capacity Fee: $1.40/MMBtu to $1.75/MMBtu

§ “Take or Pay”, permits lifting or unloading cargoes

§ Includes all facilities and Creole Trail Pipeline

Ê LNG Export Commodity Charge: $HH./MMBtu

§ Delivery Terms: FOB

§ Prevailing price for eastbound flow in local pipelines

§ Paid on a per-MMBtu basis, per cargo loaded

Ê Fuel Surcharge: 8%-12%

§ Projected based on forecast export activity

§ Trued up from period to period

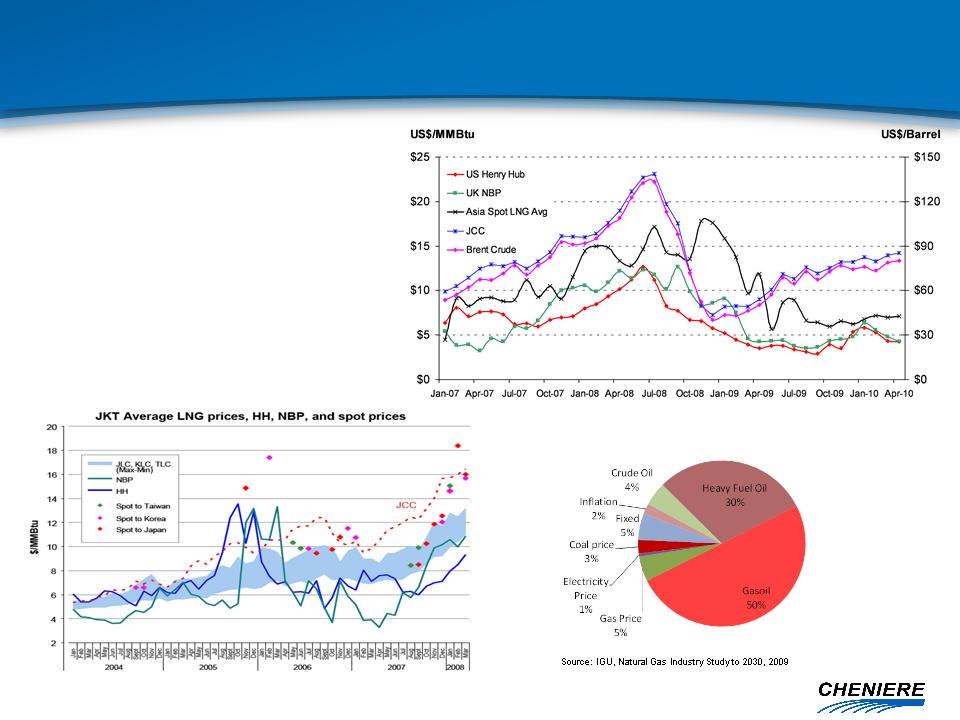

Western Europe Gas Price Indexation

§ Asian and European natural gas supplies

are predominantly priced against oil indices

are predominantly priced against oil indices

– Europe dominated by oil-indexed pricing with an

emerging but small portion tied to spot pricing

emerging but small portion tied to spot pricing

– With decreasing supplies, market prices

expected to align with oil prices, especially in

winter

expected to align with oil prices, especially in

winter

§ Abundant supply of LNG at Henry Hub-

based prices could create a market

advantage

based prices could create a market

advantage

Source: PIRA Energy Group, Petroleum Association of Japan

Source: PIRA Energy Group, Petroleum Association of Japan

LNG Supply

Oil Linkage Threatened with Large Oil-Gas Ratios

Oil Linkage Threatened with Large Oil-Gas Ratios

Source: Cheniere

Henry Hub Price

4.50

$

6.50

$

8.50

$

Terminal Fuel

0.45

0.65

0.85

Liquefaction Charge

1.50

1.50

1.50

Shipping Cost

1.00

1.00

1.00

Delivery Charges

2.95

$

3.15

$

3.35

$

DES Price (Europe)

7.45

$

9.65

$

11.85

$

Brent Crude @ 12.5%

59.60

$

77.20

$

94.80

$

$/MMBtu

Brent Crude @ 15%

49.67

64.33

79.00

$

$

$

Delivered Costs Compare Favorably

to European Price Estimates

to European Price Estimates

§ Assuming continued increase in U.S. natural gas production, unconventional

gas economics effectively cap Henry Hub at mid-range of $6.50/MMBtu

gas economics effectively cap Henry Hub at mid-range of $6.50/MMBtu

§ If oil remains above $65/Bbl, Sabine Pass LNG is cheaper than oil-indexed

pipeline gas in Europe on the margin, while forecast prices above $77/Bbl justify

it on an all-in basis

pipeline gas in Europe on the margin, while forecast prices above $77/Bbl justify

it on an all-in basis

Strong support from local and state agencies

Regulatory Process

§ Dual regulatory tracks with the DOE and FERC

– DOE regulates imports and exports of natural gas

– FERC coordinates federal and state review of proposals

to build LNG terminals

to build LNG terminals

§ Key regulatory and legislative issues

– NEPA empowers FERC as the lead Federal agency for

preparation of an Environmental Impact Statement

preparation of an Environmental Impact Statement

– Other Federal and State agency involvement on issues

§ Typical Approvals Timeline - ~18-21 months

– NEPA pre-filing to be initiated by the end of June 2010

Key Relationships

§ Preliminary favorable indications of market interest

– LNG and natural gas buyers

– LNG and natural gas sellers / producers

– Contractors

Public Unit holders

9.4% LP Interest

Cheniere Energy

Investments, LLC

Sabine Pass LNG-GP, Inc.

Sabine Pass LNG-LP, LLC

100% Ownership Interest

100% Ownership Interest

100% Ownership Interest

100% LP Interest

Non-Economic GP Interest

100% Ownership Interest

Cheniere LNG Holdings, LLC

$205 mm 2.25% Convertible Senior Unsecured Notes due 2012

$550 mm 7.25% Senior Secured Notes due 2013

$1,666 mm 7.50% Senior Secured Notes due 2016

88.6% LP Interest

100% of 2% GP Interest

100% of 2% GP Interest

NYSE Amex US: LNG

NYSE Amex US: CQP

3

$298 mm 9.75% Term Loan due 2012

$302 mm 12.0% Convertible Senior Secured Notes due 2018

Note: Balances as of March 31, 2010, term loan

balance is proforma the Freeport sale where

$102MM of proceeds paid down principal.

balance is proforma the Freeport sale where

$102MM of proceeds paid down principal.

Customer Annual TUA Pmt

Total $123MM

Chevron $128MM

CMI $252MM

Sabine Pass LNG, L.P.

Organizational Structure

Q & A