Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUN HEALTHCARE GROUP INC | d8k.htm |

1

Exhibit

99.1 |

2

Statements made in this presentation that are not historical facts are "forward-looking"

statements (as defined in the Private Securities Litigation Reform Act of 1995) that involve

risks and uncertainties and are subject to change at any time. These forward-looking statements

may include, but are not limited to, statements containing words such as "anticipate,"

"believe," "plan," "estimate,” "expect,” "hope,” "intend,”

"may” and similar expressions. Forward-looking statements in this presentation also

include all statements regarding expected financial position, results of operations, cash

flows, liquidity, financing plans, business strategy, growth opportunities, plans and objectives of

management for future operations and the timing and impact of the proposed restructuring

transactions. Factors that could cause actual results to differ are identified in the

public filings made by the company with the Securities and Exchange Commission and include our

ability to consummate the proposed spin-off; our ability to consummate the equity and debt

financings necessary, in connection with the proposed spin-off, to repay Sun’s

existing indebtedness on terms acceptable to Sun or at all; changes in Medicare and Medicaid

reimbursements; our ability to maintain the occupancy rates and payor mix at our healthcare centers;

potential liability for losses not covered by, or in excess of, our insurance; the effects of

government regulations and investigations; the significant amount of our indebtedness,

covenants in our debt agreements that may restrict our activities and our ability to make acquisitions, incur more

indebtedness and refinance indebtedness on favorable terms; the impact of the current economic

downturn on our business and our ability to collect our receivables; increasing labor costs and

the shortage of qualified healthcare personnel; and our ability to receive increases in

reimbursement rates from government payors to cover increased costs. More information on factors that

could affect our business and financial results are included in our public filings made with

the Securities and Exchange Commission, including our Annual Report on Forms 10-K and

Quarterly Reports on Form 10-Q, copies of which are available on Sun’s web site, www.sunh.com.

The forward-looking statements involve known and unknown risks, uncertainties and other factors

that are, in some cases, beyond our control. We caution that any

forward-looking statements made by us are not guarantees of future performance. We disclaim any obligation

to update any such factors or to announce publicly the results of any revisions to any of the

forward-looking statements to reflect future events or developments.

References to “Sun” refer to Sun Healthcare Group, Inc. and its subsidiaries

|

3

References are made in this presentation to EBITDA, EBITDA margin, EBITDAR, EBITDAR margin and FFO,

which are non-GAAP financial measures. These non-GAAP financial measures are

reconciled to the corresponding GAAP financial measures in the Appendices included at the end

of this presentation. EBITDA is defined as net income before loss (gain) on discontinued operations, interest expense (net

of interest income), income tax expense (benefit) and depreciation and amortization.

EBITDA margin is EBITDA as a percentage of revenue. EBITDAR is EBITDA before center rent

expense and EBITDAR margin is EBITDAR as a percentage of revenue. Sun believes that the presentation of

EBITDA, EBITDA margin and EBITDAR provides useful information regarding Sun’s operational

performance because they enhance the overall understanding of the financial performance and

prospects for the future of Sun’s core business activities, provides consistency in

Sun’s financial reporting and provides a basis for the comparison of results of core business

operations between current, past and future periods. These measures are also some of the

primary indicators Sun uses for planning and forecasting in future periods, including trending

and analyzing the core operating performance of its business from period to period without the effect of GAAP expenses,

revenues and gains that are unrelated to day-to-day performance.

FFO is defined in accordance with the definition used by the National Association of Real Estate

Investments Trusts and is defined as net income, excluding gains (or losses) from sales of

property, plus depreciation and amortization, and after adjustments for unconsolidated

partnerships and joint ventures. FFO is useful to investors in comparing operating and financial results between periods.

This is especially true because FFO excludes real estate depreciation and amortization, and real

estate values fluctuate based on market conditions rather than depreciate ratably on a

straight-line basis over time. In addition, a presentation of FFO also provides a

more meaningful measure of operating results of other real estate investment trusts.

|

4

In connection with the restructuring transaction described in this presentation, SHG Services, Inc.

(“Operating Company”) has filed with the SEC a Registration Statement on Form S-1

and Sabra Health Care REIT, Inc. has filed with the SEC a Registration Statement on Form

S-4, each containing an identical proxy statement/prospectus. The definitive proxy statement/prospectus will be mailed to Sun

stockholders. In addition, Sun has filed a shelf registration statement on Form S-3

(including a prospectus) relating to shares of common stock of Sun with the SEC, and such

registration statement has been declared effective. This presentation does not constitute an offer to

sell or a solicitation of an offer to buy shares of Sun common stock, nor shall there be any offer,

solicitation or sale of these securities in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful. The offering of shares of Sun common stock may be

made only by means of a prospectus relating to the proposed offering. Before making any voting or investment decision, Sun stockholders and investors are urged to read

the proxy statement/prospectus, the prospectus in the registration statement on Form S-3,

and other documents filed with the SEC carefully and in their entirety when they become available

because they will contain important about the proposed In addition, investors and stockholders of Sun may obtain free copies of the documents filed with the

SEC by contacting Sun’s investor relations department at (505) 468-2341 (TDD users,

please call (505) 468-4458) or by sending a written request to Investor Relations, Sun

Healthcare Group, Inc. 101 Sun Avenue N.E., Albuquerque, N.M. 87109. Sun and its directors and executive officers and other members of its management and employees may be

deemed to be participants in the solicitation of proxies from the stockholders of Sun in

connection with the transactions described in this release. Information about the

directors and executive officers of Sun and their ownership of shares of Sun common stock are set forth in the Annual Report on

Form 10-K for the year ended December 31, 2009 filed with the SEC on March 5, 2010 and in the

definitive proxy statement relating to Sun’s 2010 Annual Meeting of Stockholders filed

with the SEC on April 30, 2010. These documents can be obtained free of charge from the

sources indicated above. Additional information regarding the interests of these participants will also be included in the definitive

proxy statement/prospectus when it becomes available.

transactions.

Stockholders

will

be

able

to

obtain

these

documents

free

of

charge

at

the

SEC’s

web

site

at

www.sec.gov.

|

5

Recent Developments /

Restructuring Transactions |

6

On 05/24/10 Sun Healthcare announced plans to separate into two separate

publicly traded companies

Will own Sun’s operating

subsidiaries

Will continue to service

all of its 205 centers

Will manage and grow

ancillary services

Will own Sun’s current real

estate portfolio

Will lease property to the

Operating Company

Will grow and diversify through

acquisitions and new tenant

relationships

Operations

Operating

Company

REIT

Spin Off

Surviving

Entity

Leases

Real Estate

Sun Healthcare Group

Sabra

Health Care REIT, Inc.

Sun Healthcare Group, Inc.

Unlocks Value of Sun’s Real Estate Assets

Creates Two Companies Well Positioned To Execute Growth Strategies

|

7

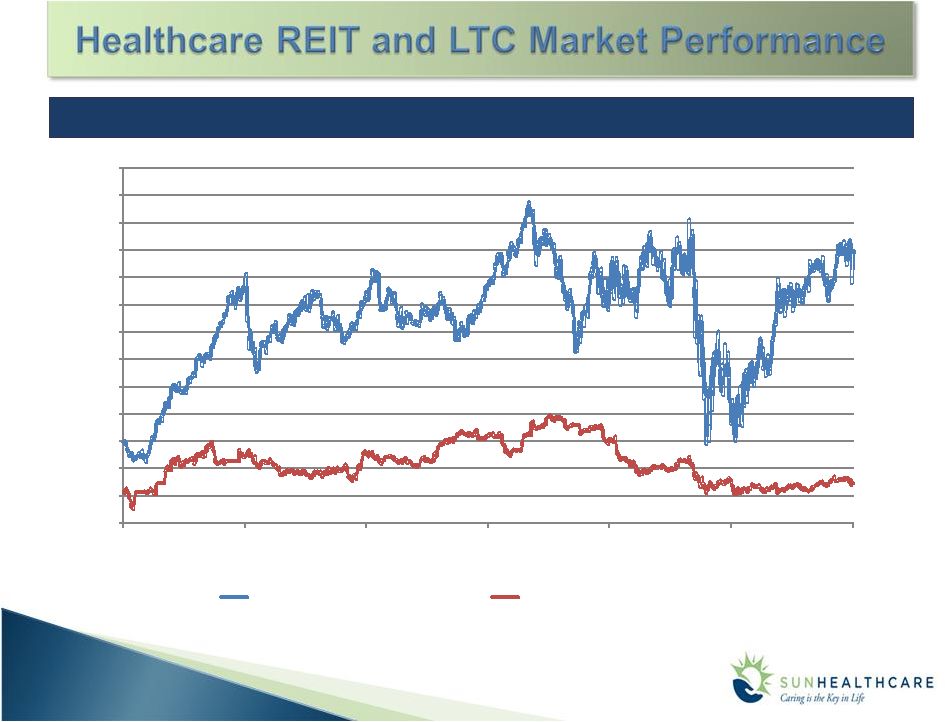

6.5x

15.0x

Source: CapitalIQ

as of 5/16/10

Long Term Care Index: EXE, SKH, ENSG, KND, SUNH, Manor Care, Genesis

HC REIT Index: VTR, NHP, HR, HCP, HCN, LTC, SNH, OHI

Forward

FFO

Multiple

and

Forward

EBITDAR

Multiple

–

2003-2010

YTD

5.0x

6.0x

7.0x

8.0x

9.0x

10.0x

11.0x

12.0x

13.0x

14.0x

15.0x

16.0x

17.0x

18.0x

Jan-03

Mar-04

Jun-05

Sep-06

Nov-07

Feb-09

May-10

HC REIT Index Forward FFO Multiple

LTC Index Forward EBITDAR Multiple |

8

Operating Company

REIT

Attractive geographic diversity

with national footprint

Proven operating platform

focused on high acuity patients

Product diversification

Stable and reliable cash flows

Strong balance sheet

Considerable growth

opportunities in higher margin

hospice sector

Strong relationships with

various landlords

Strong and predictable long

term cash flow

Attractive dividend yield

Balance sheet with no near-term

maturities

Triple-net, master lease with

high quality operator

Attractive and diversified

geographic footprint

Positioned to build broad-based

healthcare real estate portfolio

New tenant relationships

Continued focused on core

care capabilities

Unlocks value of real estate

portfolio

Will Continue to Deliver

Expected to Deliver |

9

Focused Organization Positioned for Optimal Operating Execution

High Quality Portfolio and Premium Assets

Geographically diversified with strong operating metrics

Proven track record of public company performance

Ability to manage higher acuity patients and drive better margins

Attractive Financial Position

Strong balance sheet and consistent cash flow

Provides flexibility to access the capital markets in the future

Significant Growth Opportunities within the Sector

Well

positioned

to

pursue

acquisition

opportunities

and

leverage

existing

infrastructure

in targeted growth segments

Experienced Management Team

Bill Mathies, CEO and Chairman Designate

No Changes in the rest of the management team |

10

Establishes Industry Focused REIT Well Positioned to Build a Broad-based

Healthcare Real Estate Portfolio

Healthcare has proven to be a stable asset class vs. other property types

Healthcare

REITs

have

meaningfully

outperformed

the

overall

REIT

universe

and

broader market

Significant Growth Opportunities within the Sector

Large and growing opportunity in current and other healthcare real estate asset

classes Diversify asset base (e.g., ALFs, ILFs, Hospitals, MOBs)

Size provides opportunity to pursue attractive tuck-in acquisitions

Experienced Management Team

Rick Matros, CEO and Chairman Designate

Harold Andrews, CFO Designate

REIT Focused on Diverse Expansion in the Health Care Sector

|

9,934 Licensed Beds in 21 States

9,586 Available Beds

93 Facilities

11

(82 Skilled, 9 AL/IL, 2 Mental Health) |

12

May 24

July –

August

October –

November

December

Announce Transaction

Equity Offering (Proceeds Used to Reduce Debt)

Refinance Debt at New Sun and Sabra

Separation |

13

New Sun Healthcare Group, Inc.

Sabra

Health Care REIT, Inc.

Management

Bill Mathies, CEO and Chairman

Designate

No other management changes

Bill Mathies

President of SunBridge

Healthcare

Corp. since 2002 and COO since

2006 of all operating companies

Executive Vice President of Beverly

Enterprises, Inc. (1995 to 2002) and

President of Inpatient Subsidiary

(1995-2000)

Management

Rick Matros, CEO and Chairman

Designate

Harold Andrews, CFO Designate

Rick Matros

CEO of health care companies for

over 20 years

Sun’s Chairman and CEO since 2001

Transaction Provides Continuity of Sun Healthcare Leadership

|

14

Transaction Pro Forma

Transaction Pro Forma |

15

New Sun Healthcare Group, Inc.

Sabra

Health Care REIT, Inc.

Pro Forma

(Dollars in millions)

(1)

Adjusted

for

one-time

expenses

related

to

net

restructuring

costs

and

net

loss

on

sale

of

assets.

(2) Calculated

in

accordance

with

NAREIT’s

definition

of

FFO

except

that

there

are

no

adjustments

for

gains

(or

losses)

from

sales

of

property

or adjustments for unconsolidated partnerships and joint ventures.

2009

Q1 ‘10

Revenue

1,881.8

473.3

EBITDAR

(1)

243.8

61.4

EBITDA

(1)

98.7

24.8

Net Income

36.7

8.8

2009

Q1‘10

Revenue

71.9

18.0

EBITDA

69.5

17.4

Net Income

25.5

6.4

FFO

46.4

11.6

$

$

$

$ |

16

The

actual

amount

of

the

New

Sun

and/or

New

Sabra

indebtedness

may

be

less

than

the

amount shown above if cash collections from operation s between March 31, 2010 and

the date of the Separation are received in accordance with Sun's

projections. (1) |

Q1

Financial Performance

17 |

(dollars in thousands,

except per share data) 2010

2009

Revenue

$473,255

$468,129

Depreciation and amortization

12,446

10,723

Interest expense, net

11,977

12,726

EBITDAR

$ 60,770

$ 61,473

Margin –

EBITDAR

12.8%

13.1%

EBITDA

$ 42,218

$ 43,110

Margin –

EBITDA

8.9%

9.2%

Income from continuing operations

10,499

11,602

Diluted earnings per share -

normalized

$0.24

$0.26

1

st

Quarter Ended March 31

Actual Results

18

Sun 1

st

Quarter 2010 Results |

19

Interest

Rate

9.1%

4.5%

6.5%

10.0%

6.4%

5.2%

($ in millions)

309.4

Term Loans

$ ---

Revolving Credit Facility –

$50 million

$ 679.6

200.0

479.6

0.7

169.5

$ 102.5

Total Debt

Subordinated Debt

Senior Secured Debt

Capital Leases

Mortgage

Debt

Debt:

Cash

Debt

Debt Table –

March 2010 |

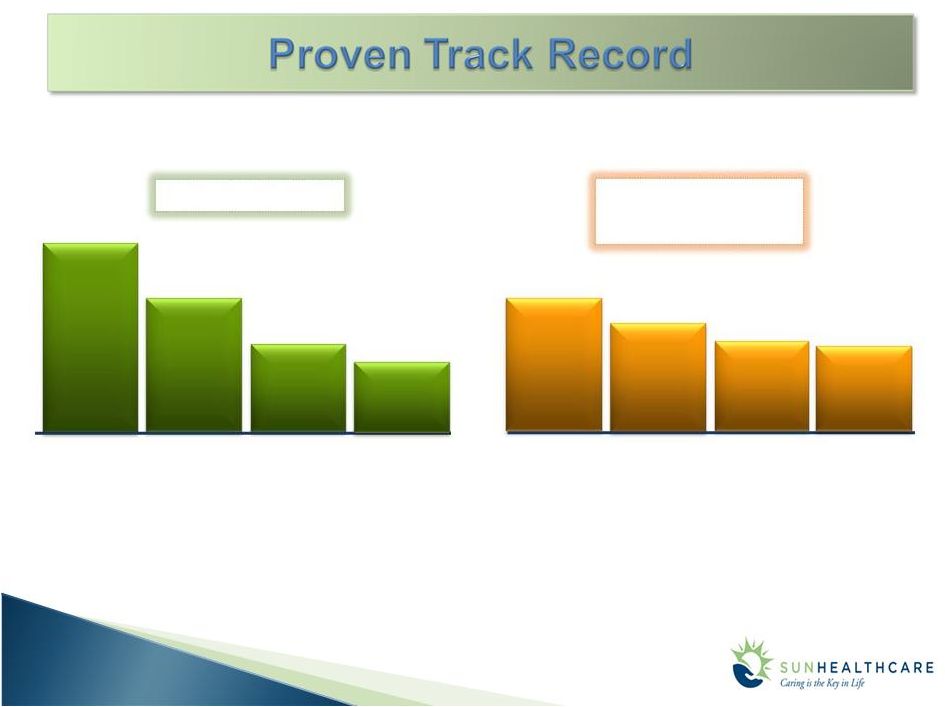

20

Q4 ‘07

Q4 ‘08

Q4 ‘09

$644

$606

$683

$587

Q1 ‘10

Q4 ‘09

Q4 ‘08

3.9x

3.4x

Q4 ‘07

4.9x

3.3x

Q1 ‘10

Net Debt

Leverage

Net Debt /EBITDA |

Strong Free Cash Flow

($ in millions)

Cash flow from operations

$38.1

Capital expenditures

(17.1)

Free cash flow

$21.0

FYE 2010

$50 to $55

First Quarter

2010

21 |

APPENDIX

22 |

23

NON GAAP RECONCILIATION |

As

Reported Reconciliation Section 24

(Dollars in millions)

For the Three

For the Three

Months Ended

Months Ended

March 31, 2010

March 31, 2009

Revenue

473.3

$

468.1

$

Income from continuing operations

10.5

11.6

Add:

Income tax expense

7.3

8.1

D&A

12.4

10.7

Interest

12.0

12.7

EBITDA

42.2

$

43.1

$

Margin - EBITDA

8.9%

9.2%

Center rent expense

18.6

18.4

EBITDAR

60.8

$

61.5

$

Margin - EBITDAR

12.8%

13.1%

Sun Healthcare Group, Inc. Reconciliation to

Reported EBITDA and EBITDAR |

25

(Dollars in millions)

Proforma

Proforma

For the Twelve

For the Three

Months Ended

Months Ended

December 31, 2009

March 31, 2010

Revenue

1,881.8

$

473.3

$

Net income from continuing operations

36.7

8.8

Add:

Income tax expense

25.5

6.1

D&A

24.6

7.2

Interest

10.7

2.7

Restructuring costs and net loss on sale

of assets 1.3

-

EBITDA

98.7

$

24.8

$

Margin - EBITDA

5.2%

5.2%

Center rent expense

145.0

36.5

EBITDAR

243.8

$

61.4

$

Margin - EBITDAR

13.0%

13.0%

Sun Healthcare Group, Inc. Reconciliation

to Pro Forma

EBITDA and EBITDAR |

Pro Forma Reconciliation Section

26

(Dollars in millions)

Proforma

Proforma

For the Twelve

For the Three

Months Ended

Months Ended

December 31, 2009

March 31, 2010

Revenue

71.9

$

18.0

$

Net income

25.5

6.4

Add: D&A

20.9

5.2

FFO

46.4

$

11.6

$

Add: Interest

23.1

5.8

EBITDA

69.5

$

17.4

$

Sabra Health Care REIT, Inc. Reconciliation to

Pro Forma FFO and EBITDA |

Q1

Operating Metrics 27 |

SunBridge

205 inpatient facilities

19,700 patients/residents

SunDance

460+ contracts/330 non-affiliated

Contract services, rehab agency,

management services

CareerStaff

More than 50% of business is in

hospital settings (also serves SNFs,

schools, prisons)

More than 50% of billings are for

therapist (also provide nursing

and

pharmacy services)

SolAmor

Targeted growth business

LTM revenues increased 93% in the

year-over-year LTM 3/31/10 period

3/31/10 LTM Net Revenue

Total: $ 1.9 billion

Medicaid

25.0%

35.0%

40.0%

Private Pay

and Other

Skilled Mix

CareerStaff

Inpatient

% of 3/31/10 LTM Net Revenue

By Business Unit

5.2%

89.1%

5.7%

SunDance

28 |

Medicare

Implementation of Resource Utilization Group (RUG) system to RUG-IV

13 new RUG categories focused on medically complex

RUGS-IV and elimination of lookback

and concurrent effective

10/1/10

Medicaid

Guidance

assumes

flat

rates

–

2010

over

2009

States continue to have budgetary issues that may effect rates

29 |

Enhance

our

clinical

product

and

service

delivery

Focus on specialty services –Solana/Rehab Recovery Suites

®

Expanding services for clinically complex patients

Continue to execute modernization of the centers

30

-

Pulmonary Disease Management

-

Neurological and Neurovascular Management

-

Cardiac Disease Management

-

Oncology Care Program

-

Pain Management

-

End of Life Program

-

Skin and Wound Management

-

Amputation Recovery Program

-

Infection Control

-

Bariatric Management

-

Diabetes Management

-

Orthopedic Recovery Program |

31

Occupancy

(3) Quality mix includes all non-Medicaid inpatient

revenues

Inpatient Revenue Quality Mix

$173

$177

$373

$466

Inpatient Revenue Per Patient Day

$450

$364

$168

Medicaid

Private and Other

(Percentages represent change from prior period)

Q1 ‘09

Q1 ‘10

$186

Managed Care/Comm

Medicare Part A

3.0%

5.1%

<2.5%>

3.5%

Skilled Mix as a % of Revenue

(1) Occupancy excludes hospital

Q1 ‘09

88.8%

Q4 ‘09

87.8%

Q1 ‘10

87.5%

56.3%

Q1 ‘09

Q4 ‘09

54.2%

55.0%

Q1 ‘10

(2) SNF beds only

Managed

Care

33.9%

Q1 ‘09

40.6%

Medicare

6.7%

31.1%

Q4 ‘09

6.3%

37.4%

6.1%

38.6%

32.5%

Q1 ‘10

SunBridge

Performance Metrics |

32

Product Differentiation

RRS and Solana

(Same Store Basis)

Q1 ‘09

Q1 ‘10

90.4%

87.7%

26.6%

25.4%

262.26

267.92

Q1 ‘09

Q1 ‘10

Q1 ‘09

Q1 ‘10

Occupancy

Rates

Q1 ‘09

Q1 ‘10

Q1 ‘09

Q1 ‘10

Q1 ‘09

Q1 ‘10

90.5%

89.0%

17.2%

15.8%

230.73

230.30

Occupancy

Skilled Mix

%

Rates

Q1 ‘09

Q1 ‘10

86.6

86.6%

19.6%

18.9%

229.94

233.87

Q1 ‘09

Q1 ‘10

Q1 ‘09

Q1 ‘10

Skilled Mix

%

Occupancy

Rates

86.6%

87.3%

15.9%

15.1%

210.60

214.36

Q1 ‘09

Q1 ‘10

Q1 ‘09

Q1 ‘10

Q1 ‘09

Q1 ‘10

Rates

Skilled Mix

%

Occupancy

(39)

(22)

(24)

(120)

Centers w/RRS Only

Centers w/Solana Only

Centers w/RRS and Solana

Centers w/o RRS or Solana

Skilled Mix

% |

33

Revenue

($ in millions)

EBITDA Margin

SolAmor

Performance Metrics

ADC

Q1 ‘10

Q1 ‘09

$3.4

$4.0

$1.7

$0.7

$5.7

$1.3

$11.0

$5.8

Q1 ‘09

Q1 ‘10

283

321

122

405

45

85

450

811

Q1 ‘09

Q1 ‘10

19.7%

19.5%

17.7%

20.3%

14.9%

14.1%

19.4%

:Legacy

:Acquisition

:DeNovo

|

34

Revenue / Contract

($ in thousands)

EBITDA Margin

Non-Affiliated Contracts

SunDance

Performance Metrics

Revenue

($ in millions)

Q1 ‘09

$43.7

Q4 ‘09

$46.3

$50.5

Q1 ‘10

Q1 ‘09

6.9%

Q4 ‘09

5.7%

8.0%

Q1 ‘10

$97.0

Q1 ‘09

Q4 ‘09

$99.8

Q1 ‘10

$107.9

337

337

Q1 ‘09

331

156

SNF

175

ALF/Other

Q4 ‘09

149

SNF

188

ALF/Other

188

ALF/Other

Q1 ‘10

149

SNF |

Pharmacy

61.9%

25.9%

Allied

Nursing

Physician Services

EBITDA Margin

35

Q1 ‘09

$27.9

Q4 ‘09

$23.6

$23.5

Q1 ‘10

7.9%

Q1 ‘09

Q4 ‘09

10.1%

Q1 ‘10

7.1%

Pharmacy

57.9%

28.9%

Allied

Nursing

Physician Services

Revenue

($ in millions)

Q1 ’10 Revenue

By Type

Q1 ’09 Revenue

By Type

CareerStaff

Unlimited Performance Metrics |

p. 2

Letter from Our CEO

p. 3

Our Public Commitments to Quality Improvement

p. 7

About Our Nursing Centers

p. 9

Our Approach to Quality and its Measurement

p. 10

Quality Information

p.

18

Enhancing

the

Quality

of

Our

Residents’

Lives

p. 20

About Our Employees

p. 22

Employee Spirit and Achievement

p. 24

Investing in Our Future

36

Published 1

st

annual report on quality

Quality First Pledge

Advancing Excellence Campaign

•

Key metrics ahead of national

peers

(Can

be

found

on

our

website

@

www.sunh.com)

36

Sun’s Commitment to Quality |