Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | form8_k.htm |

1

25 May 2010

SunTrust Robinson Humphrey

Financial Services Unconference

Financial Services Unconference

2

Forward-Looking Statements

This presentation contains statements that relate to the projected performance of Zions Bancorporation

and elements of or affecting such performance, including statements with respect to the beliefs, plans,

objectives, goals, guidelines, expectations, anticipations and estimates of management. These

statements constitute forward-looking information within the meaning of the Private Securities Litigation

Reform Act. Actual facts, determinations, results or achievements may differ materially from the

statements provided in this presentation since such statements involve significant known and unknown

risks and uncertainties. Factors that might cause such differences include, but are not limited to:

competitive pressures among financial institutions; economic, market and business conditions, either

nationally or locally in areas in which Zions Bancorporation conducts its operations, being less

favorable than expected; changes in the interest rate environment reducing expected interest margins;

changes in debt, equity and securities markets; adverse legislation or regulatory changes; and other

factors described in Zions Bancorporation’s most recent annual and quarterly reports. In addition, the

statements contained in this presentation are based on facts and circumstances as understood by

management of the company on the date of this presentation, which may change in the future. Zions

Bancorporation disclaims any obligation to update any statements or to publicly announce the result of

any revisions to any of the forward-looking statements included herein to reflect future events,

developments, determinations or understandings.

and elements of or affecting such performance, including statements with respect to the beliefs, plans,

objectives, goals, guidelines, expectations, anticipations and estimates of management. These

statements constitute forward-looking information within the meaning of the Private Securities Litigation

Reform Act. Actual facts, determinations, results or achievements may differ materially from the

statements provided in this presentation since such statements involve significant known and unknown

risks and uncertainties. Factors that might cause such differences include, but are not limited to:

competitive pressures among financial institutions; economic, market and business conditions, either

nationally or locally in areas in which Zions Bancorporation conducts its operations, being less

favorable than expected; changes in the interest rate environment reducing expected interest margins;

changes in debt, equity and securities markets; adverse legislation or regulatory changes; and other

factors described in Zions Bancorporation’s most recent annual and quarterly reports. In addition, the

statements contained in this presentation are based on facts and circumstances as understood by

management of the company on the date of this presentation, which may change in the future. Zions

Bancorporation disclaims any obligation to update any statements or to publicly announce the result of

any revisions to any of the forward-looking statements included herein to reflect future events,

developments, determinations or understandings.

3

Agenda

|

Capital

Overview of Zions

Key Performance Drivers

–Revenue

–Credit Quality

–Term CRE

–Securities Portfolio

Outlook Summary

|

|

|

4

Zions’ Recent Capital Announcement

• On May 19, Zions announced a series of capital

actions expected to create $600 million of Tier 1

capital

actions expected to create $600 million of Tier 1

capital

– Warrants:

• As announced: $150 million + $10 million greenshoe

• As completed: $175 million (additional $10 million greenshoe option expires June 18, 2010)

– No EPS dilution until Zions’ stock price reaches strike price of $36.63; gradual increase in

sharecount thereafter, based on price of common stock (i.e. net share settlement / treasury

method)

sharecount thereafter, based on price of common stock (i.e. net share settlement / treasury

method)

– Issued 21.1 million warrants (excluding greenshoe)

– Breakeven dilution to EPS occurs at a ZION stock price of $55.50

– Matures May 2020

– Common Equity Distribution Program: $300 million

– Additional $150 million of Tier 1 capital

• Capital actions expected to increase Tier 1 ratio by

approximately 120 basis points

approximately 120 basis points

• Actions expected to be accretive to tangible common equity

per common share today ($19.89 at 3/31/10)

per common share today ($19.89 at 3/31/10)

5

Pro Forma Capital Ratios

|

|

1Q09

|

1Q10

|

Pro Forma

For Sub Debt Conversion |

Pro Forma Equity Distribution, Warrants, $150mm other Tier 1 |

|

Tangible Common Equity (TCE)

|

5.26%

|

6.30%

|

6.23%

|

7.05%

|

|

Tier 1 Common

|

5.73%

|

7.14%

|

7.02%

|

7.94%

|

|

Tier 1 Risk Based

|

9.43%

|

11.19%

|

11.35%

|

12.58%

|

|

Total Risk Based

|

13.39%

|

13.93%

|

13.97%

|

15.20%

|

Note: Capital ratios pro forma for sub debt conversion include conversion of $116.6 million face value of convertible subordinated debt which elected to convert

into preferred equity, effective May 17, 2010, as detailed on Form 8-K filed with the SEC on May 18, 2010.

into preferred equity, effective May 17, 2010, as detailed on Form 8-K filed with the SEC on May 18, 2010.

Capital ratios pro forma for equity distribution, warrants and $150 million other Tier 1 assume a combined $450 million is raised via equity distribution

program and warrants, and an additional $150 million of capital that qualifies for Tier 1 regulatory capital treatment

program and warrants, and an additional $150 million of capital that qualifies for Tier 1 regulatory capital treatment

6

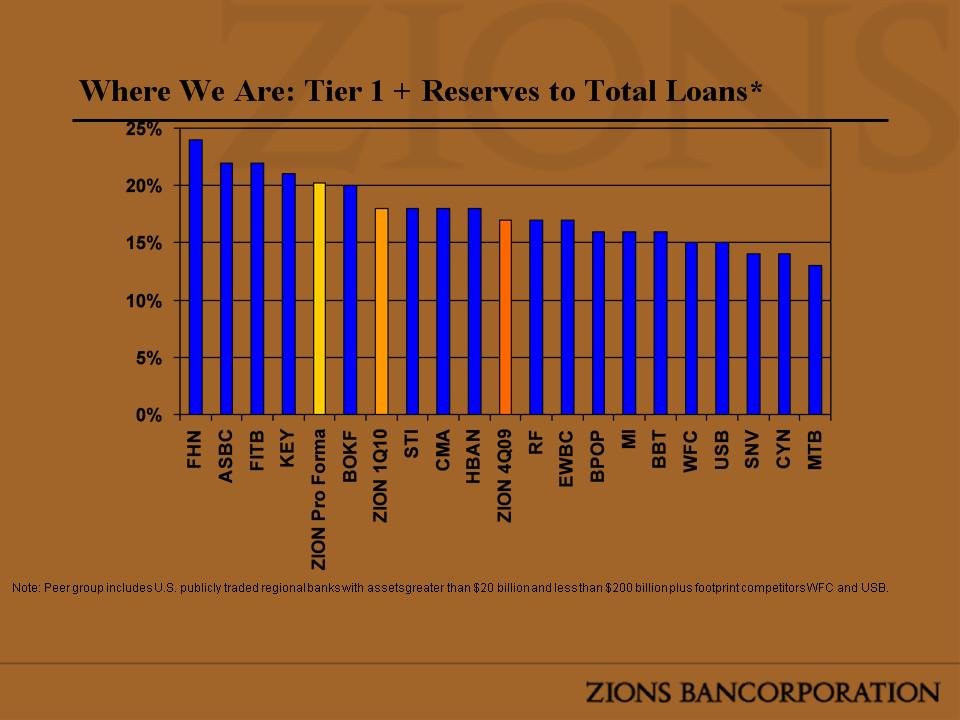

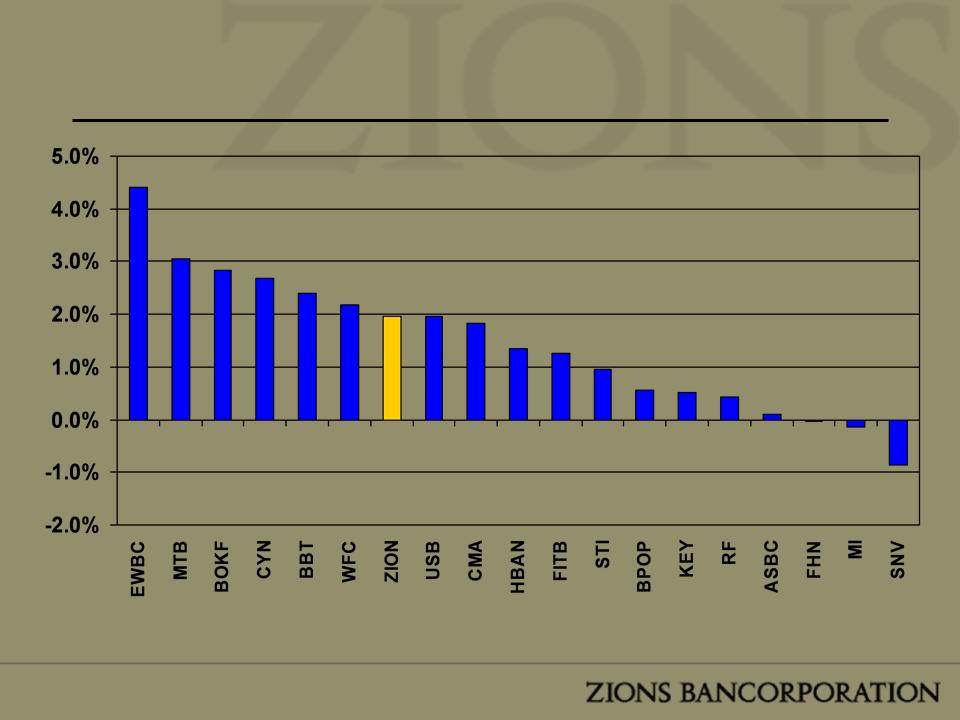

Source: SNL

TARP is included in Tier 1 Capital for the following companies: FHN, ASBC, FITB, KEY, ZION, STI, HBAN, RF, EWBC, MI, SNV, MTB.

Non-TARP: CYN, USB, WFC, BBT, CMA, BOKF; Converted TARP to TruP: BPOP.

*All data as of 1Q10 except Zions 4Q09 & 1Q10 Pro Forma, which includes $450 million combined common equity distribution and warrants, and $150 million of additional

capital that qualifies for Tier 1 regulatory capital treatment.

capital that qualifies for Tier 1 regulatory capital treatment.

7

Agenda

|

Capital

Overview of Zions

Key Performance Drivers

–Revenue

–Credit Quality

–Term CRE

–Securities Portfolio

Outlook Summary

|

|

|

8

A Collection of Great Banks

9

Strong Focus on Business Banking - Loan Mix, Profit Mix

C&I

47%

Consumer

21%

CRE

32%

*Includes FDIC Supported Assets

Loan Portfolio 1Q10

* Commercial Loans: 79%

* Retail & Other Loans: 21%

10

Small Business Banking:

National Awards:

• Overall Satisfaction

• Relationship Manager Performance

• Financial Stability

• Overall Treasury Management

Regional Awards:

• Overall Satisfaction - West

• Overall Satisfaction - Treasury Management -

West

West

What Others Say About Us

2009 Greenwich Excellence Awards

in Small Business and Middle Market Banking

Middle Market Banking

National Awards:

• Overall Satisfaction

• Personal Banking

• Relationship Manager Performance

• Credit Policy

• Financial Stability

• Overall Treasury Management

• Accuracy of Operations

• Customer Service

• Treasury Product Capabilities

Regional Awards:

• Overall Satisfaction - West

• Overall Satisfaction - Treasury Management - West

11

Zions’ Strengths & Recent Improvements

• NIM: 4.03% in 1Q10, ranked #3 of 19 regional banks/peers*

• 3rd among peers* for non-interest bearing deposits as a percent of

earning assets

earning assets

• Strong allowance for credit loss: 4.5% of net loans (excluding FDIC

supported loans)

supported loans)

• Low original LTV ratios on term commercial real estate loans

• Markets with strong long term growth profile

• Established market-leading small business lender

– Leading SBA Lender

– Superior Treasury Management Products

• Competitive operating cost structure

– Expense / Loan ratio: Best quartile

*Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and less

than $200 billion plus footprint competitors WFC and USB (updated annually at year end).

than $200 billion plus footprint competitors WFC and USB (updated annually at year end).

12

Zions’ Challenges

• Rising NPAs, to 6.4% of loans in first quarter from 6.0% in 4Q09;

5.4% in 3Q09 (1)

5.4% in 3Q09 (1)

– Total delinquent + NPA increased by 2.8% in 1Q10 compared to the prior quarter

• Net charge-off rate 2.4% in 1Q10; full year 2009 net charge-off

rate of 2.9%(1)

rate of 2.9%(1)

– Gross charge-offs down 36% from 3Q09 peak

• Continued securities impairments (OTTI), primarily on

bank/insurance CDOs - $31.3 million in 1Q10

bank/insurance CDOs - $31.3 million in 1Q10

– Although OCI mark is already reflected in GAAP capital ratios, the

difference between Amortized Cost (OTTI mark) and Carrying Value (OCI

mark) is $599 million, representing a potential earnings impairment

difference between Amortized Cost (OTTI mark) and Carrying Value (OCI

mark) is $599 million, representing a potential earnings impairment

(1) Excludes FDIC supported assets

13

Agenda

|

Capital

Overview of Zions

Key Performance Drivers

–Revenue

–Credit Quality

–Term CRE

–Securities Portfolio

Outlook Summary

|

|

|

14

Net Interest Margin

Note: Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and

less than $200 billion plus footprint competitors WFC and USB (updated annually as of year end).

less than $200 billion plus footprint competitors WFC and USB (updated annually as of year end).

Source: SNL (As Reported NIM)

Strong NIM

Driven by Strong Demand Deposits

15

Core NIM Trends

Core NIM Performance

• Due to the

extinguishment/

reissuance of

subordinated debt in

June 2009, Zions

experiences non-cash

discount accretion,

which increases interest

expense, reducing GAAP

NIM

extinguishment/

reissuance of

subordinated debt in

June 2009, Zions

experiences non-cash

discount accretion,

which increases interest

expense, reducing GAAP

NIM

Core NIM (excludes discount accretion) has been generally stable

• 1Q09 experienced a temporary dip partially due to an intentional build-up of

excess liquidity during the significant turmoil during late 2008/early 2009.

excess liquidity during the significant turmoil during late 2008/early 2009.

• Issuance of senior notes in September 2009 had about 8 bps adverse impact

on the core NIM in 4Q09.

on the core NIM in 4Q09.

16

17

Agenda

|

Capital

Overview of Zions

Key Performance Drivers

–Revenue

–Credit Quality

–Term CRE

–Securities Portfolio

Outlook Summary

|

|

|

18

Credit Quality Trends

(Regional Bank Peers)

(Regional Bank Peers)

*Annualized

Zions excludes FDIC supported assets

Note: Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and less than $200 billion plus

footprint competitors WFC and USB (updated annually as of year end).

footprint competitors WFC and USB (updated annually as of year end).

Source: SNL; Peer data includes estimates from previous quarter if current quarter is unavailable at time of printing

NPAs + Greater than 90 Days

Delinquent / Loans + OREO

Delinquent / Loans + OREO

Net Charge-offs as

a % of Loans*

a % of Loans*

19

Note: Peer group includes U.S. publicly traded regional banks with assets greater

than $20 billion and less than $200 billion plus footprint competitors WFC and USB.

than $20 billion and less than $200 billion plus footprint competitors WFC and USB.

Source: SNL

Net Charge Offs - By Loan Type

(Regional Bank Peers)

(Regional Bank Peers)

Percentage of Zions

Total Loans

Total Loans

Shaded Portion Represents

Gaming Credits

Gaming Credits

20

Agenda

|

Capital

Overview of Zions

Key Performance Drivers

–Revenue

–Credit Quality

–Term CRE

–Securities Portfolio

Outlook Summary

|

|

|

21

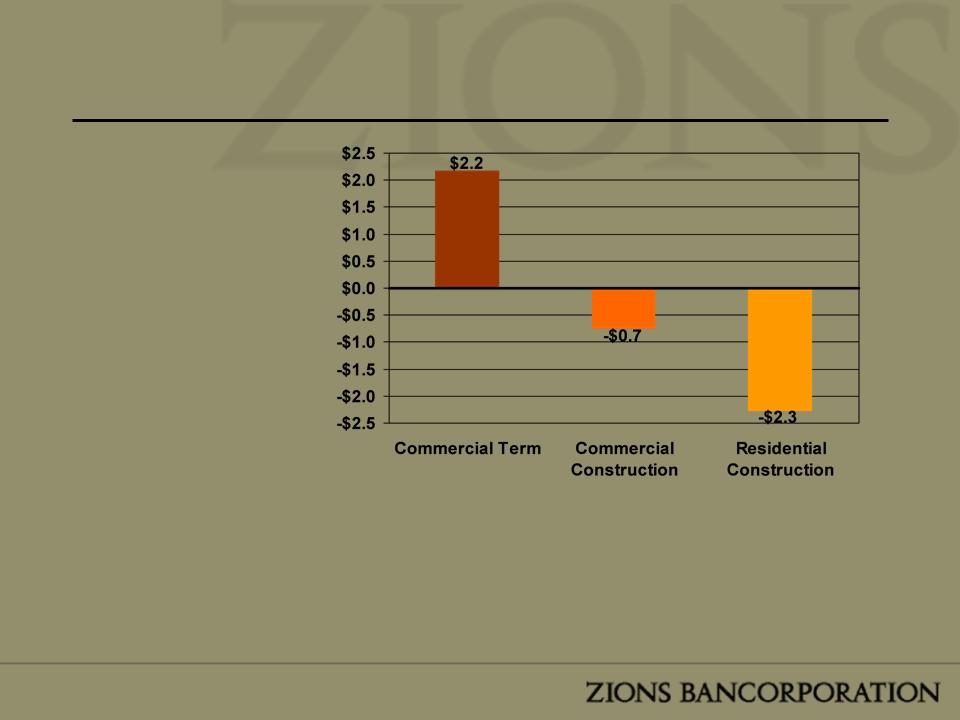

Change in CRE Loan Outstandings in $billions (4Q07 to 1Q10)

• A decline in

construction has

been partially offset

by Term CRE loan

growth

construction has

been partially offset

by Term CRE loan

growth

• Commercial

construction loans

must qualify for

“pass grade”

underwriting in

order to move from

Construction to

Term CRE

construction loans

must qualify for

“pass grade”

underwriting in

order to move from

Construction to

Term CRE

22

Term CRE Maturity Stratification

23

Term CRE - LTV Stratification At Origination*

*Or most recent appraisal; reappraisals are by policy conducted when a loan is downgraded

to special mention, and periodically thereafter as warranted by market conditions

to special mention, and periodically thereafter as warranted by market conditions

|

Percentage of Loans within each bucket that are Non-Accrual

|

||||||

|

1.9%

|

3.7%

|

1.6%

|

8.1%

|

29.9%

|

15.5%

|

12.7%

|

24

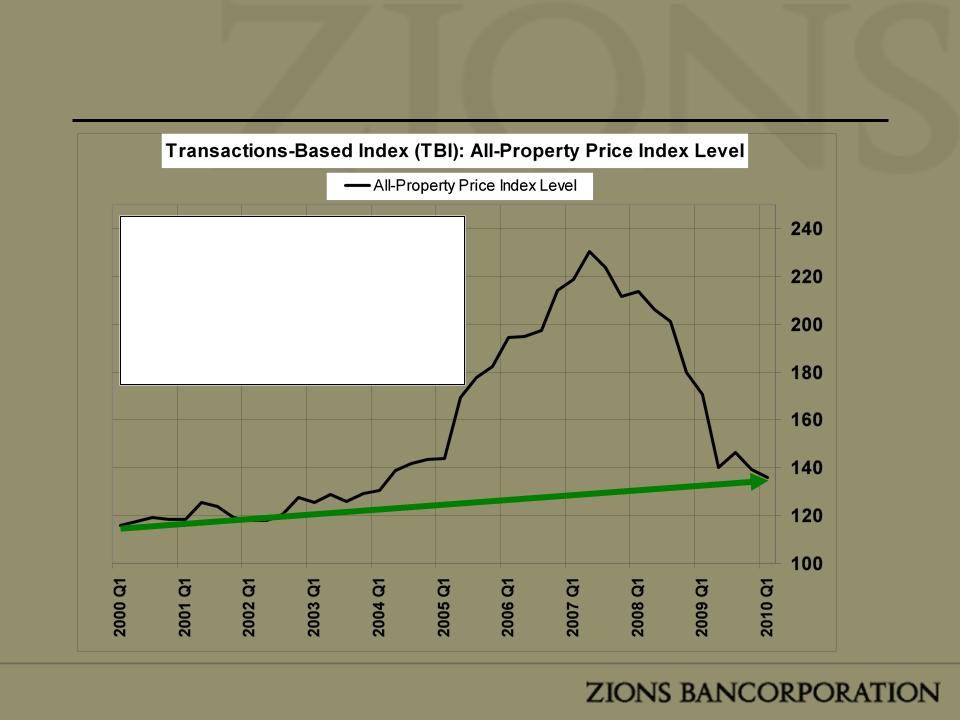

Macroeconomic Data - MIT’s Transaction Based Index

•Property prices have

appreciated at a CAGR of

1.6% during the past 10 years

appreciated at a CAGR of

1.6% during the past 10 years

•Prices are now back to 2Q04

levels

levels

25

Term CRE - TBI-Adjusted LTV Stratification (3-31-10)

The MIT Transaction Based Index is a national index that has

been applied to Zions’ mostly regional CRE Portfolio

been applied to Zions’ mostly regional CRE Portfolio

|

Percentage of Loans within each bucket that are Non-Accrual

|

||||||

|

2.3%

|

2.7%

|

3.9%

|

3.7%

|

8.8%

|

8.6%

|

4.0%

|

26

Day of Reckoning - or Not?

• Market Perception (top left chart): Eighty percent

of the industry’s CRE loans maturing in 2014 are

projected to be underwater (LTV >100%).

of the industry’s CRE loans maturing in 2014 are

projected to be underwater (LTV >100%).

• Zions Specific Data (bottom right chart): Based on

loans adjusted for price declines as reflected in the

1Q10 MIT Transaction Based Index (TBI),

approximately 7% of loans maturing at Zions in

2014 would be underwater.

loans adjusted for price declines as reflected in the

1Q10 MIT Transaction Based Index (TBI),

approximately 7% of loans maturing at Zions in

2014 would be underwater.

Source: American Banker, Foresight Analytics (Dec. 29, 2009)

Total amt maturing

(left scale)

(left scale)

About $65 MM of

loans @ risk

loans @ risk

Loan to Value > 100%

(right scale)

(right scale)

27

Nonaccrual Loan Migration

- Nonaccrual loan

inflows improved in

early 2010

inflows improved in

early 2010

- Favorable resolutions*

in stable range

in stable range

- Unfavorable

resolutions** continue

to improve

resolutions** continue

to improve

*Favorable resolutions include - change to accrual status, paid off, paid down

**Unfavorable resolutions include - charged off/down, movement to OREO status

28

Agenda

|

Capital

Overview of Zions

Key Performance Drivers

–Revenue

–Credit Quality

–Term CRE

–Securities Portfolio

Outlook Summary

|

|

|

29

CDO Portfolio Summary

•Credit-related OTTI losses $31.3 million in 1Q10

– Approximately 85% of the credit-related net impairment losses

came from original A and BBB rated, predominantly bank CDOs

came from original A and BBB rated, predominantly bank CDOs

•Noncredit-related losses on securities of $17.3 million in

1Q10 recognized in OCI

1Q10 recognized in OCI

*This table includes $2.2 billion par value of CDOs that are

backed predominantly by bank trust preferred securities. The

par value of all Bank & Insurance backed CDOs is $2.7 billion

backed predominantly by bank trust preferred securities. The

par value of all Bank & Insurance backed CDOs is $2.7 billion

30

CDO Stress Testing - OTTI

“Deterioration in PDs %” means that the default

curve applied to the performing collateral of

each deal is made worse by the percentage

indicated. Thus a deal with a default curve of

5% stressed to a 25% “Deterioration in PDs %”

would have a 6.25% default probability curve

applied to it, a deal with 20% would go to 25%

and so forth. A “Deterioration in PDs %” stress

of 100% would double the PD curve being

applied to a deal's collateral.

curve applied to the performing collateral of

each deal is made worse by the percentage

indicated. Thus a deal with a default curve of

5% stressed to a 25% “Deterioration in PDs %”

would have a 6.25% default probability curve

applied to it, a deal with 20% would go to 25%

and so forth. A “Deterioration in PDs %” stress

of 100% would double the PD curve being

applied to a deal's collateral.

•Moderate Stress - The PD curve that was

applied to the performing collateral of each

CDO deal in the 4Q09 pricing run is increased

by the % indicated and the resultant values

were used to estimate OTTI losses.

applied to the performing collateral of each

CDO deal in the 4Q09 pricing run is increased

by the % indicated and the resultant values

were used to estimate OTTI losses.

•Adverse Stress - Incorporates all of the

deterioration of PDs applied to the performing

collateral, but also stresses the PDs applied to

collateral in deferral by the same deterioration

percentages. PDs on deferring collateral are

used to estimate the value of the potential for

this collateral to cure in the future through

recovery or re-performance.

deterioration of PDs applied to the performing

collateral, but also stresses the PDs applied to

collateral in deferral by the same deterioration

percentages. PDs on deferring collateral are

used to estimate the value of the potential for

this collateral to cure in the future through

recovery or re-performance.

•Extreme Stress - This is a very severe stress

scenario that uses the “Moderate Stress”

assumptions for performing collateral, but also

immediately defaults all deferring collateral

instantly with no recovery and no probability to

re-perform in the future.

scenario that uses the “Moderate Stress”

assumptions for performing collateral, but also

immediately defaults all deferring collateral

instantly with no recovery and no probability to

re-perform in the future.

31

CDO Stress Testing - Capital

|

Model Implied Bank Failures (1 year)

|

|||

|

Scenario @ 100%

|

Total within Zions’ CDOs

|

Total in Banking Universe

|

Zions % of Universe

|

|

Actual Bank Failures in 2009

|

57

|

132*

|

43%

|

|

Actual Bank Failures in 1Q 2010

|

13

|

41

|

32%

|

|

Future 1 Year Failures Implied in 4Q09 Pricing

|

95

|

221

|

43%

|

|

Moderate Stress

|

117

|

272

|

43%

|

|

Adverse Stress

|

162

|

377

|

43%

|

|

Extreme Stress

|

218

|

507

|

43%

|

• Under various stress scenarios,

Zions’ modeling indicates that

OCI (accumulated other

comprehensive income) would

erode, although at a significantly

lower amount than OTTI (other

than temporary impairment)

Zions’ modeling indicates that

OCI (accumulated other

comprehensive income) would

erode, although at a significantly

lower amount than OTTI (other

than temporary impairment)

• OTTI: Under the moderate stress

scenario at 100% greater PD,

OTTI incurred would be

approximately $111 million (after

tax).

scenario at 100% greater PD,

OTTI incurred would be

approximately $111 million (after

tax).

• OCI: Under the same moderate

stress scenario at 100% greater

PD, OCI would deteriorate by

approximately $45 million (after

tax).

stress scenario at 100% greater

PD, OCI would deteriorate by

approximately $45 million (after

tax).

*FBOP, which failed in 2009, had 9 subsidiary banks, for consistency

in comparison of exposure Zions treated these 9 failures as 1 failure

in comparison of exposure Zions treated these 9 failures as 1 failure

32

History of Bank Deferrals & Defaults in Zions’ CDOs

As of 4-23-10

33

Outlook Summary

|

|

|

|

|

|

|

▼

|

|

Loans

|

|

|

▲

|

|

Low-Cost Deposit Growth

|

|

|

▼

|

|

Credit Costs

|

|

|

◄►

|

|

Core Net Interest Margin

|

|

|

◄►

|

|

Core Non-interest Expenses

|

|

|

◄►

|

|

OTTI

|

|

|

▲

|

|

Capital Ratios and Quality of Capital

|

34

25 May 2010

35

Appendix

36

Risk-adjusted Net Interest Margin* (MRQ)

*(Net Interest Income - Net Charge-offs)/Average Earning Assets (annualized)

Note: Peer group includes U.S. publicly traded regional banks with assets greater than $20 billion and less than

$200 billion plus footprint competitors WFC and USB (updated annually at year end).

$200 billion plus footprint competitors WFC and USB (updated annually at year end).

Source: SNL

37

38

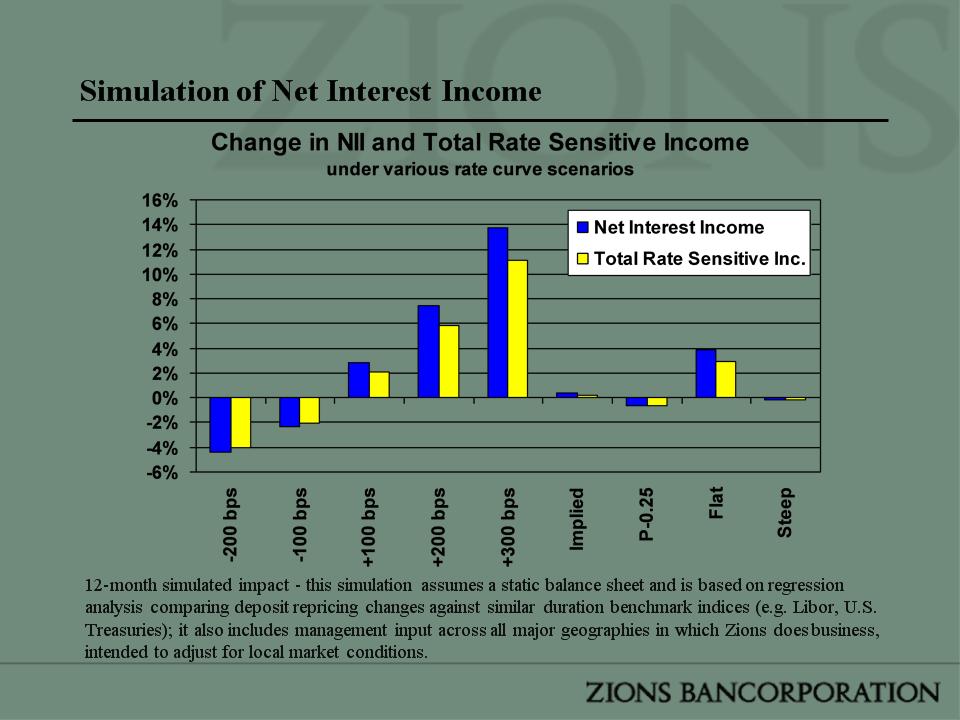

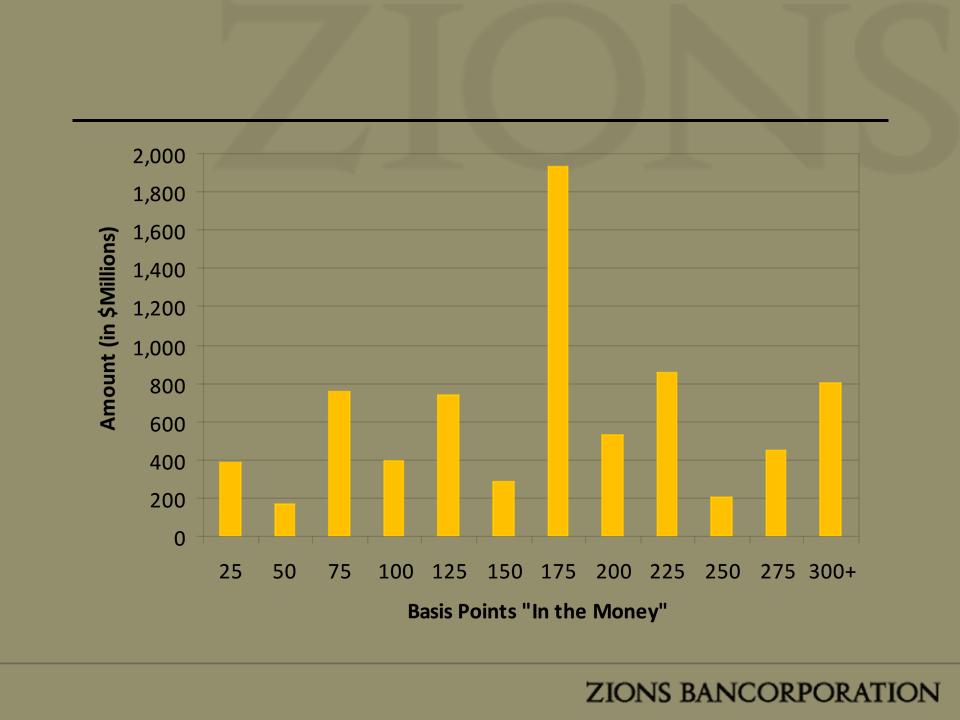

Asset Sensitivity

Fixed-rate loans:

– 27% of portfolio

– Duration of about 1 year

Variable-rate loans:

– 73% of portfolio

– Floors on 46% of variable-rate loans (79% of those loans are at the floor rate)

– Swaps: $570 million (Pay Floating, Receive Fixed)

• Continual reduction of interest rate swaps (increasing asset sensitivity)

39

Loans with Floors (as of 12/31/09)