Attached files

| file | filename |

|---|---|

| 8-K - REHABCARE INVESTOR DAY MAY 18, 2010 - REHABCARE GROUP INC | eightkirday510.htm |

Welcome and Introductions

John H. Short

President and CEO

Exhibit 99

Company Overview

2

n Headquartered in St. Louis, MO; over 18,000 full/part-time & PRN employees

n Established in 1982

n Largest contract manager of rehabilitation services; fourth largest post-acute

hospital operator, third largest long-term acute care hospital provider

hospital operator, third largest long-term acute care hospital provider

n Triumph HealthCare merger created more diversified business lines, reducing

reliance on management contracts for revenue and EBITDA streams

reliance on management contracts for revenue and EBITDA streams

RehabCare excluding Triumph

Pro Forma w/Triumph

FYE 2009 “Owned” Revenue vs. “Contract” Revenue

Division Overviews

Skilled Nursing

Rehabilitation Services

n $499 mm - 39% of pro

forma revenue

forma revenue

n Created in 1997

n 1,125 locations in 37 states

n 8.1 mm annual patient

visits

visits

$1.3 billion pro forma operating revenues for LTM 3/31/10

Hospital Rehabilitation

Services

n $178 mm - 14% of pro

forma revenue

forma revenue

n Opened first program in

1983

1983

n 144 locations in 32 states

n Annually, 43,000 inpatient

rehabilitation discharges,

1.2 mm outpatient visits

rehabilitation discharges,

1.2 mm outpatient visits

n $594 mm - 47% of pro

forma revenue

forma revenue

n Launched in 2005

n 291 long-term acute care

hospitals, 6 inpatient

rehabilitation facilities in 13

states

hospitals, 6 inpatient

rehabilitation facilities in 13

states

n 410,000 annual patient

days

days

Hospital Division

3

1Includes Triumph Hospital-The Heights, which opened in April

Day’s Agenda

n Hospital Rehabilitation Services (HRS) Division

Mary Pat Welc

Senior Vice President, HRS Operations

n Skilled Nursing Rehabilitation Services (SRS) Division

Pat Henry

Executive Vice President, SRS Operations

n Hospital Division

Kevin Gross, Senior Vice President, Hospital Operations

Brock Hardaway, Triumph President and Chief Operating Officer

n RehabCare Strategic Direction

John Short

n Q&A with Executive Management Team

n Lunch

n Tours of Clear Lake Rehabilitation Hospital and Triumph Hospital-Clear Lake

4

Hospital Rehabilitation

Services

Services

Mary Pat Welc

Senior Vice President, HRS Operations

n Manages hospital-based Inpatient Rehabilitation Facilities (IRFs) and outpatient

therapy programs on a contract basis, providing our partners with:

therapy programs on a contract basis, providing our partners with:

n Improved internal patient flow

n Ability to attract ≈ 30% admissions from external sources

n Successful clinical outcomes and broader clinical programming (brain, stroke, spinal dysfunction)

n Regulatory compliance (60% rule, RAC, 3-hour rule)

n Recruiting and labor management

Hospital Rehabilitation Services (HRS)

Division overview

Division overview

Competitive Landscape

Market Size1: 981 hospital

-based IRFs

-based IRFs

Source: Information available from public filings or from

company websites

company websites

1MedPAC March 2010 Report to Congress

²American Hospital Directory

3,8592 short-term acute

care hospitals

care hospitals

Have IRF

No IRF

6

HRS Division

Clinical outcomes

Clinical outcomes

7

|

Quality Metric

|

Benchmark1

|

Q1 10

|

|

Functional Independence Measure (FIM) Score Gain

|

>24.1

|

25.5

|

|

Discharge to Community

|

>72.4%

|

75.4%

|

|

Discharge to Short-Term Acute Care (STAC)

|

<12.2%

|

9.2%

|

1eRehab national average unadjusted data for Q1 10

|

|

2008

|

2009

|

2010

|

|

FIM Gain

|

23.6

|

24.4

|

25.5

|

HRS Division

Client profile

Client profile

n 144 total contracts at end of Q1 10

n Core contract base is 103 IRF agreements - average size, 20 beds

n Approximately 30% of our IRF contracts have an associated second product -

primarily OP

primarily OP

n Typical customer

n Small to mid-size hospital - average approximately 100 med/surg ADC

n View rehab as being outside their core competencies

n Contract model

n At Risk - Typically priced on a basis that matches CMS’ reimbursement methodology

• IRF - Fee per discharge

• OP - Fee per unit of service

n Initial contract 3 - 5 years in length, with successive renewals of 1 - 3 years each

n Our average client has been with us 9 years

n RehabCare provides an on-site management team in all contracts and therapists in

approximately 55% of IRF contracts and 75% of OP contracts

approximately 55% of IRF contracts and 75% of OP contracts

8

HRS Division

Growth strategy

Growth strategy

n Integration of business development and senior operations team

n Strategies to increase market share

n Strategic market focus- small systems, hub and spoke

n CRM process to reduce closures from historic 8% - 12% churn rate

n Product development - increased flexibility in product offerings, creating centers of

excellence

excellence

n Second product sales - OP and hospital-based skilled

n Strategies to increase same store growth

n Electronic pre-screen to reduce time to admission

n Bed expansions

n Investment in enabling technology

n Upgrade Inpatient operating system

n Develop and integrate therapy point-of-care device

n Benefits:

• Increased integration with hospital operating systems

• Improved management of regulatory compliance and productivity

• Opportunity to upsell therapy management services

• Solid base for development of next generation technology

9

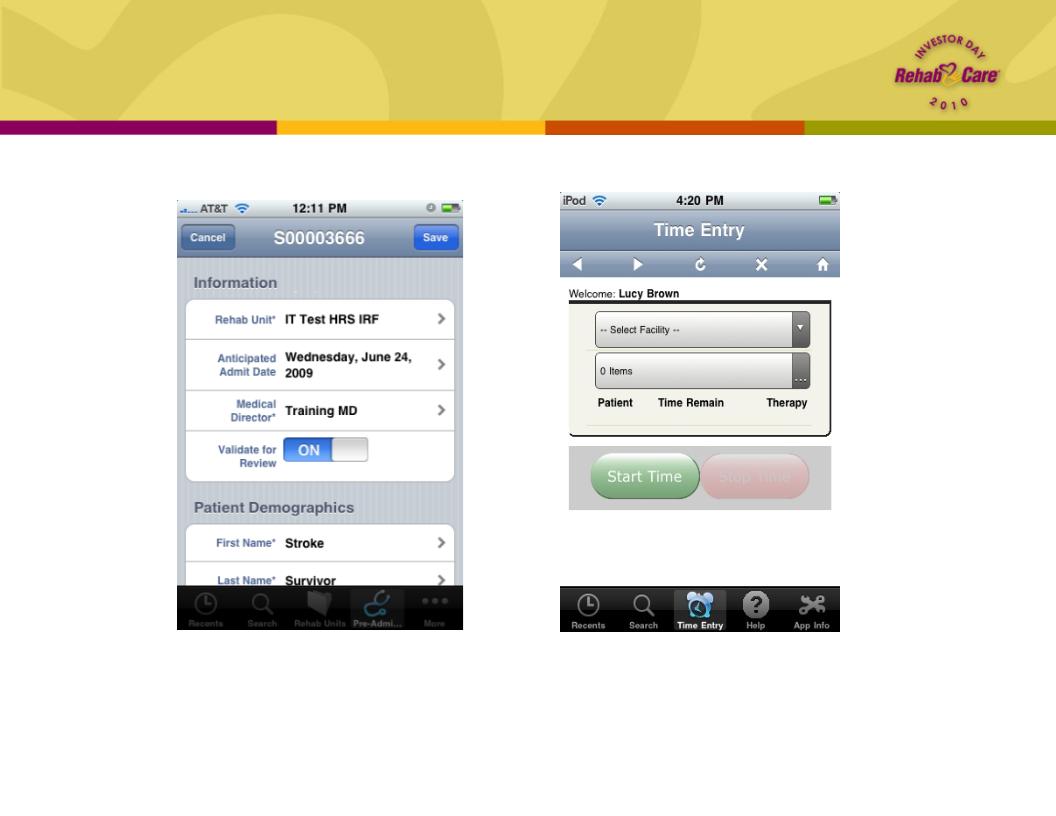

HRS Division

Technology sample

Technology sample

Therapist Handheld Device

Electronic Pre-Screening App

• Decrease time to admission

• Ensure compliance with screening

requirements

requirements

• Increase productivity

• Increase integration with operations systems

• Ensure compliance with 3-hour rule

10

HRS Division

Outlook

Outlook

n HRS is not directly impacted by changes in CMS reimbursement, but impact on our

clients may drive pricing pressure

clients may drive pricing pressure

n Inpatient

• Market basket increases will be reduced by a fraction of a percentage

• Payments will be subject to reductions for industry “productivity” gains

n Outpatient

• Hospital-based outpatient services are exempt from therapy caps

• All outpatient therapies are reimbursed based on the physician fee schedule

• Congress continues to postpone reductions to the physician fee schedule

n Expect 15% - 17% operating earnings margin for FY2010

n Anticipate 2 - 4% year-over-year growth in IRF same store discharges for FY2010

n Unit count expected to decrease in first half of year with recovery in second,

resulting in flat unit growth for year

resulting in flat unit growth for year

n 12 known openings YTD 2010 vs. 6 openings for FY2009

|

Openings

|

YTD 2010

|

FY2009

|

|

IRF

|

6

|

5

|

|

Skilled Nursing

|

4

|

0

|

|

Outpatient

|

2

|

1

|

11

Skilled Nursing

Rehabilitation Services

Rehabilitation Services

Pat Henry

Executive Vice President,

SRS Operations

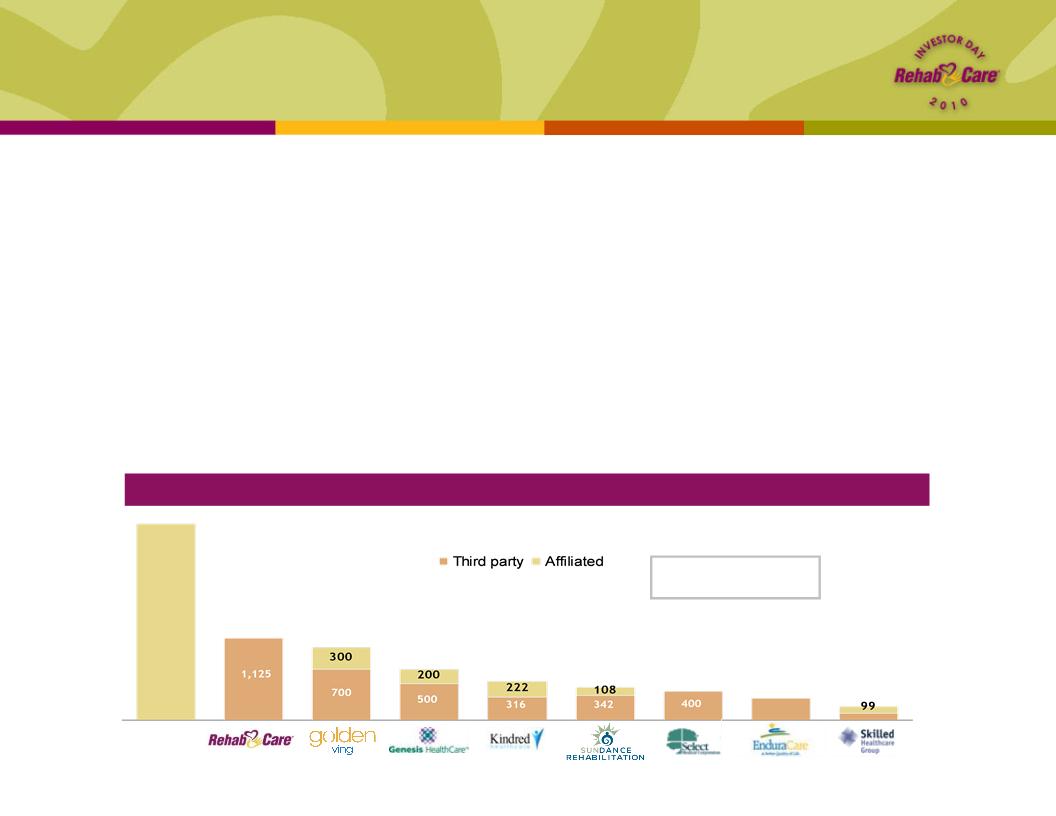

Competitive Landscape — # of facilities served

Self-

operated

Market Size1: 15,000+

Medicare-certified SNFs

Medicare-certified SNFs

Skilled Nursing Rehabilitation Services (SRS)

Division overview

Division overview

n Manages rehab programs for 1,125 Skilled Nursing Facilities (SNF), associated Long-

Term Care Centers and Assisted/Independent Living locations

Term Care Centers and Assisted/Independent Living locations

n Each Medicare-certified SNF is required to provide physical, speech and occupational therapy, but

many prefer outsourcing this component of their business

many prefer outsourcing this component of their business

n Long-term care and assisted/independent living resident services under Medicare Part B

n RehabCare provides a compelling value proposition to its SNF partners

n Access to advanced technology platform

n Broader array of clinical programming

n Better access to therapist labor pool

n Reimbursement expertise and denials management

Source: Information available from public filings or from company websites

¹Source: MedPAC Report to Congress, March 2010

11,000+

1,125

1,000

700

538

450

400

300

188

13

SRS Division

Client profile

Client profile

n Average SNF includes 120-140 beds

n Medicare Part A - 20 beds

n Residential Long-Term Care/Part B

n RHB client

n Freestanding SNF (85% of total contracts)

n Small to mid-size chain of facilities (chains of 3 or more facilities account for 47% of total

contracts)

contracts)

• Average size of chain client is 9 facilities

n Campus of Care - Assisted and Independent Living

n Contracts

n Typically 1-2 years at the outset with an automatic renewal

n Average contract life is 3.3 years

n 10% annual contract turnover

• Reasons for closures:

– Competition - 46%

– Change of ownership or facility closure - 38%

– Payment problems - 11%

– Other - 5%

14

SRS Division

Technology platform

Technology platform

n State-of-the-art iPhone and iPod Touch technology

n Planned rollout to all clinicians by year end

n Currently in the hands of about 500 therapists

n Increases speed and accuracy

• Maximizes therapist productivity

• Reduces billing errors and subsequent denials

n Systems with advanced reporting capability

n Captures Resource Utilization Group (RUG) specific information

for Minimum Data Set (MDS) input

for Minimum Data Set (MDS) input

n RUG category placement results in appropriate payment

n Records patient outcome data

n Includes discharge location and hospital re-admissions

n Tracks data to ensure optimal outcomes at lowest cost

n Benchmarking reports

n National comparative data for SNFs in RehabCare universe

• Ability to track common metrics across venues of service

• Support future research on decision making for post-acute

patient placement

patient placement

15

SRS Division

Technology sample

Technology sample

Upon logging in, therapists have the

ability to choose which facility they’re

working in, clock in for the day,

enter/edit treatment information,

balance their time card, review the

patient schedule and synchronize their

data

ability to choose which facility they’re

working in, clock in for the day,

enter/edit treatment information,

balance their time card, review the

patient schedule and synchronize their

data

The therapist chooses the appropriate

CPT codes and enters the number of

minutes spent providing each treatment.

Once the minutes have been distributed,

the daily note icon appears in yellow to

signify a note is now required.

CPT codes and enters the number of

minutes spent providing each treatment.

Once the minutes have been distributed,

the daily note icon appears in yellow to

signify a note is now required.

16

SRS Division

Clinical programming

Clinical programming

n Patient-specific care planning tools

n Care maps designed to guide decision making in patient treatment

• Incorporated into point-of-service technology

• Link initial care planning with discharge planning

• Outcomes drive future placement or discharge to home

n Provide clinical staff with the ability to determine cost of care and options for expanded

service

service

n Smart Moves Health and Wellness

n Meets the increasing demand for services designed for residents of Assisted and

Independent Living Retirement communities

Independent Living Retirement communities

• Promotes resident ability to remain at desired level of care (“Age in Place”)

n Meets demand of the “older adult” for such services

17

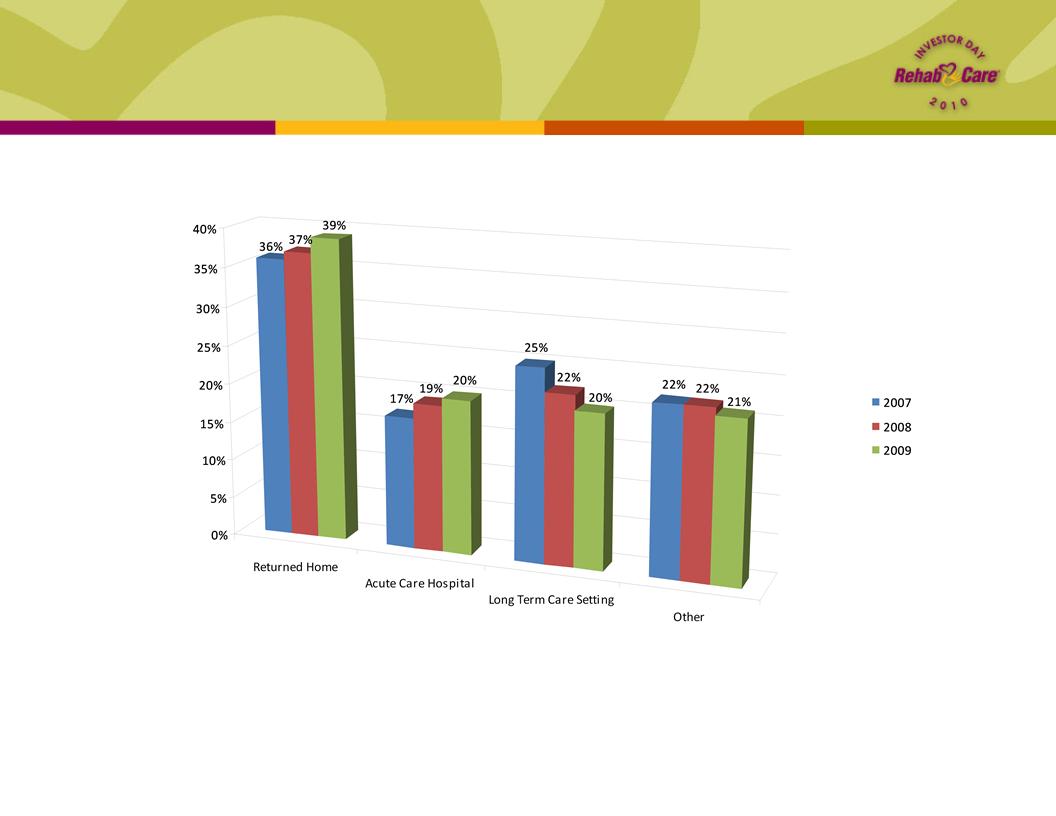

SRS Division

Clinical outcomes

Clinical outcomes

18

Discharge Disposition

n Based on internal universe of over 1,100 programs; no standardized

industry benchmarks exist for SNFs

industry benchmarks exist for SNFs

SRS Division

Access to therapy staff

Access to therapy staff

n RehabCare model of regional employment teams

n Shared resource between RehabCare divisions

n 7 teams of recruiting and staffing management

• Linked closely to operations; hired 2,150 therapists in 2009

n Student programs

• 275 academic affiliations and 332 RehabCare clinical education sites

• Providing iTouch technology and applications to selected schools

• Student hires tend to have a greater sense of loyalty

– 2005 : hired 83 new grads

– 2009 : hired 605 new grads

– 2010 : goal to hire over 750

n Industry leading therapist retention rates

n Turnover rates at 10%

n Advantages of market density for RehabCare

n Staffing managers move staff as demand changes

n Flexibility to meet patient need

• Diverse clinical opportunity supports retention

19

SRS Division

Challenges and opportunities

Challenges and opportunities

n Implementation of change to concurrent therapy rules

n Preparation underway

n RehabCare existing policy on concurrent therapy delivery model has been restrictive

n Mitigation plan in progress:

• Analysis of treatment methods - concurrent, group and individual

• Leverage technology advantage to drive enhanced productivity and offset

increased staff need

increased staff need

n RUGs IV / MDS 3.0

n October 1, 2010 or October 1, 2011????

n RUGs IV delayed but on schedule with MDS 3.0 and concurrent therapy changes

n Rehab in the SNF setting

• Rehab patients in the SNF setting will continue to be profitable

• Medically complex patients provide the opportunity to fill more Medicare beds

n Market share opportunity

n Take advantage of reimbursement changes and provide support and training to SNF

operators

operators

n Our advanced technology will be key as complexity of reporting increases

• Track superior clinical outcomes at lowest cost

• Monitor key indicators such as hospital readmission rates

20

SRS Division

Outlook

Outlook

n Growth strategy

n New sales with focus on self-operated programs

n Same store growth as patient population requiring rehabilitation increases

n Expect 7% - 8% operating earnings margins for the full year 2010, driven by mid

-single digit year-over-year same store revenue growth

-single digit year-over-year same store revenue growth

n Reflects the estimated impact of new concurrent therapy rules, the rollout of new

technologies, pricing pressures and wage rate increases during the year

technologies, pricing pressures and wage rate increases during the year

n Anticipate 50 to 75 new units in 2010

n Patient Protection and Affordable Care Act (PPACA) extended the Part B

therapy cap exception process through Dec. 31, 2010

therapy cap exception process through Dec. 31, 2010

21

Hospital Division

Kevin Gross

Senior Vice President, Hospital Operations

Brock Hardaway

Triumph HealthCare President & COO

Hospital Division

Overview

Overview

Competitive Landscape

1MedPAC, March 2010 Report to Congress

2Includes Triumph Hospital-The Heights, which opened in April

n Post Triumph merger, fourth largest post-acute hospital operator, third

largest long-term acute care hospital provider

largest long-term acute care hospital provider

n RehabCare pursues joint venture hospital partnerships (nine currently,

representing 15 locations) with market-leading acute care providers and

physician groups, in addition to our wholly owned facilities

representing 15 locations) with market-leading acute care providers and

physician groups, in addition to our wholly owned facilities

Market Size1: 221 IRFs

(Freestanding and HIHs)

Market Size1: 386 LTACHs

IRFs

LTACHs

23

Source: Information available from public

filings or from company websites

filings or from company websites

99

95

83

35

23

19

16

14

8

4

2

Hospital Division

Locations

Locations

Note: Bed figures represent licensed beds

Triumph Lima

Beds: 26

Triumph Mansfield

Beds: 33

Triumph Fargo

Beds: 31

Triumph Central Dakotas

Beds: 41

Triumph El Paso

Beds: 62

Triumph Easton

Beds: 31

Triumph Central

Houston

Beds: 40

Triumph Aurora

Beds: 37

Triumph Amarillo

Beds: 72

Triumph

Northwest

Beds: 85

Triumph

Clear Lake

Beds: 110

Triumph

Channelview

Beds: 83

Triumph

North

Beds: 86

Triumph

Tomball

Beds: 75

Triumph

Baytown

Beds: 37

Triumph

Town & Country

Beds: 66

Triumph Victoria

Beds: 23

Triumph Philadelphia

Beds: 58

Triumph Our Lady

of Peace - South

Bend

of Peace - South

Bend

Beds: 32

Triumph Heights

Beds: 42

Clear Lake

Beds: 60

Triumph

Southwest

Beds: 105

Northwest TX

Beds: 44

St. Luke’s

Beds: 35

Northland

Beds: 35

Tulsa

Beds: 60

Rome

Beds: 24

Arlington

Dallas

Central Texas

Beds: 24

Beds: 24

Beds: 20

Beds: 60

Lafayette

Beds: 68

New Orleans

Beds: 56

West Gables

Beds: 60

Denotes Hospital in Hospital (HIH) - remaining facilities are freestanding (note: freestanding LTACHs are not subject to the 25% rule)

New Orleans - grandfathered from the 25% rule

Indicates Inpatient Rehabilitation Facility (IRF)

Indicates Long-Term Acute Care Hospital (LTACH)

Greater Peoria

Beds: 50

Triumph Detroit

Beds: 77

24

25

Hospital Division

Strategy

Strategy

n Development Projects

n Houston Heights (remote provider for Triumph North)

• 42-bed LTACH - Opened April 15, 2010

n Rome, Georgia (expansion)

• 24 beds expanded to 45-bed LTACH - Opening Q2 11

n Central Texas (expansion)

• 20 beds expanded to 60-bed IRF - Opening Q1 12

n Net revenue growth

n Managed care and commercial payors

n Developing IRF opportunities within Triumph facilities

n Adding services to legacy RehabCare LTACHs - ICU, CT, expanded

laboratory

laboratory

n Leverage support functions in Houston

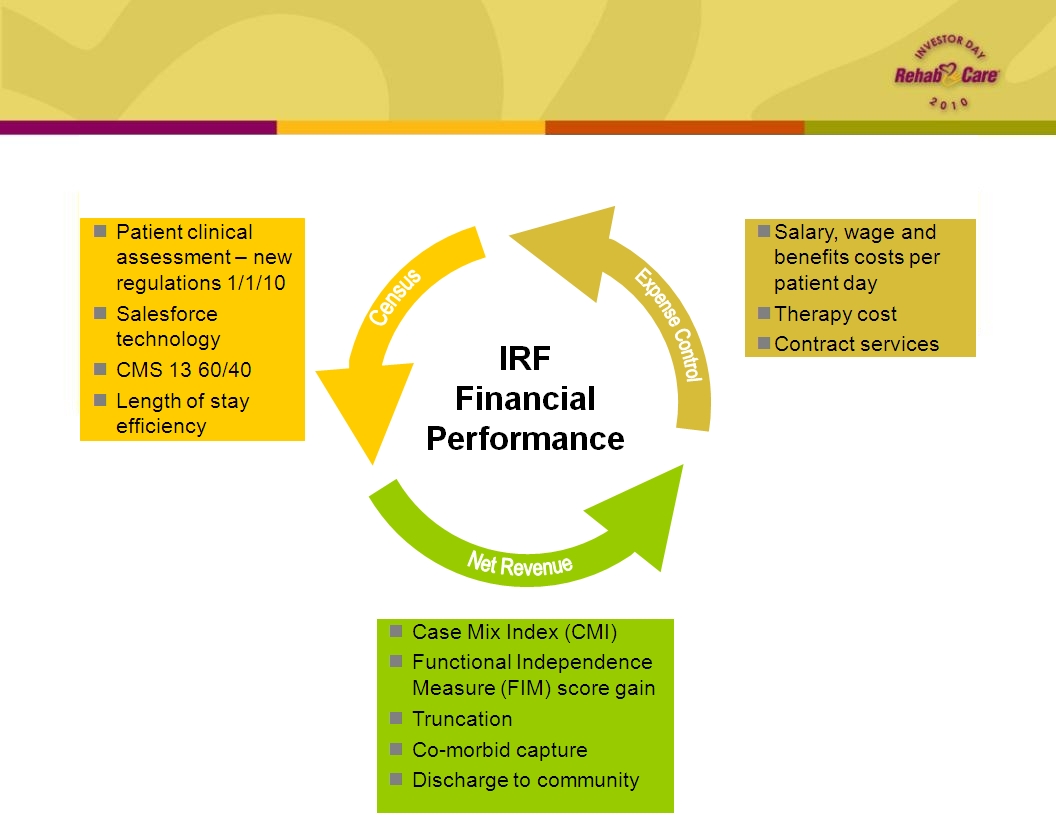

IRFs

Key operating metrics

Key operating metrics

26

IRFs

Quality measures

Quality measures

1per 1000 patient days

2eRehab national average unadjusted data for Q1 10

|

Quality and Risk Indicators

|

Benchmark

|

Q1 10

|

|

Hospital Acquired Central Line Infection Rate1

|

<1.5

|

1.66

|

|

Hospital Acquired Pressure Wound Rate1

|

<1

|

0.82

|

|

FIM Score Gain

|

>24.12

|

23.1

|

|

Discharge to Community

|

>72.4%2

|

68%

|

|

Discharge to Short-Term Acute Care (STAC)

|

<12.2%2

|

14%

|

27

Overview and Update

on LTACHs

on LTACHs

Brock Hardaway

LTACHs

Overview

Overview

n Update on integration

n Update on progress made with implementing key operating metrics at

legacy RehabCare LTACHs

legacy RehabCare LTACHs

n Update on Triumph

n Role of LTACHs in continuum

n Healthcare reform and the future

29

LTACHs

Integration update

Integration update

n Integration of back office support is either on or ahead of schedule

n Houston is Hospital Division office

n Triumph name will be used to brand all 29 LTACHs

n Taking advantage of combined scale for additional GPO savings (drugs and

supplies)

supplies)

n New regional operations structure effective May 1

n Gulf Coast Region (Texas and Louisiana)

n National Region (All other hospitals)

n Promotes a single approach and culture across the Hospital Division

n Overall, integration has been smooth

30

LTACHs

Key operating metrics

Key operating metrics

31

LTACHs

Progress w/implementing Triumph metrics

Progress w/implementing Triumph metrics

|

Performance Metric for

legacy hospitals |

2009 Actual

|

Q1 10

Actual

|

|

Volume

|

|

|

|

Occupancy

|

56%

|

58%

|

|

Case Management

|

|

|

|

Window %

|

33%

|

44%

|

|

CMI

|

1.00

|

1.01

|

|

Medicare Net Revenue per patient

day (PPD) |

$1,176

|

$1,424

|

|

Non-Medicare Net $ PPD

|

|

|

|

Commercial $ PPD

|

$1,258

|

$1,339

|

32

n Operating performance for RehabCare legacy LTACHs improved

sequentially in Q1 10 by $2.6 million

sequentially in Q1 10 by $2.6 million

LTACHs (all)

Performance on key metrics

Performance on key metrics

Medicare Net Revenue

*2009 operating stats are Pro forma

33

LTACHs

2010 operational outlook

2010 operational outlook

n Implementing services and programs that will improve quality of care and

quality of earnings

quality of earnings

n ICU (Tulsa and Rome - new construction)

n Around-the-clock physician coverage (Tulsa, Dallas, Lafayette, Peoria, Kansas

City)

City)

n Ancillary enhancements (Tulsa, Dallas, Lafayette, Peoria, El Paso)

• CT scanners

• Hyperbaric chamber(s)

• Special procedure rooms

n New hospitals are performing

n The Heights already exceeding volume expectations

n Peoria hospital ended qualifying period at the end of April

n New regional operations structure gives stability, direction and support to drive

performance across the portfolio

performance across the portfolio

34

LTACHs

Role within the continuum

Role within the continuum

n LTACHs represent the earliest discharge option from the STAC setting

n ICU/high observation unit (HOU) allows for early and safe transfer of medically

complex patients

complex patients

n Availability of ancillary services, advanced equipment and experienced staff

n LTACHs can discharge patients home or to highest level of functionality faster

n Multi-disciplinary approach means all caregivers are focused on same outcome

n Strong therapy component results in patients going home or to the next level of care

faster; therapists work with the nursing staff to resolve medical issues while dealing

with physical rehabilitation aspects of the treatment plan

faster; therapists work with the nursing staff to resolve medical issues while dealing

with physical rehabilitation aspects of the treatment plan

n LTACHs should:

n Accept patients from STAC/ICU setting within 3-5 days of diagnosis and stabilization

n Discharge at least 50% of their patients home and within the Medicare defined

expected ALOS

expected ALOS

n Return less than 5% of their patients to the STAC setting for services the LTACH can’t

provide or manage safely

provide or manage safely

n Reduce 90-day STAC discharge readmit rates by healing and educating patients and

families on care/prevention

families on care/prevention

35

LTACHs

Triumph approach

Triumph approach

n Equipped ICU or HOU with experienced, well-trained ICU staff

n 88% of Triumph hospitals have an ICU or HOU today

n All but one will have an ICU or HOU by this time next year

n Availability of on-site, 24/7 physician coverage

n 75% of Triumph hospitals have either 24/7 on-site coverage or on-site coverage on nights and

weekends and attending physicians during the day

weekends and attending physicians during the day

n All freestanding hospitals with an ICU will have 24/7 physician coverage immediately available and on

-site by end of 2010

-site by end of 2010

n Nursing and respiratory therapy on-site and dedicated around the clock

n 100% of Triumph hospitals provide on-site and dedicated nursing and RT staff

n 100% of Triumph hospitals have at least one RN on site at all times

n Ancillary support necessary to provide safe care to complex patients

n CT scanner and other routine radiological services on-site or contracted to be readily available

n Hyperbaric oxygen chamber and/or other advanced equipment for treating complex wounds on-site or

contracted to be readily available

contracted to be readily available

n Procedure room capable of doing basic procedures or contracted to be readily available

n Report quality outcomes

n Triumph benchmarks all hospitals on monthly/quarterly basis

n Core measures are tracked for all hospitals and reported to Sr. Management

n Admit high proportion of high acuity patients (CCs, MCCs, etc.)

n Triumph does not admit any patients that have a primary condition of rehabilitation

n Over 90% of Triumph Medicare discharges have either MCC or CC

n Triumph utilizes Interqual criteria

Facility/Services

Patient Admission Criteria

36

LTACHs

Quality measures

Quality measures

n Triumph measures, tracks and reports

quality related data elements - core

measures

quality related data elements - core

measures

n Variances to benchmark require

management intervention

management intervention

n Internal and external benchmarks

n Quality of earnings almost always follows

quality of care

quality of care

n Triumph core measures

n Wound improvement

n Ventilator weaning

n Hospital acquired infection rate

n Hospital acquired pressure wound

rate

rate

n Mortality rate

n Readmissions to STAC

n Little or no comparative data exists

n ALTHA benchmarking program

n Industry-wide effort to develop quality

standards

standards

n Data collection starting for Q110

|

Measure |

Benchmark |

Triumph

2009 Actual* |

|

Wound

Improvement Rate |

90% |

89% |

|

Ventilator

Weaning Rate |

75% |

62% |

|

Hospital

Acquired Infection |

2.6/1,000 days |

1.8/1,000 days |

|

Hospital

Acquired Pressure Wounds |

2.3/1,000 days |

1.8/1,000 days |

|

Mortality

Rate |

18% |

12% |

|

Unplanned

Transfers to STAC |

5% |

4% |

*excluding legacy RehabCare

37

LTACHs

Healthcare reform and proposed RY2011 Rule

Healthcare reform and proposed RY2011 Rule

n Healthcare reform signed into law March 23, 2010

n Extends all provisions of MMSEA until end of 2012

• Moratorium on new LTACH beds

• HIH quota % frozen at 50% or higher

• Restricts CMS from implementing one-time budget neutrality adjustment

• Restricts CMS from implementing short-stay outlier policy

n 25bps reduction to market basket effective Apr. 1, 2010 and another 50bps reduction

effective Oct. 1, 2010

effective Oct. 1, 2010

n Prohibits new physician-owned hospitals

n Impact of the insured patient population created by healthcare reform is unclear

n Post-acute bundling pilots

n Proposed RY2011 Rule for LTACHs

n Slight decrease in the Federal Rate

n Slight increase in the fixed loss threshold for outliers

n Adjustments to Wage Index which results in some winners and some losers

n Adjustments to Diagnosis-Related Group (DRG) weights

n If passed as proposed, the RY2011 rule would have less than a 1% impact (before

behavioral changes)

behavioral changes)

38

LTACHs

Growth plans and the future

Growth plans and the future

n With MMSEA extended until end of 2012, growth will come from acquisitions

n Growing number of interested LTACH sellers

n Attractive purchase multiples

n Triumph management team has proven results and track record

n Impact of healthcare reform

n More insured lives in markets will likely result in more pressure on inpatient utilization at

STAC hospitals

STAC hospitals

n Could result in higher referral volumes from STAC hospitals

n Working on post-acute bundling in Houston market

• Triumph has 11 LTACH locations in the Houston market

• RehabCare has 2 IRF locations in the Houston market

• RehabCare has many strong SRS client locations in the Houston market

• Relationship with Memorial Hermann

39

Hospital Division

Outlook

Outlook

40

n Expect FY2010 revenue of $650 - $675 mm

n Anticipate EBITDA of $90 - $100 mm for FY2010

n Reflects the impact of:

• Market basket reductions for IRFs and LTACHs

• RY2011 proposed LTACH rule

n Reaffirm breakeven operating earnings run rate for 13 legacy hospitals by

the end of Q2 10 and breakeven operating earnings for FY2010

the end of Q2 10 and breakeven operating earnings for FY2010

n Dallas LTACH anticipated to be accretive by end of Q2 10

n Triumph hospitals expected to achieve 18% to 20% EBITDA margins for

FY2010

FY2010

n Net income attributable to noncontrolling interests expected to approximate

$3 million for FY2010

$3 million for FY2010

Strategic Direction

John Short

Drive Continued Growth

n Achieve margin expansion in legacy RehabCare hospitals through

Triumph merger

Triumph merger

n Develop IRF opportunities in Triumph markets

n Achieve unit and same store growth in contract services divisions

n Identify and evaluate add-on acquisitions in each division

n Leverage continuum capabilities

42

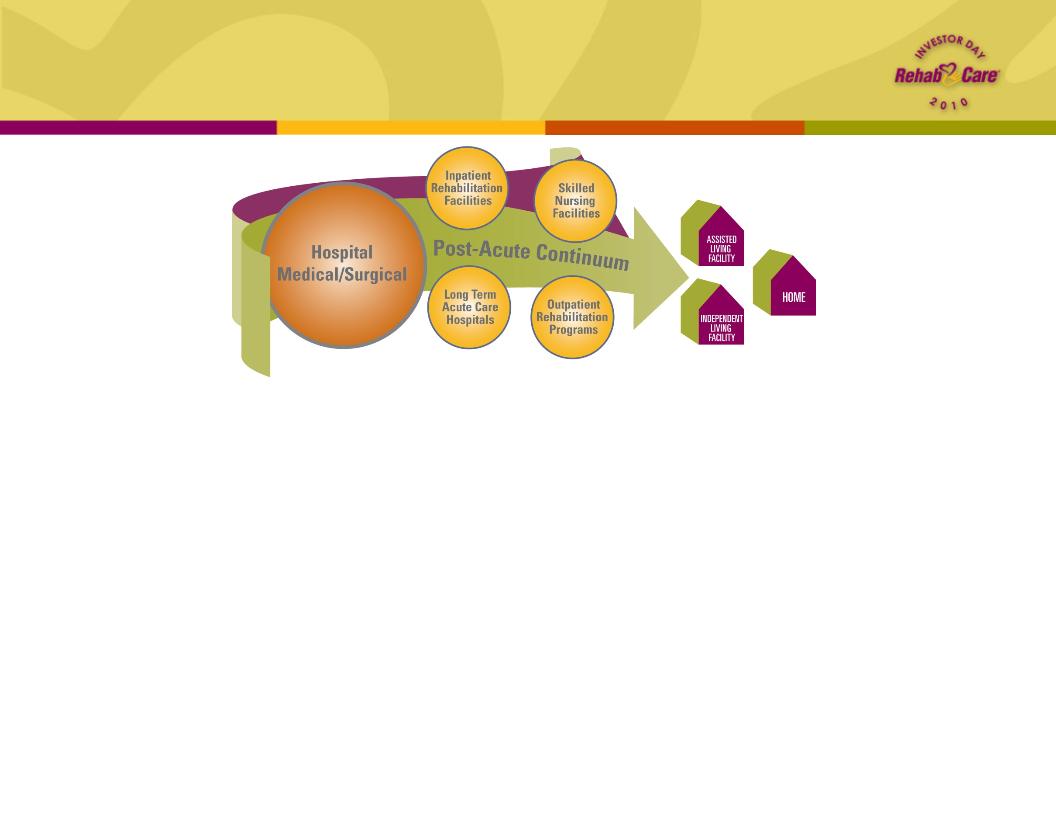

Leverage Continuum Capabilities

43

n Diversity gives us ability to withstand market pressures in any one segment

n Strong positioning in primary venues of post-acute care provides “one-stop

shop” for acute care discharge planners

shop” for acute care discharge planners

n Ensures seamless transition of patients to the right level of care at the right

time, with the best possible outcomes

time, with the best possible outcomes

n Offers flexible solutions to clients and partners and positions RehabCare for

bundled reimbursement

bundled reimbursement

n Provides opportunity to share resources, link referral relationships and

integrate clinical services in markets with significant overlap

integrate clinical services in markets with significant overlap

Market Sector Overlap

Examples

Examples

|

Market Area

|

Skilled Nursing

Rehabilitation Services programs |

Hospital

Rehabilitation Services programs |

Hospitals

|

|

Houston

|

26

|

1 Inpatient

|

11 LTACHs

1 IRF

|

|

Philadelphia

|

13

|

3 Inpatient

1 Skilled Nursing

8 Outpatient

|

2 LTACHs

|

|

Detroit

|

13

|

1 Inpatient

4 Outpatient

|

1 LTACH

|

|

St. Louis

|

99

|

3 Inpatient

|

1 IRF

|

|

Dallas

|

46

|

1 Inpatient

1 Outpatient

|

1 LTACH

1 IRF

|

44

Promote Integration

Through information sharing

Through information sharing

n Customer Relationship Management (CRM) to build and manage client relationships

n Development of Electronic Medical Record (EMR) to build consolidated repository of

clinical data

clinical data

n Human Capital Management (HCM) to integrate processes for building and retaining

workforce

workforce

n Single solution for Back Office operations to unify and standardize

n Application of Google Cloud-Based Technology to minimize capital expenditure

45

Electronic Medical Record

n Facilitates care coordination across settings

and geographic locations, reduces

administrative burden of dueling data sets

and geographic locations, reduces

administrative burden of dueling data sets

n Integrates with or provides EMR structure for

host facility (opportunity to upsell mgt. services)

host facility (opportunity to upsell mgt. services)

n Our point-of-service technology provides

currency of data

currency of data

n Enhances our ability to evaluate patient

appropriateness, provide timely information to

referrers and address care follow-up (i.e.

impact readmissions)

appropriateness, provide timely information to

referrers and address care follow-up (i.e.

impact readmissions)

46

Deploying cloud-based EMR platform to conform to

meaningful use standards; in SRS by end of 2011,

Hospitals by end of 2012

meaningful use standards; in SRS by end of 2011,

Hospitals by end of 2012

Google PHR

n Working with Google Health on customization of free, cloud-based Personal

Health Record (PHR) to be applied across divisions

Health Record (PHR) to be applied across divisions

n Allows monitoring of patient’s compliance with discharge plan and progress with

recovery goals

recovery goals

n Further engages patient and family in treatment process and teaches patient how

to make healthy lifestyle choices

to make healthy lifestyle choices

n Goal is to ensure optimal outcome post-discharge and prevent readmission

n Added benefit: Google name recognition gives RehabCare greater visibility

47

n Initially targeted at Medicare beneficiaries; demonstration project will determine

what structures and processes work best and where

what structures and processes work best and where

n Shifts away from traditional fee-for-service model

n Providers are rewarded for better care coordination that meets quality of care

indicators and cost savings targets

indicators and cost savings targets

n Provides us opportunity to participate in voluntary ACOs; broadened our product

offerings to include solutions for an ACO model as well as other integrated

delivery systems

offerings to include solutions for an ACO model as well as other integrated

delivery systems

Promote Integration

Under health reform

Under health reform

Shared savings program is established in 2012 for

providers organized as Accountable Care Organizations

(ACOs) that voluntarily meet quality thresholds.

providers organized as Accountable Care Organizations

(ACOs) that voluntarily meet quality thresholds.

48

Promote Integration

Under health reform

Under health reform

n Houston network model

n Utilizing our broad continuum services and system relationships (e.g. Memorial

Hermann) to test post-acute network strategy

Hermann) to test post-acute network strategy

n Beginning in 2011, working to determine components of successful bundling model

to assist CMS in setting national study parameters

to assist CMS in setting national study parameters

n AMRPA Continuing Care Hospital (CCH) project

n Serving on AMRPA (American Medical Rehabilitation Providers Assoc.) committee

that will be developing industry pilot to test CCH model

that will be developing industry pilot to test CCH model

n Would be an amalgam of post-acute care settings (either actual building or virtual

entity) that would be paid on a per-episode basis, which includes full period of stay

plus 30 days post discharge

entity) that would be paid on a per-episode basis, which includes full period of stay

plus 30 days post discharge

n One estimate indicates bundling acute and post-acute services could save $20

billion over 10 years; also eliminates need for complex maze of regulations

billion over 10 years; also eliminates need for complex maze of regulations

In 2013, CMS begins 3-year national pilot project to study

the effectiveness of a bundled payment system.

the effectiveness of a bundled payment system.

49

Safe Harbor

Forward-looking statements have been provided pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Such statements are based on the Company’s current

expectations and could be affected by numerous factors, risks and

uncertainties discussed in the Company’s filings with the

Securities and Exchange Commission, including its most recent

report on Form 10-K, subsequent reports on Form 10-Q and current

reports on Form 8-K. Do not rely on forward looking statements as

the Company cannot predict or control many factors that affect its

ability to achieve the results estimated. The Company makes no

promise to update any forward-looking statements whether as a

result of changes in underlying factors, new information, future

events or otherwise.

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Such statements are based on the Company’s current

expectations and could be affected by numerous factors, risks and

uncertainties discussed in the Company’s filings with the

Securities and Exchange Commission, including its most recent

report on Form 10-K, subsequent reports on Form 10-Q and current

reports on Form 8-K. Do not rely on forward looking statements as

the Company cannot predict or control many factors that affect its

ability to achieve the results estimated. The Company makes no

promise to update any forward-looking statements whether as a

result of changes in underlying factors, new information, future

events or otherwise.

50