Attached files

| file | filename |

|---|---|

| 8-K - BRYN MAWR BANK CORPORATION -- FORM 8-K - BRYN MAWR BANK CORP | d8k.htm |

Bryn Mawr

Bank Corporation

NASDAQ: BMTC

First Quarter 2010 Update

Exhibit 99.1 |

1

This

presentation

contains

certain

forward-looking

statements.

Forward-looking

statements

can

be

identified

by

the

fact

that

they

do

not

relate

strictly

to

historical

or

current

facts.

They

often

include

the

words

believe,

expect,

anticipate,

intend,

plan,

estimate

or

words

of

similar

meaning.

Forward-looking

statements,

by

their

nature,

are

subject

to

risks

and

uncertainties.

A

number

of

factors,

many

of

which

are

beyond

Bryn

Mawr

Bank

Corporation's

(“the

Corporation”)

control

could

cause

actual

conditions,

events

or

results

to

differ

significantly

from

those

described

in

the

forward

looking

statements.

Information

regarding

the

factors

and

risks

that

can

affect

the

Corporation’s

business,

financial

condition

and

results

of

operation

is

contained

in

the

Corporation’s

filings

with

the

Securities

and

Exchange

Commission,

which

are

available

at

http://www.sec.gov.

Forward-looking

statements

speak

only

as

of

the

date

they

are

made.

The

Corporation

does

not

undertake

to

update

forward-looking

statements.

Safe Harbor |

2

Where to Find More Information About the

First Keystone Financial, Inc. Merger

The

Corporation

has

filed

with

the

Securities

and

Exchange

Commission

("SEC")

a

Registration

Statement

on

Form

S-4

concerning

the

proposed

merger

of

First

Keystone

Financial,

Inc.

into

the

Corporation

(the

“Merger”).

The

Registration

Statement

includes

a

prospectus

for

the

offer

and

sale

of

the

Corporation’s

Common

Shares

to

First

Keystone

Financial,

Inc.'s

shareholders

as

well

as

a

proxy

statement

for

the

solicitation

of

proxies

from

First

Keystone

Financial,

Inc.'s

shareholders

for

use

at

the

meeting

at

which

the

Merger

will

be

voted

upon.

The

combined

prospectus

and

proxy

statement

and

other

documents

filed

by

the

Corporation

with

the

SEC

contain

important

information

about

the

Corporation,

First

Keystone

Financial,

Inc.,

and

the

Merger.

We

urge

investors

and

First

Keystone

Financial,

Inc.'s

shareholders

to

read

carefully

the

combined

prospectus

and

proxy

statement

and

other

documents

filed

with

the

SEC,

including

any

amendments

or

supplements

also

filed

with

the

SEC.

First

Keystone

Financial,

Inc.'s

shareholders

in

particular

should

read

the

combined

prospectus

and

proxy

statement

carefully

before

making

a

decision

concerning

the

Merger.

Investors

and

shareholders

may

obtain

a

free

copy

of

the

combined

prospectus

and

proxy

statement

–

along

with

other

filings

containing

information

about

the

Corporation

–

at

the

SEC’s

website

at

http://www.sec.gov.

Copies

of

the

combined

prospectus

and

proxy

statement,

and

the

filings

with

the

SEC

incorporated

by

reference

in

the

combined

prospectus

and

proxy

statement,

can

also

be

obtained

free

of

charge

by

directing

a

request

to

Bryn

Mawr

Bank

Corporation,

801

Lancaster

Avenue,

Bryn

Mawr,

PA

19010,

attention

Geoff

Halberstadt,

Secretary,

telephone

(610)

581-4873. |

3

Bryn Mawr Bank Corporation

Profile

Founded in 1889 –

120 year history

A unique business model with a traditional commercial bank ($1.2

billion)

and a trust company ($3.1 billion) under one roof

Wholly owned subsidiary –

The Bryn Mawr Trust Company

Located on Philadelphia’s affluent “Main Line”

|

4

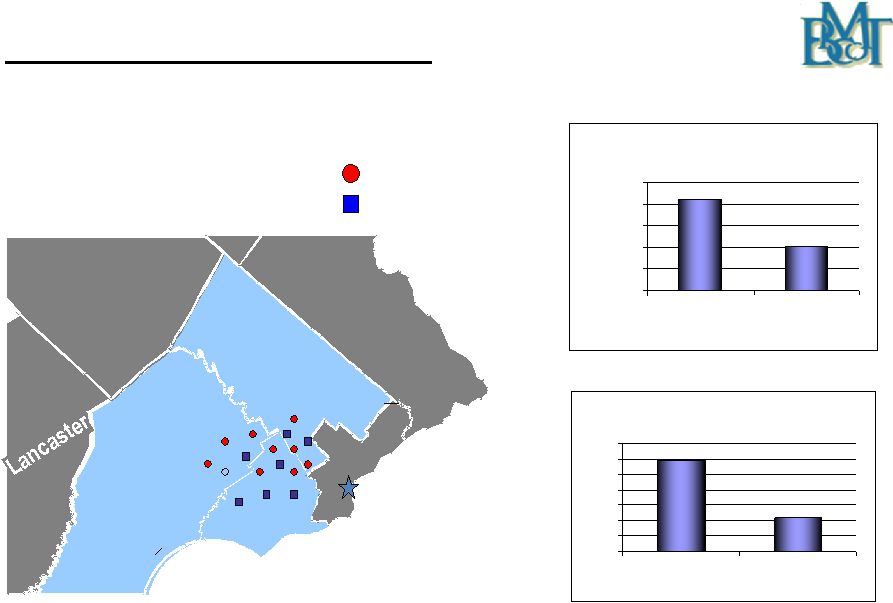

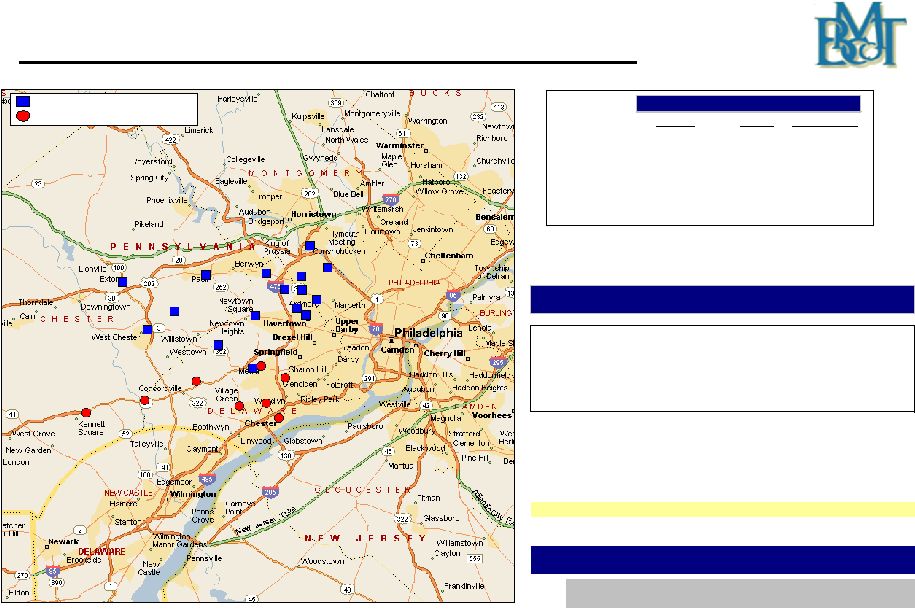

Chester

Bucks

Montgomery

Berks

State of Delaware

Philadelphia

New Jersey

Delaware

New Jersey

The Franchise Footprint

9 Full Service Branches/

7 Life Care Facilities

Average Household Income

$84,600

$41,000

$-

$20,000

$40,000

$60,000

$80,000

$100,000

BMTC Target

Market

Penna. State

Average

Percent of Population with

College Degree

59%

22%

0%

10%

20%

30%

40%

50%

60%

70%

BMTC Target Market

Penna. State

Average

Source: Public School Review

Life Care Facilities

Branch Offices |

5

Investment Considerations

A great brand & franchise

Solid financial fundamentals

Excellent credit quality

Outstanding target market demographics

New business initiatives driving growth

Well-capitalized

$3.1 billion wealth management business that provides a significant

source of non-interest income |

6

Experienced Management Team

Chairman, President and CEO –

Ted Peters

Lending –

Joseph Keefer

Wealth Management –

Frank Leto

Retail Banking –

Alison Gers

Finance –

Duncan Smith

Risk Management –

Geoffrey Halberstadt |

7

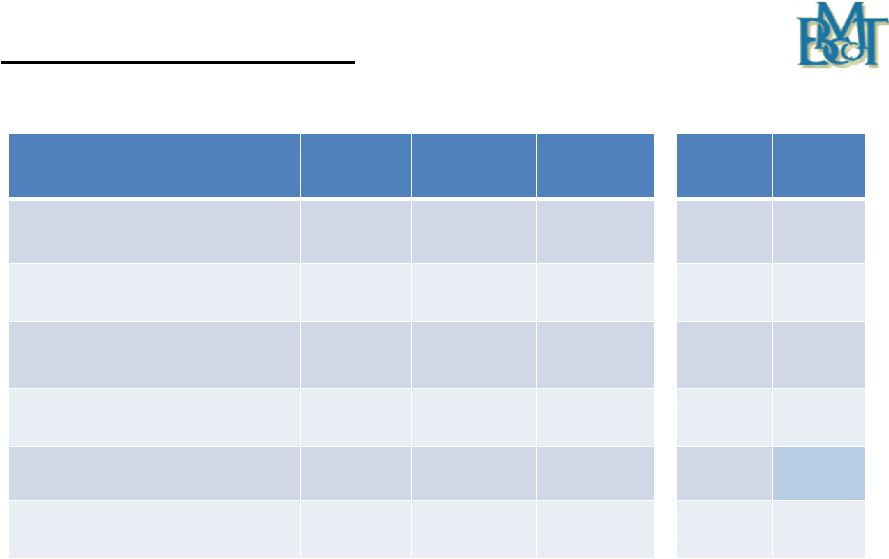

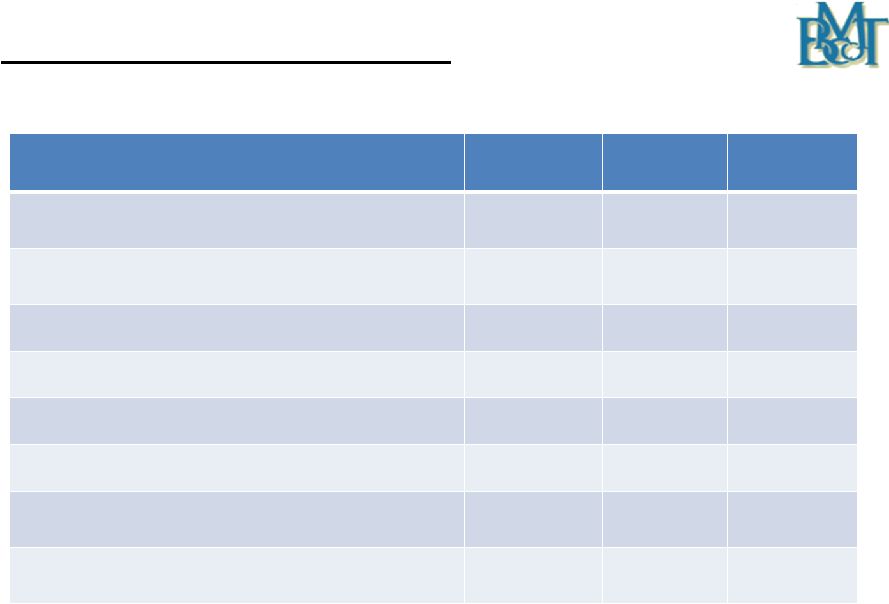

Financial Highlights

First Qtr

2010

Fourth Qtr

2009

First Qtr

2009

12/31

2009

12/31

2008

Portfolio Loans & Leases ($ in

millions)

$893

$886

$893

$886

$900

Wealth Assets in Total ($ in

billions)

$3.11

$2.87

$1.96

$2.87

$2.15

Non-performing Loans as a

% of Portfolio Loans and Leases

0.77%

0.78%

0.45%

0.78%

0.65%

Tangible Book Value Per Share

$10.56

$10.40

$9.78

$10.40

$9.55

Tangible Common Equity Ratio

7.82%

7.51%

7.20%

7.51%

7.13%

Dividends Declared

$0.14

$0.14

$0.14

$0.56

$0.54 |

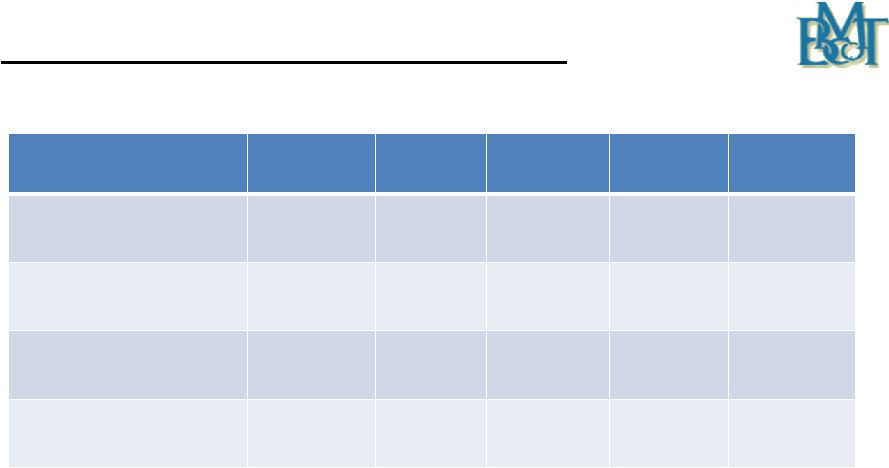

8

Financial Highlights -

continued

1

st

Qtr

2010

4

th

Qtr

2009

3

rd

Qtr

2009

2

nd

Qtr

2009

1

st

Qtr

2009

Net Income ($ in millions)

$2.22

$2.64

$2.62

$2.45

$2.63

Basic Earnings Per

Common Share

$0.25

$0.30

$0.30

$0.28

$0.31

Diluted Earnings Per

Common Share

$0.25

$0.30

$0.30

$0.28

$0.31

Dividend Declared Per

Share

$0.14

$0.14

$0.14

$0.14

$0.14 |

9

2010 Strategies

Complete the merger with First Keystone Financial Inc. in the third quarter

and introduce Bryn Mawr Trust services to its customers

Focus on the net interest margin

Continued emphasis on strong credit quality

Raise capital as needed

Monitor expenses

Use banking industry turmoil to attract new clients

Opportunistic expansion

Expand our Wealth Management offerings |

Growth Initiatives |

11

Announced acquisition of First Keystone Financial, Inc.

Announced on November 2, 2009

Approximately $500 million in assets

Expands footprint in Delaware and Chester (southeastern PA)

counties with 8 branches

New opportunities for BMTC Wealth Management, Business

Banking, Retail Banking and Mortgage Banking

Anticipate a July 2010 legal close

Growth Initiatives |

12

Growth Initiatives -

continued

Bryn Mawr

Asset Management

“Lift out”

strategy

Four investment advisers hired

Approximately $150 million in new assets as of April 30, 2010

Additional opportunities being evaluated

Institutional Trust and Escrow Services |

13

BMTC of Delaware

The Delaware Advantage

Generation Skipping Trusts

Directed Trusts

$403 million in assets at March 31, 2010

Branch Office Expansion and Modernization

West Chester Regional Banking Center Branch

Wayne and Paoli branch modernizations completed

Havertown branch modernization scheduled for 2010

Growth Initiatives -

continued |

14

Growth Initiatives -continued

Small Ticket National Leasing Business

“Lift out”

strategy

Leases outstanding: $44.0 million at 3/31/2010

Planned lease portfolio reduction of $13.7 million in the last 12 months

Average yield 10.48%

Quarterly lease charge-offs have continuously decreased since 12/31/2008

Changes made in underwriting standards and collection process have

improved results |

15

First Keystone Financial, Inc. –

Transaction Summary

(1) Based upon BMTC’s average daily closing price for twenty consecutive

trading days ending 10/30/2009 ($16.76) Acquiror:

Bryn Mawr Bank Corporation (NASDAQ: BMTC)

Seller:

First Keystone Financial, Inc. (NASDAQ: FKFS)

Consideration:

Each share of FKFS common stock will be exchanged for

0.6973 BMTC shares

Transaction Value:

Merger Consideration

Adjustment:

Per Share Merger Consideration subject to downward

adjustment based on the rise of FKFS delinquencies above

Board Representation:

Donald Guthrie (Chairman of the FKFS Board of Directors)

will join the BMTC Bank and Holding Company Boards as a

Director

Closing Condition:

Aggregate amount of FKFS delinquencies must be less than

$16.5 million

Required Approvals:

Customary Regulatory

Expected Closing:

July 2010

0.6973 BMTC shares

(1)

and $2.06 in cash

$34 million (approximate at announcement)

a specified level as of the month-end preceding the merger

|

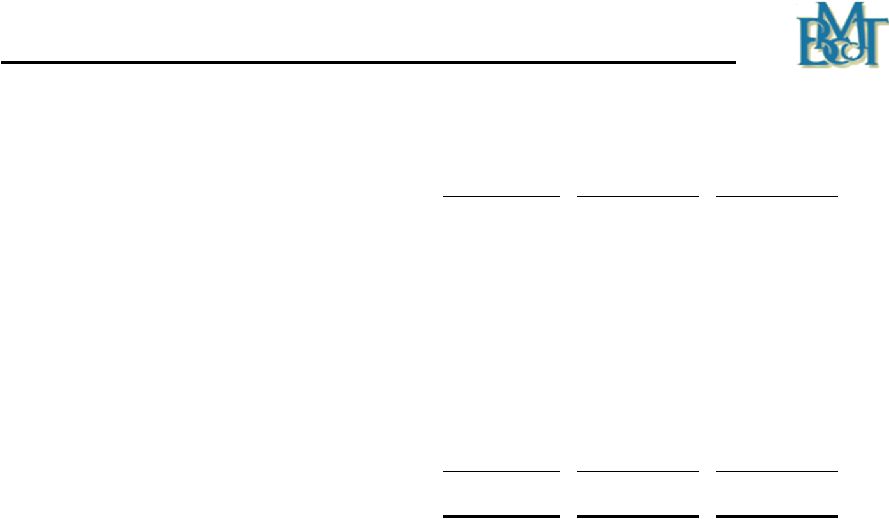

16

Merger Consideration Adjustment

FKF Delinquencies At

Month-End Preceding

Closing

Adjusted Amount Of

BMBC Stock To Be

Received For Each

FKF Share

Adjusted Per Share

Cash Consideration

For Each FKF Share

Deal Value with

BMTC Stock Valued

at $16.00 per Share

(in millions)

Less Than $10.5

million

0.6973

$2.06

$32.156

$10.5 -

$12.5 million

0.6834

$2.02

$31.518

$12.5 -

$14.5 million

0.6718

$1.98

$30.969

$14.5 -

$16.5 million

0.6589

$1.95

$30.393

$16.5 million or more

0.6485

$1.92

$29.916

Delinquencies are defined in the merger agreement as all loans delinquent 30 days

or more, non-accruing loans, other real estate owned, troubled debt

restructurings and the aggregate amount of loans charged-off between 10/01/2008 and

the month-end preceding closing in excess of $2.5 million. FKF delinquencies at

3/31/2010 were $13.1 million. |

17

First Keystone Financial Inc. -

Transaction Highlights

Expands

branch

footprint

into

the

attractive

demographic

markets

of

Delaware

and

Chester

County, Pennsylvania

Important component of strategic plan

Enhances long-term franchise value

Complementary business mix

Both banks have a “community focus”

Significant potential synergies identified in wealth management services and

residential mortgage originations

Transaction elements

Extensive due diligence performed

Conservative credit mark estimated

Achievable cost savings identified

Material earnings per share accretion after expensing merger related costs

Pro forma tangible book value per share is not expected to be materially

changed Attractive internal rate of return

Pro

Forma

capital

ratios

remain

significantly

above

“well

capitalized”

levels |

18

Source: SNL Financial

Pro forma financials do not include merger adjustments

BMTC data as of 3/31/2010; FKFS data as of 3/31/2010

(1)

Includes 7 limited service retirement community branches

Pro Forma Deposit Market Share –

Delaware County, PA

Bryn Mawr Bank Corp. (16)

First Keystone Financial, Inc. (8)

Expanding Southeast PA Footprint

Delaware, PA

2009

Total

2009

Deposits

Total

in

Market

Branch

Market

Share

Rank

Institution (ST)

Count

($000)

(%)

1

Wells Fargo & Co. (CA)

21

1,630

15.3

2

Royal Bank of Scotland Group

23

1,585

14.9

3

Toronto-Dominion Bank

15

1,360

12.8

4

Citigroup Inc. (NY)

3

1,040

9.8

5

PNC Financial Services Group (PA)

11

929

8.7

6

Banco Santander S.A.

13

830

7.8

Pro Forma

14

563

5.3

7

Beneficial Mutual Bncp (MHC) (PA)

7

386

3.6

8

Alliance Bancorp of Penn (MHC) (PA)

8

338

3.2

9

First Keystone Financial (PA)

7

337

3.2

10

Bryn Mawr Bank Corp. (PA)

7

226

2.1

Top 10

115

8,662

81.3

Market Total

181

10,651

100.0

($ in millions)

BMTC

FKFS

Pro Forma

Assets

$1,221

$489

$1,710

Loans

895

302

1,198

Deposits

914

331

1,246

Branches

16

(1)

8

24

Pro Forma Financials |

19

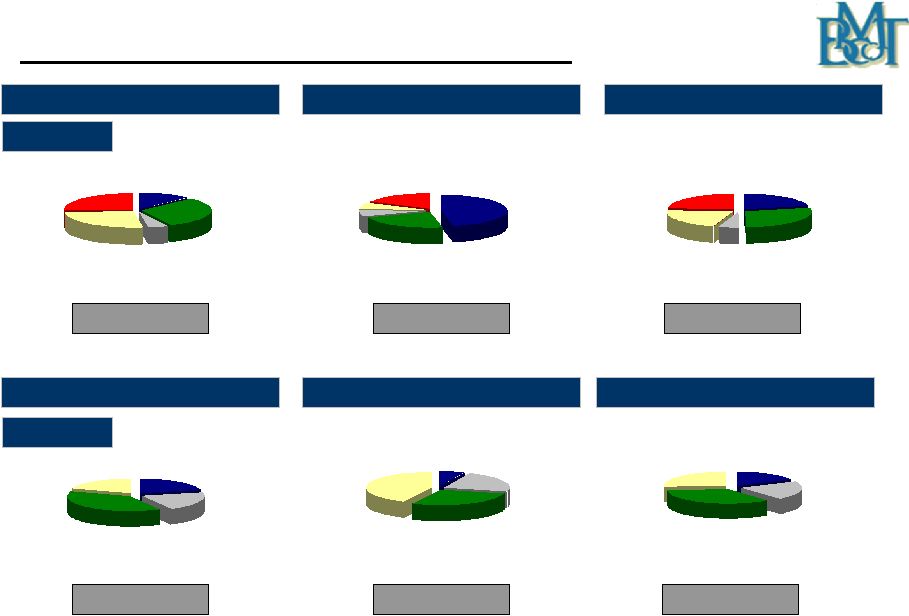

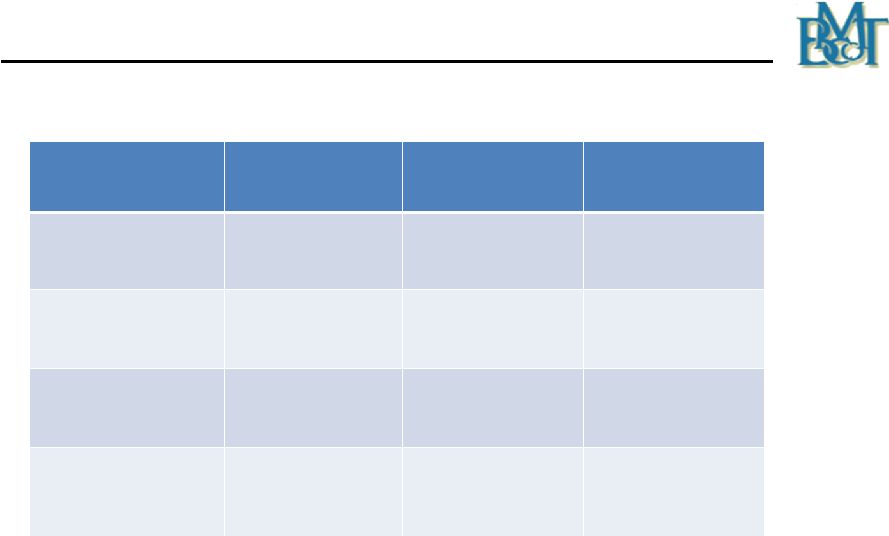

Time Deposits

25.8%

NOW & Other

Trans. Accts.

21.4%

MMDA,

Savings, &

Other

35.4%

Demand

Deposits

17.4%

Consumer &

Leases

23.8%

Commercial

21.3%

Comm. RE

28.6%

Construction

RE

5.1%

Res. RE

21.1%

Consumer &

Leases

26.0%

Commercial

26.2%

Comm. RE

30.8%

Construction

RE

4.6%

Res. RE

12.4%

Pro Forma Loans and Deposits

Source: Company filings

FKFS loan and deposit data as of 3/31/2010

BMTC loan and deposit data as of 3/31/2010; totals include loans

held for sale

Time Deposits

19.7%

NOW & Other

Trans. Accts.

20.9%

MMDA,

Savings, &

Other

38.1%

Demand

Deposits

21.3%

Deposits

Loans

BMTC Stand Alone

Total: $895M

Total: $1.2B

Total: $914M

Total: $1.2B

Res. RE

47.1%

Construction

RE

6.3%

Comm. RE

22.2%

Commercial

6.9%

Consumer &

Leases

17.6%

Time Deposits

42.7%

NOW & Other

Trans. Accts.

22.8%

MMDA &

Savings

28.0%

Demand

Deposits

6.5%

Total: $302M

Total: $331M

BMTC Stand Alone

FKFS Stand Alone

BMTC Pro Forma

FKFS Stand Alone

BMTC Pro Forma |

20

First Keystone Financial Inc. -

Due Diligence

Extensive due diligence conducted by BMTC and third parties

Extensive credit due diligence conducted

BMTC and third party loan review

Reviewed over 80% of commercial portfolio (CRE, C&I, and

Construction)

Multiple Construction / Commercial Real Estate sites visited

Conservative credit mark estimated at 4% to 5% of total loans

outstanding including existing Allowance for Loan Loss balance.

Estimated securities portfolio Mark–to–Market

KPMG conducted tax and accounting due diligence |

Financial Review

Bryn Mawr Bank Corporation Only

As of March 31, 2010 |

22

First Quarter 2010 Results

Net Income of $2.2 million

Diluted earnings per share of $0.25

Net Income includes:

$3.1 million charge-off largely attributable to one commercial

relationship

Security gains of $1.5 million

Merger and due diligence related costs associated with the pending

merger with First Keystone Financial Inc. of $347 thousand

|

23

First Quarter 2010 Results -

continued

Wealth Management Assets were $3.1 billion –

up 8.3% from the fourth

quarter 2009

Revenue from Wealth Management services was $3.8 million -

up 6.5%

from the fourth quarter 2009

Tax-equivalent net interest margin at 4.06%, the third consecutive quarterly

increase

Deposit levels of $914.4 million at 3/31/2010 as new core transaction

account openings remain strong |

24

First Quarter 2010 Results -

continued

No OTTI charges recorded in the first quarter of 2010 or for the

years

ended December 31, 2009, 2008 and 2007

Lease portfolio net charge-offs continue to decline ($1.4 million Q1 2009

to $545 thousand Q1 2010)

Loan quality strong with non-performing loans and leases of 77 basis

points at 3/31/2010

Professional fees higher due to collection activities and other initiatives

|

25

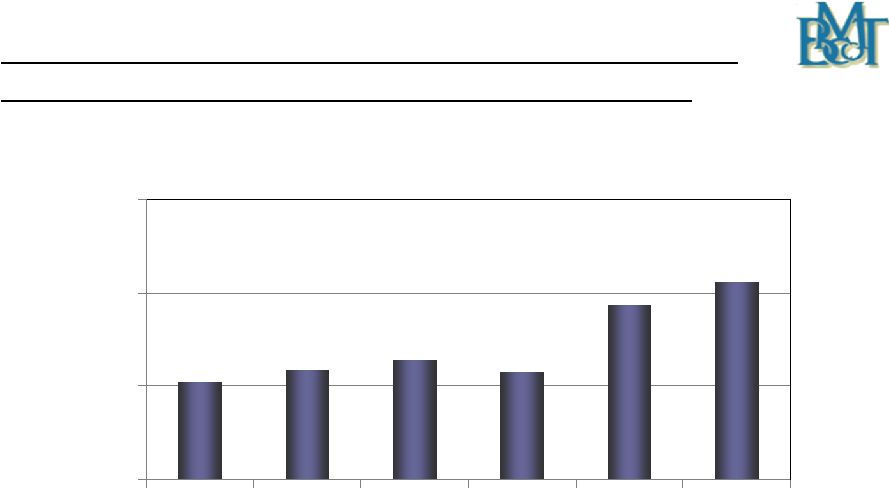

Diluted Earnings Per Share

$1.31

$1.46

$1.48

$1.08

$1.18

$0.25

$0.00

$0.40

$0.80

$1.20

$1.60

2005

2006

2007*

2008

2009**

2010

YTD**

* Excludes $0.10 per share gain on sale of real estate

** Figure includes merger related costs |

26

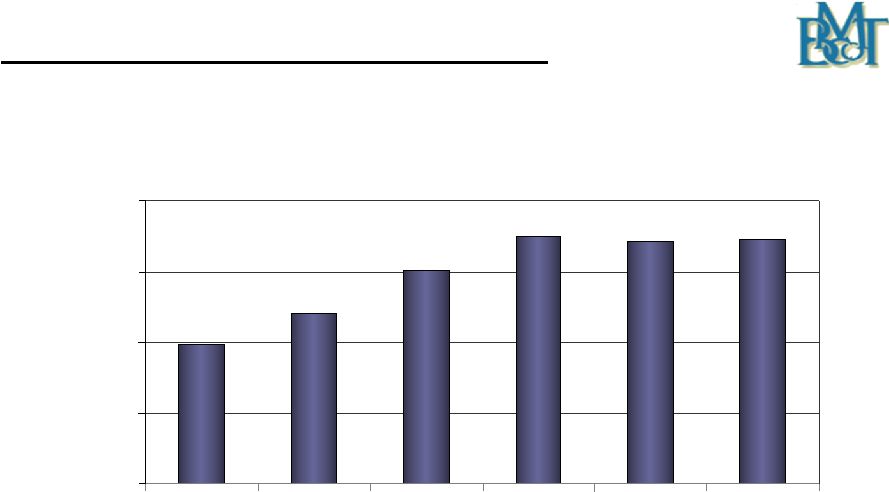

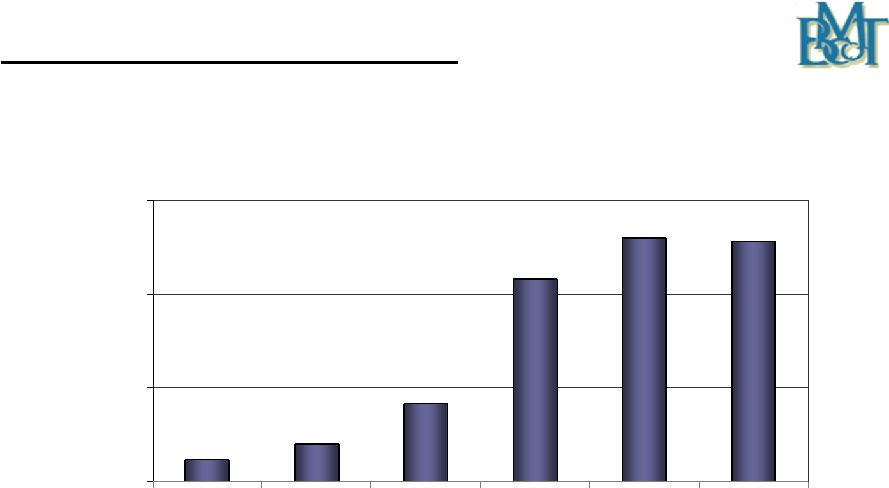

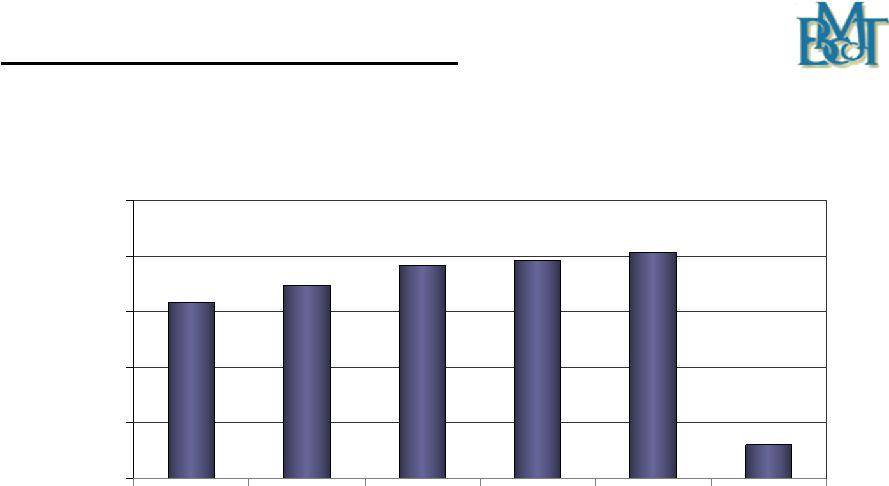

Portfolio Loan & Lease Growth

Total Portfolio Loans & Leases Outstanding

CAGR : 10.5% (2005-2009)

$595

$681

$803

$900

$886

$893

$200

$400

$600

$800

$1,000

2005

2006

2007

2008

2009

3/31/2010

($ in millions) |

27

Asset Quality

Asset Quality

First Qtr

2010

Fourth Qtr

2009

First Qtr

2009

Nonaccrual loans and leases

$5,880

$6,246

$3,251

90+ days past due loans –

still accruing

$1,015

$668

$744

Nonperforming loans and leases

$6,895

$6,914

$3,995

Other nonperforming assets

-

$1,025

$1,315

Nonperforming assets

$6,895

$7,939

$5,311

Nonperforming loans and leases / portfolio loans

0.77%

0.78%

0.45%

Nonperforming assets / assets

0.56%

0.64%

0.45%

($ in thousands) |

28

Asset Quality

First Qtr

2010

Fourth Qtr

2009

First Qtr

2009

Allowance for loan and lease losses

$9,740

$10,424

$10,137

Net loan and lease charge-offs (annualized) /

average loans

1.70%

0.53%

0.80%

Delinquency rate –

loans and leases > 30 days

1.10%

1.10%

1.01%

Delinquent loans and leases -

30-89 days

$2,917

$2,678

$5,077

Delinquency rate –

loans and leases 30-89 days

0.33%

0.30%

0.57%

TDR’s excluded from non-performing loans

$3,894

$1,622

-

Allowance for loan and leases losses / loans and

leases

1.09%

1.18%

1.13%

Allowance for loan and lease loss / nonperforming

loans and leases

141.3%

150.8%

253.7%

Asset Quality -

continued

($ in thousands) |

29

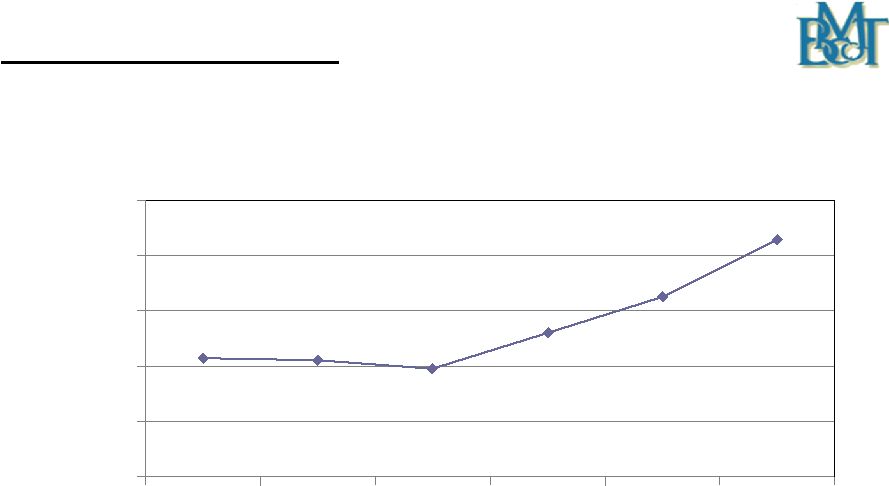

0.07%

0.12%

0.25%

0.78%

0.78%

0.77%

0.0%

0.3%

0.6%

0.9%

2005

2006

2007

2008

2009

3/31/2010

Asset

Quality

-

Continued

Nonperforming loans and leases as a % of portfolio loans and leases

|

30

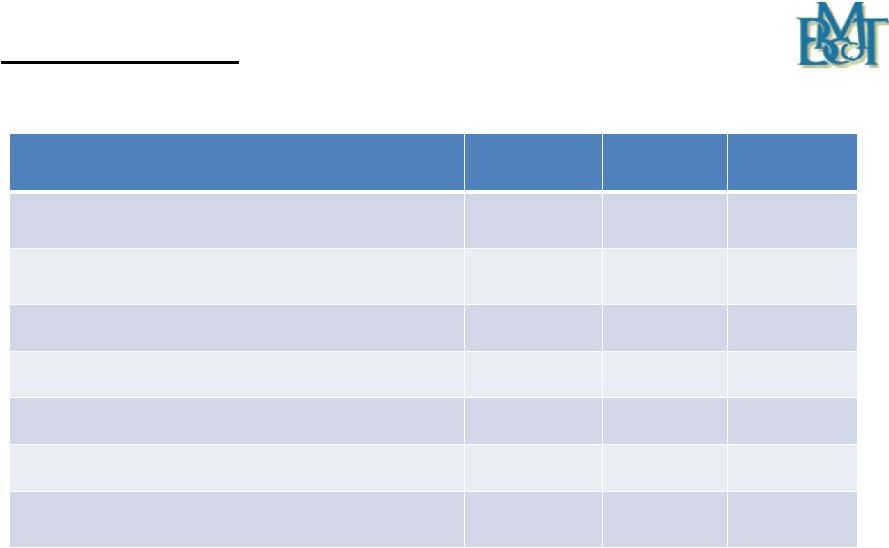

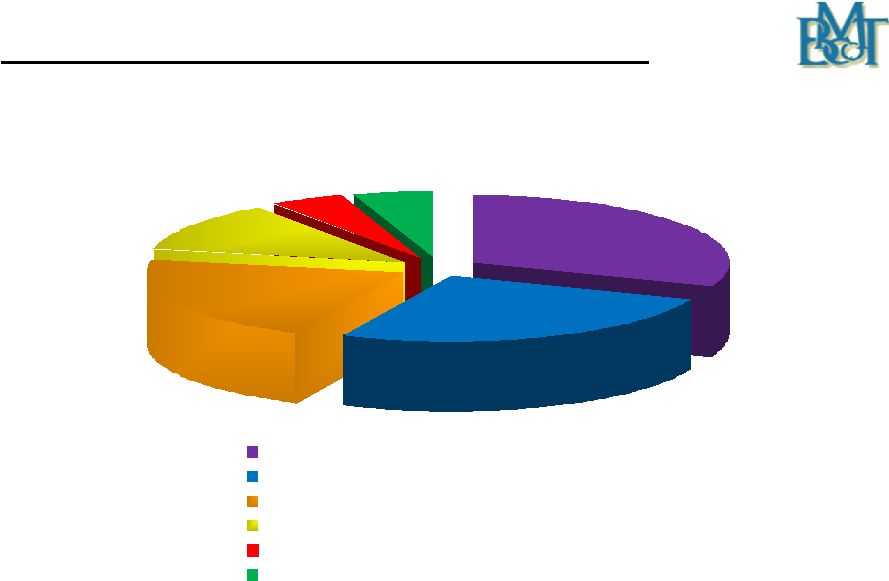

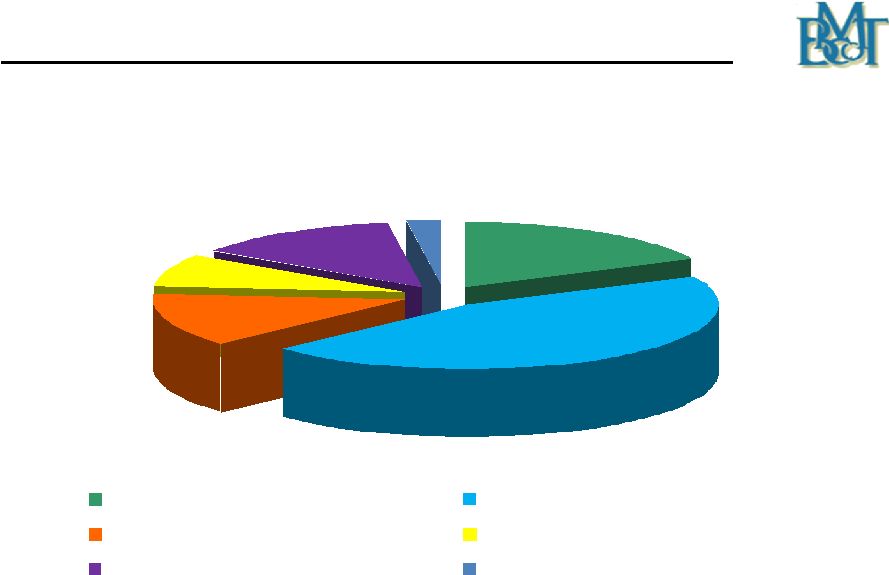

Loan Composition at March 31, 2010

$275

$234

$188

$110

$42

$44

Commercial Mortgages

Commercial & Industrial

Home Equity Lines & Loans & Consumer Loans

Residential Mortgages

Construction

Leases

($ in millions) |

31

$31.3

$33.3

$34.2

$37.1

$40.8

$11.1

$0

$10

$20

$30

$40

$50

2005

2006

2007

2008

2009

2010 YTD

Net Interest Income

CAGR: 6.9% (2005-2009)

Note: Not on a tax-equivalent basis

($ in millions) |

32

3.63%

3.62%

3.59%

3.72%

3.85%

4.06%

3.2%

3.4%

3.6%

3.8%

4.0%

4.2%

Dec-08

Mar-09

Jun-09

Sep-09

Dec-09

Mar-10

Net Interest Margin

On a tax equivalent basis |

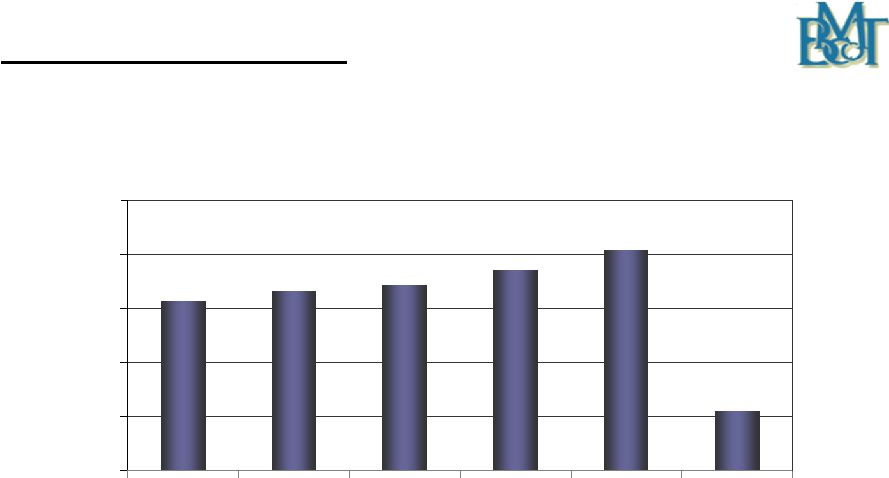

33

$626

$709

$798

$888

$899

$200

$400

$600

$800

$1,000

2006

2007

2008

2009

1stQ 2010

Deposit Growth

Average Annual Deposits

($ in millions) |

34

Average Deposits & Borrowed Funds Mix

First Quarter 2010

$23

$144

$85

$140

$484

$189

Non-Interest Bearing DDA

Savings, NOW & Money Market

Time Deposits

Wholesale Deposits, IND & IDC

Borrowed Funds

Subordinated Debt

($ in millions) |

35

Investment Portfolio as of March 31, 2010

SECURITY DESCRIPTION (AFS)

Amortized

Cost

Fair

Value

Unrealized

Gain / Loss

U. S. Government Agency

$ 94,774

$ 94,808

$

34

State, County & Municipal

24,270

24,431

161

FNMA/FHLMC Mortgage Backed Securities

12,979

13,386

407

GNMA Mortgage Backed Securities

2,524

2,518

(6)

Foreign Debt Securities

1,250

1,250

-

Bond –

Mutual Funds

37,115

37,423

308

Total Investment Portfolio

$ 172,912

$ 173,816

$ 904

Note: Other assets at March 31, 2010 include approximately $8 million of FHLB of

Pittsburgh common stock at cost which is not paying a dividend and cannot be

redeemed. ($ in thousands) |

36

Capital Considerations

Bryn Mawr Bank Corporation elected not to take TARP Capital

Maintains a “well capitalized”

capital position

Selectively add capital as needed to maintain capital levels and

fund asset

growth and acquisitions

Additional earn out payments for Lau Associates at the end of 2010 and

2011

Active Dividend Reinvestment and Direct Stock Purchase Plan

(DRIP/DSPP) |

37

Capital Position -

Bryn Mawr Bank Corporation

3/31/2010

12/31/2009

3/31/2009

Tier I

9.70%

9.41%

8.96%

Total (Tier II)

12.78%

12.53%

11.41%

Tier I Leverage

8.63%

8.35%

8.05%

Tangible Common

Equity

7.82%

7.51%

7.20% |

38

Capital Position -

Bryn Mawr Trust Company (“Bank”)

3/31/2010

12/31/2009

3/31/2009

Tier I

9.32%

9.06%

8.56%

Total (Tier II)

12.41%

12.20%

11.02%

Tier I Leverage

8.28%

8.03%

7.68% |

39

$2.04

$2.18

$2.28

$2.15

$2.87

$3.11

$1.0

$2.0

$3.0

$4.0

2005

2006

2007

2008

2009

3/31/2010

Wealth Management Assets Under Management,

Administration, Supervision and Brokerage

(1)

($ in billions)

(1) Excludes Community Bank’s assets 2005 -

2007 |

40

$11.5

$12.4

$13.5

$13.8

$14.2

$3.8

$2.0

$5.0

$8.0

$11.0

$14.0

$17.0

2005

2006

2007

2008

2009

2010 YTD

Wealth Management Fees

CAGR: 5.4% (2005 –

2009)

($ in millions) |

41

Summary

Outstanding franchise in a stable market

Focus on Wealth Services, Business Banking and Private Banking

Investing in growth opportunities today for earnings growth

tomorrow

Announced acquisition will expand footprint

Sound business strategy, strong asset quality, well capitalized

and solid risk management procedures serve as a foundation for

expansion |

Thank You

Joseph Keefer, EVP

610-581-4869

jkeefer@bmtc.com

Duncan Smith, CFO

610-526 –2466

jdsmith@bmtc.com

Ted Peters, Chairman

610-581-4800

tpeters@bmtc.com

Frank Leto, EVP

610-581-4730

fleto@bmtc.com

*******************************************

******************************************* |