Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - CORNELL COMPANIES INC | a10-8925_28k.htm |

Exhibit 99.1

For additional information regarding our directors and executive officers, executive compensation, security ownership of certain beneficial owners and management, certain relationships and related transactions, director independence, principal accountant fees and services and other corporate governance matters, please see the Company’s Annual Report on Form 10-K/A filed with the Securities Exchange Commission on April 30, 2010.

Forward-Looking Statements. Any statements included in this Annual Report that are not historical facts, including without limitation statements regarding operations, strategic direction and financial results, are forward-looking statements within the meaning of applicable securities laws. Such statements are subject to numerous risks and uncertainties, including without limitation those set forth on pages 13-21 of this Annual Report, that could cause actual results to differ materially from those projected or anticipated. Each forward-looking statement speaks only as of the date of this Annual Report and we undertake no obligation to update or revise any such statement.

Dear Shareholders,

In 2009, Cornell achieved its best financial performance ever, both in terms of earnings per share and return on capital employed. Your company achieved this performance while successfully completing two major growth projects and amid the most difficult market conditions that our industry has seen in the past decade.

Over the past five years since 2004, your company has produced a compound annual growth rate in operating income of 37% (to $70 million from $15 million) and EBITDA of 26% (to $89 million from $28 million), on an annual revenue growth rate of 8% (to $412 million from $277 million). In terms of bottom line performance, your company in 2009 has produced $1.64 per share earnings and over 12% return on capital employed compared to a loss five years ago. And in terms of improved risk management, your company has reduced portfolio concentration from its largest asset by reducing the percent of operating earnings to 24% from 53%, while simultaneously reducing exposure to customer volatility by increasing the revenue from long-term Federal Bureau of Prisons (“BOP”) contracts to 35% from 22%.

Let me now highlight some major developments during 2009 for each of our three business lines.

· In our Adult Secure division, we completed both a major facility expansion and construction of a new greenfield facility on time, on budget and on scope: the 750-bed expansion of the D. Ray James Prison in Georgia, which should begin serving the BOP in October this year, and the 1,250-bed Hudson Correctional Facility in Colorado presently serving the Alaska Department of Corrections. Collectively, these 2,000 new beds represented a 15% increase to our service capacity from where we began the year.

More recently, in January 2010, the BOP awarded us a contract to house up to 2,507 low-security adult male inmates at our D. Ray James facility under their Criminal Alien Requirement X (“CAR-10”) procurement. In addition to representing the completion of the company’s multi-year program to reposition major assets, the award provides three major benefits for the company’s future strength:

1. Greatly improved economics from the D. Ray James facility due to increased utilization at higher per diems and with potential for additional performance awards;

2. Reduced financial risk with a federal customer providing contractual price increases and population guarantees; and

3. Reduced operating risk due to the lower security level of the incoming federal inmates.

· In our Adult Community-Based division, we continued to improve occupancy and pricing across the portfolio while retaining our position as the preeminent provider of halfway house services to the BOP.

As a result, we improved our operating margin to 32% in 2009 compared to 27% in 2008.

Also, it is worth noting that during the year, we won all of our existing Federal and State contracts that came up for renewal. We believe that we are both well positioned to continue to grow this segment and that this segment will receive increased funding in the coming years as policy makers focus on how to reduce recidivism and increase alternatives to incarceration.

· Our smallest division, Abraxas Youth & Family Services, faced particular challenges during 2009 due to budget cuts across the country, and in particular with our two largest markets: Pennsylvania and Illinois. This created intense pressure on all providers of juvenile justice and substance abuse treatment programs.

These pressures compelled us to reconfigure programs and consolidate capacity at several smaller facilities. Perhaps the one bright spot in this segment is that our unrelenting focus on operating quality has enabled us to increase market share from less resilient competitors who have either exited the market or “cut corners” as they try to survive.

continued on next page

Though Abraxas did not achieve the goals that we established at the beginning of the year, we did make progress as demonstrated by increasing average contract occupancy over 2009 to 85.9% from 80.6% during 2008. Also, despite the funding cuts, average residential per diems increased by approximately 3% which illustrates our ability to shift our programs to a more attractive mix. We finished 2009 with many empty beds in this segment, but for 2010 we expect to continue to gradually increase occupancy and favorable mix so that the division can continue to generate cash for Cornell, despite the continuing budget pressures facing the segment.

* * *

All in all, your management feels good about its accomplishments in the business in 2009 and for the prior years. However, we also recognize that we have much work ahead of us in 2010 to continue to capture the opportunities that we believe our industry presents us. For 2010, our operating plan focuses on the five dimensions of performance that we use as benchmarks.

· Operating Excellence. Emphasize consistent day-to-day process performance that surpasses our customers’ measures for operating success. Complete ACA and Joint Commission accreditations across the portfolio. Continue our investment in quality assurance and enterprise risk management processes.

· Underutilized Assets. Across the portfolio, continue to fill the incremental spare capacity, and in particular, focus on opportunities to re-activate our vacant Baker and Mesa Verde facilities in California. Successfully transition our D. Ray James facility to BOP inmates.

· Capital effectiveness. Evaluate all investment opportunities in terms of risk-adjusted return on capital employed, and apply free cash to best shareholder return ranging, for example, from expansion of existing facilities for specific market opportunities to acquiring attractive community corrections facilities to expanding the company’s share repurchase program.

· Portfolio Management. Continue to evaluate opportunities to improve both profitability and utilization across our current portfolio by, for example, repositioning assets among customers or segments, or adjusting programs or services as customer requirements or the funding environment changes.

· Operating Efficiency. Continue to redesign operating and support process to a lean cost structure in order to maintain our growth in operating margins.

While we expect 2010 to be a repositioning year from an earnings standpoint as we incur costs to transition our D. Ray James facility to the BOP, we also consider it to be a transformational year for the company, both in terms of risk reduction and value enhancement. Looking beyond 2010, we believe that our demonstrated ability to win new business, coupled with the value proposition in our spare capacity across the portfolio, will enable us to deliver to shareholders substantial earnings growth and free cash flow.

Sincerely,

|

/s/ James E. Hyman |

|

James E. Hyman

Chairman, President & CEO

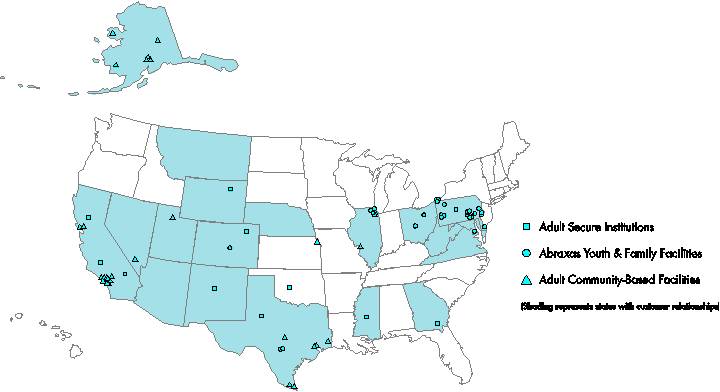

Cornell’s National Footprint

(As of December 31, 2009)

|

|

|

|

|

|

|

Total |

|

|

Adult Secure Institutions |

|

Location |

|

Gender |

|

Capacity |

|

|

Baker Community Correctional Facility |

|

Baker, CA |

|

Male |

|

262 |

|

|

Big Spring Correctional Center |

|

Big Spring, TX |

|

Male |

|

3,509 |

|

|

D. Ray James Prison |

|

Folkston, GA |

|

Male |

|

2,870 |

|

|

Great Plains Correctional Facility |

|

Hinton, OK |

|

Male |

|

2,048 |

|

|

High Plains Correctional Facility |

|

Brush, CO |

|

Female |

|

272 |

|

|

Hudson Correctional Facility |

|

Hudson, CO |

|

Male |

|

1,250 |

|

|

Leo Chesney Community Correctional Facility |

|

Live Oak, CA |

|

Female |

|

305 |

|

|

Mesa Verde Community Correctional Facility |

|

Bakersfield, CA |

|

Male |

|

360 |

|

|

Moshannon Valley Correctional Center |

|

Philipsburg, PA |

|

Male |

|

1,495 |

|

|

Regional Correctional Center |

|

Albuquerque, NM |

|

Male/Female |

|

970 |

|

|

Walnut Grove Youth Correctional Facility |

|

Walnut Grove, MS |

|

Male |

|

1,450 |

|

|

Adult Secure Institutions (11) |

|

|

|

|

|

14,791 |

|

|

|

|

|

|

|

|

Total |

|

|

Abraxas Youth & Family Facilities |

|

Location |

|

Gender |

|

Capacity |

|

|

Abraxas Counseling Center |

|

Columbus, OH |

|

Male/Female |

|

78 |

|

|

Contact |

|

Wauconda, IL |

|

Female |

|

52 |

|

|

Cornell Abraxas Academy |

|

New Morgan, PA |

|

Male/Female |

|

214 |

|

|

Cornell Abraxas Center for Adolescent Females |

|

Pittsburgh, PA |

|

Female |

|

108 |

|

|

Cornell Abraxas I |

|

Marienville, PA |

|

Male |

|

274 |

|

|

Cornell Abraxas II |

|

Erie, PA |

|

Male |

|

23 |

|

|

Cornell Abraxas III |

|

Pittsburgh, PA |

|

Male |

|

24 |

|

|

Cornell Abraxas of Ohio |

|

Shelby, OH |

|

Male |

|

108 |

|

|

Cornell Abraxas Youth Center |

|

South Mountain, PA |

|

Male/Female |

|

72 |

|

|

Delaware Community-Based Programs |

|

Milford, DE |

|

Male/Female |

|

66 |

|

|

DuPage Adolescent Center |

|

Hinsdale, IL |

|

Male |

|

38 |

|

|

Erie Residential Behavioral Health Program |

|

Erie, PA |

|

Female |

|

17 |

|

|

Harrisburg Day Treatment |

|

Harrisburg, PA |

|

Male/Female |

|

45 |

|

|

Hector Garza Residential Treatment Center |

|

San Antonio, TX |

|

Male/Female |

|

122 |

|

|

Leadership Development Program |

|

South Mountain, PA |

|

Male/Female |

|

128 |

|

|

Lehigh Valley Community-Based Programs |

|

Lehigh Valley, PA |

|

Male/Female |

|

60 |

|

continued on next page

|

|

|

|

|

|

|

Total |

|

|

Abraxas Youth & Family Facilities (continued) |

|

Location |

|

Gender |

|

Capacity |

|

|

Non-Residential Detention/Non-Residential Treatment |

|

Harrisburg, PA |

|

Male/Female |

|

91 |

|

|

Philadelphia Alternative Education |

|

Philadelphia, PA |

|

Male/Female |

|

165 |

|

|

Philadelphia Community-Based Programs |

|

Philadelphia, PA |

|

Male/Female |

|

71 |

|

|

Psychosocial Rehabilitation Unit |

|

Erie, PA |

|

Male |

|

13 |

|

|

Schaffner Youth Center |

|

Steelton, PA |

|

Male/Female |

|

63 |

|

|

Southern Peaks Regional Treatment Center |

|

Canon City, CO |

|

Male/Female |

|

160 |

|

|

Texas Adolescent Treatment Center |

|

San Antonio, TX |

|

Male/Female |

|

145 |

|

|

Washington Facility |

|

Washington, D.C. |

|

Male/Female |

|

70 |

|

|

Woodridge |

|

Woodridge, IL |

|

Male |

|

200 |

|

|

WorkBridge |

|

Pittsburgh, PA |

|

Male/Female |

|

600 |

|

|

York County Community Programs |

|

Harrisburg, PA |

|

Male/Female |

|

36 |

|

|

Abraxas Youth and Family Facilities (27) |

|

|

|

|

|

3,043 |

|

|

|

|

|

|

|

|

Total |

|

|

Adult Community-Based Facilities |

|

Location |

|

Gender |

|

Capacity |

|

|

Alhambra City Jail |

|

Alhambra, CA |

|

Male/Female |

|

67 |

|

|

Baldwin Park City Jail |

|

Baldwin Park, CA |

|

Male/Female |

|

32 |

|

|

Beaumont Transitional Treatment Center |

|

Beaumont, TX |

|

Male/Female |

|

180 |

|

|

Bell Gardens Jail |

|

Bell Gardens, CA |

|

Male/Female |

|

15 |

|

|

Cordova Center |

|

Anchorage, AK |

|

Male/Female |

|

192 |

|

|

Downey City Jail |

|

Downey, CA |

|

Male/Female |

|

30 |

|

|

East St. Louis East |

|

St. Louis, IL |

|

Male/Female |

|

200 |

|

|

El Monte Center |

|

El Monte, CA |

|

Male/Female |

|

55 |

|

|

Fontana City Jail |

|

Fontana, CA |

|

Male/Female |

|

39 |

|

|

Garden Grove City Jail |

|

Garden Grove, CA |

|

Male/Female |

|

16 |

|

|

Grossman Center |

|

Leavenworth, KS |

|

Male/Female |

|

150 |

|

|

Las Vegas Community Correctional Center |

|

Las Vegas, NV |

|

Male/Female |

|

100 |

|

|

Leidel Comprehensive Sanction Center |

|

Houston, TX |

|

Male/Female |

|

190 |

|

|

LifeWorks |

|

Joliet, IL |

|

Male/Female |

|

231 |

|

|

Marvin Gardens Center |

|

Los Angeles, CA |

|

Male |

|

52 |

|

|

McCabe Center |

|

Austin, TX |

|

Male/Female |

|

90 |

|

|

Mid Valley House |

|

Edinburg, TX |

|

Male/Female |

|

96 |

|

|

Midtown Center |

|

Anchorage, AK |

|

Male/Female |

|

32 |

|

|

Montebello City Jail |

|

Montebello, CA |

|

Male/Female |

|

25 |

|

|

Northstar Center |

|

Fairbanks, AK |

|

Male/Female |

|

135 |

|

|

Oakland Center |

|

Oakland, CA |

|

Male/Female |

|

61 |

|

|

Ontario City Jail |

|

Ontario, CA |

|

Male/Female |

|

40 |

|

|

Parkview Center |

|

Anchorage, AK |

|

Male |

|

112 |

|

|

Reality House |

|

Brownsville, TX |

|

Male/Female |

|

66 |

|

|

Reid Community Residential Facility |

|

Houston, TX |

|

Male |

|

500 |

|

|

Salt Lake City Center |

|

Salt Lake City, UT |

|

Male/Female |

|

78 |

|

|

Seaside Center |

|

Nome, AK |

|

Male/Female |

|

48 |

|

|

Southwood |

|

Chicago, IL |

|

Male/Female |

|

464 |

|

|

Taylor Street Center |

|

San Francisco, CA |

|

Male/Female |

|

177 |

|

|

Tundra Center |

|

Bethel, AK |

|

Male/Female |

|

85 |

|

|

Adult Community-Based Facilities (30) |

|

|

|

|

|

3,558 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL FACILITIES AND SERVICE CAPACITY (68) |

|

|

|

|

|

21,392 |

|

Corporate Directory (As of April 15,2010)

DIRECTORS

Max Batzer(3)

Portfolio Manager

Wynnefield Capital, Inc.

Anthony R. Chase(1)

Chairman and Chief Executive Officer

ChaseSource

Richard Crane(3)

Attorney at Law

Zachary R. George(2)

Portfolio Manager and Managing Member

FrontFour Capital Group LLC

Todd Goodwin(3)

Retired Partner

Gibbons, Goodwin, van Amerongen

James E. Hyman

Chairman, President and Chief Executive Officer

Cornell Companies, Inc.

Andrew R. Jones(2)

Managing Member

NS Advisors, LLC

Alfred Jay Moran, Jr.(1)

Director of Administration & Regulatory Affairs

City of Houston

D. Stephen Slack(1),(2)

President and Chief Executive Officer

South Bay Resources LLC

(1) Audit Committee member

(2) Compensation Committee member

(3) Governance Committee member

EXECUTIVE OFFICERS

James E. Hyman

Chairman, President and Chief Executive Officer

John R. Nieser

Senior Vice President, Chief Financial Officer and Treasurer

Patrick N. Perrin

Senior Vice President and Chief Administrative Officer

Cathryn L. Porter

Senior Vice President, General Counsel and

Corporate Secretary

KEY MANAGEMENT PERSONNEL

Blake Barras

Vice President, Financial Planning and Analysis

Troy R. Berreth

Vice President, Information Technology

Michael L. Caltabiano

Senior Vice President, Adult Secure

Benjamin E. Erwin

Senior Vice President, Corporate Development

Kathy Forsberg

Vice President and Corporate Controller

Peter Kiilu

Managing Director, Internal Audit

George Killinger

Vice President, Adult Secure

Charles Seigel

Vice President, Public Policy

Jonathan P. Swatsburg

Senior Vice President, Abraxas Youth and Family Services

|

CORPORATE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

Independent Accountants |

|

Stock Transfer Agent and Registrar |

|

Corporate Headquarters |

|

PricewaterhouseCoopers LLP |

|

Computershare Investor Services |

|

Cornell Companies, Inc. |

|

1201 Louisiana, Suite 2900 |

|

P.O. Box 43078 |

|

1700 West Loop South, Suite 1500 |

|

Houston, Texas 77002 |

|

Providence, Rhode Island 02940-3078 |

|

Houston, Texas 77027 |

|

|

|

1-800-962-4284 |

|

713-623-0790 |

Stock Listing

New York Stock Exchange Ticker Symbol: CRN

Cornell Companies, Inc. | 2009 ANNUAL REPORT