Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - StellarOne CORP | d8k.htm |

Excellence.

Partnership. Service

Welcome!

2010 Annual Meeting of Shareholders

April 27, 2010

Exhibit 99.1 |

Ed

Barham Corporate President & CEO |

Forward Looking Statements

•

In addition to historical information, this presentation contains

forward-looking statements. The forward-looking statements are

subject to certain risks and uncertainties, which could cause actual

results to differ materially from historical results, or those anticipated.

When we use words such as “believes”, “expects”,

“anticipates”

or similar expressions, we are making forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking

statements, which reflect management’s analysis only as of the date

thereof. StellarOne wishes to caution the reader that factors, such as

those listed below, in some cases have affected and could affect

StellarOne’s actual results, causing actual results to differ

materially from those in any forward looking statement. These factors

include: (i) expected cost savings from StellarOne’s acquisitions and

dispositions, (ii) competitive pressure in the banking industry or in

StellarOne’s markets may increase significantly, (iii) changes in the

interest rate environment may reduce margins, (iv) general economic

conditions, either nationally or regionally, may be less favorable than

expected, resulting in, among other things, credit quality deterioration, (v)

changes may occur in banking legislation and regulation (vi) changes may occur in

general business conditions and (vii) changes may occur in the securities

markets. Please refer to StellarOne’s filings with the Securities and

Exchange Commission for additional

information,

which

may

be

accessed

at

www.stellarone.com. |

|

|

|

|

|

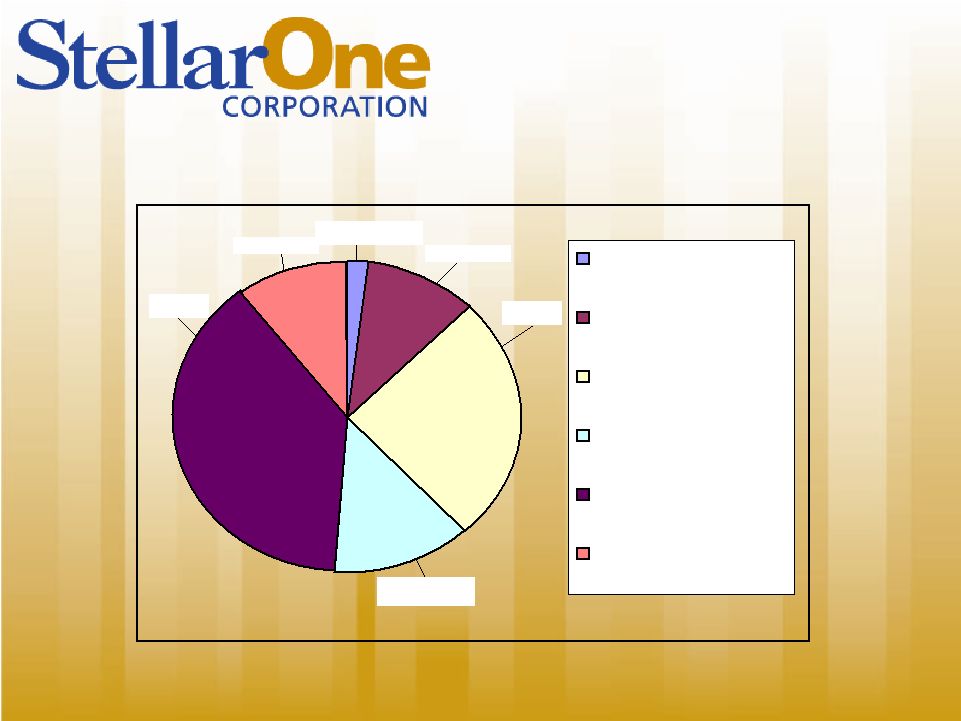

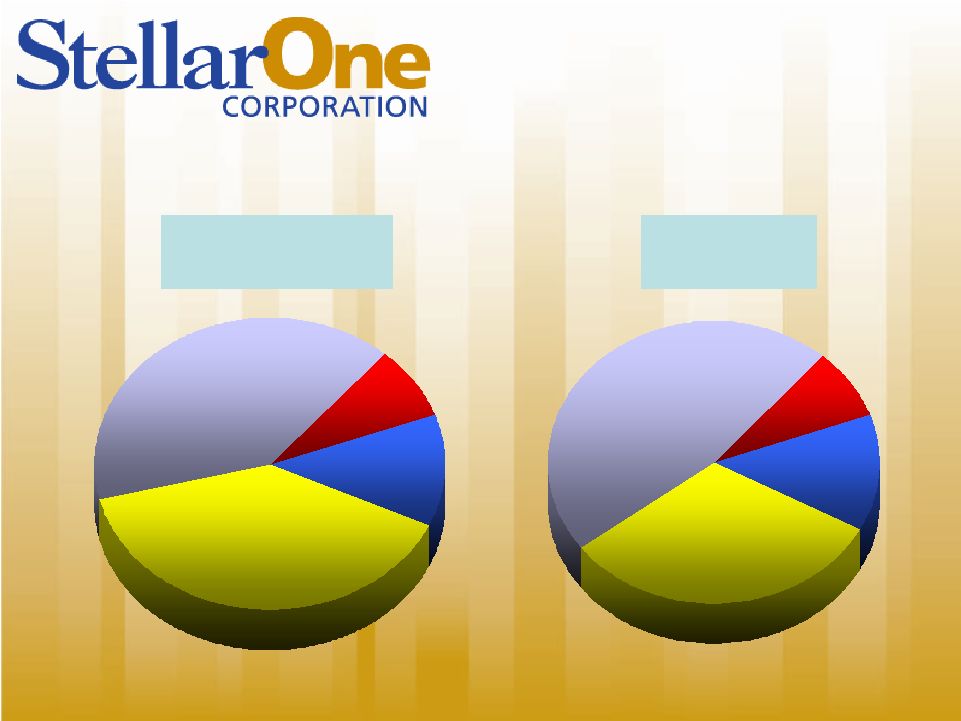

A&D/Construction:

SML

A&D/Construction

(Net of SML)

R/E Mortgage

Consumer

Commercial R/E

Commercial

10.52%

10.15%

38.73%

25.78%

12.93%

1.90%

Total Portfolio $2,181,196,000

As of 12/31/09 |

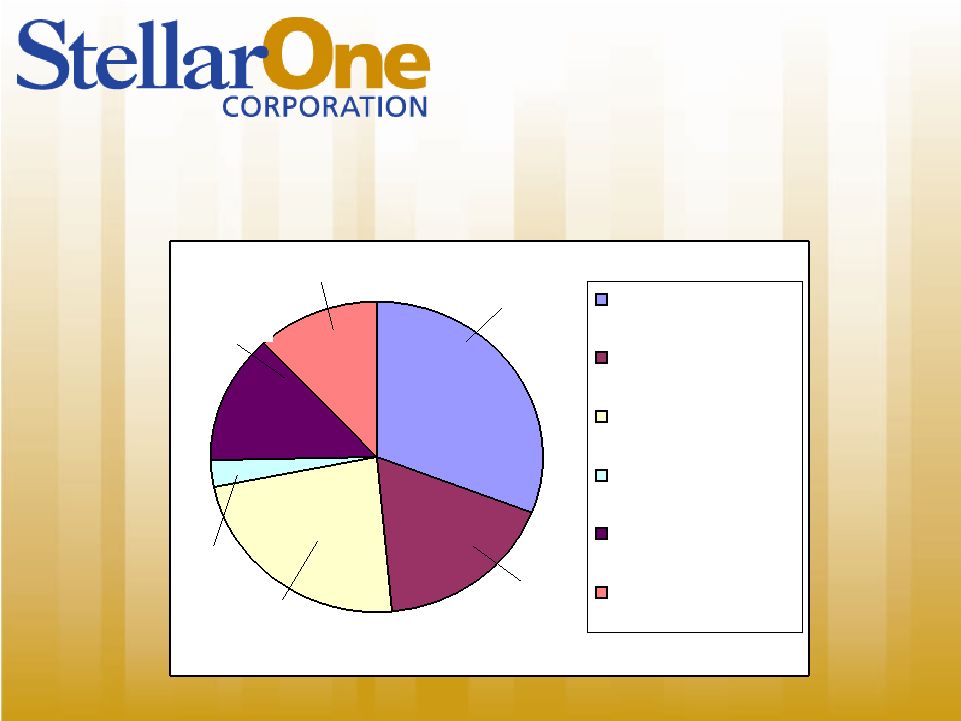

Total Non Performing Loans = $66,254,000

Total Non Performing Loans as a

Percentage of the Total Loan Portfolio = 2.79%

A&D/Construction:

SML

A&D/Construction

(Net of SML)

R/E Mortgage

Consumer

Commercial R/E

Commercial

2.85%

30.72%

17.88%

23.23%

13.47%

11.84%

As of 12/31/09 |

|

|

|

|

Line of Business Overview

Mr. Greg Feldmann

Bank President & CEO |

Retail Snapshot

Households

> 112,000

Deposits

$2.35 billion

Loans

$610 million

Annual Fee Income

$16.1 million

Financial Centers

56

Alternative Channels

CCC, Internet, Phone,

Mobile

Employees

365 |

Retail 2009 Accomplishments

Production results ~ 2009 vs

2008

Loans:

Total Consumer Loans

á

10.43%

Monthly Average Book Applications

á

8.93 %

Monthly Applications Taken

á

5.47%

Monthly Average Loan Applications

á

1.46%

Deposits:

Total Interest Bearing Deposits

á

5.74%

Total Deposits

á

3.88%

Implemented New Account Follow Up (NAFU) process to

ensure new client satisfaction and optimize cross selling

opportunities |

Retail 2009 Accomplishments

Bonanza Deposit Campaign

Total Deposits

$96.3MM

Accounts opened

5,431

Wealth Management referral program

Retail referrals up 30% from previous year

Retail revenue up nearly 20% |

Retail 2009 Accomplishments

Improved branch efficiency through

strategic realignment

Closed/Consolidated 5 Financial Centers

Overall deposit retention rate 95%

Sold Woodstock to 1

st

Bank

Annualized operating cost savings ~

$1.8 million

Relocated Market St. to Franklin

Plaza

Opened Plank Rd. facility |

2010 Key Initiatives

Retail Focus: Build Relationships, Revenue and Retention

Refinement of Retail Executive Management

Intensify focus on Sales and Service and improvement in

Operations, Compliance and Project Management

Grow noninterest income

Example: Improve check card penetration

Focus on organic growth

Integrate Client Contact Center into Retail

Developing sales campaigns for clients utilizing Next Best

Product Strategy developed through Marketing

StellarOne@Work

being promoted to Business and

Commercial Banking clients |

2010 Key Initiatives

Continue to improve operating efficiency

More sales per square foot

Manage to staffing model

Driving

“store

owner”

mentality

using

MPC

Relocate Seminole Trail Financial Center to

new Northtowne

location

Lease or sell excess space |

Plank Road |

Commercial Snapshot

Market Segments Served

Commercial: $3 to $25 million

Middle Market: >$25 million

Commercial Real Estate: A&D,

Housing, Income producing properties,

Hospitality

Treasury Management Services for

companies and municipalities

Loans

$1.3 billion

Deposits

$93 million non-interest

$62 million in sweep balances

Employees

67 |

2009 Highlights

•

Loan

production

-

$378

million

commitments

closed

•

Treasury Management:

–

Sweep

balances

-

$62

million

average

–

Account analysis income up 36% to ~$700k annually

•

Established RM staffing metric -

$40MM/150-200 notes

•

Implemented Segmentation Strategy

–

Core Commercial

–

Middle Market

–

Greater focus and refinement of Commercial Real Estate Group

•

Transferred $150mm+ in loans and reassigned 5 officers

to Business Banking to improve relationship coverage

and risk management |

2010 Initiatives & Goals

•

Grow & diversify loans in C&I

–

Growth goal of 5% on loans and 4% on deposits

–

Evaluate potential markets for LPO

–

Opportunity in government contracting sector

–

Leverage SBA

–

Cross sell treasury management, insurance, wealth management

•

Refine Commercial management structure

–

Regional Portfolio Manager Positions

–

Regional Commercial Banking Manager Positions

•

Commercial Real Estate

–

Remain vigilant on working down problems

•

A&D exposure reduced by $89 million in 2009

–

Be opportunistic in our markets

•

Further enhance products and services

–

Treasury Management capabilities (international, F/X, etc.)

–

Interest Rate hedging alternatives |

Business Banking

Market Served

Business and professional

groups with revenues $3 million

or less

Market Opportunity

> 300,000 opportunities in VA

Loans

$235 million

Deposits

Drive to Retail centers to

leverage investment in facilities

Business Model

60% business/40% retail (bank

the owners and employees)

Employees

16.5 |

2009 Highlights

•

Completed “right sizing”

to ensure

effective coverage in prime BB

markets

•

Successfully integrated $150MM loan

portfolio and 5 RMs

•

Developed scorecard system to track

effectiveness of RMs

•

Structured Specialized Lending area

with a focus on SBA lending |

2010 Initiatives

•

$67 million in new loans/$20 million in core

deposits/Cross sell fee services

–

Rolled out “Premier Profiling Program”

to expand

existing relationships

–

Generating additional fees through investments,

insurance and mortgage

–

Double SBA loan book

–

Developing a new tiered deposit product embedding

treasury management features

–

Partnering with Retail to cross sell StellarOne@Work

•

Utilizing Synapsys (CRM system) to ensure all calling

and selling activity is captured |

Mortgage Snapshot

Markets Served

Retail: customers and

prospects in or near our

Virginia markets

Wholesale: Smaller banks

and brokers principally in

VA, NC, SC

2009 Customers Served

3,422

2009 Loan Volume

$618 million

2009 Revenues

$5.6 million |

2009 Accomplishments

•

Implemented Optimal Blue system

•

Made process improvements for underwriting,

closing, and post closing functions

•

Expanded into Richmond market

•

Wholesale developed mini-correspondent

program

•

Website improvements |

2010 Initiatives

•

Cross sell Bank and affiliate services (e.g., insurance)

–

Achieving 15% or greater cross sell penetration rate

•

Continue to build strong ties to our builders in order to

help them close more business while increasing our

“purchase”

business

•

Better utilize Customer Contact Center

•

Continual improvement in Risk Management

•

Enhance Freddie Mac relationship of delivery channel to

enhance funding and delivery of loans for greater

profitability |

Wealth Management Overview

Securities

Asset

Management

Total

Employees

11

24

35

Assets

$212MM

$462MM

$674MM

Accounts

4,277

868

5,145

2009

Revenues

$1.2MM

$2.96MM

$4.16MM |

2009 Accomplishments

•

Securities Division assets grew by $39 million

or 23%

•

Asset Management booked 79 new accounts

with initial funding of $28 million

•

Retained 99.5% of Asset Management

accounts in a volatile market year

•

Hired experienced Relationship Managers in

Roanoke, Fredericksburg and Staunton

•

Implemented Investor’s View |

2010 Initiatives

•

Business Development / Marketing

–

Holding “Will Workshop”

seminars

–

Planning seminars for centers of influence (attorneys, CPA’s, etc.) that

would include continuing education credits

–

Expansion of number of staff members making business development

calls to better cover the footprint of Wealth Management

•

Account Retention Focus

–

Implementation of a call tracking system based on client tiers

–

Goals established for number of proactive client contacts per year

•

Portfolio Management

–

Implementation of a new performance measurement system

–

Creation of collateral materials documenting investment performance

|

Financial Report

Mr. Jeffrey W. Farrar

Executive Vice President and

Chief Financial Officer |

•

Discussion Topics:

–

Profitability

–

Asset Quality

–

Balance Sheet, Capital and Liquidity

–

Overhead and Efficiency Efforts

–

Stock Ownership and Performance |

First Quarter Preview

•

Earnings improvement that will exceed the

consensus estimate.

•

Decrease in total non-performing assets for the

second consecutive quarter.

•

Higher charge-offs and related provisioning

sequentially.

•

Continued improvement in net interest margin

for second consecutive quarter.

•

Improved contribution from mortgage and wealth

management.

•

Official earnings release on Thursday. |

Peer Comparisons

•

Sandy Spring

Bancorp

•

City Holding

Company

•

Capital City Group

•

Townebank

•

Cardinal Financial

•

Pinnacle Financial

•

SCBT Financial

•

S&T Bancorp

•

Seacoast Banking

•

Harleysville National

•

Sun Corporation

•

Virginia Commerce |

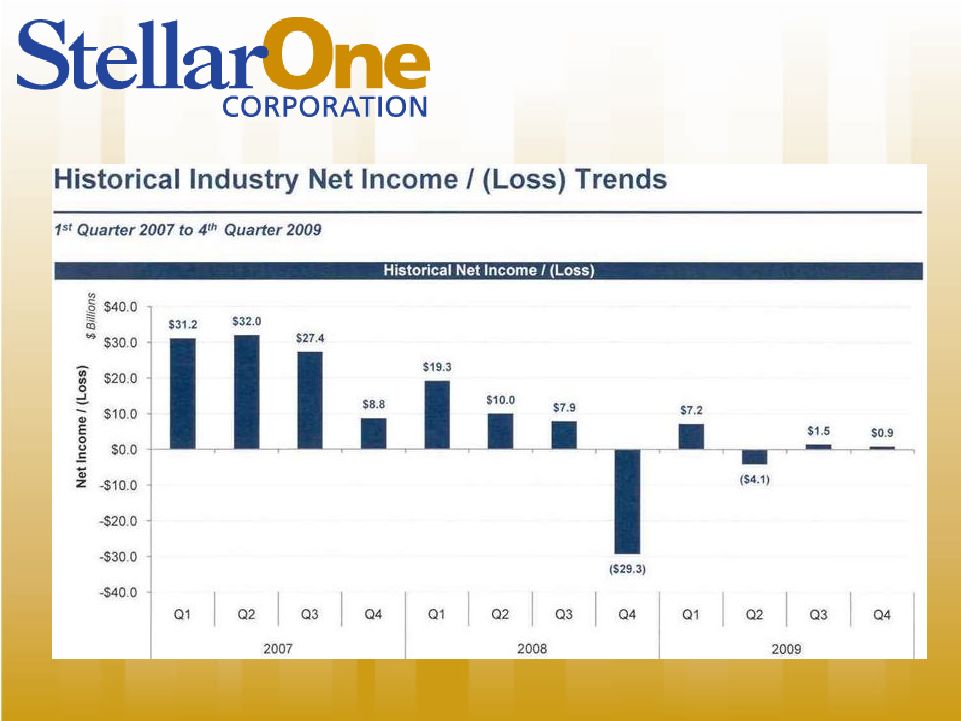

Profitability

StellarOne

2009 Actual

2009 Peer

Average

Return on Average

Assets

-.28%

-.18%

Return on Average

Equity

-1.99%

-3.02% |

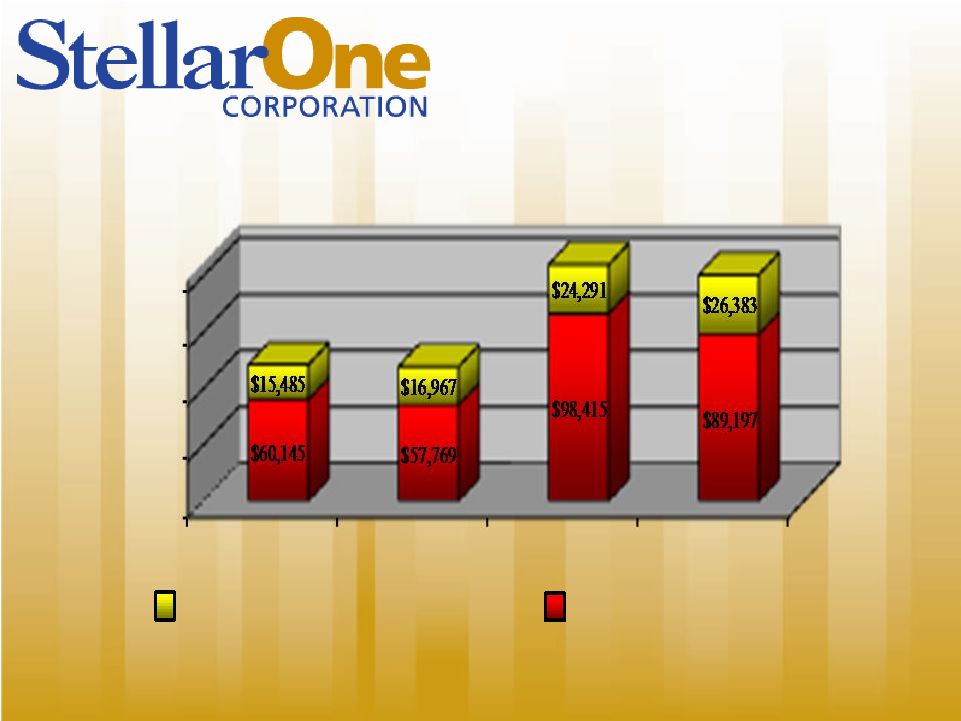

Revenue Growth and Composition

$15,000

$40,000

$65,000

$90,000

$115,000

2006

2007

2008

2009

Non

-

interest Income

Net Interest Income |

3.52%

3.34%

3.30%

3.45%

3.64%

3.25%

3.35%

3.45%

3.55%

3.65%

3.75%

3.85%

1Q 2009

2Q 2009

3Q 2009

4Q2009

Peer YE

2009

Net Interest Margin |

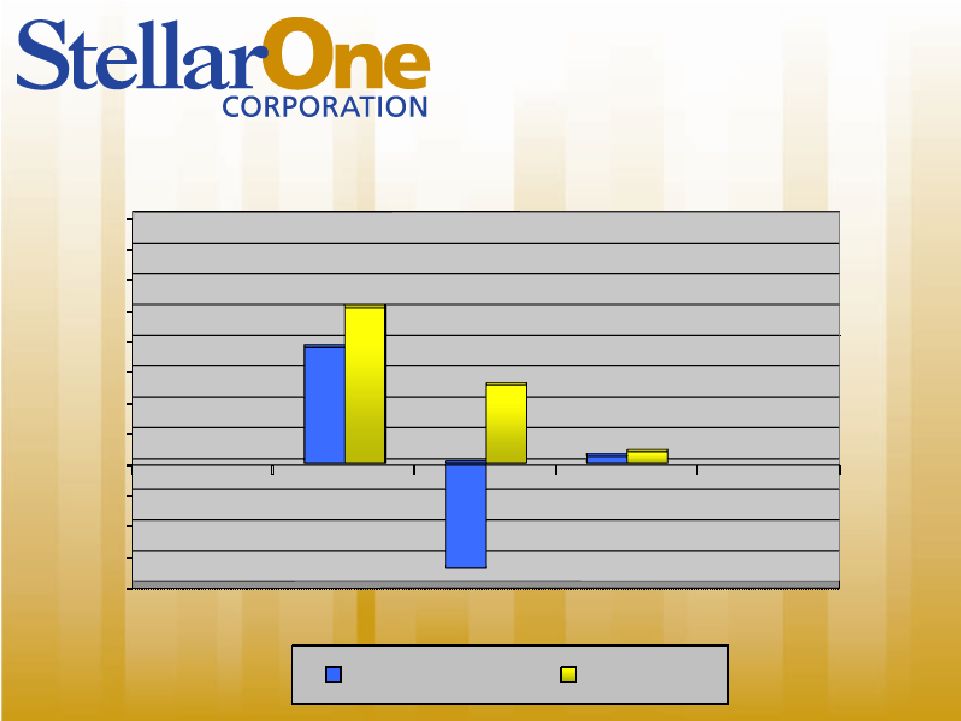

Earnings and Dividends

(in thousands)

-$10,000

-$7,500

-$5,000

-$2,500

$0

$2,500

$5,000

$7,500

$10,000

$12,500

$15,000

$17,500

$20,000

2008

2009

4Q -

2009

$9,411

($8,530)

$546

$12,614

$6,350

$908

Earnings (Loss)

Dividends |

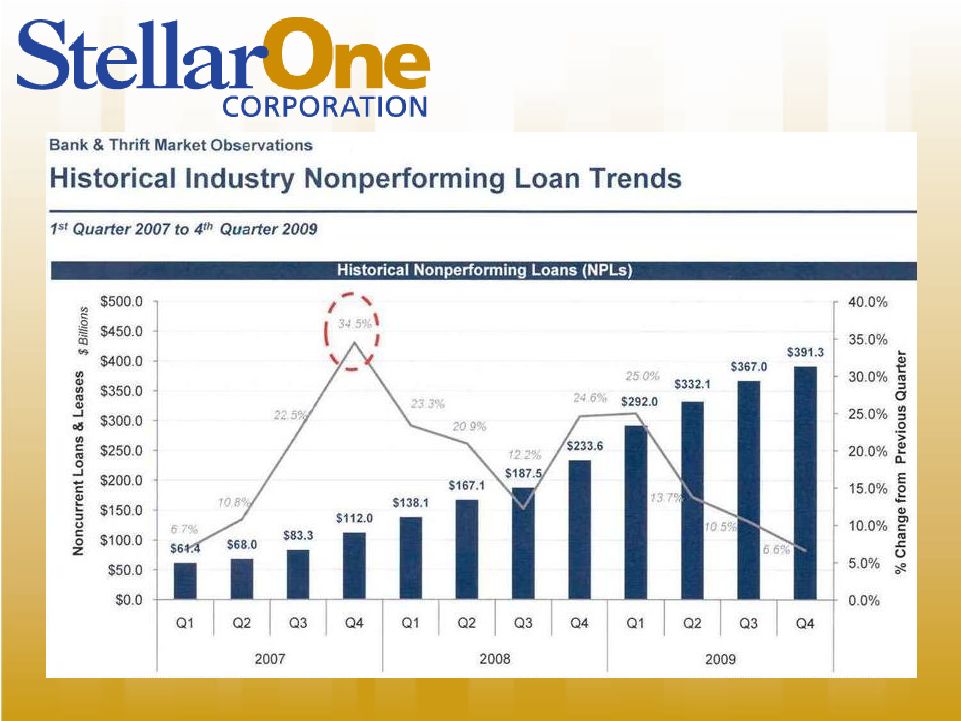

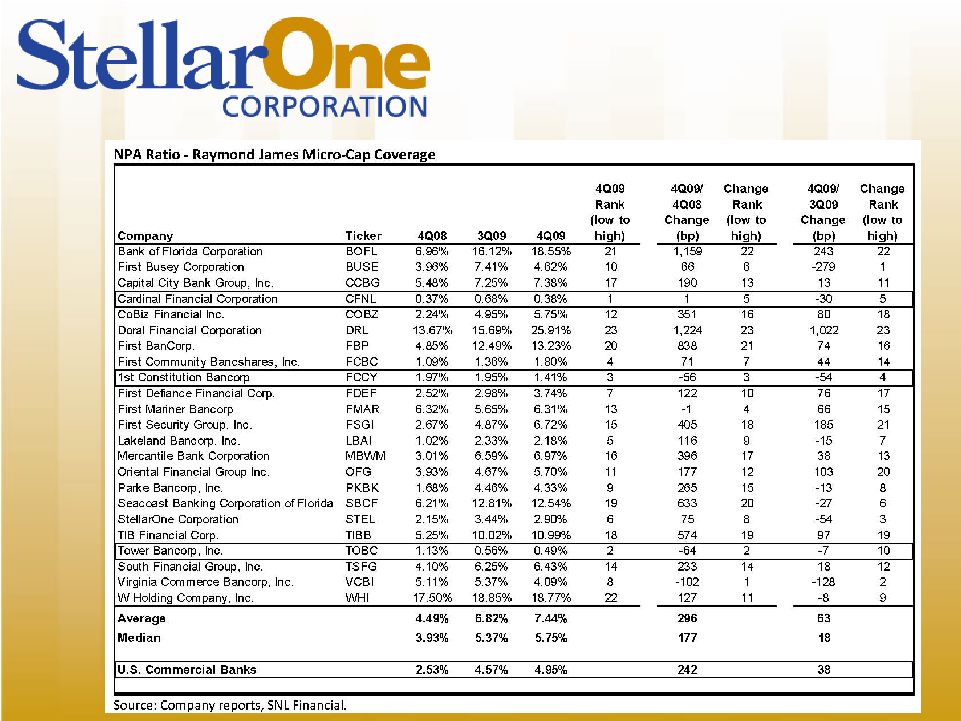

2006

2007

2008

2009

Peer

Non-performing

Assets / Total

Assets

0.19%

0.44%

1.66%

2.13%

2.60%

Net Charge-offs

/ Average

Loans

(0.01)%

0.12%

0.80%

1.24%

1.09%

Allowance /

Loans

1.19%

1.23%

1.35%

1.84%

1.69%

Asset Quality |

$400

$1,400

$2,400

$3,400

Loans

Deposits

Assets

2007

2008

2009

$400

$1,400

$2,400

$3,400

Loans

Deposits

Assets

2007

2008

2009

Balance Sheet

2009 vs. 2008

Loans

(3.4)%

Deposits

4.9%

Assets

1.3% |

Deposit Base

Time

Deposits,

40%

Savings

deposits,

8%

Demand

deposits,

39%

Non-

interest

bearing,

12%

Non-

interest

bearing

13%

Savings

deposits

8%

Demand

deposits,

32%

Time

Deposits,

47%

2009 -

$2.44

Billion

2008 –

$2.32

Billion |

$12.66

$13.97

$15.08

$17.90

$17.30

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

$20.00

2005

2006

2007

2008

2009

Book Value per Common Share |

Capital Ratios

StellarOne

2009 Actual

2009 Peer

Median

Tier 1 Capital to

Risk Adjusted

Assets

13.21%

12.35%

Tangible Equity to

Tangible Assets

10.26%

8.84%

Total

Equity

to

Total

Assets

14.46%

14.48% |

•

Liquid assets (cash and securities) of $551

million or 18% of balance sheet.

•

Securities portfolio is of a high quality with no

embedded credit risk and short duration.

•

Untapped lines of credit exceed $85 million

which are available if the need warrants for use

as standby sources of liquidity.

Liquidity |

$22,224

$24,057

$22,748

$24,875

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

1Q - 2009

2Q - 2009

3Q - 2009

4Q - 2009

Overhead by Quarter

(Dollars in thousands) |

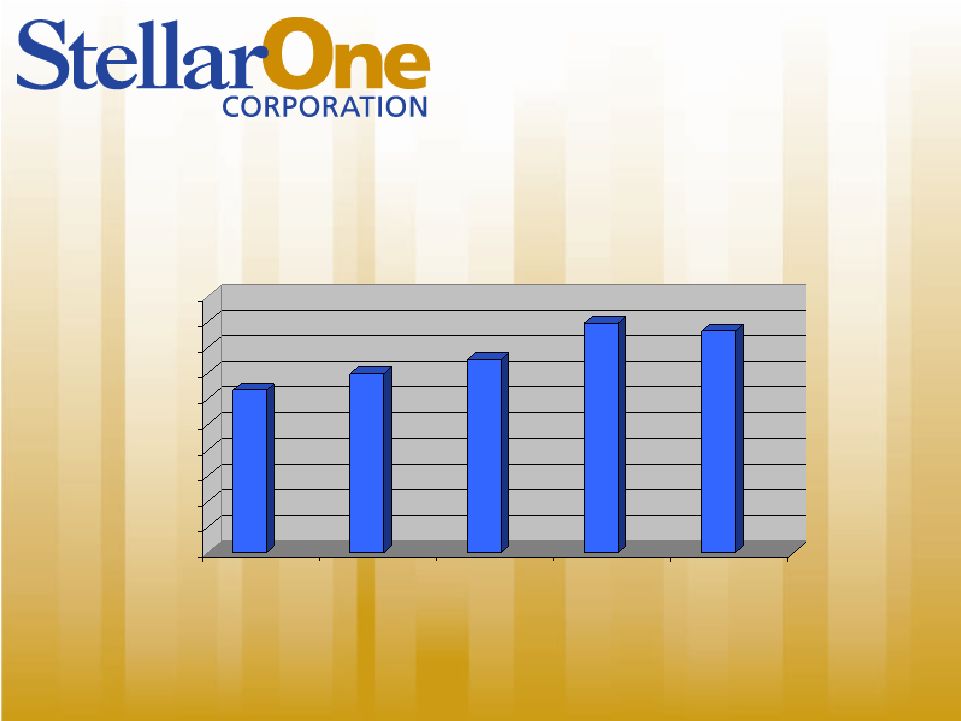

1,013

846

827

815

0

500

1,000

1,500

Jul-07

Dec-08

Dec-09

FTE History |

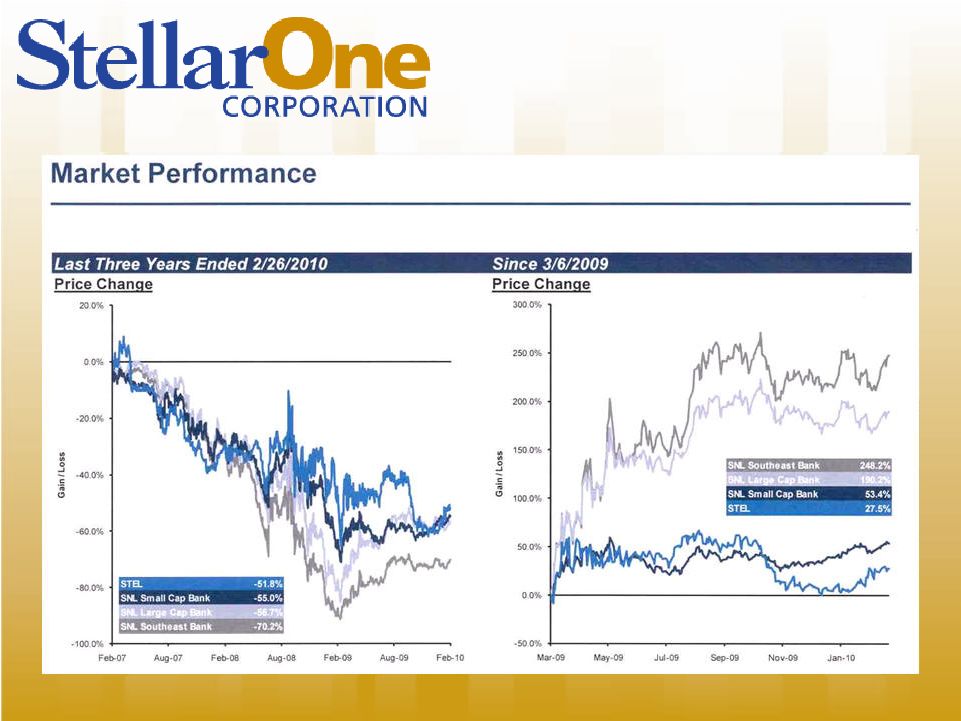

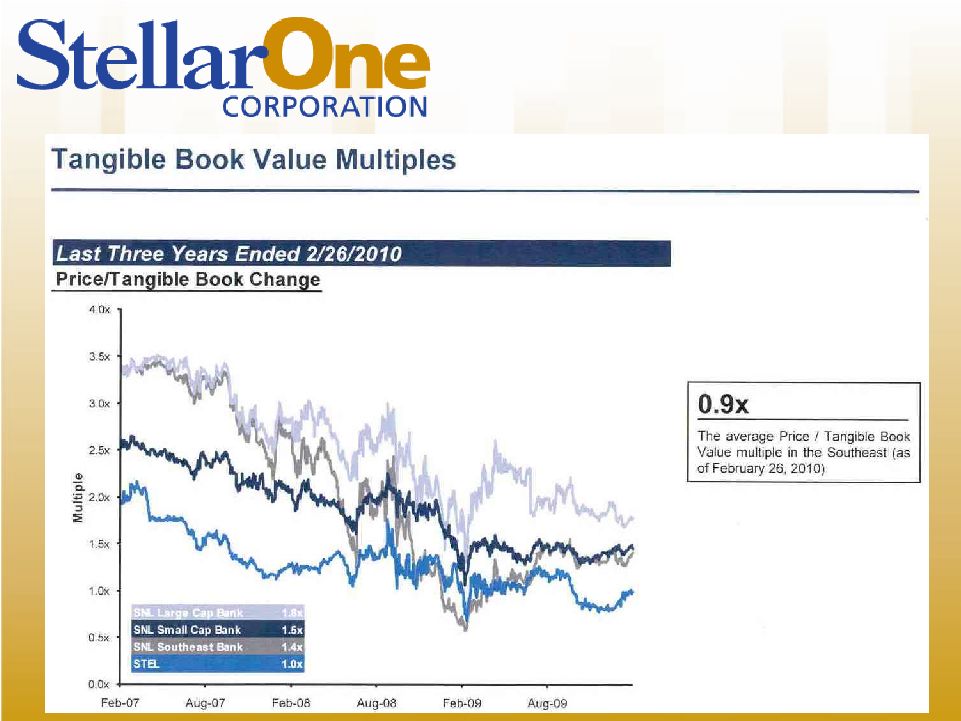

Valuation

StellarOne

2009 Actual

2009 Peer

Average

YTD Stock

Performance

44.6%

17.5%

Percentage

of

Book

Value

85%

118%

Market

Capitalization

$343 M

$372 M |

YTD

%

1yr.

%

5yr.

%

StellarOne (STEL)

46.62%

5.73%

(24.30)%

Peers

32.70%

3.47%

(22.50)%

Total Return Performance |

Coverage and Ownership

•

StellarOne now covered by ten buy side

analysts.

•

Institutional ownership is now almost 30%

of total ownership.

•

Top four holders:

–

BlackRock

Global

4.88%

–

Vanguard Group

3.99%

–

Dimensional Fund

3.74%

–

Heartland Advisors

2.74% |

Questions and Discussion

Thank You! |