Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 6, 2010 or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________________ to ____________________

Commission file number 1-10204

CPI Corp.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization)

1706 Washington Ave., St. Louis, Missouri

(Address of principal executive offices)

|

43-1256674

(I.R.S. Employer Identification No.)

63103

(Zip Code)

|

Registrant’s telephone number, including area code: 314/231-1575

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

Common Stock, par value $0.40 per share

|

Name of each exchange on which registered

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. oYes xNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. oYes xNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes oNo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). oYes oNo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer o Non-accelerated filer o Accelerated filer x Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). oYes xNo

As of July 25, 2009, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $93,102,000 based on the closing sales price of the common stock as reported on the New York Stock Exchange.

As of April 16, 2010, 9,671,756 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III of this Annual Report incorporates by reference certain information from the registrant’s definitive proxy statement for the 2010 annual meeting of the shareholders, which the registrant intends to file with the Securities and Exchange Commission no later than 120 days after the close of the registrant’s fiscal year ended February 6, 2010.

| TABLE OF CONTENTS | ||||

|

PART I

|

||||

|

Business

|

3

|

|||

|

Risk Factors

|

8

|

|||

|

Unresolved Staff Comments

|

11

|

|||

|

Properties

|

12

|

|||

|

Legal Proceedings

|

12

|

|||

|

PART II

|

||||

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13 | |||

|

Selected Financial Data

|

14

|

|||

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

16 | |||

|

Quantitative and Qualitative Disclosures About Market Risk

|

28 | |||

|

Financial Statements and Supplementary Data

|

29

|

|||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

65 | |||

|

Controls and Procedures

|

65

|

|||

|

Other Information

|

68

|

|||

|

PART III

|

||||

|

Directors, Executive Officers and Corporate Governance

|

69

|

|||

|

Executive Compensation

|

69

|

|||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

69 | |||

|

Certain Relationships and Related Transactions, and Director Independence

|

70 | |||

|

Principal Accounting Fees and Services

|

70

|

|||

|

PART IV

|

||||

|

Exhibits and Financial Statement Schedules

|

70

|

|||

|

76

|

||||

2

Forward-Looking Statements

The statements contained in this report, and in particular in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section, that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties. The Company identifies forward-looking statements by using words such as "preliminary," "plan," "expect," "looking ahead," "anticipate," "estimate," "believe," "should," "intend," and other similar expressions. Management wishes to caution the reader that these forward-looking statements, such as the Company’s outlook for portrait studios, net income, future cash requirements, cost savings, compliance with debt covenants, valuation allowances, reserves for charges and impairments and capital expenditures, are only predictions or expectations; actual events or results may differ materially as a result of risks facing the Company. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” beginning on page 8 of this report. The Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

| Business |

An Overview of the Company

CPI Corp. (“CPI”, the “Company” or “we”), a Delaware corporation formed in 1982, is a long-standing leader, based on sittings, number of locations and related revenues, in the professional portrait photography of young children, individuals and families. From a single studio opened by our predecessor company in 1942, we have grown to 2,935 studios, as of February 6, 2010, throughout the U.S., Canada, Mexico and Puerto Rico, principally under license agreements with Sears, Roebuck and Co. (“Sears”) and lease and license agreements with Walmart Stores, Inc. (“Walmart”).

The Company has provided professional portrait photography for Sears’ customers since 1959 and has been the only Sears portrait studio operator since 1986. On June 8, 2007, the Company completed its acquisition of substantially all of the assets (the “Assets”) of Portrait Corporation of America (“PCA”) and certain of its affiliates (collectively, the “Sellers”) and assumed certain liabilities of PCA (the “PCA Acquisition”). For purposes of this report, the operations acquired in the PCA Acquisition are operating within CPI Corp. under the trade names PictureMe Portrait Studio® in the U.S., Walmart Portrait Studios in Canada and Estudios Fotografia de Walmart in Mexico, collectively “PMPS” or the “PMPS brand”. As a result of the PCA Acquisition, CPI is the sole operator of portrait studios in Walmart Stores and Supercenters in all fifty states in the U.S., Canada, Mexico and Puerto Rico.

CPI entered into an Amendment (the “Amendment”) dated as of February 22, 2010, effective as of April 20, 2010, with Toys “R” Us – Delaware, Inc. (the “Licensor”, “Toys “R” Us” or “TRU”) to the Amended and Restated License Agreement (the “License Agreement”) made and entered into as of December 23, 2005, between TRU and Kiddie Kandids, LLC. Kiddie Kandids, LLC is a Chapter 7 debtor under Case No. 10-20334 brought before the United States Bankruptcy Court for the District of Utah (the “Bankruptcy Court”). The Company acquired the License Agreement in its acquisition of certain assets of Kiddie Kandids, LLC in an auction conducted by the Bankruptcy Court. Under the Amendment, TRU grants CPI an exclusive license to operate photo studios (the “Studios”) in certain Babies “R” Us stores under the Kiddie Kandids name. The term of the License Agreement, as amended by the Amendment, expires on January 31, 2016. The Amendment allows CPI significant operating flexibility and collaborative marketing opportunities and provides for the opening of additional locations over the next two years. The Amendment and the License Agreement contain certain termination rights for both the Company and TRU.

As of February 6, 2010, PMPS operates 1,923 studios worldwide, including 1,549 in the U.S. and Puerto Rico, 260 in Canada and 114 in Mexico and Sears Portrait Studios (“SPS” or the “SPS brand”) operates 1,007 studios worldwide, including 897 in the U.S. and Puerto Rico and 110 in Canada. Approximately $96.5 million, $15.7 million and $858,000 of long-lived assets are used in our domestic, Canadian and Mexican operations, respectively, as of February 6, 2010. The Company generated fiscal year 2009 net sales of $359.7 million, $54.8 million and $7.9 million related to its domestic, Canadian and Mexican operations, respectively, which accounted for 85%, 13% and 2% of total revenues in fiscal year 2009, respectively.

3

We operate websites which support and complement our Sears and Walmart studio operations. These websites serve as vehicles to archive, share portraits via email (after a portrait session) and order additional portraits and products. In 2009, revenues from on-line sales and services were approximately $2.2 million.

The Company’s Products and Services

Each of the Company’s portrait studio brands offers customers a wide range of differentiated portrait products, portrait choices, ordering options and service offerings with digital capabilities. CPI’s full digital process offers significant advantages compared to other portrait providers, including being the only company that employs trained digital technicians who optimize portrait quality during the manufacturing process. A package sitting consists of a fixed number of portraits, all of the same pose, for a relatively low price. Package customers may buy additional portrait sheets for a fee. A custom sitting consists of portraits purchased by the sheet and allows for a variety of sizes, poses and backgrounds. A collection sitting consists of a predetermined number of portraits bundled together at significant savings.

Our PMPS brand focuses on the sales of packages and portrait collections. Our packages are offered in all studios and consist of low-priced advertised “introductory” offers that provide a high volume of portraits with less customization and more limited selections. Our associates offer customers the opportunity to upgrade to portrait collections in which customers receive a greater variety in terms of poses, sizes and customization. Our SPS brand focuses on customized portrait solutions that provide a wide variety of selection, customization and an enhanced studio experience. Due to the wide variety and customization allowed within our Sears studios, the customer is charged a session fee. There are no session fees in our PMPS studios.

Each brand offers customers the opportunity to join a portrait savings club. Each club requires a one-time membership fee for a certain enrollment period, which is currently one year. PMPS Portrait Smiles Club and Sears’ Super Saver Program members receive savings on products and services and a free portrait sheet on each returning visit. Additionally, Sears’ Super Saver Program members pay no session fees for the enrollment period. Both of these plans were designed to promote customer loyalty while encouraging frequent return visits to the studio.

As of September 17, 2009, all of our studios are digital. In Sears studios, customer orders are either printed immediately in the studio and/or high-resolution images are transmitted electronically to one of our processing centers for fulfillment. PMPS studios do not offer on-site printing. All studios offer same-day portraits with full copyright on a portrait CD. Our processing centers complete the customer’s orders to their specifications and return them to the studio for pick-up. Orders placed in studios are generally available for pick-up within 5-10 days from the time of order.

SPS and PMPS studios have the ability to upload images from any portrait session to our safe and secure websites. With a code and individualized passwords, our customers can view their images from home, share them via email with family and friends, and place orders online for portraits or gifts such as personalized t-shirts, mugs, mouse pads and more.

Financial and Other Business Information

See Item 8 – Financial Statements and Supplementary Data for information on our financial condition, including revenues and net earnings for each of the last three fiscal years. For geographic related information, see Note 1 to the Notes to Consolidated Financial Statements – Summary of Significant Accounting Policies.

The Company’s results of operations for the fiscal year 2009 were adversely impacted as a result of the challenging economic environment, which affected discretionary purchases such as portraiture. As part of the Company’s continuing response to the market challenges, it has executed a number of cost reductions, which include delay or cancellation of certain expenditures. See Item 1A – Risk Factors and Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations for further information related to market challenges.

The Company’s Host Relationships

Sears

We have enjoyed a strong relationship with Sears for over 50 years under a series of license agreements, the most recent of which was entered into on December 22, 2008, pursuant to which the Company operates professional portrait studios at Sears locations in the U.S.

4

Pursuant to the terms and subject to the conditions of the License Agreement, we operate professional portrait studios under the name “Sears Portrait Studios.” The term of the License Agreement commenced on January 1, 2009, and ends on December 31, 2014. The Company has the right to extend the License Agreement for up to four additional years if (i) it makes over a certain amount of capital expenditures with respect to Sears U.S. studios that are approved by Sears within a 12 month period, (ii) the net sales under the contract satisfy certain sales growth targets in 2013 or (iii) the Company pays Sears the amount that we would have owed Sears if the sales growth targets were met (taking into account amounts already paid to Sears). Under the License Agreement, the Company pays Sears a percentage commission on the net sales of the Sears U.S. studios that is higher than the commission under the previous license agreement with Sears. The Company shares with Sears a portion of actual savings from operating productivity improvements implemented through the cooperation of the parties. The increase in commission rates has been substantially offset by these operating productivity improvements. Under the terms of our existing License Agreement with Sears in the United States, Sears is under no contractual obligation to invite us to open portrait studios in their new stores. Once we do establish a portrait studio in a new Sears store, that studio is then governed by the terms of our existing License Agreement.

The License Agreement contains certain termination rights for both the Company and Sears. These termination events include: (i) a breach of the License Agreement that is not cured (if curable) within thirty (30) days of written notice of such breach, (ii) the occurrence of a change of control of the Company without Sears’ consent, (iii) the Company’s conviction or pleading no contest to a felony or the Company engages in any conduct that is likely to materially adversely affect the Company, its Sears U.S. studios or Sears, and (iv) the Company’s failure to maintain appropriate insurance coverage or its failure to pay amounts owed to Sears under the License Agreement when due. In addition, Sears may terminate the License Agreement solely with respect to any affected Sears U.S. studio due to the closing of a Sears store.

Upon expiration of the term of the License Agreement or upon certain termination events, Sears shall have the right to purchase certain furniture, fixtures and equipment located at the Sears U.S. studios at fair market value, as determined by three independent ASA certified equipment appraisals.

On December 22, 2008, the Company and Sears entered into a Letter Agreement (the “Letter Agreement”) to resolve all amounts owed with respect to the adjustment provision to Earned Commissions set forth under paragraph (B)(2) to Exhibit C to the previous license agreement which expired on December 31, 2008, and in settlement of certain other obligations under the previous license agreement. Pursuant to the terms and subject to the conditions of the Letter Agreement, the Company agreed to pay Sears $6,750,000 in cash upon the execution of the Letter Agreement, $1,500,000 in cash on April 30, 2009, and $150,000 annually for six years. In addition, the Company transferred 325,000 shares of common stock to Sears. For further details and accounting treatment, see Note 12 and Note 16 to the Notes to Consolidated Financial Statements.

As of February 6, 2010, the Company operated 871 studios located in Sears stores and 26 freestanding studios under the Sears name in the U.S. and approximately 48% of our fiscal 2009 revenue was derived from sales within Sears. We provide all studio furniture, equipment, fixtures, leasehold improvements and advertising and are also responsible for hiring, training and compensating our employees. As a Sears licensee in studios located in Sears stores, we enjoy the benefits of using the Sears name, access to prime retail locations, Sears’ daily cashiering and bookkeeping systems, store security services and Sears’ assumption of certain credit card fees and credit and check authorization risks. Our customers also have the convenience of using their Sears credit cards to purchase our products and services. As a Sears licensee in freestanding studios under the Sears name in the U.S., we pay rent and utilities at each of these locations and benefit from the use of the Sears name.

Effective August 19, 2009, the Company entered into a new six-year license agreement with Sears Canada, Inc., a subsidiary of Sears, (“Sears Canada, Inc.”) pursuant to which the Company operates professional portrait studios in 110 Sears locations in Canada. Prior to this date, the Company operated its Sears Canadian studios under the terms of a license agreement dated January 1, 2003, and expiring on December 31, 2006. The terms of the new agreement provide greater operating flexibility than the previous contract. As a result of the new agreement, the Company converted all remaining film studios in Canada to a digital format in the 2009 third quarter. The Company pays Sears a license fee in Canadian dollars based on total annual net sales. The Company provides all studio furniture, equipment, fixtures and advertising and is responsible for hiring, training and compensating its employees.

Throughout the period of our relationship with Sears, Sears has never terminated the operation of any of our studios, except in connection with Sears store closings. In fiscal year 2009, the Company closed 19 related Sears studios. While Sears has closed 2 such stores as of April 19, 2010, in fiscal 2010, and has informed us they plan to close an additional 6 locations during the year, we are not aware of any specific intentions to close a significant number of existing full-line, mall-based stores that contain our portrait studios. There can be no assurance that some such closures may not occur in the future thus resulting in the concurrent closure of some of our existing portrait studios. The closure of a significant number of Sears full-line, mall-based stores that result in the closing of related portrait studios, to the extent such closures are not offset by openings of portrait studios in new Sears stores or other formats or venues, could have an adverse impact on the Company’s operations.

5

Walmart

Upon the PCA Acquisition on June 8, 2007, the Company became the sole operator of portrait studios in Walmart Stores and Supercenters in the U.S., Canada, Mexico and Puerto Rico. The Company operates under the trade names PictureMe Portrait Studio® in the U.S., Walmart Portrait Studios in Canada and Estudios Fotografia de Walmart in Mexico. As of February 6, 2010, the Company operated 1,923 studios in Walmart locations worldwide and approximately 52% of our fiscal 2009 revenue was derived from sales within Walmart. In fiscal year 2009, the Company closed 95 Walmart studios due to underperformance. As of April 19, 2010, the Company has closed 15 such locations in fiscal year 2010. We are not aware of any specific intentions Walmart has to close a significant number of existing stores that contain our portrait studios. There can be no assurance that some such closures may not occur in the future thus resulting in the concurrent closure of some of our existing portrait studios. The closure of a significant number of Walmart stores that result in the closing of related portrait studios, to the extent such closures are not offset by openings of portrait studios in new Walmart stores, could have an adverse impact on the Company’s operations. As part of the PCA Acquisition, we assumed certain preexisting lease and license agreements between PCA and Walmart. These agreements are summarized below.

Effective June 8, 2007, the Company entered into the U.S. Lease Agreement, negotiated by PCA and Walmart during PCA’s bankruptcy proceedings, which requires us to pay a rental fee to Walmart based upon a percentage of sales of our studios operating in Walmart’s U.S. stores. The agreement has an initial term of three years but automatically extends for an additional two years for each studio from which Walmart receives rental fees for the period July 1, 2008, through June 30, 2009, at a minimum specified rate per square foot. For each studio in which Walmart receives less than the specified rate per square foot, the Company and Walmart may mutually agree to extend the individual studio agreement for an additional two years by written agreement. The majority of studios are located in prominent locations at the front of the Store or Supercenter, affording easy access to Walmart’s significant foot traffic.

Our relationship with Walmart Canada Corp. is governed by an amended and restated license agreement effective January 1, 2006. We are required to pay Walmart Canada a license fee based on a percentage of the sales of our portrait studios operated in Walmart’s Canadian stores. The agreement has a five-year term, and Walmart Canada has an option to renew for two renewal periods of two years each. Studios that were in operation on the effective date of this agreement are subject to a license schedule, which specifies expiration dates for those specific studios. Based on this license schedule, our Canadian studios’ licenses expire as follows: 105 in 2010, 135 in 2011, 10 in 2012, 4 in 2013, and 6 in 2014. Although we anticipate that these agreements will renew, there is no assurance of such. As of February 6, 2010, we operated 260 studios under the agreement with Walmart Canada.

Within Mexico, our relationship with Nueva Walmart De Mexico, S de R.L. de C.V. ("Nueva Walmart De Mexico") is governed by an agreement dated as of June 1, 2002, for the first 44 studios. New agreements, with the same terms, are entered into as additional studios are added in Mexico. The agreements run for an undefined period of time. Neither party may terminate an agreement for a studio during the studio's first year of operation; thereafter, either party may terminate the agreement with respect to a studio by giving the other party written notice 30 days prior to the termination date. Under these agreements, Nueva Walmart De Mexico is compensated based upon a percentage of our total sales in all Walmart studios in Mexico. As of February 6, 2010, we operated in 114 Nueva Walmart De Mexico studios.

Toys “R” Us

CPI entered into an Amendment (the “Amendment”) dated as of February 22, 2010, effective as of April 20, 2010, with Toys “R” Us – Delaware, Inc. (the “Licensor”, “Toys “R” Us” or “TRU”) to the Amended and Restated License Agreement (the “License Agreement”) made and entered into as of December 23, 2005, between TRU and Kiddie Kandids, LLC. Kiddie Kandids, LLC is a Chapter 7 debtor under Case No. 10-20334 brought before the United States Bankruptcy Court for the District of Utah (the “Bankruptcy Court”). The Company acquired the License Agreement in its acquisition of certain assets of Kiddie Kandids, LLC in an auction conducted by the Bankruptcy Court.

6

Under the Amendment, TRU grants CPI an exclusive license to operate photo studios (the “Studios”) in certain Babies “R” Us stores under the Kiddie Kandids name. The term of the License Agreement, as amended by the Amendment, expires on January 31, 2016. The Amendment allows CPI significant operating flexibility and collaborative marketing opportunities and provides for the opening of additional locations over the next two years. The Amendment and the License Agreement contain certain termination rights for both the Company and TRU. The fees paid to TRU under the Amendment are based upon the Gross Sales of the Studios operated under the Amendment.

Industry Background and Competition

We compete in a highly fragmented domestic professional portrait photography industry, estimated to be over $6.5 billion. The primary customer categories within the industry are babies, preschoolers, school-age children (including youth sports and graduation portraits), adults, families/groups, weddings, passports and churches. Other categories include: cruise ships, conventions/events, glamour and business portraits. Our competitors include large studio chains operating in national retailers, other national free-standing portrait studio companies, national school and church photographers and a large number of independent portrait photography providers. The majority of the industry is comprised of small, independent photography companies and individual photographers.

Like CPI, other portrait photography companies provide services in retail hosts. These companies and their retail hosts include LifeTouch (JC Penney and Target) and Olan Mills (K-Mart, Belk’s, Meijer’s and Macy’s). We believe that we are the largest of these competitors based on revenues generated in the respective retail hosts.

A number of other companies in the professional portrait photography industry operate free-standing studios on a national, regional or local basis. Among the more sizeable of these companies are Picture People and Portrait Innovations, which operate independent mall-based or strip mall locations.

Our competitors generally compete on the basis of the following: price, service, quality, location, product mix and convenience, including the immediate fulfillment of finished portraits at the time of the portrait session. Many competitors focus heavily on price and commonly feature large portrait packages at aggressively low prices in mass marketing promotions. Some of these same competitors have eliminated all sitting or session fees.

Our PMPS brand focuses on the sales of packages and portrait collections. While our products and services are some of the lowest priced in the industry, we do not feel that we are offering lesser value. In fact, it is our lower price that enables the PMPS customer to attain some of the same products, services and professionalism that higher priced studios offer. It is an added benefit to the PMPS customer that session fees do not apply. The SPS brand focuses on customized portrait solutions that provide a wide variety of selection and customization. Except for promotions during the year, the SPS brand has not followed the “no session fee ever” practice because we believe a session fee is justified by the professionalism of our photographers, the quality of our equipment, our commitment to service and overall studio experience. Furthermore, while our products and services are competitively priced, they are not generally the lowest priced in the industry as we focus on offering a better value proposition. Other competitors, notably Picture People, have emphasized convenience and experience over low price and also the immediate fulfillment of orders in the studio as opposed to longer lead times of central lab fulfillment.

The industry remains in constant transformation brought about by significant advances in digital photographic technology. These technologies have made it possible to capture, manipulate, store and print high-resolution digital images in a decentralized environment. It is this digital evolution that has required industry incumbents to review and adjust their business models while fostering a number of new digital start-ups. The digital evolution has generated photographic experimentation with the consumer and a “do-it-yourself” mentality that did not exist in years past. This has impacted overall portrait studio activity and frequency.

Seasonality and Inflation

Our business is highly seasonal, with the largest volume occurring in the fourth fiscal quarter, between Thanksgiving and Christmas. For both fiscal years 2009 and 2008, fourth quarter net sales accounted for 33% of total net sales for the year. Historically, most, if not all, of the net earnings for the year are generated in the fourth fiscal quarter. The timing of Easter, another seasonally important time for portraiture sales, can have a significant impact on the timing of recognition of sales revenues between the Company’s first and second fiscal quarters. Historically, earlier Easters translate into lower sales due to the closer proximity of the earlier Easter date to the preceding Christmas holiday season during which customers are most portrait-active. Most of the Company’s Easter-related sales in fiscal year 2009, a year with an early Easter, were recognized as revenues, in accordance with the Company’s revenue recognition policies reflected in Note 1 in the accompanying Notes to Consolidated Financial Statements, in the first fiscal quarter. The moderate rate of inflation over the past three years has not had a significant effect on the Company’s revenues and profitability.

7

Suppliers

We purchase photographic paper and processing chemistry from four major manufacturers. Eastman Kodak provides photographic paper for all central lab fulfillment pursuant to an agreement in effect through July 31, 2011. Dye sublimation paper used for proof sheets, portrait collages and portrait orders delivered at the end of a sitting in digital studios is provided primarily by Sony and Kanematsu. Fujifilm North America Corp. provides photographic chemistry for central lab fulfillment. We purchase digital camera and lens components, monitors, computers, printers and other equipment and materials from a number of leading suppliers.

Typically, we do not encounter difficulty in obtaining equipment and materials in the quantity and quality we require and we do not anticipate any problems in obtaining our requirements in the future.

CPI operates most of its U.S. studios in full digital platform utilizing the software of a single vendor for our studio photography digital system. Our contract with our software vendor allows CPI to scale the use of the software as necessary to support all of our current and prospective studios. The Company is testing internally developed software for its U.S. studios, now functional in a number of studios, that is expected to replace the software currently in use at most studios. It is anticipated the new software will be implemented in all U.S. studios within the next two years. Once fully implemented, this software will eliminate our reliance on the single outside vendor we currently use for our U.S. studio photography digital system. CPI also utilizes a single software vendor for its manufacturing fulfillment digital system.

Intellectual Property

We own certain registered service marks and trademarks, including Portrait Creations®, Smile Savers Plan®, PictureMe Portrait Studio®, BigShots® and The Portrait Gallery®, which have been registered with the United States Patent and Trademark Office. Our rights to these trademarks will continue as long as we comply with the usage, filing and other legal requirements relating to the renewal of trademarks.

The Company’s Employees

As of February 6, 2010, the Company employed approximately 11,000 employees, including approximately 6,000 part-time and temporary employees.

The Company Website and Periodic Reports

The Company’s website address is www.cpicorp.com. We make available on the Investor Relations page of the website, free of charge, press releases, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. References to the Company’s website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document.

Environmental Regulation

Our operations are subject to commonly applicable environmental protection statutes and regulations. We do not expect that compliance with federal, state and local provisions regulating the discharge of materials into the environment or otherwise relating to the protection of the environment will have a material effect on our capital expenditures, earnings or competitive position. At present, we have not been identified as a potentially responsible party under the Comprehensive Environmental Responses, Compensation and Liability Act and have not established any reserves or liabilities relating to environmental matters under this Act.

| Risk Factors |

We wish to caution readers that in addition to the important factors described elsewhere in this Annual Report on Form 10-K, the following important factors, among others, sometimes have affected, or in the future could affect, our actual results and could cause our actual consolidated results during fiscal 2010, and beyond, to differ materially from those expressed in any forward-looking statements made by us or on our behalf. The risks and uncertainties described below are not the only ones facing us and do not include other events that we do not currently anticipate or that we currently deem immaterial that may also affect our results of operations and financial condition.

8

We are materially dependent upon Sears, Walmart and Toys “R” Us.

Substantially all of our sales are derived from sales in Sears and Walmart stores. Additionally, commencing in fiscal year 2010, sales will also be derived from Toys "R" Us stores. Therefore, we are materially dependent upon our relationship with Sears, Walmart and Toys “R” Us, the continued goodwill of Sears, Walmart and Toys “R” Us and the integrity of their brand names in the retail marketplace. Any deterioration in our host relationships could have a material adverse effect on us.

Because we represent only a small fraction of Sears, Walmart and Toys “R” Us revenues, any deterioration of any host relationship would have a far greater effect on us than on our hosts.

In addition, our competitive posture could be weakened by negative changes in Sears, Walmart or Toys “R” Us.

Our portrait studios in Walmart and Toys "R" Us are substantially dependent on customer traffic generated by our host retail stores, and if the customer traffic through these host stores decreases due to the economy or for any other reason, our sales could be materially and adversely affected.

Our business practices and operations need to be acceptable to our hosts.

Our business practices and procedures must at all times be acceptable to Sears, Walmart and Toys "R" Us. In addition, under our agreements there are substantial contractual rights, the most significant of which are described more fully in “Item 1. Business,” which the host can exercise in a manner that can have a material adverse effect on us. Consequently, in the future, we may be required to make changes to our business practices and procedures, including with regard to advertising and promotions, product offerings, studio facilities and technology in response to host requests that would not be in our best interests and could materially and adversely affect our sales, costs, margins, business development or other aspects of our business.

Our hosts may terminate, breach, otherwise limit or increase our expenses under our agreements.

Our Sears, Walmart and Toys “R” Us studios in the U.S., Canada and Mexico are operated pursuant to certain license and lease agreements. Our agreements have the following expiration dates: for our U.S. Sears studios, December 2014; for our Canada Sears studios, August 2015; for our Puerto Rico Sears studios, December 2014; for our U.S. and Puerto Rico Walmart studios, June 2010; for our Canada Walmart Studios, 105 in 2010, 135 in 2011, 10 in 2012, 4 in 2013 and 6 in 2014; for our Mexico Walmart studios, with 30-day notice after one year of operation; and for our U.S. Toys “R” Us studios, January 31, 2016. These agreements are more fully described in “Item 1. The Company’s Host Relationships.”

Sears and Walmart are under no obligation to renew these agreements. The agreement with Toys “R” Us provides the Company and Toys “R” Us terms to renew the agreement under certain conditions. Our hosts may also seek to increase the fees we pay under our agreements upon renewal of the agreements. We do not have the contractual right to close any poorly performing locations without Sears’ or Walmart’s consent. Under our agreement with Toys “R” Us, the Company and Toys “R” Us may close certain underperforming locations under specified conditions. In addition, our agreements do not prohibit Sears, Walmart or Toys “R” Us from selling many of the tangible goods we sell, or from processing digital photos in other departments within their stores. Furthermore, there is always the risk that Sears, Walmart or Toys “R” Us might breach our agreements. The loss or breach of the agreements could have a material adverse effect on us. An adverse change in any other aspects of our business relationship with Sears, Walmart or Toys “R” Us, including the reduction of the number of studios operated pursuant to such arrangements or a decision by Sears, Walmart or Toys “R” Us to license or lease studios to other persons could have a material adverse effect on us.

The economic recession has materially impacted consumer spending and may adversely affect our financial position.

Consumer discretionary spending has been materially and adversely impacted by the current recession, job losses, volatile energy and food costs, greater levels of unemployment, higher levels of consumer debt, declines in home values and in the value of consumers' investments and savings, restrictions on the availability of credit and other negative economic conditions which have affected consumer confidence and disposable income. If consumer discretionary spending further declines, demand for our products could decrease and we may be forced to discount our merchandise, which in turn could reduce our revenues, gross margins, operating cash flows and earnings. In addition, higher transportation costs, higher costs of labor, insurance and healthcare, and other negative economic factors may increase our cost of sales and operating expenses. Additionally, our business is highly seasonal, with the largest volume occurring in the fourth fiscal quarter, between Thanksgiving and Christmas. The fourth quarters in both fiscal 2009 and 2008 accounted for approximately 33% of total net sales for the year. As a result, any adverse impact on our fourth quarter operating results would significantly impact annual operating results. Our fourth quarter operating results may fluctuate significantly based on many factors, including holiday spending patterns, prevailing economic conditions and weather conditions.

9

We have a high level of indebtedness, which may impair our ability to operate effectively and impair future performances.

As of February 6, 2010, we had $77.5 million of indebtedness under the term loan portion of our existing Credit Agreement. This level of debt and the limitations imposed by the Company’s debt agreements could adversely affect operating flexibility and put the Company at a competitive disadvantage. The Company’s debt level may adversely affect future performance. The ability to make scheduled payments of principal, to pay interest on, or to refinance indebtedness and to satisfy other debt and lease obligations will depend upon future operating performance, which may be affected by factors beyond the Company’s control. In addition, there can be no assurance that future borrowings or equity financing will be available to the Company on favorable terms or at all for the payment or refinancing of indebtedness. If the Company is unable to service indebtedness, the business, financial condition and results of operations would be materially adversely affected.

The agreements governing our debt impose restrictions on our business.

Our Credit Agreement contains covenants and requires financial ratios and tests, which impose restrictions on our business. Our ability to comply with these restrictions may be affected by events beyond our control, including, but not limited to, prevailing economic, financial and industry conditions. The breach of any of these covenants or restrictions, as well as any failure to make a payment of interest or principal when due, could result in a default under the credit agreement. If our lenders were unwilling to enter into an amendment or provide a waiver, such defaults would permit our lenders to declare all amounts borrowed from them to be due and payable, together with accrued and unpaid interest, and the ability to borrow under this agreement could be terminated. If we are unable to repay debt to our lenders, these lenders could proceed against the collateral securing that debt.

A substantial or prolonged material adverse impact on our results of operations and financial condition could affect our ability to satisfy the financial covenants in our senior secured Credit Agreement, which could result in our having to seek amendments or waivers from our lenders to avoid the termination of commitments and/or the acceleration of the maturity of amounts that are outstanding under our term loan and revolving credit facility. Effective April 16, 2009, the Company amended its Credit Agreement to allow more flexibility should the economy worsen, see further details on the amendment in the “Liquidity and Capital Resources” section. This amendment significantly reduced this risk of a breach of our financial covenants. However, if the economic conditions worsen to a degree that would not be covered by the amendment, the cost of obtaining an additional amendment or waiver could be significant, and could substantially increase our cost of borrowing over the remaining term of our senior secured credit agreement.

Our inability to remain competitive could have a detrimental impact on our results of operations.

The professional portrait photography industry is highly competitive. Evolving technology and business relationships may make it easier and cheaper for our competitors and potential competitors to develop products or services similar to ours or to sell competing products or services in our markets. Likewise, the proliferation of amateur digital photography is making customers more discerning and demanding and has adversely affected overall portrait activity/frequency.

The companies in our industry compete on the basis of price, service, quality, location, product mix and convenience of retail distribution channel. If the Company cannot continue to provide perceived value for our customers, this could have a material adverse impact on sales and profitability. To compete successfully, we must continue to remain competitive in areas of price, service, quality, location, product mix and convenience of distribution.

If our key suppliers become unable to continue to provide us supplies under our current contracts, we will need to obtain an alternative source of supplies. If we enter into an agreement to obtain such supplies at less desirable terms, our financial condition and results of operations could be materially adversely affected.

As described in “Item 1. Suppliers,” the Company purchases photographic paper, dye sublimation paper and processing chemistry from several suppliers. The Company operates most of its U.S. studios in full digital platform utilizing the software of a single vendor for our studio photography digital system. The Company also utilizes a single software vendor for its manufacturing fulfillment digital system. If these companies become unable to continue to provide us supplies or services under our current arrangements or if prices are increased dramatically, we will need to obtain alternative sources of supplies or services.

Although management believes that the available alternative sources of supplies are adequate, there can be no assurance we would be able to obtain such supplies at the same or similar terms to those we currently have in place. If we enter into an agreement to obtain such supplies at less desirable terms, our financial condition and results of operations could be materially adversely affected.

Should the Company be forced to replace its digital software vendor, related costs could increase and production could be disrupted for a period of time, which could have a material adverse impact on the results of operations.

10

If we lose our key personnel, our business may be adversely affected.

Our continued success depends upon, to a large extent, the efforts and abilities of our key employees, particularly our executive management team. We cannot assure you of the continued employment of any members of management. Competition for qualified management personnel is strong. The loss of the services of our key employees or the failure to retain qualified employees when needed could materially adversely affect us.

A significant increase in piracy of our photographs could materially adversely affect our business, financial condition or results of operations.

We rely on copyright laws to protect our proprietary rights in our photographs. However, our ability to prevent piracy and enforce our proprietary rights in our photographs is limited. We are aware that unauthorized copying of photographs occurs within our industry. A significant increase in the frequency of unauthorized copying of our photographs could materially adversely affect our business, financial condition and results of operations by reducing revenues from photograph sales.

Any disruption in our manufacturing process could have a material adverse impact on our business.

Although the Company is moving to internally developed software, it currently operates most of its U.S. studios in full digital platform utilizing the software of a single vendor for our studio photography digital system. The Company also utilizes a single software vendor for its manufacturing fulfillment digital system. Any material delay in the vendor’s networking environment, coupled with a failure to identify and implement alternative solutions, could have an adverse effect upon the operations of the business. Additionally, should this vendor no longer operate, the Company may be forced to find another source of this support, which could be more costly and could delay digital production for a period of time. Although on-site printing is an available alternative to central printing in the Sears’ digital environment, it currently would be difficult and costly for on-site printing to replace central fulfillment during the holiday busy season. On-site printing is not available for our PMPS brand. Any disruption of our processing systems for any reason could adversely impact our business, financial condition and results of operations.

We are subject to litigation and other claims that could have an adverse effect on our business.

We are a defendant in a pending legal proceeding related to allegations that the Company failed to pay certain employees for “off the clock” work and provide meal and rest breaks as required by law. While we believe the claim is without merit and continue our vigorous defense, the outcome of this proceeding is difficult to assess and quantify and therefore we cannot determine whether the financial impact, if any, will be material to our financial position or results of operations. The defense of this action may be both time consuming and expensive. If this legal proceeding were to result in an unfavorable outcome, it could have a material adverse effect on our business, financial position and results of operations.

The impact of declines in global equity markets on asset values and interest rates used to value the liabilities in our pension plan and changes in rules and regulations may result in higher pension costs and the need to fund the pension plan in future years in material amounts.

The impact of declines in the global equity and bond markets on asset values may result in higher pension costs and may increase and accelerate the need to fund the pension in future years. The determination of pension expense and pension funding are based on a variety of rules and regulations. Changes in these rules and regulations could impact the calculation of pension plan liabilities and the valuation of pension plan assets. They may also result in higher pension costs and accelerate and increase the need to fully fund the pension plan.

We are subject to currency fluctuations from our operations within non-U.S. markets.

For our operations conducted in Canada and Mexico, transactions are typically denominated in local currencies. Accordingly, certain costs of our operations in these foreign locations are also denominated in those local currencies. Because our financial statements are stated in U.S. dollars, changes in currency exchange rates between the U.S. dollar and other currencies, have had, and will continue to have, an impact on our reported financial results.

| Unresolved Staff Comments |

None.

11

| Properties |

The following table sets forth certain information concerning the Company’s principal facilities as of February 6, 2010:

|

APPROXIMATE

|

|||||||||||||||

|

AREA IN

|

OWNERSHIP

|

||||||||||||||

|

LOCATION

|

SQUARE FEET

|

PRIMARY USES

|

OR LEASE

|

||||||||||||

|

Matthews, North Carolina

|

860,000

|

Unoccupied Administration and Portrait processing facility (includes 696,000 square feet in land)

|

Owned

|

(1)

|

|||||||||||

|

Charlotte, North Carolina

|

372,000

|

Administration, Warehousing and Portrait processing (includes 315,000 square feet in land)

|

Owned

|

||||||||||||

|

Charlotte, North Carolina

|

348,000

|

Undeveloped, industrial land

|

Owned

|

(1)

|

|||||||||||

|

St. Louis, Missouri

|

341,000

|

Headquarters, Administration and Portrait processing (includes 31,000 square feet in land)

|

Owned

|

||||||||||||

|

St. Louis, Missouri

|

159,000

|

Parking Lots

|

Owned

|

||||||||||||

|

Brampton, Ontario

|

156,000

|

Unoccupied Administration, Warehousing and Portrait processing facility (includes 116,000 square feet in land)

|

Owned

|

(1)

|

|||||||||||

|

St. Louis, Missouri

|

53,000

|

Warehousing

|

Leased

|

(2)

|

|||||||||||

|

Charlotte, North Carolina

|

51,000

|

Parking Lots

|

Owned

|

||||||||||||

|

(1)

|

Properties are held for sale. See Note 7 to the Notes to Consolidated Financial Statements for further discussion.

|

|

|

(2)

|

Lease term expires on July 31, 2018.

|

Studio license/lease agreements

As of February 6, 2010, the Company operates portrait studios in host stores under license and lease agreements as shown below:

|

NUMBER

|

|||||||

|

OF STUDIOS

|

COUNTRY

|

LICENSOR/LESSOR

|

|||||

|

871

|

United States and Puerto Rico

|

Sears

|

|||||

|

1,549

|

United States and Puerto Rico

|

Walmart

|

|||||

|

110

|

Canada

|

Sears Canada, Inc.

|

|||||

|

260

|

Canada

|

Walmart Canada Corp.

|

|||||

|

114

|

Mexico

|

Nueva Walmart de Mexico, S, de R.L. de C.V.

|

|||||

|

31

|

United States studios not

|

Third parties - generally leased for at least 3 years

|

|||||

|

in Sears or Walmart

|

with some having renewal options

|

||||||

The Company pays Sears and Walmart a fee based on annual sales within the respective host stores. This fee covers the Company’s use of space in the host stores, the use of Sears’ name and the use of the Walmart name in Canada and Mexico. No separate amounts are paid to hosts expressly for the use of space.

The Company believes that the facilities used in its operations are adequate for its present and anticipated future operations.

| Legal Proceedings |

The Company and two of its subsidiaries are defendants in a lawsuit entitled Shannon Paige, et al. v. Consumer Programs, Inc., filed March 8, 2007, in the Superior Court of the State of California for the County of Los Angeles, Case No. BC367546. The case was subsequently removed to the United States District Court for the Central District of California, Case No. CV 07-2498-FMC (RCx). The Plaintiff alleges that the Company failed to pay him and other hourly associates for “off the clock” work and that the Company failed to provide meal and rest breaks as required by law. The Plaintiff is seeking damages and injunctive relief for himself and others similarly situated. On October 6, 2008, the Court denied the Plaintiffs’ motion for class certification but allowed Plaintiffs to attempt to certify a smaller class, thus reducing the size of the potential class to approximately 200. Plaintiffs filed a motion seeking certification of the smaller class on November 14, 2008. The Company filed its opposition on December 8, 2008. In January 2009, the Court denied Plaintiffs' motion for class certification as to their claims that they worked "off the clock". The Court also deferred ruling on Plaintiff's motion for class certification as to their missed break claims and stayed the action until the California Supreme Court rules on a pending case on the issue of whether an employer must merely provide an opportunity for employees to take a lunch break or whether an employer must actively ensure that its employees take the break. The Company believes the claims are without merit and continues its vigorous defense on behalf of itself and its subsidiaries against these claims, however, an adverse ruling in this case could require the Company to pay damages, penalties, interest and fines.

The Company was a defendant in a lawsuit entitled Picture Me Press LLC v. Portrait Corporation of America, et al., Case No. 5:08cv32, which was filed in the United States District Court for the Northern District of Ohio on January 4, 2008. The suit alleged that the Company’s use of the name PictureMe Portrait Studios® infringed Plaintiff’s trademark for its picture books and sought damages and injunctive relief. The parties agreed to full resolution of the claims of the case on August 12, 2009. The case was dismissed with prejudice on October 2, 2009. The matter resulted in the Company recording a $527,000 charge in other charges and impairments in fiscal year 2009, net of insurance reimbursement for expenses related to the matter. A receivable of $114,000 is outstanding as of February 6, 2010, related to the insurance reimbursement. Collection of this receivable occurred subsequent to the 2009 fiscal year end.

12

The Company is also a defendant in other routine litigation, but does not believe these lawsuits, individually or in combination with the cases described above, will have a material adverse effect on its financial condition. The Company cannot, however, give assurances that these legal proceedings will not have a material adverse effect on its business or financial condition.

PART II

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

Price Range of Common Stock and Cash Dividends

Since April 17, 1989, the Company's common stock has been traded on the New York Stock Exchange under the symbol CPY.

The following tables set forth the high and low closing prices of the common stock reported by the New York Stock Exchange and the dividends declared for each full quarterly period during the Company's last two fiscal years.

|

FISCAL YEAR 2009

|

||||||||||||

|

(ending February 6, 2010)

|

HIGH

|

LOW

|

DIVIDEND

|

|||||||||

|

First Quarter

|

$ | 10.86 | $ | 6.00 | $ | 0.16 | ||||||

|

Second Quarter

|

18.80 | 9.90 | 0.16 | |||||||||

|

Third Quarter

|

18.78 | 9.99 | 0.16 | |||||||||

|

Fourth Quarter

|

15.00 | 11.60 | 0.16 | |||||||||

|

FISCAL YEAR 2008

|

||||||||||||

|

(ending February 7, 2009)

|

HIGH

|

LOW

|

DIVIDEND

|

|||||||||

|

First Quarter

|

$ | 20.25 | $ | 15.17 | $ | 0.16 | ||||||

|

Second Quarter

|

26.73 | 13.79 | 0.16 | |||||||||

|

Third Quarter

|

16.44 | 5.57 | 0.16 | |||||||||

|

Fourth Quarter

|

7.14 | 1.08 | 0.16 | |||||||||

Performance Graph

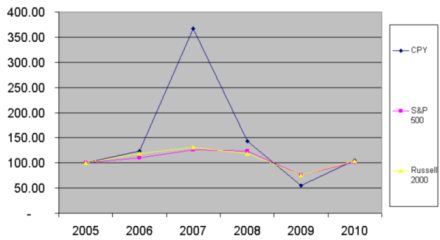

The following graph compares the five-year cumulative returns of $100 invested in (a) the Company (“CPY”), (b) the Standard & Poor’s 500 Index (“S&P 500”), and (c) the Russell 2000 Index (“Russell 2000”), assuming the reinvestment of all dividends. The Russell 2000 index was selected because it encompasses similarly sized companies to the Company. The measurement dates for the purposes of determining the stock price of the Company correspond to the fiscal year end (i.e., the first Saturday in February of each year reflected). The corresponding measurement dates for the S&P 500 and the Russell 2000 are January 31st of each of the years reflected.

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

|

CPY

|

100.00

|

123.98

|

367.18

|

142.75

|

54.44

|

104.84

|

|

S&P 500

|

100.00

|

110.26

|

126.04

|

123.26

|

76.35

|

101.33

|

|

Russell 2000

|

100.00

|

118.80

|

131.15

|

118.48

|

75.27

|

103.51

|

13

Shareholders of Record

As of April 16, 2010, the closing sales price of the Company’s common stock was $14.95 per share with 9,671,756 shares outstanding and 1,287 holders of record.

Dividends

The Company intends, from time to time, to pay cash dividends on its common stock, as its Board of Directors deems appropriate, after consideration of the Company's operating results, financial condition, cash requirements, restrictions imposed by Delaware law and credit agreements, including maximum limits of cash to be used to pay for dividends, general business conditions and such other factors as the Board of Directors deems relevant.

Issuer Repurchases of Equity Securities

The Company did not repurchase any equity securities during the fourth quarters of fiscal years 2009 or 2008.

| Selected Financial Data |

The summary historical consolidated financial data as of and for each of the fiscal years in the five-year period ended February 6, 2010, set forth below have been derived from the Company’s audited consolidated financial statements. The information presented below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included herein. The Company acquired substantially all of the assets of PCA and certain of its affiliates and assumed certain liabilities of PCA on June 8, 2007, which affected the operating result trends as depicted in the table below. Certain of this data has been reclassified to conform with the current year presentation.

|

in thousands except share and per share data

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

STATEMENT OF OPERATIONS (1)

|

||||||||||||||||||||

|

Net sales

|

$ | 422,371 | $ | 462,548 | $ | 423,429 | $ | 292,973 | $ | 291,098 | ||||||||||

|

Cost of sales (exclusive of depreciation and amortization shown below)

|

30,626 | 43,280 | 47,135 | 30,211 | 41,257 | |||||||||||||||

|

Selling, general and administrative expenses

|

339,138 | 377,310 | 326,568 | 218,282 | 215,102 | |||||||||||||||

|

Depreciation and amortization

|

22,740 | 29,432 | 27,291 | 16,861 | 19,904 | |||||||||||||||

|

Other charges and impairments (2)

|

3,294 | 13,557 | 7,695 | 1,241 | 2,767 | |||||||||||||||

|

Income (loss) from continuing operations

|

26,573 | (1,031 | ) | 14,740 | 26,378 | 12,068 | ||||||||||||||

|

Interest expense, net (3)

|

6,936 | 8,527 | 8,818 | 1,815 | 1,098 | |||||||||||||||

|

Other (expense) income, net (4)

|

(44 | ) | 190 | 175 | 1,031 | (282 | ) | |||||||||||||

|

Income tax expense (benefit)

|

5,796 | (2,644 | ) | 2,080 | 9,164 | 1,889 | ||||||||||||||

|

Net income (loss) from continuing operations

|

13,797 | (6,724 | ) | 4,017 | 16,430 | 8,799 | ||||||||||||||

|

Net (loss) income from discontinued operations, net of tax (1)

|

- | (961 | ) | (441 | ) | (103 | ) | 73 | ||||||||||||

|

Net income (loss)

|

$ | 13,797 | $ | (7,685 | ) | $ | 3,576 | $ | 16,327 | $ | 8,872 | |||||||||

|

SHARE AND PER SHARE DATA (1)

|

||||||||||||||||||||

|

Net income (loss) from continuing operations - diluted (5)

|

$ | 1.97 | $ | (1.03 | ) | $ | 0.63 | $ | 2.58 | $ | 1.12 | |||||||||

|

Net income (loss) from continuing operations - basic (5)

|

$ | 1.97 | $ | (1.03 | ) | $ | 0.63 | $ | 2.59 | $ | 1.12 | |||||||||

|

Net income (loss) - diluted

|

$ | 1.97 | $ | (1.18 | ) | $ | 0.56 | $ | 2.56 | $ | 1.13 | |||||||||

|

Net income (loss) - basic

|

$ | 1.97 | $ | (1.18 | ) | $ | 0.56 | $ | 2.57 | $ | 1.13 | |||||||||

|

Dividends

|

$ | 0.64 | $ | 0.64 | $ | 0.64 | $ | 0.64 | $ | 0.64 | ||||||||||

|

Average shares outstanding - diluted

|

7,020 | 6,510 | 6,416 | 6,376 | 7,881 | |||||||||||||||

|

Average shares outstanding - basic

|

6,993 | 6,510 | 6,391 | 6,353 | 7,854 | |||||||||||||||

|

CASH FLOW DATA (continuing operations only)

|

||||||||||||||||||||

|

Net cash provided by operating activities

|

$ | 31,289 | $ | 12,663 | $ | 39,872 | $ | 37,993 | $ | 18,624 | ||||||||||

|

Net cash (used in) provided by financing activities

|

$ | (33,494 | ) | $ | (13,419 | ) | $ | 90,788 | $ | (43,567 | ) | $ | (1,223 | ) | ||||||

|

Net cash used in investing activities

|

$ | (2,876 | ) | $ | (33,488 | ) | $ | (97,653 | ) | $ | (2,358 | ) | $ | (17,633 | ) | |||||

|

Capital expenditures

|

$ | 5,234 | $ | 36,074 | $ | 14,884 | $ | 2,760 | $ | 20,235 | ||||||||||

14

|

Item 6.

|

Selected Consolidated Financial Data (continued) |

|

in thousands

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

BALANCE SHEET

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 18,913 | $ | 23,665 | $ | 59,177 | $ | 26,294 | $ | 34,269 | ||||||||||

|

Current assets

|

53,555 | 61,480 | 92,835 | 55,164 | 69,629 | |||||||||||||||

|

Net fixed assets

|

34,169 | 50,887 | 56,280 | 26,693 | 41,282 | |||||||||||||||

|

Goodwill and intangible assets (6)

|

60,380 | 61,665 | 62,956 | 512 | 512 | |||||||||||||||

|

Other assets

|

18,487 | 18,823 | 27,152 | 11,379 | 15,641 | |||||||||||||||

|

Total assets

|

166,591 | 192,855 | 239,223 | 93,748 | 127,064 | |||||||||||||||

|

Current liabilities

|

62,643 | 55,010 | 83,051 | 49,407 | 56,065 | |||||||||||||||

|

Long-term debt, less current maturities

|

57,855 | 104,578 | 105,728 | 8,333 | 16,667 | |||||||||||||||

|

Other liabilities

|

35,905 | 32,432 | 33,470 | 23,209 | 25,739 | |||||||||||||||

|

Stockholders' equity (5)

|

10,188 | 835 | 16,974 | 12,799 | 28,593 | |||||||||||||||

|

(1)

|

The following business areas were classified as discontinued operations in the years indicated. The financial statements for the periods prior to the classification were reclassified to reflect these changes:

|

|

|

- In 2008, Portrait Gallery and E-Church operations

|

||

|

- In 2007, UK Operations which were acquired in the PCA acquisition

|

|

(2)

|

Other charges and impairments: |

|

in thousands

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Reserves for severance and related costs (a)

|

$ | 970 | $ | 2,046 | $ | 2,035 | $ | 878 | $ | 2,546 | ||||||||||

|

Proxy contest fees (b)

|

871 | - | - | - | - | |||||||||||||||

|

Other transition related costs - PCA Acquisition (c)

|

527 | 1,255 | 2,817 | - | - | |||||||||||||||

|

Impairment charges (d)

|

300 | 739 | - | - | - | |||||||||||||||

|

Sears fees related to the settlement of the previous license agreement (e)

|

- | 7,527 | 2,500 | - | - | |||||||||||||||

|

Other (f)

|

626 | 1,990 | 343 | 363 | 221 | |||||||||||||||

| $ | 3,294 | $ | 13,557 | $ | 7,695 | $ | 1,241 | $ | 2,767 | |||||||||||

|

(a)

|

Consists principally of expenses and related costs for employee severance, retirements and repositioning. Specifically, in 2008 and 2007, this cost is primarily related to the PCA Acquisition.

|

|

|

(b)

|

Relates to certain fees incurred in connection with the proxy contest in 2009.

|

|

|

(c)

|

Consists of integration-related costs relative to the PCA Acquisition.

|

|

|

(d)

(e)

|

Consists of 2009 and 2008 write-downs of certain asset values held for sale.

Consists of certain fees and charges related to the settlement of the previous Sears license agreement.

|

|

|

(f)

|

Costs in 2009 primarily relate to net legal expense incurred in connection with the settlement of the Picture Me Press LLC vs. Portrait Corporation of America case. Costs in 2008 primarily related to legal expense incurred for the settlement of the Portraits International of the Southwest vs. CPI Corp. case and in connection with the Picture Me Press LLC vs. Portrait Corporation of America case. Costs in 2007 primarily related to the write-off of software that is no longer used in the business. Costs in 2006 represent professional service expense in connection with a strategic alternative review and the write-off of certain legacy equipment that is no longer used in the business. Costs in 2005 consist primarily of the write-off of certain film assets resulting from the digital conversion of SPS, offset in part by a favorable claim settlement resulting in a refund related to previously paid loan commitment fees and costs.

|

|

(3)

|

In 2009, 2008 and 2007, includes (income) expense of ($1.5 million), $617,000 and $2.9 million, respectively, in connection with marking the interest rate swap agreement to its market value.

|

|

|

(4)

|

In 2004, the Company recorded accrued lease liability obligations relating to its lease guarantees on certain of Prints Plus’ retail stores. As the total guarantee related to these leases had decreased with the passage of time, the payment of rents by Prints Plus and the settlement by the Company of certain leases rejected in bankruptcy, the related liability was reduced by $887,000 in 2006 to reflect management’s revised estimate of remaining potential loss.

|

|

|

(5)

|

The Company recorded the repurchase of 1,658,607 shares of common stock for $32.4 million in 2006.

|

|

|

(6)

|

At the time of the PCA Acquisition, the Company acquired a host agreement and customer list with Walmart and additional goodwill. See Note 8 to the Notes to Consolidated Financial Statements for further discussion.

|

15

| Management's Discussion and Analysis of Finanical Condition and Results of Operations |

Management’s Discussion and Analysis of Financial Condition and Results of Operations is designed to provide the reader of the financial statements with a narrative on the Company’s results of operations, financial position and liquidity, significant accounting policies and critical estimates, and the future impact of accounting standards that have been issued but are not yet effective. Management’s Discussion and Analysis is presented in the following sections: Executive Overview; Results of Operations; Liquidity and Capital Resources; and Accounting Pronouncements and Policies. The reader should read Management’s Discussion and Analysis of Financial Condition and Results of Operations in conjunction with the consolidated financial statements and related notes thereto contained elsewhere in this document.

All references to earnings per share relate to diluted earnings per common share.

EXECUTIVE OVERVIEW

The Company’s Operations

CPI Corp. is a long-standing leader, based on sittings, number of locations and related revenues, in the professional portrait photography of young children, individuals and families. From a single studio opened by our predecessor company in 1942, we have grown to 2,935 studios throughout the U.S., Canada, Mexico and Puerto Rico, principally under license agreements with Sears and lease and license agreements with Walmart. The Company has provided professional portrait photography for Sears’ customers since 1959 and has been the only Sears portrait studio operator since 1986.

On June 8, 2007, the Company completed the PCA Acquisition. The results of the acquired operations have been included in the consolidated financial statements since that date. As a result of the PCA Acquisition, CPI is the sole operator of portrait studios in Walmart Stores and Supercenters in all fifty states in the U.S., Canada, Mexico and Puerto Rico. Management has determined the Company operates as a single reporting segment offering similar products and services in all locations.

As of the end of the last three fiscal years, the Company’s studio counts were:

|

2009

|

2008

|

2007

|

||||||||||

|

Within Sears stores:

|

||||||||||||

|

United States and Puerto Rico

|

871 | 887 | 893 | |||||||||

|

Canada

|

110 | 110 | 112 | |||||||||

|

Within Walmart stores:

|

||||||||||||

|

United States and Puerto Rico

|

1,549 | 1,642 | 1,702 | |||||||||

|

Canada

|

260 | 259 | 253 | |||||||||

|

Mexico

|

114 | 118 | 115 | |||||||||

|

Locations not within Sears or Walmart stores

|

31 | 30 | 33 | |||||||||

|

Total

|

2,935 | 3,046 | 3,108 | |||||||||

Certain under-performing PMPS studios have been closed during 2008 and 2009 in order to improve overall financial results. Locations not within Sears or Walmart stores include 26 free-standing SPS studio locations and 5 Shooting Star locations (located within Buy Buy Baby stores).

As of September 17, 2009, all of the Company’s studios are digital. The installation of a new digital lab sufficient to handle the worldwide fulfillment requirements of the PMPS business was completed in the first quarter of 2008 and has been in operation since the second quarter of 2008. As of the end of the second and fourth quarters of 2008, the Company had transferred all material PMPS operations to the Company’s existing support platform and completed the PMPS digital conversion, respectively.

Effective August 19, 2009, the Company entered into a new six-year license agreement with Sears Canada, Inc., pursuant to which the Company operates professional portrait studios in 110 Sears locations in Canada. The terms of the new agreement provide greater operating flexibility than the previous contract. As a result of the new agreement, the Company converted all remaining Sears film studios in Canada to a digital format in the 2009 third quarter.

16

CPI also entered into the Amendment, dated as of February 22, 2010, effective as of April 20, 2010, with Toys “R” Us to the License Agreement made and entered into as of December 23, 2005, between TRU and Kiddie Kandids, LLC. The Company acquired the License Agreement in its acquisition of certain assets of Kiddie Kandids, LLC in an auction conducted by the Bankruptcy Court. Under the Amendment, TRU grants CPI an exclusive license to operate photo studios in certain Babies “R” Us stores under the Kiddie Kandids name. The term of the License Agreement, as amended by the Amendment, expires on January 31, 2016. The Amendment allows CPI significant operating flexibility and collaborative marketing opportunities and provides for the opening of additional locations over the next two years. The Amendment and the License Agreement contain certain termination rights for both the Company and TRU.

The Company plans to continue to deliver steadily increasing growth through harvesting opportunities from its digital platform to create diversified revenue streams, driving productivity and profitability gains, leveraging our manufacturing capacity and efficiency and implementing aggressive, targeted marketing campaigns. Such increases may be restrained if the economy worsens in the foreseeable future.

Market Challenges

Credit Agreement

As of February 6, 2010, the Company was in compliance with all debt covenants under its Credit Agreement. Effective April 16, 2009, the Company entered into the third amendment (the “Amendment”) to its Credit Agreement to change the interest rate structure and the amortization schedule and to replace preexisting minimum EBITDA and interest coverage covenants with a fixed charge ratio test (i.e., EBITDA minus capital expenditures to fixed charges) and tighten the leverage ratio (i.e., Total Funded Debt to EBITDA), prospectively, with effect from February 8, 2009. These changes were made to allow for greater flexibility in the event that a worsening economic climate has an impact on the Company’s earnings. See Liquidity and Capital Resources below for further discussion.

17

RESULTS OF OPERATIONS

A summary of consolidated results of operations and key statistics follows:

|

in thousands, except per share data

|

2009

|

2008

|

2007

|

|||||||||

|

Net sales