Attached files

| file | filename |

|---|---|

| 8-K - SHENANDOAH TELECOMMUNICATIONS COMPANY 8-K 4-20-2010 - SHENANDOAH TELECOMMUNICATIONS CO/VA/ | form8k.htm |

| EX-99.2 - EXHIBIT 99.2 - SHENANDOAH TELECOMMUNICATIONS CO/VA/ | ex99_2.htm |

Annual Shareholder Meeting

April 20, 2010

Exhibit 99.1

2

Safe Harbor Statement

This presentation includes “forward-looking statements” within the meaning of Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, regarding,

among other things, our business strategy, our prospects and our financial position. These

statements can be identified by the use of forward-looking terminology such as “believes,”

“estimates,” “expects,” “intends,” “may,” “will,” “should,” “could,” or “anticipates” or the negative or

other variation of these similar words, or by discussions of strategy or risks and uncertainties. These

statements are based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the

Company’s expectations and projections. Important factors that could cause actual results to differ

materially from such forward-looking statements include, without limitation, risks related to the

following:

Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, regarding,

among other things, our business strategy, our prospects and our financial position. These

statements can be identified by the use of forward-looking terminology such as “believes,”

“estimates,” “expects,” “intends,” “may,” “will,” “should,” “could,” or “anticipates” or the negative or

other variation of these similar words, or by discussions of strategy or risks and uncertainties. These

statements are based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the

Company’s expectations and projections. Important factors that could cause actual results to differ

materially from such forward-looking statements include, without limitation, risks related to the

following:

qIncreasing competition in the communications industry; and

qA complex and uncertain regulatory environment.

A further list and description of these risks, uncertainties and other factors can be found in the

Company’s SEC filings which are available online at www.sec.gov, www.shentel.com or on request

from the Company. The Company does not undertake to update any forward-looking statements as

a result of new information or future events or developments

Company’s SEC filings which are available online at www.sec.gov, www.shentel.com or on request

from the Company. The Company does not undertake to update any forward-looking statements as

a result of new information or future events or developments

3

Use of Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures that are not determined in

accordance with US generally accepted accounting principles. These financial performance measures

are not indicative of cash provided or used by operating activities and exclude the effects of certain

operating, capital and financing costs and may differ from comparable information provided by other

companies, and they should not be considered in isolation, as an alternative to, or more meaningful

than measures of financial performance determined in accordance with US generally accepted

accounting principles. These financial performance measures are commonly used in the industry and

are presented because Shentel believes they provide relevant and useful information to investors.

Shentel utilizes these financial performance measures to assess its ability to meet future capital

expenditure and working capital requirements, to incur indebtedness if necessary, return investment

to shareholders and to fund continued growth. Shentel also uses these financial performance

measures to evaluate the performance of its businesses and for budget planning purposes.

accordance with US generally accepted accounting principles. These financial performance measures

are not indicative of cash provided or used by operating activities and exclude the effects of certain

operating, capital and financing costs and may differ from comparable information provided by other

companies, and they should not be considered in isolation, as an alternative to, or more meaningful

than measures of financial performance determined in accordance with US generally accepted

accounting principles. These financial performance measures are commonly used in the industry and

are presented because Shentel believes they provide relevant and useful information to investors.

Shentel utilizes these financial performance measures to assess its ability to meet future capital

expenditure and working capital requirements, to incur indebtedness if necessary, return investment

to shareholders and to fund continued growth. Shentel also uses these financial performance

measures to evaluate the performance of its businesses and for budget planning purposes.

4

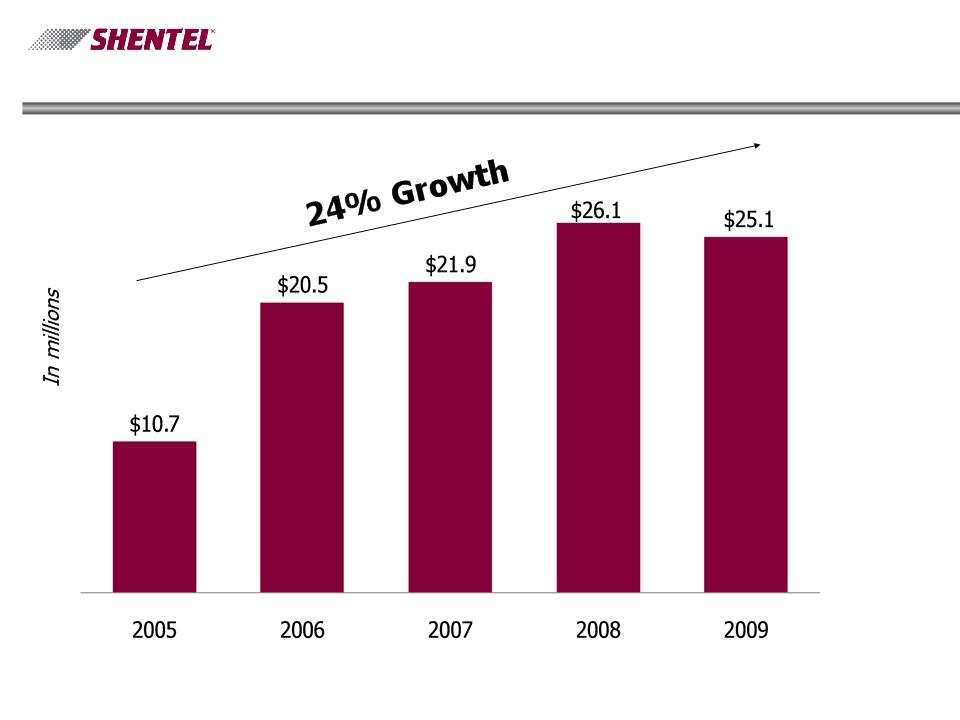

Net Income from Continuing Operations

5

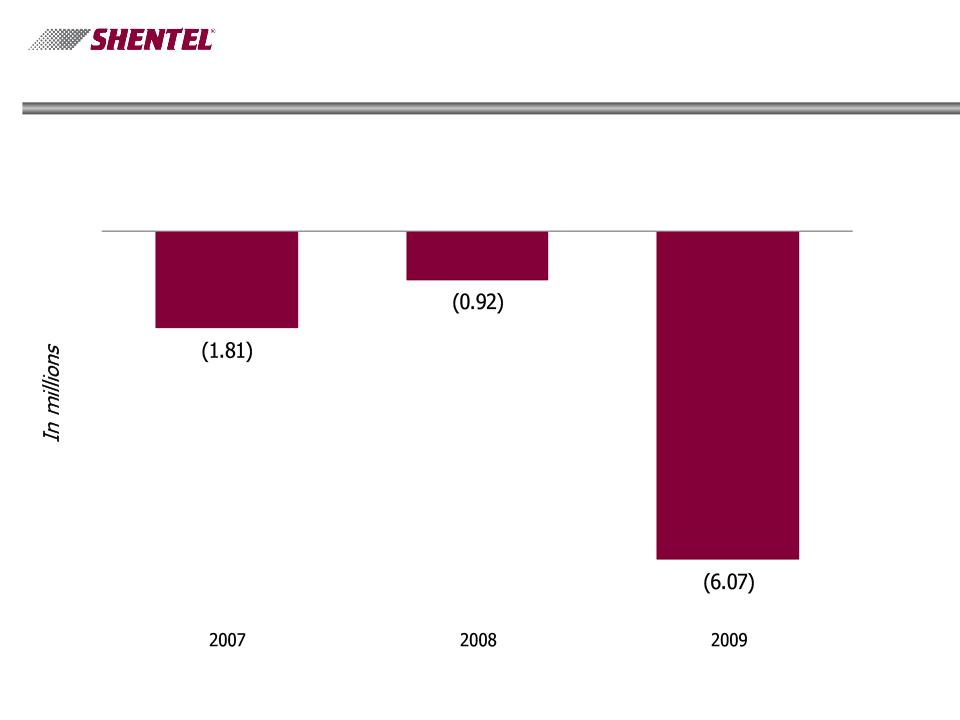

Cable Segment Operating Losses

6

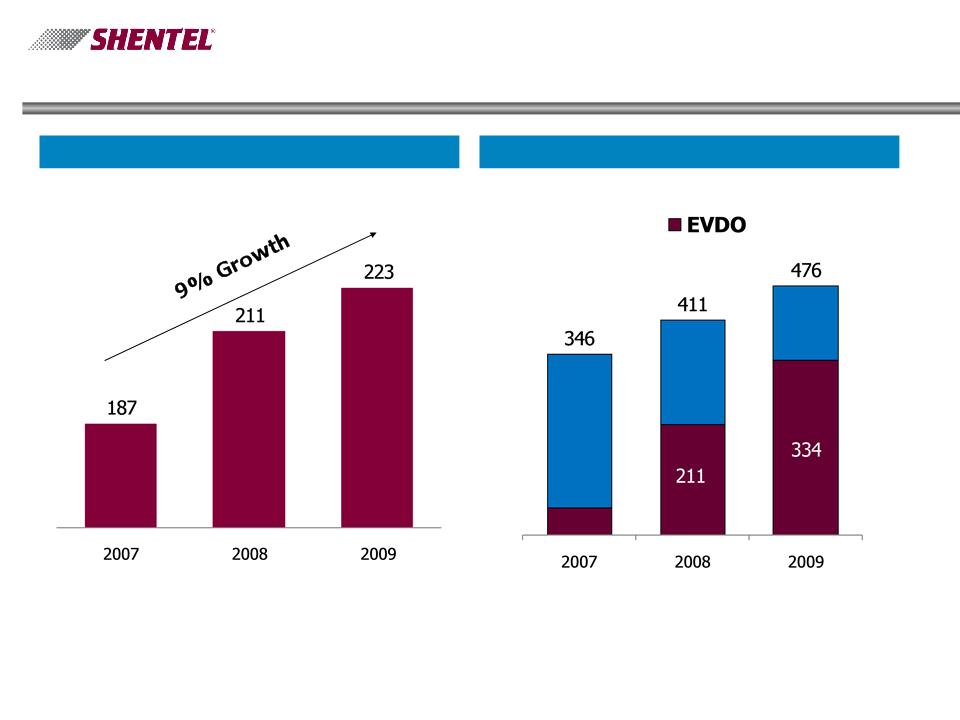

Cable Segment RGU Growth

Excludes the impact of RGU’s in markets sold in 4Q’09

7

Wireless Segment

PCS Subscribers (000s)

Number of Cell Sites

8

Need for Diversification

9

Acquisition of Jet Broadband

q Diversification

q Scale

q Coaxial Network

q Synergies

q Geographic Fit

q Leveraging Core Competencies

10

JBB Network

11

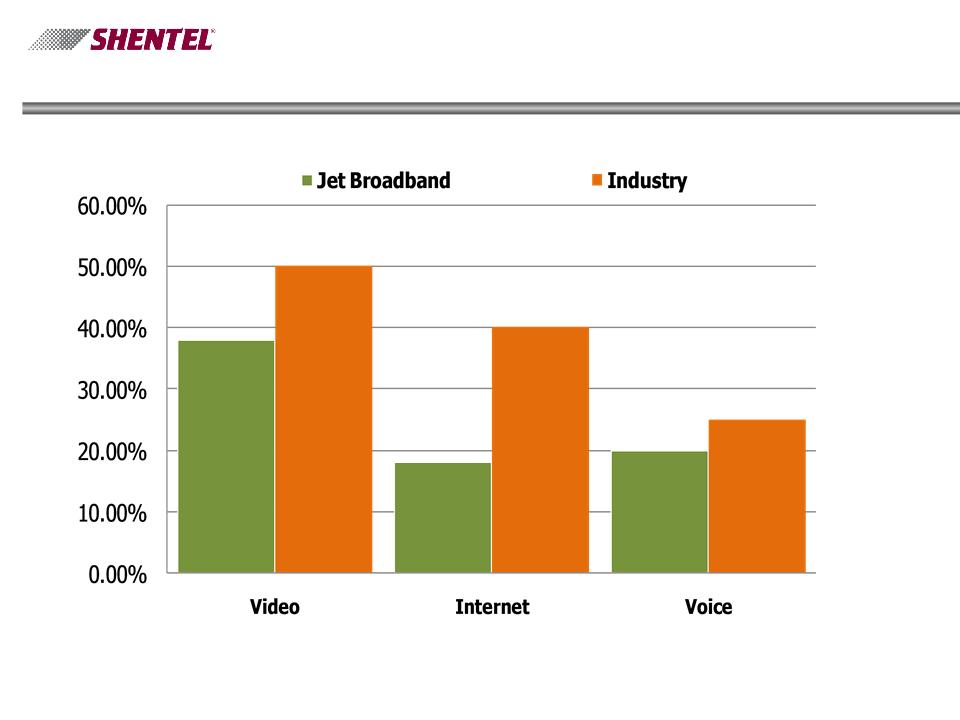

Percent of Homes Passed with Services

12

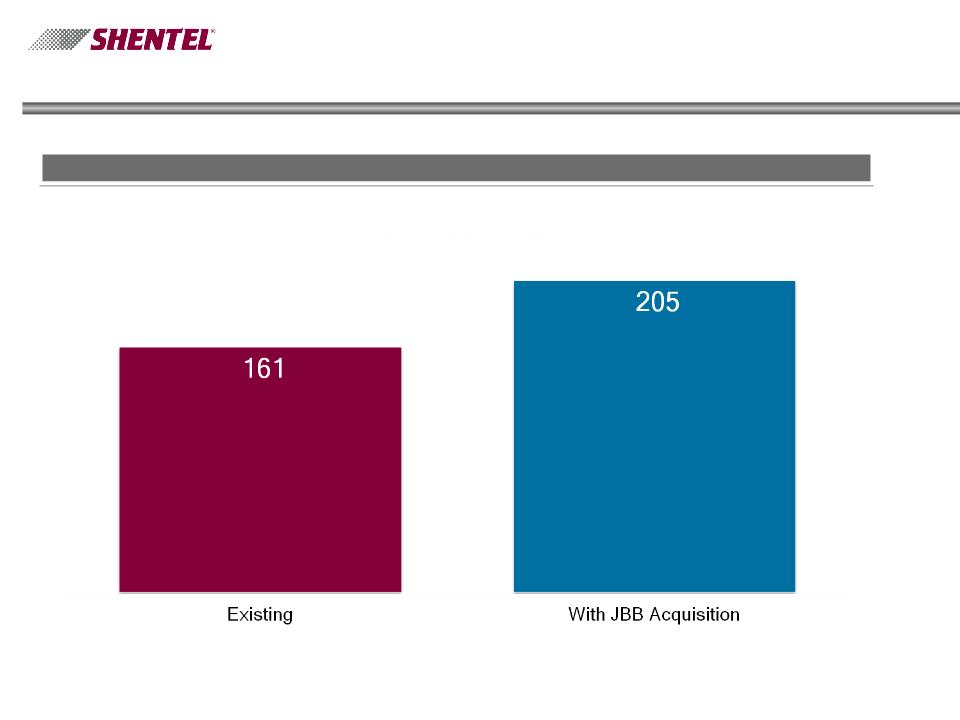

Key Operational Metrics With Jet Broadband

Pro Forma for Periods Ending December 31, 2009

Pro Forma for Periods Ending December 31, 2009

Cable Homes Passed (in 000’s)

13

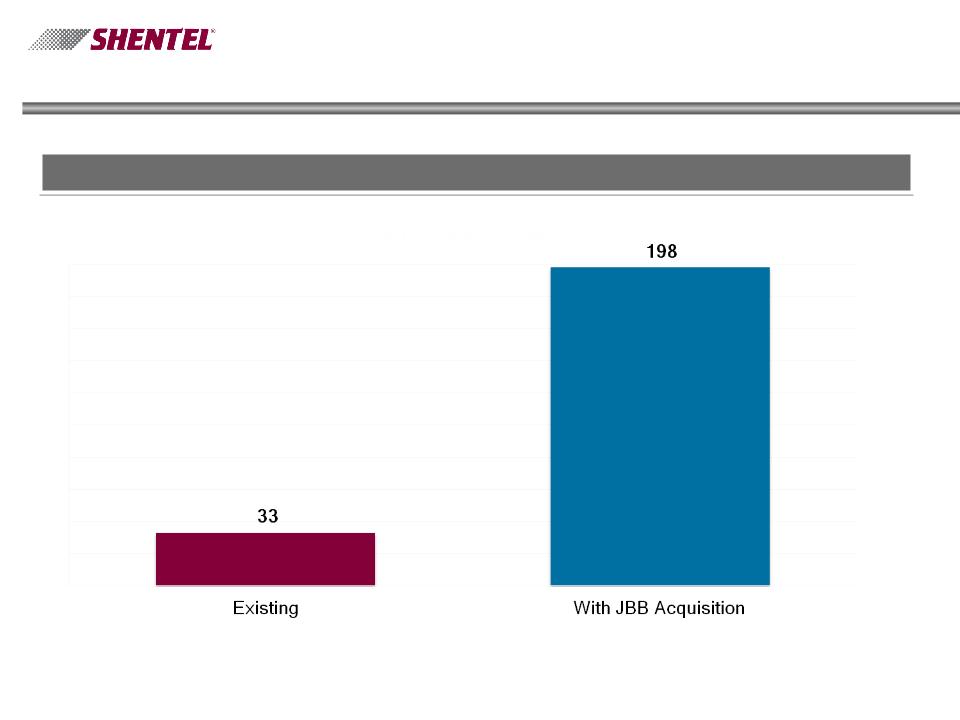

Key Operational Metrics With Jet Broadband

Pro Forma for Periods Ending December 31, 2009

Pro Forma for Periods Ending December 31, 2009

RGU’s (in 000’s)

14

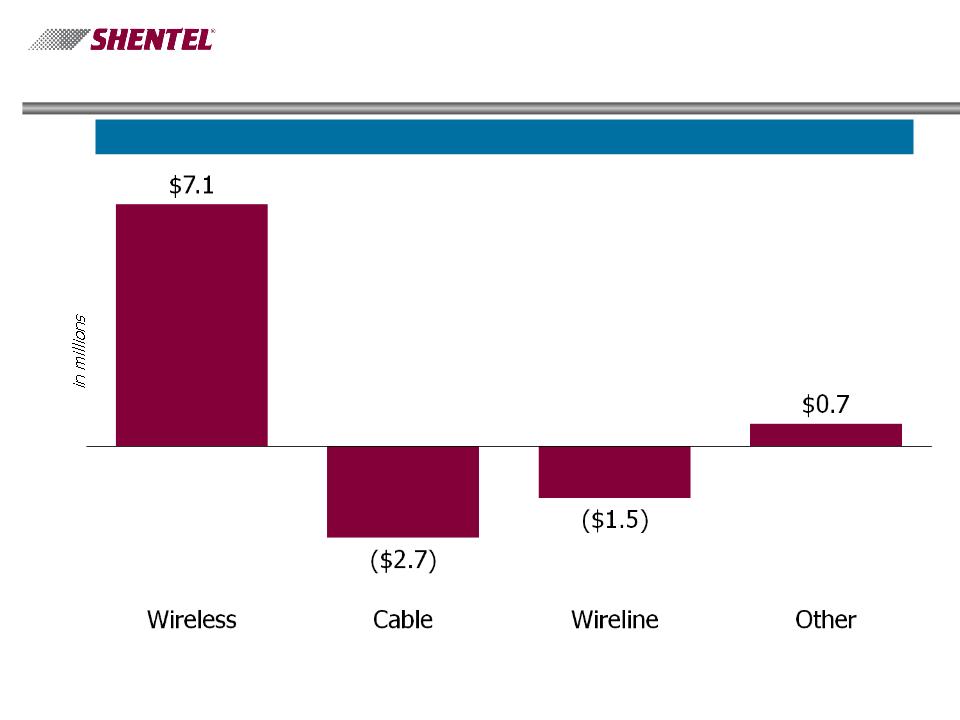

Key Operational Metrics - With Acquisition

Pro Forma for Periods Ending December 31, 2009

Pro Forma for Periods Ending December 31, 2009

Revenues (in millions)

15

Key Operational Metrics - With Acquisition

Pro Forma for Periods Ending December 31, 2009

Pro Forma for Periods Ending December 31, 2009

Operating Income Before Depreciation and Amortization (in millions)

16

Adele Skolits

CFO and VP of Finance

17

Earnings Per Share (EPS)

*-Includes gain on sale of Rural Telephone Bank stock of $.27 in EPS from Continuing

Operations and EPS

Operations and EPS

18

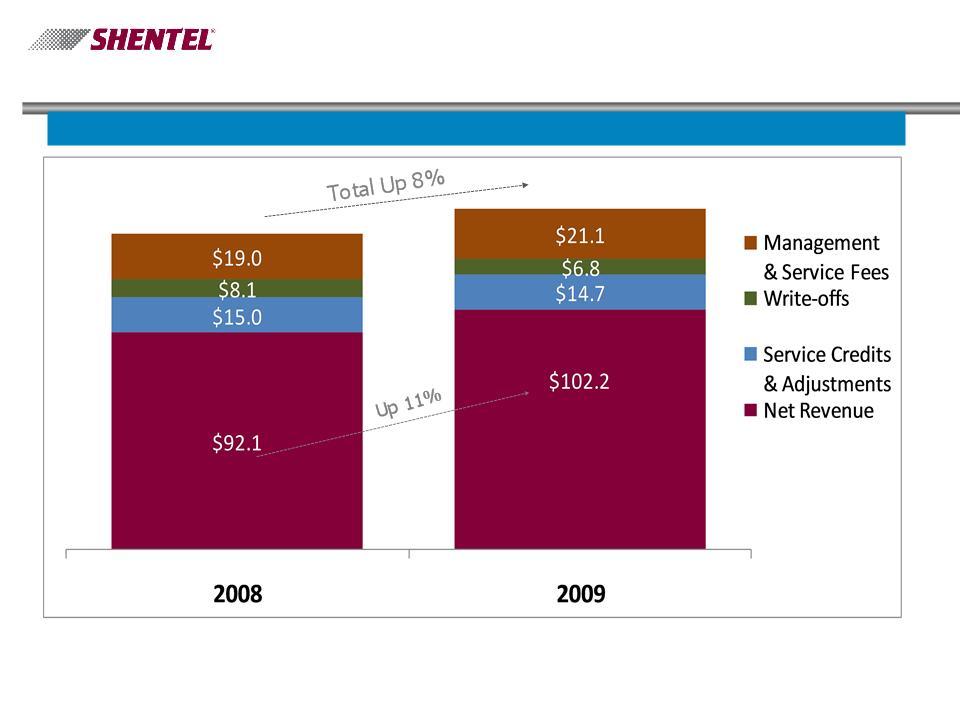

Profitability ($millions)

19

Operating Cash Flow

Change between 2008 and 2009

20

Total Return - 5 Years

21

Level of Debt

Periods Ending December 31, 2009

Periods Ending December 31, 2009

Debt (in millions)

22

Level of Debt

Debt to Operating Cash Flow

23

Shareholder Services

Direct Registration

Householding

-Eliminates the need for physical stock certificates

-Eliminates the risk of certificates being lost, stolen

or destroyed

-To use, need to surrender paper certificates

-Entirely optional

-Will now only send one copy of the proxy

statement and annual report to a household

-Still will get separate proxy cards for each

shareholder account

-Can elect to continue receiving multiple copies

-Information will be mailed in coming weeks

24

Earle MacKenzie

COO and EVP

25

Key Operational Results - Wireless

PCS Retail Subscribers (000s)

26

Key Operational Results - Wireless

PCS Gross Additions

PCS Net Additions

27

Key Operational Results - Wireless

PCS Gross Billed Data & Voice

28

$134.2

$144.8

Key Operational Results - Wireless

PCS Annual Billed Service Revenues (in millions)

29

Key Operational Results - Wireline

Access lines (000s)

30

Key Operational Results - Wireline

Internet Customers (000s)

31

Key Operational Results - Cable

Number of RGUs (000’s)

32

Capital Expenditures by Segment ($ millions)

Annual Shareholder Meeting

April 20, 2010