Attached files

| file | filename |

|---|---|

| EX-2.1 - SHARE EXCHANGE AGREEMENT BY AND BETWEEN THE COMPANY AND DYNAMIC BHORIZON LIMITED, DATED MARCH 25, 2010 - INDESTRUCTIBLE 1, INC | f8k032510ex2i_indestruc1.htm |

| EX-99.1 - THE AUDITED CONSOLIDATED FINANCIAL STATEMENTS OF XINTAI AS OF JUNE 30, 2009 AND 2008 - INDESTRUCTIBLE 1, INC | f8k032510ex99i_indestruc1.htm |

| EX-16.1 - LETTER FROM GATELY & ASSOCIATES, LLC, DATED MARCH 25, 2010 - INDESTRUCTIBLE 1, INC | f8k032510ex16i_indestruc1.htm |

| EX-99.2 - THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS OF XINTAI AS OF DECEMBER 31, 2009 AND 2008 - INDESTRUCTIBLE 1, INC | f8k032510ex99ii_indestruc1.htm |

| EX-99.3 - THE UNAUDITED PRO FORMA FINANCIAL INFORMATION OF INDESTRUCTIBLE - INDESTRUCTIBLE 1, INC | f8k032510ex99iii_indestruc1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 25, 2010

| INDESTRUCTIBLE I, INC. |

| (Exact name of registrant as specified in its charter) |

|

Delaware

|

333-154787

|

26-2603989

|

||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

Room 10, 9th Floor, Building No. 5

9 Gaoshengqiao Road, Dayi Louver Plaza

Wuhou District, Chengdu, Sichuan Province

People’s Republic of China 610041

|

|

(Address of principal executive offices) (Zip Code)

|

|

+86 (028) 8506-8768

|

|

(Registrant’s telephone number, including area code)

|

|

50 West Broadway, 10th Fl.

Salt Lake City, Utah 84101

|

|

(Former name or former address, if changed since last report)

|

––––––––––––––––

Copies to:

Joseph M. Lucosky, Esq.

Yarona Y. Liang, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, New Jersey 07726

(732) 409-1212

––––––––––––––––

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Current Report on Form 8-K contains forward looking statements that involve risks and uncertainties, principally in the sections entitled "Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long term business operations, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Current Report on Form 8-K, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file with the Securities and Exchange Commission that are incorporated into this Current Report on Form 8-K by reference. The following discussion should be read in conjunction with our annual report on Form 10-K and our quarterly reports on Form 10-Q incorporated into this Current Report on Form 8-K by reference, and the consolidated financial statements and notes thereto included in our annual and quarterly reports. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our common stock, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

2

Item 1.01Entry into a Material Definitive Agreement

As more fully described in Item 2.01 below, Indestructible I, Inc. (“we,” “Indestructible” or the “Company”) acquired a pharmaceutical company in accordance with a share exchange agreement dated March 25, 2010 (the “Exchange Agreement”) by and among the Company, Dynamic Bhorizon Limited, a Cayman Islands company (“DBL”), and the shareholders of DBL (the “DBL Shareholders”). The closing of the transaction (the “Closing”) took place on March 25, 2010 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding shares (the “Interests”) of DBL from the DBL Shareholders; and the DBL Shareholders transferred and contributed all of their Interests to us. In exchange, we issued to the DBL Shareholders, their designees or assigns, 15,830,000 shares (the “Exchange Shares”) or 93.12% of the shares of common stock of the Company issued and outstanding after the Closing (the “Share Exchange”). In addition, the shareholders of DBL agreed to pay $325,000 in cash to the shareholders of the Company.

Pursuant to the terms of the Exchange Agreement, Patrick Day, the majority shareholder of the Company, cancelled a total of 12,000,000 shares of common stock of the Company. A copy of the Exchange Agreement is included as Exhibit 2.1 to this Current Report and is hereby incorporated by reference. All references to the Exchange Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

Pursuant to the Exchange Agreement, DBL became a wholly-owned subsidiary of the Company. The sole director of the Company has approved the Exchange Agreement and the transactions contemplated under the Exchange Agreement. The directors of DBL have approved the Exchange Agreement and the transactions contemplated hereunder.

As a further condition of the Share Exchange, Patrick Day and Richard M. Day, Jr. resigned as the officers and directors of the Company. Mr. Xiaodong Zhu, Mr. Xicai Su and Mr. Di Wu were appointed as the new officers of the Company, and Mr. Xiaodong Zhu was appointed as the new director of the Company effectively immediately.

The Share Exchange transaction is discussed more fully in Section 2.01 of this Current Report. The information therein is hereby incorporated in this Section 1.01 by reference.

Item 2.01Completion of Acquisition or Disposition of Assets

CLOSING OF EXCHANGE AGREEMENT

As described in Item 1.01 above, on March 25, 2010, we acquired DBL, which is in the business of drug wholesale in the People’s Republic of China (“China” or the “PRC”), in accordance with the Exchange Agreement. The closing of the transaction took place on March 25, 2010. On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all the Interests of DBL from the DBL Shareholders; and the DBL Shareholders transferred and contributed all of their Interests to us. In exchange, we issued a total of 15,830,000 shares of common stock to the DBL Shareholders, their designees or assigns, which totals 93.12% of the issued and outstanding shares of common stock of the Company on a fully-diluted basis as of and immediately after the Closing of the Share Exchange.

Pursuant to the terms of the Exchange Agreement, Patrick Day cancelled a total of 12,000,000 shares of common stock of the Company. Following the Share Exchange, there are 17,000,000 shares of common stock issued and outstanding.

DBL was incorporated in Cayman Islands on April 8, 2009. It owns 100% of the issued and outstanding capital stock of Sichuan Xintai Pharmaceutical Co., Ltd. (“Xintai”), which was incorporated as a limited liability company on November 25, 1999 under the laws of China. On January 11, 2010, Sichuan Provincial Government approved DBL to acquire 100% of Xintai. On January 21, 2010, Sichuan Administration for Industry and Commerce issued the new business license of Xintai. With the approval and license, Xintai has been transformed from a domestic company to a wholly foreign owned enterprise (“WFOE”). Pursuant to the Exchange Agreement, DBL became a wholly-owned subsidiary of the Company. DBL and Xintai are collectively referred to herein as “DBL.”

Overview

DBL, through Xintai, is a pharmaceutical wholesale company in the PRC. Xintai was incorporated in 1999 as a small pharmaceutical sales company. On July 15th, 2006, Zhu Xiaodong and Zhu Xiaomei acquired 100% of Xintai for approximately $250,973. Xintai soon became a well-known licensed pharmaceutical wholesale company, specializing in the sales of prescription and OTC medicines. Xintai is also involved in research and development (R&D) of new drugs and medicine registration fields.

3

Our revenue increased approximately 126% for the fiscal year ended June 30, 2009 compared to the fiscal year ended June 30, 2008. We generated over $17.1 million in sales, and approximately $2.4 million in after-tax net income for the year ending June 30, 2009. Our revenue increased approximately 27% for the six months ended December 31, 2009 compared to the six months ended December 31, 2008. We generated over $9.6 million in sales, and approximately $1.77 million in after-tax net income for the six months ended December 31, 2009.

Historical Sales & Income Summary

Because Indestructible existed as a shell prior to the merger, the transaction is being accounted for as a reverse acquisition, so DBL is treated as the continuing reporting entity that acquired Indestructible. As a result, all historical financial information being presented is that of DBL and Xintai.

|

(Amounts expressed in USD)

|

Fiscal Year Ended

June 30,

|

%

|

6 Months

Ended December 31,

(Unaudited)

|

%

|

||||||||||||||||||||

|

2009

|

2008

|

Growth

|

2009

|

2008

|

Growth

|

|||||||||||||||||||

|

Revenue

|

$ | 17,127,474 | $ | 7,576,098 | 126.07 | % | $ | 9,653,544 | $ | 7,557,227 | 27.74 | % | ||||||||||||

|

Gross Profit

|

4,848,538 | 2,010,689 | 141.14 | % | 2,617,236 | 1,679,918 | 55.80 | % | ||||||||||||||||

|

Net Income

|

2,391,595 | 935,008 | 155.78 | % | 1,777,194 | 992,078 | 79.14 | % | ||||||||||||||||

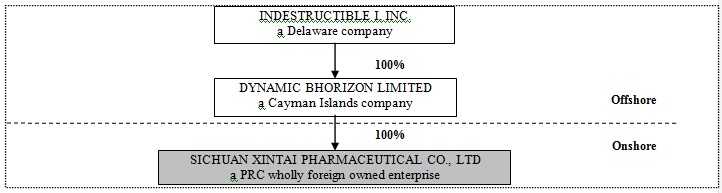

Organization & Subsidiaries

DBL’s organizational structure was developed to allow foreign capital infusion under the laws of the PRC and to maintain an efficient tax structure, as well as to maintain internal organizational efficiencies. The Company’s organization structure post-Share Exchange is summarized in the table below:

DBL was incorporated in the Cayman Islands on April 8, 2009. It owns 100% of the issued and outstanding capital stock of Xintai, which was incorporated as a limited liability company on November 25, 1999 under the laws of China. On January 11, 2010, Sichuan Provincial Government approved DBL to acquire 100% of Xintai. On January 21, 2010, Sichuan Administration for Industry and Commerce issued the new business license to Xintai. With the approval and the new business license, Xintai has been transformed from a Chinese domestic company to a WFOE.

Business

Xintai was incorporated in Chengdu City, Sichuan Province, China in November 1999. Xintai is in the business of prescription medicines sales, OTC medicines sales and medicine R&D. Effective March 25, 2010, DBL entered into a Purchase Agreement to be acquired by us.

Industry and Market Analysis

Industry Overview

According to the research conducted by Intercontinental Marketing Services (“IMS’) (website http://www.imshealth.com), the total revenue for prescription medicines in the world reached 745 billion US dollars in 2008. The prescription medicines sales in developing countries accounted for 25% of the market shares, which increased by 25.7% compared to 2007.

4

China’s pharmaceutical market is highly fragmented and inefficient. As of 2007, China had around 3,000 to 6,000 domestic pharmaceutical manufacturers and approximately 14,000 domestic pharmaceutical distributors. A lack of protection of intellectual property rights, a lack of visibility for drug approval procedures, a lack of effective governmental incentives and poor corporate support for drug research make their lives even harder.

The severe competition in China’s pharmaceutical market and market environment results in the fact that wholesalers and distributors play a major role in the value chain. Those pharmaceutical manufacturers who work closely with wholesalers with strong sales network sell more drugs. Therefore, further market consolidation is highly expected in China.

Market Analysis

According to IMS’s report dated October 8, 2009, the value of the global pharmaceutical market in 2010 is expected to grow by 4% – 6% on a constant-dollar basis, exceeding $825 billion US dollars, driven by stronger near-term growth. The forecast also predicts global pharmaceutical market sales to grow at a 4% - 7% compound annual growth rate through 2013, and takes into account the impact of the global macro economy, the changing mix of innovative and mature products, and the rising influence of healthcare access and funding on market demand. Global pharmaceutical market value is expected to expand to more than $975 billion US dollars by 2013. China’s pharmaceutical market is expected to continue to grow at more than 20% pace annually, and contribute 21 percent of overall global growth through 2013.

In addition, the PRC government announced that by 2020, the national medical insurance will cover over 90% of the total population. China’s changing health-care environment is designed to extend basic health insurance to a larger portion of the population and give individuals greater access to products and services. Following this period of change, medical insurance is now more widespread and the pharmaceutical industry is expected to continue its expansion.

Core Competencies

Since its incorporation in 1999, Xintai has become a rapidly growing pharmaceutical wholesale company. Its rapid development is built on a number of core competencies:

Professional and Experienced Sales Personnel. Currently, we have more than 2,000 contracted professional pharmaceutical sales representatives. In addition to the strong sales team, Xintai has an expert team providing post-sales support. Xintai has its point of sales throughout all of 32 provinces and municipal cities in China. This extensive sales network enables the company to make efficient product distribution and sales. All the sales representatives had educational background or training in neurological, cardio/cerebrovascular, antineoplastic medicines or antibiotics, which are some of the drugs we are specialized in marketing. They have also established long term relationship with many hospitals and doctors who are the main channels of our products. Most of our sales representatives are commission-based only, meaning they only receive payment when they make successful sales. Xintai relies on this practice to significantly reduce risk in marketing.

Extensive Sales Network. We also work with both local pharmaceutical sales companies and local authorized distribution companies. Xintai’s products are currently sold in more than 2,500 hospitals in China.

Ability to Obtain Exclusive Dealership of High Value New Medicines. Xintai carefully chooses its product lines. In light of the highly competitive market in China, Xintai focuses on authorized dealership on such popular medicines that have comprehensive usage, large consumption per patient and relative high value and high profit margin. Xintai’s competitive advantages are:

|

·

|

Xintai continues to collect market information from partners, hospitals, doctors and patients and carefully analyzes its sales data. Therefore, Xintai is able to develop market trend ahead of many of our competitors

|

|

·

|

Xintai’s suppliers are pharmaceutical manufacturers. Most domestic pharmaceutical manufacturers don’t have their own zoning distribution channels or have limited marketing capabilities. Xintai is able to secure dealership of high value-added products due to its impressive sales record and good reputation in pharmaceutical distribution.

|

|

·

|

Xintai focuses on high margin products, such as cardiovascular and antineoplastic drugs. Those medicines have long-term and stable demand. Xintai also employs other promotion channels, such as advertising on major academic journals, press conference, academic promotion conference and regional promotion to sell the company’s products.

|

Products and Competitive Advantages

The company is dedicated to the distribution and sales of prescription medicines to hospitals and medical institutions. Xintai is certified by the Provincial Food and Drug Administration for Drug Supply License and Drug Supply Certificate of Quality Management Standards. Focusing on cardiac, cerebral and vascular products, Xintai’s main products are cardiac, cerebral and vascular, oncoma and anti-infective medicines, for example ganglioside, edaravone, polydanshinolate vial, sulbenicillin sodium, imipenem and cilastatin sodium and arsenious acid.

5

Major Products sold in China:

Below is a chart which shows the major products of our company sold in China:

|

Product

|

Category

|

Covered by Medical Insurance

|

Estimated Market Share in China (2009)

|

Expected Growth Rate

|

|

Ganglioside Injection

|

Cardio/cerebrovascular

|

No

|

25%

|

25%

|

|

Edaravone Injection Injection

|

Cardio/cerebrovascular

|

Yes

|

5%

|

35%

|

|

Magnesium Lithospermate B for Injection

|

Cardio/cerebrovascular

|

Yes

|

0.5%

|

45%

|

|

Imipenem and Cilastatin Sodium for Injection

|

Antibiotics

|

Yes

|

1%

|

20%

|

Ganglioside

Product feature

The product is the medicine for repairing nerve damages with the most affirmative clinical effect, currently with no substitute. Its market share is expected to continue to increase in the next three to five years.

Market size

More than 7 million patients with central nerve damage from brain stroke are in need of treatment in China. About 8 million patients with other nerve damage by bone injury are also in need of treatment. Calculated according to the treatment cycle of three weeks, the annual Market size is around 7.3 billion US dollars; the current realized market sales of the product is 440 million US dollars. It is estimated that in the next three to five years, the market sales will reach to 2.93 billion US dollars.

Competition analysis

Currently there are five manufacturers who make this product. Only two manufacturers have the Approval for Raw Material Production, therefore ensuring a stable supply—Qilu Pharmaceutical and Harbin Medical University Pharmaceutical, while the other three manufacturers can’t maintain a stable supply due to the lack of the raw materials. Xintai’s cooperative manufacturer partner--Harbin Medical University Pharmaceutical is one of the two manufacturers with the Approval for Raw Material Production. At present, Xintai’s main competitor—Qilu Pharmaceutical (“Qilu”) employs non-agency, direct sales practice. Although Qilu entered the market earlier and has a larger market share, Xintai outperforms Qilu in terms of rapid market building, low-cost operation and academic marketing.

Edaravone Injection

Product feature

Edaravone, one of the second grade new medicines, is a protective medicine to neuronal injury. The product was listed on the 2009 National Medical Insurance List in China, having a substantial increase in market share.

Market size

The market size for Edaravone is estimated to be 1.46 billion US dollars in China. Currently, the actual sales of “Bicun” products amounted to near 87.9 million US dollars, and the sale of “Yidasheng” was 29.3 million US dollars. After the product enters the National Medical Insurance List, it is expected to expand its market share by 30% annually in the next three to five years.

Competition analysis

Our main competitive manufacturers are: 1) Simcere Pharmaceutical Group. Product name: “Bicun”. 2) Jinlin Boda Pharmaceutical. Product name: “Yidasheng”. By November 2008, SFDA had approved five pharmaceutical companies to manufacture this product. The other three are: 3) China National Medicines Guorui Pharmaceutical Co., Ltd, 4) Kunming Jida Pharmaceutical Co., Ltd, and 5) Jilin Huinan Changlong Bio-chemical Pharmaceutical Co., Ltd. Our cooperative manufacturer partner is Jilin Boda Pharmaceutical. “Yidasheng” is of exclusive specification, with certain extent of monopoly-sized market share.

6

Polydanshinolate Vial

Product feature

The Polydanshinolate Vial was bestowed with the New Medicine Certificate from China State Food and Drug Administration on May 25th 2005, classified as the second grade national new medicine, and category B national medical insurance medicine. So far it is the Danshen (Salvia miltiorrhiza Bge) formulations with the clearest and highest content of active ingredients. The relative preparation techniques are patented in China and in the US as well. It is the first Chinese medical product with pharmacokinetic parameters in human body and adopting exercise stress test to evaluate the therapeutic effect. Through large amount of clinical trials, it has been proved to have significant therapeutic effect, medicinal safety and stable quality on the treatment of coronary heart disease and angina. At present, the pharmacological activity and importance of magnesium danshinoacetate has been confirmed by the authority of Pharmacopoeia Commission of P.R.C. And magnesium danshinoacetate is confirmed to be the control index of the quality standard for Danshen pills.

The polydanshinolate vial is the successful product of 13-year academic research by Shanghai Institute of Pharmacology, a branch of Chinese Academy of Sciences. The research on the effective ingredients of Danshen water-solubility has found that the magnesium danshinoacetate dominate polyphenol niobate is the most important and most effective active ingredient in treating cardiac and vascular disease, starting from which, advanced manufacturing technologies are adopted to introduce the hi-tech finger prints technology. With the polydanshinolate content in the product reaching 100% and the content of magnesium danshinoacetate reaching 80%, the product is manufactured into frozen dry powder injection.

Market size

As the traditional Chinese medicine promoting blood circulation by removing blood stasis, Danshen has been used to treat coronary heart disease, angina, ischemic stroke, etc. The consumption of injection alone in China is over 3 billion vials. The 2008 sale volume of polydanshinolate vial was 1 million vials, with the sales revenues of 20.2 million US dollars. It is estimated the market will grow by 40% annually in the next three years.

Competition analysis

The polydanshinolate vial is the only Chinese medicine product with 100% of effective ingredient in Chinese market. It has positive clinical effect, its market advantages cannot be compared by any other products in the same category, and its clinical application is irreplaceable.

Sulbenicillion Sodium

Product feature

Sulbenicillion sodium is one of the penicillin antibiotics, applicable to sensitive pseudomonas aeruginosa, some bacillus proteus and other sensitive Gram-positive bacteria caused pneumonia, urinary track infection, CSSSI and septicemia.

Market size

In 2009, the company signed an (3+2) agency agreement with Hunan Xiangyao Pharmaceutical Co., Ltd. According to the different economic conditions, population situations in six provinces, we formulate corresponding investment inviting policies. The sale of Sulbenicillion Sodium will reach 4 million vials in the first year, and the returned money for the bottom price is nearly 5.86 million US dollars. It is estimated that the market will grow by 30% annually.

Competition analysis

There are four sulbenicillion sodium manufacturers with Manufacture Approvals in China currently, which are Shandong Reyong Pharmaceutical, Shenyang Meiluo, Harbin General Pharmaceutical Factory and Hunan Xiangyao Pharmaceutical Co., Ltd. At present, only Shandong Reyong Pharmaceutical and Hunan Xiangyao Pharmaceutical Co., Ltd are equipped with manufacturing ability. Our company represents the 1g sulbenicillion sodium from Hunan Xiangyao.

Sulbenicillion sodium has entered the category B in the adjusted National Medical Insurance in 2009, with the exceptional advantages of few manufacturers, small competition, and listed medical insurance product. Given the national restriction on the antibiotics use especially the cephems antibiotics, our product has won the unanimous appraisal from all drug agencies and medical staff. The marketing prospective is exceptionally broad.

7

Imipenem and Cilastatin Sodium

Product feature

Imipenem and cilastatin sodium is characterized by high efficiency, broad spectrum and no cross-resistance with other β-lactam antibiotics. It has good enzyme-resistance, with relatively less cross-resistance with other β-lactam antibiotics, and is still effective to the infections caused by many cephalosporin resisted bacteria. The product is mainly applicable to sensitive bacteria caused lower respiratory infection, abdominal infection, gynecological genital tract infection, urinary and reproductive system infection, skin and soft tissue infection, bone and joint infection, septicemia, and endocarditis, etc. It is also used in preoperative infection prevention and post-operative infection prevention.

Market size

Penem medicine (carbopenems) is a dark horse in antibiotics arising in recent years. It came out in 1980s, belonging to untypical β-lactam antibiotics with the broadest antimicrobial spectrum, also characterized by strong antibiotic activity. To date, there are altogether seven to eight penem medicines around the world. In 2008, the total sales volume in the globe reached to US dollars 2.5 billion, taking up around 10% of the antibiotics market.

From 2005 to 2008, the consumption by hospitals averaged a growing rate of 24.13%. In 2008, the amount for procurement of penem medicines reached 329 million US dollars.

Imipenem has the second largest sales among penem medicines. Meiluo Penem is in leading position in penem medicine market. The increasing rate in recent years was over 33.34%. In 2008, Meiluo Penem Hospital consumption scale was around 170.4 million US dollars. The growth in the next three years is expected to exceed 30% annually.

Competition analysis

There are four manufacturers importing imipenem and cilastatin sodium vial, including Shenzhen Haibin Pharmaceutical Co., Ltd, Zhejiang Hisum Pharmaceutical Co., Ltd, and China National Medicines Guorui Pharmaceutical Co., Ltd in China. The domestic imipenem enjoys price advantage, with the annual increasing rate of 30%; Tienam from Merck & Co., Inc (including Hangzhou Merck & Co., Inc) has been dominating the whole imipenem market for long. Along with the entering of new companies recent years, the market share of Merck & Co., Inc has been gradually dropping.

Research & Development

Currently, we do not maintain our own R & D department. Instead, we conduct collaborated work with some of the most prestigious medical research institutions in China, such as Academy of Military Medical Sciences, China Pharmaceutical University and Chinese Academy of Sciences. Through the collaborated work, our strategy aims at: (1) imitating popular drugs that are off-patent protection; (2) developing new drug formulations and obtaining patent protection for those drugs with greater market potentials. In October 2009, we founded a R&D center together with Dr. Di Wu, to focus on research and development of new drugs.

At present, Our Company, through collaborated work with other academic institutions, has the following key drugs under research and development:

Clopidogrel Bisulfate Tablets

Product features

It belongs to platelet aggregation inhibitor, which combines with the blood platelet through the selective inhibition of adenosine diphosphate (ADP) and then ADP mediates the activation of glycoprotein complex. It applies to the patients with stroke and myocardial infarction who have recent attack, and those who have been diagnosed with peripheral arteriosclerosis. Clopidogrel can reduce the occurrence of atherosclerosis events (such as myocardial infarction, stroke and vascular death).

Market size

The trade name of the leading brand for this product in 2008 is Plavix, whose annual sales volume is about 3.5 billion US dollars worldwide and around 73.2 million US dollars in China alone. Another top-selling product in Chinese market is called “Jiatai”, whose annual sales volume in China is about 29.3 million US dollars in 2009. Because of the exclusiveness of the patented technology and the particularity of the technique, there has not been any third pharmaceutical enterprise declaring this kind of new drug. It is predicted that there will be over 40% market growth in the following 3-5 years.

8

Competition analysis

Currently there are two similiar drugs market in China. One is Plavix produced by Sanofi-Aventis Pharmaceuticals and the other is Jiatai produced by Shenzhen Salubris Pharmaceuticals Co., Ltd in China. The curative effect of Plavix is affirmative, its price is high and it enjoys about 2/3 market share; while Jiatai has the price advantage, but the clinical popularization is insufficient, the recognition from the doctors has yet to be improved and its market share is about 1/3. The other product Aggrastat® (tirofiban HCl) which is produced by NovaMed Pharmaceuticals Inc in China, NovaMed has exclusive right from Iroko selling non US countries should also be noticed, Aggrastat® is a fast acting, reversible GP IIb/IIIa inhibitor that disaggregates platelet thrombi and improve myocardial perfusion. Aggrastat is proven to be significantly effective in improving the results of primary coronary angioplasty in patients with myocardial infarction. This drug is in the process of regulatory filing. Our clopidogrel development team possesses extensive experience working at some of the world’s most famous drug enterprises and the technology we developed has the comparative advantages over the domestic enterprises. We will develop and manufacture the drug domestically, the cost can be much lower compared to that of Plavix and we will have huge price advantage over Plavix. Our impressive marketing team has extensive and mature experience in the academic promotion of cardiovascular products and our clinical academic promotion ability can rival Plavix’s promotion techniques. Therefore, in the next 2-3 years, we expect that we will take over at least 1/3 market share. Moreover, we will focus on to further improve our production standard after reinforcing the strength of our company and aim to enter the U.S. market with the product as early as possible.

Time schedule for development

Through the collaborated work with some of the top academic institutions, we believe that we have already developed the necessary production process and we will start to apply for the Federal Manufacture Approval and apply for Clinical Verification in March – April, 2010. The predicted mass production will be by the end of 2013.

Marketing and Sales Strategy

Xintai’s revenues are mainly from authorized medicine sales. Xintai is the market leader for some medicines. For example, Xintai’s Ganglioside Injection sales accounts for 30% of the total market share in China. Overall, Xintai’s products can reach 65% of China’s upper first-class hospitals. By 2010, this number is expected to be increased to 80%.

Marketing Model

Xintai has Pharmaceutical Trade License and is approved by Good Supply Practice (GSP) to lawfully sell medicine within China. Our headquarter is located in Chengdu city of Sichuan province in China. We have a sales representative office in Hanoi, Vietnam. Xintai also has contracted dealership with certain pharmaceutical manufacturers which produce top selling drugs for neurological disorder, cardio/cerebrovascular disease, as well as antibiotics and anti-tumor medicine. Xintai’s differentiated marketing strategy is combining targeting specific hospitals with academic promotion, this strategy help to build sale channel of the products in a long term. Xintai’s suppliers are pharmaceutical manufacturers and its customers are retail companies. Xintai does not directly sell to hospitals and doctors in order to prevent business fraud and brides in the sales chain.

Academic Promotion Team

Xintai has four different academic promotion teams which consist of experts from neurological, Cardio/cerebrovascular, infectious diseases and anti-tumor areas. When Xintai starts selling new drugs, these teams will give lecture and hold forums in the cities around country by means such as road shows. These experts who are influential in the field will have positive influence on the images of Xintai’s new products since they are well known professionals. After the good reputation and image are built,, Xintai’s experts will invite local senior doctors to attend product launching meetings so that these doctors will learn the products better and build relationship with expert.

Sales Network

Xintai’s sales force has two key advantages: many years experience professional and strong structure. Three sales directors with solid medicine sales background are responsible for launching and marketing the products. 15 regional sales managers are leading 256 city-level sales managers. And another 2000 sales representatives are behind city-level sales managers who have build long term relationship with hospitals and doctors and they all have amazing sales record.

Xintai also has an exclusive database of more than 5000 “would-be” part-time sales representatives who are motivated when new products are launched. Our marketing team consists of 1 marketing director, 6 product managers and 20 promotion specialists, which are able to organize tailored marketing campaigns for specific products.

9

Distribution Channel

Xintai sales channel is structured through retail distributor companies to hospitals. These companies are legally authorized medicine distributors in China. Xintai sets up minimum sales target. If distributors cannot meet such minimum sales target, Xintai will move on to better performed retail companies with wide coverage and selling power. Each regional sales manager works with at least 10 retail companies, therefore at any point of time, there are at least 200 retail companies are selling products wholesaled through Xintai.

Marketing and Sales Strategies

Product Strategy: focusing on newly developed medicine targeting main disease area and selected the top selling drugs with high profit margin. R&D team will try to develop off-patent drugs.

Price Strategy: selling price is primarily determined by local medical insurance regulatory bodies or public bidding. Xintai can usually sell below these set prices since the profit margins are still high.

Distributor Strategy: Xintai is not relying on one major distributor; instead, it has at least 3 distributors for each region which will ensure that distribution channels are always functional at all time.

Promotion Strategy: The key members of academic promotion teams are comprise of 10 leading experts of each field. They will recruit 30-50 key field leaders who can be academics or physicians and another 100-300 promotion specialists at each time when the new products are launched or when periodic marketing campaigns are scheduled. They will attend every local seminar or forum organized by Xintai and build connections with local doctors. These teams will also promote Xintai’s products through public channel.

Government Affair Strategy: Xintai maintained long-term good relationships with Medicare, Tendering and Pricing authorities so all the latest information or policies can be obtained at a timely manner.

Incentive Mechanism: Build up the incentive policy combined with cash and bonus. The management team implement performance appraisal on sales team monthly and quarterly. Revenue received is correlated with cash bonus and also combines with profit target, market development and customer management and etc. The senior and middle management team will be allocated with bonus option.

Customer Appreciations: Focus on developing 100 VIP clients, the Company will give discounts monthly or quarterly as customer loyalty incentives; also host customer appreciation party for VIP clients quarterly;

Suppliers

The Chinese domestic pharmaceutical market is highly fragmented and inefficient. Many of the manufacturers are making similar products which are resulting in vicious competition. Xintai’s suppliers are those who produce best sell medicines with greater returns. Xintai’s longtime suppliers include Aode Pharmaceutical, Kaide Medical R&D Center, and Furuide Pharmaceutical. These three supplies account for 38.91%, 24.13% and 22.19% of Xintai’s total purchase as of June 2009.

Major Customer

Xintai usually receives payment first and then makes the delivery. When customers place the order, Xintai will deliver the products after the payments are received.

Three main customers for Xintai are Kangtai Pharmaceutical (in Anhui Province), Shandong Pharmaceutical (in Shandong Province) and Hezhonghuitong Pharmaceutical (in Henan Province). They accounts for 7.76%, 7.45% and 6.3% of our total sales respectively as of June 2009.

Development Plan

Xintai aims to expand the company’s business and maximize its profit by acquiring and merging with R&D institutes and pharmaceutical manufacturers in the next five years. The company will emphasize more on R&D, add product lines, and focus on high value-added products. This business model will maximize the company’s competitiveness in the market. Xintai plans to aggressively grow medicine import and export business with countries in South-East Asia, Africa, Mid-East, Mid-Asia, and East-Europe region, in addition to growing the domestic market. The company also intends to acquire pharmaceutical manufacturers in South-East Asia, and take the advantages of their relative low cost operation and favorable government policies to take international market shares. Medicine, medical equipments and medical supplies will become the company’s three major product lines.

10

Sign up for higher value-added product dealerships: Xintai plans to sign up for more dealerships by adding 2-3 cardiovascular products, 1-2 anti-tumor products and 2-3 antibiotics.

Increase product lines: Xintai intends to develop 3-5 prescription drugs, 5-10 OTC drugs and 10-30 generic drugs by outsourcing manufacture or manufacturing in acquired pharmaceutical manufacturers.

Acquire R&D institutes and increase self R&D capability: Xintai intends to acquire upper stream good quality pharmaceutical companies with valuable R&D assets and promising projects which have great potential developing into products so that Xintai’s developing speed could be accelerated.

Increase Production Capability by Acquiring Pharmaceutical Manufacturers: Xintai is to increase manufacturing capability by acquiring pharmaceutical companies which hold medicine production permits.

Overseas Expansion: From 2010 to 2014, Xintai plan to register local offices in Jakarta, New Delhi, Cairo, and Astana to make medicine registration and sales.

Properties

As of December 31, 2009 and June 30, 2009, the detail of property, plant and equipments was as follows:

|

As of

|

||||||||

|

December 31, 2009

|

June 30, 2009

|

|||||||

|

(Unaudited)

|

||||||||

|

Office equipment

|

$ | 29,870 | $ | 77,122 | ||||

|

Automobiles

|

110,971 | 29,854 | ||||||

|

Sub-total

|

140,841 | 106,976 | ||||||

|

Less: accumulated depreciation

|

(23,390 | ) | (15,717 | ) | ||||

|

Property, plant and equipment, net

|

$ | 117,451 | $ | 91,259 | ||||

Depreciation expense for the six months ended December 31, 2009 and 2008 was $7,662 and $2,767, respectively.

Employees

Xintai currently has senior management team of 35 people, 3 sales directors, 15 regional sales managers, 256 city-level sales managers and more than 2000 commission-based sales representatives.

Xintai’s employment agreement with Xiaodong Zhu is effective from September 10, 2009 to September 10, 2010. Monthly salary is 1,465 US dollars.

Xintai’s employment agreement with Xicai Su is effective from September 10, 2009 to September 10, 2010. Monthly salary is 879 US dollars.

Xintai’s employment agreement with Di Wu is effective from January 1, 2010 to January 1, 2011. Monthly salary is 2,930 US dollars.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

11

Risks Relating to Our Business

Substantially all of our business, assets and operations are located in the PRC.

Substantially all of our business, assets and operations are located in the PRC. The economy of PRC differs from the economies of most developed countries in many respects. The economy of PRC has been transitioning from a planned economy to a market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in PRC is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry by imposing industrial policies. It also exercises significant control over PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of PRC, but may have a negative effect on us.

Our management has no experience in managing and operating a public company. Any failure to comply or adequately comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations and financial condition.

Our current management has no experience managing and operating a public company and relies in many instances on the professional experience and advice of third parties including its attorneys and accountants. Failure to comply or adequately comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in the development of an active and liquid trading market for our stock.

Our plans to expand our product lines, to acquire a pharmaceutical factor, to build a research and development center and to improve and upgrade our internal control and management system will require capital expenditures in 2010.

Our plans to expand our product lines, to acquire a pharmaceutical factor, to build a research and development center and to improve and upgrade our internal control and management system will require capital expenditures in 2010. We may also need further funding for working capital, investments, potential acquisitions and other corporate requirements. We cannot assure you that cash generated from our operations will be sufficient to fund these development plans, or that our actual capital expenditures and investments will not significantly exceed our current planned amounts. If either of these conditions arises, we may have to seek external financing to satisfy our capital needs. Our ability to obtain external financing at reasonable costs is subject to a variety of uncertainties. Failure to obtain sufficient external funds for our development plans could adversely affect our business, financial condition and operating performance.

We derive all of our revenues from sales in the PRC and any downturn in the Chinese economy could have a material adverse effect on our business and financial condition.

All of our revenues are generated from sales in the PRC. We anticipate that revenues from sales of our products in the PRC will continue to represent the substantial portion of our total revenues in the near future. Our sales and earnings can also be affected by changes in the general economy since purchases of pork products are generally discretionary for consumers. Our success is influenced by a number of economic factors which affect disposable consumer income, such as employment levels, business conditions, interest rates, oil and gas prices and taxation rates. Adverse changes in these economic factors, among others, may restrict consumer spending, thereby negatively affecting our sales and profitability.

Our planned expansion could be delayed or adversely affected by, among other things, difficulties in obtaining sufficient financing, technical difficulties, or human or other resource constraints.

Our planned expansion could be delayed or adversely affected by, among other things, difficulties in obtaining sufficient financing, technical difficulties, or human or other resource constraints. Moreover, the costs involved in these projects may exceed those originally contemplated. Costs savings and other economic benefits expected from these projects may not materialize as a result of any such project delays, cost overruns or changes in market circumstances. Failure to obtain intended economic benefits from these projects could adversely affect our business, financial condition and operating performances.

We encounter substantial competition in our business and any failure to compete effectively could adversely affect our results of operations.

As described in the products section, for every product we sell, we encounter strong competitors. We anticipate that our competitors will continue to expand and seek to obtain additional market share with competitive price and performance characteristics. Aggressive expansion of our competitors or the entrance of new competitors into our markets could have a material adverse effect on our business, results of operations and financial condition.

12

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Our limited operating history in the pharmaceutical industry may not provide a meaningful basis for evaluating our business. Xintai entered into its current line of business in 2006, although it was incorporated in 1999. Although its revenues have grown rapidly since its inception, we cannot guaranty that we will maintain profitability or that we will not incur net losses in the future. We will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

|

·

|

obtain sufficient working capital to support our expansion;

|

|

·

|

expand our product offerings and maintain the high quality of our products;

|

|

·

|

manage our expanding operations and continue to fill customers’ orders on time;

|

|

·

|

maintain adequate control of our expenses allowing us to realize anticipated income growth;

|

|

·

|

implement our product development, sales, and acquisition strategies and adapt and modify them as needed;

|

|

·

|

successfully integrate any future acquisitions; and

|

|

·

|

anticipate and adapt to changing conditions in the pharmaceutical industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of the foregoing risks, our business may be materially and adversely affected.

We need to manage growth in operations to maximize our potential growth and achieve our expected revenues and our failure to manage growth will cause a disruption of our operations resulting in the failure to generate revenues at levels we expect.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our producing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

We cannot assure you that our growth strategy will be successful which may result in a negative impact on our growth, financial condition, results of operations and cash flow.

One of our strategies is to grow through acquiring a pharmaceutical factory and increase product lines. However, there are many obstacles to expand our product lines. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to implement this organic growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

If we need additional capital to fund our growing operations, we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

If adequate additional financing is not available on reasonable terms, we may not be able to undertake acquisitions of a pharmaceutical factory or to build a research and development center, and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

13

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our securities can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If we need additional funding we will, most likely, seek such funding in the United States (although we may be able to obtain funding in the PRC) and the market fluctuations affect on our stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding, we may be required to: (i) limit our expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are favorable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the Units. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Need for additional employees.

The Company’s future success also depends upon its continuing ability to attract and retain highly qualified personnel. Expansion of the Company’s business and operation will require additional managers and employees with industry experience, and the success of the Company will be highly dependent on the Company’s ability to attract and retain skilled management personnel and other employees. There can be no assurance that the Company will be able to attract or retain highly qualified personnel. Competition for skilled personnel in the construction industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

The loss of the services of our key employees, particularly the services rendered by Xiaodong Zhu, our director, and Xicai Su and Di Wu, our officers, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Xiaodong Zhu, Our director, and Xicai Su and Di Wu, our officers. The loss of any key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

Our failure to comply with increasingly stringent environmental regulations and related litigation could result in significant penalties, damages and adverse publicity for our business.

In recent years, the government of China has become increasingly concerned with the degradation of China’s environment that has accompanied the country’s rapid economic growth. In the future, we expect that our operations and properties will be subject to extensive and increasingly stringent laws and regulations pertaining to, among other things, the discharge of materials into the environment and the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to protection of the environment. Failure to comply with any laws and regulations and future changes to them may result in significant consequences to us, including civil and criminal penalties, liability for damages and negative publicity. We cannot assure you that additional environmental issues will not require currently unanticipated investigations, assessments or expenditures, or that requirements applicable to us will not be altered in ways that will require us to incur significant additional costs.

We will incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We will incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

14

We may not be able to meet the internal control reporting requirements imposed by the Securities and Exchange Commission resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No. 33-8934 on June 26, 2008, the Securities and Exchange Commission adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting as well as the operating effectiveness of the company’s internal controls. Commencing with its annual report for the year ending June 30, 2010, we will be required to include a report of management on its internal control over financial reporting. The internal control report must include a statement

|

·

|

Of management’s responsibility for establishing and maintaining adequate internal control over its financial reporting;

|

|

·

|

Of management’s assessment of the effectiveness of its internal control over financial reporting as of year end; and

|

|

·

|

Of the framework used by management to evaluate the effectiveness of our internal control over financial reporting.

|

Furthermore, in the following year, our independent registered public accounting firm is required to file its attestation report separately on our internal control over financial reporting on whether it believes that we have maintained, in all material respects, effective internal control over financial reporting.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the Securities and Exchange Commission, which could also adversely affect the market price of our securities and our ability to secure additional financing as needed.

The transaction involves a reverse merger of a foreign company into a domestic shell company, so that there is no history of compliance with United States securities laws and accounting rules.

In order to be able to comply with United States securities laws, DBL prepared its financial statements for the first time under U.S. generally accepted accounting principles and recently had its initial audit of its financial statements in accordance with Public Company Accounting Oversight Board (United States). As the Company does not have a long term familiarity with U.S. generally accepted accounting principles, it may be more difficult for it to comply on a timely basis with SEC reporting requirements than a comparable domestic company.

Risks Relating To Our Industry

We may be subject to substantial liability should the consumption of any of our products cause personal injury or illness. Unlike most pharmaceutical companies in the United States, we do not maintain product liability insurance to cover our potential liabilities.

The sale of drug products for human consumption involves an inherent risk of injury to consumers. Such injuries may result from tampering by unauthorized third parties or product contamination or degeneration, including the presence of foreign contaminants, chemical substances or other agents or residues during the various stages of production process. We cannot assure you that consumption of our products will not cause a health-related illness in the future, or that we will not be subject to claims or lawsuits relating to such matters.

Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertions that our products caused personal injury or illness could adversely affect our reputation with customers and our corporate and brand image. Unlike most pharmaceutical companies in the United States, but in line with industry practice in the PRC, we do not maintain product liability insurance. Furthermore, the products we sold could potentially suffer from product tampering, contamination or degeneration or be mislabeled or otherwise damaged. Under certain circumstances, we may be required to recall products. Even if a situation does not necessitate a product recall, we cannot assure you that product liability claims by our distributors will not be asserted against us as a result. A product liability judgment against us or a product recall could have a material adverse effect on our revenues, profitability and business reputation.

15

If the pharmaceutical industry in the PRC does not grow as we expect, our results of operations and financial condition will be adversely affected.

We believe drug products have strong growth potential in the PRC and, accordingly, we have continuously increased our sales of drug products. However, the market for pharmaceutical industry in the PRC has grown in recent years due to the increased wealth of the average resident of China and increasing health cautious, which has been the result of double-digit annual growth in the Chinese economy. Due to the worldwide recession, the growth of the Chinese economy has slowed. If the pharmaceutical industry in the PRC does not grow as we expect, our business will be harmed, we will need to adjust our growth strategy, and our results of operation will be adversely affected.

Sales of our products could be harmed by the widespread presence of counterfeit medication in the PRC which negatively impacting our profitability.

Chinese counterfeiting of pharmaceuticals and other products affecting public health has grown in tandem with counterfeiting and piracy of goods such as brand-name clothing, compact discs and computer software. Exact data are impossible to collect, but the FBI believes that more than half of the pharmaceuticals sold in PRC are counterfeit. Examples of the seriousness of the problem include: six months after Viagra was introduced in 2002, state media reported that some 90 percent of little blue pills sold in Shanghai were counterfeit; and 192,000 Chinese patients were reported to have died in 2001 from fake drugs. Counterfeit products shrink markets for legitimate goods. This situation affects Benda and other major domestic and foreign drug manufacturers in PRC, especially for products marketed through the OTC rather than hospital channel. However, we believe the Chinese authorities are becoming increasingly vigilant against counterfeiting because in 2001 the authorities closed 1,300 factories while investigating 480,000 cases of counterfeit drugs. Currently, active pharmaceutical ingredients are governed only by chemical regulations. We believe that a major step towards controlling the problem would be taken should the SFDA be given oversight over PRC’s bulk chemicals producers. However, our ability to increase sales as rapidly as we would like, and our profitability, could be affected if this problem persists or worsens.

Risks Relating to the People's Republic of China

Certain political and economic considerations relating to the PRC could adversely affect our company.

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of restrictions on currency conversion in addition to those described below.

The recent nature and uncertain application of many PRC laws applicable to us create an uncertain environment for business operations and they could have a negative effect on us.

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects.

Currency conversion could adversely affect our financial condition.

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

16

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Furthermore, the Renminbi is not freely convertible into foreign currencies nor can it be freely remitted abroad. Under the PRC’s Foreign Exchange Control Regulations and the Administration of Settlement, Sales and Payment of Foreign Exchange Regulations, Foreign Invested Enterprises are permitted either to repatriate or distribute its profits or dividends in foreign currencies out of its foreign exchange accounts, or exchange Renminbi for foreign currencies through banks authorized to conduct foreign exchange business. The conversion of Renminbi into foreign exchange by Foreign Invested Enterprises for recurring items, including the distribution of dividends to foreign investors, is permissible. The conversion of Reminbi into foreign currencies for capital items, such as direct investment, loans and security investment, is subject, however, to more stringent controls.

Our operating company is a FIE to which the Foreign Exchange Control Regulations are applicable. Accordingly, we will have to maintain sufficient foreign exchange to pay dividends and/or satisfy other foreign exchange requirements.

Exchange rate volatility could adversely affect our financial condition.

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable, most of the time in the region of approximately RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar and, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. If we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition.

Since our assets are located in the PRC, any dividends of proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our operating assets are located inside the PRC. Under the laws governing Foreign Invested Enterprises in the PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency’s approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

It may be difficult to affect service of process and enforcement of legal judgments upon our company and our officers and directors because they reside outside the United States.

As our operations are presently based in the PRC and our director and officer resides in the PRC, service of process on our company and such director and officer may be difficult to effect within the United States. Also, our main assets are located in the PRC and any judgment obtained in the United States against us may not be enforceable outside the United States.

Due to various restrictions under PRC laws on the distribution of dividends by our PRC Operating Companies, we may not be able to pay dividends to our stockholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended and The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of the PRC (2006) contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, such companies are required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the Company’s profits.

17

Furthermore, if our subsidiaries in China incur debt on their own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our common stock.

Risks Related To Our Securities

In order to raise sufficient funds to expand our operations, we may have to issue additional securities at prices which may result in substantial dilution to our shareholders.