Attached files

| file | filename |

|---|---|

| EX-10.1 - STOCK OPTION AGREEMENT - INDESTRUCTIBLE 1, INC | f10k2010ex10i_dongsheng.htm |

| EX-32.1 - CERTIFICATION - INDESTRUCTIBLE 1, INC | f10k2010ex32i_dongsheng.htm |

| EX-31.1 - CERTIFICATION - INDESTRUCTIBLE 1, INC | f10k2010ex31i_dongsheng.htm |

| EX-3.3 - BYLAWS - INDESTRUCTIBLE 1, INC | f10k2010ex3iii_dongsheng.htm |

| EX-32.2 - CERTIFICATION - INDESTRUCTIBLE 1, INC | f10k2010ex32ii_dongsheng.htm |

| EX-31.2 - CERTIFICATION - INDESTRUCTIBLE 1, INC | f10k2010ex31ii_dongsheng.htm |

| EX-10.3 - EMPLOYMENT AGREEMENT WITH DI WU. - INDESTRUCTIBLE 1, INC | f10k2010ex10iii_dongsheng.htm |

| EX-10.2 - EMPLOYMENT AGREEMENT WITH XIAODONG ZHU. - INDESTRUCTIBLE 1, INC | f10k2010ex10ii_dongsheng.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JUNE 30, 2010

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Dongsheng Pharmaceutical International Co., Ltd.

(Name of Registrant as specified in its charter)

|

Delaware

|

333-154787

|

26-2603989

|

|

(State or other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

China Bing’qi Plaza, Floor 17, No 69,

Zi Zhu Yuan Rd, Hai’dian District, Beijing

People’s Republic of China 100089

(Address of principal executive offices)

+86-10-88580708

(Telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.0001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ý No ¨

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

¨

|

Accelerated Filer

|

¨

|

|

Non-Accelerated Filer

|

¨

|

Smaller reporting company

|

ý

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Issuer’s revenue for its most recent fiscal year was approximately $20.5 million. The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on September 20, 2010, based on a closing price of $3.00 on June 14, 2010, was approximately $16,161,000. As of September 20, 2010, the registrant had 17,000,000 shares of its common stock, par value $0.0001 per share, outstanding.

Documents Incorporated By Reference: None.

TABLE OF CONTENTS

|

PART I

|

PAGE

|

|

| 2 | ||

| 9 | ||

| 16 | ||

| 16 | ||

| 16 | ||

| 16 | ||

|

PART II

|

||

| 17 | ||

| 17 | ||

| 17 | ||

| 22 | ||

| 22 | ||

| 23 | ||

| 23 | ||

| 23 | ||

|

PART III

|

||

| 24 | ||

| 25 | ||

| 26 | ||

| 28 | ||

| 28 | ||

|

PART IV

|

||

| 29 | ||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “expects,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predict,” “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions. Uncertainties and other factors, including the risks outlined under Risk Factors contained in Item 1A of this Form 10-K, may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements.

A variety of factors, some of which are outside our control, may cause our operating results to fluctuate significantly. They include:

|

·

|

the availability and cost of drugs from our suppliers;

|

|

·

|

changes in end-user demand for the drugs distributed to our customers;

|

|

·

|

general and cyclical economic and business conditions, domestic or foreign, and, in particular, those in China’s pharmaceutical industries;

|

|

·

|

the rate of introduction of new products by our customers;

|

|

·

|

changes in our pricing policies or the pricing policies of our competitors or suppliers;

|

|

·

|

our ability to retain key employees;

|

|

·

|

our ability to compete effectively with our current and future competitors;

|

|

·

|

our ability to manage our growth effectively, including possible growth through acquisitions;

|

|

·

|

our ability to enter into and renew key corporate and strategic relationships with our customers and suppliers;

|

|

·

|

our ability to certain key employees.

|

|

·

|

our implementation of share-based compensation plans;

|

|

·

|

changes in the favorable tax incentives enjoyed by our PRC operating companies;

|

|

·

|

foreign currency exchange rates fluctuations;

|

|

·

|

adverse changes in the securities markets; and

|

|

·

|

legislative or regulatory changes in China.

|

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the filing date to conform these statements to actual results, unless required by law.

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy and information statements and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended. You may read and copy these materials at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding us and other companies that file materials with the SEC electronically. You may also obtain copies of reports filed with the SEC, free of charge, via a link included on our website at http://www.dongshengpharm.com.

1

PART I

Item 1. Business.

As used in this annual report, “we,” “us,” “our,” “Dongsheng,” or the “Company” refers to Dongsheng Pharmaceutical International Co., Ltd.

Overview

Dongsheng Pharmaceutical International Co., Ltd. is an established national primary pharmaceutical wholesaler in the People’s Republic of China (PRC or China), which specializes in the wholesale and distribution of high quality, high margin and high demand drugs, mainly to secondary and third tier regional drug wholesalers in China. Our objective is to source the highest quality drug products to the medical community.

Our major suppliers are pharmaceutical manufacturers. We contract with them to obtain exclusive sales rights whether regionally or nationally in China to sell their products in exclusive territories. Our performance is measured by sales quotas and market development performance set up in individual contracts with each manufacturer.

Our major customers are independent secondary or third tier regional drug wholesalers who then sell the drugs to hospitals, medical institutions and retail pharmacies. We carefully select our customers, set up sales quotas and periodically measure each customer’s performance against such quotas. As of September 2010, we have about 250 independent secondary or third tier drug wholesalers, whose sales network in aggregate covers approximately 2,500 hospitals in all 32 providences and municipal cities in the PRC.

Our main pharmaceutical products primarily cover the following therapeutic areas: Parkinson’s disease, cardiovascular, immunology and infectious diseases (See “Major Products”).

We believe that our experienced management team will continue to leverage our current position to market and distribute high quality, high margin, and high demand drugs. Our senior management team shares a common vision to build Dongsheng into a global pharmaceutical company with capacities in manufacturing, sales & distribution as well as proprietary drug research & development.

Our principal executive office is located in Beijing, China. Our primary operation is located in Chengdu City, Sichuan Providence, China.

Dongsheng Pharmaceutical’s common stock is publicly traded on the Over-the Counter Bulletin Board (“OTCBB”) under the symbol “DNGH.”

Corporate History

The Company’s core operational subsidiary is Sichuan Xintai Pharmaceutical Co., Ltd. (“Xintai”), which was incorporated in 1999, as a small pharmaceutical sales company in Chengdu City, Sichuan Providence, PRC. On July 15th, 2006, Zhu Xiaodong, an experienced drug wholesaler, and his sister, Zhu Xiaomei, acquired 100% of Xintai for approximately $260,000. Under Mr. Zhu’s leadership, Xintai soon became a well-known licensed pharmaceutical wholesale company, specializing in the sales of prescription and over-the-counter medicines.

On January 11, 2010, Sichuan Provincial Government approved Dynamic Bhorizon Limited (“DBL”), a company incorporated in the Cayman Islands on April 8, 2009, to acquire 100% of Xintai. On January 21, 2010, the Sichuan Administration for Industry and Commerce issued new business license to Xintai. With the new license, Xintai has been transformed from a domestic Chinese company to a wholly foreign owned enterprise (“WFOE”).

Dongsheng Pharmaceutical International Co., Ltd. (the “Company” or “Dongsheng”) was incorporated in the state of Delaware on March 25, 2008, originally under the name ‘Indestructible I.” On March 25, 2010, the Company entered into a share exchange agreement and acquired all of the outstanding capital stock of DBL. Pursuant to the share exchange agreement, DBL became a wholly-owned subsidiary of the Company and Mr. Zhu was appointed as the Company’s Chief Executive Officer.

In connection with the acquisition of DBL, the Company issued a total of 15,830,000 shares of common stock to the shareholders of DBL, their designees or assigns, in exchange for all of the capital stock of DBL. Upon the completion of the share exchange, the stockholders of DBL owned, in aggregate, approximately 93.12% of the issued and outstanding capital stock of the Company.

The acquisition was accounted for as a reverse merger under the purchase method of accounting since there was a change of control. Accordingly, DBL and its subsidiary, Xintai, will be treated as the continuing entity for accounting purposes.

On April 5, 2010, Indestructible I, Inc. changed its name to Dongsheng Pharmaceutical International Co., Ltd. to better reflect the Company’s business.

2

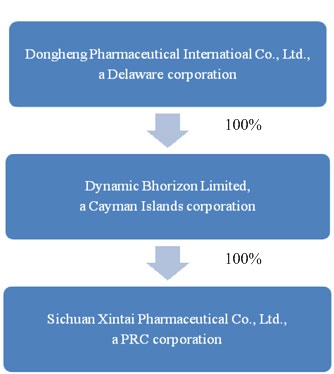

Organization Structure

Dongsheng’s organizational structure was developed to allow foreign capital infusion under the laws of the PRC and to maintain an efficient tax structure, as well as to maintain internal organizational efficiencies. The Company’s current organization structure is summarized in the table below:

Industry Overview

Dongsheng operates in the pharmaceutical wholesale and distribution sector of the larger pharmaceutical industry in the PRC. Over the years, the pharmaceutical wholesale and distribution sector has become the vital link between pharmaceutical manufacturers and pharmaceutical retailers.

There are two primary ways for pharmaceutical manufacturers to sell drugs in China. The traditional way is to sell drugs through a proprietary sales network. During the past 20 years, burdened with rising raw material prices, ongoing capital needs for manufacturing facility upgrades, as well as significant time and money spent on maintaining a “Good Manufacturing Practice” (“GMP”) license, most pharmaceutical manufacturers have realized they cannot afford the cost of capital and other resources to keep their own sales force intact. GMP guidelines define the standards for the pharmaceutical manufacturing process in order to reduce the possibility of contamination errors. The Chinese government issued its own GMP standards in 1988, followed with two sets of revisions, the most recent in 1999. In China, pharmaceutical manufacturers must have a GMP certificate in order to legally produce drug.

The second way for pharmaceutical manufacturers to sell drugs in China is to contract with a primary drug wholesaler and grant them sale authorization in exclusive territories. Over the years, pharmaceutical manufacturers have found it more efficient to leverage a sales network of drug wholesalers to achieve its sales target. The biggest wholesalers are positioning themselves as indispensable intermediaries in the supply chain and staking out a powerful position in high-growth channels.

Market Overview

The growing demand for drugs in the PRC is driving the rapid growth of the pharmaceutical wholesale and distribution market. However, in its current state, the market is highly competitive and fragmented. We believe mass consolidation in the near future is highly likely.

Fast Growing Market Size

China accounts for 20% of the world’s population. It is expected to become the world’s third-largest prescription drug market in 2011, according to a report released by pharmaceutical market research firm IMS Health (“IMS”). IMS says pharmaceutical revenue in China is growing at a rapid pace, and the potential PRC market could double by the year 2013 as the country improves its health care infrastructure and aims for near-universal health coverage. IMS predicts that drug revenue in the PRC will grow by $40 billion through the year 2013. Such fast growing drug demand is driving the rapid growth of the pharmaceutical wholesale and distribution market in the PRC.

Fragmentation and the Trend for Consolidation

3

The pharmaceutical wholesale and distribution market is highly fragmented and competitive. According to recent statistics provided by the Chinese Medical Association, in 2009, there were approximately 13,000 drug wholesalers and distributors in the PRC. Measured by sales revenue in 2009, only eight drug wholesalers and distributors have exceeded RMB 10 billion (equivalent of USD 1.5 billion), while less than 5% of all 13,000 players have exceeded RMB 50 million (equivalent of USD 7.3 million). Total market share of the three largest Chinese wholesaler and distributors (China National Pharmaceutical Group Corporation, Shanghai Pharmaceutical Co., Ltd., and China Jointown Group) in 2009, was only 20% of the entire market.

To improve overall efficiency, the Chinese government has been encouraging mass consolidation and targets to support two to three largest wholesalers and distributors achieving a sales target of RMB 100 billion (equivalent of USD 15 billion), and top 20 largest wholesalers achieving a sales target of RMB 10 billion (equivalent of USD 1.5 billion), by 2015. This consolidation tide has stimulated most players in this sector to strategically seek collaborative partners.

Business Model

Licensed with a pharmaceutical wholesale permit, Dongsheng can lawfully sell pharmaceuticals within China. Our current business model is to negotiate exclusive wholesale and distribution agreements with pharmaceutical manufacturers for products we believe we can sell. We purchase drugs at a discount from pharmaceutical manufacturers who grant us authorization to sell their drugs in exclusive territories and then sell these drugs to secondary or third tier regional drugs wholesalers at competitive prices.

Our major suppliers are large pharmaceutical manufacturers. We contract with them to obtain authorizations to sell their products in exclusive territories. Our major customers are independent secondary or third tier regional drug wholesalers who then sell drugs to end users, such as hospitals, medical institutions and pharmacies.

We specialize in high quality, high margin and high demand drugs, which primarily cover the following therapeutic areas: Parkinson’s disease, cardiovascular, immunology and infectious diseases. (See “Major products”).

Core Competencies

Dongsheng (through its wholly owned subsidiaries) operates in the pharmaceutical wholesale sector in the PRC which is highly competitive. However, with a number of core competencies, Dongsheng has established itself as a highly regarded industry player. Our main core competencies that distinguish us from our competitors are:

|

·

|

Extensive Nationwide Sales Network – Dongsheng contracts with about 250 independent secondary or third tier drug wholesalers across China to sell drugs. It carefully selects them and periodically measures their performance against a sales quota system. Over the years, the contractual relationship with these secondary and third tier drug wholesalers has evolved to become a stable and strong sales network, through which, Dongsheng can make its point of sales throughout all of 32 provinces and municipal cities in China, covering over approximately 2,500 hospitals and medical institutions. We manage this sales network through our sales management department, which is composed of approximately 30 employed sales professionals. (See “Sales Network Management”). Compared to owning our proprietary scaled nationwide sales network, we believe this contractual binding sales network creates lower overall risk and tends to be more cost effective.

|

|

·

|

Professional and Experienced Sales Personnel – Each of the 250 independent secondary or third tier wholesalers employs about eight to ten sales representatives. In total, there are approximately 2,000 professional pharmaceutical sales representatives within our sales network. These sales representatives do not have employment contractual relationships with the Company. Rather, they are employed by our customers. Most of them are compensated through a commission arrangement with no or minimum base salary.

|

All sales representatives have educational backgrounds or training in the following therapeutic areas: Parkinson’s disease, cardiovascular, immunology and infectious diseases, which are the main markets our pharmaceutical drugs target to sell. They have also established long term relationships with many hospitals and doctors who are the main channels to move our products.

|

·

|

High Quality and Personalized Customer Services – To maintain and expand our sales network, Dongsheng provides high quality and personalized customer services to our customers, who are those secondary or third tier drug wholesalers. The services begin with pre-contractual support and conclude with post sales support.

|

|

o

|

Pre-contractual support – Before entering into contracts with secondary or third tier drug wholesalers, we carefully validate their drug sale license and their qualifications based on a number of factors, including, but not limited to, historical sales performance, covered regions and their relationships with regional hospitals, medical institutions and pharmacies. This screening process ensures that we select the best secondary and third tier drug wholesalers to be part of our sales network.

|

|

o

|

Marketing services – To assist our customers to achieve or exceed sales quotas, we employ various marketing campaigns to promote our products, such as advertising in major academic journals and press and hosting academic promotion conferences (see “Marketing Strategy”).

|

4

|

o

|

Post sales support – We provide high quality post sales support as well, such as fast drug delivery and return policy. We also host large gala events every year to honor our VIP customers.

|

|

·

|

Dedicated Focus on High Value and High Growth Drugs – Dongsheng carefully chooses its product lines. We specialize in authorized exclusive dealerships for such popular medicines that have comprehensive usage, large consumption per patient, and relative high value and high profit margins. Our main pharmaceutical products cover the following therapeutic areas: Parkinson’s disease, cardiovascular, immunology and infectious diseases (See “Major Products”). This strategy ensures that we achieve both top line and bottom line growth, which eventually distinguishes us from other wholesalers with limited or no product focus.

|

|

·

|

Good Relationship with Chinese Medical Governance Body and Pharmaceutical Manufacturers. Over the years, Dongsheng has built strong collaborative relationships with the Chinese medical governance body and many pharmaceutical manufacturers.

|

|

o

|

Most Chinese pharmaceutical manufacturers don’t have their own zoning distribution channels or have limited marketing capabilities. Due to our historical sales record, we are able to gain and secure exclusive authorizations from some of the pharmaceutical manufacturers to sell their high demand and high growth products.

|

|

o

|

Once we are under contract with pharmaceutical manufacturers, we generally assist them to tender such drugs to be part of the “Chinese Basic Medicine Insurance Coverage List” at both the national and provincial levels, which not only helps to greatly increase sales volume of the drugs, but also improves the brand of such pharmaceutical manufacturers.

|

Marketing and Pricing Strategies

Marketing Strategy: We use various marketing campaigns to promote our products, such as advertising in major academic journals, press conferences, and academic promotion conferences.

|

·

|

Academic conferences: Dongsheng has four different academic expert teams, each comprised of well known professionals from therapeutic areas such as Parkinson’s disease, cardiovascular, immunology and infectious diseases. Whenever Dongsheng launches a new product, an expert team gives a lecture or hosts forums across the country. We invite doctors, pharmacists and our customers to the conferences so they get a better understanding of our products.

|

Price Strategy: In China, drug prices are primarily guided by national and local medical regulatory bodies. Along with this guidance, we offer our high quality drugs to our customers at competitive prices through various sales discounts.

Sales Network Management

Our sales network is built on various contractual relationships with independent secondary or third tier regional pharmaceutical wholesalers. We manage this network through seven of our full time regional sales directors, who are supported by approximately twenty full time sales managers. Regions are geographically divided. Sale directors and their managers are responsible for managing the relationship with the secondary and third tier pharmaceutical wholesalers.

|

·

|

Customer screening: Regional sales directors carefully select secondary or third tier pharmaceutical wholesalers based on a number of factors, such as historical sales performance, covered regions and their relationships with regional hospitals, medical institutions and pharmacies. This screening process ensures that we select the best secondary or third tier drug wholesalers to be part of our sales network.

|

|

·

|

Performance measurement: Regional sales directors periodically measure the sales performance of secondary or third tier wholesalers against our sales quota system.

|

|

·

|

Customer Appreciations: The Company has been focused on developing approximately 100 VIP clients. The Company will give discounts monthly or quarterly as customer loyalty incentives.

|

|

·

|

Incentive Mechanism: Sales directors and sales managers are compensated with a combination of base salary and bonuses. The bonus is tied to the sales target, market development and the quality of customer management.

|

Distribution Channel Management

Dongsheng has distribution capacity in Sichuan Providence, where our core operation Xintai is located. However it does not currently own its national drug distribution channel. Once sales are made to customers out of Sichuan providence, we contract with local retail distribution companies to distribute the drugs to hospitals, medical institutions and pharmacies. Each regional sales director and manager works with at least ten retail distribution companies. Therefore, at any one time, there are at least 200 retail distributors working closely with Dongsheng.

5

Inventory Management

Xintai, the Company’s core operational subsidiary, leases warehouses in Chengdu City, Sichuan Providence. Since 80% of our sales require advance payments from our customers, we are able to use customer advances to purchase drugs from our suppliers. We then either temporarily keep the drugs delivered by our suppliers in our warehouse before we ship the drugs to our customers, or we can instruct our suppliers to ship the drugs directly to our customers. This model allows us to keep inventory and storage costs low.

Major Suppliers

Measured by purchase cost in fiscal year 2010, Dongsheng’s top three suppliers include Aode Pharmaceutical, Hebei Furuide Pharmaceutical, and Beijing Guorun Pharmaceutical Co. These three supplies accounted for 35.88%, 29.97% and13.47%, respectively, of Dongsheng’s total purchases during fiscal year 2010.

Major Customers

Measured by sales revenue in fiscal year 2010, Dongsheng’s top three customers are Hezhong Huitong Pharmaceutical (in Henan Province), Jieshou City Medical Co., and Sanmenxia Huawei Mecial Co. They accounted for 5.43%, 4.57% and 4.54%, respectively, of our total sales during fiscal year of 2010.

Major Products

Dongsheng carefully chooses its product lines. We specialize in the wholesale and distribution of high quality, high margin and high demand drugs. Our main pharmaceutical products cover the following therapeutic areas: Parkinson’s disease, cardiovascular, immunology and infectious diseases.

GANGLIOSIDE

Product Indication and Pharmacology:

Ganglioside is indicated for improving symptoms, delaying disease progression, and restoring damaged brain cells in Parkinson’s disease patients.

Gangliosides are complex glycolipid molecules which are natural components of cellular membranes. Numerous gangliosides have been identified and have been found to be particularly abundant in nerve tissue, especially in brain tissue. Gangliosides stimulate the remaining brain cells to sprout new nerve endings and rescue other cells that might otherwise die. Parkinson's disease is caused by a loss of dopamine-secreting cells in the brain, which results in impaired motor skills, speech, and other functions. Abnormal accumulation of the protein α-synuclein may contribute to this neuronal cell death. Treatment with gangliosides reversed the lysosomal disruption, which suggests that gangliosides protect against the lysosomal damage of a-synuclein accumulation.

Market Analysis

According to a 2010 research report issued by a medical research firm based in Guangzhou, China, Guangzhou Biaodian Pharmaceutical Information Co., 2009 Chinese senile dementia drug sales reached over $15 billion, a 29% increase over 2008. Ganglioside by far is the second largest senile dementia drug with 28% market share and over $3 billion sales revenue in 2009.

Currently there are eleven authorized Ganglioside manufacturers in China. Among them, six are new market entrants while the other five are seasoned players. Among all Ganglioside manufacturers in China, only two of them, Qilu Pharmaceutical and Harbin Medical University Pharmaceutical, are granted with Ganglioside medicine raw material production permit by State Food and Drug Administration (“SFDA”), which ensures a stable supply. Harbin Medical University Pharmaceutical, through its affiliates, provides us steady Ganglioside drug supply.

Sales Performance

In 2007, we obtained an exclusive wholesale contract from Aode Pharmaceutical, an affiliate with Harbin Medical University Pharmaceutical, to sell Ganglioside within 11 providences in China. Since then, our sales revenue of Ganglioside has been steadily increasing. In fiscal year 2010, our revenue from Gangioside sale reached $19.3 million, which represented a 24% increase on constant dollar basis over 2009 and accounted for 94% of our total sales in 2010. Ganglioside is now admitted into the” China Provincial Base Medicine Insurance Coverage list” of a number of providences that we cover.

In September 2010, we renewed such contract with the expiration date extended to Aug 31, 2018.

EDARAVONE

Product Indication and Pharmacology:

6

Edaravone is a neuro-protectiveagent, and is indicated for relief of neurological symptoms associated with acute cerebral infarction, and for enhancing routine activity and alleviating functional disorders.

Edaravone acts as a potent antioxidant and strongly scavenges free radicals, protecting against oxidative stress and neuronal apoptosis. It has been shown to attenuate methamphetamine- and 6-OHDA-induced dopaminergic neurotoxicity in the striatum and substantial nigra, and does not affect methamphetamine-induced dopamine release or hyperthermia. It has also been demonstrated to protect against MPTP-mediated dopaminergic neurotoxicity to the substantial nigra.

Market Analysis

According to the same research report mentioned above (see details in “Galioside”) , Edaravone accounted for 7.8% market share of China senile dementia drug with sales revenue reaching $1.2 billion in 2009.

Currently there are six authorized Edaravone manufacturers in China. The one with the largest market share is Simcere Pharmaceutical Group (Product name: “Bicun”).

Edaravone is now admitted into “China National Base Medicine Insurance Coverage list Type B”

Sales Performance

On December 30, 2009, we obtained a one-year exclusive wholesale contract with Jilin Boda Pharmaceutical (Product name: “Yidasheng”) and China National Medicines Guorui Pharmaceutical Co., Ltd., to sell Edaravone in four providences in China. The contract is subject to renew on December 30 of every year.

Our sales from Edaravone are still in ramp up period. In fiscal year 2010, our revenue from Edaravone sale reached $0.6 million, which accounted for 3% of our total sales in 2010.

SALVIANOLATE INJECTION

Product Indication and Pharmacology:

Salvianolate, a cardiovascular pharmaceutical product, is a purified and isolated Chinese traditional medicine. With magnesium acetate as the main component of Salvia poly-phenol salts, Salvianolate is considered as one of the most important active ingredients for the treatment of cardiovascular diseases among the Salvia group products. It significantly improves blood circulation.

Salvianolate injection is indicated for the treatment of steady angina pectoris of Coronary heart disease with stagnation of heart-blood syndromes at stage I to II. Specifically it relieves symptoms associated with the heart-blood syndromes, such as chest pain, short of breath and palpitation.

Market Analysis

According to a report released by pharmaceutical market research firm IMS Health (“IMS”), Salvianolate market realized sales of $1.7 billion in 2009, an increase of 9.97% over 2007.

The Salvianolate is the successful product of 13-year academic research by Shanghai Institute of Pharmacology, a branch of Chinese Academy of Sciences. On May 25, 2005, Salvianolate was granted with New Medicine Grade B Certificate by China State Food and Drug Administration. Currently it is covered by Chinese National Basic Medicine Insurance Coverage list.

Sales Performance

We obtained a one year exclusive contract with Shanghai Leiyunshang Green Valley Pharmaceutical Co to sell the Salvanolate they produce in Heilongjiang providence. The contract is effective from January 14, 2010 and is subject to renew on yearly basis.

Currently our sales from Salvianolate are in ramp up period and expect to grow steadily in future years.

SULBENICILLIN INJECTION

Product Indication and Pharmacology:

Sulbenicillin Injection is a penicillin antibiotic. Sulbenicillin is a broad-spectrum semi synthetic penicillin that has actions and uses similar to those of carbenicillin. It belongs to the class of penicillins with extended spectrum.

Sulbenicillin Injection is indicated for the treatment of pneumonia, urinary tract infection, skin/soft tissue infections and septicaemia, caused by Pseudomonas aeruginosa and nonpenicillinase-producing strains of Proteus spp. Sulbenicillin Injection is also effective in treating abdominal/pelvic infections caused by sensitive bacteria when it is used in conjunction with anti anaerobic bacteria drugs.

7

Market Analysis

Sulbenicillin Injection is covered under “China National Basic Medicine Insurance Coverage List Category B)

In China, SFDA has granted manufacturing permits for producing Sulbenicillin Injection to four pharmaceutical manufactuers, Shandong Ruiyang Pharmaceutical, Shenyang Meiluo, Harbin General Pharmaceutical Factory and Hunan Xiangyao Pharmaceutical Co., Ltd. Among them, only Shandong Ruiyang Pharmaceutical and Hunan Xiangyao Pharmaceutical Co., Ltd are equipped with adequate manufacturing capacity.

Sales Performance

On December 16, 2009, we obtained a three year exclusive authorization from Hunan Xiangyao Pharmaceutical Co. Ltd to sell their Sulbenicillin Injection in six providences in China.

Currently our sales from Sulbenicillin Injection are in ramp up period and expect to grow steadily in future years.

IMIPENEM/CILASTATIN INJECTION

Product Indication and Pharmacology:

Imipenem/cilastatin Injection is a broad spectrum beta-lactam antibiotic containing equal quantities of imipenem and cilastatin. It is related to the penicillin/cephalosporin family of antibiotics but is classified as belonging to the carbapenem class. Imipenem inhibits bacterial cell wall synthesis. Cilastatin prevents metabolism of imipenem, resulting in increased urinary recovery and decreased renal toxicity.

Imipenem/cilastatin Injection is indicated for treatment of serious infections of lower respiratory tract and urinary tract, intra-abdominal and gynecologic infections, bacterial septicemia, bone and joint infections, skin and skin structure infections, endocarditis, and polymicrobic infections due to susceptible microorganisms.

Market Analysis

Imipenem/cilastatin Injection is covered by China National Basic Medicine Coverage list.

In China, there are currently five domestic Imipenem/cilastatin Injection manufacturers, including Shenzhen Haibin Pharmaceutical Co., Ltd, Zhejiang Hisum Pharmaceutical Co., Ltd, China National Medicines Guorui Pharmaceutical Co., Ltd, Shandong New Era Pharmaceutical Co, and Zhuhai United Pharmaceutical Co. Compared to the imported Imipenem/cilastatin Injection, the domestic-made Imipenem/cilastatin Injection competes in lower price with the annual sales increasing rate of 30%; Tienam from Merck & Co., Inc has been dominating imipenem market for long time. Along with the entering of new companies recent years, the market share of Merck & Co., Inc has been gradually dropping though.

Sales Performance

On April 8, 2008, we obtained a five year exclusive authorization from China National Medicines Guorui Pharmaceutical Co., Ltd to sell their Imipenem/cilastatin Injection in all 32 providences in China.

Research & Development

Currently, we do not maintain our own R & D department. Instead, we conduct collaborated work with some of the high end medical research institutions in China, such as Academy of Military Medical Sciences, China Pharmaceutical University and Chinese Academy of Sciences. Through the collaborated work, our drug Research and Development strategy aims at: (1) copying after off-patent drugs that tend to be high demand and high quality; (2) developing new drug formulations and obtaining patent protection for those drugs with greater market potentials

Future Development Plan

Dongsheng aims to become a leading global pharmaceutical company with comprehensive capabilities in pharmaceutical manufacturing, sales and distribution, as well as proprietary drug research & development. Within the next three to five years, we are targeting on achieving the followings:

Wholesaler and distributor alliance: In responsive to the mass consolidation trend in Chinese pharmaceutical wholesaler and distribution sector, we are looking to build strong alliance and strategic partnership with other highly regarded wholesalers and distributors.

8

Sign up for higher value-added product dealerships: To maximize the usage of our sales network and improve profit margins, we are looking to obtain t additional exclusive sales dealerships by adding two to three cardiovascular products, one to two anti-tumor products and two to three antibiotics drugs into our product list.

Increase Production Capability by Acquiring Pharmaceutical Manufacturers: To ensure stable supply and steadily increase product lines, we are looking to acquire one to two pharmaceutical manufacturers.

Acquire R&D institutes and increase proprietary R&D capability: Dongsheng intends to acquire quality pharmaceutical companies with valuable R&D assets and promising projects which have great potential developing into products.

Overseas Expansion: In addition to the Chinese market, we have built a sales representative office in Hanoi, Vietnam. To maximize our sales revenue and profit margin, we are looking to build more overseas presences.

Overall, our vision is to build our wholesale and distribution alliance, add more high value-added product lines, build our own manufacturing facility, put more focus on proprietary R&D and expand our overseas presences. We believe this development plan maximizes the Company’s long term competitiveness in the pharmaceutical market.

Employees

Dongsheng currently has a total of sixty nine employees, which includes ten senior management personnel, seven regional sales directors, sixteen regional sales managers and other staffs

WHERE YOU CAN FIND MORE INFORMATION

You are advised to read this Form 10-K in conjunction with other reports and documents that we file from time to time with the SEC. In particular, please read our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file from time to time. You may obtain copies of these reports directly from us or from the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E. Washington, D.C. 20549, and you may obtain information about obtaining access to the Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains information for electronic filers at its website http://www.sec.gov.

Item 1A. Risk Factors.

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

SUBSTANTIALLY ALL OF OUR BUSINESS, ASSETS AND OPERATIONS ARE LOCATED IN THE PRC.

Substantially all of our business, assets and operations are located in the PRC. The economy of PRC differs from the economies of most developed countries in many respects. The economy of PRC has been transitioning from a planned economy to a market-oriented economy. Although in recent years, the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in PRC is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry by imposing industrial policies. It also exercises significant control over PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of PRC, but may have a negative effect on us.

OUR MANAGEMENT HAS NO EXPERIENCE IN MANAGING AND OPERATING A PUBLIC COMPANY. ANY FAILURE TO COMPLY OR ADEQUATELY COMPLY WITH FEDERAL SECURITIES LAWS, RULES OR REGULATIONS COULD SUBJECT US TO FINES OR REGULATORY ACTIONS, WHICH MAY MATERIALLY ADVERSELY AFFECT OUR BUSINESS, RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

Our current management has no experience managing and operating a public company and relies in many instances on the professional experience and advice of third parties including its attorneys and accountants. Failure to comply or adequately comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in the development of an active and liquid trading market for our stock.

OUR PLANS TO EXPAND OUR PRODUCT LINES, TO ACQUIRE A PHARMACEUTICAL FACTORY, TO BUILD A RESEARCH AND DEVELOPMENT CENTER AND TO IMPROVE AND UPGRADE OUR INTERNAL CONTROL AND MANAGEMENT SYSTEM WILL REQUIRE CAPITAL EXPENDITURES IN 2010 AND FUTURE YEARS

9

Our plans to expand our product lines, to acquire a pharmaceutical factory, to build a research and development center and to improve and upgrade our internal control and management system will require capital expenditures in 2010 and future years. We may also need further funding for working capital, investments, potential acquisitions and other corporate requirements. We cannot assure you that cash generated from our operations will be sufficient to fund these development plans, or that our actual capital expenditures and investments will not significantly exceed our current planned amounts. If either of these conditions arises, we may have to seek external financing to satisfy our capital needs. Our ability to obtain external financing at reasonable costs is subject to a variety of uncertainties. Failure to obtain sufficient external funds for our development plans could adversely affect our business, financial condition and operating performance.

WE DERIVE ALL OF OUR REVENUES FROM SALES IN THE PRC AND ANY DOWNTURN IN THE CHINESE ECONOMY COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS AND FINANCIAL CONDITION.

Currently all of our revenues are generated from sales in the PRC. We anticipate that revenues from sales of our products in the PRC will continue to represent the substantial portion of our total revenues in the near future. Our success is influenced by changes in government regulations on pharmaceutical industry and a number of economic factors which affect disposable consumer income, such as employment levels, business conditions, interest rates, oil and gas prices and taxation rates. Adverse changes in government regulations on pharmaceutical industry and these economic factors, among others, may restrict consumer spending, thereby negatively affecting our sales and profitability.

OUR PLANNED EXPANSION COULD BE DELAYED OR ADVERSELY AFFECTED BY, AMONG OTHER THINGS, DIFFICULTIES IN OBTAINING SUFFICIENT FINANCING, TECHNICAL DIFFICULTIES, OR HUMAN OR OTHER RESOURCE CONSTRAINTS.

Our planned expansion could be delayed or adversely affected by, among other things, difficulties in obtaining sufficient financing, technical difficulties, or human or other resource constraints. Moreover, the costs involved in these projects may exceed those originally contemplated. Costs savings and other economic benefits expected from these projects may not materialize as a result of any such project delays, cost overruns or changes in market circumstances. Failure to obtain intended economic benefits from these projects could adversely affect our business, financial condition and operating performances.

WE ENCOUNTER SUBSTANTIAL COMPETITION IN OUR BUSINESS AND ANY FAILURE TO COMPETE EFFECTIVELY COULD ADVERSELY AFFECT OUR RESULTS OF OPERATIONS.

As described in the industry and market overviews as well as products section, for every product we sell, we encounter strong competitors. We anticipate that our competitors will continue to expand and seek to obtain additional market share with competitive price and performance characteristics. Aggressive expansion of our competitors or the entrance of new competitors into our markets could have a material adverse effect on our business, results of operations and financial condition.

OUR LIMITED OPERATING HISTORY MAY NOT SERVE AS AN ADEQUATE BASIS TO JUDGE OUR FUTURE PROSPECTS AND RESULTS OF OPERATIONS.

Our limited operating history in the pharmaceutical industry may not provide a meaningful basis for evaluating our business. Dongsheng entered into its current line of business in 2006, although its wholly owned core operational subsidiary - Xintai was incorporated in 1999. Although its revenues have grown rapidly since its inception, we cannot guaranty that we will maintain profitability or that we will not incur net losses in the future. We will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

|

·

|

obtain sufficient working capital to support our expansion;

|

|

·

|

expand our product offerings and maintain the high quality of our products;

|

|

·

|

manage our expanding operations and continue to fill customers’ orders on time;

|

|

·

|

maintain adequate control of our expenses allowing us to realize anticipated income growth;

|

|

·

|

implement our product development, sales, and acquisition strategies and adapt and modify them as needed;

|

|

·

|

successfully integrate any future acquisitions; and

|

|

·

|

anticipate and adapt to changing conditions in the pharmaceutical industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics.

|

If we are not successful in addressing any or all of the foregoing risks, our business may be materially and adversely affected.

10

WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUES AT LEVELS WE EXPECT.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

WE CANNOT ASSURE THAT OUR GROWTH STRATEGY WILL BE SUCCESSFUL WHICH MAY RESULT IN A NEGATIVE IMPACT ON OUR GROWTH, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND CASH FLOW.

One of our strategies is to grow through acquiring a pharmaceutical factory and increase product lines. However, there are many obstacles to achieve this strategy. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to implement this growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

IF WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

If adequate additional financing is not available on reasonable terms, we may not be able to undertake acquisitions of a pharmaceutical factory or to build a research and development center, and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the level of our investment in research and development; and (iii) the amount of our capital expenditures, including acquisitions and product lines expansions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our securities can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If we need additional funding we will, most likely, seek such funding in the United States (although we may be able to obtain funding in the PRC) and the market fluctuations affect on our stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding, we may be required to: (i) limit our expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions that are favorable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the shares of our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

WE MAY NOT BE ABLE TO ATTRACT AND RETAIN SKILLED QUALIFIED PERSONNEL TO SUPPORT THE EXAPNSION OF OUR BUSINESS. .

The Company’s future success also depends upon its continuing ability to attract and retain highly qualified personnel. Expansion of the Company’s business and operation will require additional managers and employees with industry experience, and the success of the Company will be highly dependent on the Company’s ability to attract and retain skilled management personnel and other employees. There can be no assurance that the Company will be able to attract or retain highly qualified personnel. Competition for skilled personnel in the pharmaceutical industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

THE LOSS OF THE SERVICES OF OUR KEY EMPLOYEES, PARTICULARLY THE SERVICES RENDERED BY XIAODONG ZHU, OUR DIRECTOR, DI WU, OUR DEVELOPMENT OFFICER, AND JIANPING CHEN, OUR CHIEF FINANCIAL OFFICER COULD HARM OUR BUSINESS.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Xiaodong Zhu, our director, Di Wu, our development officer, and Jianping Chen, our Chief Financial Officer. The loss of any key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

11

OUR FAILURE TO COMPLY WITH INCREASINGLY STRINGENT ENVIRONMENTAL REGULATIONS AND RELATED LITIGATION COULD RESULT IN SIGNIFICANT PENALTIES, DAMAGES AND ADVERSE PUBLICITY FOR OUR BUSINESS.

In recent years, the government of China has become increasingly concerned with the degradation of China’s environment that has accompanied the country’s rapid economic growth. In the future, we expect that our manufacturers’ operations and properties will be subject to extensive and increasingly stringent laws and regulations pertaining to, among other things, the discharge of materials into the environment and the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to protection of the environment. While, the laws of PRC protect distributors from claims solely related to manufacturing defects, failure by our manufacturers to comply with any laws and regulations and future changes to them may result in significant consequences to us, including civil and criminal penalties, liability for damages and negative publicity in the future. We cannot assure you that additional environmental issues will not require currently unanticipated investigations, assessments or expenditures, or that requirements applicable to us will not be altered in ways that will require us to incur significant additional costs.

WE WILL INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS.

We will incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Relating To Our Industry

WE MAY BE SUBJECT TO SUBSTANTIAL LIABILITY SHOULD THE CONSUMPTION OF ANY OF OUR PRODUCTS CAUSE PERSONAL INJURY OR ILLNESS. UNLIKE MOST PHARMACEUTICAL COMPANIES IN THE UNITED STATES, WE DO NOT MAINTAIN PRODUCT LIABILITY INSURANCE TO COVER OUR POTENTIAL LIABILITIES.

The sale of drug products for human consumption involves an inherent risk of injury to consumers. Such injuries may result from tampering by unauthorized third parties or product contamination or degeneration, including the presence of foreign contaminants, chemical substances or other agents or residues during the various stages of production process. We cannot assure you that consumption of our products will not cause a health-related illness in the future, or that we will not be subject to claims or lawsuits relating to such matters if the laws of the PRC change.

Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertions that our products caused personal injury or illness could adversely affect our reputation with customers and our corporate and brand image. Unlike most pharmaceutical companies in the United States, but in line with industry practice in the PRC, we do not maintain product liability insurance. Furthermore, the products we sold could potentially suffer from product tampering, contamination or degeneration or be mislabeled or otherwise damaged. Under certain circumstances, we may be required to recall products. Even if a situation does not necessitate a product recall, we cannot assure you that product liability claims by our distributors will not be asserted against us as a result. A product liability judgment against us or a product recall could have a material adverse effect on our revenues, profitability and business reputation.

IF THE PHARMACEUTICAL INDUSTRY IN THE PRC DOES NOT GROW AS WE EXPECT, OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION WILL BE ADVERSELY AFFECTED.

We believe drug products have strong growth potential in the PRC and, accordingly, we have continuously increased our sales of drug products. However, the market for pharmaceutical industry in the PRC has grown in recent years due to the increased wealth of the average resident of China and increasing health cautiousness, which has been the result of double-digit annual growth in the Chinese economy. Due to the worldwide recession, the growth of the Chinese economy has slowed. If the pharmaceutical industry in the PRC does not grow as we expect, our business will be harmed, we will need to adjust our growth strategy, and our results of operation will be adversely affected.

12

SALES OF OUR PRODUCTS COULD BE HARMED BY THE WIDESPREAD PRESENCE OF COUNTERFEIT MEDICATION IN THE PRC WHICH NEGATIVELY IMPACTING OUR PROFITABILITY.

Chinese counterfeiting of pharmaceuticals and other products affecting public health has grown in tandem with counterfeiting and piracy of goods such as brand-name clothing, compact discs and computer software. Exact data are impossible to collect, but the FBI believes that more than half of the pharmaceuticals sold in PRC are counterfeit. Examples of the seriousness of the problem include: six months after Viagra was introduced in 2002, state media reported that some 90 percent of little blue pills sold in Shanghai were counterfeit; and 192,000 Chinese patients were reported to have died in 2001 from fake drugs. Counterfeit products shrink markets for legitimate goods. This situation affects the Company and other major domestic and foreign drug manufacturers in PRC, especially for products marketed over-the-counter rather than through hospitals. However, we believe the Chinese authorities are becoming increasingly vigilant against counterfeiting, because, in 2001, the authorities closed approximately 1,300 factories while investigating approximately 480,000 cases of counterfeit drugs. Currently, active pharmaceutical ingredients are governed only by chemical regulations. We believe that a major step towards controlling the problem would be taken should the Chinese State Food and Drug Administration be given oversight over PRC’s bulk chemicals producers. However, our ability to increase sales as rapidly as we would like, and our profitability, could be affected if this problem persists or worsens.

Risks Relating to the People’s Republic of China

CERTAIN POLITICAL AND ECONOMIC CONSIDERATIONS RELATING TO THE PRC COULD ADVERSELY AFFECT OUR COMPANY.

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of restrictions on currency conversion in addition to those described below.

THE RECENT NATURE AND UNCERTAIN APPLICATION OF MANY PRC LAWS APPLICABLE TO US CREATE AN UNCERTAIN ENVIRONMENT FOR BUSINESS OPERATIONS AND THEY COULD HAVE A NEGATIVE EFFECT ON US.

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects.

CURRENCY CONVERSION COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION.

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

13

Furthermore, the Renminbi is not freely convertible into foreign currencies nor can it be freely remitted abroad. Under the PRC’s Foreign Exchange Control Regulations and the Administration of Settlement, Sales and Payment of Foreign Exchange Regulations, Foreign Invested Enterprises are permitted either to repatriate or distribute its profits or dividends in foreign currencies out of its foreign exchange accounts, or exchange Renminbi for foreign currencies through banks authorized to conduct foreign exchange business. The conversion of Renminbi into foreign exchange by Foreign Invested Enterprises for recurring items, including the distribution of dividends to foreign investors, is permissible. The conversion of Renminbi (Chinese currency) into foreign currencies for capital items, such as direct investment, loans and security investment, is subject, however, to more stringent controls.

Our operating company is a FIE to which the Foreign Exchange Control Regulations are applicable. Accordingly, we will have to maintain sufficient foreign exchange to pay dividends and/or satisfy other foreign exchange requirements.

EXCHANGE RATE VOLATILITY COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION.

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable, most of the time in the region of approximately RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar and, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. If we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition.

SINCE OUR ASSETS ARE LOCATED IN THE PRC, ANY DIVIDENDS OF PROCEEDS FROM LIQUIDATION ARE SUBJECT TO THE APPROVAL OF THE RELEVANT CHINESE GOVERNMENT AGENCIES.

Our operating assets are located inside the PRC. Under the laws governing Foreign Invested Enterprises in the PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency’s approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

IT MAY BE DIFFICULT TO AFFECT SERVICE OF PROCESS AND ENFORCEMENT OF LEGAL JUDGMENTS UPON OUR COMPANY AND OUR OFFICERS AND DIRECTORS BECAUSE THEY RESIDE OUTSIDE THE UNITED STATES.

As our operations are presently based in the PRC and most of our director and officer resides in the PRC, service of process on our company and such director and officer may be difficult to effect within the United States. Also, our main assets are located in the PRC and any judgment obtained in the United States against us may not be enforceable outside the United States.

DUE TO VARIOUS RESTRICTIONS UNDER PRC LAWS ON THE DISTRIBUTION OF DIVIDENDS BY OUR PRC OPERATING COMPANIES, WE MAY NOT BE ABLE TO PAY DIVIDENDS TO OUR STOCKHOLDERS.

The Wholly-Foreign Owned Enterprise Law (1986), as amended and The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of the PRC (2006) contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, such companies are required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the Company’s profits.

Furthermore, if our subsidiaries in China incur debt on their own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our common stock.

Risks Related To Our Securities

IN ORDER TO RAISE SUFFICIENT FUNDS TO EXPAND OUR OPERATIONS, WE MAY HAVE TO ISSUE ADDITIONAL SECURITIES AT PRICES WHICH MAY RESULT IN SUBSTANTIAL DILUTION TO OUR SHAREHOLDERS.

If we raise additional funds through the sale of equity or convertible debt, our current stockholders’ percentage ownership will be reduced. In addition, these transactions may dilute the value of our common shares outstanding. We may have to issue securities that may have rights, preferences and privileges senior to our common stock. We cannot provide assurance that we will be able to raise additional funds on terms acceptable to us, if at all. If future financing is not available or is not available on acceptable terms, we may not be able to fund our future needs, which would have a material adverse effect on our business plans, prospects, results of operations and financial condition.

14

OUR ARTICLES OF INCORPORATION PROVIDE FOR INDEMNIFICATION OF OFFICERS AND DIRECTORS AT OUR EXPENSE AND LIMIT THEIR LIABILITY WHICH MAY RESULT IN A MAJOR COST TO US AND HURT THE INTERESTS OF OUR SHAREHOLDERS BECAUSE CORPORATE RESOURCES MAY BE EXPENDED FOR THE BENEFIT OF OFFICERS AND/OR DIRECTORS.

Our articles of incorporation and applicable Delaware law provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s written promise to repay us if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us which we will be unable to recoup.

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter if it were to occur is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.

OUR PRINCIPAL STOCKHOLDER HAS SIGNIFICANT VOTING POWER AND MAY TAKE ACTIONS THAT MAY NOT BE IN THE BEST INTEREST OF ALL OTHER STOCKHOLDERS.

The Company’s Chairman and Chief Executive Officer controls approximately 42.135% of the Company’s current outstanding shares of voting common stock. He may be able to exert significant control over our management and affairs requiring stockholder approval, including approval of significant corporate transactions. This concentration of ownership may expedite approvals of Company decisions, or have the effect of delaying or preventing a change in control, adversely affect the market price of our common stock, or be in the best interests of all our stockholders.

CURRENTLY, THERE IS NO PUBLIC MARKET FOR OUR SECURITIES, AND THERE CAN BE NO ASSURANCES THAT ANY PUBLIC MARKET WILL EVER DEVELOP OR THAT OUR COMMON STOCK WILL BE QUOTED FOR TRADING AND, EVEN IF QUOTED, IT IS LIKELY TO BE SUBJECT TO SIGNIFICANT PRICE FLUCTUATIONS.

We have a trading symbol for our common stock, DNGH, which permits our shares to be quoted on the OTCBB. However, our stock has been thinly traded since approval of our quotation on the over-the-counter bulletin board by FINRA. Consequently, there can be no assurances as to whether:

|

·

|

any market for our shares will develop;

|

|

·

|

the prices at which our common stock will trade; or

|

|

·

|

the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors.

|

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these risk factors, investor perception of us and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

WE ARE NOT LIKELY TO PAY CASH DIVIDENDS IN THE FORESEEABLE FUTURE.

We currently intend to retain any future earnings for use in the operation and expansion of our business. Accordingly, we do not expect to pay any cash dividends in the foreseeable future, but will review this policy as circumstances dictate. Should we determine to pay dividends in the future, our ability to do so will depend upon the receipt of dividends or other payments from our PRC operating subsidiary may, from time to time, be subject to restrictions on its ability to make distributions to us, including restrictions on the conversion of RMB into U.S. dollars or other hard currency and other regulatory restrictions.

15