Attached files

| file | filename |

|---|---|

| EX-31.1 - AMERICAN DG ENERGY INC | v179343_ex31-1.htm |

| EX-32.1 - AMERICAN DG ENERGY INC | v179343_ex32-1.htm |

| EX-31.2 - AMERICAN DG ENERGY INC | v179343_ex31-2.htm |

| EX-23.1 - AMERICAN DG ENERGY INC | v179343_ex23-1.htm |

| EX-10.23 - AMERICAN DG ENERGY INC | v179343_ex10-23.htm |

| EX-10.24 - AMERICAN DG ENERGY INC | v179343_ex10-24.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended December 31, 2009

or

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

file number 0-52294

AMERICAN

DG ENERGY INC.

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

04-3569304

|

|

|

(State of

incorporation or organization)

|

(IRS Employer

Identification No.)

|

|

45 First

Avenue

|

||

|

Waltham,

Massachusetts

|

02451

|

|

|

(Address of

Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

Telephone Number, Including Area Code: (781) 622-1120

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

|

Title

of each class

|

Name

of each exchange on which registered

|

|

|

Common Stock, $0.001

par value

|

NYSE

Amex

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Securities Act.

Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months, (or for such shorter period that the registrant was

required to file such reports) and (2) has been subject to such filing

requirements for the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes o No

o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or an amendment to this

Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer”,

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large accelerated

filer o

|

Accelerated filer o | |

|

Non-accelerated

filer o

|

Smaller reporting company x | |

|

(Do not check if a

smaller reporting company)

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes o No x

As of

June 30, 2009, the aggregate market value of the voting shares of the registrant

held by non-affiliates on the OTC Bulletin Board was approximately $41,397,788

based on a closing price per share of $2.75. For purposes of this calculation,

an aggregate of 20,717,659 shares of common stock held directly or by affiliates

of the directors and officers of the registrant have been included in the number

of shares held by affiliates.

As of

March 31, 2010 the registrant’s shares of common stock outstanding were:

44,088,964.

DOCUMENTS

INCORPORATED BY REFERENCE

Certain

information required by in Items 10, 11, 12, 13 and 14 of Part III of this

Annual Report on Form 10-K is incorporated by reference to our definitive Proxy

Statement for our 2009 Annual Meeting of Shareholders scheduled to be held on

May 21, 2009.

WARNING CONCERNING

FORWARD-LOOKING STATEMENTS

THIS

ANNUAL REPORT ON FORM 10-K CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE

MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER

FEDERAL SECURITIES LAWS. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON OUR

PRESENT INTENT, BELIEFS OR EXPECTATIONS, AND ARE NOT GUARANTEED TO OCCUR AND MAY

NOT OCCUR. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR

IMPLIED BY OUR FORWARD-LOOKING STATEMENTS AS A RESULT OF VARIOUS

FACTORS.

WE

GENERALLY IDENTIFY FORWARD-LOOKING STATEMENTS BY TERMINOLOGY SUCH AS “MAY,”

“WILL,” “SHOULD,” “EXPECTS,” “PLANS,” “ANTICIPATES,” “COULD,” “INTENDS,”

“TARGET,” “PROJECTS,” “CONTEMPLATES,” “BELIEVES,” “ESTIMATES,” “PREDICTS,”

“POTENTIAL” OR “CONTINUE” OR THE NEGATIVE OF THESE TERMS OR OTHER SIMILAR WORDS.

THESE STATEMENTS ARE ONLY PREDICTIONS. THE OUTCOME OF THE EVENTS DESCRIBED IN

THESE FORWARD-LOOKING STATEMENTS IS SUBJECT TO KNOWN AND UNKNOWN RISKS,

UNCERTAINTIES AND OTHER FACTORS THAT MAY CAUSE OUR, OUR CUSTOMERS’ OR OUR

INDUSTRY’S ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS

EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS, TO

DIFFER.

THIS

REPORT ALSO CONTAINS MARKET DATA RELATED TO OUR BUSINESS AND INDUSTRY. THESE

MARKET DATA INCLUDE PROJECTIONS THAT ARE BASED ON A NUMBER OF ASSUMPTIONS. IF

THESE ASSUMPTIONS TURN OUT TO BE INCORRECT, ACTUAL RESULTS MAY DIFFER FROM THE

PROJECTIONS BASED ON THESE ASSUMPTIONS. AS A RESULT, OUR MARKETS MAY NOT GROW AT

THE RATES PROJECTED BY THESE DATA, OR AT ALL. THE FAILURE OF THESE MARKETS TO

GROW AT THESE PROJECTED RATES MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR

BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION AND THE MARKET PRICE OF OUR

COMMON STOCK.

SEE “ITEM

1A. RISK FACTORS,” “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS” AND “BUSINESS,” AS WELL AS OTHER SECTIONS IN THIS

REPORT, THAT DISCUSS SOME OF THE FACTORS THAT COULD CONTRIBUTE TO THESE

DIFFERENCES. THE FORWARD-LOOKING STATEMENTS MADE IN THIS ANNUAL REPORT ON FORM

10-K RELATE ONLY TO EVENTS AS OF THE DATE OF WHICH THE STATEMENTS ARE MADE.

EXCEPT AS REQUIRED BY LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR RELEASE ANY

FORWARD- LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR

OTHERWISE.

AMERICAN

DG ENERGY INC.

ANNUAL

REPORT ON FORM 10-K

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

TABLE

OF CONTENTS

|

PART

I

|

|||

|

Item

1.

|

Business.

|

2

|

|

|

Item

1A.

|

Risk

Factors.

|

10

|

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

13

|

|

|

Item

2.

|

Properties.

|

14

|

|

|

Item

3.

|

Legal

Proceedings.

|

14

|

|

|

Item

4.

|

Reserved.

|

14

|

|

|

PART

II

|

|||

|

|

|||

|

Item

5.

|

Market

for the Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities.

|

15

|

|

|

|

|||

|

Item

6.

|

Selected

Financial Data.

|

17

|

|

|

|

|||

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

17

|

|

|

|

|||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

24

|

|

|

|

|||

|

Item

8.

|

Financial

Statements and Supplementary Data.

|

25

|

|

|

|

|||

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

25

|

|

|

|

|||

|

Item

9A(T).

|

Controls

and Procedures.

|

25

|

|

|

|

|||

|

Item

9B.

|

Other

Information.

|

26

|

|

|

|

|||

|

PART

III

|

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance.

|

27

|

|

|

|

|||

|

Item

11.

|

Executive

Compensation.

|

27

|

|

|

|

|||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

27

|

|

|

|

|||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

27

|

|

|

|

|||

|

Item

14.

|

Principal

Accountant Fees and Services.

|

27

|

|

|

PART

IV

|

|||

|

Item

15.

|

Exhibits

and Financial Statement Schedules.

|

28

|

1

PART

I

Item

1. Business.

General

American

DG Energy Inc., or the company, we, our or us, distributes, owns and operates

clean, on-site energy systems that produce electricity, hot water, heat and

cooling. Our business model is to own the equipment that we install at

customers’ facilities and to sell the energy produced by these systems to the

customers on a long-term contractual basis. We call this business the American

DG Energy “On-Site Utility”.

We offer

natural gas powered cogeneration systems that are highly reliable and energy

efficient. Our cogeneration systems produce electricity from an internal

combustion engine driving a generator, while the heat from the engine and

exhaust is recovered and typically used to produce heat and hot water for use at

the site. We also distribute and operate water chiller systems for building

cooling applications that operate in a similar manner, except that the engine’s

power drives a large air-conditioning compressor while recovering heat for hot

water. Cogeneration systems reduce the amount of electricity that the customer

must purchase from the local utility and produce valuable heat and hot water for

the site to use as required. By simultaneously providing electricity,

hot water and heat, cogeneration systems also have a significant, positive

impact on the environment by reducing the carbon or CO2 produced

by offsetting the traditional energy supplied by the electric grid and

conventional hot water boilers.

Distributed

Generation of electricity or DG, or often referred to as cogeneration systems,

or combined heat and power systems, or CHP, is an attractive option for reducing

energy costs and increasing the reliability of available energy. DG

has been successfully implemented by others in large industrial

installations over 10 Megawatts, or MW, where the market has been growing for

several years, and is increasingly being accepted in smaller size units because

of technology improvements, increased energy costs and better DG economics. We

believe that our target market (users of up to 1 MW) has been barely penetrated

and that the reduced reliability of the utility grid, increasing cost pressures

experienced by energy users, advances in new, low cost technologies and

DG-favorable legislation and regulation at the state and federal level will

drive our near-term growth and penetration into our target market. The company

maintains a website at www.americandg.com, but our website address included in

this Annual Report on Form 10-K is a textual reference only and the information

in the website is not incorporated by reference into this Annual Report on Form

10-K.

The

company was incorporated as a Delaware corporation on July 24, 2001 to install,

own, operate and maintain complete DG systems and other complementary systems at

customer sites and sell electricity, hot water, heat and cooling energy under

long-term contracts at prices guaranteed to the customer to be below

conventional utility rates. As of December 31, 2009, we had installed energy

systems, representing approximately 4,210 kilowatts, or kW, 33.5 million British

thermal units, or MMBtu’s, of heat and hot water and 2,200 tons of cooling. kW

is a measure of electricity generated, MMBtu is a measure of heat generated and

a ton is a measure of cooling generated. Due to the high efficiency CHP systems,

the Environmental Protection Agency, or EPA, has recognized them as a means to

improve the environment. We have estimated that our currently installed energy

systems running at 100% capacity have the potential to produce approximately

23,000 metric tons of carbon equivalents, less than typical separate heat and

power systems, resulting in emissions reductions equivalent to planting 4,710

acres of forest or removing the emissions of 3,780 automobiles.

We

believe that our primary near-term opportunity for DG energy and equipment sales

is where commercial electricity rates exceed $0.12 per kW hour, or kWh, which is

predominantly in the Northeast and California. These areas represent

approximately 15% of the U.S. commercial power market, with electricity revenues

in excess of $20.0 billion per year (see Figure 1 on page 6). Attractive DG

economics are currently attainable in applications that include hospitals,

nursing homes, multi-tenant residential housing, hotels, schools and colleges,

recreational facilities, food processing plants, dairies and other light

industrial facilities. Two CHP market analysis reports sponsored by the Energy

Information Administration, or EIA, in 2000 detailed the prospective CHP market

in the commercial and institutional sectors1 and in the industrial sectors2. These data sets were used to estimate the CHP

market potential in the 100 kW to 1 MW size range. These target market segments

comprise over 163,000 sites totaling 12.2 million kW of prospective DG capacity.

This is the equivalent of an $11.7 billion annual electricity market plus a $7.3

billion heat and hot water energy market, for a combined market potential of

$19.0 billion.

1 The Market and Technical Potential

for Combined Heat and Power in the Commercial/Institutional Sector;

Prepared for the Energy Information Administration; Prepared by ONSITE

SYCOM Energy Corporation; January 2000

2 The Market and Technical Potential

for Combined Heat and Power in the Industrial Sector; Prepared for the

Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation;

January 2000

2

We

believe that the largest number of potential DG users in the U.S. require less

than 1 MW of electric power and less than 1,200 tons of cooling capacity. We are

able to design our systems to suit a particular customer’s needs because of our

ability to place multiple units at a site. This approach is part of what allows

our products and services to meet changing power and cooling demands throughout

the day (also from season-to-season) and greatly improves efficiency through a

customer’s varying high and low power requirements.

American

DG Energy purchases energy equipment from various suppliers. The primary type of

equipment used is a natural gas-powered, reciprocating engine provided by

Tecogen Inc., or Tecogen. Tecogen is a leading manufacturer of natural gas,

engine-driven commercial and industrial cooling and cogeneration systems

suitable for a variety of applications, including hospitals, nursing homes and

schools.

As power

sources that use alternative energy technologies mature to the point that they

are both reliable and economical, we will consider employing them to supply

energy for our customers. We regularly assess the technical, economic, and

reliability issues associated with systems that use solar, micro-turbine or fuel

cell technologies to generate power.

Background

and Market

The

delivery of energy services to commercial and residential customers in the U.S.

has evolved over many decades into an inefficient and increasingly unreliable

structure. Power for lighting, air conditioning, refrigeration, communications

and computing demands comes almost exclusively from centralized power plants

serving users through a complex grid of transmission and distribution lines and

substations. Even with continuous improvements in central station generation and

transmission technologies, today’s power industry is only about 33%

efficient3 meaning that it discharges to the environment

roughly twice as much heat as the amount of electrical energy delivered to

end-users. Since coal accounts for more than half of all electric power

generation, these inefficiencies are a major contributor to rising atmospheric

CO2

emissions. As countermeasures are sought to limit global warming, pressures

against coal will favor the deployment of alternative energy

technologies.

On-site

boilers and furnaces burning either natural gas or petroleum distillate fuels

produce most thermal energy for space heating and hot water services. This

separation of thermal and electrical energy supply services has persisted

despite a general recognition that CHP can be significantly more energy

efficient than central generation of electricity by itself. Except in

large-scale industrial applications (e.g., paper and chemical manufacturing),

cogeneration has not attained general acceptance. This was due, in part, to the

long-established monopoly-like structure of the regulated utility industry.

Also, the technologies previously available for small on-site cogeneration

systems were incapable of delivering the reliability, cost and environmental

performance necessary to displace or even substantially modify the established

power industry structure.

The

competitive balance began to change with the passage of the Public Utility

Regulatory Policy Act of 1978, a federal statute that has opened the door to

gradual deregulation of the energy market by the individual states. In 1979, the

accident at Three Mile Island effectively halted the massive program of nuclear

power plant construction that had been a centerpiece of the electric generating

strategy among U.S. utilities for two decades. Several factors caused utilities’

capital spending to fall drastically, including well publicized cost overruns at

nuclear plants, an end to guaranteed financial returns on costly new facilities,

and growing uncertainty over which power plant technologies to pursue. Recently,

investors have become increasingly reluctant to support the risks of the

long-term construction projects required for new conventional generating and

distribution facilities.

Because

of these factors, electricity reserve margins have declined, and the reliability

of service has begun to deteriorate, particularly in regions of high economic

growth. Widespread acceptance of computing and communications technologies by

consumers and commercial users has further increased the demand for electricity,

while also creating new requirements for very high power quality and

reliability. At the same time, technological advances in emission control,

microprocessors and internet technologies have sharply altered the competitive

balance between centralized and DG. These fundamental shifts in economics and

requirements are key to the emerging opportunity for DG equipment and

services.

The

Role of DG

DG, or

cogeneration, is the production of two sources or two types of energy

(electricity or cooling and heat) from a single energy source (natural gas). We

use technology that utilizes a low-cost, mass-produced, internal combustion

engine from General Motors, used primarily in light trucks and sport utility

vehicles that is modified to run on natural gas. The engine spins either a

standard generator to produce electricity, or a conventional compressor to

produce cooling. For heating, since the working engine generates heat, we

capture the byproduct heat with a heat exchanger and utilize the heat for

facility applications in the form of space heating and hot water for buildings

or industrial facilities. This process is very similar to an automobile, where

the engine provides the motion to the automobile and the byproduct heat is used

to keep the passengers warm during the winter months. For refrigeration or

cooling, standard available equipment uses an electric motor to spin a

conventional compressor to make cooling. We replace the electric motor with the

same modified engine that runs on natural gas to spin the compressor to run a

refrigeration cycle and produce cooling.

1 Energy Information Administration,

Voluntary Reporting of Greenhouse Gases, 2004, Section 2, Reducing

Emissions from Electric Power, Efficiency Projects: Definitions and Terminology,

page 20

3

DG refers

to the application of small-scale energy production systems, including

electricity generators, at locations in close proximity to the end-use loads

that they serve. Integrated energy systems, operating at user sites but

interconnected to existing electric distribution networks, can reduce demand on

the nation’s utility grid, increase energy efficiency, avoid the waste inherent

in long distance wire and cable transmission of electricity, reduce air

pollution and greenhouse gas emissions, and protect against power outages,

while, in most

cases, significantly lowering utility costs for power users and building

operators.

The

growing importance of DG as a key component of our future energy supply is

underscored by the establishment of a Distributed Energy Program within the

U.S. Department of Energy, or the DOE. The DOE has stated its position on

this issue as follows:

“...there

are two problems at the root of the current power crunch. There is not always

enough power generation available to meet peak demand, and existing transmission

lines cannot carry all of the electricity needed by consumers.... Distributed

Energy resources are the power of choice for providing customers with reliable

energy supplies.... These Distributed Energy products and services use natural

gas and renewable energy and will be easily interconnected into the nation’s

infrastructure for the generation of electricity. Furthermore, our Program works

to encourage the expanded use of Distributed Energy technologies in applications

with the right combination and occurrence of electrical and thermal

demand...”

Until

recently, many DG technologies have not been a feasible alternative to

traditional energy sources because of economic, technological and regulatory

considerations. Even now, many “alternative energy” technologies (such as solar,

wind, fuel cells and micro-turbines) have not been sufficiently developed and

proven to economically meet the demands of commercial users or the ability to be

connected to the existing utility grid.

We supply

cogeneration systems that are capable of meeting the demands of commercial users

and that can be connected to the existing utility grid. Specific advantages of

the company’s on-site DG of multiple energy services, compared with traditional

centralized generation and distribution of electricity alone, include

the following:

|

|

·

|

Greatly

increased overall energy efficiency (typically over 80% versus less than

33% for the existing

power grid).

|

|

|

·

|

Rapid

adaptation to changing demand requirements (e.g., weeks, not years to

add new generating capacity where and when it

is needed).

|

|

|

·

|

Ability

to by-pass transmission line and substation bottlenecks in congested

service areas.

|

|

|

·

|

Avoidance

of site and right-of-way issues affecting large-scale power generation and

distribution projects.

|

|

|

·

|

Clean

operation, in the case of natural gas fired reciprocating engines using

microprocessor combustion controls and low-cost exhaust catalyst

technology developed for automobiles, producing exhaust emissions well

below the world’s strictest regional environmental standards

(e.g., southern California).

|

|

|

·

|

Rapid

economic paybacks for equipment investments, often three to five years

when compared to existing utility costs and

technologies.

|

|

|

·

|

Relative

insensitivity to fuel prices due to high overall efficiencies achieved

with cogeneration of electricity and thermal energy services, including

the use of waste heat to operate absorption type air conditioning systems

(displacing electric-powered cooling capacity at times of peak

summer demand).

|

4

|

|

·

|

Reduced

vulnerability of multiple de-centralized small-scale generating units

compared to the risk of major outages from natural disasters or terrorist

attacks against large central-station power plants and long distance

transmission lines.

|

|

|

·

|

Ability

to remotely monitor, control and dispatch energy services on a real-time

basis using advanced switchgear, software, microprocessor and internet

modalities. Through our on-site energy products and services, energy users

are able to optimize, in real time, the mix of centralized and distributed

electricity-generating resources.

|

The

disadvantages of the company’s on-site DG are:

|

|

·

|

Cogeneration

is a mechanical process and our equipment is susceptible to downtime or

failure.

|

|

|

·

|

The

base-rate of an electric utility is determined by a certain number of

subscribers. DG at a significant scale will reduce the number of

subscribers and therefore it may increase the base-rate for the electric

utility for its customer base.

|

|

|

·

|

By

committing to our long-term agreements, a customer may be forfeiting the

opportunity to use more efficient technology that may become available in

the future.

|

Also, DG systems possess significant

positive environmental impact. The EPA has created a Combined Heat and Power

Partnership to promote the benefits of DG systems. The company is a member of

this Partnership. The following statement is found on the EPA web

site.

“Combined heat and power systems offer

considerable environmental benefits when compared with purchased electricity and

onsite-generated heat. By capturing and utilizing heat that would otherwise be

wasted from the production of electricity, CHP systems require less fuel than

equivalent separate heat and power systems to produce the same amount of

energy. Because less fuel is combusted, greenhouse gas emissions,

such as carbon dioxide (CO2), as well

as criteria air pollutants like nitrogen oxides (NOx) and

sulfur dioxide (SO2), are

reduced.”

The

DG Market Opportunity

We

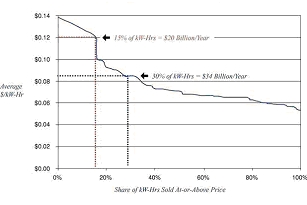

believe that our primary near-term opportunity for DG energy and equipment sales

is where commercial electricity rates exceed $0.12 per kWh, which is

predominantly in the Northeast and California. These areas represent

approximately 15% of the U.S. commercial power market, with electricity

revenues in excess of $20 billion per year (see Figure 1. on page 6).

Attractive DG economics are currently attainable in applications that include

hospitals, nursing homes, multi-tenant residential housing, hotels, schools and

colleges, recreational facilities, food processing plants, dairies and other

light industrial facilities. Two CHP market analysis reports sponsored by the

EIA in 2000 detailed the prospective CHP market in the commercial and

institutional sectors4 and in the industrial sectors5. These data sets were used to estimate the CHP

market potential in the 100 kW to 1 MW size range. These target market segments

comprise over 163,000 sites totaling 12.2 million kW of prospective DG

capacity. This is the equivalent of an $11.7 billion annual electricity

market plus a $7.3 billion heat and hot water energy market, for a combined

market potential of $19 billion.

As shown

in Figure 1 on page 6, there are substantial variations in the electric rates

paid by commercial and institutional customers throughout the U.S. In

high-cost regions, monthly payments for energy services supplied by on-site DG

projects yield rapid paybacks (e.g., often 3-5 years) on an investment

in our systems. An additional 15% of commercial sector electricity, representing

annual revenues of $14 billion, is sold at rates between $0.085 and $0.12

per kWh as shown in Figure 1 on page 6. Although paybacks on DG projects would

be less rapid in such regions, future rate increases are expected to improve

DG economics.

4 The Market and Technical Potential

for Combined Heat and Power in the Commercial/Institutional Sector;

Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM

Energy Corporation; January 2000

5 The Market and Technical Potential

for Combined Heat and Power in the Industrial Sector; Prepared for the

Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation;

January 2000

5

Figure 1

The

DG Market Opportunity

U.S.

Commercial/Institutional Electric Rate Profile

Source:

U.S. Energy Information Administration Data [2002]

Business

Model

We are a

DG onsite energy company that sells energy in the form of electricity, heat, hot

water and air conditioning under long-term contracts with commercial,

institutional and light industrial customers. We install our systems at no cost

to our customers and retain ownership of the system. Because our systems operate

at over 80% efficiency (versus less than 33% for the existing power grid),

we are able to sell the energy produced by these systems to our customers at

prices below their existing cost of electricity (or air conditioning), heat and

hot water. Our cogeneration systems consist of natural gas-powered internal

combustion engines that drive an electrical generator to produce electricity and

that capture the engine heat to produce space heating and hot water. Our energy

systems also can be configured to drive a compressor that produces air

conditioning and that also captures the engine heat. As of December 31, 2009, we

had 62 energy systems operational.

To date,

each of our installations runs in conjunction with the electric utility grid and

requires standard interconnection approval from the local utility. Our customers

use both our energy system and the electric utility grid for their electricity

requirements. We typically supply the first 20% to 60% of the building’s

electricity requirements while the remaining electricity is supplied by the

electric utility grid. Our customers are contractually bound to use the energy

we supply.

To date,

the price that we have charged our customers is set in our customer contracts at

a discount to the price of the building’s local electric utility. For the 20% to

60% portion of the customer’s electricity that we supply, the customer realizes

immediate savings on its electric bill. In addition to electricity, we sell our

customers the heat and hot water at the same price they were previously paying

or at a discount equivalent to their discount from us on electricity. Our air

conditioning systems are also priced at a discount so that the customer realizes

overall cost savings from the installation.

Since we

own and operate the energy systems and since our customers have no investment in

the units, our customers benefit from no capital requirements and no operating

responsibilities. We operate the energy systems so our customers require no

staff and have no energy system responsibilities; they are bound, however, to

pay for the energy supplied by the energy systems over the term of the

agreement.

Energy

and Products Portfolio

We

provide a full range of CHP product and energy options. Our primary

energy and products are listed below:

|

|

·

|

Energy

Sales

|

|

|

o

|

Electricity

|

|

|

o

|

Thermal

(Hot Water, Heat and Cooling)

|

|

|

·

|

Energy

Producing Products

|

|

|

o

|

Cogeneration

Packages

|

6

|

|

o

|

Chillers

|

|

|

o

|

Complementary

Energy Equipment (e.g., boilers, etc.)

|

|

|

o

|

Alternative

Energy Equipment (e.g., solar, fuel cells,

etc.)

|

|

|

·

|

Turnkey

Installation Energy Producing Products with Incentives

|

|

|

·

|

Other

Revenue Opportunities

|

Energy

Sales

For

customers seeking an alternative to the outright purchase of CHP equipment, we

will install, maintain, finance, own and operate complete on-site CHP systems

that supply, on a long-term, contractual basis, electricity and other energy

services. We sell the energy to customers at a guaranteed discount rate to the

rates charged by conventional utility suppliers. Customers are billed monthly.

Our customers benefit from a reduction in their current energy bills without the

capital costs and risks associated with owning and operating a cogeneration or

chiller system. Also, by outsourcing the management and financing of on-site

energy facilities to us, they can reap the economic advantages of DG without the

need for retaining specialized in-house staff with skills unrelated to their

core business. Customers benefit from our On-Site Utility in a number of

ways:

|

|

·

|

Guaranteed

lower price for energy

|

|

|

·

|

Only

pay for the energy they use

|

|

|

·

|

No

capital costs for equipment, engineering and

installation

|

|

|

·

|

No

equipment operating costs for fuel and maintenance

|

|

|

·

|

Immediate

cash flow improvement

|

|

|

·

|

Significant

green impact by the reduction of carbon produced

|

|

|

·

|

No

staffing, operations and equipment

responsibility

|

Our

customers pay us for energy produced on site at a rate that is a certain

percentage below the rate at which the utility companies provide them electrical

and natural gas services. We measure the actual amount of electrical and thermal

energy produced, and charge our customers accordingly. We agree to install,

operate, maintain and repair our energy systems at our sole cost and expense. We

also agree to obtain any necessary permits or regulatory approvals at our sole

expense. Our agreements are generally for a term of 15 years, renewable for two

additional five years terms upon the mutual agreement of the

parties.

In

regions where high electricity rates prevail, such as the Northeast, monthly

payments for CHP energy services can yield attractive paybacks (e.g. often 3-5

years) on our investments in On-Site Utility projects. The price of natural gas

has a minor effect on the financial returns obtained from our energy service

contracts because the value of hot water and other thermal services produced

from the recovered heat generated by the internal combustion engine in our

on-site DG system will increase in proportion to higher fuel costs. This

recovered energy, which comprises up to 60 % of the total heating value of fuel

supplied to our CHP equipment, displaces fuel that would otherwise be burned in

conventional boilers. Each of our customer sites becomes a profit center. The

example below presents the energy supplied by two 75 kW cogeneration units and

the economics of a typical energy service contract where we supply 80% of the

site’s heat and hot water and 45% of the site’s electricity:

|

Annual

|

Term

(15 years)

|

|||||||

|

American

DG Energy Revenue

|

$ | 284,000 | $ | 4,908,000 | ||||

|

American

DG Energy Gross Margin

|

$ | 84,000 | $ | 1,456,000 | ||||

|

Customer

Savings

|

$ | 32,000 | $ | 545,000 | ||||

The

example reflects an American DG Energy investment of $345,000 with a payback in

4 years or a 25% internal rate of return. The example also reflects a 2% of

expected annual increase in energy costs that should occur over the 15-year

period.

Energy

Producing Products

We

typically offer cogeneration units sized to produce 75 kW to 100 kW of

electricity and water chillers sized to produce 200 to 400 tons of cooling. For

cogeneration, we prefer a modular design approach to allow us to group multiple

units together to serve customers with considerably larger power requirements.

Often, cogeneration units are conveniently dispersed within a large operation,

such as a hospital or campus, serving multiple process heating systems that

would otherwise be impractical to serve from a single large machine. The

equipment we select often yield overall energy efficiencies in excess of 80%

(from our equipment supplier’s specifications).

7

Many

other DG technologies are challenged by technical, economic and reliability

issues associated with systems that generate power using solar, micro-turbine or

fuel cell technologies, which have not yet proven to be economical for typical

customer needs. When alternative energy technologies mature to the point that

they are both reliable and economical, we will employ them for the best-fit

applications.

Service and Installation

Where appropriate, we utilize the best

local service infrastructure for the equipment we deploy. We require long-term

maintenance contracts and ongoing parts sales. Our centralized remote monitoring

capability allows us to keep track of our equipment in the field. Our

installations are performed by local contractors with experience in energy

cogeneration systems.

For the occasional customers that want

to own the CHP system themselves, we offer our “turn-key” option whereby we

provide equipment, systems engineering, installation, interconnect approvals,

on-site labor and startup services needed to bring the complete CHP system

on-line. For some customers, we are also paid a fee to operate the systems and

may receive a portion of the savings generated from the equipment.

Other Funding and Revenue

Opportunities

American DG Energy is able to

participate in the demand response market and receive payments due to the

availability of our energy systems. Demand response programs provide payments

for either the reduction of electricity usage or the increase in electricity

production during periods of peak usage throughout a utility territory. We have

also received grants and incentives from state organizations and natural gas

companies for our installed energy systems.

Sales

and Marketing

Our On-Site Utility services are sold

directly to end-users by our in-house marketing team and by established sales

agents and representatives. We offer standardized packages of energy, equipment

and services suited to the needs of property owners and operators in healthcare,

hospitality, large residential, athletic facilities and certain industrial

sites. This includes national accounts and other customer groups having a common

set of energy requirements at multiple locations.

Our energy offering is translated into

direct financial gain for our clients, and is best appreciated by senior

management. These clients recognize the gain in cash flow, the increase in net

income and the preservation of capital we offer. As such, our energy sales are

focused on reaching these decision makers. Additionally, we have benefited with

increased sales and maintenance support through our joint venture, called

American DG NY LLC, or ADGNY, with AES-NJ Cogen Co., or AES-NJ, an established

developer of small cogeneration systems.

The company is continually expanding

its sales efforts by developing joint marketing initiatives with key suppliers

to our target industries. Particularly important are our collaborative programs

with natural gas utility companies. Since the economic viability of any CHP

project is critically dependent upon effective utilization of recovered heat,

the insight of the gas supplier to the customer energy profile is particularly

effective in prospecting the most cost-effective DG sites in any

region.

DG is enjoying growing support among

state utility regulators seeking to increase the reliability of electricity

supply with cost effective environmentally responsible demand-side resources.

New York, New Jersey, Connecticut and Massachusetts are among the states that

encourage DG through inter-connecting standards, incentives and/or supply

planning. Unlike large central station power plants, DG investments can be made

in small increments and with lead-times as short as just a few

months.

The U.S. government has been developing

and refining various funding opportunities related to its economic recovery or

stimulus initiatives. While the final decision has not been determined as of the

date of this Annual Report on Form 10-K, it appears that “shovel ready” projects

related to energy and the environment will hold great prominence. Also, there

appears to be interest in upgrading government buildings. The company’s CHP

systems would fit very well with any of these programs. Other than funding

opportunities related to the economic recovery or stimulus initiatives, there

does not appear to be any new government regulations that will affect the

company.

8

Competition

We

believe that the main competition for our DG products is the established

electric utility infrastructure. DG is beginning to gain acceptance in regions

where energy customers are dissatisfied with the cost and reliability of

traditional electricity service. These end-users, together with growing support

from state legislatures and regulators, are creating a favorable climate for the

growth of DG that is overcoming the objections of established utility providers.

In our target markets, we compete with large utility companies such as

Consolidated Edison in New York City and Westchester County, Long Island Power

Authority in Long Island, New York, Public Service Gas and Electric in New

Jersey, and NSTAR and National Grid in Massachusetts.

Engine

manufacturers sell DG units that range in size from a few kW’s to many MW’s in

size. Those manufacturers are predominantly greater than 1 MW and include

Caterpillar, Cummins, and Waukesha. In many cases, we view these companies as

potential suppliers of equipment and not as competitors. For example, we are

currently installing a Waukesha unit at a customer site.

The

alternative energy market is emerging rapidly. Many companies are developing

alternative and renewable energy sources including solar power, wind power, fuel

cells and micro-turbines. Some of the companies in this sector include General

Electric, BP, Shell, Sun Edison and Evergreen Solar (in the solar energy space);

Plug Power and Fuel Cell Energy (in the fuel cell space); and Capstone,

Ingersoll Rand and Elliott Turbomachinery (in the micro-turbine space). The

effect of these developing technologies on our business is difficult to predict;

however, when their technologies become more viable for our target markets, we

may be able to adopt their technologies into our business model.

There are

a number of energy service companies that offer related services. These

companies include Siemens, Honeywell and Johnson Controls. In general, these

companies seek large, diverse projects for electric demand reduction for

campuses that include building lighting and controls, and electricity (in rare

occasions) or cooling. Because of their overhead structures, these companies

often solicit large projects and stay away from individual properties. Since we

focus on smaller projects for energy supply, we are well suited to work in

tandem with these companies when the opportunity arises.

There are

also a few local emerging cogeneration developers and contractors that are

attempting to offer services similar to ours. To be successful, they will need

to have the proper experience in equipment and technology, installation

contracting, equipment maintenance and operation, site economic evaluation,

project financing and energy sales plus the capability to cover a broad

region.

Material

Contracts

In

January 2006, the company entered into the 2006 Facilities, Support Services and

Business Agreement, or the Agreement, with Tecogen, to provide the company with

certain office and business support services for a period of one year, renewable

annually by mutual agreement. The company also shares personnel support services

with Tecogen. The company is allocated its share of the cost of the personnel

support services based upon the amount of time spent by such support personnel

while working on the company’s behalf. To the extent Tecogen is able to do so

under its current plans and policies, Tecogen includes the company and its

employees in several of its insurance and benefit programs. The costs of these

programs are charged to the company on an actual cost basis. Under this

agreement, the company receives pricing based on a volume discount if it

purchases cogeneration and chiller products from Tecogen. For certain sites, the

company hires Tecogen to service its Tecogen chiller and cogeneration products.

Under the current Agreement, as amended, Tecogen provides the company with

office space and utilities at a monthly rate of $5,526.

We have

sales representation rights to Tecogen’s products and services. In New England,

we have exclusive sales representation rights to their cogeneration products. We

have granted Tecogen sales representation rights to our On-Site Utility energy

service in California.

Government

Regulation

We are not subject to extensive

government regulation. We are required to file for local construction permits

(electrical, mechanical and the like) and utility interconnects, and we must

make various local and state filings related to environmental

emissions.

The U.S. government has been developing

and refining various funding opportunities related to its economic recovery or

stimulus initiatives. While the final decision has not been determined as of the

date of this Annual Report on Form 10-K, it appears that “shovel ready” projects

related to energy and the environment will hold great prominence. Also, there

appears to be interest in upgrading government buildings. The company’s CHP

systems would fit very well with any of these programs. Other than funding

opportunities related to the economic recovery or stimulus initiatives, there

does not appear to be any new government regulations that will affect the

company.

9

Employees

As of December 31, 2009, we employed

thirteen active full-time employees and two part-time employees. We believe that

our relationship with our employees is satisfactory. None of our employees are

represented by a collective bargaining agreement.

Item

1A. Risk Factors.

Our

business faces many risks. The risks described below may not be the only risks

we face. Additional risks that we do not yet know of, or that we currently think

are immaterial, may also impair our business operations or financial results. If

any of the events or circumstances described in the following risks occurs, our

business, financial condition or results of operations could suffer and the

trading price of our common stock could decline. Investors and prospective

investors should consider the following risks and the information contained

under the heading ‘‘Warning Concerning Forward-Looking Statements’’ before

deciding whether to invest in our securities.

We

have incurred losses, and these losses may continue.

We have

incurred losses in each of our fiscal years since inception. Losses continued to

be incurred in 2009. There is no assurance that profitability will be achieved

in the near term, if at all.

Because

unfavorable utility regulations make the installation of our systems more

difficult or less economical, any slowdown in the utility deregulation process

would be an impediment to the growth of our business.

In the

past, many electric utility companies have raised opposition to DG, a critical

element of our On-Site Utility business. Such resistance has generally taken the

form of unrealistic standards for interconnection, and the use of targeted rate

structures as disincentives to combined generation of on-site power and heating

or cooling services. A DG company’s ability to obtain reliable and affordable

back-up power through interconnection with the grid is essential to our business

model. Utility policies and regulations in most states are often not prepared to

accommodate widespread on-site generation. These barriers erected by electric

utility companies and unfavorable regulations, where applicable, make more

difficult or uneconomic our ability to connect to the electric grid at customer

sites and are an impediment to the growth of our business. Development of our

business could be adversely affected by any slowdown or reversal in the utility

deregulation process or by difficulties in negotiating backup power supply

agreements with electric providers in the areas where we intend to do

business.

Our

onsite utility concept is largely unproven and may not be accepted by a

sufficient number of customers.

The sale

of cogeneration and cooling equipment has been successfully carried out for more

than a decade. However, our On-Site Utility concept (i.e., the sale of on-site

energy services, rather than equipment) is still in an early stage of

implementation. Unresolved issues include the pricing of energy services and the

structuring of contracts to provide cost savings to customers and optimum

financial returns to us. There is no assurance that we will be successful in

developing a profitable On-Site Utility business model, and failure to do so

would have a material adverse effect on our business and financial

performance.

The

economic viability of our projects depends on the price spread between fuel and

electricity, and the variability of the prices of these components creates a

risk that our projects will be uneconomic.

The

economic viability of DG projects is dependent upon the price spread between

fuel and electricity prices. Volatility in one component of the spread, the cost

of natural gas and other fuels (e.g., propane or distillate oil) can be managed

to a greater or lesser extent by means of futures contracts. However, the

regional rates charged for both base load and peak electricity services may

decline periodically due to excess capacity arising from over-building of

utility power plants or recessions in economic activity. Any sustained weakness

in electricity prices could significantly limit the market for our cogeneration,

cooling equipment and On-Site Utility energy services.

10

We

may fail to make sales to certain prospective customers because of resistance

from facilities management personnel to the outsourcing of their service

function.

Any

outsourcing of non-core activities by institutional or commercial entities will

generally lead to reductions in permanent on-site staff employment. As a result,

our proposals to implement On-Site Utility contracts are likely to encounter

strong initial resistance from the facilities managers whose jobs will be

threatened by energy outsourcing. The growth of our business will depend upon

our ability to overcome such barriers among prospective customers.

Future

government regulations, such as increased emissions standards, safety standards

and taxes, may adversely impact the economics of our business.

The

operation of DG equipment at our customers’ sites may be subject to future

changes in federal, state and local laws and regulations (e.g., emissions,

safety, taxes, etc.). Any such new or substantially altered rules and standards

may adversely affect our revenues, profits and general financial

condition.

If

we cannot expand our network of skilled technical support personnel, we will be

unable to grow our business.

Each

additional customer site for our services requires the initial installation and

subsequent maintenance and service of equipment to be provided by a team of

technicians skilled in a broad range of technologies, including combustion,

instrumentation, heat transfer, information processing, microprocessor controls,

fluid systems and other elements of DG. If we are unable to recruit, train,

motivate, sub-contract, and retain such personnel in each of the regional

markets where our business operates we will be unable to grow our business in

those markets.

The

company operates in highly competitive markets and may be unable to successfully

compete against competitors having significantly greater resources and

experience.

Our

business may be limited by competition from energy services companies arising

from the breakup of conventional regulated electric utilities. Such competitors,

both in the equipment and energy services sectors, are likely to have far

greater financial and other resources than us, and could possess specialized

market knowledge with existing channels of access to prospective customer

locations. We may be unable to successfully compete against those

competitors.

Future

technology changes may render obsolete various elements of equipment comprising

our On-Site Utility installations.

We must

select equipment for our DG projects so as to achieve attractive operating

efficiencies, while avoiding excessive downtimes from the failure of unproven

technologies. If we are unable to achieve a proper balance between the cost,

efficiency and reliability of equipment selected for our projects, our growth

and profitability will be adversely impacted.

We

have limited historical operating results upon which to base projections of

future financial performance, making it difficult for prospective investors to

assess the value of our stock.

Our

experience is primarily on-site energy services, and we have only a few years of

actual operating experience. These limitations make developing financial

projections more difficult. We will expand our business infrastructure based on

these projections. If these projections prove to be inaccurate, we will sustain

additional losses and will jeopardize the success of our business.

We

will need to raise additional capital for our business, which will dilute

existing shareholders.

Additional

financings will be required to implement our overall business plan. We will need

additional capital. Equity financings will dilute the percentage ownership of

our existing shareholders. Our ability to raise an adequate amount of capital

and the terms of any capital that we are able to raise will be dependent upon

our progress in implementing demonstration projects and related marketing

service development activities. If we do not make adequate progress, we may be

unable to raise adequate funds, which will limit our ability to expand our

business. If the terms of any equity financings are unfavorable, the dilutive

impact on our shareholders might be severe.

We

may make acquisitions that could harm our financial performance.

In order

to expedite development of our corporate infrastructure, particularly with

regard to equipment installation and service functions, we anticipate the future

acquisition of complementary businesses. Risks associated with such acquisitions

include the disruption of our existing operations, loss of key personnel in the

acquired companies, dilution through the issuance of additional securities,

assumptions of existing liabilities and commitment to further operating

expenses. If any or all of these problems actually occur, acquisitions could

negatively impact our financial performance and future stock value.

11

We

are controlled by a small group of majority shareholders, and our minority

shareholders will be unable to effect changes in our governance structure or

implement actions that require shareholder approval, such as a sale of the

company.

George

Hatsopoulos and John Hatsopoulos, who are brothers, beneficially own a majority

of our outstanding shares of common stock. These stockholders have the ability

to control various corporate decisions, including our direction and policies,

the election of directors, the content of our charter and bylaws and the outcome

of any other matter requiring shareholder approval, including a merger,

consolidation and sale of substantially all of our assets or other change of

control transaction. The concurrence of our minority shareholders will not be

required for any of these decisions.

We

may be exposed to substantial liability claims if we fail to fulfill our

obligations to our customers.

We enter

into contracts with large commercial and not-for-profit customers under which we

will assume responsibility for meeting a portion of the customers’ building

energy demand and equipment installation. We may be exposed to substantial

liability claims if we fail to fulfill our obligations to customers. There can

be no assurance that we will not be vulnerable to claims by customers and by

third parties that are beyond any contractual protections that we are able to

negotiate. We may be unable to obtain liability and other insurance on terms and

at prices that are commercially acceptable to us. As a result, liability claims

could cause us significant financial harm.

Investment

in our common stock is subject to price fluctuations which have been significant

for development stage companies like us.

Historically,

valuations of many companies in the development stage have been highly volatile.

The securities of many of these companies have experienced significant price and

trading volume fluctuations, unrelated to the operating performance or the

prospects of such companies. If the conditions in the equity markets further

deteriorate, we may be unable to finance our additional funding needs in the

private or the public markets. There can be no assurance that any future

offering will be consummated or, if consummated, will be at a share price equal

or superior to the price paid by our investors even if we meet our technological

and marketing goals.

Future sales of common stock by our

existing stockholders may cause our stock price to fall.

The

market price of our common stock could decline as a result of sales by our

existing stockholders of shares of common stock in the market or the perception

that these sales could occur. These sales might also make it more difficult for

us to sell equity securities at a time and price that we deem appropriate and

thus inhibit our ability to raise additional capital when it is

needed.

Because we do not intend to pay cash

dividends, our stockholders will receive no current income from holding our

stock.

We have

paid no cash dividends on our capital stock to date and we currently intend to

retain our future earnings, if any, to fund the development and growth of our

business. In addition, the terms of any future debt or credit facility may

preclude us from paying these dividends. As a result, capital appreciation, if

any, of our common stock will be your sole source of gain for the foreseeable

future. We currently expect to retain earnings for use in the operation and

expansion of our business, and therefore do not anticipate paying any cash

dividends for the foreseeable future.

Our

ability to access capital for the repayment of debts and for future growth is

limited as the financial markets are currently in a period of disruption and

recession and the company does not expect these conditions to improve in the

near future.

Our ability to continue to access

capital could be impacted by various factors including general market conditions

and the continuing slowdown in the economy, interest rates, the perception of

our potential future earnings and cash distributions, any unwillingness on the

part of lenders to make loans to us and any deterioration in the financial

position of lenders that might make them unable to meet their obligations to

us.

12

Our

business is affected by general economic conditions and related uncertainties

affecting markets in which we operate. The current economic conditions including

the global recession could adversely impact our business in 2010 and

beyond.

The

current economic conditions including the global recession could adversely

impact our business in 2010 and beyond, resulting in reduced demand for our

products, increased rate of order cancellations or delays, increased risk of

excess and obsolete inventories, increased pressure on the prices for our

products and services; and greater difficulty in collecting accounts

receivable.

Trading of our common stock is

restricted by the Securities and Exchange Commission’s, or the SEC’s, “penny

stock” regulations which may limit a stockholder’s ability to buy and sell our

stock.

The SEC has adopted regulations which

generally define “penny stock” to be any equity security that has a market price

less than $5.00 per share or an exercise price of less than $5.00 per share,

subject to certain exceptions. Our securities are covered by the penny stock

rules, which impose additional sales practice requirements on broker-dealers who

sell to persons other than established customers and accredited investors. The

penny stock rules require a broker-dealer, prior to a transaction in a penny

stock not otherwise exempt from the rules, to deliver a standardized risk

disclosure document in a form prepared by the SEC that provides information

about penny stocks and the nature and level of risks in the penny stock market.

The broker-dealer also must provide the customer with current bid and other

quotations for the penny stock, the compensation of the broker-dealer and its

salesperson in the transaction and monthly account statement showing the market

value of each penny stock held in the customer’s account. The bid and offer

quotations, and the broker-dealer and salesperson compensation information, must

be given to the customer orally or in writing prior to effecting the transaction

and must be given to the customer in writing before or with the customer’s

confirmation. In addition, the penny stock rules require that prior to a

transaction in a penny stock not otherwise exempt from these rules, the

broker-dealer must make a special written determination that the penny stock is

a suitable investment for the purchaser and receive the purchaser’s written

agreement to the transaction. These disclosure and suitability requirements may

have the effect of reducing the level of trading activity in the secondary

market for a stock that is subject to these penny stock rules. Consequently,

these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor interest

in and limit the marketability of our capital stock. Trading of our capital

stock is restricted by the SEC’s “penny stock” regulations which may limit a

stockholder’s ability to buy and sell our stock.

There has been a material weakness in

our financial controls and procedures, which could harm our operating results or

cause us to fail to meet our reporting obligations.

As of the

end of the period covered by this report, our Chief Executive Officer and Chief

Financial Officer have performed an evaluation of controls and procedures and

concluded that our controls were not effective to provide reasonable assurance

that information required to be disclosed by our company in reports that we file

under the Securities Exchange Act of 1934, as amended, or the Exchange Act, is

recorded, processed, summarized and reported as when required. Management

conducted an evaluation of our internal control over financial reporting and

based on this evaluation, management concluded that the company’s internal

control over financial reporting was not effective as of the end of the period

covered by this report. The company currently does not have personnel with a

sufficient level of accounting knowledge, experience and training in the

selection, application and implementation of generally acceptable accounting

principles as it relates to complex transactions and financial reporting

requirements. The company also has a small number of employees dealing with

general controls over information technology security and user access. This

constitutes a material weakness in financial reporting. Any failure to implement

effective internal controls could harm our operating results or cause us to fail

to meet our reporting obligations. Inadequate internal controls could also cause

investors to lose confidence in our reported financial information, which could

have a negative effect on the trading price of our common stock, and may require

us to incur additional costs to improve our internal control

system.

Item

1B. Unresolved Staff Comments.

None.

13

Item

2. Properties.

Our

headquarters are located in Waltham, Massachusetts and consist of 3,339 square

feet of office and storage space that are leased from Tecogen. The lease expires

on March 31, 2014. We believe that our facilities are appropriate and adequate

for our current needs.

Item

3. Legal Proceedings.

We are

not currently a party to any material litigation, and we are not aware of any

pending or threatened litigation against us that could have a material adverse

affect on our business, operating results or financial condition.

Item

4. Reserved.

14

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

Market

Our common stock started trading on

November 8, 2007, on the OTC Bulletin Board, or OTCBB, under the symbol “ADGE”.

OTCBB market quotations reflect inter-dealer prices, without retail mark-up,

mark-down or commissions and may not necessarily represent actual

transactions.

During

the period from November 8, 2007 to December 31, 2007, the high price was $1.25

and the low price was $0.83 as reported by the OTCBB. The following table sets

forth the high and low per share sales prices for our common stock for each of

the quarters in the period beginning January 1, 2008, through December 31,

2009, as reported by the OTCBB. On October 19, 2009, the company’s common stock

began trading on the NYSE Amex market.

|

2009

|

2008

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

First

Quarter

|

$ | 2.20 | $ | 1.50 | $ | 1.09 | $ | 0.73 | ||||||||

|

Second

Quarter

|

3.25 | 2.45 | 1.92 | 1.01 | ||||||||||||

|

Third

Quarter

|

3.08 | 2.70 | 2.05 | 1.35 | ||||||||||||

|

Fourth

Quarter

|

3.55 | 2.52 | 2.31 | 1.65 | ||||||||||||

The closing price of our common stock

as reported on the NYSE Amex on March 30, 2010, was $2.94 per

share.

Holders

As of

February 2, 2010, there were approximately 610 beneficial holders of our common

stock.

Dividends

We have

never declared or paid any cash dividends on shares of our common stock. We

currently intend to retain earnings, if any, to fund the development and growth

of our business and do not anticipate paying cash dividends in the foreseeable

future. Our payment of any future dividends will be at the discretion of our

board of directors after taking into account various factors, including our

financial condition, operating results, cash needs and growth

plans.

Recent

Sales of Unregistered Securities

Set forth

below is information regarding common stock issued, warrants issued and stock

options granted by the company during fiscal year 2008 and 2009. Also included

is the consideration, if any, we received and information relating to the

section of the Securities Act of 1933, as amended, or the Securities Act, or

rule of the SEC, under which exemption from registration was

claimed.

Common

Stock and Warrants

In 2008,

the company raised $707,000 through the exercise of 1,010,000 warrants at a

price of $0.70 per share. The warrant exercises were done exclusively by 17

accredited investors, representing 3.1% of the total shares then

outstanding.

In 2008,

two holders of the company’s 8% Convertible Debenture, elected to convert

$150,000 of the outstanding principal amount of the debenture into 178,572

shares of common stock.

On February 24, 2009, the company sold

a warrant to purchase shares of the company’s common stock to an accredited

investor, for a purchase price of $10,500. The warrant, which expires on

February 24, 2012, gives the investor the right but not the obligation to

purchase 50,000 shares of the company’s common stock at an exercise price per

share of $3.00.

On April

23, 2009, the company raised $2,260,000 in a private placement of 1,076,190

shares of common stock at a price of $2.10 per share. The private placement was

done exclusively by 5 accredited investors, representing 3.1% of the total

shares then outstanding.

15

On July

24, 2009, the company raised $3,492,650 in a private placement of 1,663,167

shares of common stock at a price of $2.10 per share. The company also granted

the investors the right to purchase additional shares of common stock at a

purchase price of $3.10 per share by December 18, 2009, which as of December 31,

2009, have expired unexercised. The private placement was done exclusively by 22

accredited investors, representing 4.7% of the total shares then

outstanding.

On

October 1, 2009, the company signed an investor relations consulting agreement

with Hayden IR for a period of twelve months. In connection with that agreement

the company granted Hayden IR a warrant to purchase 12,000 shares of the

company’s common stock at an exercise price per share of $2.98, with one-third

vesting on October 1, 2009, one-third vesting on February 1, 2010, and one-third

vesting on June 1, 2010, provided that at any such vesting date the agreement is

still in effect and Hayden IR has provided all required services to the company.

The warrants carry a cashless exercise provision and expire on May 30, 2013.

On

October 14, 2009, the company raised $525,000 in a private placement of 250,000

shares of common stock at a price of $2.10 per share. The company also granted

the investor the right to purchase additional shares of common stock at a

purchase price of $3.10 per share by December 18, 2009, which as of December 31,

2009, have expired unexercised. The private placement was done exclusively by an

accredited investor, representing 0.7% of the total shares then

outstanding.

All of

such investors were accredited investors, and such transactions were exempt from

registration under the Securities Act under Section 4(2) and/or Regulation D

thereunder.

Restricted

Stock Grants

In

December 2008, the company made a restricted stock grant to one employee by

permitting him to purchase an aggregate of 40,000 shares of common stock,

representing 0.1% of the total shares then outstanding at a price of $0.001 per

share. Those shares have a vesting schedule of four years.

Such

transactions were exempt from registration under the Securities Act under

Section 4(2), Regulation D and/or

Rule 701 thereunder.

Stock

Options

In