Attached files

| file | filename |

|---|---|

| EX-32.1 - CASI Pharmaceuticals, Inc. | v178789_ex32-1.htm |

| EX-31.1 - CASI Pharmaceuticals, Inc. | v178789_ex31-1.htm |

| EX-31.2 - CASI Pharmaceuticals, Inc. | v178789_ex31-2.htm |

| EX-32.2 - CASI Pharmaceuticals, Inc. | v178789_ex32-2.htm |

| EX-23.1 - CASI Pharmaceuticals, Inc. | v178789_ex23-1.htm |

FORM

10-K

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D. C., 20549

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended December 31, 2009

Commission

file number 0-20713

ENTREMED,

INC.

|

Delaware

|

58-1959440

|

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification No.)

|

|

|

9640 Medical Center Drive, Rockville, MD

|

20850

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's

telephone number, including area code: (240)

864-2600

Securities

registered pursuant to Section 12(b) of the Act:

|

Common Stock, $0.01 par value

|

The NASDAQ Stock Market LLC

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

Securities

registered pursuant to Section 12(g) of the Act: NONE

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15 (d) of the Act. Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this form 10-K or any amendment to this

Form 10-K x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

Non-accelerated

filer x

|

Smaller

reporting company ¨

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes ¨ No x

As of

June 30, 2009, the aggregate market value of the shares of common stock held by

non-affiliates was approximately $38,148,385.

As of

March 15, 2010, 95,694,736 shares of the Company’s common stock were

outstanding.

Documents

Incorporated By Reference

The

registrant intends to file a definitive proxy statement pursuant to

Regulation 14A within 120 days of the end of the fiscal year ended

December 31, 2009. The proxy statement is incorporated herein by reference

into the following parts of the Form 10K:

Part III,

Item 10, Directors, Executive Officers and Corporate

Governance;

Part III,

Item 11, Executive Compensation;

Part III,

Item 12, Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder

Matters;

Part III,

Item 13, Certain Relationships and Related Transactions, and Director

Independence; and

Part III,

Item 14, Principal Accounting Fees and Services.

ENTREMED,

INC.

FORM

10-K - FISCAL YEAR ENDED DECEMBER 31, 2009

Contents

and Cross Reference Sheet

|

Form 10-K

Part No.

|

Form 10-K

Item No.

|

Description

|

Form 10-K

Page No.

|

|||

|

I

|

1

|

Business

|

3

|

|||

|

|

||||||

|

1A

|

Risk

Factors

|

10

|

||||

|

1B

|

Unresolved

Staff Comments

|

19

|

||||

|

2

|

Properties

|

20

|

||||

|

3

|

Legal

Proceedings

|

20

|

||||

|

4

|

Reserved

|

20

|

||||

|

II

|

5

|

Market

for Registrant's Common Equity, Related Stockholder Matters And Issuer

Purchases of Equity Securities

|

20

|

|||

|

6

|

Selected

Financial Data

|

23

|

||||

|

7

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

24

|

||||

|

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

33

|

||||

|

8

|

Financial

Statements and Supplementary Data

|

33

|

||||

|

9

|

Changes

in and Disagreements with Accountants On Accounting and Financial

Disclosure

|

33

|

||||

|

9A

|

Controls

and Procedures

|

34

|

||||

|

9B

|

Other

Information

|

36

|

||||

|

III

|

10

|

Directors,

Executive Officers and Corporate Governance

|

36

|

|||

|

11

|

Executive

Compensation

|

36

|

||||

|

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

36

|

||||

|

|

||||||

|

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

37

|

||||

|

14

|

Principal

Accounting Fees and Services

|

37

|

||||

|

IV

|

15

|

Exhibits

and Financial Statement Schedules

|

37

|

|||

|

Signatures

|

42

|

|||||

|

Audited

Consolidated Financial Statements

|

F-1

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report contains certain forward-looking statements within the meaning of Section

27A of the Securities Exchange Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements also may be included in other statements that we make. All

statements that are not descriptions of historical facts are forward-looking

statements. These statements can generally be identified by the use

of forward-looking terminology such as “believes,” “expects,” “intends,” “may,”

“will,” “should,” or “anticipates” or similar terminology. These

forward-looking statements include, among others, statements regarding the

timing of our clinical trials, our cash position and future expenses, and our

future revenues.

Our

forward-looking statements are based on information available to us today, and

we will not update these statements.

1

Actual

results could differ materially from those currently anticipated due to a number

of factors, including the risk that we may be unable to continue as a

going concern as a result of our inability to raise sufficient capital for our

operational needs; the possibility that we may be delisted from trading on the

Nasdaq Capital Market; the volatility of our common stock; risks relating to the

need for additional capital and the uncertainty of securing additional funding

on favorable terms; the failure to consummate a transaction to monetize our

Thalomid® royalty

stream for any reason, including our inability to obtain the required

third-party consents; declines in actual sales of Thalomid®

resulting in reduced royalty payments; risks associated with our product

candidates; the early-stage products under development; results in preclinical

models are not necessarily indicative of clinical results; uncertainties

relating to preclinical and clinical trials, including delays to the

commencement of such trials; success in the clinical development of any

products; dependence on third parties; and risks relating to the

commercialization, if any, of our proposed products (such as

marketing, safety, regulatory, patent, product liability, supply, competition

and other risks). Additional information about the factors and risks

that could affect our business, financial condition and results of operations,

are contained in Section 1A, “Risk Factors,” of this Annual Report on Form 10-K

and our other filings with the U.S. Securities and Exchange Commission (SEC),

which are available at www.sec.gov.

2

PART

I

ITEM

1. BUSINESS.

ENMD-2076

EntreMed, Inc. (“EntreMed” or “the

Company”) (Nasdaq: ENMD) is a clinical-stage pharmaceutical company focused on

developing ENMD-2076, an Aurora A and angiogenic kinase inhibitor for the

treatment of cancer. ENMD-2076 is currently in Phase 1 studies in

advanced cancers, multiple myeloma and leukemia. We anticipate the

initiation of a Phase 2 study in ovarian cancer during the second quarter of

2010.

ENMD-2076

is a novel orally-active, Aurora A/angiogenic kinase inhibitor with potent

activity against Aurora A and multiple tyrosine kinases linked to cancer and

inflammatory diseases. ENMD-2076 is relatively selective for the

Aurora A isoform in comparison to Aurora B. Aurora kinases are key

regulators of the process of mitosis, or cell division, and are often

over-expressed in human cancers. ENMD-2076 exerts its effects through multiple

mechanisms of action, including antiproliferative activity and the inhibition of

angiogenesis. ENMD-2076 has demonstrated significant, dose-dependent preclinical

activity as a single agent, including tumor regression, in multiple xenograft

models (e.g. breast, colon, leukemia), as well as activity towards ex

vivo-treated human leukemia patient cells.

ENMD-2076

has received orphan drug designation from the United States Food and Drug

Administration (the “FDA”) for the treatment of ovarian cancer, multiple myeloma

and acute myeloid leukemia (“AML”). In the United States, the

Orphan Drug Act is intended to encourage companies to develop therapies for the

treatment of diseases that affect fewer than 200,000 people in this

country. Orphan drug designation provides us with seven years of

market exclusivity that begins once ENMD-2076 receives FDA marketing

approval. It also provides certain financial incentives that can help

support the development of ENMD-2076.

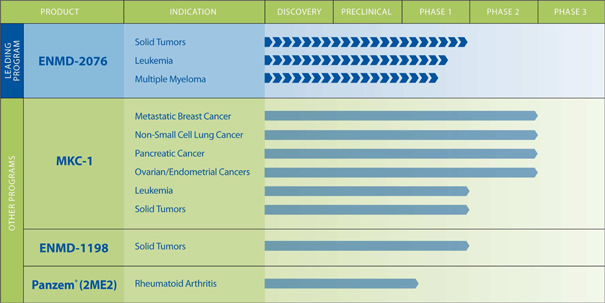

The table

below illustrates the current status of our product pipeline.

3

OTHER

DRUG CANDIDATES

ENMD-2076

is the only program currently under active clinical evaluation by the

Company. The selection of ENMD-2076 as our lead product allows us to

direct the majority of our resources to accelerate its clinical

development. However, we also own the intellectual property of our

other early-stage therapeutic candidates. We do not intend to

initiate additional new studies for programs other than ENMD-2076 unless

additional significant financing becomes available to us. Our other

therapeutic candidates include MKC-1, an oral cell-cycle inhibitor with activity

against the mTOR pathway that has completed multiple Phase 2 clinical trials for

cancer, and ENMD-1198, a novel antimitotic agent that has completed a Phase 1

study in advanced cancers. We also have an approved Investigational

New Drug Application (“IND”) for the use of Panzem® in

rheumatoid arthritis (“RA”) treatment. All of our candidates are

multi-mechanism in that they target disease cells and the blood vessels that

nourish them, which we believe can be developed to be safe and convenient, and

provide the potential for improved patient outcomes.

MKC-1 for

Oncology. MKC-1 is an orally-active, small molecule, cell

cycle inhibitor with in

vitro and in

vivo efficacy against a broad range of human solid tumor cell lines,

including multi-drug resistant cell lines. MKC-1 acts through multiple

mechanisms of action, arresting cellular mitosis and inducing cell death

(apoptosis) by binding to a number of different cellular proteins

including tubulin and members of the importin β family. MKC-1 also

inhibits activation of the oncogenic kinase Akt and the mTOR pathway through a

mechanism that is a subject of investigation by EntreMed

scientists.

MKC-1 has

demonstrated broad antitumor effects in multiple preclinical models, including

paclitaxel-resistant models, and was evaluated in several Phase 1 and 2 clinical

studies involving nearly 270 patients prior to the licensing of the drug from

Hoffman La Roche. These studies have provided extensive pharmacokinetic and

safety data. Since acquired by EntreMed, MKC-1 has shown single agent antitumor

activity in breast cancer patients and in combination with Alimta® in NSCLC

patients. MKC-1 has completed multiple Phase 2 clinical trials for

cancer and has a robust data set.

ENMD-1198 for

Oncology. ENMD-1198 is a potent, orally-active, antimitotic

agent that induces cell cycle arrest and apoptosis in tumor cells. ENMD-1198 has

shown pronounced antitumor activity as well as substantial synergistic effects

in combination with standard of care chemotherapeutic agents in numerous

preclinical models.

ENMD-1198

does not exhibit sensitivity to multi-drug resistance mechanisms in preclinical

studies. ENMD-1198 also has shown preclinical activity towards

taxane and vinca alkaloid resistant tumor cells. Additionally, ENMD-1198

decreases the activity of three oncogenic proteins (HIF-1α, NF-κB and STAT3)

that are known to promote tumor growth and

progression. ENMD-1198 has been evaluated in a Phase 1

clinical trial for safety, tolerability, pharmacokinetics, and clinical benefit

in advanced cancer patients.

Panzem® (2ME2) for Rheumatoid

Arthritis. Panzem® is an

orally active compound that has antiproliferative, antiangiogenic and

anti-inflammatory properties. The inhibition of angiogenesis is an important

approach to the treatment of both cancer and rheumatoid arthritis. Panzem® has

potential as a single agent in rheumatoid arthritis based on its antiangiogenic,

anti-inflammatory, and anti-osteoclastic (bone resorption)

properties.

An IND to

develop Panzem®

(2-methoxyestradiol, 2ME2) in rheumatoid arthritis (RA) was accepted based on

its safety profile demonstrated throughout the oncology development effort, and

preclinical research results showing that 2ME2 has disease modifying or “DMARD”

activity in a variety of animal models of RA. DMARDs are drugs that

have the ability to slow down disease progression in rheumatoid arthritis and

other autoimmune diseases, in contrast to non-steroidal anti-inflammatory drugs

which only treat the immune reaction resulting from tissue damage. We

have generated substantial preclinical data demonstrating the positive effects

of 2ME2 treatment on inflammation and disease progression in standard animal

models of RA. Radiographic and immunohistochemical staining results from these

preclinical studies have shown consistent therapeutic effects on the hallmarks

of the disease, including the inhibition of the highly angiogenic pannus,

infiltrating cells, cartilage lesions and bone resorption.

4

PANZEM® NCD

(2ME2) for Oncology

In

2008, we discontinued clinical development of 2ME2 (Panzem® NCD) for

oncology. Substantial clinical trial and manufacturing/process

development costs would be required to narrow the oncology indications for

larger registration-track randomized studies. These expenditures

would require the commitment of a disproportionate amount of resources and limit

clinical development efforts on other assets.

PRECLINICAL

Our focus

is on clinical development. Accordingly, we are not devoting any significant

resources to preclinical activities.

2010

OUTLOOK

In 2010,

we will continue to focus on three principal objectives:

|

|

·

|

to

initiate Phase 2 for ENMD-2076 in the second quarter and to continue to

concentrate our resources on ENMD-2076 in order to accelerate clinical

objectives so that we can provide a more direct path forward to product

registration and ultimately to the

market;

|

|

|

·

|

to

conserve our cash by deferring new program initiatives and reducing

expenses; and

|

|

|

·

|

to

be opportunistic in raising capital and in seeking collaborations for our

principal assets.

|

More specifically, in order to further

advance our commercial objectives, we may seek strategic alliances,

co-development partnerships and other collaborations with other companies to

develop our drug candidates. Our focus will continue to be clinical

development and, as such, will not devote any significant resources to

preclinical activities.

OPERATING

LOSSES

To date,

we have been engaged exclusively in research and development

activities. As a result, we have incurred operating losses through

December 31, 2009 and expect to continue to incur operating losses for the

foreseeable future before commercialization of any products. We spent $7,902,000 on

research and development in 2009, which includes costs associated with ENMD-2076

of $5,036,000, with MKC-1 of $449,000, with ENMD-1198 of $177,000 and with

Panzem® oncology

of $126,000, as compared to $20,069,000 in 2008 and $23,739,000 in

2007. To accomplish our business goals, we, or prospective

development partners, will be required to conduct substantial development

activities for all proposed products that we intend to pursue to

commercialization. We intend to continue to pursue strategic relationships to

provide resources for the further development of our product candidates. There

can be no assurance, however, that these discussions will result in

relationships or additional funding. In addition, we may continue to

seek capital through the public or private sale of securities. There can be no

assurance that we will be successful in seeking such additional

capital.

MANAGEMENT

EntreMed's

management team has aligned the Company's business strategy with its core

scientific strengths, while maintaining prudent resource management, fiscal

responsibility and accountability. The team has redirected EntreMed's

financial resources and R&D strategy to focus primarily on the development

of our Aurora A/angiogenic kinase inhibitor, ENMD-2076.

The

current senior management team includes: Carolyn F. Sidor, M.D., Vice President

& Chief Medical Officer; Mark R. Bray, Ph.D., Vice President, Research;

Cynthia W. Hu, JD, Chief Operating Officer, General Counsel & Secretary; and

Kathy R. Wehmeir-Davis, Principal Accounting Officer. This senior

management team reports directly to the Executive Committee of the Board

comprised of three directors: Michael M. Tarnow, Dwight L. Bush and Jennie

Hunter-Cevera, Ph.D. Mr. Tarnow serves as our Executive Chairman and

Mr. Bush serves as our Vice Chairman.

5

SCIENTIFIC

FOUNDATION

We

developed our drug candidates based on comprehensive research into the

relationship between malignancy and angiogenesis (the growth of new blood

vessels). This research led to a focus on drug candidates that act on the

cellular pathways that affect biological processes important in multiple

diseases, specifically angiogenesis and cell cycle regulation through the

inhibition of key kinases. Our drug candidate, ENMD-2076, has

potential applications in oncology and other diseases that are dependent on the

regulation of these processes.

Kinase

Inhibition. Kinases are enzymes that are primary regulators of

many essential processes in living cells. There are approximately 500 different

kinases encoded in the human genome, and these proteins act together in

intricate communication networks and pathways to control virtually every aspect

of cellular function. The reliance of the cell on kinases to regulate function

can be disastrous when kinase signaling becomes aberrant. Many human diseases

have been linked to these enzymes including all forms of cancer, arthritis,

inflammation, diabetes, and cardiovascular disease. The inhibition of kinases as

a targeted therapeutic approach has now been validated by several drugs that

have advanced successfully through clinical trials to the marketplace. The

integral role kinases play in angiogenesis and cell cycle regulation has led

EntreMed to develop inhibitors to key kinases involved in these

processes.

Cell Cycle

Regulation. Precise regulation of the cell cycle is essential

for healthy cell functions including the replication, growth, and

differentiation. One specific aspect of cell cycle regulation is the programmed

control of cell death (apoptosis). In certain diseases, such as cancer, the

balance between cell proliferation and cell death is altered, resulting in

inappropriate cell growth. Our compounds impact biochemical pathways in cells

that result in their death via apoptosis. We believe that the selective

induction of apoptosis through drugs that induce cell cycle arrest can either

stabilize or cause the regression of cancer, inflammation and other disease

processes characterized by inappropriate cell growth.

Angiogenesis. Angiogenesis

is a multi-step process whereby new blood vessels are formed. This tightly

regulated process involves the migration, proliferation and differentiation of

endothelial cells. In normal physiology, angiogenesis is a necessary component

of the menstrual cycle and wound healing, where the process is regulated through

appropriate shifts in the balance of pro-angiogenic and antiangiogenic signals.

This tight regulation of angiogenesis in normal physiology is absent or aberrant

in multiple disease settings that are characterized by persistent, inappropriate

blood vessel development. Inappropriate angiogenesis occurs in more

than 80 diseases, particularly in various cancers where the growth of new blood

vessels is necessary to sustain tumor growth.

BUSINESS

DEVELOPMENT AND COMMERCIALIZATION STRATEGY

Oncology

is our principal clinical and commercial focus. Based on the

compound’s strong preclinical antitumor activity, favorable safety profile and

bioavailability, we believe that ENMD-2076 has significant therapeutic potential

in a broad range of tumor types and continue to focus our resources on ENMD-2076

as our priority program. We believe that ENMD-2076 represents a potential Phase

2 partnering opportunity. As a result, our strategy is to pursue the

development of ENMD-2076 for oncology, obtain additional clinical data while

being selective and opportunistic in exploring strategic alliances for this and

other compounds in our pipeline. We may pursue co-development

partners for our other pipeline product candidates to help accelerate their

development and strengthen the development program with complementary

expertise. We can also provide our co-development partners with

substantial know-how relating to small molecules that inhibit angiogenesis and

inflammation, as well as regulate cell cycle pathways.

RELATIONSHIPS RELATING TO CLINICAL

PROGRAMS

Contract

Manufacturing. The manufacturing efforts for the production of

our clinical trial materials are performed by contract manufacturing

organizations. Established relationships, coupled with supply agreements, have

secured the necessary resources to ensure adequate supply of clinical materials

to support our clinical development program. We believe that our

current strategy of outsourcing manufacturing is cost-effective and allows for

the flexibility we require.

6

Sponsored Research

Agreements. To complement our in-house research and

development efforts, we have entered into sponsored research agreements with

outside scientists to conduct specific projects. Under these

agreements, we have secured the rights to intellectual property and to develop

under exclusive license any discoveries resulting from these collaborations. The

funds we provide in accordance with these agreements partially support the

scientists’ laboratory, research personnel and research supplies.

Clinical Trial

Centers. As of March 12, 2010, we are conducting clinical

trials for ENMD-2076 at the following institutions:

|

|

- Dana-Farber

Cancer Institute, Boston, MA

|

|

|

- Massachusetts

General Hospital, Boston, MA

|

|

|

- Indiana

University Cancer Center, Indianapolis,

IN

|

|

|

- Princess

Margaret Hospital, Toronto, Ontario

|

|

|

- University

of Colorado Cancer Center, Aurora,

CO

|

PATENTS,

LICENSES AND PROPRIETARY RIGHTS

Our

success will depend in part on our ability to obtain patent protection for our

products, both in the United States and abroad. The patent position of

biotechnology and pharmaceutical companies, in general, is highly uncertain and

involves complex legal and factual questions.

All of

our programs are backed by strong intellectual property rights. Each

product candidate is covered by issued or pending composition, method and use

patents. With respect to our leading program, ENMD-2076, we directly

own patent applications for the lead compound, ENMD-2076, and also for a library

of over 600 analogs. Ownership includes 1 issued US patent, 3 pending

US applications, 2 issued foreign patents and 43 pending foreign

applications. Our issued patents for ENMD-2076 expire September 9,

2026, and in the case of the issued US patent, March 5, 2027. Pending

patent applications for ENMD-2076 provide coverage through

2026. Patent applications pending for the over 600 analogs provide

coverage ranging from 2025 to 2028.

With

respect to our entire patent estate for all of our product candidates, we

directly own 40 U.S. issued patents and patent applications and 48 foreign

issued patents and patent applications; and have exclusively in-licensed 9 U.S.

issued patents and 135 foreign issued patents and patent

applications. We review and assess our portfolio on a regular basis

to ensure protection and to align our patent strategy with our overall business

strategy.

We have

registered the trademarks ENTREMED, MIIKANA, and PANZEM in

the U.S. Patent and Trademark Office and have applications pending for

registration of the trademarks in selected foreign countries.

GOVERNMENT

REGULATION

Our

development, manufacture, and potential sale of therapeutics in the United

States are subject to extensive regulations.

In the

United States, the FDA regulates our product candidates currently being

developed as drugs or biologics. New drugs are subject to regulation

under the Federal Food, Drug, and Cosmetic Act (FFDCA), and biological products,

in addition to being subject to certain provisions of that Act, are regulated

under the Public Health Service Act (PHSA). We believe that the FDA

is likely to regulate the products currently being developed by us or our

collaborators as new drugs. Both the FFDCA and PHSA and corresponding

regulations govern, among other things, the testing, manufacturing, safety,

efficacy, labeling, storage, recordkeeping, advertising and other promotion of

biologics or new drugs, as the case may be. FDA clearances or

approvals must be obtained before clinical testing, and before manufacturing and

marketing of biologics or drugs.

7

Preparing

drug candidates for regulatory approval has historically been a costly and

time-consuming process. Generally, in order to gain FDA permission to

test a new agent, a developer first must conduct preclinical studies in the

laboratory and in animal model systems to gain preliminary information on an

agent's effectiveness and to identify any safety problems. The

results of these studies are submitted as a part of an IND application for a

drug or biologic, which the FDA must review before human clinical trials of an

investigational drug can begin. In addition to the known safety and

effectiveness data on the drug or biologic, the IND must include a detailed

description of the clinical investigations proposed to be

undertaken. Based on the current FDA organizational structure,

ENMD-2076 is regulated as a new drug by the FDA’s Center for Drug Evaluation and

Research (CDER). Generally, as new chemical entities like our small

molecules are discovered, formal IND-directed toxicology studies are required

prior to initiating human testing. Clinical testing may begin 30 days

after submission of an IND to the FDA unless FDA objects to the initiation of

the study or has outstanding questions to discuss with the IND

sponsor.

In order

to commercialize any drug or biological products, we or our collaborators must

sponsor and file an IND and conduct clinical studies to demonstrate the safety

and effectiveness necessary to obtain FDA approval of such

products. For studies conducted under INDs sponsored by us or our

collaborators, we or our collaborators will be required to select qualified

investigators (usually physicians within medical institutions) to supervise the

administration of the products, test or otherwise assess patient results, and

collect and maintain patient data; monitor the investigations to ensure that

they are conducted in accordance with applicable requirements, including the

requirements set forth in the general investigational plan and

protocols contained in the IND; and comply with applicable reporting and

recordkeeping requirements.

Clinical

trials of drugs or biologics are normally done in three phases, although the

phases may overlap. Phase 1 trials for drug candidates to be used to treat

cancer patients are concerned primarily with the safety and preliminary

effectiveness of the drug, involve a small group ranging from 15 - 40 subjects,

and may take from six months to over one year to complete. Phase 2

trials normally involve 30 - 200 patients and are designed primarily to

demonstrate effectiveness in treating or diagnosing the disease or condition for

which the drug is intended, although short-term side effects and risks in people

whose health is impaired may also be examined. Phase 3 trials are

expanded clinical trials with larger numbers of patients which are intended to

evaluate the overall benefit-risk relationship of the drug and to gather

additional information for proper dosage and labeling of the

drug. Phase 3 clinical trials generally take two to five years to

complete, but may take longer. The FDA receives reports on the

progress of each phase of clinical testing, as well as reports of unexpected

adverse experiences occurring during the trial. FDA may require the

modification, suspension, or termination of clinical trials, if it concludes

that an unwarranted risk is presented to patients, or, in Phase 2 and 3, if it

concludes that the study protocols are deficient in design to meet their stated

objectives.

If

clinical trials of a new drug candidate are completed successfully, the sponsor

of the product may seek FDA marketing approval. If the product is

classified as a new drug, an applicant must file a New Drug Application (NDA)

with the FDA and receive approval before commercial marketing of the

drug. The NDA must include detailed information about the product and

its manufacture and the results of product development, preclinical studies and

clinical trials.

The

testing and approval processes require substantial time and effort and there can

be no assurance that any approval will be obtained on a timely basis, if at

all. Although it is the policy of the FDA to complete the review of

the initial submission of NDAs within six to twelve months, the entire FDA

review process may take several years. Notwithstanding the submission

of relevant data, the FDA may ultimately decide that the NDA does not satisfy

its regulatory criteria and deny the approval. Further, the FDA may

require additional clinical studies before making a decision on approval. In

addition, the FDA may condition marketing approval on the conduct of specific

post-marketing studies to further evaluate safety and

effectiveness. Even if FDA regulatory clearances are obtained, a

marketed product is subject to continuing regulatory requirements and review

relating to Good Manufacturing Practices, adverse event reporting, promotion and

advertising, and other matters. Discovery of previously unknown

problems or failure to comply with the applicable regulatory requirements may

result in restrictions on the marketing of a product or withdrawal of the

product from the market, as well as possible civil or criminal

sanctions.

8

COMPETITION

Competition

in the pharmaceutical, biotechnology and biopharmaceutical industries is intense

and based significantly on scientific and technological factors, the

availability of patent and other protection for technology and products, the

ability and length of time required to obtain governmental approval for testing,

manufacturing and marketing and the ability to commercialize products in a

timely fashion. Moreover, the biopharmaceutical industry is

characterized by rapidly evolving technology that could result in the

technological obsolescence of any products that we develop.

We

compete with many specialized biopharmaceutical firms, as well as a growing

number of large pharmaceutical companies that are applying biotechnology to

their operations. Many biopharmaceutical companies have focused their

development efforts in the human therapeutics area, including oncology and

inflammation, and many major pharmaceutical companies have developed or acquired

internal biotechnology capabilities or made commercial arrangements with other

biopharmaceutical companies. These companies, as well as academic institutions,

governmental agencies and private research organizations, also compete with us

in recruiting and retaining highly qualified scientific personnel and

consultants.

Our

competition will be determined in part by the potential indications for which

our product candidates may be developed and ultimately approved by regulatory

authorities. We may rely on third parties to commercialize our products, and

accordingly, the success of these products will depend in significant part on

these third parties' efforts and ability to compete in these markets. The

success of any collaboration will depend in part upon our collaborative

partners' own competitive, marketing and strategic considerations, including the

relative advantages of alternative products being developed and marketed by our

collaborative partners and our competitors.

Many of

our existing or potential competitors have substantially greater financial,

technical and human resources than we do and may be better equipped to develop,

manufacture and market products. In addition, many of these competitors have

extensive experience in preclinical testing and human clinical trials and in

obtaining regulatory approvals. The existence of competitive products, including

products or treatments of which we are not aware, or products or treatments that

may be developed in the future, may adversely affect the marketability of

products that we may develop.

EMPLOYEES

In

December 2008, we selected ENMD-2076 as our leading program and accordingly

realigned our human resources to directly support and accelerate the clinical

development of ENMD-2076. Our work force currently consists of 13

full-time employees and 1 part-time employee dedicated to the core areas of our

operations. Certain of our activities, such as manufacturing and

clinical trial operations, are outsourced at the present time. We may

hire additional personnel, in addition to utilizing part-time or temporary

consultants, on an as-needed basis. None of our employees are

represented by a labor union, and we believe our relations with our employees

are satisfactory.

CORPORATE

HEADQUARTERS

We were

incorporated under Delaware law in 1991. Our principal executive

offices are located at 9640 Medical Center Drive, Rockville, Maryland 20850, and

our telephone number is (240) 864-2600. We also lease office space in

Durham, North Carolina where our clinical and regulatory operations are based

and lease laboratory space in Toronto, Ontario where we conduct correlative

research to support our development of ENMD-2076.

AVAILABLE

INFORMATION

Through our website at

www.entremed.com, we make available, free

of charge, our filings with the Securities and Exchange Commission (“SEC”),

including our annual proxy statements, annual reports on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K, and all amendments

thereto, as soon as reasonably practicable after such reports are filed

with or furnished to the Securities and Exchange Commission. Our

filings are also available through the Securities and Exchange Commission via

their website, http://www.sec.gov. You

may also read and copy any materials we file with the SEC at the SEC’s Public

Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may

obtain information on the operation of the Public Reference Room by calling the

SEC at 1-800-SEC-0330. The information contained on our website is

not incorporated by reference in this annual report on Form 10-K and should not

be considered a part of this report.

9

|

ITEM 1A.

|

RISK

FACTORS.

|

We

Have an Immediate Need for Capital and Will Need to Raise Additional Capital in

the Future to Continue our Business, and our Independent Registered Public

Accounting Firm Has Expressed Substantial Doubt as to our Ability to Continue as

a Going Concern

We estimate that our current capital

resources will not be sufficient to fund our operations significantly beyond

September 2010 without an additional curtailment of operating expenditures or

new equity or debt financing. In addition, our financial statements have been

prepared on the assumption that we will continue as a going concern, which

contemplates the realization of assets and liquidation of liabilities in the

normal course of business. However, our independent registered public accounting

firm’s report on our financial statements as of and for the fiscal year ended

December 31, 2009, includes an explanatory paragraph that states that our

recurring losses from operations raise substantial doubt about our ability to

continue as a going concern.

Our ability to continue as a going

concern is dependent on our success at raising additional capital sufficient to

meet our obligations on a timely basis and to ultimately attain profitability.

In the event we are unable to successfully raise additional capital, it is

unlikely that we will have sufficient cash flows and liquidity to finance our

business operations as currently contemplated. Accordingly, in the event new

financing is not obtained, we will likely reduce general and administrative

expenses and delay clinical development activity until we are able to obtain

sufficient financing to do so. These factors could significantly limit our

ability to continue as a going concern.

We

Have a History of Losses and Anticipate Future Losses

To date,

we have been engaged primarily in research and development activities. Although

we receive limited revenues on royalties from sales of Thalomid® and in

the past have received license fees and research and development funding from a

former collaborator and limited revenues from certain research grants, we have

not derived significant revenues from operations.

We have experienced losses in each year

since inception. Through December 31, 2009, we had an accumulated

deficit of approximately $366 million. We expect that it will

be very difficult to raise capital to continue our operations and our

independent registered public accounting firm has issued an opinion with an

explanatory paragraph to the effect that there is substantial doubt about our

ability to continue as a going concern. Although we have been

successfully funded to date by attracting investors in our equity securities and

through royalty payments, there is no assurance that our capital-raising efforts

will be able to attract the capital needed to sustain our operations beyond that

date or that such royalty payments will continue to provide revenues at

historical levels. If we are unable to obtain additional funding for

operations, we may not be able to continue operations as proposed, requiring us

to modify our business plan, curtail various aspects of our operations or cease

operations. In such event, investors may lose a portion or all of their

investment.

Losses

have continued since December 31, 2009. We will also be required to

conduct substantial research and development and clinical testing activities for

ENMD-2076. We expect that these activities will result in operating losses for

the foreseeable future before we commercialize any products, if

ever. In addition, to the extent we rely on others to develop and

commercialize our products, our ability to achieve profitability will depend

upon the success of these other parties. To support our research and

development of certain product candidates, we may seek and rely on cooperative

agreements from governmental and other organizations as a source of support. If

a cooperative agreement were to be reduced to any substantial extent, it may

impair our ability to continue our research and development

efforts. Even if we do achieve profitability, we may be unable to

sustain or increase it.

10

Our

Common Stock May be Delisted From The NASDAQ Capital Market, Which Could

Negatively Impact the Price of Our Common Stock and Our Ability to Access the

Capital Markets

NASDAQ Minimum $1.00 Closing Bid

Price

On

April 4, 2008, we received a letter from The NASDAQ Stock Market LLC

(“NASDAQ”) advising that for the previous 30 consecutive business days, the bid

price of the Company’s common stock had closed below the minimum $1.00 per share

requirement for continued inclusion on The NASDAQ Global Market. The

letter also advised us that failure to comply with this minimum bid price

requirement, or any other listing standard applicable to issuers listed on The

NASDAQ Global Market, by October 1, 2008, would result in our common stock

being ineligible for quotation on The NASDAQ Global Market. Our stock price has

not closed above $1.00 for ten consecutive trading days since the date of the

receipt of the letter from NASDAQ.

On

September 22, 2008, we submitted an application to transfer the trading of

our common stock to The NASDAQ Capital Market. On October 1, 2008, we

received a letter from The NASDAQ Listing Qualifications Department stating that

our application had been approved and that our common stock would commence

trading on The NASDAQ Capital Market on October 3, 2008. The NASDAQ Capital

Market operates in substantially the same manner as The NASDAQ Global Market.

Our trading symbol remains as “ENMD” and the trading of our stock was unaffected

by the transfer.

NASDAQ

suspended the enforcement of the minimum bid price rule, because of the current

extraordinary market conditions, until July 31, 2009. Upon

reinstatement of the rule on August 3, 2009, under NASDAQ rules, we had

until January 15, 2010, to regain compliance with the minimum bid price

standard. We did not regain compliance with the minimum bid price

standard of the NASDAQ rules by January 15, 2010.

On

January 19, 2010, we received a Staff Determination letter from NASDAQ stating

that we were not in compliance with the continued listing rules and that our

Common Stock would be delisted unless we requested an appeal of such

determination. On January 20, 2010, we filed an appeal of the

Staff's determination to a NASDAQ Hearings Panel (the “Panel”), pursuant to the

procedures set forth in the NASDAQ Marketplace Rules. The hearing request

stayed the delisting of the Company’s securities pending the Panel's

decision. On February 25, 2010, we met with the Panel providing them

a plan of action, with the intention of returning to compliance with NASDAQ’s

requirements. On March 23, 2010, we received a decision letter from

the Panel granting our request to extend the compliance date for an additional

180 days or until July 16, 2010. As a result of this decision by the

Panel, our stock will continue to trade on The Nasdaq Capital Market until such

date, by which time our minimum bid price must have exceeded $1.00 for ten

consecutive trading days.

In the

event that our common stock continues to trade under $1.00, we will consider all

alternatives in order to maintain the public trading status of our stock,

including electing to implement a reverse stock split with the approval of our

stockholders. We

have not made a final determination as to whether to affect a reverse split, as

we continue to have an opportunity to meet the $1.00 minimum closing bid price

during the 180-day extension period. An alternative to not having to

meet both the NASDAQ $1.00 minimum closing bid price and the $2.5 million

stockholders’ equity is to apply to have our common stock traded on the

Over-The-Counter Bulletin Board (the “OTCBB”), an electronic quotation system

that displays stock quotes by market makers. If such course of action

is taken, there can be no assurance that our common stock would be timely

admitted for trading on that market. This alternative may result in a

less liquid market available for existing and potential shareholders to buy and

sell shares of our common stock and could further depress the price of our

stock.

The

delisting of our common stock from a national exchange could significantly

affect the ability of investors to trade our securities and could negatively

affect the value and liquidity of our common stock. Delisting could also have

other negative results, including the potential loss of confidence by employees,

the loss of institutional investor interest and fewer business development

opportunities. In addition, the delisting of our common stock could materially

adversely affect our ability to raise capital on terms acceptable to us or at

all.

11

NASDAQ

Minimum $2.5 Million Stockholders’ Equity

Additionally,

we must continually maintain (1) stockholders’ equity of at least $2.5 million

or (2) a minimum of $35 million in market value of our listed securities for ten

consecutive trading days to be in compliance with the continued listing

standards for The NASDAQ Capital Market. At December 31, 2009, our

consolidated stockholders’ deficit was approximately $1.9 million and the market

value of our listed securities was $70.9 million. There can be no

assurance that we will be able to meet either of these listing standards in the

future. If we do not meet one of these NASDAQ listing requirements,

we will be in a deficiency period and will submit a plan of compliance with

NASDAQ. After the deficiency period, if we are unable to successfully

appeal to the NASDAQ Panel for an extension of time to regain compliance, our

common stock could be delisted from The NASDAQ Capital Market.

The

Current Capital and Credit Market Conditions May Adversely Affect the Company’s

Access to Capital, Cost of Capital, and Ability to Execute its Business Plan as

Scheduled

Access to

capital markets is critical to our ability to operate. Traditionally,

biopharmaceutical companies (such as we) have funded their research and

development expenditures through raising capital in the equity

markets. Declines and uncertainties in these markets over the past

two years have severely restricted raising new capital and have affected our

ability to continue to expand or fund existing research and development efforts.

We require significant capital for research and development for our product

candidates and clinical trials. In recent years, the general economic and

capital market conditions in the United States have deteriorated significantly

and have adversely affected our access to capital and increased the cost of

capital, and there is no certainty that a recovery in the capital and credit

markets, enabling us to raise capital in an amount to sufficiently fund our

short-term and long-term plans, will occur in 2010. If these economic

conditions continue or become worse, the Company’s future cost of equity or debt

capital and access to the capital markets could be adversely affected. In

addition, an inability by the Company to access the capital markets on favorable

terms because of our low stock price, or upon our delisting from the NASDAQ

Stock Market if we fail to satisfy a listing requirement, could affect our

ability to execute our business plan as scheduled. Moreover, we rely and intend

to rely on third parties, including our clinical research organizations, third

party manufacturers, and certain other important vendors and consultants. As a

result of the current volatile and unpredictable global economic situation,

there may be a disruption or delay in the performance of our third-party

contractors and suppliers. If such third parties are unable to adequately

satisfy their contractual commitments to us in a timely manner, our business

could be adversely affected.

We

are Uncertain Whether Additional Funding Will Be Available For Our Future

Capital Needs and Commitments, and If We Cannot Raise Additional Funding, or

Access the Credit Markets, We May Be Unable to Complete Development of Our

Product Candidates

We will

require substantial funds in addition to our existing working capital to develop

our product candidates and otherwise to meet our business objectives. We have

never generated sufficient revenue during any period since our inception to

cover our expenses and have spent, and expect to continue to spend, substantial

funds to continue our research and development and clinical programs. Any one of

the following factors, among others, could cause us to require additional funds

or otherwise cause our cash requirements in the future to increase

materially:

|

|

·

|

results of research and

development activities;

|

|

|

·

|

progress of our preclinical

studies or clinical trials;

|

|

|

·

|

results of clinical

trials;

|

|

|

·

|

changes in or terminations of our

relationships with strategic

partners;

|

|

|

·

|

changes in the focus, direction,

or costs of our research and development

programs;

|

|

|

·

|

competitive and technological

advances;

|

|

|

·

|

establishment of marketing and

sales capabilities;

|

|

|

·

|

manufacturing;

|

|

|

·

|

the regulatory approval process;

or

|

|

|

·

|

product

launch.

|

12

At

December 31, 2009, we had cash, cash equivalents and short-term investments of

approximately $6,366,253. During the first quarter of 2010, we

raised an additional $4.6 million. We currently have no commitments

or arrangements for any financing. We may continue to seek additional

capital through public or private financing or collaborative agreements. Our

operations require significant amounts of cash. We may be required to seek

additional capital, whether from sales of equity or debt or additional

borrowings, for the future growth and development of our business. We can give

no assurance as to the availability of such additional capital or, if available,

whether it would be on terms acceptable to us. In addition, we may continue to

seek capital through the public or private sale of securities, if market

conditions are favorable for doing so. If we are successful in raising

additional funds through the issuance of equity securities, stockholders will

likely experience substantial dilution, or the equity securities may have

rights, preferences, or privileges senior to those of the holders of our common

stock. If we raise funds through the issuance of debt securities, those

securities would have rights, preferences, and privileges senior to those of our

common stock. The current credit environment has negatively affected the

economy, and we have considered how it might affect our business. Events

affecting credit market liquidity could increase borrowing costs or limit

availability of funds, and due to the continued adverse trends in the credit

market, it may not be possible to refinance our existing credit facility to take

advantage of lower interest rates. Moreover, the covenants of our term loan

agreement contain provisions that may restrict the debt we may incur in the

future. If we are not successful in obtaining sufficient capital because we are

unable to access the capital markets at financially economical interest rates,

it could reduce our research and development efforts and may materially

adversely affect our future growth, results of operations and financial results,

and we may be required to curtail significantly, or eliminate at least

temporarily, one or more of our drug development programs.

We Rely Exclusively on the Royalty

Payments Based upon Thalomid ® Sales by a Third Party to Produce our

Revenues

We

entered into a licensing agreement in 2001 regarding royalty payments for

Thalomid®, and in

2004, certain provisions of that agreement were satisfied, which then entitled

the Company to share in royalty payments received by Royalty Pharma Finance

Trust on annual Thalomid® sales

above a certain threshold. Based on the licensing agreement royalty formula,

annual royalty sharing commences with Thalomid® annual

sales of approximately $225 million. During the year ended

December 31, 2009, royalty payments from Thalomid® sales by

Celgene Corporation accounted for substantially all of our total

revenues. As Thalomid® is

distributed and sold by Celgene and/or its affiliates, we are reliant on a third

party for our revenues. Our royalty payment in the third quarter of

2009 experienced a decline as compared to the same quarter in 2008, and our

total revenues earned in 2009 were lower than 2008. A wide

variety of events could cause Thalomid® sales to

decline, resulting in a material reduction in our revenues. For

example, if a competing drug gains greater market share or wider acceptance, or

if regulatory approvals for certain uses of Thalomid® are

withdrawn, such events could adversely affect our royalty revenue. In

the event that Celgene determines to cease selling Thalomid® or

target its sales efforts to other proprietary drugs, or unexpected adverse

effects are reported by patients or doctors in connection with the use of

Thalomid®, patient

and physician confidence in Thalomid® as a

treatment could be adversely affected. The inability of one of these third

parties to perform these functions, or the failure of any of these parties to

perform successfully, could cause our revenues to suffer. Additionally, if a

competitor to Celgene successfully introduces a generic pharmaceutical product

equivalent to Thalomid® at a

relatively lower price and bypasses Celgene’s S.T.E.P.S.®

proprietary distribution program, such action could have the effect of reducing

the market share and profitability of Thalomid®, thus

potentially causing a material adverse effect on our revenues and cash flow.

Because we are dependent on sales of Thalomid®, any

reduction in Thalomid® sales

for any reason, including, but not limited to, the reasons described, would

cause our results of operations to suffer.

13

The

Market Price of Our Common Stock May Be Highly Volatile or May Decline

Regardless of Our Operating Performance

Our

common stock price has fluctuated from year-to-year and quarter-to-quarter and

will likely continue to be volatile. Our stock has not traded at the

minimum closing bid price of $1.00 for a period of ten or more days in the past

twelve months. The valuations of many biotechnology companies without

consistent product revenues and earnings are extraordinarily high based on

conventional valuation standards, such as price to earnings and price to sales

ratios. These trading prices and valuations may not be sustained. In the future,

our operating results in a particular period may not meet the expectations of

any securities analysts whose attention we may attract, or those of our

investors, which may result in a decline in the market price of our common

stock. Any negative change in the public’s perception of the prospects of

biotechnology companies could depress our stock price regardless of our results

of operations. These factors may materially and adversely affect the market

price of our common stock.

Our

Existing Term Loan Contains Affirmative and Negative Covenants That May Restrict

our Business and Financing Activities

We entered into a $20 million loan

agreement with General Electric Capital Corporation, as agent for the lenders

party thereto, on September 12, 2007. The loan agreement is

secured by a pledge of all of our assets other than intellectual property,

including the shares of the outstanding capital stock, or other equity

interests, of each of our subsidiaries, and contains a variety of operational

covenants, including limitations on our ability to incur liens or additional

debt, make dispositions, pay dividends, redeem our stock, make certain

investments and engage in certain merger, consolidation or asset sale

transactions and transactions with affiliates, among other restrictions. Any

future debt financing we enter into may involve similar or more onerous

covenants that restrict our operations. Our borrowings under the loan agreement

or any future debt financing we do will need to be repaid, which creates

additional financial risk for our company, particularly if our business, or

prevailing financial market conditions, are not conducive to paying-off or

refinancing our outstanding debt obligations. Furthermore, our failure to comply

with the covenants in the loan agreement could result in an event of default

that, if not cured or waived, could result in the acceleration of all or a

substantial portion of our debt, which could have a material adverse effect on

our cash position, business, prospects, financial condition and results of

operations. Our final scheduled payment under the loan agreement is

in January 2011.

Our

Secured Lender and Preferred Stockholder Would Have Priority in Distributions

Over our Common Stockholders Following a Liquidation Event Affecting the

Company. As a Result, in the Event of a Liquidation Event, our Common

Stockholders Would Receive Distributions Only After Priority Distributions Are

Paid

In the

event of a Liquidation Event (as such term is defined in our Certificate of

Designation of Series A Convertible Preferred Stock), our senior lender would be

repaid first out of the proceeds received. Celgene, the sole holder of our

outstanding Series A Convertible Preferred Stock (“Series A

Preferred”), then would be paid an amount equal to the Series A Preferred

liquidation preference of $10.00 per share of Series A Preferred, plus all

accrued and unpaid dividends on such shares of Series A Preferred, which

totals approximately $7 million as of December 31,

2009. Additionally, unless waived, the holder of the Series A

Preferred would be entitled to receive the Series A liquidation preference

plus all accrued and unpaid dividends prior to any distributions to our common

stockholders upon the occurrence of certain other liquidation

events. As a result, in the event of a Liquidation Event, our common

stockholders’ ability to realize value for their shares would be subject to the

payment of such priority distributions.

Development

of Our Products is at an Early Stage and is Uncertain

Our

proposed products and research programs are in the early stage of clinical

development and require significant, time-consuming and costly research and

development, testing and regulatory clearances. In developing our products, we

are subject to risks of failure that are inherent in the development of these

products and therapeutic procedures. For example, it is possible that any or all

of our proposed products will be ineffective or toxic, or otherwise will fail to

receive necessary FDA clearances. There is a risk that the proposed products

will be uneconomical to manufacture or market or will not achieve market

acceptance. There is also a risk that third parties may hold proprietary rights

that preclude us from marketing our proposed products or that others will market

a superior or equivalent product. Further, our research and development

activities might never result in commercially viable products.

14

A number

of companies in the pharmaceutical and biotechnology industries have suffered

significant setbacks in advanced clinical trials even after promising results in

earlier trials.

In

particular, given the current conditions in the financial markets, an

unfavorable outcome in our Phase 2 trials for ENMD 2076, or a significant delay

in initiating such trials, may require us to delay, reduce the scope of, or

eliminate this program and could have a material adverse effect on our company

and the value of our common stock.

Once a

clinical trial has begun, it may be delayed, suspended or terminated due to a

number of factors, including:

|

|

·

|

ongoing

discussions with regulatory authorities regarding the scope or design of

our clinical trials or requests by them for supplemental information with

respect to our clinical trial

results;

|

|

|

·

|

failure

to conduct clinical trials in accordance with regulatory

requirements;

|

|

|

·

|

lower

than anticipated retention rate of patients in clinical

trials;

|

|

|

·

|

serious

adverse events or side effects experienced by participants;

and

|

|

|

·

|

insufficient

supply or deficient quality of product candidates or other materials

necessary for the conduct of our clinical

trials.

|

Many of

these factors may also ultimately lead to denial of regulatory approval of a

current or potential product candidate. If we experience delays,

suspensions or terminations in a clinical trial, the commercial prospects for

the related product candidate will be harmed, and our ability to generate

product revenues will be delayed.

Our

product candidates are at the clinical stage of development. Although several of

our product candidates have demonstrated some promising results in early

clinical (human) trials and preclinical (animal) studies, they may not

prove to be effective in humans. For example, testing on animals may occur under

different conditions than testing in humans and therefore the results of animal

studies may not accurately predict human experience. Likewise, early clinical

studies may not be predictive of eventual safety or effectiveness results in

larger-scale pivotal clinical trials.

There are

many regulatory steps that must be taken before any of these product candidates

will be eligible for FDA approval and subsequent sale, including the completion

of preclinical and clinical trials. We do not expect that these product

candidates will be commercially available for several years, if

ever.

Technological

Developments By Competitors May Render Our Products Obsolete

If

competitors were to develop superior technologies, our technologies could be

rendered noncompetitive or obsolete, resulting in a material adverse effect to

our business. Developments in the biotechnology and pharmaceutical industries

are expected to continue at a rapid pace. Success depends upon achieving and

maintaining a competitive position in the development of products and

technologies. Competition from other biotechnology and pharmaceutical companies

can be intense. Many competitors have substantially greater research and

development capabilities, marketing, financial and managerial resources and

experience in the industry. Even if a competitor creates a technology that is

not superior, we may not be able to compete with such technology.

We

Must Show the Safety and Efficacy of Our Product Candidates Through Clinical

Trials, the Results of Which are Uncertain

Before

obtaining regulatory approvals for the commercial sale of our products, we must

demonstrate, through preclinical studies (animal testing) and clinical trials

(human testing), that our proposed products are safe and effective for use in

each target indication. Testing of our product candidates will be required, and

failure can occur at any stage of testing. Clinical trials may not demonstrate

sufficient safety and efficacy to obtain the required regulatory approvals or

result in marketable products. The failure to adequately demonstrate the safety

and efficacy of a product under development could delay or prevent regulatory

approval of the potential product.

15

Clinical

trials for the product candidates we are developing may be delayed by many

factors, including that potential patients for testing are limited in number.

The failure of any clinical trials to meet applicable regulatory standards could

cause such trials to be delayed or terminated, which could further delay the

commercialization of any of our product candidates. Newly emerging safety risks

observed in animal or human studies also can result in delays of ongoing or

proposed clinical trials. Any such delays will increase our product development

costs. If such delays are significant, they could negatively affect our

financial results and the commercial prospects for our products.

The

Independent Clinical Investigators and Contract Research Organizations That We

Rely Upon to Assist in the Conduct of Our Clinical Trials May Not Be Diligent,

Careful or Timely, and May Make Mistakes, in the Conduct of Our

Trials

We depend

on independent clinical investigators and contract research organizations, or

CROs, to assist in the conduct of our clinical trials under their agreements

with us. The investigators are not our employees, and we cannot control the

amount or timing of resources that they devote to our programs. If independent

investigators fail to devote sufficient time and resources to our drug

development programs, or if their performance is substandard, it will delay the

approval of our FDA applications and our introduction of new drugs. The CROs we

contract with to assist with the execution of our clinical trials play a

significant role in the conduct of the trials and the subsequent collection and

analysis of data. Failure of the CROs to meet their obligations could adversely

affect clinical development of our products.

The

Success of Our Business Depends Upon the Members of Our Senior Management Team,

Our Scientific Staff and Our Ability to Continue to Attract and Retain Qualified

Scientific, Technical and Business Personnel

We are

dependent on the principal members of our reconstituted senior management team

and scientific staff for our business success. The loss of any of these people

could impede the achievement of our development and business objectives. We do

not carry key man life insurance on the lives of any of our key personnel. There

is intense competition for human resources, including management, in the

scientific fields in which we operate and there can be no assurance that we will

be able to attract and retain qualified personnel necessary for the successful

development of ENMD-2076, and any expansion into areas and activities requiring

additional expertise. In addition, there can be no assurance that such personnel

or resources will be available when needed. In addition, we rely on a

significant number of consultants to assist us in formulating our clinical

strategy and other business activities. All of our consultants may have

commitments to, or advisory or consulting agreements with, other entities that

may limit their availability to us.

We

May Need New Collaborative Partners to Further Develop and Commercialize

Products, and if We Enter Into Such Arrangements, We May Give Up Control Over

the Development and Approval Process and Decrease our Potential

Revenue

We plan

to develop and commercialize our product candidates both with and without

corporate alliances and partners. Nonetheless, we intend to explore

opportunities for new corporate alliances and partners to help us develop,

commercialize and market our product candidates. We expect to grant to our

partners certain rights to commercialize any products developed under these

agreements, and we may rely on our partners to conduct research and development

efforts and clinical trials on, obtain regulatory approvals for, and manufacture

and market any products licensed to them. Each individual partner will seek to

control the amount and timing of resources devoted to these activities

generally. We anticipate obtaining revenues from our strategic partners under

such relationships in the form of research and development payments and payments

upon achievement of certain milestones. Since we generally expect to obtain a

royalty for sales or a percentage of profits of products licensed to third

parties, our revenues may be less than if we retained all commercialization

rights and marketed products directly. In addition, there is a risk that our

corporate partners will pursue alternative technologies or develop competitive

products as a means for developing treatments for the diseases targeted by our

programs.

16

We may

not be successful in establishing any collaborative arrangements. Even if we do

establish such collaborations, we may not successfully commercialize any

products under or derive any revenues from these arrangements. Our strategy also

involves entering into multiple, concurrent strategic alliances to pursue

commercialization of our core technologies. There is a risk that we will be

unable to manage simultaneous programs successfully. With respect to existing

and potential future strategic alliances and collaborative arrangements, we will

depend on the expertise and dedication of sufficient resources by these outside

parties to develop, manufacture, or market products. If a strategic alliance or

collaborative partner fails to develop or commercialize a product to which it

has rights, we may not recognize any revenues on that particular

product.

We

Have No Current Manufacturing or Marketing Capacity and Rely on Only One

Supplier For Some of Our Products

We do not

expect to manufacture or market products in the near term, but we may try to do

so in certain cases. We do not currently have the capacity to manufacture or

market products and we have limited experience in these activities. The

manufacturing processes for all of the small molecules we are developing have

not yet been tested at commercial levels, and it may not be possible to

manufacture these materials in a cost-effective manner. If we elect

to perform these functions, we will be required to either develop these

capacities, or contract with others to perform some or all of these tasks. We

may be dependent to a significant extent on corporate partners, licensees, or

other entities for manufacturing and marketing of products. If we engage

directly in manufacturing or marketing, we will require substantial additional

funds and personnel and will be required to comply with extensive regulations.

We may be unable to develop or contract for these capacities when required to do

so in connection with our business.

We depend

on our third-party manufacturers to perform their obligations effectively and on

a timely basis. These third parties may not meet their obligations and any such

non-performance may delay clinical development or submission of products for