Attached files

Southwest Iowa Renewable Energy, LLC

Annual Meeting - Financial Overview

March 19, 2010

1

Strictly Confidential

• The following information contains, or may be deemed to contain, “forward

-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended. These forward-looking statements include all

statements regarding the current intent, belief or expectations regarding

matters covered and all statements which are not statements of historical

fact. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances

that may or may not occur in the future. The future results of the issuer

may vary from the results expressed in, or implied by, forward-looking

statements, possibly to a material degree. Since these factors can cause

results, performance and achievements to differ materially from those

discussed in this presentation, you are cautioned not to place undue

reliance on the forward-looking statements. Southwest Iowa Renewable

Energy, LLC (“SIRE”) will update these forward-looking statements to

reflect any material changes occurring prior to the completion of the

offering. For a discussion of some of the important factors that could

cause results to differ from those expressed in, or implied by, the forward-

looking statements contained herein, please refer to SIRE’s Annual Report

(SEC File No. 083-00131), in particular, the “Risk Factors” section. The

forward-looking statements in this document are excluded from the safe

harbor protection of Section 27A of the Securities Act of 1933.

-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended. These forward-looking statements include all

statements regarding the current intent, belief or expectations regarding

matters covered and all statements which are not statements of historical

fact. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances

that may or may not occur in the future. The future results of the issuer

may vary from the results expressed in, or implied by, forward-looking

statements, possibly to a material degree. Since these factors can cause

results, performance and achievements to differ materially from those

discussed in this presentation, you are cautioned not to place undue

reliance on the forward-looking statements. Southwest Iowa Renewable

Energy, LLC (“SIRE”) will update these forward-looking statements to

reflect any material changes occurring prior to the completion of the

offering. For a discussion of some of the important factors that could

cause results to differ from those expressed in, or implied by, the forward-

looking statements contained herein, please refer to SIRE’s Annual Report

(SEC File No. 083-00131), in particular, the “Risk Factors” section. The

forward-looking statements in this document are excluded from the safe

harbor protection of Section 27A of the Securities Act of 1933.

2

3

P&L Summary

v Gross Margin of $6.22M or $0.65 per gal

v Op Ex of $4.09M or $0.42 per gal

v EBITDA of $2.13M or $0.22 per gal (before hedging gain of $448k)

Operating Summary - January 31, 2010

4

Ethanol

v Denatured production of 8.7 MMGY

v 90.246% of nameplate production based on 352 days/yr

Turnover

v Sold 99.71% of gallons produced and 104.8% of DDGS tons produced

v Ground 96.73% of corn purchased bringing ending inventory to 1,741k bu

Yields

v 2.80 denatured yield was equal to the 6 month average of 2.80

v Energy consumption of 28,406 mmbtu per gal

Co Product Return

v Co Product revenue / corn cost = 26.5% vs. 6 mo avg. = 23.3%

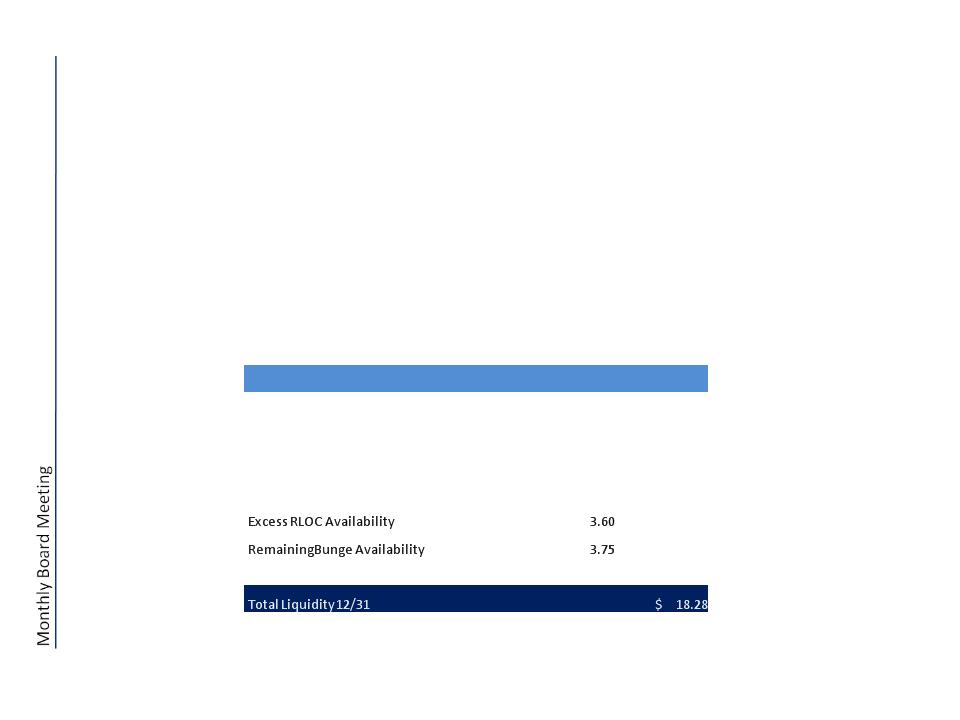

Liquidity Summary

5

v Additional availability on Revolving Line of Credit (RLOC) = $3.60 million

v Total liquidity of $18.28M including $3.75 of remaining availability on Bunge line

|

|

|

|

|

|

|

|

|

|

Borrowing Base on RLOC

|

|

$15.10

|

|

||

|

|

Outstanding RLOC

|

|

9.50

|

|

|

|

|

|

Mid Am LC Reserve

|

|

2.00

|

|

|

|

|

|

Amounts against BB

|

|

|

11.50

|

|

|

|

|

|

|

|

|

|

|

|

|

Excess RLOC Availability 12/31

|

|

$3.60

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

|

$ 10.93

|

|

|

|

|

|

|

||||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Liquidity Graph - January 31, 2010

6