Attached files

| file | filename |

|---|---|

| 10-K - ANNUAL REPORT FOR YEAR ENDED DECEMBER 31, 2009 - MNP Petroleum Corp | form10k.htm |

| EX-10.41 - FORM OF STOCK OPTION AGREEMENT (INVESTOR RELATIONS) - MNP Petroleum Corp | exhibit10-41.htm |

| EX-31.1 - SECTION 302 CERTIFICATION OF CEO - MNP Petroleum Corp | exhibit31-1.htm |

| EX-23.2 - CONSENT OF BDO VISURA - MNP Petroleum Corp | exhibit23-2.htm |

| EX-32.2 - SECTION 906 CERTIFICATION OF CFO - MNP Petroleum Corp | exhibit32-2.htm |

| EX-23.1 - CONSENT OF DELOITTE AG - MNP Petroleum Corp | exhibit23-1.htm |

| EX-31.2 - SECTION 302 CERTIFICATION OF CFO - MNP Petroleum Corp | exhibit31-2.htm |

| EX-10.42 - FORM OF STOCK OPTION AGREEMENT (NON-INVESTOR RELATIONS) - MNP Petroleum Corp | exhibit10-42.htm |

| EX-32.1 - SECTION 906 CERTIFICATION OF CEO - MNP Petroleum Corp | exhibit32-1.htm |

ENGLISH TRANSLATION

FRAMEWORK AGREEMENT

TRANSFER OF RIGHTS

AND OTHERS

SPECIAL OPERATION AGREEMENT FOR

HYDROCARBON EXPLORATION AND EXPLOITATION

– TRANQUILO BLOCK

GEOPARK MAGALLANES LIMITADA

AND OTHERS

<><><><><><><><><><>><><><><><><><><><><><><><><><>

In Santiago, Republic of Chile, the following agreement was reached on the 29 January 2010 between the following companies:

GEOPARK MAGALLANES LIMITADA, a company whose line of business is hydrocarbon exploration and exploitation, Taxpayer’s number 76,031,342-4 (seventy-six million thirty-one thousand three hundred forty-two hyphen four), duly represented as accredited by Mr. Andrés Eduardo Aylwin Chiorrini, Chilean, lawyer, national identity card number seven million three hundred forty-seven thousand two hundred forty-four hyphen K), both with addresses for these purposes at Avenida Isidora Goyenechea number three thousand one hundred sixty-two, office eight hundred one, Las Condes municipality, Santiago, Chile, hereinafter referred to indistinctly as “Geopark”;

PLUSPETROL CHILE S.A., company whose line of business is hydrocarbon exploration and exploitation, Taxpayer’s number 76.041.566 -9, represented by Mr. Rafael Rencoret Portales, Chilean, single, lawyer, identity card number 15.313.075 -2, all with addresses at Avenida Andrés Bello N. 2711, 16th floor, municipality of Las Condes, Santiago, Metropolitan Region, hereinafter referred to indistinctly as “Pluspetrol”;

IPR CHILE TRANQUILO LIMITADA, a company whose line of business is hydrocarbon exploration and exploitation, Taxpayer’s number 76,015,333-8, represented, as accredited, by Ms. Jimena Bronfman Crenovich, Chilean, single, lawyer, identity card number 4,709,492-5, all with address for these purposes at Vitacura 2939, 8th Floor, Las Condes municipality, Santiago, Metropolitan Region, hereinafter referred to indistinctly as “IPR”;

MANAS ENERGÍA CHILE LIMITADA, a company whose line of business is hydrocarbon exploration and exploitation, Taxpayer’s number still to be settled, represented, as accredited, by Ms. Jimena Bronfman Crenovich, Chilean, single, lawyer, identity card number 4,709,492-5, all with address for these purposes at Miraflores 178, 12th Floor, Santiago municipality, Santiago, Metropolitan Region, hereinafter referred to indistinctly as “Manas”;

1

WINTERSHALL CHILE LIMITADA, a company whose line of business is hydrocarbon exploration, exploitation, transport, marketing and sale, Taxpayer’s number 76,064,278-5 (seventy-six million thirty-four thousand two hundred seventy-eight hyphen five), duly represented as accredited by Mr. Heiko Hans-Jorg Meyer, German, married, engineer, passport of the Federal Republic of German number C4CKG1LJT and Ms Brenda Inés Anthony, Argentine, single, lawyer, passport of Argentina number twenty-four million five hundred and sixty-three thousand three hundred and seventy-five N, all with addresses at Avendia Isidora Goyeneche, municipality of Las Condes, Santiago, Metropolitan Region, hereinafter referred to indistinctly as “Wintershall”;

METHANEX CHILE S.A., a company incorporated according to the laws of Chile and whose line of business is the manufacturing, production, marketing and distribution of basic chemical substances, Taxpayer’s number 76,030,472-7 (seventy-six million thirty thousand four hundred seventy-two hyphen seven), represented, as will be accredited, by Mr. Francisco Ajenjo Isasi, Chilean, married, industrial civil engineer, identity number 5,295,001-5, and Mr. Juan Enrique González Sierra, Chilean, married, commercial engineer, identity card number 5,059,414-9, all with address for these purposes at Avenida Apoquindo 3200 (three thousand two hundred), fifth floor, Las Condes municipality, Santiago, hereinafter referred to indistinctly as “Methanex”;

FIRST: BACKGROUND

1) That Pluspetrol, Geopark, IPR and Manas are the current participants of the Special Operation Agreement for Hydrocarbon Deposit Exploration and Exploitation, Tranquilo Block, XII Region of Magallanes and Chilean Antarctic, executed with the Chilean State, hereinafter referred to as the “CEOP”, with the following participation percentages: 20% for IPR, 20% for Manas, 30% for Pluspetrol and 30% for Geopark. With respect to the CEOP, the Contracting Participants place on the record the following: 1.1) That by means of the public instrument executed in presence of the Public Notary of Santiago, Mr. Raúl Iván Perry Pefaur, dated the twenty-ninth of April of two thousand eight, the Chilean State, as one party, and, as the other party, the Contractor, formed by the participants IPR and MANAS, with 50% participation each, executed the CEOP. 1.2) That by means of the public instrument executed in presence of the Public Notary of Santiago, Mrs. Antonieta Mendoza Escalas, dated the nineteenth of January of two thousand nine, IPR and Manas transferred part of their rights in the CEOP to Geopark and to Pluspetrol, with the Contractor Participants then being IPR, Manas, Geopark and Pluspetrol, each one with the following participation percentages: 30% for Geopark, 30% for Pluspetrol, 20% for IPR and 20% for Manas. 1.3) That the Contractor Participants designated Geopark as Operator of the CEOP, with authority and exclusive right to carry out the oil operations within the area of the CEOP.

2) That it is the intention of the appearing parties to modify the participation in the CEOP for the purpose of incorporating Wintershall, Methanex and IFC to it, with IPR and Manas transferring all their rights, interests and obligations in the CEOP, as well as to regulate their relations and financing contributions while the approval of the public authority referred to in the following paragraph is pending.

2

3) That even if the IFC party does not appear in the present Framework Agreement, it is the intention and the interest of the appearing parties that IFC be incorporated as participating in the CEOP by which motive Geopark, with the approval of the other appearing parties, assumes the obligation to cede and transfer to it, under the terms and conditions established in this Framework Agreement, 12.5% of the rights in the CEOP. Thus IFC’s willingness to be incorporated in the CEOP is established as IFC accepts the request for approval as referred to in the above clause 2.

4) That in compliance with the provisions of article 14.1 of the CEOP, prior written approval of the Mining Ministry is required for the transfer of all or part of the rights, interests and obligations in the CEOP by a Contractor Participant.

5) That the terms used in this Agreement and that are not expressly defined, will have the meaning that is given them in the CEOP.

SECOND: PURPOSE

In order to achieve the proposal expressed in the preceding clause, the appearing parties have made the following agreements:

1) That, once the provisions of clauses 3.1 and 3.3 of this instrument are fulfilled, the new participation percentages of the CEOP will be the following: 25% for Pluspetrol, 25% for Geopark, 25% for Wintershall, 12.5% for Methanex and 12.5% for IFC. As a consequence of the above, IPR and Manas will transfer all their rights, interests and obligations to the CEOP.

2) For the purpose of achieving these new participations and for IPR and Manas to leave off being Contractor Participants in the CEOP, the appearing parties are obliged to present to the Mining Ministry the request for approval of the transfer of rights, interests and obligations in the CEOP and to formalize the corresponding transfer agreements once the Mining Ministry grants its approval.

3) While the approval by the Mining Ministry is pending, considering the contents of number 2 of the first clause, the appearing parties agree to assume in the form considered in the fourth clause the disbursements necessary for the financing of the oil operations necessary to comply with the provisions of the CEOP.

4) To regulate the effects that a possible refusal by the Mining Ministry to approve the transfer of rights by IPR and Manas will have.

THIRD: NEW PARTICIPATION PERCENTAGES IN THE CEOP

1) In order to achieve the participations indicated in number one of the second clause, Pluspetrol, Geopark, IPR and Manas are required to assign and transfer all or part of their rights, interests and obligations in the CEOP to Wintershall, Methanex and IFC, as follows: (i) Pluspetrol will transfer 5% of its rights, interests and obligations in the CEOP to Wintershall, in this way reducing to 25% its participation in the aforementioned CEOP. (ii) Geopark will transfer 5% of its rights, interests and obligations in the CEOP to IFC, thus reducing to 25% its participation in the aforementioned CEOP. (iii) Manas will transfer 12.5% of its rights, interests and obligations in the CEOP to Methanex and 7.5% of its rights, interests and obligations in the CEOP to IFC, which results in the transfer of all its rights, no longer being a Contractor Participant of the CEOP. (iv) IPR will transfer all of its rights, interests and obligations in the CEOP to Wintershall, which correspond to 20%, as a consequence of which it will not longer be a Contractor Participant of the CEOP.

3

2) As a result of the aforementioned transfers, the companies Pluspetrol with 25%, Geopark with 25% - after having ceded a 12.5% stake to IFC -, Wintershall with 25%, Methanex with 12.5% and IFC with 12.5% - ceded by Geopark - will remain as Contractor Participants of the CEOP.

3) The corresponding transfers of rights, interests and obligations in the CEOP to will be carried out as soon as the Mining Ministry grants the approval to these transfers, in accordance with the provisions of number 2 of the fourth clause.

4) In this act, through separate instruments, the appearing parties sign the letter addressed to the Mining Ministry requesting approval of the transfer of rights, interests and obligations in the “Special Operation Agreement for the Hydrocarbon Deposit Exploration and Exploitation of the Tranquilo Block, Region XII”, referring to the new participations in the CEOP, entrusting Geopark with its presentation and processing before the public authority.

5) The companies Wintershall, Methanex and IFC, as regards Future Contractor Participants in the CEOP, and the companies Pluspetrol and Geopark by virtue of the new participations that they take as contractors of the CEOP, ratify and are bound to ratify in the public instruments of transfer of rights, with Geopack as Operator of the CEOP, with authority and exclusive right to carry out the oil operations in the CEOP area.

FOURTH: OBLIGATIONS OF THE APPEARING PARTIES.

The appearing parties undertake the following obligations:

1) Obligation to agree to the financing of the oil operations while the approval by the Mining Ministry is pending, hereinafter “Disbursements during the intermediate stage”.

1.1) From the date of the signing of this agreement, during the entire time that the approval by the Mining Ministry is pending regarding the request for transfer of rights, and until the date in which the corresponding public instruments and acceptance of the rights are signed –the “Intermediate Stage”- Pluspetrol, Geopark – for itself and for the percentage of the rights to be ceded to IFC -, Wintershall, Methanex and IFC agree and promise to agree monthly on the financing of all the expenses and investments generated by the oil operations of the CEOP, which cannot exceed the sum of US$15,000,000 (fifteen million dollars of the United States of America) for a period of five months counting from the date of this agreement. The percentage of the contribution of each of the aforementioned companies during the Intermediate Stage will be the following: i) Pluspetrol, 30%; ii) Geopark, 37.5% – for itself and for the percentage of the rights to be ceded to IFC -; iii) Wintershall, 20%; and iv) Methanex, 12.5% .

1.2) Considering that all the financing of the oil operations will be carried out with contributions from the companies Pluspetrol, Geopark – for itself and for the percentage of the rights to be ceded to IFC -, Wintershall, Methanex, and IFC, excluding IPR and Manas from them, and that the financial contribution that corresponds to these last two companies according to the CEOP is 20% for each one, that is, 40% of the total financing, in their character of current participants of the CEOP, which will be assumed by Wintershall, Methanex and Geopark – for itself and for the percentage of the rights to be ceded to IFC - in the Intermediate Stage, IPR and Manas agree to assume the obligations that are set forth in the following clause, in order to respond for the return of 20% that corresponds to each one in the contributions, in the event that the Mining Ministry does not approve the transfer.

4

1.3) For the purpose of materializing the contributions, Pluspetrol, Geopark – for itself and for the percentage of the rights to be ceded to IFC -, Wintershall, Methanex, and IFC agree to make available and to transfer the funds and financial resources in the percentages referred to in number 1.1 of this clause, to the joint bank account of the Tranquilo Block whose owner is Geopark as operator of the CEOP. For these purposes, Geopark will send to each of the contributors a request for funds –called “cash call”- with instructions on the amount to be transferred by each one, the currency of the contribution, the due date of the transfer, the bank account information and any other background information necessary to be able to place the required funds at the disposal of the operator in a timely manner. The cash call with the instructions must be done in writing or through electronic means and set to Wintershall, Pluspetrol, Methanex and Geopark – for itself and for the percentage of the rights to be ceded to IFC -, at least 15 days in advance of the disbursement. All the amounts of funds must be exempt from bank costs and commissions.

1.4) In case of non-compliance by any of the Parties of its commitments to make the contributions during the Intermediate Stage stipulated in the Fourth Clause 1.1, the non-complying party will only have the right to receive, while the situation of non-compliance persists, the proportional part of the participation by which it has effectively paid and, in addition, the owed sums will accrue interest equal to the LIBOR plus 3% calculated at six months. The complying parties will have the option but not the obligation to agree with financing the non-complying party and, in case that one or more parties through common accord makes use of this option, these parties will accrue ownership of the corresponding right from the non-complying party.

2) Obligation to transfer the rights in the CEOP after the approval by the Mining Ministry

2.1) The appearing parties are required to sign the public instrument(s) of transfer of rights, interests and obligations in the CEOP, and to carry out all the acts and to perform all the procedures necessary for and conducive to formalizing the new participations in the CEOP, under the terms set forth in the third clause. The corresponding transfer of rights, interests and obligations in the CEOP will be carried out as soon as the Mining Ministry gives its written approval to such assignments, and after acceptance by the assignees of the obligations included in the CEOP, all according to article fourteen thereof.

2.2) The parties recognize the existence of costs prior to the signing of this agreement, which correspond to disbursements 1 to 3 – Request for Provision of Funds or “Cash-calls” 1 to 3- for the total sum of US$2,922,222, called “Past Costs”, which were made in participations other than those agreed in the third clause number 2. The composition of these Past Costs is detailed in Annex I of this agreement, which forms part of this instrument.

2.3) As a consequence of the fact that the contributions to make during the Intermediate Stage under the mechanism established in number one of this clause, as well as those contributions made corresponding to the “Past Costs”, will have been made with participation percentages other than those agreed in clause three of this agreement, the parties agree on the following compensation formula for the corresponding participation transfers: the price of the compensation will be equal to the contributions effectively made during the Intermediate Period plus Past Costs (detailed in Annex I) effectively made minus the contributions resulting from applying the new participation percentages to the amounts of the Intermediate Stage, less the amounts resulting from applying the new participation percentages to Past Costs. The result that this formula presents will be the global price of the transfer of rights of the CEOP.

5

2.4) Due to the fact that the disbursements during the Intermediate Stage are not determinable on the date of signing this agreement, it is agreed that the Operator will make the final calculation of the amount to compensate for the disbursements of the financing mechanisms during the Intermediate Stage, and also for the Past Costs of Annex I. This final calculation or settlement will be done once the authorization for the transfer of rights, interests and obligations in the CEOP is granted by the Mining Ministry and the corresponding signing of the public instruments has been performed. The compensation amount must be deposited in the bank accounts that are indicated by each of the parties for this purpose within ten calendar days of sending the final liquidation. This calculation must be certified by PricewaterhouseCoopers, with the parties having a period of five days counting from the notification of this certification to make any observations. Having transpired that period, and if there are no observations, the parties must make the deposit in the bank accounts indicated by each party. Without prejudice of the above, it is hereby recorded that the expenses to be paid by the Operator during the Intermediate Stage and those that correspond to Past Costs cannot be significantly separated from the costs and expenses reported by the operator in the Annual Budgets and Work Schedules presented to the parties which form part of this instrument as Annex II.

3) The companies Geopark – for itself and for the percentage of the rights to be ceded to IFC -, Pluspetrol, Methanex and Wintershall are required, within the period of sixty days counting from the approval by the Mining Ministry of the request for the transfer of rights, interests and obligations of the CEOP, to sign a Joint Operation Agreement for the CEOP Tranquilo Block –called “JOA”- taking as its base the JOA of the Otway Block.

FIFTH: EFFECTS OF THE REFUSAL OR DENIAL BY THE MINING MINISTRY IN APPROVING THE TRANSFER OF RIGHTS OF THE CEOP

Considering the commitments of pecuniary contributions assumed by Wintershall, Methanex and IFC, even before being owners of the rights, interests and obligations of the CEOP, in which IRP and Manas are not included, and in view of the possibility of refusal or negative decision by the Mining Ministry to the request for approval of transfer of rights, IPR and Manas, as well as IPR Chile LLC and MKD Holdings Inc., in their capacity as sole shareholders of IPR, and Manas Management Services Ltd. and Manas Petroleum Corporation, in their capacity as sole shareholders of Manas, declare and agree that, in case of the refusal or denial by the Mining Ministry to grant the referred authorization, the following effects will be produced, assuming the obligations that are indicated:

1) The funds or financial resources that are contributed by Wintershall, Methanex and Geopark – for itself and for the percentage of the rights to be ceded to IFC - for carrying out the CEOP oil operations based on this agreement, from the date of this instrument and until the negative decision of the Mining Ministry, hereinafter called “the total amount owed”, are required to be returned. The return or refund of the funds must be done within the period of ten days counting from the notification of the rejection by the Mining Ministry of the request for approval of the transfer of rights. In order to comply with this obligation, both IPR and Manas are required to pay the total amount due to Wintershall, Methanex and Geopark – for itself and for the percentage of the rights to be ceded to IFC - in the following proportion: a) IPR: 25% of the amount owed to Wintershall, 15.625% of the amount owed to Methanex and 9.375% of the amount owed to Geopark – for itself and for the percentage of the rights to be ceded to IFC -, totalling in this way 50% of the amount owed; and, b) Manas: 25% of the amount owed to Wintershall, 15.625% of the amount owed to Methanex and 9.375% of the amount owed to Geopark – for itself and for the percentage of the rights to be ceded to IFC -, totalling the remaining 50% of the amount owed, equivalent overall to 40% of the participation in the rights of the CEOP.

6

2) In case that IPR and/or Manas do not return to Wintershall, Methanex and Geopark – for itself and for the percentage of the rights to be ceded to IFC - the total amount owed within the period indicated in the previous paragraph, IPR Chile LLC and MKD Holdings Inc., in their capacity of sole shareholders of IPR, and Manas Management Services Ltd., and Manas Petroleum Corporation, in their capacity as sole shareholders of Manas, are required to assign and transfer the total amount of the corporate rights that they have in IPR Chile Tranquilo Limitada and in Manas Energía Chile Limitada, respectively, to the companies Wintershall, Methanex and Geopark – for itself and for the percentage of the rights to be ceded to IFC -, in the following proportions: a) IPR Chile LLC and MKD Holdings Inc.: 50% of the corporate rights to Wintershall, 31.25% of the corporate rights to Methanex and 18.75% of the corporate rights to Geopark; and, b) 50% of the corporate rights to Wintershall, 25% of the corporate rights to Methanex and 31.25% of the corporate rights to Methanex and 18.75 of the corporate rights to Geopark. In order to ensure compliance with this transfer of rights, the appearing parties that are implicated and the respective shareholders of IPR and Manas sign in this act, in separate instruments, in presence of the same authorizing Notary, public instruments “of transfer of corporate rights and modification of the company IPR” and “of transfer of corporate rights and modification of the company Manas”, subject to the condition precedent consisting of IPR and Manas not complying with the requirement to return the total amount owed that was assumed in number one of this clause. Consequently, after the period of ten days has transpired without IPR and/or Manas having returned that total amount owed, the condition precedent will be understood ipso facto as met and the agreements of transfer and modification of the company will be effective.

3) The obligations that IPR and Manas assume in reference to numbers One and Two of this clause will have an indivisible nature. Consequently, the obligation to return considered in number one above fulfilled by only one of the debtors will not be considered as fulfilled if the other debtor does not return or refund what is owed.

SIXTH: MISCELLANEOUS

1) Any reference to the Mining Ministry that is made in this document is understood as also referring to the Energy Ministry, if applicable, as a consequence of the recent legal creation of the Energy Ministry by Law No. 20,402, published in the Official Journal on three December two thousand nine.

2) The term “days” refers to calendar days, so that they will not be suspended or interrupted for any reason.

7

SEVENTH: ADDRESS. For all the legal purposes that may be pertinent, the parties set their address in the city and municipality of Santiago.

EIGHTH: APPEARANCE OF THE COMPANIES OWNERS OF IPR AND MANAS

1) In this Framework Agreement appears IPR CHILE, LLC, a company validly incorporated and organized under the laws of the State of Texas, United States of America, and MKD HOLDINGS, INC., a company validly incorporated and organized under the laws of the State of Texas, United States of America, appear in this act. Both companies are represented as accredited by Ms. Jimena Bronfman Crenovich, Chilean, single, lawyer, identity card number 4,709,492-5, all with addresses for these purposes in Vitacura 2939, 8th Floor, Las Condes municipality, Santiago, Metropolitan Region, and she states: that in the representation that she holds, she declares: 1.1) The companies IPR Chile LLC owner of 99% of the corporate rights and MKD Holdings, Inc. owner of 1% of the corporate rights, are the sole and current shareholders of the company of limited liability IPR Chile Tranquilo Limitada, hereinafter indistinctly “IPR”, a company incorporated under the public deed dated twenty-fourth March of two thousand eight, executed in the Public Notary’s Office of Santiago of Mr. Raúl Iván Perry Pefaur, whose extract is registered on folios 14,661 (fourteen thousand six hundred sixty-one) number 9,935 (nine thousand nine hundred thirty-five) in the Commercial Registry of the Property Registry of Santiago of the year two thousand eight and it was published in the Official Journal dated seventh April two thousand eight. The aforementioned company has not registered modifications to date. 1.2) That it authorizes and approves the execution of this instrument and each and every one of the obligations of which it is aware, especially the obligation stipulated in the fifth clause, and it promises to execute the legal acts and carry out the procedures and actions that may correspond, in order to obtain the return and timely compliance of this agreement.

2) In this Framework Agreement appears MANAS MANAGEMENT SERVICES LTD., a company incorporated and in force according to the laws of the Commonwealth of the Bahamas, with address on Fort Street 400-31 (four hundred hyphen thirty-one), Victoria, British Columbia, Canada and MANAS PETROLEUM CORPORATION, a company incorporated and in force according to the laws of the State of Nevada, United States of America, with address in Bahnhofstrasse 9, Baar, Switzerland appear in this act. Both companies are represented, as will be accredited, by Ms. Jimena Bronfman Crenovich, specified above, and she states: That in the representation that she holds, she declares: 2.1) The companies Manas Management Services Ltd., owner of 99% of the corporate rights and Manas Petroleum Corporation, owner 1% of the corporate rights, are the sole and current shareholders of the commercial company of limited liability Manas Energía Chile Limitada, company incorporated through public deed on the date of seventh April two thousand eight, executed in the Public Notary’s Office of Santiago of Mr. Eduardo Avello Concha, whose extract is registered in the folios 18,541 (eighteen thousand five hundred forty-one) number 12,557 (twelve thousand five hundred fifty-seven) in the Commercial Register of the Property Registry of Santiago of the year two thousand eight and it was published in the Official Journal dated twenty-eighth April two thousand eight. The aforementioned company has not registered modifications to date and it is fully valid. 2.2) That it authorizes and approves the execution of this instrument and each and every one of the obligations of which it is aware, especially the obligation stipulated in the fifth clause, and it promises to execute the legal acts and carry out the procedures and actions that may correspond, in order to obtain the return and timely compliance of this agreement.

8

NINTH: BEARER’S AUTHORIZATION. The bearer of an authorized copy of this instrument or of an authorized extract of it is hereby given authority to request and to sign all the registrations, supplemental registrations, annotations and publications that may be appropriate.

TENTH: This Agreement is signed in seven copies, one copy to remain with each of the parties hereto.

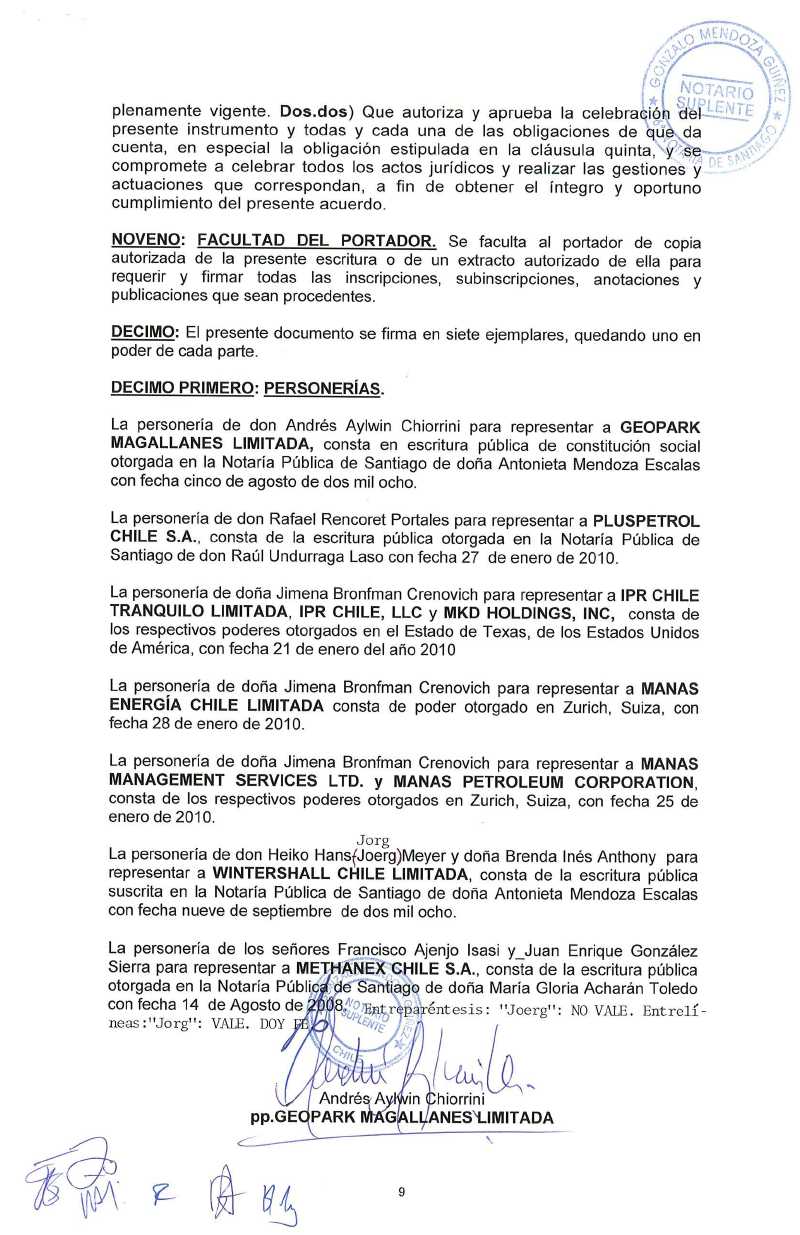

ELEVENTH: DESIGNATED REPRESENATIVES

Mr. Andrés Aylwin Chiorrini is designated to represent GEOPARK MAGALLANES LIMITADA, as recorded in the articles of incorporation in the Public Notary’s Office of Santiago of Mrs. Antonieta Mendoza Escalas dated fifth August two thousand eight.

Mr. Rafael Rencoret Portales is designated to represent PLUSPETROL CHILE S.A., as recorded in the public deed executed in the Public Notary’s Office of Santiago of Mr. Raúl Undurrage Laso dated 27 January 2010.

Ms. Jimena Bronfman Crenovich is designated to represent IPR CHILE TRANQUILO LIMITADA, IPR CHILE, LLC and MKD HOLDINGS, INC, as recorded in the respective public deeds executed in the State of Texas, United States of America dated 21 January 2010.

Ms. Jimena Bronfman Crenovich is designated to represent MANAS ENERGÍA CHILE LIMITADA, MANAS MANAGEMENT SERVICES LTD. and MANAS PETROLEUM CORPORATION, as recorded in the public deed executed in the city of Zurich, Switzerland dated 28 January 2010.

Mr Heiko Hans-Joerg Meyer and Mrs. Brenda Inés Anthony are designated to represent WINTERSHALL CHILE LIMITADA, as recorded in the public deed recorded in the Public Notary’s Office of Santiago of Mrs. Antonieta Mendoza Escalas dated third September two thousand eight.

Messrs. Francisco Ajenjo Isasi and Juan Enrique González

Sierra are designated to represent METHANEX CHILE S.A., as recorded in

the public deed executed in the Public Notary’s Office of Santiago of María

Gloria Acharán Toledo dated 14 August 2008.

Remark between the lines: “Joerg” is NOT VALID. Between the lines:

“Jorg” is VALID. THIS I HEREWITH CONFIRM.

(stamp and signature:)

Andrés Aylwin Chiorrini

p.pa. GEOPARK MAGALLANES LIMITADA

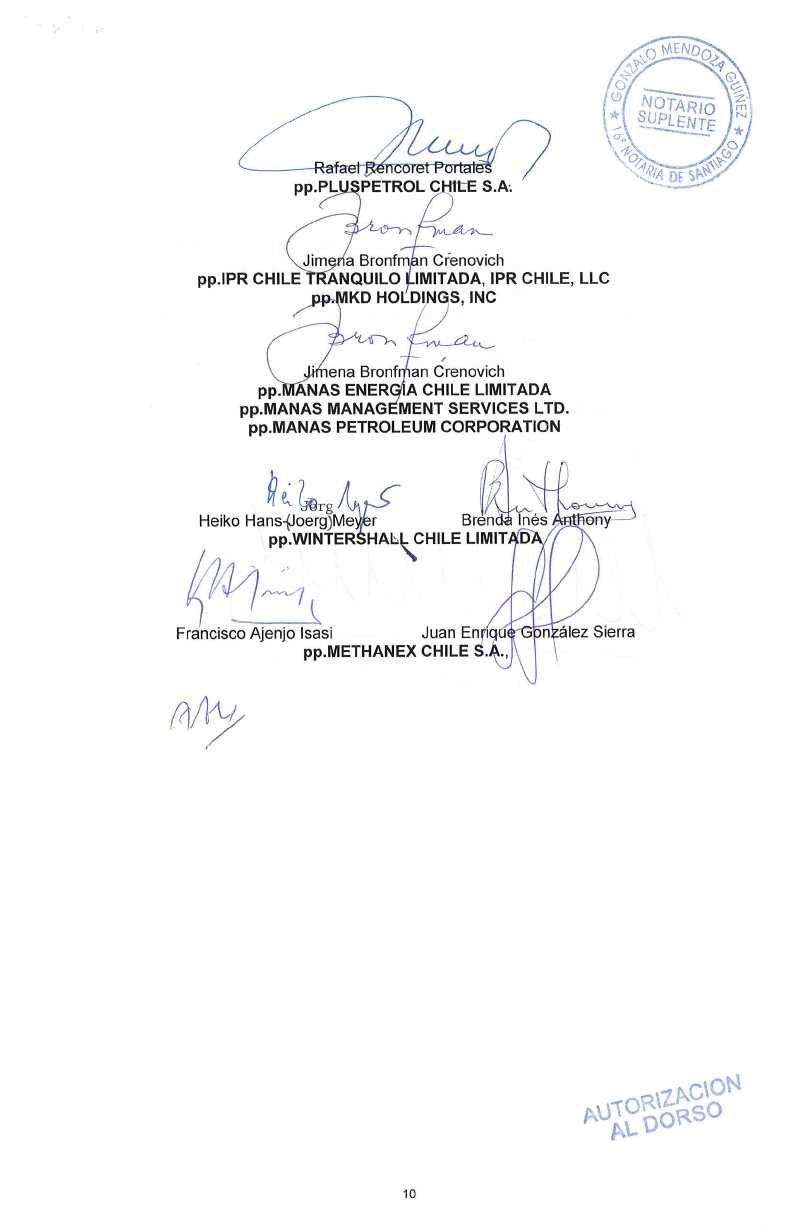

(signature:)

Rafael Rencoret Portales

p.pa. PLUSPETROL CHILE S.A.

9

(signature:)

Jimena Bronfman Crenovich

p.pa. IPR CHILE TRANQUILO LIMITADA, IPR CHILE , LLC

p.pa. MKD HOLDINGS, INC.

(signature:)

Jimena Bronfman Crenovich

p.pa. MANAS ENERGÍA CHILE LIMITADA

p.pa. MANAS MANAGEMENT SERVICES LTD.

p.pa. MANAS PETROLEUM CORPORATION

(signatures:)

Heiko Hans-Jorg Meyer

Brenda Inés Anthony

p.pa. WINTERSHALL CHILE LIMITADA

(signatures:)

Francisco Ajanjo Isasi

Juan Enrique González Sierra

p.pa. METHANEX CHILE S.A.

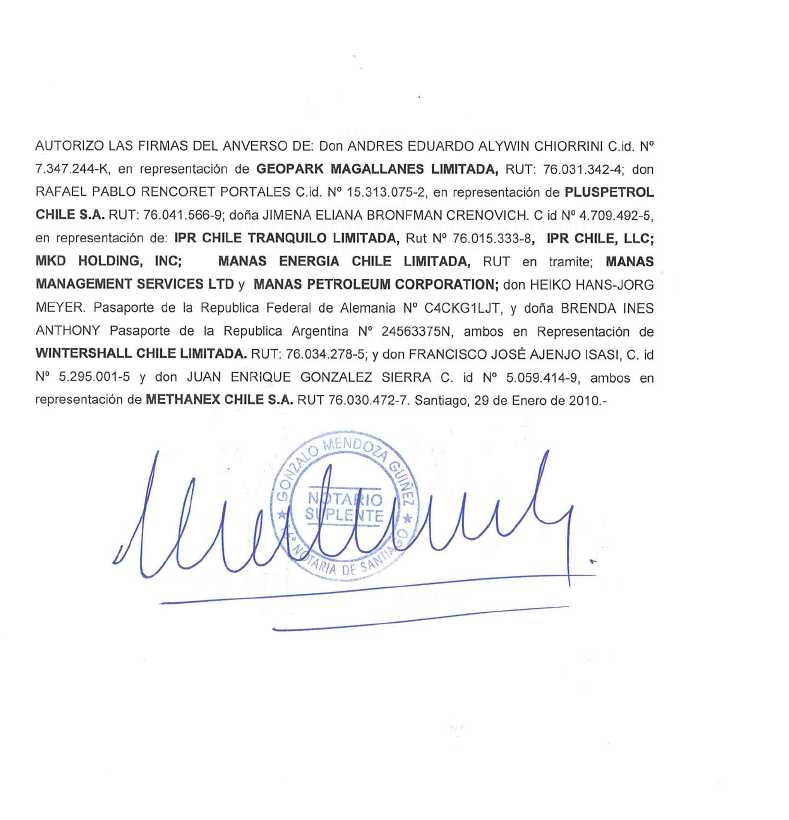

I HEREWITH CONFIRM THE SIGNATURES APPOSED ABOVE OF: Mr ANDRES EDUARDO ALYWIN CHIORRINI, identity card no. 7.347.244 -K, representing GEOPARK MAGALLANES LIMITADA, company register 76.031.342 -4; Mr RAFALE PABLO RENCORET PORTALES, identity card no. 15.313.075 -2, representing PLUSPETROL CHILE S.A., company register 76.041.566 -9; Ms JIMENA ELIANA BRONFMAN CRENOVICH, identity card no. 4.709.492 -5, representing IPR CHILE TRANQUILO LIMITADA, company register 76.015.333 -8, IPR CHILE, LLC, MKD HOLDING, INC; MANAS ENERGIA CHILE LIMITADA, company number to be issued, MANAS MANAGEMENT SERVICES LTD and MANAS PETROLEUM CORPORATION; Mr HEIKO HANS-JORG MEYER, passport of the Federal Republic of Germany no. C4CKG1LJT, and Mr BRENDA INES ANTHONY, passport of Argentine no. 24563375N, both representing WINTERSHALL CHILE LIMITADA, company register 76.034.278 -5; and Mr FRANCISCO JOSÉ AJENJO ISASI, identity card no. 5.295.001 -5 and Mr JUAN ENRIQUE GONZALEZ SIERRA, identity card no. 5.059.414 -9, both representing METHANEX CHILE S.A., company register 76.030.472 -7. Santiago, 29 January 2010.-

(stamp of Gonzalo Mendoza Guiñez, Acting Notary

of the 16th Public Notary’s Office of Santiago)

10