Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - MNP Petroleum Corp | exhibit32-1.htm |

| EX-21.1 - EXHIBIT 21.1 - MNP Petroleum Corp | exhibit21-1.htm |

| EX-31.1 - EXHIBIT 31.1 - MNP Petroleum Corp | exhibit31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - MNP Petroleum Corp | exhibit23-1.htm |

| EX-31.2 - EXHIBIT 31.2 - MNP Petroleum Corp | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - MNP Petroleum Corp | exhibit32-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - MNP Petroleum Corp | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to __________________

Commission file number: 333-107002

MNP PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 91-1918324 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

Bahnhofstrasse 9, 6341 Baar, Switzerland

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code +41 (44) 718 10 30

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Name of each exchange on which registered |

| Nil | N/A |

Securities registered pursuant to Section 12(g) of the Act

Common Stock, par value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No

[X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) |

Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter the aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant was approximately $8,456,628, based on the closing price (last sale of the day) for the registrant’s common stock on the OTCQB on June 30, 2014 of $0.0627 per share.

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 31, 2015, there were 166,112,792 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Not Applicable

ii

TABLE OF CONTENTS

iii

PART I

ITEM 1 BUSINESS

Forward-Looking Statements

This annual report contains forward-looking statements. Forward-looking statements are statements that relate to future events or future financial performance. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements speak only as of the date of this annual report. Examples of forward-looking statements made in this annual report include statements pertaining to, among other things:

- management’s assessment that our company is a going concern;

- our plans to rehabilitate a producing asset in Tajikistan;

- our plans to form a new consortium to pursue Somon Oil’s project in Tajikistan;

- the quantity of potential natural gas and crude oil resources;

- potential natural gas and crude oil production levels;

- capital expenditure programs;

- projections of market prices and costs;

- supply and demand for natural gas and crude oil;

- our need for, and our ability to raise, capital; and

- treatment under governmental regulatory regimes and tax laws.

The material assumptions supporting these forward-looking statements include, among other things:

- our monthly burn rate of approximately USD 382,596 (corporate USD 249,666, ventures USD 132,929) for our operating costs excluding exploration and redevelopment expenses;

- our ability to obtain necessary financing on acceptable terms;

- timing and amount of capital expenditures;

- our ability to obtain necessary drilling and related equipment in a timely and cost-effective manner to carry out exploration activities;

- our venture partners’ successful and timely performance of their obligations with respect to the exploration programs in which we are involved;

- retention of skilled personnel;

- the timely receipt of required regulatory approvals;

- continuation of current tax and regulatory regimes;

- current exchange rates and interest rates; and

- general economic and financial market conditions.

Although management considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including:

- our ability to establish or find resources or reserves;

- our need for, and our ability to raise, capital;

- volatility in market prices for natural gas and crude oil;

- liabilities inherent in natural gas and crude oil operations;

- uncertainties associated with estimating natural gas and crude oil resources or reserves;

- competition for, among other things, capital, resources, undeveloped lands and skilled personnel;

- political instability or changes of law in the countries we operate and the risk of terrorist attacks;

- assessments of the acquisitions;

- geological, technical, drilling and processing problems; and

- other factors discussed under the section entitled “Risk Factors” beginning on page 14 of this annual report.

These risks, as well as risks that we cannot currently anticipate, could cause our company’s or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

- 4 -

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform them to actual results.

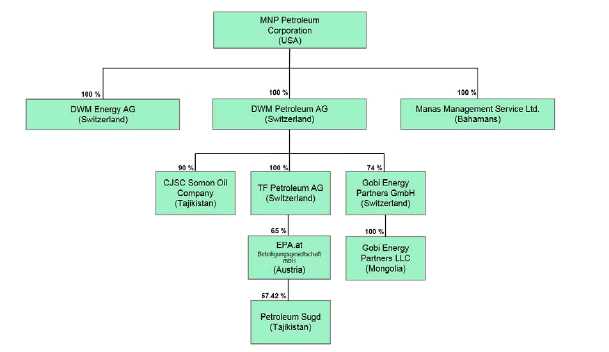

As used in this annual report, the terms “we”, “us”, and “our” refer to MNP Petroleum Corporation, its wholly-owned subsidiaries DWM Petroleum AG, a Swiss company, DWM Energy AG (formerly Manas Petroleum AG), a Swiss company, Manas Management Services Ltd., a Bahamian company, and TF Petroleum AG, a Swiss company, and its partially owned subsidiaries CJSC Somon Oil Company, a Tajikistan company, Gobi Energy Partners GmbH, a Swiss company, and Gobi Energy Partners LLC, a Mongolian company, its 65% interest in Energy Partners Austria GmbH, an Austria registered company and its 57.42% equity interest in Petroleum Sugd, a Tajik company, held by Energy Partners Austria GmbH, as the context may require.

Organizational Structure

The following chart reflects our current organizational structure:

Our Current Business

We are in the business of exploring for and producing oil and gas, primarily in Central and East Asia. If we discover sufficient reserves of oil or gas, we intend to exploit them. Although we are currently focused on projects located in Asia, we remain open to attractive opportunities in other parts of the world.

We operate exploration projects in Mongolia and Tajikistan. In addition the company recently completed the purchase of an interest in a producing oilfield in Tajikistan.

Our executive offices are located in Switzerland.

- 5 -

Through DWM Petroleum, we own:

-

74% of Gobi Energy Partners GmbH, a Swiss company that holds two oil and gas production sharing contracts covering exploration acreage located in Mongolia, which is described in detail on page 6, under the heading “Mongolia”.

-

90% of CJSC Somon Oil Company, a closed joint stock company registered in Tajikistan. Somon Oil Company holds two licenses under one oil and gas production sharing agreement in Tajikistan. This project is described in detail on page 9, under the heading “Tajikistan – CJSC Somon Oil Company”.

-

a 65% interest in Energy Partners Austria GmbH, an Austria registered company. Energy Partners Austria holds 57.42% of the equity interest in the Tajik company, Petroleum Sugd. Petroleum Sugd owns ten producing oil fields. The acquisition of the 65% interest in Energy Partners Austria is described in detail on page 11, under the heading “Tajikistan – Petroleum Sugd”.

Overview of Our Projects

- Mongolia

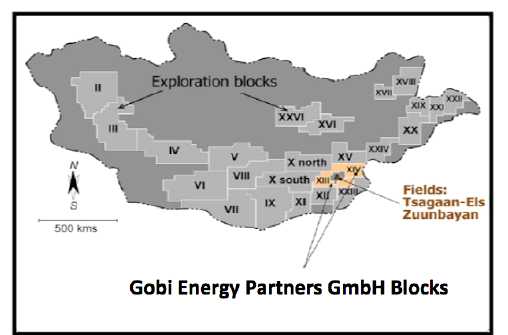

DWM Petroleum owns 74% of Gobi Energy Partners GmbH, which owns record title to exploration licenses for Blocks XIII and XIV. These Blocks are located on Mongolia’s southern border in the central part of the East Gobi Rift oil and gas basin in South-eastern Mongolia, as shown on the map, below. Gobi Energy Partners LLC, a wholly-owned Mongolian subsidiary of Gobi Energy Partners GmbH, is the operator of the oil and gas project on Blocks XIII and XIV.

On April 21, 2009, DWM Petroleum AG entered into production sharing contracts for these two blocks with the Mongolian government. These production sharing contracts provide for a five-year exploration period (with a two year extension) that began on May 21, 2009, and a twenty-year exploitation period (with two five year extensions allowed). On May 31, 2011, these two production sharing contracts were assigned to Gobi Energy Partners GmbH as part of a restructuring. Block XIII, also known as Tsagaan-Els, originally contained 11,590 km2 (2,863,951 acres) and Block XIV, also known as Zuunbayan, originally contained 8,731 km2 (2,157,477 acres). In April 2012, Gobi Energy Partners GmbH relinquished 8,734 km2 leaving 6,930 km2 in Block XIII and 4,657 km2 in Block XIV. In April 2013, Gobi Energy Partners GmbH relinquished 8,566 km2, leaving 1,030 km2 in Block XIII and 1,911 km2 in Block XIV. In 2014 Gobi Energy Partners GmbH did not relinquish any further areas. These production sharing contracts were the subject of a Moratorium that expired in May 2014, which extended the contract period by one year until May 21, 2015. We have applied for an additional extension of the Moratorium to give us until May 21, 2016 but this additional extension has not yet been granted. We originally asked for the Moratorium and the extension because we were unable to identify economic prospects on which to expend our outstanding commitments.

- 6 -

The location of these blocks is set out in the map below:

Ten percent of the equity in Gobi Energy Partners GmbH is owned by Wit Alliance Ltd, a 100% subsidiary of Shunkhlai Group LLC. Shunkhlai Group is a Mongolian company engaged in beverage production, logistics, mining, petroleum, transport, finance, health, property, telecommunications, publishing and infrastructure. Pursuant to a cooperation agreement dated November 5, 2010, Shunkhlai Group provides our company with ongoing advisory and consulting services.

In our November 5, 2010 cooperation agreement with Shunkhlai Group LLC, we agreed to pay all of the exploration and overhead expenses contemplated in an agreed work program and budget during a five-year exploration period consisting of a first phase of one year, a second phase of two years and a third phase of two years. In the event of a commercial discovery, trade sale and/or a corporate market transaction, Shunkhlai Group LLC agreed to repay its proportionate share (10%) of exploration and overhead expenses incurred during phases 2 and 3, together with interest at a rate of eight percent per annum, but we agreed not to charge interest during 2010. Also, if Shunkhlai Group LLC transfers its interest in Gobi Energy Partners GmbH to a third party, or if there is a change in control of Shunkhlai Group LLC, Shunkhlai Group LLC will be required to repay its proportionate share of exploration and overhead expenses incurred during phases 2 and 3 together with all accrued interest.

- 7 -

The financial and work commitment of each production sharing contract for Blocks XIII and XIV is as follows (excluding PSC fees):

| Period |

Contract Year |

THE WORK PLAN |

Cost (USD) |

Investment per year (USD) |

| I |

1

|

Collection and processing of geological data | 150,000 | 625,000 |

| Reconnaissance of work of the block, 4000 km | 40,000 | |||

| Geological mapping 500 km2 | 50,000 | |||

| Geological mapping 100 km2 | 30,000 | |||

| Geologic structural sections 400 km | 140,000 | |||

| Lithologic-stratigraphical sections 1900m | 95,000 | |||

| Paleontologic stratigraphical works | 40,000 | |||

| Sampling 300 | 15,000 | |||

| Laboratory analytical works | 35,000 | |||

| Data processing | 30,000 | |||

| II

|

2 |

Geological mapping 850 km2 | 85,000 | 825,000 |

| Geological mapping 400 km2 | 120,000 | |||

| Lithologic-stratigraphical sections 3200m | 160,000 | |||

| Paleontologic stratigraphical works | 80,000 | |||

| Sampling 800 | 40,000 | |||

| Laboratory analytical works | 75,000 | |||

| Data processing | 55,000 | |||

| 3 |

Data processing | 15,000 | 1,740,000 | |

| Topographic geodesic works | 50,000 | |||

| Exploration seismology 2D, 200 km | 1,600,000 | |||

| Exploration seismology 3D, 5 km | 75,000 | |||

| III |

4 |

Data processing | 40,000 | 4,360,000 |

| Topographic geodesic works | 20,000 | |||

| Exploration seismology 2D, 100 km | 800,000 | |||

| Exploration seismology 3D, 20 km | 300,000 | |||

| Preparation to drilling, well 1 | 30,000 | |||

| Well drilling, 1 well | 2,870,000 | |||

| Log survey, 1 well | 300,000 | |||

| IV |

5 |

Data processing | 50,000 | 6,900,000 |

| Preparation to drilling, well 2 | 60,000 | |||

| Well drilling, 2 well | 5,740,000 | |||

| Log survey, 1 well | 600,000 | |||

| Well test, 3 well | 450,000 | |||

| TOTAL | 14,450,000 |

The following table shows the incurred and forecasted PSC fees:

| Period |

Contract Year |

Cost (USD) |

| I | 1 | 640,323 |

| II | 2 | 460,642 |

| 3 | 460,642 | |

| III | 4 | 501,284 |

| IV | 5 | 432,114* |

| TOTAL | 2,495,005 |

* Estimated

Up to this date, there are no known reserves on either block.

Expenditures and Commitments

The following table sets forth the approximate expenditures actually incurred by us pursuant to each production sharing contract for Blocks XIII and XIV during the periods indicated (in USD):

| Production Sharing Contract | 2008 | 2009 | 2010 | 2011 | 20122 | 20133 | 20143 |

| Block XIII1 | 179,573 | 276,377 | 738,052 | 1,992,203 | 4,836,094 | Nil | Nil |

| Block XIV1 | 179,573 | 276,377 | 847,242 | 2,336,397 | 1,511,429 | Nil | Nil |

| 1 Actual figures, reported based on calendar year |

- 8 -

2 Subject to audit by local authorities

3

Moratorium ended May 2014. We request an extension to the moratorium until

May 2015; approval pending.

The following table sets forth the approximate financial commitment amounts to be incurred by us pursuant to each production sharing contract for Blocks XIII and XIV during the periods indicated (in USD):

| Production Sharing Contract | 2013* | 2014* |

| Block XIII | 6,900,000 | 6,900,000 |

| Block XIV | 6,900,000 | 6,900,000 |

| * Financial commitment for the fifth contract year (starting May 21 of each year) of the production sharing contract |

Operating Activities

Early in 2012, Gobi Energy Partners LLC focused on the integration and interpretation of seismic data acquired in 2011. From April to May 2012, it conducted a passive seismic campaign using low-frequency spectroscopy to support the seismic. From June to August 2012, Gobi Energy also conducted a 2D seismic acquisition (vibroseis) program covering 335 kilometers over both blocks.

Gobi Energy spudded its first well, Ger Chuluu A1, on August 23, 2012. It stopped drilling at a depth of 1098 meters without having encountered any seal. The initially planned second well East Sainshand A1 was located in another sub-basin 170 kilometers away. In order to have a conclusive evaluation of the Ger Chuluu sub-basin, Gobi Energy decided to drill a second well before moving to East Sainshand. Ger Chuluu D1, the second well in the Ger Chuluu sub-basin, was spudded on September 21, 2012. Drilling was stopped after reaching 600 meters without any hydrocarbon shows. After logging, the well was plugged and abandoned.

Gobi Energy had originally focused on six sub-basins in Mongolia; after drilling in the Ger Chuluu sub basin and conducting additional studies, Gobi Energy focused on two sub basins, East and West Sainshand. In order to enlarge the area to define more prospects to drill the outstanding commitments, Gobi Energy signed a moratorium with the government of Mongolia for the duration of one year ending in May 2014. Gobi Energy applied for an extension of the moratorium until the end of May 2015. The approval is still pending. During this period Gobi Energy expects the government to award us with relinquished areas from adjacent blocks.

- Tajikistan

CJSC Somon Oil Company:

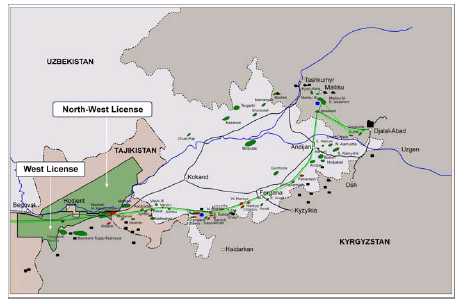

Through our wholly-owned subsidiary, DWM Petroleum AG, we own 90% of the issued and outstanding shares of CJSC Somon Oil Company (“Somon Oil”), a Tajik company originally formed in 2005. The remaining 10% is owned by Anavak LLC. Somon Oil owns two exploration licenses located in Tajikistan. One of these licenses, known as Zapadnaya, or the West license, was granted by the Tajikistan government on July 25, 2007; the other, known as Severo-Zapadnaya, or the North-West license, was granted by the Tajikistan government on July 27, 2009.

- 9 -

The locations of these licenses are shown on the map below:

Santos International Ventures Pty Ltd funded all expenditures of Somon Oil, and had an option to enter into a farm in agreement in respect of these licenses, but decided on December 21, 2012 not to pursue this option. Santos continued to fund current capital expenditures, as well as certain general and administrative costs of Somon Oil until January 2013. We remain confident that the project has exploration potential and we are actively working to form a new consortium. Commitments were transferred from 2012/2013 to 2013/2014 and Somon Oil plans to complete them once a new consortium is formed and funded.

Expenditures and Commitments

The following table sets forth the approximate expenditures incurred by Somon Oil, pursuant to the licenses during the periods indicated (in USD):

| License | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| West | 625,261 | 465,818 | Nil | 1,830,159 | 519,962 | 1,814,367 | 705,626 | 1,143,288 |

| North-West | Nil | Nil | Nil | 1,747,517 | 4,333,961l | 5,315,649 | 597,569 | 81,112 |

The following table sets forth the approximate commitments pursuant to the licenses during the periods indicated (in USD):

| License Area | 2013* | 2014* | 2015* | 2016* |

| West1 | 4,500,000 | 2,500,000 | to be agreed | to be agreed |

| North-West2 | 8,680,000 | 8,700,000 | 3,600,000 | 4,600,000 |

| *Commitments are based on calendar year. Amounts indicative,

work plan prevails 1 Granted on July 25, 2007, extension after July 25, 2014 and the related commitments to be agreed 2 License granted on July 28, 2009 |

The West License

The West license is located in the Fergana Basin and contains approximately 303,198 acres (approximately 1,227 km2). Although this license expired on July 25, 2014, Somon Oil received an extension in January 2015 and the license has been extended to July 25, 2017. Approximately sixty percent of the block in this license area is covered by former Soviet era seismic data. It is within this area that Somon Oil’s targeted leads and prospects are found and the geological and structural setting appears to be very similar to the former Tuzluk license in Kyrgyzstan. Somon Oil has identified prospects located close to existing oil fields, all of which were originally identified by Soviet seismic. The seven year work commitment for the West license contains 650 km of 2D seismic and two wells.

- 10 -

Somon Oil intends to spud the first well in the beginning of the third quarter 2015; it believes that critical bottlenecks consist of Long Lead Items and rig availability. Depending on the results from the first well, Somon Oil intends to drill a second well during the license extension period.

The North-West License

In July 2009, Somon Oil was granted the North-West petroleum license which entitles the company to explore an exploration area covering 2,169 km2 (535,971 acres) for a seven year term expiring in July 2016. The license area is located in the north part of the Sugd region, bordering on Uzbekistan. To the south-west the license area is adjacent to Somon Oil’s West license area. The seven year work commitment for the North-West license contains 430 km of 2D seismic, 100 km2 of 3D seismic and three wells. Somon Oil plans to drill its second exploration well in the North West License. Existing exploration data within the North-West license area includes six wells and 1,100 km of 2D seismic which was acquired during Soviet exploration campaigns between 1964 and 1992. In case of discovery, the license provides that Somon Oil will have the exclusive right to develop and exploit the discovery. Somon Oil is targeting subsalt structures as well as structural prospects in the center and at the edge of the Fergana basin.

To date, Somon Oil has not discovered any reserves on either the West or the North-West license areas in Tajikistan.

Operating Activities – Somon Oil

In April 2012, Somon Oil finalized the acquisition of 871 km of 2D seismic. The survey was very complex due to the different landscapes which had to be covered. It included areas with vibro seismic, different dynamite seismic in the mountains and offshore seismic on Lake Kayrakkum. Final seismic processing and interpretation was concluded in 2013.

On May 7, 2012, Somon Oil entered into a Production Sharing Agreement (we refer to this agreement as a “PSA”) with the Government of the Republic of Tajikistan. The PSA grants to Somon Oil the exclusive right and authority to carry out all petroleum exploration, development and production activities in the defined contract area. The PSA also regulates these activities and determines how funds invested by Somon Oil will be recovered and how profit oil will be shared between the government and Somon Oil.

During the third quarter of 2012, Somon Oil finalized the first steps of processing and interpretation of the seismic acquisition program finished in April 2012 and commenced the studies for the first two wells. At the beginning of 2014, Somon Oil entered into a contract for the preparation of the first well location, Kayrakkum B, located in the West License. The civil construction at the well site was completed in June 2014, and the well site has been handed over to Somon Oil, which had suspended operations when the license expired in July of 2014. Operations resumed when the West license was extended on January 31, 2015 and activities to spud the first well have now resumed. As disclosed above, Somon Oil now plans to spud the first well during the third quarter of 2015.

Petroleum Sugd:

On December 31, 2012, DWM Petroleum entered into a Share Purchase Agreement with Kavsar General Trading FZE, an unrelated third party, to purchase 80% of the equity interest in TF Petroleum AG, a Swiss company, for USD 21,000,000 in cash. The agreement provided that, at the time of the closing of the transaction, TF Petroleum would own Petroleum Sugd, a limited liability joint venture formed under the laws of Tajikistan. Petroleum Sugd owns and operates certain producing oilfield assets located in Tajikistan. Energy Partners Austria GmbH, Kavsar’s then wholly-owned subsidiary and an Austria registered company, currently owns the majority of the equity in Petroleum Sugd.

On March 31, 2014 DWM Petroleum and Kavsar signed a Supplement Agreement dated for effect September 27, 2013. The Supplement Agreement provided that DWM Petroleum was entitled to receive from Kavsar 65% of the equity in Energy Partners Austria, which was the beneficial owner of 57.42% of the equity in Petroleum Sugd, subject to the payment of USD 2,000,000 by DWM Petroleum. The equity in Energy Partners Austria was to be transferred to TF Petroleum AG at closing. The Supplement Agreement also provided that Kavsar was to transfer all shares of TF Petroleum AG, a Swiss company, to DWM Petroleum, for a consideration of CHF 100,000 (approx. USD 111,656). DWM Petroleum was then to be eligible to future profits and dividends from Energy Partners Austria from January 1, 2014 onwards. On April 4, 2014, DWM Petroleum gained control of TF Petroleum AG, which resulted in an increase in restricted cash and a decrease in transaction prepayment of CHF 100,000 (approx. USD 111,656). The closing of the transaction was subject to the capital restructuring requirement of Energy Partners Austria by Kavsar, the notary act and regulatory approval. On November 21, 2014 the notary act was signed which is effective November 21, 2014. On November 28, 2014, DWM transferred USD 2,000,000 to Kavsar in order to finalize the transaction. After the finalization of the Supplement Agreement, the Share Purchase Agreement is concluded.

- 11 -

On January 15, 2015, pursuant to the Supplement Agreement dated September 11, 2014 and a Notary Act dated November 21, 2014, DWM Petroleum AG, through its 100% subsidiary TF Petroleum AG, completed the acquisition of the 65% interest in Energy Partners Austria, for total consideration of USD 12,000,000 to the seller, Kavsar General Trading FZE. Energy Partners Austria holds 57.42% of the equity interest in the Tajik company, Petroleum Sugd; the remaining 42.58% equity interest in Petroleum Sugd is held by the Tajik state-owned oil company Sugdneftugas. Petroleum Sugd owns ten producing oil fields in the north of Tajikistan.

A field development program for the first five years has been developed. This program consists of light work overs (such as changing pumps, tubing, pumping units and clean ups), heavy work overs (plug backs, reperforations, stimulations, fishing and casing repairs) and new wells mainly in the shallow fields. The program will also include replacing the gathering lines, the pumping units and setting up the necessary operating facilities.

The focus will be initially on the low risk shallow fields and then gradually moving to the deeper fields.

- Kyrgyz Republic (South Petroleum Company)

At the beginning of 2014, our wholly-owned subsidiary, DWM Petroleum AG, owned 25% of the issued shares of South Petroleum Company, a Kyrgyz company incorporated in 2004. South Petroleum Company was formally liquidated as of October 24, 2014.

Competition

The oil and gas industry is intensely competitive. We compete with numerous individuals and companies, including many major oil and gas companies that have substantially greater technical, financial and operational resources and staff. We compete with these individuals and companies for desirable oil and gas leases, exploration and exploitation licenses, and necessary drilling equipment, as well as access to personnel and funds.

We believe several factors that differentiate us from our competitors include our extensive personal network among the oil and gas industry in the Commonwealth of Independent States, an ability to increase value through exploration of known structures and our command of modern geological knowledge and new concepts implemented to existing seismic and well data bases.

Need for Government Approval

Our business depends on the approval of different governments for various matters, including land tenure, prices, royalties, production rates, environmental protection, income, the grant of exploration and exploitation rights for oil and gas projects and the imposition of drilling obligations in connection with these grants, and the exportation of crude oil, natural gas and other products. Government regulations may change from time-to-time in response to economic or political conditions. The exercise of discretion by governmental authorities under existing regulations, the implementation of new regulations or the modification of existing regulations affecting the oil and gas industry could reduce demand for crude oil and natural gas, increase our costs and have a material adverse impact on our operations. Before proceeding with a project, the participants in the project must obtain all required regulatory approvals. The process of obtaining these approvals can involve stakeholder consultation, environmental impact assessments and public hearings, among other things. In addition, regulatory approvals can involve conditions, including the payment of security deposits and other financial commitments.

All our licenses depend on government regulation and approval.

- 12 -

Regulation

Our industry is affected by numerous laws and regulations, including discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, pooling of properties, taxation and other laws and regulations relating generally to the energy industry. These laws and regulations vary according to where each project is located. Changes in any of these laws and regulations or the denial or vacating of permits and licenses could have a material adverse effect on our business.

Our operations are in, and our focus will continue to be on, operations in emerging markets. Generally, legal structures, codes and regulations in emerging markets are not as well defined as they can be in more developed markets and they are therefore more likely to change rapidly. In view of the many uncertainties with respect to current and future laws and regulations, including their applicability to us, we cannot predict the overall effect of such laws and regulations on our future operations.

We believe that our operations currently comply in all material respects with applicable laws and regulations. There are no pending or threatened enforcement actions related to any such laws or regulations. We believe that the existence and enforcement of such laws and regulations will have no more restrictive effect on our operations than on other similar companies in the energy industry.

Environmental Matters

We and the projects that we have invested in are subject to national and local environmental laws and regulations relating to water, air, hazardous substances and wastes, and threatened or endangered species that restrict or limit our business activities for purposes of protecting human health and the environment. Compliance with the multitude of regulations issued by the appropriate administrative agencies can be burdensome and costly. We believe that our operations currently comply in all material respects with applicable national and local environmental laws and regulations.

Exploration

Our business plan was focused on exploration until 2012 (the execution of our business plan has largely focused on acquiring prospective oil and gas licenses and negotiating production sharing and farm-out agreements). Since then, while we have continued to focus on exploration, we have also begun to look for ways to expand into production as we believe that such a strategy will allow us to maximize the long-term exploration and development of our oil and gas projects.

Except in connection with the exploration of our properties or the conduct of due diligence on properties that we might be interested in acquiring, we do not conduct research and development.

Employees

We have 32 employees, including our directors. Of our 30 full-time employees (excluding two non-executive directors), eight are located in Switzerland and the rest are located in Mongolia and Tajikistan. We anticipate increasing our number of employees and outsourced contract employment over the next twelve months depending on the need of our exploration and production activities.

ITEM 1A RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this annual report in evaluating our company and our business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks. You should invest in our common stock only if you can afford to lose your entire investment.

- 13 -

Risks Associated with Our Company

We need additional financing to support operations and future capital commitments.

There is no guarantee that we will be able to secure additional financing on acceptable terms, or at all, if needed to fully fund our 2015 drilling budget and to support future development activities. As shown in the report from our independent auditors, there is a substantial doubt about the Company’s ability to continue as a going concern, however, the financial statements do not show any adjustments to reflect this.

Our lack of diversification increases the risk of an investment in us, and our financial condition and results of operations may deteriorate if we fail to diversify.

We have or are directly involved in projects in Mongolia and Tajikistan. Our focus on a limited number of countries in Asia presents the risk that we could be impacted more acutely by factors affecting this region, and in particular factors in this region that affect our industry.

We may not effectively manage the growth necessary to execute our business plan.

Our business plan anticipates an increase in the number of our strategic partners, equipment suppliers, manufacturers, dealers, distributors and customers especially as we attempt to expand our operations to include production. This growth could place significant strain on our current personnel, systems and resources. We expect that we will be required to hire qualified employees to help us manage our growth effectively. We believe that we may also be required to improve our management, technical, information and accounting systems, controls and procedures. We may not be able to maintain the quality of our operations, control our costs, continue complying with all applicable regulations and expand our internal management, technical information and accounting systems to support our desired growth. If we fail to manage our anticipated growth effectively, our business could be adversely affected.

We may be forced to liquidate one or more subsidiaries due to regulatory requirements which could have a material adverse effect on our business and operations.

All of our licenses and assets are owned by our subsidiaries. These subsidiaries are formed in various countries pursuant to local law and regulation. In some cases, local regulation could result in the forced liquidation of one or more of these subsidiary companies. If any of our subsidiaries is liquidated before we can transfer its assets, the licenses and assets held by it could revert to the respective government. If this happens, our business could be harmed.

We are subject to various risks of foreign operations.

None of our projects are located in the United States or Canada. We have or are involved in projects in Mongolia and Tajikistan. As such, our business is subject to governmental, political, economic, and other uncertainties in Mongolia and Tajikistan including, by way of example and not in limitation, expropriation of property without fair compensation, changes in energy policies or the personnel administering them, delays caused by the extensive bureaucracy, nationalization, currency fluctuations and devaluations, exchange controls and royalty increases, changes in oil or natural gas pricing policy, renegotiation or nullification of existing concessions and contracts, changes in taxation policies, economic sanctions, restrictions on the repatriation of currency and the imposition of specific drilling obligations and the other risks arising out of foreign governmental sovereignty over the areas in which our operations (or those of our venture partners) are conducted, as well as risks of loss due to civil strife, acts of war, guerrilla activities, insurrections, the actions of national labor unions, terrorism and abduction.

Our operations (and those of our venture partners) may also be adversely affected by laws and policies of the United States affecting foreign trade, taxation and investment. In the event of a dispute arising in connection with our operations (and those of our venture partners) in foreign countries, we may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdictions of the courts of the United States or enforcing judgments in such other jurisdictions. We may also be hindered or prevented from enforcing our rights with respect to a governmental instrumentality because of the doctrine of sovereign immunity. Accordingly, our exploration, development and production activities (or those of our venture partners) could be substantially affected by factors beyond our control, any of which could have a material adverse effect on our business or our company.

- 14 -

Substantially all of our assets are located outside the United States and Canada and three of our directors and all of our officers are nationals and/or residents of countries other than the United States and Canada, with the result that it may be difficult for investors to enforce within the United States or Canada any judgments obtained against us or our officers or directors.

Substantially all of our assets are located outside the United States and Canada. In addition, three of our five directors and all of our officers are nationals and/or residents of countries other than the United States and Canada, and all or a substantial portion of such persons’ assets are located outside of North America. As a result, it may be difficult for investors to enforce within the United States or Canada any judgments obtained against us or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States and Canada. Consequently, you may be effectively prevented from pursuing remedies against us or them under applicable securities laws.

The unavailability or high cost of drilling rigs, equipment, supplies, personnel and oil field services could adversely affect our ability to execute on a timely basis our exploration and development plans within our budget.

Shortages or the high cost of drilling rigs, equipment, supplies or personnel could delay or adversely affect our development and exploration operations. As the price of oil and natural gas increases, the demand for production equipment and personnel will likely also increase, potentially resulting, at least in the near-term, in shortages of equipment and personnel. In addition, larger producers may be more likely to secure access to such equipment by virtue of offering drilling companies more lucrative terms. If we are unable to acquire access to such resources, or can obtain access only at higher prices, not only would this potentially delay our ability to convert our reserves into cash flow, but could also significantly increase the cost of producing those reserves, thereby negatively impacting anticipated net income.

Our articles of incorporation exculpate our officers and directors from any liability to our company or our stockholders.

Our articles of incorporation contain a provision limiting the liability of our officers and directors for their acts or failures to act, except for acts involving intentional misconduct, fraud or a knowing violation of law. This limitation on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our stockholders from suing our officers and directors based upon breaches of their duties to our company.

The loss of certain key management employees could have a material adverse effect on our business.

Exploration and development of resource properties depends, in large part, on the ability to attract and maintain qualified key personnel. Competition for such personnel is intense, and we cannot assure you that we will be able to attract and retain them. Our development now and in the future will depend on the efforts of key management figures, such as Heinz Scholz, the Chairman of our Board of Directors, Dr. Werner Ladwein, Executive Director and President and Chief Executive Officer and Peter-Mark Vogel, Chief Financial Officer. The loss of any of these key people could have a material adverse effect on our business. We do not currently maintain key-man life insurance on any of our key employees.

There are potential conflicts of interest between our company and some of our directors and officers.

Some of our directors and officers are also directors and officers of other companies. Conflicts of interest could arise as a result of this. As of the date of this annual report and to the knowledge of our directors and officers, there are no existing conflicts of interest between our company and any of these individuals but situations may arise where directors and/or officers of our company may be in competition with our company. Any conflicts of interest will be subject to and governed by the law applicable to directors’ and officers’ conflicts of interest. In the event that such a conflict of interest arises at a meeting of our directors, a director who has such a conflict is required to abstain from any discussion and vote for or against the approval of such participation or such terms. As a result, our Board of Directors will be deprived of that person’s experience and expertise, which could adversely affect the outcome.

- 15 -

Risks Associated with Our Business

We have not discovered any oil and gas reserves, and we cannot assure you that we ever will.

We are in the business of exploring for oil and natural gas and the development and exploitation of any oil and gas that we might find in commercially exploitable quantities. Oil and gas exploration involves a high degree of risk that the exploration will not yield positive results. These risks are more acute in the early stages of exploration. We have not discovered any reserves, and we cannot guarantee that we ever will. Even if we succeed in discovering oil or gas reserves, these reserves may not be in commercially viable quantities or locations. Until we discover such reserves, we will not be able to generate any revenues from their exploitation and development. If we are unable to generate revenues from the exploitation and development of oil and gas reserves, we will be forced to change our business or cease operations.

Even if we discover and then develop oil and gas reserves, we may have difficulty distributing our production.

If we are able to produce oil and gas, we will have to make arrangements for storage and distribution of that oil and gas. We would have to rely on local infrastructure and the availability of transportation for storage and shipment of oil and gas products, but any readily available infrastructure and storage and transportation facilities may be insufficient or not available at commercially acceptable terms. This could be particularly problematic to the extent that operations are conducted in remote areas that are difficult to access, such as areas that are distant from shipping or pipeline facilities. Furthermore, weather conditions or natural disasters, actions by companies doing business in one or more of the areas in which we will operate, or labor disputes may impair the distribution of oil and gas. These factors may affect the ability to explore and develop properties and to store and transport oil and gas and may increase our expenses to a degree that has a material adverse effect on operations.

The oil and natural gas industry is highly competitive and there is no assurance that we will be successful in acquiring leases, equipment and personnel.

The oil and natural gas industry is intensely competitive. Although we do not compete with other oil and gas companies for the sale of any oil and gas that we may produce, as there is sufficient demand in the world market for these products, we compete with numerous individuals and companies for desirable oil and natural gas leases, suitable properties for drilling operations and necessary drilling equipment, qualified personnel and access to capital. Many of these individuals and companies with whom we compete have substantially greater technical, financial and operational resources and staff than we have. If we cannot compete for personnel, equipment and oil and gas properties, our business could be harmed.

Prices and markets for oil are unpredictable and tend to fluctuate significantly, which could reduce profitability, growth and the value of our business if we ever begin exploitation of reserves.

Our revenues and earnings, if any, will be highly sensitive to the price of oil and gas. Prices for oil and gas are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil and gas, market uncertainty and a variety of additional factors beyond our control. These factors include, without limitation, governmental fixing, pegging, controls or any combination of these and other factors, changes in domestic, international, political, social and economic environments, worldwide economic uncertainty, the availability and cost of funds for exploration and production, the actions of the Organization of Petroleum Exporting Countries, governmental regulations, political stability in the Middle East and elsewhere, war, or the threat of war, in oil producing regions, the foreign supply of oil, the price of foreign imports and the availability of alternate fuel sources. Significant changes in long-term price outlooks for crude oil or natural gas could, if we ever discover and exploit any reserves of oil or natural gas, have a material adverse effect on revenues as well as the value of our licenses or other assets.

- 16 -

An extended decline in oil prices may affect the commercial viability of our projects and may adversely affect our business, financial condition or results of operations.

The price of crude oil has declined over the last twelve months, a trend that accelerated sharply in the fourth fiscal quarter ended December 31, 2014, primarily due to a less optimistic forecast of worldwide economic growth and increased global oil and gas production. The commercial viability of our exploration and development projects is highly dependent on the price of oil. Prices also affect our ability to borrow money or raise additional capital. We will need to obtain additional financing to fund our operating activities. Our ability to do so may be adversely affected by an extended decline in oil prices. If we are unable to obtain such financing when needed, on commercially reasonable terms, we may be required to cease or curtail our operations, which could have a materially adverse impact on the market price of our stock. An extended decline in oil prices may adversely affect our business, financial condition or results of operations and our ability to meet our capital expenditure obligations and financial commitments.

Our business will suffer if we cannot obtain or maintain necessary licenses or if there is a defect in the chain of title.

Our operations require that we obtain and maintain licenses and permits from various governmental authorities. Our ability to obtain, maintain, extend or renew such licenses and permits on acceptable terms is subject to extensive regulation and to changes, from time to time, in those regulations. Also, the decision to grant or renew a license or permit is frequently subject to the discretion of the applicable government. If we cannot obtain, maintain, extend or renew these licenses or permits our business could be harmed. An overview of our licenses and their renewal dates can be found on page 57.

Also, although title reviews have been conducted on our existing properties, such reviews do not guarantee or certify an unforeseen defect in the chain of title will not arise to defeat our claim which could result in the loss of title and a reduction of the revenue received, if any.

Amendments to current laws and regulations governing our proposed operations could have a material adverse impact on our proposed business.

We are subject to substantial regulation relating to the exploration for, and the development, upgrading, marketing, pricing, taxation, and transportation of, oil and gas. Amendments to current laws and regulations governing operations and activities of oil and gas exploration and extraction operations could have a material adverse impact on our proposed business. In addition, we cannot assure you that income tax laws, royalty regulations and government incentive programs related to the oil and gas industry generally, or to us specifically will not be changed in a manner which may adversely affect us and cause delays, inability to complete or abandonment of projects.

Penalties we may incur could impair our business.

Failure to comply with government regulations could subject us to civil and criminal penalties, could require us to forfeit property rights or licenses, and may affect the value of our assets. We may also be required to take corrective actions, such as installing additional equipment, which could require substantial capital expenditures. We could also be required to indemnify our employees in connection with any expenses or liabilities that they may incur individually in connection with regulatory action against them. As a result, our future business prospects could deteriorate due to regulatory constraints, and our profitability could be impaired by our obligation to provide such indemnification to our employees.

Our inability to obtain necessary facilities could hamper our operations.

Oil and gas exploration and development activities depend on the availability of equipment, transportation, power and technical support in the particular areas where these activities will be conducted, and our access to these facilities may be limited. To the extent that we conduct our activities in remote areas or in under-developed markets, needed facilities may not be readily available, which could increase our expenses. Demand for such limited equipment and other facilities or access restrictions may affect the availability of such equipment and may delay exploration and development activities. The quality and reliability of necessary facilities may also be unpredictable and we may be required to make efforts to standardize our facilities, which may entail unanticipated costs and delays. Shortages or the unavailability of necessary equipment or other facilities will impair our activities, either by delaying our activities, increasing our costs or otherwise.

- 17 -

Emerging markets are subject to greater risks than more developed markets, including significant legal, economic and political risks.

In recent years Mongolia and Tajikistan have undergone substantial political, economic and social change. As in any emerging market, Mongolia and Tajikistan do not possess as sophisticated and efficient business, regulatory, power and transportation infrastructures as generally exist in more developed market economies. Investors in emerging markets should be aware that these markets are subject to greater risks than more developed markets, including in some cases significant legal, economic and political risks. Investors should also note that emerging economies are subject to rapid change and that the information set out herein may become outdated relatively quickly. We cannot predict what economic, political, legal or other changes may occur in these or other emerging markets, but such changes could adversely affect our ability to carry out exploration and development projects.

Particularly, the legal systems of Mongolia and Tajikistan are less developed than those of more established jurisdictions, which may result in risk such as: the lack of effective legal redress in the courts, whether in respect of a breach of law or regulation, or, in an ownership dispute, a higher degree of discretion on the part of governmental authorities, the delays caused by the extensive bureaucracy, the lack of judicial or administrative guidance on interpreting applicable laws and regulations, inconsistencies or conflicts between and within various laws, regulations, decrees, orders and resolutions, or relative inexperience of the judiciary and courts in such matters.

Our business in Mongolia may be subject to legal risk.

Mongolia transitioned from state socialism and a planned economy to parliamentary democracy and a free market economy. Much progress has been made in this transition, but much remains to be done, particularly with respect to the rule of law. The legal framework in Mongolia is, in many instances, based on recent political reforms or newly enacted legislation, which may not be consistent with long-standing local conventions and customs. As a result, there may be ambiguities, inconsistencies and anomalies in the agreements, licenses and title documents through which we hold our interests in Mongolia, or the underlying legislation upon which those interests are based. Many laws have been enacted, but in many instances they are neither understood nor enforced and may be applied in an inconsistent, arbitrary or unfair manner, while legal remedies may be uncertain, delayed or unavailable. For decades Mongolians have looked to politicians and bureaucrats as the sources of the “law”. This has changed in theory, but often not in practice. With respect to most day-to-day activities in Mongolia, government civil servants interpret, and often effectively make, the law. This situation is gradually changing but at a relatively slow pace. Although we believe that we have taken the legal steps necessary to obtain and hold its property and other interests in Mongolia, there can be no guarantee that such steps will be sufficient to preserve those interests.

Strategic relationships upon which we may rely are subject to change, which may diminish our ability to conduct our operations.

Our ability to discover reserves, to participate in drilling opportunities and to identify and enter into commercial arrangements depends on developing and maintaining close working relationships with industry participants and government officials and on our ability to select and evaluate suitable properties and to consummate transactions in a highly competitive environment. We may not be able to establish these strategic relationships or, if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to undertake in order to fulfill our obligations to these partners or maintain our relationships. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

Environmental risks may adversely affect our business.

All phases of the oil and gas business present environmental risks and hazards and are subject to environmental regulation pursuant to a variety of laws and regulations. Environmental legislation provides for, among other things, restrictions and prohibitions on spills, releases or emissions of various substances produced in association with oil and gas operations. The legislation also requires that wells and facility sites be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. Compliance with such legislation can require significant expenditures and a breach may result in the imposition of fines and penalties, some of which may be material. The application of environmental laws to our business may cause us to curtail our production or increase the costs of any production, development or exploration activities.

- 18 -

Losses and liabilities arising from uninsured or under-insured hazards could have a material adverse effect on our business.

If we develop and exploit oil and gas reserves, those operations will be subject to the customary hazards of recovering, transporting and processing hydrocarbons, such as fires, explosions, gas leaks, migration of harmful substances, blowouts and oil spills. An accident or error arising from these hazards might result in the loss of equipment or life, as well as injury, property damage or other liability. We have not made a determination as to the amount and type of insurance that we will carry. We cannot assure you that we will obtain insurance on reasonable terms or that any insurance we may obtain will be sufficient to cover any such accident or error. Our operations could be interrupted by natural disasters or other events beyond our control. Losses and liabilities arising from uninsured or under-insured events could have a material adverse effect on our business, financial condition and results of operations.

Fluctuations in currency exchange rates could have a material adverse impact on our operations.

All of our current operations are located in foreign countries. The terms and conditions of our major production sharing contracts and licenses are denominated in U.S. dollar, but various agreements, such as contractors, local staff and infrastructure, may be denominated in currencies other than U.S. dollar. Fluctuations in the value of the U.S. dollar or the local currency may cause a negative impact on costs. These types of fluctuations could have an adverse impact on our operations.

Risks Associated with Our Common Stock

The price of our common stock may become volatile, which could lead to losses by investors and costly securities litigation.

The trading price of our common stock is likely to be highly volatile and could fluctuate in response to factors such as:

- actual or anticipated variations in our operating results;

- announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, capital commitments, or other business developments, such as oil or gas discoveries;

- adoption of new accounting standards affecting our industry;

- additions or departures of key personnel;

- sales of our common stock or other securities in the open market;

- conditions or trends in our industry; and

- other events or factors, many of which are beyond our control.

The stock market has experienced significant price and volume fluctuations, and the market prices of stock in exploration stage companies have been highly volatile. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been initiated against the company. Litigation initiated against us, whether or not successful, could result in substantial costs and diversion of our management’s attention and resources, which could harm our business and financial condition.

If we obtain additional financing through the sale of additional equity in our company, the issuance of additional shares of common stock will result in dilution to our existing stockholders.

We are authorized to issue 600,000,000 shares of common stock and, as of March 31, 2015, 166,112,792 shares of our common stock were issued and outstanding. In addition, holders of options had, as of that date, the right to acquire up to an additional 12,300,000 number of shares of our common stock. Our Board of Directors has the authority to issue additional shares of common stock up to the authorized capital without the consent of any of our stockholders. Our Board of Directors may choose to issue some or all of such shares to acquire one or more businesses or to provide additional financing in the future. The issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. If we do issue any such additional shares, such issuance will cause a reduction in the proportionate ownership and voting power of all other stockholders. Further, any such issuance may result in a change of control of our company.

- 19 -

Our directors and executive officers own approximately 27.7% of our outstanding common stock.

In the aggregate, our directors and executive officers own approximately 21.9% of our outstanding common stock and they have the right to exercise options that would permit them to acquire, in the aggregate, up to an additional 5.8% of our common stock within the next 60 days. As a result, our directors and executive officers as a group may have a significant effect in delaying, deferring or preventing any potential change in control of our company, be able to strongly influence the actions of our Board of Directors even if they were to cease being our directors and control the outcome of actions brought to our stockholders for approval. Such a high level of ownership may adversely affect the voting and other rights of other stockholders.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. We cannot assure you of a positive return on investment or that you will not lose the entire amount of your investment in our common stock.

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) of less than USD 5.00 per share or an exercise price of less than USD 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of USD 5,000,000 or individuals with a net worth in excess of USD 1,000,000 or annual income exceeding USD 200,000 or USD 300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

The Financial Industry Regulatory Authority sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority, or “FINRA”, has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for shares of our common stock.

- 20 -

ITEM 1B UNRESOLVED STAFF COMMENTS

Not Applicable.

ITEM 2 PROPERTIES

Executive Offices and Registered Agent

Our principal executive office address is Bahnhofstrasse 9, 6341 Baar, Switzerland. Its telephone number is +41 (44) 718 10 30. Gobi Energy Partners LLC has an office in Ulan Bator, the capital of Mongolia. Somon Oil Company has offices in Dushanbe, the capital of Tajikistan, and Kudjant, which serve as base camps for geological expeditions for our operations in Tajikistan.

We maintain a registered office for service in the State of Nevada, located at Nevada Corporate Services, Inc., 8883 West Flamingo Road Suite 102, Las Vegas. Nevada 89147, U.S.A. In addition, the offices of Velletta and Company, located in Victoria, British Columbia, serves as our registered office in the Province of British Columbia. Velletta and Company’s address is 4th Floor – 931 Fort Street, Victoria, British Columbia V8V 3K3, Canada.

Oil and Gas Properties

The description of our oil and gas property interests is under the section entitled “Business” beginning on page 6 starting with the subsection “Overview of Our Projects”.

ITEM 3 LEGAL PROCEEDINGS

There are no pending legal proceedings to which our company or any of our subsidiaries is a party or of which any of our properties, or the properties of any of our subsidiaries, is the subject. In addition, we do not know of any such proceedings contemplated by any governmental authorities.

Litigation in Chile

Manas Management Services Ltd., our wholly-owned Bahamian subsidiary, owned 99% of Manas Energia Chile Limitada which in turn, was one of the parties to a farm-out agreement in respect of a project located in Chile.

During the initial phase of applying for our Chilean Exploration license, we formed a joint bidding group with Improved Petroleum Recovery Tranquillo Chile (commonly referred to as “IPR”) and a start-up company called Energy Focus Limitada (“Energy Focus”). Each had a one-third interest. Of its own accord, Energy Focus left the bidding group. The three parties signed a side letter which provided that Energy Focus would have an option to rejoin the bidding group under certain conditions.

Even though Energy Focus had been asked many times to join the group by contributing its prorated share of capital, it failed to do so. Despite this, Energy Focus claims that it is entitled to participate in the consortium at any future time, not just under certain conditions. We and IPR believe that Energy Focus no longer has any right to join the bidding group because the conditions specified in the side letter did not occur, and can no longer occur.

Energy Focus commenced litigation for specific performance and damages in an unspecified amount in Santiago de Chile, claiming interest in the Tranquilo Block from our company and IPR, and our respective subsidiaries. Our company, IPR and our respective legal counsel are of the view that the Energy Focus’ claim is without merit, that it was brought in the wrong jurisdiction and that Energy Focus failed to properly serve the parties. The trial courts of Santiago have dismissed the case. Energy Focus took an appeal, which was also dismissed. Energy Focus took a second appeal and that too was also dismissed. The time to bring a further appeal has lapsed and our legal advisors inform us that the matter is now finally concluded in favor of our company.

- 21 -

In January 2010, we signed an agreement to transfer our interest in this Chilean project and on April 14, 2011, we transferred all our rights, interests and obligations in the project to Methanex and Wintershall. The Chilean Minister of Energy authorized this transfer on April 28, 2011. The cash payment for the transfer of the Company’s interest in the Chilean project of USD 72,000 was received on September 23, 2011 from the new owners.

ITEM 4 MINE SAFETY DISCLOSURES

Not applicable.

- 22 -

PART II

ITEM 5 MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is quoted on the OTCQB, the over-the-counter-market operated by OTC Markets Group, under the trading symbol “MNAP”. Our common stock is also listed on the TSX Venture Exchange in Canada under the trading symbol “MNP”. The CUSIP number for our common stock is 55315B 109. Quotations of our common stock on all of these markets have been sporadic, and trading volume has been low.

Set forth below are the range of high and low bid quotations for our common stock from the OTCQB and high and low closing prices for our common stock from the TSX Venture Exchange for each fiscal quarter during the fiscal years ended December 31, 2014 and 2013. The market quotations were obtained from the OTCQB and the TSX Venture Exchange, respectively, and reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions:

| TSX Venture Exchange (Canadian Dollars) |

OTCQB (US Dollars) | |||

| Quarter Ended | High | Low | High | Low |

| March 31, 2013 | 0.1150 | 0.700 | 0.070 | 0.068 |

| June 30, 2013 | 0.075 | 0.050 | 0.058 | 0.055 |

| September 30, 2013 | 0.080 | 0.050 | 0.055 | 0.054 |

| December 31, 2013 | 0.080 | 0.040 | 0.070 | 0.044 |

| March 31, 2014 | 0.080 | 0.045 | 0.070 | 0.050 |

| June 30, 2014 | 0.095 | 0.055 | 0.090 | 0.050 |

| September 30, 2014 | 0.165 | 0.045 | 0.160 | 0.040 |

| December 31, 2014 | 0.155 | 0.080 | 0.140 | 0.080 |

On March 26, 2015, the closing price for our common stock as reported by the OTCQB was USD 0.11 and the closing price of our common stock on the TSX Venture Exchange was CAD 0.12.

Transfer Agent

Our shares of common stock are issued in registered form. The transfer agent and registrar for our common stock is Island Stock Transfer. Its address is 15500 Roosevelt Boulevard, Suite 301 Clearwater, FL 33760. The co-transfer agent for our common stock is Equity Financial Trust Company, 1185 West Georgia Street, Suite 1620, Vancouver B.C. V6E 4E6.

Holders of Common Stock

As of March 26, 2015, there were approximately 555 registered holders of record of our common stock. As of such date, 166,112,792 shares were issued and outstanding.

Dividends

The payment of dividends, if any, in the future, rests within the sole discretion of our Board of Directors. The payment of dividends will depend upon our earnings, our capital requirements and our financial condition, as well as other relevant factors. We have not declared any cash dividends since our inception and have no present intention of paying any cash dividends on our common stock in the foreseeable future.

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. |

We would not be able to pay our debts as they become due in the usual course of business; or | |

| 2. |

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

- 23 -

Securities authorized for issuance under equity compensation plans.

We have no long-term incentive plans, other than the Stock Option Plans described below.

Stock Option Plans

2007 Omnibus Stock Option Plan

In April 2007, our Board of Directors adopted and our shareholders approved our 2007 Omnibus Stock Option Plan. On October 21, 2008 our Board of Directors approved a modification to our 2007 Omnibus Stock Option Plan and, on October 31, 2008, our shareholders approved the modified 2007 Omnibus Stock Option Plan. Under the 2007 Omnibus Stock Option Plan, as amended, we may grant our qualified directors, officers, employees, consultants and advisors stock options (which may be designated as nonqualified stock options or incentive stock options), stock appreciation rights, restricted stock awards, performance awards or other forms of stock-based incentive awards, up to a maximum of 20,000,000 shares.

Our Board of Directors administers the 2007 Omnibus Stock Option Plan. Members of the Board of Directors receive no additional compensation for their services in connection with the administration of the Stock Option Plan. They have full discretion and exclusive power to:

- select who will participate in our 2007 Omnibus Stock Option Plan and what awards they will be granted;

- determine the time at which awards shall be granted and any terms and conditions, within the limits of the 2007 Omnibus Stock Option Plan, of such awards; and

- resolve all questions relating to the administration of the 2007 Omnibus Stock Option Plan.

The Board of Directors may grant nonqualified stock options or incentive stock options that are evidenced by stock option agreements. The exercise price of the common stock subject to a non-qualified stock option or an incentive stock option may be paid in cash or, at the discretion of our Board of Directors, by a promissory note, by the tender of common stock or through a combination thereof. The Board of Directors may provide for the exercise of options in installments and upon such terms, conditions and restrictions as it may determine.

A non-qualified stock option is a right to purchase a specific number of shares of common stock during such time as the Board of Directors may determine, not to exceed 10 years, at a price determined by the Board of Directors that, unless deemed otherwise by the Board of Directors, is not less than the fair market value of the common stock on the date the Board grants the non-qualified stock option.