Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 2, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-22512

WEST MARINE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 77-0355502 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| 500 Westridge Drive, Watsonville, CA | 95076-4100 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (831) 728-2700

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 par value | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933, as amended. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act of 1934, as amended (Exchange Act). Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of July 2, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $123.3 million based on the closing sale price of $5.55, as reported on the NASDAQ Global Market on such date.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

Outstanding at March 9, 2010 | |

| Common stock, $.001 par value per share | 22,350,829 shares |

DOCUMENTS INCORPORATED BY REFERENCE

| Document |

Parts Into Which Incorporated | |

| Proxy Statement for the Annual Meeting of Stockholders to be held on May 20, 2010. | Part II, Item 5 and Part III |

Table of Contents

WEST MARINE, INC.

2009 FORM 10-K ANNUAL REPORT

| Page | ||||

| PART I |

||||

| Item 1. |

Business | 1 | ||

| Item 1A. |

Risk Factors | 4 | ||

| Item 1B. |

Unresolved Staff Comments | 13 | ||

| Item 2. |

Properties | 13 | ||

| Item 3. |

Legal Proceedings | 13 | ||

| Item 4. |

[Reserved] | 14 | ||

| PART II |

||||

| Item 5. |

15 | |||

| Item 6. |

17 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 | ||

| Item 7A. |

32 | |||

| Item 8. |

33 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

60 | ||

| Item 9A. |

60 | |||

| Item 9B. |

60 | |||

| PART III |

||||

| Item 10. |

61 | |||

| Item 11. |

61 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

61 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

61 | ||

| Item 14. |

61 | |||

| PART IV |

||||

| Item 15. |

Exhibits and Financial Statement Schedules | 62 | ||

i

Table of Contents

PRELIMINARY NOTE

This report is for the year ended January 2, 2010. This report modifies and supersedes documents filed prior to this report. The Securities and Exchange Commission (the “SEC”) allows us to “incorporate by reference” information that we file with them, which means that we can disclose important information to you by referring you directly to those documents. Information incorporated by reference is considered to be part of this report. In addition, information that we file with the SEC in the future automatically will update and supersede information contained in this report.

We undertake no obligation (other than that required by law) to publicly update or revise any disclosures contained in this report, whether as a result of new information, future events or otherwise. Website references throughout this report are for information only, and the content of these websites is not incorporated by reference and should not otherwise be considered a part of this report.

ii

Table of Contents

PART I

General

West Marine is the largest boating supply retailer in the world with 2009 net revenues of $588.4 million. Our business strategy is to offer an assortment of competitively-priced merchandise for the boat and for the boater that meets the needs of individual boaters and boating businesses, provide great customer experiences, and offer the convenience of multi-channel shopping.

We have three reportable segments: Stores; Port Supply, our wholesale segment; and Direct Sales, which includes Internet and call center transactions. Our Stores segment generated approximately 89% of our 2009 net revenues. Our 335 Company-operated stores open at the end of 2009 are located in 38 states, Puerto Rico and Canada. In addition, we have two franchised stores in Turkey. Our Port Supply segment is one of the largest wholesale distributors of marine supply and equipment in the United States. Products shipped to Port Supply customers directly from our warehouses represented approximately 5% of our 2009 net revenues. Our Direct Sales segment offers customers around the world more than 50,000 products and accounted for the remaining 6% of our 2009 net revenues. Financial information about our segments appears in Note 10 to our consolidated financial statements, in Item 8 of this report.

West Marine, Inc. was incorporated in Delaware in September 1993 as the holding company for West Marine Products, Inc., which was incorporated in California in 1976. Unless the context otherwise requires, “West Marine,” “we,” “us,” “Company” and “our” refer to West Marine, Inc. and its subsidiaries. Our principal executive offices are located at 500 Westridge Drive, Watsonville, California 95076-4100, and our telephone number is (831) 728-2700. Our two distribution centers are located in Rock Hill, South Carolina and Hollister, California.

All references to 2009, 2008 and 2007 in this report refer to our fiscal years ended on January 2, 2010, January 3, 2009 and December 29, 2007, respectively. Fiscal year 2008 was a 53-week year, while both fiscal years 2009 and 2007 were 52-week years.

Stores Segment

Since opening our first store in Palo Alto, California in 1975, we have grown through internal expansion and through strategic acquisitions to 335 locations open at the end of 2009. During 2009, we opened nine new stores.

In addition to our standard-sized stores—which typically range from 6,000 to 12,000 square feet and carry over 6,000 items—we operate flagship stores, large format stores and smaller “express” stores. The large format stores range from 13,000 to 19,000 square feet and carry about 11,000 items. Express stores typically range from 2,500 to 3,000 square feet and carry over 4,000 items, mainly hardware and other supplies needed for day-to-day boat maintenance and repairs.

At the end of 2009, we had flagship stores in Ft. Lauderdale, Florida, San Diego, California, Brick, New Jersey and Jacksonville, Florida. Our flagship stores, at 20,000 square feet or larger, offer an expansive array of merchandise—about 16,000 items—as well as interactive displays designed to help customers make informed product selections. These stores offer not only an extensive assortment of core boating hardware and supplies, but also present a broader selection of boating-related lifestyle products, such as apparel. The flagship stores feature unique visual design elements and fixtures with a nautical theme, designed to create an exciting atmosphere that we believe appeal to our customers.

We regularly monitor and take steps to improve individual store performance, including remodeling or expanding stores, relocating stores to more profitable locations and closing lower-performing stores which, along with our flagship store concept, form a part of our “market optimization” strategy. In 2009, we closed 18 stores

1

Table of Contents

and remodeled two stores. In 2010, we expect to open three standard-sized stores, five large format stores and three flagship stores. We also will close underperforming stores as and when appropriate, although no specific locations have been identified. In addition, we continue to pursue opportunities to consolidate multi-store markets with larger stores.

Port Supply Segment

Port Supply, our wholesale segment, was created to expand our market share across a broader customer base and to leverage our purchasing and distribution efficiencies. Our extensive store network gives Port Supply an advantage in serving wholesale customers seeking convenience and a larger assortment of products than those carried by typical distributors. We serve the wholesale market through commissioned sales representatives, our stores, our call center and the Internet at www.portsupply.com.

In 2009, we distributed marine supplies to domestic and international wholesale customers. Our largest wholesale customer accounted for less than 2% of total Port Supply segment revenues. Port Supply customers include businesses involved in boat sales, boat building, boat commissioning and repair, yacht chartering, marina operations and other boating-related activities. In addition, Port Supply sells to government and industrial customers who use our products for boating and non-boating purposes. We believe that with continued customer focus and breadth of product selection and availability, we will continue to be recognized as the preferred wholesale distributor in the industry.

Direct Sales Segment

Our e-commerce website and virtual call center comprise the Direct Sales, or direct-to-customer, segment. This direct-to-customer channel complements the Stores segment by building brand awareness, acting as an additional marketing vehicle, and providing our customers with the option of shopping from across the globe.

Our e-commerce website provides our customers with access to a broad selection of over 50,000 products, unique product advisor tips and technical information, over 250 product videos and customer-submitted product reviews. We believe our website is a cost-effective means of testing market acceptance of new products and concepts.

This segment also provides customers with access to knowledgeable technical advisors who can assist our customers in understanding the various uses and applications of the products we sell. We operate a virtual call center from which our associates assist our customers by taking calls at home or from our support center in Watsonville, California. Our virtual call center supports sales generated through the e-commerce website, catalogs and stores and provides customer service offerings. Fulfillment of customer orders placed on the website or via our virtual call center is completed through our distribution centers, or in certain cases directly from the vendor to the customer.

We mail our catalogs to addresses from our proprietary customer list. In addition, we acquire potential customer names from a variety of sources, including lists purchased from or exchanged with other mail order merchandisers. All mail list exchanges are consistent with our published privacy policies. Our customer list is continually updated to include customer address changes and new customer prospects, and to eliminate non-responders and information of customers requesting to opt out of our marketing programs.

Foreign Sales

We promote and sell our marine products internationally through our Port Supply and Direct Sales segments. Through our Stores segment, we operate 10 stores located in Canada and we franchise two stores in Turkey. For each of 2009, 2008 and 2007, revenues outside of the United States represented 5% or less of our total net revenues.

2

Table of Contents

Customer Service

Offering exceptional customer service has been the cornerstone of West Marine since our beginning. We remain focused on the customer and providing great customer experiences—a commitment to excellence that is embraced by all West Marine associates. Many of our selling associates receive advanced product and technical training, empowering them to take great care of our customers. We will continue to listen to our customers and refine our business to meet their needs.

Merchandising

West Marine is committed to a broad assortment of merchandise that provides what our customers want, when they want it. Our merchandising department is responsible for vendor and product selections; and our planning and replenishment department is responsible for purchasing and managing inventory levels in our distribution centers and our stores. We also offer our customers the ability to special order products that we do not keep in inventory in our stores or at our distribution centers.

We purchased merchandise from more than 800 vendors during 2009 and realized savings through quantity purchases and direct shipments. In 2009, no single vendor accounted for more than 11% of our merchandise purchases, and our 20 largest vendors accounted for approximately 43% of our merchandise purchases. Generally, we purchase merchandise from our vendors on an order-by-order basis.

During 2009, we continued to offer private label merchandise, which typically feature higher gross margins than comparable branded products. Private label products, which we sell under the “West Marine” and “Seafit” brand names, usually are manufactured in Asia, the United States and Europe. We have a limited number of long-term contracts with our manufacturing sources and we compete with other companies for production facilities and import quota capacity.

Logistics

We operate two distribution centers: a 472,000 square foot facility in Rock Hill, South Carolina and a 240,000 square foot facility in Hollister, California. Generally vendors ship products to our distribution centers, where merchandise is inspected and prepared for shipment to stores or drop-shipped directly to customers in order to fulfill inventory or outstanding customer orders for all of our business segments (Stores, Port Supply, and Direct Sales). Some vendors ship products directly to our stores. We use various third-party domestic and international transportation methods, such as ocean, air and ground, including Company-owned vehicles. Our distribution centers utilize advanced material handling equipment and voice-picking technologies, as well as radio frequency identification tagging, to enable real-time management of inventory.

Marketing

Our overall marketing objectives are to provide compelling product offerings to our customers that are aligned with our mission statement and financial goals, drive customer traffic, acquire new customers, and increase sales and profit. West Marine is committed to being a leader in sustainability within the industry by promoting “Green Boating” messages to our customers and the media. We position our West Marine brand to stand for better selection, trust, friendly and knowledgeable service, competitive prices and shopping convenience. We market our products and services through direct mail catalogs and flyers, email and advertisements in boating specialty publications, newspapers and on the Internet.

We participate in a number of boat shows and sponsor a number of boating-related events each year, ranging from sailing regattas and fishing derbies to waterway clean-up and environmental quality campaigns. These events are designed to encourage participation in boating, increase the number of people enjoying the boating lifestyle, promote environmental responsibility and improve West Marine’s brand recognition.

3

Table of Contents

Our free and paid-subscription loyalty programs rank among the largest recreational boating membership programs in the United States.

Competition

The retail market for marine supplies is highly competitive and our stores compete with other specialty boating supply stores, and a variety of local and regional specialty stores, sporting good stores and mass merchants. Many of these competitors have stores in markets where we now operate. Also, we have a number of competitors engaged in the catalog, Internet and wholesale distribution of marine products. The principal factors of competition in our marketplace are selection, quality, availability, price, customer service, convenience and access to a wide variety of merchandise.

Trademarks and Service Marks

We own the trademarks and service marks “West Marine” and “Port Supply,” among others. These marks and a number of others are registered with the U.S. Patent and Trademark Office and in certain foreign countries. Each federal registration is renewable indefinitely if the mark is still in use at the time of renewal. We have a license to use the “BoatU.S.” tradename under a marketing agreement with the Boat Owners Association of the United States, although we have discontinued the use of the BoatU.S. tradename except in certain limited situations.

Associates

As of February 27, 2010, we had 3,963 associates, of whom 1,810 were full-time and 2,153 were part-time or temporary. A significant number of temporary associates are hired during our peak selling season, which is summer. For example, West Marine employed 4,559 associates on July 4, 2009.

Available Information

West Marine’s Internet address is www.westmarine.com. We make available, free of charge through the “Investor Relations” portion of our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Forms 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act including the exhibits thereto, as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the SEC. Interested persons may also access copies of these reports through the SEC’s website, www.sec.gov. We will furnish to our stockholders any exhibit to this annual report upon the written request of such stockholder and the payment of a specified fee, which is limited to our reasonable expenses.

We have adopted a code of ethics for our associates and Board of Directors, as well as an additional code of ethics for our senior financial officers (including our principal executive officer, principal financial officer and principal accounting officer). Copies of these codes of ethics are available on our website at www.westmarine.com, or printed copies can be obtained by writing to the Secretary, West Marine, Inc., 500 Westridge Drive, Watsonville, California 95076. Any amendments to these codes of ethics, as well as any waivers that are required to be disclosed under the rules of the SEC or the NASDAQ Stock Market, are posted on our website.

Our business faces many risks. The risks described below may not be the only risks we face. Additional risks of which we are not yet aware, or that we currently think are immaterial, may also impair our business operations or financial results. If any of the events or circumstances described in the following risks actually occurs, our business, financial condition or results of operations could suffer and the trading price of our common stock could decline.

4

Table of Contents

Our ability to generate revenue could be significantly affected by prolonged economic uncertainty.

The global economic crisis caused a general tightening in credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, and extreme volatility in credit, equity and fixed-income markets. A continued slowdown in the U.S. or global economy, or an uncertain economic outlook, could adversely affect consumer spending habits and our operating results in the future. Because consumers often consider boats to be luxury items, our success depends upon a number of factors relating to consumer spending, including current and future economic conditions affecting disposable consumer income such as consumer confidence, employment, business conditions, fuel prices, interest rates, tax rates and rising consumer debt levels. In addition, our business opportunities are directly dependent upon the level of consumer spending on recreational boating supplies, a discretionary spending item. There can be no assurance that the current trends of reduced spending in the boating industry in general and the recreational boating after-market in particular will not continue or that reduced consumer spending in general will not continue, thereby adversely affecting our net revenues and profitability.

An inability to find suitable new and expanded store sites or delays in new store openings could materially affect our financial performance.

In order to meet our growth objectives, we will need to secure an adequate number of suitable new or expanded store sites, typically near marinas or other locations readily accessible by boaters. We require that all proposed store sites satisfy our criteria regarding cost and location. In addition, we may experience increased competition for store sites and, at some point, exhaust available coastal locations for new stores. We cannot assure that we will be able to find a sufficient number of suitable new sites for any planned expansion in any future period.

Our expected financial performance is based on our new or expanded stores opening on expected dates. It is possible that events such as construction delays caused by permitting or licensing issues, material shortages, labor issues, weather delays or other acts of God, discovery of contaminants or accidents could delay planned new store openings beyond their expected dates or force us to abandon planned openings altogether. Any failure on our part to recognize or respond to these issues may adversely affect our revenue growth, which in turn may adversely affect our future operating results.

If we cannot successfully implement our expansion strategy, our growth and profitability could be adversely impacted.

Our continued growth depends to a significant degree on our ability to continue to expand our operations through the opening of new stores or the expanding or remodeling of existing stores, and our ability to operate these stores on a profitable basis. There can be no assurance that new, expanded and remodeled stores will achieve our expected level of profitability.

Our expansion is dependent upon a number of factors, including the adequacy of our capital resources and our ability to locate suitable store sites and negotiate acceptable lease terms, to hire, train and integrate associates and to adapt our distribution and other operational systems. There can be no assurance that we will be able to achieve our planned expansion or that such expansion will be accomplished on a profitable basis. Failure to achieve our planned expansion could have a material adverse effect on us.

Our expansion into new, unfamiliar markets presents increased risks that may prevent us from being profitable in these new markets.

Pursuant to our growth strategy, sometimes we open stores in new geographic markets. Typically, the first stores opened in a new market initially will not achieve operating results comparable to our existing stores due in large part to factors that generally affect store performance in new markets. These factors include less familiarity with local demographics, customer preferences, discretionary spending patterns, difficulties in attracting customers due to a reduced level of customer familiarity with our brand, difficulties in hiring a sufficient number

5

Table of Contents

of qualified store associates and other factors. In addition, entry into new markets may bring us into competition with new, unfamiliar competitors. We cannot assure you that we will be successful in operating our stores in new markets on a profitable basis.

We experience fluctuations in our comparable store sales.

Our comparable store sales have fluctuated significantly in the past on an annual, quarterly and monthly basis, and we expect that they will continue to fluctuate in the future. A variety of factors affect comparable store sales, including boat usage, boating participation, current economic conditions, competition, the timing and release of new merchandise and promotional events, changes in our merchandise mix, the success of marketing programs and weather conditions. These factors and others may cause our comparable store sales to differ significantly from prior periods and from expectations. Failure to meet the expectations of investors in one or more future periods could reduce the market price of our common stock.

We have undertaken a number of initiatives designed to build our long-term strength. If one or more of these initiatives is unsuccessful, our profitability could be adversely affected.

Over the past couple of years, we launched a number of initiatives designed to increase sales and lower costs. These initiatives include optimizing our supply chain and inventory levels, closing under-performing stores with corresponding workforce adjustments, tailoring store merchandise assortments for local markets, expanding our wholesale business, investing in Internet business growth and investing in flagship stores. Each of these initiatives carries a certain level of risk, primarily related to increased expenses or reduced sales, which, when combined, could be substantial. If we fail to successfully execute one or more of these strategies, our profitability could be adversely affected.

Our results of operations could be adversely affected if unseasonably cold weather, prolonged winter conditions, natural disasters such as hurricanes or extraordinary amounts of rainfall occur, especially during the peak boating season in the second and third fiscal quarters.

Our business is highly seasonal. The majority of our revenues occur between the months of April and August, which represent the peak boating months in most of our markets. Our annual results would be materially and adversely affected if our net revenues were to fall below expected seasonal levels during this period. Our business also is significantly affected by weather patterns. Unseasonably cool weather, prolonged winter conditions, extraordinary amounts of rainfall or natural disasters may decrease boating use in the peak season, resulting in lower maintenance needs and, therefore, decreased revenues.

Intense competition in the boating supply and outdoor recreation markets could reduce our revenue and profitability.

The retail market for recreational boating supplies and apparel is highly competitive. Our stores compete with other specialty marine supply stores. Many of these competitors have stores in the markets in which we now operate and in which we plan to expand. We also compete, to a lesser extent, with sporting goods stores and mass merchants. Our Internet and call center operations compete with other Internet and catalog retailers. We also have a number of competitors in the wholesale distribution of marine products. In addition, a key competitive factor in the marine supplies market is price. The bankruptcy or liquidation of one or more of our competitors in any one of our market segments could result in such competitors offering close-out prices that we cannot viably match. Competitive pressures resulting from competitors’ pricing policies have adversely affected our gross margins, and such pressures are expected to continue. There can be no assurance that we will not face greater competition from other retailers or that we will be able to compete successfully with existing and new competitors.

6

Table of Contents

If any of our key vendors or manufacturers fail to supply us with merchandise, we may not be able to meet the demands of our customers and our sales could decline.

We depend on merchandise purchased from our vendors and sourced from third-party manufacturers to obtain products for our sales channels. Generally, we deal with our suppliers on an order-by-order basis and have limited long-term purchase contracts or other contractual assurances of continued supply or pricing. Accordingly, our vendors and manufacturers could discontinue selling products to us at any time. The loss of any key vendor or manufacturer for any reason could limit our ability to offer products that our customers want to purchase. In addition, we believe many of our vendors obtain their products from China, Taiwan, Korea, Mexico and other countries, and we source products from third-party manufacturers in these countries. A vendor could discontinue selling to us products manufactured in foreign countries at any time for reasons that may or may not be within our control or the vendor’s control, including foreign government regulations, political unrest, war, disruption or delays in shipments, changes in local economic conditions, quotas, quality control and trade issues. Also, during weak economic times, such as those we are currently facing, there is an increased risk that certain of our vendors may experience financial difficulty resulting in inability to service, manufacture or deliver products to us in a timely manner. Additionally, changes in commercial practices of our key vendors or manufacturers, such as changes in vendor support and incentives or changes in credit or payment terms, could negatively impact our operating results. Our operating results also could suffer if we are unable to promptly replace a vendor or manufacturer who is unwilling or unable to satisfy our requirements with a vendor or manufacturer providing equally appealing products.

If we lose key management or are unable to attract and retain the talent required for our business, our operating results and financial condition could suffer.

Our future performance is substantially dependent upon the continued services of certain members of our senior management. We do not maintain any key-man life insurance for our senior management, including Randolph K. Repass, Chairman of our Board of Directors, nor Geoff Eisenberg, our President and Chief Executive Officer. The loss of the services of any key members of senior management could have a material adverse effect upon us. In addition, our continued growth depends on our ability to attract and retain skilled executives. There can be no assurance that we will be able to retain our existing personnel or attract additional qualified executives in the future or that our current management team can achieve our planned expansion or continue to operate West Marine in a profitable manner.

Our business depends on our ability to meet our labor needs.

Our success depends in part upon our ability to attract, motivate and retain a sufficient number of qualified associates, including general managers, assistant managers, call center associates and store associates, who understand and appreciate boating and the boating lifestyle and are able to communicate knowledgeably with our customers. Qualified individuals of the requisite caliber and in the numbers needed to fill these positions may be in short supply in some areas, and the turnover rate in the retail industry is high.

If we are unable to hire and retain sales associates capable of consistently providing a high level of customer service, as demonstrated by their enthusiasm for our culture and knowledge of our merchandise, our business could be materially adversely affected. Although none of our associates currently are covered by collective bargaining agreements, we cannot guarantee that our associates will not elect to be represented by labor unions in the future, which could increase our labor costs. Additionally, competition for qualified associates could require us to pay higher wages to attract a sufficient number of associates. An inability to recruit and retain a sufficient number of qualified individuals in the future may delay the planned openings of new stores. Any such delays, any material increases in associate turnover rates at existing stores or any increases in labor costs could have a material adverse effect on our business, financial condition or operating results.

7

Table of Contents

We must successfully order and manage our inventory to reflect customer demand in a volatile market and anticipate changing consumer preferences and buying trends or our revenues and profitability will be adversely affected.

Our success depends upon our ability to successfully manage our inventory and to anticipate and respond to merchandise trends and customer demands in a timely manner. The retail consumer industry, by its nature, is volatile and sensitive to numerous economic factors, including consumer preferences, competition, market conditions and general economic conditions. None of these factors are within our control. We cannot predict consumer preferences with certainty, and consumer preferences often change over time. We usually must order merchandise well in advance of the following selling season. The extended lead times for many of our purchases may make it difficult for us to respond rapidly to new or changing product trends, increases in customer demand or changes in prices. If we misjudge either the market for our merchandise or our customers’ purchasing habits, our revenues may decline significantly and we may not have sufficient quantities of merchandise to satisfy customer demand or we may be required to mark down excess inventory, either of which would result in lower profit margins.

A natural disaster or other disruption at our support center or either of our distribution centers could cause us to lose merchandise or inhibit our ability to process orders and, therefore, make us unable to effectively deliver to our direct customers and retail stores.

We rely on the continuous operation of our support center in Watsonville, California, and our distribution centers in Hollister, California, and Rock Hill, South Carolina. Any natural disaster or other serious disruption to these operations due to fire, flood, earthquake, hurricane, terrorism or any other unforeseen circumstance could materially impair our ability to do business and adversely affect our financial position and future operating results.

Reliance on our information technology systems exposes us to potential risks.

Reliance on our information technology systems exposes us to potential risks of interruptions due to natural disasters, cyber-attacks, unplanned outages, fraud perpetrated by malicious individuals or other causes. Our information technology systems and processes are based in our support center in Watsonville, California and a co-location managed by a third-party provider. We intend to increase our reliance on information technology systems in order to improve our business processes and supply chain efficiencies. Any unmitigated interruption of our information technology systems may have a negative impact on future financial results.

Our founder and Chairman, Randolph K. Repass, beneficially owns approximately 33% of our common stock. As a result, his interests may differ from that of our other stockholders.

Randolph K. Repass, the Chairman of our Board of Directors, beneficially owns approximately 33% of our common stock. As a result, Mr. Repass has substantial influence in the election of directors of West Marine and, in general, the outcome of any matter submitted to a vote of our stockholders, including mergers, consolidations or the sale of all or substantially all of our assets. Due to his significant ownership position, Mr. Repass may be able, in concert with others, to prevent or to cause a change in control of West Marine.

We face periodic reviews, audits and investigations by government agencies, and these audits could have adverse findings, which may negatively impact our business.

We are subject to various routine and non-routine reviews, audits and investigations by various federal and state governmental regulators, including environmental, tax and customs agencies. Violation of the laws and regulations governing our operations, or changes in interpretations of those laws, could result in the imposition of civil or criminal penalties, the suspension or revocation of our licenses, or the revision and recoupment of past payments made based on audit findings. If we become subject to material fines or if other sanctions or other corrective actions were imposed upon us, our results of operations may be negatively impacted.

8

Table of Contents

Our business and financial results may be adversely affected by global climate change or by legal, regulatory or market responses to such change.

The growing political and scientific sentiment is that increased concentrations of carbon dioxide and other greenhouse gases in the atmosphere are influencing global weather patterns. Changing weather patterns, along with the increased frequency or duration of extreme weather conditions, especially during our peak boating season, could reduce the sale of our products or materially affect our store locations, which are primarily located in coastal areas, through storm damage, reduced traffic, or increased insurance rates. Additionally, concern over climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting greenhouse gas emissions. For example, proposals that would impose mandatory requirements on greenhouse gas emissions continue to be considered by policy makers which, if adopted, may adversely affect the boating industry and the suppliers of our retail products. Laws enacted may increase production costs for many of our retail products and, therefore, the prices we pay to stock such products may increase. We may not be able to pass along these increased prices to our customers, which could adversely impact our business and financial results.

Our failure to comply with certain environmental regulations could adversely affect our business.

We sell paints, varnishes and other products. The storage, distribution, transportation and disposal of some of these products are subject to a variety of federal and state environmental regulations. Our failure to comply with these regulations could have an adverse impact on our business. In addition, we have indemnified certain of our landlords for any hazardous waste which may be found on or about the particular property or operation. If any such hazardous waste were to be found on property that we occupy, a significant claim giving rise to our indemnity obligation could adversely impact our operating results.

Because we self-insure against certain risks and maintain high deductibles on certain of our insurance policies, our operating results may be adversely affected if we suffer a substantial casualty.

We believe that insurance coverage is prudent for risk management, and we expect that our insurance costs will continue to increase. For certain types or levels of risk, including medical care, we have decided to limit our purchase of relevant insurance, choosing instead to self-insure. With medical insurance, we have individual and aggregate stop loss insurance to protect us from large claims. In other cases, we have elected to retain a higher portion of the risk in the form of higher deductibles. If we suffer a substantial loss that is not covered by commercial insurance, the loss and attendant expenses could have a material adverse effect on our business and operating results.

In 1999, we began insuring our workers’ compensation losses through a high deductible program. This high per-claim deductible permits us to maintain low premium rates but may result in unexpectedly high costs if actual losses greatly exceed the expected losses in a year, with a corresponding negative effect on our operating results.

Our workers’ compensation expense is tied directly to the frequency and severity of workplace injuries to our associates. The costs associated with our workers’ compensation program include case reserves for reported claims up to the per claim deductible, an additional expense provision for unanticipated increases in the cost of open injury claims and for claims incurred in prior periods but not reported, as well as fees payable for claims administration. We recognize our liability for the ultimate payment of incurred claims and claims adjustment expenses by accruing liabilities on an actuarial basis which represent estimates of future amounts necessary to pay claims and related expenses with respect to covered events that have occurred. It is possible that our actual future workers’ compensation obligations may exceed the amount of its accrued liabilities, with a corresponding negative effect on future earnings, due to such factors as unanticipated adverse loss development of known claims, and the effect, if any, of claims incurred but not reported.

9

Table of Contents

A material weakness in our internal control over financial reporting could lead to errors in our financial statements and a lack of investor confidence in us and a resulting decline in our stock price.

Management has concluded that, as of January 2, 2010, we had not maintained effective internal control over financial reporting. As a result of the identified material weakness, an adjustment was necessary to accrued liabilities and costs of goods sold with respect to accrued freight charges during the fourth quarter ended January 2, 2010. However, the adjustment related to the material weakness and other fourth quarter adjustments, viewed individually or in the aggregate, did not result in any material misstatement of any financial statements we previously issued.

Although, as disclosed in Item 9A in this annual report on Form 10-K, we are in the process of implementing measures to remediate the material weakness by reviewing and improving our process for reconciling significant management estimates related to accrued freight charges, there can be no assurance that our remedial efforts will be effective, nor can there be any assurances that additional material weaknesses will not be identified in the future. Until our remediation efforts are completed, we will continue to be at an increased risk that our financial statements could contain errors that will be undetected, and we will continue to incur the expense and management burdens associated with the remediation efforts and the additional procedures required to prepare our consolidated financial statements. Any failure to remedy our material weakness could have a material adverse effect on our business and results of operations and could have a substantial adverse impact on the trading price of our common stock.

Further, the existence of our material weakness in our internal control over financial reporting could lead investors to question the reliability and accuracy of our reported financial information. Any such lack of confidence in the financial information that we produce could result in a decline in our stock price.

Failure to comply with the SEC’s permanent injunction entered on consent against us could subject us to further SEC enforcement actions, which could adversely affect our business.

As previously disclosed, we were the subject of a formal investigation by the SEC’s Division of Enforcement. We reached a consensual resolution of the SEC’s civil complaint resulting in a permanent injunction (the “SEC Injunction”) entered on August 31, 2009 in the U.S. District Court for the Northern District of California, San Jose Division. In agreeing to the entry of the SEC Injunction, we neither admitted nor denied the allegations in the SEC’s complaint. The SEC Injunction, by its terms, permanently restrains and enjoins us from, among other things, (1) filing with the SEC any report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and rules and regulations adopted under the Exchange Act, that contains any untrue statement of a material fact, which omits to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading, or that omits to disclose any information required to be disclosed, (2) failing to make and keep accurate books, records and accounts, and (3) failing to devise and maintain an adequate system of internal accounting controls and procedures. Our failure to comply with any of the provisions of the SEC Injunction could adversely affect our business as a result of further SEC investigations, enforcement action, criminal prosecution and penalties, which could be significant.

The price of our common stock may be subject to volatile fluctuations based on fluctuations in our quarterly results, general economic and market conditions and by our ability to meet market expectations.

The market price of our common stock may be subject to significant fluctuations in response to operating results, comparable store sales announcements, announcements by competitors, our ability to meet market expectations and other factors. Variations in the market price of our common stock may also be the result of changes in the trading characteristics that prevail in the market for our common stock, including low trading volumes, trading volume fluctuations and other similar factors. These market fluctuations, as well as general economic conditions, may adversely affect the market price of our common stock. We cannot assure that the market price of our common stock will not fluctuate or decline significantly in the future.

10

Table of Contents

Our efforts to expand internationally, whether through acquisitions, franchising, licensing or similar arrangements, may not be successful and could impair the value of our brands.

The effect of international expansion, either by the acquisition of existing marine businesses or through franchising, licensing, joint venture or other similar arrangements, on our business and results of operations is uncertain and will depend upon various factors, including the demand for our products in new markets internationally, our ability to identify appropriate acquisition candidates or third parties to act as franchisees, licensees, distributors or in a similar capacity, the ability of third parties to meet their projections regarding store openings and sales, and our ability to employ personnel or consultants experienced in international operations. Failure to expand internationally successfully or a failure to protect the value of our brands could have an adverse effect on our results of operations.

General economic and business conditions as well as those specific to the retail industry may adversely affect our business and results of operations.

Worsening economic and business conditions may adversely impact consumer spending, particularly in discretionary areas, such as boating. Discretionary consumer spending, which is critical to our success, is influenced by general economic conditions and the availability of discretionary income. Accordingly, we may experience declines in sales during economic downturns or during periods of uncertainty. In addition, volatility in fuel and other energy prices as well as consumer uncertainty that has accompanied the ongoing home mortgage and credit “crisis” and general weakness in housing markets and the economy in general has resulted in decreased discretionary consumer spending. A continuing decline in consumer confidence or the amount of discretionary spending could have a material adverse effect on our sales, results of operations, business and financial condition.

Our profitability may be adversely affected if we do not continue to improve our business processes in response to worsening economic conditions.

From time to time we may have to restructure our business to react to worsening economic conditions, a decline in the boating industry (or the softening of our industry) and/or to changing technology, products and markets. If we are not able to continue to improve our business processes, our financial and our information technology systems, or if we are not able to restructure our business in response to the deteriorating economic conditions, we may not be able to achieve our financial objectives.

Fluctuations in currency exchange rates may adversely impact our cash flows and earnings.

We have retail stores located in Canada, and therefore our cash flows and earnings are exposed to currency exchange rate fluctuations between the U.S. dollar and the Canadian dollar. While we may attempt to limit our exposure to exchange rate changes by entering into short-term currency exchange contracts, there is no assurance that we will hedge or will be able to hedge such foreign currency exchange risk or that our hedges will be successful. Our currency exchange gains or losses may adversely impact our cash flows and earnings. Additionally, adverse movements in currency exchange rates could result in a reduction in growth of international direct sales, impacting our cash flows and earnings.

Economic and other factors affecting financial institutions and the value of our collateral could affect our access to capital.

Borrowings against our credit facility represent our primary source of capital. U.S. and global credit markets have recently undergone significant disruption, making it difficult for many businesses to obtain financing on acceptable terms. In addition, an increasing number of financial institutions have reported significant deterioration in their financial condition. If our lender is unable to perform its obligations under our existing credit facility, and we are unable to find suitable replacements on acceptable terms, our results of operations, liquidity and cash flows could be adversely affected. Further, our existing credit facility expires in December 2010. Given the current credit environment, we do not expect to renew the facility with terms and conditions similar to our existing facility and our cost of borrowing will likely be higher than our existing facility.

11

Table of Contents

Our credit facility is secured by a security interest in our assets, primarily inventory and accounts receivable. Under the terms of our credit facility, the availability of borrowings under the facility is directly related to the assessed values of these assets. If the value of these assets were to decline due to market conditions or any other reason, this would, in turn, reduce the amount of capital available to West Marine. The resulting lack of liquidity could adversely affect our ability to operate and appropriately invest in the business.

Our reputation and business could be materially harmed as a result of data breaches, data theft, unauthorized access or hacking.

The protection of our customer, associate and Company data is critical to West Marine. The regulatory environment surrounding information security and privacy is increasingly demanding, with the frequent imposition of new and constantly changing requirements. Additionally, our Internet operations are subject to a number of risks, including reliance on third-party providers, online security breaches and/or credit card fraud. Credit card issuers have promulgated credit card security guidelines as part of their ongoing effort to battle identity theft and credit card fraud. We continue to work with our third-party providers and credit card issuers to assure that our products and services comply with the credit card association’s security regulations. There can be no assurances, however, that our processes and systems, or those of our third-party providers, are invulnerable to unauthorized access or hacking. Unauthorized intrusion into portions of our computer systems, or those of our third-party providers that process and store information related to our customer transactions, may result in a data breach and theft of customer data.

We rely on proprietary and commercially available systems, software, tools and monitoring to provide security for processing, transmitting and storing confidential customer information, such as customer’s payment cards and personal information. Furthermore, the systems currently used for transmission and approval of payment card transactions, and the technology utilized in payment cards themselves, all of which can put payment card data at risk, are determined and legally mandated by payment card industry standards, not by us. Compliance with these requirements may result in cost increases due to necessary system and administrative process changes. Improper activities by third parties, advances in computer and software capabilities and encryption technologies, new tools and discoveries, and other events or developments, may facilitate or result in a compromise or breach of our computer systems. Any such compromises or breaches could cause interruptions in our operations, damage our reputation, subject us to costs, fines or liabilities, and potentially hurt sales, revenues and profits.

We face the risk of exposure to product liability claims, product recalls and adverse publicity.

We market and distribute products purchased from third-party suppliers, including products which are marketed and resold under our private label brand. We may inadvertently resell product(s) that contain a defect which may cause property damage or personal injury to our end-user customers, which therefore exposes us to the risk of adverse publicity, product liability claims, and product recalls or other regulatory or enforcement actions, including those initiated by the U.S. Consumer Product Safety Commission, by state regulatory authorities or through private causes of action. We generally seek contractual indemnification and insurance coverage from our suppliers and we carry our own insurance. However, if the insurance coverage is not adequate and/or the contractual indemnification is not provided by or enforceable against the supplier, product liability claims relating to defective and/or recalled products could have a material adverse effect on our ability to successfully market our products and on our business, financial condition and results of operations. In addition, even if a product liability claim is not successful or is not fully pursued, the negative publicity surrounding a product recall or any assertion that our products caused property damage or personal injury could damage our brand identity and our reputation with existing and potential customers and have a material adverse effect on our business, financial condition and results of operations.

Changes in laws and regulations could increase our cost of doing business.

We are subject to a wide variety of laws and regulations in the United States and the other countries and jurisdictions in which we operate, and changes in the level of government regulation of our business have the

12

Table of Contents

potential to materially alter our business practices and/or our profitability. Changes in U.S. or foreign law that change our operating requirements with respect to sourcing or reselling products could increase our costs of compliance or make it too expensive for us to offer such products, which could lead to a reduction in revenue. Also, changing regulations and laws governing the Internet and e-commerce transactions (including taxation, user privacy, data protection, pricing and electronic communications) could impede the growth of our Internet business and increase our cost of doing business. Furthermore, changes in federal or state wage requirements (including changes in entitlement programs such as health insurance, paid leave programs, or other changes in workplace regulation) could adversely impact our ability to achieve our financial targets. Additionally, because a portion of our merchandise is imported from overseas, changes in trade restrictions, new tariffs and quotas, and higher shipping costs for goods could adversely impact our merchandise costs and our ability to achieve anticipated operating results.

Changes in accounting standards, interpretations or applications of accounting principles, and subjective assumptions, estimates and judgments by management related to complex accounting matters, could significantly affect our financial results.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business including, but not limited to, inventory valuation adjustments, capitalized indirect costs, costs associated with exit activities, impairment of long-lived assets, workers’ compensation reserves, and valuation allowances against our deferred tax assets, are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes in underlying assumptions, estimates or judgments by our management could significantly change our reported or expected financial performance. Additionally, changes in accounting principles and related accounting pronouncements, their interpretation and/or their application to our financial statements could result in material charges to our financial statements.

ITEM 1B—UNRESOLVED STAFF COMMENTS

None.

Our executive offices and support center are located in a 106,000 square foot facility in Watsonville, California, which we occupy under a lease that expires in 2016. We operate a 240,000 square foot distribution center located in Hollister, California, under a lease that expires in 2011, and a 472,000 square foot distribution center located in Rock Hill, South Carolina, under a lease that expires in 2017.

At January 2, 2010, our 335 stores comprised an aggregate of approximately 2.7 million square feet of space. Nearly all of our stores are leased, typically for a five-year or 10-year initial term, with options to renew for at least one five-year period. In some leases, we pay a fixed rent, in others we have a period of fixed rent and then a rent change that is either fixed or determined by a consumer price index calculation. Substantially all of our leases require us to pay insurance, utilities, real estate taxes, repair and maintenance expenses and common area maintenance.

We are involved in various legal and administrative proceedings, claims and litigation arising in the ordinary course of business. Based on the facts currently available, we do not believe that the disposition of matters that are pending or asserted, individually and in the aggregate, will have a material adverse effect on our financial position. However, an adverse judgment by a court, administrative or regulatory agency, arbitrator or a settlement could adversely impact our results of operations in any given period.

13

Table of Contents

Additionally, U.S. Customs and Border Protection has advised us that it will be performing a “focused assessment” of our import practices for fiscal 2008. We intend to cooperate with the agency in its assessment. At this time, this matter is in a preliminary stage and the outcome cannot be predicted.

14

Table of Contents

PART II

ITEM 5—MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the NASDAQ Global Market tier of the NASDAQ Stock Market under the symbol “WMAR”. The following table sets forth, for the periods indicated, the high and low closing sales prices for our common stock, as reported by the NASDAQ Stock Market.

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter | |||||||||

| 2009 |

||||||||||||

| High |

$ | 5.75 | $ | 6.25 | $ | 9.50 | $ | 8.20 | ||||

| Low |

$ | 3.80 | $ | 4.95 | $ | 5.48 | $ | 6.88 | ||||

| 2008 |

||||||||||||

| High |

$ | 9.44 | $ | 7.05 | $ | 6.21 | $ | 6.47 | ||||

| Low |

$ | 6.40 | $ | 4.10 | $ | 3.45 | $ | 3.91 | ||||

As of March 9, 2010, there were approximately 7,000 holders of record of our common stock, and the last sale price reported on the NASDAQ Global Market was $10.78 per share.

We have not paid any cash dividends on our common stock, and we do not anticipate doing so in the foreseeable future.

The information required by this item with respect to securities authorized for issuance under equity compensation plans is incorporated by reference from our definitive proxy statement for the 2010 annual meeting of stockholders.

15

Table of Contents

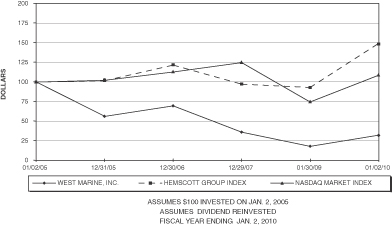

The following graph compares the five-year cumulative total stockholder return on West Marine common stock with the five-year cumulative total return of (i) the NASDAQ Market Index and (ii) peer companies in the Hemscott Industry Group 745—Specialty Retail, Other index. The graph showing the Hemscott Industry Group 745—Specialty Retail, Other was compiled and prepared for West Marine by Morningstar, Inc. The index presented below consists of 62 specialty retailers. †

| 01/02/2005 | 12/31/2005 | 12/30/2006 | 12/29/2007 | 01/03/2009 | 01/02/2010 | |||||||||||||

| West Marine, Inc. |

$ | 100.00 | $ | 56.48 | $ | 69.78 | $ | 36.44 | $ | 18.42 | $ | 32.57 | ||||||

| Specialty Retail, Other |

100.00 | 101.71 | 121.44 | 97.29 | 93.10 | 148.88 | ||||||||||||

| NASDAQ Market Index |

100.00 | 102.20 | 112.68 | 124.57 | 74.71 | 108.56 | ||||||||||||

The performance graph set forth above will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference, and will not otherwise be deemed to be soliciting material or to be filed under such Acts.

| † | The specialty retailers in the Hemscott Industry Group 745—Specialty Retail, Other index that are included in West Marine’s performance graph are as follows: A.C. Moore Arts & Crafts, Inc., Able Energy, Inc., ACTIS Global Ventures, Inc., Assured Pharmacy, Inc., Barnes & Noble, Inc., Bio-Clean, Inc., Blink Couture, Inc., Books-A-Million, Inc., Borders Group, Inc., Carbon Credits International, Inc., China Daquing M&H Petroleum, Inc., Clickable Enterprises, Inc., Clyvia, Inc., Coldwater Creek, Inc., Emerging Vision, Inc., Ferrellgas Partners, L.P., Gallery of History, Inc., Gander Mountain Company, Genex Pharmaceutical, Inc., Glacier Water Services, Hancock Fabrics, Inc., Hennes & Mauritz AB, Indigo Books & Music, Inc., Inergy Holdings, L.P., Inergy, L.P., IParty Corp., Jo-Ann Stores, Inc., LI3 Energy, Inc., Luxottica Group S.P.A. (ADR), MarineMax, Inc., Medifast, Inc., Midas, Inc., Office Depot, Inc., OfficeMax, Inc., Omphalos Corp., Ovale Group, Inc., Paper Warehouse, Inc., Perfumania Holdings, Inc., Petal Decorative Accents, Inc., PetSmart, Inc., Regal Life Concepts, Inc., Sally Beauty Holdings, Inc., Sharper Image, Sherwin-Williams Company, Silver Pearl Enterprises, Inc., Sotheby’s, Staples, Inc., Star Gas Partners, L.P., Suburban Propane Partners, L.P., SureQuest Systems, Inc., Tasty Fries, Inc., TechniScan, Inc., Titan Machinery, Inc., Tractor Supply Company, TravelCenters of America LLC, Vertical Branding, Inc., Vibe Records, Inc., Vitamin Shoppe, Inc., WaterPure International, Inc., Wireless Age Communications, Inc., Zagg, Inc., and West Marine, Inc. |

16

Table of Contents

ITEM 6—SELECTED CONSOLIDATED FINANCIAL DATA

The following consolidated balance sheet data for 2009 and 2008 and consolidated statement of operations data for 2009, 2008 and 2007 have been derived from our consolidated financial statements for the fiscal years appearing elsewhere in this report and should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7 and our consolidated financial statements and notes thereto in Item 8.

| (in thousands, except per share and operating |

2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

| Consolidated Statement of Operations Information: |

||||||||||||||||||||

| Net revenues |

$ | 588,416 | $ | 631,258 | $ | 679,561 | $ | 716,644 | $ | 692,137 | ||||||||||

| Income (loss) from operations |

10,345 | (22,932 | )(1) | (51,107 | )(3) | (4,356 | )(4) | (666 | )(5) | |||||||||||

| Income (loss) before income taxes |

9,539 | (25,270 | )(1) | (55,069 | )(3) | (10,762 | )(4) | (7,741 | )(5)(6) | |||||||||||

| Net income (loss) |

12,376 | (38,800 | )(1)(2) | (49,976 | )(3) | (7,624 | )(4) | (3,022 | )(5)(6) | |||||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

$ | 0.56 | $ | (1.76 | )(1)(2) | $ | (2.30 | )(3) | $ | (0.36 | )(4) | $ | (0.14 | )(5)(6) | ||||||

| Diluted |

0.55 | (1.76 | )(1)(2) | (2.30 | )(3) | (0.36 | )(4) | (0.14 | )(5)(6) | |||||||||||

| Consolidated Balance Sheet Information: |

||||||||||||||||||||

| Working capital |

$ | 157,620 | $ | 183,223 | $ | 207,722 | $ | 213,674 | $ | 256,171 | ||||||||||

| Total assets |

292,237 | 314,592 | 368,318 | 430,129 | 475,997 | |||||||||||||||

| Long-term debt, net of current portion |

— | 47,000 | 52,338 | 69,027 | 117,000 | |||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Stores open at year-end |

335 | 344 | 372 | 377 | 404 | |||||||||||||||

| Comparable stores net sales (decrease) increase |

(3.6 | %) | (6.8 | %) | (1.9 | %) | 2.4 | % | (2.2 | %) | ||||||||||

| (1) | Includes the following items on a pre-tax basis: a $10.7 million pre-tax charge for store closures and other restructuring costs (see Note 3 to our consolidated financial statements for further discussion); a $2.9 million pre-tax charge for impairment of long-lived assets; and $2.2 million of costs related to the now-settled SEC investigation. |

| (2) | Includes the impact of a $23.2 million non-cash charge, to provide a full valuation allowance against all net deferred tax assets, including 2008 additions to deferred tax assets. |

| (3) | Includes the following items on a pre-tax basis: a $56.9 million non-cash charge for impairment of goodwill (see Note 1 to our consolidated financial statements for further discussion); $2.7 million of costs related to the now-settled SEC investigation; $1.3 million of termination severance payments to our former chief executive officer; a $1.3 million non-cash charge for impairment of long-lived assets; and a $0.6 million pre-tax charge for store closure and other restructuring costs. |

| (4) | Includes a $10.9 million pre-tax charge for store closures and other restructuring costs (see Note 3 to our consolidated financial statements for further discussion), and a $4.6 million pre-tax charge for impairment of long-lived assets. |

| (5) | Includes a $4.0 million pre-tax charge for reducing inventory value, an $8.8 million pre-tax charge for cancelled software development projects and a $2.0 million pre-tax charge for discontinuing use of an acquired tradename. |

| (6) | Includes a $0.8 million pre-tax charge for the unamortized portion of loan costs related to the repayment of then-existing debt, in connection with obtaining our current credit facility. |

17

Table of Contents

ITEM 7—MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis is based upon our financial statements as of the dates and for the periods presented in this section. You should read this discussion and analysis in conjunction with the financial statements and supplementary data in Item 8.

Forward-Looking Statements

The statements in this Form 10-K that relate to future plans, events, expectations, objectives or performance (or assumptions underlying such matters) are forward-looking statements that involve a number of risks and uncertainties. These forward-looking statements include, among other things, statements that relate to our future plans, expectations, objectives, performance and similar projections, as well as facts and assumptions underlying these statements or projections. These forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause our actual results and performance in future periods to be materially different from any future results or performance suggested by the forward-looking statements in this report. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurance that actual results will not differ materially from these expectations. These risks, uncertainties and other factors are discussed under risk factors in Item 1A of this report.

Readers are cautioned not to place undue reliance on forward-looking statements, which are based only upon information available as of the date of this report. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

Overview

We are the largest boating supply retailer in the world with 2009 net revenues of $588.4 million and net income of $12.4 million. Our business strategy is to offer an assortment of competitively-priced merchandise for the boat and for the boater that meets the needs of individual boaters and boating businesses, provides great customer experiences and offers the convenience of multi-channel shopping.

We believe that revenues were adversely affected during fiscal year 2009 by less-than-desired in-stock levels. We attribute this to a combination of factors. The two most significant of these were higher demand than forecasted and poor fulfillment from a number of our key suppliers. While we cannot quantify missed sales due to in-stock issues, we do believe merchandise availability had a negative impact on us in 2009, and we have taken, and will continue to take, a host of targeted steps to address this issue during 2010. We have increased our focus and investment in the total supply chain, and we believe we will be in a better position to react to changes in customer demand.

A few of the new or continuing key strategies we are implementing or building upon during 2010 include:

| • | Expanding our merchandise selection, including adding product assortment throughout all of our wide range of merchandise categories and accelerating development of West Marine private-label brands across a number of categories. |

| • | Improving the on-line experience for our customers with more and better content, improved search capabilities, faster speed and other new features. |

| • | Providing outstanding product information and search capabilities by taking steps to better provide information that customers want and need through technology solutions and educational programs that help our customers and associates better access products and information. |

| • | Continuing associate development, which will prioritize both product knowledge and management development with a focus on better planning, execution and supervisory skills. |

18

Table of Contents

We have three reportable segments: Stores; Port Supply; and Direct Sales. Our Stores segment generated approximately 89% of our 2009 net revenues. Our 335 Company-operated stores open at the end of 2009 are located in 38 states, Puerto Rico and Canada. In addition, we have two franchised stores in Turkey. Our Port Supply segment is one of the largest wholesale distributors of marine equipment in the United States. Products shipped to Port Supply customers directly from our warehouses represented approximately 5% of our 2009 net revenues. Our Direct Sales segment, which includes our Internet and call center operations, offers customers around the world more than 50,000 products and it accounted for the remaining 6% of our 2009 net revenues.

Results of Operations

The following table sets forth certain income statement components expressed as a percent of net revenues:

| 2009 | 2008 | 2007 | |||||||

| Net revenues |

100.0 | % | 100.0 | % | 100.0 | % | |||

| Cost of goods sold |

72.7 | % | 73.5 | % | 71.3 | % | |||

| Gross profit |

27.3 | % | 26.5 | % | 28.7 | % | |||

| Selling, general and administrative expense |

25.8 | % | 28.0 | % | 27.6 | % | |||

| Goodwill impairment |

0.0 | % | 0.0 | % | 8.4 | % | |||

| Store closures and other restructuring costs |

(0.3 | %) | 1.6 | % | 0.1 | % | |||

| Impairment of long-lived assets |

0.0 | % | 0.5 | % | 0.1 | % | |||

| Income(loss) from operations |

1.8 | % | (3.6 | %) | (7.5 | %) | |||

| Interest expense |

0.2 | % | 0.4 | % | 0.6 | % | |||

| Income (loss) before income taxes |

1.6 | % | (4.0 | %) | (8.1 | %) | |||

| Provision (benefit) for income taxes |

(0.5 | %) | 2.1 | % | (0.7 | %) | |||

| Net income (loss) |

2.1 | % | (6.1 | %) | (7.4 | %) |

Fiscal 2009 Compared with Fiscal 2008

Net revenues for 2009 were $588.4 million, a decrease of 6.8%, compared to net revenues of $631.3 million for 2008. Net revenues were unfavorably impacted by $6.1 million due to an extra week in fiscal year 2008, when compared to fiscal year 2009. Net income for 2009 was $12.4 million. This compares to a net loss for 2008 of $38.8 million, which included a $10.7 million pre-tax charge for store closures and other restructuring costs, a $2.9 million non-cash, pre-tax charge for impairment of long-lived assets and the impact of a $23.2 million charge to provide a valuation allowance against our deferred tax assets.

Segment revenues

Net revenues for the Stores segment decreased $26.4 million, or 4.8%, to $525.4 million in 2009, primarily due to an $18.7 million, or 3.6%, decrease in comparable store sales and a $27.1 million decrease attributable to store closures in 2008 and 2009. Partially offsetting these decreases was $18.4 million of revenue from new stores opened in 2008 and 2009. The Stores segment generated $5.5 million of revenues in the first and extra week of fiscal 2008, which negatively impacted comparisons year-over-year. During fiscal 2009, we experienced some favorable impacts on our business including continued improvement in boat usage, continued movement towards do-it-yourself projects, and favorable results from our product expansions and larger store formats. We believe we have also benefited from changes in the competitive landscape, including the liquidation of one of our primary national competitors, and lower gas prices during peak boating season.

While recently we have seen increased boat usage in some markets, we expect consumers to continue to carefully evaluate their needs-based boating purchases and continue to be very conservative with their spending on discretionary items. During 2010, we expect to open and close a small number of stores in connection with

19

Table of Contents

our real estate optimization strategy of evolving to having fewer, larger stores in many of our key markets. As a result of these actions, we expect that our overall store counts will decline slightly, while our total selling square footage will remain stable or increase slightly. In addition, we will continue with our practice of monitoring the operating performance and economics of all store locations and evaluating for closure any underperforming stores when the economics favor doing so.

Port Supply net revenues through our distribution centers decreased $10.5 million, or 26.7%, to $28.9 million in 2009, primarily due to lower sales year-over-year to two customer types, boat dealers and boat builders. We believe these customers were negatively impacted by the challenging economic environment and tight credit markets and we expect sales to these customers to stabilize during fiscal 2010.

Net revenues from our Direct Sales segment decreased $5.9 million, or 14.7%, to $34.1 million, due to a decline in the international market year-over-year, at a much greater pace than domestic activity. During fiscal 2010, we do not expect total revenues from this segment to exceed revenues levels experienced last year.