Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION OF PFO PURSUANT TO SECTION 906 - INTRICON CORP | intricon101266_ex32-2.htm |

| EX-32.1 - CERTIFICATION OF PEO PURSUANT TO SECTION 906 - INTRICON CORP | intricon101266_ex32-1.htm |

| EX-10.7 - SUMMARY SHEET FOR EXECUTIVE OFFICER COMPENSATION - INTRICON CORP | intricon101266_ex10-7.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - INTRICON CORP | intricon101266_ex23-1.htm |

| EX-10.6 - SUMMARY SHEET FOR DIRECTOR FEES - INTRICON CORP | intricon101266_ex10-6.htm |

| EX-31.1 - CERTIFICATION OF PEO PURSUANT TO SECTION 302 - INTRICON CORP | intricon101266_ex31-1.htm |

| EX-31.2 - CERTIFICATION OF PFO PURSUANT TO SECTION 302 - INTRICON CORP | intricon101266_ex31-2.htm |

| EX-21.1 - LIST OF SIGNIFICANT SUBSIDIARIES OF THE COMPANY - INTRICON CORP | intricon101266_ex21-1.htm |

|

|

|

UNITED STATES |

|

Washington, D.C. 20549 |

|

|

|

|

|

|

|

FORM 10-K |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark one) |

|

|

||

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||

|

|

|

For the fiscal year ended December 31, 2009 |

|

|

|

|

|

|

or |

|

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||

|

|

|

|

|

|

|

|

|

|

For the transition period from ____________ to ____________. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission File Number 1-5005 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

INTRICON CORPORATION |

|||||

|

|

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

|

|

Pennsylvania |

|

23-1069060 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer Identification No.) |

|

incorporation or organization) |

|

|

|

|

|

|

|

1260 Red Fox Road |

|

55112 |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

Registrant’s telephone number, including area code |

(651) 636-9770 |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Name of each exchange on |

|

Common Shares, $1 par value per share |

|

The NASDAQ Global Market |

|

|

||

|

|

||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by

check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o

No x

Indicate by

check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o

No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

Large accelerated filer o |

Accelerated filer o |

|

|

|

|

Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined by rule 12b-2 of the Act). Yes o Nox

The aggregate market value of the voting common shares held by non-affiliates of the registrant on June 30, 2009 was $14,477,621. Common shares held by each officer and director and by each person who owns 10% or more of the outstanding common shares have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding shares of the registrant’s common shares on February 26, 2010 was 5,470,108.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive proxy statement for the 2010 annual meeting of shareholders are incorporated by reference into Part III of this report; provided, however, that the Audit Committee Report and any other information in such Proxy Statement that is not required to be included in this Annual Report on Form 10-K, shall not be deemed to be incorporated herein or filed for the purposes of the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended.

2

3

|

|

|

|

Business |

Company Overview

IntriCon Corporation, formerly Selas Corporation of America (together with its subsidiaries referred herein as the “Company”, or “IntriCon”, “we”, “us” or “our”) is an international firm engaged in the designing, developing, engineering and manufacturing of body-worn devices. The Company serves the body-worn device market by designing, developing, engineering and manufacturing micro-miniature injection-molded plastics, microelectronics, micro-mechanical assemblies and complete assemblies, primarily for bio-telemetry devices, medical equipment, hearing instruments, professional audio and telecommunications devices. The Company, headquartered in Arden Hills, Minnesota has facilities in Minnesota, California, Maine, Singapore and Germany, and operates through subsidiaries. The Company is a Pennsylvania corporation formed in 1930. The Company has gone through several transformations since its formation. The Company’s core business of body-worn devices was established in 1993 through the acquisition of Resistance Technologies Inc., now known as IntriCon, Inc. The majority of IntriCon’s current management came to the Company with the Resistance Technologies Inc. acquisition, including IntriCon’s President and CEO, who was a co-founder of Resistance Technologies Inc.

Currently, the Company operates in one business segment, the body-worn device segment (formally known as the precision miniature medical segment). In 2009, the Company decided to exit its non-core electronic products segment, to allow for greater focus on its body-worn device segment. The Company is in the process of exiting the electronic products segment and expects this to be completed by mid 2010. For all periods presented, the Company classified its heat technology segment and electronics products segment as discontinued operations.

Business Highlights

Major Events in 2009

On August 13, 2009, the Company acquired all of the outstanding stock of Jon Barron, Inc. doing business as Datrix (“Datrix”), a privately held developer, manufacturer, tester and marketer of medical devices and related software products, based in Escondido, California. The acquisition provides the Company entry into the ambulatory electrocardiograph (AECG) and event recording markets.

The purchase price included a closing cash payment of $1,225,000, issuance of 75,000 shares of restricted common stock of the Company and the issuance of a promissory note in the amount of $1,050,000 bearing annual interest at 6%. In addition the Company paid off Datrix’s outstanding line of credit with Wells Fargo of $130,000 at closing.

The principal amount of the promissory note is payable in three installments of $350,000 on August 13, 2010, August 13, 2011 and August 13, 2012. The note bears annual interest at 6% and is payable with each principal payment as set forth above.

To finance a portion of the Datrix acquisition and replace the Company’s existing credit facilities with Bank of America, including capital leases, the Company and its domestic subsidiaries entered into a new three year credit facility with The PrivateBank and Trust Company on August 13, 2009. The credit facility provides for:

|

|

|

|

|

|

§ |

an $8,000,000 revolving credit facility, with a $200,000 subfacility for letters of credit. Under the revolving credit facility, the availability of funds depends on a borrowing base composed of stated percentages of the Company’s eligible trade receivables, eligible inventory, and eligible equipment less a reserve; and |

|

|

|

|

|

|

§ |

a $3,500,000 term loan. |

The credit facilities are further described in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

4

On December 29, 2009, the Company decided to exit the electronics products segment operated by its wholly-owned subsidiary, RTI Electronics, and divest the assets used in the business. The decision to exit the electronics products segment was made to allow the Company to focus on its core body-worn device segment and to improve the Company’s overall margins and profitability. In connection with its decision to divest the electronics business, the Company evaluated assets for impairment and severance costs and recorded the following: (i) an impairment charge of $685,000 relating to goodwill, (ii) a reduction to realizable value of $720,000 to tangible assets, and (iii) $275,000 in employee termination costs for the year ended December 31, 2009. Additional employee termination costs are expected to be approximately $185,000 in 2010.

Major Events in 2008

On July 20, 2008, the Company entered into a strategic alliance agreement with Australia-based Dynamic Hearing Pty Ltd (“Dynamic Hearing”), a designer of proprietary digital signal processing (“DSP”) firmware used in ultra-low power (“ULP”) DSP hardware platforms for the hearing health and professional audio market. Effective October 1, 2008, Dynamic Hearing granted a license to the Company to use certain of Dynamic Hearing’s technology, including ULP-DSP technology. IntriCon intends to use the license from Dynamic Hearing to develop new body-worn ULP-DSP applications and expand its hearing health and professional audio product portfolio.

The initial term of the agreement is five years from the date of execution and may be extended upon agreement of the parties within two months of the expiration of the initial term; however, either party may terminate the agreement after the second year of the term upon three months notice. The Company agreed to pay Dynamic Hearing: (i) an annual fee for access to the technology licensed pursuant to the agreement and (ii) an additional “second component” fee to maintain exclusive rights granted to the Company with respect to hearing health products. Additionally, IntriCon agreed to make royalty payments on products that incorporate Dynamic Hearing’s technology and Dynamic Hearing has also agreed to provide the Company with engineering and other services in connection with the licensed technology.

Major Events in 2007

On May 22, 2007, the Company completed the acquisition of substantially all of the assets of Tibbetts Industries, Inc., other than real estate. Pursuant to an Asset Purchase Agreement, dated as of April 19, 2007, by and among the Company and Tibbetts and certain of the principal shareholders of Tibbetts, the Company purchased substantially all of the assets of Tibbetts, other than real estate, for cash of $4,500,000, subject to a closing adjustment, and the assumption of certain liabilities (total purchase price of $5,569,000 including acquisition costs of $228,000). The acquisition was financed with borrowings under the then senior secured credit facilities, which the Company closed on May 22, 2007.

In October 2007, the Company entered into a strategic alliance with Advanced Medical Electronics Corp. (“AME”) to develop and manufacture new miniature, wireless, ultra-low-power bio-telemetry instruments. Through this partnership, AME and IntriCon intend to develop and manufacture wireless instruments including a:

|

|

|

|

|

|

• |

binaural hearing aid which will use wireless technology to enhance hearing by allowing hearing aids on both ears to coordinate their operations; |

|

|

• |

hearing aid companion microphone that will transmit companion voice signals to the wearer of a hearing aid, allowing vast improvement in speech intelligibility in noisy environments; |

|

|

• |

miniature wearable electroencephalograph (EEG) transmitter that will digitize EEG signals and transmit them for neuroscience research; and |

|

|

• |

wearable electromyograph (EMG) and inertial limb tracking systems for bio-mechanical research and clinical studies. |

AME receives support from the federal Small Business Innovation Research program and will develop the bio-telemetry instruments. IntriCon will manufacture these devices and supply them to third-party distributors. IntriCon also gains exclusive access to key AME technology and will be able to use this technology to develop additional bio-telemetry applications. In 2008 and 2009, there were amendments to the strategic alliance to include additional funded projects, related to the development of advanced biotelemetry technologies.

5

Market Overview: Body-Worn Devices

IntriCon designs, develops, engineers and manufactures micro-miniature injection-molded plastics, microelectronics, micro-mechanical assemblies and complete assemblies, primarily for bio-telemetry devices, medical equipment, hearing instruments, professional audio and telecommunications devices.

Products and Industries Served. IntriCon designs, develops and manufactures miniature and micro-miniature body-worn products based on its proprietary technology to meet the rising demand for smaller, portable and more advanced devices. Our expertise is focused on three main markets: medical, hearing health and professional audio communications. Within these chosen markets, we combine ultra-miniature mechanical and electronics capabilities with proprietary technology – including ULP wireless and DSP capabilities - that enhances the performance of body-worn devices.

Medical

In the medical market, the Company is focused on sales

of multiple bio-telemetry devices from life-critical diagnostic monitoring

devices to drug-delivery systems. Using our nanoDSP™ and ULP nanoLink™

technology, the Company manufactures microelectronics, micro-mechanical

assemblies, high-precision injection-molded plastic components and complete

bio-telemetry devices for emerging and leading medical device manufacturers.

Targeted customers include medical product manufacturers of portable and

lightweight battery powered devices, as well as a variety of sensors designed

to connect a patient to an electronic device.

The medical industry is faced with pressures to reduce the costs of healthcare. IntriCon currently serves this market by offering medical manufacturers the capabilities to design, develop and manufacture components for medical devices that are easier to use, more miniature, lower power, and lighter weight. These devices measure with greater accuracy and provide more functions while reducing the costs to manufacture these devices. IntriCon manufactures and supplies bubble sensors and flow restrictors that monitor and control the flow of fluid in an intravenous infusion system. IntriCon also manufactures a family of safety needle products for an OEM customer that utilizes IntriCon’s insert and straight molding capabilities. These products are assembled using full automation including built-in quality checks within the production lines. Other examples include sensors used to detect pathologies in specific organs of the body and monitoring devices to detect cardiac, respiratory functions, and blood glucose levels. The early and accurate detection of pathologies allows for increased likelihood for successful treatment of chronic diseases and cancers. Accurate monitoring of multiple functions of the body, such as heart rate, breathing and blood glucose levels, aids in generating more accurate diagnosis and treatments for patients.

In addition, there has been an industry-wide trend toward further miniaturization and ambulatory operation enabled by wireless connectivity, which is also referred to as bio-telemetry. Through the further development of our ULP BodyNet™ family, a series of wirelessly enabled products including our new wireless nanoLink™ and physioLink™ families, we believe the bio-telemetry offers a significant future opportunity. Increasingly, the medical industry is looking for wireless, low-power capabilities in their devices. We believe our strategic partnership with AME will allow us to develop new bio-telemetry devices that better connect patients and care givers, providing critical information and feedback. Current examples of IntriCon bio-telemetry products used by medical device manufacturers include components found in wireless glucose sensor pumps that introduce drugs into the bloodstream. In 2009, we also entered the cardiac diagnostic monitoring (CDM) market, with our acquisition of Datrix, a supplier of patient monitoring devices. We are leveraging Datrix’s cardiac monitoring capabilities and incorporating IntriCon’s core competencies to develop and launch a new line of CDM devices.

Hearing Health

IntriCon manufactures hybrid amplifiers and integrated

circuit components (“hybrid amplifiers”), along with faceplates for in-the-ear

and in-the-canal hearing instruments. IntriCon is a leading manufacturer and

supplier of microminiature electromechanical components to hearing instrument

manufacturers. These components consist of volume controls, microphones,

receivers, trimmer potentiometers and switches. Components are offered in a

variety of sizes, colors and capacities in order to accommodate a hearing

manufacturer’s individualized specifications.

6

Hearing instruments, which fit behind or in a person’s ear to amplify and process sound for a hearing impaired person, generally are composed of four basic parts and several supplemental components for control or fitting purposes. The four basic parts are microphones, amplifier circuits, miniature receivers/speakers and batteries, all of which IntriCon manufactures, with the exception of the battery. IntriCon’s hybrid amplifiers are a type of amplifier circuit. Supplemental components include volume controls, trimmer potentiometers, which shape sound frequencies to respond to the particular nature of a person’s hearing loss, and switches used to turn the instrument on and off and to go from telephone to normal speech modes. Faceplates and an ear shell, molded to fit the user’s ear, often serve as housing for hearing instruments. IntriCon manufactures its components on a short lead-time basis in order to supply “just-in-time” delivery to its customers and, consequently, order backlog amounts are not meaningful.

Using our ULP BodyNet™ family technology, specifically nanoDSP™ and our new wireless nanoLink™ and physioLink™ technologies, IntriCon is building a new generation of affordable, high-quality hearing aids and similar amplifier devices under contracts for OEM’s. DSP devices have better clarity, attractive pricing points and an improved ability to filter out background noise. During 2009, we introduced our Scenic™ DSP amplifier with acoustic scene analysis, our new high-performance adaptive DSP hearing instrument amplifier. In our view, Scenic advanced capabilities are ideally suited for the hearing health market. We believe the introduction of Scenic solidifies our position as a leader of high-performance adaptive DSP hearing instrument amplifiers. Furthermore, we believe our strategic alliance with Dynamic Hearing will allow us to develop new body-worn applications and further expand both our hearing health and professional audio product portfolio.

Overall, we believe the hearing health market holds significant opportunities for the Company. In the United States, Europe and Japan, the 65-year-old-plus age demographic is the fastest growing segment of the population, and many of those individuals could, at some point, benefit from a hearing device that uses IntriCon’s proprietary technology.

While it harbors great potential, the hearing health market is experiencing slowness due to macroeconomic conditions. In general, the U.S. market does not provide insurance reimbursement for hearing aid purchases. People can defer their hearing aid purchase. We believe the sporadic buying patterns will continue into 2010. Reimbursement trends in Europe are more favorable, with insurers and the governments covering more devices.

Professional Audio Communications

IntriCon entered the high-quality audio communication

device market in 2001, and now has a line of miniature, professional audio

headset products used by customers focusing on homeland security and emergency

response needs. The line includes several communication devices that are

extremely portable and perform well in noisy or hazardous environments. These

products are well suited for applications in the fire, law enforcement, safety,

aviation and military markets. In addition, the Company has a line of miniature

ear- and head-worn devices used by performers and support staff in the music

and stage performance markets. Our May 2007 acquisition of Tibbett’s Industries

provided the Company access to homeland security agencies in this market. We

believe performance in difficult listening environments and wireless operations

will continue to improve as these products increasingly include our proprietary

nanoDSP™, wireless nanoLink™ and physioLink™ technologies.

In 2010, we plan to introduce a line of situational listening devices (SLD’s) intended to help hearing impaired people hear in noisy environments like restaurants and automobiles, and to listen to television and music by direct wireless connection. Such devices are intended to be supplements to their conventional hearing aids, which do not handle those situations well. The product line consists of an earpiece, TV transmitter, companion microphone, iPod/iPhone transmitter, and USB transmitter.

For information concerning our net sales, net income and assets, see the consolidated financial statements in Item 8 of this Annual Report on Form 10-K.

Marketing and Competition. IntriCon sells its hearing instrument components directly to domestic hearing instrument manufacturers through an internal sales force. Sales of medical and professional audio communications products are also made primarily through an internal sales force. In recent years, five companies have accounted for a substantial portion of the Company’s sales in this segment.

In 2009, one customer accounted for 22 percent of the Company’s body-worn device net sales. During 2009, the top five customers accounted for approximately $23.8 million or 46 percent of the Company’s body-worn device net sales. See note 4 to the consolidated financial statements for a discussion of net sales and long-lived assets by geographic area and segment.

7

Internationally, sales representatives employed by IntriCon GmbH (“GmbH”), a German company of which the Company owns 90% of its capital stock, solicit sales from European hearing instrument manufacturers on behalf of IntriCon.

IntriCon believes that it is the largest supplier worldwide of micro-miniature electromechanical components to hearing instrument manufacturers and that its full product line and automated manufacturing process allow it to compete effectively with other manufacturers within this market. In the market of hybrid amplifiers and molded plastic faceplates, IntriCon’s primary competition is from the hearing instrument manufacturers themselves. The hearing instrument manufacturers produce a substantial portion of their internal needs for these components.

IntriCon markets its high performance microphone products to the radio communication and professional audio industries and has several larger competitors who have greater financial resources. IntriCon holds a small market share in the global market for microphone capsules and other related products.

Employees. As of December 31, 2009, our body-worn device segment had a total of 515 full time equivalent employees, of whom 34 are executive and administrative personnel, 17 are sales personnel and 464 are engineering and operations personnel. The Company considers its relations with its employees to be satisfactory. None of the Company’s employees are represented by a union.

As a supplier of parts for consumer and medical products, IntriCon is subject to claims for personal injuries allegedly caused by its products. The Company maintains what it believes to be adequate insurance coverage.

Research and Development. IntriCon conducts research and development activities primarily to improve its existing products and proprietary technology. The Company is committed to increasing its investment in the research and development of proprietary technologies, such as the ULP nanoDSP and Bodynet technologies. The Company believes the continued development of key proprietary technologies will be the catalyst for long-term revenues and margin growth. Research and development expenditures were $3,345,000, $3,248,000, and $3,089,000 in 2009, 2008 and 2007, respectively. These amounts are net of customer reimbursed research and development. See note 1 to the consolidated financial statements for information regarding customer funded research and development projects.

IntriCon owns a number of United States patents which cover a number of product designs and processes. The Company believes that, although these patents collectively add some value to the Company, no one patent or group of patents is of material importance to its business as a whole.

Regulation. The health care industry is highly regulated, and there can be no guarantee that the regulatory environment in which we operation will not change significantly and adversely to us in the future. We believe that the health care legislation, rules, regulations and interpretations will change, and we will monitor our agreements and operations from time to time to adhere to such changes in the health care regulatory environment.

Certain of our products are regulated by the U.S. Food and Drug Administration (the “FDA”) as medical devices under the Federal Food, Drug, and Cosmetic Act. Failure to comply with applicable regulatory requirements can result in enforcement action by the FDA including any of the following sanctions: fines injunctions and civil penalties; recall or seizure of medical devices incorporating our products and intellectual property; operating restrictions, partial suspension or total shutdown of production; withdrawal of clearance; and criminal prosecution.

Discontinued Operations – Electronic Products

Our electronic products segment business is conducted by RTI Electronics, Inc. (“RTIE”), a wholly owned subsidiary of the Company. RTIE designs and manufactures thermistor, film capacitor and magnetic products to industrial, commercial and military customers. The Company approved a plan to divest this business segment in the fourth quarter of 2009 and has accounted for it as discontinued operations as further described in note 2 in the accompanying consolidated financial statements in Item 8.

8

Products and Industries Serviced. RTIE manufactures and sells thermistors and thermistor assemblies, which are solid state devices that produce precise changes in electrical resistance as a function of any change in absolute body temperature. RTIE sells through its Surge-Gard™ product line, an inrush current limiting device used primarily in computer power supplies. The balance of sales represents various industrial, commercial and military sales for other thermistor, film capacitor and magnetic products to domestic and international markets. RTIE’s principal raw materials are plastics, polymers, metals, various metal oxide powders and silver paste, for which it believes there are multiple sources of supply.

Marketing and Competition. RTIE sells its thermistors, film capacitors and magnetic products through a combination of independent sales representatives and internal sales force. This business has many competitors, both domestic and foreign, that sell various thermistors, film capacitors and magnetics and some of these competitors are larger and have greater financial resources. In addition, RTIE holds a relatively small market share in the world-market of thermistor and film capacitor products.

In 2009, one customer accounted for 12 percent of the RTIE’s electronic products net sales. During 2009, the top five customers accounted for approximately $1.8 million or 32 percent of RTIE’s electronic products net sales.

Employees. As of December 31, 2009, RTIE had a total of 57 full time equivalent employees, of whom 6 are executive and administrative personnel, 3 are sales personnel and 48 are operations personnel. RTIE considers its relations with its employees to be satisfactory. None of the RTIE’s employees are represented by a union.

As a supplier of parts for consumer products, RTIE is subject to claims for personal injuries allegedly caused by its products. The Company maintains what it believes to be adequate insurance coverage.

Forward-Looking Statements

Certain statements included or incorporated by reference in this Annual Report on Form 10-K or the Company’s other public filings and releases, which are not historical facts, or that include forward-looking terminology such as “may”, “will”, “believe”, “expect”, “should”, “optimistic” or “continue” or the negative thereof or other variations thereof, are forward-looking statements (as such term is defined in Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933, and the regulations thereunder), which are intended to be covered by the safe harbors created thereby. These statements may include, but are not limited to:

|

|

|

|

|

|

• |

statements in “Business,” “Legal Proceedings” and “Risk Factors”, such as the Company’s ability to focus on the body-worn device segment, the ability to compete, statements concerning the Datrix and Tibbetts acquisitions, the divestiture of its electronic products segment, strategic alliances and their benefits, the adequacy of insurance coverage, and potential increase in demand for the Company’s products; and |

|

|

• |

statements in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Notes to the Consolidated Financial Statements,” such as the net operating loss carryforwards, the ability to meet cash requirements for operating needs, the ability to meet liquidity needs, assumptions used to calculate future level of funding of employee benefit plans, the adequacy of insurance coverage, the impact of new accounting pronouncements and litigation. |

Forward-looking statements also include, without limitation, statements as to the Company’s expected future results of operations and growth, the Company’s ability to meet working capital requirements, the Company’s business strategy, the expected increases in operating efficiencies, anticipated trends in the Company’s body-worn device markets, the effect of compliance with environmental protection laws, estimates of goodwill impairments and amortization expense of other intangible assets, estimates of asset impairment, the effects of changes in accounting pronouncements, the effects of litigation and the amount of insurance coverage, and statements as to trends or the Company’s or management’s beliefs, expectations and opinions. Forward-looking statements are subject to risks and uncertainties and may be affected by various risks, uncertainties and other factors that can cause actual results and developments to be materially different from those expressed or implied by such forward-looking statements, including, without limitation, the risk factors discussed in Item 1A of this Annual Report on Form 10-K.

The Company does not undertake to update any forward-looking statement that may be made from time to time by or on behalf of the Company.

9

Available Information

The Company files or furnishes its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other information with the SEC. You may read and copy any reports, statements and other information that the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company’s filings are also available on the SEC’s Internet site as part of the EDGAR database (http://www.sec.gov).

The Company maintains an internet web site at www.IntriCon.com. The Company maintains a link to the SEC’s website by which you may review its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended.

The information on the website listed above, is not and should not be considered part of this annual report on Form 10-K and is not incorporated by reference in this document. This website is and is only intended to be an inactive textual reference.

In addition, we will provide, at no cost (other than for exhibits), paper or electronic copies of our reports and other filings made with the SEC. Requests should be directed to:

|

|

|

|

|

Corporate Secretary |

|

|

IntriCon Corporation |

|

|

1260 Red Fox Road |

|

|

Arden Hills, MN 55112 |

10

|

|

|

|

Risk Factors |

You should carefully consider the risks described below. If any of the risks actually occur, our business, financial condition or results of future operations could be materially adversely affected. This Annual Report on Form 10-K contains forward-looking statements that involve risk and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of many factors, including the risks faced by us described below and elsewhere in this Annual Report on Form 10-K.

We have experienced and expect to continue to experience fluctuations in our results of operations, which could adversely affect us.

Factors that affect our results of operations include, but are not limited to, the volume and timing of orders received, changes in the global economy and financial markets, changes in the mix of products sold, market acceptance of our products and our customer’s products, competitive pricing pressures, global currency valuations, the availability of electronic components that we purchase from suppliers, our ability to meet demand, our ability to introduce new products on a timely basis, the timing of new product announcements and introductions by our or our competitors, changing customer requirements, delays in new product qualifications, and the timing and extent of research and development expenses. These factors have caused and may continue to cause us to experience fluctuations in operating results on a quarterly and/or annual basis. These fluctuations could materially adversely affect our business, financial condition and results of operations, which in turn, could adversely affect the price of our common stock.

The loss of one or more of our major customers could adversely affect our results of operations.

We are dependent on a small number of customers for a large portion of our revenues. In fiscal year 2009, our largest customer accounted for 22% of our net sales and our five largest customers accounted for 46% of our net sales. A significant decrease in the sales to or loss of any of our major customers could have a material adverse effect on our business and results of operations. Our revenues are largely dependent upon the ability of customers to develop and sell products that incorporate our products. No assurance can be given that our major customers will not experience financial, technical or other difficulties that could adversely affect their operations and, in turn, our results of operations.

We may not be able to collect outstanding accounts receivable from our customers.

Some of our customers purchase our products on credit, which may cause a concentration of accounts receivable among some of our customers. As of December 31, 2009, we had accounts receivable, less allowance for doubtful accounts, of $7,084,000, which represented approximately 40.5 percent of our shareholders’ equity as of that date. As of that date, two customers accounted for approximately 16 and 11 percent of our accounts receivable, respectively. Our financial condition and profitability may be harmed if one or more of our customers are unable or unwilling to pay these accounts receivable when due.

The current domestic economic downturn could cause a severe disruption in our operations.

Our business has been negatively impacted by the current domestic economic downturn. If this downturn is prolonged or worsens, there could be several severely negative implications to our business that may exacerbate many of the risk factors we identified including, but not limited to, the following:

|

|

|

|

|

Liquidity: |

||

|

|

|

|

|

|

• |

The domestic economic downturn and the associated credit crisis could continue or worsen and reduce liquidity and this could have a negative impact on financial institutions and the country’s financial system, which could, in turn, have a negative impact on our business. |

|

|

|

|

|

|

• |

We may not be able to borrow additional funds under our existing credit facility and may not be able to expand our existing facility if our lender becomes insolvent or its liquidity is limited or impaired or if we fail to meet covenant levels going forward. In addition, we may not be able to renew our existing credit facility at the conclusion of its current term or renew it on terms that are favorable to us. |

11

|

|

|

|

|

Demand: |

||

|

|

• |

The current recession has resulted in lower sales by our customers. Additionally, our customers may not have access to sufficient cash or short-term credit to obtain our product or services. |

|

|

|

|

|

Prices: |

||

|

|

• |

Certain markets have experienced and may continue to experience deflation, which would negatively impact our average prices and reduce our margins. |

If we are unable to continue to develop new products that are inexpensive to manufacture, our results of operations could be adversely affected.

We may not be able to continue to achieve our historical profit margins in our body-worn device segment due to advancements in technology. The ability to continue our profit margins is dependent upon our ability to stay competitive by developing products that are technologically advanced and inexpensive to manufacture.

Our need for continued investment in research and development may increase expenses and reduce our profitability.

Our industry is characterized by the need for continued investment in research and development. If we fail to invest sufficiently in research and development, our products could become less attractive to potential customers and our business and financial condition could be materially and adversely affected. As a result of the need to maintain or increase spending levels in this area and the difficulty in reducing costs associated with research and development, our operating results could be materially harmed if our research and development efforts fail to result in new products or if revenues fall below expectations. In addition, as a result of our commitment to invest in research and development, management expects that research and development expenses as a percentage of revenues could increase in the future.

We operate in a highly competitive business and if we are unable to be competitive, our financial condition could be adversely affected.

Several of our competitors have been able to offer more standardized and less technologically advanced hearing products at lower prices. Price competition has had an adverse effect on our sales and margins. There can be no assurance that we will be able to maintain or enhance our technical capabilities or compete successfully with our existing and future competitors.

Merger and acquisition activity in our hearing health market has resulted in a smaller customer base. Reliance on fewer customers may have an adverse effect on us.

Several of our customers in the hearing health market have undergone mergers or acquisitions, resulting in a smaller customer base with larger customers. If we are unable to maintain satisfactory relationships with the reduced customer base, it may adversely affect our operating profits and revenue.

Unfavorable legislation in the hearing health market may decrease the demand for our products, and may negatively impact our financial condition.

In some of our foreign markets, government subsidies cover a portion of the cost of hearing aids. A change in legislation that would reduce or eliminate these subsidies could decrease the demand for our hearing health products. This could result in an adverse effect on our operating results. We are unable to predict the likelihood of any such legislation.

12

Implementation of our growth strategy may not be successful, which could affect our ability to increase revenues.

Our growth strategy includes developing new products and entering new markets, as well as identifying and integrating acquisitions. Our ability to compete in new markets will depend upon a number of factors including, among others:

|

|

|

|

|

|

• |

our ability to create demand for products in new markets; |

|

|

• |

our ability to manage growth effectively; |

|

|

• |

our ability to successfully identify, complete and integrate acquisitions; |

|

|

• |

our ability to respond to changes in our customers’ businesses by updating existing products and introducing, in a timely fashion, new products which meet the needs of our customers; |

|

|

• |

the quality of our new products; and |

|

|

• |

our ability to respond rapidly to technological change. |

The failure to do any of the foregoing could have a material adverse effect on our business, financial condition and results of operations. In addition, we may face competition in these new markets from various companies that may have substantially greater research and development resources, marketing and financial resources, manufacturing capability and customer support organizations.

We operate in Singapore and Germany, and various factors relating to our international operations could affect our results of operations.

In 2009, we operated in Singapore and Germany. Approximately 18 percent of our revenues were derived from our facilities in these countries in 2009. As of December 31, 2009 approximately 17 percent of our long-lived assets are located in these countries. Political or economic instability in these countries could have an adverse impact on our results of operations due to diminished revenues in these countries. Our future revenues, costs of operations and profit results could be affected by a number of factors related to our international operations, including changes in foreign currency exchange rates, changes in economic conditions from country to country, changes in a country’s political condition, trade protection measures, licensing and other legal requirements and local tax issues. Unanticipated currency fluctuations in the Euro could lead to lower reported consolidated revenues due to the translation of these currencies into U.S. dollars when we consolidate our revenues.

We may explore acquisitions that complement or expand our business. We may not be able to complete these transactions and these transactions, if executed, pose significant risks and may materially adversely affect our business, financial condition and operating results.

We intend to explore opportunities to buy other businesses or technologies that could complement, enhance or expand our current business or product lines or that might otherwise offer us growth opportunities. We may have difficulty finding these opportunities or, if we do identify these opportunities, we may not be able to complete the transactions for various reasons, including a failure to secure financing. Any transactions that we are able to identify and complete may involve a number of risks, including: the diversion of our management’s attention from our existing business to integrate the operations and personnel of the acquired or combined business or joint venture; possible adverse effects on our operating results during the integration process; unanticipated liabilities; and our possible inability to achieve the intended objectives of the transaction. In addition, we may not be able to successfully or profitably integrate, operate, maintain and manage our newly acquired operations or employees. In addition, future acquisitions may result in dilutive issuances of equity securities or the incurrence of additional debt.

We may experience difficulty in paying our debt when it comes due, which could limit our ability to obtain financing.

As of December 31, 2009, we had bank indebtedness of $8,378,000 and additional indebtedness of $1,983,000, including $1,050,000 payable to the former shareholder of Datrix and $760,000 payable to HIMPP. Our ability to pay the principal and interest on our indebtedness as it comes due will depend upon our current and future performance. Our performance is affected by general economic conditions and by financial, competitive, political, business and other factors. Many of these factors are beyond our control. We believe that availability under our existing credit facility combined with funds expected to be generated from operations and control of capital spending will be sufficient to meet our anticipated cash requirements for operating needs for at least the next 12 months. If, however, we are unable to renew these facilities or obtain waivers (see Liquidity and Capital Resources) in the future or do not generate sufficient cash or complete such financings on a timely basis, we may be required to seek additional financing or sell equity on terms which may not be as favorable as we could have otherwise obtained. No assurance can be given that any refinancing, additional borrowing or sale of equity will be possible when needed or that we will be able to negotiate acceptable terms. In addition, our access to capital is affected by prevailing conditions in the financial and equity capital markets, as well as our own financial condition.

13

If we fail to meet our financial and other covenants under our loan agreement with our lender, absent a waiver, we will be in default of the loan agreement and The PrivateBank and Trust Company can take actions that would adversely affect our business.

There can be no assurances that we will be able to maintain compliance with the financial and other covenants in our loan agreement. In the event we are unable to comply with these covenants during future periods, it is uncertain whether our lender will grant waivers for our non-compliance. If there is an event of default by us under the loan agreement, our lender has the option to, among other things, accelerate any and all of our obligations under the loan agreement which would have a material adverse effect on our business, financial condition and results of operations.

If the Company is unable to liquidate the assets it has marked as discontinued operations, its results of operations maybe adversely affected.

The Company may not be successful in liquidating the assets of its non-core electronic products business in 2010, which is shown as a discontinued operation. There can be no assurance that the customers of this business will continue to purchase product until the inventory is liquidated. If the remaining electronics business losses its competitiveness, it may be difficult to sell the assets at a price favorable to the Company or at all. In connection with any liquidation or sale, the Company may be required to take additional charges to earnings which could adversely affect the market price of our stock.

Our success depends on our senior management team and if we are not able to retain them, it could have a materially adverse effect on us.

We are highly dependent upon the continued services and experience of our senior management team, including Mark S. Gorder, our President, Chief Executive Officer and director. We depend on the services of Mr. Gorder and the other members of our senior management team to, among other things, continue the development and implementation of our business strategies and maintain and develop our client relationships.

Our future success depends in part on the continued service of our engineering and technical personnel and our ability to identify, hire and retain additional personnel.

There is intense competition for qualified personnel in our markets. We may not be able to continue to attract and retain engineers or other qualified personnel necessary for the development and growth of our business or to replace engineers or other qualified personnel who may leave our employ in the future. The failure to retain and recruit key technical personnel could cause additional expense, potentially reduce the efficiency of our operations and could harm our business.

We and/or our customers may be unable to protect our and their proprietary technology and intellectual property rights or keep up with that of competitors.

Our ability to compete effectively against other companies in our markets depends, in part, on our ability and the ability of our customers to protect our and their current and future proprietary technology under patent, copyright, trademark, trade secret and unfair competition laws. We cannot assure that our means of protecting our proprietary rights in the United States or abroad will be adequate, or that others will not develop technologies similar or superior to our technology or design around the proprietary rights we own or license. In addition, we may incur substantial costs in attempting to protect our proprietary rights.

Also, despite the steps taken by us to protect our proprietary rights, it may be possible for unauthorized third parties to copy or reverse-engineer aspects of our and our customers’ products, develop similar technology independently or otherwise obtain and use information that we or our customers regard as proprietary. We and our customers may be unable to successfully identify or prosecute unauthorized uses of our or our customers’ technology.

14

If we become subject to material intellectual property infringement claims, we could incur significant expenses and could be prevented from selling specific products.

We may become subject to material claims that we infringe the intellectual property rights of others in the future. We cannot assure that, if made, these claims will not be successful. Any claim of infringement could cause us to incur substantial costs defending against the claim even if the claim is invalid, and could distract management from other business. Any judgment against us could require substantial payment in damages and could also include an injunction or other court order that could prevent us from offering certain products.

Environmental liability and compliance obligations may affect our operations and results.

Our manufacturing operations are subject to a variety of environmental laws and regulations as well as internal programs and policies governing:

|

|

|

|

|

|

• |

air emissions; |

|

|

• |

wastewater discharges; |

|

|

• |

the storage, use, handling, disposal and remediation of hazardous substances, wastes and chemicals; and |

|

|

• |

employee health and safety. |

If violations of environmental laws occur, we could be held liable for damages, penalties, fines and remedial actions. Our operations and results could be adversely affected by any material obligations arising from existing laws, as well as any required material modifications arising from new regulations that may be enacted in the future. We may also be held liable for past disposal of hazardous substances generated by our business or former businesses or businesses we acquire. In addition, it is possible that we may be held liable for contamination discovered at our present or former facilities.

We are subject to numerous asbestos-related lawsuits, which could adversely affect our financial position, results of operations or liquidity.

We are a defendant along with a number of other parties in approximately 122 lawsuits as of December 31, 2009, (approximately 122 lawsuits as of December 31, 2008) alleging that plaintiffs have or may have contracted asbestos-related diseases as a result of exposure to asbestos products or equipment containing asbestos sold by one or more named defendants. These lawsuits relate to the discontinued Heat Technologies segment which we sold in March 2005. Due to the noninformative nature of the complaints, we do not know whether any of the complaints state valid claims against us. Certain insurance carriers have informed us that the primary policies for the period August 1, 1970-1973, have been exhausted and that the carriers will no longer provide a defense under those policies. We have requested that the carriers substantiate this situation. We believe we have additional policies available for other years which have been ignored by the carriers. Because settlement payments are applied to all years a litigant was deemed to have been exposed to asbestos, we believe when settlement payments are applied to these additional policies, we will have availability under the years deemed exhausted. If our insurance policies do not cover the costs and any awards for the asbestos-related lawsuits, we will have to use our cash or obtain additional financing to pay the asbestos-related obligations and settlement costs. There is no assurance that we will have the cash or be able to obtain additional financings on favorable terms to pay asbestos related obligations or settlements should they occur. The ultimate outcome of any legal matter cannot be predicted with certainty. In light of the significant uncertainty associated with asbestos lawsuits, there is no guarantee that these lawsuits will not materially adversely affect our financial position, results of operations or liquidity.

15

The market price of our common stock has been and is likely to continue to be volatile, which may make it difficult for shareholders to resell common stock when they want to and at prices they find attractive.

The market price of our common stock has been and is likely to be highly volatile, and there has been limited trading volume in the common stock. The common stock market price could be subject to wide fluctuations in response to a variety of factors, including the following:

|

|

|

|

|

|

• |

announcements of fluctuations in our or our competitors’ operating results; |

|

|

• |

the timing and announcement of sales or acquisitions of assets by us or our competitors; |

|

|

• |

changes in estimates or recommendations by securities analysts; |

|

|

• |

adverse or unfavorable publicity about our services or us; |

|

|

• |

the commencement of material litigation, or an unfavorable verdict, against us; |

|

|

• |

terrorist attacks, war and threats of attacks and war; |

|

|

• |

additions or departures of key personnel; and |

|

|

• |

sales of common stock. |

In addition, the stock market in recent years has experienced significant price and volume fluctuations. Such volatility and decline has affected many companies irrespective of, or disproportionately to, the operating performance of these companies. These broad fluctuations and limited trading volume may materially adversely affect the market price of our common stock, and your ability to sell our common stock.

Most of our outstanding shares are available for resale in the public market without restriction. The sale of a large number of these shares could adversely affect the share price and could impair our ability to raise capital through the sale of equity securities or make acquisitions for common stock.

“Anti-takeover” provisions may make it more difficult for a third party to acquire control of us, even if the change in control would be beneficial to shareholders.

We are a Pennsylvania corporation. Anti-takeover provisions in Pennsylvania law and our charter and bylaws could make it more difficult for a third party to acquire control of us. These provisions could adversely affect the market price of the common stock and could reduce the amount that shareholders might receive if we are sold. For example, our charter provides that the board of directors may issue preferred stock without shareholder approval. In addition, our bylaws provide for a classified board, with each board member serving a staggered three-year term. Directors may be removed by shareholders only with the approval of the holders of at least two-thirds of all of the shares outstanding and entitled to vote.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential shareholders and customers could lose confidence in our financial reporting, which could harm our business, the trading price of our stock and our ability to retain our current customers or obtain new customers.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, referred to as Section 404, we are required to include in our Annual Reports on Form 10-K, our management’s report on internal control over financial reporting and, beginning with our Annual Report on Form 10-K for 2010, our registered public accounting firm’s attestation report on internal control over financial reporting. While we have reported no “material weaknesses” in the Form 10-K for the fiscal year ended December 31, 2009, we cannot guarantee that we will not have “material weaknesses” reported by our management or our independent registered public accounting firm in the future. Compliance with the requirements of Section 404 is expensive and time-consuming. If in the future we fail to complete this evaluation in a timely manner, or if our independent registered public accounting firm cannot timely attest to our internal controls, we could be subject to regulatory scrutiny and a loss of public confidence in our internal control over financial reporting. In addition, any failure to establish an effective system of disclosure controls and procedures could cause our current and potential investors and customers to lose confidence in our financial reporting and disclosure required under the Securities Exchange Act of 1934, which could adversely affect our business and the market price of our common stock.

16

|

|

|

|

Unresolved Staff Comments. |

Not Applicable.

|

|

|

|

Properties |

The Company leases eight facilities, six domestically and two internationally, as follows:

|

|

|

|

|

|

• |

a 47,000 sq. ft. manufacturing facility in Arden Hills, Minnesota, which also serves as the Company’s headquarters, from a partnership consisting of two former officers of IntriCon Inc. and Mark S. Gorder who serves as the president and CEO of the Company and IntriCon Inc. and on the Company’s Board of Directors. At this facility, the Company manufactures body-worn devices, other than plastic component parts. Annual base rent expense, including real estate taxes and other charges, is approximately $477,000. The Company believes the terms of the lease agreement are comparable to those which could be obtained from unaffiliated third parties. The lease expires in October 2011. |

|

|

• |

a 46,000 sq. ft. building in Vadnais Heights, Minnesota at which IntriCon produces plastic component parts for body-worn devices. Annual base rent expense, including real estate taxes and other charges, is approximately $382,000. The lease expires in June 2016. |

|

|

• |

two buildings in Camden, Maine, which contain Tibbetts manufacturing facilities and offices and consist of a total of 32,000 square feet. Annual base rent expense on the 25,000 square foot facility, including real estate taxes and other charges, is approximately $104,000. This lease expires in June 2012. Annual base rent expense on the 7,000 square foot facility, including real estate taxes and other charges, is approximately $62,000. This lease expires in June 2017. |

|

|

• |

a 4,000 square foot building in Escondido, California, which houses assembly operations and administrative offices relating to our cardiac monitoring business. Annual base rent expense, including real estate taxes and other charges, is approximately $48,000. This lease expires in April 2010. |

|

|

• |

a 21,000 square foot building in Singapore which houses production facilities and administrative offices. Annual base rent expense, including real estate taxes and other charges, is approximately $208,000. This lease expires in May 2010. |

|

|

• |

a 2,000 square foot facility in Germany which houses sales and administrative offices. Annual base rent expense, including real estate taxes and other charges, is approximately $48,000. This lease expires in June 2012. |

|

|

• |

a building in Anaheim, California, which contains RTIE’s electronics products manufacturing facilities and offices and consists of a total of 50,000 square feet. Annual base rent expense, including real estate taxes and other charges, is approximately $404,000. This facility houses our non-core electronic products business, which is classified as a discontinued operation. The lease is month to month. |

All of the foregoing facilities are used in the Company’s body-worn device segment, other than the Anaheim, California facility which is used in the electronic products segment and has now been classified as discontinued operations. See notes 15 and 16 to the Company’s consolidated financial statements in Item 8 of the Annual Report on Form 10-K.

|

|

|

|

Legal Proceedings |

The Company is a defendant along with a number of other parties in approximately 122 lawsuits as of December 31, 2009, (approximately 122 lawsuits as of December 31, 2008) alleging that plaintiffs have or may have contracted asbestos-related diseases as a result of exposure to asbestos products or equipment containing asbestos sold by one or more named defendants. These lawsuits relate to the discontinued heat technologies segment which was sold in March 2005. Due to the noninformative nature of the complaints, the Company does not know whether any of the complaints state valid claims against the Company. Certain insurance carriers have informed the Company that the primary policies for the period August 1, 1970-1973, have been exhausted and that the carriers will no longer provide a defense under those policies. The Company has requested that the carriers substantiate this situation. The Company believes it has additional policies available for other years which have been ignored by the carriers. Because settlement payments are applied to all years a litigant was deemed to have been exposed to asbestos, the Company believes when settlement payments are applied to these additional policies, the Company will have availability under the years deemed exhausted. The Company does not believe that the asserted exhaustion of the primary insurance coverage for this period will have a material adverse effect on its financial condition, liquidity, or results of operations. Management believes that the number of insurance carriers involved in the defense of the suits and the significant number of policy years and policy limits, to which these insurance carriers are insuring the Company, make the ultimate disposition of these lawsuits not material to the Company’s consolidated financial position or results of operations.

17

The Company’s wholly owned French subsidiary, Selas SAS, filed for insolvency in France and is being managed by a court appointed judiciary administrator. The Company may be subject to additional litigation or liabilities as a result of the French insolvency proceeding.

The Company is also involved in other lawsuits arising in the normal course of business, as further described in Note 14 to the consolidated financial statements in Item 8. While it is not possible to predict with certainty the outcome of these matters, management is of the opinion that the disposition of these lawsuits and claims will not materially affect the Company’s consolidated financial position, liquidity, or results of operations.

|

|

|

|

(Removed and Reserved) |

|

|

|

|

|

Executive Officers of the Registrant |

The names, ages and offices (as of February 28, 2010) of the Company’s executive officers were as follows:

|

|

|

|

|

|

|

Name |

|

Age |

|

Position |

|

Mark S. Gorder |

|

63 |

|

President, Chief Executive Officer and Director of the Company; President of IntriCon, Inc. |

|

Scott Longval |

|

33 |

|

Chief Financial Officer and Treasurer of the Company |

|

Christopher D. Conger |

|

49 |

|

Vice President, Research and Development |

|

Michael P. Geraci |

|

51 |

|

Vice President, Sales and Marketing |

|

Dennis L. Gonsior |

|

51 |

|

Vice President, Operations |

|

Steve M. Binnix |

|

60 |

|

Vice President and General Manager, RTI Electronics, Inc. |

|

Greg Gruenhagen |

|

56 |

|

Vice President, Corporate Quality and Regulatory Affairs |

Mr. Gorder joined the Company in October 1993 when IntriCon Inc. was acquired by the Company. Mr. Gorder received a Bachelor of Arts degree in Mathematics from the St. Olaf College, a Bachelor of Science degree in Electrical Engineering from the University of Minnesota and a Master of Business Administration from the University of Minnesota. Prior to the acquisition, Mr. Gorder was President and one of the founders of IntriCon Inc., which began operations in 1977. Mr. Gorder was promoted to Vice President of the Company and elected to the Board of Directors in April 1996. In December 2000, he was elected President and Chief Operating Officer and in April 2001, Mr. Gorder assumed the role of Chief Executive Officer.

Mr. Longval has served as the Company’s Chief Financial Officer since July 2006. Mr. Longval received a Bachelor of Science degree in Accounting from the University of St. Thomas. Prior to being appointed as CFO, Mr. Longval served as the Company’s Corporate Controller since September 2005. Prior to joining the Company, Mr. Longval was Principal Project Analyst at ADC Telecommunications, Inc., a provider of innovative network infrastructure products and services, from March 2005 until September 2005. From May 2002 until March 2005 he was employed by Accellent, Inc., formerly MedSource Technologies, a provider of outsourcing solutions to the medical device industry, most recently as Manager of Financial Planning and Analysis. From September 1998 until April 2002, he was employed by Arthur Andersen, most recently as experienced audit senior.

Mr. Conger joined the Company in September 1997. Mr. Conger received a Bachelor of Science degree in Electrical Engineering from the University of Missouri and a Master of Science degree in Electrical Engineering from the University of Minnesota. He has served as the Company’s Vice President of Research and Development since February 2005. Prior to that, Mr. Conger served as Director of Research and Development since 1997. Before joining IntriCon, Mr. Conger served in various positions in the hearing health industry including 3M Company and Siemens.

18

Mr. Geraci joined the Company in October 1983. Mr. Geraci received a Bachelor of Science degree in Electrical Engineering from Bradley University and a Master of Business Administration from the University of Minnesota – Carlson School of Business. He has served as the Company’s Vice President of Sales and Marketing since January 1995.

Mr. Gonsior joined the Company in February 1982. Mr. Gonsior received a Bachelor of Science degree from Saint Cloud State University. He has served as the Company’s Vice President of Operations since January 1996.

Mr. Binnix joined the Company in January 1989. Mr. Binnix is a Certified Manufacturing Engineer and received his Bachelor of Science degree from the University of LaVerne, California. He has served as the Company’s Vice President of RTI Electronics, Inc. since April 2006 and as General Manager since 1993.

Mr. Gruenhagen joined the Company in November 1984. Mr. Gruenhagen received a Bachelor of Science degree from Iowa State University. He has served as the Company’s Vice President of Corporate Quality and Regulatory Affairs since December 2007. Prior to that, Mr. Gruenhagen served as Director of Corporate Quality since 2004 and Director of Project Management since 2000.

19

|

|

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Since January 2, 2008, the Company’s common shares have been listed on the NASDAQ Global Market under the ticker symbol “IIN”. From April 4, 2005 through January 1, 2008 the Company’s common shares were listed on the American Stock Exchange under the ticker symbol “IIN”.

Market and Dividend Information

The high and low sale prices of the Company’s common stock during each quarterly period during the past two years were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

|

2008 |

|

||||||||

|

|

|

Market |

|

Market |

|

||||||||

|

|

|

Price Range |

|

Price Range |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter |

|

High |

|

Low |

|

High |

|

Low |

|

||||

|

First |

|

$ |

5.01 |

|

$ |

2.83 |

|

$ |

13.30 |

|

$ |

5.71 |

|

|

Second |

|

|

3.35 |

|

|

2.56 |

|

|

10.07 |

|

|

7.10 |

|

|

Third |

|

|

4.11 |

|

|

2.60 |

|

|

9.00 |

|

|

3.01 |

|

|

Fourth |

|

|

3.76 |

|

|

2.80 |

|

|

6.50 |

|

|

3.12 |

|

The closing sale price of the Company’s common stock on March 11, 2010, was $3.05 per share.

At March 1, 2010 the Company had 388 shareholders of record of common stock. Such number of records does not reflect shareholders who beneficially own common stock in nominee or street name.

The Company ceased paying quarterly cash dividends in the fourth quarter of 2001 and has no intention of paying cash dividends in the foreseeable future. Any payment of future dividends will be at the discretion of the Board of Directors and will depend upon, among other things, the Company’s earnings, financial condition, capital requirements, level of indebtedness, contractual restrictions with respect to the payment of dividends, and other factors that the Board of Directors deems relevant. Terms of the Company’s banking agreements prohibit the payment of cash dividends without prior bank approval.

See “ITEM 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters — Equity Compensation Plans” of this Annual Report on Form 10-K for disclosure regarding our equity compensation plans.

20

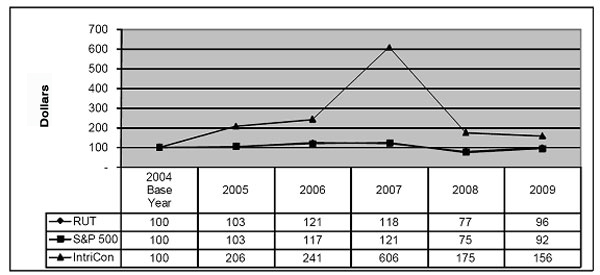

Stock Performance Graph

The following graph shows the cumulative total return for the last five years, calculated as of December 31 of each such year, for the Common Shares, the Standard & Poor’s 500 Index, and the Russell 2000 Index (“RUT”). The graph assumes that the value of the investment in each of three was $100 at December 31, 2004 and that all dividends were reinvested.

Source: Yahoo Finance

Note: Stock price performance shown in this Performance Graph for our common stock is historical and not necessarily indicative of future price performance. The information contained in this Performance Graph is not “soliciting material” and has not been “filed” with the Securities and Exchange Commission. This Performance Graph will not be incorporated by reference into any of our future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934.

21

|

|

|

|

Selected Financial Data |

Five-Year Summary of Operations*

(In thousands, except for per share and share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years ended December 31, |

|

2009(d) |

|

2008 |

|

2007(a) |

|

2006 |

|

2005(b) |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Sales, net |

|

$ |

51,676 |

|

$ |

57,908 |

|

$ |

59,669 |

|

$ |

41,438 |

|

$ |

36,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

11,051 |

|

|

14,657 |

|

|

15,425 |

|

|

10,320 |

|

|

9,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

11,681 |

|

|

12,360 |

|

|

12,360 |

|

|

8,638 |

|

|

8,679 |

|

|

Interest expense |

|

|

837 |

|

|

679 |

|

|

942 |

|

|

438 |

|

|

409 |

|

|

Equity in loss (earnings) of partnerships |

|

|

149 |

|

|

3 |

|

|

158 |

|

|

— |

|

|

— |

|

|

Other (income) expense, net |

|

|

220 |

|

|

36 |

|

|

79 |

|

|

54 |

|

|

(161 |

) |

|

Income (loss) from continuing operations before income taxes and discontinued operations |

|

|

(1,836 |

) |

|

1,579 |

|

|

1,886 |

|

|

1,190 |

|

|

624 |

|

|

Income tax expense (benefit) |

|

|

(34 |

) |

|

265 |

|

|

173 |

|

|

168 |

|

|

395 |

|

|

Income (loss) from continuing operations before discontinued operations |

|

|

(1,802 |

) |

|

1,314 |

|

|

1,713 |

|

|

1,022 |

|

|

229 |

|

|