Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission file number 001-33961

HILL INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-0953973 | |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

| 303 Lippincott Centre, Marlton, NJ | 08053 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (856) 810-6200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.0001 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by a check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by a check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of shares of common stock held by non-affiliates based upon the closing sale price of the stock on the New York Stock Exchange on June 30, 2009 was approximately $93,236,000.

As of March 4, 2010, there were 39,295,529 shares of the Registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the Annual Meeting of Shareholders of Hill International, Inc. are incorporated by reference into Part III of this Form 10-K.

Table of Contents

HILL INTERNATIONAL, INC. AND SUBSIDIARIES

INDEX TO FORM 10-K

| Item 1. |

4 | |||

| Item 1A. |

12 | |||

| Item 1B. |

17 | |||

| Item 2. |

17 | |||

| Item 3. |

18 | |||

| Item 4. |

19 | |||

| Item 5. |

20 | |||

| Item 6. |

22 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 | ||

| Item 7A. |

40 | |||

| Item 8. |

41 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

78 | ||

| Item 9A. |

78 | |||

| Item 9B. |

79 | |||

| Item 10. |

80 | |||

| Item 11. |

80 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

80 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

81 | ||

| Item 14. |

81 | |||

| Item 15. |

82 | |||

2

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“Reform Act”). We may also make forward-looking statements in other reports filed with the Securities and Exchange Commission, in materials delivered to stockholders and in press releases. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Although we believe that the expectations, estimates and assumptions reflected in our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. You can identify forward-looking statements by the use of terminology such as “may,” “will,” “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” “could,” “should,” “potential” or “continue” or the negative or other variations thereof, as well as other statements regarding matters that are not historical fact.

Those forward-looking statements may concern, among other things:

| • | The markets for our services |

| • | Projections of earnings, anticipated contractual obligations, capital expenditures, funding requirements or other financial items; |

| • | Statements concerning our plans, strategies and objectives for future operations; and |

| • | Statements regarding future economic conditions or performance. |

Important factors that could cause our actual results, performance and achievements, or industry results to differ materially from estimates or projections contained in our forward-looking statements include:

| • | Modifications and termination of client contracts; |

| • | Control and operational issues pertaining to business activities that we conduct pursuant to joint ventures with other parties; |

| • | Difficulties we may incur in implementing our acquisition strategy; |

| • | The need to retain and recruit key technical and management personnel; and |

| • | Unexpected adjustments and cancellations related to our backlog. |

Other factors that may affect our businesses, financial position or results of operations include:

| • | Special risks of international operations, including uncertain political and economic environments, acts of terrorism or war, potential incompatibilities with foreign joint venture partners, foreign currency fluctuations, civil disturbances and labor issues; and |

| • | Special risks of contracts with governmental entities, including the failure of applicable governing authorities to take necessary actions to secure or maintain funding for particular projects with us, the unilateral termination of contracts by the government and reimbursement obligations to the government for funds previously received. |

We assume no obligation to update or revise any forward-looking statements. In accordance with the Reform Act, Item 1A of this Report entitled “Risk Factors” contains cautionary statements that accompany those forward-looking statements. You should carefully review such cautionary statements as they identify certain important factors that could cause actual results to differ materially from those in the forward-looking statements and from historical trends. Those cautionary statements are not exclusive and are in addition to other factors discussed elsewhere in this Form 10-K, in our other filings with the Securities and Exchange Commission or in materials incorporated therein by reference.

3

Table of Contents

| Item 1. | Business. |

General

The Company was incorporated in Delaware in 2004 as Arpeggio Acquisition Corporation (“Arpeggio”), a specified purpose acquisition corporation. On June 28, 2006, Arpeggio merged with Hill International, Inc. (“Old Hill”), a Delaware corporation, and was the surviving entity of the merger. Old Hill was founded in 1976 by our current Chairman and Chief Executive Officer, Irvin E. Richter. Immediately following the merger, the stockholders of Old Hill owned approximately 63.6% of the total voting power of Arpeggio. The merger was accounted for as a reverse acquisition under U.S. generally accepted accounting principles pursuant to which Old Hill was considered to be the acquiring entity and Arpeggio was the acquired company for accounting purposes, accompanied by a recapitalization of Old Hill. Accordingly, the historical financial statements relate to the business of Old Hill and its consolidated subsidiaries. Following the merger, Arpeggio changed its name to “Hill International, Inc.” In this report, the terms “Company,” “we,” “us,” “our” or “Hill” refer to Hill International, Inc.

We provide fee-based project management and construction claims services to clients worldwide, but primarily in the United States, Europe, the Middle East, North Africa and Asia/Pacific. Our clients include the United States and other national governments and their agencies, state and local governments and their agencies and the private sector.

We are one of the leading firms in the world in both the project management and construction claims consulting businesses. We are a global company with approximately 2,400 personnel operating out of over 80 offices in more than 30 countries.

We compete for business based on reputation and past experience, including client requirements for substantial experience in similar projects and claims work. We have developed significant long-standing relationships which bring us repeat business and would be very difficult to replicate. We have an excellent reputation for developing and rewarding employees which allows us to attract and retain superior professionals. In addition, we believe there are high barriers to entry for new competitors especially in the project management market.

Reporting Segments

We operate through two segments: the Project Management Group and the Construction Claims Group. Reimbursable expenses are reflected in equal amounts in both total revenue and total direct expenses. Because these revenue/costs are subject to significant fluctuation from year to year, we measure the performance of many of our key operating metrics as a percentage of consulting fee revenue (“CFR”), as we believe that this is a better and more consistent measure of operating performance than total revenue. Throughout this report we have used CFR as the denominator in many of our ratios. The following table sets forth the amount and percentage of our CFR from our operations in each reporting segment for each of the past three fiscal years:

Consulting Fee Revenue by Segment

| 2009 | 2008 | 2007 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||

| Project Management |

$ | 276,811 | 76.0 | % | $ | 247,326 | 74.1 | % | $ | 134,968 | 66.4 | % | ||||||

| Construction Claims |

87,199 | 24.0 | % | 86,556 | 25.9 | % | 68,150 | 33.6 | % | |||||||||

| Total |

$ | 364,010 | 100.0 | % | $ | 333,882 | 100.0 | % | $ | 203,118 | 100.0 | % | ||||||

Project Management

Our Project Management Group provides fee-based or “agency” construction management services to our clients leveraging our construction expertise to identify potential trouble, difficulties and sources of delay on a construction project before they develop into costly problems. Our services include program management,

4

Table of Contents

project management, construction management, project management oversight, troubled project turnaround, staff augmentation, estimating and cost management, project labor agreements and management consulting.

Our clients are typically billed a negotiated multiple of the actual direct cost of each consultant assigned to a project and we are reimbursed for our out-of-pocket expenses. We believe our fee-based consulting has significant advantages over traditional general contractors. Specifically, because we do not assume project completion risk, our fee-based model eliminates many of the risks typically associated with construction projects.

As construction managers, we have managed all phases of the construction process on behalf of project owners and developers, from pre-design through completion. Specific activities that we undertake as part of these services include: planning, scheduling, estimating, budgeting, design review, constructability analyses, value engineering, regulatory compliance, development of project procedures, procurement, project reporting, expediting, inspection, quality assurance/quality control, safety oversight, contract administration, change order processing, claims management, and on-site management of contractors, subcontractors and suppliers.

In its June 9, 2009, issue, Engineering News-Record ranked us as the eighth largest construction management firm and the ninth largest program management firm in the United States.

Construction Claims

Our Construction Claims Group advises clients in order to assist them in preventing or resolving claims and disputes based upon schedule delays, cost overruns and other problems on major construction projects worldwide.

We may be retained as a claims consultant at the onset of a project, during the course of a project or upon the completion of a project. We assist owners or contractors in adversarial situations as well as in situations where an amicable resolution is sought. Specific activities that we undertake as part of these services include claims preparation, analysis and review, litigation support, lender advisory services, cost/damages assessment, delay/disruption analysis, contract review and assessment, risk assessment, adjudication and expert witness testimony. Clients are typically billed based on an hourly rate for each consultant assigned to the project, and we are reimbursed for our out-of-pocket expenses. Our claims consulting clients include participants on all sides of a construction project, including owners, contractors, subcontractors, architects, engineers, attorneys, lenders and insurance companies.

Consulting Fee Revenue by Geographic Region

| 2009 | 2008 | 2007 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||

| Americas |

$ | 75,468 | 20.7 | % | $ | 79,199 | 23.7 | % | $ | 70,264 | 34.6 | % | ||||||

| Europe |

107,193 | 29.4 | % | 110,416 | 33.1 | % | 48,257 | 23.7 | % | |||||||||

| Middle East |

126,749 | 34.8 | % | 116,254 | 34.8 | % | 76,144 | 37.5 | % | |||||||||

| North Africa |

47,482 | 13.1 | % | 20,693 | 6.2 | % | 1,787 | 0.9 | % | |||||||||

| Asia / Pacific |

7,118 | 2.0 | % | 7,320 | 2.2 | % | 6,666 | 3.3 | % | |||||||||

| Total |

$ | 364,010 | 100.0 | % | $ | 333,882 | 100.0 | % | $ | 203,118 | 100.0 | % | ||||||

Growth Organically and Through Acquisition

Our business has expanded through organic growth and the acquisition of a number of project management and claims consulting businesses. Since 1998, we have completed 16 acquisitions.

We believe that our industry includes a number of small regional companies in a highly fragmented market. We believe that we have significant experience and expertise in identifying, negotiating, completing and integrating acquisitions and view the acquisition of these smaller competitors as a key part of our growth strategy.

5

Table of Contents

On December 15, 2009, the Company acquired Boyken International, Inc. (“Boyken”). Boyken is a 40-employee project management, cost estimating and claims firm headquartered in Atlanta with additional offices in Orlando and Houston. Boyken significantly expands our resources and experience in the Southeastern U.S. and the Caribbean, and provides additional capabilities in the healthcare, higher education, hotel and governmental sectors. Total consideration amounted to approximately $2,236,000, consisting of 349,876 shares of the Company’s common stock. The Company acquired intangible assets and goodwill amounting to $1,493,000 and $1,296,000, respectively. The acquired intangible assets have a weighted average life of 7.7 years. The acquired intangible assets consist of a client related intangible of $1,063,000 with a ten-year life and a contract intangible of $430,000 with a two-year life. Goodwill, which is not deductible for income tax purposes, has been allocated to the Project Management segment. The results of operations of Boyken are not material to the consolidated results of the Company.

On December 31, 2009, we acquired TRS Consultants, Inc. (“TRS”). TRS is a 40-employee construction management firm headquartered in San Ramon, California with additional offices throughout Northern California. TRS increases our resources and experience in California and adds additional capabilities in the transportation and infrastructure sectors. Total consideration amounted to approximately $4,000,000, consisting of $2,500,000 in cash, 79,365 shares of the Company’s common stock with a fair value of $500,000 based on the closing price of the Company’s common stock on December 29, 2009, and contingent consideration amounting to $1,000,000. The contingent consideration will be paid in the event that TRS achieves operating profit of $1,000,000 in 2010, 2011 or 2012. The contingent consideration has been accrued and is included in other current liabilities in the consolidated balance sheet. In the event that TRS does not achieve the required level of earnings, the contingent consideration will be written off through a credit to the 2012 consolidated statement of earnings. The Company acquired intangible assets and goodwill amounting to $2,079,000 and $1,512,000, respectively. The acquired intangible assets have a weighted average life of 6.9 years. The acquired intangible assets consist of a client related intangible of $1,269,000 with a ten-year life and a contract intangible of $810,000 with a two-year life. Goodwill, which is expected to be deductible for income tax purposes, has been allocated to the Project Management segment. The results of operations of TRS are not material to the consolidated results of the Company.

During 2008, the Company purchased six companies for aggregate consideration amounting to $46,093,000, consisting of cash of $40,842,000, 82,436 shares of the Company’s common stock amounting to $1,300,000, and contingent consideration amounting to $2,872,000. The contingent consideration was settled in 2009 for cash of $1,138,000 and 132,479 shares of common stock aggregating $1,650,000. In addition, the sellers of one of the acquired companies had the opportunity to receive additional consideration of up to $8,413,000 under an earn-out arrangement payable at the rate of $4,364,000 in 2009 and $4,049,000 in 2010 based on the acquired company’s financial performance in 2008 and 2009. Based on that company’s performance in 2008, an earn-out payment of $1,526,000 was paid in 2009. The company’s financial results in 2009 did not achieve the level necessary to require an earn-out payment.

Clients

Our clients consist primarily of the United States and other national governments, state and local governments, and the private sector. In the fourth quarter of 2009, the Company refined its identification of client type and, accordingly, revised its allocation of revenue in the following table. The amounts for 2008 and 2007 have been changed to conform to the current year’s presentation.

6

Table of Contents

Consulting Fee Revenue by Client Type

| 2009 | 2008 | 2007 | ||||||||||||||||

| (Revised) | (Revised) | |||||||||||||||||

| (in thousands) | ||||||||||||||||||

| U.S. federal government |

$ | 45,493 | 12.5 | % | $ | 45,048 | 13.5 | % | $ | 30,696 | 15.1 | % | ||||||

| U.S. state and local governments |

39,003 | 10.7 | % | 34,876 | 10.4 | % | 31,242 | 15.4 | % | |||||||||

| Foreign governments |

104,764 | 28.8 | % | 61,561 | 18.4 | % | 28,001 | 13.8 | % | |||||||||

| Private sector |

174,750 | 47.9 | % | 192,397 | 57.7 | % | 113,179 | 55.7 | % | |||||||||

| Total |

$ | 364,010 | 100.0 | % | $ | 333,882 | 100.0 | % | $ | 203,118 | 100.0 | % | ||||||

Our five largest clients accounted for 13.1%, 9.4%, 4.0%, 2.9% and 1.7% of our CFR during fiscal year 2009. During fiscal year 2008 our five largest clients accounted for 9.8%, 4.5%, 2.2%, 1.3% and 1.2% of our CFR and during fiscal year 2007 our five largest clients accounted for 7.5%, 7.3%, 2.7%, 2.3% and 1.9% of our CFR.

Business Development

The process for acquiring business from each of these categories of clients is principally the same, by participating in a competitive request-for-proposal (“RFP”) process, with the primary difference among clients being that the process for public sector clients is significantly more formal and complex than for private sector clients as a result of government procurement rules and regulations that govern the public sector process.

Although a significant factor in our business development consists of our standing in our industry, including existing relationships and reputation based on performance on completed projects, our marketing department undertakes a variety of activities in order to expand our exposure to potential new clients. These activities include media relations, advertising, promotions, market sector initiatives and maintaining our website and related web marketing. Media relations include placing articles that feature us and our personnel in trade publications and other media outlets. Our promotions include arranging speaking engagements for our personnel, participation in trade shows and other promotional activities. Market sector initiatives are designed to broaden our exposure to specific sectors of the construction industry, such as, for example, participating in or organizing industry seminars targeted to one sector of an industry.

For the year ended December 31, 2009, CFR from U.S. federal government contracts represented approximately 12.5% of our total CFR. Doing business with governments, including the U.S. federal government, is complex and requires the ability to comply with intricate regulations and satisfy periodic audits. We believe that the ability to understand these requirements and to successfully conduct business with government agencies is a barrier to entry for smaller, less experienced competitors. Most government contracts, including our contracts with the federal government, are subject to termination by the government, to government audits and to continued appropriations.

We are required from time to time to obtain various permits, licenses and approvals in order to conduct our business in some of the jurisdictions where we operate. The inability to obtain any particular permits, licenses or governmental approvals would not have a material effect on our business. Our business of providing construction management and construction claims services are not subject to significant regulation by state, federal or foreign governments.

Contracts

The price provisions of our contracts can be grouped into three broad categories: cost-plus, time and materials, and fixed-price.

7

Table of Contents

Cost-plus contracts provide for reimbursement of our costs and overhead plus a predetermined fee. Under some cost-plus contracts, our fee may be based partially on quality, schedule and other performance factors.

We also enter into contracts whereby we bill our clients monthly at hourly billing rates. The hourly billing rates are determined by contract terms. For governmental clients, the hourly rates are generally calculated as salary costs plus overhead costs plus a negotiated profit percentage. For commercial clients, the hourly rate can be taken from a standard fee schedule by staff classification or it can be a discount from this schedule. In some cases, primarily for foreign work, a fixed monthly staff rate is negotiated rather than an hourly rate. This monthly rate is a build-up of staffing costs plus overhead and a profit. Hill accounts for these contracts on a time-and-materials method, recognizing revenue as costs are incurred.

Fixed price contracts are accounted for using the “percentage-of-completion” method, wherein revenue is recognized as costs are incurred. Due to our recent acquisitions, this type of contract is having an increasing role in our business.

Backlog

We believe a strong indicator of our future performance is our backlog of uncompleted projects under contract or awarded. Our backlog represents management’s estimate of the amount of contracts and awards in hand that we expect to result in future consulting fee revenue. Project management backlog is evaluated by management, on a project-by-project basis, and is reported for each period shown based upon the binding nature of the underlying contract, commitment or letter of intent, and other factors, including the economic, financial and regulatory viability of the project and the likelihood of the contract being extended, renewed or cancelled. Construction claims backlog is based largely on management’s estimates of future revenue based on known construction claims assignments and historical results for new work. Because a significant number of construction claims may be awarded and completed within the same period, our actual construction claims revenue has historically exceeded backlog by a significant amount.

Our backlog is important to us in anticipating and planning for our operational needs. Backlog is not a measure defined in U.S. generally accepted accounting principles, and our methodology for determining backlog may not be comparable to the methodology used by other companies in determining their backlog.

At December 31, 2009, our backlog was approximately $620,000,000 compared to approximately $667,000,000 at December 31, 2008. We estimate that approximately $282,000,000, or 45.5%, of the backlog at December 31, 2009 will be recognized during our 2010 fiscal year.

The schedule below includes backlog under two categories: (1) contracts for which work authorizations have been or are expected to be received and (2) contracts awarded to us where some or all of the work has not yet been authorized. As of December 31, 2009, approximately $468,000,000, or 75.5%, of our backlog was in category (1) and approximately $152,000,000 or 24.5%, of our backlog was in category (2). We do not track whether contracts included in our backlog are fully funded, incrementally funded, or unfunded.

Included in category (2) of our backlog is the maximum amount of all indefinite delivery/indefinite quantity (“ID/IQ”), or task order, contracts, or a lesser amount if we do not reasonably expect to be issued task orders for the maximum amount of such contracts. Also included in category (2) of our backlog is the amount of anticipated revenue in option years beyond the base term of our contracts if we reasonably expect our clients to exercise such option years. Although backlog reflects business that we consider to be firm, cancellations or scope adjustments may occur. Further, substantially all of our contracts with our clients may be terminated at will, in which case the client would only be obligated to us for services provided through the termination date. The impact of terminations and modifications on our realization of revenue from our backlog has not been significant. Furthermore, reductions of our backlog as a result of contract terminations and modifications may be more than offset by additions to the backlog.

8

Table of Contents

We adjust backlog to reflect project cancellations, deferrals and revisions in scope and cost (both upward and downward) known at the reporting date; however, future contract modifications or cancellations may increase or reduce backlog and future revenue.

| Total Backlog | 12 Month Backlog | |||||||||||

| (in thousands) | ||||||||||||

| As of December 31, 2009: |

||||||||||||

| Project Management |

$ | 583,000 | 94.0 | % | $ | 249,000 | 88.3 | % | ||||

| Construction Claims |

37,000 | 6.0 | 33,000 | 11.7 | ||||||||

| Total |

$ | 620,000 | 100.0 | % | $ | 282,000 | 100.0 | % | ||||

| As of September 30, 2009: |

||||||||||||

| Project Management |

$ | 563,000 | 94.3 | % | $ | 245,000 | 88.8 | % | ||||

| Construction Claims |

34,000 | 5.7 | 31,000 | 11.2 | ||||||||

| Total |

$ | 597,000 | 100.0 | % | $ | 276,000 | 100.0 | % | ||||

| As of December 31,2008: |

||||||||||||

| Project Management |

$ | 623,000 | 93.4 | % | $ | 236,000 | 87.7 | % | ||||

| Construction Claims |

44,000 | 6.6 | 33,000 | 12.3 | ||||||||

| Total |

$ | 667,000 | 100.0 | % | $ | 269,000 | 100.0 | % | ||||

Competition

The project management and claims consulting industries are highly competitive. We compete for contracts, primarily on the basis of technical capability, with numerous entities, including design or engineering firms, general contractors, other “pure” construction management companies, other claims consulting firms, the “Big Four” and other accounting firms, management consulting firms and other entities. Compared to us, many of these competitors are larger, well-established companies that have broader geographic scope and greater financial and other resources. During 2009, some of our largest project management competitors included: AECOM Technology Corp.; Bovis Lend Lease, Inc.; Jacobs Engineering Group, Inc.; Parsons Brinckerhoff, Inc.; Tishman Construction Corp.; Turner Construction Corp.; and URS Corp. Some of our largest claims consulting competitors last year included: Exponent, Inc.; FTI Consulting, Inc.; and Navigant Consulting, Inc.

Insurance

We maintain insurance covering professional liability, as well as for claims involving bodily injury and property damage. We have historically enjoyed a favorable loss ratio in all lines of insurance and our management considers our present limits of liability, deductibles and reserves to be adequate. We endeavor to reduce or eliminate risk through the use of quality assurance/control, risk management, workplace safety and similar methods to eliminate or reduce the risk of losses on a project. Although our actual rates have decreased, we have experienced and expect to continue to experience increases in the dollar amount of our insurance premiums because of the increase in our revenue.

9

Table of Contents

Management

We are led by an experienced management team with significant experience in the construction industry. Additional information about our executive officers is set forth below.

Executive Officers

| Name |

Age | Position | ||

| Irvin E. Richter |

65 | Chairman of the Board of Directors and Chief Executive Officer | ||

| David L. Richter |

43 | President and Chief Operating Officer, Director | ||

| Raouf S. Ghali |

48 | President, Project Management Group (International) | ||

| Thomas J. Spearing III |

43 | President, Project Management Group (Americas) | ||

| Frederic Z. Samelian |

62 | President, Construction Claims Group | ||

| John Fanelli III |

55 | Senior Vice President and Chief Financial Officer | ||

| Ronald F. Emma |

58 | Senior Vice President and Chief Accounting Officer | ||

| William H. Dengler, Jr. |

43 | Senior Vice President and General Counsel | ||

| Catherine H. Emma |

50 | Senior Vice President and Chief Administrative Officer | ||

| Michael J. Petrisko |

44 | Senior Vice President and Chief Information Officer |

IRVIN E. RICHTER has been Chairman of our Board of Directors since 1985 and he has been Chief Executive Officer and a member of our Board of Directors since he founded the company in 1976. In 2002, Mr. Richter was selected as a Fellow by the Construction Management Association of America (“CMAA”) for his contributions to the construction management industry. He is a member of the World Presidents’ Organization and the Construction Industry Round Table. He is the author of several books including Handbook of Construction Law & Claims and International Construction Claims: Avoiding and Resolving Disputes. He has served or does serve on a number of Boards of Directors, including Rutgers University, Temple University Hospital, CMAA, incNETWORKS, Inc., Energy Storage & Power and Proton Therapy, Inc. Mr. Richter holds a B.A. in government from Wesleyan University and a J.D. from Rutgers University School of Law at Camden, and he has been named a Distinguished Alumnus at both schools.

DAVID L. RICHTER has been President and Chief Operating Officer since April 2004, and he has been a member of our Board of Directors since February 1998. Prior to his current position, he was President of our Project Management Group from April 2001 to March 2004. Before that, Mr. Richter was Senior Vice President, General Counsel and Secretary from August 1999 to March 2001 and Vice President, General Counsel and Secretary from April 1995 to August 1999. Prior to joining us, he was an attorney with the New York City law firm of Weil, Gotshal & Manges LLP from 1992 to 1995. Mr. Richter is a member of the Young Presidents’ Organization, a member of the Board of Trustees of the Southern New Jersey Development Council and served on the Board of Directors of the CMAA from 2001 to 2007. He earned a B.S. in management, a B.S.E. in civil engineering and a J.D. from the University of Pennsylvania. Mr. Richter is a son of Irvin E. Richter.

THOMAS J. SPEARING III has been President of our Project Management Group (Americas) since April 2009. Before that, he was Hill’s Senior Vice President and Chief Strategy Officer, from September 2007 to March 2009. Prior to joining Hill, Mr. Spearing worked for more than ten years with STV Group, Inc., most recently as Principal-in-Charge of its western region. Before that, Mr. Spearing was a Vice President of business development with Hill. Mr. Spearing earned his B.B.A. in computer and information science from Temple University, his B.S. in construction management and his B.S. in civil engineering from Spring Garden College, and his M.S. in management from Rosemont College. He is an active member of the American Public Transportation Association, the Women’s Transportation Seminar, the New Jersey Business & Industry Association, the Southern New Jersey Development Council, and the New Jersey Alliance for Action, among others.

RAOUF S. GHALI has been President of our Project Management Group (International) since January 2005. Before that, he was Senior Vice President in charge of project management operations in Europe and the Middle East from June 2001 to December 2004. Before that, Mr. Ghali was a Vice President with us from September 1993 to May 2001. Prior to joining us, he worked for Walt Disney Imagineering from 1988 to 1993.

10

Table of Contents

Mr. Ghali has a B.S. degree in business administration and economics and an M.S. in business organizational management from the University of LaVerne.

FREDERIC Z. SAMELIAN has been President of our Construction Claims Group since January 2005. Before that, he was a Senior Vice President with us from March 2003 until December 2004. Before that, Mr. Samelian was President of Conex International, Inc., a construction dispute resolution firm, from March 2002 to March 2003 and from April 2000 to February 2001, an Executive Director with Greyhawk North America, Inc., a construction management and consulting firm, from March 2001 to February 2002, and a Director with PricewaterhouseCoopers LLP from September 1998 to March 2000. Before that, he had worked with Hill from 1983 to August 1998. He served as Hill’s President and Chief Operating Officer from September 1996 to August 1998. Mr. Samelian has a B.A. in international affairs from George Washington University and an M.B.A. from Southern Illinois University. He is a Project Management Professional certified by the Project Management Institute and he is a licensed General Building Contractor in California.

JOHN FANELLI III has been Senior Vice President and Chief Financial Officer since September 2006. Before that, Mr. Fanelli was Vice President and Chief Accounting Officer of CDI Corp. from June 2005 until June 2006, and he was Vice President and Corporate Controller of CDI Corporation (a subsidiary of CDI Corp.) from October 2003 until June 2006. CDI Corp. is a New York Stock Exchange-traded professional services and outsourcing firm based in Philadelphia with expertise in engineering, technical services and information technology. From February 2003 until October 2003, Mr. Fanelli was a financial consultant to Berwind Corporation, an investment management company based in Philadelphia which owns a diversified portfolio of manufacturing and service businesses and real estate. Before that, Mr. Fanelli was employed for 18 years by Hunt Corporation, then a New York Stock Exchange-traded manufacturer and marketer of office products. At Hunt, he served as Vice President and Chief Accounting Officer from 1995 until February 2003, and before that as Director of Budgeting, Financial Analysis and Control, from 1985 to 1995. Before that, for eight years Mr. Fanelli was employed with Coopers & Lybrand in various accounting and auditing positions. Mr. Fanelli earned his B.S. in accounting from LaSalle University, and he is a Certified Public Accountant in Pennsylvania.

RONALD F. EMMA has been Senior Vice President and Chief Accounting Officer since January 2007. Mr. Emma had been Hill’s Senior Vice President of Finance from August 1999 to January 2007. Before that, he was Hill’s Vice President of Finance since 1979. Before joining Hill, he was Assistant Controller of General Energy Resources, Inc., a mechanical contracting firm, and prior to that was a Staff Accountant with the accounting firm of Haskins & Sells. Mr. Emma has a B.S. in accounting from St. Joseph’s University and is a Certified Public Accountant in New Jersey.

WILLIAM H. DENGLER, JR. has been Senior Vice President and General Counsel since March 2007. Mr. Dengler was previously Vice President and General Counsel from January 2002 to March 2007, and Corporate Counsel from April 2001 to December 2001. Mr. Dengler also serves as corporate secretary to Hill and its subsidiaries. Prior to joining Hill, Mr. Dengler served as Assistant Counsel to former New Jersey Governors Donald DiFrancesco and Christine Todd Whitman from September 1999 to April 2001. Mr. Dengler earned his B.A. in political science from Western Maryland College and his J.D. from Rutgers University School of Law at Camden. He is licensed to practice law in New Jersey, as well as before the U.S. Court of Appeals for the Third Circuit and the U.S. Supreme Court.

CATHERINE H. EMMA has been Senior Vice President and Chief Administrative Officer since January 2007. Ms. Emma had been Vice President and Chief Administrative Officer from August 2005 to January 2007. Before that, she served as Hill’s Vice President of Human Resources and Administration. Ms. Emma has been with Hill since 1982. She is certified by the Society for Human Resource Management as a Professional in Human Resources (PHR) and has held professional memberships with Tri-State Human Resources, the Society for Human Resource Management and the BNA Human Resources Personnel Policies Forum. Ms. Emma is the wife of Ronald F. Emma.

MICHAEL J. PETRISKO has been Senior Vice President and Chief Information Officer since January 2009. Before that, he was our Vice President and Chief Information Officer from May 2007 to December 2008.

11

Table of Contents

Before that, Mr. Petrisko was Director of Global IT Operations for AECOM Technology Corp. from September 2005 to May 2007 and Vice President and Chief Information Officer for DMJM Harris, Inc., a subsidiary of AECOM Technology Corp., a global architecture, engineering and construction management firm, from January 2002 to September 2005. Before that he was Director of Technical Services for Foster Wheeler Corp., an engineering and construction services firm, from April 1999 to January 2002. Mr. Petrisko studied management information technology at Thomas Edison State College and he is a member of the New Jersey Society of Information Management.

Employees

At February 24, 2010, we had 2,356 personnel. Of these individuals, 1,717 worked in our Project Management Group, 434 worked in our Construction Claims Group and 205 worked in our Corporate Group. Our personnel at February 24, 2010 included 2,001 full-time employees, 151 part-time employees and 204 independent contractors. Our future success will depend significantly on our ability to attract, retain and motivate highly qualified personnel. We are not a party to any collective bargaining agreements and we have not experienced any strikes or work stoppages. We consider our relationship with our employees to be satisfactory.

Access to Company Information

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports with the Securities and Exchange Commission (the “SEC”). The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC maintains an Internet site (www.sec.gov) that contains periodic reports, proxy statements, information statements and other information regarding issuers that file electronically.

We make available, free of charge, through our website or by responding to requests addressed to our Legal Department, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed by us with the SEC pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act, as amended. These reports are available as soon as practicable after such material is filed with or furnished to the SEC. Our primary website is www.hillintl.com. We post the charters for our audit, compensation and governance and nominating committees, corporate governance principles and code of ethics on our website. The information contained on our website, or on other websites linked to our website, is not part of this document.

| Item 1A. | Risk Factors |

Our business involves a number of risks, some of which are beyond our control. The risks and uncertainties described below are not the only ones we face. Such factors could have a significant impact on our business, operating results and financial condition. We believe the most significant of these risks and uncertainties are as follows:

Recent global economic trends could adversely affect our business, liquidity and financial results.

Recent global economic conditions, including disruption of financial markets, could adversely affect our business and results of operations, primarily by limiting our access to credit and disrupting our clients’ businesses. The reduction in financial institutions’ willingness or ability to lend has increased the cost of capital and reduced the availability of credit. Although we currently believe that the financial institutions with whom we do business, will be able to fulfill their commitments to us, there is no assurance that those institutions will be able to continue to do so, which could have a material adverse impact on our business. In addition, continuation or worsening of general market conditions in the United States or other national economies important to our businesses may adversely affect our clients’ level of spending, ability to obtain financing, and ability to make

12

Table of Contents

timely payments to us for our services, which could require us to increase our allowance for doubtful accounts, negatively impact our days sales outstanding and adversely affect our results of operations.

We depend on long-term government contracts, many of which are funded on an annual basis. If appropriations are not made in subsequent years of a multiple-year contract, we will not realize all of our potential revenue and profit from that project.

A significant portion of our consulting fee revenue is derived from contracts with federal, state, local and foreign governments. During 2009, 2008 and 2007, approximately 52.0%, 42.4%, and 44.3%, respectively, of our consulting fee revenue were derived from such contracts.

Most government contracts are subject to the continuing availability of legislative appropriation. Legislatures typically appropriate funds for a given program on a year-by-year basis, even though contract performance may take more than one year. As a result, at the beginning of a program, the related contract is only partially funded, and additional funding is normally committed only as appropriations are made in each subsequent fiscal year. These appropriations and the timing of payment of appropriated amounts may be influenced by, among other things, the state of the economy, competing priorities for appropriation, the timing and amount of tax receipts and the overall level of government expenditures. If appropriations are not made in subsequent years on government contracts, then we will not realize all of our potential revenue and profit from those contracts.

Because we depend on government contracts for a significant portion of our consulting fee revenue, our inability to win profitable government contracts could harm our operations and adversely affect our net earnings.

In 2009, U.S. federal government contracts and state and local government contracts contributed approximately 12.5% and 10.7%, respectively, of our total consulting fee revenue, and foreign government contracts contributed approximately 28.8% of our total consulting fee revenue. Our inability to win profitable government contracts could harm our operations and adversely affect our net earnings. Government contracts are typically awarded through a heavily regulated procurement process. Some government contracts are awarded to multiple competitors, causing increases in overall competition and pricing pressure. In turn, the competition and pricing pressure may require us to make sustained post-award efforts to reduce costs under these contracts. If we are not successful in reducing the amount of costs we anticipate, our profitability on these contracts may be negatively impacted. Also, some of our federal government contracts require U.S. government security clearances. If we or certain of our personnel were to lose these security clearances, our ability to continue performance of these contracts or to win new contracts requiring a clearance may be negatively impacted.

We depend on contracts that may be terminated by our clients on short notice, which may affect our ability to recognize all of our potential revenue and profit from the project.

Substantially all of our contracts are subject to termination by the client either at its convenience or upon our default. If one of our clients terminates a contract at its convenience, then we typically are able to recover only costs incurred or committed, settlement expenses and profit on work completed prior to termination, which could prevent us from recognizing all of our potential revenue and profit from that contract. If one of our clients terminates the contract due to our default, we could be liable for excess costs incurred by the client in re-procuring services from another source, as well as other costs.

Our contracts with governmental agencies are subject to audit, which could result in adjustments to reimbursable contract costs or, if we are charged with wrongdoing, possible temporary or permanent suspension from participating in government programs.

Our books and records are subject to audit by the various governmental agencies we serve and by their representatives. These audits can result in adjustments to reimbursable contract costs and allocated overhead. In

13

Table of Contents

addition, if as a result of an audit, we or one of our subsidiaries is charged with wrongdoing or the government agency determines that we or one of our subsidiaries is otherwise no longer eligible for federal contracts, then we or, as applicable, that subsidiary, could be temporarily suspended or, in the event of convictions or civil judgments, could be prohibited from bidding on and receiving future government contracts for a period of time. Furthermore, as a U.S. government contractor, we are subject to an increased risk of investigations, criminal prosecution, civil fraud, whistleblower lawsuits and other legal actions and liabilities, the results of which could have a material adverse effect on our operations.

We submit change orders to our clients for work we perform beyond the scope of some of our contracts. If our clients do not approve these change orders, our net earnings could be adversely impacted.

We typically submit change orders under some of our contracts for payment for work performed beyond the initial contractual requirements. The clients may not approve or may contest these change orders and we cannot assure you that these claims will be approved in whole, in part or at all. If these claims are not approved, our net earnings could be adversely impacted.

Because our backlog of uncompleted projects under contract or awarded is subject to unexpected adjustments and cancellations, including the amount, if any, of future appropriations by the applicable contracting government agency, it is an uncertain indicator of our future revenue and profits.

At December 31, 2009, our backlog of uncompleted projects under contract or awarded was approximately $620,000,000. We cannot assure you that the revenue attributed to uncompleted projects under contract will be realized or, if realized, will result in profits.

Many projects may remain in our backlog for an extended period of time because of the size or long-term nature of the contract. In addition, from time to time projects are scaled back or cancelled. These types of backlog reductions adversely affect the revenue and profit that we ultimately receive. Included in our backlog is the maximum amount of all indefinite delivery/indefinite quantity (“ID/IQ”), or task order, contracts, or a lesser amount if we do not reasonably expect to be issued task orders for the maximum amount of such contracts. We cannot provide any assurance that we will in fact be awarded the maximum amount of such contracts.

We depend on the continued services of certain executive officers. We cannot assure you that we will be able to retain the services of these individuals.

We are dependent upon the efforts and service of certain executive officers, particularly Irvin E. Richter, our Chairman and Chief Executive Officer, and David L. Richter, our President and Chief Operating Officer, because of their knowledge, experience, skills and relationships with major clients and other members of our management team. Irvin E. Richter has served as our Chief Executive Officer since 1976. We have employment agreements with these individuals which contain non-competition covenants which survive their actual term of employment. If we lost the services of one or both of these individuals for any reason, that could have an adverse effect on our operations.

Our ability to grow and compete in our industry will be harmed if we do not retain the continued service of our key management, sales and technical personnel and identify, hire and retain additional qualified personnel.

There is intense competition for qualified management, sales and technical personnel in the industry sectors in which we compete. We may not be able to continue to attract and retain qualified personnel who are necessary for the development of our business or to replace qualified personnel. Any growth we experience is expected to place increased demands on our resources and will likely require the addition of personnel and the development of additional expertise by existing personnel. Also, some of our personnel hold security clearance levels required to obtain government projects and, if we were to lose some or all of these personnel, they may be difficult to replace. Loss of the services of, or failure to recruit, key personnel could limit our ability to complete existing projects successfully and to compete for new projects.

14

Table of Contents

Our dependence on subcontractors, partners and specialists could adversely affect our business.

We rely on third-party subcontractors as well as third-party strategic partners and specialists to complete our projects. To the extent that we cannot engage such subcontractors, partners or specialists or cannot engage them on a competitive basis, our ability to complete a project in a timely fashion or at a profit may be impaired. If we are unable to engage appropriate strategic partners or specialists in some instances, we could lose the ability to win some contracts. In addition, if a subcontractor or specialist is unable to deliver its services according to the negotiated terms for any reason, including the deterioration of its financial condition or over-commitment of its resources, we may be required to purchase the services from another source at a higher price. This may reduce the profit to be realized or result in a loss on a project for which the services were needed.

If our partners fail to perform their contractual obligations on a project, we could be exposed to legal liability, loss of reputation or reduced profits.

We sometimes enter into joint venture agreements and other contractual arrangements with outside partners to jointly bid on and execute a particular project. The success of these joint projects depends on the satisfactory performance of the contractual obligations of our partners. If any of our partners fails to satisfactorily perform its contractual obligations, we may be required to make additional investments and provide additional services to complete the project. If we are unable to adequately address our partner’s performance issues, then our client could terminate the joint project, exposing us to legal liability, loss of reputation or reduced profits.

Our services expose us to significant risks of liability and our insurance policies may not provide adequate coverage.

Our services involve significant risks of professional and other liabilities that may substantially exceed the fees that we derive from our services. In addition, we sometimes contractually assume liability under indemnification agreements. We cannot predict the magnitude of potential liabilities from the operation of our business.

We currently maintain comprehensive general liability, umbrella and professional liability insurance policies. Professional liability policies are “claims made” policies. Thus, only claims made during the term of the policy are covered. Additionally, our insurance policies may not protect us against potential liability due to various exclusions and retentions. Partially or completely uninsured claims, if successful and of significant magnitude, could have a material adverse affect on our business.

International operations expose us to legal, political and economic risks in different countries and currency exchange rate fluctuations could adversely affect our financial results.

Our international operations contributed 80.0%, 77.7% and 67.6% of our consulting fee revenue for 2009, 2008 and 2007, respectively. We expect the percentage of revenue attributable to our international operations to continue to increase. There are risks inherent in doing business internationally, including:

| • | Lack of developed legal systems to enforce contractual rights; |

| • | Greater risk of uncollectible accounts and longer collection cycles; |

| • | Currency exchange rate fluctuations; |

| • | Restrictions on the transfer of cash from foreign countries; |

| • | Imposition of governmental controls; |

| • | Political and economic instability; |

| • | Changes in U.S. and other national government policies affecting the markets for our services; |

| • | Changes in regulatory practices, tariffs and taxes; |

15

Table of Contents

| • | Potential non-compliance with a wide variety of non-U.S. laws and regulations; and |

| • | General economic and political conditions in these foreign markets. |

Any of these factors could have a material adverse effect on our business, results of operations, financial condition or cash flows.

Changes to the laws of the foreign countries in which we operate may adversely affect our international operations.

We have contracts to perform services for projects located in a number of foreign countries, including, among others, Canada, Mexico, the United Kingdom, Spain, Germany, Poland, Latvia, Romania, Serbia, Croatia, Greece, Turkey, Kazakhstan, Azerbaijan, Egypt, Libya, Iraq, Afghanistan, Kuwait, Bahrain, Qatar, Saudi Arabia, the United Arab Emirates, China, Singapore, Malaysia, Vietnam, South Korea and Australia. We expect to have additional similar contracts in the future. In addition, we have offices or operations in over 30 foreign countries. The laws and regulations in the countries in which we are working on projects or in which we have offices might change. Such changes could have a material adverse effect on our business.

Our business sometimes requires our employees to travel to and work in high security risk countries, which may result in employee injury, repatriation costs or other unforeseen costs.

Many of our employees often travel to and work in high security risk countries around the world that are undergoing or that may undergo political, social and economic upheavals resulting in war, civil unrest, criminal activity or acts of terrorism. For example, we have employees working in Iraq, a high security risk country with substantial civil unrest and acts of terrorism. As a result, we may be subject to costs related to employee injury, repatriation or other unforeseen circumstances.

We have acquired and may continue to acquire businesses as strategic opportunities arise and may be unable to realize the anticipated benefits of those acquisitions.

Since 1998, we have acquired 16 businesses and our strategy is to continue to expand and diversify our operations with additional acquisitions as strategic opportunities arise. Some of the risks that may affect our ability to realize any anticipated benefits from businesses that we acquire include:

| • | Unexpected losses of key personnel or clients of the acquired business; |

| • | Difficulties arising from the increasing scope, geographic diversity and complexity of our operations; |

| • | Diversion of management’s attention from other business concerns; and |

| • | Adverse effects on existing business relationships with clients. |

In addition, managing the growth of our operations will require us to continually increase and improve our operational, financial and human resources management and our internal systems and controls. If we are unable to manage growth effectively or to successfully integrate acquisitions, that could have a material adverse effect on our business.

We cannot be certain that we will be able to raise capital or obtain debt financing to execute future acquisitions or to meet required capital needs.

We are currently party to a revolving credit agreement to assist in funding working capital needs and for potential future acquisitions. This agreement contains certain financial covenants with respect to minimum net worth, total funded debt to EBITDA ratio, fixed charge coverage ratio, billed accounts receivable to senior secured indebtedness ratio, as well as other covenants. If our operating results are not as positive as we expect, that could cause us to be in default of these covenants. In addition, our current revolving credit agreement may

16

Table of Contents

not provide us with sufficient credit to meet all of the future financial needs of our business. Although under certain circumstances, we may be able to increase availability by an additional $50,000,000, there is no guarantee that we could increase the availability under our current revolving credit agreement or obtain alternative debt or equity financing on terms that would be acceptable to us, or at all.

The market price for our common stock could be volatile and could decline, resulting in a substantial or complete loss of your investment.

The stock markets, including the New York Stock Exchange on which we list our common stock, have experienced significant price and volume fluctuations. As a result, the market price of our common stock could be similarly volatile, and investors in our common stock may experience a decrease in the value of their shares, including decreases unrelated to our operating performance or prospects. The price of our common stock could be subject to wide fluctuations in response to a number of factors, including:

| • | Our operating performance and the performance of other similar companies; |

| • | Actual or anticipated differences in our operating results; |

| • | Changes in our revenue or earnings estimates or recommendations by securities analysts; |

| • | Publication of research reports about us or our industry by securities analysts; |

| • | Additions and departures of key personnel; |

| • | Speculation in the press or investment community; |

| • | Actions by institutional shareholders; |

| • | Changes in accounting principles; |

| • | Terrorist acts; and |

| • | General market conditions, including factors unrelated to our performance. |

Future sales of our common and preferred stock may depress the price of our common stock.

As of March 4, 2010, there were 39,295,529 shares of our common stock outstanding. An additional 2,039,395 shares of our common stock may be issued upon the exercise of options held by employees, management and directors. In connection with earn-out provisions of the merger agreement with Arpeggio, 1,000,000 shares will be issued in the second quarter of 2010. We also have the authority to issue up to 1,000,000 shares of preferred stock, and additional options and warrants to purchase shares of our common stock without stockholder approval. Sales of a substantial number of these shares in the public market could decrease the market price of our common stock. In addition, the perception that such sales might occur may cause the market price of our common stock to decline. Future issuances or sales of our common stock could have an adverse effect on the market price of our common stock.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

Our executive and operating offices are located at 303 Lippincott Centre, Marlton, New Jersey 08053. We lease all of our office space and do not own any real property. The telephone number at our executive office is (856) 810-6200. In addition to our executive offices, we have over 80 operating leases for office facilities throughout the world. Due to acquisition and growth we may have more than one operating lease in the cities in which we are located. Additional space may be required as our business expands geographically, but we believe we will be able to obtain suitable space as needed.

17

Table of Contents

Following are our principal worldwide office locations:

| Americas |

Europe |

Middle East | ||

| Atlanta, GA |

Ankara, Turkey | Abu Dhabi, UAE | ||

| Baltimore, MD |

Athens, Greece | Ajman, UAE | ||

| Bellevue, WA |

Baku, Azerbaijan | Baghdad, Iraq | ||

| Bensalem, PA |

Barcelona, Spain | Doha, Qatar | ||

| Birmingham, AL |

Belgrade, Serbia | Dubai, UAE | ||

| Boston, MA |

Birmingham, UK | Jeddah, Saudi Arabia | ||

| Cancun, Mexico |

Bristol, UK | Manama, Bahrain | ||

| Danbury, CT |

Bucharest, Romania | Riyadh, Saudi Arabia | ||

| Granite Bay, CA |

Cardiff, Wales | Sharq, Kuwait | ||

| Houston, TX |

Daresbury, UK | |||

| Irvine, CA |

Dusseldorf, Germany | North Africa | ||

| Las Vegas, NV |

Edinburgh, Scotland | Cairo, Egypt | ||

| Little Falls, NJ |

Exeter, UK | Tripoli, Libya | ||

| Marlton, NJ |

Glasgow, Scotland | |||

| Miami, FL |

Krakow, Poland | Asia/Pacific | ||

| New Orleans, LA |

Leeds, UK | Beijing, China | ||

| New York, NY |

London, UK | Hong Kong, China | ||

| Orlando, FL |

Luxembourg | Kuala Lumpur, Malaysia | ||

| Philadelphia, PA |

Madrid, Spain | Perth, Australia | ||

| Phoenix, AZ |

Manchester, UK | Singapore | ||

| Portland, OR |

Munich, Germany | Shanghai, China | ||

| San Ramón, CA |

Riga, Latvia | Sydney, Australia | ||

| Spokane, WA |

Rijeka, Croatia | |||

| Tampa, Florida |

Tbilisi, Georgia | |||

| Toronto, Canada |

Teesside, UK | |||

| Trinidad and Tobago |

Warsaw, Poland | |||

| Universal City, CA |

Winchester, UK | |||

| Vancouver, Canada |

Wroclaw, Poland | |||

| Washington, DC |

| Item 3. | Legal Proceedings. |

Litigation

On July 16, 2009, Al Areen Desert Resort Holding Company (“Al Areen”) filed a complaint with the Ministry of Justice & Islamic Affairs in the Kingdom of Bahrain against the Company alleging breach of contract and other causes of action in connection with its performance of a construction project known as Al Areen Desert Spa and Resort (the “Project”), seeking the sum of approximately 10,200,000 Bahraini dinars (approximately $27,052,000 at December 31, 2009) in damages. The Company provided project management services on the Project and Al Areen failed to pay the Company 679,000 Bahraini dinars (approximately $1,801,000 at December 31, 2009) for services rendered on the Project. The Company served notice of termination on April 28, 2009. On September 26, 2009, the Company filed a Request for Arbitration with the International Chamber of Commerce, International Court of Arbitration, seeking the sum of 679,000 Bahraini dinars. The Company has reserved approximately $531,000 against the receivable, however, the Company believes that Al Areen’s claim is without merit and, based on the Company’s current understanding and evaluation of the relevant facts and circumstances, no accrual has been made because the Company considers the chance of loss to be remote.

On September 23, 1996, William Hughes General Contractors, Inc. (“Hughes”) filed a complaint in the Superior Court of New Jersey, Law Division, Gloucester County, against the Monroe Township Board of

18

Table of Contents

Education, the Company and other parties, alleging breach of contract and other causes of action in connection with its performance of a construction project for Monroe Township, seeking in excess of $3,500,000 in damages. Monroe Township, which had terminated Hughes from the construction project prior to the commencement of the litigation on the basis of Hughes’ performance, made a cross claim against the Company and other parties for contribution and indemnification. Monroe Township is seeking approximately $89,000 in damages from the Company, in addition to an indemnification for Hughes’ claims. In relation to the Hughes claims, a claim was made against the Company by Fidelity and Deposit Company of Maryland (“F&D”). F&D is claiming damages in the range of $425,000 to $470,000. The F&D claim is being defended by the New Jersey Professional Liability Insurance Guarantee Association (“NJPLIGA”) and losses are covered up to $300,000. On September 18, 2009, the parties reached a global settlement in which the NJPLIGA agreed to pay $110,000 to Hughes and Hill agreed to pay $30,000. The Company’s payment of $30,000 is reflected in selling, general and administrative expenses for the year ended December 31, 2009.

General Litigation

From time to time, the Company is a defendant or plaintiff in various legal actions which arise in the normal course of business. As such the Company is required to assess the likelihood of any adverse outcomes to these matters as well as potential ranges of probable losses. A determination of the amount of the provision required for these commitments and contingencies, if any, which would be charged to earnings, is made after careful analysis of each matter. The provision may change in the future due to new developments or changes in circumstances. Changes in the provision could increase or decrease the Company’s earnings in the period the changes are made. It is the opinion of management, after consultation with legal counsel, that the ultimate resolution of these matters will not have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

| Item 4. | Reserved. |

19

Table of Contents

| Item 5. | Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

Since February 22, 2008, our common stock has traded on the New York Stock Exchange under the symbol HIL. From June 29, 2006 through February 21, 2008, our common stock traded on the Nasdaq Global Market under the symbol HINT. The following table sets forth the range of high and low closing sale prices on the Nasdaq Global Market from January 1, 2008 through February 21, 2008 and the range of high and low closing prices on the New York Stock Exchange from February 22, 2008 through December 31, 2009.

| Common Stock | ||||||

| High | Low | |||||

| 2009: |

||||||

| Fourth Quarter |

$ | 7.80 | $ | 6.10 | ||

| Third Quarter |

8.01 | 3.95 | ||||

| Second Quarter |

4.43 | 2.98 | ||||

| First Quarter |

8.23 | 2.35 | ||||

| 2008: |

||||||

| Fourth Quarter |

$ | 13.32 | $ | 3.83 | ||

| Third Quarter |

19.30 | 13.53 | ||||

| Second Quarter |

17.40 | 11.70 | ||||

| First Quarter |

13.62 | 11.03 | ||||

Stockholders

As of March 4, 2010, there were 101 holders of record of our common stock. However, a single record stockholder account may represent multiple beneficial owners, including holders of shares in street name accounts. Including those multiple owners, we believe there are more than 5,000 holders of our common stock.

Dividends

We have not paid any dividends on our common stock. The payment of dividends in the future will be contingent upon our revenue and earnings, if any, capital requirements and general financial condition of our business. The payment of any dividends is within the discretion of our Board of Directors. It is the present intention of our Board to retain all earnings, if any, for use in our business operations and, accordingly, we do not anticipate declaring any dividends in the foreseeable future.

Issuer Purchases of Equity Securities

On November 10, 2008, we announced that our Board of Directors approved the purchase of up to $20,000,000 of our common shares, from time to time over the subsequent 12 months. On August 4, 2009, our Board of Directors amended the stock repurchase program to increase the authorized amount to $40,000,000 and extend the program to December 31, 2010. Under the terms of our Credit Agreement with Bank of America, our ability to repurchase our common shares is limited to $20,000,000. Purchases in excess of that amount require a waiver from the bank.

| Period |

(a) Total Number of Shares Purchased |

(b) Average Price Paid per Share |

(c) Total Number of Shares Purchased as Part of Publicly Announced Plan |

(d) Maximum Dollar Value of Shares that May Yet Be Purchased Under the Plan | ||||||

| November 2009 |

400 | $ | 6.02 | 3,652,572 | $ | 24,889,813 | ||||

20

Table of Contents

Securities Authorized for Issuance under Equity Compensation Plans

The table setting forth this information is included in Part III—Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

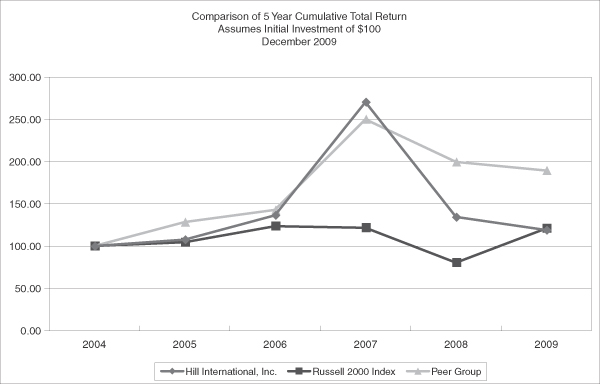

Performance Graph

The performance graph and table below compare the cumulative total return of our common stock for the period December 31, 2004 to December 31, 2009 with the comparable cumulative total returns of the Russell 2000 Index and a peer group, which consists of the following ten companies: AECOM Technology Corp. (ACM), Michael Baker Corp. (BKR), Exponent, Inc. (EXPO), Fluor Corporation (FLR), ICF International, Inc. (ICFI), Jacobs Engineering Group, Inc. (JEC), Navigant Consulting, Inc. (NCI), Tutor Perini Corp. (TPC), Tetra Tech, Inc. (TTEK), and URS Corp. (URS).

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||

| Hill International, Inc |

$ | 100.00 | $ | 107.76 | $ | 136.53 | $ | 270.57 | $ | 134.42 | $ | 119.14 | ||||||

| Russell 2000 Index |

100.00 | 104.56 | 123.75 | 121.83 | 80.66 | 121.14 | ||||||||||||

| Peer Group |

100.00 | 128.35 | 142.75 | 249.98 | 199.49 | 189.35 | ||||||||||||

21

Table of Contents

| Item 6. | Selected Financial Data. |

The following is selected financial data from Hill’s audited consolidated financial statements for each of the last five years. This data should be read in conjunction with Hill’s consolidated financial statements (and related notes) appearing elsewhere in this report and with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. The data presented below is in thousands, except for per share data.

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| (Revised)(1) | (Revised)(1) | (Revised)(1) | (Revised)(1) | |||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Consulting fee revenue |

$ | 364,010 | $ | 333,882 | $ | 203,118 | $ | 129,987 | $ | 80,108 | ||||||||||

| Reimbursable expenses |

57,772 | 46,600 | 87,205 | 67,485 | 32,121 | |||||||||||||||

| Total revenue |

421,782 | 380,482 | 290,323 | 197,472 | 112,229 | |||||||||||||||

| Cost of services |

209,052 | 183,485 | 107,447 | 71,552 | 43,466 | |||||||||||||||

| Reimbursable expenses |

57,772 | 46,600 | 87,205 | 67,485 | 32,121 | |||||||||||||||

| Total direct expenses |

266,824 | 230,085 | 194,652 | 139,037 | 75,587 | |||||||||||||||

| Gross profit |

154,958 | 150,397 | 95,671 | 58,435 | 36,642 | |||||||||||||||

| Selling, general and administrative expenses |

136,683 | 131,857 | 80,280 | 48,142 | 31,671 | |||||||||||||||

| Equity in earnings of affiliates |

(8,222 | ) | (3,658 | ) | (2,221 | ) | (1,080 | ) | (685 | ) | ||||||||||

| Operating profit |

26,497 | 22,198 | 17,612 | 11,373 | 5,656 | |||||||||||||||

| Interest (income) expense, net |

1,737 | (134 | ) | 433 | 312 | 669 | ||||||||||||||

| Earnings before provision for income taxes |

24,760 | 22,332 | 17,179 | 11,061 | 4,987 | |||||||||||||||

| Provision for income taxes |

4,577 | 3,654 | 2,788 | 2,534 | 1,845 | |||||||||||||||

| Consolidated net earnings |

20,183 | 18,678 | 14,391 | 8,527 | 3,142 | |||||||||||||||

| Less: net earnings—non controlling interests |

713 | 1,027 | 247 | (53 | ) | — | ||||||||||||||

| Net earnings attributable to Hill International, Inc. |

$ | 19,470 | $ | 17,651 | $ | 14,144 | $ | 8,580 | $ | 3,142 | ||||||||||

| Basic earnings per common share |

$ | 0.49 | $ | 0.43 | $ | 0.53 | $ | 0.50 | $ | 0.27 | ||||||||||

| Basic weighted average common shares outstanding |

39,659 | 40,809 | 26,720 | 17,240 | 11,644 | |||||||||||||||

| Diluted earnings per common share |

$ | 0.49 | $ | 0.43 | $ | 0.45 | $ | 0.46 | $ | 0.23 | ||||||||||

| Diluted weighted average common shares outstanding |

40,124 | 41,148 | 31,387 | 18,489 | 13,894 | |||||||||||||||

|

(1) In the fourth quarter of 2009, the Company began charging a portion of depreciation and amortization expense to cost of services. The income statement data for 2008, 2007, 2006 and 2005 have been revised to conform to the current year’s presentation. |

| |||||||||||||||||||

| 12/31/2009 | 12/31/2008 | 12/31/2007 | 12/30/2006 | 12/31/2005 | ||||||||||||||||

| Selected Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 30,923 | $ | 20,430 | $ | 66,128 | $ | 11,219 | $ | 2,716 | ||||||||||

| Accounts receivable, net |

130,900 | 118,124 | 83,151 | 61,159 | 27,623 | |||||||||||||||

| Current assets |

183,602 | 161,492 | 162,428 | 83,344 | 33,351 | |||||||||||||||

| Total assets |

291,539 | 254,041 | 207,199 | 118,993 | 40,723 | |||||||||||||||

| Current liabilities |

82,657 | 80,563 | 59,648 | 50,835 | 31,707 | |||||||||||||||

| Total debt |

28,244 | 18,887 | 3,312 | 11,287 | 10,374 | |||||||||||||||

| Equity: |

||||||||||||||||||||

| Hill International, Inc. |

155,635 | 135,506 | 128,371 | 46,036 | 6,159 | |||||||||||||||

| Noncontrolling interests |

4,005 | 3,510 | 259 | 286 | — | |||||||||||||||

| Total equity |

$ | 159,640 | $ | 139,016 | $ | 128,630 | $ | 46,322 | $ | 6,159 | ||||||||||

22

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |