Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Scripps Networks Interactive, Inc. | d8k.htm |

Credit Suisse Global Media & Communications Convergence Conference March 8, 2010 Exhibit 99.1 |

Safe

Harbor These slides contain certain forward-looking statements related

to the company's businesses that are based on management's current expectations. Forward-looking statements are subject to certain risks, trends and uncertainties, including changes in advertising demand and other economic conditions that could cause actual results to differ materially from the expectations expressed in forward-looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. The company's written policy on forward-looking statements can be found on page F-3 of its 2009 Form 10K and on page F-20 of its most recent Form 10Q. We undertake no obligation to publicly update any forward-looking statements to reflect events or circumstances after the date the statement is made. |

HOME FOOD TRAVEL Powerful Lifestyle Media Brands, Powerful Lifestyle Categories |

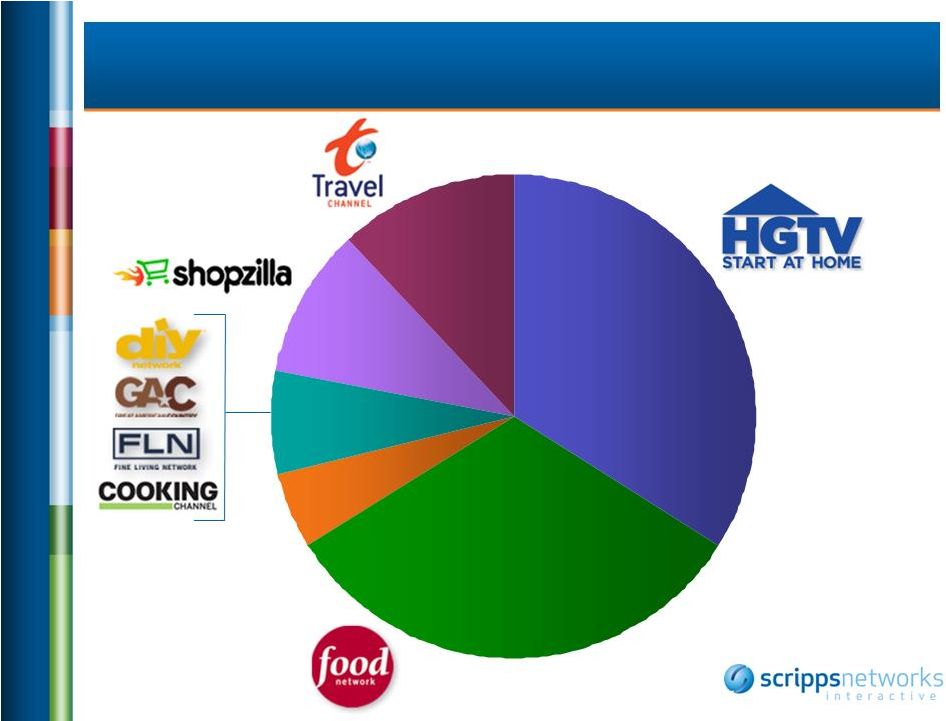

Revenue Profile 2010E 10% 10% Other 5% 5% Other includes: •Lifestyle Digital •International 7% 7% 32% 32% 12% 12% 34% 34% |

Key

Growth Drivers • Higher affiliate fee

rates for Food Network, HGTV • International development • Audience growth across all brands • Travel Channel integration • Cooking Channel rebranding |

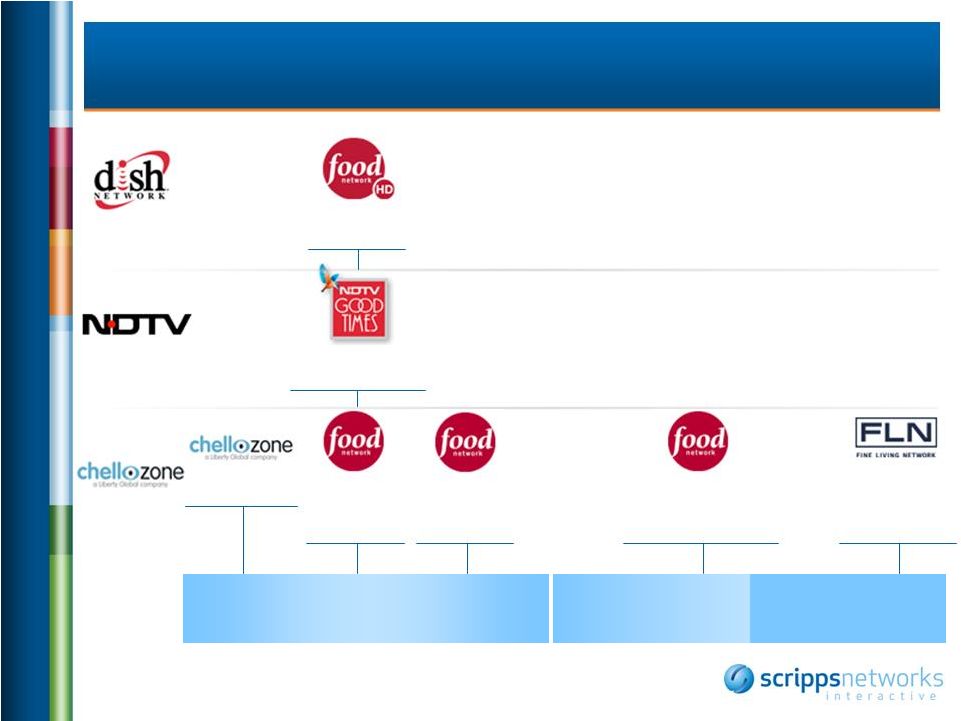

Successful Affiliate Renewals • Significant rate reset for Food Network • Rates for both networks more in line with competitive set • Consent secured for Cooking Channel rebranding • Affiliate revenues forecast to grow 32% to 35% in 2010 (excluding Travel) |

|

Video |

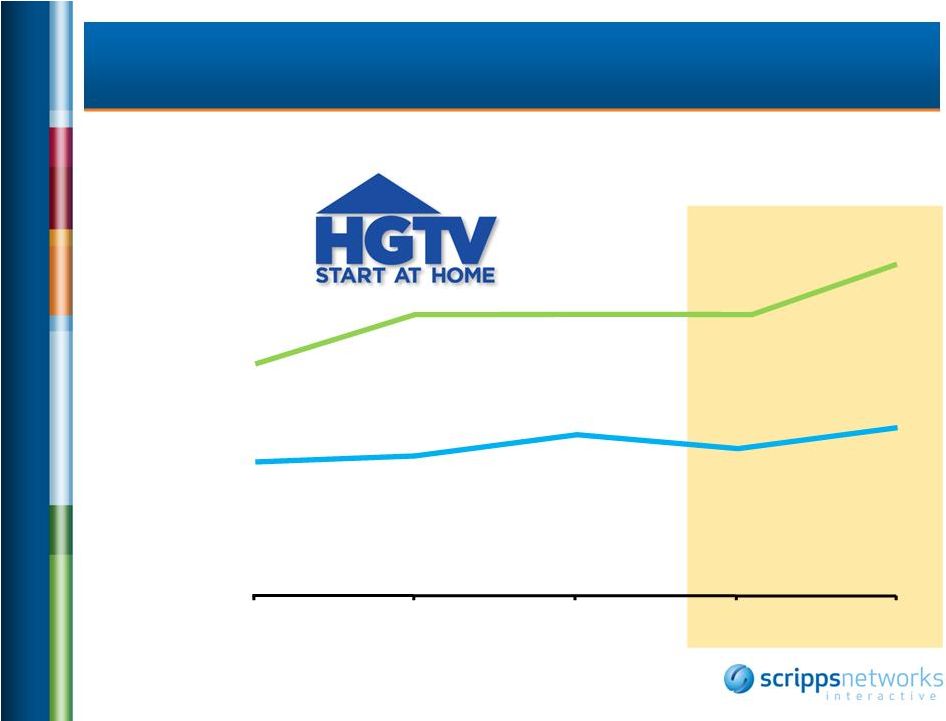

HGTV

Audience Growth [Total Households in Thousands] 616 1,052 514 780 Total Day Prime Time January +11% +16% 2006 2007 2010 2008 2009 |

|

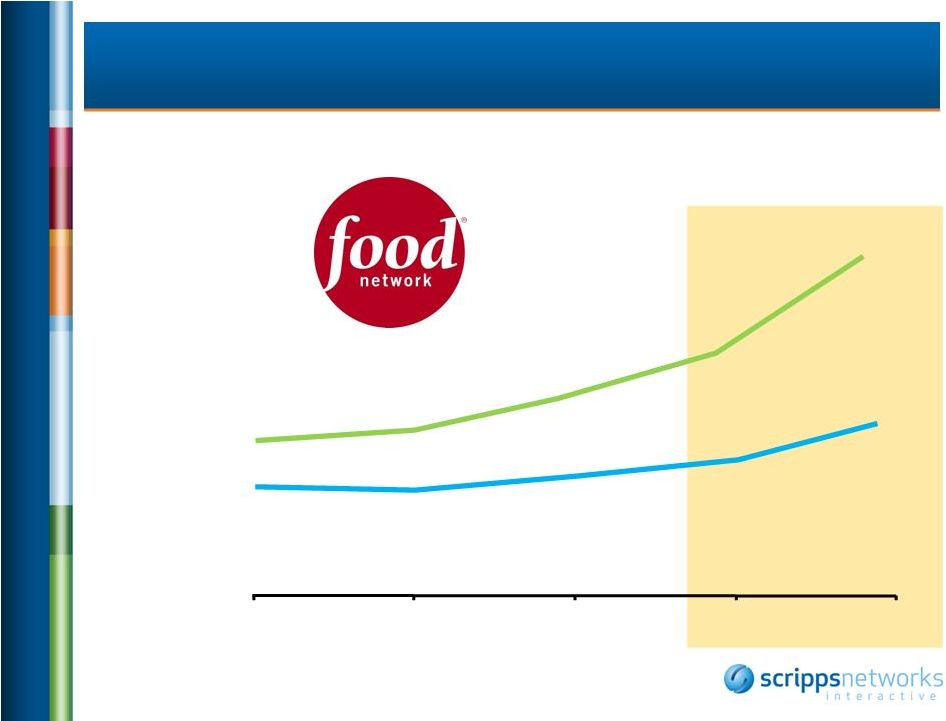

2006 2007 2010 2008 2009 Food Network Audience Growth [Total Households in Thousands] 586 884 481 559 Total Day Prime Time January +14% +25% |

Olympics Impact • Clear impact on Food Network, HGTV, Travel Channel • Not all dayparts were affected • Effect offset by strong pre- Olympics audience delivery • Strategy in place to draw viewers back |

|

Travel Channel Integration On Track • SNI assumes ad sales April 1 • Most internal systems and processes migrated to SNI • Additional synergies identified |

Travel Channel Going Forward • Evolve from “programming” to “category” destination • Accelerate viewership momentum • Build on success of hit shows – Man v. Food – Anthony Bourdain’s No Reservations – Ghost Adventures |

Coming Soon: The Cooking Channel • Capitalize on growing interest in television food genre • Quicker pathway to success for sizeable distribution footprint • Raise barrier to entry for 24/7 food competitor • Memorial Day Weekend debut |

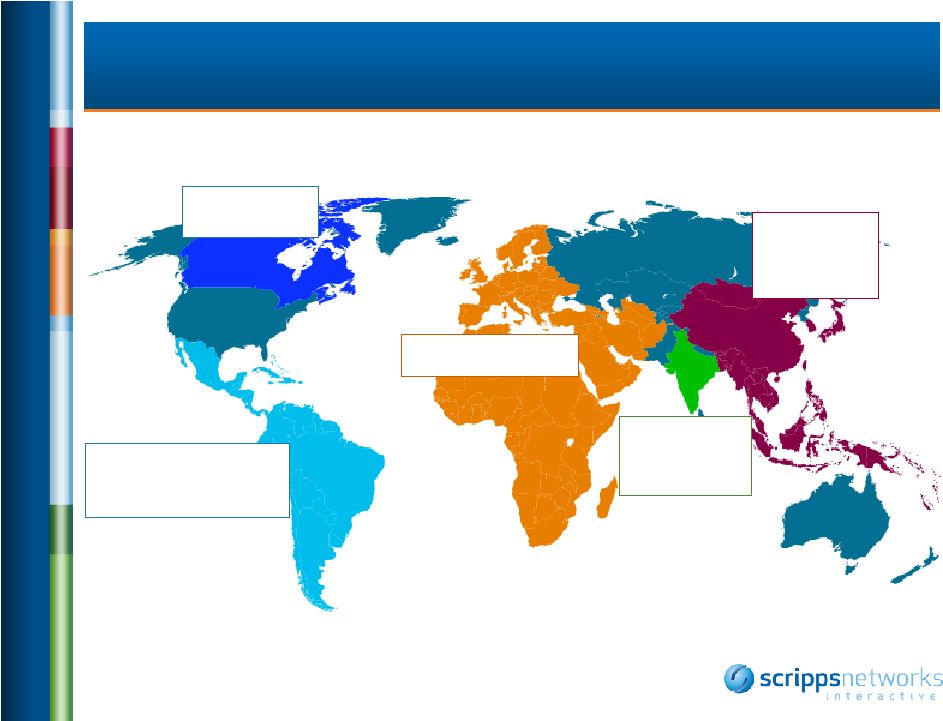

International Development: Four Theaters of Operation Chello Zone CanWest Food Network Asia NDTV Lifestyle Latin America (to come) |

International Expansion Recap Launched in U.K. (Sky) Debuts in 60 Countries Across EMEA October November December 2009 January February March April 2010 JV Announced (India) Launched in Middle East (Orbit Showtime) JV Announced Launched in Asia Freesat Adds in U.K. |

Financial Review and 2010 Outlook |

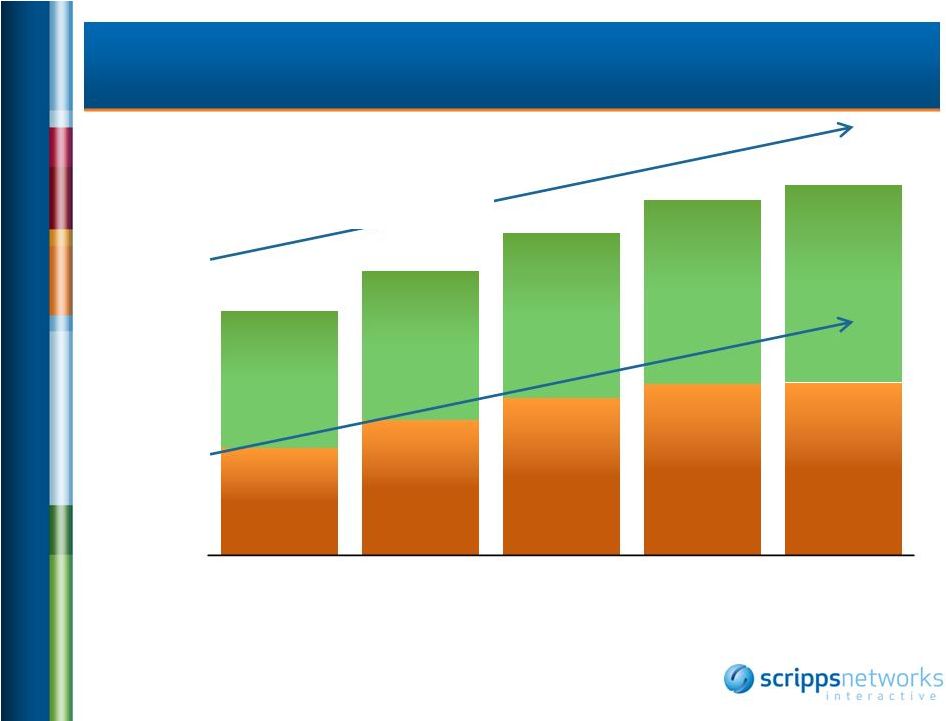

$504 $587 $632 $403 $637 $1,052 $1,185 $1,312 $903 $1,367* Consistent Growth at Lifestyle Media Revenue Segment Profit * 2009 as reported including 16 days of Travel Channel results [$ in Millions] 2005 2006 2007 2008 2009 11% Four-Year CAGR 12% Four-Year CAGR |

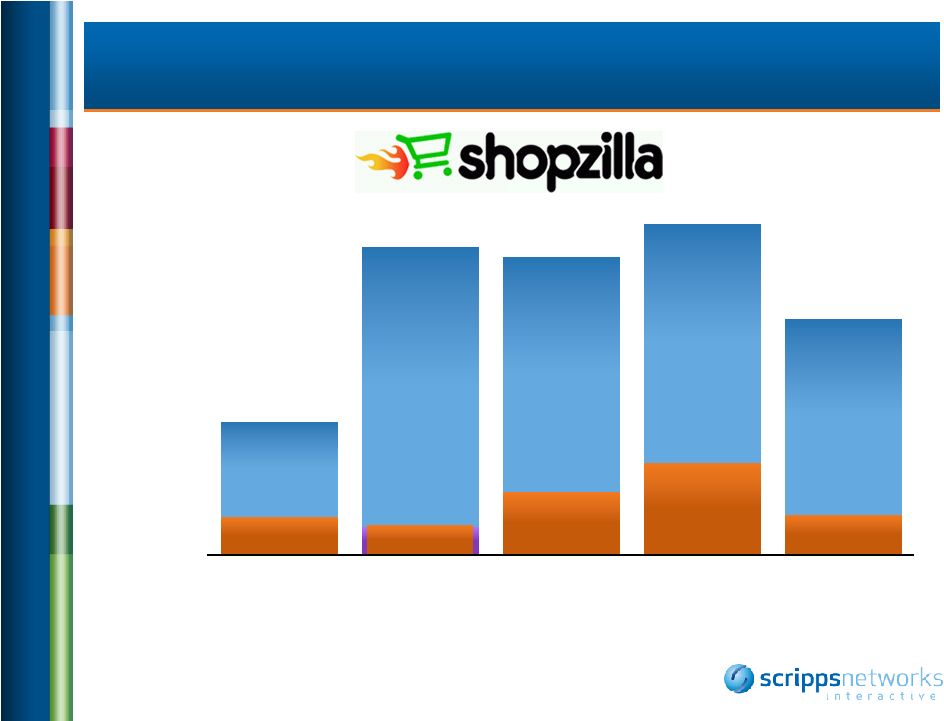

$53 $47 $63 $28 $31 $228 $220 $238 $99* $174 Finding the Right Model at Shopzilla Revenue Segment Profit * Shopzilla 2005 results are for the six months of the year it was owned [$ in Millions] 2005 2006 2007 2008 2009 |

2010

Interactive Services Outlook 1 st half Restaging continues; performance similar to 2009 2 nd half Stronger growth profile as repositioning takes hold Full-year Segment profit, $33 to $35 million |

• Total affiliate fee revenue $530 to $540 million • Programming expenses $380 to $400 million • Non-programming expenses $550 to $570 million ( $100 million is Travel) 2010 Lifestyle Media Outlook [Including Travel Channel] |

Non-Programming Expense Drivers • Restoring marketing budgets to: – Strengthen HGTV, Food Network, Travel Channel brands – Support Cooking Channel debut • Hiring freeze thaw [Lifestyle Media] |

Items Affecting 2010 Net Income,

Segment Profit Travel transition costs $30 to $40M Affiliate renewal support (marketing & legal) $10 to $15M Lifestyle Media impact $40 to $55M International build-up $15 to $20M Total $55 to $75M |

2010

Guidance Recap – Other Items • Capital expenditures $95 to $100 million • Interest expense $33 to $35 million • Depreciation and amortization $135 to $145 million • Effective tax rate 31 to 33 percent |

Credit Suisse Global Media & Communications Convergence Conference |