Attached files

| file | filename |

|---|---|

| 8-K - INTERFACE, INC. FORM 8-K INVESTOR PRESENTATION FEBRUARY 2010 - INTERFACE INC | form8-k.htm |

2

This

presentation contains forward-looking statements, including, in particular,

statements about Interface’s

plans, strategies and prospects. These are based on the Company’s current assumptions, expectations and

projections about future events.

plans, strategies and prospects. These are based on the Company’s current assumptions, expectations and

projections about future events.

Although

Interface believes that the expectations reflected in these forward-looking

statements are

reasonable, the Company can give no assurance that these expectations will prove to be correct or that

savings or other benefits anticipated in the forward-looking statements will be achieved. Important factors,

some of which may be beyond the Company’s control, that could cause actual results to differ materially from

management’s expectations are discussed under the heading “Risk Factors” included in Item 1A of the

Company’s most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission,

which discussion is hereby incorporated by reference. Forward-looking statements speak only as of the date

made. The Company assumes no responsibility to update or revise forward-looking statements and cautions

listeners and conference attendees not to place undue reliance on any such statements.

reasonable, the Company can give no assurance that these expectations will prove to be correct or that

savings or other benefits anticipated in the forward-looking statements will be achieved. Important factors,

some of which may be beyond the Company’s control, that could cause actual results to differ materially from

management’s expectations are discussed under the heading “Risk Factors” included in Item 1A of the

Company’s most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission,

which discussion is hereby incorporated by reference. Forward-looking statements speak only as of the date

made. The Company assumes no responsibility to update or revise forward-looking statements and cautions

listeners and conference attendees not to place undue reliance on any such statements.

Forward

Looking Statements

3

Daniel

Hendrix

§ President

and Chief Executive Officer

Patrick

Lynch

§ Senior

Vice President and Chief Financial Officer

Presenters

4

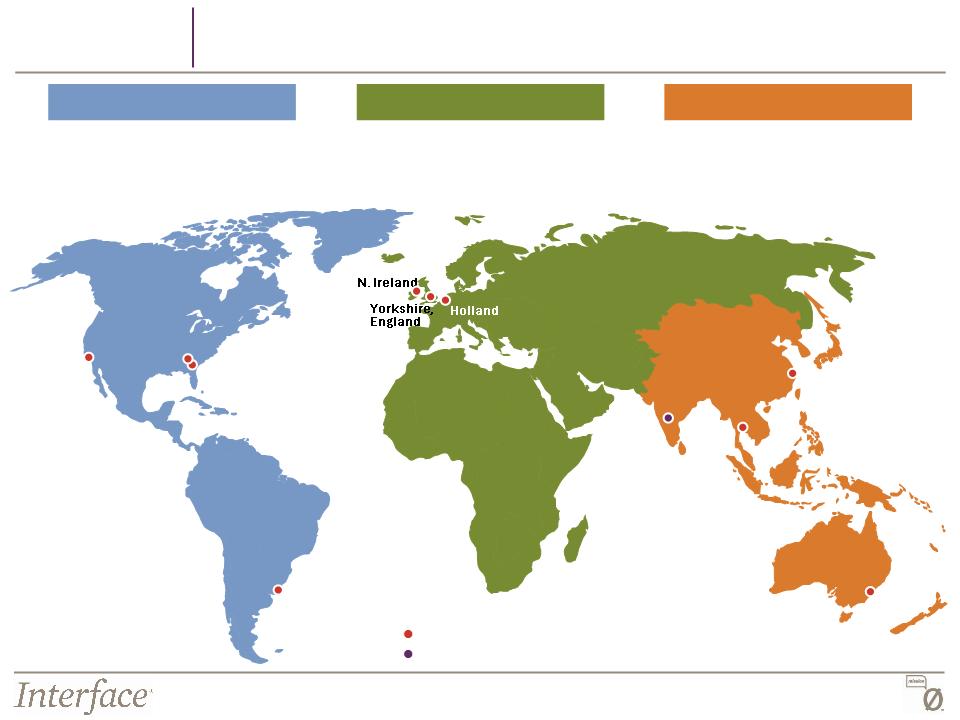

§ Interface

is leading

the secular shift to modular carpet as

it moves from a niche

to a

category with the leading global market share.

category with the leading global market share.

§ Interface

is the largest global

manufacturer

of

modular carpet with a presence on four

continents (United States, England, Holland, Ireland, Thailand, China, Australia).

continents (United States, England, Holland, Ireland, Thailand, China, Australia).

§ Interface

has established diversified

end markets

including emerging markets, non-

office commercial markets, and consumer representing nearly 55% of the overall

business.

office commercial markets, and consumer representing nearly 55% of the overall

business.

§ Interface

is creating a consumer

brand (FLOR)

as modular carpet is moving from a

concept to awareness for the home.

concept to awareness for the home.

§ Interface’s

global

sales and marketing capabilities have

created significant growth in

emerging markets which will experience growth faster than developed countries.

emerging markets which will experience growth faster than developed countries.

§ Interface

is the recognized thought leader in sustainability -

the marketplace is

rewarding our leading position.

rewarding our leading position.

Investment

Highlights

5

Interface

Brands - Most Recognized in the Industry

6

Leadership

Position in Sustainability

Global

Make-to-Order Manufacturing and Local Distribution

Rapid

Innovation and Designs

Invest

in the Growth

of Emerging Markets

of Emerging Markets

Grow a

Consumer

Brand

Diversify

End

Use

Markets

Maintain

Dominant

Share in the

Share in the

Office

Market

§ Establish

our position as

the leader in modular

carpet for the home

the leader in modular

carpet for the home

§ Drive

sales through direct

channels

channels

§ Potential

roll out of FLOR-

branded store network in

the U.S.

branded store network in

the U.S.

§ Drive

growth of carpet tile

market in China with local

manufacturing presence

market in China with local

manufacturing presence

§ Invest

in growth in Latin

America, Eastern Europe,

Middle East, Africa and

Indo-China

America, Eastern Europe,

Middle East, Africa and

Indo-China

§ Gain

share in commercial

non-office segments

non-office segments

§ Establish

“main street”

commercial presence in

the U.S. and Australia

commercial presence in

the U.S. and Australia

§ Pursue

the airline

transportation segment in

the U.S.

transportation segment in

the U.S.

§ Capture

opportunity as

the Office market

rebounds

the Office market

rebounds

§ Gain

share in European

carpet tile market

carpet tile market

Lead

the Secular Shift of Modular Carpet

Reduce

the Cyclical Nature of our Business

Customer

Intimacy

Interface

Strategy: Be the Global Category Leader for Modular

Carpet

7

Secular

Shift

1. Creative

DESIGN freedom

2. NO

glue, NO pad

3. LOWER

COST to change

4. Produces

LESS WASTE

5. FASTER

and more PROFITABLE

INSTALLATION for contractors

INSTALLATION for contractors

6. Easier

to RECONFIGURE and

MAINTAIN

MAINTAIN

7. Easily

RECYCLED and

REPURPOSED

REPURPOSED

2009

Floor Focus U.S. Top 250 Design Survey: Hot Products

Benefits

of Modular

Source: Floor

Focus

Modular

Carpet is Moving from a Niche to a Category for

Commercial Flooring

Commercial Flooring

Easy

Repairs

9

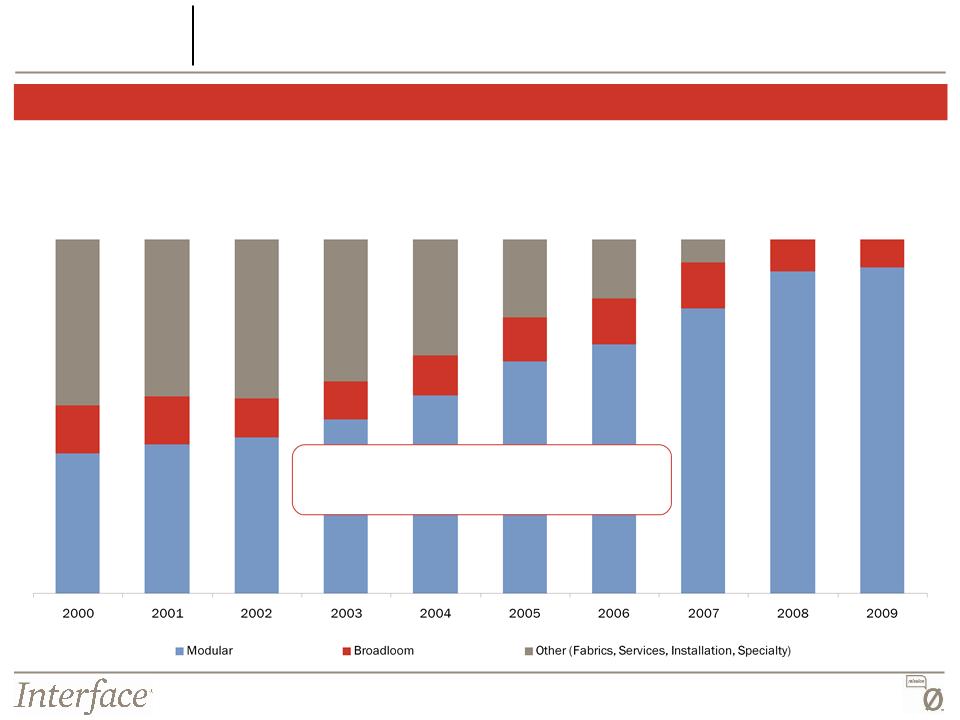

Long-Term

Strategy Has Been to Focus on Organic Growth of

Modular Carpet

Modular Carpet

Sales

by Business Type

Divested

Raised Access

Flooring

Raised Access

Flooring

Divested

European

Fabrics

European

Fabrics

Divested

N.

American

Fabrics

Divested

European

Broadloom

Divested

Installation &

Maintenance

Installation &

Maintenance

Divested

Vinyl

Matting

Divested

$500M in Revenue Base and

Replaced

with Organic Modular Sales Growth

Secular

Shift

40%

92%

10

Functionality

and Design Create a Secular Shift in Modular

Carpet From a Niche to a Category

Carpet From a Niche to a Category

§ Preferred

interior design element

§ “Becoming

the Flooring of Choice”

§ Random

products merge design with function

§ Sustainability

drives recycled and repurposed

products

products

§ Stressed

the functionality of

modular carpet

modular carpet

§ Exploited

the benefits of

modular vs. broadloom

modular vs. broadloom

§ Limited

application and design

§ Open

office plans emerge

Pioneering

Stage

Functionality

Stage

Secular

Shift

2009

Total U.S. Specified

Commercial

Carpet Market = $2.3B

§ Celebrating

the square

§ Sustainability

introduced

§ Pattern

by tile

Liberation

of Design

2020P

Total U.S. Specified

Commercial

Carpet Market = $3.3B

3%

CAGR

CAGR

2009

38%

Penetration

2020P

65%

Penetration

Carpet

Tile Share of U.S. Commercial Carpet Market

($

in millions)

What

if modular

carpet reached

65% market share

of the commercial

market by 2020?

carpet reached

65% market share

of the commercial

market by 2020?

2004

26%

Penetration

($

in millions)

Source: Invista,

Floor Focus, Carpet and Rug Institute, Catalina Research Inc., U.S. Flooring

Forecast and management estimates

Secular

Shift

11

Carpet

Tile Penetration of European Contract Soft Flooring Market

European

Market Opportunity

(millions

of square meters)

(Billions

of square meters)

Significant

Opportunity

65%

Penetration

8%

44%

24%

42%

24%

30%

23%

Carpet

Tile

Broadloom

and Other Soft Flooring

Source: BMW

Associates and management estimates

Secular

Shift

23%

Total

Europe

12

Carpet

Tile Penetration of the Asia-Pacific Contract Soft Flooring Market

Asia-Pacific

Market Opportunity

(millions

of square meters)

28%

($

in millions)

25%

Carpet

Tile

Broadloom

and Other Soft Flooring

Source: BMW

Associates and management estimates

Secular

Shift

65%

Penetration

13

Interface

has a Significant Share of the Global Carpet Tile Market

Secular

Shift

Americas

Europe

& MEAI

Australia/NZ

Source: BMW

Associates and management estimates

§ Interface

has significant market presence

in key major markets

in key major markets

§ Interface

has manufacturing, sales &

marketing support on four continents

marketing support on four continents

14

Segmented

Market Approach

Diversified

End Use Markets

Growth

Platforms

15

Diversify

End Use Markets

Current

Portfolio

Growth

Platforms

Target

Portfolio

Mature

Office Market

Non-Office

Commercial Segments

Emerging

Markets

Consumer

16

Capture

the Rebound in the Corporate Office Segment

Growth

Platforms

Modular

Mature Corporate Office Sales

Excludes

Latin America, Eastern Europe, Russia, Middle East, Africa, India and NE

Asia

23%

28%

18%

5%

U.S.

Office Construction Starts

§ U.S.

office construction is expected to

remain flat in 2010 and then rebound in

late 2011, returning to 2007 levels by the

end of 2012

remain flat in 2010 and then rebound in

late 2011, returning to 2007 levels by the

end of 2012

($

in Billions)

Source: McGraw-Hill

17

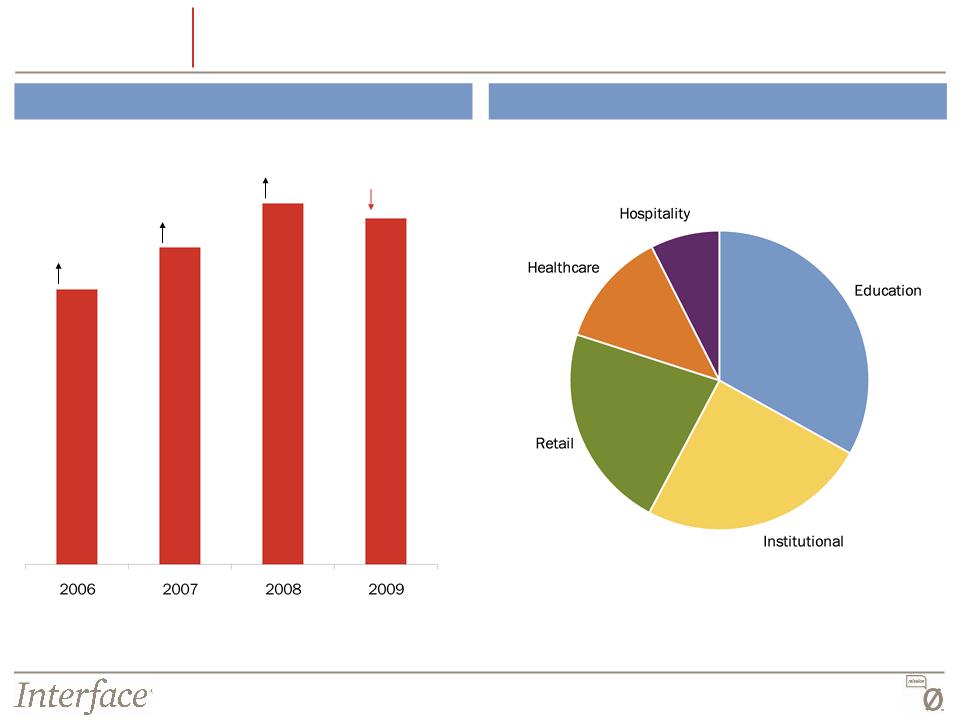

Strong

Growth from Non-Corporate Segments

Modular

Non-Office Commercial Sales

15%

14%

4%

10%

Non-Office

Commercial Sales by Segment

Growth

Platforms

18

New

Segment Opportunities - Main Street Commercial

§ Access

to secondary Contract and Main

Street commercial markets in smaller rural

and suburban areas

Street commercial markets in smaller rural

and suburban areas

§ Broadened

reach in primary markets

beyond specified market

beyond specified market

§ Exploring

several strategies to expand

reach and distribution

reach and distribution

Opportunity

Main

Street Commercial Market

U.S.

Commercial Carpet Market

($

in billions)

Main

Street Commercial

Contract

Commercial

$3.0B

Growth

Platforms

19

New

Segment Opportunities - Transportation

§ Single

tile replace-ability

§ Longer

Life construction

§ Highest

standards of Smoke Toxicity with Nylon

§ Lighter

weight than current carpet options

§ Quick

replacement - no “out of service” time

required

required

§ Recycled

after use by manufacturer

Benefits

of Modular for Transportation

$200M

Airline

Opportunity

Southwest

Airlines Green Plane

§ Pilot

project serving as a test for new

environmentally responsible materials

environmentally responsible materials

§ InterfaceFLOR,

in collaboration with Boeing,

designed a carpet tile to meet Federal Aviation

requirements and Southwest’s environmental

expectations

designed a carpet tile to meet Federal Aviation

requirements and Southwest’s environmental

expectations

§ First

ever modular carpet product used for the

airline industry

airline industry

Growth

Platforms

20

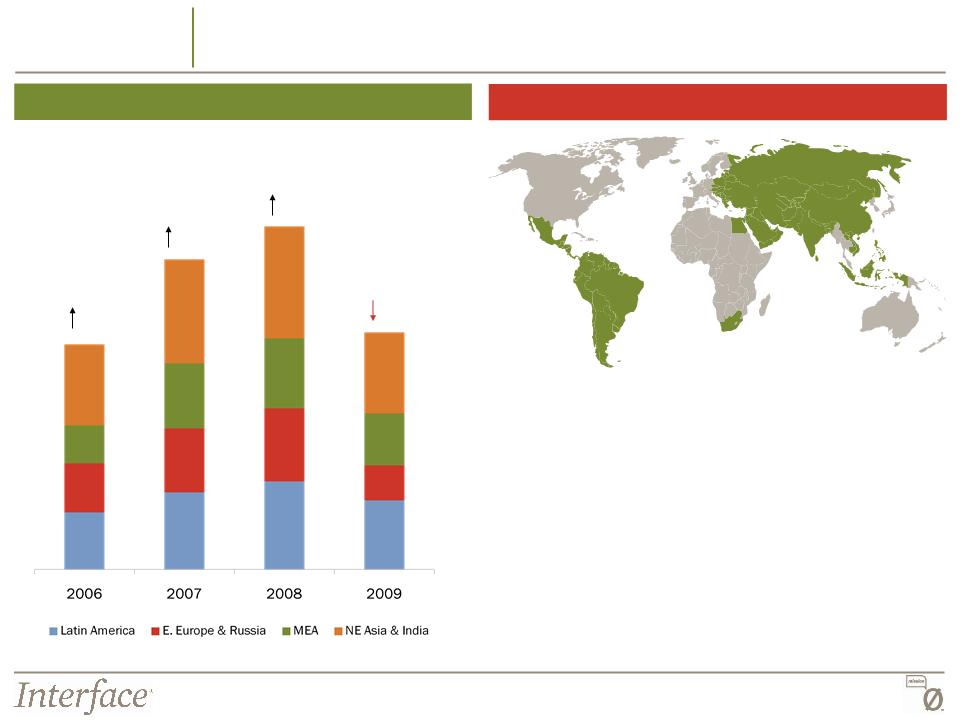

Invest

in Emerging Markets

Growth

Platforms

Interface

Target Emerging Markets

§ Central

America

§ South

America

§ Eastern

Europe

§ Russia

§ Middle

East

§ Africa

§ India

§ China

§ Vietnam

§ Cambodia

§ Singapore

§ Indonesia

§ Philippines

Emerging

Market Sales

38%

10%

31%

31%

21

Invest

in Emerging Markets: Establishing Local Manufacturing

in High Growth China Market

in High Growth China Market

Growth

Platforms

InterfaceFLOR

Taicang Facility

§ Targeting

LEED Silver certification for Office and

Customer spaces

Customer spaces

§ Expect

to begin production by third quarter 2010

§ Greater

access to Local customers -

reduced exposure to Multi-National

Corporations

reduced exposure to Multi-National

Corporations

§ Improved

service speed

§ “Made

in China”

§ Leading

with our strengths

- Design

Flexibility & Responsiveness

- Local

Sustainability Position

§ Non-office

segment opportunities in

Institutional and Hospitality

Institutional and Hospitality

§ Future

opportunity to capitalize on

urbanization of population

urbanization of population

Benefits

of China Manufacturing Plant

22

FLOR

is…

§

A new way to think about floor covering

§

A new kind of customer experience

§

A new way to design for your life

§

A new standard in sustainable residential

design

design

Grow

a Consumer Brand: Modular Goes in the Home

Growth

Platforms

23

2010

catalog, online and in-store experiences bring the proposition to life for

consumers

Grow

a Consumer Brand: FLOR Connects Directly with

Consumers

Consumers

Growth

Platforms

24

FLOR

Sales by Channel

Grow

a Consumer Brand: FLOR is Creating a Category:

“Modular Carpet for the Home”

“Modular Carpet for the Home”

% Direct

Sales

Percent of Total

Percent of Total

75%

77%

88%

90%

of FLOR

sales

are

generated

Online

and via Catalog

and via Catalog

90%

Growth

Platforms

25

Grow

a Consumer Brand: FLOR Store Opened

§ First

store opened in Chicago in June 2009

§ Opportunity

to interact with the customer about

the modular concept, design and sustainability

the modular concept, design and sustainability

§ 8x10

grid allowing visitors to bring design ideas

to life

to life

§ Exceeded

budget in 2009

§ Exploring

opportunities for future stores

FLOR

Store Highlights

Growth

Platforms

26

Global

Manufacturing Capabilities and Local Distribution

City

of

Industry,

California

Bangkok,

Thailand

Thailand

Picton,

Australia

Australia

Current

Manufacturing Facility

LaGrange,

Georgia

Georgia

58%

of Sales

51%

of Production

30%

of Sales

34%

of Production

12%

of Sales

15%

of Production

Note:

Figures represent FYE 2009

Value

Drivers

Shanghai,

China

Americas

Europe

& MEAI

Asia-Pacific

Future

Manufacturing Facility

Uruguay

(commissioned)

India

27

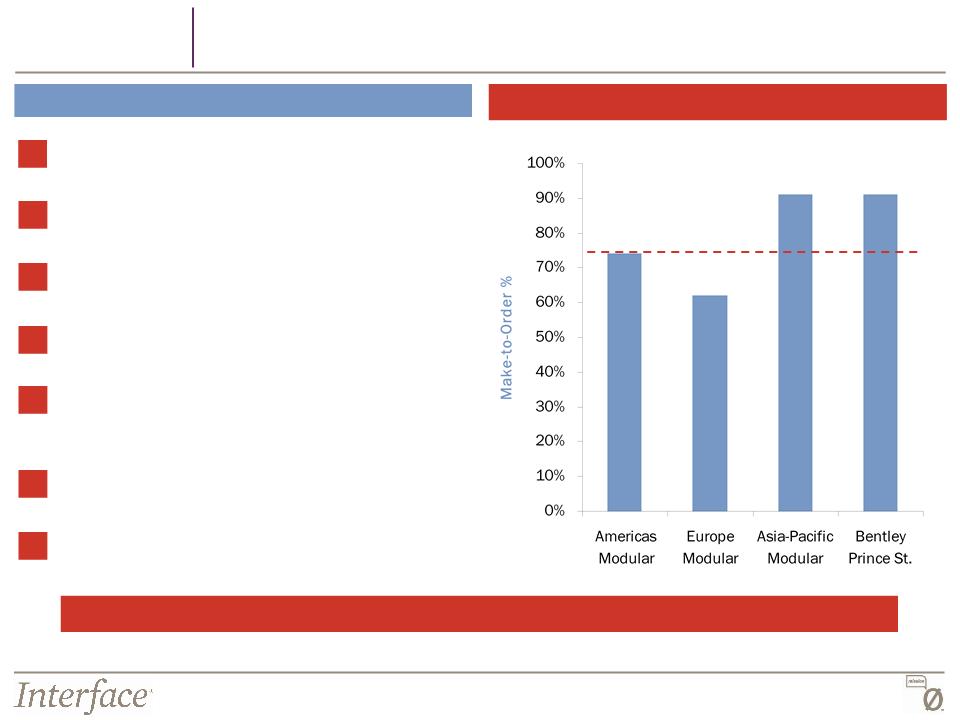

1. Increases

speed to market

2. Promotes

innovation

3. Offers

unique custom product capabilities

4. Supports

a constant flow of new products

5. Offers

sales force the opportunity to visit the

customer with new products

customer with new products

6. Decreases

lead time to customers

7. Increases

inventory turns

The

Made-to-Order Advantage

Interface

Modular Percentage Make-to-Order

Interface

is the ONLY company with a “make-to-order” approach to the market

75%

TARGET Level

Note:

Figures represent FYE 2009

Value

Drivers

Strong

Competitive Advantage Through Make-to-Order Philosophy

28

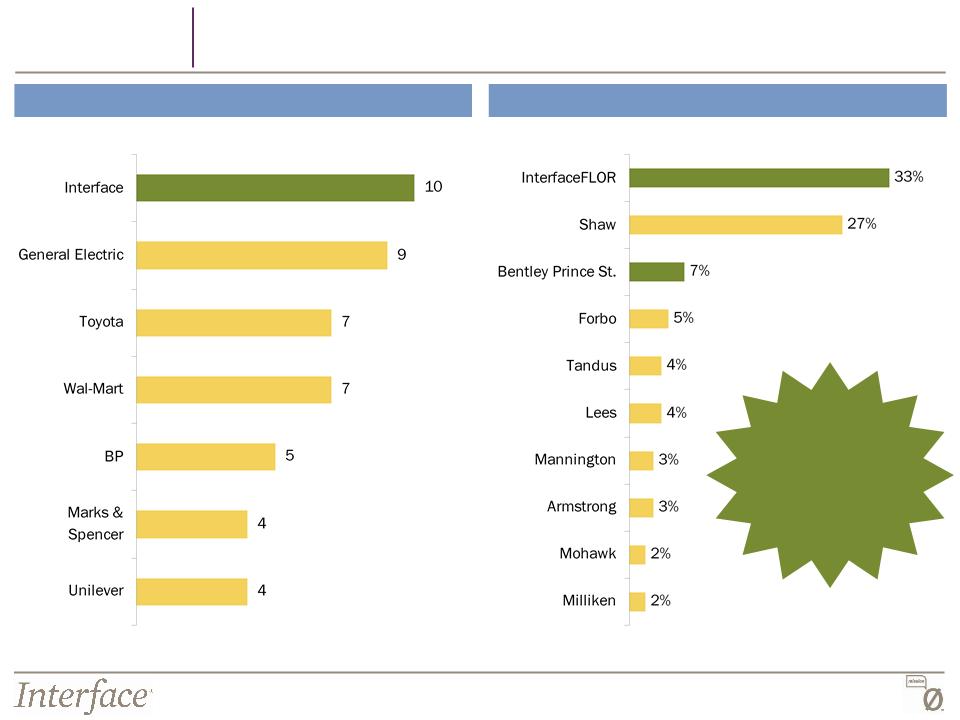

Contract

Magazine 2009 Brand Report

Value

Drivers

Top

Modular Carpet Brands

1. InterfaceFLOR

2. Shaw

Contract Group

3. Lees

Carpets

4. Milliken

5. Bentley

Prince Street

5. Tandus

7. Patcraft

Designweave

8. C&A

8. Mannington

10. J&J/Invision

Top-ranked

Modular Carpet brands for 2009

Source:

Contract Magazine 10th Annual Brand

Report

Market

Leader in Product Design and Fashion

29

Corporate

Office

Value

Drivers

30

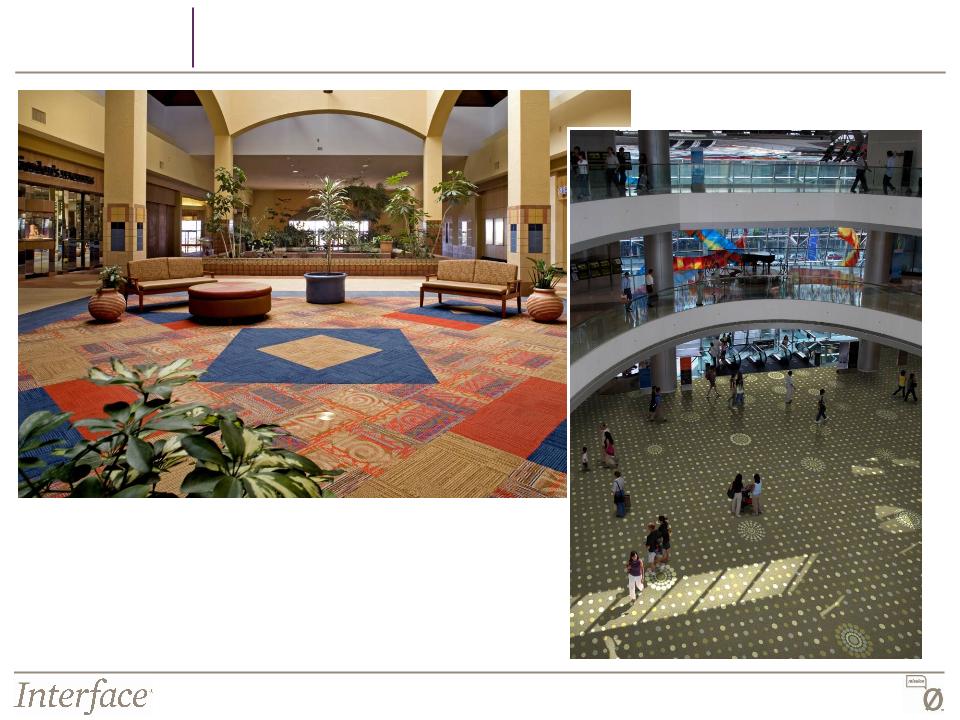

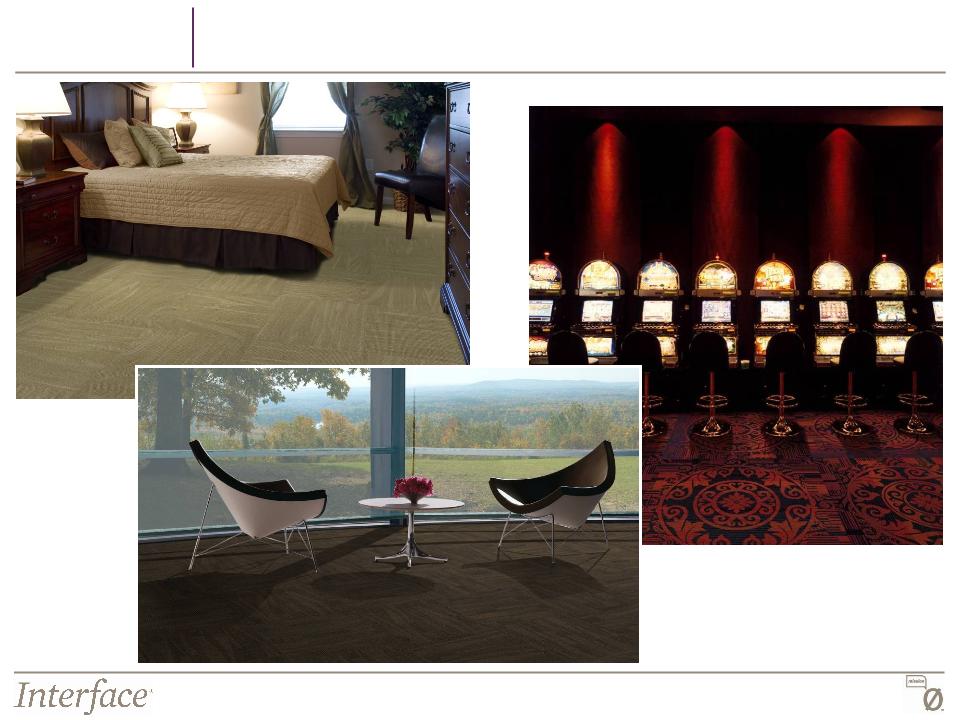

Retail

Value

Drivers

31

Colleges

& Universities

Value

Drivers

32

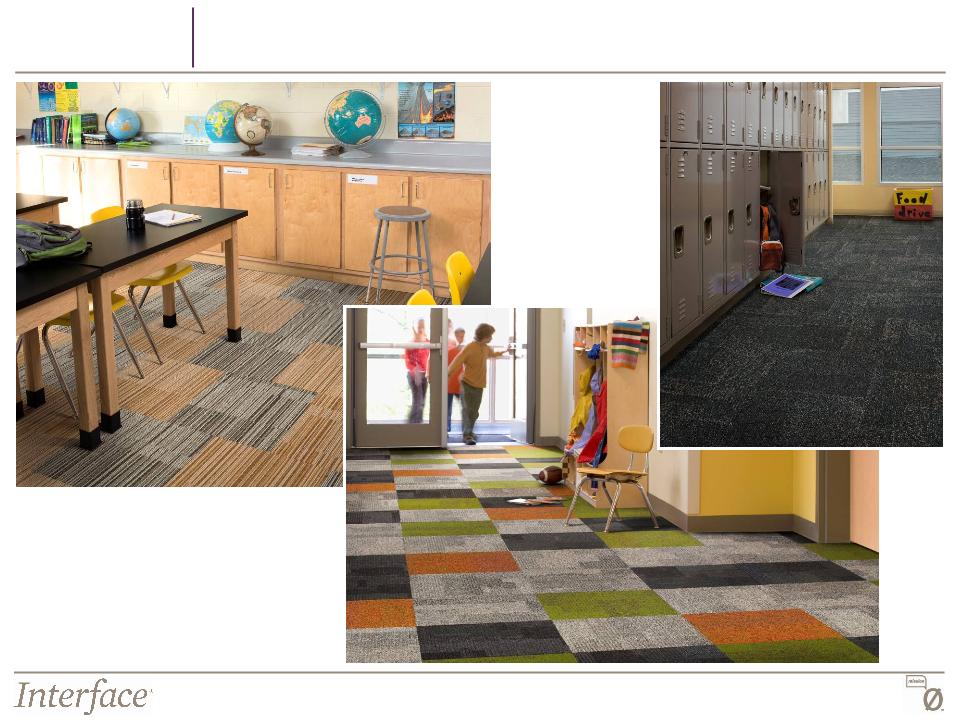

K-12

Education

Value

Drivers

33

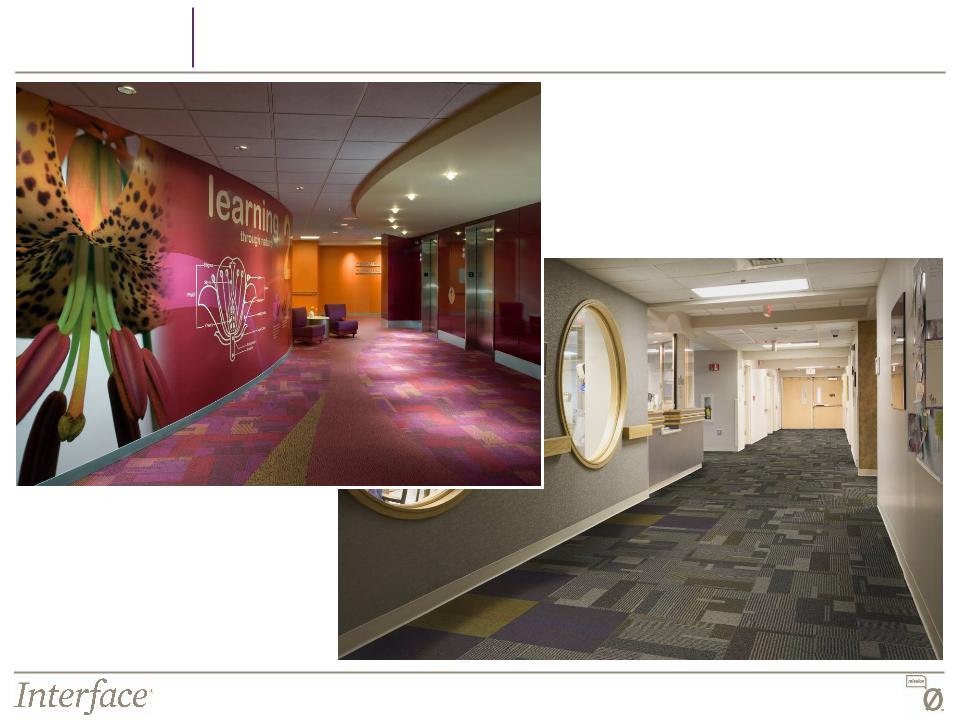

Healthcare

Value

Drivers

34

Government

& Public Spaces

Value

Drivers

35

Hospitality

Value

Drivers

36

Interface

is the Recognized Leader in Sustainability

GlobeScan

Corporate Sustainability Leaders 2009

Floor

Focus Green Leaders 2009

Unprompted,

Combined Mentions 2009

Value

Drivers

Source:

2009 Floor Focus Top 250 Design Survey (U.S. Market)

Interface

received

“Green

Kudos”

for

Sustainable

Products with good

Design options and

Closed Loop

Processes

Products with good

Design options and

Closed Loop

Processes

Source:

The Sustainability Survey from GlobeScan

37

Sustainability

Inspires Innovation

Value

Drivers

§ i2

Design Platform - biomimicry inspired

random carpet tile patent

random carpet tile patent

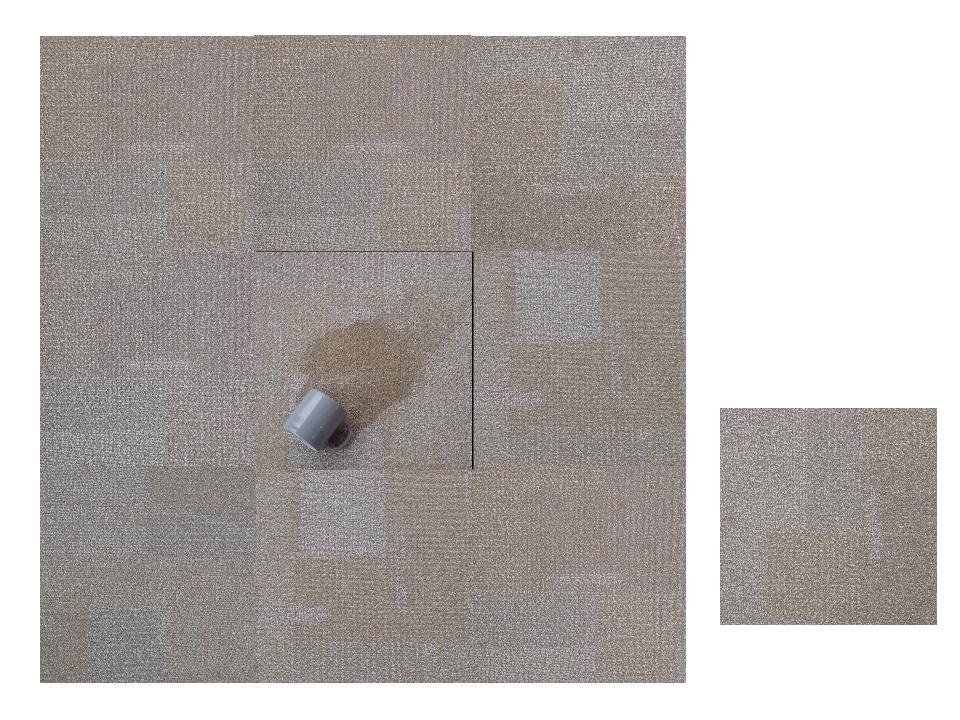

§ TacTiles

- no glue installation

§ Cool

Blue - 100% recycled backing process

§ Cool

Carpet - climate neutral product

§ ReEntry

2.0 - carpet reclamation and

recycling program

recycling program

§ Convert

- post-consumer recycled content

product platform

product platform

§ Southwest

Green Plane - pilot project

testing new environmentally responsible

materials for airplanes

testing new environmentally responsible

materials for airplanes

Sustainability-Focused

Innovation

Cool

Blue™

Greenbuild

2009

i2

Products

38

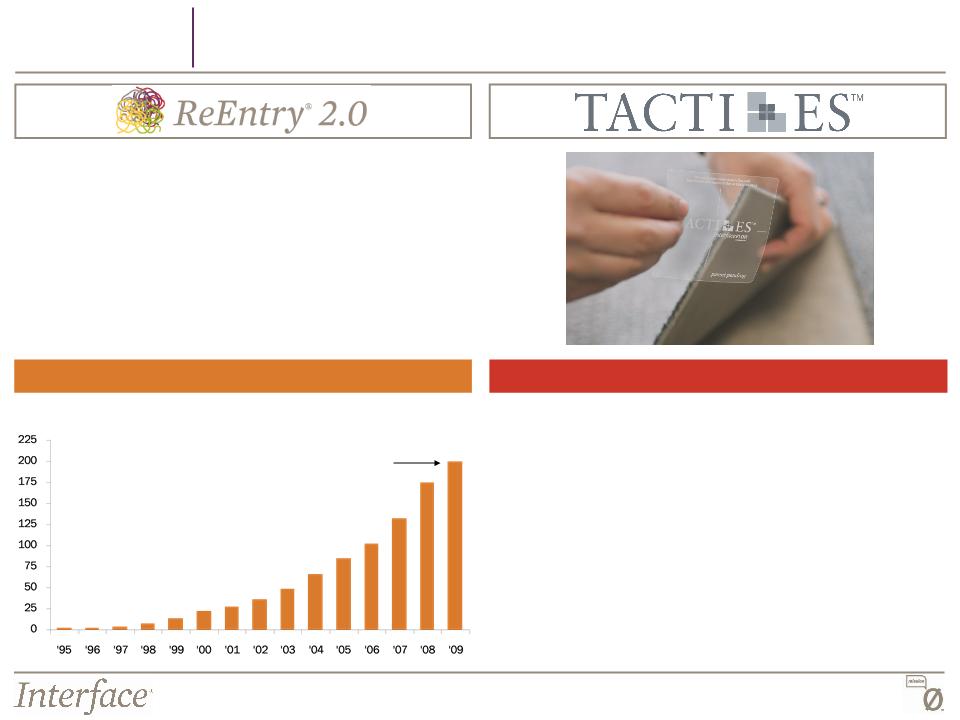

ReEntry

2.0 Brings Convert Product Platform

Value

Drivers

§ Reclaiming

both Interface and competitor carpet tile

and broadloom, sorting & separating

and broadloom, sorting & separating

§ Access

to recycled N6 and N6,6 face fiber, boosting

post consumer recycled content in our products

post consumer recycled content in our products

§ Diverted

200 million pounds of materials from

landfills from 1995-2009

landfills from 1995-2009

ReEntry

- Cumulative Carpet Diverted from Landfill

200m

pounds of

carpet

diverted

(millions

of lbs)

Benefits

of TacTiles

§ Patented

No Glue / No VOCs installation system

§ 25%

of current orders include TacTiles

§ High

margin product

§ Leading

to other new innovations - Moisture Guard

2.0 moisture vapor barrier

2.0 moisture vapor barrier

§ Integrating

TacTiles into Design - designing

installation patterns that drive TacTile demand

installation patterns that drive TacTile demand

Interface,

Inc. Financials

40

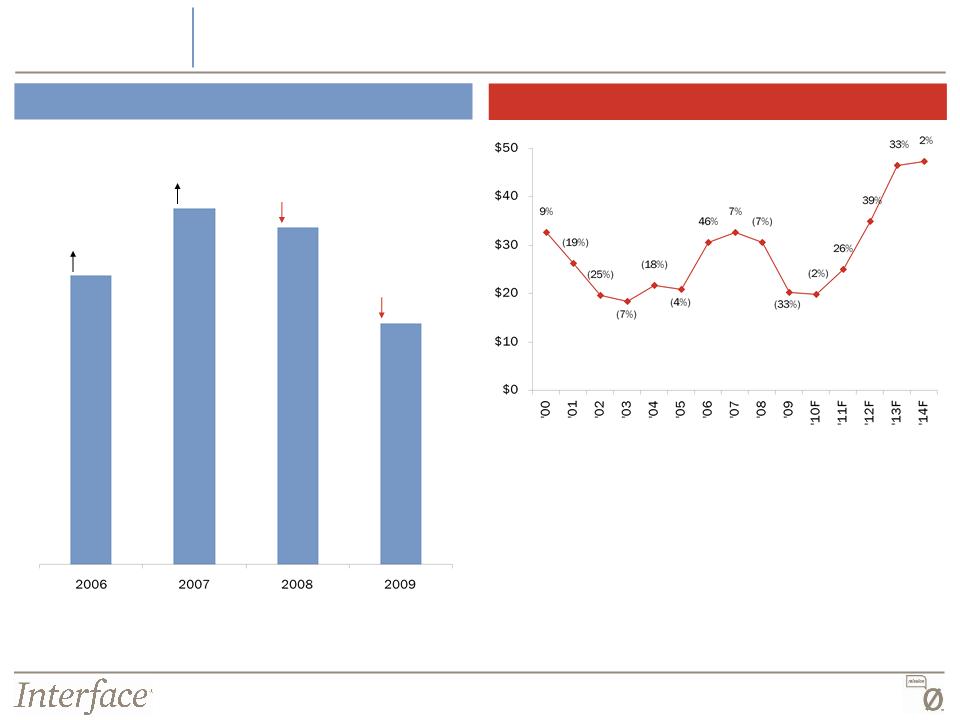

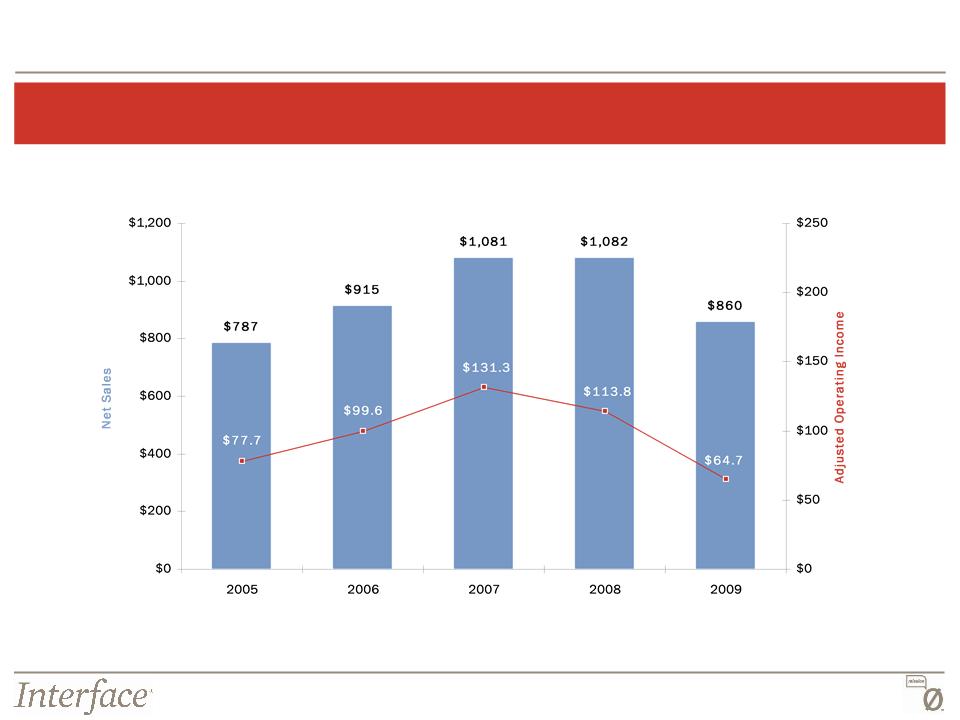

Consolidated

Financial Results

Net

Sales and Adjusted Operating Income

(Continuing

Operations)*

* See the Appendix for a

reconciliation of Adjusted Operating Income from Continuing

Operations

($

in millions)

41

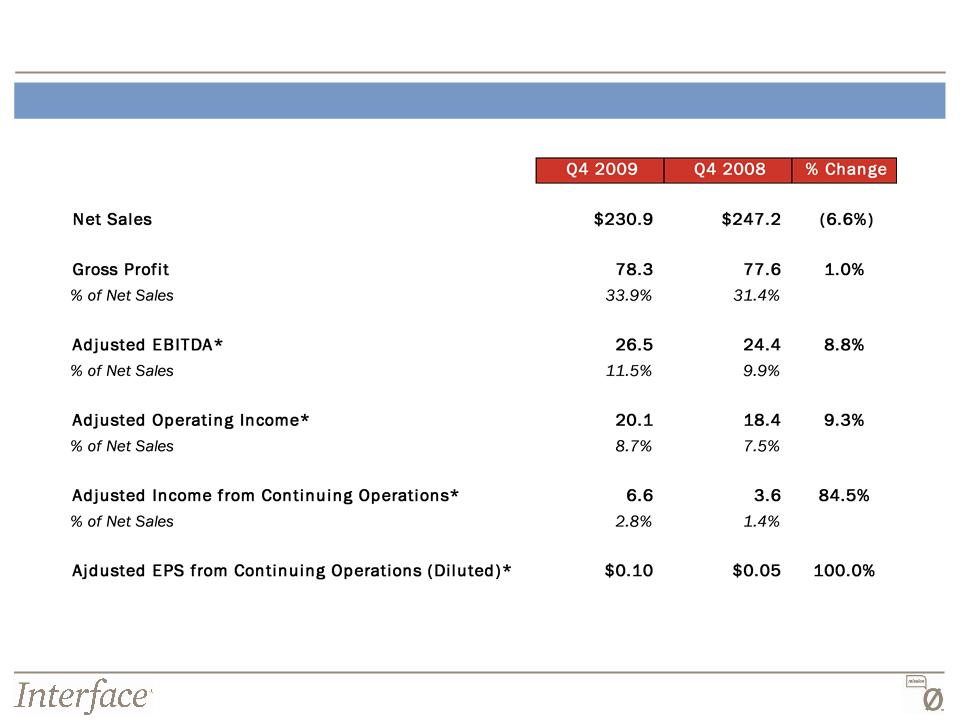

Quarterly

Results

Q4

Comparison*

* See the Appendix for a

reconciliation of adjusted figures

($

in millions)

42

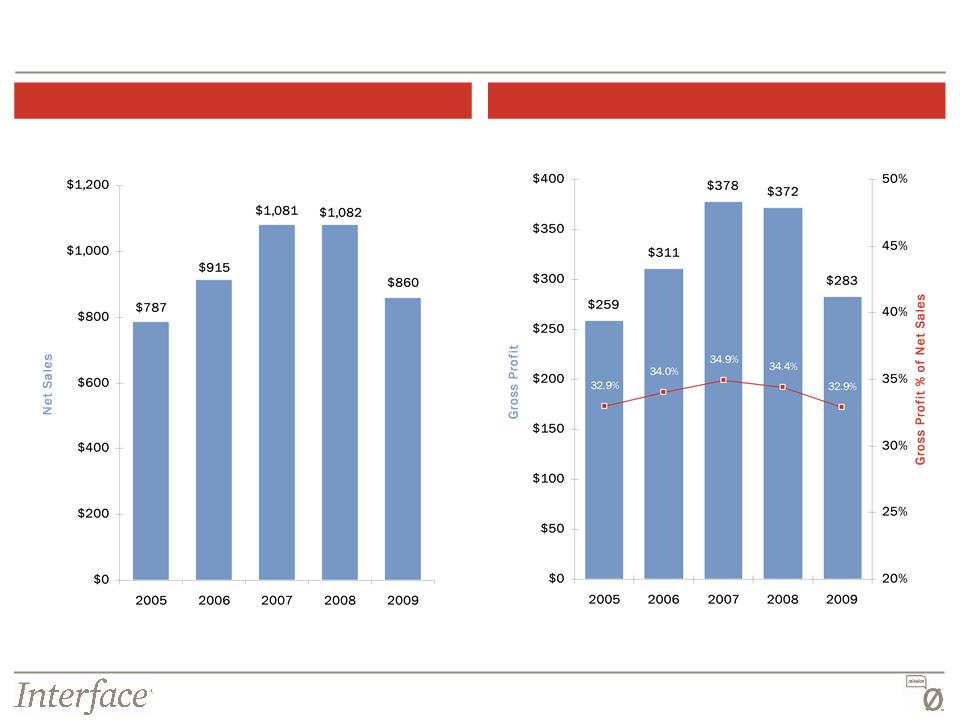

Interface

Financial Results from Continuing Operations

Net

Sales

Gross

Profit

($

in millions)

($

in millions)

43

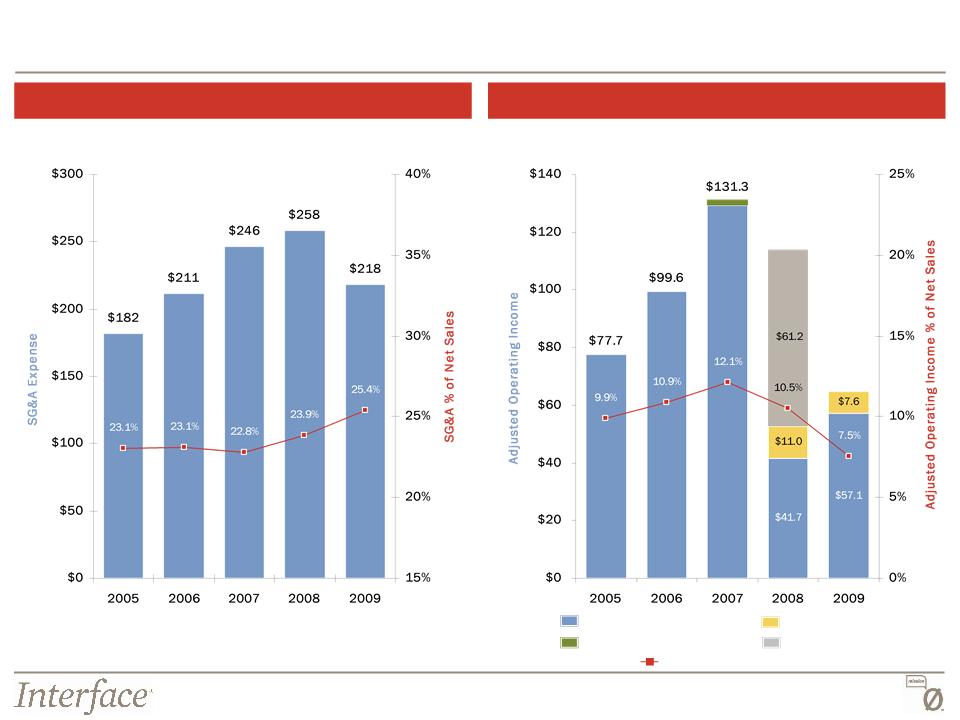

Interface

Financial Results from Continuing Operations

SG&A

Expense

Adjusted

Operating Income*

($

in millions)

($

in millions)

(1)

Reported Operating Income of $57.1M in 2009 excludes Income from Litigation

Settlements of $5.9M

* See the Appendix for a

reconciliation of Adjusted Operating Income

Reported

Operating Income

Restructuring

Charges

Loss

on Disposal ($1.9m)

Operating

Income % of Net Sales

Goodwill

Impairment

$113.8

$64.7

(1)

44

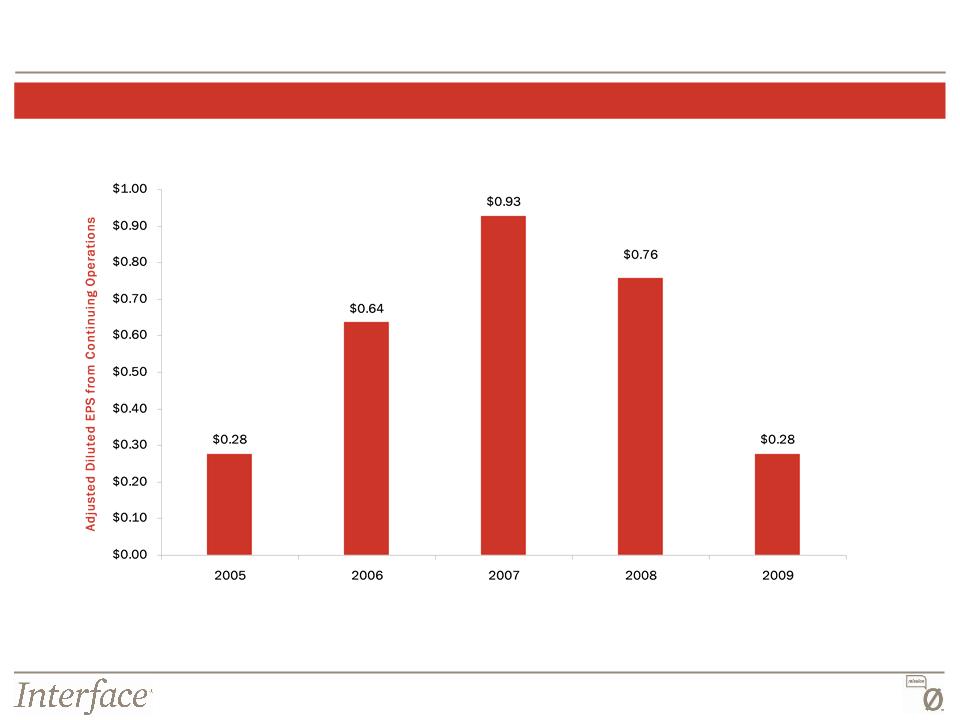

Interface

Financial Results from Continuing Operations

Adjusted

Diluted Earnings Per Share (Continuing Operations)*

* See the Appendix for a

reconciliation of Adjusted Diluted Earnings Per Share from Continuing

Operations

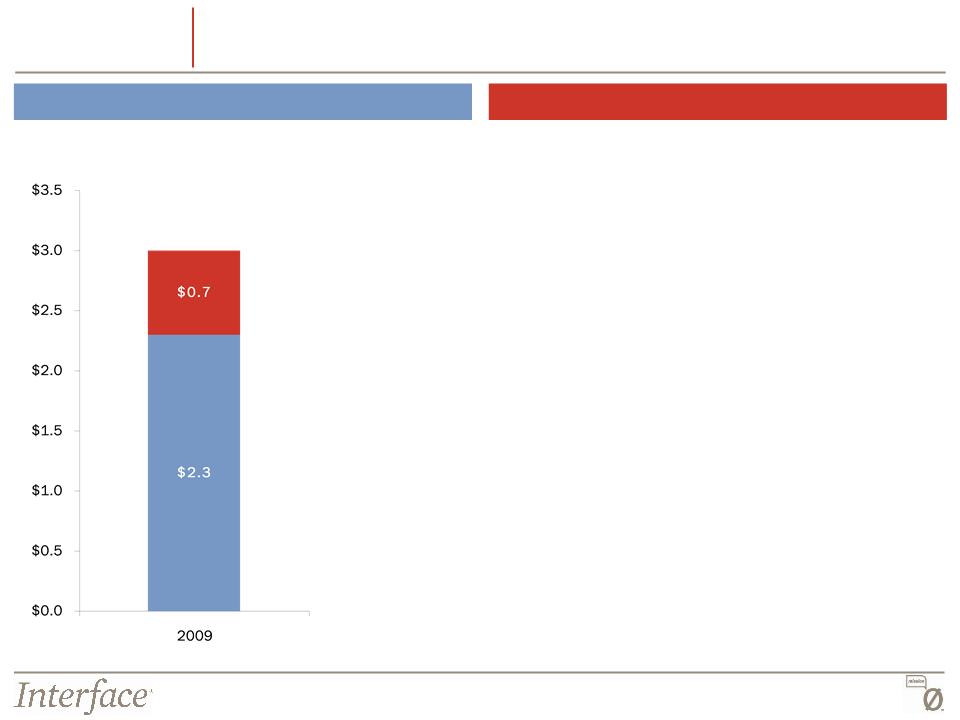

45

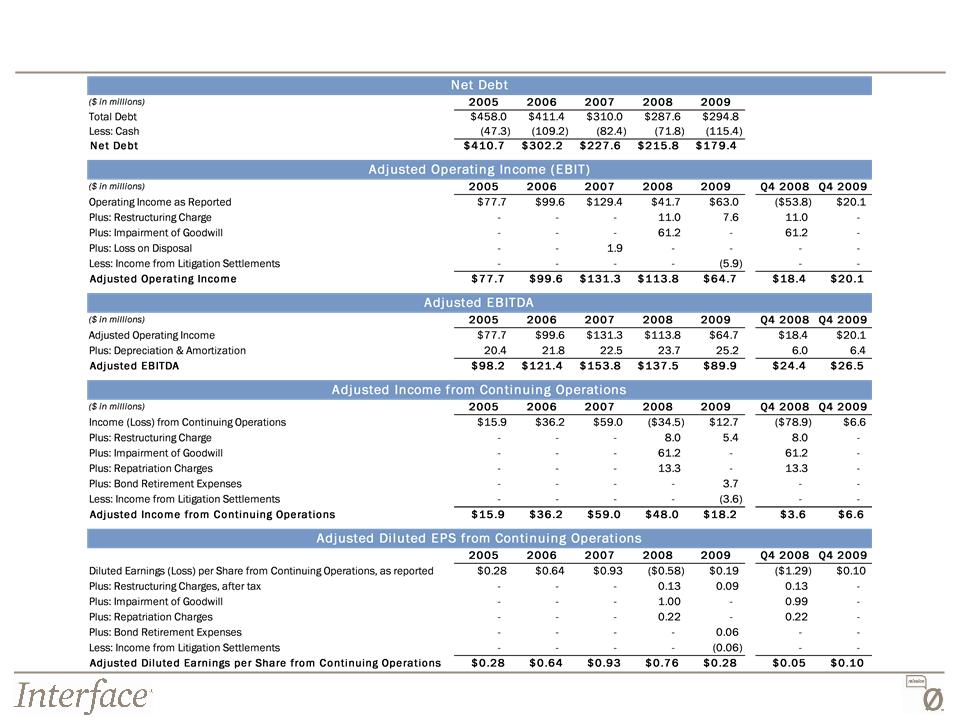

Key

Leverage Statistics

Ending

Cash Balance

Net

Debt*

* See the Appendix for a

reconciliation of Net Debt and Adjusted EBITDA

46

Appendix:

Reconciliation of Non-GAAP Financial Measures