Attached files

Exhibit 10.2(x)

| Supplemental Group Insurance for Belgian Employees graded G20 and higher (AXA Supplemental Pension Plan) | ||

| Cytec Surface Specialties nv/sa | ||

| Handbook | ||

Edition – 02/2008

Foreword

The Cytec Surface Specialties Supplemental Pension Plan is a group insurance plan in addition to the regular Cytec Group Insurance Plan. It is intended to provide employees with a Belgian employment agreement, who are subject to Belgian social security contributions and graded G20 and higher, with a comfortable standard of living when they retire.

In this handbook you will find the necessary information about this supplemental pension plan. Note that this new supplemental plan will be in force as from 1 March 2008 onwards and replaces any existing AXA supplemental plans.

We are sure this supplemental plan will contribute to your satisfaction as an employee of Cytec.

Table of contents

| Why does Cytec offer you a supplemental pension plan? | 1 | |

| What are the basic principles of this supplemental plan? | 2 | |

| How are my retirement benefits granted? | 3 | |

| How is my death benefit defined? | 5 | |

| What does happen to my retirement benefits when I leave Cytec? | 6 | |

| Final remarks | 9 | |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| Why does Cytec offer you a supplemental pension plan? | ||

| How can I position “employee benefits” in my own financial plan? | We all know that only few financial instruments allow an employer to deliver income to its employees on a tax efficient basis. One of those vehicles is a supplemental group insurance which defers current employment income, taxable at marginal income rates and subject to full employee and employer social security contributions, to retirement income which is taxable at much lower tax rates (currently 16.66%) and subject to limited social taxes (currently between 3.55% and 5.55% depending on the amount). | |

| Cytec has set up such a group insurance with AXA. This handbook is therefore intended to explain the following benefits in detail: | ||

| - additional savings benefits (retirement) | ||

| - additional death in service benefits | ||

| 1 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| What are the basic principles of the supplemental pension plan? | ||

| Who is a member? | All employees with a Belgian employment agreement (whether fixed term or open-ended), who are subject to Belgian social security contributions and graded G20 and higher, automatically become members of this supplemental pension plan. Membership is immediate from the date of hire (if taking a job graded G20 and higher) or at the date of promotion to a job graded G20 and higher. | |

| You continue your participation in this supplemental plan as long as you work for Cytec and are graded G20 or higher. This plan is interrupted in case of suspension of the employment agreement (for example: termination, career interruption, full-time time credit). | ||

| All eligible employees who work part-time will have the same benefits as those working full time, subject to pro ration in accordance with their working time, | ||

| When does the group insurance end? | Membership to the group insurance will cease as soon as you stop working for Cytec and, more precisely, in the following cases: | |

| - retirement or early retirement | ||

| - dismissal or resignation | ||

| - death | ||

| Membership to this pension plan will also cease in case of demotion to a grade below G20. Note that in this case, no new contributions will be paid into this plan but you will remain entitled to the already accrued reserves which will continue to earn interest (currently 3.25% plus profit sharing interest) until one of the three above listed situations occurs. | ||

| 2 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| How are my retirement benefits granted? | ||||

| As soon as you become a member of this supplemental plan, you start accruing additional retirement benefits. | ||||

| How is the pension benefit defined? | The additional retirement benefit you will receive when you retire (normal retirement age is 65), depends on the invested contributions and the return granted by the insurance company. | |||

| The contributions are fixed as follows: | ||||

| Grade | % of your real individual ICP budget |

|||||

|

G20 |

30% | |||||

|

G21 |

30% | |||||

|

G22 |

30% | |||||

|

G23 |

50% | |||||

|

G24 |

50% | |||||

|

G25 |

50% | |||||

| The ICP budget is determined by Cytec’s Executive Leadership Team in accordance with Cytec Industries’ Incentive Compensation Plan and relates to the prior year of performance. | ||||

| The contribution is calculated and paid once a year, on March 1 of every year. The payment to the insurance company occurs within 8 working days. | ||||

| The contribution can never be lower than €250. In case of an incomplete year, a proportionate minimum amount will be paid (based on the effective number of full affiliation months). | ||||

| The contribution can on the other hand not exceed the authorised tax deductible level. Indeed the sum of your legal/state pension and your extra-legal pensions cannot exceed 80% of your last normal gross salary and this for a full career of 40 years. | ||||

| AXA grants a guaranteed/fixed interest (of currently 3.25%) as well as a profit sharing interest on these contributions. | ||||

| 3 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| Who does pay this contribution? | From a tax/legal perspective the contribution is qualified as an employer contribution. On top, the company pays the insurance tax (currently 4.4%) and the social security charges (currently 8.86%) related to these contributions. | |

| What does happen in case of early retirement or leaving Cytec? | In case of early retirement or when leaving Cytec, AXA will determine the amount that has already been accrued at that point in time (= sum of contributions + interest). | |

|

From a tax and legal perspective the same regulations are applicable as for your regular group insurance plan (i.e. the accrued amount will be reduced with 3.55% up to 5.55% as social security charge and the remaining amount will be taxed at currently 16.66% in case of early retirement or 10.09% if you continue working up to age 65). | ||

| What does happen if you chose payment or transfer? | The retirement benefit is payable at age 65. If you retire earlier and ask your retirement benefit, AXA will simply determine the amount that has already been accrued. | |

|

As from the January 1, 2010 the retirement benefit will no longer be payable before age 60. | ||

|

AXA makes the necessary social and income tax deductions on the retirement benefit. On January 1, 2008, those amounted to about 3.55% to 5.55% social security contribution (depending on the level of the capital to be paid) plus 16.66% taxes, increased with communal taxes. | ||

| 4 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| How is my death benefit defined? | ||

| As mentioned, besides the “retirement” part, your additional group insurance does also include a “death” part. | ||

| If you die during the time you are affiliated to this additional savings plan, (following an illness, an accident at work or at home,…), your relatives are entitled to a death benefit which is defined as follows: | ||

| Death benefit = minimum of 1 x S | ||

| The accrued savings amount of your retirement benefit is included in the above benefit. In other words, if you would die, the insurance company would pay the accrued savings amount of the retirement benefit to your heir with a minimum of 1 time annual base salary. | ||

| Where: | ||

| S = gross monthly salary of December (preceding year) x 13.92 | ||

| The cost for this death benefit is entirely paid for by the Company. | ||

| Who does receive the benefits? In which order? | In case of death, the above benefits will be paid according to the following order: | |

|

1. Your wife / husband or legal cohabitant | ||

|

2. Your children | ||

| 3. Everyone designed by you in a signed document | ||

| 4. Your mother and father | ||

| 5. Your brothers and sisters | ||

| 6. Every other legal heir(ess) | ||

| 7. The financial fund | ||

| Cytec allows you to change this order on condition that you specify it in a signed document given to HR. | ||

| 5 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| What does happen to my retirement benefits when I leave Cytec? | ||||||

| What will happen when I leave Cytec? | When, for whatever reason, you leave Cytec, your supplemental pension plan stops. At retirement you will be entitled to the retirement benefits which have been built up while you worked for Cytec and were eligible for this supplemental plan, increased with the accrued return since this date. | |||||

| Be careful, the additional death cover stops immediately, which means that you are no longer insured against this risk from that moment on. | ||||||

| Can I transfer my accrued rights in my new employer’s pension plan or elsewhere? | Whatever the reason for leaving, you are the owner of the retirement capital. | |||||

|

The following procedure is legally defined. | ||||||

|

Chronological procedure to be followed by the employer, AXA and the employee | ||||||

|

Action to take |

By who | Time limit | ||||

| Announce your departure to AXA | Employer | 30 days | ||||

| Inform employer | AXA | 30 days | ||||

| Inform employee | Employer | Immediately | ||||

| Communicate your choice to your former employer | Employee | 30 days | ||||

| Communicate your decision to AXA | Employer | 15 days | ||||

| Execute the employee’s decision | AXA | 30 days |

| What are the possible choices? | ||||

| Choice 1 | Keep the accrued amount (*) in the plan | |||

| Choice 2 | Transfer the already accrued amount (*) into the pension plan (pension fund or insurance group) of your new employer | |||

| Choice 3 | Transfer the already accrued amount (*) into a “caisse commune” | |||

| Choice 4 | Transfer the already accrued amount (*) into a host structure | |||

| A host structure is a group insurance which is isolated from the company group insurance and in which you can transfer your accrued rights when you leave. You can also use them to finance a death benefit. | ||||

| 6 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| Until end 2009 you still have a last option which consists in having the accrued amount deposited in your bank account ( = surrender). Be careful, this option does have negative consequences as the taxes are high. | ||

| (*) If you have worked less than one year at Cytec, the accrued rights consist in the reserves accrued with the personal contributions. If you leave the company with at least one year seniority in the plan, then the accrued rights consist in the reserves accrued with the personal contributions and the employer contributions. | ||

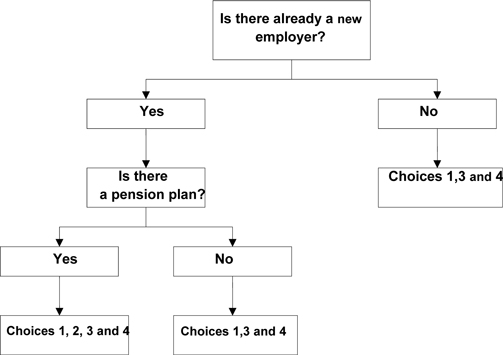

| Which choice do I have? | Here is a flowchart to help you make your choice. According to your personal situation you can identify the most suitable option. | |

| ||

| 7 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| How do I communicate my choice? | Once AXA has been informed of your departure, you will be informed by AXA within one month of the different possibilities relative to your accrued pension rights. | |

| You then have one month to communicate your choice to AXA. | ||

| After this deadline, the transfer can still be asked anytime. Surrender is still possible until end 2009. | ||

| Who can I go to if I still have questions? | For further questions, please send an email to the following address: | |

|

Filip.vandervelden@cytec.com | ||

| 8 |

| USER’S HANDBOOK – AXA’S SUPPLEMENTAL PENSION PLAN FOR EMPLOYEES OF GRADE 20 OR MORE |

| Final remarks | ||

| This handbook is for information only. | ||

| This handbook does not open any rights. Only the official plan rules of Cytec’s supplemental group insurance create such right. In case of dispute, only the official plan rules are applicable. | ||

| You can get a copy of these rules by asking the HR department. | ||

| 9 |