Attached files

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission file number 1-12372

CYTEC INDUSTRIES INC.

(Exact name of registrant as specified in its charter)

| Delaware | 22-3268660 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No). |

| Five Garret Mountain Plaza Woodland Park, New Jersey |

07424 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (973) 357-3100

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |

| Common Stock, par value $.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for at least the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

At June 30, 2009 the aggregate market value of common stock held by non-affiliates was $895,424,330 based on the closing price ($18.60 per share) of such stock on such date.

There were 48,775,331 shares of common stock outstanding on February 18, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

| Documents | Part of Form 10-K | |

| Portions of Cytec’s Proxy Statement for 2010 Annual Meeting of Common Stockholders to be held on April 22, 2010. | Parts III, IV |

Table of Contents

SUBSIDIARIES

Form 10-K

Table of Contents

Table of Contents

COMMENTS ON

FORWARD-LOOKING STATEMENTS

A number of the statements made by us in our Annual Report on Form 10-K, in other documents, including but not limited to the Chairman, President and Chief Executive Officer’s and Vice President and Chief Financial Officer’s letters to stockholders and stakeholders, respectively, in our press releases and in other reports to the Securities and Exchange Commission, may be regarded as “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this report, including those made by the management of Cytec, other than historical statements, are forward-looking statements.

Forward-looking statements include, among others, statements concerning: our or any of our segments outlook for the future, anticipated results of acquisitions and divestitures, selling price and raw material cost trends, anticipated changes in currency rates and their effects, economic forces within the industry we operate, anticipated costs, target completion dates and expenditures for capital projects, expected sales growth, operational excellence strategies and their results, expected annual tax rates, our long-term goals, future legal settlements and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Such statements are based upon our current beliefs and expectations and are subject to significant risks and uncertainties including those discussed in Item 1A, “Risk Factors” below and elsewhere in this report. Actual results may vary materially from those set forth in the forward-looking statements.

The following factors, among others, could affect our anticipated results: our ability to successfully complete planned or ongoing restructuring and capital expansion projects, including realization of the anticipated results from such projects; our ability to maintain or improve current ratings on our debt; our ability to obtain financing or borrow fully against committed lines, changes in financial conditions or the financial status of our existing lenders markets; changes in global and regional economies; the financial well-being of our customers and the end consumers of our products; changes in demand for our products or in the quality, costs and availability of our raw materials and energy; customer inventory reductions; the actions of competitors; currency and interest rate fluctuations; technological change; our ability to renegotiate expiring long-term contracts; our ability to raise our selling prices when our product costs increase; changes in employee relations, possible strikes or work stoppages at our facilities or at the facilities of our customers or suppliers; new laws and regulations or changes in their interpretation, including those related to taxation, global warming and those particular to the purchase, sale, storage and manufacture of chemicals or operation of chemical plants; governmental funding for those military programs that utilize our products; litigation, including its inherent uncertainty and changes in the number or severity of various types of claims brought against us and changes in the laws applicable to these claims; quality problems; difficulties in plant operations and materials transportation, including those caused by hurricanes or other natural forces; short or long term climate changes; environmental matters; returns on employee benefit plan assets and changes in the discount rates used to estimate employee benefit liabilities; changes in the medical cost trend rate; changes in accounting principles or new accounting standards; political instability or adverse treatment of foreign operations in any of the significant countries in which we or our customers operate; war, terrorism or sabotage; epidemics; and other unforeseen circumstances. Unless indicated otherwise, the terms “Cytec,” “Company,” “we,” “us,” and “our” each refer collectively to Cytec Industries Inc. and its subsidiaries.

AVAILABLE INFORMATION

We maintain a website that contains various information on our Company and products. It is accessible at www.Cytec.com. Through our website, stockholders and the general public may access free of charge (other than any connection charges from internet service providers) filings we make with the Securities and Exchange Commission as soon as practicable after filing. Filing accessibility in this manner includes our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934.

- 1 -

Table of Contents

PART I

(Currencies in millions, except per share amounts)

We are a global specialty chemicals and materials company focused on developing, manufacturing and selling value-added products. Our products serve a diverse range of end markets including aerospace, adhesives, automotive and industrial coatings, construction, chemical intermediates, inks, mining and plastics. We use our technology and application development expertise to create chemical and material solutions that are formulated to perform specific and important functions for our customers. We operate on a global basis with 38% of our 2009 revenues in North America, 39 % in Europe, Middle East, and Africa, 17 % in Asia-Pacific and 6 % in Latin America. We have manufacturing and research facilities located in 16 countries. We had net sales of $2,789.5 and earnings from operations of $31.1 in 2009. Cytec was incorporated as an independent public company in December 1993.

We have five reportable business segments: Coating Resins, Additive Technologies, In Process Separation, Engineered Materials, and Building Block Chemicals. Coating Resins, Additive Technologies, and In Process Separation are managed under one executive leader, and are referred to collectively as Cytec Specialty Chemicals. The Coating Resins segment is substantially comprised of the Surface Specialties business acquired from UCB in 2005, and includes the following product lines: radiation-cured resins (Radcure resins), powder coating resins, and liquid coating resins. Included in the liquid coating resins product line are waterborne resins, amino cross-linkers, solventborne resins, and urethane resins. Additive Technologies includes polymer additives, specialty additives, and polyurethanes. As of May 19th, 2009, all polyurethanes assets have been divested. In Process Separation includes mining chemicals and phosphines. Engineered Materials principally includes advanced composites, carbon fiber, structural film and pressure sensitive adhesives, and formulated resins. Building Block Chemicals principally includes acrylonitrile, hydrocyanic acid, sulfuric acid and melamine.

We regularly review our segment reporting and classifications and may periodically change our reportable segments to align with operational changes.

Our corporate vision is to deliver technology beyond our customers’ imagination. To achieve our corporate vision, our strategy includes the following initiatives:

| • | Achieve sustainable and profitable growth by providing innovative solutions to meet customer needs. We seek to collaborate closely with our customers to understand their needs and provide them with a superior value proposition, whether through improvement in product quality, performance, cost or a new enabling technology. We seek to market our specialty products in terms of the value they provide and focus on delivering a high level of technical service to our customers as we work with them on solving problems and providing them with better products for their applications. |

| • | Provide a culture that challenges, engages and rewards our employees. We know that progress and growth depend on every employee taking responsibility, being creative, and contributing to our overall successful performance. We strive to have employees be challenged and to enjoy success as we continue to build a stronger Cytec. As part of this process, employees have opportunities to embark on career paths geared towards advancement in various areas of our organization. Our goal is to attract, retain and develop employees to their highest potential and be recognized as a global employer of choice. |

| • | Be universally recognized as the technology leader in our markets. We are dedicated to creating a sustainable competitive advantage through superior technology. We believe our technology is the ultimate engine of our growth and success. To that end we focus on our new product pipeline and delivering value-added products to our customers every year. Even in a difficult period such as 2009, we continued to invest in our three growth platforms i.e. Engineered Materials, Eco-Friendly Coatings (radiation cured and waterborne resins) and In-Process Separation. We also launched our High Performance Industrial Materials (“HPIM”) product line. The HPIM product line is comprised of technologies from our specialty chemical adhesives product lines, certain coating resins and our non aerospace engineered materials products. HPIM is designed to leverage our competencies across these technology platforms and grow our share in the adjacent rapidly expanding structural adhesive and fiber reinforced composite industrial markets. |

| • | Positively impact society by our commitment to safety, health, and environmental stewardship. We focus our innovation on the development of environmentally sustainable products, and demonstrate our respect for the communities in which we operate. We operate on a global basis with manufacturing plants and research facilities located in 16 countries including high growth emerging markets where we will continue to expand sales as markets |

- 2 -

Table of Contents

| develop. Our global operations add to the vitality and the economy of the regions in which we operate. |

We are focused on operational excellence. To develop and implement best practices, we benchmark our performance against our competitive peer group. This has had a significant positive impact in terms of our safety and environmental performance.

Manufacturing has the largest impact on our costs and we use various techniques such as six-sigma and lean manufacturing to reduce our product costs by improving process yields, reducing batch times, increasing capacity and improving and/or streamlining our manufacturing processes. We continuously review our operational footprint versus current and projected market demand and from time to time we may also shutdown parts of or close certain manufacturing or laboratory facilities.

Over the years, in the course of our ongoing operations, we have made a number of other strategic business and product line acquisitions and dispositions.

Our management team regularly reviews our product line portfolio in terms of strategic fit and capital allocation based on financial performance which includes factors such as growth, profitability and return on invested capital. From time to time, we may also dispose of or withdraw certain product lines. We may also acquire additional product lines or technologies. We conduct regular reviews of our plant sites’ cost effectiveness, including individual facilities within such sites to insure our long-term competitiveness.

SEGMENT INFORMATION

Revenues from external customers, earnings from operations and total assets for each of our five reportable segments can be found in Note 16 of the Notes to Consolidated Financial Statements.

COATING RESINS

Set forth below are our primary product lines and major products in this segment and their principal applications.

| Product Line | Major Products | Principal Applications | ||

| Radcure resins | Oligomers, monomers, photo-initiators | Coatings and inks used in industrial metal, wood and plastic coatings including parquet, furniture, safety glass interlayer, printing varnishes and inks | ||

| Powder coating resins | Conventional and ultraviolet powder coating resins | Powder coatings for industrial and heavy duty metal applications, appliance, white goods, architecture and wood | ||

| Liquid coating resins | Waterborne resins, solventborne resins, amino cross-linkers, and urethane resins | Industrial coatings for automobiles, cans, coil, metal fixtures, metal and wood furniture, and heavy-duty industrial machinery, architectural applications, products used in abrasives, tires, electronics, marine, sanitary and swimming pools |

We market our coating resins chemicals through specialized sales and technical service staffs for each of our product lines. Sales are typically made directly to large customers and through distributors to smaller customers. Certain of our products, primarily amino cross-linkers, in this segment are manufactured using melamine that is manufactured by our Building Block Chemicals segment. For further discussion of raw materials, refer to “Customers and Suppliers.”

RADCURE RESINS

We are a leading producer of environmentally friendly, radiation-cured resins for high-performance coatings and graphics applications. These resins are cured (dried and hardened) by exposing them to ultraviolet or electron-beam radiation, rather than heat which typically reduces processing costs and increases productivity. Products such as inks, compact discs, DVDs, flat panel displays, credit cards, packaging, parquet and furniture utilize advanced resins like the ones we have developed.

POWDER COATING RESINS

Our polyester powder resin technologies which are environmentally friendly account for a significant portion of the industrial finishing market. We offer innovations such as powder resins for super durable clear coats, weather-resistant finishes and ultraviolet-curing powder coating resins systems for heat-sensitive substrates such as plastic and wood. These powder coatings provide original equipment

- 3 -

Table of Contents

manufacturers with a number of cost and environmental benefits compared to traditional coating systems.

LIQUID COATING RESINS

We manufacture a broad range of waterborne and solventborne resins. We are a market leader in resins for high-solids and waterborne coating systems. Our extensive portfolio includes products based on seven chemistries: acrylics, amino cross-linkers, epoxy systems, alkyds and polyesters, urethanes, phenolics and unsaturated polyesters.

We also market a broad range of additives to assist customers in formulating high-performance coatings for protective and decorative applications.

ADDITIVE TECHNOLOGIES

Set forth below are our primary product lines and major products in this segment and their principal applications.

| Product Line | Major Products | Principal Applications | ||

| Polymer additives | Ultraviolet light stabilizers and absorbers, high performance antioxidants and antistatic agents | Plastics, coatings, and fibers for: agricultural films, automotive parts, architectural lighting, housewares, packaging, outdoor furniture, sporting goods, toys and apparel | ||

| Specialty additives | Surfactants, specialty monomers, resin amines, and PTZ® Phenothiazine (acrylic acid stabilizers) | Textiles, non-wovens and adhesives, super absorbent polymers, pharmaceuticals and acrylic acid |

We market our additives technologies chemicals through specialized sales and technical service staffs for each of our product lines. Sales are usually made directly to large customers and through distributors to smaller customers. For a discussion of raw materials, refer to “Customers and Suppliers.”

POLYMER ADDITIVES

We are a global supplier to the plastics industry of specialty additives which protect plastics from the ultraviolet radiation of sunlight and from oxidation. We seek to enhance our position with new products based on proprietary chemistries combined with our technical support. In certain cases, we use a combination of additives to achieve a level of efficiency not previously achieved in polymer applications.

SPECIALTY ADDITIVES

We are a leading global supplier of sulfosuccinate surfactants, Docusate sodium, acrylamide-based specialty monomers, and PTZ® phenothiazine. Sulfosuccinate surfactants and acrylamide-based specialty monomers products are used in emulsion polymers, paints, paper coatings, printing inks, and other diverse customer applications. Docusate is a pharmaceutical grade product used as both an active ingredient and excipient/ formulating aid. PTZ® phenothiazine is primarily used as an acrylic acid, acrylic ester and methacrylate monomer stabilizer.

IN PROCESS SEPARATION

Set forth below are our primary product lines and major products in this segment and their principal applications.

| Product Line | Major Products | Principal Applications | ||

| Mining chemicals | Promoters, collectors, solvent extractants, flocculants, frothers, filter and dewatering aids, antiscalants, dispersants, depressants, defoamers, and phosphine specialty reagents | Mineral separation and processing for copper, alumina, cobalt, nickel, and other minerals | ||

| Phosphines | Flame retardants, catalyst ligands, high purity phosphine gas and biocides | Pharmaceutical, chemical and electronic manufacturing, and fumigants |

We market our In Process Separation chemicals through specialized sales and technical service staffs for each of our product lines. Sales are usually made directly to large customers and through distributors to smaller customers. For a discussion of raw materials, refer to “Customers and Suppliers.”

- 4 -

Table of Contents

MINING CHEMICALS

Our mining chemicals product line is primarily used in applications to separate desired minerals from host ores. We have a leading position in the copper processing industry, particularly in the flotation and solvent extraction of copper. We also have a leading position in the alumina processing industry, where our patented HxPAMs are particularly effective at the flocculation of “red mud” and our patented MaxHT™ antiscalant is sold for suppressing sodalite scale formation. We also sell phosphine specialty reagents which have leading positions in cobalt, nickel solvent extraction separation and complex sulfide flotation applications. Demand for mining chemicals is cyclical and varies with industry conditions such as global demand, inventory levels and prices for the particular minerals with respect to which our products have processing applications. We strive to develop new technologies as well as new formulations tailored for specific applications.

PHOSPHINES

Our phosphine specialties are utilized for a variety of applications. We are a leading supplier of ultra-high purity phosphine gas, used in semiconductor manufacturing and light emitting diode applications, and have significant positions in various phosphine derivative products including phosphonium salts used in pharmaceutical catalysts and biocides. Included in the phosphine line are organo phosphorus compounds. The compounds are used primarily as intermediates and catalyst ligands for organic and chemical synthesis in the pharmaceutical and chemical industries.

ENGINEERED MATERIALS

Set forth below are our primary product lines and major products in this segment and their principal applications.

| Product Line | Major Products | Principal Applications | ||

| Carbon Fibers | High performance fiber | Raw material input for industrial and aerospace advanced composite materials | ||

| Advanced composites and Aerospace adhesives |

Advanced composite materials and structural film adhesives | Large commercial airliners, regional and business jets, military aircraft (including rotorcraft, satellites and launch vehicles), high performance automotive and specialty applications | ||

| High Performance Industrial Materials | Prepregs, resin infusion, adhesives and gelcoats/top coats; pressure sensitive adhesives; formulated resins | Industrial markets including alternative energy, construction, marine and high performance automotive; pressure sensitive adhesives for signage, labels, tapes, graphics and medical applications; formulated resins for bonding and/or sealing of electrical and electronic components, tooling applications and specialty adhesives and sealants | ||

We market engineered materials through a dedicated sales and technical service staff typically direct to customers. Sales are dependent to a large degree on the commercial and military aircraft build-rates and the number of applications and aircraft programs for which we are a qualified supplier. The majority of commercial aircraft programs in the western world have qualified and use our products. We are a major supplier to such U.S. military programs as the F-35 Joint Strike Fighter, the F/A-22 and F/A-18 combat aircraft and the C-17 transport aircraft. We have a number of long-term agreements, expiring over various periods, to supply aerospace customers with their requirements of various engineered materials at prices that are generally fixed by year.

CARBON FIBERS, ADVANCED COMPOSITES, AND STRUCTURAL ADHESIVES

Our Engineered Materials segment manufactures and sells advanced structural film adhesives and advanced composite materials primarily to the aerospace industry and other high performance specialty applications. The primary applications for both aerospace adhesives and advanced composites are large commercial airliners, regional and business jets, military aircraft (including rotorcraft, satellites and launch vehicles), high-performance automotive, marine and specialty applications. Advanced composites are exceptionally strong and lightweight materials manufactured by impregnating fabrics and tapes made from high performance fibers (such as carbon fiber) with epoxy, bismaleimide, phenolic, polyimide and other resins formulated or purchased by us.

- 5 -

Table of Contents

Advanced composites generally account for a higher percentage of the structural weight on a military aircraft than on a commercial aircraft. They also account for a higher percentage of the structural weight on newer design commercial aircraft than older design commercial aircraft as technology progresses and manufacturers design planes to achieve greater fuel efficiency. Advanced composites made from carbon fibers and epoxy or bismaleimide resins are primarily used for structural aircraft applications such as wing, tail and rudder components, engine housings, and fuselage components while advanced composites made from fiberglass or aramid materials and phenolic resins are primarily used for secondary structure applications such as fairings and interior aircraft applications such as sidewall, ceiling and floor panels and storage and cargo bins. In addition, our ablatives are used in manufacturing rocket nozzles and our carbon/carbon products are used in manufacturing aircraft and other high performance brakes. We expect the demand for advanced composites to continue to increase as new applications are developed.

Our structural adhesives and advanced composites also have various applications in industrial, high performance automotive, marine and selected recreational products.

We purchase from third parties all of the aramid and glass fibers and much of the carbon fibers and base resins used in the manufacture of composites. They are mainly used as a reinforcement material for advanced composites used in the aerospace and certain other industries and have many advantageous characteristics such as light weight, high strength, long fatigue life and strong heat and corrosion resistance.

We manufacture and sell various high-performance grades of both polyacrylonitrile (“PAN”) type and pitch type carbon fibers. Approximately 65% of our carbon fiber production is utilized internally (which represents approximately 35% of our demand for carbon fiber) with the balance being sold to third parties. We have started a project to build a new carbon fiber line at our existing site in South Carolina which is forecasted to cost in a range of $200 to $250, of which $172 has been spent through December 31, 2009. Taking into account our expectations of the future business environment and the impact on the overall demand profile for carbon fiber, we decided in the first quarter of 2009 to delay the completion of the carbon fiber expansion project for at least eighteen months. The new line will increase our capacity of PAN carbon fiber for aerospace applications by approximately 50%. The project will include certain infrastructure to support additional carbon fiber production expansion. For additional information refer to “Customers and Suppliers”.

HIGH PERFORMANCE INDUSTRIAL MATERIALS (“HPIM”)

Our HPIM product line leverages our composites and adhesives technologies across multiple industrial markets.

We supply composites and adhesives to a broad range of markets such as alternative energy, construction, marine and high performance automotive to meet increasing requirements for weight, strength and cost optimized products and materials.

We manufacture and sell specialty pressure sensitive adhesives for waterborne, solventborne and radiation cured systems, featuring innovative products such as high-performance emulsions, adhesives for medical (transdermal patch) applications and removable adhesives. The adhesives are applied to a variety of substrates by our customers who utilize them in applications for signage, labels, tapes (high performance automotive, aerospace and other specialty markets), graphics and medical systems. Formulations are designed for broad market use and for customer-specific applications.

Our formulated resins products include formulated high technology, specialty polyurethane and epoxy resin systems tailored to suit the individual needs of our customers. These resins are commonly used in the tooling industry, and to encapsulate and protect electronics, coat printed circuit boards and adhere/seal filters. Urethane and epoxy systems are also formulated and sold to adhesive applications that bond metal to composite materials, laminate composite layers and adhere/seal filtration membranes.

BUILDING BLOCK CHEMICALS

Building Block Chemicals are manufactured at our world-scale, highly integrated Fortier facility. The Fortier facility is located on the bank of the Mississippi River near New Orleans, Louisiana and has access to all major forms of transportation and supplies of raw materials. This segment’s product lines include acrylonitrile, hydrocyanic acid (a co-product of acrylonitrile), sulfuric acid, acetonitrile and melamine which is produced both for use internally within our other segments and for third party sale. The integration of the facility comes from its steam usage whereas the acrylonitrile and sulfuric acid production produces excess steam which is used in the production of melamine. Additionally, a tenant at the site purchases substantially all of the hydrocyanic acid we produce as well as substantial amounts of the sulfuric acid

- 6 -

Table of Contents

we produce for their manufacture of methyl methacrylate at the site. We strive to operate our plants at capacity subject to market conditions and raw material availability.

ACRYLONITRILE AND HYDROCYANIC ACID

We expect to sell up to approximately 15% of our current acrylonitrile production to an international trading company under a long-term distribution agreement at a market based price. Another 30% is expected to be sold to Kemira Group (“Kemira”) under long-term agreements to make acrylamide and the remainder is sold within the United States or exported to international markets principally in Europe and Asia depending upon selling prices in the regions. We sell all of our hydrocyanic acid under a long-term supply agreement to a tenant at our Fortier site.

OTHER BUILDING BLOCK CHEMICALS

We are the only manufacturer of melamine in North America and about 30% of our approximately 150 million pound capacity is used internally to make amino cross-linkers. Depending on market conditions, the remainder is marketed and sold to third parties. Our ability to manufacture melamine at a competitive cost depends primarily on the cost of ammonia (which is dependent on the cost of natural gas) and freight rates.

We manufacture and sell sulfuric acid and regenerated sulfuric acid under a long-term supply agreement to a tenant at our Fortier site and sell sulfuric acid in the merchant marketplace.

Prices of Building Block Chemicals are sensitive to the stages of economic cycles, raw material cost and availability, energy prices and currency rates, as well as to periods of insufficient or excess capacity. Building Block Chemicals and its competitors tend to operate their plants at capacity even in poor market environments, which may result in strong downward pressure on product pricing.

We sell Building Block Chemicals to third parties through a direct sales force and distributors.

ASSOCIATED COMPANY AND MINORITY INTERESTS

We own a 50% interest in SK Cytec Co., Ltd. and a majority share of two consolidated entities. All make products for principal applications similar to those listed in our Coating Resins segment. Each of the entities is immaterial to the results of our operations.

COMPETITION

We actively compete with companies producing the same or similar products and, in some instances, with companies producing different products designed for the same uses. We encounter competition in price, delivery, service, performance, product innovation, product recognition and quality, depending on the product involved. For some of our products, our competitors are larger and have greater financial resources than we do. As a result, these competitors may be better able to withstand a change in conditions within the industries in which we operate, a change in the prices of raw materials without increasing their prices or a change in the economy as a whole.

Our competitors can be expected to continue to develop and introduce new and enhanced products, which could cause a decline in market acceptance of our products. Current and future consolidation among our competitors and customers may also cause a loss of market share as well as put downward pressure on pricing. Our competitors could cause a reduction in the prices for some of our products as a result of intensified price competition. Competitive pressures can also result in the loss of major customers.

In general, we compete by maintaining a broad range of products, focusing our resources on products in which we have a competitive advantage and fostering our reputation for quality products, competitive prices and excellent technical service and customer support. To help increase sales and margins, we are seeking to leverage our research and development efforts to develop value-added products and products based on proprietary technologies. If we cannot compete successfully, our businesses, financial condition, results of operations, and cash flows could be adversely affected.

CUSTOMERS AND SUPPLIERS

Sales derived from any single customer did not exceed 10% of our consolidated revenues for fiscal years 2009, 2008, and 2007. Sales to one of our customers, including sales to that customer’s subcontractors, are significant to our Engineered Materials segment. The loss of this customer and related subcontractors would have a material adverse effect on the operating results of our Engineered Materials segment. Sales of hydrocyanic acid and acrylonitrile, as well as tolling manufacturing of regenerated sulfuric acid to two of our customers are significant to our Building Block Chemicals segment. The loss of these customers would have a material adverse effect on the operating results of our Building Block Chemicals segment. Sales to one customer of our Coating Resins segment are significant to this segment and, if such sales were lost, would have a material adverse effect on the operating results of our Coating Resins segment. A summary of various

- 7 -

Table of Contents

long-term customer supply agreements is disclosed in Note 11, of the Notes to Consolidated Financial Statements which is incorporated by reference herein.

A number of our customers operate in cyclical industries such as the aerospace, automotive, construction and mining. This in turn, causes demand for our products to also be cyclical. Industry cycles also impact profitability of our Building Block Chemicals’ sales.

Key raw materials for the Cytec Specialty Chemicals segments are propylene derivatives such as acrylic acid, methanol derivatives and natural gas for energy. Key raw materials for the Engineered Materials segment are carbon fiber and various resins. We require natural gas, propylene, ammonia and sulfur to manufacture our Building Block Chemicals. These are typically available although we have experienced tight markets for certain raw materials from time to time.

Oil and natural gas are important indirect raw materials for many of our products. The prices of both of these commodities have been volatile over time. Sudden price swings can adversely affect our ability to recover increased costs from our customers or demand for our products. Because natural gas is not easily transported, the price may vary widely between geographic regions. As a result of this, many of our products could compete with similar products made with less expensive natural gas available elsewhere and we may not be able to recover any or all of the increased cost of gas in manufacturing our products.

Our Fortier facility is served principally by a single propylene pipeline owned by a supplier. Propylene deliveries from two suppliers will utilize this pipeline with contracts expiring at the end of 2010. A significant quantity of propylene was received via rail in 2009 and this trend is anticipated to continue in 2010.

To minimize reliance on any one supplier, we generally attempt to retain multiple sources for high volume raw materials, other than our own Building Block Chemicals. We are dependent on a limited number of suppliers for carbon fibers that are used in many of our advanced composite products. As we manufacture some of our own carbon fibers, the risk of future carbon fiber supply limitations is somewhat reduced. There can be no assurance that the risk of encountering supply limitations can be entirely eliminated.

Changes to raw material costs year on year are an important factor in profitability. Raw material prices can increase or decrease based on supply and demand and other market forces. We have from time to time experienced difficulty procuring several key raw materials, such as but not limited to, methanol derivatives, propylene, natural gas and carbon fiber, due to general market conditions or conditions unique to a significant supplier. We may experience supply disruptions of these and other materials in the future. Such conditions, if protracted, could result in our inability to manufacture our products, resulting in lower than anticipated revenues. If we are unable to raise our selling prices to recover the increased costs of raw materials driven by higher energy costs or other factors, our profit margins will be adversely affected. In other cases, we may have to reduce the selling prices of our products due to competitive pressures and may not be able to retain the additional profitability from the reduced raw material costs.

INTERNATIONAL

We operate on a global basis, with manufacturing and research facilities located in 16 countries. Through our sales forces, third party distributors and agents, we market our products internationally. Geographical information is contained in Note 16 of the Notes to Consolidated Financial Statements.

International operations are subject to various risks which may or may not be present in U.S. operations. These risks include political instability, the possibility of expropriation, restrictions on royalties, dividends and remittances, exchange rate fluctuations, requirements for governmental approvals for new ventures and local participation in operations such as local equity ownership and workers’ councils. Since we conduct business through subsidiaries in many different countries, fluctuations in currency exchange rates could have a significant impact on our reported revenues, which are reported in U.S. dollars. In 2009, approximately 64 % of our consolidated net sales occurred outside of the U.S., a significant portion of which are denominated in foreign currencies. However, we have material operations outside the U.S. which tend to offset some of the impact on earnings. Accordingly, changes in currency exchange rates could cause favorable or unfavorable fluctuations in our reported results of operations. Cross border transactions, both with external parties and intercompany relationships result in increased exposure to foreign exchange effects. Such fluctuations between the various currencies in which we do business have caused and will continue to cause currency transaction gains and losses, which may be material. While we may periodically enter into currency forward contracts to hedge currency fluctuations of transactions denominated in currencies other than the functional currency of the respective entity, it is

- 8 -

Table of Contents

not always cost effective to hedge all foreign currency exposures in a manner that would completely eliminate the effects of changes in foreign currency exchange rates on our results of operations or cash flows. Further, our international sales are translated into U.S. dollars for reporting purposes. The strengthening or weakening of the U.S. dollar could result in favorable or unfavorable translation effects as the results of our foreign operations are translated into U.S. dollars. Foreign currency translation unfavorably impacted our sales and favorably impacted our income from operations for the year ended December 31, 2009 by approximately $45.0 and $16.0, respectively as compared to fiscal 2008. While we do not currently believe that we are likely to suffer a material adverse effect on our results of operations in connection with our existing international operations, any of these events could have an adverse effect on our international operations in the future by reducing the demand for our products, affecting the prices at which we can sell our products or otherwise having an adverse effect on our operating performance.

RESEARCH AND PROCESS DEVELOPMENT

During 2009, 2008 and 2007, we incurred $75.2, $81.6 and $75.7, respectively, of research and process development expense.

TRADEMARKS AND PATENTS

We have approximately 1,900 patents issued in various countries around the world. We also have trademark applications and registrations for approximately 250 product names. We do not believe that the loss of patent or trademark protection on any one product or process would have a material adverse effect on our company. While the existence of a patent is presumptive evidence of its validity, we cannot assure that any of our patents will not be challenged, nor can we predict the outcome of any challenge.

EMPLOYEES

We employ approximately 5,800 employees of whom about 42 % are represented by unions. We believe that our relations with employees and unions are generally good.

OPERATING RISKS

Our revenues are largely dependent on the continued operation of our various manufacturing facilities. There are many risks involved in operating chemical manufacturing plants, including the breakdown, failure or substandard performance of equipment, operating errors, natural disasters, the need to comply with directives of, and maintain all necessary permits from, government agencies, and potential terrorist attack. Our operations can be adversely affected by labor force shortages or work stoppages and events impeding or increasing the cost of transporting our raw materials and finished products. The occurrence of material operational problems, including but not limited to the above events, may have a material adverse effect on the productivity and profitability of a particular manufacturing facility. With respect to certain facilities, such events could have a material effect on our company as a whole.

Our operations are also subject to various hazards incident to the production of industrial chemicals. These include the use, handling, processing, storage and transportation of certain hazardous materials. Under certain circumstances, these hazards could cause personal injury and loss of life, severe damage to and destruction of property and equipment, environmental damage and suspension of operations. Claims arising from any future catastrophic occurrence at one of our locations may result in Cytec being named as a defendant in lawsuits asserting potentially large claims.

We typically seek to utilize third party insurance. This insurance covers portions of certain of these risks to the extent that coverage is available and can be obtained on terms we believe are economically justified.

ENVIRONMENTAL MATTERS AND REACH

We are subject to various laws and regulations which impose stringent requirements for the control and abatement of pollutants and contaminants and the manufacture, transportation, storage, handling and disposal of hazardous substances, hazardous wastes, pollutants and contaminants.

In particular, under various laws in the U.S. and certain other countries in which we operate, a current or previous owner or operator of a facility may be liable for the removal or remediation of hazardous materials at the facility and nearby areas. Such laws typically impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of such hazardous materials. In addition, under various laws governing the generation, transportation, treatment, storage or disposal of solid and hazardous wastes, owners and operators of facilities may be liable for removal or remediation, or other corrective action at areas where hazardous materials have been released. The costs of removal, remediation or corrective action may be substantial. The presence of hazardous materials in the environment at any of our facilities, or the failure to abate such materials

- 9 -

Table of Contents

promptly or properly, may adversely affect our ability to operate such facilities. Certain of these laws also impose liability for investigative, removal and remedial costs on persons who dispose of or arrange for the disposal of hazardous substances at facilities owned or operated by third parties. Liability for such costs is retroactive, strict, and joint and several.

We are required to comply with laws that govern the emission of pollutants into the ground, waters and the atmosphere and with laws that govern the generation, transportation, treatment, storage, and disposal of solid and hazardous wastes. We are also subject to laws that regulate the manufacture, processing, and distribution of chemical substances and mixtures, as well as the disposition of certain hazardous substances. In addition, certain laws govern the abatement, removal, and disposal of asbestos-containing materials and the maintenance of underground storage tanks and equipment which contains or is contaminated by polychlorinated biphenyls. The costs of compliance with such laws and related regulations may be substantial, and regulatory standards tend to evolve towards more stringent requirements. These requirements might, from time to time, make it uneconomic or impossible to continue operating a facility. Non-compliance with such requirements at any of our facilities could result in substantial civil penalties or our inability to operate all or part of the facility, or our ability to sell certain products.

In regards to concerns about global warming, global warming could have an adverse impact on our operations, particularly in hurricane prone or low lying areas near the ocean. At this time, we are not able to speculate as to the potential timing or impact from potential global warming, however we believe we currently have adequate insurance coverage related to natural disasters at our sites. There are several initiatives in the United States and other countries to regulate certain industries and actions to reduce the impact of global warming. Some of these initiatives, if made effective, could have a direct adverse impact on our operations or an indirect adverse impact by affecting our suppliers or customers. In September 2009, the U.S. Environmental Protection Agency (“EPA”) promulgated a new regulation regarding the registry of greenhouse gas emissions for certain facilities. Currently we have two sites that are required to report such emissions under the new EPA climate registry rule. We do not expect the regulation to have a significant impact from a cost or operations perspective, as we already have systems in place to measure and report our emissions. We continue to monitor proposed legislation and regulation and its impact.

Further discussion of environmental matters is discussed in Note 11 of the Notes to Consolidated Financial Statements.

The Registration, Evaluation and Authorization of Chemicals (“REACH”) legislation became effective in the European Union on June 1, 2007. This legislation requires manufacturers and importers of certain chemicals to register certain chemicals and evaluate their potential impact on human health and the environment. Under REACH, where warranted by a risk assessment, specified uses of some hazardous substances may be restricted. Covered substances were registered as of December 31, 2009. Subsequently, registration is required based on volume for covered substances manufactured or imported into the European Union in quantities greater than one metric ton per year. REACH is expected to take effect in three primary stages over eleven years following the effective date. The registration, evaluation and authorization phases would require expenditures and resource commitments, for example, in order to compile and file comprehensive reports, including testing data, on each chemical substance and perform chemical safety assessments. We did not incur significant costs for REACH compliance in 2008 and 2009 and do not expect to incur significant costs in 2010. However, the overall cost of compliance over the next 10-15 years could be substantial although at this time, we do not expect costs to be substantial. In addition, it is possible that REACH may affect raw material supply, customer demand for certain products, and our decision to continue to manufacture and sell certain products in the European Union.

RISK FACTORS

Our indebtedness could adversely affect our financial condition, limit our ability to grow and compete and prevent us from fulfilling our obligations under our notes and our other indebtedness.

As of December 31, 2009, we had $685.5 of total debt outstanding. Our indebtedness could adversely affect our financial condition, limit our ability to grow and compete and prevent us from fulfilling our obligations under our notes and our other indebtedness. A discussion of our debt is contained in Note 10 of the Notes to Consolidated Financial Statements.

There is $400.0 of availability under our $400.0 five-year revolving credit facility, which expires June 2012, and $77.3 of availability under various non-U.S. credit facilities. The requirements to meet

- 10 -

Table of Contents

financial ratios could limit our ability to plan for or react to market conditions or meet extraordinary capital needs and could otherwise restrict our financing activities. Our ability to comply with the covenants will depend on our future operating performance. If we fail to comply with those covenants and terms, we will be in default. In this case, we would be required to obtain waivers from our lenders in order to maintain compliance. If we were unable to obtain any necessary waivers, the amounts outstanding under this agreement could be accelerated, and become immediately due and payable, and we would not be able to borrow any additional funds under the agreement while such default continued. Our ability to fully utilize our facility is limited by our actual calculated Debt Covenant Ratios as compared to the maximum Debt Covenant Ratio permitted under the agreement. We would be required to obtain waivers from our lenders in order to maintain the full use of the revolver if our actual calculated Debt Covenant Ratios were expected to exceed the maximum Debt Covenant Ratios permitted under the agreement, and as a result, we believe our financing costs would be significantly higher.

Disposition or restructuring charges, goodwill impairment, acquisition intangible impairment, or other asset impairment charges may affect our results of operations in the future.

Management regularly reviews our business portfolio in terms of strategic fit and financial performance and may from time to time dispose of or withdraw certain product lines. Additionally, management regularly reviews the cost effectiveness of its plant sites and/or assets at such sites. Long-lived assets with determinable useful lives are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. We may find it necessary to record disposition, restructuring or asset impairment charges in connection with such reviews. For example, we recorded restructuring charges of approximately $90.2 in 2009 principally related to plant closures and employee severance. See Note 3 of the Notes to the Consolidated Financial Statements for further details. Such charges could have a material adverse effect on our results of operations in the period in which they are recorded.

We test goodwill for impairment on an annual basis each October 1st and more often if events occur or circumstances change that would likely reduce the fair value of a reporting unit to an amount below its carrying value. We also test for other possible acquisition intangible impairments if events occur or circumstances change that would indicate that the carrying amount of such intangible asset may not be recoverable. Any resulting impairment loss would be a non-cash charge and may have a material adverse impact on our results of operations in any future period in which we record a charge. For example, in connection with our annual goodwill impairment test in 2008, we recorded in the fourth quarter of 2008 a $385.0 ($358.3 after-tax) non-cash goodwill impairment charge related to our Coating Resins reporting unit, comprised primarily of our former Surface Specialties reporting unit. In total, we had goodwill of $701.9 and acquisition intangibles with a net carrying value of $399.5 at December 31, 2009. See Critical Accounting Policies for further discussion on our goodwill impairment testing.

We may be adversely impacted by increased costs related to our defined benefit pension plans.

We sponsor defined benefit pension plans for employees in the United States and various foreign locations. The major defined benefit pension plans are funded with trust assets invested in a globally diversified portfolio of securities and other investments. Changes in regulatory requirements or the market value of plan assets, investment returns, interest rates and mortality rates may affect the funded status of our defined benefit pension plans and cause volatility in the net periodic benefit cost and future funding requirements of the plans. A significant increase in our obligations or future funding requirements could have an adverse effect on our financial results and financial position.

Prices and availability of raw materials could adversely affect our operations.

Loss of certain significant customers may have an adverse effect on results of the affected segment and loss of several significant customers may have an adverse effect on our consolidated results.

See “Item 1. BUSINESS – Customers and Suppliers”

We face active competition from other companies, which could adversely affect our revenue and financial condition.

See “Item 1. BUSINESS – Competition”

We face numerous risks relating to our international operations that may adversely affect our results of operations.

See “Item 1. BUSINESS – International”

Our production facilities are subject to operating risks that may adversely affect our operations.

See “Item 1. BUSINESS – Operating Risks”

- 11 -

Table of Contents

We are subject to significant environmental and product regulatory expenses and risks.

See “Item 1. BUSINESS – Environmental Matters”

We are subject to significant litigation expense and risk.

See “Item 3. LEGAL PROCEEDINGS”

A further worsening of global economic conditions coupled with a lack of credit availability from the credit markets could adversely impact our customer’s demand for our products, their ability to pay their accounts receivable with us and/or their viability.

During 2009, certain customers in our Specialty Chemicals segments and Building Block Chemical segment experienced financial difficulties. Certain customers filed for bankruptcy protection as a result of the prevailing economic conditions of 2009, especially in the first half of the year. We attempt to mitigate the risks associated with extending credit to our customers by maintaining detailed credit procedures and routinely updating customer credit limits. It is possible that these procedures will not fully mitigate customer collectability risk. Our results of operations in 2009 were not significantly impacted by the inability of our customers to pay. However, the risks associated with extending credit to our customers could increase if global economic conditions or the financial viability of our customers worsen.

A further worsening of global economic conditions could also adversely impact our supplier’s ability to supply our raw materials requirements.

The economic conditions that prevailed for most of 2009 impacted our suppliers in many of the same ways that such conditions impacted us. If economic conditions further deteriorate or the financial viability of our suppliers worsens, our suppliers may not be able to meet their raw material commitments to us, could request shortened payment terms, or could reduce or in extreme cases eliminate the amount of credit they extend to us. Our operations in 2009 were not significantly impacted by these factors due to the diversity of our supplier base and our materials sourcing strategies. However, it is possible that such procedures and strategy may not completely eliminate these risks.

If the current global economic weakness worsens or continues for an extended period, it could significantly impact our results of operations and cash flows. This could impact our ability to fund certain investments for growth, could cause a significant reduction in global operations, our ability to borrow and impact our current credit rating.

The economic conditions of 2009 and the resulting downturn in the global economy especially impacted the automotive, construction and general industrial markets that we serve and led to a significant reduction in our sales and operating profitability. If economic conditions further deteriorate we may be forced to take additional cost reduction initiatives that could lead to further reductions in profitability and could jeopardize our ability to fund growth programs designed to position us for success when economic conditions improve. Further, the reduced profitability and cash generation that would be triggered by a further weakening of economic conditions, could limit the amounts we can borrow under our primary credit facility due to the covenants contained in the agreement and could unfavorably impact our credit rating. In both instances, our ability to borrow could be limited and thus our liquidity adversely impacted.

UNRESOLVED STAFF COMMENTS

None.

- 12 -

Table of Contents

PROPERTIES

We operate manufacturing and research facilities in 16 countries. Capital spending for the years ended December 31, 2009, 2008 and 2007 was $193.9, $195.8 and $114.8, respectively.

Our capital expenditures are intended to provide increased capacity, to improve the efficiency of production units, to improve the quality of our products, to modernize or replace older facilities, or to install equipment for protection of employees, neighboring communities and the environment.

Our manufacturing and research facilities and the segments served by each such facility are as follows:

| FACILITY | SEGMENTS SERVED | |

| Anaheim, California |

Engineered Materials | |

| Antofagasta, Chile |

In Process Separation | |

| Atequiza, Mexico |

In Process Separation; Additive Technologies | |

| Avondale (Fortier), Louisiana |

Building Block Chemicals | |

| Bassano, Italy |

Coating Resins | |

| Belmont (Willow Island), West Virginia |

Coating Resins; Additive Technologies | |

| D’Aircraft (Anaheim), California |

Engineered Materials | |

| Drogenbos, Belgium |

Coating Resins; Additive Technologies; Engineered Materials | |

| Graz, Austria |

Coating Resins | |

| Greenville, South Carolina |

Engineered Materials | |

| Greenville, Texas |

Engineered Materials | |

| Hamburg, Germany |

Coating Resins | |

| Havre de Grace, Maryland |

Engineered Materials | |

| Indian Orchard, Massachusetts |

Engineered Materials | |

| Kalamazoo, Michigan |

Coating Resins; Additive Technologies; In Process Separation; Engineered Materials | |

| Langley, South Carolina |

Coating Resins; Engineered Materials | |

| Lillestrom, Norway |

Coating Resins | |

| Mount Pleasant, Tennessee |

Additive Technologies; In Process Separation | |

| North Augusta, South Carolina |

Coating Resins | |

| Oestringen, Germany |

Engineered Materials | |

| Olean, New York |

Engineered Materials | |

| Orange, California |

Engineered Materials | |

| Rayong, Thailand |

Coating Resins; In Process Separation; Engineered Materials | |

| Rock Hill, South Carolina |

Engineered Materials | |

| San Fernando, Spain |

Coating Resins | |

| Schoonaarde, Belgium |

Coating Resins | |

| Seremban, Malaysia |

Coating Resins | |

| Shanghai, China |

Coating Resins, Engineered Materials | |

| Shimonoseki, Japan |

Coating Resins | |

| Smyrna, Georgia |

Coating Resins | |

| Stamford, Connecticut |

Coating Resins; In Process Separation; Additive Technologies | |

| Suzano, Brazil |

Coating Resins | |

| Wallingford, Connecticut |

Coating Resins; Additive Technologies | |

| Welland, Canada |

In Process Separation | |

| Werndorf, Austria |

Coating Resins | |

| Wiesbaden, Germany |

Coating Resins | |

| Winona, Minnesota |

Engineered Materials | |

| Wrexham, U. K. |

Engineered Materials |

We own all of the foregoing facilities and their sites except for the land at the Indian Orchard, Lillestrom, Shanghai and Shimonoseki facilities and the land and the facilities at the Smyrna, and Wiesbaden sites. We have long-term leases and/or operating agreements for the Indian Orchard, Lillestrom, Smyrna, Shanghai, Shimonoseki and Wiesbaden sites. We lease our corporate headquarters in Woodland Park, New Jersey, our Cytec Specialty Chemicals headquarters in Brussels, Belgium and our Engineered Materials headquarters located in Tempe, Arizona. We are in negotiations with the municipal authorities in San Fernando, Spain regarding the consideration to be received by Cytec from the government on the expropriation of our San Fernando site and we are currently reviewing our options.

LEGAL PROCEEDINGS

Information regarding legal proceedings is included in Note 11 of the Notes to Consolidated Financial Statements.

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not applicable.

- 13 -

Table of Contents

PART II

(Currencies in millions, except per share amounts)

MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our stock is listed on the New York Stock Exchange. On February 18, 2010, there were approximately 6,123 registered holders of our Common Stock.

The high and low closing stock prices and declared dividends per share for each quarter were:

| 1Q | 2Q | 3Q | 4Q | |||||||||

| 2009 |

||||||||||||

| High |

$ | 23.87 | $ | 24.67 | $ | 34.84 | $ | 39.20 | ||||

| Low |

$ | 10.58 | $ | 13.95 | $ | 17.59 | $ | 30.52 | ||||

| Dividends |

$ | 0.125 | $ | 0.0125 | $ | 0.0125 | $ | 0.0125 | ||||

| 2008 |

||||||||||||

| High |

$ | 60.35 | $ | 63.77 | $ | 58.19 | $ | 38.67 | ||||

| Low |

$ | 47.66 | $ | 54.56 | $ | 38.91 | $ | 16.28 | ||||

| Dividends |

$ | 0.125 | $ | 0.125 | $ | 0.125 | $ | 0.125 | ||||

On April 16, 2009, our Board of Directors reduced our quarterly dividend by 90% in light of economic conditions to $0.0125 from $0.125. On January 28, 2010, our Board of Directors declared a quarterly cash dividend of $0.0125 per common share, payable on February 25, 2010 to stockholders of record as of February 10, 2010.

See Part III, Item 12. “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” for information relating to our equity compensation plans.

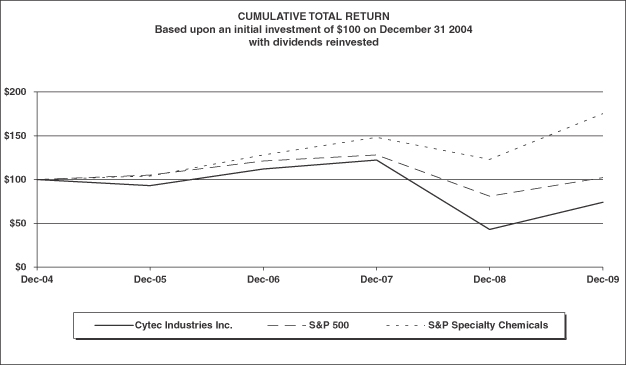

PERFORMANCE GRAPH

The graph set forth below is based on the assumption that $100 had been invested in our common stock and in each index on December 31, 2004, with reinvestment of dividends at market prices. The total cumulative dollar returns represent the value such investments would have had on December 31, 2009.

| Dec-04 | Dec-05 | Dec-06 | Dec-07 | Dec-08 | Dec-09 | |||||||||||||

| Cytec Industries Inc. |

$ | 100 | $ | 93 | $ | 112 | $ | 122 | $ | 43 | $ | 74 | ||||||

| S&P 500 |

$ | 100 | $ | 105 | $ | 121 | $ | 128 | $ | 81 | $ | 102 | ||||||

| S&P Specialty Chemicals |

$ | 100 | $ | 104 | $ | 128 | $ | 148 | $ | 123 | $ | 175 | ||||||

Copyright © 2010 Standard & Poor’s, a division of The McGraw-Hill Companies Inc. All rights reserved.

- 14 -

Table of Contents

SELECTED FINANCIAL DATA

FIVE-YEAR SUMMARY

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| Statements of income data: |

||||||||||||||||||||

| Net sales |

$ | 2,789.5 | $ | 3,639.9 | $ | 3,503.8 | $ | 3,329.5 | $ | 2,925.7 | ||||||||||

| Earnings/(loss) from operations |

$ | 31.1 | (1),(9) | $ | (121.1 | )(3),(9) | $ | 324.1 | (5),(9) | $ | 305.4 | (7),(9) | $ | 162.1 | (10) | |||||

| (Loss)/Earnings from continuing operations before accounting change |

$ | (2.5 | )(2) | $ | (198.8 | )(4) | $ | 206.5 | (6) | $ | 196.4 | (8) | $ | 58.9 | (11) | |||||

| Earnings from discontinued operations, net of taxes |

– | – | – | – | 1.2 | |||||||||||||||

| Cumulative effect of accounting change, net of taxes |

– | – | – | (1.2 | )(9) | – | ||||||||||||||

| Net (loss)/earnings attributable to Cytec |

$ | (2.5 | ) | $ | (198.8 | ) | $ | 206.5 | $ | 195.2 | $ | 60.1 | ||||||||

| Basic net (loss)/earnings attributable to Cytec Industries Inc.: |

||||||||||||||||||||

| (Loss)/earnings attributable to Cytec Industries Inc. before discontinued operations and accounting change |

$ | (0.05 | ) | $ | (4.16 | ) | $ | 4.29 | $ | 4.13 | $ | 1.30 | ||||||||

| Earnings from discontinued operations, net of taxes |

– | – | – | – | 0.03 | |||||||||||||||

| Cumulative effect of accounting change, net of taxes |

– | – | – | (0.02 | ) | – | ||||||||||||||

| Net (loss)/earnings attributable to Cytec |

$ | (0.05 | ) | $ | (4.16 | ) | $ | 4.29 | $ | 4.11 | $ | 1.33 | ||||||||

| Diluted net (loss)/earnings attributable to Cytec Industries Inc.: |

||||||||||||||||||||

| (Loss)/earnings attributable to Cytec Industries Inc. before discontinued operations and accounting change |

$ | (0.05 | ) | $ | (4.16 | ) | $ | 4.20 | $ | 4.03 | $ | 1.28 | ||||||||

| Earnings from discontinued operations, net of taxes |

– | – | – | – | 0.02 | |||||||||||||||

| Cumulative effect of accounting change, net of taxes |

– | – | – | (0.02 | ) | – | ||||||||||||||

| Net (loss)/earnings attributable to Cytec |

$ | (0.05 | ) | $ | (4.16 | ) | $ | 4.20 | $ | 4.01 | $ | 1.30 | ||||||||

| Cash dividends declared and paid per common share |

$ | 0.16 | $ | 0.50 | $ | 0.40 | $ | 0.40 | $ | 0.40 | ||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Total assets |

$ | 3,559.4 | $ | 3,640.0 | (12) | $ | 4,085.6 | (12) | $ | 3,830.5 | (12) | $ | 3,864.1 | (12) | ||||||

| Long-term debt |

$ | 658.4 | $ | 806.4 | $ | 705.3 | $ | 900.4 | $ | 1,225.5 | ||||||||||

| (1) | Includes pre-tax charge of $90.2 ($63.7 after-tax) for various manufacturing and organizational restructuring initiatives across the Specialty Chemical segments and Engineered Materials segment and within corporate operations as well as restructuring charges related to the shared services initiative. Also includes a net pre-tax loss of $1.4 ($1.9 after-tax) related to the exit of the polyurethane product line in Europe and Asia. |

| (2) | In addition to items in Note (1) above, includes a net pre-tax loss of $8.6 ($5.2 after-tax) associated with the premium for the debt tender, a pre-tax, non-cash gain of $8.9 ($5.5 after-tax) as a result of a land sale for which the proceeds were received in 2004, a pre-tax gain of $6.2 ($3.8 after-tax) related to a legal settlement, a pre-tax, non-cash charge of $12.2 ($9.1 after-tax) relating to a pension settlement in an international jurisdiction, and a benefit of $4.0 related to a favorable tax adjustment for an audit settlement in an international jurisdiction. |

| (3) | Includes a pre-tax charge of $5.6 ($3.6 after-tax) for incremental accelerated depreciation related to our exit of Radcure manufacturing at our leased facility in Pampa, Texas, a pre-tax goodwill impairment charge of $385.0 ($358.3 after-tax), and a pre-tax charge of $14.9 ($10.4 after-tax) for additional restructuring costs primarily associated with various organizational restructuring initiatives across the Specialty Chemicals segments. |

| (4) | In addition to items in Note (3) above, includes a pre-tax gain of $6.1 ($4.0 after-tax) for a legal settlement and an income tax benefit of $2.6 related to a favorable tax development related to the sale of the water treatment business in 2007. |

| (5) | Includes a pre-tax restructuring charge of $6.2 ($5.0 after-tax) for restructuring initiatives and a pre-tax gain of $13.6 ($13.3 after-tax) for the sale of certain product lines. |

- 15 -

Table of Contents

| (6) | In addition to the items in Note (5) above, includes $6.3 related to various income tax rate changes in various jurisdictions. |

| (7) | Includes pre-tax restructuring charges of $19.3 ($16.1 after-tax) primarily related to plant closures, pre-tax impairment charges of $29.3 ($24.6 after-tax) related to two unprofitable manufacturing sites in Europe, a pre-tax charge of $2.6 ($1.9 after-tax) related to a change in employee benefit plans in the U.K., a pre-tax charge of $2.2 ($1.6 after-tax) related to a contingent liability study update, pre-tax integration costs of $1.7 ($1.3 after-tax) related to the Surface Specialties acquisition and a pre-tax gain of $75.5 ($59.6 after-tax) for the sale of certain product lines. |

| (8) | In addition to the items in Note (7) above, includes a pre-tax $15.7 ($12.4 after-tax) gain related to resolution of a legal dispute and an income tax benefit of $3.5 related to the completion of prior years tax audits, partially offset by a $1.7 tax charge related to a taxable capital reduction at our Thailand subsidiary. |

| (9) | 2006 cumulative effect of accounting change represents the cumulative effect of adopting accounting pronouncement on share-based payments. The pronouncement requires that all share-based payments be recorded at a fair value to compensation costs. Pre-tax expenses resulting from the application of this pronouncement included in Earnings from Operations were $6.6, $9.1, $11.6, and $10.4 in 2009, 2008, 2007, and 2006, respectively. |

| (10) | Includes a non-deductible charge of $37.0 for the write-off of acquired in-process research and development, a pre-tax charge of $20.8 ($15.4 after-tax) resulting from the amortization of the write-up to fair value of acquired inventory, pre-tax restructuring charges of $16.8 ($12.4 after-tax) and pre-tax integration costs of $0.2 ($0.1 after-tax). |

| (11) | In addition to the items in Note (10) above, includes pre-tax charges of $44.2 ($28.1 after-tax) related to derivative contracts entered into to hedge currency and interest rate exposure associated with the purchase of Surface Specialties, pre-tax $22.0 ($14.0 after-tax) of interest charges and unamortized put premiums and rate lock agreements related to the redemption of the Mandatory Par Put Remarketed Securities (“MOPPRS”) and $28.3 benefit representing the favorable resolution of several prior year tax matters. |

| (12) | We revised and appropriately reclassified the prior year amounts related to an immaterial misclassification of certain current and long-term deferred income tax liabilities. |

- 16 -

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and Notes to the Consolidated Financial Statements. It is assumed that the reader is familiar with the description of our business and risk factors contained in Part I of this report. Currency amounts are in millions, except per share amounts. Percentages are approximate.

GENERAL

We are a global specialty chemicals and materials company and sell our products to diverse major markets for aerospace, adhesives, automotive and industrial coatings, chemical intermediates, inks, mining and plastics. Sales price and volume by region and the impact of exchange rates on our reporting segments are important measures that are analyzed by management and are provided in our segment analysis.

We report net sales in four geographic regions: North America, Latin America, Asia/Pacific and Europe/Middle East/Africa. The destination of the sale determines the region under which it is reported consistent with management’s view of the business. North America consists of the United States and Canada. Latin America includes Mexico, Central America, South America and the Caribbean Islands. Asia/Pacific is comprised of Asia, Australia and the islands of the South Pacific Rim.

Selling price changes and raw material cost changes year on year are an important factor in profitability especially in years of high volatility. Global oil and natural gas costs in certain countries are highly volatile and many of our raw materials are derived from these two commodities. Discussion of the year to year impact of raw materials and energy is provided in our segment discussion. In addition, higher global demand levels and, occasionally, operating difficulties at suppliers, have limited the availability of certain of our raw materials.

The downturn in the global economy during the fourth quarter of 2008 led to a dramatic reduction in demand for our products across many of our industrial markets, which resulted in a significant decrease in earnings starting in the fourth quarter of 2008. Beginning in January 2009, we initiated various restructuring initiatives within our Specialty Chemical segments and corporate service functions. We have substantially completed these actions to reduce our structural costs and the elimination of these positions as of December 31, 2009. In addition, in the second and third quarters of 2009, we also initiated restructuring actions within our Engineered Materials segment to respond to lower demand due to inventory destocking and sharper than expected decline in business and regional jet build rates. We estimate that the aforementioned structural cost reduction actions as well as actions initiated in prior years improved our 2009 results by approximately $50.0 and the expected full year annualized rate of savings is approximately $120.0. In addition to these restructuring initiatives, we implemented additional short-term cost reduction and liquidity measures across our operations. These short-term measures include the implementation of furloughs in certain production facilities in order to better align our cost structure with the reduced demand in 2009, a global salary freeze and bonus limitations, except as required by local law and contracts, and suspension of the company matching contributions to the 401(k) savings program for all U.S. salaried and non-bargaining employees effective May 1, 2009. We estimate that these short-term actions improved our 2009 operating earnings by approximately $76.0.

- 17 -

Table of Contents

RESULTS OF OPERATIONS

The following table sets forth the percentage relationship that certain items in our Consolidated Statements of Income bear to net sales:

| Years Ended December 31, | 2009 | 2008 | 2007 | ||||||

| Net sales |

100.0 | % | 100.0 | % | 100.0 | % | |||

| Manufacturing cost of sales |

83.1 | 80.0 | 78.6 | ||||||

| Gross profit |

16.9 | 20.0 | 21.4 | ||||||

| Selling and technical services |

7.1 | 6.3 | 6.1 | ||||||

| Research and process development |

2.7 | 2.2 | 2.2 | ||||||

| Administrative and general |

4.5 | 3.1 | 3.2 | ||||||

| Amortization of acquisition intangibles |

1.4 | 1.1 | 1.1 | ||||||

| Net gain on sale of assets |

– | – | – | ||||||

| Asset impairment charge |

0.2 | – | – | ||||||

| Goodwill impairment charge |

– | 10.6 | – | ||||||

| Gain on sale of assets held for sale |

– | – | 0.4 | ||||||

| Earnings/(loss) from operations |

1.1 | (3.3 | ) | 9.2 | |||||

| Net (loss)/earnings attributable to Cytec Industries Inc. |

(0.1 | ) | (5.5 | ) | 5.9 |

NET SALES BY SEGMENT AND GEOGRAPHIC AREA

| Net Sales | North America | Latin America | Asia/ Pacific |

Europe/ Middle East/ Africa |

Total | ||||||||||

| 2009 |

|||||||||||||||

| Coating Resins |

$ | 260.0 | $ | 50.5 | $ | 274.3 | $ | 622.1 | $ | 1,206.9 | |||||

| Additive Technologies |

90.8 | 19.7 | 55.4 | 73.2 | 239.1 | ||||||||||

| In Process Separation |

69.0 | 79.7 | 69.5 | 47.6 | 265.8 | ||||||||||

| Engineered Materials |

432.9 | 4.3 | 50.4 | 229.9 | 717.5 | ||||||||||