Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nuverra Environmental Solutions, Inc. | d8k.htm |

HECKMANN CORPORATION

Exhibit 99.1

Credit Suisse 12th Annual Global Services Conference February 23, 2010 NYSE: HEK

LEGAL DISCLAIMER

This presentation may contain statements about future events, outlook, plans, and expectations of Heckmann Corporation (“Heckmann”) all of which are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements related to the status of the business, benefits of various current and prospective transactions and business alliances, expansion plans and opportunities, and attempts to enter new and existing markets for the products and services of Heckmann.

These forward-looking statements are based on information available to Heckmann as of the date of this filing and current expectations, forecasts and assumptions and involve a number of risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing Heckmann’s views as of any subsequent date and Heckmann does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made. Any statement in this presentation that is not a historical fact may be deemed to be a forward-looking statement. These forward-looking statements rely on a number of assumptions concerning future events that are believed to be reasonable, but are subject to a number of risks, uncertainties and other factors, many of which are outside Heckmann’s control, and which could cause the actual results, performance or achievements of Heckmann to be materially different. While we believe that the assumptions concerning future events are reasonable, we caution that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of our businesses.

Information concerning risks, uncertainties, and additional factors that could cause results to differ materially from those projected in the forward-looking statements is contained in our Annual, Quarterly, and Periodic Current Reports filed with the Securities and Exchange Commission.

Stockholders will also be able to obtain a copy of the presentation, without charge, by directing a request to: Heckmann Corporation, 75080 Frank Sinatra Drive, Palm Desert, California 92211. The presentation can also be obtained, without charge, at the U.S. Securities and Exchange Commission’s internet site (http://www.sec.gov).

HECKMANN CORPORATION

| 2 |

|

What is HEK?

(Heckmann Corporation)

We are in the water business

We own 100% of China Water

– One of the largest suppliers of water to Coca Cola in China

– 405 million bottles produced and sold in 2009

We own 7% of Underground Solutions Inc.

– A manufacturer of PVC pipe with patented technologies

We own 100% of Heckmann Water Resources

– A water pipeline and disposal company based in Tyler, Texas

We own 50% of Energy Transfer Water Solutions JV, LLC.

– A joint venture between Heckmann Corporation and Energy Transfer Partners, L.P.

HECKMANN CORPORATION

| 3 |

|

China Water

We exited the “SPAC” category with the purchase of China Water in November 2008

– Initially a troubled deal with insiders involved in serious accounting irregularities, so as part of the acquisition we held back the stock of the China Water insiders

– Recovered 17 million shares and are in litigation to recover another 8.5 million shares

– In 2009, China Water was written down to $21 million dollars

– It is now profitable and a cash generator

HECKMANN CORPORATION

| 4 |

|

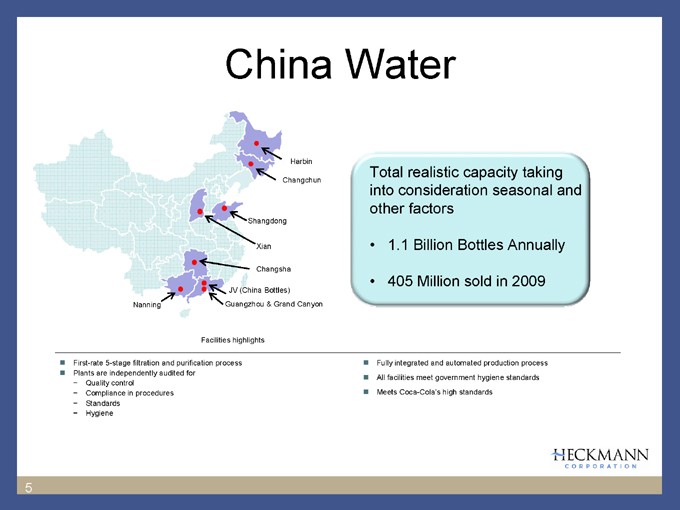

China Water

Harbin

Changchun

Shangdong Xian Changsha

JV (China Bottles)

Nanning Guangzhou & Grand Canyon

Facilities highlights

First-rate 5-stage filtration and purification process

Plants are independently audited for

– Quality control

– Compliance in procedures

– Standards

– Hygiene

Total realistic capacity taking into consideration seasonal and other factors

1.1 Billion Bottles Annually

405 Million sold in 2009

Fully integrated and automated production process

All facilities meet government hygiene standards

Meets Coca-Cola’s high standards

HECKMANN CORPORATION

| 5 |

|

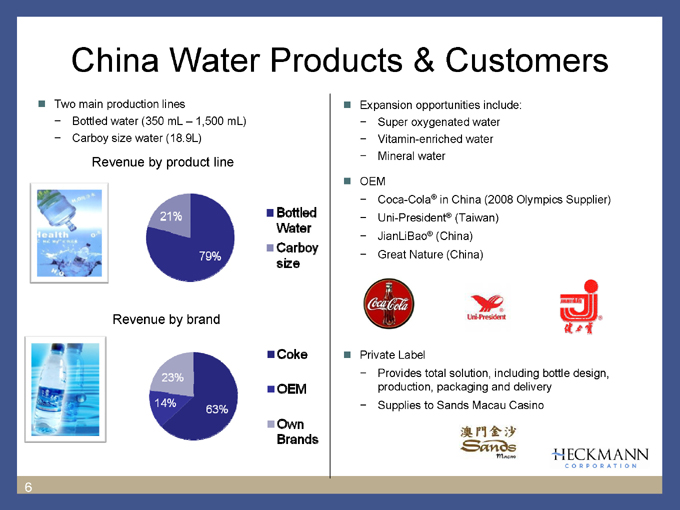

China Water Products & Customers

Two main production lines

– Bottled water (350 mL – 1,500 mL)

– Carboy size water (18.9L) Revenue by product line

Revenue by brand

21% 79% Bottled Water

Carboy size

23% 14% 63% Coke OEM Own Brands

Expansion opportunities include:

– Super oxygenated water

– Vitamin-enriched water

– Mineral water

OEM

– Coca-Cola® in China (2008 Olympics Supplier)

– Uni-President® (Taiwan)

– JianLiBao® (China)

– Great Nature (China)

Private Label

– Provides total solution, including bottle design, production, packaging and delivery

– Supplies to Sands Macau Casino

HECKMANN CORPORATION

| 6 |

|

Heckmann Water Resources

We constructed and are operating a 50-mile pipeline in the Haynesville Shale in Northeast Texas and Louisiana

Pipeline can take up to 100,000 barrels per day of water (4,200,000 gallons)

We take the water to our disposal wells (8 now with more permitted)

36% of pipeline now under contract

– $57 million dollars of firm multi-year contracts

At current rates, and at capacity, the EBITDA run rate can exceed $20 million dollars annually

Pipeline cost was approximately $28,000,000 or $560,000/mile

– Plus approximately $20,000,000 for disposal field & wells

HECKMANN CORPORATION

| 7 |

|

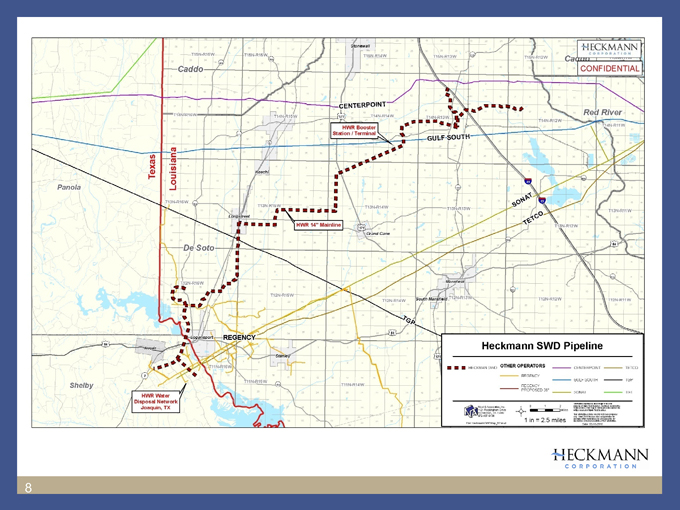

HECKMANN CONFIDENTIAL

Heckmann SWD Pipeline

HECKMANN CORPORATION

| 8 |

|

Heckmann Water Resources Customers & Partners

EXCO Resources, Inc

El Paso Corporation

EnCana

BP America

XTO Energy

JW Operating

BEUSA Energy Inc.

Maximus Operating, Ltd.

KCS Resources, Inc

Classic Operating Co. Llc

Coronado Energy

HECKMANN CORPORATION

9

HECKMANN CORPORATION

10

The Haynesville Shale Water Disposal Opportunities

In Haynesville and Barnett Shales there are over 50,000 depleted wells

Many can be converted to disposal wells

Laws allow produced water to be injected into the ground through the deep wells

Thousands of 130 barrel capacity trucks transfer the water from the producing wells to the disposal wells each day

All in costs run on average from $1.25/barrel to $1.75/barrel depending on distance trucked and diesel costs

HEK pipeline disposal prices average $.85/barrel to $1.25/barrel depending on distance

HEK pipeline will replace over 750 water trucks per day

HECKMANN CORPORATION

11

The Marcellus Shale Water Disposal Opportunities

Water laws very stringent

We believe there are less than 50 deep injection disposal wells available

It will be difficult to develop additional injection wells for disposal according to the D.O.E.

Mountainous roadways throughout the region make transporting billions of gallons of water over long distances difficult at best and in many cases just not viable

Spans 15 million acres, 5x the Haynesville / 10x the Barnett

Located largely in rural areas but close to US population centers

4 to 10 times the amount of shale gas when compared to the Haynesville

HECKMANN CORPORATION

12

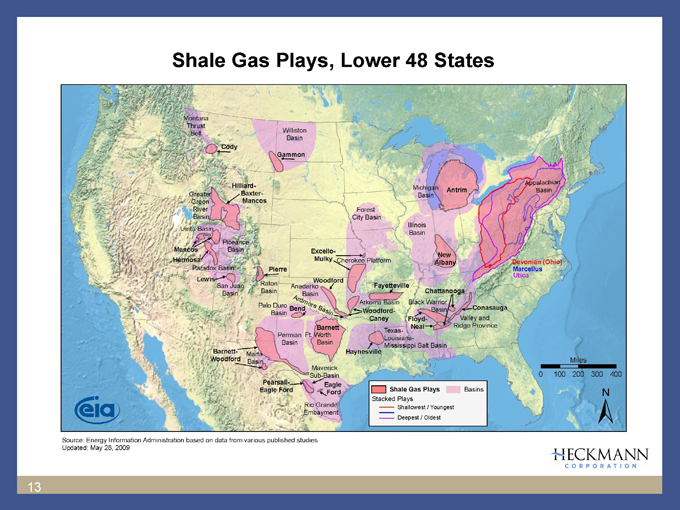

Shale Gas Plays, Lower 48 States

Source: Energy Information Administration based on data from various published studies

Updated: May 28, 2009

HECKMANN CORPORATION

13

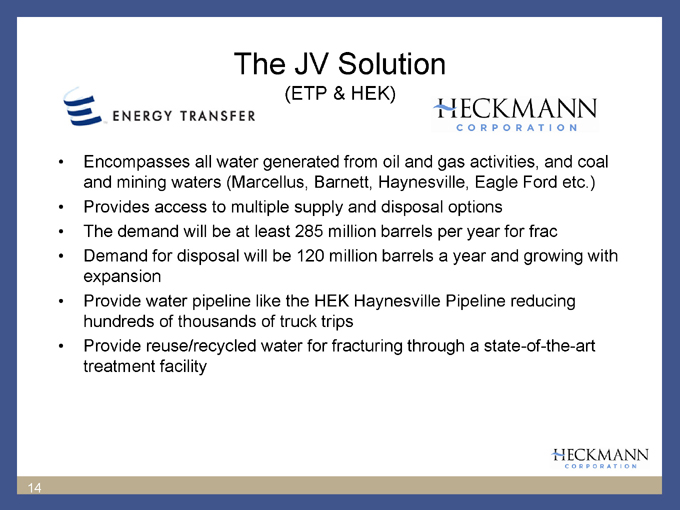

The JV Solution

(ETP & HEK)

ENERGY TRANSFER

HECKMANN CORPORATION

Encompasses all water generated from oil and gas activities, and coal and mining waters (Marcellus, Barnett, Haynesville, Eagle Ford etc.)

Provides access to multiple supply and disposal options

The demand will be at least 285 million barrels per year for frac

Demand for disposal will be 120 million barrels a year and growing with expansion

Provide water pipeline like the HEK Haynesville Pipeline reducing hundreds of thousands of truck trips

Provide reuse/recycled water for fracturing through a state-of-the-art treatment facility

HECKMANN CORPORATION

14

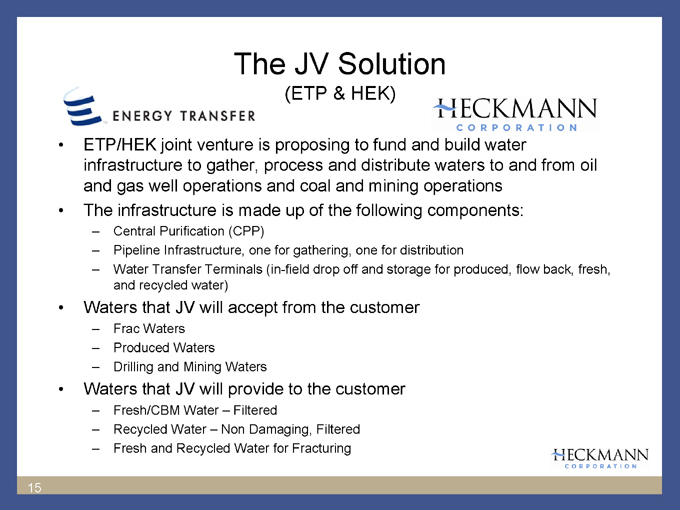

The JV Solution

(ETP & HEK)

ENERGY TRANSFER

HECKMANN CORPORATION

ETP/HEK joint venture is proposing to fund and build water infrastructure to gather, process and distribute waters to and from oil and gas well operations and coal and mining operations

The infrastructure is made up of the following components:

– Central Purification (CPP)

– Pipeline Infrastructure, one for gathering, one for distribution

– Water Transfer Terminals (in-field drop off and storage for produced, flow back, fresh, and recycled water)

Waters that JV will accept from the customer

– Frac Waters

– Produced Waters

– Drilling and Mining Waters

Waters that JV will provide to the customer

– Fresh/CBM Water – Filtered

– Recycled Water – Non Damaging, Filtered

– Fresh and Recycled Water for Fracturing

HECKMANN CORPORATION

15

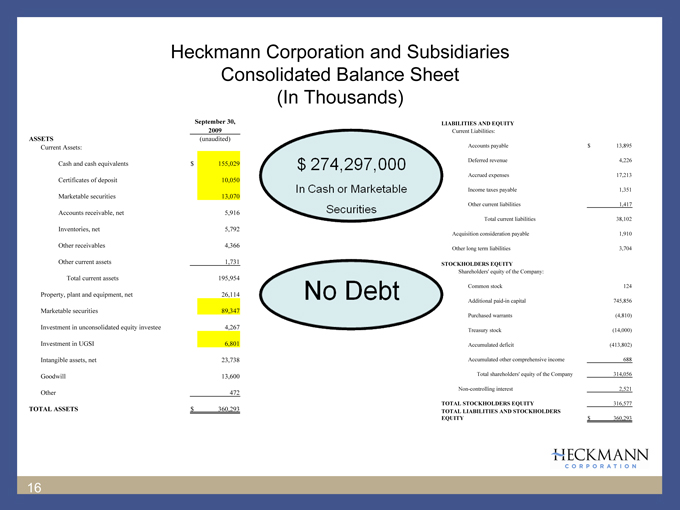

Heckmann Corporation and Subsidiaries Consolidated Balance Sheet (In Thousands)

September 30, 2009

ASSETS (unaudited)

Current Assets:

Cash and cash equivalents $ 155,029

Certificates of deposit 10,050

Marketable securities 13,070

Accounts receivable, net 5,916

Inventories, net 5,792

Other receivables 4,366

Other current assets 1,731

Total current assets 195,954

Property, plant and equipment, net 26,114

Marketable securities 89,347

Investment in unconsolidated equity investee 4,267

Investment in UGSI 6,801 Intangible assets, net 23,738

Goodwill 13,600 Other 472

TOTAL ASSETS $ 360,293

LIABILITIES AND EQUITY

Current Liabilities:

Accounts payable $ 13,895

Deferred revenue 4,226

Accrued expenses 17,213

Income taxes payable 1,351

Other current liabilities 1,417

Total current liabilities 38,102

Acquisition consideration payable 1,910

Other long term liabilities 3,704

STOCKHOLDERS EQUITY

Shareholders’ equity of the Company:

Common stock 124

Additional paid-in capital 745,856

Purchased warrants (4,810)

Treasury stock (14,000)

Accumulated deficit (413,802)

Accumulated other comprehensive income 688

Total shareholders’ equity of the Company 314,056

Non-controlling interest 2,521

TOTAL STOCKHOLDERS EQUITY 316,577

TOTAL LIABILITIES AND STOCKHOLDERS EQUITY $ 360,293

HECKMANN CORPORATION

16

We know that water issues are key to the development of energy

We know that shale gas development depends on the issues around water being solved

We know who the big oil and gas companies are

And

We know who the big pipeline companies are

Who’s the Big Water Company?

HECKMANN CORPORATION

17

HECKMANN CORPORATION

Company Contacts:

Dick Heckmann / Don Ezzell Tel: +1 760 341-3606

Investor Relations Contact:

Kristen McNally

The Piacente Group, Inc. Tel. +1 212 481 2050 heckmann@tpg-ir.com NYSE: HEK

18