Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Arlington Asset Investment Corp. | v174888_8k.htm |

Investor Presentation

February 18, 2010

Investor Presentation

February 18, 2010

Information Related to Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning

of the Private Securities Litigation

Information Related to Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning

of the Private Securities Litigation

Reform Act of 1995. These include statements regarding future results or expectations. Forward-looking

statements can be identified by forward-looking language, including words such as “believes,”

“anticipates,”

“expects,” “estimates,” “intends,” “may,” “plans,” “projects,” “potential,” “prospective,” “will” and similar

expressions, or the negative

of these words. Such forward-looking statements are based on facts and

conditions as they exist at the time such statements are made. Forward-looking statements are also based on

predictions as to future facts and conditions, the accurate

prediction of which may be difficult and involve the

assessment of events beyond our control. Forward-looking statements are further based on various operating

and return assumptions. Caution must be exercised in relying on forward-looking

statements. Due to known

and unknown risks, actual results may differ materially from expectations or projections.

You should carefully consider these risks when you make a decision concerning an investment

in our common

stock, along with the following factors, among others, that may cause our actual results to differ materially from

those described in any forward-looking statements: risks and uncertainties relating to the recent global

economic downturn;

changes in economic and market conditions; impacts of regulatory changes and changes

to Fannie Mae and Freddie Mac; availability of opportunities that meet or exceed our risk adjusted return

expectations, changes in interest rates; changes in anticipated

earnings and returns; our ability to maintain

adequate liquidity; increased costs of borrowing; decreased interest spreads; changes in mortgage pre-payment

speeds; risks associated with merchant banking investments; the realization of gains and losses

on principal

investments; our ability to maintain our exemption from registration as an investment company pursuant to the

Investment Company Act of 1940; our ability to generate earnings or gains and otherwise realize and protect

taxable benefits

associated with net operating loss carry-forwards and net capital loss carry-forwards; our ability

to realize continued cost savings; our ability and willingness to pay future dividends; available technologies;

competition for business and personnel;

changes in, and our ability to remain in compliance with, law,

regulations or government policies affecting our business; and the factors described in the sections entitled

“Risk Factors” in our annual report on Form 10-K for the year ended

December 31, 2008 and our other public

filings with the SEC. You should not place undue reliance on these forward-looking statements, which apply

only as of the date of this presentation. We undertake no obligation to update or

revise any forward-looking

statement, whether written or oral, relating to matters discussed in this presentation, except as may be required

by applicable securities laws.

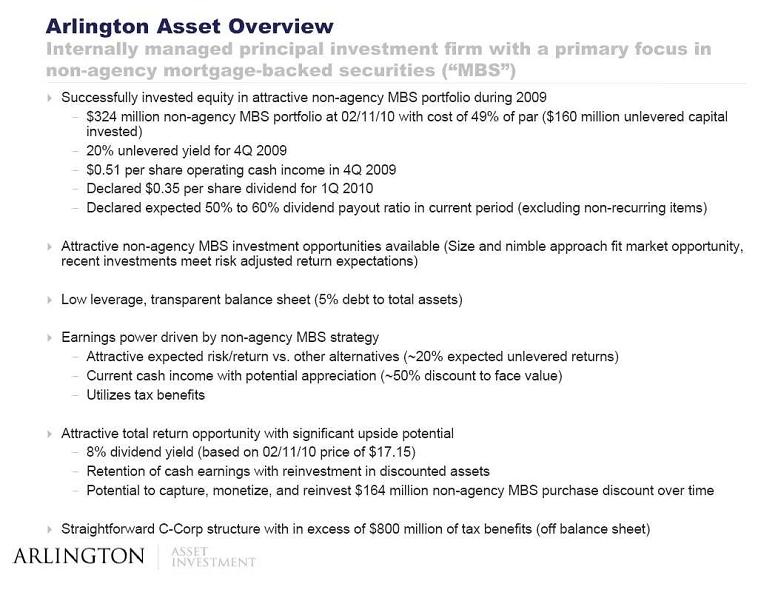

Arlington Asset Overview

Arlington Asset Overview

Internally managed principal

investment firm with a primary focus in

non-agency mortgage-backed securities (“MBS”)

Successfully invested equity in attractive non-agency MBS portfolio during 2009

$324 million non-agency MBS portfolio at 02/11/10 with cost of 49% of par ($160 million unlevered capital

invested)

20% unlevered yield for 4Q 2009

$0.51 per share operating cash income in 4Q 2009

Declared $0.35 per share dividend for 1Q 2010

Declared expected 50% to 60% dividend payout ratio in current period (excluding non-recurring items)

Attractive non-agency MBS investment opportunities available (Size and nimble approach fit market opportunity,

recent investments meet risk adjusted return expectations)

Low leverage, transparent balance sheet (5% debt to total assets)

Earnings power driven by non-agency MBS strategy

Attractive expected risk/return vs. other alternatives (~20% expected unlevered returns)

Current cash income with potential appreciation (~50% discount to face value)

Utilizes tax benefits

Attractive total return opportunity with significant upside potential

8% dividend yield (based on 02/11/10 price of $17.15)

Retention of cash earnings with reinvestment in discounted assets

Potential to capture, monetize, and reinvest $164 million non-agency MBS purchase discount over time

Straightforward C-Corp structure with in excess of $800 million of tax benefits (off balance sheet)

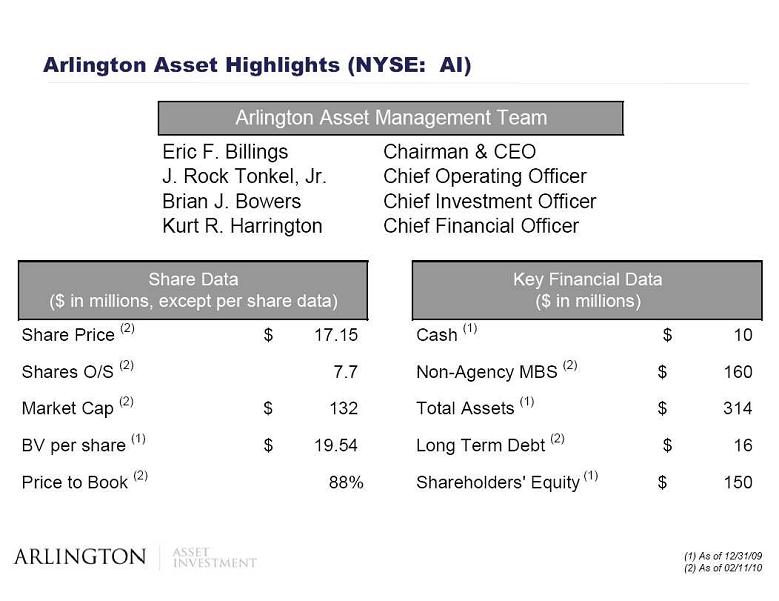

Arlington Asset Highlights (NYSE: AI)

Eric F. Billings

Chairman & CEO

J. Rock Tonkel, Jr.

Chief Operating Officer

Brian J. Bowers

Chief Investment Officer

Kurt R. Harrington

Chief Financial Officer

Arlington Asset Management Team

Share Price

(2)

17.15

$

Cash

(1)

10

$

Shares O/S

(2)

7.7

Non-Agency MBS

(2)

160

$

Market Cap

(2)

132

$

Total Assets

(1)

314

$

BV per share

(1)

19.54

$

Long Term Debt

(2)

16

$

Price to Book

(2)

88%

Shareholders' Equity

(1)

150

$

Share Data

($ in millions, except per share data)

Key Financial Data

($ in millions)

Arlington Asset Highlights (NYSE: AI)

Eric F. Billings

Chairman & CEO

J. Rock Tonkel, Jr.

Chief Operating Officer

Brian J. Bowers

Chief Investment Officer

Kurt R. Harrington

Chief Financial Officer

Arlington Asset Management Team

Share Price

(2)

17.15

$

Cash

(1)

10

$

Shares O/S

(2)

7.7

Non-Agency MBS

(2)

160

$

Market Cap

(2)

132

$

Total Assets

(1)

314

$

BV per share

(1)

19.54

$

Long Term Debt

(2)

16

$

Price to Book

(2)

88%

Shareholders' Equity

(1)

150

$

Share Data

($ in millions, except per share data)

Key Financial Data

($ in millions)

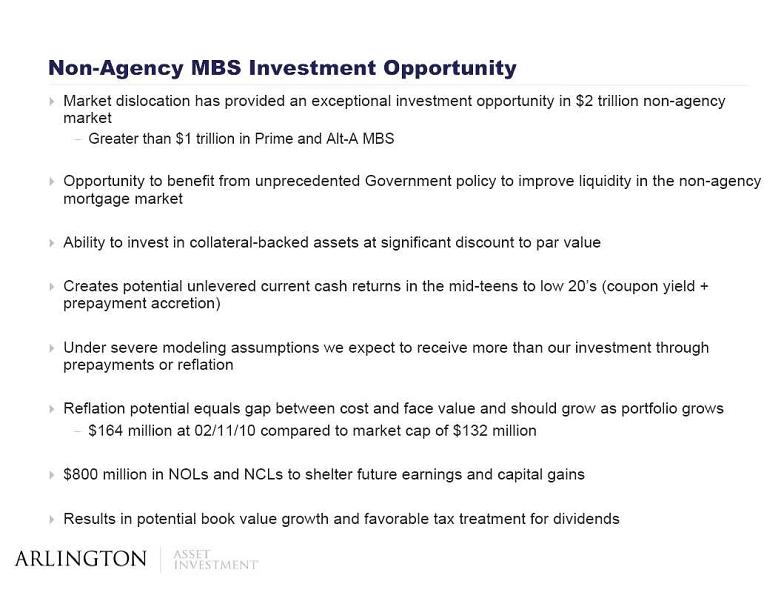

Non-Agency MBS Investment Opportunity

Market dislocation has provided an exceptional investment opportunity in $2 trillion non-agency

Non-Agency MBS Investment Opportunity

Market dislocation has provided an exceptional investment opportunity in $2 trillion non-agency

market

Greater than $1 trillion in Prime and Alt-A MBS

Opportunity to benefit from unprecedented Government policy to improve liquidity in the non-agency

mortgage market

Ability to invest in collateral-backed assets at significant discount to par value

Creates potential unlevered current cash returns in the mid-teens to low 20’s (coupon yield +

prepayment accretion)

Under severe modeling assumptions we expect to receive more than our investment through

prepayments or reflation

Reflation potential equals gap between cost and face value and should grow as portfolio grows

$164 million at 02/11/10 compared to market cap of $132 million

$800 million in NOLs and NCLs to shelter future earnings and capital gains

Results in potential book value growth and favorable tax treatment for dividends

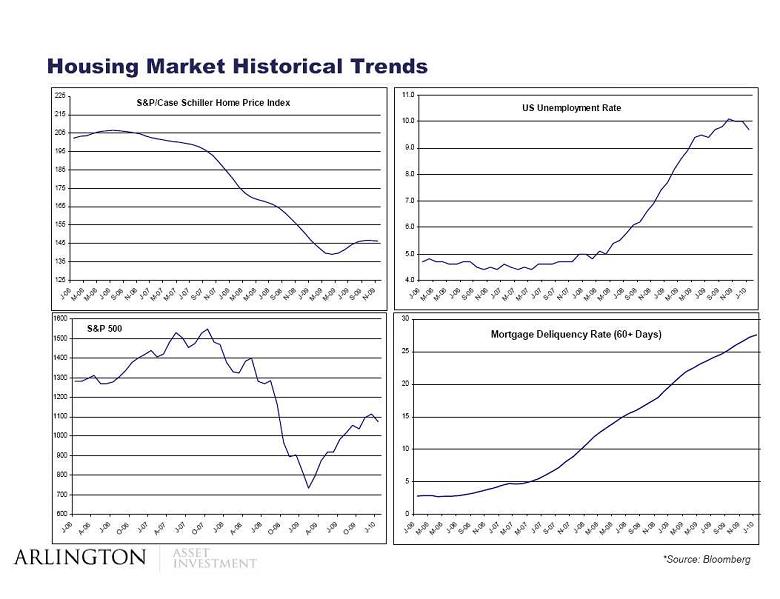

Housing Market Historical Trends

*Source: Bloomberg

S&P/Case Schiller Home Price Index

125

135

145

155

165

175

185

195

205

215

225

S&P 500

600

700

800

900

1000

1100

1200

1300

1400

1500

1600

US Unemployment Rate

4.0

5.0

6.0

7.0

8.0

9.0

10.0

11.0

Mortgage Deliquency Rate (60+ Days)

0

5

10

15

20

25

30

Housing Market Historical Trends

*Source: Bloomberg

S&P/Case Schiller Home Price Index

125

135

145

155

165

175

185

195

205

215

225

S&P 500

600

700

800

900

1000

1100

1200

1300

1400

1500

1600

US Unemployment Rate

4.0

5.0

6.0

7.0

8.0

9.0

10.0

11.0

Mortgage Deliquency Rate (60+ Days)

0

5

10

15

20

25

30

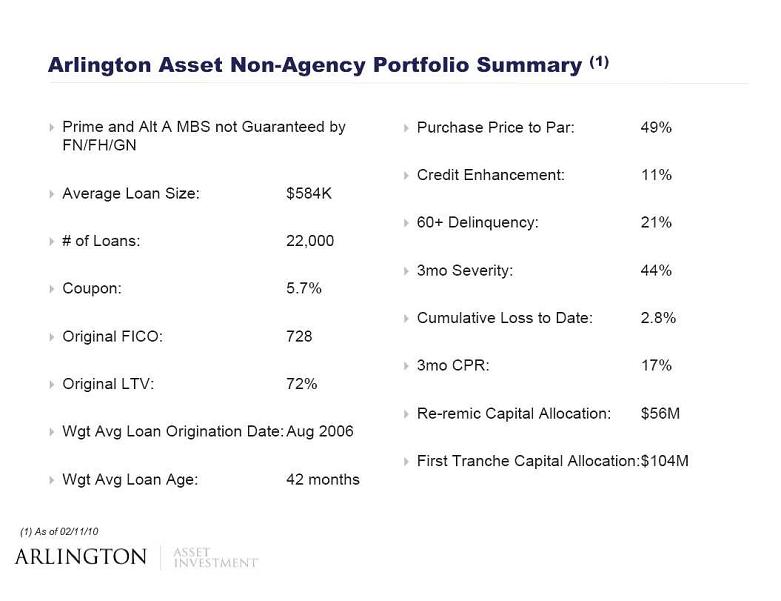

Arlington Asset Non-Agency Portfolio Summary (1)

Prime and Alt A MBS not Guaranteed by

Arlington Asset Non-Agency Portfolio Summary (1)

Prime and Alt A MBS not Guaranteed by

FN/FH/GN

Average Loan Size: $584K

# of Loans: 22,000

Coupon: 5.7%

Original FICO: 728

Original LTV: 72%

Wgt Avg Loan Origination Date: Aug 2006

Wgt Avg Loan Age: 42 months

Purchase Price to Par: 49%

Credit Enhancement: 11%

60+ Delinquency: 21%

3mo Severity: 44%

Cumulative Loss to Date: 2.8%

3mo CPR: 17%

Re-remic Capital Allocation: $56M

First Tranche Capital Allocation:$104M

(1) As of 02/11/10

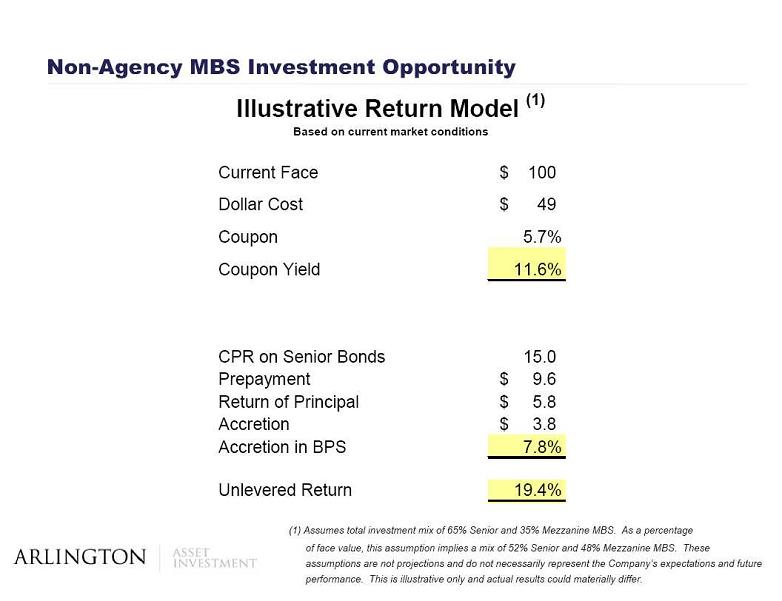

Non-Agency MBS Investment Opportunity

(1) Assumes total investment mix of 65% Senior and 35% Mezzanine MBS. As a percentage

of face value, this assumption implies a mix of 52% Senior and 48% Mezzanine

MBS. These

Non-Agency MBS Investment Opportunity

(1) Assumes total investment mix of 65% Senior and 35% Mezzanine MBS. As a percentage

of face value, this assumption implies a mix of 52% Senior and 48% Mezzanine

MBS. These

assumptions are not projections and do not necessarily represent the Company’s expectations and future

performance. This is illustrative only and actual results could materially differ.

Current Face

100

$

Dollar Cost

49

$

Coupon

5.7%

Coupon Yield

11.6%

CPR on Senior Bonds

15.0

Prepayment

9.6

$

Return of Principal

5.8

$

Accretion

3.8

$

Accretion in BPS

7.8%

Unlevered Return

19.4%

Illustrative Return Model

(1)

Based on current market conditions

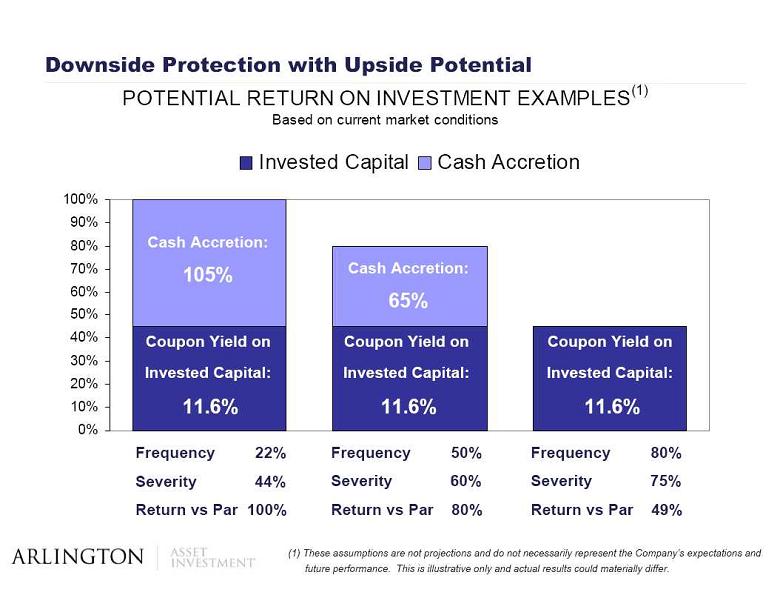

Downside Protection with Upside Potential

Frequency 22%

Severity 44%

Return vs Par 100%

Frequency 50%

Severity 60%

Return vs Par 80%

Frequency 80%

Severity 75%

Return vs Par 49%

Coupon Yield on

Invested Capital:

11.6%

Coupon Yield on

Invested Capital:

11.6%

Coupon Yield on

Invested Capital:

11.6%

Cash Accretion:

105%

Cash Accretion:

65%

(1) These assumptions are not projections and do not necessarily represent the Company’s expectations and

Downside Protection with Upside Potential

Frequency 22%

Severity 44%

Return vs Par 100%

Frequency 50%

Severity 60%

Return vs Par 80%

Frequency 80%

Severity 75%

Return vs Par 49%

Coupon Yield on

Invested Capital:

11.6%

Coupon Yield on

Invested Capital:

11.6%

Coupon Yield on

Invested Capital:

11.6%

Cash Accretion:

105%

Cash Accretion:

65%

(1) These assumptions are not projections and do not necessarily represent the Company’s expectations and

future performance. This is illustrative only and actual results could

materially differ.

POTENTIAL RETURN ON INVESTMENT EXAMPLES

(1)

Based on current market conditions

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Invested Capital

Cash Accretion

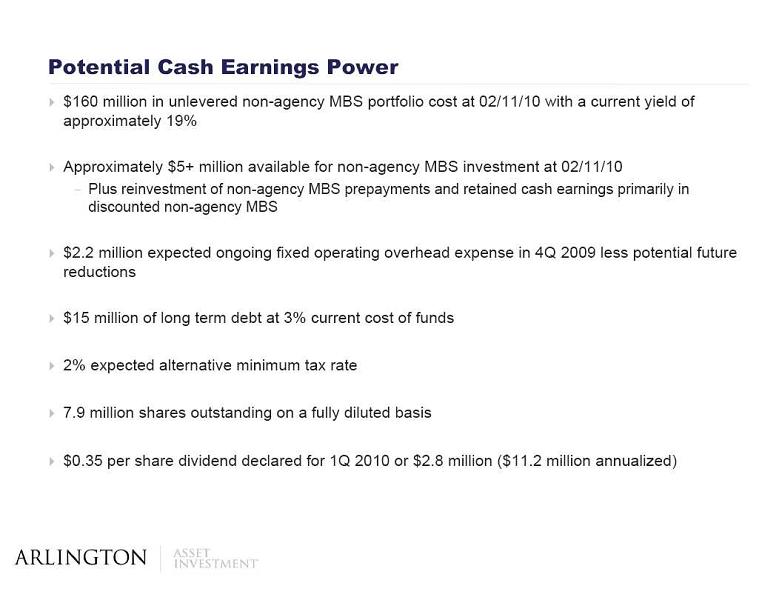

Potential Cash Earnings Power

$160 million in unlevered non-agency MBS portfolio cost at 02/11/10 with a current yield of

Potential Cash Earnings Power

$160 million in unlevered non-agency MBS portfolio cost at 02/11/10 with a current yield of

approximately 19%

Approximately $5+ million available for non-agency MBS investment at 02/11/10

Plus reinvestment of non-agency MBS prepayments and retained cash earnings primarily in

discounted non-agency MBS

$2.2 million expected ongoing fixed operating overhead expense in 4Q 2009 less potential future

reductions

$15 million of long term debt at 3% current cost of funds

2% expected alternative minimum tax rate

7.9 million shares outstanding on a fully diluted basis

$0.35 per share dividend declared for 1Q 2010 or $2.8 million ($11.2 million annualized)

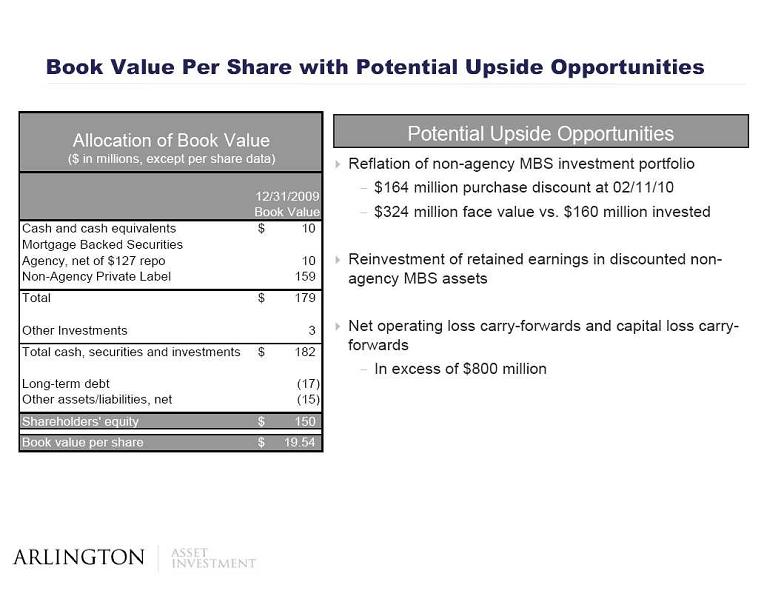

Book Value Per Share with Potential Upside Opportunities

Reflation of non-agency MBS investment portfolio

$164 million purchase discount at 02/11/10

$324 million face value vs. $160 million invested

Reinvestment of retained earnings in discounted non-

Book Value Per Share with Potential Upside Opportunities

Reflation of non-agency MBS investment portfolio

$164 million purchase discount at 02/11/10

$324 million face value vs. $160 million invested

Reinvestment of retained earnings in discounted non-

agency MBS assets

Net operating loss carry-forwards and capital loss carry-

forwards

In excess of $800 million

Potential Upside Opportunities

12/31/2009

Book Value

Cash and cash equivalents

10

$

Mortgage Backed Securities

Agency, net of $127 repo

10

Non-Agency Private Label

159

Total

179

$

Other Investments

3

Total cash, securities and investments

182

$

Long-term debt

(17)

Other assets/liabilities, net

(15)

Shareholders' equity

150

$

Book value per share

19.54

$

Allocation of Book Value

($ in millions, except per share data)

Conclusion

Successfully invested equity in attractive non-agency MBS portfolio during 2009

$324 million non-agency MBS portfolio at 02/11/10 with cost of 49% of par ($160 million unlevered capital

Conclusion

Successfully invested equity in attractive non-agency MBS portfolio during 2009

$324 million non-agency MBS portfolio at 02/11/10 with cost of 49% of par ($160 million unlevered capital

invested)

20% unlevered yield for 4Q 2009

$0.51 per share operating cash income in 4Q 2009

Declared $0.35 per share dividend for 1Q 2010

Declared expected 50% to 60% dividend payout ratio in current period (excluding non-recurring items)

Attractive non-agency MBS investment opportunities available (Size and nimble approach fit market opportunity,

recent investments meet risk adjusted return expectations)

Low leverage, transparent balance sheet (5% debt to total assets)

Earnings power driven by non-agency MBS strategy

Attractive expected risk/return vs. other alternatives (~20% expected unlevered returns)

Current cash income with potential appreciation (~50% discount to face value)

Utilizes tax benefits

Attractive total return opportunity with significant upside potential

8% dividend yield (based on 02/11/10 price of $17.15)

Retention of cash earnings with reinvestment in discounted assets

Potential to capture, monetize, and reinvest $164 million non-agency MBS purchase discount over time

Straightforward C-Corp structure with in excess of $800 million of tax benefits (off balance sheet)