Attached files

| file | filename |

|---|---|

| 8-K - 8-K FOR 2009 EARNINGS RELEASE - TEMPLE INLAND INC | tin8k2009earnings20100209.htm |

| EX-99.2 - CONFERENCE CALL SLIDES - TEMPLE INLAND INC | tinex99220100209.htm |

| EX-99.1 - 2009 EARNINGS RELEASE - TEMPLE INLAND INC | tinex99120100209.htm |

43

Our

job is to be the best

Investor

Presentation

44

This

presentation contains “forward-looking statements” within the meaning of

the federal securities laws. These statements reflect management’s current views

with respect to future events and are subject to risk and uncertainties. We note

that a variety of factors and uncertainties could cause our actual results to differ

significantly from the results discussed in the forward-looking statements.

Factors and uncertainties that might cause such differences include, but are not

limited to: general economic, market, or business conditions; the opportunities

(or lack thereof) that may be presented to us and that we may pursue;

fluctuations in costs and expenses including the costs of raw materials,

purchased energy, and freight; changes in interest rates; current conditions in

financial markets could adversely affect our ability to finance our operations;

demand for new housing; accuracy of accounting assumptions related to

impaired assets, pension and postretirement costs, contingency reserves, and

income taxes; competitive actions by other companies; changes in laws or

regulations; our ability to execute certain strategic and business improvement

initiatives; the accuracy of certain judgments and estimates concerning the

integration of acquired operations; and other factors, many of which are beyond

our control.

the federal securities laws. These statements reflect management’s current views

with respect to future events and are subject to risk and uncertainties. We note

that a variety of factors and uncertainties could cause our actual results to differ

significantly from the results discussed in the forward-looking statements.

Factors and uncertainties that might cause such differences include, but are not

limited to: general economic, market, or business conditions; the opportunities

(or lack thereof) that may be presented to us and that we may pursue;

fluctuations in costs and expenses including the costs of raw materials,

purchased energy, and freight; changes in interest rates; current conditions in

financial markets could adversely affect our ability to finance our operations;

demand for new housing; accuracy of accounting assumptions related to

impaired assets, pension and postretirement costs, contingency reserves, and

income taxes; competitive actions by other companies; changes in laws or

regulations; our ability to execute certain strategic and business improvement

initiatives; the accuracy of certain judgments and estimates concerning the

integration of acquired operations; and other factors, many of which are beyond

our control.

This

presentation includes non-GAAP financial measures. The

required

reconciliations to GAAP financial measures are included on our website,

www.templeinland.com.

reconciliations to GAAP financial measures are included on our website,

www.templeinland.com.

Forward

Looking Statements

45

Create

Superior and Sustainable Value

• Maximize

ROI

• Profitably grow our

business

46

2009

Scorecard

• Maximize ROI —» 7.0%

ROI

– Corrugated Packaging

—» 16.5%

ROI

• Record earnings of

$347 million

• Highest ROI in peer

group

• Fourth consecutive

year of above cost of capital

returns

returns

– Building

Products —»

(5.0)% ROI

• Generated positive

EBITDA of $17 million, a $9

million improvement over 2008

million improvement over 2008

• Significantly

outperformed peers

47

2009

Scorecard

• Profitably grow our

company

– PBL

acquisition

• $20 million of

synergies

• $30 million from

white-top

• 60%

ROI

48

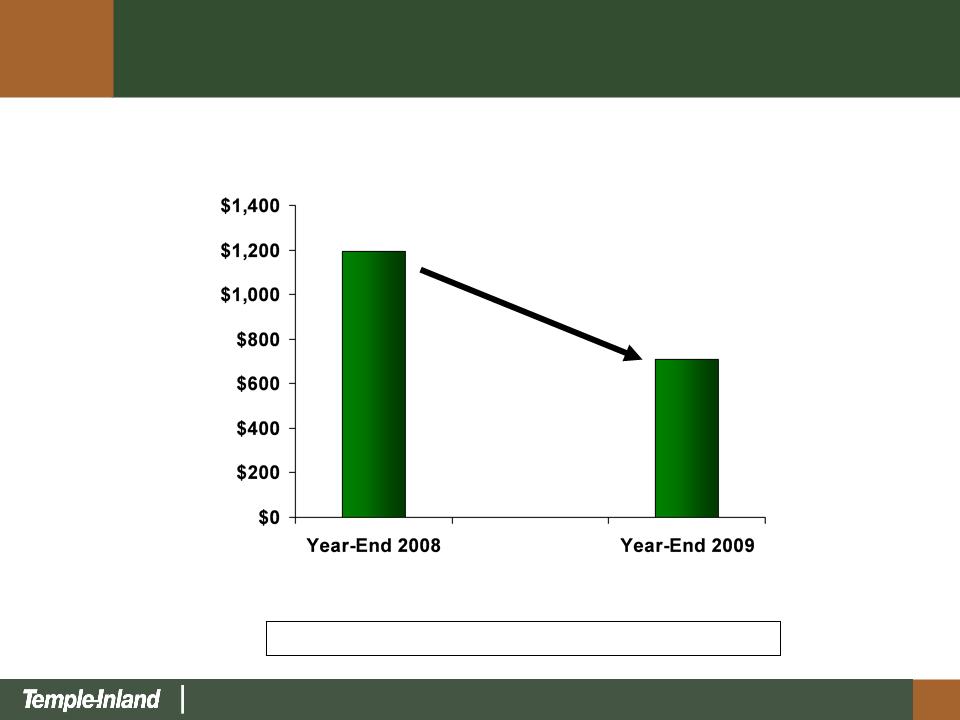

$482

$710

$1,192

Long-term

debt reduced by $482 million in 2009

2009

Long-Term Debt Reduction

49

• Corrugated

Packaging

• Building

Products

Business

Description

Financial

Highlights

|

($

in Millions)

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

|

Revenue

|

$3,587

|

$3,723

|

$4,096

|

$3,850

|

$3,884

|

$3,577

|

|

EBIT

|

$134

|

$133

|

$331

|

$161

|

$111

|

$192

|

|

Investment

|

$2,370

|

$2,431

|

$2,620

|

$2,570

|

$2,484

|

$2,762

|

|

ROI

|

5.7%

|

5.5%

|

12.6%

|

6.3%

|

4.5%

|

7.0%

|

|

EBITDA

|

$340

|

$339

|

$542

|

$364

|

$317

|

$392

|

Notes: Excludes

2004-2007 timber and timberland segment results.

Temple-Inland

50

• 7 mills

- 3.9 million

tons

• 63 converting

facilities

- 3.7 million

tons

• # 3 industry

producer

Business

Highlights

Financial

Highlights

|

($

in Millions)

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

|

Revenue

|

$2,700

|

$2,736

|

$2,825

|

$2,977

|

$3,044

|

$3,190

|

$3,001

|

|

EBIT

|

$18

|

$96

|

$120

|

$255

|

$287

|

$225

|

$347

|

|

Investment

|

$2,237

|

$2,042

|

$2,125

|

$2,039

|

$2,004

|

$1,990

|

$2,109

|

|

ROI

|

0.8%

|

4.7%

|

5.6%

|

12.5%

|

14.3%

|

11.3%

|

16.5%

|

|

EBITDA

|

$185

|

$255

|

$280

|

$408

|

$429

|

$371

|

$492

|

Corrugated Packaging

Segment Highlights

51

•

Maintain high integration level

- Box

plant consumption =

mill

capacity

• Drive

for

low

cost

- Asset utilization

and manufacturing excellence

• Improve

mix and margins

- Sales

excellence

•

Profitably grow business

-

Organically / Acquisition

Lowering

Costs, Improving Efficiencies and Growing Profitably

Corrugated Packaging

Strategic Initiatives

52

Source: Company

reports

Temple-Inland

is the most integrated producer of corrugated containers

Integration Level -

Highest in the Industry

53

Drive

For Low Cost

• Lower mill

costs

– Enhanced

reliability

– Targeted investments

to reduce energy consumption and

enhance mix flexibility

enhance mix flexibility

• Lower box plant

costs

– Box plant

transformation

• Cultural change to

lower costs by driving asset utilization

• Fewer plants, fewer

machines, fewer people

54

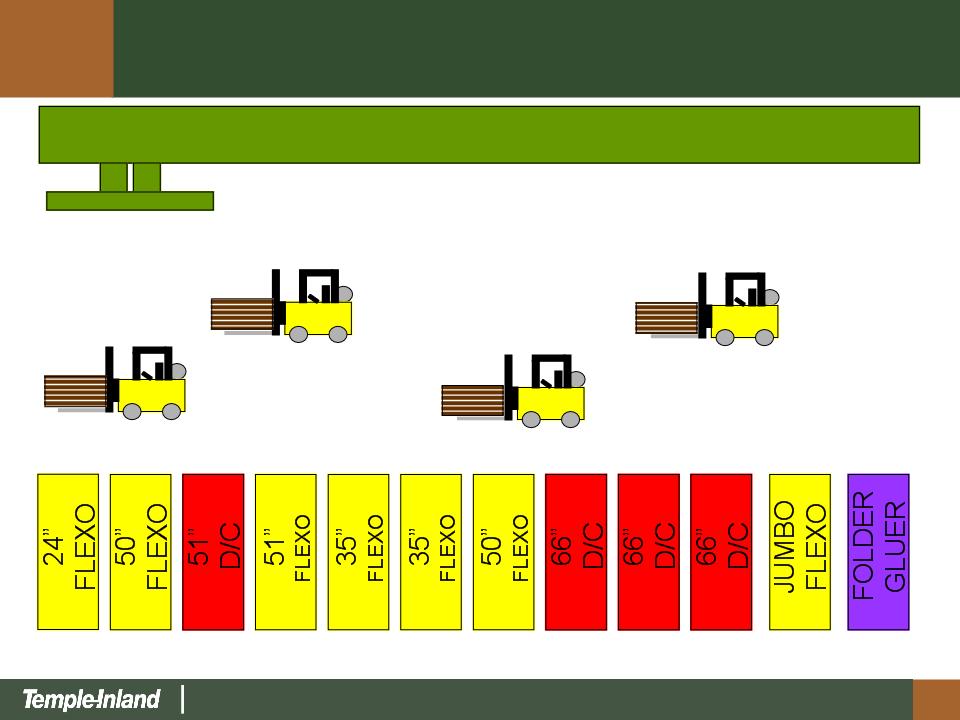

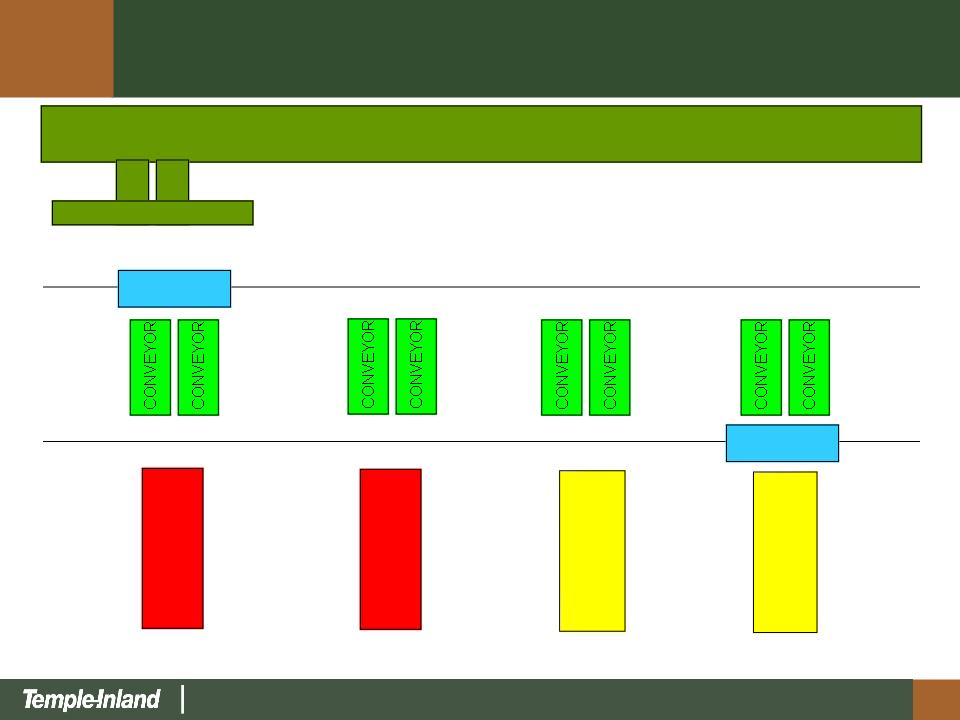

98”

CORRUGATOR

12

Machines

Asset

Utilization

Lexington Plant - Old Layout

Lexington Plant - Old Layout

55

98”

CORRUGATOR

T-CART

T-CART

66”

D/C

35”

EVOL

66”

D/C

4

Machines

35”

EVOL

Asset

Utilization

Lexington Plant - New Layout

Lexington Plant - New Layout

56

Box

Plant Transformation I (2006-2010)

• EBIT (Lower

Costs)

$80MM/Year

– Fewer Plants

4

– Fewer Machines

88

– Fewer People

1,157

• Investment

$174MM

• ROI

46%

57

Box

Plant Transformation II (2010-2013)

• EBIT (Lower

Costs)

$100MM/Year

– Fewer Plants

12

– Fewer Machines

66

– Fewer People

917

• Investment

$250MM

• ROI

40%

58

Improve

Mix and Margins

• Centralized pricing

decision making

• Structured and

disciplined approach to

market

market

• Target customers

where we can create

value

value

59

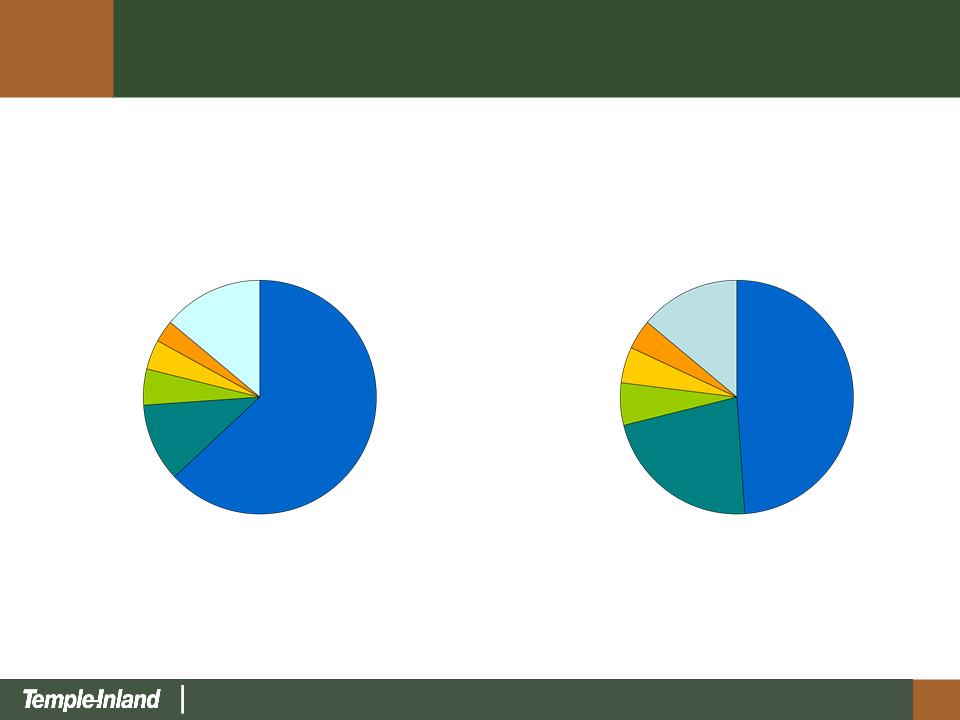

Food

& Beverage

63%

Misc.

Mfg.

3%

Other

14%

Chemicals

4%

Rubber

& Plastics

5%

Paper

& Allied

11%

Food

& Beverage

49%

Paper

& Allied

22%

Rubber

& Plastics

6%

Chemicals

5%

Misc.

Nondurables

4%

Misc.

Durable Goods

14%

Temple-Inland

Industry*

*Source: Fibre Box

Association

Shipments by End-Use

Industry

60

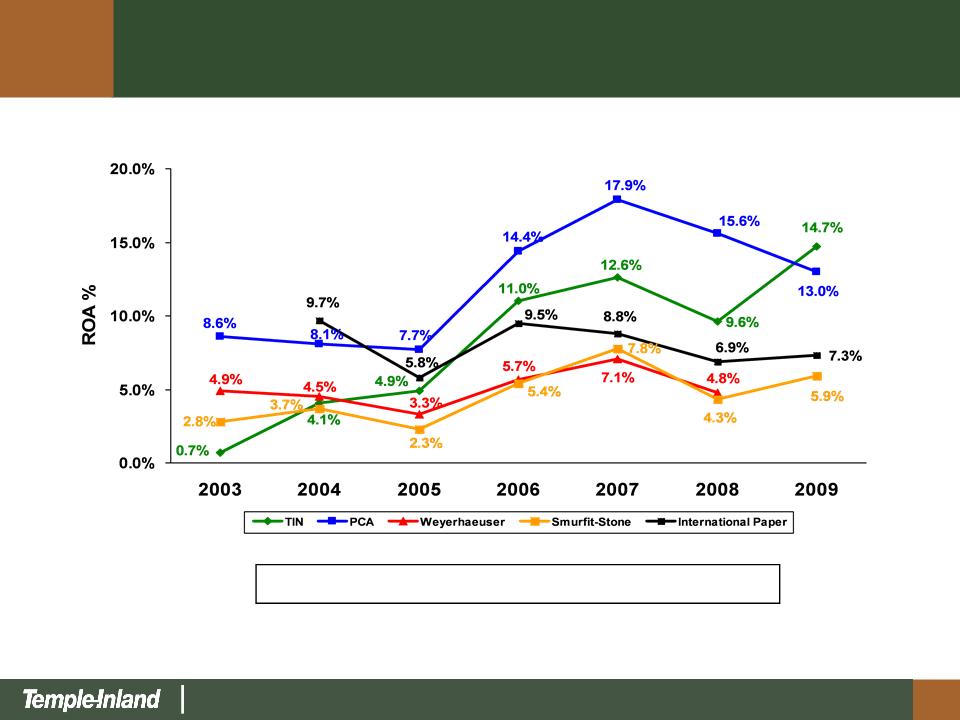

TIN

has highest ROA in the Peer Group

Notes:

(1) As reported by segment excluding special items

for TIN,

IP and Weyerhaeuser. For TIN and IP, the asset base was adjusted to include

acquisitions made in Q3 2008. (2) For PCA, EBIT =

Gross profit-selling and administrative expenses. (3) For SSCC, EBIT as reported by segment; total assets reported for the company in 2007, 2008 and 2009. For prior years, total assets =

segment assets + other assets of $3.3 billion.

Gross profit-selling and administrative expenses. (3) For SSCC, EBIT as reported by segment; total assets reported for the company in 2007, 2008 and 2009. For prior years, total assets =

segment assets + other assets of $3.3 billion.

Corrugated Packaging

- Highest ROA in

Peer Group

Peer Group

61

North

American Corrugated Packaging

Industry Fundamentals

Industry Fundamentals

• Consolidating industry

• Significant capacity

rationalization and

downtime

downtime

• Lower

inventories

• Improved

pricing

62

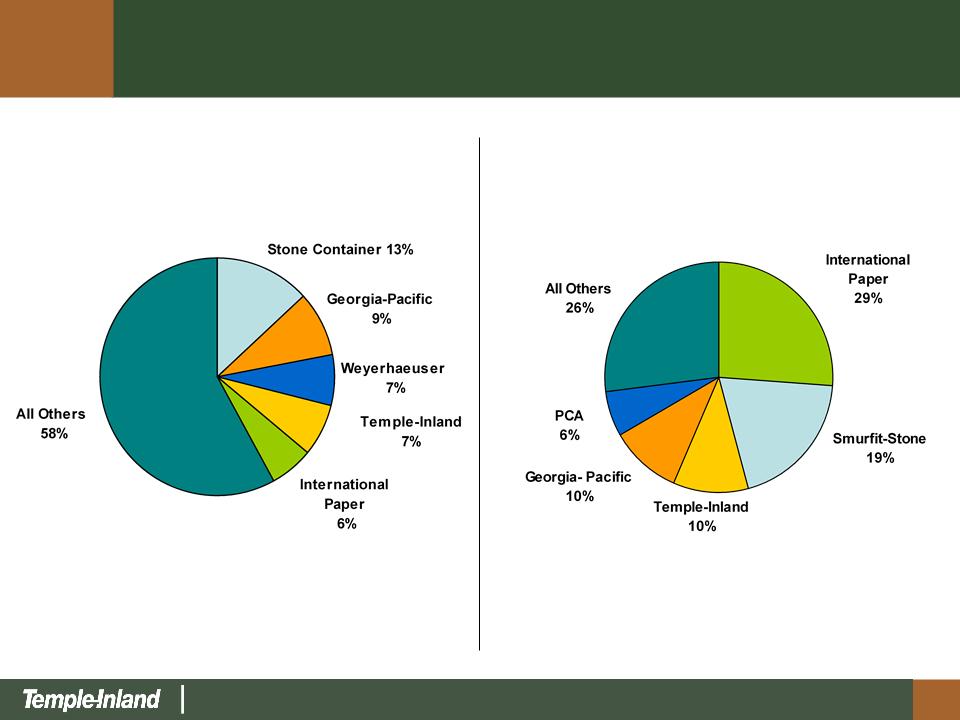

Top 5

Producers= 42%

1998

2010

Top 5

Producers= 74%

North

American Containerboard Market

Share 1998 vs. Today

Share 1998 vs. Today

63

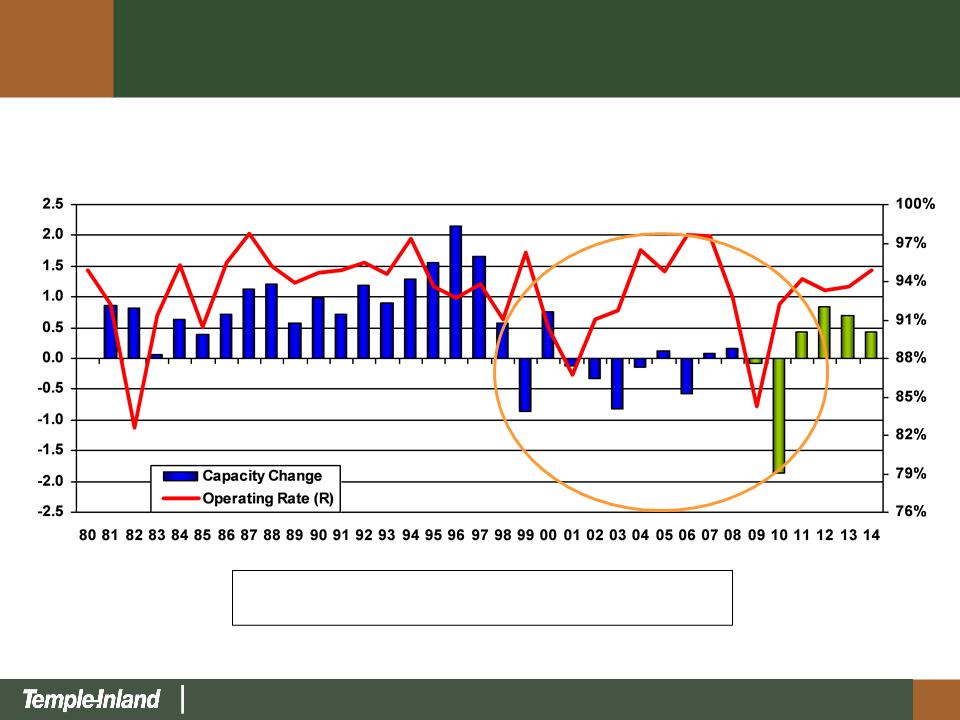

(Million

Short Tons)

Source:

RISI and

Company

reports

Permanent

closure announcements of 2.9 million

tons,

7%

of North American capacity, since Q4 2008

Corrugated

Packaging

Industry Containerboard Capacity Changes and Operating Rate

Industry Containerboard Capacity Changes and Operating Rate

64

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

11.0

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

00

01

02

03

1980

- 1989

Average: 6.4 Weeks

Average: 6.4 Weeks

1990

- 1999

Average: 5.1 Weeks

Average: 5.1 Weeks

2000

- 2009

Average: 4.3 Weeks

Average: 4.3 Weeks

04

05

06

07

Source:

Fibre Box Association

Inventory

levels are at lowest levels since 1994

08

09

Inventory Levels

Continue to Decline

65

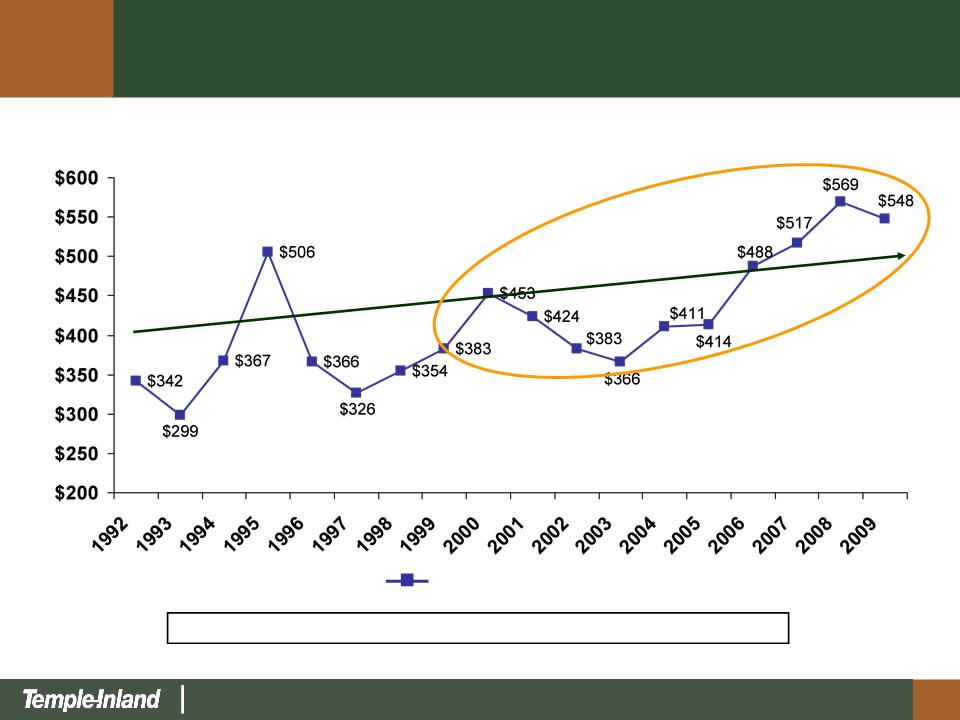

Source:

RISI

Linerboard

($/ton)

Improved

Linerboard Pricing

Linerboard Pricing

Trends

Average

annual linerboard price declined only modestly in 2009

66

Corrugated Packaging

Summary

• Simple, effective

strategy…execution = results

• Track record of

success

• Improving industry

fundamentals

67

• Portfolio

of Products

– Lumber

– Gypsum

– Particleboard

– MDF

• Lowest

quartile cost converting

operations

operations

• Located

near large, high-growth

markets

markets

Financial

Highlights

Business

Highlights

|

($

in Millions)

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

|

Revenue

|

$851

|

$898

|

$1,119

|

$806

|

$694

|

$576

|

|

EBIT

|

$129

|

$125

|

$221

|

$8

|

($40)

|

($27)

|

|

Investment

|

$396

|

$361

|

$586

|

$562

|

$560

|

$535

|

|

ROI

|

32.6%

|

34.6%

|

37.7%

|

1.4%

|

(7.1%)

|

(5.0%)

|

|

EBITDA

|

$167

|

$160

|

$265

|

$53

|

$8

|

$17

|

Building

Products

68

Building Products

Strategic Initiatives

• Deliver

tailored portfolio of building products

– Products for new

home, repair and remodeling

and commercial markets

and commercial markets

• Drive

low cost

– Manufacturing

excellence

• Serve

preferred markets

– Favorable

demographics

• Profitably

grow business

69

Buna

Pineland

Diboll

Rome

DeQuincy

Lumber

Competitive

Position

Temple-Inland

Sawmills

1st

Quartile

2nd

Quartile

3rd

Quartile

4th

Quartile

Source:

Beck &

RISI Studies

RISI Studies

Temple-Inland

Sawmills

Sawmill

Locations

Lumber

• Low cost, state of

art manufacturing system

• Logistically

advantaged to large growing markets

• Stable fiber supply

at market prices

70

Synthetic

Gypsum Furnish

Gypsum

Competitive

Position

Cumberland

Fletcher

W. Memphis

McQueeney

1st

Quartile

2nd

Quartile

3rd

Quartile

4th

Quartile

Source:

Internal

Analysis

Internal

Analysis

Gypsum

• Low-cost

manufacturing system

• Synthetic gypsum

furnish 65% vs. 30% for industry

71

Panels

Competitive

Position

Monroeville

Hope

Diboll

Thomson

1st

Quartile

2nd

Quartile

3rd

Quartile

4th

Quartile

Source:

Beck Study

Beck Study

PB

MDF

El

Dorado

Mt.

Jewett

Industrial Panels -

Particleboard & MDF

• Lowest cost

system

• High-value

engineered family of

products

products

• Targeted

markets

– Kitchen

cabinets

– Laminators

– MDF laminate

flooring

72

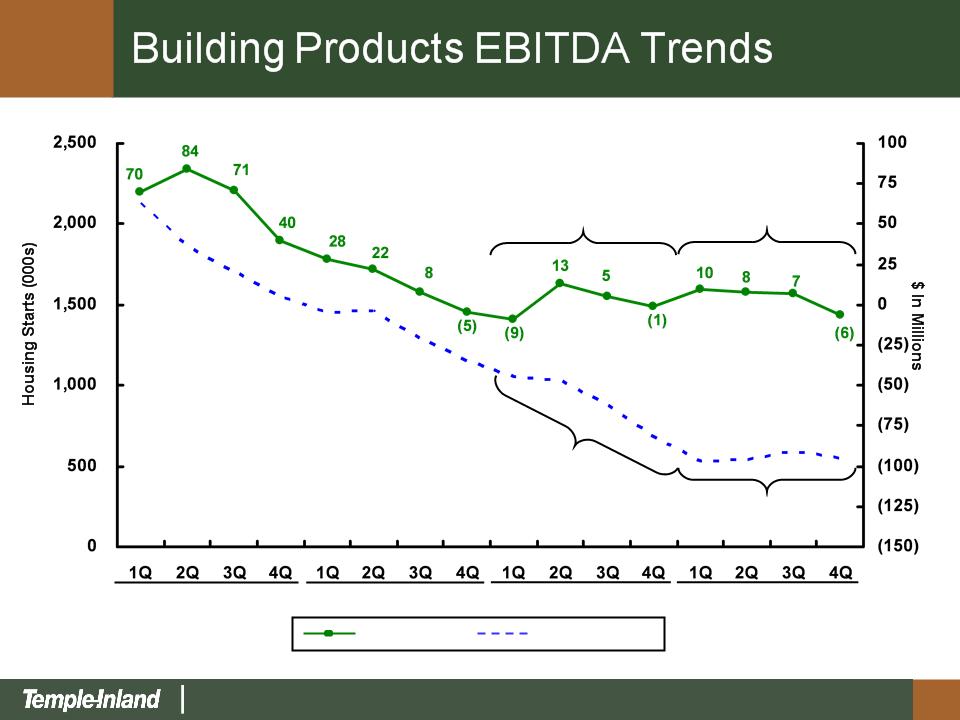

Housing

Starts

TIN

EBITDA

2006

2007

2008

2,127

2009

906

554

$8

$17

73

2010

Financial Priorities

• Return cash to

shareholders

– Maintained dividend

during 2009

– Q1 2010 dividend

increased 10% to

annual rate of $0.44 per share

annual rate of $0.44 per share

• Reduce

debt

• Invest in our

business

• Grow

74

Feb

2010

Create

Superior and Sustainable Value

• Maximize

ROI

• Profitably grow our

business

75

Appendix

76

Total

Debt

$710

Borrowings

Under

Committed

Credit

Facilities

$155

Term

Debt

$555

($

In Millions)

Year-End 2009 Debt

Structure

77

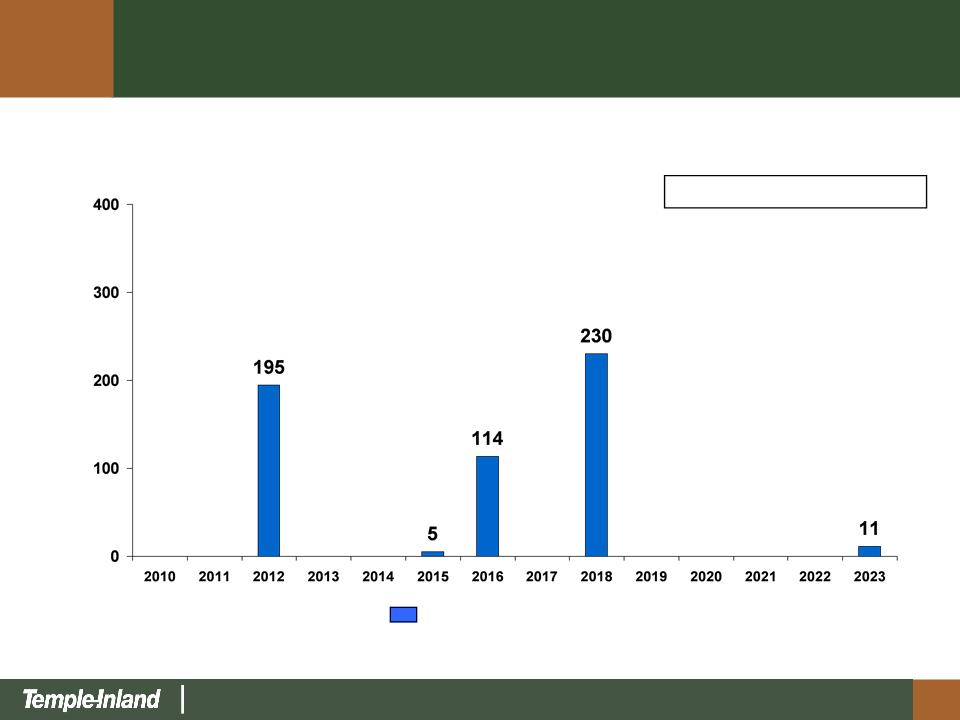

Term

debt

($

In Millions)

Total

Term Debt = $555MM

Term

Debt Maturity Profile as of Year-End

2009

2009

78

Accounts

Receivable Committed

Securitization Credit

Facility Agreements Total

($

In Millions)

Year-End,

2009

Committed Credit Facilities

Committed Credit Facilities

Committed $

250 $

825 $1,075

Less:

Borrowings (130) (25) (155)

Letters

of credit - (30) (30)

Unused

borrowing capacity $ 120 $

770 $ 890

Facility

Maturities Oct,

2012 July,

2011 ($750MM revolver)

Covenants (as

specifically defined): 4Q-End,

2009

Debt/total

capital 43.0% 70%

Max

Interest

coverage * 10.2x

3.0x Min

* Best

4 out of 5 trailing quarters

4Q/2009

= 10.2x