Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CISCO SYSTEMS, INC. | d8k.htm |

| EX-99.1 - PRESS RELEASE OF REGISTRANT - CISCO SYSTEMS, INC. | dex991.htm |

EXHIBIT 99.2

The following is the transcript of a video of the Registrant’s Chief Financial Officer discussing the results of operations for the Registrant’s fiscal second quarter ended January 23, 2010.

Hello, I am Frank Calderoni, Cisco’s Chief Financial Officer.

Today, we announced very strong results for the second quarter of our fiscal year 2010. We exceeded our expectations with $9.8 billion in net sales this quarter representing 8% year over year growth and marking the third quarter of sequentially positive revenue growth.

On a GAAP basis, net income was $1.9 billion or $0.32 per share. On a non-GAAP basis, net income was $2.3 billion and earnings of $0.40 per share. This represents a 25% year over year increase in non-GAAP net income and earnings per share. We are quite pleased with the profitability we continue to return to investors driven by strength across our portfolio.

Today’s results demonstrate the continued successful execution of our strategy with the network becoming the platform for all forms of communications and IT.

We saw continuing good growth in our business validating our portfolio approach in strategically investing in our market adjacencies and core business with an intense focus on profitability and operational execution.

With $39.6 billion in total cash and investments and $2.5 billion in operating cash flow, we exit this quarter with a very compelling financial position and remain very confident in our strategic position in the industry.

Thank you.

February 3, 2010 Q2 Fiscal Year 2010 Frank Calderoni, Executive Vice President and Chief Financial Officer |

2 GAAP RECONCILIATION GAAP RECONCILIATION During this presentation references to financial measures of Cisco will include references to non-GAAP financial measures. Cisco provides a reconciliation between GAAP and non-GAAP at http://investor.cisco.com FORWARD-LOOKING STATEMENTS FORWARD-LOOKING STATEMENTS This presentation contains projections and other forward- looking statements regarding future events or the future financial performance of Cisco, including future operating results. These projections and statements are only predictions. Actual events or results may differ materially from those in the projections or other forward-looking statements. Please see Cisco’s filings with the SEC, including its most recent filings on Form 10-K and Form 10-Q, for a discussion of important risk factors that could cause actual events or results to differ materially from those in the projections or other forward-looking statements. |

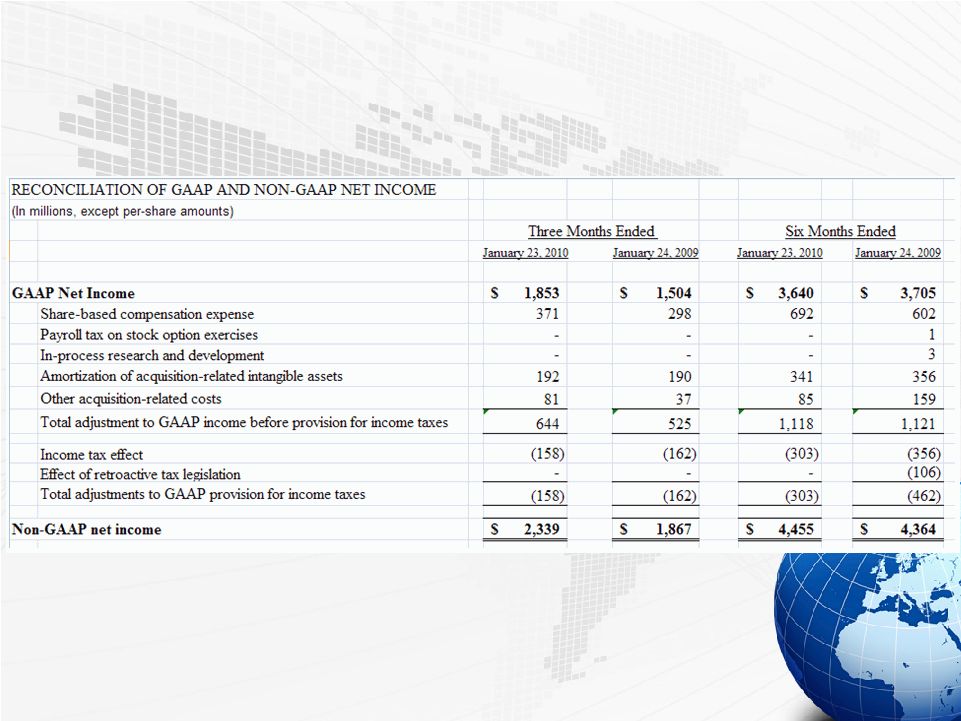

3 RECONCILIATION OF GAAP TO NON-GAAP NET INCOME (In millions, except per-share amounts) |

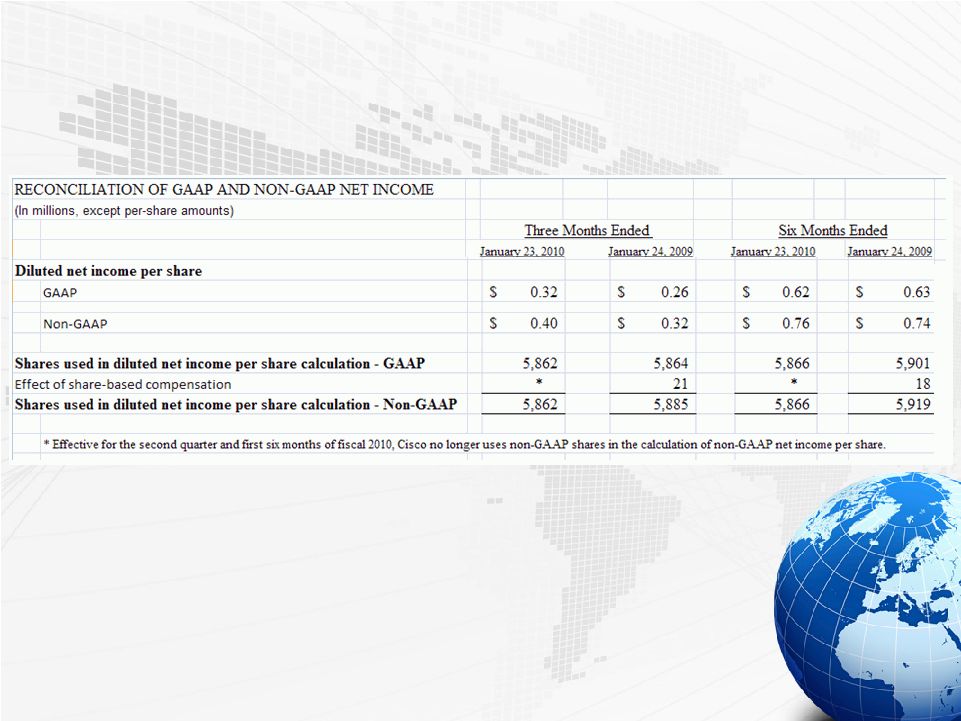

4 RECONCILIATION OF GAAP TO NON-GAAP NET INCOME (In millions, except per-share amounts) |

5 This video may be deemed to contain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among other things, statements regarding future events (such as the profitability we continue to return to investors, the continued successful execution of our strategy, our portfolio approach in strategically investing in our market adjacencies and core business, and our strategic position in the industry) and the future financial performance of Cisco that involve risks and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors, including: business and economic conditions and growth trends in the networking industry, our customer markets and various geographic regions; global economic conditions and uncertainties in the geopolitical environment; overall information technology spending; Forward-Looking Statements |

6 the growth and evolution of the Internet and levels of capital spending on Internet-based systems; variations in customer demand for products and services, including sales to the service provider market and other customer markets; the return on our investments in certain market adjacencies and geographical locations; the timing of orders and manufacturing and customer lead times; changes in customer order patterns or customer mix; insufficient, excess or obsolete inventory; variability of component costs; variations in sales channels, product costs or mix of products sold; our ability to successfully acquire businesses and technologies and to successfully integrate and operate these acquired businesses and technologies; increased competition in our product and service markets, including the data center; dependence on the introduction and market acceptance of new product offerings and standards; rapid technological and market change; manufacturing and sourcing risks; product defects and returns; litigation involving patents, intellectual property, antitrust, shareholder and other matters, and governmental investigations; natural catastrophic events; a pandemic or epidemic; our ability to achieve the benefits anticipated from our |

7 investments in sales and engineering activities; our ability to recruit and retain key personnel; our ability to manage financial risk, and to manage expenses during economic downturns; risks related to the global nature of our operations, including our operations in emerging markets; currency fluctuations and other international factors, including relating to transactions to hedge foreign currency consideration for acquisitions; changes in provision for income taxes, including changes in tax laws and regulations or adverse outcomes resulting from examinations of our income tax returns; potential volatility in operating results; and other factors listed in Cisco’s most recent reports on Form 10-K and Form 10-Q. The financial information contained in this video should be read in conjunction with the consolidated financial statements and notes thereto included in Cisco’s most recent reports on Form 10-K and Form 10-Q, as each may be amended from time to time. Cisco’s results of operations for the three and six months ended January 23, 2010 are not necessarily indicative of Cisco’s operating results for any future periods. Any projections in this video are based on limited information currently available to Cisco, which is subject to change. Although any such projections and the factors influencing them will likely change, Cisco will not necessarily update the information, since Cisco will only provide guidance at certain points during the year. Such information speaks only as of the date of this video. |

8 For more information on Cisco and Cisco’s financials, please visit: http://investor.cisco.com |

|