Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ManpowerGroup Inc. | form_8k.htm |

| EX-99.3 - SUMMARY OF RESTATED RESULTS - ManpowerGroup Inc. | exhibit_99-3.htm |

| EX-99.1 - PRESS RELEASE DATED FEBRUARY 2, 2010 - ManpowerGroup Inc. | exhibit_99-1.htm |

Helping

Clients and Candidates

Win for Over

Six

Decades

2010 February

2

MANPOWER

INC.

2009

4th Quarter

Results

Exhibit

99.2

2

Manpower Inc. 2009

4th Quarter

Results

This presentation

includes forward-looking statements, including earnings projections and the

timing,

completion and results of the proposed transaction, which are subject to risks and uncertainties.

Actual results might differ materially from those projected in the forward-looking statements.

Additional information concerning factors that could cause actual results to materially differ from

those in the forward-looking statements is contained in the Company’s Annual Report on Form 10-K

dated December 31, 2008, which information is incorporated herein by reference, and such other

factors as may be described from time to time in the Company’s SEC filings.

completion and results of the proposed transaction, which are subject to risks and uncertainties.

Actual results might differ materially from those projected in the forward-looking statements.

Additional information concerning factors that could cause actual results to materially differ from

those in the forward-looking statements is contained in the Company’s Annual Report on Form 10-K

dated December 31, 2008, which information is incorporated herein by reference, and such other

factors as may be described from time to time in the Company’s SEC filings.

This presentation

was issued by Manpower Inc. on February 2, 2010 and does not constitute an

offer

of any securities for sale. The exchange offer described herein has not commenced. Manpower

intends to commence an exchange offer and file a Schedule TO and a registration statement on

Form S-4, and COMSYS IT Partners, Inc. intends to file a Solicitation/Recommendation Statement

on Schedule 14D-9, with the Securities and Exchange Commission in connection with the

transaction. Manpower and COMSYS expect to mail a Preliminary Prospectus, the Schedule 14D-9

and related exchange offer materials to stockholders of COMSYS. These documents, however, are

not currently available. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE

DOCUMENTS CAREFULLY WHEN THEY ARE AVAILABLE BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT MANPOWER, COMSYS AND THE TRANSACTION.

Documents filed by Manpower with the SEC may be obtained without charge at the SEC's website at

www.sec.gov and at Manpower's website at www.manpower.com. Documents filed by COMSYS

with the SEC may be obtained without charge at the SEC's website and at COMSYS' website at

www.comsys.com.

of any securities for sale. The exchange offer described herein has not commenced. Manpower

intends to commence an exchange offer and file a Schedule TO and a registration statement on

Form S-4, and COMSYS IT Partners, Inc. intends to file a Solicitation/Recommendation Statement

on Schedule 14D-9, with the Securities and Exchange Commission in connection with the

transaction. Manpower and COMSYS expect to mail a Preliminary Prospectus, the Schedule 14D-9

and related exchange offer materials to stockholders of COMSYS. These documents, however, are

not currently available. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE

DOCUMENTS CAREFULLY WHEN THEY ARE AVAILABLE BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT MANPOWER, COMSYS AND THE TRANSACTION.

Documents filed by Manpower with the SEC may be obtained without charge at the SEC's website at

www.sec.gov and at Manpower's website at www.manpower.com. Documents filed by COMSYS

with the SEC may be obtained without charge at the SEC's website and at COMSYS' website at

www.comsys.com.

Forward-Looking

Statement

3

Manpower Inc. 2009

4th Quarter

Results

(1) Excludes

non-recurring items for 2009 and 2008 as set forth on page 15.

90%

CC

4%

12%

CC

220

bps

Operating

Profit $43M

OP

Margin 1.0%

Revenue $4.4B

Gross

Margin 17.1%

EPS

$.37

360

bps

62%

71%

75%

CC

Q4

Highlights

Throughout

this presentation, the difference between reported variances and Constant

Currency (CC) variances

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

Consolidated

Financial Highlights

As

Reported

Reported

49%

CC

4%

12%

CC

220

bps

140

bps

44%

54%

60%

CC

Excluding

Non-recurring

Items

Items

(1)

4

Manpower Inc. 2009

4th Quarter

Results

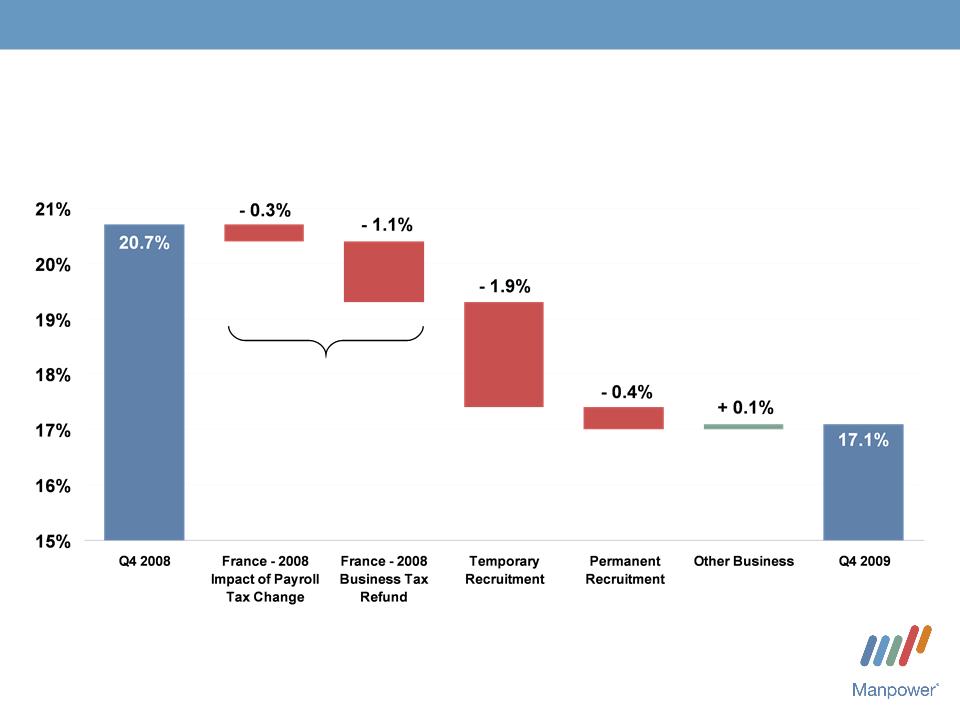

Consolidated Gross

Margin Change

Impact

of Non-recurring Items

= - 1.4%

= - 1.4%

5

Manpower Inc. 2009

4th Quarter

Results

1%

CC

(1) Included in these

amounts is the US, which had revenue of $436M (-6%) and OUP of

$(5M).

(2) Excludes the impact

of the reorganization charges of $1.3M in 2009 and $3.0M in 2008.

1%

CC

0%

Excluding

Non

-recurring

Items

-recurring

Items

Americas

Segment

(16% of Revenue)

(16% of Revenue)

Q4

Financial Highlights

OUP

Margin

0.1%

Revenue

$720M

OUP

$1M

40

bps

As

Reported

Reported

20

bps

Operating

Unit Profit (OUP) is the measure that we use to evaluate

segment

performance. OUP is equal to segment revenues less direct costs and branch and

national headquarters operating costs.

performance. OUP is equal to segment revenues less direct costs and branch and

national headquarters operating costs.

53%

CC

56%

(1)

(2)

0%

54%

CC

55%

6

Manpower Inc. 2009

4th Quarter

Results

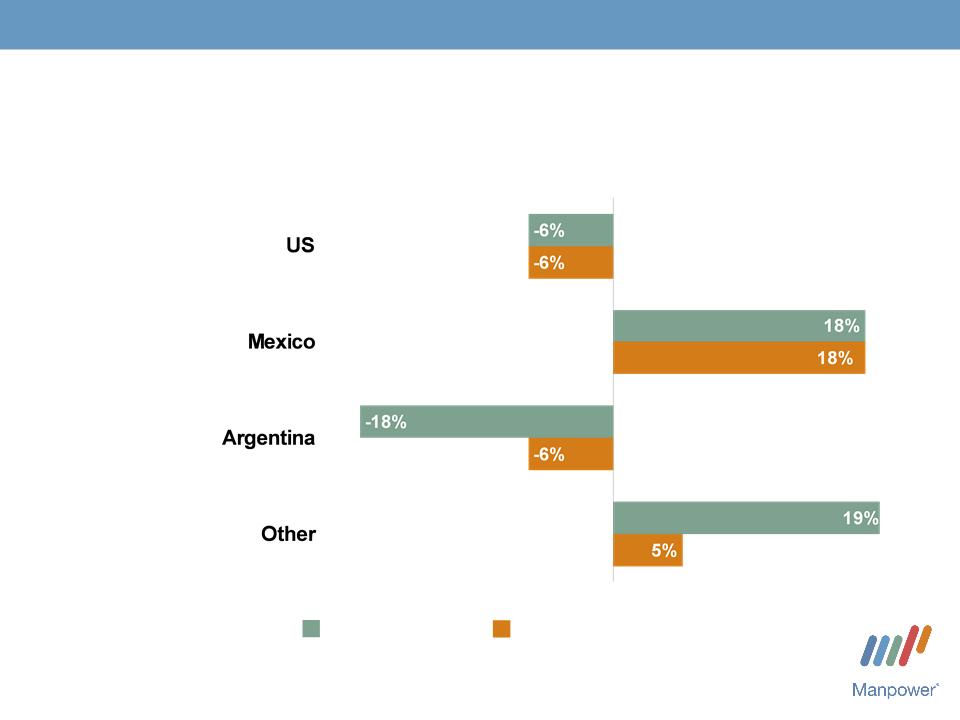

Americas - Q4

Revenue Growth YoY

Revenue

Growth - CC

Revenue

Growth

%

of Segment

Revenue

61%

14%

8%

17%

(1)

(1) On an organic

basis, US revenue decreased 8% in USD.

7

Manpower Inc. 2009

4th Quarter

Results

France

Segment

(29% of Revenue)

(29% of Revenue)

Q4

Financial Highlights

OUP

Margin

0.4%

Revenue

$1.3B

OUP

$5M

3%

14%

CC

290

bps

80%

82%

CC

(1) Excludes the impact

of $4.7M of reorganization charges in 2009, and the business tax refund

of

$48.2M, the payroll tax adjustment of $14.5M and reorganization charges of $2.7M in 2008 (net

favorable impact $60.0M).

$48.2M, the payroll tax adjustment of $14.5M and reorganization charges of $2.7M in 2008 (net

favorable impact $60.0M).

As

Reported

Reported

3%

14%

CC

770

bps

95%

96%

CC

(1)

Excluding

Non

-recurring

Items

-recurring

Items

8

Manpower Inc. 2009

4th Quarter

Results

Excluding

Non

-recurring

Items

-recurring

Items

EMEA

Segment

(40% of Revenue)

(40% of Revenue)

Q4

Financial Highlights

OUP

Margin

2.1%

Revenue

$1.7B

OUP

$36M

7%

15%

CC

200

bps

48%

54%

CC

As

Reported

Reported

7%

15%

CC

120

bps

41%

47%

CC

(2)

(1) Included in these

amounts is Italy, which had revenue of $269M (-11% in USD, -20% in CC) and OUP

of

$11M (-55% in USD, -60% in CC).

$11M (-55% in USD, -60% in CC).

(2) Excludes the impact

of the reorganization charges of $6.4M in 2009 and $21.2M in 2008.

(1)

9

Manpower Inc. 2009

4th Quarter

Results

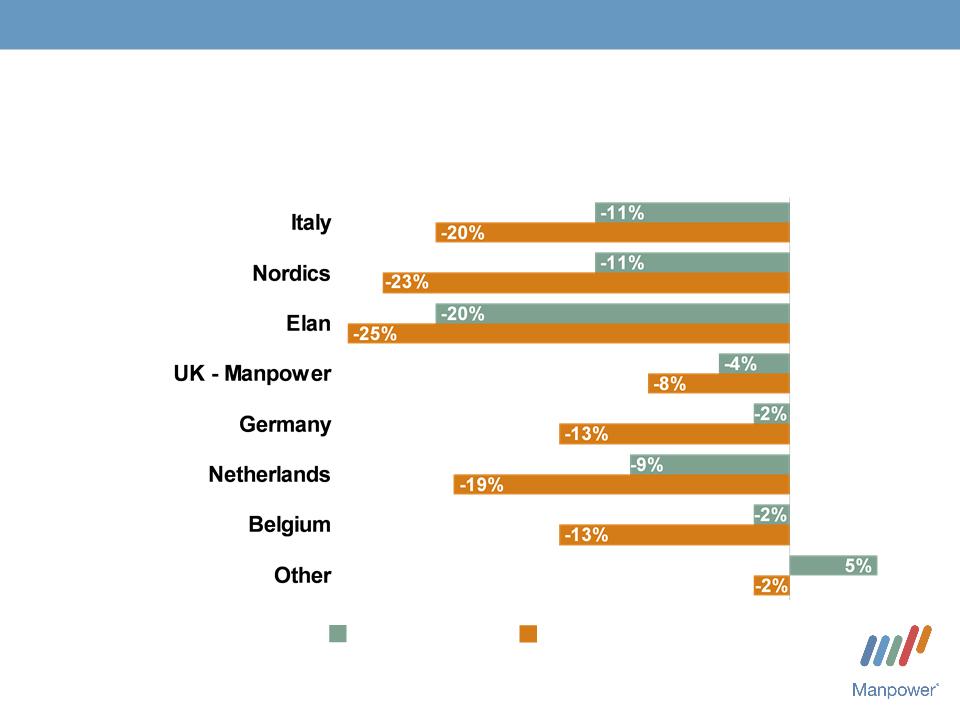

EMEA -

Q4 Revenue Growth YoY

Revenue

Growth - CC

Revenue

Growth

%

of Segment

Revenue

15%

14%

13%

11%

10%

6%

22%

9%

10

Manpower Inc. 2009

4th Quarter

Results

4%

6%

CC

(1) Excludes the impact

of the reorganization charges of $0.4M in 2009 and $0.8M in 2008.

Excluding

Non

-recurring

Items

-recurring

Items

Asia

Pacific Segment

(11% of Revenue)

(11% of Revenue)

Q4

Financial Highlights

OUP

Margin

1.5%

Revenue

$469M

OUP

$7M

170

bps

As

Reported

Reported

4%

6%

CC

180

bps

N/A

(1)

N/A

N/A

N/A

11

Manpower Inc. 2009

4th Quarter

Results

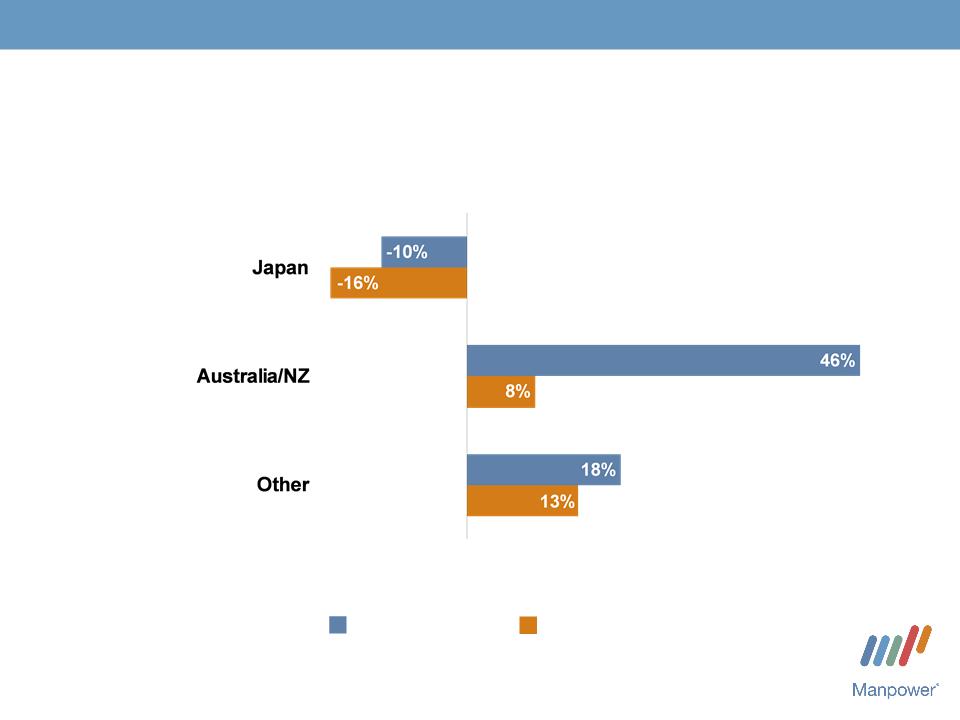

Asia

Pacific - Q4 Revenue Growth YoY

Revenue

Growth - CC

Revenue

Growth

%

of Segment

Revenue

55%

22%

23%

12

Manpower Inc. 2009

4th Quarter

Results

Right

Management Segment

(3% of Revenue)

(3% of Revenue)

Q4

Financial Highlights

OUP

Margin

16.0%

Revenue

$130M

OUP

$21M

5%

1%

CC

100

bps

12%

6%

CC

(1) Excludes the impact

of the reorganization charges of $1.5M in 2008.

As

Reported

Reported

5%

1%

CC

230

bps

22%

16%

CC

(1)

Excluding

Non

-recurring

Items

-recurring

Items

13

Manpower Inc. 2009

4th Quarter

Results

Excluding

Non

-recurring

Items

-recurring

Items

Jefferson Wells

Segment

(1% of Revenue)

(1% of Revenue)

Q4

Financial Highlights

OUP

Margin

-

8.6%

Revenue

$43M

OUP

$(4M)

32%

50

bps

N/A

As

Reported

Reported

32%

1300

bps

N/A

(1)

(1) Excludes the impact

of the reorganization charges of $7.8M in 2008.

14

Manpower Inc. 2009

4th Quarter

Results

Financial

Highlights

15

Manpower Inc. 2009

4th Quarter

Results

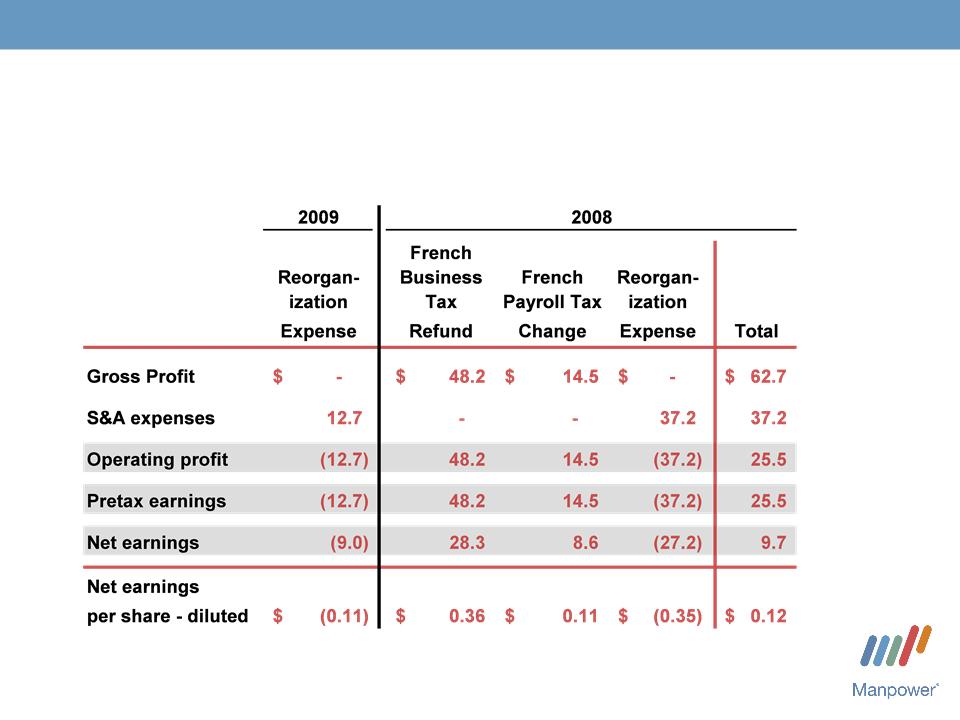

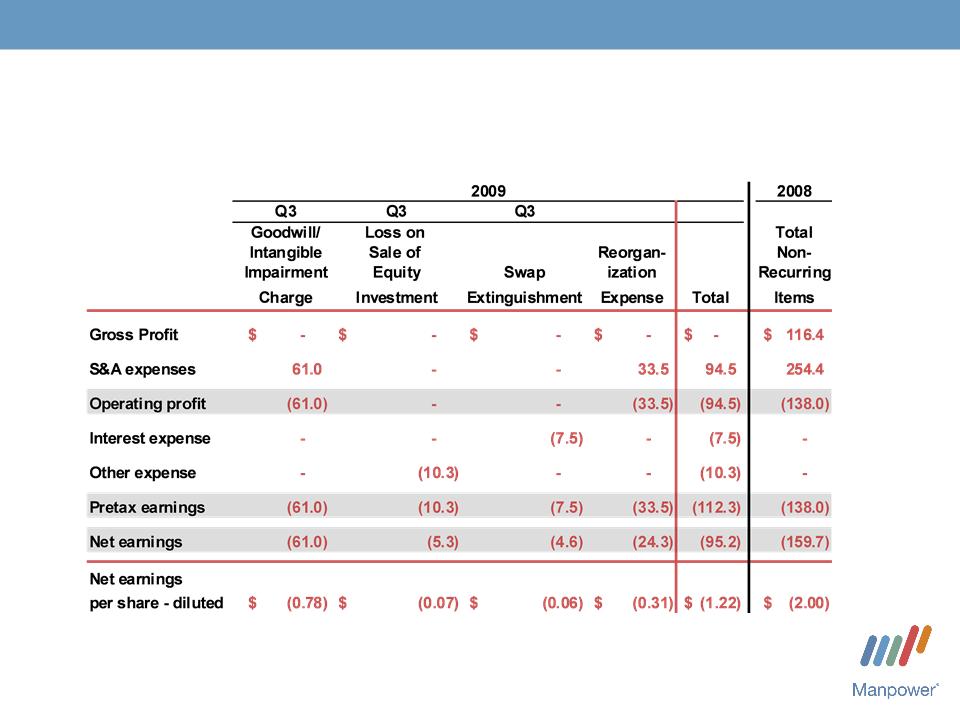

Q4

Non-recurring Items

($ in

millions, except per share amounts)

16

Manpower Inc. 2009

4th Quarter

Results

Full

Year Non-recurring Items

($ in

millions, except per share amounts)

(1) Reorganization

expense was $6.9M pretax in Q1($0.06 per share), $13.0M in Q2 ($0.11 per share),

$0.9M in

Q3 ($0.01 per share) and $12.7M in Q4 ($0.11 per share).

Q3 ($0.01 per share) and $12.7M in Q4 ($0.11 per share).

(1)

17

Manpower Inc. 2009

4th Quarter

Results

Other

(26)

Change

in Cash

141

337

(39)

Cash

Flow Summary - Full Year

2009

2008

Cash

from Operations

414

792

Capital

Expenditures

(35)

(93)

Free

Cash Flow

379

699

Share

Repurchases

-

(125)

Change

in Debt

(22)

79

($ in

millions)

Effect

of Exchange Rate Changes

37

(35)

Acquisitions

of Businesses,

net of

cash acquired

(242)

(227)

18

Manpower Inc. 2009

4th Quarter

Results

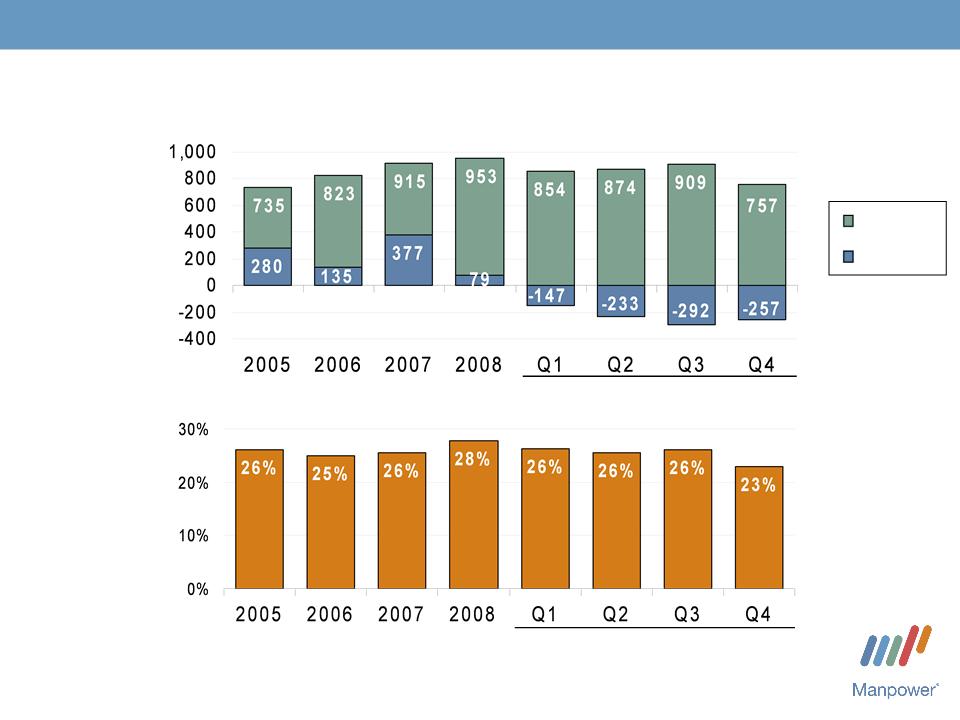

2009

Balance

Sheet Highlights

Total

Debt

($ in

millions)

Total

Debt to

Total

Capitalization

Total

Debt

Net

Debt

2009

19

Manpower Inc. 2009

4th Quarter

Results

Credit

Facilities as of December 31, 2009

($ in millions)

($ in millions)

(a)

(a)

Effective October 16,

2009, we amended our Revolving Credit Agreement. The

amendment reduces the size of the facility from $625M to

$400M and revises covenant levels and pricing. The amended agreement requires, as of December 31, that we comply with a Debt-to-

EBITDA ratio of less than 5.25 to 1 and a fixed charge coverage ratio of greater than 1.25 to 1. As defined in the agreement, we had a Debt-to

-EBITDA ratio of 3.64 and a fixed charge coverage ratio of 1.55 as of December 31, 2009.

$400M and revises covenant levels and pricing. The amended agreement requires, as of December 31, that we comply with a Debt-to-

EBITDA ratio of less than 5.25 to 1 and a fixed charge coverage ratio of greater than 1.25 to 1. As defined in the agreement, we had a Debt-to

-EBITDA ratio of 3.64 and a fixed charge coverage ratio of 1.55 as of December 31, 2009.

On

October 16, 2009, we elected to repay the €100M ($143M) borrowing under the

agreement and terminated the related interest rate swaps.

There are currently no outstanding borrowings under the agreement.

There are currently no outstanding borrowings under the agreement.

Interest

Rate

Maturity

Date

Total

Outstanding

Remaining

Available

Euro

Notes:

-

Euro 200M

4.86%

June

2013

286

-

-

Euro 300M

4.58%

June

2012

429

-

Revolving

Credit Agreement

2.78%

Nov

2012

-

391

368

Uncommitted

lines and Other

Various

Various

42

Total

Debt

757

759

(b)

(b)

Total

additional borrowings are limited to $334 million due to the Revolving Credit

Agreement covenants.

20

Manpower Inc. 2009

4th Quarter

Results

First

Quarter Outlook

Revenue

Up

9-11%

(Up

0-2% CC)

Total

Gross

Profit Margin

16.8-17.0%

Operating

Profit Margin

(0.2) -

0.2%

Tax

Rate

40%

EPS

Loss of

$0.05-$0.15

(Pos. $.03 Currency)

Americas

Up

17-19%

France

Up

13-15%

(Up

5-7% CC)

Up

8-10%

Asia

Pacific

(Down

0-2% CC)

Jefferson

Wells

Right

Management

Down

18-20%

(Down

23-25% CC)

Down

20-22%

EMEA

(Down

2-4% CC)

Up

7-9%

(Up

13-15% CC)

COMSYS

Acquisition

2010 February

MANPOWER

INC.

Strategic

Rationale

• Increased capability

to service clients’ IT requirements

• Stronger platform in

higher growth market

• Enhances business

mix, with over 20% of company

revenue now coming from specialty services

revenue now coming from specialty services

• Good cultural

fit

22

Manpower Inc. -

COMSYS Acquisition

COMSYS

Business Overview

• Third largest IT

staffing and managed solutions company

in the U.S. with $650 million in revenue

in the U.S. with $650 million in revenue

– Project

Management

– Business

Analysis

– Network

Infrastructure

– Business

Intelligence

• National footprint

with 52 branches

• Diversified client

base across several high growth

industry sectors

industry sectors

23

Manpower Inc. -

COMSYS Acquisition

– Applications

Programming and Development

– Quality Assurance

and Testing

– Workforce Solutions

(RPO and MSP)

Combined

Business

• Combined revenue of

Manpower Professional and

COMSYS will be over $2.5 billion

COMSYS will be over $2.5 billion

• Combined number of

contractors on assignment daily

will be over 25,000

will be over 25,000

• Combined footprint

will be 400 offices

• Combined MSP

offering will be total flow through dollars

of $3.5 billion

of $3.5 billion

24

Manpower Inc. -

COMSYS Acquisition

25

Manpower Inc. -

COMSYS Acquisition

(1) Forecast based upon

management guidance issued January 6, 2010.

(2) Excludes one-time

items.

(1)

(1)

(6.0%) (6.3%) (6.8%) (6.0%) (4.0%)

(2)

Acquisition

Summary

• Purchase

Price: $17.65

per share

• Equity Value: $378

million, including net settlement

of stock options, restricted stock and

warrants

of stock options, restricted stock and

warrants

• Debt

Retired: $53

million, net debt outstanding as of

January 31, 2010

January 31, 2010

26

Manpower Inc. -

COMSYS Acquisition

Acquisition

Summary

• Consideration: 50%

stock / 50% cash,

with option to pay all cash

with option to pay all cash

• Tender

Offer: Expected

to commence March 2010

• Expected

Closing: April

2010

• Approvals: Normal

regulatory

27

Manpower Inc. -

COMSYS Acquisition

Acquisition

Summary

• Synergies: $20

million (3% of revenue) by 2011

• Tax NOL: $35

million (NPV) tax shelter utilized

over next 10 years

over next 10 years

• Integration

Costs: $18

million

• EPS

Accretive: 10

cents accretive in 2010

excluding intangible amortization

excluding intangible amortization

28

Manpower Inc. -

COMSYS Acquisition

Manpower

Inc.

Questions?

Answers