Attached files

| file | filename |

|---|---|

| 8-K - BLUEGREEN VACATIONS CORP | i00035_bxg-8k.htm |

Statements in this presentation may constitute forward looking statements and are made pursuant to the Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Forward looking statements are based largely on expectations and are subject to a number of risks and uncertainties including but not limited to the risks and uncertainties associated with economic, credit market, competitive and other factors affecting the Company and its operations, markets, products and services, as well as the risk that the Company may not be able to refinance or restructure outstanding debt; the Company’s strategic initiatives are not maintained successfully, do not have the expected impact on the Company’s financial position, results or operations, liquidity, and credit prospects; the performance of the Company’s vacation ownership notes receivable may continue to deteriorate in the future; the Company may not be in a position to draw down on its existing credit lines or may be unable to renew, extend or replace such lines of credit; the Company may require new credit lines to provide liquidity for its operations, including facilities to sell or finance its notes receivable; real estate inventories, notes receivable, retained interests in notes receivable sold or other assets will be determined to be impaired in the future; risks relating to pending or future litigation, claims and assessments; sales and marketing strategies related to Resorts and Communities properties may not be successful; retail prices and homesite yields for Communities properties may be below the Company’s estimates; marketing costs will increase and not result in increased sales; sales to existing owners will not continue at current levels; fee-for-service initiatives may not be successful; deferred sales may not be recognized to the extent or at the time anticipated; and the risks and other factors detailed in the Company’s SEC filings, including its most recent Annual Report on Form 10-K filed on March 16, 2009, Form 10K/A filed on April 30, 2009, and Form 10-Q filed on November 9, 2009.

Safe Harbor

Company Profile

Top-4(1)publicly-held timeshare company with desirable vertical integration.

Flexible Vacation Club product with broad national footprint, which diversifies

risk.

Communities business focused on retail sales of residential homesites in select

markets.

Strong emphasis on customer experience.

Attractive demographic profile.

Increasing focus on growing base of recurring, Fee-Based Service revenues.

Experienced management team, focused on navigating current market

conditions.

2008 – Implemented dramatic restructuring to preserve liquidity, reduce

overhead and best position the Company for the long term.

(1) Based on VOI Sales

Bluegreen Resorts

RESORTS

Bluegreen Corporation

Vacation Ownership Interests sold through real-

estate based Bluegreen Vacation Club®

215,400 owners (166,700 in Bluegreen Vacation

Club) at 9/30/09

51 in-network resorts, near “drive to” vacation

destinations and Aruba

Access to 18 Shell Vacations Club Resorts

through “Select Connections” partnership

Unique Club Configuration

Bluegreen Vacation Club- ‘Trust’ architecture allows for the

retention of voting rights once inventory is sold, perpetual

management control, and allows for non-judicial foreclosures for

non performing consumer mortgages or assessment fee

obligations.

Members’ ownership is conveyed through a deeded

real estate interest in a specific resort unit

and week which is held in a bankruptcy-remote

trust on the members’ behalf

Members’ ownership is in perpetuity and can be sold,

bequeathed or otherwise conveyed to third parties

Members’ beneficial usage rights consist of an annual or biennial

allotment of vacation points that can be used for varying length

of stays at any of 51 in-network resorts or can be indirectly

exchanged for stays at over 3,700 resorts in over 100 countries

through Resort Condominiums International, LLC (RCI), the

largest vacation ownership exchange company

Advantages of Vacation Club

Distribution Channel – Not limited to typical constraints of selling real estate at a

single site location. Instead, through the Club any approved inventory can be

sold at most of our sales offices.

Long-term relationship with customer – Our agreement to manage the Club

enables us to ensure a consistent service experience for our owners in addition

to providing us with a recurring management fee.

Long-term relationship with resorts – The property management agreements we

have with homeowners’ associations in Club resorts allows us to ensure that

owners receive consistent high quality vacation experiences at all of our resorts.

Similar to the vacation club management agreement, our property management

agreements also provide us with a recurring source of cash-based income.

Bluegreen Vacation Club Attributes

The typical sales objections regarding inventory mix are reduced by allowing the

sales team to focus on the Club structure and the network of resort opportunities

and not just a single site location.

Based on consumers being geographically diverse, regional credit risk in the

Bluegreen mortgage portfolio is mitigated.

Sales team quality and career paths are enhanced due to continuance of sales

beyond typical sellout.

Hotel Room vs. Timeshare Vacation Home

Typical Hotel Room

Typical Bluegreen Resort Villa

1 Bedroom

1 Bathroom

400 Sq. Ft.

2 Bedrooms

2 Bathrooms

Living Area

Full Kitchen

Washer/Dryer

1,100+ Sq. Ft.

Bluegreen Resorts

Mountain Run at Boyne, Boyne Falls Michigan

Club 36, Las Vegas, Nevada

Grande Villas at World Golf Village, St. Augustine, Florida

The Fountains, Orlando, Florida

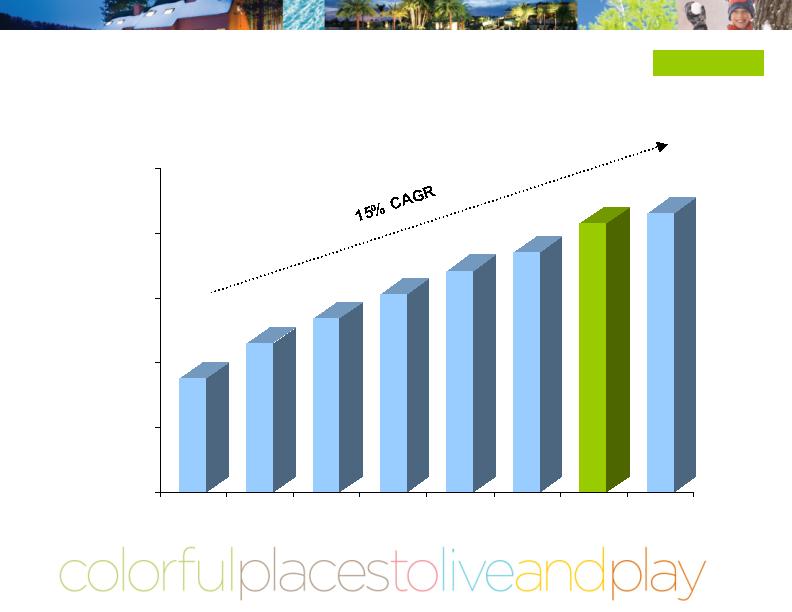

0

50,000

100,000

150,000

200,000

250,000

12/31/2005

12/31/2004

12/31/2003

12/31/2002

12/31/2006

185,000

171,000

12/31/2007

153,000

134,000

115,000

88,000

BluegreenCorporation

RESORTS

Growing Number of Resort Owners

12/31/2008

208,000

215,400

9/30/2009

Additional Sales to Existing Owner Base

0

5

10

15

20

25

30

35

40

45

50

55

2004

2005

2006

2007

2008

YTD Q3 2009

24%

28%

34%

41%

46%

55%

BluegreenCorporation

RESORTS

Timeshare Industry: Impact of Liquidity Crisis

Despite robust sales, most timeshare companies have taken measures to

downsize. Bluegreen was proactively the first amongst the larger entities in the

space to make such changes.

Lack of securitization activity, not lack of consumer demand, has been the

primary driver of Bluegreen’s actions.

Industry-wide impact, including:

Wyndham

Starwood

Marriott

Bluegreen

Goals of Bluegreen’s 2008/2009 Strategic Initiatives

Significantly reduced our timeshare sales operations in an attempt to reduce our

sales pace to our known receivable financing capacity and projected cash sales;

Emphasizing cash-based businesses in our sales, resort management and

finance operations;

Minimizing the cash requirements of Bluegreen Communities;

Reducing overhead and increasing efficiencies;

Minimizing capital spending;

Continuing to provide a high level of quality vacation experiences and customer

service to our VOI owners; and

Generating cash and income.

Sales Mix By Payment Type

2008

2009*

Cash at Close (1)

13%

24%

30-Day Cash-outs (2)

13%

23%

Sales realized in cash in 30 days (1)

24%

41%

% of Sales consisting of mortgage loan

76%

59%

(1)

Includes both 100% cash sales and down payments.

(2)

30-Day Cash-Outs are computed as % of loan balance, not as a % of sales.

* Preliminary

Fee-Based Services

A customized suite of timeshare services and product offerings for third-party property

owners/developers.

Services are based on Bluegreen’s core competencies in:

Sales & Marketing

Property Management

Risk management

Title & Escrow

Design & Development

Mortgage Servicing

Allows third-party property owners/developers to lever off of the benefits of the

Bluegreen Vacation Club product and sales distribution platform.

Cash business, which requires little if any capital expenditure by Bluegreen.

Expands the offerings of the Bluegreen Vacation Club.

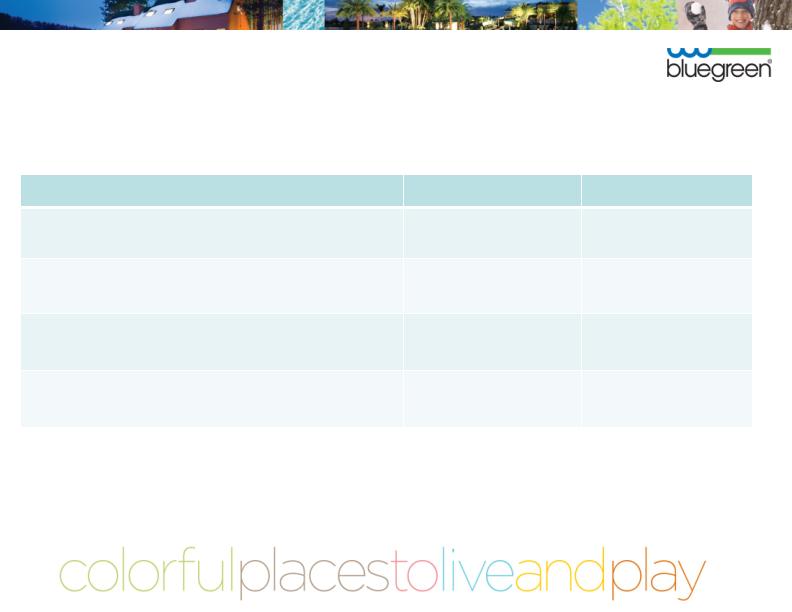

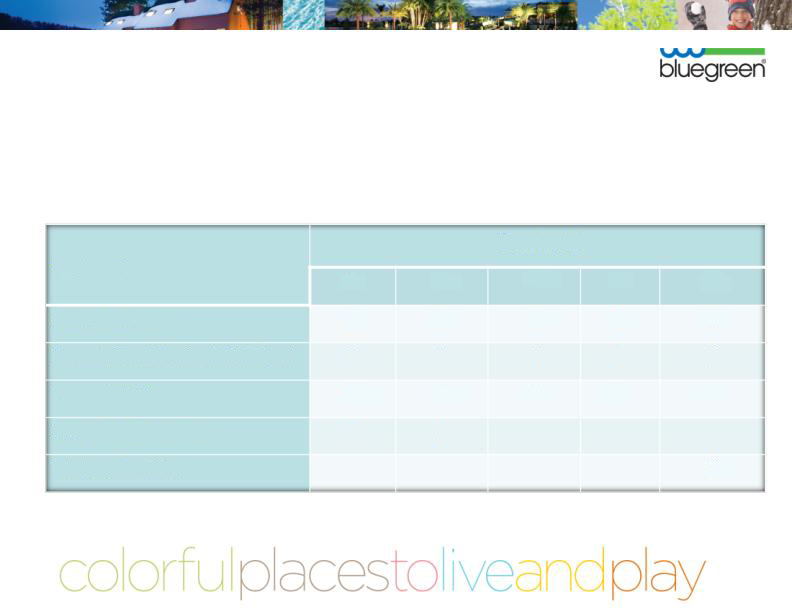

Fee-Based Services

Contract

Service

A

B

C

D

E

Sales & Marketing

X

X

X

X

X

Property Mgmt Services/ Risk Mgmt

X

X

X

X

X

Title & Escrow

X

X

X

X

X

Design & Development

X

X

Mortgage Servicing

X

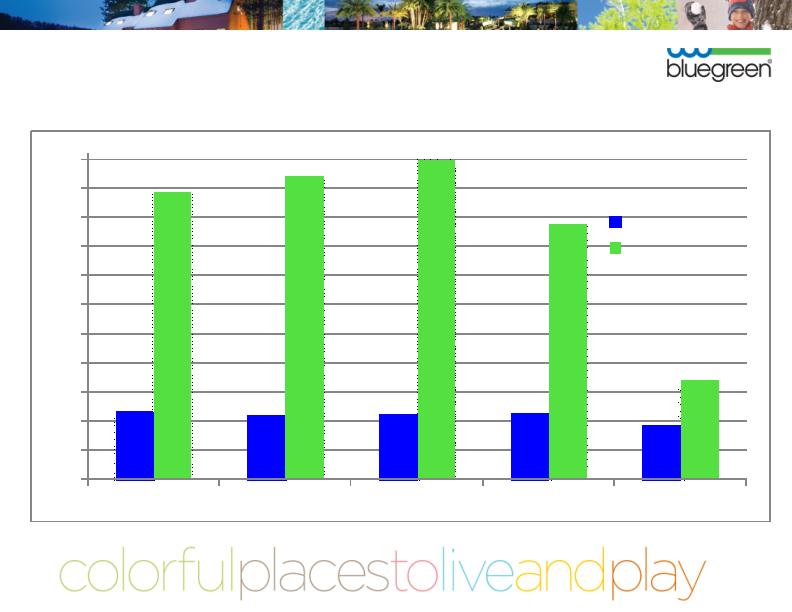

Selling and Marketing Expenses

59

55

56

57

47

247

261

275

220

86

0

25

50

75

100

125

150

175

200

225

250

275

2006

2007

2008

YTD 9/08

YTD 9/09

% of Gross Sales

$ in Millions

Headcount

As of 9/30/08

As of 1/31/09

As of 1/21/10

Resorts

(Excluding Management)

4,187

1,348

1,973

Resorts Management

1,467

1,388

1,338

Communities

342

211

91

Corporate Support

310

202

207

Total

6,306

3,159

3,609

Reduce Capital Expenditures

(in millions)

2008 Actual

2009 Preliminary

Reduction %

Inventory

Spending:

Resorts

$ 119

$ 25

(79)%

Communities

40

6

(85)%

PP&E and

Other Cap Ex

31

2

(94)%

Total:

$ 190

$ 33

(83)%

Results of 2008/2009

Strategic Initiatives YTD 9/30/09

Increased operating/investing cash flow by over $204 million (9 months ended

9/30/09 vs. 9 months ended 9/30/08).

Repaid over $32 million under lines-of-credit and notes payable.

Generated Resorts Field Operating Profit of $31.5 million (19% of sales; YTD 2009)

vs. $31.9 million (10% of sales, YTD 2008), despite over 50% decrease in sales.

Generated positive cash flow from Bluegreen Communities.

Successfully launched “capital-light” fee-based service business model.

Successfully extended over $200 million in debt obligations.

* GAAP Basis.

$0

$100

$200

$300

$400

$500

$600

2006

2007

2008

YTD Q3 ‘08

YTD Q3 ‘09

$420

$476

$496

$385

$184

(a) Excludes estimated uncollectable VOI notes receivable and gain on sales of notes receivable.

BluegreenCorporation

RESORTS

Gross VOI Sales (a)

($ in millions)

Resorts Segment Operating Profit(1)

RESORTS

BluegreenCorporation

$0

$10

$20

$30

$40

$50

$60

2006

2007

2008

YTD Q3 ‘08

YTD Q3 ‘09

$10

$24

$39

$24

$32

(2)

(2)

(2)

(2)

(2)

($ in millions)

(1)

Operating profit prior to the allocation of corporate overhead, interest income, other income (expense), interest expense, income taxes, minority interest, and cumulative effect of change in accounting

principle. Pro forma adjustments by year as noted below.

(2)

Reflects impact of SFAS No. 152, however includes pro forma adjustments to exclude gain on sale of notes receivable of $44.7 million, $39.4 million, $8.2 million, $8.2 million and $0 in 2006, 2007, 2008,

YTD Q3 ‘08 and YTD Q3 ‘09 respectively.

Bluegreen Communities

Direct-to-consumer sales of residential

homesites

Deed restricted communities

“Exurbia” in southeastern and

southwestern United States

Certain properties include golf courses

designed by PGA champions

Primarily a cash business

Pre-sales possible through combination

of bonding to completion and corporate

guaranty

COMMUNITIES

BluegreenCorporation

Bluegreen Communities Strategic Initiatives

Consolidated field operations, thereby eliminating sales, construction and/or administrative

activities at 12 locations.

Eliminated those advertising programs which we believe have become less effective, and focus

primarily on internet marketing campaigns.

Eliminated over 70% of our sales, marketing, development and administrative associates.

As we have completed development of phases of our communities, development expenditures

in 2009 were materially below expenditures in 2008.

Pursue opportunities to use our core competencies to provide services to third-parties on a fee

basis in the areas of:

asset management

market research

other real estate consulting services

Goal : Strive to operate Bluegreen Communities at a cash break-even or better until market

conditions provide other opportunities.

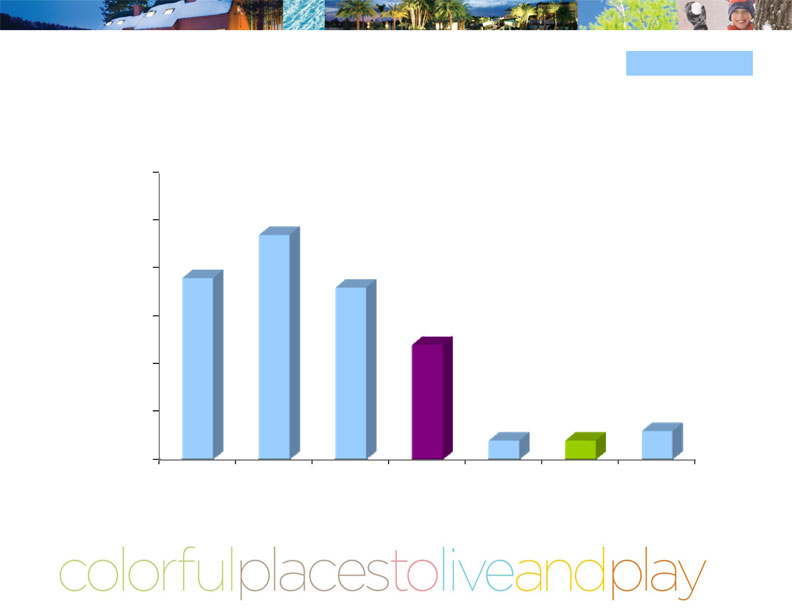

$192

$192

$164

$129

$47

$45

$13

0

20

40

60

80

100

120

140

160

180

200

220

2004

2005

2006

2007

2008

YTD Q3

‘08

YTD Q3

‘09

Bluegreen Communities Sales

COMMUNITIES

BluegreenCorporation

($ in millions)

$0

$10

$20

$30

$40

$50

$60

2004

2005

2006

2007

2008

YTD Q3’08

YTD Q3 ’09

$38

$36

$24

$(4)

$4

$(6)

$47

(2)

($ in millions)

BluegreenCorporation

COMMUNITIES

(1)

Operating profit prior to the allocation of corporate overhead, interest income, other income (expense), interest expense, income taxes, and minority interest.

(2)

Includes $5.2 million of pre-tax inventory impairment charges in 2008.

Bluegreen Communities Segment Operating Profit (Loss)(1)

Bluegreen Corporation Earnings Per Share

(Pro forma as noted)

(a)

Reflects impact of SFAS No. 152

(b)

Pro forma to exclude $ 0.89 per share gain on sale of notes receivable. GAAP EPS was $0.96.

(c)

Pro forma to exclude $0.78 per share gain on sale of notes receivable. GAAP EPS was $1.02.

(d)

Pro Forma to exclude $0.59 per share in primarily non-cash changes for restructuring, goodwill impairment and communities inventory impairment, as well as $ 0.16 gain on sale of receivables. GAAP EPS was $(0.02).

(e)

Pro Forma to excludes $0.16 per share gain on sale of receivables. GAAP EPS was $0.37

$0.00

$0.20

$0.40

$0.60

$0.80

2006

2007

2008

YTD Q3’08

YTD Q3’09

$0.07

$0.24

$0.41

$0.21

$0.46

(a) (b)

(a) (c)

(a) (d)

(a) (e)

(a)

BLUEGREEN CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

$ (220)

$ (54,734)

Net decrease in cash and cash equivalents

(32,338)

117,283

Net cash provided by financing activities

(4,936)

(2,724)

Payment of debt issuance costs

—

132

Proceeds from exercise of stock options

—

(55,000)

Payments on 10.50% senior secured notes

(32,722)

(72,943)

Payments under lines-of-credit facilities and other notes payable

11,818

104,278

payable

Proceeds from borrowings under lines-of-credit facilities and other notes

(67,995)

(76,387)

Payments on borrowings collateralized by notes receivable

61,497

219,927

Proceeds from borrowings collateralized by notes receivable

Financing activities:

25,534

8,357

Net cash provided by investing activities

32,361

34,414

Cash received from retained interests in notes receivable sold

—

(6,105)

Cash used in business acquisitions

13

8

Proceeds from the sale of property and equipment

(6,840)

(19,960)

Purchases of property and equipment

Investing activities:

$ 6,584

$ (180,374)

Net cash (used) provided in operating activities

2009

2008

September 30,

Nine Months Ended

Credit Facilities

($ in thousands)

Lender

Type

Revolving

Advance Period

Expiration

Maturity

Facility

Amount

Amount

Outstanding

Amount

Available

Resorts Division

BB&T

Receivables Purchase Facility

6/29/2010

6/5/2022

$150,000

$131,302

$18,698

(A)(B)

Liberty

Receivable Hypothecation

Facility

8/27/2010

8/27/2014

75,000

59,676

15,324

(A)

Wells Fargo

Capital Finance

Receivable Hypothecation

Facility

12/31/2009

12/31/2010

30,000

14,409

15,591

(A)(C)

$49,613

A.

Facility amount is revolving, so additional availability is generated as the principal balance amortizes, subject to eligible collateral and/or other

terms and conditions.

B.

On-balance sheet, non-recourse (except for representations and warranties).

C.

In discussion regarding up to one year extension on a revolving basis.

As of December 31, 2009

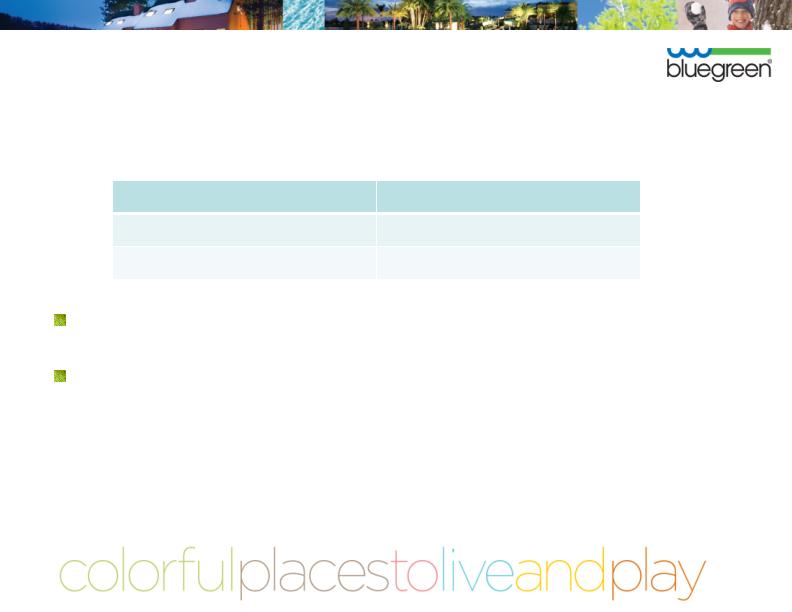

Contractual Debt Maturities

As of December 31, 2009

Debt

Balance

($ in millions)

12/31/09

2010

2011

2012

2013

2014

2015 beyond

Receivable Backed Notes (1)

$ 243.4

$ -

$ -

$ 14.4

$ -

$ 59.7

$ 169.4

Lines of Credit & Notes Payable (1)

185.8

48.0

60.4

59.9

14.4

0.5

2.5

Jr Subordinated Debentures

110.8

-

-

-

-

-

110.8

Subtotal

$ 540.1

$ 48.0

$ 60.4

$ 74.4

$ 14.4

$ 60.1

$ 282.7

Pre-Extension Maturities

540.1

87.5

51.8

50.8

4.1

60.4

285.4

Increase / (Reduction)

$ (39.4)

$ 8.5

$ 23.5

$ 10.3

$ (0.2)

$ (2.6)

1)

Assumes that $40.2 million of Wachovia debt and $14.4 million of Wells Fargo debt are extended pursuant to current

discussions, and that Wachovia further extends remaining $20.7 million again for two years in 2012. There can be no

assurances, that such extensions will occur on favorable terms or at all.

In-house servicing of all receivables;

servicing is centralized at our Boca

Raton, FL headquarters.

Loans Serviced on LSAMS

(Loan Servicing and

Accounting Management

System).

Bluegreen has been servicing

loans for over 20 years. Our

Mortgage management team has

a combined 120 years of

servicing experience, with an

average tenure of 13 years

with Bluegreen.

Notes Receivable Outstanding

(Resorts and Communities)

(in millions)

$171

$218

$250

$300

$371

$460

$569

$699

$823

$932

$833

$0

$250

$500

$750

$1,000

Receivables Financing Program

Bluegreen Resorts

Credit Underwriting Standards

1994 – 2008: 10% Down Payment; No other credit verification

Effective December 15, 2008: Implemented FICO® Score-Based Standards

to determine if credit will be offered and if so on what terms:

* No reduction of interest rate

FICO ®

Minimum Cash %

X > = 600

10%

500 - 599

20% *

X < = 499

100%

* No reduction of interest rate

Effective January 1, 2010 Bluegreen implemented an additional, more

stringent, FICO® Score-Based Standard:

Bluegreen Resorts

Credit Underwriting Standards

FICO ®

Minimum Cash %

X > = 600

10%

575 - 599

20% *

X < = 574

100%

* In the event a borrower goes off of pre-authorized checking, the interest rate will increase by 1%.

Interest Rates

VOI RATES & TERMS

HISTORICAL

Int. Rate

w/o

Down Payment Int. Rate Auto-Debit Max Term

10% 15.90%* 16.90% 10 years

20% 12.90%* 13.90% 10 years

50% 8.25% 8.25% 1 year

VOI RATES & TERMS

EFFECTIVE 11/01/08

Int. Rate

w/o

Down Payment Int. Rate Auto-Debit Max Term

10% 16.99%* 17.99% 10 years

20% 15.99%* 16.99% 10 years

10% 15.99%* 16.99% 7 years

50% 9.99% 9.99% 1 year

BXG VOI receivables have historically yielded significant interest income; in

November 2008 we implemented a revised interest rate program for new obligors

which has increased the YTD WAC (on non-50/50 loans through September 30, 2009)

to 16.13%; by way of comparison, the YTD WAC for similar loans through September

30, 2008 was approximately 14.95%.

How Bluegreen VOI Buyers Finance Their Purchase

*Dollar amount rounded to the nearest whole dollar.

**Note: Based on average household income of $73,000 for timeshare buyers.

Purchase Price of a Typical Vacation Ownership Interest: $13,200 100%

Cash Down Payment:

($ 1,320) (10%)

Amount Financed:

$11,880 90%

Terms of Typical Financing:

Term / Amortization: 10 years

Fixed Interest Rate: 16.99%

Monthly Payment: $ 206*

Annual Maintenance Fee/ Club Dues: $ 661

Annual Cost During Financing Period: $ 3,138* (4.3% of Income**)

Annual Cost After Financing Period: $ 661 (0.9% of Income**)

Bluegreen VOI Loan Payment Methods

Each sale facility/securitization has a separate, dedicated lockbox at Bank of

America.

There is a daily automated, repetitive wire to the paying agent for each sale

facility/securitization.

PAC/ACH/Automated

84.4%

Coupon Book

15.6%

Total

100.0%

Bluegreen’s Previous Receivables Purchase Facilities

and Term Securitizations

Purchase Facility/Term Securitization Note Amount

1998 GE Purchase Facility $100.0 MM

2000 GE Purchase Facility $ 90.0 MM

2001-A ING Purchase Facility $125.0 MM

2002-A Term Securitization $170.2 MM

2004-A GE Purchase Facility $ 38.6 MM

2004-B Term Securitization $156.6 MM

2004-C BB&T Purchase Facility $140.0 MM

2005-A Term Securitization $203.8 MM

2006-A GE Purchase Facility $125.0 MM

2006-B Term Securitization $139.2 MM

2007-A Term Securitization $177.0 MM

2008-A Term Securitization $ 60.0 MM

2009 BB&T Purchase Facility $150.0 MM

Total $ 1.7 Billion

Typical Collection Process - VOI

10 Days – Telephone contact initiated on delinquent accounts when an account is as few as

10 days past due

30 Days – Letter mailed advising the borrower (if a U.S. resident) that if the loan is not brought

current, the delinquency will be reported to the credit reporting agencies (telephone contact

continues)

60 Days – “Lock-out” letter mailed, return receipt requested and regular mail, advising that the

borrower cannot use any accommodations until the delinquency is cured (telephone contact

continues)

90 Days – “Notice of Intent to Cancel Membership” mailed, return receipt requested and

regular mail, which informs the borrower that unless the delinquency is cured within 30 days,

the borrower will forfeit ownership (telephone contact continues)

Approximately 120 Days – Termination letter mailed, return receipt requested and regular

mail, advising the borrower that the owner’s beneficial rights in the Bluegreen Vacation Club

have been terminated

The VOI is placed back into inventory for resale to a new purchaser

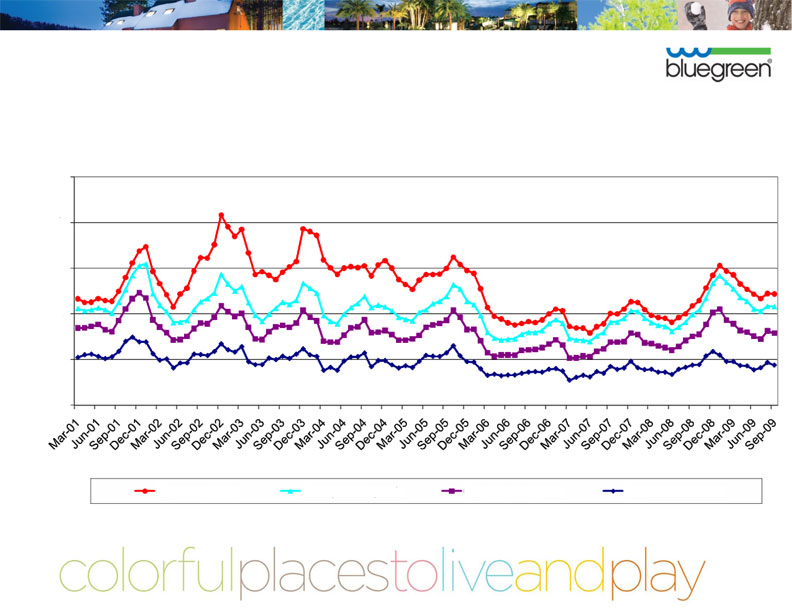

VOI Portfolio Performance

* In the event a borrower goes off of pre-authorized checking, the interest rate will increase by 1%.

Unlike floating rate residential mortgage loans (many of which have “teaser” rates),

the monthly payment for Bluegreen’s borrowers does not change over the life of

the loan.*

The average monthly payment (approximately $200) for Bluegreen’s borrowers is

much less than a typical mortgage payment.

The vast majority of Bluegreen’s borrowers are on PAC.

Bluegreen’s collectors have an average of 11.5 years of collections experience.

Our collections team is incentivized through a performance-based compensation

program.

In addition, Bluegreen implemented FICO® score-based credit requirements on

12/15/08 and further raised such guidelines on 1/1/10.

Portfolio Performance

Bluegreen VOI Delinquency Performance

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

Total Delinquent

90 Days Delinquent

60 Days Delinquent

31 Days Delinquent