Attached files

| file | filename |

|---|---|

| 8-K - TWIN DISC, INC. 8K PRESENTATION - TWIN DISC INC | r8k01272010presen.htm |

Twin Disc, Incorporated

WE PUT HORSEPOWER TO WORK ™

January 27, 2010

2

Twin Disc, Incorporated

Safe Harbor Statement

This presentation contains statements that are forward-looking

within the meaning of Section 21E of the Securities Exchange Act

of 1934, as amended. These statements are based on

management’s current expectations that are based on

assumptions that are subject to risks and uncertainties. Actual

results may vary because of variations between these

assumptions and actual performance. Investors are referred to

Twin Disc’s fiscal year 2009 Annual Report and Form 10-K,

“Management’s Discussion and Analysis of Financial Condition

and Results of Operations - Forward-Looking Information,” which

outlines certain risks regarding the Company’s forward-looking

statements. Copies of the Company’s SEC filings may be

obtained from the SEC, and are available on Twin Disc’s web site

(www.twindisc.com), or by request from the Investor Relations

department at the Company.

within the meaning of Section 21E of the Securities Exchange Act

of 1934, as amended. These statements are based on

management’s current expectations that are based on

assumptions that are subject to risks and uncertainties. Actual

results may vary because of variations between these

assumptions and actual performance. Investors are referred to

Twin Disc’s fiscal year 2009 Annual Report and Form 10-K,

“Management’s Discussion and Analysis of Financial Condition

and Results of Operations - Forward-Looking Information,” which

outlines certain risks regarding the Company’s forward-looking

statements. Copies of the Company’s SEC filings may be

obtained from the SEC, and are available on Twin Disc’s web site

(www.twindisc.com), or by request from the Investor Relations

department at the Company.

January 27, 2010

3

Twin Disc, Incorporated

2

1

1

#

Manufacturing location (# of facilities in each location)

Company owned distribution/service location

Purchasing/sourcing offices

Twin Disc At A Glance

• Founded in 1918

• Headquartered in Racine, WI

• ≈1,000 employees

• FY09 Revenues of $296M

FY08 Revenues of $332M

FY08 Revenues of $332M

• We are a global company

– Well-known customers

around the world

around the world

– Mfg Operations in the U.S.,

Italy, Belgium, Switzerland

and Japan (JV)

Italy, Belgium, Switzerland

and Japan (JV)

– World-wide distributor

network

network

– 61% of fiscal 2009 sales to

international markets

international markets

January 27, 2010

4

Twin Disc, Incorporated

FY 2010 Financial Highlights

• Financial Results Improved Sequentially

– Q2 versus Q1 Sales up 17%

• Year-to-Date Cash Flow From Operations Strong

– Generated $16.1 million thru first 6 months of

fiscal year

• Total Debt Reduced $9.2 million, or 18%, in First Six

Months

Months

• Six Month Backlog Up 16% Year-to-Date

– Driven by higher order activity for 8500 series

transmission

for oil & gas market

for oil & gas market

– Military backlog also increased and remains strong

January 27, 2010

5

Twin Disc, Incorporated

$ millions

• Sales down 32% off near record levels

– Experienced continued softness in

certain end markets

certain end markets

– Seasonal and temporary plant

shutdowns impacted Q1 shipments

shutdowns impacted Q1 shipments

– Asian markets continued at record

levels

levels

– Six month backlog grew over 12% in

the quarter

the quarter

• Gross Margin as % of Sales improved

590 basis points to 26.8% in Q2,

compared to 20.7% in Q1

590 basis points to 26.8% in Q2,

compared to 20.7% in Q1

Net Sales & Net Earnings

(Second Fiscal Quarter)

(Second Fiscal Quarter)

January 27, 2010

6

Twin Disc, Incorporated

$ millions

• Sales down 34% off near record levels

– Experienced continued softness

– Seasonal and temporary plant

shutdowns impacted Q1 shipments

shutdowns impacted Q1 shipments

– Asian markets continued at record

levels

levels

• Q2 loss of $0.5 million improved

sequentially from Q1 loss of $2.4

million

sequentially from Q1 loss of $2.4

million

Net Sales & Net Earnings

(First Six Months)

(First Six Months)

January 27, 2010

7

Twin Disc, Incorporated

$ millions

• Q2 Sales up 17.2% vs. Q1 Sales

– 6 month backlog increased 12.1% in

the quarter to $70 million

the quarter to $70 million

– Asian markets continued at record

levels

levels

– ARFF & Military transmission

markets holding steady

markets holding steady

– Pleasure craft marine remains weak

• Gross Margin as % of Sales

improved 590 basis points to 26.8%

in Q2, compared to 20.7% in Q1

improved 590 basis points to 26.8%

in Q2, compared to 20.7% in Q1

Net Sales & Net Earnings

(First & Second Fiscal Quarter)

(First & Second Fiscal Quarter)

January 27, 2010

8

Twin Disc, Incorporated

$ millions

16%

of sales

2%

of sales

• Generated $16.1 million of operating

cash flow in first half of Fiscal 2010

cash flow in first half of Fiscal 2010

– Continue to focus on inventory and

receivables management

receivables management

• Debt Reduction & Cash

– Revolver balance has decreased

$14.5 million over the past 3 quarters

$14.5 million over the past 3 quarters

– As of December 25, 2009, over $21

million of available borrowing on

revolver & nearly $17 million of cash

million of available borrowing on

revolver & nearly $17 million of cash

– In compliance with all financial

covenants

covenants

Operating Cash Flows

(First Six Months)

(First Six Months)

January 27, 2010

9

Twin Disc, Incorporated

Marine & Propulsion Systems

• Pleasure Craft market soft

worldwide

worldwide

– However, building share of

market with new technology

market with new technology

• Work Boat market steady

– Europe soft

– North America moderating

– Asia-Pacific growing

• Patrol Boat market

experiencing global growth

experiencing global growth

– Asian market experiencing

strong growth

strong growth

January 27, 2010

10

Twin Disc, Incorporated

Land-Based Products

• Industrial markets soft

– Agriculture, irrigation,

recycling and construction

recycling and construction

– No impact from ‘stimulus’

• ARFF and Military holding

steady

steady

– ARFF: Continue

to increase

market share with ‘pump &

roll’ transmissions

market share with ‘pump &

roll’ transmissions

• Oil & Gas markets picking up

– Orders increasing globally

for 8500 & air clutches

for 8500 & air clutches

– New 7500 series

January 27, 2010

11

Twin Disc, Incorporated

2006

2007

2008

48% International Sales

61% International Sales

USA

Italy

Rest of

World

2009

Corporate Profile - Geographic Diversity

January 27, 2010

12

Twin Disc, Incorporated

Global Outsourcing

Lean Manufacturing

$25 million Global Cost

Reduction & Avoidance Program

Reduction & Avoidance Program

• Pension freeze

• Salary & wage reductions

• Temporary layoffs in US

• Government-sponsored programs in Europe

• ME&A cost reductions

• Restructuring

• Voluntary retirement packages

• Suspension of corporate incentive program

Managing Our Cost Structure

January 27, 2010

13

Twin Disc, Incorporated

What Differentiates Us?

• Technology

– Oil & Gas

• 8500 Series

• 7500 Series - new

in Fiscal 2010

– ARFF

• “Pump & Roll”

– Military

• “Legacy” Contracts

• Global Distribution and Service Network

• Product/Market & Geographic Diversity

• Niche Market Focus

• 90+ Years of Proven Application Know-How

• Core Manufacturing Capabilities

– Marine

• Patented QuickShift®

• Joystick Docking - new

in Fiscal 2010

• Dynamic Positioning/DP 2

• Rolla CFD

Twin Disc, Incorporated

Looking Ahead

January 27, 2010

15

Twin Disc, Incorporated

FY04

FY05

FY06

FY07

$ millions

FY08

FY09

FY10

• 6 month backlog up 16%

since start of fiscal year

since start of fiscal year

Ø Increased order activity

for 8500 series

transmission for the oil

& gas market

for 8500 series

transmission for the oil

& gas market

Ø Military and ARFF

holding steady

holding steady

Ø Industrial & Marine

continue to be soft

continue to be soft

Corporate Six Month Backlog

(Mfg Orders to be shipped in the next 6 months)

(Mfg Orders to be shipped in the next 6 months)

January 27, 2010

16

Twin Disc, Incorporated

Fiscal Year 2010 Outlook

• FY09 softness continued thru 1st half of FY10

• Mega Yacht - weakness expected to continue

• ARFF & Military will remain strong

• Oil & Gas - order activity is increasing

• Patrol Boat market expanding

• Asian market continues at record levels

• New product launches: 7500 & Joystick Docking

• “Cash is King” - continued focus on working capital

management and debt reduction

management and debt reduction

• Expect sequential quarterly improvements

Twin Disc, Incorporated

WE PUT HORSEPOWER TO WORK ™

Twin Disc, Incorporated

Appendices

January 27, 2010

19

Twin Disc, Incorporated

Appendix I

FY 2009 Financial Highlights

• Sales were down 10.8% versus FY 2008

– 1st Half:

down less than 1% off record ’08 levels

– 2nd Half:

down nearly 20% off record ’08 levels

• Key Markets

– Mega Yacht, Oil & Gas and Industrial markets

saw

significant fall off as the year progressed

significant fall off as the year progressed

– ARFF, Military and Commercial Marine were steady

– Sales in the Pacific Rim continued at record

pace and

experienced double-digit growth

experienced double-digit growth

• $25 million cost reduction and avoidance program

announced in 4th Fiscal Quarter, including significant

1st Fiscal Quarter 2010 temporary plant shutdowns

announced in 4th Fiscal Quarter, including significant

1st Fiscal Quarter 2010 temporary plant shutdowns

January 27, 2010

20

Twin Disc, Incorporated

Appendix II

Corporate Profile - Market Diversity

Pleasure Craft Market:

• Target Markets: High

speed

planing and displacement yachts

from 50’ to 150’, diesel powered

planing and displacement yachts

from 50’ to 150’, diesel powered

• Products: Transmissions,

Surface Drives, Propellers,

Steering/Thruster/Trim Systems,

Water Jets, Controls

Surface Drives, Propellers,

Steering/Thruster/Trim Systems,

Water Jets, Controls

• Channels: Engine

OEMs &

dealers, & boat builders

dealers, & boat builders

• Customers: CAT,

CMD, MAN,

MTU, Volvo / Azimuth, Baia,

Ferretti, Palmer Johnson, Riviera,

Sanlorenzo, Sunseeker

MTU, Volvo / Azimuth, Baia,

Ferretti, Palmer Johnson, Riviera,

Sanlorenzo, Sunseeker

• Competition: ZF/

Kamewa /Side

Power, Ultraflex

Power, Ultraflex

January 27, 2010

21

Twin Disc, Incorporated

Appendix III

Corporate Profile - Market Diversity

Work Boat Market:

• Target Markets: planing

and

displacement vessels from 30’ to

250’, diesel powered

displacement vessels from 30’ to

250’, diesel powered

• Products: Transmissions,

Propellers, MCD’s, Water Jets,

Controls

Propellers, MCD’s, Water Jets,

Controls

• Channels: Engine

OEMs &

dealers, boat builders &

distribution

dealers, boat builders &

distribution

• Customers: CAT,

Cummins,

IVECO, Mitsubishi, Volvo /

Damen / Sewart Supply

(operators: Secor, Tidewater,

Groupe Bourbon)

IVECO, Mitsubishi, Volvo /

Damen / Sewart Supply

(operators: Secor, Tidewater,

Groupe Bourbon)

• Competition: ZF,

Reintjes

January 27, 2010

22

Twin Disc, Incorporated

Appendix IV

Corporate Profile - Market Diversity

Patrol Boat Market:

• Target Markets: military,

patrol

and coast guard vessels from 30’

to 90’, diesel powered

and coast guard vessels from 30’

to 90’, diesel powered

• Products: Transmissions,

Surface Drives, Propellers,

Steering/Thruster/Trim Systems,

Water Jets, Controls

Surface Drives, Propellers,

Steering/Thruster/Trim Systems,

Water Jets, Controls

• Channels: Engine

OEMs &

dealers, naval authorities & boat

builders

dealers, naval authorities & boat

builders

• Customers: CAT,

CMD, MAN,

MTU, Volvo / Israeli Navy, Turkish

Coast Guard, USCG, US Navy,

RCMP

MTU, Volvo / Israeli Navy, Turkish

Coast Guard, USCG, US Navy,

RCMP

• Competition: ZF

/ Kamewa,

Hamilton

Hamilton

January 27, 2010

23

Twin Disc, Incorporated

QuickShift®

Transmissions

Transmissions

Electronic Controls

Bow Thrusters

Anchor Winches

Gangways

Trim Tabs, Stern Thrusters

Power Steering

Marine Transmissions, Propulsion & Boat Management Systems

We have been very successful “bundling” more marine products

• Increasing content and value on each vessel

• Working directly with the shipyards

• Industry expert on vessel performance and handling

Appendix V

Corporate Profile - Market Diversity

January 27, 2010

24

Twin Disc, Incorporated

Appendix VI

Corporate Profile - Market Diversity

Industrial Products:

• Target Market: Heavy

duty

industrial disconnect applications

industrial disconnect applications

• Products: Mechanical

& hydraulic

clutches, PTOs & pump mount

drives, 100 - 2,500 HP

clutches, PTOs & pump mount

drives, 100 - 2,500 HP

• Channels: Distribution

& OEMs

• Customers: Bandit,

Morbark,

Peterson Pacific / OEM engine

dealers

Peterson Pacific / OEM engine

dealers

• Competitors: Funk,

NACD, PT

Tech, Stiebel, Transfluid, WPT

Tech, Stiebel, Transfluid, WPT

January 27, 2010

25

Twin Disc, Incorporated

Appendix VII

Corporate Profile - Market Diversity

Industrial Transmissions:

• Target Market: Off-highway

and

all-terrain specialty vehicles,

diesel powered

all-terrain specialty vehicles,

diesel powered

• Products: Powertrain

components - 400 to 3,000 HP

components - 400 to 3,000 HP

• Channel: OEM

vehicle mfrs.

• Customers: BAE,

Rosenbauer,

Oshkosh, Tatra / BJ Services,

Cisco High-Lift, Crown Energy,

Enerflo, Fractec, Trican, Tai’an

Oshkosh, Tatra / BJ Services,

Cisco High-Lift, Crown Energy,

Enerflo, Fractec, Trican, Tai’an

• Competitors: Allison,

ZF

January 27, 2010

26

Twin Disc, Incorporated

$ millions

% sales

* See Appendix XI for reconciliation of TTM figures to reported figures.

Appendix VIII

January 27, 2010

27

Twin Disc, Incorporated

Non-GAAP Financial Disclosures

Financial information excluding the impact of certain significant items in this presentation are not measures that

are defined in U.S. Generally Accepted Accounting Principles (“GAAP”). These items are measures that

management believes are important to adjust for in order to have a meaningful comparison to prior and future

periods and to provide a basis for future projections and for estimating our earnings growth prospects. Non-

GAAP measures are used by management as a performance measure to judge profitability of our business

absent the impact of foreign currency exchange rate changes and acquisitions. Management analyzes the

company’s business performance and trends excluding these amounts. These measures, as well as EBITDA,

provide a more consistent view of performance than the closest GAAP equivalent for management and

investors. Management compensates for this by using these measures in combination with the GAAP

measures. The presentation of the non-GAAP measures in this presentation are made alongside the most

directly comparable GAAP measures.

are defined in U.S. Generally Accepted Accounting Principles (“GAAP”). These items are measures that

management believes are important to adjust for in order to have a meaningful comparison to prior and future

periods and to provide a basis for future projections and for estimating our earnings growth prospects. Non-

GAAP measures are used by management as a performance measure to judge profitability of our business

absent the impact of foreign currency exchange rate changes and acquisitions. Management analyzes the

company’s business performance and trends excluding these amounts. These measures, as well as EBITDA,

provide a more consistent view of performance than the closest GAAP equivalent for management and

investors. Management compensates for this by using these measures in combination with the GAAP

measures. The presentation of the non-GAAP measures in this presentation are made alongside the most

directly comparable GAAP measures.

Definition - Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA)

The sum of, net earnings and adding back provision for income taxes, interest expense, depreciations and

amortization expenses: this is a financial measure of the profit generated excluding the above mentioned

items.

amortization expenses: this is a financial measure of the profit generated excluding the above mentioned

items.

Appendix IX

Non-GAAP Financial Disclosures

January 27, 2010

28

Twin Disc, Incorporated

* See Appendix XI for reconciliation of TTM figures to reported figures.

Appendix X

Reconciliation of Net Earnings to EBITDA

January 27, 2010

29

Twin Disc, Incorporated

Appendix XI

Reconciliation of TTM Data to Reported Quarterly Figures

January 27, 2010

30

Twin Disc, Incorporated

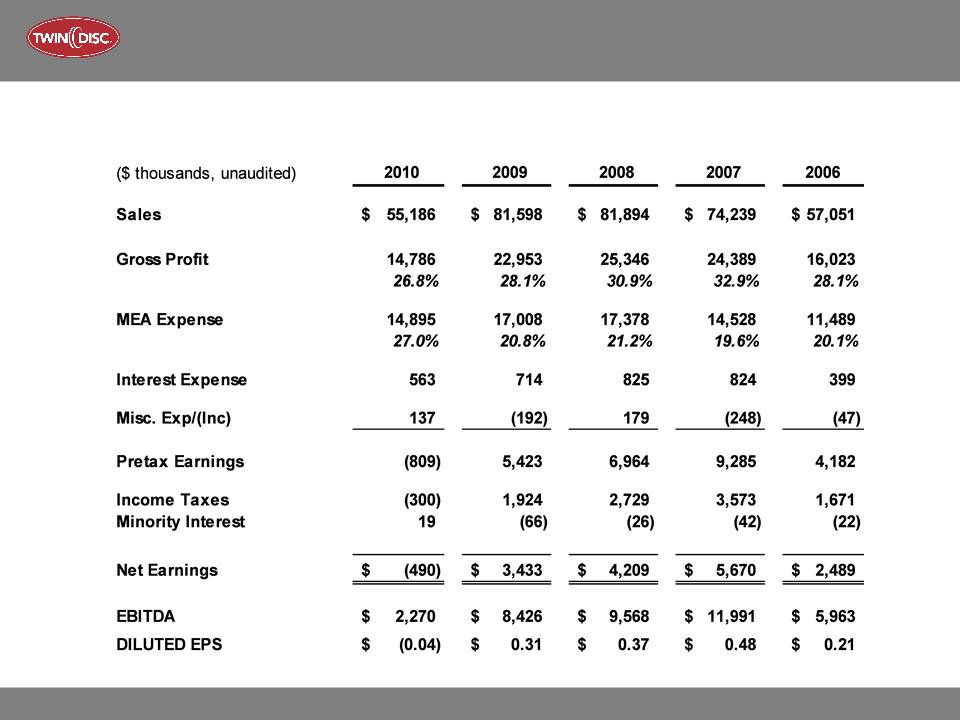

Appendix XII

Fiscal Year Condensed Consolidated Statements of Operations

January 27, 2010

31

Twin Disc, Incorporated

Appendix XIII

2nd Fiscal Qtr Condensed Consolidated Statements of Operations

January 27, 2010

32

Twin Disc, Incorporated

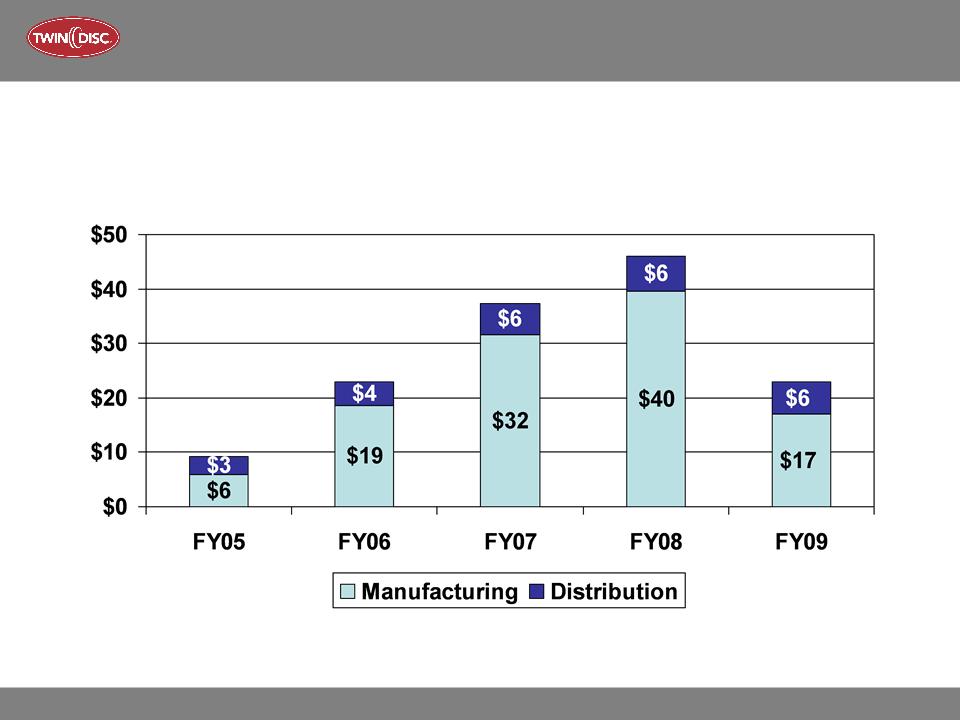

$317

$243

$219

$332

$296

Net Sales by Segment

Appendix XIV

January 27, 2010

33

Twin Disc, Incorporated

Net Earnings by Segment (before Corporate Expense)

Appendix XV

January 27, 2010

34

Twin Disc, Incorporated

$ millions

% sales

Operating Cash Flows - Fiscal Year

Appendix XVI

* See Appendix XI for reconciliation of TTM figures to reported figures.

Twin Disc, Incorporated

WE PUT HORSEPOWER TO WORK ™