Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - TWIN DISC INC | r10k09132011ex23.htm |

| EX-24 - EXHIBIT 24 - TWIN DISC INC | r10k09132011ex24.htm |

| EX-21 - EXHIBIT 21 - TWIN DISC INC | r10k09132011ex21.htm |

| EX-31.B - EXHIBIT 31B - TWIN DISC INC | r10k09132011ex31b.htm |

| EX-32.B - EXHIBIT 32B - TWIN DISC INC | r10k09132011ex32b.htm |

| EX-31.A - EXHIBIT 31A - TWIN DISC INC | r10k09132011ex31a.htm |

| EX-32.A - EXHIBIT 32A - TWIN DISC INC | r10k09132011ex32a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2011

Commission File Number 1-7635

TWIN DISC, INCORPORATED

(Exact Name of Registrant as Specified in its Charter)

|

Wisconsin

|

39-0667110

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification Number)

|

|

1328 Racine Street, Racine, Wisconsin

|

53403

|

|

(Address of Principal Executive Office)

|

(Zip Code)

|

|

Registrant's Telephone Number, including area code:

|

(262) 638-4000

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered:

|

|

Common stock, no par

|

The NASDAQ Stock Market LLC

|

|

Preferred stock purchase rights

|

The NASDAQ Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES [ ] NO [ √ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES [ ] NO [ √ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [√ ] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)YES [ ] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ √ ].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

Large Accelerated Filer [ ] Accelerated Filer [ √ ] Non-accelerated Filer [ ]Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

YES [ ] NO [ √ ]

At December 31, 2010, the last business day of the registrant’s second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was $248,814,593. Determination of stock ownership by affiliates was made solely for the purpose of responding to this requirement and registrant is not bound by this determination for any other purpose.

At August 18, 2011, the registrant had 11,419,701 shares of its common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held October 21, 2011, which will be filed pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this report, are incorporated by reference into Part III.

PART I

Item 1. Business

Twin Disc was incorporated under the laws of the state of Wisconsin in 1918. Twin Disc designs, manufactures and sells marine and heavy duty off-highway power transmission equipment. Products offered include: marine transmissions, surface drives, propellers and boat management systems as well as power-shift transmissions, hydraulic torque converters, power take-offs, industrial clutches and controls systems. The Company sells its products to customers primarily in the pleasure craft, commercial and military marine markets as well as in the energy and natural resources, government and industrial markets. The Company's worldwide sales to both domestic and foreign customers are transacted through a direct sales force and a distributor network. The products described above have accounted for more than 90% of revenues in each of the last three fiscal years.

Most of the Company's products are machined from cast iron, forgings, cast aluminum and bar steel which generally are available from multiple sources and which are believed to be in adequate supply.

The Company has pursued a policy of applying for patents in both the United States and certain foreign countries on inventions made in the course of its development work for which commercial applications are considered probable. The Company regards its patents collectively as important but does not consider its business dependent upon any one of such patents.

The business is not considered to be seasonal except to the extent that employee vacations are taken mainly in the months of July and August, curtailing production during that period.

The Company's products receive direct widespread competition, including from divisions of other larger independent manufacturers. The Company also competes for business with parts manufacturing divisions of some of its major customers. Primary competitive factors for the Company’s products are performance, price, service and availability. The Company’s top ten customers accounted for approximately 43% of the Company's consolidated net sales during the year ended June 30, 2011. There were no customers that accounted for 10% or more of consolidated net sales in fiscal 2011.

Unfilled open orders for the next six months of $146,899,000 at June 30, 2011 compares to $84,419,000 at June 30, 2010. The Company saw an increase in orders by oil and gas customers for its 8500 series transmission as higher oil and gas prices have driven demand for new high-horsepower rigs. Since orders are subject to cancellation and rescheduling by the customer, the six-month order backlog is considered more representative of operating conditions than total backlog. However, as procurement and manufacturing "lead times" change, the backlog will increase or decrease, and thus it does not necessarily provide a valid indicator of the shipping rate. Cancellations are generally the result of rescheduling activity and do not represent a material change in backlog.

Management recognizes that there are attendant risks that foreign governments may place restrictions on dividend payments and other movements of money, but these risks are considered minimal due to the political relations the United States maintains with the countries in which the Company operates or the relatively low investment within individual countries. No material portion of the Company’s business is subject to renegotiation of profits or termination of contracts at the election of the Government.

Engineering and development costs include research and development expenses for new product development and major improvements to existing products, and other costs for ongoing efforts to refine existing products. Research and development costs charged to operations totaled $2,475,000, $2,347,000 and $2,636,000 in fiscal 2011, 2010 and 2009, respectively. Total engineering and development costs were $8,776,000, $7,885,000 and $9,142,000 in fiscal 2011, 2010 and 2009, respectively.

The Company’s development of its 7500 series transmission is in the final testing phase, and initial shipment of production units has begun. The 7500 series transmission is specifically designed for oil and gas high-pressure pumping applications, and is expected to offer significant advantages in those applications over the Company’s current product mix. For example, the 7500 series transmission will be considerably lighter than the Company’s 8500 series transmission, and will be able to fit within the frame rails of on-road fracturing rigs so that the rigs won’t need special permits to move from one field to another. It is also designed to work in a range of 1500 to 2500 horsepower, which is a larger market than the 2500 to 3000 horsepower application market for the Company’s 8500 series transmission.

In fiscal 2011, the Company completed the development and introduced the Express Joystick System (EJS®) to the marine market. The EJS smoothly and simultaneously actuates and controls engines, transmissions and thrusters to allow for effortless movement of the boat in any direction.

Compliance with federal, state and local provisions regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, is not anticipated to have a material effect on capital expenditures, earnings or the competitive position of the Company.

The number of persons employed by the Company at June 30, 2011 was 941.

A summary of financial data by segment and geographic area for the years ended June 30, 2011, 2010 and 2009 appears in Note J to the consolidated financial statements.

The Company’s internet website address is www.twindisc.com. The Company makes available free of charge (other than an investor’s own internet access charges) through its website the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after it electronically files such material with, or furnishes such material to, the United States Securities and Exchange Commission. In addition, the Company makes available, through its website, important corporate governance materials. This information is also available from the Company upon request. The Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

Item 1A. Risk Factors

The Company’s business involves risk. The following information about these risks should be considered carefully together with other information contained in this report. The risks described below are not the only risks the Company faces. Additional risks not currently known, deemed immaterial or that could apply to any issuer may also result in adverse results for the Company’s business.

As a global company, we are subject to currency fluctuations and any significant movement between the U.S. Dollar and the Euro, in particular, could have an adverse effect on our profitability. Although the Company’s financial results are reported in U.S. Dollars, a significant portion of our sales and operating costs are realized in Euros and other foreign currencies. The Company’s profitability is affected by movements of the U.S. Dollar against the Euro and the other currencies in which we generate revenues and incur expenses. Significant long-term fluctuations in relative currency values, in particular a significant change in the relative values of the U.S. Dollar or Euro, could have an adverse effect on our profitability and financial condition.

Certain of the Company’s products are directly or indirectly used in oil exploration and oil drilling, and are thus dependent upon the strength of those markets and oil prices. In recent years, the Company has seen a significant growth in the sales of its products that are used in oil and energy related markets. The growth in these markets has been spurred by the rise in oil prices and the global demand for oil. In addition, there has been a substantial increase in capital investment by companies in these markets. In fiscal 2009, a significant decrease in oil prices, the demand for oil and capital investment in the oil and energy markets had an adverse effect on the sales of these products and ultimately on the Company’s profitability. While this market has recovered to historically high levels in fiscal 2011, the cyclical nature of the global oil and gas market presents the ongoing possibility of a severe cutback in demand, which would create a significant adverse effect on the sales of these products and ultimately on the Company’s profitability.

Many of the Company’s product markets are cyclical in nature or are otherwise sensitive to volatile or variable factors. A downturn or weakness in overall economic activity or fluctuations in those other factors can have a material adverse effect on the Company’s overall financial performance. Historically, sales of many of the products that the Company manufactures and sells have been subject to cyclical variations caused by changes in general economic conditions and other factors. In particular, the Company sells its products to customers primarily in the pleasure craft, commercial and military marine markets, as well as in the energy and natural resources, government and industrial markets. The demand for the products may be impacted by the strength of the economy generally, governmental spending and appropriations, including security and defense outlays, fuel prices, interest rates, as well as many other factors. Adverse economic and other conditions may cause the Company's customers to forego or otherwise postpone purchases in favor of repairing existing equipment.

In the event of an increase in the global demand for steel, the Company could be adversely affected if it experiences shortages of raw castings and forgings used in the manufacturing of its products. With the continued development of certain developing economies, in particular China and India, the global demand for steel has risen significantly in recent years. The Company selects its suppliers based on a number of criteria, and we expect that they will be able to support our growing needs. However, there can be no assurance that a significant increase in demand, capacity constraints or other issues experienced by the Company’s suppliers will not result in shortages or delays in their supply of raw materials to the Company. If the Company were to experience a significant or prolonged shortage of critical components from any of its suppliers, particularly those who are sole sources, and could not procure the components from other sources, the Company would be unable to meet its production schedules for some of its key products and would miss product delivery dates which would adversely affect our sales, profitability and relationships with our customers.

If the Company were to lose business with any key customers, the Company’s business would be adversely affected. Although there were no customers that accounted for 10% or more of consolidated net sales in fiscal 2011, deterioration of a business relationship with one or more of the Company’s significant customers would cause its sales and profitability to be adversely affected.

The Company continues to face the prospect of increasing commodity costs, including steel, other raw materials and energy that could have an adverse effect on future profitability. To date, the Company has been successful with offsetting the effects of increased commodity costs through cost reduction programs and pricing actions. However, if material prices were to continue to increase at a rate that could not be recouped through product pricing, it could potentially have an adverse effect on our future profitability.

The termination of relationships with the Company’s suppliers, or the inability of such suppliers to perform, could disrupt its business and have an adverse effect on its ability to manufacture and deliver products. The Company relies on raw materials, component parts, and services supplied by outside third parties. If a supplier of significant raw materials, component parts or services were to terminate its relationship with the Company, or otherwise cease supplying raw materials, component parts, or services consistent with past practice, the Company’s ability to meet its obligations to its customers may be affected. Such a disruption with respect to numerous products, or with respect to a few significant products, could have an adverse effect on the Company’s profitability and financial condition.

A significant design, manufacturing or supplier quality issue could result in recalls or other actions by the Company that could adversely affect profitability. As a manufacturer of highly engineered products, the performance, reliability and productivity of the Company’s products is one of its competitive advantages. While the Company prides itself on putting in place procedures to ensure the quality and performance of its products and suppliers, a significant quality or product issue, whether due to design, performance, manufacturing or supplier quality issue, could lead to warranty actions, scrapping of raw materials, finished goods or returned products, the deterioration in a customer relation, or other action that could adversely affect warranty and quality costs, future sales and profitability.

The Company faces risks associated with its international sales and operations that could adversely affect its business, results of operations or financial condition. Sales to customers outside the United States approximated 59% of our consolidated net sales for fiscal 2011. We have international manufacturing operations in Belgium, Italy and Switzerland. In addition, we have international distribution operations in Singapore, China, Australia, Japan, Italy and Canada. Our international sales and operations are subject to a number of risks, including:

|

Þ

|

currency exchange rate fluctuations

|

|

Þ

|

export and import duties, changes to import and export regulations, and restrictions on the transfer of funds

|

|

Þ

|

problems with the transportation or delivery of our products

|

|

Þ

|

issues arising from cultural or language differences and labor unrest

|

|

Þ

|

longer payment cycles and greater difficulty in collecting accounts receivables

|

|

Þ

|

compliance with trade and other laws in a variety of jurisdictions

|

|

Þ

|

changes in tax law

|

These factors could adversely affect our business, results of operations or financial condition.

A material disruption at the Company’s manufacturing facilities in Racine, Wisconsin could adversely affect its ability to generate sales and meet customer demand. The majority of the Company’s manufacturing, based on fiscal 2011’s sales, came from its two facilities in Racine, Wisconsin. If operations at these facilities were to be disrupted as a result of significant equipment failures, natural disasters, power outages, fires, explosions, adverse weather conditions or other reasons, the Company’s business and results of operations could be adversely affected. Interruptions in production would increase costs and reduce sales. Any interruption in production capability could require the Company to make substantial capital expenditures to remedy the situation, which could negatively affect its profitability and financial condition. The Company maintains property damage insurance which it believes to be adequate to provide for reconstruction of its facilities and equipment, as well as business interruption insurance to mitigate losses resulting from any production interruption or shutdown caused by an insured loss. However, any recovery under this insurance policy may not offset the lost sales or increased costs that may be experienced during the disruption of operations. Lost sales may not be recoverable under the policy and long-term business disruptions could result in a loss of customers. If this were to occur, future sales levels and costs of doing business, and therefore profitability, could be adversely affected.

Any failure to meet our debt obligations and satisfy financial covenants could adversely affect our business and financial condition. Beginning in 2008 and continuing into 2010, general worldwide economic conditions experienced a downturn due to the combined effects of the subprime lending crisis, general credit market crisis, collateral effects on the finance and banking industries, slower economic activity, decreased consumer confidence, reduced corporate profits and capital spending, adverse business conditions and liquidity concerns. While some recovery has been seen in 2011, these conditions made it difficult for customers, vendors and the Company to accurately forecast and plan future business activities, and cause U.S. and foreign businesses to slow spending on products, which delay and lengthen sales cycles. These conditions led to declining revenues in several of the Company’s divisions in fiscal 2009 and 2010. The Company’s amended revolving credit facility and senior notes agreements require it to maintain specified quarterly financial covenants such as a minimum consolidated net worth amount, a minimum EBITDA, as defined, for the most recent four fiscal quarters of $11,000,000 and a funded debt to EBITDA ratio of 3.0 or less. At June 30, 2011, the Company was in compliance with these financial covenants. Based on its annual financial plan, the Company believes that it will generate sufficient EBITDA levels throughout fiscal 2012 in order to maintain compliance with its financial covenants. However, as with all forward-looking information, there can be no assurance that the Company will achieve the planned results in future periods especially due to the significant uncertainties flowing from the current economic environment. If the Company is not able to achieve these objectives and to meet the required covenants under the agreements, the Company may require forbearance from its existing lenders in the form of waivers and/or amendments of its credit facilities or be required to arrange alternative financing. Failure to obtain relief from covenant violations or to obtain alternative financing, if necessary, would have a material adverse impact on the Company.

The Company may experience negative or unforeseen tax consequences. The Company reviews the probability of the realization of our net deferred tax assets each period based on forecasts of taxable income in both the U.S. and foreign jurisdictions. This review uses historical results, projected future operating results based upon approved business plans, eligible carryforward periods, tax planning opportunities and other relevant considerations. Adverse changes in the profitability and financial outlook in the U.S. or foreign jurisdictions may require the creation of a valuation allowance to reduce our net deferred tax assets. Such changes could result in material non-cash expenses in the period in which the changes are made and could have a material adverse impact on the Company’s results of operations and financial condition.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Manufacturing Segment

The Company owns two manufacturing, assembly and office facilities in Racine, Wisconsin, U.S.A., one in Nivelles, Belgium, two in Decima, Italy and one in Novazzano, Switzerland. The aggregate floor space of these six plants approximates 847,000 square feet. One of the Racine facilities includes office space, which includes the Company's corporate headquarters. The Company leases additional manufacturing, assembly and office facilities in Italy (Limite sull’Arno) and India (outsourcing office in Chennai).

Distribution Segment

The Company also has operations in the following locations, all of which are leased and are used for sales offices, warehousing and light assembly or product service:

|

Jacksonville, Florida, U.S.A.

|

Limite sull’Arno, Italy

|

|

Medley, Florida, U.S.A.

|

Brisbane, Queensland, Australia

|

|

Coburg, Oregon, U.S.A.

|

Perth, Western Australia, Australia

|

|

Kent, Washington, U.S.A.

|

Singapore

|

|

Edmonton, Alberta, Canada

|

Shanghai, China

|

|

Burnaby, British Columbia, Canada

|

Guangzhou, China

|

The Company believes its properties are well maintained and adequate for its present and anticipated needs.

Item 3. Legal Proceedings

Twin Disc is a defendant in several product liability or related claims of which the ultimate outcome and liability to the Company, if any, are not presently determinable. Management believes that the final disposition of such litigation will not have a material impact on the Company’s results of operations, financial position or statement of cash flows.

Item 4. Reserved

Executive Officers of the Registrant

Pursuant to General Instruction G(3) of Form 10-K, the following list is included as an unnumbered Item in Part I of this Report in lieu of being included in the Proxy Statement for the Annual Meeting of Shareholders to be held on October 21, 2011.

|

Name

|

Age

|

Position

|

|

Michael E. Batten

|

71

|

Chairman and Chief Executive Officer

|

|

John H. Batten

|

46

|

President and Chief Operating Officer

|

|

Christopher J. Eperjesy

|

43

|

Vice President – Finance, Chief Financial Officer and Treasurer

|

|

James E. Feiertag

|

54

|

Executive Vice President

|

|

Henri-Claude Fabry

|

65

|

Vice President - International Distribution

|

|

Dean J. Bratel

|

47

|

Vice President - Engineering

|

|

Denise L. Wilcox

|

54

|

Vice President - Human Resources

|

|

Jeffrey S. Knutson

|

46

|

Corporate Controller

|

|

Thomas E. Valentyn

|

52

|

General Counsel and Secretary

|

Officers are elected annually by the Board of Directors at the Board meeting held in conjunction with each Annual Meeting of the Shareholders. Each officer holds office until a successor is duly elected, or until he/she resigns or is removed from office.

Michael E. Batten, Chairman and Chief Executive Officer. Mr. Batten has been employed with the Company since 1970, and was named Chairman and Chief Executive Officer in 1991.

John H. Batten, President and Chief Operating Officer. Effective July 1, 2008, Mr. Batten was named President and Chief Operating Officer. Prior to this promotion, Mr. Batten served as Executive Vice President since November 2004, Vice President and General Manager – Marine and Propulsion since October 2001 and Commercial Manager – Marine and Propulsion since 1998. Mr. Batten joined Twin Disc in 1996 as an Application Engineer. Mr. Batten is the son of Mr. Michael Batten.

Christopher J. Eperjesy, Vice President – Finance, Chief Financial Officer and Treasurer. Mr. Eperjesy joined the Company in his current role in November 2002. Prior to joining Twin Disc, Mr. Eperjesy was Divisional Vice President – Financial Planning & Analysis for Kmart Corporation since 2001, and Senior Manager – Corporate Finance with DaimlerChrysler AG since 1999.

James E. Feiertag, Executive Vice President. Mr. Feiertag was appointed to his present position in October 2001. Prior to being promoted, he served as Vice President – Manufacturing since joining the Company in November 2000. Prior to joining Twin Disc, Mr. Feiertag was the Vice President of Manufacturing for the Drives and Systems Group of Rockwell Automation since 1999.

Henri Claude Fabry, Vice President – International Distribution. Mr. Fabry was appointed to his current position in January 2009, after serving as Vice President – Global Distribution since 2001. Mr. Fabry joined Twin Disc in 1997 as Director, Marketing and Sales of the Belgian subsidiary.

Dean J. Bratel, Vice President - Engineering. Mr. Bratel was promoted to his current role in November 2004 after serving as Director of Corporate Engineering (since January 2003), Chief Engineer (since October 2001) and Engineering Manager (since December 1999). Mr. Bratel joined Twin Disc in 1987.

Denise L. Wilcox, Vice President - Human Resources. After joining the Company as Manager Compensation & Benefits in September 1998, Ms. Wilcox was promoted to Director Corporate Human Resources in March 2002 and to her current role in November 2004. Prior to joining Twin Disc, Ms. Wilcox held positions with Johnson International and Runzheimer International.

Jeffrey S. Knutson, Corporate Controller. Mr. Knutson was appointed to his current role in October 2005 after joining the Company in February 2005 as Controller of North American Operations. Prior to joining Twin Disc, Mr. Knutson held Operational Controller positions with Tower Automotive (since August 2002) and Rexnord Corporation (since November 1998).

Thomas E. Valentyn, General Counsel and Secretary. Mr. Valentyn joined the Company in his current role in September 2007. Prior to joining Twin Disc, Mr. Valentyn served as Vice President and General Counsel at Norlight Telecommunications, Inc. since July 2000.

PART II

Item 5. Market for the Registrant's Common Stock and Related Stockholder Matters

The Company's common stock is traded on the NASDAQ Global Select Market under the symbol TWIN. The price information below represents the high and low sales prices from July 1, 2009 through June 30, 2011:

|

Fiscal Year Ended 6/30/11

|

Fiscal Year Ended 6/30/10

|

|||||

|

Quarter

|

High

|

Low

|

Dividend

|

High

|

Low

|

Dividend

|

|

First Quarter

|

$13.95

|

$10.52

|

$0.07

|

$15.23

|

$6.21

|

$0.07

|

|

Second Quarter

|

30.25

|

12.68

|

0.07

|

14.77

|

9.12

|

0.07

|

|

Third Quarter

|

35.10

|

25.24

|

0.08

|

13.17

|

8.77

|

0.07

|

|

Fourth Quarter

|

39.43

|

29.22

|

0.08

|

14.92

|

11.35

|

0.07

|

For information regarding the Company’s equity-based compensation plans, see the discussion under Item 12 of this report. As of August 18, 2011, shareholders of record numbered 699. The closing price of Twin Disc common stock as of August 18, 2011 was $32.55.

Issuer Purchases of Equity Securities

|

Period

|

(a) Total Number of Shares Purchased

|

(b) Average Price Paid per Share

|

(c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

(d) Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs

|

|

March 26, 2011 – April 29, 2011

|

0

|

NA

|

0

|

250,000

|

|

April 30, 2011 – May 27, 2011

|

0

|

NA

|

0

|

250,000

|

|

May 28, 2011 - June 30, 2011

|

0

|

NA

|

0

|

250,000

|

|

Total

|

0

|

On February 1, 2008, the Board of Directors authorized the purchase of up to 500,000 shares of Common Stock at market values, of which 250,000 were purchased during the second quarter of fiscal 2009.

Performance Graph

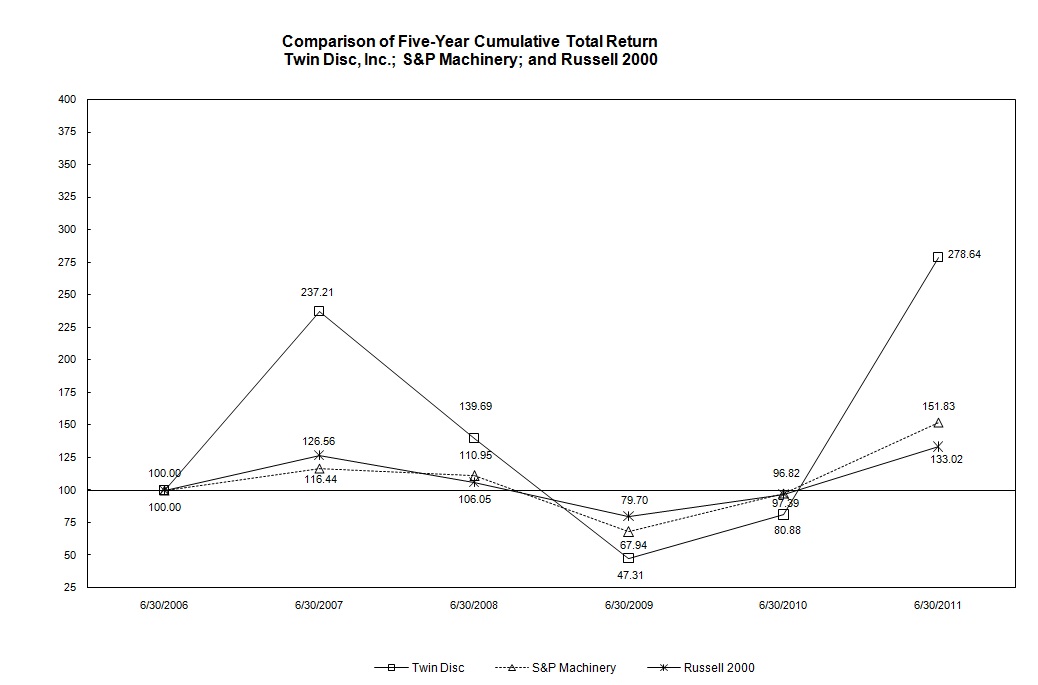

The following table compares total shareholder return over the last 5 fiscal years to the Standard & Poor’s 500 Machinery (Industrial) Index and the Russell 2000 index. The S&P 500 Machinery (Industrial) Index consists of a broad range of manufacturers. The Russell 2000 Index consists of a broad range of 2,000 companies. The Company believes, because of the similarity of its business with those companies contained in the S&P 500 Machinery (Industrial) Index, that comparison of shareholder return with this index is appropriate. Total return values for the Corporation’s common stock, the S&P 500 Machinery (Industrial) Index and the Russell 2000 Index were calculated based upon an assumption of a $100 investment on June 30, 2006 and based upon cumulative total return values assuming reinvestment of dividends on a quarterly basis.

Item 6. Selected Financial Data

Financial Highlights

(in thousands, except per share amounts)

|

Fiscal Years Ended June 30,

|

|||||

|

Statement of Operations Data:

|

2011

|

2010

|

2009

|

2008

|

2007

|

|

Net sales

|

$310,393

|

$227,534

|

$295,618

|

$331,694

|

$317,200

|

|

Net earnings attributable to Twin Disc

|

18,830

|

597

|

11,502

|

24,252

|

21,852

|

|

Basic earnings per share attributable to Twin Disc common shareholders

|

1.66

|

0.05

|

1.04

|

2.15

|

1.88

|

|

Diluted earnings per share attributable to Twin Disc common shareholders

|

1.64

|

0.05

|

1.03

|

2.13

|

1.84

|

|

Dividends per share

|

0.30

|

0.28

|

0.28

|

0.265

|

0.205

|

Balance Sheet Data (at end of period):

|

Total assets

|

$309,120

|

$259,056

|

$290,008

|

$304,628

|

$267,184

|

|

Total long-term debt

|

25,784

|

27,211

|

46,348

|

48,227

|

42,152

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Note on Forward-Looking Statements

Statements in this report (including but not limited to certain statements in Items 1, 3 and 7) and in other Company communications that are not historical facts are forward-looking statements, which are based on management’s current expectations. These statements involve risks and uncertainties that could cause actual results to differ materially from what appears here.

Forward-looking statements include the Company’s description of plans and objectives for future operations and assumptions behind those plans. The words “anticipates,” “believes,” “intends,” “estimates,” and “expects,” or similar anticipatory expressions, usually identify forward-looking statements. In addition, goals established by the Company should not be viewed as guarantees or promises of future performance. There can be no assurance the Company will be successful in achieving its goals.

In addition to the assumptions and information referred to specifically in the forward-looking statements, other factors, including, but not limited to those factors discussed under Item 1A, Risk Factors, could cause actual results to be materially different from what is presented in any forward looking statements.

Results of Operations

(In thousands)

|

2011

|

%

|

2010

|

%

|

2009

|

%

|

|

|

Net sales

|

$310,393

|

$227,534

|

$295,618

|

|||

|

Cost of goods sold

|

202,710

|

167,069

|

214,175

|

|||

|

Gross profit

|

107,683

|

34.7

|

60,465

|

26.6

|

81,443

|

27.6

|

|

Marketing, engineering and administrative expenses

|

72,713

|

23.4

|

56,886

|

25.0

|

60,470

|

20.5

|

|

Restructuring of operations

|

254

|

0.1

|

494

|

0.2

|

1,188

|

0.4

|

|

Earnings from operations

|

$34,716

|

11.2

|

$3,085

|

1.4

|

$19,785

|

6.7

|

Fiscal 2011 Compared to Fiscal 2010

Net Sales

Net sales increased $82.9 million, or 36.4%, in fiscal 2011. The year-over-year movement in foreign exchange rates resulted in a net favorable translation effect on sales of $3.2 million in fiscal 2011 compared to fiscal 2010.

In fiscal 2011, sales for our worldwide manufacturing operations, before eliminating intra-segment and inter-segment sales, were higher by $84.3 million, or 46.0%, than in the prior fiscal year. Year-over-year changes in foreign exchange rates had a net favorable impact on sales of $0.7 million. In fiscal 2011, our domestic manufacturing operation saw the largest growth, with a 63.8% increase in sales versus fiscal 2010. The primary driver for this increase was the sale of transmissions and related products for the oil and gas markets as well as increased aftermarket shipments. The Company’s Italian manufacturing operations, which were adversely impacted by the softness in the European mega yacht and industrial markets in fiscal 2009 and 2010, experienced some growth, with a 28.2% increase in sales compared to the prior fiscal year, after an extended period of decline in the second half of fiscal 2009 and throughout fiscal 2010. The Company’s Belgian manufacturing operation saw an 11.8% increase in sales versus the prior year, although it continued to be adversely impacted by the softness in the global mega yacht market. The Company’s Swiss manufacturing operation, which supplies customized propellers for the global mega yacht and patrol boat markets, experienced a 10.1% increase in sales compared to the prior fiscal year, primarily due to the impact of the strengthening Swiss Franc compared to the US Dollar.

Our distribution segment, buoyed by continued growth in Asia and the North American oil and gas markets, experienced an increase of $27.2 million, or 26.9%, in sales in fiscal 2011 compared to fiscal 2010. Compared to fiscal 2010, on average, the Asian currencies strengthened against the U.S. Dollar. The net translation effect of this on foreign distribution operations was to increase revenues for the distribution segment by approximately $7.8 million versus the prior year, before eliminations. The Company’s distribution operations in Singapore continued to experience strong demand for marine transmission products for use in various commercial applications. This operation saw a 7.6% increase in sales versus the same period a year ago, and set a new sales record. The Company’s distribution operation in the Northwest of the United States and Southwest of Canada experienced nearly a tripling of its sales due to strength in the Canadian oil and gas market. The Company’s distribution operation in Italy, which provides boat accessories and propulsion systems for the pleasure craft market, saw a decrease in sales of 23.6% due to continued weakness in the Italian mega yacht market. The Company’s distribution operation in Australia, which provides boat accessories, propulsion and marine transmission systems for the pleasure craft market, saw an increase in sales of 26.1%, due to improving market conditions, including sales of components parts for the Company’s new Express Joystick System® that were shipped in fiscal 2011.

Net sales for the Company’s largest product market, marine transmission and propulsion systems, were up 9% compared to the prior fiscal year. Sales of the Company’s boat management systems manufactured at our Italian operation and servicing the global mega yacht market, were up approximately 12% versus the prior fiscal year. The Company saw modest recovery across most of the marine product markets it serves. In the off-highway transmission market, the year-over-year increase of just over 124% can be attributed primarily to increased sales of the 8500 series transmission system for the oil and gas markets. Sales of transmission systems for the military market were up slightly over the prior fiscal year. Vehicular transmissions for the airport rescue and fire fighting (ARFF) and agricultural tractor markets were down versus fiscal 2010, however, the year-end backlog was up versus the prior fiscal year end. The increase experienced in the Company’s industrial products of roughly 10% was due to increased sales into the agriculture, mining and general industrial markets, primarily in the North American and Italian markets, as well as increased activity related to oil field markets.

The elimination for net intra-segment and inter-segment sales increased $28.6 million, or 50.1%, from $57.2 million in fiscal 2010 to $85.8 million in fiscal 2011. Year-over-year changes in foreign exchange rates had a net unfavorable impact of $5.2 million on net intra-segment and inter-segment sales.

Gross Profit

In fiscal 2011, gross profit increased $47.2 million, or 78.1%, to $107.7 million. Gross profit as a percentage of sales increased 810 basis points in fiscal 2011 to 34.7%, compared to 26.6% in fiscal 2010. The table below summarizes the gross profit trend by quarter for fiscal years 2011 and 2010:

|

1st Qtr

|

2nd Qtr

|

3rd Qtr

|

4th Qtr

|

Year

|

|

|

Gross Profit:

|

|||||

|

($ millions)

|

|||||

|

2011

|

$20.0

|

$23.8

|

$27.8

|

$36.1

|

$107.7

|

|

2010

|

$ 9.7

|

$14.8

|

$16.5

|

$19.5

|

$ 60.5

|

|

% of Sales:

|

|||||

|

2011

|

32.6%

|

31.6%

|

36.3%

|

37.1%

|

34.7%

|

|

2010

|

20.7%

|

26.8%

|

27.1%

|

30.2%

|

26.6%

|

There were a number of factors that impacted the Company’s overall gross margin rate in fiscal 2011. Gross margin for the year was favorably impacted by higher volumes, improved product mix, the absence of extended shutdowns in the first half of the fiscal year at the Company’s domestic and European manufacturing operations, which occurred in fiscal 2010, and a decrease in expenses related to the Company’s defined benefit plans. In addition, warranty expense as a percentage of sales decreased from 1.63%, or $3.7 million, in fiscal 2010 to 1.27%, or $3.9 million, in fiscal 2011 (for additional information on the Company’s warranty expense, see Note F of the Notes to the Consolidated Financial Statements). The Company estimates the net favorable impact of higher volumes on gross margin in fiscal 2011 was approximately $36 million. The favorable shift in product mix related to the Company’s oil and gas transmission business had an estimated impact of $7 million. The decrease in warranty expense as a percentage of sales can be attributed to an increase in volume and an overall reduction in specific warranty campaigns that were experienced in fiscal 2010. In addition, the year-over-year movement in foreign exchange rates, primarily driven by movements in the Euro and Asian currencies, resulted in a net favorable translation effect on gross profit of $1.9 million in fiscal 2011 compared to fiscal 2010. Partially offsetting the above favorable items, the Company reinstituted its annual incentive plan in fiscal 2011. Approximately $1.5 million of the expense associated with the plan was recorded in cost of goods sold in fiscal 2011 compared to $0 in fiscal 2010.

Marketing, Engineering and Administrative (ME&A) Expenses

Marketing, engineering, and administrative (ME&A) expenses increased $15.8 million, or 27.8%, in fiscal 2011 versus fiscal 2010. Despite a significant increase in sales, and an increase in compensation related costs, as a percentage of sales, ME&A expenses decreased by 160 basis points to 23.4% in fiscal 2011, compared to 25.0% in fiscal 2010. The table below summarizes significant changes in certain ME&A expenses for the fiscal year:

|

Fiscal Year Ended

|

Increase/

|

||

|

$ thousands – (Income)/Expense

|

June 30, 2011

|

June 30, 2010

|

(Decrease)

|

|

Stock-Based Compensation

|

$ 6,148

|

$ 507

|

$ 5,641

|

|

Incentive/Bonus Expense

|

4,964

|

-

|

4,964

|

|

10,605

|

|||

|

Foreign Currency Translation

|

1,015

|

||

|

11,620

|

|||

|

All Other, Net

|

4,207

|

||

|

$ 15,827

|

|||

The net remaining increase in ME&A expenses for the year of $4,207,000 was primarily driven by the restoration of salary and wage reductions effected in fiscal 2010, higher benefit costs, increased travel, higher project related expenses and a continued emphasis on the Company’s product development program. As announced in June 2009, the Company implemented various measures which included a reduction of annual base salaries of the Company’s salaried employees including all executive officers, removal of the fiscal 2010 bonus/incentive plan, changes to several benefit programs, an across-the-board reduction of marketing, advertising, travel and entertainment expenses, and staff reductions and layoffs. The significant increase in stock-based compensation versus the prior year ($5,641,000) was driven by the accrual for performance-based awards granted in fiscal 2011, a catch-up accrual for performance-based awards granted in fiscal 2010 and the impact of the significant increase in the Company’s stock price (+340%) on the cash-based performance stock unit awards. The Company began accruing the performance-based awards granted in fiscal 2009 and 2010 at the maximum payout level in fiscal 2011 due to the strong improvement in operating results. No accrual was recorded for performance awards in fiscal 2010 due to the shortfall against performance targets, resulting in the required “catch-up” accrual for the fiscal 2010 awards. For additional information on the Company’s stock-based compensation, see Note K of the Notes to the Consolidated Financial Statements.

Restructuring of Operations

During the fourth quarter of fiscal 2009, the Company recorded a pre-tax restructuring charge of $948,000 related to a workforce reduction at its Racine, Canadian and Australian operations. The charge consisted of severance costs for 22 salaried employees and voluntary early retirement charges for an additional 16 manufacturing employees. During fiscal 2009, the Company made cash payments of $180,000, resulting in an accrual balance at June 30, 2009 of $767,000. The remainder of this balance was paid during fiscal 2010, resulting in no accrual balance at June 30, 2010 or 2011.

During the fourth quarter of fiscal 2007, the Company recorded a pre-tax restructuring charge of $2,652,000 related to a workforce reduction at its Belgian operation that will allow for improved profitability through targeted outsourcing savings and additional focus on core manufacturing processes. The charge consisted of prepension costs for 32 employees: 29 manufacturing employees and 3 salaried employees. This charge was adjusted in the fourth quarter of fiscal 2008, resulting in a pre-tax benefit of $373,000, due to final negotiations primarily related to notice period pay. Further adjustments were made in the fourth quarter of fiscal 2009 (resulting in a pre-tax expense of $240,000 related to legally required inflationary adjustments to benefits) and fiscal 2010 (resulting in a pre-tax expense of $342,000 primarily related to a Belgian legislation change surrounding the prepension costs and legally required inflationary adjustments). An additional adjustment was made during the fourth quarter of fiscal 2011, resulting in pre-tax expense of $187,000 related to the annual legally required inflationary adjustments to benefits. During fiscal 2011 and 2010, the Company made cash payments of $252,000 and $152,000, respectively. The exchange impact in fiscal 2011 was to increase the accrual by $413,000. Accrued restructuring costs were $2,663,000 and $2,315,000 at June 30, 2011 and 2010, respectively.

The Company recorded a restructuring charge of $2,076,000 in the fourth quarter of fiscal 2005 as the Company restructured its Belgian operation to improve future profitability. The charge consists of prepension costs for 37 employees: 33 manufacturing employees and 4 salaried employees. An adjustment was made in the fourth quarter of fiscal 2010, resulting in a pre-tax expense of $138,000 primarily related to a Belgian legislation change surrounding the prepension costs and legally required inflationary adjustments. An additional adjustment was made in the fourth quarter of fiscal 2011, resulting in pre-tax expense of $58,000 related to the annual legally required inflationary adjustments to benefits. During fiscal 2011 and 2010, the Company made cash payments of $220,000 and $192,000, respectively. The exchange impact in fiscal 2011 was to increase the accrual by $161,000. Accrued restructuring costs were $944,000 and $945,000 at June 30, 2011 and 2010, respectively.

Interest Expense

Interest expense decreased by $0.5 million, or 24.7%, in fiscal 2011. Total interest on the Company’s $40 million revolving credit facility (“revolver”) decreased $0.2 million from $0.6 million in fiscal 2010 to $0.4 million in fiscal 2011. This decrease can be attributed to an overall decrease in the average borrowings year-over-year. The average borrowing on the revolver, computed monthly, decreased to $9.9 million in fiscal 2011, compared to $14.4 million in fiscal 2010. The interest rate on the revolver remained flat at 4.00%, the rate floor, for the first eleven months of the fiscal year. In the fourth fiscal quarter of fiscal 2011, the Company entered into an amended revolver agreement that eliminated the rate floor. As of June 30, 2011, the rate on the revolver was 2.09%. Interest expense for the Company’s $25 million Senior Notes, which carry a fixed interest rate of 6.05%, decreased by $0.2 million to $1.2 million in fiscal 2011.

Income Taxes

The effective tax rate for fiscal 2011 of 40.8 percent is significantly lower than the prior year rate of 57.6 percent. As announced in the third fiscal quarter, the current year rate was unfavorably impacted by the recording of a valuation allowance against the net deferred tax asset at one of the Company’s foreign jurisdictions, resulting in additional tax expense of approximately $1,613,000 related to the reversal of the fiscal 2010 ending deferred tax asset, along with the absence of a tax benefit on the current year losses in this jurisdiction. This unfavorable item was partially offset by a $794,000 benefit due to a favorable adjustment to the domestic net deferred tax asset resulting from the increase in the domestic estimated tax rate from 34.0 percent to 35.0 percent during fiscal 2011. The current year also includes the favorable impact of the reinstatement of the R&D credit, which was passed into law during the second fiscal quarter. The annualized effective rate before 2011 discrete items is 33.3 percent. The prior year rate was relatively high due to the impact of permanent deferred items, which remained relatively constant but had a greater impact on the rate due to the low base of earnings.

Order Rates

As of June 30, 2011, the Company’s backlog of orders scheduled for shipment during the next six months (six-month backlog) was $146.9 million, or approximately 74% higher than the six-month backlog of $84.4 million as of June 30, 2010. The improvement in backlog is a result of increased orders by oil and gas customers for the Company’s 8500 series transmission as stable oil and gas prices have driven demand for new high-horsepower rigs. With oil and gas prices remaining firm, the Company is optimistic demand for these transmissions will continue. In addition, the Company has begun to accept orders and has shipped initial units of its new 7500 series transmission for the oil and gas market. In the second half of fiscal 2011, the Company also saw modest growth in the six-month backlog for most of its marine and industrial products.

Fiscal 2010 Compared to Fiscal 2009

Net Sales

Net sales decreased $68.1 million, or 23.0%, in fiscal 2010. The year-over-year movement in foreign exchange rates resulted in a net favorable translation effect on sales of $3.3 million in fiscal 2010, compared to fiscal 2009.

In fiscal 2010, sales for our worldwide manufacturing operations, before eliminating intra-segment and inter-segment sales, were lower by $82.5 million, or 31.0%, than in the prior fiscal year. Year-over-year changes in foreign exchange rates had a net favorable impact on sales of $1.0 million. Sales at the Company’s domestic manufacturing location were down $37.1 million, primarily driven by lower sales of marine transmissions, industrial products and aftermarket parts, partially offset by higher sales of land-based oil and gas transmissions and surface drives for the global patrol boat market. The net remaining decrease came at the Company’s European manufacturing operations and was primarily due to the impact of the continued softening experienced in the global mega yacht, European commercial marine and industrial markets.

Net sales for distribution operations were down a more modest $11.0 million, or 9.8%, in fiscal 2010. Year-over-year changes in foreign exchange rates had a net favorable impact on sales of $4.9 million. The Company’s distribution operation in Singapore, which serves the Asian market, saw a 3.9% year-over-year decrease in sales, off of fiscal 2009’s record level. This slight decrease was primarily driven by decreased shipments in the fourth fiscal quarter of commercial marine transmissions for Asian markets. The Company’s distribution operations in Europe, Australia and the Southeastern United States experienced sharper declines versus the prior fiscal year due to the continued softening of the global mega yacht and industrial markets. The Company provides marine transmissions, and propulsion and boat management systems to serve the global mega yacht market.

Net sales for the Company’s largest product market, marine transmission and propulsion systems, were down 22.7% compared to the prior fiscal year. Increased sales of propulsion and transmission systems for the military patrol boat market were up significantly, but were more than offset by continued weakness in the European mega yacht market as well as some softening off of record levels in the commercial marine market. Sales of the Company’s boat management systems manufactured at our Italian operation and servicing the global mega yacht market, were off approximately 40% versus the prior fiscal year. This was primarily driven by continued weakening in sales to builders of mega yachts. In the off-highway transmission market, the year-over-year decrease of just over 10% can be attributed primarily to decreased sales of the Company’s vehicular transmissions for the airport, rescue and fire fighting (ARFF) and agricultural tractor markets, only partially offset by increased transmission sales in land-based oil field markets. Sales of transmission systems for the military market were relatively flat year-over-year. The decrease experienced in the Company’s industrial products of roughly 29% was due to decreased sales into the agriculture, mining and general industrial markets, primarily in the North American and Italian markets, partially offset by increased activity related to oil field markets.

The elimination for net intra-segment and inter-segment sales decreased $25.4 million, or 30.7%, from $82.6 million in fiscal 2009 to $57.2 million in fiscal 2010. Year-over-year changes in foreign exchange rates had a net unfavorable impact of $2.6 million on net intra-segment and inter-segment sales.

Gross Profit

In fiscal 2010, gross profit decreased $21.0 million, or 25.8%, to $60.5 million. Gross profit as a percentage of sales decreased 100 basis points in fiscal 2010 to 26.6%, compared to 27.6% in fiscal 2009. The table below summarizes the gross profit trend by quarter for fiscal years 2010 and 2009:

|

1st Qtr

|

2nd Qtr

|

3rd Qtr

|

4th Qtr

|

Year

|

|

|

Gross Profit:

|

|||||

|

($ millions)

|

|||||

|

2010

|

$ 9.7

|

$14.8

|

$16.5

|

$19.5

|

$60.5

|

|

2009

|

$20.1

|

$22.9

|

$19.2

|

$19.2

|

$81.4

|

|

% of Sales:

|

|||||

|

2010

|

20.7%

|

26.8%

|

27.1%

|

30.2%

|

26.6%

|

|

2009

|

27.6%

|

28.1%

|

27.6%

|

26.7%

|

27.6%

|

There were a number of factors that impacted the Company’s overall gross margin rate in fiscal 2010. Gross margin for the year was unfavorably impacted by lower volumes, extended shutdowns in the first half of the fiscal year at the Company’s domestic and European manufacturing operations, and an increase in expenses related to the Company’s defined benefit plans. The Company estimates the net unfavorable impact of lower volumes on gross margin in fiscal 2010 was approximately $27 million. On June 3, 2009 the Company announced it would freeze future accruals under the domestic defined benefit pension plans effective August 1, 2009. This resulted in a curtailment gain of $1.7 million recorded in the fourth quarter of fiscal 2009. Of this amount, $1.2 million was recorded as income in cost of goods sold, with the remainder recorded in ME&A expenses. As a result, there was a net increase in the defined benefit pension expense recorded in cost of goods sold of $2.8 million, from a net benefit of $(0.5) million in fiscal 2009 to a net expense of $2.3 million in fiscal 2010 (see Note M of the Notes to the Consolidated Financial Statements). The net impact of this change was to decrease gross profit as a percentage of sales by nearly 120 basis points. The above were partially offset by a favorable shift in product mix, primarily related to oilfield products in the second half of the fiscal year (estimated impact was $0.7 million), selective pricing actions, and lower warranty expenses. Total warranty expense decreased over $2.7 million in the current fiscal year, from $6.4 million in fiscal 2009 to $3.7 million in fiscal 2010 (see Note F of the Notes to the Consolidated Financial Statements). The decrease in warranty expense can be attributed to a decrease in volume and an overall reduction in specific warranty campaigns that were experienced in fiscal 2009. The net impact of this change was to increase gross profit as a percentage of sales by nearly 50 basis points. In addition, the year-over-year movement in foreign exchange rates, primarily driven by movements in the Euro and Asian currencies, resulted in a net favorable translation effect on gross profit of $1.2 million in fiscal 2010, compared to fiscal 2009.

Marketing, Engineering and Administrative (ME&A) Expenses

Marketing, engineering, and administrative (ME&A) expenses decreased $3.6 million, or 5.9%, in fiscal 2010 versus fiscal 2009. As a percentage of sales, ME&A expenses increased by 450 basis points to 25.0% in fiscal 2010, compared to 20.5% in fiscal 2009. The table below summarizes significant changes in certain ME&A expenses for the fiscal year:

|

Fiscal Year Ended

|

Increase/

|

||

|

$ thousands – (Income)/Expense

|

June 30, 2010

|

June 30, 2009

|

(Decrease)

|

|

Pension

|

$ 2,044

|

$ 413

|

$ 1,631

|

|

Stock Based Compensation

|

505

|

(581)

|

1,086

|

|

Severance

|

-

|

1,308

|

(1,308)

|

|

Domestic/Corporate IT Expenses

|

4,847

|

5,740

|

(893)

|

|

516

|

|||

|

Foreign Currency Translation

|

924

|

||

|

1,440

|

|||

|

All Other, Net

|

(5,024)

|

||

|

$ (3,584)

|

|||

The net remaining decrease in ME&A expenses for the year of $5,024,000 primarily relates to the global cost reduction initiatives implemented by the Company at the end of fiscal 2009. As announced in June 2009, the actions included a reduction of annual base salaries of the Company’s salaried employees including all executive officers, removal of the fiscal 2010 bonus/incentive plan, changes to several benefit programs, an across-the-board reduction of marketing, advertising, travel and entertainment expenses, and staff reductions and layoffs. In fiscal 2009, the decrease in stock based compensation expense for executive officers was primarily driven by the reversal of accruals for long-term incentive compensation awards for fiscal years 2010 and 2011, due to the low probability of achieving the threshold performance levels (see Note K of the Notes to the Consolidated Financial Statements). The severance charge in fiscal 2009 related to actions announced in the second quarter at the Company’s Belgian operation. In fiscal 2009, domestic and corporate IT expenses included a higher level of spending related to the implementation of the Company’s new global ERP system.

Restructuring of Operations

During the fourth quarter of fiscal 2009, the Company recorded a pre-tax restructuring charge of $948,000 related to a workforce reduction at its Racine, Canadian and Australian operations. The charge consisted of severance costs for 22 salaried employees and voluntary early retirement charges for an additional 16 manufacturing employees. During fiscal 2009, the Company made cash payments of $180,000, resulting in an accrual balance at June 30, 2009 of $767,000. The remainder of this balance was paid during fiscal 2010, resulting in no accrual balance at June 30, 2010.

During the fourth quarter of fiscal 2007, the Company recorded a pre-tax restructuring charge of $2,652,000 related to a workforce reduction at its Belgian operation to improve profitability through targeted outsourcing savings and additional focus on core manufacturing processes. The charge consisted of prepension costs for 32 employees: 29 manufacturing employees and 3 salaried employees. An adjustment was made in the fourth quarter of fiscal 2009, resulting in a pre-tax expense of $240,000 related to legally required inflationary adjustments to benefits. An additional adjustment was made in the fourth quarter of fiscal 2010, resulting in a pre-tax expense of $342,000 primarily related to a Belgian legislation change surrounding the prepension costs and legally required inflationary adjustments. During fiscal 2010 and 2009, the Company made cash payments of $152,000 and $120,000, respectively. The exchange impact in fiscal 2010 was to reduce the accrual by $292,000. Accrued restructuring costs were $2,315,000 and $2,417,000 at June 30, 2010 and 2009, respectively.

The Company recorded a restructuring charge of $2,076,000 in the fourth quarter of fiscal 2005 as the Company restructured its Belgian operation to improve future profitability. The charge consists of prepension costs for 37 employees: 33 manufacturing employees and 4 salaried employees. An adjustment was made in the fourth quarter of fiscal 2010, resulting in a pre-tax expense of $138,000 primarily related to a Belgian legislation change surrounding the prepension costs and legally required inflationary adjustments. During fiscal 2010 and 2009, the Company made cash payments of $192,000 and $200,000, respectively. The exchange impact in fiscal 2010 was to reduce the accrual by $122,000. Accrued restructuring costs were $945,000 and $1,121,000 at June 30, 2010 and 2009, respectively.

Interest Expense

Interest expense decreased by $0.2 million, or 8.2%, in fiscal 2010. Total interest on the Company’s $35 million revolving credit facility (“revolver”) decreased $0.2 million from $0.8 million in fiscal 2009 to $0.6 million in fiscal 2010. This decrease can be attributed to an overall decrease in the average borrowings year-over-year partially offset by an increase in the interest rate on the revolver year-over-year. The average borrowing on the revolver, computed monthly, decreased to $14.4 million in fiscal 2010, compared to $24.0 million in fiscal 2009. Partially offsetting the average decreased borrowing, the interest rate on the revolver increased from a range of 1.69% to 4.00% in fiscal 2009 to 4.00%, the rate floor, for all of fiscal 2010. Interest expense for the Company’s $25 million Senior Notes, which carry a fixed interest rate of 6.05%, remained flat at $1.5 million. The net remaining interest expense of $0.2 million was from various borrowings at the Company’s foreign subsidiaries.

Income Taxes

For 2010, the effective tax rate was 57.6 percent, compared to 34.7 percent last fiscal year. The increased rate for 2010 was primarily due to the impact of permanent items, which remained relatively constant with the prior year, but had a greater impact on the tax rate due to the low base of earnings. In addition, the prior fiscal year included a 3.0 percentage point benefit (rate reduction) related to an increase in foreign tax credits, which resulted in the relatively low rate for fiscal 2009.

Order Rates

As of June 30, 2010, the Company’s backlog of orders scheduled for shipment during the next six months (six-month backlog) was $84.4 million, or approximately 40% higher than the six-month backlog of $60.6 million as of June 30, 2009. The improvement in backlog is a result of increased orders by oil and gas customers for the Company’s 8500 series transmission as stable oil and gas prices have driven demand for new high-horsepower rigs. With oil and gas prices remaining firm, the Company is optimistic demand for these transmissions will continue. In addition, the Company continues to work on the development of its 7500 series transmission and expects to start production in the second half of fiscal 2011.

Liquidity and Capital Resources

Fiscal Years 2011, 2010 and 2009

The net cash provided by operating activities in fiscal 2011 totaled $13.9 million, a decrease of $21.3 million, or 61%, versus fiscal 2010. The net decrease was driven by a net increase in working capital, primarily due to increases in net inventories and trade accounts receivable balances, partially offset by a net increase in trade accounts payable and net earnings of $18.2 million. The majority of the net increase in inventory came at the Company’s North American manufacturing and distribution operations. This increase was driven by strong demand for the Company’s 8500 series transmission for the oil and gas market as well as a build-up of inventory in anticipation of the demand for the Company’s new 7500 series transmission. Net inventory as a percentage of the six-month backlog decreased from 86.2% as of June 30, 2010 to 67.4% as of June 30, 2011. The increase in trade accounts receivable was a result of higher sales in the second half of fiscal 2011 compared to the same period in fiscal 2010.

The net cash provided by operating activities in fiscal 2010 totaled $35.1 million, an increase of $23.5 million, or 203%, versus fiscal 2009. The net increase was driven by a net decrease in working capital, primarily due to decreases in net inventories and trade accounts receivable balances, partially offset by a net decrease in net earnings of $11.1 million. The net decrease in inventory came primarily at the Company’s European manufacturing locations and its distribution operation in Singapore. The decrease in trade accounts receivable was a result of lower sales in the second half of fiscal 2010 compared to the same period in fiscal 2009 as well as a continued effort to collect outstanding receivables balances globally.

The net cash provided by operating activities in fiscal 2009 totaled $11.6 million, a decrease of $8.3 million, or 42%, versus fiscal 2008. The net decrease was driven primarily by a net decrease in net earnings of $12.6 million, partially offset by decreases in working capital, primarily accounts payable and accrued liabilities. The decrease in accounts payable can primarily be attributed to the general volume decline in the fourth fiscal quarter as well as reduced inventories at the Company’s manufacturing locations. The decrease in accrued liabilities primarily relates to the reduction in bonus and stock-based compensation accruals versus the end of the prior fiscal year. The net increase in inventory came primarily at the Company’s distribution operation in Singapore, which saw double-digit sales growth throughout fiscal 2009 when compared to the same period in fiscal 2008.

The net cash used for investing activities in fiscal 2011 of $12.0 million consisted primarily of capital expenditures for machinery and equipment at our domestic and Belgian manufacturing operations. In fiscal 2011, the Company spent $12.0 million for capital expenditures, up from $4.5 million and $8.9 million in fiscal years 2010 and 2009, respectively.

The net cash used for investing activities in fiscal 2010 of $4.6 million consisted primarily of capital expenditures for machinery and equipment at our domestic and Belgian manufacturing operations, and the continuation of the global implementation of a new ERP system started in fiscal 2007. In fiscal 2010, the Company spent $4.5 million for capital expenditures, down from $8.9 million and $15.0 million in fiscal years 2009 and 2008, respectively. The software costs associated with the new ERP have been substantially paid for and were capitalized as appropriate in fiscal years 2007 and 2008.

The net cash used for investing activities in fiscal 2009 of $7.8 million consisted primarily of capital expenditures for machinery and equipment at our domestic and Belgian manufacturing operations, and the continuation of the global implementation of a new ERP system started in fiscal 2007. In fiscal 2010, the Company expects to complete the majority of the remaining ERP implementation work for its foreign manufacturing and distribution operations. The software costs associated with the new ERP have been substantially paid for and capitalized as appropriate in fiscal years 2007 and 2008.

In fiscal 2011, the net cash used by financing activities of $4.2 million consisted primarily of payments on long-term debt of $1.4 million and dividends paid to shareholders of the Company of $3.4 million.

In fiscal 2010, the net cash used by financing activities of $23.2 million consisted primarily of payments on long-term debt and dividends paid to shareholders of the Company.

In fiscal 2009, the net cash used by financing activities of $4.2 million consisted primarily of dividends paid to shareholders of the Company and the purchase of shares of the Company’s outstanding common stock under a Board authorized stock repurchase program, offset by net borrowings on the Company’s revolving credit facility. In the second fiscal quarter of 2009, the Company repurchased a total of 250,000 shares of its outstanding common stock at an average price of $7.25 per share, for a total of $1.8 million. In addition, the Company paid $3.1 million in dividends to its shareholders, a 3.5% increase over fiscal 2008. These were offset by over $2.8 million in additional borrowings under the Company’s revolving credit facility.

Future Liquidity and Capital Resources

In December 2002, the Company entered into a $20,000,000 revolving loan agreement with M&I Marshall & Ilsley Bank (“M&I”), which had an original expiration date of October 31, 2005. Through a series of amendments, the last of which was agreed to during the fourth quarter of fiscal 2011, the total commitment was increased to $40,000,000 and the term was extended to May 31, 2015. This agreement contains certain covenants, including restrictions on investments, acquisitions and indebtedness. Financial covenants include a minimum consolidated net worth amount, a minimum EBITDA for the most recent four fiscal quarters of $11,000,000 at June 30, 2011, and a maximum total funded debt to EBITDA ratio of 3.0 at June 30, 2011. As of June 30, 2011, the Company was in compliance with these covenants with a four quarter EBITDA total of $43,517,000 and a funded debt to EBITDA ratio of 0.68. The minimum net worth covenant fluctuates based upon actual earnings and is subject to adjustment for certain pension accounting adjustments to equity. As of June 30, 2011, the minimum equity requirement was $108,427,000 compared to an actual result of $171,085,000 after all required adjustments. The outstanding balance under the revolving loan agreement of $11,300,000 and $9,000,000 at June 30, 2011 and June 30, 2010, respectively, is classified as long-term debt. In accordance with the loan agreement as amended, the Company can borrow at LIBOR plus an additional “Add-On,” between 1.5% and 2.5%, depending on the Company’s Total Funded Debt to EBITDA ratio. The rate was 2.09% and 4.0% at June 30, 2011 and 2010, respectively.

On April 10, 2006, the Company entered into a Note Agreement (the “Note Agreement”) with The Prudential Insurance Company of America and certain other entities (collectively, “Purchasers”). Pursuant to the Note Agreement, Purchasers acquired, in the aggregate, $25,000,000 in 6.05% Senior Notes due April 10, 2016 (the “Notes”). The Notes mature and become due and payable in full on April 10, 2016 (the “Payment Date”). Prior to the Payment Date, the Company is obligated to make quarterly payments of interest during the term of the Notes, plus prepayments of principal of $3,571,429 on April 10 of each year from 2010 to 2015, inclusive. The outstanding balance was $17,857,143 and $21,428,571 at June 30, 2011 and 2010, respectively. Of the outstanding balance, $3,571,429 was classified as a current maturity of long-term debt at June 30, 2011 and 2010, respectively. The remaining $14,287,714 and $17,857,142 is classified as long-term debt as of June 30, 2011 and 2010, respectively. The Company also has the option of making additional prepayments subject to certain limitations, including the payment of a Yield-Maintenance Amount as defined in the Note Agreement. In addition, the Company will be required to make an offer to purchase the Notes upon a Change of Control, and any such offer must include the payment of a Yield-Maintenance Amount. The Note Agreement includes certain financial covenants which are identical to those associated with the revolving loan agreement discussed above. The Note Agreement also includes certain restrictive covenants that limit, among other things, the incurrence of additional indebtedness and the disposition of assets outside the ordinary course of business. The Note Agreement provides that it shall automatically include any covenants or events of default not previously included in the Note Agreement to the extent such covenants or events of default are granted to any other lender of an amount in excess of $1,000,000. Following an Event of Default, each Purchaser may accelerate all amounts outstanding under the Notes held by such party.

Four quarter EBITDA and total funded debt are non-GAAP measures, and are included herein for the purpose of disclosing the status of the Company’s compliance with the four quarter EBITDA covenant and the total funded debt to four quarter EBITDA ratio covenant described above. In accordance with the Company’s revolving loan agreement with M&I and the Note Agreement:

|

·

|

“Four quarter EBITDA” is defined as “the sum of (i) Net Income plus, to the extent deducted in the calculation of Net Income, (ii) interest expense, (iii) depreciation and amortization expense, and (iv) income tax expense;” and

|

|

·

|

“Total funded debt” is defined as “(i) all Indebtedness for borrowed money (including without limitation, Indebtedness evidenced by promissory notes, bonds, debentures and similar interest-bearing instruments), plus (ii) all purchase money Indebtedness, plus (iii) the principal portion of capital lease obligations, plus (iv) the maximum amount which is available to be drawn under letters of credit then outstanding, all as determined for the Company and its consolidated Subsidiaries as of the date of determination, without duplication, and in accordance with generally accepted accounting principles applied on a consistent basis.”

|

|

·

|

“Total funded debt to four quarter EBITDA” is defined as the ratio of total funded debt to four quarter EBITDA calculated in accordance with the above definitions.

|

The Company’s total funded debt as of June 30, 2011 and June 30, 2010 was equal to the total debt reported on the Company’s June 30, 2011 and June 30, 2010 Consolidated Balance Sheet, and therefore no reconciliation is included herein. The following table sets forth the reconciliation of the Company’s reported Net Earnings to the calculation of four quarter EBITDA for the four quarters ended June 30, 2011:

|

Four Quarter EBITDA Reconciliation

|

|

|

Net Earnings Attributable to Twin Disc

|

$18,830,000

|

|

Depreciation & Amortization

|

9,904,000