Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jazz Pharmaceuticals plc | d8k.htm |

Exhibit 99.1

Relevant slides from Jazz Pharmaceuticals’ presentation at the

J.P. Morgan Healthcare Conference by Bruce Cozadd, Chairman & CEO

January 14, 2010

2

Forward-Looking Statements

This presentation contains forward-looking statements, including, but not limited to, statements related to Jazz

Pharmaceuticals’ financial performance and growth potential, including 2010 financial guidance, statements related to

Jazz Pharmaceuticals’ JZP-6 product candidate, including statements related to its efficacy and safety, future regulatory

matters, and its continuing development and future commercialization, and statements related to market potential and

potential upside from product candidates. These forward-looking statements are based on the company’s current

expectations and inherently involve significant risks and uncertainties. Jazz Pharmaceuticals’ actual results and the

timing of events could differ materially from those anticipated in such forward-looking statements as a result of these

risks and uncertainties, which include, without limitation, risks related to: Jazz Pharmaceuticals’ ability to increase sales

of its Xyrem® and Luvox CR® products; Jazz Pharmaceuticals’ dependence on single source suppliers and

manufacturers; the uncertain and time-consuming regulatory approval process for JZP-6; Jazz Pharmaceuticals’ inability

to successfully market JZP-6 in the U.S. if approved by the FDA for the treatment of fibromyalgia; Jazz Pharmaceuticals’

cash flow estimates and the potential need to raise additional funds; competition; Jazz Pharmaceuticals’ future financial

performance and financial position; and those risks detailed from time-to-time under the caption “Risk Factors” and

elsewhere in Jazz Pharmaceuticals’ Securities and Exchange Commission filings and reports, including in its

Registration Statement on Form S-1 (File No. 333-163999) filed by Jazz Pharmaceuticals with the Securities and

Exchange Commission on December 23, 2009. Jazz Pharmaceuticals undertakes no duty or obligation to update any

forward-looking statements contained in this presentation as a result of new information, future events or changes in its

expectations.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

Jazz Pharmaceuticals

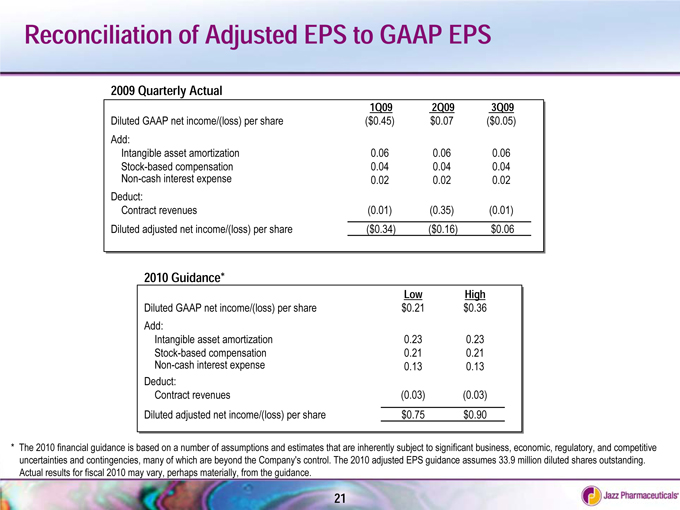

Reconciliation of Adjusted EPS to GAAP EPS

2009 Quarterly Actual

1Q09 2Q09 3Q09

Diluted GAAP net income/(loss) per share ($0.45) $0.07 ($0.05)

Add:

Intangible asset amortization 0.06 0.06 0.06

Stock-based compensation 0.04 0.04 0.04

Non-cash interest expense 0.02 0.02 0.02

Deduct:

Contract revenues (0.01) (0.35) (0.01)

Diluted adjusted net income/(loss) per share ($0.34) ($0.16) $0.06

2010 Guidance*

Low High

Diluted GAAP net income/(loss) per share $0.21 $0.36

Add:

Intangible asset amortization 0.23 0.23

Stock-based compensation 0.21 0.21

Non-cash interest expense 0.13 0.13

Deduct:

Contract revenues (0.03) (0.03)

Diluted adjusted net income/(loss) per share $0.75 $0.90

* The 2010 financial guidance is based on a number of assumptions and estimates that are inherently subject to significant business, economic, regulatory, and competitive uncertainties and contingencies, many of which are beyond the Company’s control. The 2010 adjusted EPS guidance assumes 33.9 million diluted shares outstanding.

Actual results for fiscal 2010 may vary, perhaps materially, from the guidance.

Jazz Pharmaceuticals

21

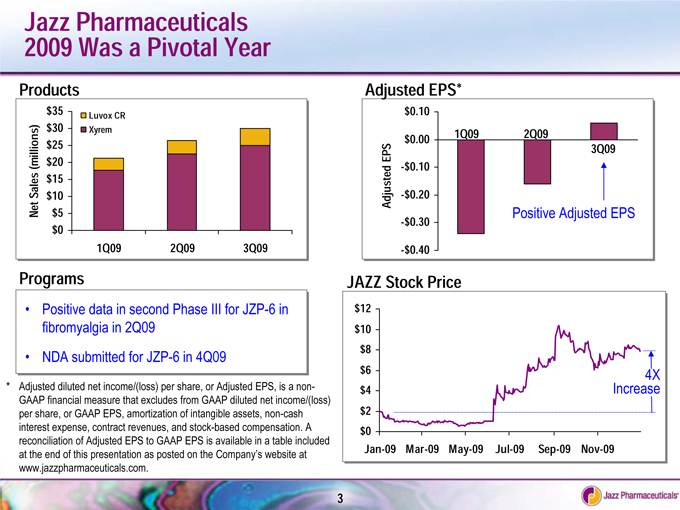

Jazz Pharmaceuticals 2009 Was a Pivotal Year

Products

$35 Luvox CR

$30 Xyrem

$25 (millions) $20 Sales $15 $10 Net $5 $0

1Q09 2Q09 3Q09

Adjusted EPS*

$0.10 $0.00 1Q09 2Q09

EPS 3Q09

-$0.10 Adjusted -$0.20

Positive Adjusted EPS

-$0.30

-$0.40

Programs

Positive data in second Phase III for JZP-6 in fibromyalgia in 2Q09

NDA submitted for JZP-6 in 4Q09

JAZZ Stock Price

$12 $10 $8

$6 4X

$4 Increase

$2 $0

Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09

* Adjusted diluted net income/(loss) per share, or Adjusted EPS, is a non-GAAP financial measure that excludes from GAAP diluted net income/(loss) per share, or GAAP EPS, amortization of intangible assets, non-cash interest expense, contract revenues, and stock-based compensation. A reconciliation of Adjusted EPS to GAAP EPS is available in a table included at the end of this presentation as posted on the Company’s website at www.jazzpharmaceuticals.com.

Jazz Pharmaceuticals

3

Relevant portion of Jazz Pharmaceuticals’ transcript

11:00am PST, January 14, 2010

28th Annual J.P. Morgan Healthcare Conference

Westin St. Francis Hotel

San Francisco, California

[Bruce Cozadd, CEO, Jazz Pharmaceuticals]

So I’m going to spend most of the presentation today talking about the future, but I want to spend just one slide reviewing our recent performance, starting with product sales. Sales of our two products in 2009 have increased nicely. Our last reported quarter was the third quarter of 2009, where we reported 30 million dollars in net sales for a run-rate of 120 million dollars. We also like to look at the bottom line, and in the third quarter for the first time we achieved what we consider to be profitability. Now I’m showing here an adjusted EPS number. It’s our best representation of a cash-flow EPS, so we’re backing out intangible amortization, we’re backing out non-cash interest, we’re backing out non-cash stock-based compensation. We’re also subtracting out non-cash revenues to give what we think is the best approximation of our cash flow. That would have been 6 cents for the third quarter of 2009. We do provide a reconciliation to GAAP EPS for every period we’re going to talk about, in an additional slide that you can find on our website after this presentation. Looking forward from our current results, we also had some significant progress in our pipeline, announcing in the second quarter very positive Phase III results in our second pivotal Phase III trial in fibromyalgia, where we did meet our primary endpoint with high statistical significance. And at the very close of the year, in the first half of December, we submitted our NDA for fibromyalgia for JZP-6. And the last thing I’ll mention for 2009 is that we think, if you look at our stock price graph, we showed additional financial strength as we moved toward the end of the year, so as people started to recognize the growing revenue stream, the profitability, our financial position became stronger, I think people began to realize that the company was not in need of near-term financing.