Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOWER BANCORP INC | d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - TOWER BANCORP INC | dex21.htm |

| EX-99.1 - PRESS RELEASE - TOWER BANCORP INC | dex991.htm |

| EX-99.3 - EMPLOYEE COMMUNICATION - TOWER BANCORP INC | dex993.htm |

& December 2009 “Creating Central/Southeastern Pennsylvania’s Premier Community

Bank” Exhibit 99.2 |

2 FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements that are intended to be covered by the safe harbor

for forward-looking statements provided by the Private Securities Litigation Reform Act of

1995. Forward-looking statements are not statements of historical fact, and can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,”

“will,” “should,” “project,” “plan,” “seek,” “target,” “intend” or “anticipate” or the negative thereof or comparable terminology. Forward-looking statements include discussions of strategy,

financial projections and estimates and their underlying assumptions, statements regarding

plans, objectives, expectations or consequences of various transactions, and statements about the future performance, operations, products and services of Tower Bancorp, Inc. (“Tower”), First Chester

County Corporation (“First Chester”) and our respective subsidiaries. These

forward-looking statements are subject to various assumptions, risks, uncertainties and other factors . These risks are detailed in documents filed by Tower and First Chester with the Securities and Exchange Commission, including

Tower’s and First Chester’s Quarterly Report on Form 10-Q, Annual Report on Form

10-K, and other required filings. Because of these uncertainties, risks and the possibility of changes in these assumptions, actual results

could differ materially from those expressed in any forward-looking statements. Investors

are cautioned not to place undue reliance on these statements. Neither Tower nor First Chester assume any duty or obligation to update any forward-looking statements made in this presentation. The proposed transaction will be submitted to the shareholders of First Chester and Tower for their

consideration and approval. In connection with the proposed transaction, Tower will be

filing with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 which will include a joint proxy statement/prospectus and other relevant documents to be distributed to the

shareholders of Tower and First Chester. Investors are urged to read the registration statement

and the joint proxy statement/prospectus regarding the proposed transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents,

because they will contain important information. Investors will be able to obtain a free copy

of the joint proxy statement/prospectus, as well as other filings containing information about Tower and First Chester, free of charge from the SEC’s Internet site (www.sec.gov), by contacting Tower

Bancorp, Inc., 112 Market Street, Harrisburg, Pennsylvania 17101, Attention: Brent Smith,

Investor Relations, telephone 717-724-4666 or by contacting First Chester Financial Corporation, 9 North High Street, West Chester, Pennsylvania 19381, Attention: John Stoddart, Investor Relations,

telephone 484-881-4141. INVESTORS SHOULD READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TRANSACTION. Tower, First Chester and their respective directors, executive officers, and certain other members of

management and employees may be soliciting proxies from Tower and First Chester shareholders in

favor of the transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Tower and First Chester shareholders in connection

with the proposed transaction will be set forth in the joint proxy statement/prospectus when it

is filed with the SEC. You can find information about Tower’s executive officers and directors in its most officers and directors is set forth in its most recent proxy statement filed with the SEC, which is

available at the SEC’s Internet site. You can also obtain free copies of these

documents from Tower or First Chester, as appropriate, using the contact information above. This document is not an offer to sell shares of Tower’s securities which may be issued in the proposed

transaction. Such securities are offered only by means of the joint proxy statement/prospectus

referred to above. recent proxy statement filed with the SEC, which is available at the SEC’s Internet site (www.sec.gov). Information about First Chester’s executive |

3 MERGER HIGHLIGHTS Source: SNL Financial and Microsoft MapPoint Pro forma assets of $2.7 billion creates immediate scale Strong presence in attractive Pennsylvania markets Creates deep management team with highly talented Board of Directors Brings wealth management platform to Tower Bancorp Significantly accretive to earnings Strong pro forma capital levels Pro Forma Footprint TOBC FCEC “Creating Central/Southeastern Pennsylvania’s Premier Community Bank”

|

4 TRANSACTION OVERVIEW (1) Based on FCEC delinquencies of approximately $45 million and TOBC’s closing price on 12/24/2009 of $22.55 Acquiror: Tower Bancorp, Inc. (NASDAQ: TOBC) Target: First Chester County Corporation (NASDAQ: FCEC) Consideration: Each share of FCEC common stock will be exchanged for 0.453 TOBC shares, subject to adjustment (see page 5) Transaction Value (1) : $10.22 per share or approximately $65 million (90% of Tangible Book Value) Management: Senior management of TOBC will remain the same following the merger. Chairman and CEO John Featherman will remain in this role with the First National Bank of Chester County subsidiary and will become Vice Chairman of TOBC Board Representation: Three board members from FCEC will join the TOBC board Closing Condition: Aggregate amount of FCEC delinquencies must be less than $90.0 million Termination Fee: $3.5 Million Required Approvals: Customary Regulatory and Shareholders of each company Expected Closing: Q2 2010 |

5 PRICE ADJUSTMENT MECHANISM FCEC Delinquencies - 9/30/2009 Loans 30-89 Days Past Due $9,591 Loans 90 Days Past Due 0 Nonaccrual Loans 15,787 Restructured & Impaired Loans 16,706 OREO 3,062 Charge-Offs Post 9/30/2009 0 Total Delinquencies $45,146 Deal Value Delinquencies Exchange Per > <= Ratio Share $35.0 0.464 x $10.46 35.0 55.0 0.453 10.22 55.0 60.0 0.420 9.47 60.0 65.0 0.388 8.75 65.0 70.0 0.356 8.03 70.0 75.0 0.323 7.28 75.0 80.0 0.291 6.56 80.0 85.0 0.259 5.84 85.0 90.0 0.237 5.34 Deal value per share based upon TOBC’s closing price on 12/24/2009 of $22.55 Delinquencies defined as the sum of (i) all loans with principal and/or interest that are 30-89 days

past due, (ii) all loans with principal and/or interest that are at least 90 days past due and still accruing, (iii) all loans with principal and/or interest that are non-accruing, (iv)

restructured and impaired loans, (v) other real estate owned and (vi) net charge-offs must be approved by TOBC from the most recent quarter prior to announcement through the last business day of the month prior to the completion of the merger. All portfolio loan sales prior to closing

|

6 One of Pennsylvania’s largest independent banks Assets: $1.31 billion Gross Loans: $1.15 billion Deposits: $986 million Tangible Common Equity: $73.3 million 23 branches concentrated in Chester County Comprehensive financial services provider Retail Banking Commercial Banking Trust and Investment Management Mortgage Banking FIRST CHESTER OVERVIEW First Chester Overview Deposit market share data as of 6/30/09 Chester County, PA Total Total Deposits Market Branch in Market Share Rank Institution Count ($000) (%) 1 Wells Fargo & Co. (CA) 18 1,479,482 14.49 2 National Penn Bancshares Inc. (PA) 19 893,880 8.75 3 Royal Bank of Scotland Group 18 872,791 8.55 4 First Chester County Corp. (PA) 18 862,382 8.44 5 PNC Financial Services Group (PA) 12 786,856 7.70 6 Toronto-Dominion Bank 10 778,974 7.63 7 Malvern Federal Bncp Inc (MHC) (PA) 8 530,420 5.19 8 First Niagara Finl Group (NY) 15 516,165 5.05 9 DNB Financial Corp. (PA) 12 452,093 4.43 10 Banco Santander S.A. 7 280,904 2.75 11 Stonebridge Financial Corp. (PA) 3 278,205 2.72 12 Phoenixville Federal Bk & Tr (PA) 3 219,979 2.15 13 Fulton Financial Corp. (PA) 7 215,881 2.11 14 Meridian Bank (PA) 3 205,597 2.01 15 NOVA Financial Holdings Inc. (PA) 2 159,133 1.56 Top 10 137 7,453,947 72.98 Totals 202 10,212,787 100.00 |

7 ATTRACTIVE MARKETS FCEC operates in 4 of the top 10 wealthiest counties in Pennsylvania as measured by

median household income Chester County median household income is in the top 1% of counties nationwide

Chester County is the third fastest growing PA county measured by projected

population growth 2009 '09-'14 2014 '09-'14 Med. HHI Proj. HHI Proj. HHI Proj. Pop. Rank County ($) Growth ($) Growth 1 Chester $87,308 7.36 % $93,734 6.64 % 2 Montgomery 80,212 5.01 84,231 1.85 3 Bucks 79,444 4.95 83,376 2.22 4 Delaware 66,300 5.25 69,781 0.10 5 Cumberland 61,622 6.42 65,578 4.06 6 Northampton 60,207 6.11 63,886 5.48 7 Monroe 59,940 0.44 60,204 9.97 8 Lancaster 59,484 5.61 62,821 3.46 9 York 59,123 3.89 61,423 6.36 10 Berks 58,885 4.18 61,346 3.73 Source: SNL Financial |

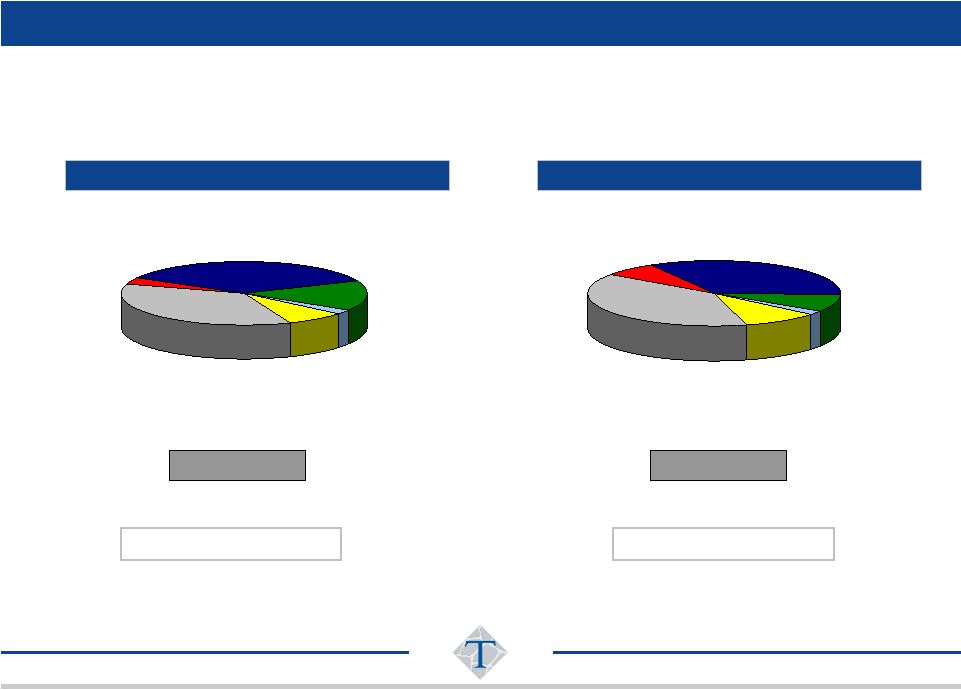

8 Retail Time Deposits 20% Demand Deposits 8% NOW Accounts 4% Jumbo Time Deposits 20% Money Market & Savings 48% Retail Time Deposits 24% Jumbo Time Deposits 12% Demand Deposits 9% Money Market & Savings 45% NOW Accounts 10% DEPOSIT COMPOSITION Source: Data per 9/30/2009 FFIEC reports and Company Documents TOBC Stand Alone Total: $1.13B Total: $986M FCEC Stand Alone Cost of interest bearing deposits: 1.62% Cost of interest bearing deposits: 1.86% |

9 LOAN COMPOSITION Total: $1.01B Total: $1.15B TOBC Stand Alone FCEC Stand Alone Consumer & Other 2% Multifamily Residential 3% Commercial & Industrial 15% 1-4 Family 37% Construction & Land Development 8% Commercial Real Estate 35% Consumer & Other 2% Multifamily Residential 7% Commercial & Industrial 9% 1-4 Family 38% Construction & Land Development 10% Commercial Real Estate 34% Source: Data per 9/30/2009 FFIEC reports and Company Documents Yield on loans: 5.72% Yield on loans: 5.95% |

10 CREDIT REVIEW FCEC recently completed a third party loan review with identified problems addressed in Q3 ‘09 All impaired loans and all large loans reviewed by TOBC TOBC loan review supplemented with two external loan review firms Estimated loan mark of just under 7% of the gross loan held for investment portfolio NPLs / Loans (%) Source: SNL Financial and Company Documents All financial information for periods prior to March 31, 2009 represents historical financials for Graystone Financial Corp., as the accounting acquirer in the reverse merger 2005 financial data reflects the period from September 2, 2005 (inception date) to

December 31, 2005 * Peers include BMTC, CZNC, CCNE, FNB, FCF, FNCB, METR,

NPBC, ORRF, RBPAA, STBA, TOBC, UVSB AND VIST NCOs / Average Loans (%) (0.03) 0.00 0.00 0.00 0.14 0.23 0.20 0.01 0.06 0.06 0.11 0.27 1.04 0.44 0.15 0.17 0.70 0.54 0.46 0.31 0.14 (0.30%) 0.00% 0.30% 0.60% 0.90% 1.20% 2005 2006 2007 2008 Q1 '09 Q2 '09 Q3 '09 FCEC TOBC Peers* Due Diligence 0.00 0.00 0.28 0.26 0.46 0.62 0.66 2.84 1.48 1.84 1.02 0.16 1.05 1.26 2.11 1.91 0.95 1.12 0.49 0.33 0.31 0.00% 0.60% 1.20% 1.80% 2.40% 3.00% 2005 2006 2007 2008 Q1 '09 Q2 '09 Q3 '09 FCEC TOBC Peers* |

11 FINANCIAL IMPACT Significant EPS accretion in 2010 and 2011 Long-term EPS accretion greater than 20% Exceeds management IRR threshold with returns greater than 20% Conservative cost save assumptions of 15% of FCEC’s expense base Estimated loan mark of just under 7% of the gross loan portfolio partially offset by write-up to fixed assets Pro forma capital ratios continue to remain “well-capitalized” Tower will support FCEC’s bank level capital ratios prior to closing through a holding company loan and loan participation facility

|

& December 2009 “Creating Central/Southeastern Pennsylvania’s Premier Community

Bank” |