Attached files

| file | filename |

|---|---|

| 8-K - 8-K WEST COAST UTILITIES - NORTHWESTERN CORP | ek_121009.htm |

West

Coast Utilities

Seminar

Seminar

Four

Seasons Hotel, Las Vegas, NV

December

10, 2009

2

forward-looking

statement…

During

the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

Except

as noted herein, the information in this presentation is based upon

our current expectations as of the date hereof unless otherwise noted.

Our actual future business and financial performance may differ

materially and adversely from those expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

our current expectations as of the date hereof unless otherwise noted.

Our actual future business and financial performance may differ

materially and adversely from those expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

3

who we

are…

(1) As

of 9/30/09

(2) Book

capitalization calculated as total debt, excluding capital leases, plus

shareholders’ equity.

¾ 656,000

customers

» 392,000

electric

» 264,000

natural gas

¾ Approximately

123,000 square

miles of service territory in

Montana, Nebraska and South Dakota

miles of service territory in

Montana, Nebraska and South Dakota

¾ Total

generation (mostly

base load coal)

» MT

- 222 MW - regulated beginning 1/1/09

» SD

- 312 MW - regulated

¾ Total

Assets: $2,754 MM (1)

¾ Total

Capitalization: $1,666 MM (1)(2)

¾ Total

Employees: 1,385

Located

in states with relatively stable economies with potential grid

expansion to support renewables.

expansion to support renewables.

¾ Solid

operations

» Cost

competitive

» Above-average

reliability

» Award-winning

customer service

¾ Improving

credit ratings and strong balance sheet and liquidity

» Secured

and unsecured investment grade ratings

» Moody’s

has us on “positive” outlook

¾ Positive

earnings and ROE trend

» Colstrip

Unit 4 into rates effective January 1, 2009

» Delivery

services rate cases for Montana electric and natural gas

¾ Strong

cash flows

» NOLs

and repair tax deduction provide an effective tax shield until likely

2014

¾ Competitive

dividend

» Current

yield approximately 5.5%

¾ Improving

regulatory environment

¾ Realistic

growth prospects

4

NorthWestern’s

attributes…

improving credit

ratings…

5

6

strong

balance sheet and liquidity …

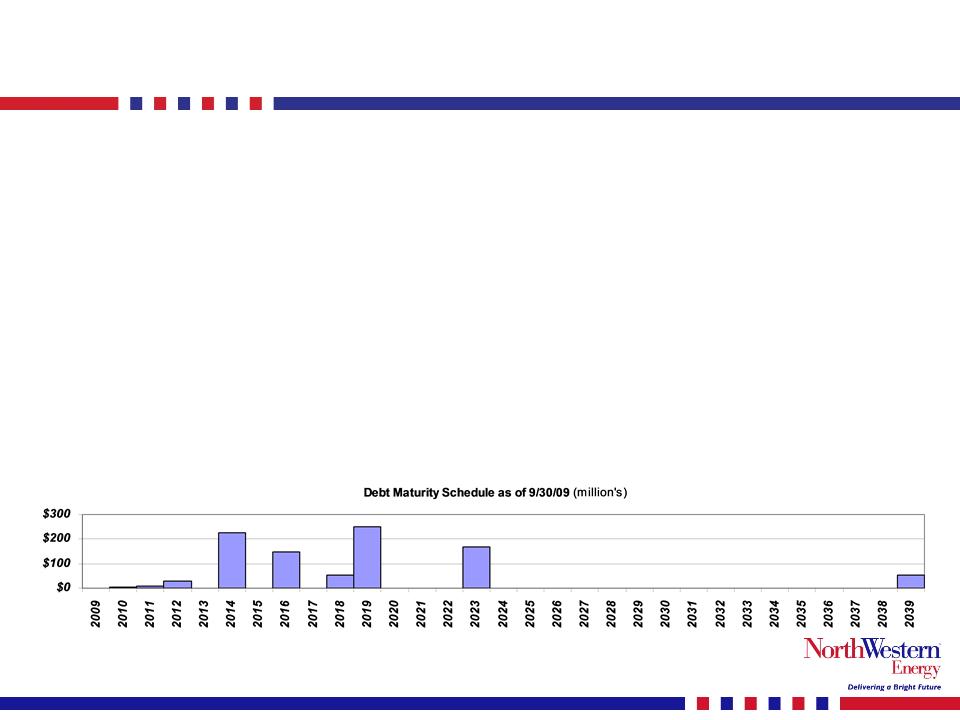

¾ Debt

/ Total capitalization of 53.4% (9/30/09)

¾ October

2009

» $55

million, 30 year First Mortgage Bonds issued at 5.71%

¾ June

2009

» Extended

unsecured revolver maturity to June 30, 2012

» Increased

size from $200 million to $250 million

¾ March

2009

» $250

million, 10 year First Mortgage Bonds issued at 6.34%

¾ Total

liquidity currently in the $250 million range

¾ Nearly

all long-term debt matures after 2014

positive earnings

and ROE trend…

Mill

Creek and Colstrip Unit 4 ROE’s of

10.25% & 10.00% respectively.

7

8

strong

cash flows…

Earnings

growth, NOLs, and repairs tax deduction provide strong cash flows

to fund future growth projects.

to fund future growth projects.

9

2009

return of approximately 20% year-to-date and expect to be greater than

90% funded.

90% funded.

pension

funding and expense …

competitive

dividend…

10

Goal

for dividend payout ratio of 60% - 70%.

Current dividend yield about 5.5%.

Current dividend yield about 5.5%.

11

regulatory

update…

¾ Montana

» Rate

cases filed October 2009 requesting $17.5 million revenue increase

♦ We

anticipate a rate adjustment to go into effect October 2010

» Mill

Creek Generation Station filed with MPSC

♦ MPSC

approval in 2Q 2009

♦ Under

construction with $40.5 million capitalized CWIP as of 9/30/09

» Colstrip

Unit 4 into rate base starting January 2009

¾ South

Dakota / Nebraska

» Expect

to file natural gas rate cases during 2010

¾ FERC

» Working

with FERC for MSTI rate design

♦ FERC

encouraged Company to develop MSTI on a cost of service basis

by requesting appropriate tariff waivers from existing OATT

by requesting appropriate tariff waivers from existing OATT

» FERC

approved 230kV Renewable Collector System open season as

submitted

submitted

Establishing

positive regulatory regulations in all jurisdictions.

12

near-term potential

earnings drivers…

¾ 2010

» Expecting

flat volumes

♦ Due

to higher mix of residential/commercial vs. industrial customers as

compared to other utilities

compared to other utilities

● Electric:

67% Residential & Commercial, 33% Industrial

● Natural

Gas: 99% Residential & Commercial, 1% Industrial

» Montana

rate adjustment expected to take effect second half of 2010

¾ 2011

» Full

year effect of Montana rate adjustment

» South

Dakota and Nebraska natural gas rate adjustments expected

» Mill

Creek in rate base

♦ Approximately

$10 million annualized contribution to net income

Near-term

earnings drivers independent of transmission projects.

13

Balanced

growth opportunities across the business.

longer-term

potential earnings drivers …

¾ Distribution

system enhancements

» Exploring

incremental rate based investment (early

stages)

¾ Energy

supply

» Mill

Creek Generation Station

» South

Dakota peaking generation

» Natural

gas reserves (early

stages)

» Wind

projects and other renewable projects (early

stages)

¾ Transmission

projects

» Colstrip

500 kV upgrade

» 230

kV Renewable Collector System

» Mountain

States Transmission Intertie (MSTI)

» Electric

Transmission America (ETA) (early

stages)

» Green

Power Express (ITC) (early

stages)

14

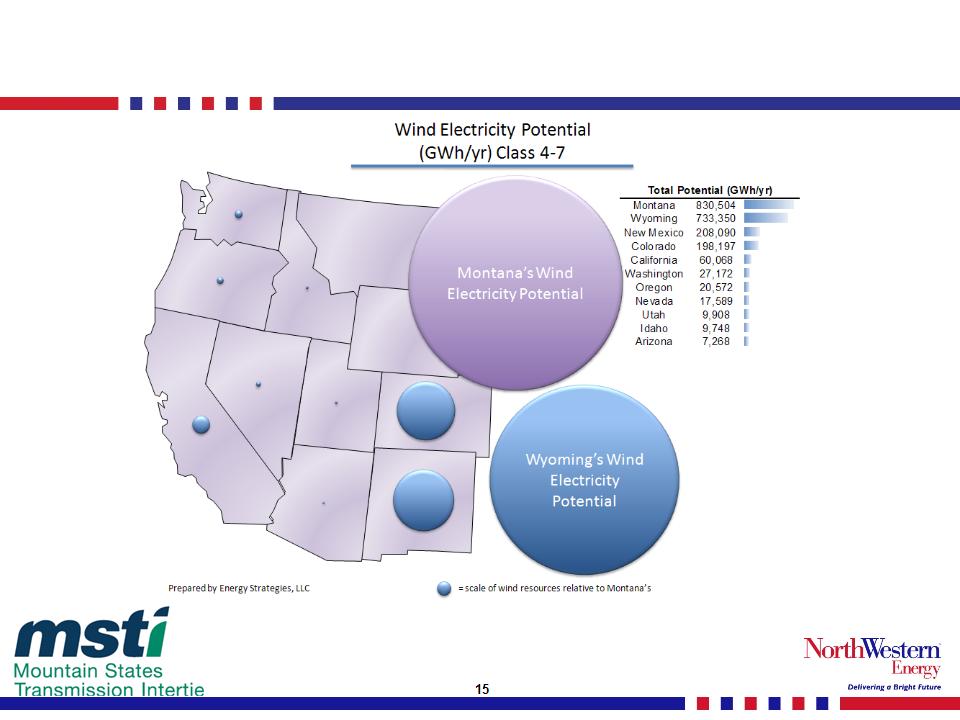

great

wind potential in our service territory…

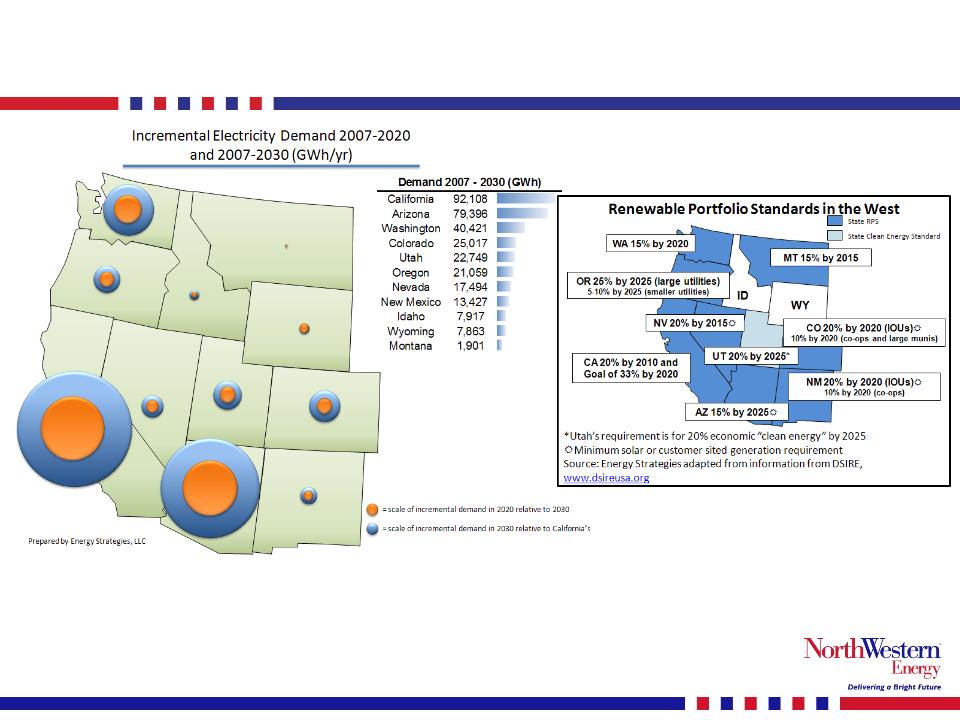

MSTI

provides link between supply …

16

and

demand…

our

proposed transmission projects…

18

capex

spending - next few years…

Additional

equity not

anticipated until we proceed

with MSTI or other major

investments.

anticipated until we proceed

with MSTI or other major

investments.

We

will move forward with

the funding of these projects

only when they make

economic sense.

the funding of these projects

only when they make

economic sense.

MSTI

project is now slated for

early 2015 and capex has

been modified accordingly.

Capital still shown at 100%

but still evaluating partners.

early 2015 and capex has

been modified accordingly.

Capital still shown at 100%

but still evaluating partners.

Utility

Maintenance

Capex is funded 100%

by free cash flow.

Capex is funded 100%

by free cash flow.

19

growth

project potential…

Opportunity

to double and diversify earnings as compared with our existing

$1.5 billion rate base.

$1.5 billion rate base.

20

growth

project milestones ’09 & ’10…

2009

Mill

Creek

ü Expect

decision from the MPSC

(APPROVED) Q2

ü Begin

construction Q3

500

kV Upgrade

ü Complete

engineering and planning studies Q4

ü WECC

regional planning process begins Q4

¾ Finalize

commercial terms w/partners Q4

230

kV Collector System

ü Information

meeting with customers Q2

ü FERC

ruling allowing “open

season” Q2

¾ Identify

potential anchor tenant Q4

MSTI

ü Work

with FERC to clarify filings process Q3

¾ EIS

admin draft for public review due Q4

2010

Mill

Creek

¾ Complete

construction Q4

¾ Start

up, commissioning and completion Q4

500

kV Upgrade

¾ Complete

detailed engineering Q3

¾ Complete

regional planning process Q4

230

kV Collector System

¾ Conduct

“open season” Q1

¾ Siting

and permitting process begins Q1

¾ WECC

regional planning process Q2

MSTI

¾ Draft

EIS Q1

¾ Conduct

“open season”/commercial terms Q1

¾ EIS

Record of Decision Q3

¾ Begin

right of way procurement Q4

¾ Begin

Final Engineering Q4

21

in

summary…

¾ Solid

operations

¾ Improving

credit ratings and strong balance

sheet and liquidity

sheet and liquidity

¾ Positive

earnings and ROE trend

¾ Strong

cash flows

¾ Competitive

dividend

¾ Improving

regulatory environment

¾ Realistic

growth prospects

22

2009

guidance change… (appendix)

Earnings

guidance range for 2009 revised to $1.95 - $2.05

23

results

through Q3 2009… (appendix)

Prior

earnings guidance of $1.75 - $1.85 revised upward to $1.95 - $2.05 on

October 28, 2009 due to repairs tax deduction.

October 28, 2009 due to repairs tax deduction.

24

Q4 2009

earnings bridge … (appendix)

25

MPSC

rate request … (appendix)

¾ Requested

revenue increase of $17.5 million

» Electric

T&D = $15.5 million (6.98%)

» Natural

gas T&D = $2.0 million (1.89%)

» Expect

decision within nine months after accepted filing

» Interim

rates requested

» Increase

primarily due to pension and wage increases

¾ Requested

for both Electric and Natural Gas Cases

» ROE

of 10.90%

» Ratio

of 50.55% debt / 49.45% equity

» Cost

of debt of 5.76%

» Resulting

cost of capital of 8.30%

» Electric

and Natural Gas rate base of $632 million and $257 million,

respectively

¾ We

anticipate a rate adjustment to go into effect October 2010

Rate

request excludes power supply costs, Colstrip Unit 4 generation and

the

under- construction Mill Creek Generation Plant.

under- construction Mill Creek Generation Plant.