Attached files

David

Blackford

CEO & President

California Bank & Trust

CEO & President

California Bank & Trust

December

1, 2009

Portfolio

and Performance Update

Page

*

CB&T

Overview

® $11 billion in

assets

® 116

branches

throughout California

throughout California

® $9.2 billion in

loans

® $9.4 billion

in

deposits

deposits

® Accomplished

management team

in place for last 10

years

management team

in place for last 10

years

Page

*

Bank

Performance

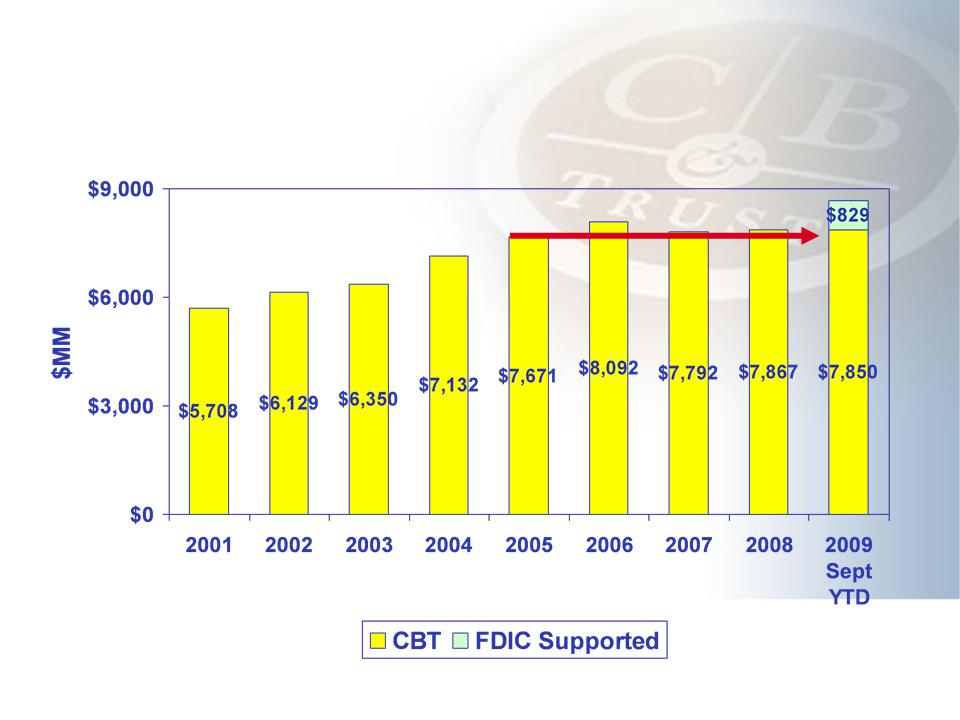

® Loans:

Ø Modest growth since

2004 (less than 3% organic CAGR)

® Deposits:

Ø 32% DDA, 80% core

deposits1

Ø Stable, low cost

deposit base to relationship customers

® Profitability:

Ø YTD NIM of 4.76%

-among the highest in the country (92nd

percentile)(2)

percentile)(2)

Ø Flat expenses since

2004 provide strong operating efficiency (88th

percentile) (2)

percentile) (2)

® Strategic

Growth:

Ø Low risk expansion

thru 2 FDIC assisted acquisitions in 2009

(1) Excludes all CDs and

Foreign Deposits

(2) Source:

SNL Financial

Sept 09

YTD. Compared

to coml.. banks with assets

>$2.0B. Adj. for FDIC Insurance Assessment and Alliance and Vineyard acq.

>$2.0B. Adj. for FDIC Insurance Assessment and Alliance and Vineyard acq.

Page

*

Credit

Metrics

|

|

2008

|

Sept.

2009 YTD |

|

|

Non-accrual

Loans / Loans

|

1.72

|

2.75

|

|

|

Net

Charge-offs / Avg Loans

|

0.78

|

1.79

|

Provision

156 bp

higher than NCO: Result = $95MM reserve build 2009 |

|

Loan Loss

Provision / Avg Loans

|

1.05

|

3.35

|

|

|

ACL /

NPLs

|

98.6

|

107.0

|

Over

100% coverage

|

|

ACL /

Loans

|

1.69

|

2.94

|

|

® Strong core

operating earnings have enabled us to build reserves and

expediently dispose of real estate assets in weaker markets

expediently dispose of real estate assets in weaker markets

® Credit deterioration

has been manageable

Data

excludes FDIC Supported Assets

Sept

YTD charge-offs and provision annualized for ratios

Page

*

California

Housing Overview

® Improving demand for

finished lots in all Western

markets

markets

Ø Lot prices

increasing as inventory contracts

® Very

recent signs of SFR

stabilization appearing

Ø October 2009 year

over year SFR price increase for

Orange County, San Diego, and the Bay Area, with LA

decline in single digits.

Orange County, San Diego, and the Bay Area, with LA

decline in single digits.

Ø Affordability much

improved following 30-40% price

declines from peak

declines from peak

® Entitled land demand

remains soft, although prices

expected to firm as finished lot inventory reduces

expected to firm as finished lot inventory reduces

Page

*

California

Commercial Overview

® Valuation declines

driven by:

Ø Rising Cap

rates

Ø Increase in vacancy

rates across all product types

Ø Rental rate declines

and larger concessions

® Current prices off

40% from 2007 peak (Moody’s

REAL Cml.

PPI Index)

PPI Index)

® No safe haven - all

product types affected

® Huge wave of CMBS

and bank loans maturing that

will not qualify for refinance

will not qualify for refinance

® CBT proactively

identifying at-risk projects to

resolve

resolve

Page

*

® Lending practices

have constrained problem loan

migration and limited loss exposure

migration and limited loss exposure

® Careful

Loan Origination

Ø Strong initial

underwriting

Ø LTV

maintenance

Ø Remargin

requirements

Ø Market and loan

diversification

Ø Borrower financial

capacity to support project

® Rigorous

Loan Management

Ø Early problem

recognition

Ø Reappraise and

remargin - first mover advantage

Ø Concentrated efforts

to reduce exposure

Ø Solution

oriented

Ø Intense executive

management involvement and support

CBT’s

Lending Philosophy

Page

*

Loan

Growth

Average loans ($MM)

Average loans ($MM)

Page

*

Page

*

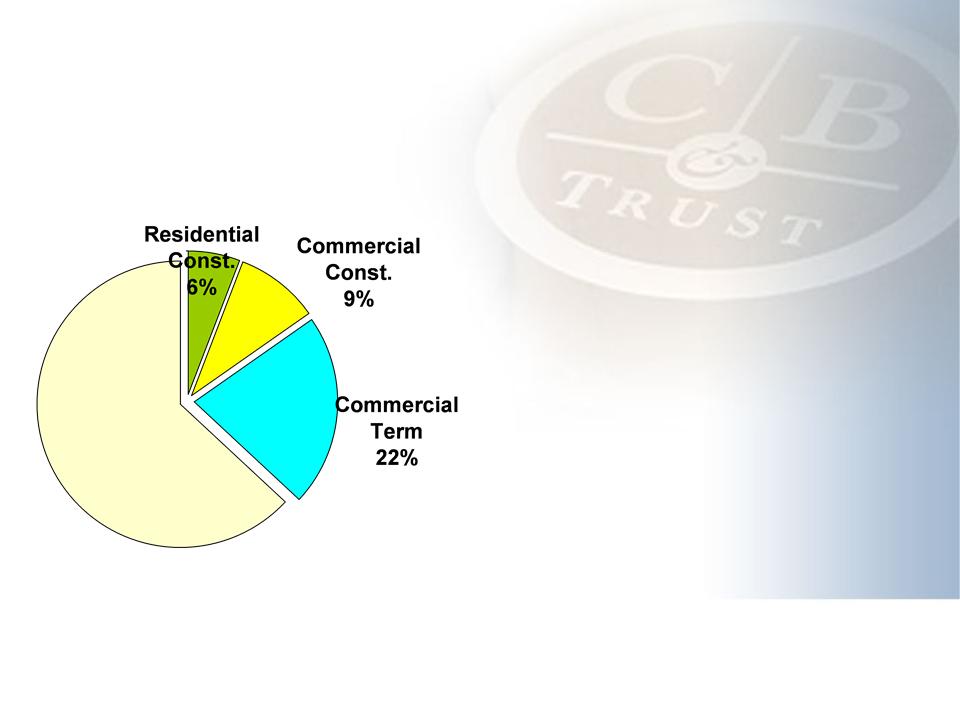

CBT

Loan Portfolio

Outstandings of 9/30/09

Outstandings of 9/30/09

1st TD

Mortgages

Page

*

CBT

Loan Portfolio

Outstandings of 9/30/09

Outstandings of 9/30/09

Owner

Occupied Real

Estate

Estate

Ø Well secured smaller

loans

Ø Diversification by

product

and geography

and geography

Ø Largely plain

vanilla RE

SBA

504

Ø Problems arising

from

business failures

business failures

Ø 504 NPLs to total at

9/30 =

6.2%.

6.2%.

Ø Loss content

mitigated by

60% LTV/LTC at origination

60% LTV/LTC at origination

Ø CO = .32% total

2008, 1.1%

2009 Sept YTD annualized

2009 Sept YTD annualized

Page

*

CBT

Loan Portfolio

Outstandings of 9/30/09

Outstandings of 9/30/09

Commercial

Real Estate

Ø Specialized RE

lending group

for construction and larger

term

for construction and larger

term

Ø Branch and Cml.

network

originations small investor

miniperms with strong

guarantees

originations small investor

miniperms with strong

guarantees

Ø Portfolio within

targets for

market and product

diversification

market and product

diversification

Ø Substantial

reductions in at-

risk product types

risk product types

Ø Construction

outstandings down

$575MM (35%) from 12/31/07

$575MM (35%) from 12/31/07

Page

*

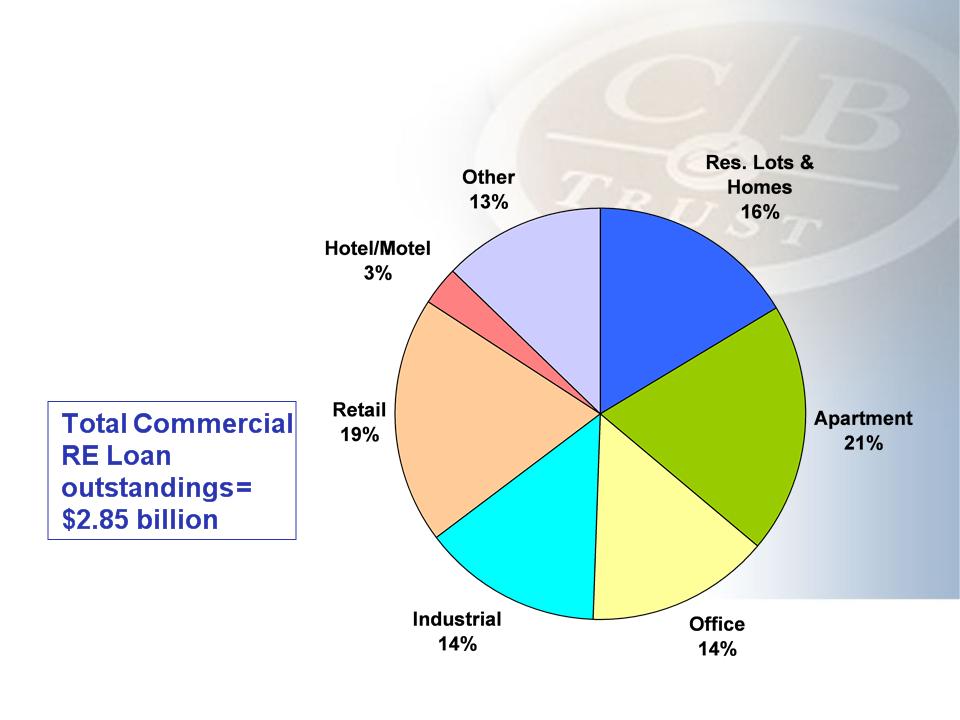

CBT

Commercial RE Loan Portfolio

Product Outstandings as of 9/30/09

Product Outstandings as of 9/30/09

* Excludes

FDIC supported assets

Well

Diversified Product Mix

Page

*

CBT

Commercial RE Loan Portfolio

CRE as a % of Total Loans

CRE as a % of Total Loans

Page

*

CBT

Residential Lot and Home Builder Portfolio

Outstandings as of 9/30/09

Outstandings as of 9/30/09

Residential

Builder

portfolio = $467M OS

portfolio = $467M OS

Ø Current market

conditions

showing improvement

showing improvement

Ø Growing demand for

finished

developed lots

developed lots

Ø Multiple offers from

major

homebuilders on lot sales

homebuilders on lot sales

Ø Significant success

in managing

through residential downturn

through residential downturn

Ø Remaining portfolio

manageable

with selected new originations

for developments with solid

market conditions and low LTC

with selected new originations

for developments with solid

market conditions and low LTC

Page

*

Residential

Construction Commitment Declines

$2.1

billion

ê

Page

*

Commercial

Construction and Term Real Estate

® CBT’s

commercial

strategy has mitigated

impact

strategy has mitigated

impact

Ø Utilize refinancing

interest

rates for initial underwriting

rates for initial underwriting

Ø 55-70% LTV at

origination -

Sponsorship with solid equity

and remargin requirements

Sponsorship with solid equity

and remargin requirements

® Originations spread

over 10

year period

year period

® Reappraisal stress

primarily

limited to 2006-2007 vintages

limited to 2006-2007 vintages

Page

*

Capitalization

Rate Trends

Source:

CB Richard Ellis, Inc., Market View

Page

*

Commercial

Term Originations

Asset

value declines = opportunity for better

structure and pricing = increase in CBT loan

originations 2nd half 2008

structure and pricing = increase in CBT loan

originations 2nd half 2008

Page

*

Commercial

Construction Real Estate

® Completed

cash-flowing projects represent bulk of

commercial construction exposure (which is less than

10% CBT loan total)

commercial construction exposure (which is less than

10% CBT loan total)

Ø Interest reserve use

limited to construction period

Ø Cash flow sweeps or

out-of-pocket payments cover interest for

completed projects

completed projects

Ø No increases to loan

amount to repack interest reserves

Ø Over 90% of watch

credits reappraised during 2009

Ø Commercial

construction disposition strategy mirrors

successful residential efforts

successful residential efforts

Ø Identify at-risk

projects

Ø Reappraise,

restructure and remargin

Ø Dispose at

market-clearing prices

Page

*

Product

Summary - Commercial RE

Outstandings

as of 9/30/09

David

note:

Construction

“Other”

comprised of

Cml. land =

$103MM

Construction

“Other”

comprised of

Cml. land =

$103MM

Page

*

OREO

CBT

OREO exposure low due to

ability and willingness to react at

market clearing prices via note

sales prior to foreclosure or rapidly

following transfer to OREO

ability and willingness to react at

market clearing prices via note

sales prior to foreclosure or rapidly

following transfer to OREO

3Q

09 exposure

reduced by $8MM 11/09

reduced by $8MM 11/09

Page

*

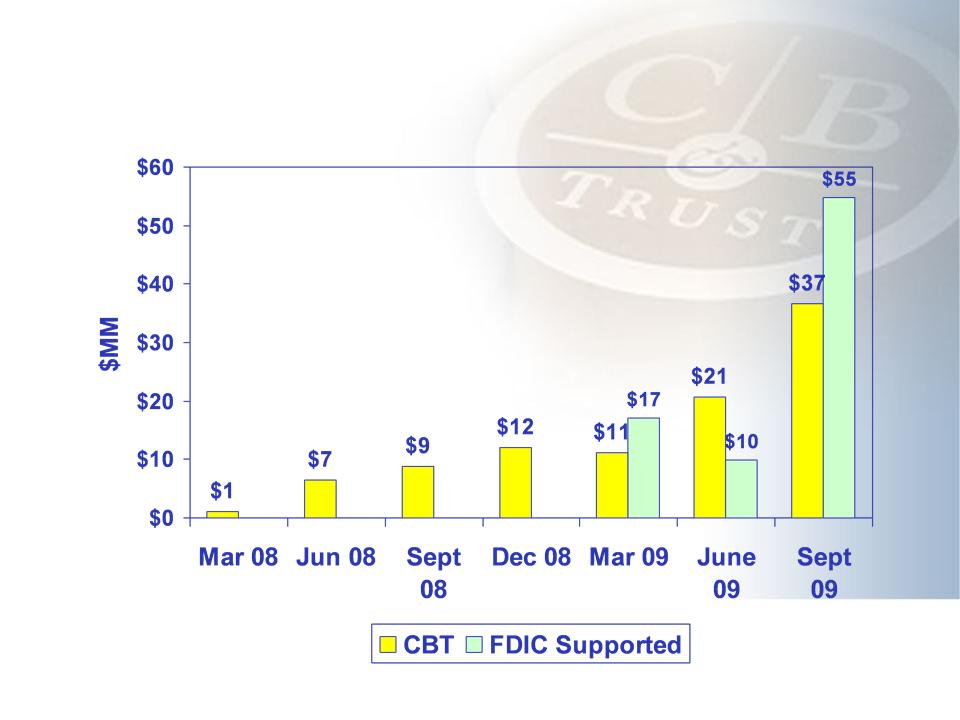

FDIC

Failed Bank Acquisitions

® February

2009 - Alliance Bank headquartered in Culver

City, CA

City, CA

Ø $925MM loans, five

branches

Ø Successful

integration onto CBT platform

Ø Removed brokered and

money desk CDs

Ø $264MM or 28%

resolved in first seven months

® July

2009 - Vineyard Bank HQ in Corona, CA

Ø $1.3 billion loans,

16 branches

Ø $146MM bargain

purchase price

Ø Strengthens CBT’s

franchise in eastern LA and the stronger

western portion of Inland Empire (CBT to keep 13 branches)

western portion of Inland Empire (CBT to keep 13 branches)

Ø CBT investing in

branch network

Ø Platform for

business and commercial banking expansion

Page

*

Conclusion

® Core

franchise operating very profitability

® One

of the highest NIMs for a bank our size,

coupled with a low efficiency ratio, results in high pre-

tax, pre-provision operating income to absorb credit

costs

coupled with a low efficiency ratio, results in high pre-

tax, pre-provision operating income to absorb credit

costs

Ø Significant reserve

build 2009 ($94MMM Sept

YTD)

® CBT

business strategy effectively implemented

Ø Moderate 10 year

growth (CAGR

5.0%)

Ø Disciplined

underwriting and loan management

Ø Reality based

approach to problem loan identification

and resolution

and resolution

Page

*

2010

Look forward

® 2010 expected to be

transitional year

® However, scrubbed

real estate portfolio and

commercial loan growth sets stage for

improvement late 2010 and into 2011

commercial loan growth sets stage for

improvement late 2010 and into 2011

® Counter-cyclical

lending opportunities provide

excellent structure and improved pricing

excellent structure and improved pricing

® CBT projected to

emerge early and strong

from current downturn

from current downturn