Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BRYN MAWR BANK CORP | d8k.htm |

Bryn Mawr Bank Corporation NASDAQ: BMTC Third Quarter 2009 Update Exhibit 99.1 |

2 This presentation contains certain forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words believe, expect, anticipate, intend, plan, estimate or words of similar meaning. Forward-looking statements, by their nature, are subject to risks and uncertainties. A number of factors, many of which are beyond the Corporation's control could cause actual conditions, events or results to differ significantly from those described in the forward looking statements. Forward-looking statements speak only as of the date they are made. The Corporation does not undertake to update forward-looking statements. Safe Harbor |

3 Bryn Mawr Bank Corporation Profile Founded in 1889 – 120 year history A unique business model with a traditional commercial bank ($1.2 billion) and a trust company ($2.7 billion) under one roof Wholly owned subsidiary – The Bryn Mawr Trust Company Located on Philadelphia’s affluent “Main Line”

|

4 Chester Bucks Montgomery Berks State of Delaware Philadelphia New Jersey Delaware New Jersey The Franchise Footprint 9 Full Service Branches/ 7 Life Care Facilities Source: Public School Review Average Household Income $84,600 $41,000 $- $20,000 $40,000 $60,000 $80,000 $100,000 BMTC Target Market Penna. State Average Percent of Population with College Degree 0% 20% 40% 60% 70% BMTC Target Market Penna. State Average 10% 30% 50% 59% 22% |

5 Investment Considerations A great brand & franchise Solid financial fundamentals Excellent overall credit quality Outstanding target market demographics New business initiatives driving growth Well-capitalized |

6 2009 (YTD) 2008 2007 Net Interest Income $29.9M $37.1M $34.2M Net Income $7.7M $9.3M $13.6M Diluted EPS $0.88 $1.08 $1.58 ROA 0.88% 0.89% 1.59% Financial Highlights Portfolio Loans & Leases $887M $900M $803M Tangible Book Value Per Share $10.44 $9.55 $10.60 Tangible Common Equity Ratio 7.74% 7.19% 9.02% Dividends Declared $0.42 $0.54 $0.50 |

7 2008 Results Leasing portfolio provision Mortgage servicing rights impairment Margin contraction Financial market impact on Wealth Management Revenue 2009 Results (YTD) Robust in-market residential mortgage originations Strong rebound in wealth management assets: $2.7 billion Stable margin: 3.64% (Q32009) versus 3.63% (Q42008) Strong deposit growth Solid investment performance, No OTTI charges Loan quality strong with nonperforming loans of 78 basis points Lease portfolio charge-offs have gradually declined each quarter in 2009 |

8 2009 Strategies Increase the net interest margin Credit quality Control expenses Use banking industry turmoil to attract new clients Opportunistic expansion Raise capital as needed |

New

Business Initiatives |

10 BMTC of Delaware opened (4 th Qtr 2008) The Delaware Advantage Generation Skipping Trusts Directed Trusts $333 million in assets at 9/30/2009 West Chester, PA Regional Banking Office Branch, loan center, and wealth office Opened 1/02/2009 Preceded by loan production office $19 million in deposits at 9/30/2009 Growth Initiatives - 2009 |

11 Announced acquisition of First Keystone Financial, Inc. (11/2/2009) $525 million in assets Expands footprint in Delaware and Chester counties with 8 branches Bryn Mawr Asset Management “Lift out” strategy Three investment advisers hired, $90 million in new assets Additional opportunities being evaluated Acquisition of Lau Associates Financial and Investment Planning Firm acquired 7/15/2008 $526 million in assets under management & supervision at 9/30/2009 Immediately accretive to earnings Acquisition Initiatives |

12 First Keystone Financial, Inc. – Transaction Summary Acquiror: Bryn Mawr Bank Corporation (NASDAQ: BMTC) Seller: First Keystone Financial, Inc. (NASDAQ: FKFS) Consideration: Each share of FKFS common stock will be exchanged for 0.6973 BMTC shares (1) and $2.06 in cash Transaction Value: $34 million Merger Consideration Adjustment: Per Share Merger Consideration subject to downward adjustment based on the rise of FKFS delinquencies above a specified level one month prior to close Board Representation: Donald Guthrie (Chairman of the FKFS Board of Directors) will join the BMTC Bank and Holding Company Boards as a Director Closing Condition: Aggregate amount of FKFS delinquencies must be less than $16.5 million Required Approvals: Customary Regulatory and FKFS Shareholders Expected Closing: Q2 2010 Acquiror: Bryn Mawr Bank Corporation (NASDAQ: BMTC) Seller: First Keystone Financial, Inc. (NASDAQ: FKFS) Consideration: Each share of FKFS common stock will be exchanged for 0.6973 BMTC shares (1) and $2.06 in cash Transaction Value: $34 million Merger Consideration Adjustment: Per Share Merger Consideration subject to downward adjustment based on the rise of FKFS delinquencies above a specified level one month prior to close Board Representation: Donald Guthrie (Chairman of the FKFS Board of Directors) will join the BMTC Bank and Holding Company Boards as a Director Closing Condition: Aggregate amount of FKFS delinquencies must be less than $16.5 million Required Approvals: Customary Regulatory and FKFS Shareholders Expected Closing: Q2 2010 (1) Based upon BMTC’s average daily closing price for twenty consecutive trading days ending

10/30/2009 ($16.76) |

13 First Keystone Financial Inc. - Transaction Highlights Expands branch footprint into the attractive demographic markets of Delaware and Chester County, Pennsylvania Important component of strategic plan Enhances long-term franchise value Complementary business mix Both banks have a “community focus” Significant potential synergies identified in wealth management services and residential

mortgage originations Low risk Transaction Extensive due diligence performed Conservative credit mark estimated Achievable cost savings identified Material earnings per share accretion Attractive internal rate of return Pro Forma capital ratios remain significantly above “well capitalized” levels |

14 Source: SNL Financial Pro forma financials do not include merger adjustments BMTC data as of 9/30/2009; FKFS data as of 6/30/2009 (1) Includes 7 limited service retirement community branches Pro Forma Deposit Market Share – Delaware County, PA 2009 Total 2009 Deposits Total in Market Branch Market Share Rank Institution (ST) Count ($M) (%) 1 Wells Fargo & Co. (CA) 21 1,630 15.3 2 Royal Bank of Scotland Group 23 1,585 14.9 3 Toronto-Dominion Bank 14 1,360 12.8 4 Citigroup Inc. (NY) 3 1,040 9.8 5 PNC Financial Services Group (PA) 11 929 8.7 6 Banco Santander S.A. 13 830 7.8 Pro Forma 14 563 5.3 7 Beneficial Mutual Bncp (MHC) (PA) 7 386 3.6 8 Alliance Bancorp of Penn (MHC) (PA) 8 338 3.2 9 First Keystone Financial (PA) 7 337 3.2 10 Bryn Mawr Bank Corp. (PA) 7 226 2.1 Top 10 114 8,662 81.3 Market Total 180 10,651 100.0 Expanding Southeast PA Footprint ($ in millions) BMTC FKFS Pro Forma Assets $1,196 $525 $1,721 Loans 886 317 1,203 Deposits 899 354 1,253 Branches 16 (1) 8 24 Pro Forma Financials Bryn Mawr Bank Corp. (16) First Keystone Financial, Inc. (8) |

15 Time Deposits 32.7% NOW & Other Trans. Accts. 16.7% MMDA, Savings, & Other 35.8% Demand Deposits 14.8% Consumer & Other 24.5% Commercial & Industrial 21.6% Residential R.E. 22.0% Commercial R.E. 26.4% Construction R.E. 5.6% Consumer & Other 26.8% Commercial & Industrial 26.8% Residential R.E. 13.3% Commercial R.E. 28.9% Construction R.E. 4.2% Pro Forma Loans and Deposits Source: Company filings FKFS loan and deposit data as of 6/30/2009 BMTC stand alone loan and deposit data as of 9/30/2009 Time Deposits 26.8% NOW & Other Trans. Accts. 14.3% MMDA, Savings, & Other 40.2% Demand Deposits 18.7% Deposits Loans BMTC Stand Alone Total: $886M Total: $1.2B Total: $899M Total: $1.3B Consumer & Other 18.0% Commercial & Industrial 7.0% Residential R.E. 46.1% Commercial R.E. 19.4% Construction R.E. 9.6% Time Deposits 47.7% NOW & Other Trans. Accts. 22.7% MMDA & Savings 24.4% Demand Deposits 5.1% Total: $317M Total: $354M BMTC Stand Alone FKFS Stand Alone BMTC Pro Forma FKFS Stand Alone BMTC Pro Forma |

16 First Keystone Financial Inc. - Due Diligence Extensive due diligence conducted by BMTC and third parties over the past month Conducted extensive credit diligence BMTC and third party loan review Reviewed over 65% of commercial portfolio (CRE, C&I, and Construction) Multiple Construction / Commercial Real Estate sites visited Conservative credit mark estimated at 4% to 5% of total loans outstanding including existing Allowance for Loan Loss balance. Estimated securities portfolio mark – to – market KPMG hired to conduct tax and accounting due diligence assistance

|

Financial Review Bryn Mawr Bank Corporation Only As of 9/30/2009 |

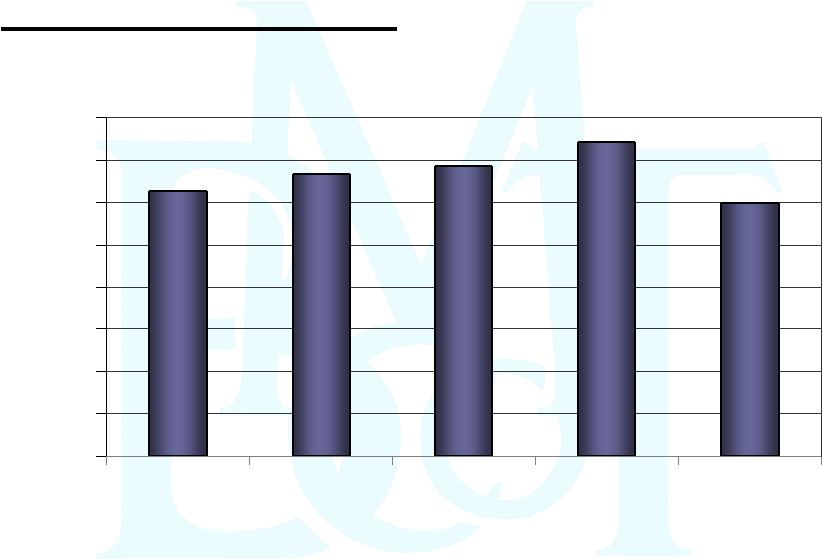

18 Diluted Earnings Per Share (1) Excludes $0.10 per share gain on sale of real estate (2) As of September 30, 2009 $1.46 $1.31 $1.48 $1.08 $0.88 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 2005 2006 2007 (1) 2008 2009 (2) |

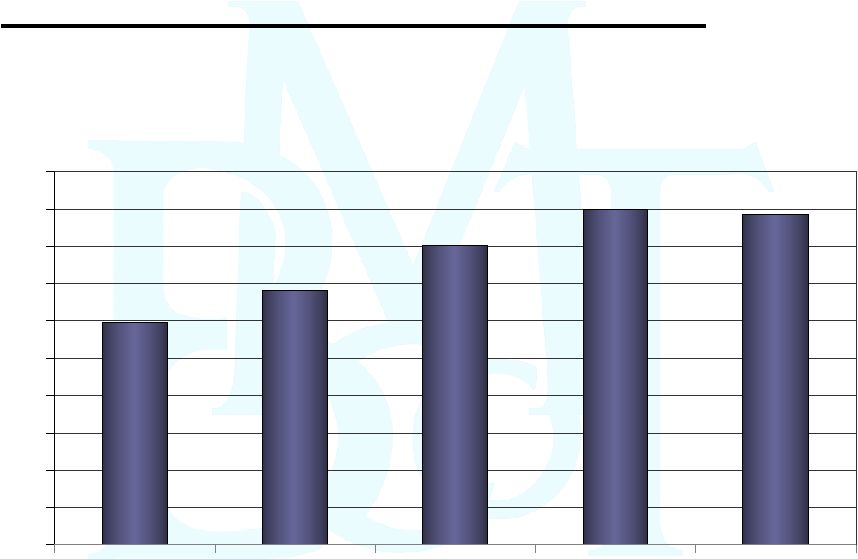

19 Portfolio Loan & Lease Growth Total Portfolio Loans & Leases Outstanding ($ in millions) CAGR 14.8% (2005-2008) 1) As of September 30, 2009 $595 $681 $803 $900 $887 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 2005 2006 2007 2008 2009 (1) |

20 Strong Asset Quality Nonperforming Loans and Leases 1) As of September 30, 2009 0.07% 0.12% 0.25% 0.65% 0.78% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 0.8% 0.9% 2005 2006 2007 2008 2009 (1) |

21 Loan Composition at September 30, 2009 ($ in millions) Commercial Mortgages Commercial & Industrial Home Equity Lines & Loans & Consumer Loans Residential Mortgages Construction Leases $256 $237 $187 $118 $37 $ 52 |

22 Small Ticket National Leasing Business “Lift out” strategy Leases outstanding: $51.8 million at 9/30/2009 Average yield 10.54% Experiencing credit issues at this time Charge-offs have decreased gradually since 12/31/2008 Changes made in underwriting standards and collection process Lease portfolio reduced by design - $7.5 million since 12/31/2008 |

23 $31.3 $33.3 $34.2 $37.1 $29.9 $0 $5 $10 $15 $20 $25 $30 $35 $40 2005 2006 2007 2008 2009 (1) Net Interest Income CAGR 5.8% (2005-2008) 1) As of September 30, 2009 Note: Not on a tax-equivalent basis ($ in millions) |

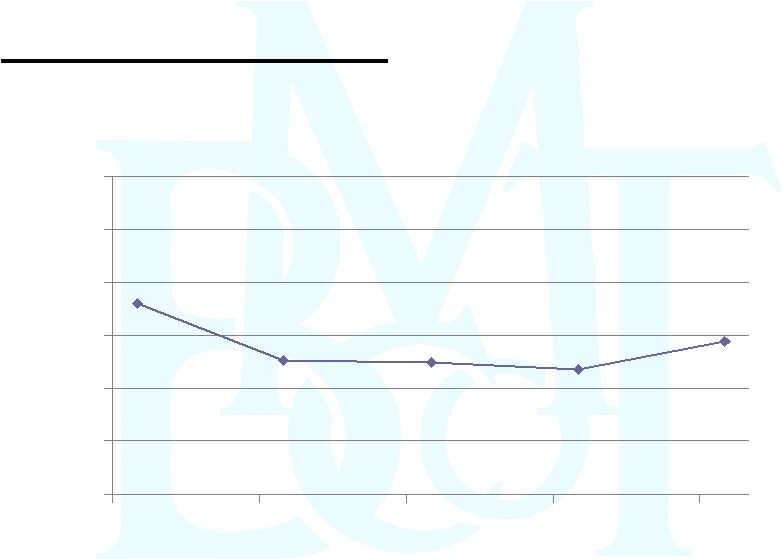

24 Net Interest Margin On a tax equivalent basis 3.90% 3.63% 3.62% 3.59% 3.64% 3.0% 3.3% 3.5% 3.8% 4.0% 4.3% 4.5% Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 |

25 Deposit Growth Average Annual Deposits ($ in millions) 1) As of September 30, 2009 $596 $626 $709 $798 $881 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2005 2006 2007 2008 2009 (1) |

26 Average Deposits & Borrowed Funds Mix Third Quarter 2009 ($ in millions) $20 $168 $394 $199 $120 $151 Non-Interest Bearing DDA Savings, NOW & Money Market Time Deposits Wholesale Deposits, IND & IDC Borrowed Funds Subordinated Debt |

27 Wholesale Funding Totals Type September 30, 2009 % of Wholesale Funding December 31, 2008 % of Wholesale Funding Wholesale CD $ 23.9 9.0% $ 51.3 16.8% PLIGIT - - 40.0 13.1 FHLB Advances 147.4 55.5 154.9 50.7 CDARS 40.8 15.3 29.1 9.5 IND/IDC 53.8 20.2 30.5 10.0 Total Wholesale Funding $ 265.9 100.0% $ 305.8 100.0% Total Funding * $ 1,046.9 $ 1,024.4 Total Wholesale Funding/Total Funding 25.4% 29.9% * Total Funding = All deposits plus borrowings (includes wholesale funding; excludes sub debt) ($ in millions) |

28 Additional Funding Sources at September 30, 2009 $ in millions Available Used Fed Funds Line of Credit (7 Banks) $ 75 $ 0 FHLB of Pittsburgh* $ 411 $147 Federal Reserve Bank – Discount Window Program $ 75 $ 0 Total $ 561 $ 147 Total (Percentage) 100% 26% * Additional FHLB of Pittsburgh common stock would need to be purchased to

utilize the unused availability |

29 Investment Portfolio as of September 30, 2009 ($ in thousands) Amortized Fair Unrealized SECURITY DESCRIPTION (AFS) Cost Value Gain / Loss U. S. Government Agency $ 55,159 $ 55,242 $

83 State, County & Municipal 24,628

25,094

466

FNMA/FHLMC Mortgage Backed Securities 52,963

54,826

1,863 GNMA Mortgage Backed Securities 7,580

7,726

146

Foreign Debt Securities 1,450 1,450 - Corporate Bonds 12,231 12,634

403

Bond – mutual funds 11,722 11,783 61 Total AFS Securities 165,733 168,755 3,022 SECURITY DESCRIPTION (Trading) Short term bond fund 5,076 5,076 - Total Investment Portfolio $170,809 $173,831 $3,022 Note: Other assets at September 30, 2009 include approximately $8 million of FHLB of

Pittsburgh common stock at cost. |

30 Capital Considerations Bryn Mawr Bank Corporation elected not to take TARP Capital Maintains a “well capitalized” capital position Selectively add capital as needed to fund growth and acquisitions Three additional earn out payments for Lau Associates at the end of 2009, 2010 and 2011 Active Dividend Reinvestment and Direct Stock Purchase Plan (DRIP/DSPP) |

31 Capital Position - Bryn Mawr Bank Corporation Regulatory Minimum to be Well Capitalized Actual 9/30/2009 Tier I 6.00% 9.36% Total (Tier II) 10.00% 12.49% Tier I Leverage 5.00% 8.39% Common Equity - 8.54% Tangible Common Equity - 7.74% |

32 Capital Position - Bryn Mawr Trust Company (“Bank”) Regulatory Minimum to be Well Capitalized Actual 9/30/2009 Tier I 6.00% 8.91% Total (Tier II) 10.00% 12.06% Tier I Leverage 5.00% 7.98% |

33 Capital Raised in 2009 $7.5 million in subordinated debt in April 2009 (Tier Two) $2.5 million in common stock in April 2009 DRIP/DSPP to provide an incremental stream of capital |

34 $2.04 $2.18 $2.28 $2.26 $2.71 $1.0 $1.5 $2.0 $2.5 $3.0 2005 2006 2007 2008 2009 (1) BMT DE Lau Associates Brokerage Wealth Division Assets Under Management, Administration, Supervision and Brokerage (2) ($ in billions) (1) As of September 30, 2009 (2) Excludes Community Banks 2005 - 2007 |

35 Wealth Management Fees ($ in millions) Lau Associates (1) As of September 30, 2009 $11.5 $12.4 $13.5 $13.8 $10.6 $0 $3 $6 $9 $12 $15 2005 2006 2007 2008 2009 (1) CAGR 6.3% 2005 – 2008 |

36 Summary Outstanding franchise in a vibrant, growing market Focus on Wealth Services, Business Banking, and Private Banking Investing in growth opportunities today for earnings growth tomorrow Announced acquisition will expand footprint Solid 2009 Strategy to succeed in current economic recession |

Thank You Joseph Keefer, EVP 610- 581- 4869 jkeefer@bmtc.com Duncan Smith, CFO 610- 526 – 2466 jdsmith@bmtc.com Ted Peters, Chairman 610-581-4800 tpeters@bmtc.com Frank Leto, EVP 610-581-4730 fleto@bmtc.com |