Attached files

| file | filename |

|---|---|

| 8-K - CHENIERE ENERGY, INC. 8-K - Cheniere Energy, Inc. | form_8-k.htm |

CHENIERE

ENERGY

Cheniere

Energy

Corporate Presentation

November 2009

Corporate Presentation

November 2009

2

Safe

Harbor Act

1

This

presentation contains certain statements that are, or may be deemed to be,

“forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of

the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements of historical facts, included herein are “forward-looking statements.”

Included among “forward-looking statements” are, among other things:

the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements of historical facts, included herein are “forward-looking statements.”

Included among “forward-looking statements” are, among other things:

§ statements

that we expect to commence or complete construction of each or any of our

proposed liquefied natural gas, or LNG, receiving terminals by certain dates, or

at all;

§ statements

that we expect to receive authorization from the Federal Energy Regulatory

Commission, or FERC, to construct and operate proposed LNG receiving terminals

by a

certain date, or at all;

certain date, or at all;

§ statements

regarding future levels of domestic natural gas production and consumption, or

the future level of LNG imports into North America, or regarding projected

future

capacity of liquefaction or regasification facilities worldwide regardless of the source of such information;

capacity of liquefaction or regasification facilities worldwide regardless of the source of such information;

§ statements

regarding any financing transactions or arrangements, whether on the part of

Cheniere or at the project level;

§ statements

relating to the construction of our proposed LNG receiving terminals, including

statements concerning estimated costs, and the engagement of any EPC

contractor;

§ statements

regarding any Terminal Use Agreement, or TUA, or other commercial arrangements

presently contracted, optioned, marketed or potential arrangements to be

performed

substantially in the future, including any cash distributions and revenues anticipated to be received; statements regarding the commercial terms and potential revenues from activities

described in this presentation;

substantially in the future, including any cash distributions and revenues anticipated to be received; statements regarding the commercial terms and potential revenues from activities

described in this presentation;

§ statements

regarding the commercial terms or potential revenue from any arrangements which

may arise from the marketing of uncommitted

capacity from any of the terminals, including the Creole Trail and Corpus Christi terminals which do not currently have contractual commitments;

capacity from any of the terminals, including the Creole Trail and Corpus Christi terminals which do not currently have contractual commitments;

§ statements

regarding the commercial terms or potential revenue from any arrangement

relating to the proposed contracting for excess or expansion

capacity for the Sabine Pass LNG Terminal described in this presentation;

capacity for the Sabine Pass LNG Terminal described in this presentation;

§ statements

that our proposed LNG receiving terminals, when completed, will have certain

characteristics, including amounts of regasification and

storage capacities, a number of storage tanks and docks and pipeline interconnections;

storage capacities, a number of storage tanks and docks and pipeline interconnections;

§ statements

regarding Cheniere, Cheniere Energy Partners and Cheniere Marketing forecasts,

and any potential revenues, cash flows and capital expenditures which may be

derived

from any

of Cheniere business groups;

§ statements

regarding Cheniere Pipeline Company, and the capital expenditures and potential

revenues related to this business group; statements

regarding our proposed LNG receiving terminals’ access to existing pipelines, and their ability to obtain transportation capacity on existing pipelines;

regarding our proposed LNG receiving terminals’ access to existing pipelines, and their ability to obtain transportation capacity on existing pipelines;

§ statements

regarding possible expansions of the currently projected size of any of our

proposed LNG receiving terminals;

§ statements

regarding the payment by Cheniere Energy Partners, L.P. of cash

distributions;

§ statements

regarding our business strategy, our business plan or any other plans,

forecasts, examples, models, forecasts or objectives; any or all of which are

subject to change;

§ statements

regarding estimated corporate overhead expenses; and

§ any

other statements that relate to non-historical information.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,” “expect,” “forecast,” “opportunities,”

“plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable,

they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which

speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors,

including those discussed in “Risk Factors” in the Cheniere Energy, Inc. Annual Report on Form 10-K for the year ended December 31, 2008, which are incorporated by reference into this

presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking

statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,” “expect,” “forecast,” “opportunities,”

“plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable,

they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which

speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors,

including those discussed in “Risk Factors” in the Cheniere Energy, Inc. Annual Report on Form 10-K for the year ended December 31, 2008, which are incorporated by reference into this

presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking

statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

3

Cheniere

Energy

Marketing

Sabine

Pass LNG (SPLNG) (90.6%)

Freeport

LNG (30%)

Approved

Permits:

Creole

Trail LNG

Corpus

Christi LNG

Creole

Trail P/L (100%)

Approved

Permits:

Creole

Trail P/L Phase II

Corpus

Christi P/L

Development

Projects:

Southern

Trail P/L

Frontera

2.0

Bcf/d SPLNG TUA

MSPAs

with major

LNG suppliers,

merchants, utilities

LNG suppliers,

merchants, utilities

Isle

of Grain Put

Option

12 Cargoes/yr

Over

100 domestic

NAESBs and ISDAs

NAESBs and ISDAs

Pipelines

Terminals

Cheniere

Business Segments

4

|

Sold

- Terminal Use

Agreement (TUA) |

Capacity

(Bcf/d)

|

Estimated

Annual

Distribution to Cheniere* |

|

Conoco

Dow

Mitsubishi

|

0.90

0.50

0.15

|

~

$15MM

|

*Quarterly cash

distributions commenced in 1Q09 and are subject to Freeport board

approval.

April

2009

Freeport

LNG Development, L.P.

Cheniere Energy, Inc. 30%

Cheniere Energy, Inc. 30%

5

|

TUA

|

Capacity

|

2010

Full-Year

Payments ($ in MM) |

|

Total LNG

USA

Chevron

USA

Cheniere

Marketing

|

1.0

Bcf/d

1.0

Bcf/d

2.0

Bcf/d

|

$123

$128

$252

|

Aerial

view of Sabine Pass LNG August 2009

3

Sabine

Pass LNG

Cheniere Energy, Inc. 90.6%

Cheniere Energy, Inc. 90.6%

§ Vaporization

– ~4.3 Bcf/d peak

send-out

§ Storage

– 5 tanks x 160,000 cm

(16.9 Bcfe)

§ Berthing

/ Unloading

– Two

docks

– LNG carriers up to

266,000 cm

– Four dedicated

tugs

§ Land

– 853 acres in Cameron

Parish, LA

§ Accessibility

- Deep Water Ship Channel

– Sabine River Channel

dredged to 40

feet

feet

§ Proximity

– 3.7 nautical miles

from coast

– 22.8 nautical miles

from outer buoy

§ LNG

Export Licenses Approved

6

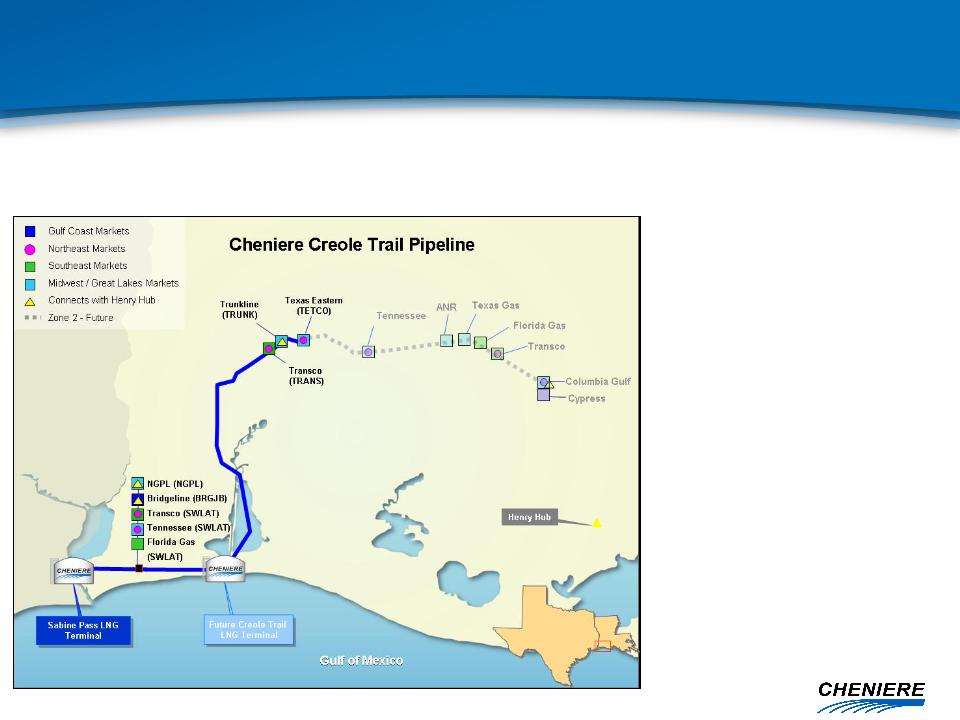

§ Size:

– 2.0

Bcf/d

§ Diameter:

– 42-inch

diameter

§ Cost:

– ~$560 million first

94 miles

§ Initial

interconnects:

– 4.1 Bcf/d of

interconnect

capacity

capacity

§ Provides

optimal market access for LNG from the Sabine Pass terminal

§ First

94 miles complete and in-service, additional 58 miles permitted

Creole

Trail Pipeline

Cheniere Energy, Inc. 100%

Cheniere Energy, Inc. 100%

7

Strategic

Focus

§ Commercial -

monetize 2 Bcf/d regas capacity at Sabine

Pass receiving terminal held by Cheniere Marketing

Pass receiving terminal held by Cheniere Marketing

– International LNG

marketing efforts

– Seek long-term TUAs,

LNG purchase/sale agreements

– Purchase spot

cargoes available in the Gulf of Mexico

§ Financial - manage

liquidity

8

Annualized*

($ in

MM)

Disbursements

§ Cheniere Marketing

TUA @ Sabine Pass $252

§ G&A 30-40

§ Pipeline & tug

services 10

§ Other, incl adv tax

payments 3-5

§ Debt service 44

$50 -

65

*Estimates represent

a summary of internal forecasts, are based on current assumptions and are

subject to change. Actual

performance

may differ materially from, and there is no plan to update the forecast. See

“Safe Harbor” cautions. Estimates

exclude

earnings

forecasts from operating activities.

Net

cash outflow

Estimated

Future Cash Flows

Cheniere Energy, Inc.

Cheniere Energy, Inc.

Receipts

§ Freeport

investment $10-20

§ Distributions from

CQP 254

§ Management fees from

CQP 19

9

Annualized*

($ in

MM)

Disbursements

§ Operating

Expenses $34

§ Management Fees 19

§ Debt Service 165

$285

*Estimates represent

a summary of internal forecasts, are based on current assumptions and are

subject to change. Actual

performance

may differ materially from, and there is no plan to update the forecast. See

“Safe Harbor” cautions.

Available

Cash

Distributions to

Unitholders

$281

Estimated

Future Cash Flows

Cheniere Energy Partners

Cheniere Energy Partners

Receipts

§ TUA Customers $503

10

Current

Global Issues for LNG and Natural Gas

§ The world has

abundant reserves of natural gas, but will they be produced?

§ The current global

gas oversupply is expected to last at least 2 to 4 years

§ The growth of LNG

production capacity will provide a bridge between the

continents

continents

– Flexible LNG of 10

to 12 Bcf/d means the world can send a price signal to 3

or 4

LNG vessels every day

LNG vessels every day

§ The substantial

disconnect between oil-indexed prices for gas and spot

prices is straining traditional business models

prices is straining traditional business models

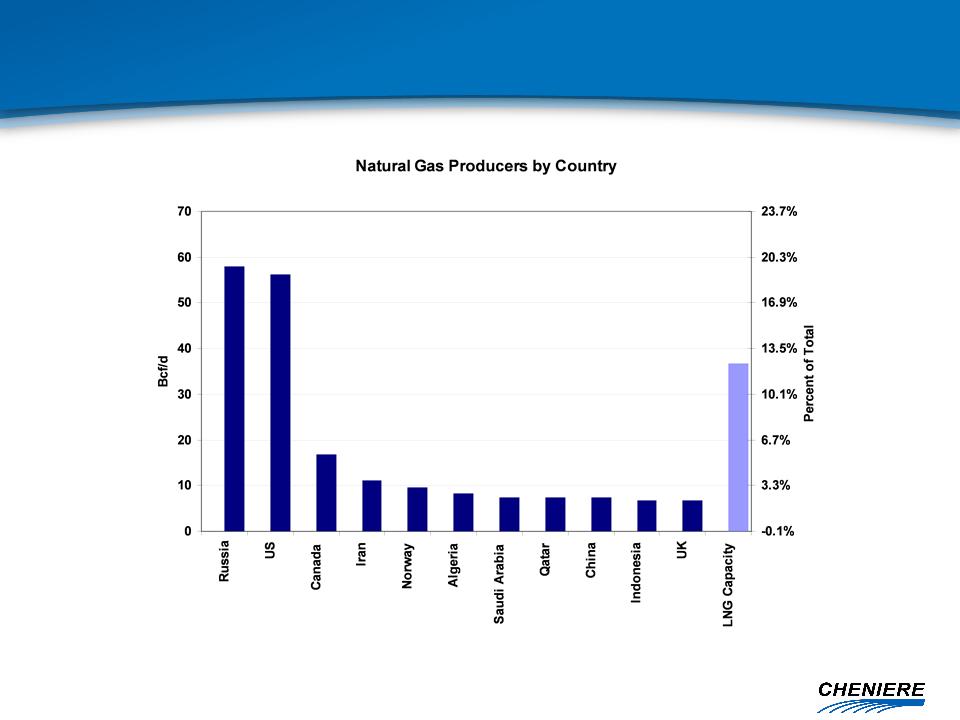

§ Russia, the U.S. and

Canada provide the lion share of world gas supply -

everything else is several orders of magnitude smaller

everything else is several orders of magnitude smaller

§ New supply is being

secured under two very different business models

– Underpinned by crude

based contracts such as in the recent Gorgon deals and

most of Gazprom’s production

most of Gazprom’s production

– Market based

contracting as is the case in the U.S., Canada and the UK model

§ Incremental volumes

from unconventional reserves abundant in U.S. at $6

to $8/MMBtu

to $8/MMBtu

11

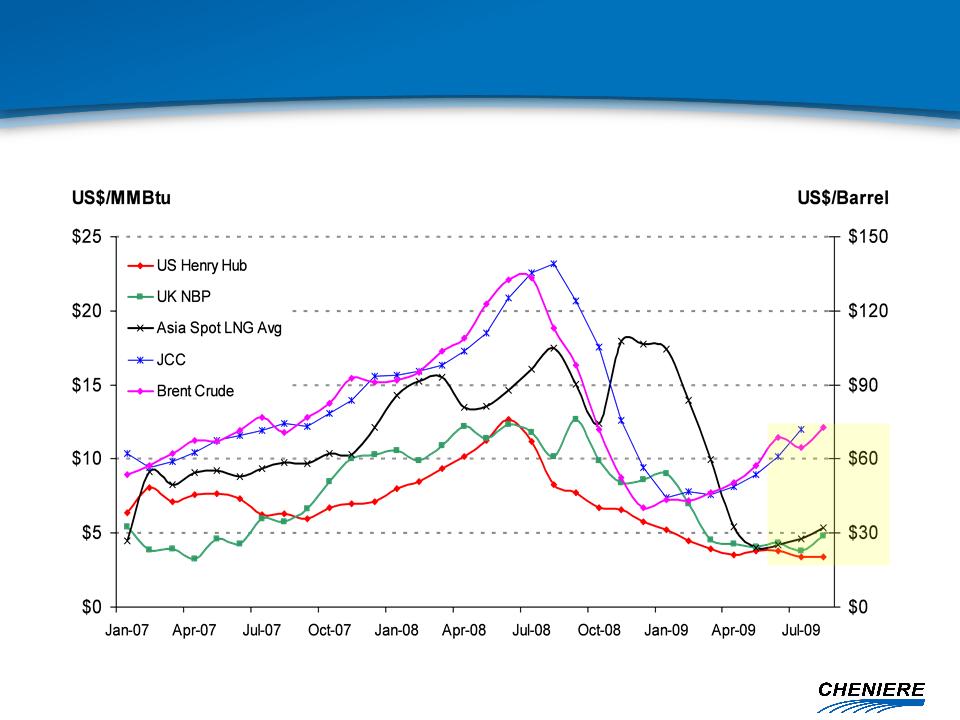

Source:

PIRA Energy Group, Petroleum Association of Japan (JCC)

Note: 6

MMBtu per 1 Oil Barrel

JCC =

Japanese Crude Cocktail

• Convergence of spot

prices

• Disconnect from

crude

Global

Prices & Linkage

Implications

Implications

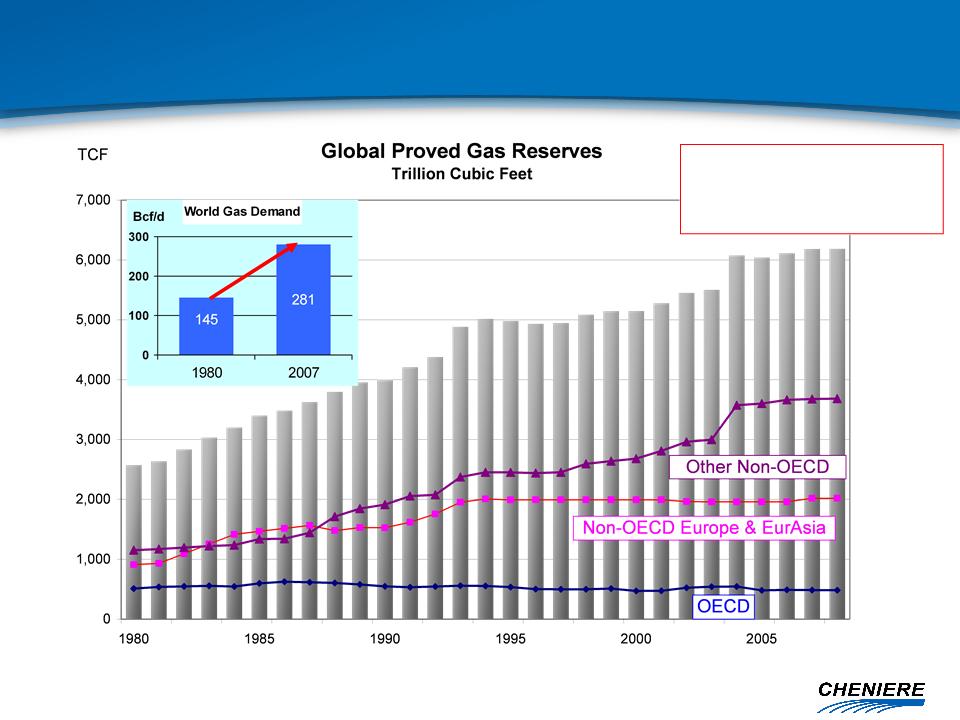

12

Since

1980

World

Gas Demand: +94%

World

Gas Reserves:+140%

Source:

EIA 2009 (Historical World Reserves & Demand)

Bcf/d

Bcf/d

Global

Natural Gas Supply & Demand

Rapid reserve and demand growth

Rapid reserve and demand growth

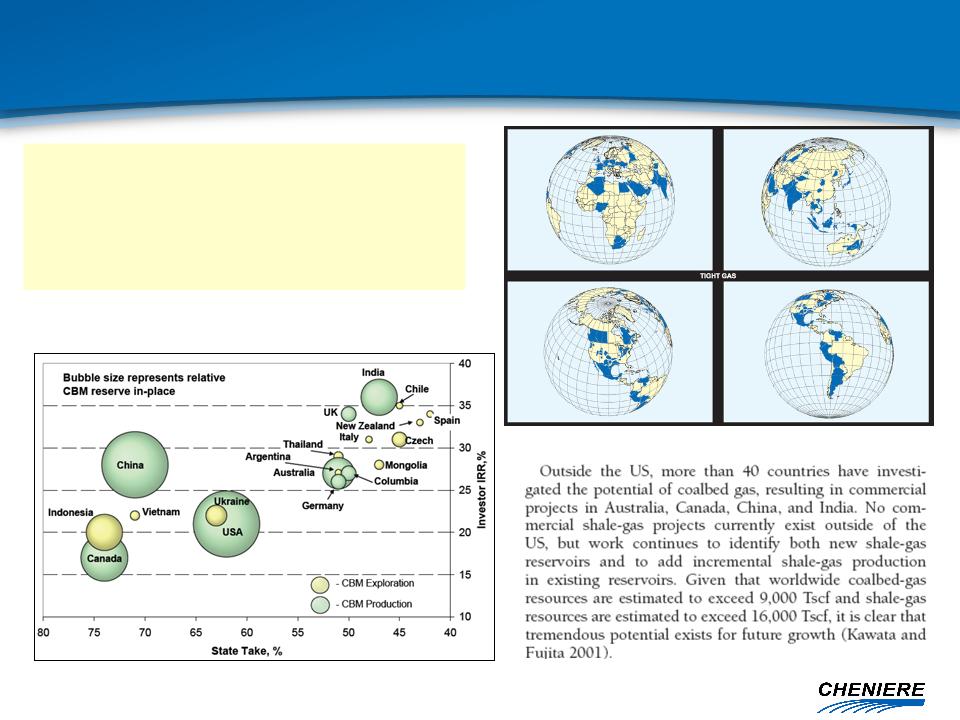

13

“[Ultimately

recoverable remaining resources of] Non-

conventional gas resources - including coalbed

methane, tight gas sands and gas shales - are much

larger, amounting perhaps to over 900 tcm (31,000

Tcf), with 25% in the US and Canada combined.”

conventional gas resources - including coalbed

methane, tight gas sands and gas shales - are much

larger, amounting perhaps to over 900 tcm (31,000

Tcf), with 25% in the US and Canada combined.”

IEA

World Energy Outlook 2008

Coalbed

and Shale-Gas Reservoirs, Jenkins et al, Society

of Petroleum Engineers paper 103514

of Petroleum Engineers paper 103514

Comparison

of Global CBM Resources (IHS)

Global

Distribution of Tight Gas Resources

(Wood

McKenzie)

Global

Potential for Unconventional

Gas Production is Huge

Gas Production is Huge

14

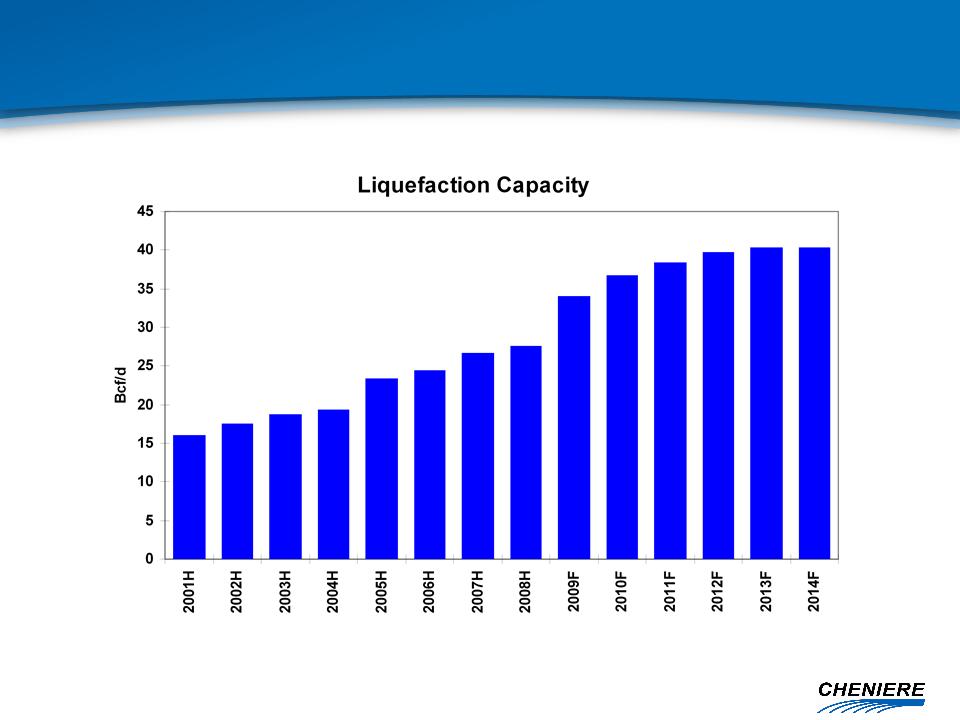

Source:

Cheniere Research

Liquefaction

Capacity Growing Sharply

15

•

Slippage in startup of commercial deliveries: QG II T4, Tangguh,

Yemen

Source:

Cheniere Research

Expected

Incremental Capacity

16

Source:

BP Statistical Review 2009

Russia

and U.S. Account for Nearly 40% of Natural

Gas Production

Gas Production

17

Source:

IGU- Natural Gas Industry Study to 2030

How

Will Current Market Conjuncture Affect the

Evolution of these Pricing Mechanisms?

Evolution of these Pricing Mechanisms?

18

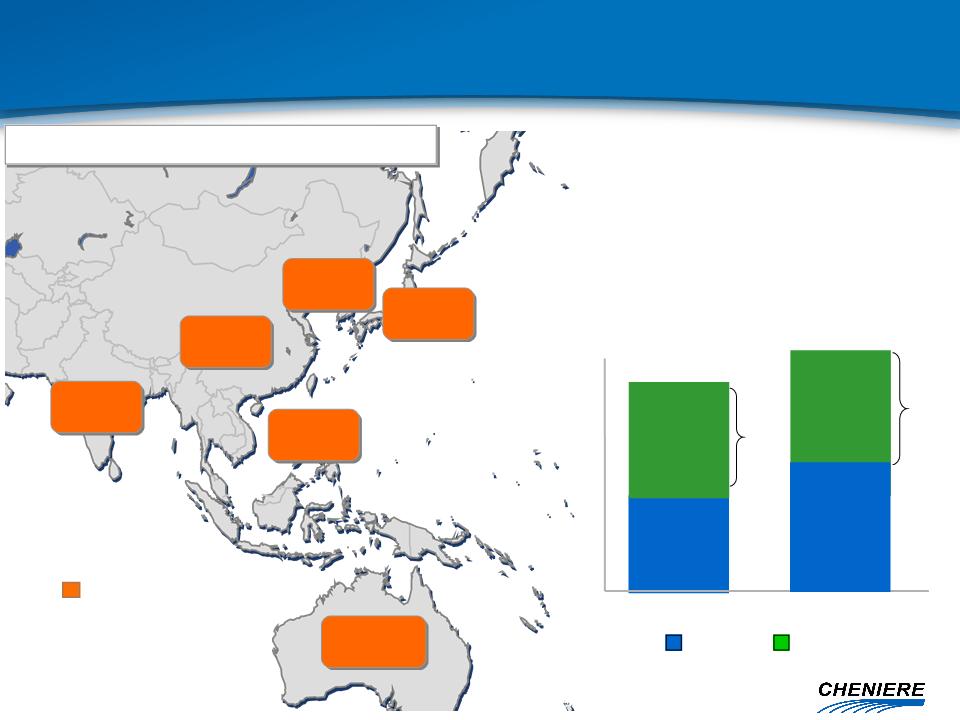

Bcf/d

Source:

Historical: Cedigaz (2007);

Forecast: Cheniere

Research

30

25

20

15

10

5

0

2007

2010

Oil

Indexed

Pipeline

LNG

Japan

9

15

Bcf/d

Bcf/d

Korea

3

China

7

Australia

3

India

4

Taiwan

1

16

Bcf/d

LNG

56%

LNG

50%

Incremental

LNG

Need

2010

= ~1

Bcf/d

Consumption

2007

= 27 Bcf/d

2010

= 32 Bcf/d

*

OECD Asia plus India & China

LNG

Import Capacity

2007

= 34 Bcf/d

2010

= 37 Bcf/d

Pipeline

Import

Capacity

Eventually

Large

Bcf/d

Oil

Indexed

Regional

Demand by Country (2007)

Asia

Pacific* Natural Gas Demand Projection

19

Krishna

Godavari

Basin

Turkmenistan-

China Pipeline

China Pipeline

+3

Bcf/d

CBM

India

KJV

Pipeline

Pipeline

+2.8

Bcf/d

China

West-

East #2 Pipeline

+2.9 Bcf/d

East #2 Pipeline

+2.9 Bcf/d

CBM

CBM

Central

Asia

400

Tcf

Proved*

Russia

1,600

Tcf

Proved

Source:

Cheniere Research, BP Statistical Review 2008 (Reserve data)

*Based

on updated Turkmenistan reserves from Oct. 2008 Gaffney, Cline & Associates

survey of South Yolotan-Osman

field

field

Siberia

1,500+

Tcf

Unexplored

Potential

New

Asia Pipelines

Major projects boost access to indigenous reserves

Major projects boost access to indigenous reserves

20

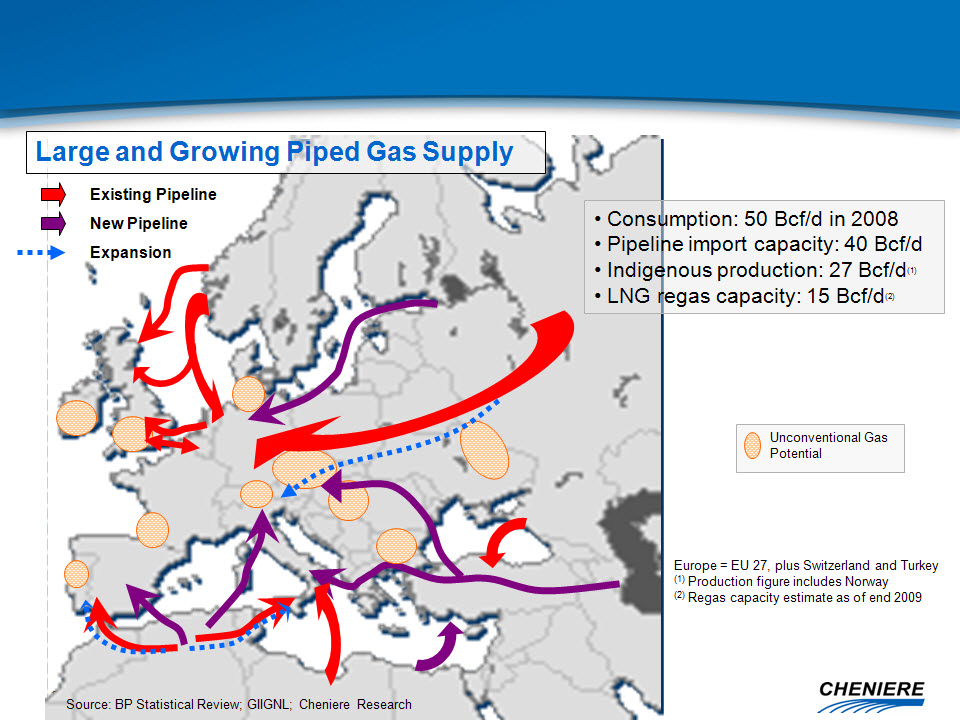

European

Suppliers are Undertaking a Significant

Expansion of Pipeline Capacity

Expansion of Pipeline Capacity

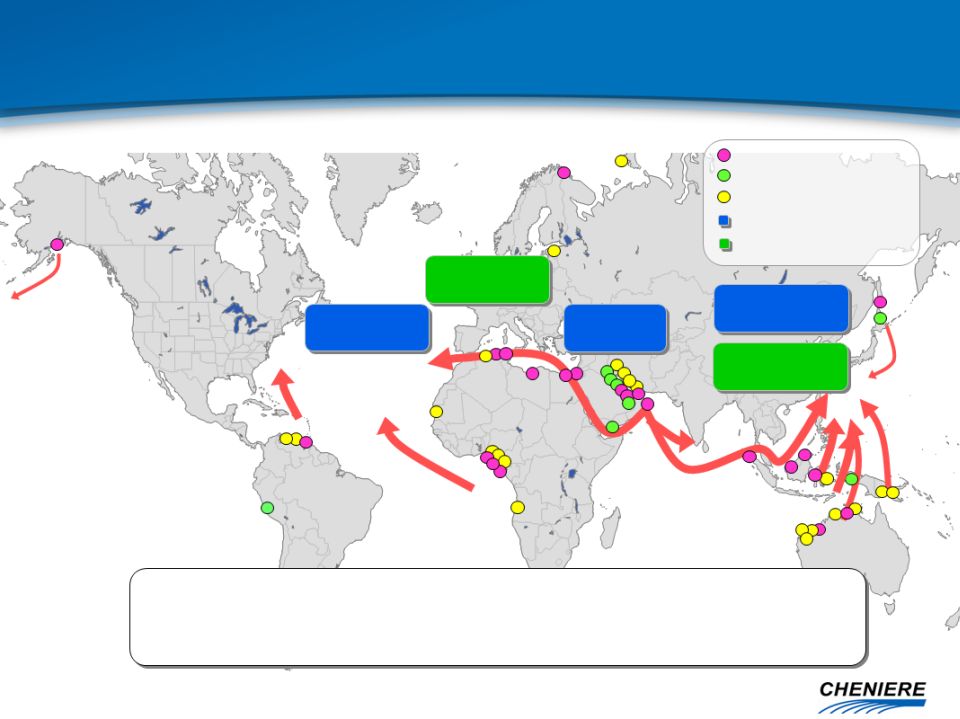

21

Existing

Liquefaction

Under

Construction

Proposed

Liquefaction

Atlantic

Basin

~11

Bcf/d

ME

Gulf

13

Bcf/d

Asia

Pacific

13

Bcf/d

Europe

5-7

Bcf/d

Asia

Pacific

16

Bcf/d

2010

Liquefaction Capacity

2010

Consumption

Source:

Cheniere Research

MEG LNG

to Atlantic Basin*: 6-8 Bcf/d

LNG

Available for Atlantic Price Arbitrage: 10-12 Bcf/d

3

to 4 cargoes every day

*

Assumes 85%-92% LNG plant utilization rate.

Projected

LNG Flows in 2010

Global LNG Supply of ~30 Bcf/d

Global LNG Supply of ~30 Bcf/d

22

North

America

§ Critical role of US

in global gas market

Questions:

§ Can the US absorb

the LNG?

§ Will LNG become a

part of the US energy mix?

§ What are the

implications for oil & gas linkage in the US

& globally?

& globally?

23

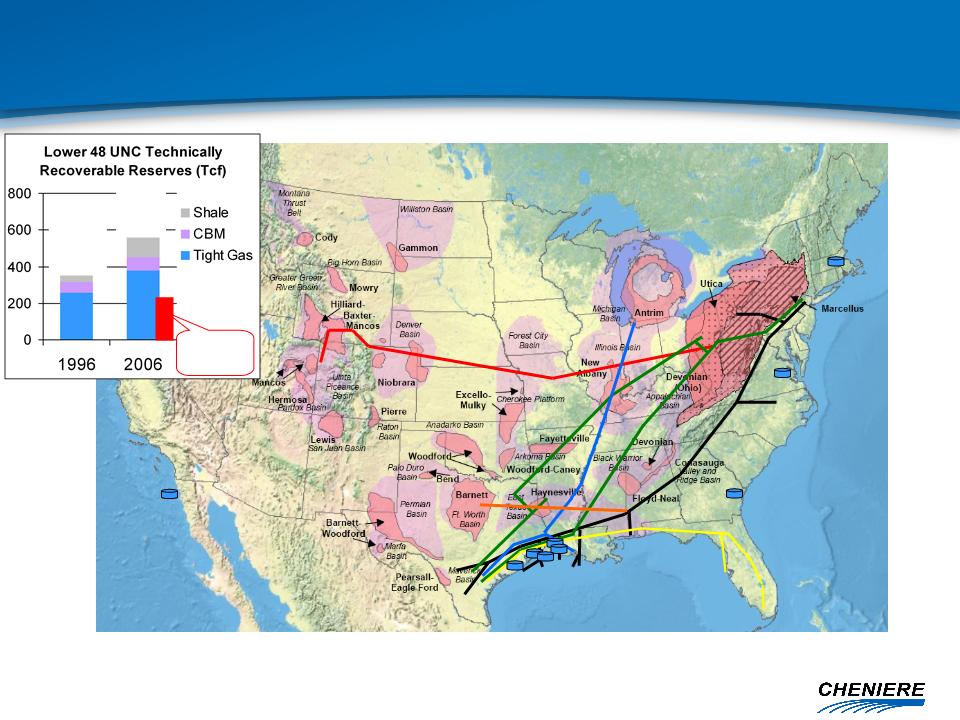

Sources:

EIA (US map graphic, pipelines and LNG terminals placed by

Cheniere).

Advanced

Resources Intl (Lower 48 Unconventional Recoverable Reserves)

Depicted

Pipelines: Rockies

Express, Texas Eastern, Trunkline, Transco, FGT, C/P/SESH/Gulf Crossing (as a

single route)

Depicted

LNG terminals: Freeport,

Golden Pass, Sabine Pass, Cameron, Trunkline, Elba Island, Cove Point,

Everett.

366

Tcf

Tcf

580

Tcf

Tcf

US

Proved

Reserves

Proved

Reserves

US

Unconventional Production

Basins Proximate to Premium Markets and Major Pipelines

Basins Proximate to Premium Markets and Major Pipelines

24

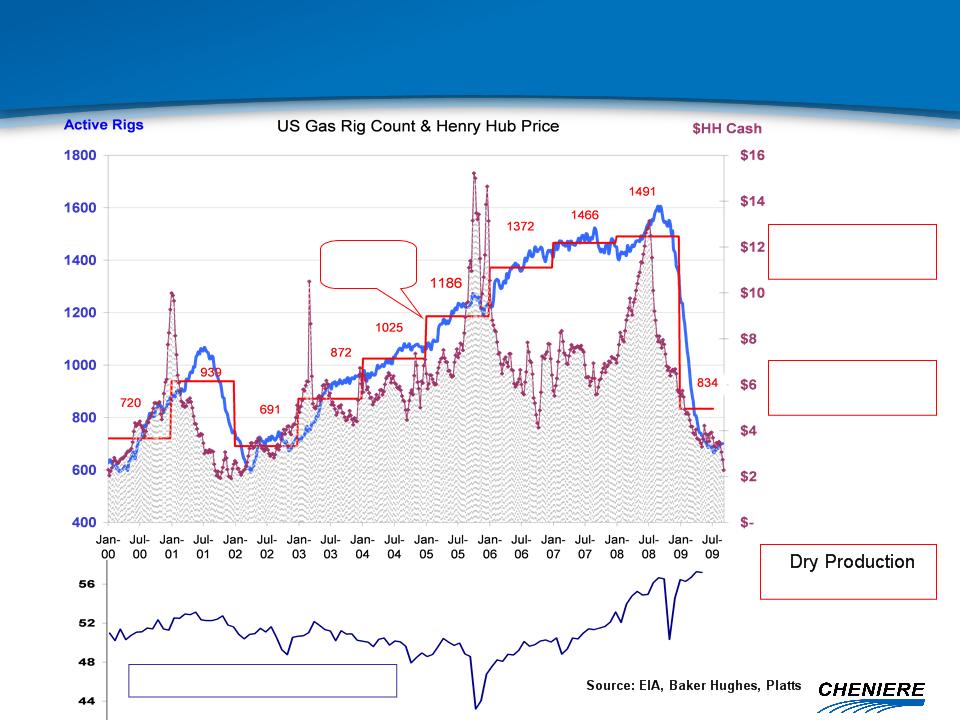

+ 2.7

Bcf/d YE ’08

Rigs

-58%

from

’08 Peak

Gas

Prices -80%

from

’08 Peak

Annual

average

average

Lower

48 Production (Bcf/d)

US

Gas Rig Count, Production & Prices

Drilling has Collapsed with Price, Oversupply

Drilling has Collapsed with Price, Oversupply

25

Lower

48 Dry Gas

Production

Production

Lower

48 Gas

Rig Count

Rig Count

Source:

Lippman Consulting, EIA, Baker Hughes, Cheniere Research

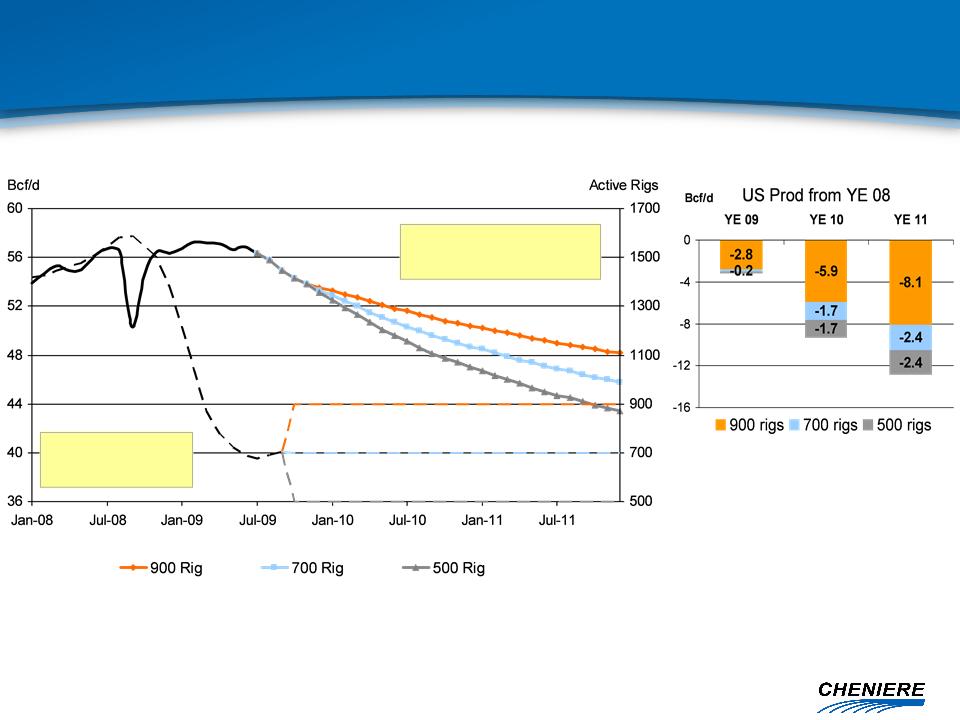

Lower

48 Wellhead Production & Gas Rig Count

Productive Capacity will Fall Sharply as Drilling is Curtailed

Productive Capacity will Fall Sharply as Drilling is Curtailed

26

Conclusions

§ North America is

about to join the global gas market

§ Unconventional

reserves and the growth of the LNG trade are

challenging the conventional business models

challenging the conventional business models

§ Questions:

– Can the oil linked

model survive?

– Which gas price

index would replace it?

– What is the gas

price required to justify additional production?

– Is it unconventional

gas in the US?

– Could it be

unconventional gas globally?

§ The answers are

unclear

§ Increased volatility

is expected until the industry learns to adapt to a

new business model

new business model

Appendix

28

Public

Unit holders

9.4% LP

Interest

Cheniere

Energy

Investments,

LLC

Sabine

Pass LNG-GP, Inc.

Sabine

Pass LNG, L.P.

Sabine

Pass LNG-LP, LLC

100%

Ownership Interest

100%

Ownership Interest

100%

Ownership Interest

100% LP

Interest

Non-Economic GP

Interest

100%

Ownership Interest

Cheniere LNG

Holdings, LLC

$205 mm

2.25% Convertible Senior Unsecured Notes due 2012

$550 mm

7.25% Senior Secured Notes due 2013

$1,666

mm 7.50% Senior Secured Notes due 2016

88.6%

LP Interest

100% of 2% GP Interest

100% of 2% GP Interest

NYSE

Amex US: LNG

NYSE

Amex US: CQP

3

$400 mm

9.75% Term Loan due 2012

$283 mm

12.0% Convertible Senior Secured Notes due 2018

Note:

Balances as indicated in September 30, 2009 10Q.

Organizational

Structure

29

(1)

(2)

(3)

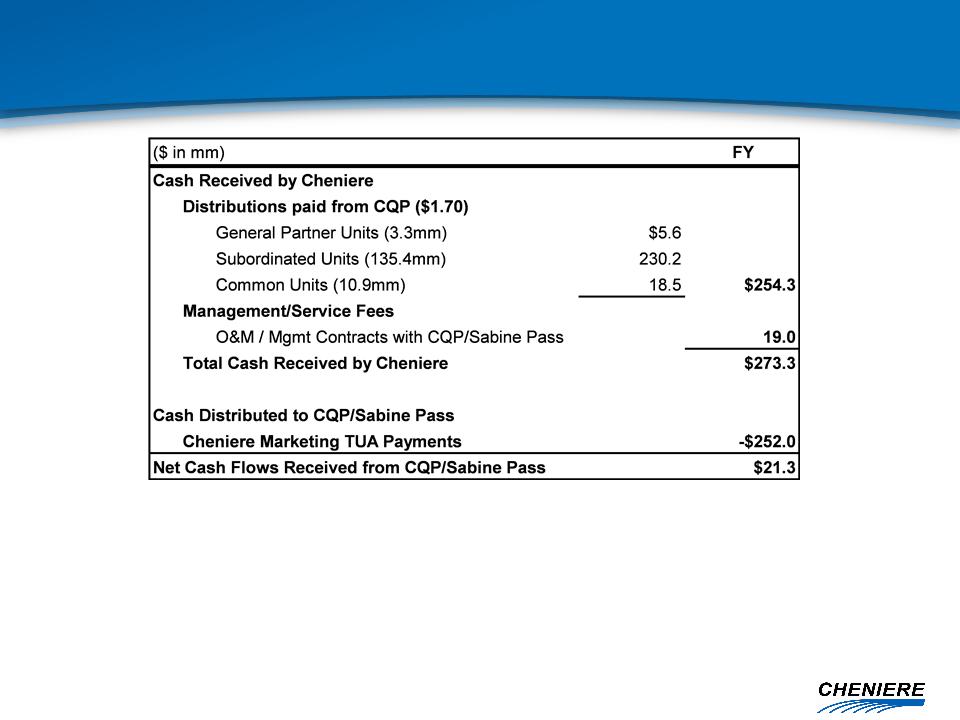

Expected

Cash Flows Between LNG and CQP/Sabine

(1)

Cheniere owns 90.6% of CQP through units held and expects to receive $1.70 per

unit in

distributions within 45 days of each quarter end

distributions within 45 days of each quarter end

(2)

Cheniere has three operations/management contracts with Sabine Pass / CQP under

which

Cheniere will receive payments monthly

Cheniere will receive payments monthly

(3)

Cheniere’s marketing segment contracted for 2.0 Bcf/d capacity at Sabine Pass

and has begun

making TUA capacity payments quarterly in advance

making TUA capacity payments quarterly in advance

30

Cheniere

Energy

Other

Cheniere

Consolidated

Unrestricted

cash

$

-

87

$

87

$

Restricted

cash and securities (2)

259

7

266

Property,

plant and equipment

1,605

633

2,238

Goodwill

and other assets

Total

assets

Deferred

revenue and other liabilities

209

$

(41)

$

168

$

Long-term

debt

2,182

847

3,029

Non-Controlling

interest

-

224

224

Equity

(Deficit)

(1) Includes intercompany

eliminations and reclassifications.

(2) Restricted cash

includes cash for construction of the Sabine Pass regas facility and debt

service reserves as required per indenture.

Cash is restricted at consolidated level.

Cash is restricted at consolidated level.

(3) For a complete

balance sheet see the

Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Form

10-Q’s for the period ended

September 30, 2009 filed with the SEC.

September 30, 2009 filed with the SEC.

September

30, 2009

(in

millions)

-

Condensed

Balance Sheet

31

Contracted

Capacity - TUAs

(1) Fees

do not vary with the actual quantity of LNG processed; tax reimbursement not

included in the fees.

(2) No

inflation adjustments.

(3)

Subject to annual inflation adjustment.

Summary

of 20-year Terminal Use Agreements

Total

LNG

Chevron

USA

Cheniere

Marketing

Capacity

1.0

Bcf/d

1.0

Bcf/d

2.0

Bcf/d

Fees

(1)

Reservation

Fee

(2)

$0.28/MMBTU

$0.28/MMBTU

$0.28/MMBTU

Opex

Fee

(3)

$0.04/MMBTU

$0.04/MMBTU

$0.04/MMBTU

2010

Full-Year Payments

$123

million

$128

million

$252

million

Term

20

years

20

years

20

years

Guarantor

Total

S.A.

Chevron

Corp.

Cheniere Energy,

Inc.

Guarantor

Credit Rating

Aa1/AA

Aa1/AA

NR/CCC+

Payment

Start Date

April

1, 2009

July 1,

2009

January

1, 2009

6

32

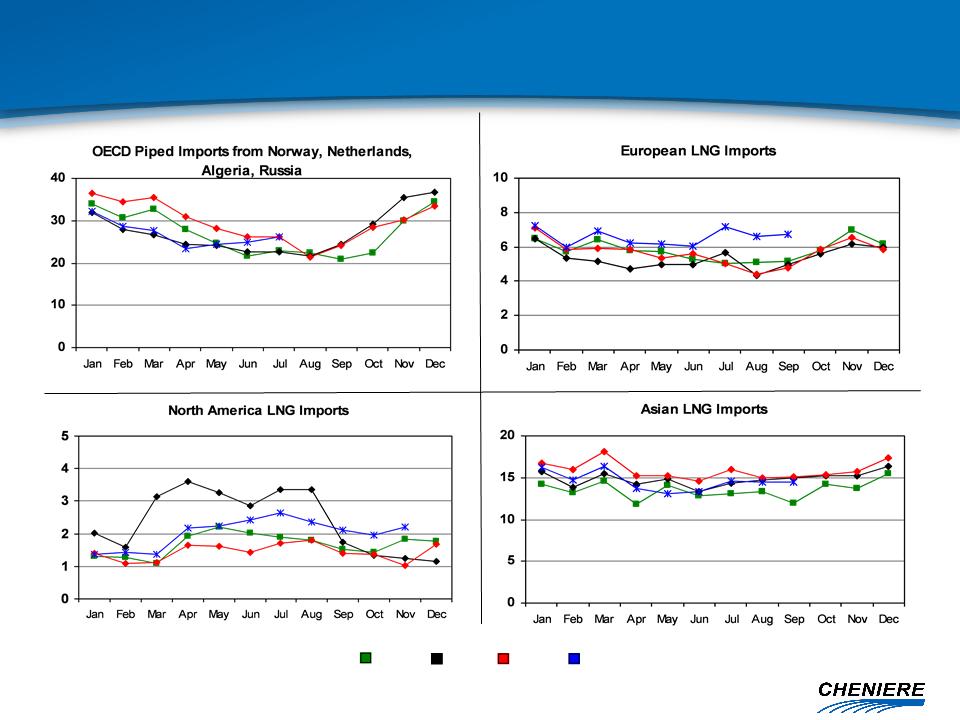

Source:

Waterborne LNG, EIA

2006

2007

2008

2009

Historical

LNG Imports by Region

(Bcf/d)

(Bcf/d)