Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Behringer Harvard Opportunity REIT I, Inc. | a09-34030_18k.htm |

| EX-99.1 - EX-99.1 - Behringer Harvard Opportunity REIT I, Inc. | a09-34030_1ex99d1.htm |

| EX-99.2 - EX-99.2 - Behringer Harvard Opportunity REIT I, Inc. | a09-34030_1ex99d2.htm |

Exhibit 99.3

|

|

Behringer Harvard Opportunity REIT I, Inc. Quarterly Update – November 2009 Chase Park Plaza, St. Louis, MO This presentation contains information regarding certain offerings and securities and the issuers thereof and must be read in conjunction with the applicable prospectus in order to understand fully all of the implications and risks of investment in such securities. A copy of the prospectus must be made available to you at or prior to this presentation. 403937 November 19, 2009 |

|

|

2 © 2009 Behringer Harvard Forward-Looking Statements This presentation contains forward-looking statements relating to the business and financial outlook of certain Behringer Harvard programs that are based on our current expectations, estimates, forecasts, and projections and are not guarantees of future performance. Forward-looking statements can generally be identified by the use of forward-looking terminology, such as “may,” “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “would,” “could,” “should,” and variations of these words and similar expressions. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. Risks that could cause actual results to vary materially from those expressed in forward-looking statements include absence of a public market for these securities, limited operating history, absence of properties identified for acquisition, limited transferability and lack of liquidity, risks associated with lending activities, no assurance that distributions will continue to be made or that any particular rate of distribution will be maintained, reliance on the investment REIT’s advisor, payment of significant fees to the advisor and its affiliates, potential conflicts of interest, and lack of diversification in property holdings until significant funds have been raised, potential development risks and construction delays, risk associated with mortgage and mezzanine financing, and the potential inability to retain current residents and attract new residents due to a competitive housing market, risk that the REIT’s operating results will be affected by economic and regulatory changes that have an adverse impact on our investments, and risk the program will not achieve all of its objectives if it does not fully complete its current securities offering. These risks may impact a real estate program’s ability to make distributions as stated in the current prospectus. Real Estate investment programs are not suitable for all investors. Refer to the prospectus for a more detailed discussion of risks and suitability standards in your state. Forward-looking statements in this presentation speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events. We claim the safe harbor protection for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. |

|

|

3 © 2009 Behringer Harvard Questions? During the call, please e-mail questions to: bhreit@behringerharvard.com |

|

|

4 © 2009 Behringer Harvard Agenda • Market Commentary • Financial Review and Capital Availability • Debt Maturity Schedule • Asset Updates • Questions Crossroads in San Diego, CA |

|

|

5 © 2009 Behringer Harvard Market Overview • GDP is back in the black after four consecutive quarters of negative growth. • Commercial real estate market fundamentals are expected to remain weak through 2010, or until healthy job growth resumes. • Sales transactions are still well below the peak volumes of 2007 and 2008, but sales ticked up slightly in the third quarter. • The debt markets remain inefficient and financing continues to be a major challenge for institutional investors and property owners. • However, optimism appears to be rebounding as signs of economic recovery begin to emerge. Northborough Tower, Houston, TX |

|

|

6 © 2009 Behringer Harvard Market Overview •Hospitality Sector – 2009 was a very tough year for the hospitality sector, but most industry professionals believe that occupancy and rates have stabilized – Corporate rates continue to be depressed but small increases seen in advance group business bookings and leisure travel •International Markets – Central Europe, especially Poland, is faring better than Western Europe – London office market hit especially hard in 2009 The Lodge & Spa at Cordillera, Edwards, CO |

|

|

7 © 2009 Behringer Harvard • FFO and MFFO • Challenges Faced –In this environment, which includes rising cap rates, occupancy declines, increased leasing concessions and pressure on rental rates, real estate in general has declined in value, which has increased the frequency and amount of impairment charges recognized. –$7.1 million non-cash impairment charge for Becket House investment in Q3 2009. Together with Q2 2009 non-cash impairment charge on Becket House of $2.7 million, represents about 1% of total assets as presented on our September 30, 2009 balance sheet. –Impairment charges are non-cash and for this and other reasons are added back to modified FFO. Funds from Operations and Modified Funds from Operations Becket House in London, England |

|

|

8 © 2009 Behringer Harvard FFO and MFFO Results –Current Quarter vs. Prior Quarter • FFO, including the impact of impairment charges and gains/losses recognized on interest rate derivatives totaled negative $13.4 million, or $0.24 per share. • Modified FFO, which excludes the impact of impairment charges and the derivative gains/losses, totaled negative $8 million, or negative $0.14 per share. –Key items impacting Q3 2009 Modified FFO • Slight increase in NOI at consolidated properties. • $0.18 per share decrease related to Chase Park reserve. • Lower G&A charges. GrandMarc at Westbery Place, Ft. Worth, TX GrandMarc at The Corner, Charlotesville, VA Funds from Operations and Modified Funds from Operations |

|

|

9 © 2009 Behringer Harvard Liquidity and Capital Availability Portfolio Level Cash •As of September 30, 2009, Opportunity REIT I had a portfolio cash balance of $19 million. Property Level Cash • In addition, $7 million was held across the 22 assets but in restricted accounts. Those accounts are restricted to various hurdles, such as leasing in which the monies can only be used for tenant improvements and for the payment of real estate taxes and insurance at several operating properties. Frisco Square, Frisco, TX |

|

|

10 © 2009 Behringer Harvard Debt Maturities Schedule of Debt Maturities in 2009 Property Lender Loan Amount 1 Current Maturity Date Current Financing Plan Becket House RBS £11.7 M 1/31/09 Extended for 2 years to 3/31/11 Frisco Square Land Bank of America / Regions $25.8 M 10/28/09 Extend for 2 yrs to be coterminous with the other tranches in facility Alexan Black Mountain2 $29.0 M Comerica Negotiating a multi-year extension with lender GrandMarc at The Corner2 (UVA) $26.9 M KeyBank 12/31/09 Refinance with a 10 year Freddie Mac loan 1) As of September 30, 2009 2) BH Opportunity REIT I, Inc. is not the obligor nor the guarantor 12/29/09 |

|

|

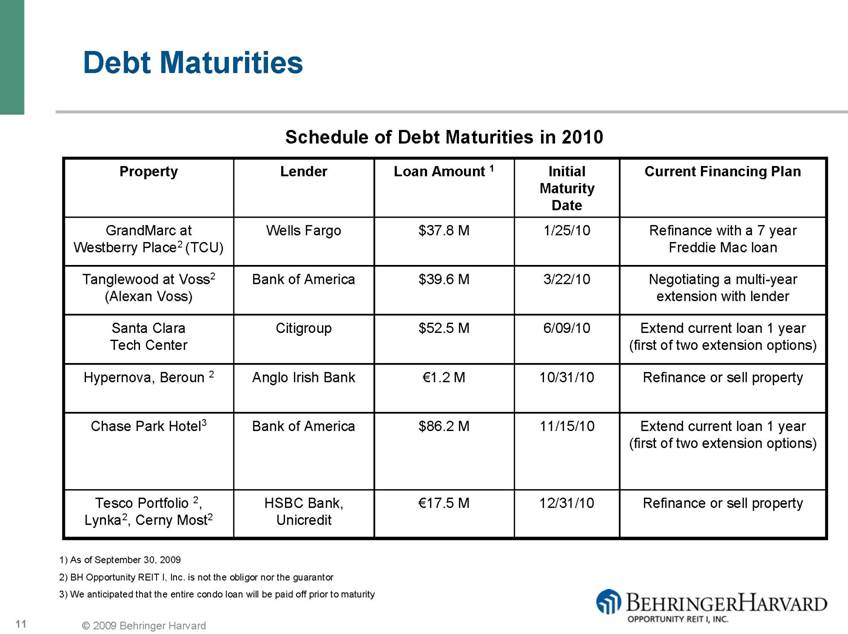

11 © 2009 Behringer Harvard 1) As of September 30, 2009 2) BH Opportunity REIT I, Inc. is not the obligor nor the guarantor 3) We anticipated that the entire condo loan will be paid off prior to maturity Schedule of Debt Maturities in 2010 Property Lender Loan Amount 1 Initial Maturity Date Current Financing Plan Wells Fargo Bank of America Citigroup Anglo Irish Bank Bank of America HSBC Bank, Unicredit GrandMarc at Westberry Place2 (TCU) $37.8 M 1/25/10 Refinance with a 7 year Freddie Mac loan Tanglewood at Voss2 (Alexan Voss) $39.6 M 3/22/10 Negotiating a multi-year extension with lender Santa Clara Tech Center $52.5 M 6/09/10 Extend current loan 1 year (first of two extension options) Hypernova, Beroun 2 €1.2 M 10/31/10 Refinance or sell property Chase Park Hotel3 $86.2 M 11/15/10 Extend current loan 1 year (first of two extension options) Tesco Portfolio 2 , Lynka2, Cerny Most2 €17.5 M 12/31/10 Refinance or sell property Debt Maturities |

|

|

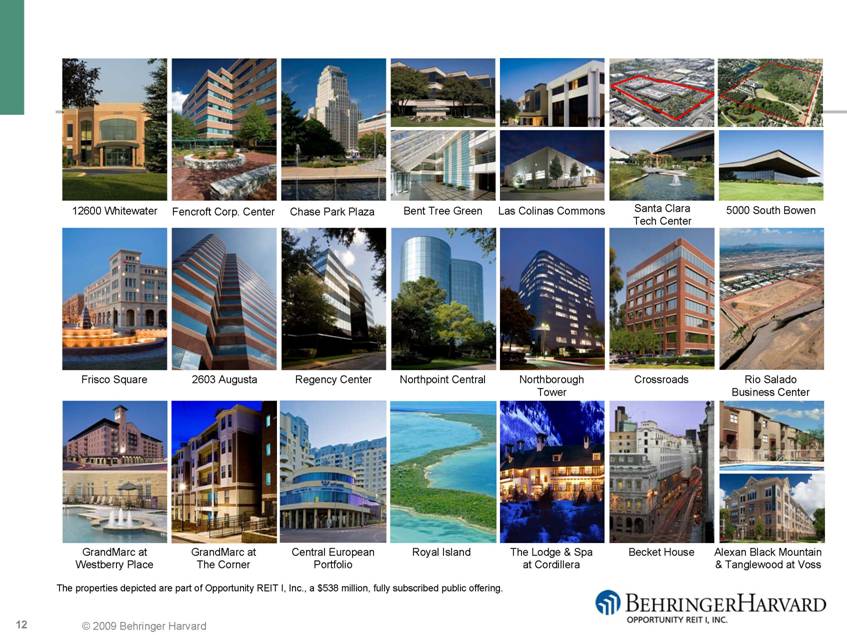

12 © 2009 Behringer Harvard 12600 Whitewater Fencroft Corp. Center Chase Park Plaza Bent Tree Green Las Colinas Commons Santa Clara 5000 South Bowen Tech Center Frisco Square Northpoint Central Northborough 2603 Augusta Regency Center Crossroads Rio Salado GrandMarc at GrandMarc at Royal Island The Lodge & Spa Tower Central European Becket House Business Center Alexan Black Mountain Westberry Place The Corner at Cordillera Portfolio & Tanglewood at Voss The properties depicted are part of Opportunity REIT I, Inc., a $538 million, fully subscribed public offering. |

|

|

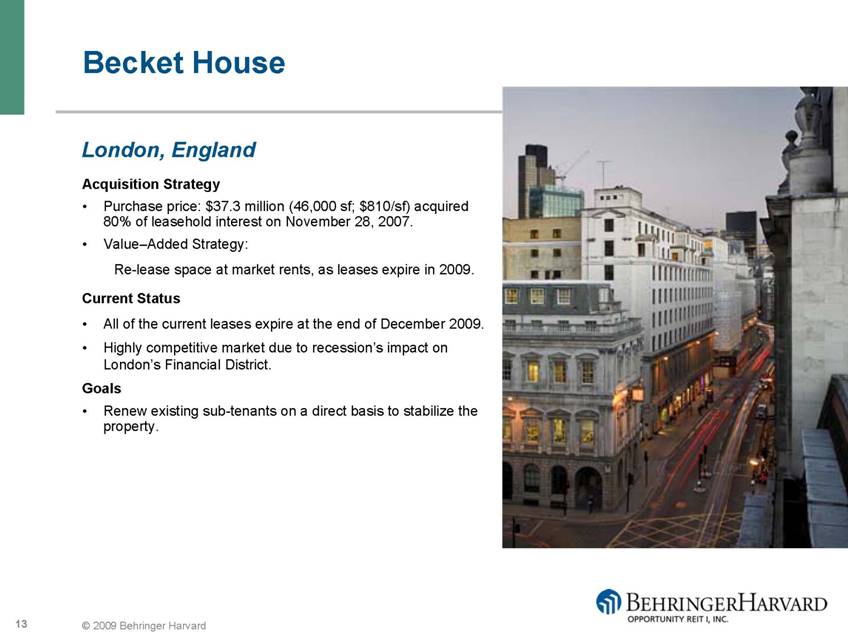

13 © 2009 Behringer Harvard Becket House London, England Acquisition Strategy • Purchase price: $37.3 million (46,000 sf; $810/sf) acquired 80% of leasehold interest on November 28, 2007. • Value–Added Strategy: Re-lease space at market rents, as leases expire in 2009. Current Status • All of the current leases expire at the end of December 2009. • Highly competitive market due to recession’s impact on London’s Financial District. Goals • Renew existing sub-tenants on a direct basis to stabilize the property. |

|

|

14 © 2009 Behringer Harvard GrandMarc at Westberry Place Fort Worth, Texas Acquisition Strategy • Made a mezzanine loan on 2/1/2007 in the amount of $8,125,000. • Acquired a 50% Interest in the property on 9/21/2007 (mezzanine loan conversion). • Total project cost basis is $54.5 million (OP REIT I cost basis is $27.2 million-50%). Current Status • Behringer converted to 50% equity partner September 2007. • Construction completed December 2005. • Occupancy as of September 30, 2009 was 96%. • Average net effective rent/bed of $875; average rent/psf of $1.90 with no concessions. • 20,661 sq ft or 70% of retail space has been leased. • TCU committed to master lease 88 beds for the 2009-10 school year. • 3,557 sq ft of retail space currently has active lease prospects. Goals • Achieve lease up of 97% by the start of the 2010-11 school year. • Achieve rent growth of 3% for the new leases. • Secure tenants for remaining retail vacancy. |

|

|

15 © 2009 Behringer Harvard GrandMarc at The Corner Charlottesville, Virginia Acquisition Strategy • Made a mezzanine loan on 2/1/2007 in the amount of $6,040,000. • Acquired a 50% Interest in the property on 9/21/2007 (mezzanine loan conversion). • Total project cost basis is $42 million (OP REIT I cost basis is $21 million-50%). Current Status Behringer converted to 50% equity partner September 2007. • Construction was completed October 2007. • Average lease rate is $657.57. • As of September 30, the community was 98% occupied with net effective rent/bed of $884 & net effective rent/psf of $1.90. • Currently 11% preleased (68 leases) for Fall 2010. Goals • Achieve lease up of 97% by the start of the 2010-11 school year. • Achieve rent growth of 3% for the new leases. |

|

|

16 © 2009 Behringer Harvard Questions? During the call, please e-mail questions to: bhreit@behringerharvard.com |