Attached files

| file | filename |

|---|---|

| 8-K - SINOHUB, INC. | c1117928k.htm |

Electronic

Components Supply Chain Management

Investor

Presentation

November 2009

November 2009

www.sinohub.com

2

Safe

Harbor Statement

This

presentation contains “forward-looking statements” within the meaning of the

“safe-harbor”

provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and

unknown risks, uncertainties and other factors that could cause the actual results of the company to

differ materially from the results expressed or implied by such statements, including changes of

anticipated sales levels, future international, national or regional economic and competitive conditions,

changes in relationships with customers, access to capital, difficulties in developing and marketing new

products and services, marketing existing products and services, customer acceptance of existing and

new products and services, and other factors, including those factors described on Exhibit 99.1 to

SinoHub’s Current Report on Form 8-K filed on September 28, 2009. Any statements that are not

historical facts and that express, or involve discussions, as to expectations, beliefs, plans, objectives,

assumptions or future events or performance (often, but not always, through the use of words or

phrases such as "will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,”

“intends,” “plans,” and “projection”) are not historical facts, may be forward-looking statements and

may involve estimates and uncertainties. Accordingly, although the company believes that the

expectations reflected in such forward-looking statements are reasonable, there can be no assurance

that such expectations will prove to be correct. The company undertakes no obligation to update the

forward-looking information contained in this presentation.

provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and

unknown risks, uncertainties and other factors that could cause the actual results of the company to

differ materially from the results expressed or implied by such statements, including changes of

anticipated sales levels, future international, national or regional economic and competitive conditions,

changes in relationships with customers, access to capital, difficulties in developing and marketing new

products and services, marketing existing products and services, customer acceptance of existing and

new products and services, and other factors, including those factors described on Exhibit 99.1 to

SinoHub’s Current Report on Form 8-K filed on September 28, 2009. Any statements that are not

historical facts and that express, or involve discussions, as to expectations, beliefs, plans, objectives,

assumptions or future events or performance (often, but not always, through the use of words or

phrases such as "will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,”

“intends,” “plans,” and “projection”) are not historical facts, may be forward-looking statements and

may involve estimates and uncertainties. Accordingly, although the company believes that the

expectations reflected in such forward-looking statements are reasonable, there can be no assurance

that such expectations will prove to be correct. The company undertakes no obligation to update the

forward-looking information contained in this presentation.

www.sinohub.com

3

By

revitalizing electronics supply chain management in China,

SinoHub

believes it is poised to play a major role

in the world’s largest electronics marketplace

in the world’s largest electronics marketplace

SinoHub

At a Glance

● Headquarters:

Shenzhen,

PRC

● Founded: 2000

● NYSE Amex: SIHI

● Market cap: ~$110

million

● Revenues

(TTM) : $112

million

+77%

vs. year-ago TTM

● Net income

(TTM): $12

million

+81%

vs. year-ago TTM

● EPS (TTM) : $0.46

● Working capital:

$32

million

● ROE: 25.7%

TTM

data as of September 30, 2009.

www.sinohub.com

4

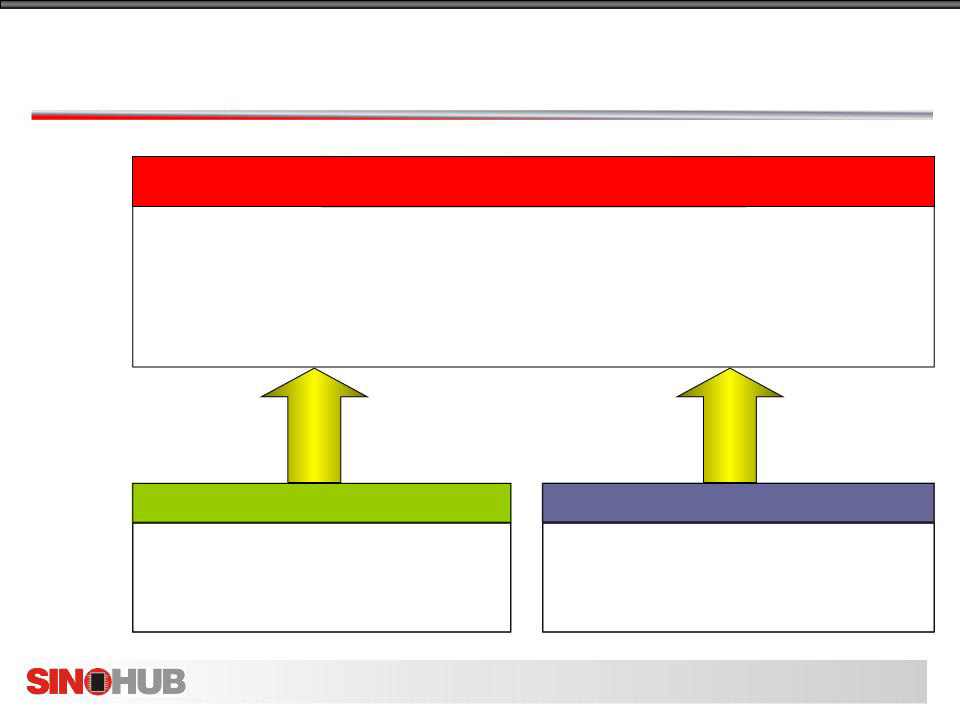

Chinese

Electronics Industry

SINOHUB’S

STRATEGIC POSITION

● Industry

participants seeking to

outsource supply chains

outsource supply chains

Web-Based

Supply Chain Management

● Largest producer

of electronic

products

products

● Biggest consumer

of electronic

components - and rising

components - and rising

● New approach to information access and

sharing

● Core

SCM services specialized for electronics industry - gives

SinoHub leverage along entire electronics supply

chain

●

Proprietary SCM platform for electronics industry in

China

● Positioned to consolidate a substantial

portion of the electronic industry on SCM

platform

Capitalizing on Current Trends

www.sinohub.com

5

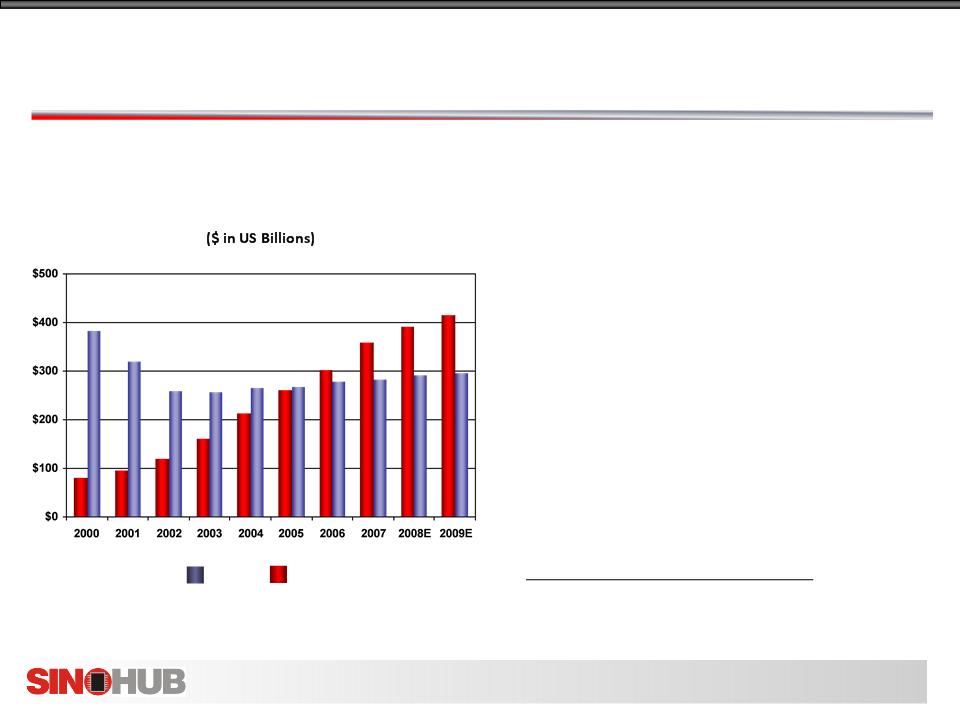

Electronic

Products Production1

U.S.

China

1 Reed Electronics

Research (RER), November 2007

2 Global Sources,

February 2009

Large

Electronic Components Industry in China

● World’s largest

consumer of electronic components

§ Produced US$391B

electronic products in

20081

20081

§ Domestically

consumed US$117B electronic

components in 20082

components in 20082

● Existing

electronic components supply chain

management (SCM) infrastructure offers significant

opportunities

management (SCM) infrastructure offers significant

opportunities

§ SCM providers in

U.S. and Europe have not

made the investments to provide adequate

services in China

made the investments to provide adequate

services in China

§ Existing

distributors in China lack ability to

provide full services

provide full services

● Large

manufacturers of non-branded products now

outsourcing SCM functions to reduce overhead

outsourcing SCM functions to reduce overhead

www.sinohub.com

6

Web-based

proprietary SCM platform = Competitive edge

The

Secret Sauce

● Import business

generates real-time, continually updated database

of electronic component market prices

of electronic component market prices

§ Competitors must

devote significant time, energy and resources to gain

access to similar information and build database with critical mass

access to similar information and build database with critical mass

● Proprietary

database search engine capability allows SinoHub to

identify most competitive deals for procurement-fulfillment and

electronic component sales

identify most competitive deals for procurement-fulfillment and

electronic component sales

● New business model

with much lower cost structure than

competitors

competitors

www.sinohub.com

7

The

SinoHub Advantage

● Integration of

Electronic Component Purchasing and Custom Phone

Supply around SCM core

Supply around SCM core

● Web-based

proprietary SCM technology platform

§ Provides insight

into price, quantity, lead time on 30,000+ components

§ Online MIS system

geared to expanding usage of Internet for business

transactions and information exchange

transactions and information exchange

§ Complete real time

supply chain transparency 24X7

§ Supports rapidly

growing electronic component sales

● Deep

entrepreneurial, managerial and local field expertise in

electronics industry

electronics industry

● Strong

relationships with Chinese Customs

www.sinohub.com

8

SinoHub

SCM™

Online

MIS

system

Strategically

located

warehouse

and service center network

150+

team of employees with deep

local

experience in the electronics industry

SinoHub’s

SCM Platform

Power

of SinoHub’s SCM Platform

SinoHub’s

SCM Platform provides a competitive advantage

in

a rapidly expanding electronic components industry in

China

www.sinohub.com

9

SCM

- Web-based MIS System

● Key

differentiator

● Creates barrier to

entry and provides competitive advantage

● Fully integrated

SCM services tailored to electronic components

● Promotes

transparency

§ 24X7, real time,

Web-based solution

§ Information

sharing between our customers and their customers and

suppliers

suppliers

● Integrated

solution combines information entry with automatic price

checking, processing, query and services

checking, processing, query and services

www.sinohub.com

10

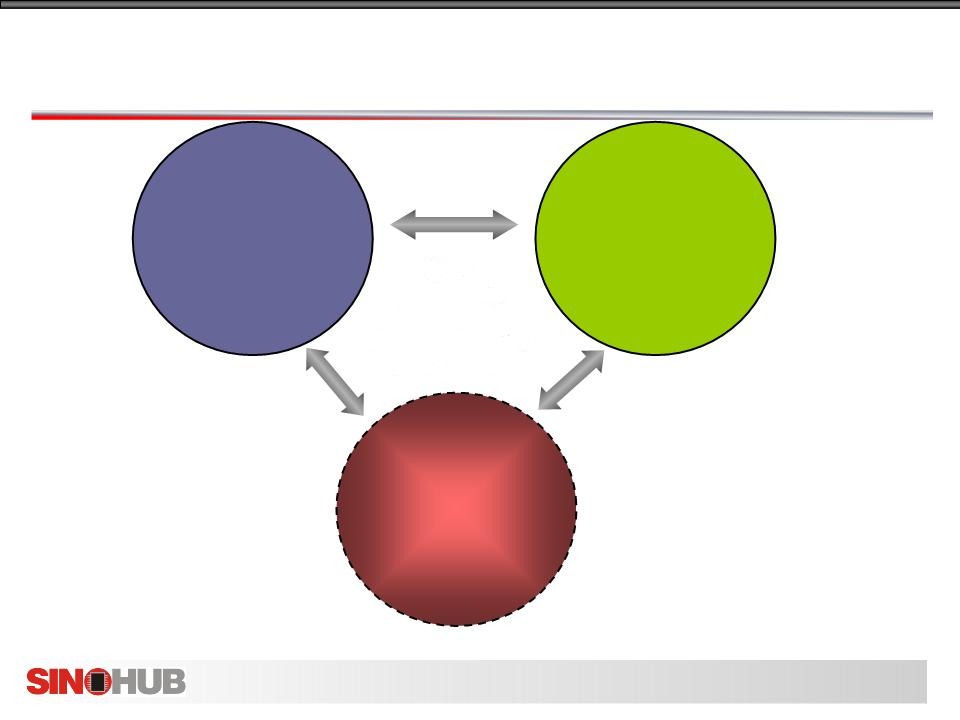

Supply

Chain

Management

(SCM)

Management

(SCM)

Electronic

Component

Purchasing

(ECP)

Component

Purchasing

(ECP)

Custom

Phone

Supply*

(CPS)

Supply*

(CPS)

*

Represents recently-developed business line in early stages of revenue, which is

not yet material to results of operations.

Key

Service Offerings

Three

interdependent

business units

sharing information

at every level

www.sinohub.com

11

● Web-based SCM

platform to support services and provide information

● Makes supply chain

transparent for all participants

● Fully integrated

services:

§ Bill of material

and order processing management

§ Inventory

management

§ Import and export

services - customs applications,

tax reports, payment

services, certificates for paid customs tax

services, certificates for paid customs tax

§ Delivery services

- door-to-door

and just-in-time freight forwarding

Key

Service Offerings

Supply

Chain Management (SCM)

www.sinohub.com

12

Electronic

Component

Procurement

Logistics

Services

SCM

MIS

Solution

Enablement

Open

to 3rd

Parties

SinoHub

Vendors

(TI,

Motorola, etc.)

Distributors

(Avnet,

Arrow, etc.)

Express

Forwarders

(UPS,

DHL, FedEx, etc.)

Local

Import/Export

Companies

(Shenzhen

Eternal Asia, etc.)

Services

Chart

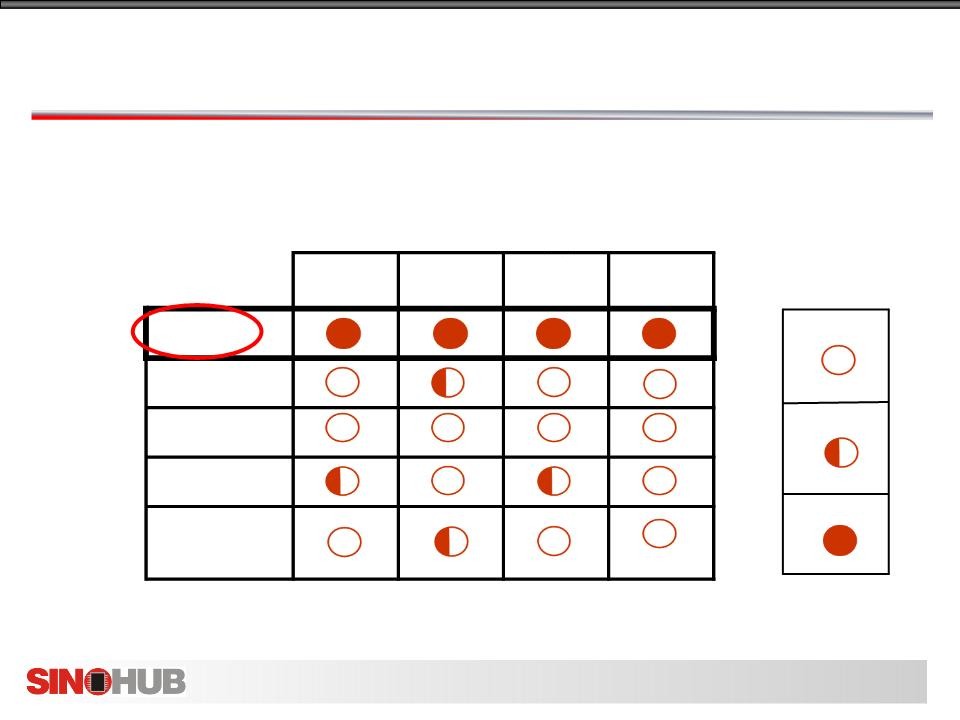

based on SinoHub’s internal research.

Supply

Chain Management - Powerful

Differentiation

SinoHub’s

SCM platform has an outstanding reputation with some of the

world’s largest electronic component distributors

world’s largest electronic component distributors

Key

No

Service

Limited

Scope

Partial

Scope

Full Scope

www.sinohub.com

13

Electronic

Component Purchasing (ECP)

Key

Service Offerings

● Spot component

sales based on information generated by core SCM -

presents revenue generating opportunities for SinoHub and allows design

houses, contract manufacturers and OEMs to purchase at better prices

presents revenue generating opportunities for SinoHub and allows design

houses, contract manufacturers and OEMs to purchase at better prices

● Procurement

services - SinoHub

buys and finances electronic components

for customers

for customers

● Fulfillment

services - SinoHub

manages customer determined purchasing

and finances purchases for customers

and finances purchases for customers

www.sinohub.com

14

Chart

based on SinoHub’s internal research.

Database

from

Core SCM

Business

Core SCM

Business

Minimum

Inventory

Requirement

Inventory

Requirement

Sales

Force not

Dedicated to

Product Line

Dedicated to

Product Line

Minimum

Sales

Engineers

Engineers

Requirement

SinoHub

Vendors

(TI,

Motorola, etc.)

Distributors

(Avnet,

Arrow, etc.)

Independent

stocking

distributors

Traders

Key

Does

Not Apply

Partially

Applies

Applies

Electronic

Component Purchasing - Enhancing

Efficiencies

SinoHub’s

ECP platform has enabled the company to create what we

believe to be the industry’s most cost effective business model

believe to be the industry’s most cost effective business model

www.sinohub.com

15

Custom

Phone Supply* (CPS)

*

Represents recently-developed business line in early stages of revenue, which is

not yet material to results of operations.

Key

Service Offerings

● Online CPS

platform to connect customers with design houses and

manufacturers

manufacturers

● Minimal investment

in R&D and fixed assets

● Flexibility on

order quantities which creates a distinct opportunity in

under-serviced markets

under-serviced markets

www.sinohub.com

16

Chart

based on SinoHub’s internal research.

Outsource

R&D

Small

Minimum

Minimum

Order

Size

Complete

Platform

SinoHub

OEMs

(Nokia,

Samsung, etc.)

Tier

1 Contract Mfgs.

(Foxconn,

Flextronics, etc.)

Local

Contract Mfgs.

(TCL,

Skyworth, Konka, etc.)

Design

Houses

(Longcheer,

Wintech, etc.)

Outsource

Manufacturing

Key

Does

Not Apply

Partially

Applies

Applies

*

Represents recently-developed business line in early stages of revenue, which is

not yet material to results of operations.

Custom

Phone Supply* - Niche

Position

SinoHub’s

CPS Platform allows customers to place small orders

for exactly what their markets need while generating a profit

for the company by eliminating fixed overhead

for exactly what their markets need while generating a profit

for the company by eliminating fixed overhead

www.sinohub.com

17

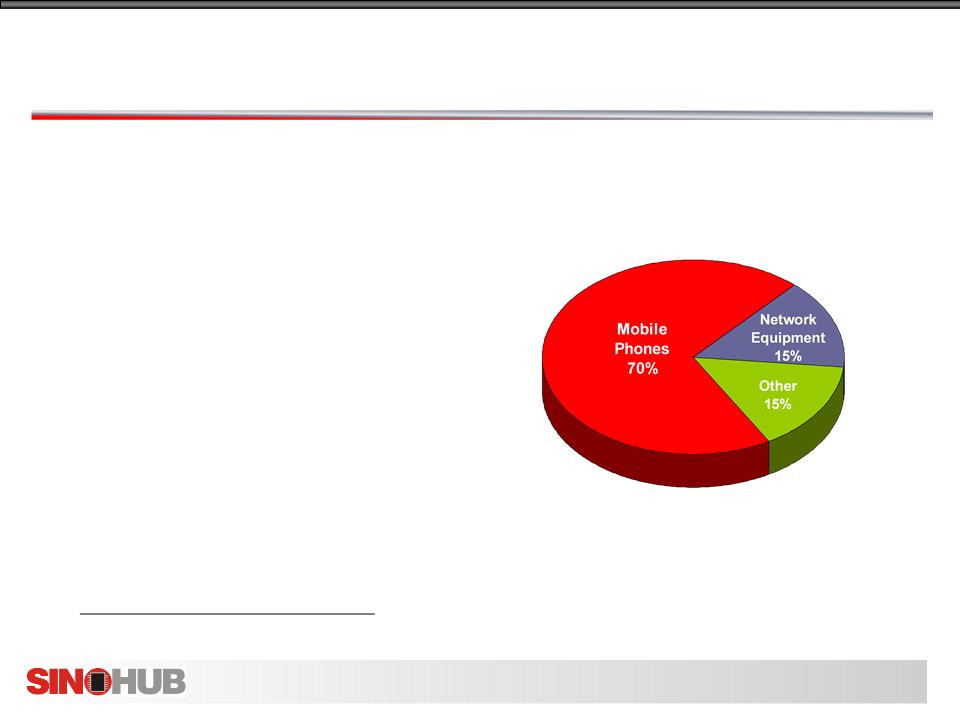

SinoHub

Revenue by Verticals

(2008)

No

one customer represents more than

10% of total revenues

10% of total revenues

1 China Market

Intelligence Center (CMIC) data for 2008

Industry

Verticals

● Mobile phone

industry in China

§ More than 1,000

mobile phone models -

“Must Have” not “Nice-to-Have”

“Must Have” not “Nice-to-Have”

§ China responsible

for 50% of worldwide

mobile phone manufacturing capacity1

mobile phone manufacturing capacity1

§ Price and

functionality replacing brand as

primary market driver

primary market driver

§ Non-branded mobile

phone sales expected

to account for 33% of total market in China

in 2010

to account for 33% of total market in China

in 2010

§ Large local

manufacturers - whose

phones

are sold into 2nd tier market - seeking to

outsource procurement, SCM functions

are sold into 2nd tier market - seeking to

outsource procurement, SCM functions

● Success in mobile

phone market replicable

in other industry verticals

in other industry verticals

www.sinohub.com

18

Independent

Distributors

Distributors

Franchise

Distributors

Distributors

Design

Houses

Manufacturer

Customers

EMS

Providers

Vendors

(electronic

component

manufacturers)

(electronic

component

manufacturers)

Supplier

Customers

Strong

Customer Relationships

More

than 120 enterprises utilize SinoHub’s SCM platform …

including

some of the largest electronic components distributors in the

world

www.sinohub.com

19

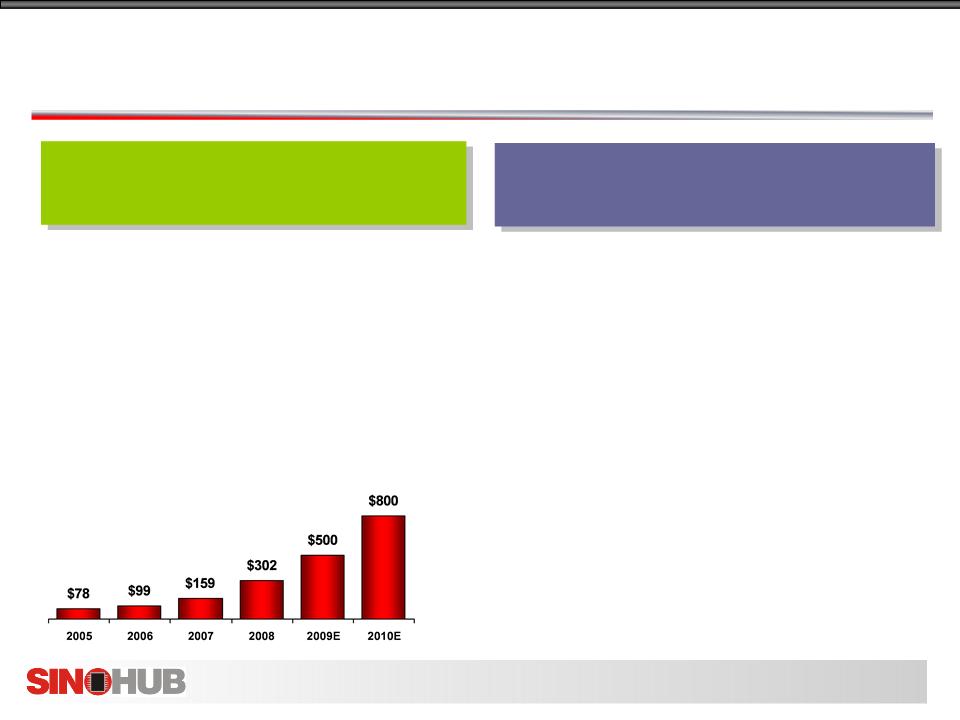

Value

of Customer Goods Processed by

SinoHub Through Huanggang Customs

SinoHub Through Huanggang Customs

($

in US millions)

Client

Coordinator Enterprise

(At

Huanggang - Main Border Crossing

Between Hong Kong

and China)

AA

Customs High Credit Enterprise

(Throughout

China)

Priority

Customs Clearance Status

● Awarded to top

service providers

§ Highest

reputation

§ Strong track

record

§ Greater than RMB

200 million per year

in VAT paid

in VAT paid

● Accelerates

SinoHub’s Huanggang

customs clearance in Shenzhen

customs clearance in Shenzhen

§ Releases goods by

up to 20X faster

● Highest level of

achievement awarded

to long-standing enterprises

to long-standing enterprises

§ Standardized

operations

§ Reliable customs

declaration

● Perfect record of

compliance

● Recognized in all

China’s customs ports

§ Expedited

clearance

§ Exemption from

customs examinations

§ Processing by

dedicated personnel

www.sinohub.com

20

Hong

Kong

China

Beijing

Regional

Office

(300

sq. ft.)

Shanghai

(Pudong)

Regional

Service Center + Warehouse

(6,000

sq. ft.)

Shanghai

(Wai Gao Qiao)

Regional

Service Center + Warehouse

(5,300

sq. ft.)

Hangzhou

Regional

Service Center

(500

sq. ft.)

Shenzhen

HQ + Regional Service Center + Warehouse

(27,600

sq. ft.)

Hong

Kong

Procurement-Fulfillment

Hub

+ Bonded Warehouse

+ Transportation Hub (26,500 sq. ft.)

+ Bonded Warehouse

+ Transportation Hub (26,500 sq. ft.)

System

of warehouses, trucking and freight handling

equipment add value to physical logistics

equipment add value to physical logistics

Shenzhen

Hangzhou

Strategic

Service Center Network

www.sinohub.com

21

|

|

2006

|

2007

|

2008

|

|

Revenue

|

$19.1

|

$28.8

|

$79.5

|

|

Gross

profit

|

$4.0

|

$6.7

|

$16.2

|

|

Net

income

|

$1.2

|

$3.5

|

$8.5

|

|

Earnings

per share - basic

Number

of shares (millions)

- basic

|

$0.09

13.9

|

$0.22

15.8

|

$0.41

20.9

|

|

Earnings

per share - diluted

Number

of shares (millions)

- diluted

|

$0.09

14.0

|

$0.22

15.9

|

$0.40

21.5

|

(Audited,

$ in US millions, except EPS data)

|

Gross

margin

|

21.2%

|

23.2%

|

20.4%

|

|

Net

income margin

|

6.4%

|

12.2%

|

10.7%

|

|

Revenue

|

44.4%

|

51.1%

|

176.0%

|

|

Gross

profit

|

92.0%

|

65.0%

|

143.1%

|

|

Net

income

|

190.7%

|

191.5%

|

142.3%

|

Year-Over-Year

Growth Rates

Growth Rates

Margin

Analysis

Analysis

Financial

Highlights

www.sinohub.com

22

|

|

Q3

2009

|

Q3

2008

|

YTD

2009

|

YTD

2008

|

|

Revenue

|

$36.2

|

$28.2

|

$85.6

|

$53.0

|

|

Gross

profit

|

$6.4

|

$6.1

|

$16.0

|

$9.9

|

|

Income

from operations

|

$4.7

|

$5.0

|

$11.4

|

$7.1

|

|

Net

income

|

$3.5

|

$3.9

|

$8.7

|

$5.5

|

|

Earnings

per share - basic

|

$0.14

|

$0.19

|

$0.35

|

$0.28

|

|

Earnings

per share - diluted

|

$0.13

|

$0.18

|

$0.34

|

$0.28

|

($

in US millions, except EPS data)

|

|

9/30

2009

|

12/31

2008

|

|

Cash

and cash equivalents

(unrestricted) |

$6.7

|

$5.9

|

|

Total

current assets

|

$47.3

|

$29.3

|

|

Total

current liabilities

|

$15.2

|

$6.5

|

|

Working

capital

|

$32.1

|

$22.8

|

|

Total

stockholders’ equity

|

$34.0

|

$23.5

|

|

Total

liabilities and

stockholders’ equity |

$49.2

|

$30.0

|

Condensed

Income Statement

Financial

Condition

($

in US millions)

2009

Q3Financial Results

www.sinohub.com

23

Proven

Organic Growth Strategy

● Add more

value-added services and enlarge footprint through

customer-driven improvements in SCM platform

customer-driven improvements in SCM platform

§ Optimize web-based

MIS system to bolster industry position

§ Open offices and

warehouses in additional key locations

● Leverage

capabilities and customer benefits to increase market share

and processing volume

and processing volume

§ Combination of

procurement-fulfillment and end-to-end, integrated SCM

services maximizes customers’ supply chain efficiencies

services maximizes customers’ supply chain efficiencies

§ Promotes industry

participants to seek SinoHub’s services to remain

competitive in the market

competitive in the market

● Build SinoHub

brand and distribution capabilities

www.sinohub.com

24

Experienced

Management Team

● Henry

T. Cochran - CEO

and Chairman of the Board

§ 30+ years founding

and managing companies

§ Former CEO and

president - Content Integrity and Advanced Visual Systems

§ Former VP - Sybase

§ Strong MIS

background

● Lei

Xia - President

§ 15 years in

electronic components industry in China

§ Significant senior

management experience in the Chinese electronics industry

§ First sales

manager of Arrow Electronics’ Shanghai office

§ Founded RGL

Beijing (high-end distributor and solution provider) and NEFAB China

(manufacturer and packaging solution provider)

(manufacturer and packaging solution provider)

● Willa

Li - CFO

§ Years of

experience working with Chinese banks

§ Significant

knowledge of electronic components industry

§ Prior CFO of

Shenzhen Excellence Investment Development Company where he raised

RMB 120 million

RMB 120 million

§ Prior EFO of Hong

Kong B&D Engine Company

www.sinohub.com

25

|

|

BOARD

OF DIRECTORS

|

Audit

Committee

|

|

|

Harry

Cochran -

Chairman

of the Board and CEO

|

|

|

Lei

Xia -

President

|

|

|

|

|

Will

Wang Graylin -

CEO,

ROAM Data

-

Extensive operational and entrepreneurial skills in mobile phone

industry

|

|

|

Charles

Kimball -

Chief

Research Consultant, Bosera Fund Management

- Significant Wall Street and financial management experience as 30-year veteran of JPMorgan |

P

|

|

|

Dr.

Richard King -

Venture

Partner,

GRP; Advisor, Nexit; and Science Advisory Board, NYU

-

Extensive experience in financial markets as an electronics analyst and

investment banker, advanced economic studies

|

|

|

|

Robert

Torino -

COO,

iPayment

-

CPA, former CFO, significant public company experience

|

P

|

|

|

Afshin

Yazdian -

EVP

& General Counsel, iPayment

-

SEC reporting knowledge, strong M&A experience

|

P

|

Building

World Class Corporate Governance

www.sinohub.com

26

Customers will

utilize

SinoHub’s platforms to

manage electronics supply

chain, electronic component

purchases and order

fulfillment themselves

SinoHub’s platforms to

manage electronics supply

chain, electronic component

purchases and order

fulfillment themselves

Centered in China

with

strategically located sales

offices around the world

strategically located sales

offices around the world

Global,

profitable

electronics company

electronics company

Leading

independent

distributor of electronic

components in China

distributor of electronic

components in China

Strong force in

electronics

products sales in selected

verticals worldwide

products sales in selected

verticals worldwide

Supply

Chain

Management (SCM)

Management (SCM)

SinoHub SCM

platform is making

entire electronics supply chain

transparent to all SinoHub

customer/supplier participants

entire electronics supply chain

transparent to all SinoHub

customer/supplier participants

Electronic

Component

Purchasing

(ECP)

Purchasing

(ECP)

SinoHub ECP

platform will set new

standard for online electronic

component purchasing

standard for online electronic

component purchasing

Custom

Phone Supply*

(CPS)

(CPS)

SinoHub CPS

platform will enable

distributors and operators to fill

orders quickly regardless of size and

allow manufacturers to track all

aspects of production process

distributors and operators to fill

orders quickly regardless of size and

allow manufacturers to track all

aspects of production process

Three

interdependent

business units

sharing information

at every level

interdependent

business units

sharing information

at every level

Increasing

Shareholder

Returns

*

Represents recently-developed business line in early stages of revenue, which is

not yet material to results of operations.

Five-Year

Goals - The

Big Picture

www.sinohub.com

27

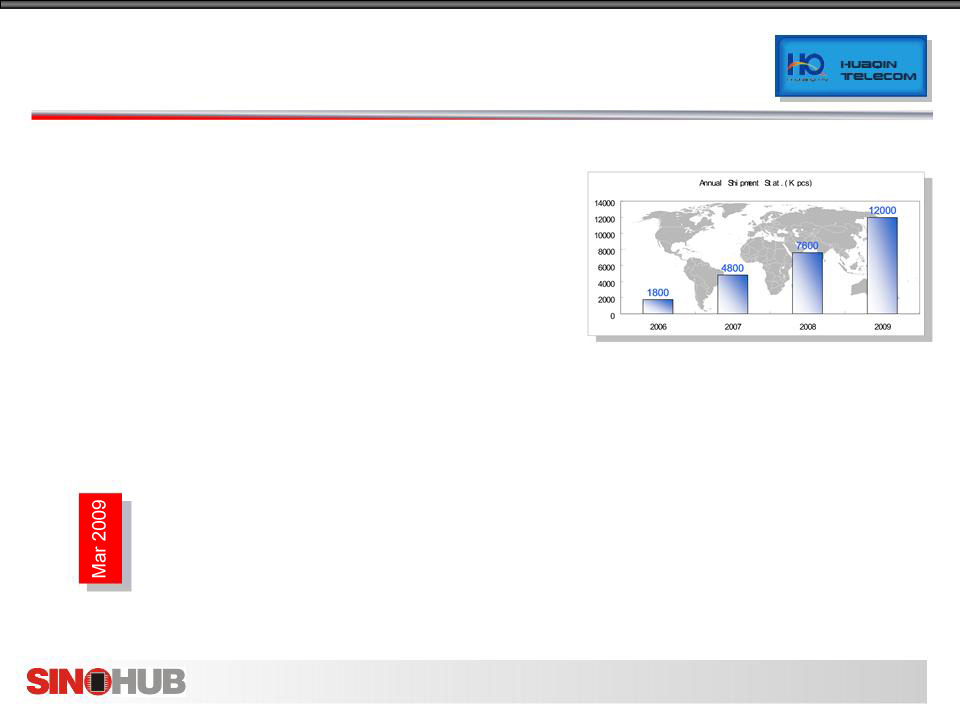

HuaQin begins

utilizing SinoHub SCM for

warehousing/inventory management,

import/export and logistics services

warehousing/inventory management,

import/export and logistics services

“SinoHub

SCM has enabled us to

reduce our production cycle by 33%

thus far. We regard SinoHub SCM as

an indispensable tool to enhancing

our efficiencies and increasing our

profitability.”

reduce our production cycle by 33%

thus far. We regard SinoHub SCM as

an indispensable tool to enhancing

our efficiencies and increasing our

profitability.”

Ms.

Qiang Qinlin

Vice

President of HuaQin

Case

Study:

Enhancing Efficiencies through SinoHub SCM

Enhancing Efficiencies through SinoHub SCM

● Founded June 2005

and dedicated to the research and

development of leading mobile handsets

development of leading mobile handsets

● Aug 2008 - Signed

license agreement with Qualcomm to

introduce advanced 3G CDMA2000 products in China

introduce advanced 3G CDMA2000 products in China

● Aug 2008 -

Received ISO-9001 certification

● Awards

§ 2008 Top 10

Project Design of Mobil Phone

§ Lenovo’s Best

Provider 2008

● Achieving nearly

100% CAGR in shipment volumes

● Annual revenue

approaching RMB 1.7 billion for 2009

www.sinohub.com

28

Investment

Opportunity Highlights

● Revolutionary

business model making existing franchise distribution model in China

obsolete

● Growing

utilization of SinoHub SCM propagates information generation

● Database

management system maximizes value of sales network and inventory

● Operating in

largest and growing electronic components market in the world

● Web-based

proprietary system and electronics components focus provides high barriers

to

entry

entry

● Success in mobile

phone market replicable in other industry verticals

● Proven organic

growth strategy

● Solid, experienced

management team and board with clear roadmap for continued growth

● Low SG&A and

attractive valuation