Attached files

| file | filename |

|---|---|

| EX-31.2 - SINOHUB, INC. | ex31_2.htm |

| EX-32.2 - SINOHUB, INC. | ex32_2.htm |

| EX-31.1 - SINOHUB, INC. | ex31_1.htm |

| EX-32.1 - SINOHUB, INC. | ex32_1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

|

|

For

the fiscal year ended December 31,

2009

|

|

|

OR

|

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

|

|

For

the transition period from ________________ to

________________

|

Commission

file number: 000- 52746

SINOHUB,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

87-0438200

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

incorporation

or organization)

|

Identification

No.)

|

|

|

6/F,

Bldg 51, Rd 5, Qiongyu Blvd.

Technology

Park, Nanshan District

Shenzhen,

People’s Republic of China

|

518057

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

86

755 2661 2106

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par

value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o

No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Date File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes o No

o

1

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained here, and will not be contained, to the best of

registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of

“accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange

Act. (Check one)

Large

accelerated

filer o

Accelerated

filer o

Non-accelerated

filer o

Smaller

Reporting

Company x

(Do not

check if a smaller reporting company.)

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act).Yes o No

x

The

aggregate market value of common stock held by non-affiliates of SinoHub Inc.,

based upon the closing price of its common stock as of June 30, 2009, was

$23,723,355. Shares of the Registrant’s common stock held by each

executive officer and director and by each person who owns 10 percent or more of

the outstanding common stock have been excluded in that such persons may be

deemed to be affiliates of the Registrant. This determination of affiliate

status is not necessarily a conclusive determination for other

purposes.

Indicate

the number of shares outstanding of each of the issuer's classes of common

stock, as of the latest practicable date.

|

Class

|

Outstanding

at March 24, 2010

|

|

|

Common

Stock, $0.001 par value per share

|

28,393,016 shares

|

DOCUMENTS

INCORPORATED BY REFERENCE:

The

Registrant incorporates by reference portions of its Definitive Proxy Statement

for the 2010 Annual Meeting of Stockholders, which is expected to be filed no

later than April 30, 2010, into Part III of this Form 10-K to the extent stated

herein.

2

SINOHUB,

INC.

FORM

10-K

|

Page

|

||

|

PART I

|

||

|

5

|

||

|

17

|

||

|

31

|

||

|

31

|

||

|

32

|

||

|

32

|

||

|

PART II

|

||

|

32

|

||

|

35

|

||

|

35

|

||

|

51

|

||

|

51

|

||

|

51

|

||

|

51

|

||

|

52

|

||

|

PART III

|

||

|

53

|

||

|

53

|

||

|

53

|

||

|

53

|

||

|

53

|

||

|

Part IV

|

||

|

53

|

||

|

58

|

||

|

59

|

||

|

Certifications

|

|

PART

I

Except

as otherwise required by the context, all references in this report to "we",

"us”, "our", “SinoHub” or "Company" refer to the consolidated operations of

SinoHub, Inc., a Delaware corporation, and its wholly owned

subsidiaries.

Special

Note Regarding Forward Looking Statements

This

Annual Report on Form 10-K, including “Management’s Discussion and Analysis of

Financial Condition and Results of Operations,” contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Such statements include, among others, those concerning our expected financial

performance and strategic and operational plans, as well as assumptions,

expectations, predictions, intentions or beliefs about future events. You are

cautioned that any such forward-looking statements are not guarantees of future

performance and that a number of risks and uncertainties could cause actual

results of the Company to differ materially from those anticipated, expressed or

implied in the forward-looking statements. The words “believe,” “expect,”

“plan,” “estimate,” “anticipate,” “project,” “targets,” “optimistic,”

“potential,” “intend,” “aim,” “may,” “will,” “continue” or similar expressions,

or the negative thereof, are intended to identify forward-looking

statements.

These

forward-looking statements involve known and unknown risks and uncertainties.

Our actual results may differ materially from those projected or assumed in such

forward-looking statements. Among the factors, risks and uncertainties that

could cause actual results to differ materially are the following:

|

|

the

rate of growth of the mobile telephone and network equipment markets in

China;

|

|

|

our

ability to overcome competition from other suppliers;

|

|

|

any

increase in the cost of component parts that we supply to third parties or

use in our own products or increases in operating costs which cannot be

passed on to our customers;

|

|

|

the

availability of financing necessary to fund our operations and planned

expansion on attractive terms or at all, which may adversely impact our

growth plans or increase our future interest expense;

|

|

|

changes

in interest rate levels and volatility in securities

markets;

|

|

|

the

retention of import/export licenses and SinoHub SCM SZ’s Client

Coordinator Enterprise Coordinator status with the Huanggang Customs

authority;

|

|

|

economic,

political, regulatory, legal and foreign exchange risks associated with

our operations;

|

|

|

Uncertainties

related to China’s legal system and economic, political and social events

in China;

|

|

|

changes

in governmental regulation, tax rates and similar

matters;

|

|

|

retention

of key members of our senior management;

|

|

|

the

abatement of the current global economic crisis over

time;

|

and the

additional factors, risks and uncertainties detailed under the heading “Risk

Factors” in Item 1A of this Annual Report on Form 10-K. Readers are urged

to carefully review and consider the various disclosures made by us in this

Report and our other filings with the SEC. These reports attempt to advise

interested parties of the risks and factors that may affect our business,

financial condition and results of operations and prospects. All

forward-looking statements and risk factors included in this Report are made as

of the date hereof, based on information available to us as of the date hereof,

and we assume no obligation to update any forward-looking statement or risk

factor to reflect changes in our expectations or future events.

Overview

SinoHub,

Inc. (the “Company”) is engaged in electronic component sales, outsourced

electronics product production and sales, and electronic component supply chain

management (SCM) services. Our electronic component sales include

procurement-fulfillment and individually negotiated electronic component sales

to manufacturers. We only deal in original parts in original packing and do not

alter or modify the parts in any way. Accordingly, any quality issues

with respect to the parts would be the responsibility of the manufacturer of the

parts. In Q4 2009 we began providing virtual contract manufacturing (VCM)

services for mobile phones to customers who are resellers in developing

countries. We believe our asset light business model provides optimal

flexibility for our VCM customers while minimizing risk for SinoHub. Our SCM

services include warehousing, delivery and import/export. At present all of our

component sales and SCM services occur in the PRC and Hong Kong, and all mobile

phone sales are made outside China.

The

Company provides SCM services to electronics manufacturers and component

suppliers in the People’s Republic of China (the “PRC”). Our

professional Supply Chain Management platform integrates SinoHub SCM, logistics

service centers located in key distribution/manufacturing cities in the PRC, and

a service team of about 200 employees.

As a

seller of electronic components and an electronic component supply chain

management service provider, we manage all aspects of the purchase and movement

of electronic components from their receipt from suppliers in our Hong Kong

warehouse to their delivery in Hong Kong or import into China and delivery to a

manufacturer there. We also handle the export of the finished goods when that is

required. Roughly eighty percent (80%) of our business with manufacturer

customers is related to mobile phones. The components we source in this vertical

market change rapidly in line with the rapid change of technology in this

industry.

Each

mobile phone built by one of our customers contains between 100 and 200

electronic components. We have customers who make over one million

phones per month. In the past, we have only been able to handle part

of their business because of liquidity constraints (our procurement-fulfillment

business requires us to have available capital to purchase components for

inventory prior to reselling them to customers). However, we are

currently ramping up with several customers who want to give us the opportunity

to supply them with components for a larger share of their

business. Our ability to scale with these growing customers will

continue to depend upon the availability of working capital.

In the

last three years, mobile phone components have accounted for approximately 70% -

80% of our business and network equipment components have accounted for

approximately 15% of our business. We expect the percentage of our business in

the mobile phone vertical to grow in 2010 as we ramp up our VCM

business. 90% of our manufacturer customers in the electronic

component purchasing business sell their products into the local Chinese

market. As a result, we have yet to feel much adverse effect from the

global slowdown because demand has remained strong for these products in

China.

SinoHub

carries inventory for its virtual contract manufacturing business, we carry

electronic components that we are staging for procurement-fulfillment projects

and we carry a small amount of inventory that results from the service we

provide to customers to help them sell that portion of a minimum order quantity

they do not need. We never buy components in our electronic component purchasing

business without a corresponding order to purchase the components. We do not

have backlog orders, but with the successful completion of each

procurement-fulfillment project and component sale, we look for repeat orders

from existing customers.

Business

Operations

SinoHub’s

business operations are primarily dedicated toward utilizing the value of the

SCM Platform to

source and deliver electronic components and electronic products for our

customers. In this sense, SinoHub has become a market maker for our SCM

customers by using them as suppliers in our electronic component sales business

and for our electronic component sales customers by using them as suppliers in

our electronic product production and sales business.

The

Company offers customers the use of the SCM Platform under a fee based program

whereby customers outsource the supply chain process to SinoHub, while retaining

title to inventory, receivables, and commitments on supplier payables. SinoHub

provides the customer a complete SCM solution that includes importing and

exporting services, facilitating Customs clearance, performing warehouse and

distribution functions, and enabling foreign currency settlements through

SinoHub’s banking relationships and its licensed qualifications as a Client

Coordinator Enterprise in China.

SinoHub

also supports customers by providing a sourcing channel for electronic

components that are not part of a specific SCM or procurement-fulfillment

program. In these cases, SinoHub utilizes its industry knowledge and

relationships with components suppliers and manufacturers to source products at

competitive prices and within time constraints. SinoHub responds to

these “spot” orders from customers, sources the product, confirms pricing, and

executes delivery as required. Customers are required to pay on

delivery of product.

Development

of SinoHub’s Business; Component Sales; and Component Procurement-Fulfillment

Programs

SinoHub’s

original business was the provision of SCM services to assist suppliers of

electronic components with their supply chains into the PRC. We refer

to these customers as our “supplier” customers. SinoHub developed an integrated

SCM service offering, including warehousing, delivery and import/export to assist suppliers

delivery of electronic components to Chinese manufacturers. As a

result of SinoHub’s position as a provider of SCM services in China and our

close relationships with a number of electronic component suppliers and Chinese

manufacturers as well as our experience in the electronic components industry,

we eventually decided we had an opportunity to supply certain Chinese

manufacturers with electronic components and began to source and sell components

for our own account. As these sales grew as a percentage of

revenue, we increased the resources which we dedicated to sales of components.

As our component customers and the market became more aware of and confident in

our SCM service offering, the opportunity arose for us to generate integrated

sales of components and SCM services in a streamlined approach to inventory

management and order procurement-fulfillment. Currently, the vast

majority of our revenues are the result of sales of electronic

components. Our sales of components currently fall into two different

categories, namely individually negotiated spot component sales, which accounted

for approximately 55% of revenues in 2009 (compared to 51% in 2008) and

component sales as part of procurement-fulfillment programs which accounted for

approximately 38% (compared to 43% in 2008).

Currently,

our electronic component procurement and sales staff members look for

opportunities to source components for manufacturer customers at more

competitive prices than the manufacturer customer is currently

receiving. If a lower price can be achieved and the customer agrees

with the price we quote, an opportunity to lower customer costs and increase our

revenues and profits exits. Although we are not contractually

obligated to refrain from any sales activity, if a manufacturer customer of ours

is buying a specific component directly from one of SinoHub’s supplier

customers, we will not interrupt that purchase.

Market

Overview

The

Electronic Component Industry in China

The world

has witnessed the enormous growth of the Chinese electronic manufacturing

industry over the past decade. Accordingly, China is a major consumer of

electronic components.

This growth is expected to continue to increase with the rapid

development of new technologies and in turn to lead to the growth in the

consumption of electronics products in China and China’s continuing growth as

the world’s key electronics factory.

The rapid

growth of electronic component distributors in China and the growth of Web-based

Internet procurement have created a very fragmented electronic components

market, with no distributor capturing significant market share. To

date even the biggest electronic component distributors in China (WPG, Arrow,

Avnet and Yosun) do not provide complete SCM services to their customers, unlike

in the US and Europe where large component manufacturers and franchise

distributors provide complete SCM services to their

customers. SinoHub believes that the fragmented market for

electronics components in China and the lack of an end-to-end SCM service

offering create an opportunity for SinoHub to combine the sale of electronic

components with efficient SCM services to garner a share of the growing market

for such components and services in China.

White

Box Mobile Phones in Developing Countries

Unlike

the developed countries where most consumers identify mobile phones with a few

large vendors, in the developing countries a large proportion of the mobile

phones sold are so called white box phones meaning they are either unbranded or

carry a local brand name. According to a report published by JP

Morgan Global Equity Research October 7, 2009 there were 335.2 million mobile

phones sold in developed countries in 2009, but 797.3 mobile phones sold in

developing countries and the projected growth rate in developing countries is

almost 13% for the next two years versus a little over 5% in developed

countries. SinoHub continues its primary focus on the Chinese market,

which is expected to grow in coming years, and has targeted Southeast Asia for

its initial push into virtual contract manufacturing of mobile

phones. With a potential of over 20 million phones per month in 2010

according to the same report, the Southeast Asian market is very large and

provides good opportunity for SinoHub’s VCM business in the future.

Company

Strengths

We

believe the strengths outlined below have contributed to our growth so

far:

|

|

-

|

a

supply chain management platform for the electronic components industry in

China that connects manufacturer customers, supplier customers and SinoHub

in a real time, transparent environment to allow our customers to manage

their own components supply chain operations with

efficiency;

|

|

|

-

|

continuous

innovation of our proprietary supply chain management system to expand

functionality and improve customer

satisfaction;

|

|

|

-

|

dedication

and focus on providing supply chain management services for the electronic

components sector in China;

|

|

|

-

|

specialized

knowledge about component sourcing and pricing which we obtain from our

supply chain management operations and use in our procurement-fulfillment,

component sales and VCM business;

|

|

|

-

|

our

ability to fill the niche market for custom mobile phones in developing

markets with high quality, low cost handsets and the flexibility our

business model provides to permit us to be competitive even on low volume

orders;

|

|

|

-

|

our

ability to provide one-stop-shop for our customers who wish to purchase

components from us for delivery to the factory without the need to handle

sourcing, import/export, or any other aspect of logistics or

fulfillment;

|

|

|

-

|

SinoHub

SCM SZ’s Client Coordinator Enterprise Coordinator status with the

Huanggang Customs authority, which facilitates our ability to clear

shipments through Customs and enables us to permit our customers to defer

payment of Value Added Tax;

|

|

|

-

|

a

strong and seasoned management team with many years experience in the

electronic components industry.

|

SinoHub’s

Strategy

SinoHub

is an electronics company in China that has succeeded because of the business

model we have built around our superior supply chain platform. Our

goal is to make the SinoHub SCM Platform the most effective SCM Platform for

electronic component suppliers and electronics product manufacturers. To

accomplish this strategy, we plan to:

|

|

-

|

increase

brand awareness of SinoHub as a leading electronic component sales and SCM

service provider for electronic component manufacturers and

distributors;

|

|

|

-

|

continue

to expand our SCM Platform and improve process efficiency. We will

continue to invest in improving our processing efficiencies by enhancing

our technologies and expanding our service

team;

|

|

|

-

|

optimize

our SinoHub SCM software system, to create a dominant

position;

|

|

|

-

|

continue

to expand the services we provide to our customers. We believe that the

scope of our services differentiates us from many of our competitors. We

will continue to look for ways to provide more value added services to

become a best-in-class service

provider;

|

|

|

-

|

expand

our virtual contract manufacturing business in developing countries

outside of China; and

|

|

|

-

|

expand

our SCM Platform to locations outside China, including the United States,

through strategic acquisitions as opportunities and funding are available.

We intend to leverage our reputation to pursue strategic acquisitions

which we think will be accretive and fit with our business

model.

|

SinoHub’s

Solution

While we

derive the vast majority of our revenues from the sale of electronic components

and, in the future, we believe a growing portion of our revenues will come from

virtual contract manufacturing, these business lines are made possible by

information derived from and the relationships made through our SCM platform.

SinoHub offers a full SCM Platform solution. The SinoHub SCM Platform

brings a systems approach to our customers, which enables them to understand,

manage, and coordinate the flow of products and services, within their supply

chain. SinoHub’s SCM Platform consists of a Web-based online supply

chain management system (SinoHub SCM), key service centers in Hong Kong,

Shenzhen, and Shanghai, and a supply chain management service team that is able

to work with our customers through our online system in real time.

SinoHub

SCM

SinoHub

SCM is a proprietary, Web-based software system that provides our customers

information along with security, accuracy and ease of use. Because we only deal

with electronic components, we can more easily implement features our customers

require. Since our SCM Platform is Web based, our customers can quickly

determine the status of shipments, the status and location of inventory in our

warehouses, and the status of financial transactions. SinoHub SCM is

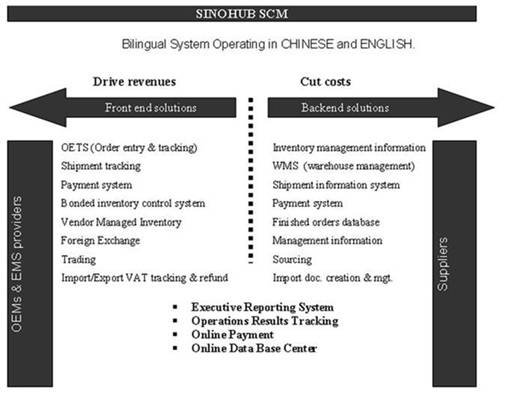

accessible in both Chinese and English. The following flow chart

illustrates the SinoHub SCM functionality.

As

described by the graph, SinoHub SCM operates in Simplified Chinese and English,

providing the following functionality for electronic component

suppliers:

|

|

-

|

Order

entry with automated price and category

checking

|

|

|

-

|

Order

tracking

|

|

|

-

|

Inventory

management information system (warehouse

management)

|

|

|

-

|

Shipment

information system

|

|

|

-

|

Payment

system

|

|

|

-

|

Finished

orders database

|

|

|

-

|

Operations

results tracking

|

|

|

-

|

Executive

reporting system

|

And for

OEMs and EMS companies it provides:

|

|

-

|

Order

tracking

|

|

|

-

|

Shipment

tracking

|

|

|

-

|

Payment

system

|

|

|

-

|

Bonded

inventory control system

|

|

|

-

|

Operations

results tracking

|

|

|

-

|

Vendor

Managed Inventory

|

|

|

-

|

VAT

tracking for recovery on export

|

SinoHub

Service Centers

SinoHub

utilizes its physical locations as service centers for electronic component

suppliers and OEM/EMS manufacturers. Geographical distances can significantly

affect the ability to provide effective SCM services. Establishing

multifunctional and technologically advanced service centers in major cities in

China may lower costs and improve service standards. SinoHub has established

service centers in Shenzhen and Shanghai which are connected through the SinoHub

SCM platform.

SCM

Service Team

SinoHub

has expended time and resources to hire employees with experience in the

electronic component field and to provide additional training to ensure the

highest quality of service to our customers.

SinoHub

SCM Services

SinoHub’s

supply chain management services include:

1. Import

and export

services:

|

|

-

|

Customs

applications and declaration: bonded Customs declaration, application of

import approval document, help with inspection & quarantine of the

imports & exports

|

|

|

-

|

Tax

reports generation and recording

|

|

|

-

|

Value

added Tax advances and insurance (required by our customers for future

rebate purposes)

|

|

|

-

|

Certificates

for paid custom tax

|

|

|

-

|

A

flexible combination of payment methods, including currency

exchange

|

2. Warehouse

services in Hong Kong, Shenzhen and Shanghai:

|

|

-

|

Inventory

management

|

|

|

-

|

Kitting,

Repacking

|

|

|

-

|

Warehouse

storage and insurance

|

3. Delivery

services:

|

|

-

|

Door-to-door

just-in-time delivery service

|

|

|

-

|

Guarantee

one day for Shenzhen and two day delivery for other cities in China from

Hong Kong

|

Our

customers may access the status of their components in real time through SinoHub

SCM and interact directly with our Customer Service representatives to resolve

any problems that may arise. The system has helped reduce errors, save cost and

time and enable customers to shorten their production cycle.

We

believe approximately 50% of the electronic components entering China are

imported at Huanggang Customs in Shenzhen. SinoHub has achieved Client

Coordinator Enterprise status with Huanggang Customs (the highest status

possible).

We

believe that through providing SCM services to our customers we gain critical

information about the market for electronic components used in the industries we

serve, including information about price and availability. We believe

that providing these services also allows us to gain visibility and credibility

in the Chinese market for electronic components for our industry. We plan to

establish the SinoHub brand to be synonymous with SCM services for electronic

components in China, and to complement our procurement-fulfillment services with

our total SCM solution.

Unlike

express forwarders, SinoHub is able to charge for its SCM services as a

percentage of the value of the goods it handles. SinoHub’s processing

volume for SCM services in 2009 exceeded US$500 million in inventory value

processed on behalf of our customers. We estimate that approximately

85% of all of the electronic components that are used in manufacturing in China

must be imported as China’s production of electronic components is very limited

at this point. Our manufacturer customers, who are all located in China, must

import electronic components from outside the PRC to operate their businesses.

Our supplier customers are mainly companies incorporated outside of China who

have representative offices in China and supply electronic components to Chinese

manufacturers. Supplier customers use our warehousing, logistics and

import/export services. Our supply chain management platform for the

electronic components industry in China connects manufacturer customers,

supplier customers and SinoHub in real time.

Import/Export Licenses; Client Coordinator

Enterprise

The

various companies listed above hold import/export licenses as

follows:

SinoHub

Electronics Shenzhen, Ltd. obtained its import/export license on April 30,

2004. The current license is renewable within 30 days prior to

September 19, 2010.

SinoHub

SCM Shenzhen, Ltd. obtained its import/export license on January 18,

2002. The current license is renewable within 30 days prior to

January 18, 2011.

SinoHub

SCM Shanghai, Ltd. obtained its import/export license on April 1,

2006. The current license is renewable within 30 days prior to April

6, 2011.

The

licenses will expire if not renewed by the respective dates set forth

above. The licenses can be terminated prior to expiration if, among

other reasons:

|

|

|

the

license owner declares bankruptcy,

|

|

|

|

the

license owner engages in smuggling,

|

|

|

|

the

license owner fails to pay Customs duties and Value Added Taxes when due,

or

|

|

|

|

the

license owner fails to otherwise comply with the conditions of the

license.

|

In

addition to its license, in September 2008, SinoHub SCM Shenzhen attained Client

Coordinator Enterprise Coordinator status with the Huanggang Customs authority

in China. As a Client Coordinator Enterprise, SinoHub SCM Shenzhen is

able to achieve expedited Customs clearance of its goods that it is importing

into China and may defer the payment of Value Added Tax and Customs Duty for two

weeks.

Customers

and Suppliers

SinoHub

has approximately 30 manufacturer customers. Our manufacturer customers are

Chinese companies that are in the business of contract manufacturing or are

design houses (currently limited to mobile phone design) in

China. These customers purchase components from us and ancillary to

these purchases we also provide them procurement-fulfillment, electronic

component sales and SCM services including warehousing, logistics and

import/export. Sales of components to these customers constituted

approximately $120 million in 2009.

SinoHub

has approximately 95 supplier customers. Our supplier customers

are mainly companies incorporated outside of China which have representative

offices in China and supply electronic components to Chinese

manufacturers. The services we provide to our supplier customers are

SCM services comprised of warehousing, delivery and

import/export. Pricing for our supplier customers is

negotiated, but on average it is about 1% of the value of the goods we handle

for them. Sales of services to these customers (which do not involve

sales of components) were $8.6 million in 2009.

SinoHub

also has 5 new mobile phone distributor customers in developing markets

(Indonesia, India, Malaysia and Vietnam). Revenues from these

customers were immaterial in 2009.

For the year ended

December 31, 2009, our top three customers represented 11%, 7%, and 6% of

SinoHub’s total revenues, respectively; our top three suppliers represented 6%,

5%, and 3% respectively of the electronic components we

purchased.

SinoHub

does not expect significant customer concentration in our electronic component

purchasing business to continue in the future since our customers are generally

small to medium size equipment manufacturers in China. As our

business has grown our customer base has expanded and the percentage of business

we do with any one customer has declined.

Supplies

of the electronic components that we currently purchase are readily available

from numerous suppliers and resellers most of whom are based overseas but have

representative offices in China. Purchases are generally made based on purchase

orders and we do not have any long term supply

agreements. Conversely, we do not have long term contracts with our

customers to buy the components from us.

Competition

We

compete with a number of companies in China that sell or distribute electronic

component parts and which may also offer import/export, logistics and other SCM

services. We also compete with “in house” purchasing departments of large

electronic component vendors, EMS providers and OEMs. We believe that

many of the distributors against which we compete provide some but not all of

the SCM services that we provide. We do not believe that any other company

distributing electronic components in China currently provides a complete SCM

solution, although some electronic component vendors and distributors provide

logistic services to their customers and we expect that our competitors will

eventually seek to offer, directly or indirectly, a greater number of SCM

services. We also face competition from local import/export

companies, such as Shenzhen Eternal Asia Supply Chain Company, Ltd., Shenzhen

Strongjet Technology Company, Ltd. and Shenzhen Huafuyang Import and Export

Company, Ltd. (HopeSea), which also offer logistics services, although none of

these companies focuses exclusively on the electronic components

market. Professional freight forwarders such as Federal Express and

DHL provide express delivery to customers, however, they do not provide

electronic component inventory management, currency exchange, VAT invoicing, and

Customs and excise tax services, and they are not focused on the electronics

field. We believe that SinoHub’s primary advantage over in-house

purchasing departments is that the up-to-date sourcing and pricing knowledge

which we gain from the large volume of components we handle as part of our SCM

service business for suppliers and the knowledge we gain from the purchase

transactions for our own component resales allows us to obtain better pricing

and availability than these in-house departments in product categories such as

mobile phones where the technology, pricing and availability of parts changes

rapidly. Our advantage over many electronic component distributors is that

we have very detailed knowledge of what manufacturers are buying and that we

have a broader knowledge of electronic component pricing from our database of

parts that we import. Many of our competitors have much greater

financial resources than we do and we expect competition to grow over time and

to present greater challenges for us, especially if any of our competitors were

to effectively adopt the elements of our business model.

Bank

Facilities

The

Company has secured financing facilities (RMB based) with certain PRC banks to

support our business operations. The facilities generally run for one year terms

and are replaced by new facilities upon expiration. We expect that we

will be able to obtain replacement facilities for the facilities listed below

upon their expiration. The bank facilities include:

|

-

|

Letter

of credit facility with China Construction Bank in the amount of

$4,700,000 to support its component sales business. Restricted

cash balances are required as security for draws against the

facility. The Company also has a $1,500,000 Customs duty import

facility and a $3,200,000 Customs export refund facility through this bank

to support short term duty collections for its component sales

business. These facilities renew each year and are available

through December 2010. The Customs export refund facility

allows the Company to advance to its customers refunds of Value Added Tax

to which such customers may be entitled by shipping products on which the

tax was paid overseas prior to the receipt of the refunded

amount.

|

|

-

|

Letter

of credit facility with Industrial Bank in the amount of $4,400,000 to

support our component sales business. Restricted cash balances are

required as security for draws against the facility. In

addition, the bank requires third party guarantees from a subsidiary,

SinoHub Electronics Shenzhen, Ltd., and Lei Xia , our President, and his

spouse Hantao Cui and a lien on a PRC property co-owned by Henry T.

Cochran, our CEO with his spouse, Linda Marie Hetue. Also, the

bank requires a third party guarantor. The third-party

guarantor is Shenzhen Yin Zhao Co., Ltd. The only relationship

between the Company and Shenzhen Yin Zhao Co., Ltd. is the guaranty. The facility is

available through September, 2010.

|

|

-

|

Letter

of credit facility with Hangzhou Bank in the amount of $6,400,000 to

support our component sales business. Restricted cash balances

are required as security for draws against the facility. In

addition, the bank requires third party guarantees from two subsidiaries,

SinoHub Electronics Shenzhen, Ltd., and B2B Chips, Ltd., and Lei Xia, our

President, and his spouse Hantao Cui, and Li De Hai, our

CFO. Also, the bank requires a third party

guarantor. The third-party guarantor is Meisun Technology

Ltd. The only relationship between the Company and Meisun

Technology Ltd. is the guaranty. The facility

renews each year and is available through April,

2010.

|

Our

Corporate Structure

The

following is information about the corporate structure of SinoHub, Inc. and its

subsidiaries:

SinoHub

International, Inc. was incorporated on March 23, 1999 as a Delaware

corporation. Prior to the Merger, this company was named SinoHub, Inc. and was

the primary holding company for the Chinese and Hong Kong subsidiaries listed

below. SinoHub International, Inc. is wholly owned by SinoHub, Inc.

SinoHub

Electronics Shenzhen, Ltd. was incorporated on September 19, 2000 in the

People’s Republic of China to provide one-stop SCM services for electronic

manufacturers and distributors in southern China. SinoHub Electronics

Shenzhen, Ltd. is wholly owned by SinoHub International, Inc.

SinoHub

SCM Shenzhen, Ltd. was incorporated in December 2001 in the PRC to hold an

import and export license in the PRC. SinoHub SCM Shenzhen, Ltd. purchases and

sells electronic component parts and also provides Customs clearance services to

our customers. SinoHub SCM Shenzhen, Ltd. is wholly owned by SinoHub Electronics

Shenzhen, Ltd.

SinoHub

SCM Shanghai, Ltd. was incorporated on March 9, 2005 in the PRC to provide

one-stop SCM services for electronic manufacturers and distributors in northern

China. SinoHub SCM Shanghai, Ltd. is wholly owned by SinoHub Electronics

Shenzhen, Ltd. which acquired record ownership of the company on January 17,

2008.

SinoHub

Electronics Shanghai, Ltd. was incorporated on July 5, 2005 in the PRC to

provide one-stop SCM services for electronic manufacturers and distributors in

the PRC. SinoHub Electronics Shanghai, Ltd. is wholly owned by SinoHub

International, Inc. SinoHub Electronics Shanghai has the same purpose

as SinoHub Electronics Shenzhen, with each company focused on operating in

Shanghai and Shenzhen, respectively. The reason for the use of two

subsidiaries is driven by PRC law, which generally requires that a company be

organized in the area in which it is operating.

B2B

Chips, Limited was incorporated on June 12, 2006 in Hong Kong to purchase and

sell electronic components. B2B Chips is wholly owned by SinoHub Electronics

Shenzhen, Ltd.

SinoHub

Technology (Hong Kong) Limited was incorporated on May 8, 2007 in Hong Kong and

has not yet commenced business. SinoHub Technology (Hong Kong) is wholly owned

subsidiary of B2B Chips and was acquired on April 10, 2008. B2B Chips

acquired SinoHub Technology (Hong Kong) from its owners, Henry T. Cochran and

Lei Xia, for HKD 10,000.

History

Our

predecessor, Liberty Alliance, Inc. was a corporation organized in Utah in

1986. In 1991, Liberty Alliance, Inc. completed its domestication as

a Delaware corporation. Liberty Alliance, Inc. filed for bankruptcy

in 1994 and the bankruptcy proceedings were completed in 1995. From 1995 to

2006, Liberty Alliance, Inc. had no or nominal assets and was not conducting any

business operations. In August 2006, Liberty Alliance, Inc. changed

its name to Vestige, Inc., and in September 2006 it changed its name back to

Liberty Alliance, Inc. On August 1, 2007, Liberty Alliance, Inc.

became a voluntary reporting company under the Exchange Act when it filed a Form

10 registration statement with respect to its shares of common

stock. Shares of Liberty Alliance, Inc. common stock began to be

reported on the over-the-counter bulletin board under the symbol “LBTI” on

November 14, 2007.

In May

2008, Liberty Alliance, Inc., its wholly-owned subsidiary SinoHub Acquisition

Corp., SinoHub, Inc., and Steven L. White, the principal stockholder of Liberty

Alliance, Inc., entered into an Agreement and Plan of Merger pursuant to which

SinoHub Acquisition Corp. merged with and into SinoHub, Inc. and SinoHub, Inc.

became a wholly-owned subsidiary of Liberty Alliance, Inc. Pursuant

to the Agreement and Plan of Merger, the holders of 5,203,907 shares of Liberty

Alliance, Inc. common stock tendered their shares to the Company for

cancellation, Liberty Alliance, Inc. issued to the former stockholders of

SinoHub, Inc. 18,290,000 shares of Liberty Alliance, Inc. common stock in

exchange for all the outstanding shares of SinoHub, Inc.’s preferred and common

stock, and Liberty Alliance, Inc. assumed options to purchase shares of SinoHub,

Inc. common stock which became exercisable for 489,451 shares of Liberty

Alliance common stock. In addition, Liberty Alliance, Inc. also

issued 510,000 shares of its common stock to certain consultants for services

rendered in connection with the merger, including 500,000 shares issued to JC

Global Capital Partners LLC. These consulting services included

investment banking advice and strategic advisory services relating to the

structure and consummation of the reverse merger between SinoHub and Liberty

Alliance, Inc. that was eventually consummated. Immediately following

the merger, Liberty Alliance, Inc. had 20,000,000 shares of common stock

outstanding and options exercisable for an additional 489,451 shares of common

stock. The merger was accounted for as a reverse acquisition with SinoHub, Inc.

as the acquirer for accounting purposes. After completion of the

merger, the original stockholders of Liberty Alliance, Inc. held approximately

6% of the issued and outstanding shares of Liberty Alliance, Inc. common stock

on a fully diluted basis and the former stockholders of SinoHub, Inc., including

the shares issued to consultants for services rendered in connection with the

merger, held approximately 94% of Liberty Alliance, Inc. issued and outstanding

shares of common stock.

Subsequent

to the completion of the merger, on July 18, 2008:

|

|

-

|

SinoHub,

Inc. amended its certificate of incorporation to change its name to

SinoHub International, Inc.;

|

|

|

-

|

Liberty

Alliance, Inc. amended its certificate of incorporation to change its name

to SinoHub, Inc. and effect a 3.5-to-1 reverse stock split of all issued

and outstanding shares of its common stock;

and

|

|

|

-

|

shares

of SinoHub, Inc. (formerly Liberty Alliance, Inc.) common stock began to

be reported on the over-the-counter bulletin board under the new symbol

“SIHI” on a post-merger, post-split

basis.

|

For

financial reporting purposes, the reverse takeover of the Company has been

accounted for as a recapitalization of the Company with SinoHub International as

the accounting acquirer whereby the historical financial statements and

operations of SinoHub International, Inc. became the historical financial

statements of the Company, with no adjustment of the carrying value of the

assets and liabilities. When we refer in this Form 10-K to business and

financial information for periods prior to the consummation of the reverse

acquisition, we are referring to the business and financial information of

SinoHub International, Inc. on a consolidated basis unless the context suggests

otherwise.

Employees

At

December 31, 2009, there were 191 full-time employees of SinoHub and

its subsidiaries, compared to 110 full-time employees of SinoHub and its

subsidiaries at December 31, 2008.

Available

Information

The

Company’s mailing address and principal executive offices are located at 6/F,

Building 51, Road 5, Qiongyu Blvd., Technology Park, Nanshan District, Shenzhen

518057, People’s Republic of China. The Company’s telephone number, including

the International Code and Area Code is +86-755-2661-2106 and its corporate

website is www.sinohub.com. The information contained on our website is not part

of this Report. The reports that the Company files with the

Securities and Exchange Commission pursuant to the Exchange Act are available on

the Securities and Exchange Commission website at http://www.sec.gov. The public

may read and copy any materials filed by the Company with the Securities and

Exchange Commission at the Public Reference Room at 100 F Street, N.E.,

Washington, DC 20549. The public may obtain information on the operation of

the Public Reference Room by calling the Securities and Exchange Commission at

1-800-SEC-0330. The Securities and Exchange Commission maintains an Internet

site that contains reports, proxy and information statements and other

information regarding issuers that file electronically with the Securities and

Exchange Commission at http://www.sec.gov. The contents of these websites are

not incorporated into this filing.

Risks

Related To Our Business

The

industry in which we have chosen to concentrate our sales efforts is fast moving

and our customers may not be successful in growing in pace with the

industry.

We have

chosen to concentrate our sales efforts in the fast moving mobile phone

business, where the life cycles of new products can be relatively short, and our

available capital limits the number of new customers we can handle at any given

time. We face the risk of our customers’ growth not keeping pace with this

dynamic market, whether as a result of manufacturing products for which there is

lesser demand, lack of capitalization or otherwise. In addition,

given our limited resources to evaluate new customers, if we ultimately select

new customers who are less successful, it will provide a smaller return on our

efforts than if we select more successful customers. Despite our

requirement of non-cancelable purchase orders from our customers and our efforts

to investigate the credit histories of our customers, there is no guarantee that

all our customers will be able to pay for all of the goods they

order.

Our

management and two significant shareholders collectively own a majority of our

common stock.

Collectively,

our officers, directors and certain significant shareholders own or exercise

voting and investment control over approximately 56% of our outstanding common

stock. As a result, investors may be prevented from affecting matters involving

the company, including:

|

|

-

|

the

composition of our board of directors and, through it, any determination

with respect to our business direction and policies, including the

appointment and removal of

officers;

|

|

|

-

|

any

determinations with respect to mergers or other business

combinations;

|

|

|

-

|

our

acquisition or disposition of assets;

and

|

|

|

-

|

our

corporate financing activities.

|

Furthermore,

this concentration of voting power could have the effect of delaying, deterring

or preventing a change of control or other business combination that might

otherwise be beneficial to our stockholders. This significant concentration of

share ownership may also adversely affect the trading price for our common stock

because investors may perceive disadvantages in owning stock in a company that

is controlled by a small number of stockholders.

Changes

in governmental regulations affecting the export of electronics from China may

hurt our business.

While we

believe that our manufacturer customers sell approximately 90% of their products

in the Chinese market, to the extent the Company or its manufacturer customers

sell overseas, factors which adversely affect export of electronic products from

China may materially and adversely affect our business, financial condition,

results of operations and business prospects, including regulatory restrictions,

trade disputes, industry-specific quotas, copyright levies, tariffs, non-tariff

barriers and taxes that may result in limiting exports from China.

Our

business is sensitive to general economic conditions.

As the

vast majority of our sales are to manufacturers and design firms in China which

in turn causes the end products to be distributed to consumers in China, our

business could be adversely affected if there were to be a slowdown in the

consumer demand in China for products incorporating the components we sell or we

process for our supplier customers. Our business may also be

negatively affected by rising labor and material costs in China and, to the

limited extent the Company or its manufacturer customers sell overseas, by a

downturn in general economic conditions in importing countries and

regions.

Negative

perception or publicity of Chinese products may hurt our business.

Any

negative perception or publicity of Chinese electronic products may cause a

decline in demand for Chinese electronic products and in turn negatively affect

our sales and revenue outside China.

SinoHub

envisions a period of rapid growth that may impose a significant burden on its

administrative and operational resources which if not effectively managed, could

impair its growth.

SinoHub’s

strategy envisions a period of rapid growth that may impose a significant burden

on its administrative and operational resources. The growth of SinoHub’s

business will require significant investments of capital and management’s close

attention. SinoHub’s ability to effectively manage its growth will require it to

substantially expand the capabilities of its administrative and operational

resources and to attract, train, manage and retain qualified management,

technicians and other personnel. If SinoHub is unable to successfully

manage its growth, SinoHub may be unable to achieve its goals.

In

order to grow at the pace expected by management, we will require additional

capital to support our long-term business plan. If we are unable to obtain

additional capital in future years, we may be unable to proceed with our

long-term business plan and we may be forced to curtail or cease our operations

or further business expansion.

We will

require additional working capital to support our long-term business

plan. A large proportion of the Company’s business (currently

approximately 38%) is procurement-fulfillment which requires the Company to have

available capital to purchase components for inventory prior to reselling those

components to customers. In addition, our VCM business will also

require working capital to purchase components required for products to fill

orders. A lack of sufficient capital beyond cash on hand and funds available

under the Company’s credit facilities can be expected to significantly impair

the Company’s ability to take on new customers and the size of the orders the

Company can take from existing customers. Our working capital

requirements and the cash flow provided by future operating activities, if any,

will vary greatly from quarter to quarter, depending on the volume of business

during the period and payment terms with our customers and suppliers. We may not

be able to obtain adequate levels of additional financing, whether through

equity financing, debt financing or other sources, especially in light of the

global financial crisis and the market downturn. To raise funds, we may need to

issue new equities or debt which could result in additional dilution to our

shareholders and investors. Additional financings could result in significant

dilution to our earnings per share or the issuance of securities with rights

superior to our current outstanding securities or contain covenants that would

restrict our operations and strategy. In addition, we may grant registration

rights to investors purchasing our equity or debt securities in the future. If

SinoHub borrows money or issues debt securities, it will be subject to the risks

associated with indebtedness, including the risk that interest rates may

fluctuate and the possibility that it may not be able to repay principal and

interest on the indebtedness when due. If we are unable to raise

additional financing, we may be unable to implement our long-term business plan,

develop or enhance our products and services, take advantage of future

opportunities or respond to competitive pressures on a timely basis. In

addition, a lack of additional financing could force us to substantially curtail

or cease operations.

The competitive

pressures the Company faces could have a material adverse affect on the

Company’s business.

The

market for the Company’s products and services is very competitive and subject

to rapid technological change. Not only does the Company compete with in-house

service teams and other third-party logistics providers, it also competes for

customers with distributors and with many of its own suppliers. The

Company’s failure to maintain and enhance its competitive position could

adversely affect its business and prospects. Furthermore, the Company’s efforts

to compete in the marketplace could cause deterioration of gross profit margins

and, thus, overall profitability. The sizes of the Company’s competitors vary

across market sectors, as do the resources the Company has allocated to the

sectors in which it does business. Therefore, some of the competitors may have a

more extensive customer base than the Company has in all or some of its market

sectors or greater resources and funding to capture clients in such

sectors.

Unexpected

order cancellations by our customers could materially adversely affect our

business, results of operations, financial condition or liquidity.

Our sales

are typically made pursuant to individual purchase orders, and we generally do

not have long-term contracts with our customers. While we try to

limit the risk of non-payment by providing that customer orders for

procurement-fulfillment projects and purchase orders for component purchases are

non-cancelable, and by making almost all of our spot component sales on a COD

basis, we do provide our customers with payment terms on component sales that

occur in connection with procurement-fulfillment projects. While we

generally collect a deposit of 15-20% on each procurement-fulfillment project,

deal only in standard components, and limit the size of each order, we cannot be

certain that every invoice for a completed order will be paid on time and that

collection issues will not materially adversely affect our business, results of

operations, financial condition or liquidity.

SinoHub

generally does not have long-term contracts with its significant

customers.

We

generally do not have long-term contracts with our customers. In

2009, SinoHub had three customers, all in the mobile phone business, who

accounted for 11%, 7%, and 6% of our revenue, respectively. While we

expect this concentration to go down as our business expands, if the

concentration remains and we are not able to secure further business from these

customers or are unable to replace the business provided by these customers, it

may have a material adverse affect on our business, results of operations,

financial condition or liquidity.

We face risks

associated with debt financing (including exposure to variation in interest

rates).

Our total

outstanding indebtedness for bank borrowings as of December 31, 2009 was $11.8

million. The interest rates on these bank loans are fixed on an annual basis.

Our obligations under our existing loans have been mainly met through the cash

flow from our operations and our financing activities. We are subject to risks

normally associated with debt financing, including the risk of significant

increase in interest rates as borrowings increase or are rolled over for

additional periods, typically on an annual basis and the risk that our cash flow

will be insufficient to meet required payment of principal and interest. In the

past, cash flow from operations had been sufficient to meet payment obligations

and/or we have been able to roll over our borrowings. There is however no

assurance that we will be able to do so in the future. We may also underestimate

our capital requirements and other expenditures or overestimate our future cash

flows. In such event, additional capital, debt or other forms of financing may

be required for our working capital. If any of the aforesaid events occur and we

are unable for any reason to raise additional capital, debt or other financing

to meet our working capital requirements, our business, operating results,

liquidity and financial position will be adversely affected.

The components and products which we

sell in our electronic components sales business are designed or manufactured by

third parties and if third-party manufacturers lack sufficient quality control

or if there are significant changes in the financial or business condition of

such third-party manufacturers, it may have a material adverse effect on our

business.

We rely

on third-party suppliers for the components which we sell in our electronic

components sales business. If third parties lack sufficient quality control or

if there are significant changes in the financial or business condition of such

third parties, it could have a material adverse effect on our

business. While we do not believe we have any warranty liability for

the components we sell in our electronic components sales business, if the

manufacturers do not stand by their warranties or other problems with such

supply develops, it could affect our business. With respect to

products we sell in our VCM business, we may face product liability or return

issues if such products do not function as required.

We also

have third-party arrangements for the design or manufacture of certain products,

parts and components. If we are not able to engage such parties with the

capabilities or capacities required by our business, or if these third parties

fail to deliver quality products, parts and components on time and at reasonable

prices, we could have difficulties fulfilling our orders and our sales and

profits could decline.

If the quality of our products does

not meet our customers’ expectations, then our sales and operating earnings, and

ultimately our reputation, could be adversely affected.

Some of

the products we sell may have quality issues resulting from the design or

manufacture of the product, or from the components or software used in the

product. Sometimes, these issues may be caused by components we

purchase from other manufacturers or suppliers. These issues may be

identified prior to the shipment of the products or after they have been shipped

to our customers. Such pre-shipment and post-shipment quality issues

can have legal and financial ramifications, including: delays in the recognition

of revenue, loss of revenue or future orders, customer-imposed penalties on us

for failure to meet contractual requirements, increased costs associated with

repairing or replacing products, and a negative impact on our goodwill and brand

name reputation.

In some

cases, if the quality issue affects the product’s safety or regulatory

compliance, then such a “defective” product may need to be

recalled. Depending on the nature of the defect and the number of

products in the field in the case of our VCM business, we might have an

obligation to recall a product, which could cause us to incur substantial recall

costs, in addition to the costs associated with the potential loss of future

orders, and the damage to our goodwill. In addition, we may be

required to pay damages for failed performance that might exceed the

revenue that we receive from the contracts. Recalls involving

regulatory agencies could also result in fines and additional

costs. Finally, recalls could result in third-party litigation,

including class action litigation by persons alleging common harm resulting from

the purchase of the products.

SinoHub faces many risks relating to

intellectual property rights.

Our

business will be harmed if: (i) we, our customers and/or our suppliers are

found to have infringed intellectual property rights of third parties,

(ii) if the intellectual property indemnities in our supplier agreements

are inadequate to cover damages and losses due to infringement of third-party

intellectual property rights by supplier products, (iii) if we are required

to provide broad intellectual property indemnities to our customers, or

(iv) if our intellectual property protection is inadequate to protect our

proprietary rights.

Because

our products are comprised of complex technology, substantially all of which we

acquire from suppliers through the purchase of components, we may become

involved in or impacted by litigation regarding patent and other intellectual

property rights. Third parties may assert intellectual property

infringement claims against us and against our customers and

suppliers. Defending claims may be expensive and divert the time and

efforts of our management and employees. If we do not succeed in any

such litigation, we could be required to expend significant resources to pay

damages, develop, license or purchase non-infringing intellectual property or to

obtain licenses to the intellectual property that is the subject of such

litigation. However, we cannot be certain that any such licenses, if

available at all, will be available to us on commercially reasonable

terms. In some cases, we might be forced to stop delivering certain

products if we or our customer or supplier are subject to a final

injunction.

SinoHub

will be required to hire and retain skilled technical and managerial

personnel.

SinoHub’s

continued success depends in large part on its ability to attract, train,

motivate and retain qualified management and highly-skilled employees,

particularly managerial, technical, sales, and marketing personnel, technicians,

and other critical personnel. Any failure to attract and retain the required

highly-trained managerial and technical personnel who are integral to production

and development and technical support teams may have a negative impact on the

operation of SinoHub’s plants, which would have a negative impact on revenues.

There can be no assurance that SinoHub will be able to attract and retain

skilled persons and the loss of skilled technical personnel would adversely

affect its business.

SinoHub

is dependent upon its key officers for management and direction and the loss of

any of these persons could adversely affect its operations and

results.

SinoHub

is dependent upon its officers for implementation of its proposed expansion

strategy and execution of its business plan. These key officers include Henry T.

Cochran, our CEO, Lei Xia, our President, and De Hai Li, our chief financial

officer. The loss of any of these officers could have a material

adverse effect upon its results of operations and financial position and could

delay or prevent the achievement of its business objectives. SinoHub

does not maintain “key person” life insurance for any of its

officers.

Future

acquisitions may have an adverse effect on our ability to manage our

business.

Selective

acquisitions form part of our strategy to further expand our business. If we are

presented with appropriate opportunities, we may acquire additional companies,

products or technologies. Future acquisitions and the subsequent integration of

new companies into ours would require significant attention from our management.

Our company has little experience with integrating newly acquired businesses.

Potential problems encountered by each organization during mergers and

acquisitions would be unique, posing additional risks to the company. The

diversion of our management's attention and any difficulties encountered in any

integration process could have an adverse effect on our ability to manage our

business. Future acquisitions would expose us to potential risks, including

risks associated with the assimilation of new operations, technologies and

personnel, unforeseen or hidden liabilities, the diversion of resources from our

existing businesses, the inability to generate sufficient revenue to offset the

costs and expenses of acquisitions, and potential loss of, or harm to,

relationships with employees, customers and suppliers as a result of integration

of new businesses.

We

may incur significant costs to ensure compliance with United States corporate

governance and accounting requirements.

We may

incur significant costs associated with our public company reporting

requirements, costs associated with applicable corporate governance

requirements, including requirements under the Sarbanes-Oxley Act of 2002 and

other rules implemented by the Securities and Exchange Commission, or the

Commission. We expect all of these applicable rules and regulations to cause us

to continue to incur substantial legal and financial compliance costs and to

make some activities more time consuming and costly. We also expect that these

applicable rules and regulations may make it more difficult and more expensive

for us to maintain affordable director and officer liability insurance and we

may be required to accept reduced policy limits and coverage or incur

substantially higher costs to obtain the same or similar coverage. As a result,

it may be more difficult for us to attract and retain qualified individuals to

serve on our board of directors or as executive officers. We are currently

evaluating and monitoring developments with respect to these newly applicable

rules, and we cannot predict or estimate the amount of additional costs we may

incur or the timing of such costs.

Compliance

with Section 404 of the Sarbanes-Oxley Act on a timely basis may strain

SinoHub’s limited financial and management resources, negatively affect its

operating results, and cause SinoHub to fail to meet its reporting

obligations.

The SEC,

as directed by Section 404 of the Sarbanes-Oxley Act, adopted rules generally

requiring each public company to include a report of management on the company’s

internal controls over financial reporting in its annual report on Form 10-K

that contains an assessment by management of the effectiveness of the company’s

internal controls over financial reporting. A report of our management is

included under Item 9A(T) of our Annual Report on Form 10-K for the year ended

December 31, 2009. In addition, commencing with our annual

report for the fiscal year ending December 31, 2010, our independent registered

accounting firm must attest to and report on the effectiveness of our internal

controls over financial reporting. We can provide no assurance that

we will comply with all of the requirements imposed thereby. There can be no

assurance that we will receive a positive attestation from our independent

registered public accountants. In the event we identify significant deficiencies

or material weaknesses in our internal controls that we cannot remediate in a

timely manner or we are unable to receive a positive attestation from our

independent registered public accountants with respect to our internal controls,

such matters would be required to be disclosed in future filings with the SEC

and investors and others may lose confidence in the reliability of our financial

statements, which could have a negative effect on stock price.

SinoHub

may need to hire and/or engage additional personnel and incur incremental costs

in order to perform the work required by Section 404 of the Sarbanes-Oxley

Act. The financial and management resources required to

implement and comply with Section 404 of the Sarbanes-Oxley Act, and any failure

to implement required new or improved controls or difficulties encountered in

their management and implementation, could negatively affect SinoHub’s operating

results or cause it to fail to meet its reporting obligations.

Risks

Related to Conducting Business in the People’s Republic of China

SinoHub’s

Chinese operations subject it to certain risks inherent in conducting business

operations in China, including political instability and foreign government

regulation, which could significantly impact its ability to operate in such

countries and impact its results of operations.

To date,

SinoHub has conducted substantially all of its business in

China. SinoHub’s Chinese operations are, and will be, subject to

risks generally associated with conducting businesses in foreign countries, such

as:

|

|

-

|

any

general economic downturn in China which affects consumer demand for the

components we process and sell;

|

|

|

-

|

changes

in applicable laws and regulations– for example, Customs regulations in

China are quite complicated and are subject to

change;

|

|

|

-

|

challenges

to, or failure of, title – should the Company purchase facilities, it is

more difficult in China to perfect clear title than it is in the United

States and this represents a potential

risk;

|

|

|

-

|

changes

in foreign economic and political conditions – to the limited extent that

the Company’s manufacturer customers sell overseas, economic downturns and

political instability outside of China is bad for our business. Also,