Attached files

| file | filename |

|---|---|

| 8-K - WUHAN GENERAL GROUP (CHINA), INC | v166899_8k.htm |

November 2009

Safe Harbor Statement

The words “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “projects,” “should,” and similar expressions, or the negatives of such terms, identify forward-looking

statements.The matters discussed herein that are forward-looking statements are based on current management expectations that involve

risks and uncertainties that may result in such expectations not being realized. Forward-looking statements involve risks and uncertainties that may cause actual results, performance or financial condition to be materially different from the expectations

of future results, performance or financial condition expressed or implied in any forward-looking statements. Such risks include, but are not limited to, competition in the industrial blower and

turbine markets, , the effects of PRC environmental controls, our ability to increase

our market share,

changes to management or key personnel, risks associated with conducting business in China and other risks detailed in the Company’s filings with the Securities and Exchange Commission.

Actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous potential risks and uncertainties. Forward-looking statements made during this presentation speak only as of

the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this presentation.

Because forward-looking statements are subject to risks and uncertainties, we caution you not to place undue reliance on any forward-looking statements. All written or oral forward-looking statements by the

Company or persons acting on its behalf are qualified by these cautionary statements.

Equity Snap Shot

Ticker Symbol

Fiscal Year End

Share Price (11/13/2009)

Shares Outstanding

Market Capitalization^

Revenue (ttm)

Net income (ttm)*

Diluted EPS (ttm)*

P/E (ttm) *

EV/EBITDA (ttm)

P/B (mrq)

NASDAQ: WUHN

December 31

$2.38

39.1 million

$93.1 million

$88.0 million

$11.9 million

$0.30

8.0x

8.3x

0.9x

*Excluding stock penalty for late listing on NASDAQ and one-time and non-cash charges

^Based on 39,135,314 weighted average diluted shares outstanding

Investment Highlights

Growth opportunities from government mandate for environmental

protection and demand for electricity

Only non-government player among top five blower and turbine producers

Strong capabilities in R&D and design with experienced management team

Potential to take market share from SOEs due to lower costs and greater

flexibility

Strong barriers to entry – brand equity, technology, investment

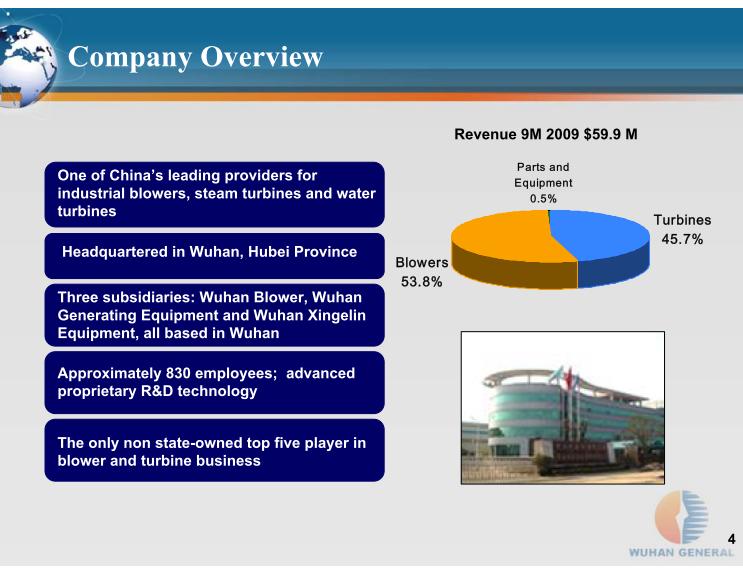

Company Overview

One of China’s leading providers for industrial blowers, steam turbines and water turbines

Headquartered in Wuhan, Hubei Province

Three subsidiaries: Wuhan Blower, Wuhan Generating Equipment and Wuhan Xingelin Equipment, all based in Wuhan

Approximately 830 employees; advanced proprietary R&D technology

The only non state-owned top five player in blower and turbine business

Revenue 9M 2009 $59.9 M

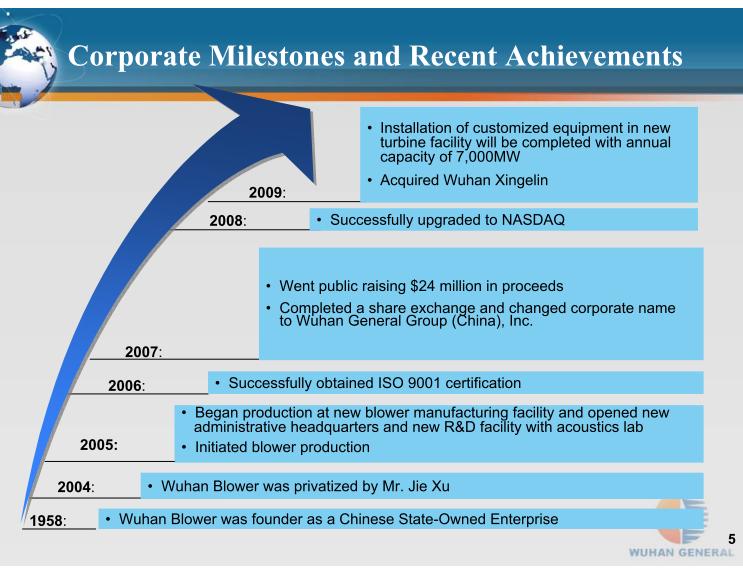

Corporate Milestones and Recent Achievements

Wuhan Blower was founder as a Chinese State-Owned Enterprise

Wuhan Blower was privatized by Mr. Jie Xu

Began production at new blower manufacturing facility and opened new

administrative headquarters and new R&D facility with acoustics lab

Initiated blower production

Went public raising $24 million in proceeds

Completed a share exchange and changed corporate name to Wuhan General Group (China), Inc.

Successfully upgraded to NASDAQ

Installation of customized equipment in new turbine facility will be completed with annual capacity of 7,000MW

Acquired Wuhan Xingelin

Successfully obtained ISO 9001 certification

:

2005:

:

:

:

:

:

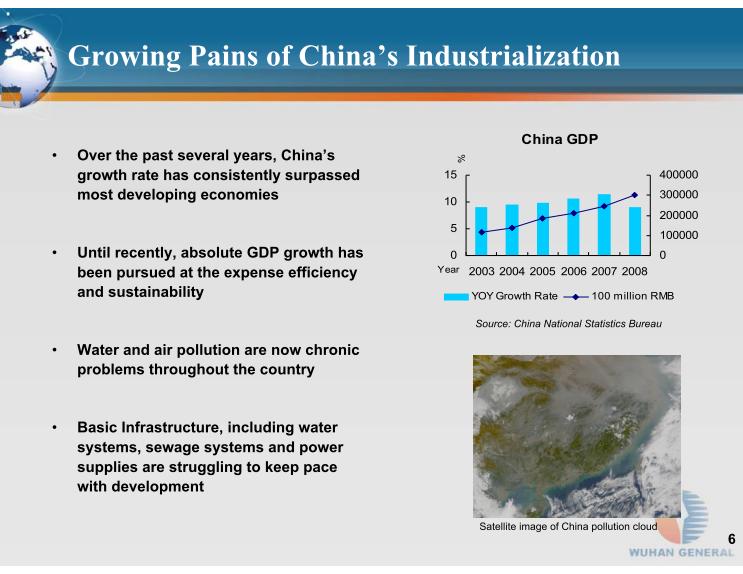

Growing Pains of China’s Industrialization

Over the past several years, China’s growth rate has consistently surpassed most developing economies

Until recently, absolute GDP growth has been pursued at the expense efficiency and sustainability

Water and air pollution are now chronic problems throughout the country

Basic Infrastructure, including water systems, sewage systems and power supplies are struggling to keep pace with development

Satellite image of China pollution cloud

Source: China National Statistics Bureau

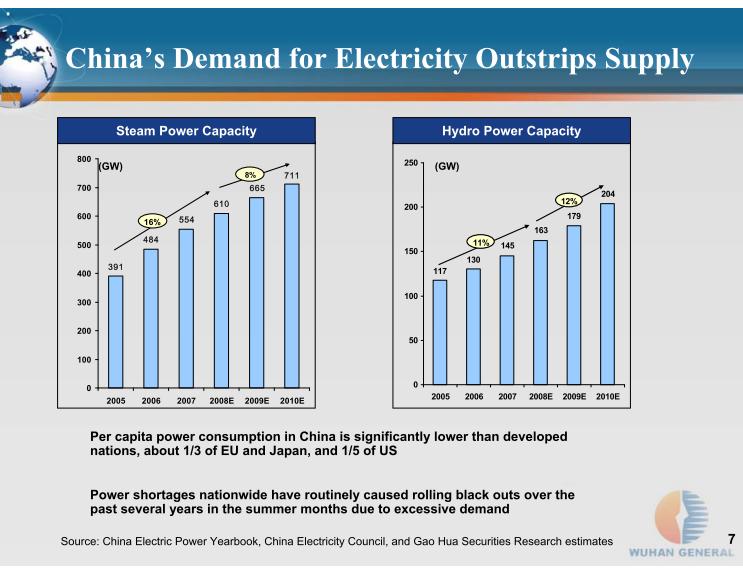

China’s Demand for Electricity Outstrips Supply

Steam Power Capacity

Hydro Power Capacity

Per capita power consumption in China is significantly lower than developed nations, about 1/3 of EU and Japan, and 1/5 of US

Power shortages nationwide have routinely caused rolling black outs over the past several years in the summer months due to excessive demand

(GW)

(GW)

Source: China Electric Power Yearbook, China Electricity Council, and Gao Hua Securities Research estimates

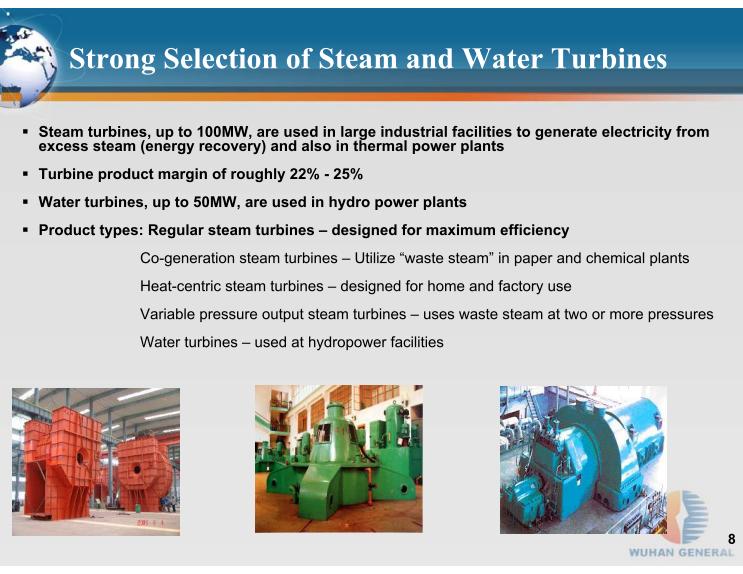

Strong Selection of Steam and Water Turbines

Steam turbines, up to 100MW, are used in large industrial facilities to generate electricity from excess steam (energy recovery) and also in thermal power plants

Turbine product margin of roughly 22% - 25%

Water turbines, up to 50MW, are used in hydro power plants

Product types: Regular steam turbines – designed for maximum efficiency

Co-generation steam turbines – Utilize “waste

steam” in paper and chemical plants

Heat-centric steam turbines – designed for

home and factory use

Variable pressure output steam turbines –

uses waste steam at two or more pressures

Water turbines – used at hydropower facilities

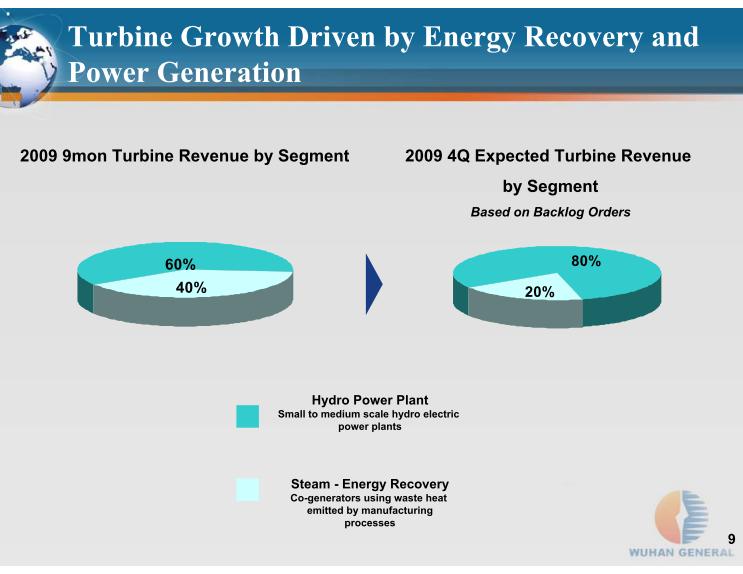

Turbine Growth Driven by Energy Recovery and Power Generation

2009 9mon Turbine Revenue by Segment

Hydro Power Plant

Small to medium scale hydro electric

power plants

Steam - Energy Recovery

Co-generators using waste heat

emitted by manufacturing

processes

2009 4Q Expected Turbine Revenue

by Segment

Based on Backlog Orders

China’s Pollution Reduction Plans

China is now the global leader in greenhouse emissions, having over taken the US*

emission in China

#

emissions by 57.8%

from 2005 levels

Due in large part to this, the Chinese market for industrial blowers is forecast to be approximately $1.9 billion in 2010^

*The Guardian #The New York Times ^China Blower Association

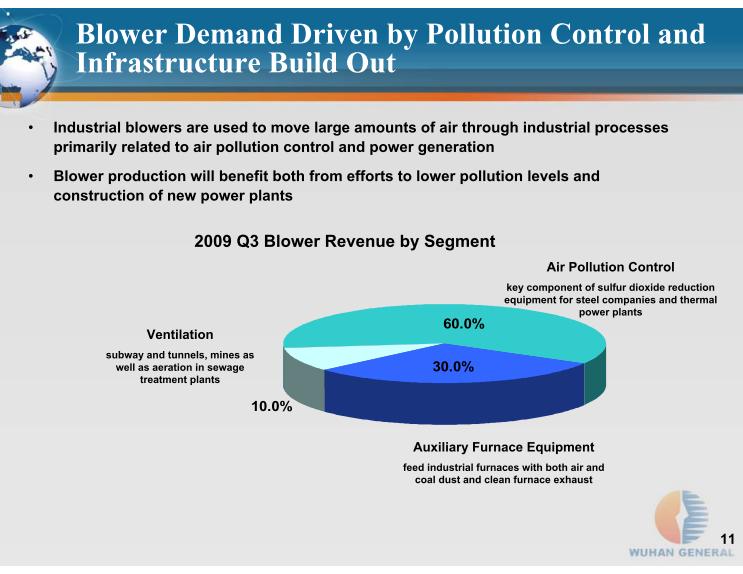

Blower Demand Driven by Pollution Control and Infrastructure Build Out

2009 Q3 Blower Revenue by Segment

Air Pollution Control

key component of sulfur dioxide reduction equipment for steel companies and thermal power plants

Auxiliary Furnace Equipment

feed industrial furnaces with both air and coal dust and clean furnace exhaust

Ventilation

subway and tunnels, mines as well as aeration in sewage treatment plants

Industrial blowers are used to move large amounts of air through industrial processes primarily related to air pollution control and power generation

Blower production will benefit both from efforts to lower pollution levels and construction of new power plants

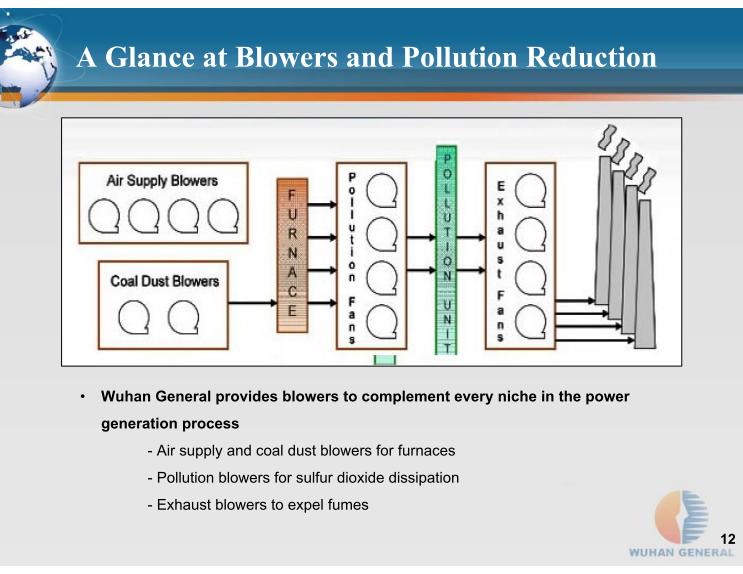

A Glance at Blowers and Pollution Reduction

Wuhan General provides blowers to complement every niche in the power

generation process

- Air supply and coal dust blowers for furnaces

- Pollution blowers for sulfur dioxide dissipation

- Exhaust blowers to expel fumes

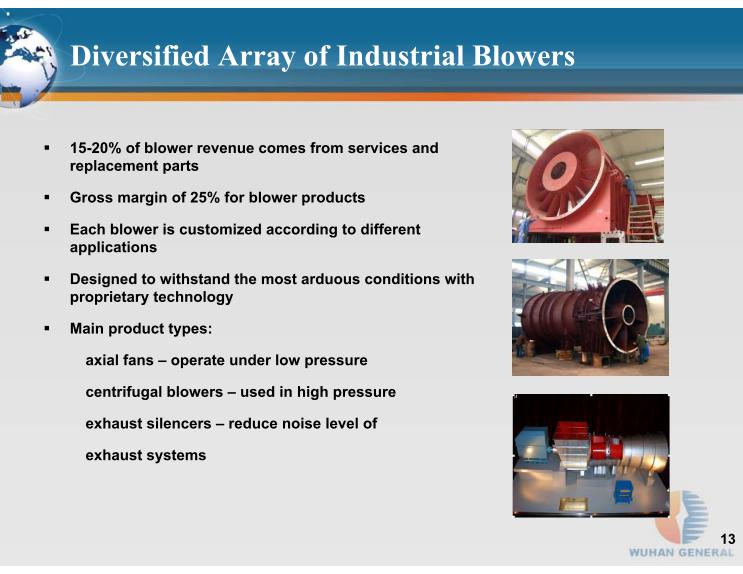

Diversified Array of Industrial Blowers

15-20% of blower revenue comes from services and replacement parts

Gross margin of 25% for blower products

Each blower is customized according to different applications

Designed to withstand the most arduous conditions with proprietary technology

Main product types:

axial fans – operate under low pressure

centrifugal blowers – used in high pressure

exhaust silencers – reduce noise level of

exhaust systems

Strong Customer Base and Established Market Channels

Wuhan General has a leading sales force

It has over 300 customers for its blower division and over 30 for its turbine segment

Sales offices covering major cities including: Xi’an, Guangzhou, Shanghai, Beijing, Chongqing and Nanjing

Sales wins based on strong customer relationships, competitive price, strong brand name, high quality products and tailored customer service

Superior after sales services allow Wuhan General to gain market share at the expense of state-owned competitors

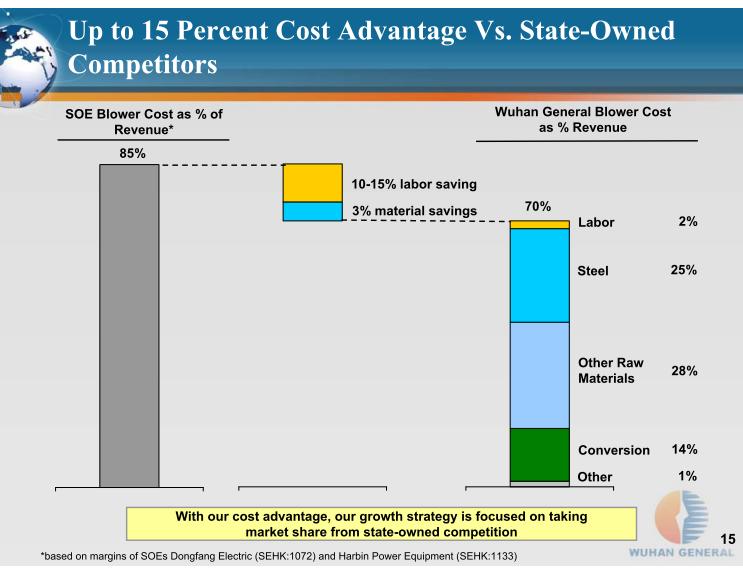

Labor

2%

Steel

25%

Other Raw Materials

28%

Conversion

14%

Other

1%

SOE Blower Cost as % of Revenue*

10-15% labor saving

3% material savings

Wuhan General Blower Cost as % Revenue

85%

70%

With our cost advantage, our growth strategy is focused on taking market share from state-owned competition

Up to 15 Percent Cost Advantage Vs. State-Owned Competitors

*based on margins of SOEs Dongfang Electric (SEHK:1072) and Harbin Power Equipment (SEHK:1133)

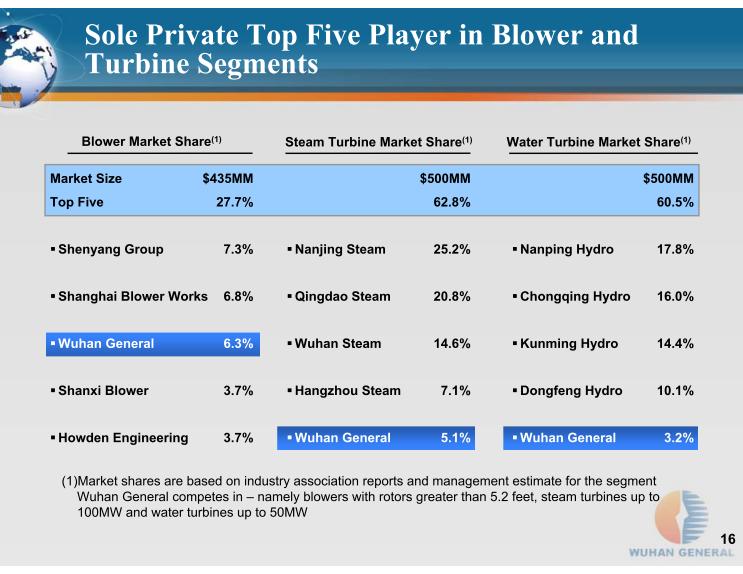

Sole Private Top Five Player in Blower and Turbine Segments

Market Size

Top Five

Shenyang Group

Shanghai Blower Works

Wuhan General

Shanxi Blower

Howden Engineering

$435MM

27.7%

7.3%

6.8%

6.3%

3.7%

3.7%

(1)

(1)

(1)

Nanjing Steam

Qingdao Steam

Wuhan Steam

Hangzhou Steam

Wuhan General

$500MM

62.8%

25.2%

20.8%

14.6%

7.1%

5.1%

Nanping Hydro

Chongqing Hydro

Kunming Hydro

Dongfeng Hydro

Wuhan General

$500MM

60.5%

17.8%

16.0%

14.4%

10.1%

3.2%

(1)

Market shares are based on industry association reports and management estimate for the segment Wuhan General competes in – namely blowers with rotors greater than 5.2 feet, steam turbines up to 100MW

and water turbines up to 50MW

Commitment to Quality and R&D, Tailored Solutions

50 senior professionals, of which 10 enjoy special government subsidies

Licensed technology from Mitsubishi

One of the few Chinese companies capable of making variable angled blades

Established one of the three major national testing centers for industrial blowers

Recipient of national gold awards for turbine products

Solid relationships with the Science and Technology University of Central China, Jiaotong University and the Acoustic Institute of the China Science Academy

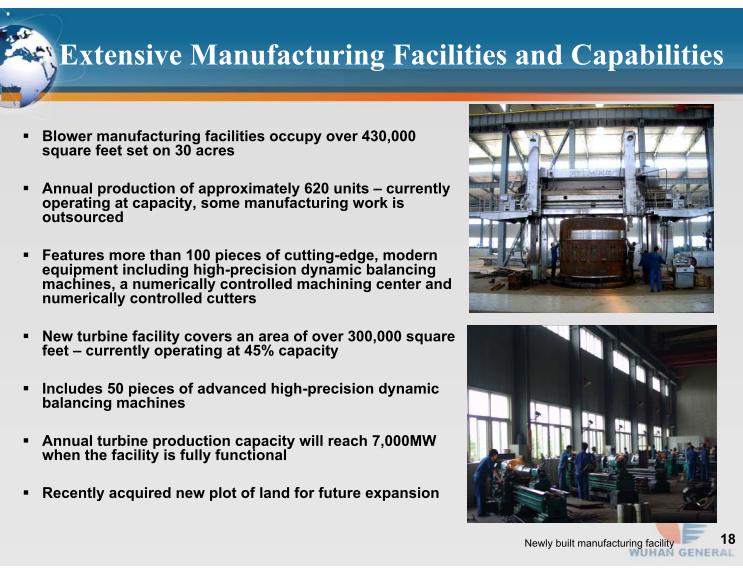

Extensive Manufacturing Facilities and Capabilities

Blower manufacturing facilities occupy over 430,000 square feet set on 30 acres

Annual production of approximately 620 units – currently operating at capacity, some manufacturing work is outsourced

Features more than 100 pieces of cutting-edge, modern equipment including high-precision dynamic balancing machines, a numerically controlled machining center and numerically controlled cutters

New turbine facility covers an area of over 300,000 square feet – currently operating at 45% capacity

Includes 50 pieces of advanced high-precision dynamic balancing machines

Annual turbine production capacity will reach 7,000MW when the facility is fully functional

Recently acquired new plot of land for future expansion

Newly built manufacturing facility

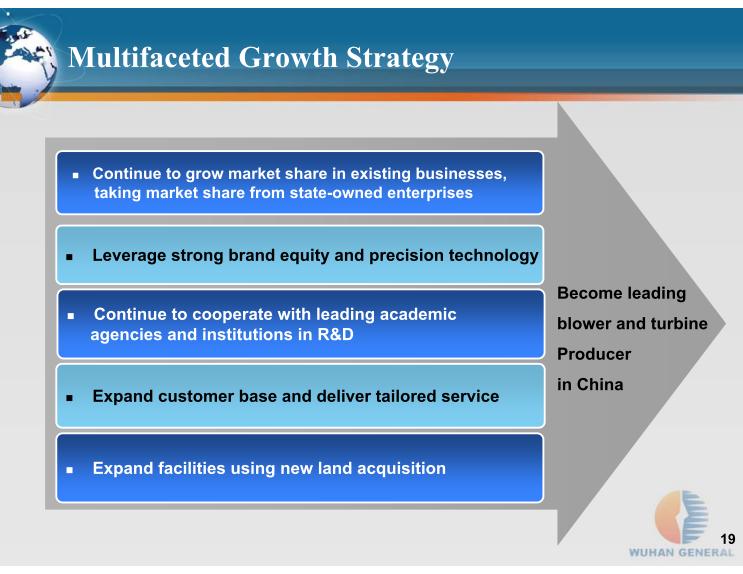

Multifaceted Growth Strategy

Continue to grow market share in existing businesses,

taking market share from state-owned enterprises

Leverage strong brand equity and precision technology

Continue to cooperate with leading academic

agencies and institutions in R&D

Expand customer base and deliver tailored service

Become leading

blower and turbine

Producer

in China

Expand facilities using new land acquisition

Strong and Experienced Management Team

Mr. Jie Xu Chairman and CEO

Served as Chairman and CEO of Wuhan Blower since 2004

Over 20 years of industry experience, including 10 years at Wuhan Blower’s sales department prior to privatization

Mr. Haiming Liu, CFO

13 years at PricewaterhouseCoopers with extensive audit experience, familiar with both U.S. and Chinese GAAP

Served as legal advisor and legal counsel for Jiangxi Foreign Economic Law Office prior to PricewaterhouseCoopers

Mr. Juntao Chen, General Manager, Blower Division

Mr. Zengke Ge, General Manager, Turbine Division

Prior joining Wuhan General, Mr. Chen held managerial roles in real estate and industrial companies in China

Prior to Wuhan General, general manager with Wuhan Changli Power Station Equipment Co. Ltd and several other companies

20 years of industry experience

Served as general manager at Wuhan Blower since October 2006

Over 30 years of experience in production and management in the manufacturing industry

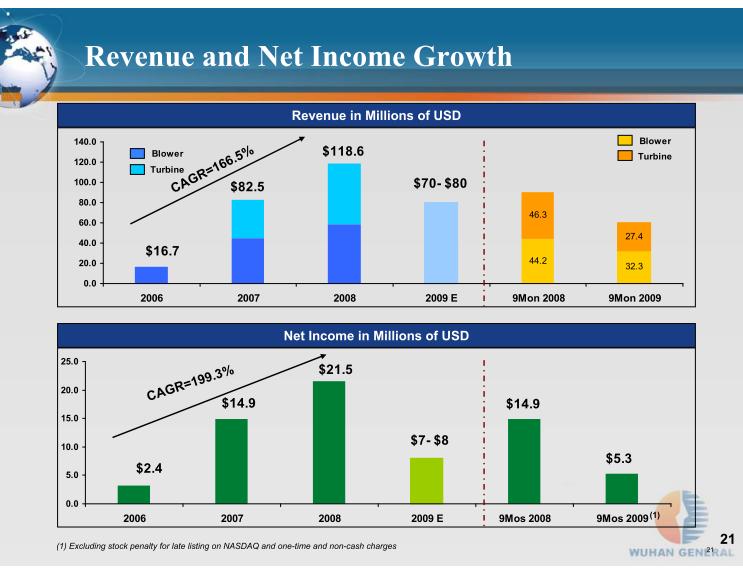

Revenue and Net Income Growth

21

Revenue in Millions of USD

Net Income in Millions of USD

(1)

(1) Excluding stock penalty for late listing on NASDAQ and one-time and non-cash charges

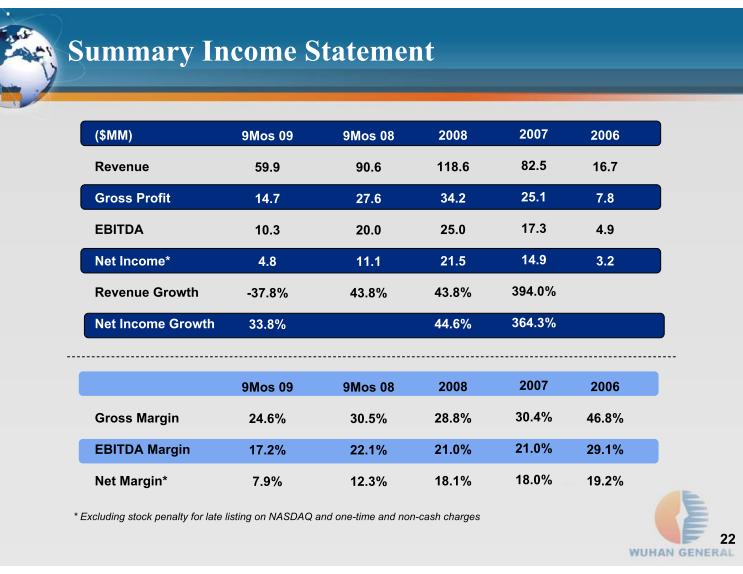

Summary Income Statement

($MM)

Revenue

Gross Profit

EBITDA

Net Income*

Revenue Growth

Net Income Growth

Gross Margin

EBITDA Margin

Net Margin*

2006

16.7

7.8

4.9

3.2

2006

46.8%

29.1%

19.2%

2007

82.5

25.1

17.3

14.9

394.0%

364.3%

2007

30.4%

21.0%

18.0%

2008

118.6

34.2

25.0

21.5

43.8%

44.6%

2008

28.8%

21.0%

18.1%

9Mos 09

59.9

14.7

10.3

4.8

-37.8%

33.8%

9Mos 09

24.6%

17.2%

7.9%

9Mos 08

90.6

27.6

20.0

11.1

43.8%

9Mos 08

30.5%

22.1%

12.3%

* Excluding stock penalty for late listing on NASDAQ and one-time and non-cash charges

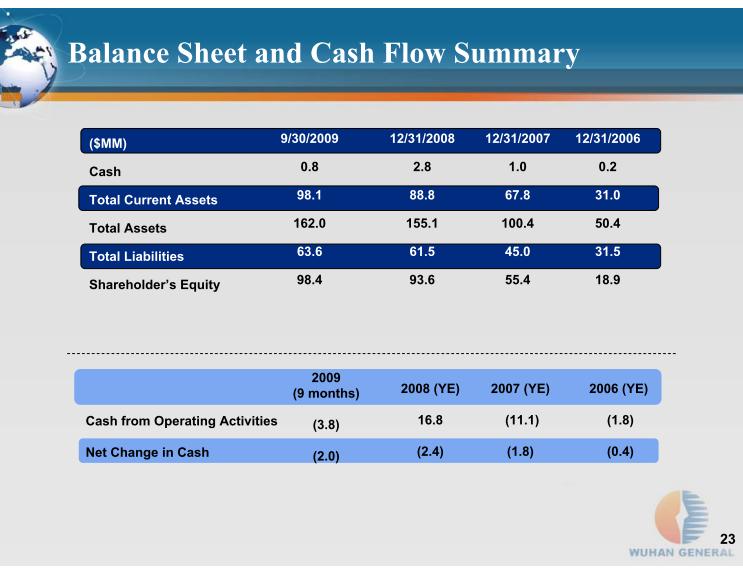

Balance Sheet and Cash Flow Summary

($MM)

Cash

Total Current Assets

Total Assets

Total Liabilities

Shareholder’s Equity

12/31/2006

0.2

31.0

50.4

31.5

18.9

12/31/2007

1.0

67.8

100.4

45.0

55.4

12/31/2008

2.8

88.8

155.1

61.5

93.6

Cash from Operating Activities

Net Change in Cash

2006 (YE)

(1.8)

(0.4)

2007 (YE)

(11.1)

(1.8)

2008 (YE)

16.8

(2.4)

9/30/2009

0.8

98.1

162.0

63.6

98.4

2009 (9 months)

(3.8)

(2.0)

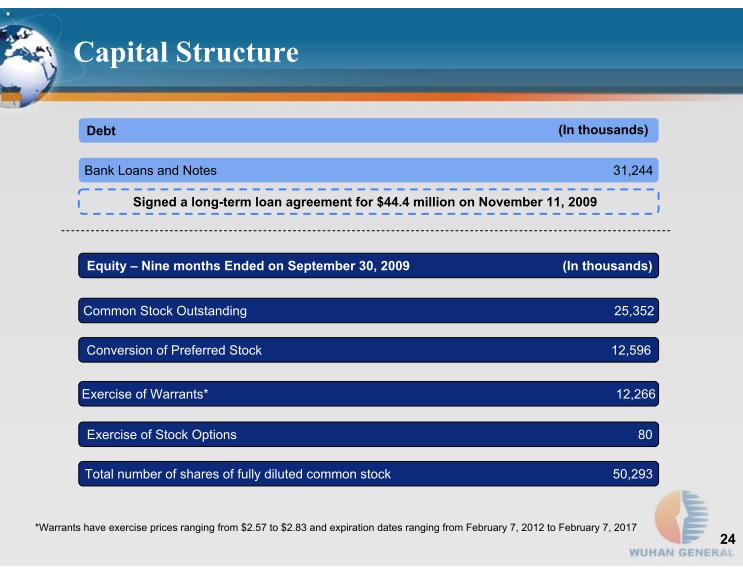

Capital Structure

Bank Loans and Notes

31,244

Equity – Nine months Ended on September 30, 2009 (In

thousands)

Debt

(In thousands)

Common Stock Outstanding 25,352

Conversion of Preferred Stock 12,596

Exercise of Warrants*

12,266

80

*Warrants have exercise prices ranging from $2.57 to $2.83 and expiration dates ranging from February 7, 2012 to February 7, 2017

Total number of shares of fully diluted common stock

50,293

Signed a long-term loan agreement for $44.4 million on November 11, 2009

Attractive Valuation

3.4

1.03

20.7

Average (excluding WUHN)

1.21

0.33

24.8

$0.15

$42.5 M

$3.76

CECE

Cece Environmental Corp.

0.57

0.15

3.22

$2.02

$44.3M

$6.51

MFRI

MFRI Inc.

3.2

3.5

NA

($0.13)

$246.9M

$10.20

FTEK

Fuel Tech Inc.

1.38

0.58

NA

($0.32)

$126.7M

$4.86

FLDR

Flanders Corp

12.86

1.34

42

HK$1.04

HK$37.88B

HK$42.95

HK:1072

Dongfang Electric Corp, Ltd.**

1.08

0.3

12.9

HK$0.53

HK$7.39B

HK$7.39

HK:1133

Harbin Power Equipment Co.** Ltd.

0.9

1.1

8.0*

$0.30*

$93.1M

$2.38

WUHN

Wuhan General Group (China) Inc.

P/B

(mrq)

P/S

(ttm)

P/E

(ttm)

EPS

(ttm)

Market Cap

Price

(11/13/09)

Ticker

*Net income (ttm) excluding non-cash penalties of $5,355,233 (FY 2008) and $1,153,439 (2Q 2009)

** For the period ended June 30, 2009

Summary

Growth opportunities from government mandate for environmental

protection and demand for electricity

Only non-government player among top five blower and turbine producers

Strong capabilities in R&D and design with experienced management team

Potential to take market share from SOEs due to lower costs and greater

flexibility

Strong barriers to entry – brand equity, technology, investment

Thank You

Company Contact:

Mr. Haiming Liu, CFO

Wuhan General Group (China), Inc.

27-5970-0069

Auditor:

Samuel H. Wong & Co. LLP

400 Oyster Point Blvd. ste. 122

South San Francisco

CA 94080

Investor Relations:

Mr. Crocker Coulson, President

CCG Investor Relations Inc.

Phone: +1 646-213-1915 (New York)

www.ccgirasia.com

Legal Counsel:

Paul Davis Fancher

Troutman Sanders LLP

600 Peachtree Street, N.E.

Suite 5200

Atlanta, Georgia 30308-2216

Telephone: (404) 885-3310

E-mail: paul.fancher@troutmansanders.com

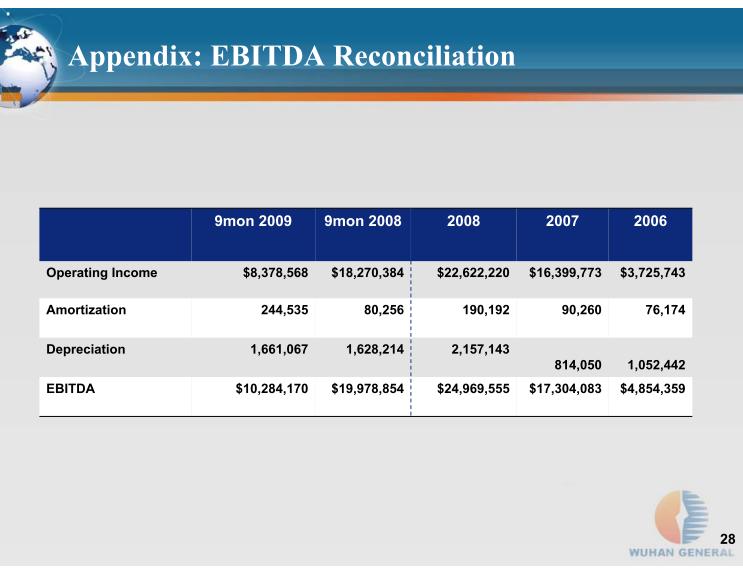

Appendix: EBITDA Reconciliation

$19,978,854

1,628,214

80,256

$18,270,384

9mon 2008

$4,854,359

$17,304,083

$24,969,555

$10,284,170

EBITDA

1,052,442

814,050

2,157,143

1,661,067

Depreciation

76,174

90,260

190,192

244,535

Amortization

$3,725,743

$16,399,773

$22,622,220

$8,378,568

Operating Income

2006

2007

2008

9mon 2009

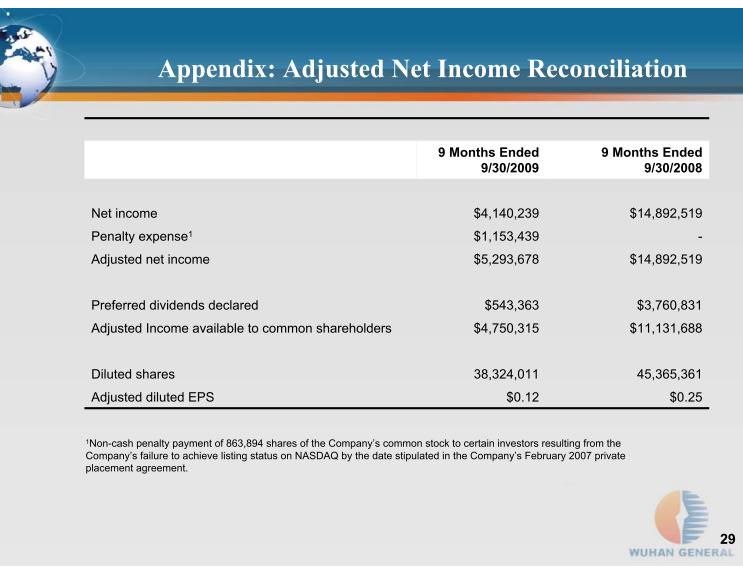

Appendix: Adjusted Net Income Reconciliation

$0.12

38,324,011

$4,750,315

$543,363

$5,293,678

$1,153,439

$4,140,239

9 Months Ended 9/30/2009

$0.25

Adjusted diluted EPS

45,365,361

Diluted shares

$11,131,688

Adjusted Income available to common shareholders

$3,760,831

Preferred dividends declared

$14,892,519

Adjusted net income

-

$14,892,519

Net income

9 Months Ended 9/30/2008

Non-cash penalty payment of 863,894 shares of the Company’s common stock to certain investors resulting from the Company’s failure

to achieve listing status on NASDAQ by the date stipulated in the Company’s February 2007 private placement agreement.