Attached files

| file | filename |

|---|---|

| 8-K - MAA INVESTOR PRESENTATION NOVEMBER 2009 - MID AMERICA APARTMENT COMMUNITIES INC. | form8-k.htm |

November

2009

2

• Positive

15-Year Track Record

– Top-Tier Returns to

Shareholders

– Proven Strong

Operator

– S&P Small-Cap

600

– Stable Management;

Long Tenure

– Strong Corporate

Governance

• Disciplined

Capital Deployment

– Value

Investor

– Extensive Network

& Deal Flow

– Proven Success with

Joint Ventures

• High

Quality Multifamily Portfolio

– High Growth Sunbelt

Region Focus

– Young Portfolio (~

15 years)

– Two-Tier Market

Strategy

• Strong

Balance Sheet

– Capacity to Pursue

Opportunities

– Superior

Ratios

• Dividend

Payout

• Leverage

• Fixed

Charge

– Debt Financing

Covered through 2010

Talus

Ranch, Phoenix, AZ

Providence

at Brier Creek, Raleigh, NC

Strong

Public Company Platform

3

Six+

Year Timeframe Inclusive of

Recovery/Strong

Market Cycle and

Weakening

Market Cycle

Full

Cycle Performance

• MAA began

re-positioning its portfolio

in 2003 resulting in a profile that is

well positioned to compete favorably

in ‘up’ cycles while also holding up

better in ‘down’ cycles

in 2003 resulting in a profile that is

well positioned to compete favorably

in ‘up’ cycles while also holding up

better in ‘down’ cycles

• MAA’s operating

platform has been

significantly strengthened through

expanded asset management focus,

commitment to new technologies and

improved efficiencies

significantly strengthened through

expanded asset management focus,

commitment to new technologies and

improved efficiencies

• MAA’s average

same-store NOI

growth 2003 - 2009 (1st half)

growth 2003 - 2009 (1st half)

– Out-performing the

sector mean

– Strong relative

performance in both

‘up cycle’ and more recent ‘down

cycle’ market environment

‘up cycle’ and more recent ‘down

cycle’ market environment

– MAA has delivered

third strongest

operating performance since 2003

operating performance since 2003

4

Edge

at Lyon’s Gate, Phoenix, AZ

Eagle

Ridge, Birmingham, AL

Increased

full year FFO guidance based

on

solid core performance

Strong

Third Quarter Results

• FFO per share of

$0.89; top-end of guidance

range

range

• Same store physical

occupancy at 96.0%;

70 basis points ahead of prior year

70 basis points ahead of prior year

• Strong FFO results

driven primarily by better

than expected same store performance; NOI

down 2.1% on prior year comparison

than expected same store performance; NOI

down 2.1% on prior year comparison

• Increased full year

guidance $0.09 per share

($3.74 mid-point); increase over prior year

($3.74 mid-point); increase over prior year

• Fixed charge

coverage ratio at a third quarter

record of 2.59; up from 2.49 at the same point

in prior year

record of 2.59; up from 2.49 at the same point

in prior year

• Completed the

renovation and repositioning of

514 units capturing rent increases averaging

10%

514 units capturing rent increases averaging

10%

• Mid-America

Multifamily Fund II makes initial

investment

investment

• New ancillary income

programs drive 6.8%

growth in fee income

growth in fee income

5

Near-Term Outlook

and 2009 Forecast

• Leasing is expected

to be challenged over the next few quarters as a result of

weak employment conditions

weak employment conditions

– Weak pricing power

has been off-set to some degree with strong occupancy and

expense performance (lower resident turnover)

expense performance (lower resident turnover)

• As a result of

marking rents to market over the course of 2009, until we cycle

through the leases written in 2009 and begin to re-price inventory to what is

expected to be an improving pricing environment in mid to late 2010, the

“math” will work against revenue performance over the next several quarters

through the leases written in 2009 and begin to re-price inventory to what is

expected to be an improving pricing environment in mid to late 2010, the

“math” will work against revenue performance over the next several quarters

• Off-set to weak

pricing trends captured through year-over-year improvement in

occupancy and expense performance will be more challenged in 2010

occupancy and expense performance will be more challenged in 2010

• More upside in

ancillary fee programs in 2010 will help

• Lower expense trends

fueled by lower resident turnover is likely close to

‘bottoming out’

‘bottoming out’

• Expect to see

positive momentum in revenues emerge late 2010

6

Source: Witten

Advisors

Recovery

begins in 2010 and outlook very strong for 2011 and 2012

Strong

Long-Term Outlook

• Eventual recovery in

employment trends will generate a rapid recovery in NOI

– Pent-up demand;

rapid growth of echo boomers; prime rental demographic

• New apartment starts

are predicted to hit a post-WW II low

– Lack of financing;

investment returns insufficient as construction costs stay robust

• Single family home

ownership likely to remain relatively constrained

– Higher

down-payments; tighter credit; higher mortgage interest rates

• Home ownership

currently 67.5% of households

– Peaked at 69.5%; may

revert to more sustainable 30 year level of 64.5%

– Each 1% movement is

1.1 million households

7

|

National MSA

Average

|

1.1%

|

|

Sunbelt Region

MSA Average

|

1.5%

|

Employment Growth

Projections 2009 - 2013

Annual

Compounded Growth Rates

MAA in

7 of the top 10 projected “Echo Boom Household” Markets:

Dallas,

Houston, Atlanta, Phoenix, Austin, South FL, Orlando.

Source: Economy.com

Well

Positioned For Recovery Cycle

• Positive demographic

flows

• Positive migration,

immigration flows

• Low business/living

costs

• Pro-business

regulatory environment

• Good access to

global markets

• Increasing port of

entry for imports

• Good transportation

infrastructure

• Access to skilled

labor

• Diversified

industrial base with

exposure

to

– Financial

industries

– Health/education

– Global

trade

– Leisure

travel

– High

tech

– Logistics

– Manufacturing

8

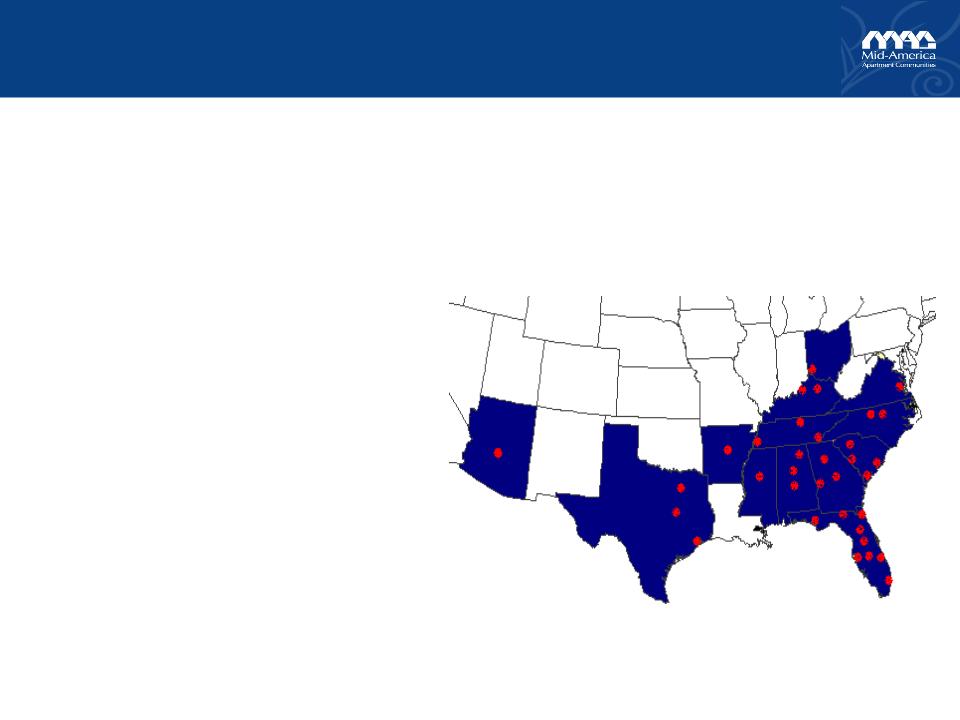

• 85% of the

properties owned by the Apartment REIT

Sector are concentrated in 25 national markets

Sector are concentrated in 25 national markets

• MAA’s markets -

concentrated in the high growth

Sunbelt region, including a large presence in many of

these “top 25” markets (58% of portfolio) as well as

diversification in other high growth secondary markets

throughout the region - are forecast to out-perform

Sunbelt region, including a large presence in many of

these “top 25” markets (58% of portfolio) as well as

diversification in other high growth secondary markets

throughout the region - are forecast to out-perform

Most

Concentrated Markets Among

The

Multifamily REIT

(sorted

by # of units)

1. Baltimore/Wash

D.C.

2. Los

Angeles

3. San Francisco Bay

Area

4. Atlanta

*

5. Dallas/Ft. Worth

*

6. New York Metro

Area

7. Orlando

*

8. Seattle

9. SE Florida

*

10. Phoenix

*

11. Tampa *

12. Boston

13. San

Diego

14. Denver

15. Houston

*

16. Philadelphia

17. Raleigh

*

18. Austin

*

19. Jacksonville

*

20. Charlotte

21. Chicago

22. Inland

Empire

23. Indianapolis

24. Nashville

*

25. Richmond

* MAA

Market

Source:

Economy.com

Positioned to

Out-Perform - Demand

9

New

Multifamily Supply Projections (REIS Data)

|

Market

|

Average

Annual

Supply (#

of Units)

1999-2009

|

Projected

Average

Annual

Supply

(#

of Units)

2010-2013

|

%

Drop in Average

Annual

Supply

|

|

MAA Markets

(*)

|

58,698

|

24,304

|

59%

|

|

Primary REIT

Markets

|

88,155

|

43,549

|

51%

|

|

United

States

|

129,372

|

68,363

|

47%

|

|

West

Region

|

33,767

|

19,940

|

41%

|

|

Northeast

Region

|

12,395

|

6,792

|

45%

|

|

Midwest

Region

|

13,134

|

7,199

|

45%

|

*

Represents over 75% of MAA’s portfolio

While

delivery of new supply over the next few years is expected to drop

significantly

in most every market across the country, MAA’s portfolio is

particularly

well positioned to see lower levels of new supply pressure.

Positioned to

Out-Perform - Supply

10

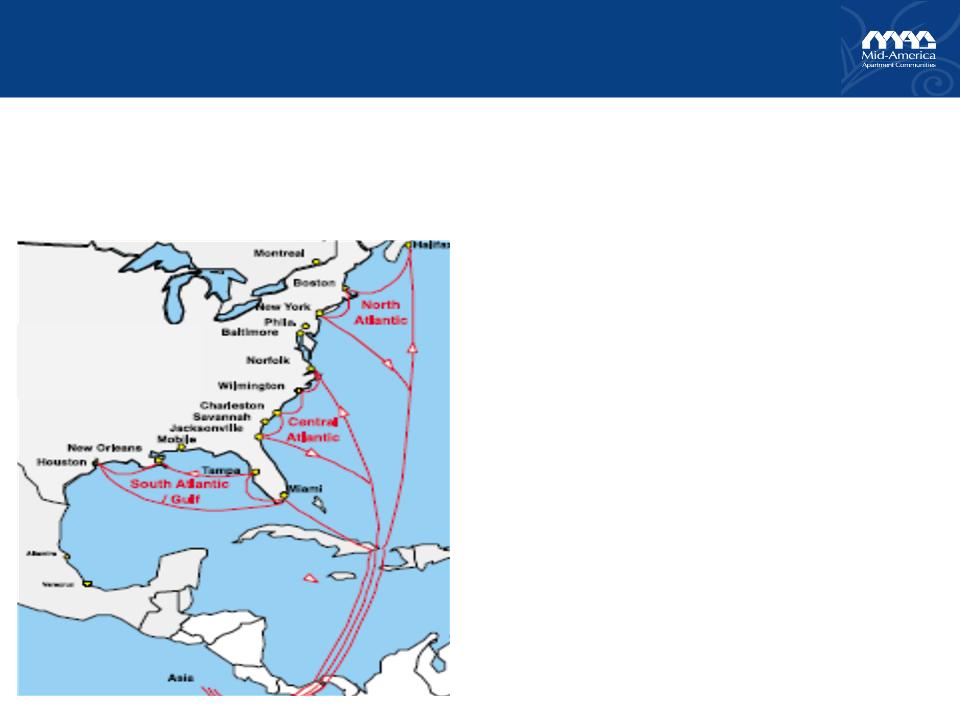

• The Panama canal is

currently undergoing a $5

billion expansion that will allow ships triple the size

of current capacity to pass.

billion expansion that will allow ships triple the size

of current capacity to pass.

• Currently, these

ships port on the West Coast or

reach the East Coast via the Suez Canal.

reach the East Coast via the Suez Canal.

• These ships will now

have a more direct, cost

efficient route to the Gulf Coast and the East Coast.

efficient route to the Gulf Coast and the East Coast.

• The combination of a

well developed rail and truck

delivery network, coupled with the closer access to

the majority of U.S. population (east of the MS

River), makes port access to the U.S. via the Gulf

Coast and East Coast attractive.

delivery network, coupled with the closer access to

the majority of U.S. population (east of the MS

River), makes port access to the U.S. via the Gulf

Coast and East Coast attractive.

• In addition, lower

labor costs, lower taxes and

greater expansion capabilities, makes the Gulf and

Southeast markets very attractive for business

expansion.

greater expansion capabilities, makes the Gulf and

Southeast markets very attractive for business

expansion.

• This route is

expected to gain an increasing market

share, creating jobs and spurring economic

development for the Southeast and affected ports.

share, creating jobs and spurring economic

development for the Southeast and affected ports.

• Ports impacted

include Houston, Tampa, Miami,

Jacksonville, Savannah, Charleston, and Norfolk.

Jacksonville, Savannah, Charleston, and Norfolk.

• Many of these ports

are already beginning upgrades

and dredging projects to accommodate increased

traffic.

and dredging projects to accommodate increased

traffic.

Port

cities likely

to

benefit

Expansion of Panama

Canal Expected

To

Create Additional Long-Term

Employment Growth

For The Southeast

Positioned to

Out-Perform

11

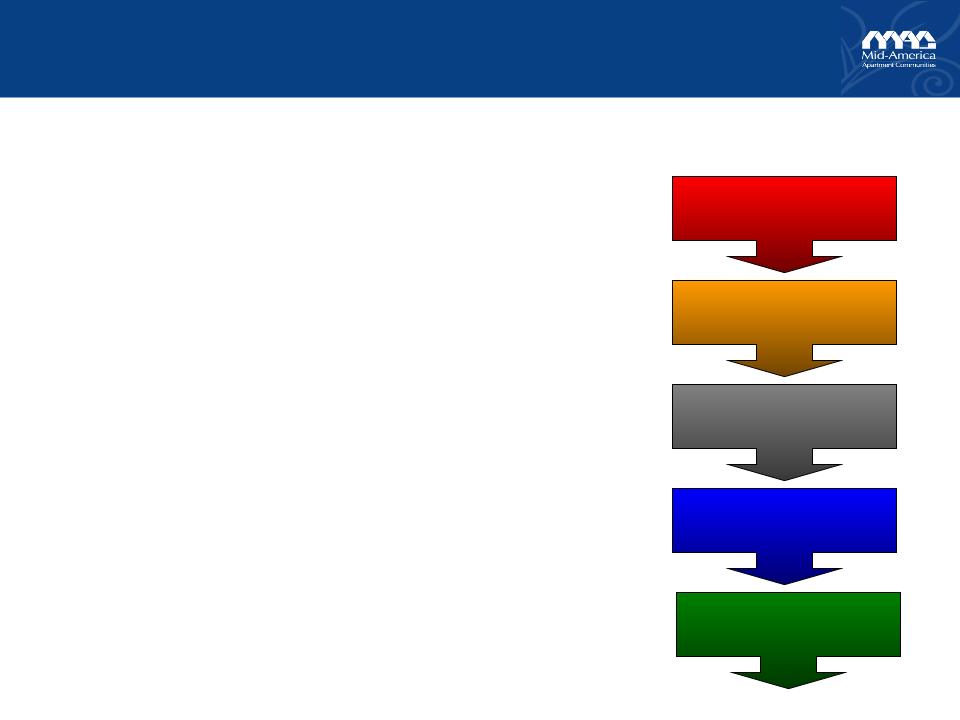

Technology

platform supports efforts to both optimize revenue growth

and

better control expenses

Prospects/Resident

Contact

Pricing

& Fees Optimization

Resident

Screening

Inventory

Management

Billing

& Collections

Well

Positioned For Recovery Cycle

• Pricing

system

– Supported strong

occupancy while achieving optimal pricing in a weak

leasing environment

leasing environment

– Enabled more

comprehensive analysis of ‘market environment’ and leads

to higher quality and faster decision making

to higher quality and faster decision making

– Enabled more

differentiation in ‘price points’ and thereby created more

revenue opportunity without adding complexity for on-site staff

revenue opportunity without adding complexity for on-site staff

• Fee

programs

– Bulk-cable roll-out

has been well received

– New billing platform

has supported opportunity to capture higher fees

without compromising occupancy or turnover

without compromising occupancy or turnover

– “In house” utility

reimbursement billing driven more cost efficiency

• Resident screening

and collections

– Creating more

efficiencies with on-site staff time

– More controlled

lease application review without compromising timing

– Quicker and more

effective collection efforts

• Efficient prospect

and resident contact

– Web based traffic

> 50% of total

– On-line leasing

driving more traffic and driving down cost per new lease

– Electronic payment

processing improving collections efforts and on-site

time

time

• Lower turn

costs

– Inventory management

more efficient

– “Make ready”

process

12

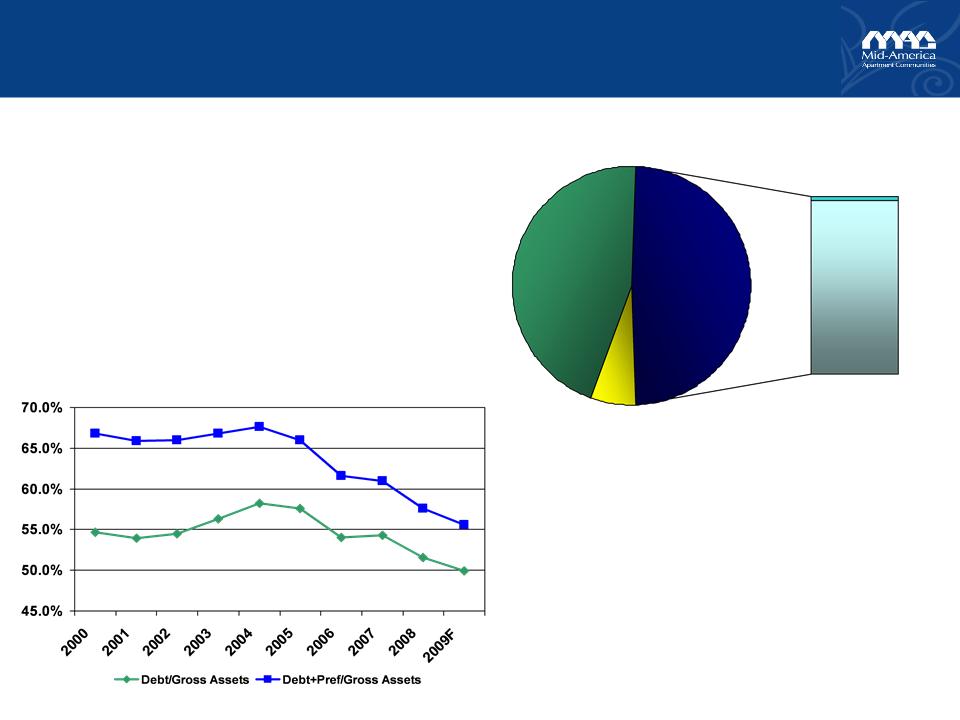

• Leverage and ratios

at historically

strong levels

strong levels

• Plenty of capacity -

$177 MM unused

• No 2009 refinancing,

only $50 MM

(bank line) for 2010 (well underway)

(bank line) for 2010 (well underway)

• Agency loan

maturities well laddered

2011 - 2018

2011 - 2018

Capital

Structure - 9/30/2009

Common

45%

6%

Preferred

Debt

49%

Agency

Debt

97%

Other

Debt

3%

|

|

|

Sector

|

|

|

MAA

|

Median

|

|

Fixed

Charge Coverage

|

2.59

|

2.5

|

|

FFO

Payout ratio 2009

|

66%

|

*

|

|

Debt/Gross

Assets

|

49%

|

57%

|

Sources:

Sector data from Barclays Capital 10-29-09

MAA

3Q Press Release

*Sector

Median impacted by stock dividends and dividend reductions

Strong

Balance Sheet Position

13

Grand

Courtyards, Dallas, TX

Lanier

Club, Atlanta, GA

External Growth

Opportunities

• Improving

opportunities for

attractive acquisitions

attractive acquisitions

– Distressed

markets

– Distressed

lease-ups

– Failed condo/condo

conversions

– Pending refinancing

requirement

• MAA

has balance sheet capacity

– Credit facilities in

place at pre-crisis

pricing

pricing

– Lowest leverage

since the IPO

• Fund

Management

– Fund II: a new $250

MM (total

investment) value-add fund

investment) value-add fund

– MAA share

33%

– Focus on existing

MAA foot-print

– 7+ year-old assets,

6-year hold

– First acquisition

completed in July

14

Lighthouse

Court, Jacksonville, FL

Georgetown

Grove, Savannah, GA

External Growth

Opportunities

• Competitive

advantage over other potential

buyers; particularly in some of select

secondary markets

buyers; particularly in some of select

secondary markets

• MAA’s acquisition

team sources an average

of 200-300 potential acquisition opportunities

each year

of 200-300 potential acquisition opportunities

each year

• Since late 2002, we

have closed on $1 billion

worth of acquisitions

worth of acquisitions

• Ability to move

quickly and with fewer

contingencies than many other private and

less well capitalized buyers

contingencies than many other private and

less well capitalized buyers

• Strong, positive and

long track record with

sellers in the region

sellers in the region

• Best opportunities

at the moment with ‘less

than stabilized’ properties

than stabilized’ properties

• Evidence growing

that newer, high quality

and stabilized properties are trading in the 6

cap range

and stabilized properties are trading in the 6

cap range

• Values likely to

hold and increase

– Cash flows set to

improve in late 2010 and

grow meaningfully in 2011+

grow meaningfully in 2011+

– Long-term

demographics are compelling

– Investor and capital

interest in apartment real

estate likely to increase

estate likely to increase

15

Strong

Management and Governance

• Long-planned CFO

transition effective January 1st

– Al Campbell promoted

to CFO; 11+ years with company; well prepared

– Simon Wadsworth

continues as a Director & Special Advisor to the CEO

– Management depth,

length of tenure, and company commitment to succession

planning facilitates transition

planning facilitates transition

• Active succession

planning and ‘back-up’ assessment processes

• Active leadership

development program

– Strong bench

strength with top 26 managers employed at MAA 11+ avg. years

– Active ‘promotion

from within’ culture and track record

• Very strong Board of

Directors

– Six independent

directors with extensive backgrounds in public company

governance, capital markets, accounting/finance, leadership development, real

estate investing

governance, capital markets, accounting/finance, leadership development, real

estate investing

– MAA’s corporate

governance rating exceeds 90% of the S&P 600 and 91% of

real estate group companies

real estate group companies

16

Village

Oaks, Tampa, FL

Prescott,

Atlanta, GA

MAA

Offers An Attractive Value

• Currently trading at

an implied price

per unit of approximately $65k

per unit of approximately $65k

– Replacement value of

$110k - $120k

– $110k/unit generates

price/share of $105

• Currently trading at

an implied cap rate

in the range of 6.8 - 7.0

in the range of 6.8 - 7.0

– 6.0 cap rate

generates a price/share of $55

• MAA very well

positioned for the

recovery in leasing conditions

recovery in leasing conditions

– Region/Markets will

out-perform

– Balance sheet

strength with capacity

– Strong dividend and

coverage ratios

– Forecast of rapid

market growth 2011-2013

– Limited new supply

risks

• Relative to size and

balance sheet

capacity, MAA offers one of the more

compelling external growth stories in

the sector

capacity, MAA offers one of the more

compelling external growth stories in

the sector

17

ü MAA

Is a Proven Platform

• 15+

Years as a Public Company

• Strong

Operating Platform

• Top-Tier

Performance for Shareholders

• Full

Cycle Performer

ü Opportunity

to Invest Ahead of Recovery

• Balance

Sheet is Strong, With Capacity

• Fund

II New Growth Opportunities

• Strong

Deal Flow

ü Young

Portfolio with Growth Upside

• Invested

in Fastest-Growing Markets

• Portfolio

Provides Stable Earnings

• Superior

Risk-Adjusted Performance

• Positioned

for a Recovering Economy

ü Disciplined

Capital Allocation Drives High

Quality of Earnings

Quality of Earnings

ü Strong

Coverage Ratios and Liquidity

ü MAA’s

Earnings Outlook and Implied Cap

Rate Provide an Attractive Relative

Opportunity Within the Apt Sector

Rate Provide an Attractive Relative

Opportunity Within the Apt Sector

St.

Augustine, Jacksonville, FL

Sky

View Ranch, Phoenix, AZ

Summary

18

Statements

contained in this presentation, which are not historical facts, are

forward-looking statements, as the term is defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which can cause actual results to

differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to, unfavorable changes in the

apartment market, changing economic conditions, the impact of competition, acquisitions which may not achieve anticipated results and other risk

factors discussed in documents filed with the Securities and Exchange Commission from time to time including the Company’s Annual Report on

Form 10-K and the Company’s Quarterly Report on Form 10-Q. The statements in this presentation are made based upon information currently

known to management and the company assumes no obligation to update or revise any of its forward-looking statements.

Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which can cause actual results to

differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to, unfavorable changes in the

apartment market, changing economic conditions, the impact of competition, acquisitions which may not achieve anticipated results and other risk

factors discussed in documents filed with the Securities and Exchange Commission from time to time including the Company’s Annual Report on

Form 10-K and the Company’s Quarterly Report on Form 10-Q. The statements in this presentation are made based upon information currently

known to management and the company assumes no obligation to update or revise any of its forward-looking statements.

Watermark,

Dallas, TX

Safe

Harbor Disclosure