Attached files

| file | filename |

|---|---|

| 8-K - J2 GLOBAL COMMUNICATIONS, INC. - J2 GLOBAL, INC. | form8-k_16637.htm |

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 4, 2009 - J2 GLOBAL, INC. | exh99-1_16637.htm |

Future operating results

Global economic conditions

Subscriber growth, retention and usage levels

Fax and voice service growth

New products, services and features

Corporate spending

Intellectual property

Liquidity

Network capacity, coverage and security

Regulatory developments

Taxes

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, particularly those contained

in the slide “2009 Guidance.” These forward-

looking statements are based on management’s current expectations or beliefs as of November 4, 2009 and are

subject to numerous assumptions, risks and uncertainties that could cause actual results

to differ materially from those

described in the forward-looking statements. We undertake no obligation to revise or publicly release the results of

any revision to these

forward-looking statements. Readers should carefully review the risk factors described in this

presentation. Such forward-looking statements address the following subjects, among others:

Safe Harbor for Forward-Looking Statements

All information in this presentation speaks as of November 4, 2009 and any

distribution of this presentation after that date is not intended and will not be

construed as updating or

confirming such information.

Risk Factors

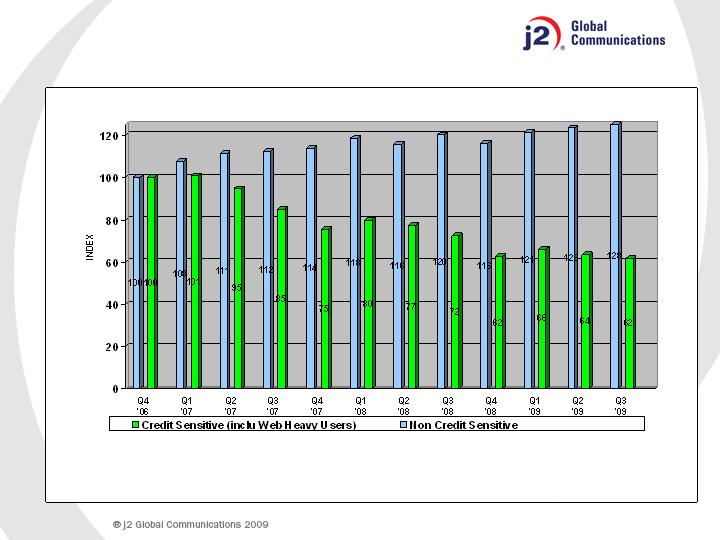

Inability to sustain growth in our customer base, revenue or profitability, particularly in light of

the uncertain U.S. or

worldwide economy and the related impact on customer acquisitions, cancelations and credit card payment declines

Competition in price, quality, features and geographic coverage

Higher than expected tax rates or exposure to additional tax liability

Inability to obtain telephone numbers in sufficient quantities on acceptable terms in desired locations

Enactment of burdensome telecommunications or Internet regulations including increased taxes or fees

Reduced use of fax services due to increased use of email, scanning or widespread adoption of digital signatures

Inadequate intellectual property protection or violations of third party intellectual property rights

System failures or breach of system or network security and resulting harm to our reputation

Inability to adapt to technological change, or third party development of new technologies superior to ours

Loss of services of executive officers and other key employees

Inability to maintain existing or enter into new supplier and marketing relationships on acceptable terms

Other factors set forth in our Annual Report on Form 10-K filed on 02/25/2009, as amended on 03/05/2009, and the other

reports filed by us from time to time with the Securities and Exchange Commission

The following factors, among others, could cause our business, prospects, financial condition, operating results and cash flows to

be materially adversely affected:

All brand names and logos are trademarks of j2 Global Communications, Inc. or its affiliates in the U.S. and/or internationally.

Messaging/Communications as a Service

Core j2 Global Assets

1.274 M Paid DIDs

Global Advanced Messaging Network

3,500 cities in 46 countries on 6 continents

Intellectual Property

Many issued patents and licensing programs designed to monetize the portfolio

Protection of brands and marks

Programs designed to effectively collect evidence to prosecute junk faxers

Expertise

Effective customer acquisition strategies and Web marketing

Breadth, depth and management of a complex network & architecture

Successful acquisition and integration of 22 businesses in 7 countries

Strong Financial Position

13 consecutive years of Revenue growth

7 consecutive years of positive and growing Operating Earnings

$26.1M of Free Cash Flow (Q3 2009)

$222.5M of cash & investments to fund growth/ No debt (at 9/30/09)

Individuals

Targeted marketing (search, online media and radio)

Sold through: eFax.com, Onebox.com, eVoice.com, Fax.com, Rapidfax.com and other brand

Websites

Use of proprietary Life Cycle Management

Advertising, Up-selling, and Calling-Party-Pays revenue supports the Free base

Small to Mid-Sized Businesses (SMBs)

Sold through: eFax Corporate, Onebox and eVoice Websites

Supported by Chat and Telesales groups in U.S. and Europe (in multiple languages)

Self-service Web-based broadcast fax engine at jblast.com

Outsourced email, spam & virus protection and archiving

Use of proprietary Life Cycle Management (i.e. feature up-sell)

Enterprise (SMEs)/Large Enterprise/Government

Direct sales force in U.S. and Europe

Marketed through Web and traditional direct selling methods

Designed for > 150 DID accounts

Subscriber Acquisition

Eight Drivers for Paid DID Additions

Subscribers coming directly to the Company’s Websites/Telesales

Brand awareness driven by demand-generation programs and “word of mouth”

Search engine discovery

Accounts for 40%+ of monthly paid DID signups

Free-to-Paid subscriber upgrades

Life Cycle Management

eFax Corporate SMB sales

Hybrid Website and human interaction (i.e. Telesales)

Direct SME/Enterprise/Government

Through the outside Corporate Sales team

Direct domestic marketing spend for paid subscribers

Targeted marketing program across various media

International marketing programs

Cross-sell

Offer additional services to existing customers

Acquisitions

Paid Subscription Drivers

(1) Includes non-cash compensation expense.

(2) Includes non-cash compensation expense and related tax impact. Q3’s tax rate is 28% due to a change in state apportionment.

(3) See slide 17 for computation of free cash flow.

GAAP Results

Revenues

$61.8M

Gross Profit/Margin (1)

$50.5M

81.8%

Operating Profit/Margin (1)

$26.7M

43.1%

GAAP EPS (2)

$0.43/Share

Free Cash Flow (3)

$26.1M

Cash and Investments

$222.5M

$

Margin

Q3 2009

Current Highlights

Fax

Corporate continued winning big deals – 3 + 3 already in October

Record month on secondary fax brands

New performance-based marketing campaigns underway

Added 170 cities totaling 3,500 in 46 countries

Voice

iPhone and Blackberry apps launching – extend Onebox ® experience to smart-phones

Mobile Features include: message center access; voice-mail list display; playback; V2T

display; click to call; searchable voice-mail for transcription search

Continued commitment to enhanced Mobile user experience

Invitation only extended free trial version on eVoice

Streamlined brand strategy

During October eVoice® and eReceptionistTM broke weekly sign-ups records

New website to launch before year-end

Continuing work on added features

Focus on building critical mass via M&A

Operational

Continued attention to operational excellence, diligent on costs

Deploy cash into new opportunities for 2010

Analyst/Investor Outreach

In-depth Survey Program

Analyst/Investor Insight and Needs

Ongoing Commitment

Launched in 2003/seven annual studies

Follow-up feedback to key events/calls

Track change, respond, and improve over time

Tangible Response

Enhanced disclosure

More robust metrics provided

Guidance practices improved

Management visibility

Communications Strategy Fine-Tuned with Feedback

Analyst/Investor Outreach

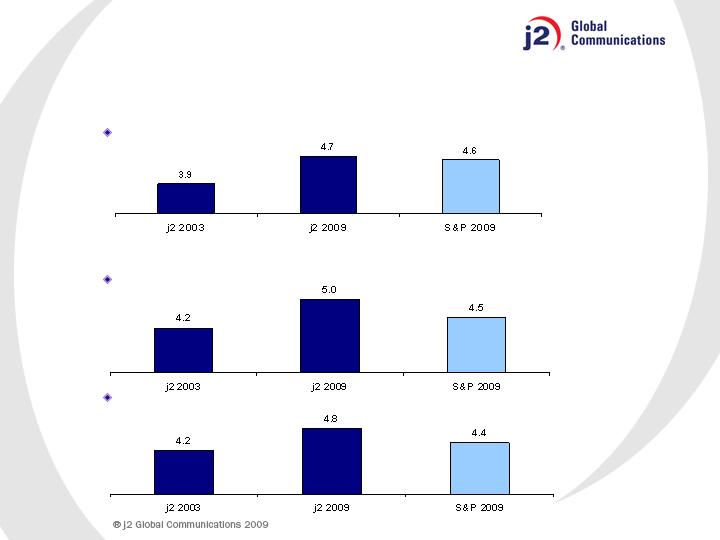

Making Progress in Communications

IR effectiveness score

Comparative Company and Strategy Scores

Overall impression of JCOM

Strategy effectiveness rating

(6 point scale)

2009 Guidance

Maintain Modest Increase in Revenues and Non-GAAP(1) EPS

(1) Net of expenses related to share-based compensation and one time charges. See Reconciliation between GAAP

and non-GAAP

EPS on slide 18.

Metrics

Free cash flow is net cash provided by operating activities, plus excess tax benefits from share based compensation, less purchases of property and equipment. See slide 17 for computation of free cash flow.

(3)

Cancel Rate is defined as individual customer DIDs with greater than 4 months of continuous service (continuous service includes customer DIDs which are administratively cancelled and reactivated within calendar

month), and DIDs related

to enterprise customers beginning with their first day of service. Calculated monthly and expressed here as an average over the three months of the quarter.

(2)

Paid DIDs reflect reserves for: anticipated product migration and/or price increase.

(1)

2007

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Fixed Subscriber Revenues

$43,336

$44,260

$46,593

$47,481

$48,125

$48,799

$49,726

$49,782

Variable Subscriber Revenues

12,057

12,956

12,943

12,985

11,503

10,842

11,322

11,264

Subscriber Revenues

$55,393

$57,216

$59,536

$60,466

$59,628

$59,640

$61,049

$61,046

Other Revenues

1,437

1,433

1,140

1,086

1,014

751

1,415

756

Total Revenues

$56,830

$58,649

$60,676

$61,552

$60,642

$60,391

$62,464

$61,801

DID - Based Revenues

$53,473

$55,301

$57,551

$58,440

$57,698

$57,449

$58,904

$58,969

Non-DID Revenues

3,357

3,348

3,125

3,112

2,944

2,942

3,560

2,832

Total Revenues

$56,830

$58,649

$60,676

$61,552

$60,642

$60,391

$62,464

$61,801

Subscriber Revenues/Total Revenues

97.5%

97.6%

98.1%

98.2%

98.3%

98.8%

97.7%

98.8%

DID - Based/Total Revenues

94.1%

94.3%

94.8%

94.9%

95.1%

95.1%

94.3%

95.4%

%

Fixed

Subscriber Revenues

78.2%

77.4%

78.3%

78.5%

80.7%

81.8%

81.5%

81.5%

%

Variable

Subscriber Revenues

21.8%

22.6%

21.7%

21.5%

19.3%

18.2%

18.5%

18.5%

Paid DIDs

(1)

1,063,698

1,098,650

1,162,872

1,198,950

1,236,079

1,273,876

1,274,145

1,274,240

Average Monthly Revenue/DID

$16.44

$16.30

$16.29

$15.87

$15.29

$14.85

$14.96

$15.03

Cancel Rate

(2)

2.7%

2.8%

2.9%

3.0%

3.1%

3.5%

3.3%

3.1%

Free DIDs (MM)

10.9

10.1

10.2

10.4

10.4

10.1

10.1

10.0

Average Monthly Revenue/DID

$0.07

$0.08

$0.07

$0.07

$0.06

$0.05

$0.06

$0.05

Cities Covered

3,024

3,084

3,126

3,137

3,135

3,207

3,327

3,500

Countries Covered

42

44

45

46

46

46

46

46

Cash & Investment

(millions)

$229.8

$181.3

$149.9

$151.8

$161.9

$179.3

$194.8

$222.5

Free Cash Flow

(3)

(millions)

$22.7

$27.2

$23.2

$15.0

$24.4

$30.4

$22.9

$26.1

2008

2009

(1)

Free cash flow is defined as net cash provided by operating activities plus excess tax benefit from share

based compensation, less purchases of property & equipment. Free cash flow amounts are

not meant as a

substitute for GAAP, but are solely for informational purposes.

Computation of Free Cash Flow

($ in millions)

Q4 '07

Q1 '08

Q2 '08

Q3 '08

Q4 '08

Q1 '09

Q2 '09

Q3 '09

Net cash provided by operating activities

$25.779

$27.411

$23.840

$15.676

$23.789

$31.152

$20.362

$26.469

Purch. of property & equipment

($4.340)

($0.469)

($0.796)

($0.937)

($0.305)

($0.721)

($0.217)

($0.767)

Excess tax benefit from share based compensation

$1.271

$0.239

$0.204

$0.212

$0.910

$0.005

$2.718

$0.403

Free Cash Flow

(1)

$22.710

$27.181

$23.248

$14.951

$24.394

$30.436

$22.863

$26.105

Non-GAAP Results & Reconciliation to GAAP

(1) Stock-based compensation is as follows: for Q3, Cost of

revenues is $323K, Sales and Marketing is $477K, R&D is $217K, and G&A is $1,877K, for YTD 2009, Cost of revenue is $935K, Sales

and Marketing is $1,338K, R&D is $634K, and G&A is $5,188K.

(2) Income tax expense adjusted for the net impact of item 1 above is $893K for Q3 and $2,463K for YTD 2009.

(3) Impairment charge for auction rate securities in Q2 is $9,193K.

(4) Income tax expense adjusted for the net impact of item 3 above is $776K.

Reported

Non-GAAP

Reported

Non-GAAP

Revenues

Subscriber

61,045

$

-

$

61,045

$

181,734

$

-

$

181,734

$

Other

756

-

756

2,922

-

2,922

Total revenue

61,801

-

61,801

184,656

-

184,656

Cost of revenues

(1)

11,258

(323)

(1)

10,935

34,250

(935)

(1)

33,315

Gross profit

50,543

323

50,866

150,406

935

151,341

Operating expenses:

Sales and marketing

(1)

9,347

(477)

(1)

8,870

27,443

(1,338)

(1)

26,105

Research, development and engineering

(1)

2,862

(217)

(1)

2,645

8,685

(634)

(1)

8,051

General and administrative

(1)

11,667

(1,877)

(1)

9,790

33,582

(5,188)

(1)

28,394

Total operating expenses

23,876

(2,571)

21,305

69,710

(7,160)

62,550

Operating earnings

26,667

2,894

29,561

80,696

8,095

88,791

Other-than-temporary impairment losses

(3)

(9,193)

9,193

(3)

-

Interest and other income, net

20

-

20

477

-

477

Earnings before income taxes

26,687

2,894

29,581

71,980

17,288

89,268

Income tax expense

(2), (4)

7,353

893

(2)

8,246

22,857

3,239

(2)

26,096

Net earnings

19,334

$

2,001

$

21,335

$

49,123

$

14,049

$

63,172

$

Diluted net earnings per share

0.43

$

0.47

$

1.09

$

1.40

$

Diluted weighted average shares outstanding

45,296,147

45,296,147

44,985,160

44,985,160

NINE MONTHS ENDED SEPTEMBER 30, 2009

Non-GAAP Entries

j2 GLOBAL COMMUNICATIONS, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL RESULTS

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS)

Non-GAAP Entries

THREE MONTHS ENDED SEPTEMBER 30, 2009

THREE MONTHS AND NINE MONTHS ENDED SEPTEMBER 30, 2009