Attached files

| file | filename |

|---|---|

| 8-K - Eagle Bulk Shipping Inc. | d1041932_8-k.htm |

| EX-99.1 - Eagle Bulk Shipping Inc. | d1044259_ex99-1.htm |

Eagle

Bulk Shipping Inc.

3Q09

Results Presentation

Eagle

Bulk Shipping Inc.

5

November 2009

Eagle

Bulk Shipping Inc.

1

Forward Looking

Statements

This

presentation contains certain statements that may be deemed to be

“forward-looking statements” within the

meaning of the Securities Acts. Forward-looking statements reflect management’s current views with respect to future

events and financial performance and may include statements concerning plans, objectives, goals, strategies, future

events or performance, and underlying assumptions and other statements, which are other than statements of historical

facts. The forward-looking statements in this presentation are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without limitation, management's examination of historical operating

trends, data contained in our records and other data available from third parties. Although Eagle Bulk Shipping Inc.

believes that these assumptions were reasonable when made, because these assumptions are inherently subject to

significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, Eagle

Bulk Shipping Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-

looking statements include the strength of world economies and currencies, general market conditions, including changes

in charterhire rates and vessel values, changes in demand that may affect attitudes of time charterers to scheduled and

unscheduled drydocking, changes in our vessel operating expenses, including dry-docking and insurance costs, or actions

taken by regulatory authorities, ability of our counterparties to perform their obligations under sales agreements, charter

contracts, and other agreements on a timely basis, potential liability from future litigation, domestic and international

political conditions, potential disruption of shipping routes due to accidents and political events or acts by terrorists. Risks

and uncertainties are further described in reports filed by Eagle Bulk Shipping Inc. with the US Securities and Exchange

Commission.

meaning of the Securities Acts. Forward-looking statements reflect management’s current views with respect to future

events and financial performance and may include statements concerning plans, objectives, goals, strategies, future

events or performance, and underlying assumptions and other statements, which are other than statements of historical

facts. The forward-looking statements in this presentation are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without limitation, management's examination of historical operating

trends, data contained in our records and other data available from third parties. Although Eagle Bulk Shipping Inc.

believes that these assumptions were reasonable when made, because these assumptions are inherently subject to

significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, Eagle

Bulk Shipping Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-

looking statements include the strength of world economies and currencies, general market conditions, including changes

in charterhire rates and vessel values, changes in demand that may affect attitudes of time charterers to scheduled and

unscheduled drydocking, changes in our vessel operating expenses, including dry-docking and insurance costs, or actions

taken by regulatory authorities, ability of our counterparties to perform their obligations under sales agreements, charter

contracts, and other agreements on a timely basis, potential liability from future litigation, domestic and international

political conditions, potential disruption of shipping routes due to accidents and political events or acts by terrorists. Risks

and uncertainties are further described in reports filed by Eagle Bulk Shipping Inc. with the US Securities and Exchange

Commission.

Eagle

Bulk Shipping Inc.

Agenda

2

n 3Q

2009 Results

n Company

Updates

n Industry

View

n Financial

Overview

n Conclusion

3Q09

Results

Eagle

Bulk Shipping Inc.

3Q

2009 Highlights

4

n 3Q Net Income of

3.9 million, or $0.06 per share,

as

adjusted for one-time, non

-cash charge related to amendment to debt facility

-cash charge related to amendment to debt facility

n Net Income without

adjustments of $0.5 million, or $0.01 per share

n Net time charter

revenue of $41.6 million

n EBITDA1 of

$25.0

million

n Fleet Utilization

of 99.7%

n Five vessels

chartered on rates that are tied to the Baltic Supramax Index

("BSI")

("BSI")

n Established

in-house technical capabilities to manage Eagle Bulk vessels and

third party vessels

third party vessels

1 EBITDA, as defined

by our credit agreement, is Net Income plus Interest Expense, Depreciation and

Amortization, and Exceptional Items

Steady

Cash Flow and Continued Operating Excellence

Company

Updates

Eagle

Bulk Shipping Inc.

6

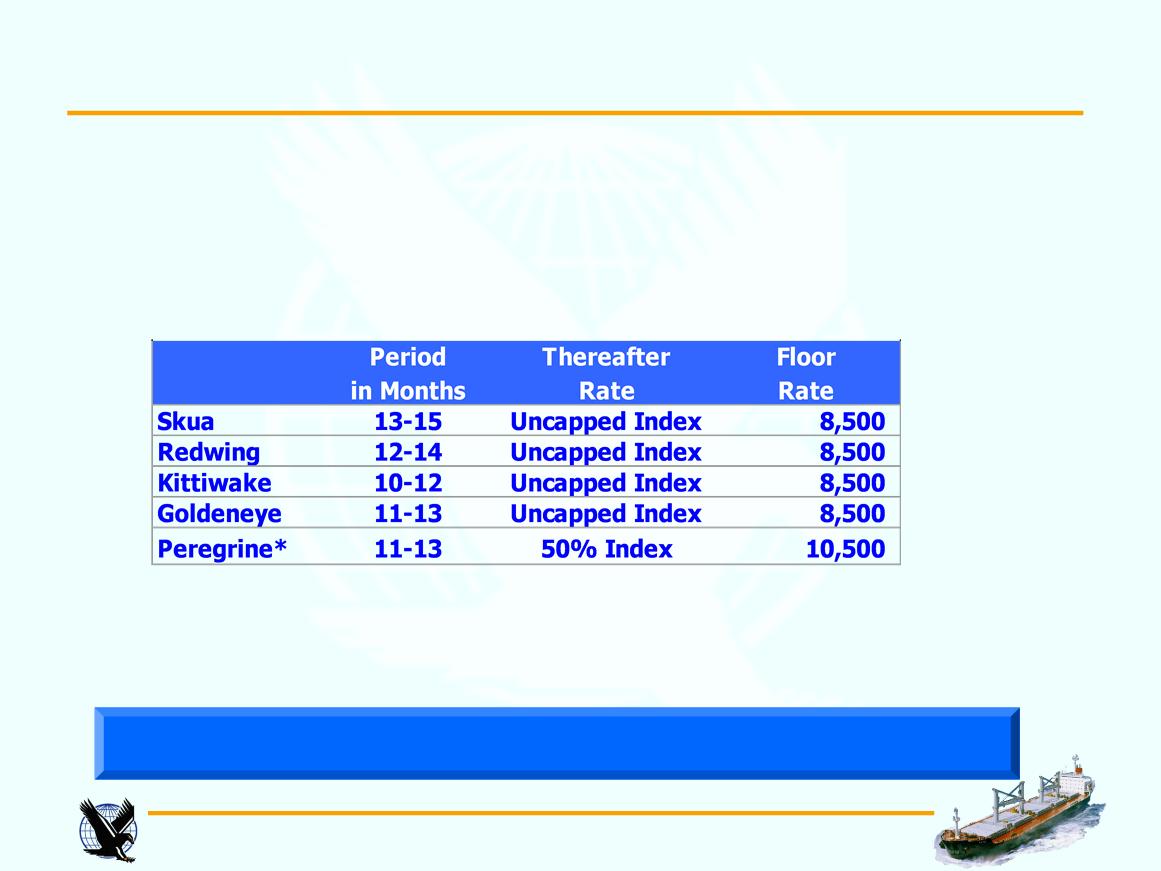

Charter

Updates

Charter

Updates

Fleet

Growth Ensures Revenue Stability with Upside Potential

n Cardinal chartered

one year at $16,250 per day

n 2010 - Balanced

approach with 63% fixed coverage, including:

n Five vessels

placed on charters tied to Baltic Supramax Index

*

Commencing Jan-end 2010

Eagle

Bulk Shipping Inc.

7

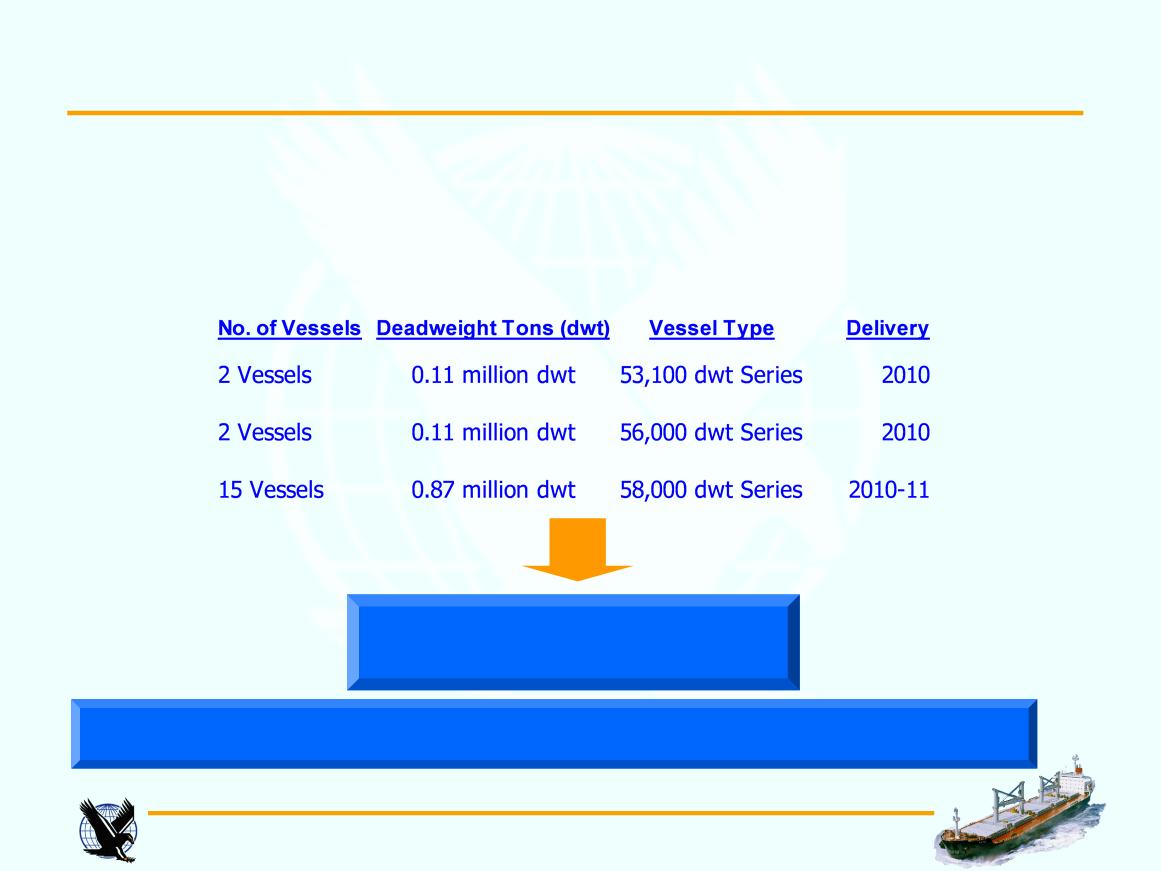

Supramax

Newbuildings - Begin to Deliver EBITDA Growth

Supramax

Newbuildings - Begin to Deliver EBITDA Growth

*

Excluding profit sharing

Existing

Cash, Undrawn Facility and Operating Cash Flow to Fund Newbuildings

Contracted

Revenue: $730 Million*

n

Took

delivery of the Bittern, which commenced 10 year time charter with minimum

contracted

revenue of $62m

revenue of $62m

n Canary expected to

be delivered in 4Q09, with minimum contracted revenue of $61m

n Thrasher expected

to be delivered in 4Q09, with minimum contracted revenue of

$61m

Eagle

Bulk Shipping Inc.

8

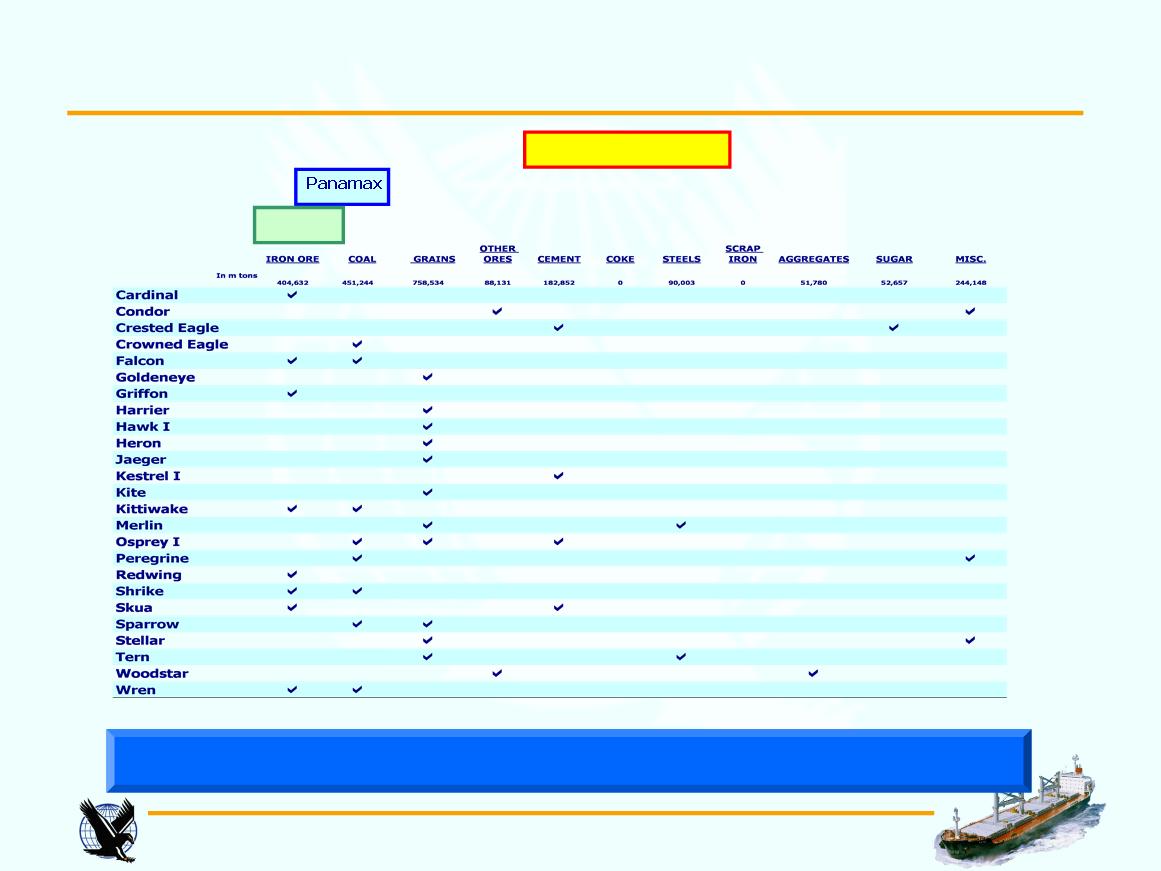

Handymax/Supramax

Capesize

Eagle

vessels carried 2.3 million tons of cargo in 3Q

2009 MISC.

cargoes include eucalyptus chips, phosrock

Supramax Vessels

Benefit from Shifts in Commodity Movements

Supramax Vessels

Benefit from Shifts in Commodity Movements

69%

of Eagle’s 3Q09 Cargoes Were “Capesize and Panamax

Cargoes”

Industry

View

Eagle

Bulk Shipping Inc.

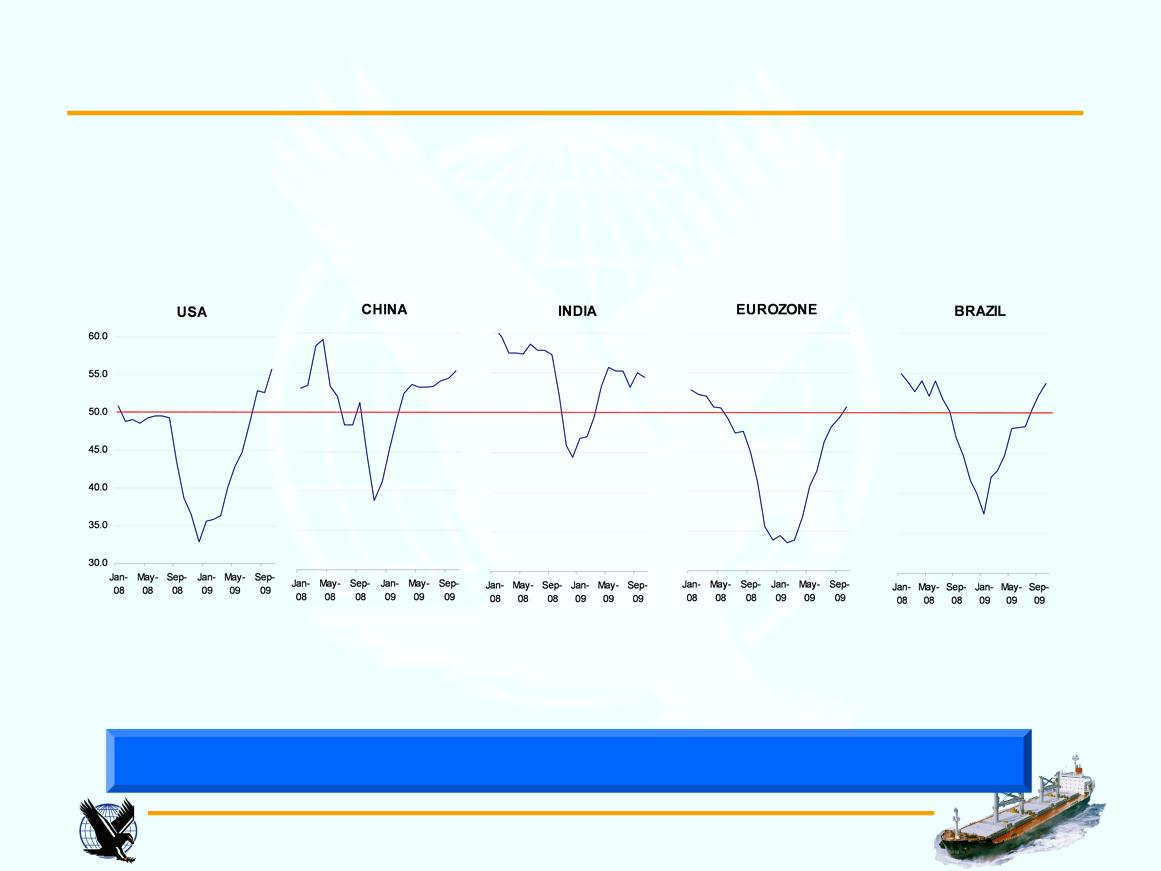

Purchasing

Managers’ Index

PMI

Above 50 Indicates Growing Industrial Production and Raw Materials

Demand

Source: various

sources

10

Manufacturing

Surveys Indicate a Global Recovery

Eagle

Bulk Shipping Inc.

11

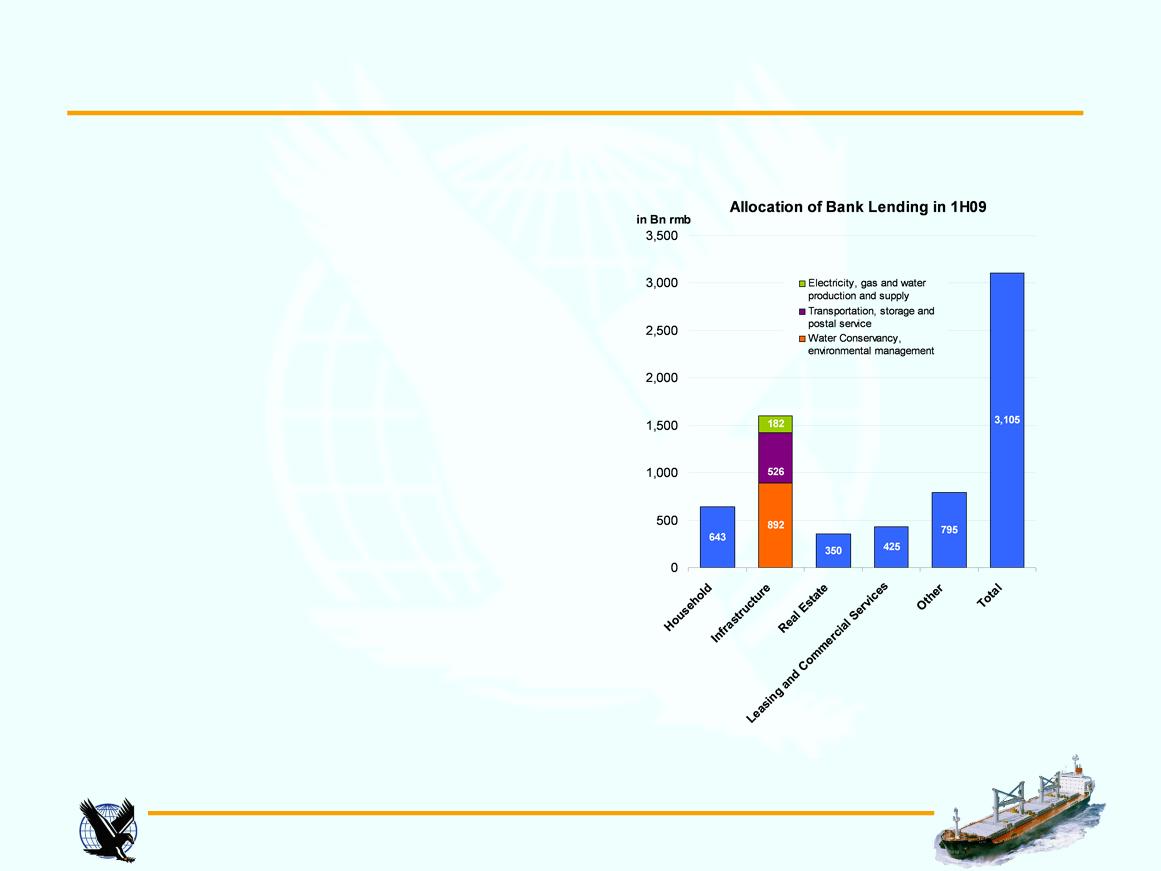

Source: BCA

Research, PBoC

§ 3Q growth fastest

in a year, supported by

infrastructure investment and record bank

lending

infrastructure investment and record bank

lending

§ 26% MoM rise in new

lending in Sep, and a

record $1.27 trillion in new loans in the first

nine months

record $1.27 trillion in new loans in the first

nine months

§ Surging auto sales

helped industrial

production to rise 13.9% in September, the

fastest pace in more than a year

production to rise 13.9% in September, the

fastest pace in more than a year

§ Urban fixed-asset

investment climbed 33.3

percent in the first nine months, as the $586

billion stimulus plan spurred the construction

of roads and power plants

percent in the first nine months, as the $586

billion stimulus plan spurred the construction

of roads and power plants

§ Half of medium and

long-term loans in 1H09

were directed to infrastructure and real estate

sectors

were directed to infrastructure and real estate

sectors

Chinese Economy

Continues to Show Growth Momentum

Eagle

Bulk Shipping Inc.

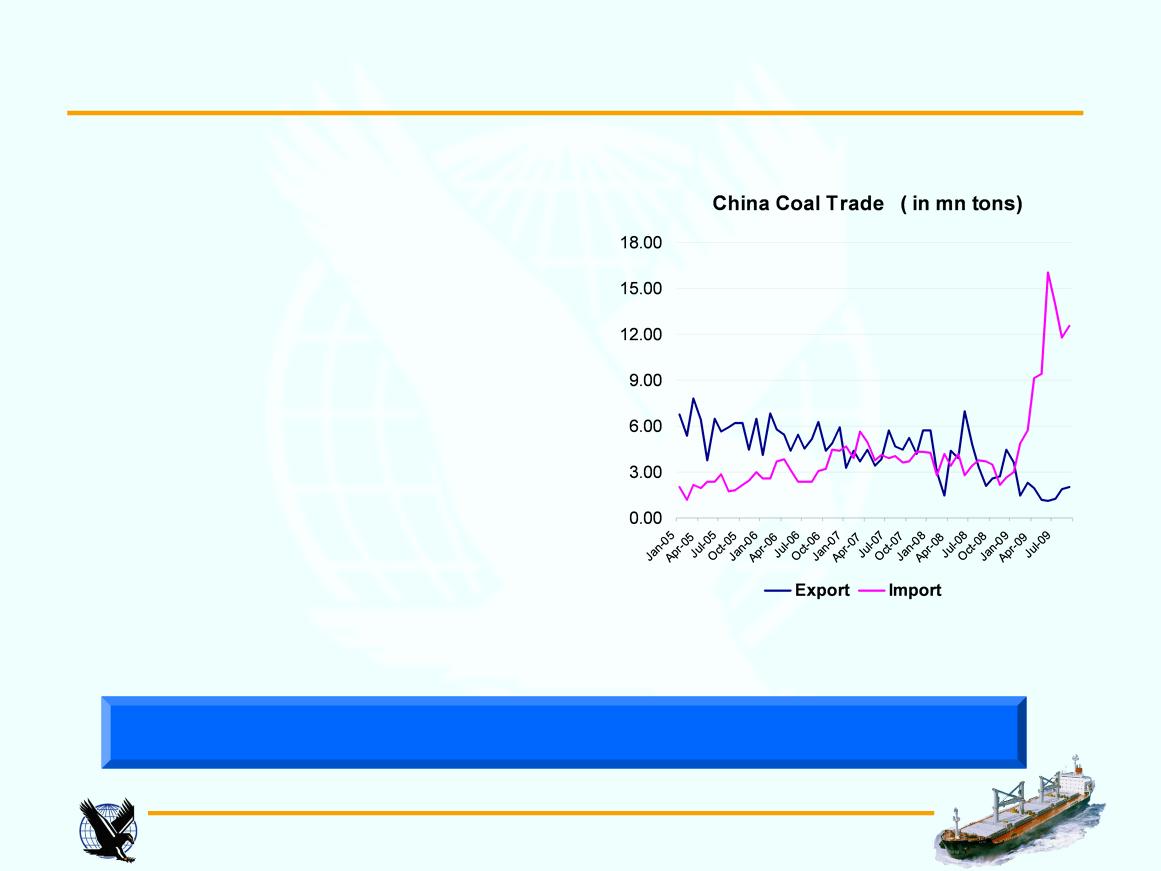

n China’s growth is

resource intensive and

lacks reserves

lacks reserves

§ 43% of global coal

consumption vs. 14% of

the world’s proven coal reserves; 44% of

global iron ore consumption vs. 9% of the

world’s proven iron ore reserves

the world’s proven coal reserves; 44% of

global iron ore consumption vs. 9% of the

world’s proven iron ore reserves

§ September Iron ore

imports rebounded

30% MoM to a record high of 64.6 million

tones

30% MoM to a record high of 64.6 million

tones

§ China’s crude steel

production rose 29% in

September to 50.71 million metric tons, the

second-highest on record

September to 50.71 million metric tons, the

second-highest on record

Source: BOA ML

report, Bloomberg

China

Becomes Net Importer of Coal in 2009

12

China’s Demand for

Commodities Remains Strong

Eagle

Bulk Shipping Inc.

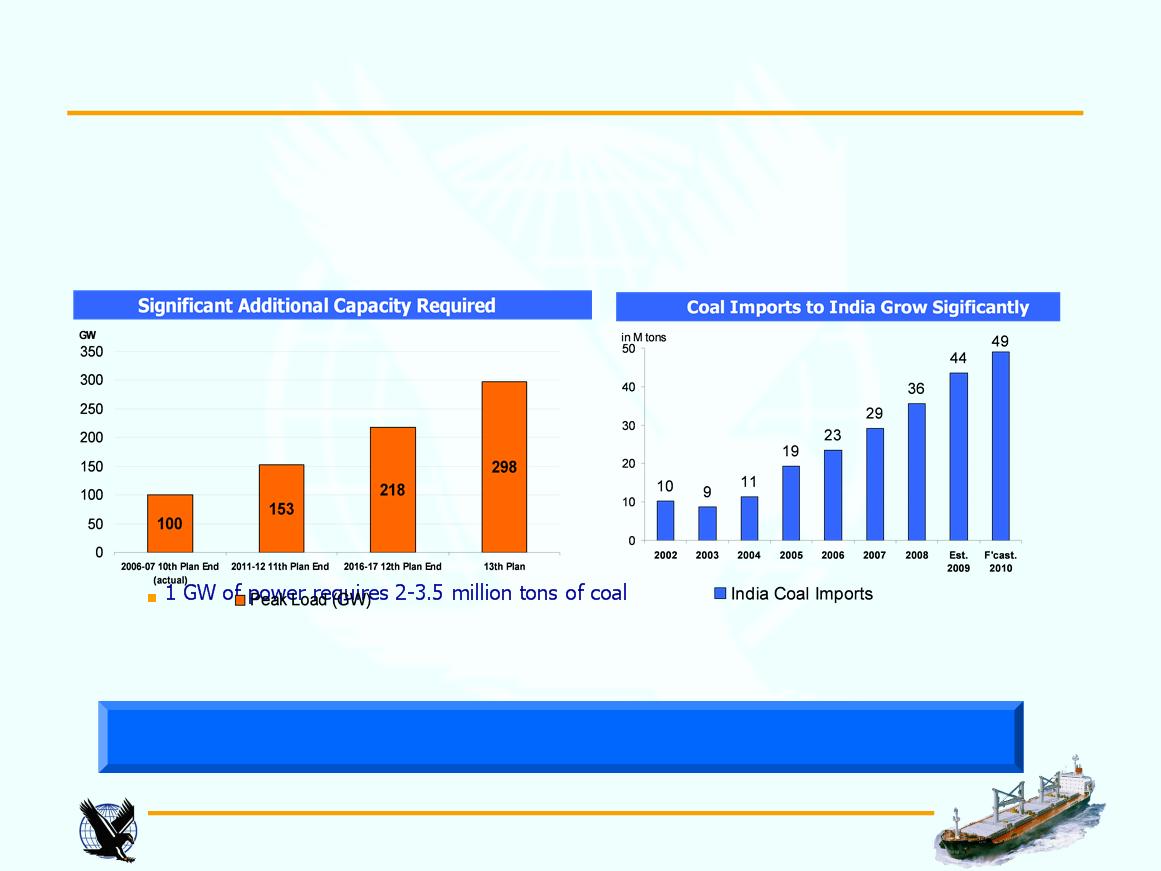

13

India’s Power

Demand Fuels Coal Trade

India’s Power

Demand Fuels Coal Trade

Source: India’s

Central Electricity Authority, Clarksons

Indian

Coal Imports to be Key Demand Driver for Supramax

n Power

generation sector faces huge demand-supply gap for coal

n Slow capacity

addition widening the gap: only 13 GW added in 2007-2008 against the target

of

27 GW

27 GW

n Over 40% of Indian

population still don’t have access to electricity

Eagle

Bulk Shipping Inc.

14

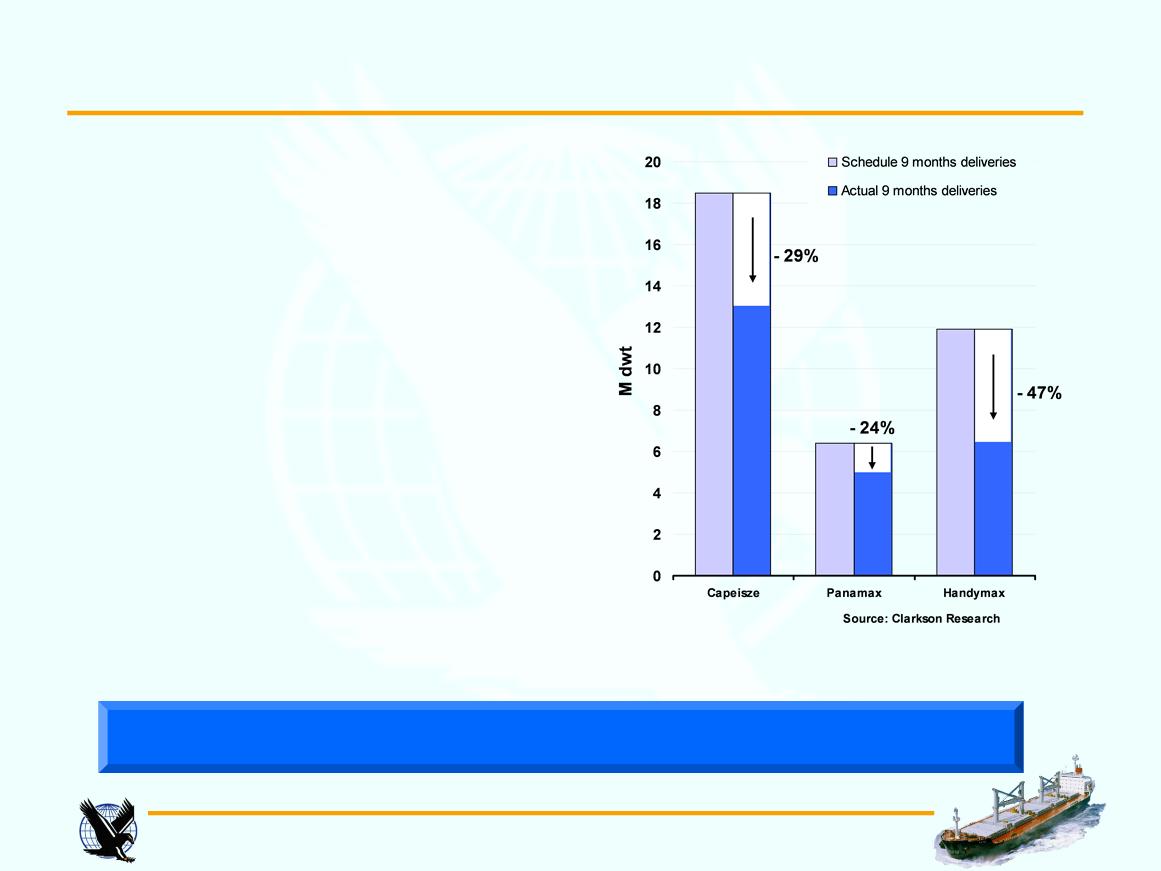

n Clarkson Research

estimated 29% drybulk

slippage from the beginning of 2009

slippage from the beginning of 2009

n Extensive analysis

by ABS suggests that through

2012 almost 1,000 bulk carriers can be

considered at risk.

2012 almost 1,000 bulk carriers can be

considered at risk.

n China’s National

Development and Reform

Commission announced in Oct that half the

orderbook (50m dwt) this year at Chinese

shipyards would be either cancelled or delayed

Commission announced in Oct that half the

orderbook (50m dwt) this year at Chinese

shipyards would be either cancelled or delayed

n Wang Jinlian,

Secretary General of China

Association of National Shipbuilding Industry, said

at China Shipbuilding Summit in Oct that more

than a third of Chinese shipyards would be idled

Association of National Shipbuilding Industry, said

at China Shipbuilding Summit in Oct that more

than a third of Chinese shipyards would be idled

Orderbook Update -

Sub-Panamax Sector Benefits Most from Slippage

Orderbook Update -

Sub-Panamax Sector Benefits Most from Slippage

Source: Clarkson,

ABS, China’s National Development and Reform Commission

Orderbook

Remains a Concern but Actual Deliveries Fall Behind

Schedule

Eagle

Bulk Shipping Inc.

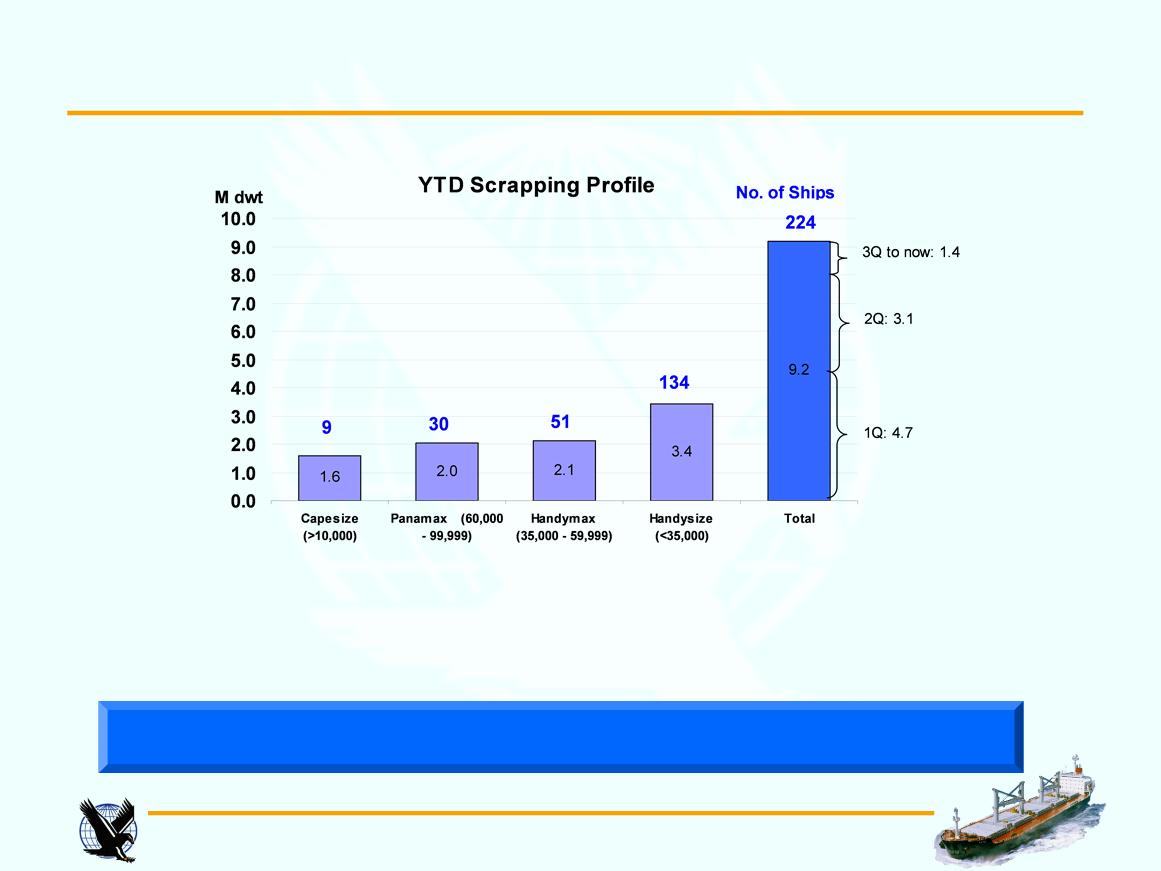

15

About

224 bulkers (9.2 million DWT) have been sold for scrap this year

Scrapping

Update

Scrapping

Update

Source:

Clarkson

About

2500 bulkers (111 million DWT) are over 20 years old

Financial

Overview

Eagle

Bulk Shipping Inc.

17

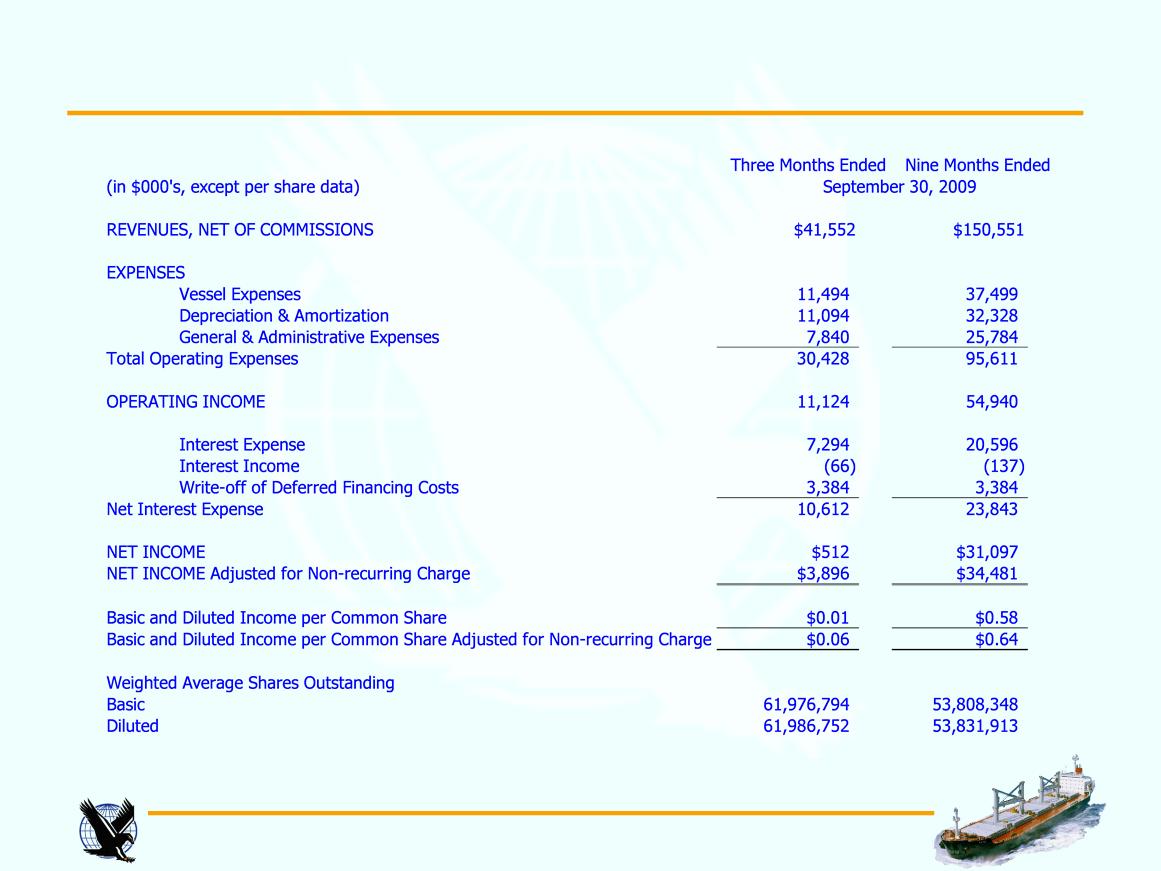

3rd Quarter

Earnings

Eagle

Bulk Shipping Inc.

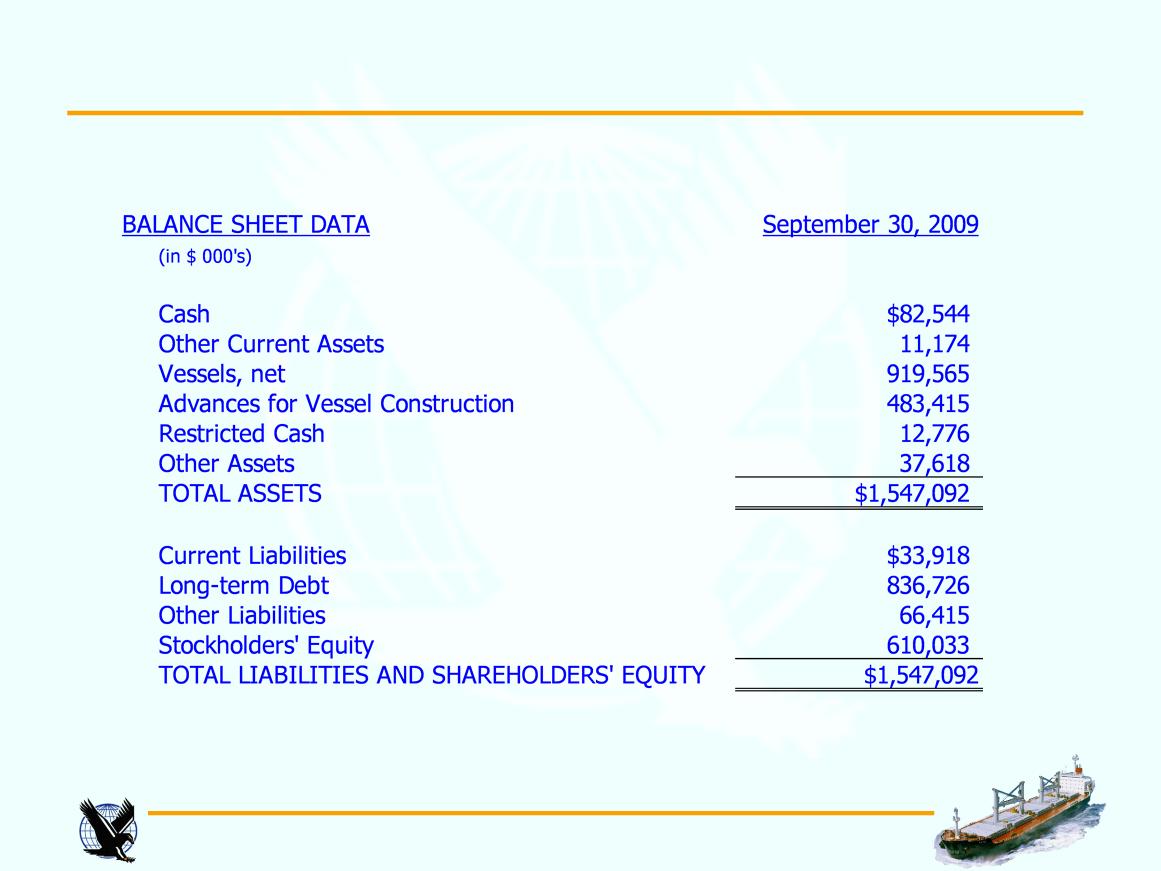

Balance

Sheet

18

Conclusion

Eagle

Bulk Shipping Inc.

20

3Q

2009 Summary

3Q

2009 Summary

n Cash

flow stability

Steady cash flow

from fixed charter coverage

n Upside

potential

Five vessels placed

on index-based charters

Newbuildings begin

to deliver EBITDA growth

n Operating

performance

Continuing superior

fleet utilization - 99.7% in 3Q

n Established

in-house technical management

Eagle Bulk

fleet

Third party

vessels

Fleet

Growth Continues: 7 Vessels to Deliver by End 1Q10

5

Vessels Chartered

with Revenue of $259 M; 2 Vessels Open

Appendix

Eagle

Bulk Shipping Inc.

22

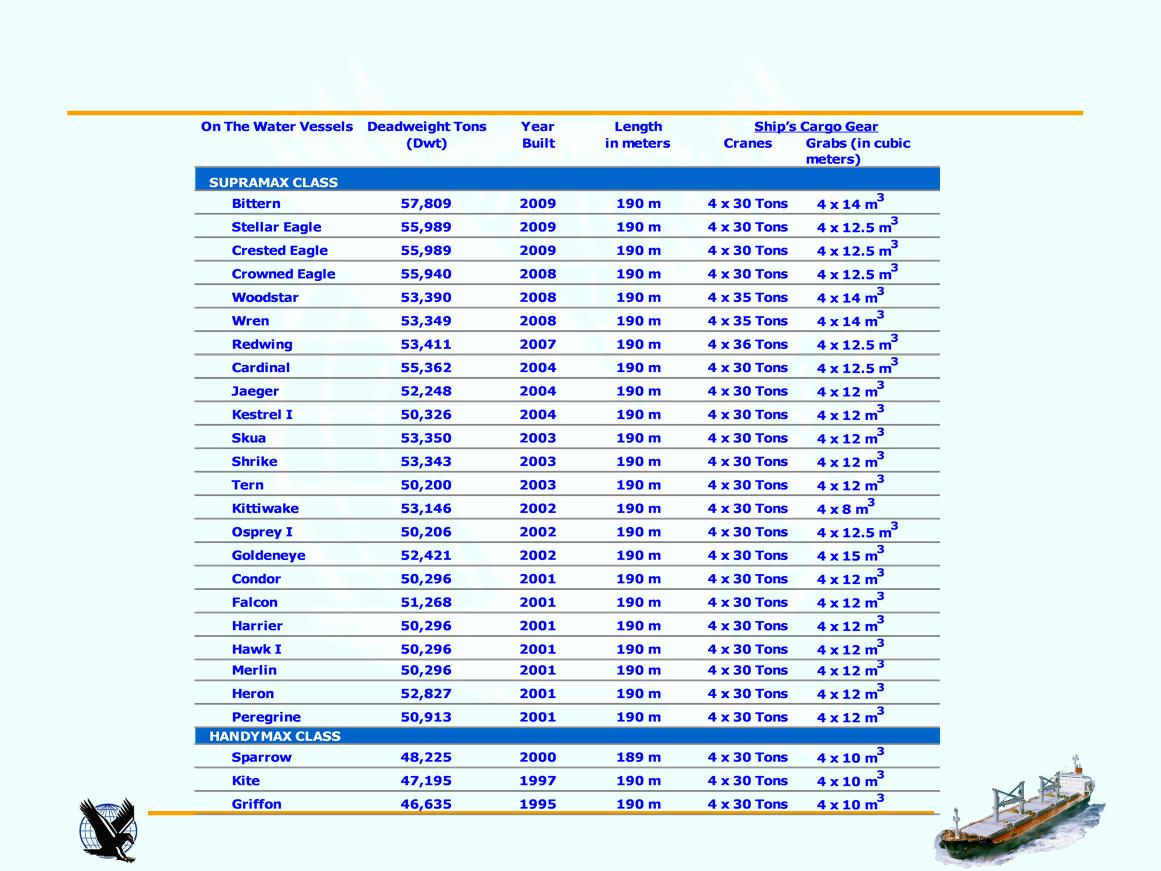

Current Fleet - 92%

Built After 2000

Current Fleet - 92%

Built After 2000

Eagle

Bulk Shipping Inc.

23

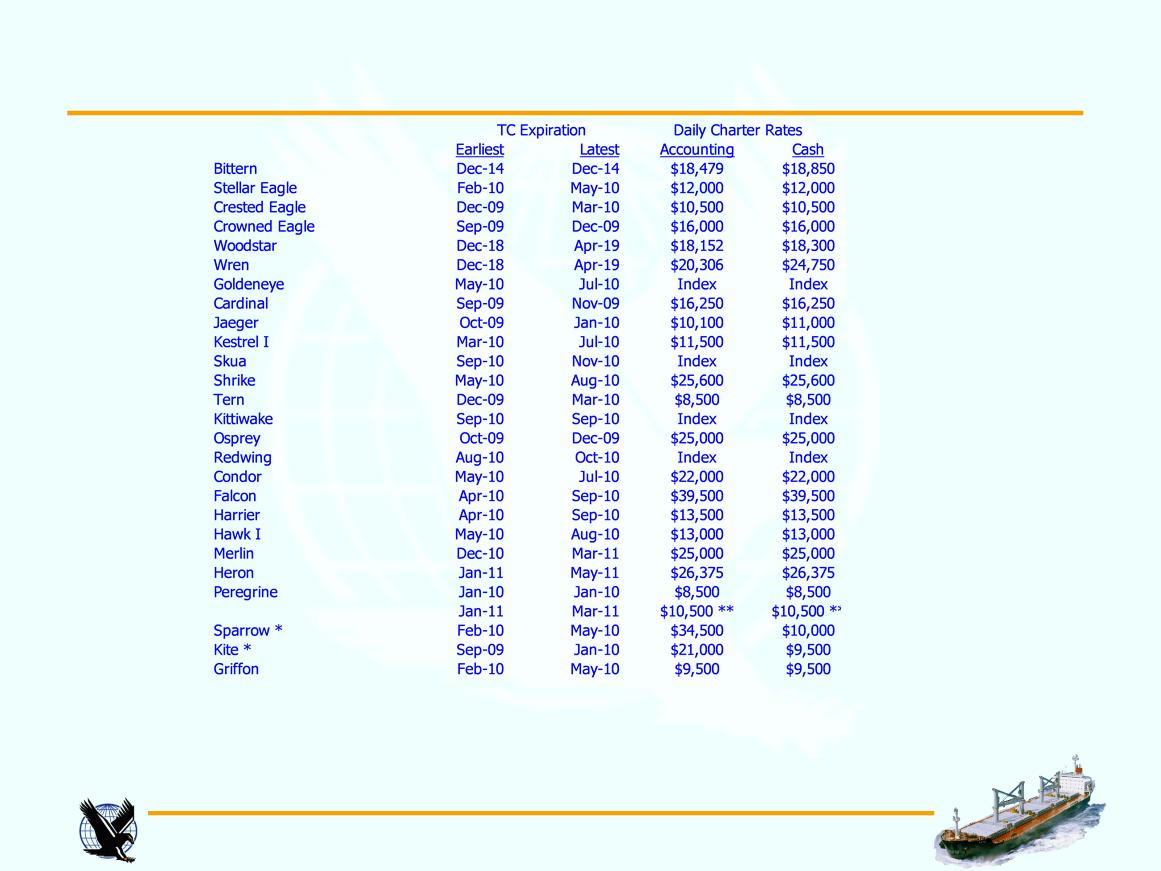

* The

charterer of Sparrow has paid in advance for the duration of the charter an

amount equal to the difference between the prevailing daily charter rate and

a

new cash market rate per day. This amount has been recorded in Deferred Revenue in the Company’s financial statements and is being recognized into revenue

ratably over the charter period such that the daily charter rate remains effectively the prevailing charter rate per day (accounting rate).

new cash market rate per day. This amount has been recorded in Deferred Revenue in the Company’s financial statements and is being recognized into revenue

ratably over the charter period such that the daily charter rate remains effectively the prevailing charter rate per day (accounting rate).

** The

charterer of the PEREGRINE has exercised the option to extend the charter period

by 11 to 13 months. The rate for the option period is index based with

a minimum daily time charter rate of $10,500 and a profit share which is equal to 50% of the difference between the base rate and the average of the trailing

Baltic Supramax Index for each 30 day hire period.

a minimum daily time charter rate of $10,500 and a profit share which is equal to 50% of the difference between the base rate and the average of the trailing

Baltic Supramax Index for each 30 day hire period.

Charter

Updates

Eagle

Bulk Shipping Inc.

Eagle

Bulk Shipping Inc.