Attached files

Table of Contents

Exhibit 13

Table of Contents

WASHINGTON FEDERAL, INC.

ANNUAL REPORT 2009

425 Pike Street, Seattle, WA 98101

| 1 | ||

| 2 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

5 | |

| 11 | ||

| 12 | ||

| 17 | ||

| Management’s Report on Internal Control over Financial Reporting |

37 | |

| 37 | ||

| 39 | ||

| 40 | ||

| 41 |

A SHORT HISTORY

Washington Federal, Inc. (Company or Washington Federal) is a unitary thrift holding company headquartered in Seattle, Washington. Its principal subsidiary is Washington Federal Savings, which operates 150 offices in eight western states.

The Company had its origin on April 24, 1917, as Ballard Savings and Loan Association. In 1935, the state-chartered Company converted to a federal charter, became a member of the Federal Home Loan Bank (FHLB) system and obtained federal deposit insurance. In 1958, Ballard Federal Savings and Loan Association merged with Washington Federal Savings and Loan Association of Bothell, and the latter name was retained for wider geographical acceptance. In 1971, Seattle Federal Savings and Loan Association, with three offices, merged into the Company, and at the end of 1978, was joined by the 10 offices of First Federal Savings and Loan Association of Mount Vernon.

On November 9, 1982, the Company converted from a federal mutual to a federal stock association. In 1987 and 1988, acquisitions of United First Federal, Provident Federal Savings and Loan, and Northwest Federal Savings and Loan, all headquartered in Boise, Idaho, added 28 Idaho offices to the Company. In 1988, the acquisition of Freedom Federal Savings and Loan Association in Corvallis, Oregon, added 13 Oregon offices, followed in 1990 by the eight Oregon offices of Family Federal Savings.

In 1991, the Company added three branches with the acquisition of First Federal Savings and Loan Association of Idaho Falls, Idaho, and acquired the deposits of First Western Savings Association of Las Vegas, Nevada, in Portland and Eugene, Oregon, where they were doing business as Metropolitan Savings Association. In 1993, 10 branches were added with the acquisition of First Federal Savings Bank of Salt Lake City, Utah. In 1994, the Company expanded into Arizona.

In 1995, the stockholders approved a reorganization whereby Washington Federal Savings became a wholly owned subsidiary of a newly formed holding company, Washington Federal, Inc. That same year, the Company purchased West Coast Mutual Savings Bank with its one branch in Centralia, Washington, and opened six additional branches. In 1996, the Company acquired Metropolitan Bancorp of Seattle, adding eight offices in Washington in addition to opening four branches in existing markets. Between 1997 and 1999, Washington Federal Savings continued to develop its branch network, opening a total of seven branches and consolidating three offices into existing locations.

In 2000, the Company expanded into Las Vegas, opening its first branch in Nevada along with two branches in Arizona. In 2001, the Company opened two additional branches in Arizona and its first branch in Texas with an office in the Park Cities area of Dallas. In 2002, Washington Federal Savings opened five full-service branches in existing markets. In 2003, the Company purchased United Savings and Loan Bank with its four branches in the Seattle metropolitan area, added one new branch in Puyallup, Washington, and consolidated one branch in Nampa, Idaho. In 2005, the Company consolidated two branches in Mount Vernon, Washington, into one and opened branches in Plano, Texas, and West Bend, Oregon. In 2006, the Company opened locations in Klamath Falls, Oregon, Richardson, Texas and another in Las Vegas, Nevada. During 2006, a branch in Medford, Oregon, was opened.

The Company acquired First Federal Banc of the Southwest, Inc., the holding company for First Federal Bank located in Roswell, New Mexico, on February 13, 2007. First Federal Bank had 13 branch locations, 11 in New Mexico and two in El Paso, Texas.

The Company acquired First Mutual Bancshares, Inc. (“First Mutual”), the holding company for First Mutual Bank, on February 1, 2008. First Mutual had 12 branches primarily located in the eastside of Seattle. The Company also opened a location in Redmond, Oregon in 2008.

During 2009, the Company opened two new locations, one in Las Vegas, Nevada and the other in Prescott Valley, Arizona.

The Company obtains its funds primarily through deposits from the general public, from repayments of loans, borrowings and retained earnings. These funds are used largely to make loans to individuals and business for the purchase of new and existing homes, construction and land loans, commercial real estate, commercial and industrial loans, and for investments.

Table of Contents

| September 30, | 2009 | 2008 | % Change | ||||||||

|

|

(In thousands, except per share data) |

| |||||||||

| Assets |

$ | 12,582,475 | $ | 11,830,141 | 6 | % | |||||

| Cash and cash equivalents |

498,388 | 82,600 | 503 | ||||||||

| Investment securities |

21,259 | 49,001 | -57 | ||||||||

| Loans receivable, net |

8,983,430 | 9,501,620 | -5 | ||||||||

| Mortgage-backed securities |

2,282,865 | 1,551,603 | 47 | ||||||||

| Customer accounts |

7,842,310 | 7,169,539 | 9 | ||||||||

| FHLB advances and other borrowings |

2,879,530 | 3,175,908 | -9 | ||||||||

| Stockholders’ equity |

1,745,485 | 1,332,674 | 31 | ||||||||

| Net income available to common shareholders |

40,684 | 62,332 | -35 | ||||||||

| Diluted earnings per share |

0.46 | 0.71 | -35 | ||||||||

| Dividends per share |

0.20 | 0.84 | -76 | ||||||||

| Stockholders’ equity per share |

15.55 | 15.16 | 3 | ||||||||

| Shares outstanding |

112,248 | 87,916 | — | ||||||||

| Return on average stockholders’ equity |

2.87 | % | 4.59 | % | — | ||||||

| Return on average assets |

0.33 | 0.55 | — | ||||||||

| Efficiency ratio |

27.30 | 27.23 | — | ||||||||

|

1 |

Table of Contents

Dear Stockholder,

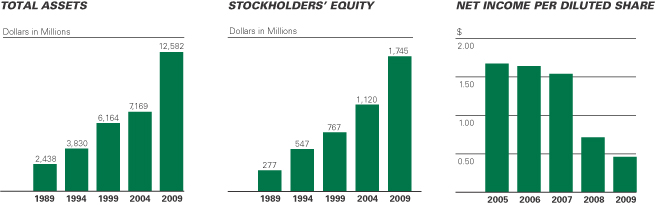

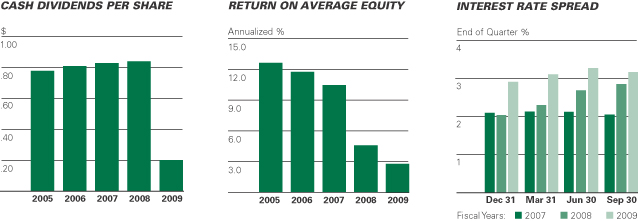

It is my privilege to report that your Company completed another successful year, although results were dampened considerably by the most difficult economic environment since the Great Depression. Net income amounted to $40,684,000, or $.46 per share, a decline of 35% from fiscal 2008 and a 70% reduction from near-peak earnings posted in 2007. In that year, lower earnings became inevitable after the credit bubble that had been building for years finally burst. Consumers and businesses alike responded rationally to the prospect of difficult times ahead by reducing spending as they moved to pay down debt and increase liquid reserves. The ensuing slack demand for virtually everything meant that asset values declined, and those asset classes already in excess supply, such as housing, were hit particularly hard. Washington Federal, with 95% of its assets in some way tied to residential real estate, was clearly in harm’s way. Under the circumstances, the Company has thus far weathered the economic downturn and the housing correction quite well.

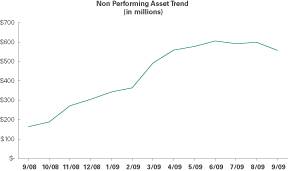

Non-performing assets, defined as loans on which we are no longer accruing interest, plus foreclosed collateral, increased sharply and were the primary focus of management attention during the year. At year-end, total non-performing assets amounted to $557 million, which is a three-fold increase over the $164 million at the prior year’s end. As the adjacent chart indicates, the year-end total is actually a decline from the $606 million reported on June 30, 2009, enabling us to feel somewhat encouraged that we may have passed the peak in problem assets for this cycle. The majority of problem loans originated in the Company’s land and construction lending portfolio, although new, early-stage problems from that source have slowed from a flood to a trickle. Not so with the mortgage portfolio, where quality indicators show some deterioration, primarily due to loss of income related to unemployment. We expect losses to increase from that segment in the new fiscal year, but remain very hopeful that, overall, problem assets and loan losses from all sources will be lower in the new fiscal year.

Fortunately, the Company’s core business of earning a spread between loans and deposits was very strong last year. Net interest income, which is that spread measured in dollars, increased by 23% to $373 million during the year. The sizable increase came as a result of the Company’s large fixed rate mortgage portfolio being funded short-term with lower cost deposits as interest rates declined during the fiscal year. The increase in net interest income is particularly notable given the rise in nonperforming assets, on which we earn nothing. The improvement in net interest income was very timely in aiding our ability to absorb lost interest and principal writedowns on the loan portfolio.

Operating expenses increased by $20 million, or 23%, over the prior year because they include a full year of operating expenses related to our acquisition of First Mutual versus only eight months last year, as well as a $10 million increase in FDIC insurance premiums. Our operating efficiency ratio, an expression of the number of pennies spent to produce a dollar of net revenue, was .27 last year and continues to be among the best in the industry. Tight control over spending has always been a Washington Federal trademark and has been especially important during the past few quarters – sometimes making the difference between profitability and operating at a loss. Stockholders can expect management to continue to be careful stewards of the Company’s resources.

The economic crisis we faced during much of the past year led management and the board to make three important capital planning decisions. The most difficult choice was to cut the cash dividend in December 2008. We know that this caused some personal hardships for many loyal stockholders, yet it was the correct decision for the Company in hindsight. As soon as the future becomes more predictably prosperous, we’ll commence cautiously increasing the dividend once again.

Another important capital decision was to accept a preferred stock investment from the U.S. Treasury in November 2008 under their Troubled Asset Relief Program (“TARP”). I wish we could call that decision correct in hindsight also, but history reveals otherwise. After averting disaster by making TARP investments in the country’s largest banks and investment banks, the U.S. Treasury selected Washington Federal as one of 22 regional institutions to participate in the program. The investment was not needed or sought after by us. We were contacted unilaterally by the Treasury through our primary regulator and strongly urged to participate. The idea seemed to be to get capital into the hands of strong

2

Table of Contents

institutions who would use the funds to help heal the system by maintaining the flow of credit and who would also be able to repay the funds one day with a profit to the Treasury. The Fall of 2008 was among the most uncertain and dark times ever faced by the international financial community and it seemed at the time as though the government was picking winners and losers. Not wanting to appear unqualified for the funds and risk panicking already nervous depositors, we chose to accept the investment. Unfortunately, the U.S. government, the Treasury and the regulators failed to get ahead of public sentiment in explaining the program and it backfired. Even strong institutions like Washington Federal were perceived to have been “bailed-out” by the government at the expense of taxpayers. In response to public pressure, follow-on legislation was subsequently passed by Congress adding burdensome requirements not anticipated in November, but also allowing for early repurchase of the preferred stock. In May 2009, we most happily returned the funds in full and it should be noted that the Treasury earned a very nice return on their investment. What we believed at the time was an act of responsible corporate citizenship left us feeling that, indeed, “no good deed goes unpunished”.

Finally, in September 2009, the Company returned to the capital markets for the first time since going public in 1982. A $350 million offering of common stock was more than four times oversubscribed and provided market validation of our business model and recognition of the Company’s long track record of success. Strong demand enabled us to command a price for the stock that was a mere 1% below the pre-announcement price. Our lead underwriter advised us that it was the second-best outcome of the year and it compared very favorably to the 15% average discount off the pre-announcement price being received by other issuers during the summer. The additional capital will provide important flexibility in managing the balance sheet when interest rates inevitably rise, and it also gives us the equity needed to take market share from our troubled competitors.

Other important events include steady progress on Project Tritan, which is a major rewrite of our in-house core data processing system. By the time you read these words, 85% of our branches will have been converted to the new system with the balance to be completed early in 2010. As part of the project, internet banking was added as an additional customer service in February and we now have 29,000 customers using the system. Check scanning equipment was installed in each of our branches, which not only allows us to comply with regulations requiring digital processing of items known as Check 21, but also enhances efficiency by speeding up the clearing process and providing better service to our clients. Ninety-seven percent of checks deposited now clear on the same day and clients can obtain a copy of the front and back of each scanned item using our internet banking portal.

As part of a strategic plan approved by the board of directors in May of last year, the Company is also planning to update its branding. Deferred maintenance on many of our Washington Federal signs, coupled with the need to replace the signage on acquired branches in New Mexico and Washington, make this a good time to introduce a fresh look to call attention to the Company at a time when we stand out from the competition in very positive ways. We plan to introduce our new image in the Spring of 2010 and look forward to your comments.

Looking ahead, the overall economy is showing signs of improvement, yet we expect the new fiscal year to burden us with many of the same challenges as the last. The housing market is still oversupplied and the unemployment rate continues to increase, meaning that credit costs will remain elevated. Consumers and businesses alike are still behaving defensively and continue to reduce their debt and increase their rainy day funds. This means that while deposits will remain relatively inexpensive, loan demand will be weak, limiting the prospect of industry-wide revenue growth. We also expect that interest rates may begin to rise later next year, resulting in pressure on spread income. We are already taking steps to be prepared for that possibility. Meanwhile, Congress is ramping up to pass new legislation that will make our business more complex and therefore more expensive to run. Also, large FDIC insurance premiums will clearly be required to replenish the insurance fund. It’s an irony of the business that those who do things right get to pay for those who fail. It hardly seems fair, but we are happy to be in the former camp rather than the latter.

On the other hand, for companies like Washington Federal with plenty of capital, the opportunities are truly immense. It is well known that there are numerous financial institutions operating within our market territory that are likely to fail, giving us the potential opportunity to work with the FDIC to remove risky assets from the system and, at the same time, earn a reasonable profit with limited risk on our part. Likewise, the condition of the industry puts the Company in a strong position to grow organically by acquiring customers from competitors one at a time as depositors seek safety, borrowers migrate to well-capitalized institutions that have the ability to lend, and both seek certainty in their banking relationship.

3

Table of Contents

TO OUR STOCKHOLDERS (CONTINUED)

(Back row - from left to right) Mark A. Schoonover, Executive Vice President and Chief Credit Officer, Linda S. Brower, Executive Vice President, Jack B. Jacobson, Executive Vice President, Rick J. Collette, Executive Vice President (Front row - from left to right) Brent J. Beardall, Executive Vice President and Chief Financial Officer, Roy M. Whitehead, Chairman, President and Chief Executive Officer, Edwin C. Hedlund, Executive Vice President and Secretary.

All in all, and with the qualifier that significant risks remain, we expect that the new fiscal year will result in at least modestly improving trends for the Company. We are among the strongest financial institutions in the country and as well positioned as any in the western U.S. to benefit from current market conditions. You can help by remembering to refer your friends, neighbors and acquaintances to Washington Federal for their banking needs. We will treat them as trusted and honored clients, not simply as targets for profit maximization. In other words, we’ll do what’s right for them even if it means we lose an opportunity to make an extra buck.

I’d like to extend special appreciation to our stockholders, who remained loyal and supportive through a very volatile period for the stock, our loyal employees who make a difference every day in the lives of our clients, and to the board of directors for their calm and sensible advice in very uneasy times. Thanks also go to the investors who entrusted us with new capital during the past year. We will do everything within our power to reward that trust and make your investment a profitable one.

The Annual Meeting of Stockholders is scheduled to take place at 2:00 pm, January 20, 2010, at the Sheraton Hotel in downtown Seattle. I look forward to seeing you there.

Sincerely,

Roy M. Whitehead

Chairman, President and Chief Executive Officer

4

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In addition to historical information, this Annual Report on Form 10-K includes certain “forward-looking statements,” as defined in the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, based on current management expectations. Actual results could differ materially from those management expects. Such forward-looking statements include statements regarding Washington Federal’s intentions, beliefs or current expectations as well as the assumptions on which such statements are based. Stockholders and potential stockholders are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause future results to vary from current management expectations include, but are not limited to: general economic conditions; legislative and regulatory changes; monetary fiscal policies of the federal government; changes in tax policies; rates and regulations of federal, state and local tax authorities; changes in interest rates; deposit flows; cost of funds; demand for loan products; demand for financial services; competition; changes in the quality or composition of the Company’s loan and investment portfolios; changes in accounting principles; policies or guidelines and other economic, competitive, governmental and technological factors affecting Washington Federal’s operations, markets, products services and fees. Washington Federal undertakes no obligation to update or revise any forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time.

| GENERAL |

Washington Federal, Inc. (Company or Washington Federal) is a unitary thrift holding company. The Company’s primary operating subsidiary is Washington Federal Savings, a federally-chartered savings and loan association. |

The Company’s fiscal year end is September 30th. All references to 2009, 2008 and 2007 represent balances as of September 30, 2009, September 30, 2008, and September 30, 2007, or activity for the fiscal years then ended.

On September 15, 2009, the Company issued additional common stock in a follow on offering for the first time since going public in 1982. Net proceeds received totaled $333,176,688 upon the issuance of 24,150,000 additional common shares. The proceeds will be used for general corporate purposes, which may include capital to support growth and acquisition opportunities.

| CRITICAL ACCOUNTING POLICIES |

Preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions that affect reported amounts of certain assets, liabilities, revenues and expenses in the Company’s consolidated financial statements. Accordingly, estimated amounts may fluctuate from one reporting period to another due to changes in assumptions underlying estimated values. |

The Company has determined that the only accounting policy deemed critical to an understanding of the consolidated financial statements of Washington Federal relates to the methodology for determining the valuation of the allowance for loan losses, as described below.

The Company maintains an allowance for loan losses to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company’s methodology for assessing the appropriateness of the allowance consists of several key elements, which include the general allowance and specific allowances.

The general loan loss allowance is established by applying a loss percentage factor to the different loan types. The allowance is provided based on Management’s continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, collateral values, geographic concentrations, seasoning of the loan portfolio, specific industry conditions and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company’s control, which may result in losses or recoveries differing from those provided.

Specific allowances are established for loans which are individually evaluated, in cases where Management has identified significant conditions or circumstances related to a loan that Management believes indicate the probability that a loss has been incurred.

5

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)

| INTEREST RATE RISK |

The Company accepts a high level of interest rate volatility as a result of its policy to originate fixed-rate single-family home loans that are longer-term than the short-term characteristics of its liabilities of customer accounts and borrowed money. The following table shows the estimated repricing periods for earning assets and paying liabilities. |

| Repricing Period | ||||||||||||||||

| Within One Year |

After 1 year - before 4 Years |

Thereafter | Total | |||||||||||||

| (In thousands) | ||||||||||||||||

| As of September 30, 2009 |

||||||||||||||||

| Earning Assets * |

$ | 2,929,902 | $ | 4,247,528 | $ | 4,753,808 | $ | 11,931,238 | ||||||||

| Paying Liabilities |

(7,068,190 | ) | (3,652,513 | ) | (1,137 | ) | (10,721,840 | ) | ||||||||

| Excess (Liabilities) Assets |

$ | (4,138,288 | ) | $ | 595,015 | $ | 4,752,671 | |||||||||

| Excess as % of Total Assets |

-32.9 | % | ||||||||||||||

| Policy limit for one year excess |

-60.0 | % | ||||||||||||||

| * | Asset repricing period includes estimated prepayments based on historical activity |

At September 30, 2009, the Company had approximately $4.1 billion more liabilities subject to repricing in the next year than assets, which amounted to a negative maturity gap of 33% of total assets. As of September 30, 2008, the amount of excess liabilities subject to repricing within one year was approximately $4.0 billion, or 34%, of total assets. The increase of approximately $150 million of liabilities in excess of assets repricing within one year was due to the continued growth of long term assets, primarily 30 year mortgage-backed securities, funded primarily through growth of short term customer deposits. Although the absolute dollar amount of the one year gap increased by approximately $150 million, the negative maturity gap percentage actually decreased by 1%, due to the growth in the balance sheet. By having an excess of liabilities repricing within one year over assets, the Company is subject to decreasing net interest income should interest rates rise. However, if the size and/or mix of the balance sheet changes, rising rates may not cause a decrease in net interest income. The Company’s interest rate risk approach has never resulted in the recording of a monthly operating loss, although there can be no assurance that this will always be the case.

The Company’s net interest spread increased from 2.85% at September 30, 2008 to 3.17% at September 30, 2009. Net interest spread represents the difference between the contractual rates of earning assets and the contractual rates of paying liabilities as of a specific date. The spread increased primarily because rates on customer accounts decreased by 129 basis points over the prior year while rates on earning assets decreased by 51 basis points (see Period End Spread table on page 11). This increase in spread was driven by falling short term market interest rates.

During 2009, the Company chose to grow earning assets by increasing the amount of cash and investments by $1,119,309,000. Offsetting this growth was the net decrease in loans outstanding of $518,190,000. This growth was primarily funded by growth in customer accounts of $672,771,000 and a net increase in equity of $412,811,000. Stockholders’ equity of $1,745,485,000 at September 30, 2009, provides management with flexibility in managing interest rate risk, by providing the ability to borrow additional funds or grow customer accounts and still maintain sufficient capital levels.

| ASSET QUALITY & ALLOWANCE FOR LOAN LOSSES |

The Company maintains an allowance to absorb losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Company’s methodology for assessing the appropriateness of the allowance consists of several key elements, which include the general allowance and specific allowances. |

The general portion of the loan loss allowance is established by applying a loss percentage factor to the different loan types. Management believes loan types are the most relevant factor to group loans for the allowance calculation as the risk characteristics in these groups are similar. The allowances are provided based on Management’s continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, geographic concentrations, seasoning of the loan portfolio, specific industry conditions, and the duration of the current business cycle. The recovery of the carrying value of loans is susceptible to future market conditions beyond the Company’s control, which may result in losses or recoveries differing from those provided.

During 2009, the Company enhanced its general reserve allowance calculation to be more reflective of the current economic environment. Changes included shortening the look-back period for determining historical loss factors “HLF” and modifying the methodology to give more weighting to risks by asset type rather than geographic exposure. In addition to utilizing the HLF to calculate the general reserve, we utilize a qualitative risk factor ”QRF”, which is determined by loan type and allows management to augment reserve levels to reflect the current environment and portfolio performance trends.

6

Table of Contents

By shortening the look-back period the Company has taken into account the current housing environment where home values have declined substantially from the housing peak of 2007. We monitor delinquency trends as well as regional economic conditions including employment and housing values when determining the QRF.

Washington Federal did not originate many of the “high risk” loan types, such as Option ARM or interest only long-term loans, that have caused significant losses throughout the industry.

Specific allowances are established for loans which are individually evaluated, in cases where Management has identified significant conditions or circumstances related to a loan that Management believes indicate the probability that a loss has been incurred.

Loans for commercial purposes, including multi-family loans, builder construction loans and commercial loans are reviewed on an individual basis to assess the ability of the borrowers to continue to service all of their principal and interest obligations. If a loan shows signs of weakness, it is downgraded and, if warranted, placed on non-accrual status. Updated valuations are generally obtained from external sources on collateral dependent commercial loans when a loan exhibits weakness or is modified. The Company has an asset quality review function that reports the results of its internal reviews to the Board of Directors on a quarterly basis.

Non-performing assets were $557,120,000, or 4.43%, of total assets, at September 30, 2009, compared to $164,191,000, or 1.39%, of total assets, at September 30, 2008. This significant increase in non-performing assets is a result of the significant decline in housing values in the western United States and the national recession that occurred during 2009. Total delinquencies over 30 days were $456,318,000, or 5.08%, of net loans at

September 30, 2009, compared to $236,848,000, or 2.49%, of net loans at September 30, 2008.

The following table details non-performing asset by type, comparing 2009 and 2008.

| September 30, | |||||||||||||

| Non-Performing Assets | 2009 | 2008 | $ Change | % Change | |||||||||

| (In thousands) | |||||||||||||

| Non-accrual loans: |

|||||||||||||

| Single-family residential |

$ | 116,268 | $ | 38,017 | $ | 78,251 | 206 | % | |||||

| Construction – speculative |

50,348 | 33,003 | 17,345 | 53 | % | ||||||||

| Construction – custom |

— | 1,315 | (1,315 | ) | — | ||||||||

| Land – acquisition & development |

187,061 | 51,562 | 135,499 | 263 | % | ||||||||

| Land – consumer lot loans |

— | — | — | — | |||||||||

| Multi-Family |

4,368 | 748 | 3,620 | 484 | % | ||||||||

| Commercial real estate |

2,733 | 1,929 | 804 | 42 | % | ||||||||

| Commercial & industrial |

18,823 | — | 18,823 | NA | |||||||||

| HELOC |

— | — | — | — | |||||||||

| Consumer |

656 | 535 | 121 | — | |||||||||

| Total non-accrual loans |

380,257 | 127,109 | 253,148 | 199 | % | ||||||||

| Total REO & REHI |

176,863 | 37,082 | 139,781 | 377 | % | ||||||||

| Total non-performing assets |

$ | 557,120 | $ | 164,191 | $ | 392,929 | 239 | % | |||||

The significant increase in overall non-performing assets is the result of declining home values, rising unemployment and deteriorating economic conditions in the Company’s eight state market territory.

Speculative construction loans and land acquisition and development loans are the weakest performing segments of the portfolio. The amount of non-performing assets in those categories increased considerably due to lower new home sales and construction starts during the year.

In response to the deteriorating credit quality of our loan portfolio, the allowance for loan loss increased by $81,778,000 or 95% over 2008. $59,461,000 of the allowance is calculated under the formulas contained in our methodology and the remaining $107,375,000 is made up of specific reserves on loans that were deemed to be impaired at September 30, 2009.

| LIQUIDITY AND CAPITAL RESOURCES |

The principal sources of funds for the Company’s activities are retained earnings, loan repayments (including prepayments), net deposit inflows, repayments and sales of investments and borrowings. Washington Federal’s principal sources of revenue are interest on loans and interest and dividends on investments. |

The Company’s net worth at September 30, 2009, was $1,745,485,000, or 13.9%, of total assets. This is an increase of $412,811,000 from September 30, 2008, when net worth was $1,332,674,000, or 11.3%, of total assets. The Company’s net worth increased due in part to the issuance of additional common stock which resulted in net proceeds of $333,177,000, an increase in accumulated other comprehensive income of $51,959,000 resulting from

7

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)

| an increase in the value of our investment portfolio, net income before accrual of preferred dividends of $48,172,000, proceeds from the issuance of preferred stock and warrants of $200,000,000 and purchases by the Employee Stock Ownership Plan of $1,341,000. Net worth was reduced by the preferred stock redemption of $200,000,000, as well as cash dividends paid of $18,847,000 and $5,361,000 on common stock and preferred stock, respectively. The Company paid out 43% of its 2009 earnings in cash dividends to common shareholders, compared with 118% last year. Over the long term, the Company would prefer its dividend payout ratio to be less than 50%. |

On November 14, 2008, the Company entered into a Letter Agreement (“Agreement”) with the United States Department of the Treasury (“Treasury”) to participate in the Troubled Asset Relief Program Capital Purchase Program (“CPP”). Pursuant to the Agreement, the Company issued and sold to the Treasury (i) 200,000 shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock (“Preferred Stock”), and (ii) a warrant to purchase 1,707,456 shares of the Company’s common stock, par value $1.00 per share, for an aggregate purchase price for both the preferred stock and warrants of $200 million in cash. The Preferred Stock qualified as Tier 1 capital and paid cumulative dividends at a rate of 5% per annum for the first five years, and 9% per annum thereafter. On May 27, 2009, the Company repurchased the $200 million of Preferred Stock, resulting in a charge of $2.0 million to net income available to common shareholders. The Company has decided not to repurchase the 1.7 million warrants issued in conjunction with the preferred stock at this time.

Washington Federal Saving’s percentage of net worth to total assets is over two times the minimum required under Office of Thrift Supervision (OTS) regulations (see Note M). Management believes this strong net worth position will help the Company manage its interest rate risk and will enable it to compete more effectively.

Customer accounts increased $672,771,000, or 9.4%, from one year ago. Management’s strategy has been to remain competitive in deposit pricing to attract new deposit relationships necessary to fund asset growth. Deposit growth benefited from the disruption in the market place caused by the failure or distressed acquisition of several competitors.

The Company has a credit line with the FHLB Seattle equal to 50% of total assets, providing a substantial source of liquidity if needed. FHLB advances are collateralized as provided for in the Advances, Pledge and Security Agreement by all FHLB stock owned by the Company, deposits with the FHLB and certain mortgages or deeds of trust securing such properties as provided in the agreements with the FHLB.

The Company’s cash and cash equivalents amounted to $498,388,000 at September 30, 2009, a 503.4% increase from the cash and cash equivalents balance of $82,600,000 one year ago. The primary factor in the increased cash balance was the equity offering which resulted in net proceeds of $333,177,000 which were received by the Company on September 21, 2009, only 9 days prior to the balance sheet date. Additionally, see “Interest Rate Risk” above and the “Statement of Cash Flows” included in the financial statements.

| CHANGES IN FINANCIAL POSITION |

Available-for-sale and held-to-maturity securities. The Company purchased $1,175,321,000 of securities during 2009, all of which have been classified as available-for-sale. |

The Company sold $18,453,000 of available-for-sale securities in the current year. As of September 30, 2009, the Company had net unrealized gains in its available-for-sale portfolio of $86,057,000, as compared to net unrealized gains of $3,907,000 as of September 30, 2008. The increase in net unrealized gains was primarily a result of the increase in value of long term fixed rate assets as long term market interest rates have decreased.

Loans receivable. Loans receivable decreased $518,190,000, or 5.5%, to $8,983,430,000 at September 30, 2009, from $9,501,620,000 one year earlier. The decrease resulted primarily from loan repayments (including prepayments) of $2,116,355,000, which exceeded originations by $275,895,000. The Company’s decision not to originate and hold in its loan portfolio 30 year fixed-rate loans at rates below 5.00%, due to the duration risk associated with such low mortgage rates, contributed to the net run off of the loan portfolio. Additionally, during the year, $254,742,000 of loans were transferred to real estate owned as foreclosures. The following table shows the change in the geographic distribution by state of the gross loan portfolio from 2008 to 2009.

| 2009 | 2008 | |||||

| Washington |

43.9 | % | 43.7 | % | ||

| Oregon |

17.0 | % | 16.6 | % | ||

| Idaho |

7.3 | % | 8.2 | % | ||

| Arizona |

8.5 | % | 8.2 | % | ||

| Utah |

7.8 | % | 7.8 | % | ||

| New Mexico |

4.1 | % | 4.0 | % | ||

| Texas |

1.7 | % | 1.1 | % | ||

| Nevada |

1.7 | % | 1.4 | % | ||

| Other |

8.0 | % | 9.0 | % | ||

| 100.0 | % | 100.0 | % | |||

8

Table of Contents

Real estate held for sale. The balance of real estate held for sale at September 30, 2009 was $176,863,000, an increase of $139,756,000 from one year ago. This significant increase is a result of the foreclosure of non-performing loans as discussed in the “Asset Quality” section above.

Intangible assets. The Company’s intangible assets are made up of $251,653,000 of goodwill, servicing rights intangible of $2,469,000, as well as the unamortized balances of the core deposit intangible of $2,675,000 at September 30, 2009.

Customer accounts. Customer accounts at September 30, 2009 totaled $7,842,310,000 compared with $7,169,539,000 at September 30, 2008, a 9.4% increase. See “Liquidity and Capital Resources” above.

FHLB advances and other borrowings. Total borrowings decreased $296,378,000, or 9.3%, to $2,879,530,000 at September 30, 2009 as the Company chose to fund asset growth with a mix of customer accounts and stockholders’ equity. See “Interest Rate Risk” above.

Contractual obligations. The following table presents, as of September 30, 2009, the Company’s significant fixed and determinable contractual obligations, within the categories described below, by payment date or contractual maturity.

| Contractual Obligations | Total | Less than 1 Year |

1 to 5 Years |

Over 5 Years | ||||||||

| (In thousands) | ||||||||||||

| Debt obligations* |

$ | 2,879,530 | $ | 600 | $ | 528,930 | $ | 2,350,000 | ||||

| Operating lease obligations |

8,713 | 2,610 | 4,632 | 1,471 | ||||||||

| $ | 2,888,243 | $ | 3,210 | $ | 533,562 | $ | 2,351,471 | |||||

| * | Represents final maturities of debt obligations. See a description in Notes H and I. |

These contractual obligations, except for the operating leases, are included in the Consolidated Statements of Financial Condition. The payment amounts represent those amounts contractually due.

| RESULTS OF OPERATIONS |

GENERAL |

See Note P, “Selected Quarterly Financial Data (Unaudited),” which highlights the quarter-by-quarter results for the years ended September 30, 2009 and 2008.

Net income mentioned below refers to net income available to common shareholders, which consists of net income less dividends accrued on the preferred stock that was repaid in full in May 2009. See Liquidity and Capital Resources above for a full discussion of the preferred stock transaction.

COMPARISON OF 2009 RESULTS WITH 2008

In 2009 net income decreased $21,648,000, or 34.7% from 2008, primarily as a result of an $193,000,000 provision for loan losses which resulted from the significant decline in asset quality and higher net charge offs. In addition, the other expenses increased $19,840,000 in 2009 over the prior year, due primarily to increased FDIC insurance costs of $9,896,000, which resulted from the significant increase in bank failures during the year that necessitated replenishment of the deposit insurance fund.

In comparing operating results of 2009 versus 2008 it is important to understand that 2009 had 12 months of operating results, both income and expense, from the First Mutual acquisition; 2008 had only 8 months of operating results from the First Mutual acquisition.

Interest income on loans and mortgage-backed securities increased only $427,000, or 0.1%, in 2009 due to a 7.7% increase in the average outstanding balance of loans and mortgage-backed securities, offset by a 46 basis point decrease in the weighted average yield during the year from 6.51% in 2008 to 6.04% in 2009.

Interest and dividend income on investment securities and cash equivalents decreased $10,081,000, or 76.8%, in 2009 from 2008. This decrease was primarily due to a decrease in the weighted average rate earned on investment securities, cash equivalents and FHLB stock, which decreased 284 basis points to 0.85%. The Company’s required investment in FHLB stock, which amounted to $144,495,000 as of 2009, produced a yield of only 0.28% during the year.

Interest expense on customer accounts decreased 26.3% to $191,435,000 for 2009 from $259,769,000 for 2008. The decrease primarily related to a 131 basis point decrease in the average cost of customer accounts to 2.56% during the year compared to 3.87% one year ago, offset by a 11.5% increase in the average balance of customer accounts over the prior year. Interest expense on FHLB advances and other borrowings decreased to $127,192,000 in 2009 from $137,872,000 in 2008 due to a decrease in the average cost of borrowings for the year ended September 30, 2009 to 3.93% from 4.41% for the same period one year ago. Partially offsetting the decrease in average cost of borrowings was an increase in the average balance of borrowings to $3,235,231,000 during 2009 from $3,122,950,000 during 2008.

9

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)

The Company recorded a $193,000,000 provision for loan losses in 2009 compared to $60,516,000 in 2008. The current year provision is due to the significant increase in the Company’s non-performing asset balances. Non-performing assets increased by $392,929,000 over 2008. Non-accrual loans as a percentage of total loans increased from 1.34% in 2008 to 4.23% in 2009. Economic conditions deteriorated in the primary markets served by the Company, as evidenced by an increase in unemployment, a reduction in the number of home sales and weak consumer confidence. Total delinquencies over 30 days were $456,318,000, or 4.97% of net loans at September 30, 2009 compared to $236,848,000, or 2.49% of net loans at September 30, 2008. Actual net charge-offs during 2009 were $111,222,000. Management believes the allowance for loan losses, totaling $166,836,000, is sufficient to absorb estimated losses inherent in the portfolio.

Total other income increased $78,200,000, or 132.1%, in 2009 from 2008. The increase in 2009 was driven primarily by the other than temporary impairment (“OTTI”) charge of $87,747,000 in the prior year. Additionally in 2008, the Company reported $13,123,000 of gain on the sale of real estate.

Compensation expense increased $4,265,000, or 8.1%, in 2009 primarily due to full year of operations combined with First Mutual. Personnel, including part-time employees considered on a full-time equivalent basis, increased to 1,105 at September 30, 2009 compared to 1,095 one year ago.

Occupancy expense increased $1,836,000, or 16.4%, during the year primarily due to the 12 additional branches acquired in the First Mutual transaction. The branch network increased to 150 offices at September 30, 2009 versus 148 offices one year ago.

FDIC insurance expense increased to $9,896,000 for 2009 from $792,000 in 2008 as a result of the significant increase in bank failures during the year which has depleted the FDIC fund. The FDIC has undertaken to replenish the FDIC fund through special assessments are higher insurance premiums for all insured depository institutions. Other expenses increased $2,160,000 during the year primarily related to the operating costs added from First Mutual and increased information technology spending. Operating expense for 2009 and 2008 equaled .87% and .77% of average assets, respectively. Despite the increase in operating expenses, the Company continues to operate as one of the most efficient financial institutions in the country.

The loss on real estate acquired through foreclosure increased from $1,021,000 in 2008 to $16,354,000 in 2009 due to the growth in balances of real estate acquired through foreclosure and the resulting loss on sale of some of those properties stemming from continued declines in real estate values in the western United States.

Income tax expense decreased $5,937,000, or 17.7%, in 2009 due to a lower taxable income base. Additionally, 2009 included $1,500,000 of additional tax related to a tax liability arising from the First Mutual acquisition (see Note A). The effective tax rate was 36.40% for 2009 versus 34.96% for 2008.

COMPARISON OF 2008 RESULTS WITH 2007

In 2008 net income decreased $72,685,000, or 53.8% from 2007, primarily as a result of an $87,747,000 pretax OTTI charge recognized in September 2008 on FHLMC and FNMA preferred stock. The value of these securities declined significantly after the U.S. Government placed both companies into conservatorship in September 2008. See related discussion in the “Changes in Financial Position” section above. In addition, the provision for loan losses increased $58,966,000 in 2008 over the prior year, due to the decline in asset quality and higher net charge offs.

In comparing operating results of 2008 versus 2007 it is important to understand that 2007 had 8 months of operating results, both income and expense, from the First Federal acquisition. 2008 had a full 12 months of operating results from the First Federal acquisition and 8 months from the First Mutual acquisition.

Interest income on loans and mortgage-backed securities increased $85,902,000, or 14.3%, in 2008 due to a 17.7% increase in the average outstanding balance of loans and mortgage-backed securities, offset by a 19 basis point decrease in the weighted average yield during the year from 6.70% in 2007 to 6.51% in 2008.

Interest and dividend income on investment securities and cash equivalents decreased $3,156,000, or 19.4%, in 2008 from 2007. This decrease was primarily due to a decrease in the average combined balance of investment securities, cash equivalents and FHLB stock, which decreased 10.2% to $355,440,000 for the year ended September 30, 2008 versus $396,008,000 for the year ended September 30, 2007. In addition to the decrease in balance, the weighted average yield on investment securities, cash equivalents and FHLB stock decreased from 4.11% in 2007 to 3.69% in 2008. The Company’s required investment in FHLB stock, which amounted to $144,874,000 as of 2008, produced a yield of only 1.22% during the year.

Interest expense on customer accounts increased 6.5% to $259,769,000 for 2008 from $243,837,000 for 2007. The increase primarily related to a 17.4% increase in the average balance of customer accounts over the prior year, offset by a 39 basis point decrease in the average cost of customer accounts to 3.87% during the year compared to 4.26% one year ago. Interest expense on FHLB advances and other borrowings increased to $137,872,000 in 2008 from $114,664,000 in 2007 due to an increase in the average balance of borrowings to $3,122,950,000 during 2008 from $2,497,555,000 during 2007. Offsetting the increase in average balance, the average cost of borrowings for the year ended September 30, 2008 decreased to 4.41% from 4.59% for the same period one year ago.

10

Table of Contents

The Company recorded a $60,516,000 provision for loan losses in 2008 compared to $1,550,000 in 2007. The 2008 provision was due to the 16.0% growth in loans receivable over the prior year and the significant increase in the Company’s non-performing asset balances. Non-performing assets increased by $148,260,000 over 2007. Non-accrual loans as a percentage of total loans increased from .18% in 2007 to 1.34% in 2008. Economic conditions deteriorated in the primary markets served by the Company, as evidenced by an increase in unemployment, a reduction in the number of home sales and weak consumer confidence. Total delinquencies over 30 days were $236,848,000, or 2.49% of net loans at September 30, 2008 compared to $48,405,000, or .59% of net loans at September 30, 2007. Actual net charge-offs during 2008 were $15,193,000. Management believes the allowance for loan losses, totaling $85,058,000, is sufficient to absorb estimated losses inherent in the portfolio.

Total other income decreased $74,432,000, or 488.4%, in 2008 from 2007. The decrease in 2008 was driven primarily by the OTTI charge of $87,747,000 discussed in the “Changes in Financial Position” section above. Partially offsetting the OTTI charge was $13,123,000 of gain on the sale of real estate.

Compensation expense increased $9,266,000, or 21.3%, in 2008 primarily due to the addition of approximately 169 staff members in February 2008 from the First Mutual transaction and annual performance increases for existing staff. Personnel, including part-time employees considered on a full-time equivalent basis, increased to 1,095 at September 30, 2008 compared to 886 one year ago.

Occupancy expense increased $2,493,000, or 28.6%, during the year primarily due to the 12 additional branches acquired in the First Mutual transaction. The branch network increased to 148 offices at September 30, 2008 versus 135 offices one year ago.

Amortization expense increased to $2,441,000 for 2008 from $1,819,000 in 2007 as a result of the acquisition. Other expenses increased $8,859,000 during the year primarily related to the operating costs added from First Mutual and First Federal and increased information technology spending. Operating expense for 2008 and 2007 equaled .77% and .67% of average assets, respectively. Despite the increase in operating expenses, the Company continues to operate as one of the most efficient financial institutions in the country.

Income tax expense decreased $40,788,000 or 54.9%, in 2008 due to a lower taxable income base. The effective tax rate was 34.96% for 2008 versus 35.49% for 2007.

PERIOD END SPREAD – AS OF THE DATE SHOWN

| Dec 31 2007 |

Mar 31 2008 |

Jun 30 2008 |

Sep 30 2008 |

Dec 31 2008 |

Mar 31 2009 |

Jun 30 2009 |

Sep 30 2009 |

|||||||||||||||||

| Interest rate on loans and mortgage-backed securities |

6.49 | % | 6.41 | % | 6.35 | % | 6.33 | % | 6.22 | % | 6.17 | % | 6.12 | % | 6.04 | % | ||||||||

| Interest rate on investment securities* |

4.63 | 4.28 | 4.35 | 2.78 | 1.22 | 1.68 | 0.69 | 0.45 | ||||||||||||||||

| Combined |

6.42 | 6.35 | 6.30 | 6.26 | 6.11 | 6.09 | 5.99 | 5.75 | ||||||||||||||||

| Interest rate on customer accounts |

4.33 | 3.91 | 3.52 | 3.25 | 2.99 | 2.54 | 2.14 | 1.96 | ||||||||||||||||

| Interest rate on borrowings |

4.47 | 4.37 | 3.83 | 3.77 | 3.64 | 4.08 | 4.25 | 4.25 | ||||||||||||||||

| Combined |

4.38 | 4.05 | 3.61 | 3.41 | 3.20 | 2.98 | 2.72 | 2.58 | ||||||||||||||||

| Interest rate spread |

2.04 | % | 2.30 | % | 2.69 | % | 2.85 | % | 2.91 | % | 3.11 | % | 3.27 | % | 3.17 | % | ||||||||

| * | Includes municipal bonds at tax-equivalent rates and cash equivalents |

The interest rate spread increased during 2009 from 2.85% at September 30, 2008 to 3.17% at September 30, 2009. See “Interest Rate Risk” on page 5.

11

Table of Contents

| Year ended September 30, | 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||

| (In thousands, except per share data) | |||||||||||||||||

| Interest income |

$ | 691,774 | $ | 701,428 | $ | 618,682 | $ | 529,883 | $ | 461,901 | |||||||

| Interest expense |

318,627 | 397,641 | 358,501 | 273,361 | 195,260 | ||||||||||||

| Net interest income |

373,147 | 303,787 | 260,181 | 256,522 | 266,641 | ||||||||||||

| Provision for (reversal of) loan losses |

193,000 | 60,516 | 1,550 | 535 | (134 | ) | |||||||||||

| Other income |

2,655 | (60,212 | ) | 15,569 | 16,252 | 7,852 | |||||||||||

| Other expense |

107,060 | 87,220 | 64,888 | 53,579 | 52,319 | ||||||||||||

| Income before income taxes |

75,742 | 95,839 | 209,312 | 218,660 | 222,308 | ||||||||||||

| Income taxes |

27,570 | 33,507 | 74,295 | 75,558 | 76,419 | ||||||||||||

| Net income |

48,172 | 62,332 | 135,017 | 143,102 | 145,889 | ||||||||||||

| Preferred dividends accrued |

7,488 | — | — | — | — | ||||||||||||

| Net income available to common shareholders |

$ | 40,684 | $ | 62,332 | $ | 135,017 | $ | 143,102 | $ | 145,889 | |||||||

| Per share data |

|||||||||||||||||

| Basic earnings |

$ | 0.46 | $ | 0.71 | $ | 1.55 | $ | 1.64 | $ | 1.68 | |||||||

| Diluted earnings |

0.46 | 0.71 | 1.54 | 1.64 | 1.67 | ||||||||||||

| Cash dividends |

0.20 | 0.84 | 0.83 | 0.81 | 0.78 | ||||||||||||

| September 30, | 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||

| (In thousands) | |||||||||||||||||

| Total assets |

$ | 12,582,475 | $ | 11,830,141 | $ | 10,285,417 | $ | 9,069,020 | $ | 8,234,450 | |||||||

| Loans and mortgage-backed securities |

11,266,295 | 11,053,223 | 9,601,947 | 8,457,759 | 7,084,274 | ||||||||||||

| Investment securities |

21,259 | 49,001 | 240,391 | 256,650 | 214,993 | ||||||||||||

| Cash and cash equivalents |

498,388 | 82,600 | 61,378 | 45,722 | 637,791 | ||||||||||||

| Customer accounts |

7,842,310 | 7,169,539 | 5,996,785 | 5,311,726 | 5,031,505 | ||||||||||||

| FHLB advances |

2,078,930 | 1,998,308 | 1,760,979 | 1,500,000 | 1,230,000 | ||||||||||||

| Other borrowings |

800,600 | 1,177,600 | 1,075,000 | 870,000 | 655,000 | ||||||||||||

| Stockholders’ equity |

1,745,485 | 1,332,674 | 1,318,127 | 1,262,720 | 1,187,308 | ||||||||||||

| Number of |

|||||||||||||||||

| Customer accounts |

305,129 | 298,926 | 281,778 | 249,533 | 232,707 | ||||||||||||

| Mortgage loans |

44,453 | 47,331 | 44,713 | 36,955 | 38,014 | ||||||||||||

| Offices |

150 | 148 | 135 | 123 | 122 | ||||||||||||

12

Table of Contents

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

| September 30, | 2009 | 2008 | ||||||

| (In thousands, except share data) |

||||||||

| ASSETS |

||||||||

| Cash and cash equivalents |

$ | 498,388 | $ | 82,600 | ||||

| Available-for-sale securities, including encumbered securities of $860,655 and $762,857 |

2,201,083 | 1,476,067 | ||||||

| Held-to-maturity securities, including encumbered securities of $80,717 and $98,917 |

103,042 | 124,537 | ||||||

| Loans receivable, net |

8,983,430 | 9,501,620 | ||||||

| Interest receivable |

53,288 | 54,365 | ||||||

| Premises and equipment, net |

133,477 | 133,357 | ||||||

| Real estate held for sale |

176,863 | 37,107 | ||||||

| FHLB stock |

144,495 | 144,874 | ||||||

| Intangible assets, including goodwill of $251,653 |

256,797 | 260,158 | ||||||

| Other assets |

31,612 | 15,456 | ||||||

| $ | 12,582,475 | $ | 11,830,141 | |||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Liabilities |

||||||||

| Customer accounts |

||||||||

| Savings and demand accounts |

$ | 7,786,467 | $ | 7,146,045 | ||||

| Repurchase agreements with customers |

55,843 | 23,494 | ||||||

| 7,842,310 | 7,169,539 | |||||||

| FHLB advances |

2,078,930 | 1,998,308 | ||||||

| Other borrowings, primarily securities sold under agreements to repurchase |

800,600 | 1,177,600 | ||||||

| Advance payments by borrowers for taxes and insurance |

38,376 | 37,206 | ||||||

| Federal and state income taxes, including net deferred liabilities of $449 and assets of $1,236 |

18,075 | 33,716 | ||||||

| Accrued expenses and other liabilities |

58,699 | 81,098 | ||||||

| 10,836,990 | 10,497,467 | |||||||

| Stockholders’ equity |

||||||||

| Common stock, $1.00 par value, 300,000,000 shares authorized, 129,320,072 and 105,092,724 shares issued; 112,247,748 and 87,916,286 shares outstanding |

129,320 | 105,093 | ||||||

| Paid-in capital |

1,574,555 | 1,261,032 | ||||||

| Accumulated other comprehensive income, net of tax |

54,431 | 2,472 | ||||||

| Treasury stock, at cost; 17,072,324 and 17,176,438 shares |

(208,985 | ) | (210,250 | ) | ||||

| Retained earnings |

196,164 | 174,327 | ||||||

| 1,745,485 | 1,332,674 | |||||||

| $ | 12,582,475 | $ | 11,830,141 | |||||

| SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

13 |

Table of Contents

CONSOLIDATED STATEMENTS OF OPERATIONS

| Year ended September 30, | 2009 | 2008 | 2007 | |||||||||

| (In thousands, except per share data) | ||||||||||||

| INTEREST INCOME |

||||||||||||

| Loans |

$ | 579,244 | $ | 599,878 | $ | 526,923 | ||||||

| Mortgage-backed securities |

109,486 | 88,425 | 75,478 | |||||||||

| Investment securities |

3,044 | 13,125 | 16,281 | |||||||||

| 691,774 | 701,428 | 618,682 | ||||||||||

| INTEREST EXPENSE |

||||||||||||

| Customer accounts |

191,435 | 259,769 | 243,837 | |||||||||

| FHLB advances and other borrowings |

127,192 | 137,872 | 114,664 | |||||||||

| 318,627 | 397,641 | 358,501 | ||||||||||

| Net interest income |

373,147 | 303,787 | 260,181 | |||||||||

| Provision for loan losses |

193,000 | 60,516 | 1,550 | |||||||||

| Net interest income after provision for loan losses |

180,147 | 243,271 | 258,631 | |||||||||

| OTHER INCOME (LOSS) |

||||||||||||

| Other than temporary impairment charge |

— | (87,747 | ) | — | ||||||||

| Gain on sale of real estate held for sale |

— | 13,123 | — | |||||||||

| Other |

19,009 | 15,433 | 15,241 | |||||||||

| 19,009 | (59,191 | ) | 15,241 | |||||||||

| OTHER EXPENSE |

||||||||||||

| Compensation and fringe benefits |

57,097 | 52,832 | 43,566 | |||||||||

| Amortization of intangibles |

3,331 | 2,441 | 1,819 | |||||||||

| Occupancy expense |

13,049 | 11,213 | 8,720 | |||||||||

| FDIC insurance |

10,688 | 792 | 668 | |||||||||

| Other |

25,105 | 22,945 | 14,210 | |||||||||

| Deferred loan origination costs |

(2,210 | ) | (3,003 | ) | (4,095 | ) | ||||||

| 107,060 | 87,220 | 64,888 | ||||||||||

| Gain (loss) on real estate acquired through foreclosure, net |

(16,354 | ) | (1,021 | ) | 328 | |||||||

| Income before income taxes |

75,742 | 95,839 | 209,312 | |||||||||

| Income taxes |

||||||||||||

| Current |

56,075 | 81,158 | 74,464 | |||||||||

| Deferred |

(28,505 | ) | (47,651 | ) | (169 | ) | ||||||

| 27,570 | 33,507 | 74,295 | ||||||||||

| Net income |

48,172 | 62,332 | 135,017 | |||||||||

| Preferred dividends accrued |

7,488 | — | — | |||||||||

| NET INCOME available to common shareholders |

$ | 40,684 | $ | 62,332 | $ | 135,017 | ||||||

| PER SHARE DATA |

||||||||||||

| Basic earnings per share |

$ | 0.46 | $ | 0.71 | $ | 1.55 | ||||||

| Diluted earnings per share |

0.46 | 0.71 | 1.54 | |||||||||

| Cash dividends |

0.20 | 0.84 | 0.83 | |||||||||

| Basic weighted average number of shares outstanding |

88,689,553 | 87,675,978 | 87,357,444 | |||||||||

| Diluted weighted average number of shares outstanding, including dilutive stock options |

88,711,694 | 87,818,580 | 87,696,225 | |||||||||

|

14 |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Table of Contents

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

| Common Stock |

Preferred Stock |

Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Income (loss) |

Treasury Stock |

Total | ||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||

| Balance at September 30, 2006 |

$ | 104,467 | $ | — | $ | 1,246,025 | $ | 123,133 | $ | (5,975 | ) | $ | (204,930 | ) | $ | 1,262,720 | ||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||

| Net Income |

135,017 | 135,017 | ||||||||||||||||||||||||

| Other comprehensive income, |

||||||||||||||||||||||||||

| Unrealized losses on securities |

(7,058 | ) | (7,058 | ) | ||||||||||||||||||||||

| Reclassification adjustment |

— | — | ||||||||||||||||||||||||

| Total comprehensive income |

127,959 | |||||||||||||||||||||||||

| Dividends on common stock |

(72,467 | ) | (72,467 | ) | ||||||||||||||||||||||

| Compensation expense related to |

1,095 | 1,095 | ||||||||||||||||||||||||

| Proceeds from exercise of |

389 | 5,174 | 5,563 | |||||||||||||||||||||||

| Tax benefit related to |

1,189 | 1,189 | ||||||||||||||||||||||||

| Restricted stock |

65 | 234 | — | 299 | ||||||||||||||||||||||

| Proceeds from Employee |

773 | 844 | 1,617 | |||||||||||||||||||||||

| Treasury stock |

(9,848 | ) | (9,848 | ) | ||||||||||||||||||||||

| Balance at September 30, 2007 |

$ | 104,921 | $ | — | $ | 1,254,490 | $ | 185,683 | $ | (13,033 | ) | $ | (213,934 | ) | $ | 1,318,127 | ||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||

| Net income |

62,332 | 62,332 | ||||||||||||||||||||||||

| Other comprehensive income, |

||||||||||||||||||||||||||

| Unrealized gains on securities |

72,540 | 72,540 | ||||||||||||||||||||||||

| Reclassification adjustment |

(57,035 | ) | (57,035 | ) | ||||||||||||||||||||||

| Total comprehensive income |

77,837 | |||||||||||||||||||||||||

| Dividends on common stock |

(73,688 | ) | (73,688 | ) | ||||||||||||||||||||||

| Compensation expense related to |

1,286 | 1,286 | ||||||||||||||||||||||||

| Proceeds from exercise of |

146 | 2,052 | 2,198 | |||||||||||||||||||||||

| Tax benefit related to |

348 | 348 | ||||||||||||||||||||||||

| Restricted stock |

26 | 769 | — | 795 | ||||||||||||||||||||||

| Proceeds from Employee |

2,087 | 3,684 | 5,771 | |||||||||||||||||||||||

| Treasury stock |

— | — | ||||||||||||||||||||||||

| Balance at September 30, 2008 |

$ | 105,093 | $ | — | $ | 1,261,032 | $ | 174,327 | $ | 2,472 | $ | (210,250 | ) | $ | 1,332,674 | |||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||

| Net income |

48,172 | 48,172 | ||||||||||||||||||||||||

| Other comprehensive income, |

||||||||||||||||||||||||||

| Unrealized gains on securities |

51,273 | 51,273 | ||||||||||||||||||||||||

| Reclassification adjustment |

686 | 686 | ||||||||||||||||||||||||

| Total comprehensive income |

100,131 | |||||||||||||||||||||||||

| Preferred stock issuance |

197,873 | 197,873 | ||||||||||||||||||||||||

| Preferred stock discount and accretion |

2,127 | (2,127 | ) | — | ||||||||||||||||||||||

| Dividends on common stock |

(18,847 | ) | (18,847 | ) | ||||||||||||||||||||||

| Dividends on preferred stock |

(5,361 | ) | (5,361 | ) | ||||||||||||||||||||||

| Preferred stock redemption |

(200,000 | ) | (200,000 | ) | ||||||||||||||||||||||

| Compensation expense related to |

1,327 | 1,327 | ||||||||||||||||||||||||

| Proceeds from exercise of |

13 | 145 | 158 | |||||||||||||||||||||||

| Proceeds from issuance |

24,150 | 309,027 | 333,177 | |||||||||||||||||||||||

| Tax benefit related to |

22 | 22 | ||||||||||||||||||||||||

| Restricted stock |

64 | 799 | — | 863 | ||||||||||||||||||||||

| Issuance of Warrants |

2,127 | 2,127 | ||||||||||||||||||||||||

| Proceeds from Employee |

76 | 1,265 | 1,341 | |||||||||||||||||||||||

| Treasury stock |

— | — | ||||||||||||||||||||||||

| Balance at September 30, 2009 |

$ | 129,320 | $ | — | $ | 1,574,555 | $ | 196,164 | $ | 54,431 | $ | (208,985 | ) | $ | 1,745,485 | |||||||||||

| SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

15 |

Table of Contents

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Year ended September 30, | 2009 | 2008 | 2007 | |||||||||

| (In thousands) | ||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||||||

| Net income |

$ | 48,172 | $ | 62,332 | $ | 135,017 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities |

||||||||||||

| Amortization (accretion) of fees, discounts, premiums and intangible assets, net |

4,813 | 2,951 | 776 | |||||||||

| Depreciation |

5,153 | 4,281 | 3,296 | |||||||||

| Stock option compensation expense |

1,327 | 1,286 | 1,095 | |||||||||

| Provision for loan losses |

193,000 | 60,516 | 1,550 | |||||||||

| Loss (gain) on investment securities and real estate held for sale, net |

15,101 | (12,655 | ) | (339 | ) | |||||||

| Other than temporary impairment |

— | 87,747 | — | |||||||||

| Decrease (increase) in accrued interest receivable |

1,077 | 185 | (5,320 | ) | ||||||||

| Increase (decrease) in income taxes payable |

(45,831 | ) | (48,910 | ) | 1,878 | |||||||

| FHLB stock dividends |

(15 | ) | (103 | ) | (178 | ) | ||||||

| Decrease (increase) in other assets |

(16,156 | ) | (586 | ) | 2,541 | |||||||

| Increase (decrease) in accrued expenses and other liabilities |

(22,399 | ) | 5,186 | 2,490 | ||||||||

| Net cash provided by operating activities |

184,242 | 162,230 | 142,806 | |||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES |

||||||||||||

| Loans originated |

||||||||||||

| Single-family residential |

(855,213 | ) | (857,334 | ) | (827,270 | ) | ||||||

| Construction – speculative |

(102,630 | ) | (218,145 | ) | (518,024 | ) | ||||||

| Construction – custom |

(262,952 | ) | (303,844 | ) | (337,575 | ) | ||||||

| Land – acquisition & development |

(45,425 | ) | (148,221 | ) | (443,793 | ) | ||||||

| Land – consumer lot loans |

(14,681 | ) | (25,909 | ) | (42,299 | ) | ||||||

| Multi-family |

(97,621 | ) | (105,805 | ) | (98,453 | ) | ||||||

| Commercial real estate |

(117,447 | ) | (66,876 | ) | (16,266 | ) | ||||||

| Commercial & industrial |

(243,240 | ) | (187,748 | ) | (10,320 | ) | ||||||

| HELOC |

(85,754 | ) | (63,855 | ) | (5,074 | ) | ||||||

| Consumer |

(15,497 | ) | (96,438 | ) | (2,871 | ) | ||||||

| (1,840,460 | ) | (2,074,175 | ) | (2,301,945 | ) | |||||||

| Loan principal repayments |

2,116,355 | 1,845,324 | 1,718,798 | |||||||||

| Other changes in loans, net |

(204,386 | ) | (269,088 | ) | (128,564 | ) | ||||||

| FHLB stock redeemed |

394 | 748 | 1,762 | |||||||||

| Available-for-sale securities purchased |

(1,175,321 | ) | (313,950 | ) | (328,101 | ) | ||||||

| Principal payments and maturities of available-for-sale securities |

513,218 | 240,368 | 252,417 | |||||||||

| Available-for-sale securities sold |

18,453 | 72,030 | 44,041 | |||||||||

| Principal payments and maturities of held-to-maturity securities |

21,691 | 13,983 | 46,781 | |||||||||

| Net cash paid for acquisition |

— | (166,859 | ) | (35,221 | ) | |||||||

| Proceeds from sales of real estate held for sale |

98,822 | 39,193 | 5,401 | |||||||||

| Premises and equipment purchased |

(5,273 | ) | (22,334 | ) | (2,484 | ) | ||||||

| Net cash used by investing activities |

(456,507 | ) | (634,760 | ) | (727,115 | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||||||

| Net increase in customer accounts |

672,771 | 426,000 | 305,554 | |||||||||

| Net increase in short-term borrowings |

(377,000 | ) | 102,000 | 105,000 | ||||||||

| Proceeds from long-term borrowings |

100,000 | 436,313 | 490,210 | |||||||||

| Repayments of long-term borrowings |

(19,378 | ) | (408,821 | ) | (228,204 | ) | ||||||

| Proceeds from exercise of common stock options and related tax benefit |

180 | 2,546 | 6,752 | |||||||||

| Dividends paid on common stock |

(18,847 | ) | (73,688 | ) | (72,467 | ) | ||||||

| Dividends paid on preferred stock |

(5,361 | ) | — | — | ||||||||

| Net proceeds from follow on stock offering |

333,177 | — | — | |||||||||

| Proceeds from issuance of preferred stock and warrants |

200,000 | — | — | |||||||||

| Preferred stock redeemed |

(200,000 | ) | — | — | ||||||||

| Proceeds from Employee Stock Ownership Plan |

1,341 | 5,771 | 1,617 | |||||||||

| Treasury stock purchased, net |

— | — | (9,848 | ) | ||||||||

| Increase in advance payments by borrowers for taxes and insurance |

1,170 | 3,631 | 1,351 | |||||||||

| Net cash provided by financing activities |

688,053 | 493,752 | 599,965 | |||||||||

| Increase in cash and cash equivalents |

415,788 | 21,222 | 15,656 | |||||||||

| Cash and cash equivalents at beginning of year |

82,600 | 61,378 | 45,722 | |||||||||

| Cash and cash equivalents at end of year |

$ | 498,388 | $ | 82,600 | $ | 61,378 | ||||||

|

16 |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

Table of Contents

| Year ended September 30, | 2009 | 2008 | 2007 | ||||||||

| (In thousands) | |||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

|||||||||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

|||||||||||

| Noncash investing activities |

|||||||||||

| Real estate acquired through foreclosure |

$ | 254,742 | $ | 58,509 | $ | 5,951 | |||||

| Cash paid during the year for |

|||||||||||

| Interest |

325,157 | 391,209 | 355,688 | ||||||||

| Income taxes |

77,761 | 83,239 | 70,942 | ||||||||

| The following summarizes the non-cash activities related to the First Mutual acquisition (2008) and the First Federal acquisition (2007) |

|||||||||||

| Fair value of assets and intangibles acquired, including goodwill |

(1,186,754 | ) | (576,750 | ) | |||||||

| Fair value of liabilities assumed |

1,005,769 | 480,033 | |||||||||

| Cash paid out for acquisition |

(180,985 | ) | (96,717 | ) | |||||||

| Plus cash acquired |

14,126 | 61,496 | |||||||||

| Net cash paid out for acquisition |

$ | — | $ | (166,859 | ) | $ | (35,221 | ) | |||

| SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

17 |

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED SEPTEMBER 30, 2009, 2008 AND 2007

| NOTE A |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Principles of consolidation. The consolidated financial statements include the accounts of Washington Federal, Inc. (Company or Washington Federal) and its wholly owned subsidiaries. Intercompany transactions and balances have been eliminated.

Description of business. Washington Federal is a unitary thrift holding company. The Company’s principal operating subsidiary is Washington Federal Savings. The Company is principally engaged in the business of attracting savings deposits from the general public and investing these funds, together with borrowings and other funds, in one-to-four family residential real estate loans, multi-family real estate and commercial loans. The Company conducts its activities through a network of 150 offices located in Washington, Oregon, Idaho, Utah, Arizona, Nevada, New Mexico, and Texas.

On February 1, 2008, the Company acquired 100% of the outstanding shares of First Mutual. The merger agreement provided for the merger of First Mutual with and into the Company, followed by the merger of First Mutual Bank, a state savings bank and wholly owned subsidiary of First Mutual, into the Company’s wholly owned subsidiary, Washington Federal Savings and Loan Association. As a result of the acquisition, Washington Federal added 169 employees and 12 branches primarily located on the rapidly growing eastside of Seattle. The acquisition was accounted for as a purchase transaction with the total cash consideration funded through internal sources. As of February 1, 2008, the fair value of First Mutual’s assets and liabilities prior to the acquisition were: loans $933 million, investments $24 million, cash $14 million, property $35 million, other assets $29 million, deposits $744 million, borrowings $209 million and other liabilities $14 million. The purchase price was $219,849,000, which included $180,985,000 paid in cash as well as $38,864,000 of assumed liabilities (see related discussion in the following paragraph). The purchase price has been allocated to the underlying assets and liabilities based on estimated fair values at the date of acquisition. Results of operations are included from the date of acquisition. The Company acquired assets with an estimated fair value of $1,186,754,000 and assumed liabilities with an estimated fair value of $1,005,769,000. The acquisition produced goodwill of $149,246,000 and a core deposit intangible of $2,523,000.

During the quarter ended June 30, 2009, the Company became aware of a tax liability of $39 million resulting from the acquisition of First Mutual, Inc. in February 2008. Although substantial uncertainty remains as to the ultimate outcome of this matter, under current U.S. accounting rules, the Company should have recorded this as an income tax liability, with a corresponding increase to goodwill, in purchase accounting. As a result, the Company has corrected the September 30, 2008, consolidated balance sheet for the $39 million increase in income tax liability and goodwill from amounts previously reported of $0 and $213 million, respectively. The only income statement impact was $1.5 million of additional tax expense recognized in the quarter ended June 30, 2009, resulting from interest due on the tax liability. The Company is in discussions with the IRS regarding this matter and will pursue all available remedies to mitigate the financial impact to the Company.

The balance of the Company’s intangible assets was as follows, which includes the additional goodwill discussed above:

| Goodwill | Servicing Rights Intangible |

Core Deposit Intangible |

Non- Compete Agreements |

Total | |||||||||||||||

| (In thousands) | |||||||||||||||||||

| Balance at September 30, 2007 |

$ | 102,407 | $ | — | $ | 4,733 | $ | 105 | $ | 107,245 | |||||||||

| First Mutual acquisition |

149,246 | 4,233 | 2,523 | 0 | 156,002 | ||||||||||||||

| Additions |

— | 552 | — | — | 552 | ||||||||||||||

| Accumulated amortization |

— | (1,201 | ) | (2,335 | ) | (105 | ) | (3,641 | ) | ||||||||||

| Balance at September 30, 2008 |

251,653 | 3,584 | 4,921 | — | 260,158 | ||||||||||||||

| Additions |

— | — | — | — | — | ||||||||||||||

| Accumulated amortization |

— | (1,115 | ) | (2,246 | ) | (3,361 | ) | ||||||||||||

| Balance at September 30, 2009 |

$ | 251,653 | $ | 2,469 | $ | 2,675 | $ | — | $ | 256,797 | |||||||||

The Company’s fiscal year end is September 30th. All references to 2009, 2008 and 2007 represent balances as of September 30, 2009, September 30, 2008 and September 30, 2007, or activity for the fiscal years then ended. References to net income in this document refer to net income available to common shareholders.

18

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)